- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 29-11-2021

- The EUR/JPY pair begins the Asian session in the right foot, advancing some 0.26%.

- An upbeat market sentiment hurts safe-haven assets, like the Japanese yen and the Swiss franc.

- EUR/JPY Technical outlook: The inverse head-and-shoulders chart pattern target is 129.40.

As the Asian session begins, the EUR/JPY advances during the session, up some 0.26%, trading at 128.54 at the time of writing. On Monday, the shared currency, despite closing in the red, recovered some of last Friday’s losses, bouncing off the daily lows at 127.48, up to reclaim the 128.00 figure, as the market sentiment improved throughout the weekend, on “positive” news regarding the omicron COVID-19 variant, first discovered in South Africa.

At press time, the market sentiment is upbeat, with all the Asian equity futures in the green, except for the Hang-Seng, losing 1.35%. In the FX market, mild risk-on market sentiment benefits risk-sensitive currencies, to the detriment of safe-haven ones, like the Japanese yen and the Swiss franc.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY 1-hour chart displays the formation of an inverse head-and-shoulders a reversal pattern with bullish implications. Furthermore, at press time, the EUR/JPY jumped off the confluence of the 50-hour simple moving average (HSMA) and the neckline, from 128.20s levels towards the November 29 high at 128.67.

In the outcome of breaking above the latter, the following target would be the 100-hour SMA at 128.79, followed by the 200-hour SMA at 129.00. A breach of that level would expose the inverse head-and-shoulders target, at 129.42.

-637738267777695375.png)

- EUR/USD picks of bids to consolidate recent losses.

- RSI divergence hints at further upside towards breaking weekly resistance.

- 50-SMA, one-month-old descending trend line offer extra challenges to bulls.

- Sellers eye clear break of 1.1260 for fresh entries.

EUR/USD buyers flirt with the 1.1300 threshold, following a quick drop to 1.1258. In doing so, the currency major pair traces upbeat technical signals during the initial Asian session trading on Tuesday.

It’s worth noting that the EUR/USD prices diverge from the RSI conditions since November 18, signaling further advances as the quote is yet to track the bullish momentum signals.

With the bullish RSI divergence suggesting further advances of the stated currency pair, the immediate hurdle of the weekly resistance line around 1.1315 becomes imminent to be knocked down by buyers.

However, the pair’s further advances will be challenged by 50-SMA and descending resistance line from October 28, near 1.1365 and 1.1460. During the run-up, the November 11-12 lows around 1.1430 may offer an intermediate halt.

Alternatively, pullback moves will aim for 1.1260 and 1.1230 levels before directing the EUR/USD bears to the recently flashed yearly low surrounding 1.1185.

In a case where the pair sellers dominate below 1.1185, June 2020 swing low near 1.1160 and March 2020 peak close to 1.1145-50 will be in focus.

EUR/USD: Four-hour chart

Trend: Further recovery expected

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, decline for the third consecutive day to test lowest levels since November 05 by the end of Monday’s North American session, per the data source Reuters.

In doing so, the inflation gauge eyes the monthly bottom surrounding 2.50% while flashing 2.52% level at the latest.

The fall in the inflation expectations could be linked to the market’s receding fears over the South African variant of the coronavirus after experts and policymakers reassessed Friday’s heavy risk-off action. Adding to the market optimism were the latest comments from US President Joe Biden and prepared remarks from Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen.

It’s worth noting that the easing hopes of inflation and Fed’s Powell citing covid fears cut the previously hyped odds of the Fed rate hike and may weigh on the US Dollar Index (DXY), defending 96.00 level so far following a pullback from the 16-month top.

Read: Forex Today: Mood improves, dollar advances

- The Australian dollar extended to three days in a row loss amid mild risk-on market sentiment.

- AUD/JPY daily and hourly charts are tilted to the downside.

The AUD/JPY slides for the second consecutive day, though recovered some Friday’s losses, trading at 81.07 as the New York session wanes at the time of writing. On Monday, the market sentiment slightly improved. However, as the Asian Pacific session began, equity futures in Asia are tilted to the upside, except for the Chinese Hang-Seng, retreating almost 1.40%.

In the overnight session, the AUD/JPY pair traded within a 70-pip range, with no clear direction, meandering around the Monday central daily pivot. It is trading just above the central daily pivot at press time, despite the daily chart depicting a bullish flag.

AUD/JPY Price Forecast: Technical outlook

Daily chart

On Friday, the AUD/JPY pair dripped 200 pips, from 82.85 towards 80.79, breaking on its way down, crucial support levels, like the 50, 100, and the 200-day moving averages (DMA’s). That is due to the COVID-19 omicron variant, as countries closed borders, banning flights from South Africa and African countries. On Friday, the pair broke beneath the abovementioned, but as the Asian session began, the AUD/JPY opened within the bullish flag pattern on Monday The Relative Strength Index (RSI) is at 33, aims slightly flat, but as it remains below the 50-midline, the AUD/JPY has a downward bias.

In the outcome of continuing lower, the first support would be the bottom of the bullish flag around the 80.50-75 range. A breach of that level and the bullish flag would expose the November 26 low at 80.46, followed by the October 1 swing low at 79.89.

-637738243534883202.png)

1-hour chart

On this chart, the AUD/JPY has a downward bias confirmed by the hourly simple moving averages (HSMA) residing above the spot price. Further, as the price action consolidates in a 70-pip range, an ascending wedge is forming, indicating that the pair might trade to the downside in the near term, thus negating the bullish flag pattern formed in the daily chart.

In the outcome of breaking to the downside, the first support would be the S1 daily pivot at 80.67. A breach of the latter would expose the November 26 low at 80.47, followed by the S2 daily pivot at 80.27.

-637738243615689958.png)

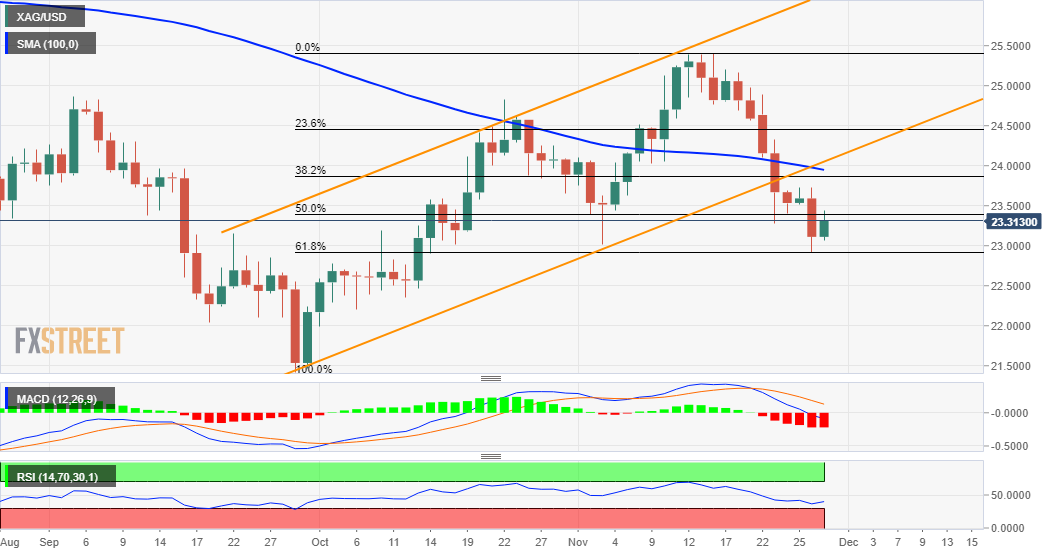

- Silver prints corrective pullback from multiday low, bears keep reins.

- Sustained break of 61.8% Fibonacci retracement, weekly resistance line join bearish MACD signals to favor sellers.

- 50-DMA adds to the upside filters, yearly low can lure bears past $22.00.

Silver (XAG/USD) licks its wounds near the lowest levels since mid-October during the early Asian session on Tuesday. That said, the quote eyes to regain $23.00 by the press time.

The bright metal refreshed multi-day low the previous day after breaking the 61.8% Fibonacci retracement (Fibo.) of September-November downside. The corrective pullback could be linked to multiple supports marked since late August.

In addition to the stated key Fibo. level near $22.95, bearish MACD signals and sustained trading below the one-week-old descending trend line, as well as the 50-DMA, adds strength to the downside bias.

That said, further weakness may find multiple speed-breakers around $22.80 and $22.20 before testing the $22.00 level comprising September 22 bottom.

It should be noted, however, that the metal’s weakness past $22.00 will make it vulnerable to refresh yearly low, around $21.40 at the latest.

Meanwhile, an upside break of the 61.8% Fibonacci retracement level of $22.95 will push the XAG/USD prices towards the stated short-term resistance line near $23.15.

However, any further upside past $23.15 will be challenged by 50% Fibo. and 50-DMA levels surrounding $23.40 and $23.60 in that order.

Silver: Daily chart

Trend: Bearish

- NZD/USD holds onto the bounce from yearly low, recently picking up bids.

- Market sentiment improved as second thoughts revealed Friday’s moves as overreaction to South African covid variant.

- Biden rejected restrictive measures for now, Fed’s Powell up for citing covid challenges employment, inflation.

- China’s official PMI for November will be important to watch.

NZD/USD cheers improvement in market’s mood following a slump to refresh the yearly low around 0.6800, picking up bids to 0.6825 during early Tuesday morning in Asia.

With the global medical experts buying some time before ringing alarm on the South African covid variant, dubbed as Omicron, market sentiment improved at the week’s start. Adding to the risk-on mood were comments from US President Joe Biden and prepared testimony of Federal Reserve (Fed) Chairman Jerome Powell, as well as US Treasury Secretary Janet Yellen. Furthermore, a lenient start to New Zealand’s traffic-light system also favors the optimists, which in turn favors the NZD/USD prices.

However, comments from Atlanta Federal Reserve President Raphael Bostic and caution ahead of the week’s top-tier data weighed on commodities, which in turn challenges NZD/USD buyers.

The US National Institutes of Health (NIH) and Israeli covid expert Dror Mevorach were joined by Australia’s Health Secretary Greg Hunt to initially ease the market’s extreme fears from the coronavirus variant. The optimism gained momentum after US President Biden said, “Variant is a cause for concern, not a cause for panic,” while also adding, “lockdowns are off the table, for now.”

Following that, prepared remarks for today’s Testimony of Fed’s Powell eased concerns over the rate hike and offered additional support to the Antipodeans. Fed Chair Powell said, per Reuters, “The recent rise in COVID-19 cases along with the emergence of the new Omicron variant pose "downside risks" to employment and economic growth, and "increased uncertainty for inflation.” The same contradicts comments from Fed’s Bostic who said during the weekend that covid is the source of inflation.

It’s worth observing that US Treasury Secretary Yellen also placates market pessimism while pushing Congress to overcome the US debt limit deadlock, as well as highlighting the strength of the US economy.

Furthermore, New Zealand’s new COVID-19 Protection Framework, known as the traffic light system, comes into effect on Friday and has initially put most country parts in the Orange zone, with mild restrictions, except for North Island. Additional support measures to help businesses battle the activity restrictions also back the NZD/USD bulls.

Amid these plays, stocks in the US and Europe recovered, after mildly bid Asian equities, whereas US 10-year Treasury yields regains 1.5% status and underpinned the US Dollar Index (DXY) to consolidate Friday’s losses.

Moving on, New Zealand’s monthly sentiment numbers from Australia and New Zealand Baking Group (ANZ) may entertain NZD/USD traders. However, major attention will be given to China’s official NBS Manufacturing PMI and Non-Manufacturing PMI for November, expected 49.6 and 53 versus 59.2 and 52.4 in that order. Above all, virus updates and testimony by Fed’s Powell, as well as Yellen, will be crucial to watch.

Technical analysis

NZD/USD keeps the rebound from the 0.6800-0.6790 support zone, where 61.8% Fibonacci retracement (Fibo.) level of June 2020 to February 2021 upside joins multiple levels marked during September and November 2020. However, a sustained trading below the 17-month-old support line, now resistance around 0.6900, keeps pair sellers hopeful.

“Failure to deal with debt limit would 'eviscerate' us economic recovery,” said US Treasury Secretary Janet Yellen during her Prepared remarks to Senate banking committee testimony, per Reuters.

“Cannot overstate importance for congress to deal with us debt limit,” adds Treasury Secretary Yellen.

Additional comments

Failure to deal with debt limit would 'eviscerate' US economic recovery.

The recovery cannot be detached from progress against covid.

It is critical for Congress to address the US debt limit.

FX reaction

Given the latest recovery in market sentiment, backed by easing fears over the South African variant of the coronavirus, dubbed as Omicron, Yellen’s comments seem neutral and were reacted with little action.

Read: Fed's powell: Inflation will linger well into next year

- AUD/USD bulls have moved in at the start of the week, price correcting the daily bear trend.

- Bulls eye 0.7170 old daily support and 50% mean-reversion targets.

AUD/USD has found solace in world leaders who are sounding optimistic that they can deal with the Omicron variant. As such, it has done little to impact Fed tightening expectations so far which is supporting the greenback.

However, sentiment in markets has been helped by the WHO; while urging caution, the organization noted that symptoms linked to the new strain so far have been mild. This gives the Aussie a much-needed boost as well. Additionally, Moderna added to the positive sentiment by predicting it would have a modified vaccine ready by early 2022.

On the charts, the outlook is bullish in so far that a correction would be expected so long as the price remains above water and 0.7100.

On a break of 0.71, other hand, then bears would be expected to pile in towards 0.7030 weekly structure.

Federal Reserve Chair Jerome Powell, in testimony prepared for delivery Tuesday at the US Senate Banking Committee, and released Monday by the Fed, said that he continues to expect high inflation to recede over the next year as supply and demand come into better balance, but warned that prices could continue to rise for longer than earlier thought.

"It is difficult to predict the persistence and effects of supply constraints, but it now appears that factors pushing inflation upward will linger well into next year."

"In addition, with the rapid improvement in the labor market, slack is diminishing, and wages are rising at a brisk pace."

The recent rise in COVID-19 cases along with the emergence of the new Omicron variant pose "downside risks" to employment and economic growth, and "increased uncertainty for inflation," Powell added.

The Fed, Powell promised, "is committed to our price-stabilty goal" will use its to support the economy and the labor market but also to prevent any upward spiral in inflation.

Key comments

- Factors pushing inflation upward will linger well into next year - prepared testimony to senate banking committee.

- Inflation running well above 2% goal, pushed up by pandemic-related supply and demand imbalances

- continue to expect inflation will move down significantly over the next year.

- We will use our tools to support economy and strong labor market, and to prevent higher inflation from becoming entrenched.

- Economy continues to strengthen.

- conditions in labor market have continued to improved.

- Still ground to cover to reach maximum employment, expect progress to continue.

- Slack is diminishing in the labor market.

- Rise in covid cases, omicron variant pose downside risks to employment, increased uncertainty for inflation.

Market implications

This is supportive of the US dollar that is likely to outperform from both a risk-off profile and due to the divergence between the Federal Reserve and those central banks of other nations where growth is lagging the US.

- The shared currency slides on Monday as market sentiment improves, as COVID-19 omicron variant worries ease.

- Broad US Dollar strength across the board, weighing on the EUR/USD pair.

- EUR/USD sellers, to resume the downward move, will need to break below the 200-hour SMA at 1.1271.

On Monday, the EUR/USD grinds lower during the New York session, trading at 1.12880 at the time of writing. Since the beginning of the Asian session, the shared currency edged lower as market sentiment improved on the back of positive news from South African health authorities. The greenback advances against most G8 currencies in the FX markets, except for the AUD and the CAD.

Friday’s price action was exacerbated by COVID-19 omicron news in conditions of thin liquidity after the observance of Thanksgiving. Furthermore, World Health Organization (WHO) authorities sounded the alarm with some countries banning flights from South Africa and some African countries. That would last unless scientists could prove that although highly transmissible, the new variant is not as dangerous as the delta. Until that news arrives, market participants will remain cautious, waiting for further information.

That said, the USD weakened across the board, with the US Dollar Index closing near the psychological 96.00, as investors scaled back bets that the Federal Reserve would hike rates three times in 2022, as money market futures have priced in just two increases, pushing the third one until 2023. That is due to assessing what the new coronavirus variant impact would be on the global economy.

Meanwhile, on Monday, the USD recovered some ground against the shared currency. Early in the Asian session, the EUR/USD broke below the 1.1300 figure, printing a daily low nearby the 50-hour simple moving average (HSMA) at 1.1258, though in the last couple of hours jumped above the 50 and the 200-HSMA, at current levels.

On the economic docket, the Eurozone unveiled the HICOP for Germany for November, which rose by 6%, higher than the 5.4% estimated. Meanwhile, across the pond, the US Pending Home Sales for October on a monthly basis increased by 7.5%, higher than the 1% expected.

EUR/USD Price Forecast: Technical outlook

In the 1-hour chart, the EUR/USD remained subdued, failing to gain traction further to the downside. Also, the low-yield status of the EUR helps it attain a “safe-haven” status, despite usually not being one of them, like the JPY, the CHF, and the greenback. That put a lid on the downward move, near the 50 and the 200-hour simple moving averages (HSMA’s), which acted as dynamic support.

However, to resume the downward bias observed in a higher time frame like the daily chart, USD bulls would need to push the pair below the 200-HSMA.

In that outcome, the first support would be the S1 pivot point at 1.1238. A break below the latter would expose the November 26 swing low at 1.1204, followed by the S2 pivot point at 1.1158.

On the other hand, the daily central pivot point at 1.1285 would be the first resistance. A breach above that level would expose crucial supply zones, like the 1.1300 figure, followed by the R1 resistance at 1.1365.

-637738162943531658.png)

- CAD/JPY is under pressure as bears move in for a test of 89 the figure.

- The price is carving out a bearish formation on the hourly chart that can be executed on lower time frames.

The yen is a top performer due to the uncertainty surrounding the coronavirus and how central banks intend to deal with the dire implications for their domestic economies. The yen is renowned as a safe haven currency which gives it an edge, especially over the high beta and commodity currencies, such as the Canadian dollar.

However, regardless of the fundamentals pertaining to the threat of the new coronavirus variant, the technical picture leans with a bearish bias, albeit within a trapped environment. The following illustrates this environment in a top-down analysis and arrives at a short term bearish thesis.

CAD/JPY daily chart

-637738141646140862.png)

Firstly, from a daily perspective, the price is testing demand territory from which would be expected to hold on to initial tests throughout the week and potentially carve out a correction. The 50% mean reversion has a confluence of prior lows near 89.80. A break there will look for a test of 90 the figure and this would open risk towards a 61.8% golden ratio target of near 90.20. On the other hand, the 89.50 could guard such a retracement where the 38.2% Fibonacci retracement is located.

Meanwhile, however, there could be a shorter-term opportunity on the lower time frames as follows:

CAD/JPY 4-hour chart

-637738147414933878.png)

From a 4-hour perspective, the price is carving out a symmetrical triangle at the bottom of a strong bearish impulse which is regarded as a continuation chart pattern. So the bias is to the downside and traders will be on the look out for a break of the dynamic support.

CAD/JPY hourly chart

-637738152395374698.png)

The hourly chart shows that the price is being resisted below 89.20 and following a 50% mean reversion of the latest bearish impulse, albeit with a sideways consolidation. This makes for a higher risk profile of the market structure, but bearish nevertheless for intraday scaling opportunities to the downside.

CAD/JPY 15-min chart

-637738155518007338.png)

The price has been rejected at the counter trend line on the 15-min chart, so the bears will be preparing to short below the support around 89.02. This can also be executed on the 5-min time frame as follows:

CAD/JPY 5-min chart

-637738158189656509.png)

The failed inverse head and shoulders pattern is encouraging and a break of the 21-EMA again will raise prospects of a break of the support. Bears would expect that level to then work as resistance on a restest from which the price could deteriorate within the sideways hourly channel towards 88.80 or lead to an outright breakout of the 4-hour symmetrical triangle towards 88.30/40.

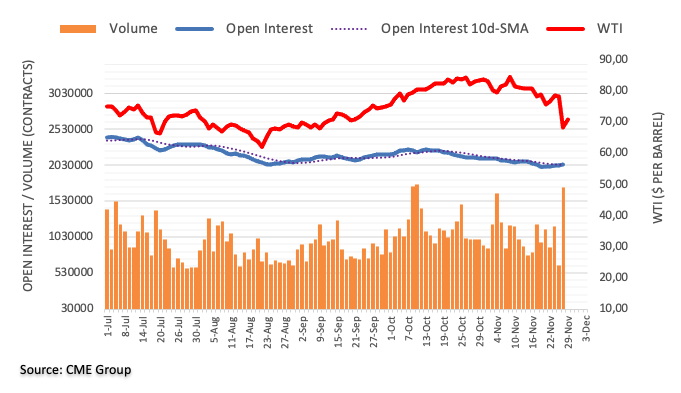

- USD/CAD tried to test last week’s highs at 1.2800 earlier in the session, but have since fallen back towards 1.2750.

- Oil prices fell back from their earlier highs, making it difficult for CAD to recoup recently lost ground versus USD.

USD/CAD flirted with last Friday’s multi-week highs close to 1.2800 in earlier trade, but the pair has since backed off and is now trading around the 1.2760 mark with very marginal on the day losses of around 0.1%. That means the pair is close to the centre of its recent 1.2730-1.2800 intraday ranges, though is still some way above last week’s lows under 1.2650. To recap, the pair rallied more than 1.0% last week as crude oil prices tanked amid fears about the impact that the global spread of the Omicron Covid-19 variant would have on demand. Indeed, those gains all came last Friday in tandem with WTI prices tanking nearly $10 to under $70.00.

Oil prices attempted a rebound on Monday, but as the US session drew on, oil prices gradually found themselves coming under more selling pressure again. WTI nearly went as high as $73.00 prior to the US open but has slipped back under the $70.00 level and its 200DMA again ahead of the close. Whilst WTI is still set to finish the session about 2.0% or just under $1.50 higher, the erosion of earlier gains has made it difficult for the loonie to regain some recently lost ground versus the US dollar.

There was some focus on Canadian data earlier in the session; the Canadian Current Account in Q3 2021, released at 1330GMT, was significantly weaker than expected at C$ 1.4B versus expectations for C$ 4.6B, weighing on the loonie at the time. Industrial Product and Raw Material Price data was also released at 1330GMT. As usual, it didn’t move markets, but the data is quite alarming. Raw Material Price inflation rose to 38.4% in October following a 4.8% MoM rise on the month, while Industrial Production Price inflation came in at 16.7%, after a 1.3% rise in October. While both YoY rates of inflation have been higher at other points during the year, both are historically elevated.

Looking ahead to the rest of the week, the focus will mainly be on Fedspeak and US data (November ISM surveys and the official November jobs report), though the November Canadian jobs report on Friday will also be worth watching. Perhaps more important than the calendar scheduled events, however, will be developments on the Omicron variant front. Market participants eagerly await more information on the strain’s 1) transmissibility, 2) severity of sickness, 3) ability to avoid the existing vaccines and treatments. Only once this information is clearer can market participants may well informed adjustments (if any are required) to their economic/central bank policy forecasts. As a result, markets are likely to be very headline-driven.

What you need to know on Tuesday, November 30:

Fears receded on Monday after panic dominated financial markets on Friday when stocks markets collapsed following the announcement of a new covid variant discovered in South Africa named Omicron. However, the market’s reaction may have been exacerbated by thin market conditions due to the Thanksgiving holiday in the US.

Anyway, up to today, the market knows little about the new strain. However, Pfizer announced its testing its vaccine on a new variant, while Moderna announced it would have a new shot ready for early on 2022 if needed. Also, US President Joe Biden made a press conference to update the country on the matter. Biden said that the new strain is of concern but should not trigger panic, adding that lockdowns are not required at the time being.

Stocks fell in Asia, but European and American indexes posted gains, reflecting the better mood. US government bond yields ticked higher, with the 10-year Treasury note yielding 1.53% ahead of Wall Street’s close.

European Central Bank (ECB) governing council member Pablo Hernandez de Cos said this Monday that European policymakers aim to avoid the premature tightening of the monetary policy, repeating that high inflation could be expected to be transitory, despite being stronger and more persistent than anticipated a few months ago. German inflation printed at 6% YoY in November, according to preliminary estimates.

The greenback trades mostly higher against its major rivals, although volatility was limited. The EUR/USD pair trades around 1.1260, while GBP/USD is below the 1.3300 threshold. USD/CAD is at 1.2760, while the AUD/USD pair is close to the year low at 0.7105. Safe-haven currencies bounced modestly, with the USD/JPY pair now at 113.80.

Gold edged modestly lower after flirting with the 1,800 level, now trading at around $1,782 a troy ounce. Crude oil prices also ticked lower, with the barrel of WTI currently at $70.40.

XRP price on edge of cliff as Ripple faces imminent collapse

Like this article? Help us with some feedback by answering this survey:

- Gold struggles in the region of the $1,780 support area as the US dollar picks up a bid.

- US yields are higher as fears of the Omicron impact are dialled back.

Gold is resuming the downside, although it could be carving out a trendline to the upside in what appears to be a dynamic support line. However, a meaningful break lower from here will likely invalidate that technical argument which makes today's lows near $1,170 important for the week ahead. At the time of writing, the yellow metal is trading $1,784 and down some 0.5% so far. The price fell from a high near the psychological $1,800 as the US dollar firmed and risk sentiment recovered.

The markets are weighing how severe the economic impact would be from the Omicron coronavirus variant which is so far balanced following last week's market sell-off. The major risk-off theme supported the gold price momentarily but a semblance of calm returned to world markets. US Treasury yields and the US dollar have climbed while US stocks are back in the green which is weighing on the gold price.

World leaders are sounding optimistic that they can deal with the Omicron variant and as such, it has done little to impact Fed tightening expectations so far which is supporting the greenback. Sentiment in markets has been helped by the WHO; while urging caution, the organization noted that symptoms linked to the new strain so far have been mild. Additionally, Moderna added to the positive sentiment by predicting it would have a modified vaccine ready by early 2022.

As a consequence, the US ten-year yield is up 3.31% and that is helping the greenback to recover. After two straight down days, DXY is trading higher near 96.445 the high for the day so far after finding support near 96. Gold traders will be keeping an eye out for another test of last week’s high near 97 and then the June 2020 high near 97.802 will be in focus.

However, markets are on edge due to the uncertainty of what is a very fluid situation and traders will be scouting out for more news on the matter. As such, the safe havens will likely hold up for the tie being, although rallies could well be faded so long as the optimists stay in play.

Fed speakers will be important

This puts Fed speak this week high up on agenda for gold traders. We will hear from Fed’s John Williams, chairman Jerome Powell, and Michelle Bowman. Last Friday, Raphael Bostic played down the risk of the omicron variant. He said that is hopeful that the momentum of the US economy will carry it through the next wave of the coronavirus pandemic and that he remains open to accelerating the pace of the central bank's bond taper.

If the new Omicron coronavirus variant follows the pattern seen with previous variants, it should cause less of an economic slowdown than the Delta variant, Bostic said. "We have a lot of momentum in the economy right now," Bostic said during an interview with Fox News, citing strong jobs growth. "And that momentum, I'm hopeful, will be able to carry us through this next wave, however, it turns out." Other central banks have also been optimistic, such as the Reserve Bank of New Zealand. 'Chief Economist Ha said that the new variant would have to have a dramatic economic impact to prevent the bank from continuing to hike interest rates.

Gold technical analysis

The daily chart is carving out dynamic support that is coming under pressure.

The 4-hour chart indicates to be long above $1,810 and short below $1,780 and again below $1,770. Between these levels, traders will be at risk of whipsaw price action and sideways consolidation. From a shorter-term perspective, the 15-min chart indicates to be long above 1,785 to target between 1,791 and 1,795.

- The New Zealand dollar slides, despite reclaiming the 0.6800, as the market assesses the impact of the omicron variant.

- COVID-19 omicron variant causes “mild” symptoms, according to SA health authorities

- Fed policymakers would like to increase the pace of the bond taper, according to FOMC’s last meeting minutes.

During the New York session, the New Zealand dollar continued its free fall versus the greenback, reaching a new year-to-date low at 0.6787, though it bounced off that level, trading at 0.6804 at press time. The market sentiment is upbeat at the time of writing, as major US equity indices print gains between 0.92% and 2.32%, amid COVID-19 omicron variant woes, seem to fade on the back of positive news from South African health authorities.

COVID-19 omicron variant causes “mild” symptoms, according to SA health authorities

According to the Telegraph, the South African Medical Association chair Angelique Coetzee called symptoms associated with the variant at this point “different and so mild” compared with others she treated in recent months. She was asked that if authorities worldwide were panicking unnecessarily, Coetzee said, “yes, at this stage, I would say definitely,” as she confirmed not admitting anyone to the hospital with the new variant.

That said, it seems that investors are assessing current COVID-19 news, with what the World Health Organization(WHO) has to say about it. On Monday, the financial markets seem to have stabilized after Friday’s collapse.

Putting this aside, the NZD/USD has been trading downwards, attributed to the Reserve Bank of New Zealand (RBNZ), disappointing market participants, who were expecting a rate hike of 50 basis points in the Overnight Cash Rate (OCR) on its last meeting. Furthermore, the last Wednesday, the FOMC’s last meeting minutes showed that Fed policymakers would like to increase the pace of the QE’s reduction so that the US central bank could have room to maneuver in the case of inflation stating elevated. That firmly reinforced USD strength against the NZD, which has been adrift since RBNZ’s last meeting.

In the meantime, the US Dollar Index, which tracks the buck’s performance against a basket of six rivals, advances 0.26%, sitting at 96.33, acting as a tailwind for the US dollar.

Meanwhile, analysts of Brown Brother Harriman noted that RBZ chief economist Ha said that “the new variant would have to have a dramatic economic impact to prevent the bank from continuing to hike interest rates. He added that the bank would have hiked last week even if omicron was known then, stressing it’s not the same as August when RBNZ delayed a hike due to a just-announced lockdown.”

That said, the fall on the NZD/USD could be viewed as an opportunity for NZD bulls to open fresh bets, as the RBNZ is looking forward to hiking rates again, faster than the Federal Reserve.

- USD/JPY rebounded on Monday to the upper 113.00s from previously just above 1.1300.

- The bounce is in tandem with a rise in longer-term US yields, though USD/JPY remains well off last week's highs.

USD/JPY has seen a solid rebound on Monday, bouncing from earlier session (and last week’s) lows around 113.00 to session highs in the upper-113.00s, where is continues to trade midway through the US session. A brief dip below the 50-day moving average, which currently resides at 113.13, earlier in the day was used as a dip-buying opportunity. For now, though, selling pressure ahead of the psychologically important 114.00 level and the 21DMA just above it is preventing any further gains. Thus, while the pair does trade higher on the day by about 0.4%, USD/JPY remains about 1.5% below last week’s highs around 115.50.

The main reason for the pair’s rebound on Monday, as well as the main reason why it still remains some ways below recent highs, has to do with its tight correlation to US bond yields. The 10-year yield has bounced well since hitting its 200DMA At 1.48% last Friday and is on Monday trading well back to the north of 1.50%. But at 1.525%, that still leaves it some 16bps below last week’s pre-Omicron highs just shy of the 1.70% mark. Recall that market sentiment took a sharp turn on Friday as fears about the newly discovered, highly transmissible and potentially vaccine-resistant Omicron Covid-19 variant emerged. That saw markets dial back aggressively on their Fed rate hike bets, which encouraged investors to pile into bonds for their safe haven properties, as well as on the expectation of lower for longer.

Markets have been somewhat reticent to rebuild these Fed hike expectations back on Monday, despite the more risk-on market tone and early signs out of South African that those ill with the new variant (so far) are showing mild symptoms. The implied yield on the December 2022 eurodollar future (a proxy for where markets think the Fed funds rate is going to be) remained around 0.9% on Monday, having dumped from its pre-Omicron highs around 1.08% last week.

Caution makes sense. Fed Chair Jerome Powell is scheduled to speak at 2005GMT. Then, the rest of the week is packed with Fed-related risk events such as plenty more Fed speak (including a two-day testimony where Powell appears before Congress given his recent renomination) and US ISM and jobs data. As is typically the case, USD/JPY has not been to responsive to domestic Japanese news. Japan reportedly is set to ban the entry of all foreigners by the end of the month. Meanwhile, Retail Sales data there for October was broadly in line with expectations and showed a sluggish YoY pace of growth.

- AUD/USD corrects but the focus is on the downside.

- There is a risk of a break below 0.7110 for the days ahead.

- Coronavirus is driving risk sentiment while Fed speakers will be keenly watched.

AUD/USD is trading at 0.7130 and between a range of 0.7159 and 0.7113 as the price corrects from daily lows. However, the recent news cycle around the focus on the Omicron variant suggests that mobility divergence and reopening strategies will shift back on the radar screen for AUD traders this week as cases are detected locally. This leaves a downside bias on the higher-yielding commodity currencies.

Australia has already paused plans to reopen its borders to some foreign nationals amid fears over the new Covid variant. The nation was due to allow vaccinated skilled migrants and international students entry from 1 December. But Prime Minister Scott Morrison said a delay of a fortnight was "necessary" following Omicron's discovery. However, Australia, which has so far found five Omicron infections among travellers arriving in the country, has not announced rolling back any of the restrictions it had already eased earlier this month.

The omicron variant has done little to impact Fed tightening expectations so far, but it is bound to affect consumer confidence which has been known to impact the US dollar at times of despair. Nevertheless, sentiment has been helped by the WHO; while urging caution, the organization noted that symptoms linked to the new strain so far have been mild. Additionally, Moderna added to the positive sentiment by predicting it would have a modified vaccine ready by early 2022. As a consequence, global equity markets are higher, as are global bond yields. The US ten year yield is up 3.31% and that is helping the greenback to recover.

After two straight down days, DXY is trading higher near 96.445 the high for the day so far after finding support near 96. Forex traders will be keeping an eye out for another test of last week’s high near 97 and then the June 2020 high near 97.802 will be in focus. In this regard, the bias is tilted to the downside for AUD/USD and for a continuation below daily support near 0.7110. This, however, will depend upon the Federal Reserve's tightening expectations.

Central bank speak is key

This makes Fed speak high up on the watchlist for the week ahead where we will hear from Fed’s John Williams, chairman Jerome Powell, and Michelle Bowman. Last Friday, Raphael Bostic played down the risk of the omicron variant. He said that is hopeful that the momentum of the US economy will carry it through the next wave of the coronavirus pandemic and that he remains open to accelerating the pace of the central bank's bond taper.

If the new Omicron coronavirus variant follows the pattern seen with previous variants, it should cause less of an economic slowdown than the Delta variant, Bostic said. "We have a lot of momentum in the economy right now," Bostic said during an interview with Fox News, citing strong jobs growth. "And that momentum, I'm hopeful, will be able to carry us through this next wave, however it turns out."

However, ''the added uncertainty is likely to keep the bar fairly high to a faster taper,'' analysts at Brown Brothers Harriman argued. ''Odds of Q2 liftoff have risen back to nearly two thirds, which we think is way too aggressive. That said, we believe that the monetary policy outlook continues to favour the dollar over the euro, yen, and Swiss franc. None of those central banks are likely to hike rates until 2023 at the earliest and so the 2-year yield differentials should continue to move back in the dollar’s favour this week after plunging last week.'

It is worth noting that the Reserve Banks of New Zealand hase also downplayed omicron risks. The analysts at BBH noted that ''Chief Economist Ha said that the new variant would have to have a dramatic economic impact to prevent the bank from continuing to hike interest rates. He added that the bank would have hiked last week even if omicron was known then, stressing it’s not the same as August when RBNZ delayed a hike due to a just-announced lockdown.''

Given the divergence between the Reserve Bank of Australia to that of the Fed and RBNZ and also considering how fluid of a situation this new variant is, the uncertainty will be a weight on both AIUD/NZD and AUD/USD/ AUD/JPY is also regarded as the forex market's risk barometer due to the Aussie's high beta nature and the yen's safe-haven qualities, so this cross is also biased tot he downside.

- GBP/USD slipped under 1.3300 in recent trade and is eyeing year-to-date lows.

- The pair has been weighed by concerns about an Omicron outbreak in the UK.

Sterling has been under pressure during US trading hours, pulling back from earlier session highs above 1.3350 to fresh session lows under 1.3300. That leaves the pair only a few pips above annual lows printed last Friday at 1.3278. Recent weakness could be a reflection of fears that the Omicron Covid-19 variant, multiple infections of which have now been picked up across the UK, poses downside risks to the UK’s economic recovery this winter.

The government advised citizens over the weekend that masks would be required in indoor spaces once more and that social distancing was encouraged. Meanwhile, the UK’s health minister seemed to hint that any potential lockdown restrictions, which have not yet been taken off of the table, would be linked to hospitalisation rates. An FT article, which claimed that analysts think the impact of Omicron on the UK economy will be minimal, has been broadly ignored.

More broadly, the fact that the US dollar has been picking up amid a rise in long-term US government bond yields (long-term UK yields have seen a much more modest rise on Monday) is weighing on the pair. The tone of US President Joe Biden in a press conference on Omicron was relatively upbeat/glass half full. The variant is concerning, but not a cause for panic, the vaccine is still expected to protect, as are masks and lockdowns are off the table, for now, was the general message and it seems to have boosted US equities, which could be aiding the dollar also.

- The market sentiment has slightly improved, though it failed to lift silver prospects, which fell to a seven-week low.

- The US Dollar Index advances 0.32%, sitting at 96.39, following the US 10-year Treasury yield footsteps, up to 1.514%.

- XAG/USD Technical outlook: Failure to reclaim last’s Friday low at $22.89 could send silver tumbling towards $22.32.

Silver (XAG/USD) spot extends last week’s Friday decline, trading below the former low at $22.84 during the New York session at the time of writing. Market sentiment has improved, throughout the weekend, after Friday’s turmoil in the financial markets. According to South African health authorities, the COVID-19 omicron variant, although it has more mutations than the alpha and the prevailing delta variant and seems to spread more quickly, causes mild symptoms in young and healthy people.

On Friday's COVID-19 omicron variant news, spurred silver's fall below $23.00

Despite the abovementioned, the white metal keeps extending its downfall, after collapsing more than $0.80, on COVID-19 omicron variant news, amid broad US dollar weakness. At press time, the story is different, with the greenback advancing 0.32%. The US Dollar Index that measures the greenback’s value against its peers sits at 96.39.

US bond yields lick their wounds in the bond market after posting heavy losses in the last week. The US T-bond 10-year benchmark note rises three basis points, sitting at 1.514%, while the US10-year Treasury Inflation-Protected Security (TIPS) rises to -1.06%, weighing on precious metals prices, like silver and gold.

In the US macroeconomic docket, Pending Home Sales for October on a monthly basis rose by 7.5%, higher than the 2.3% drop witnessed in September. On a yearly basis, for the same period, it shrank 1.4%, better than the 8% contraction in the last year.

Later the US economic docket will feature the Federal Reserve Chairman Jerome Powell, at 20:05 GMT, who could offer fresh impetus to commodity traders, amid cautious market sentiment surrounding the financial markets.

XAG/USD Price Forecast: Technical outlook

Silver in the 1-hour chart depicts the white metal has a downward bias, as the hourly simple moving averages (HSMA’s) with a downslope reside well above the spot price. At press time, it is trading below the November 26 low at $22.90, as XAG/USD sellers are pushing prices towards a daily low below the S1 pivot point at $22.75.

In the outcome of XAG/USD extending its free fall, the first support would be the S2 pivot point at $22.42, followed by the October 12 daily swing low at $22.32.

On the other hand, the psychological $23.00 would be the first resistance. A breach of the latter would expose the central daily pivot point at $23.23, followed by the 50-HSMA at $23.39.

US President Joe Biden said in a speech on Monday that, for now, lockdowns are off the table as there would be no need if people get vaccinated and wear the mask. Asked whether he expects additional travel curbs, he said none were needed for now and, asked whether this would be the new normal for the US, he said he did not think so.

Market Reaction

FX markets have not seen much of a reaction to Biden's remarks, but the statement that lockdowns are off the table, for now, could be lending some support to the equity complex, with the S&P 500 recently pushing to fresh session highs in the 4660s.

US President Joe Biden, in a White House speech to the public on the Omicron variant, said that while the variant is a cause for concern, it is not a cause for panic. Biden urged that the best protection against the vaccine is to get fully vaccinated, and, if already fully vaccinated prior to June 2021, to get the booster shot as well. Biden also asked that the American people wear masks again in indoor settings.

President Biden added that the White House is working with vaccine makers to develop a new variant-specific booster shot if it is needed. Biden said that he would announce a new plan to fight Covid-19 this coming winter that would not include lockdowns.

Asked about the travel restrictions on South Africa, Biden said the restrictions were necessary to buy Americans more time to get prepared/vaccinated, given that the Omicron variant is expected to spread around the world anyway.

Market Reaction

FX markets have not seen any reaction to Biden's comments, which did not contain much by way of any surprises.

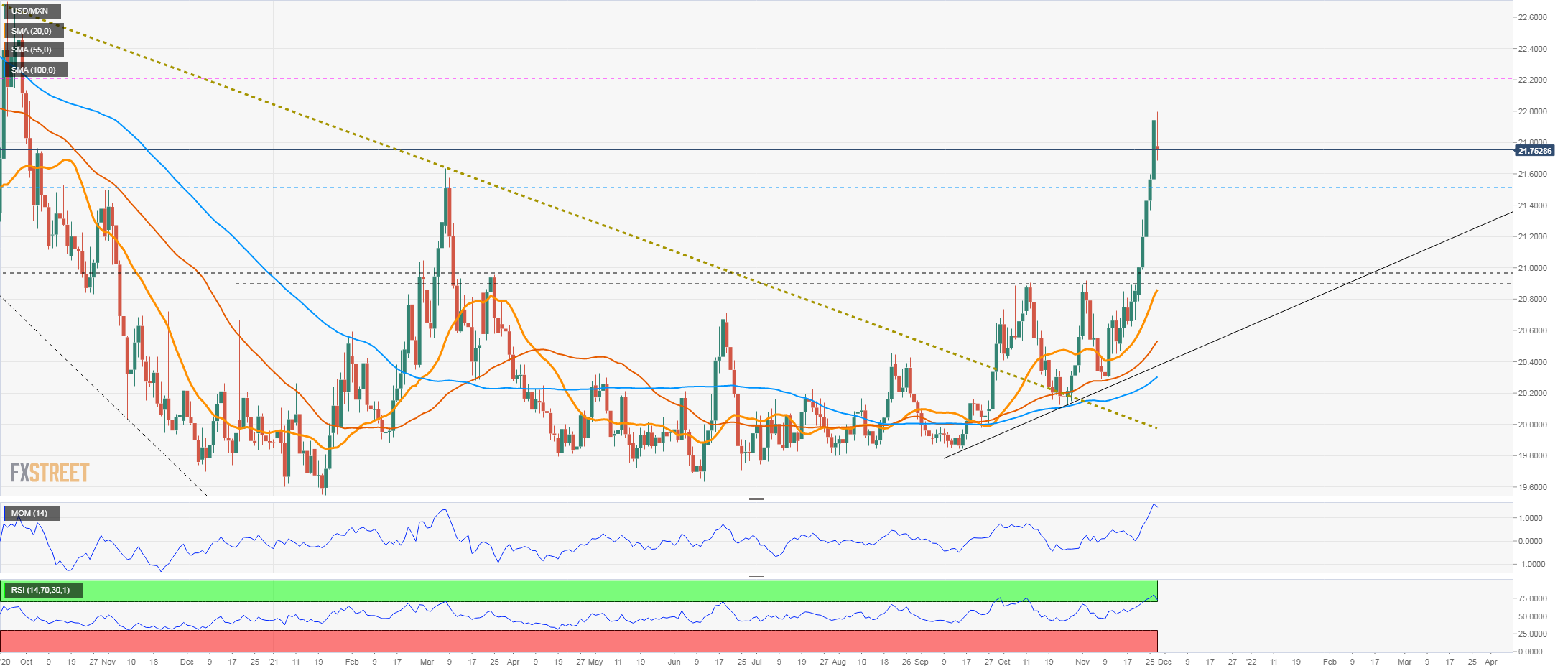

- Mexican peso flat on Monday versus US dollar after falling during seven days in a row.

- USD/MXN far from 22.00, above 21.60.

- Technical indicators turn south from overbought readings.

The USD/MXN is trading marginally lower on Monday, on what could be the end of a seven-day positive streak. Last week, the Mexican peso tumbled on domestic and international developments, with the cross reaching the highest intraday level at 22.15.

It pulled back under 22.00, finding support around 21.65. The main trend and the bias point to the upside. In the short-term technical indicators favor some consolidation ahead, as RSI and Momentum are turning south from overbought levels.

A retreat is seen finding support initially at 21.65 and below at 21.50. If price drops under 21.50, it could alleviate the bullish pressure. Below, the next strong support is located around 21.00.

On the upside, if USD/MXN rises above 21.90, it could likely rise further to test 22.00. The next medium-term resistance area is 22.20 that should hold, at least at the first attempt. A firm break higher, would clear the way to more gains, triggering more volatility.

USD/MXN daily chart

- EUR/USD has spent Monday’s session ebbing lower after losing its grip on the 1.1300 level.

- Some strategists saw Friday’s big move higher as overly excessive.

EUR/USD has spent the majority of Monday’s session gradually ebbing lower, with the pair now trading close to session lows in the 1.1260s, having opened Monday trade above 1.1300. On the day, the pair is now down close to 0.5%. The move lower is in fitting with a broader reversal of last Friday’s big moves seen across asset classes. For FX markets, that means the US dollar has been picking up, with those gains concentrated most heavily against the currencies it lost out to the most on Friday.

Recall that panic over the emergence of the highly transmissible and potentially vaccine-evading Omicron variant roiled global markets at the end of last week, triggering a combination of risk-off and an unwind of hawkish central bank bets. For USD, this meant it got battered against the euro, yen, and Swiss franc as Fed rate hike expectations for 2022 were dialed down, while the movement in rate hike expectations for the ECB, BoJ, and SNB wasn’t much changed. That’s because markets hadn’t been expecting much by way of rate hikes from these central banks anytime soon anyway!

The opposite trend is being observed for the most part on Monday, with the dollar paring back on some of its recent losses against both the euro and yen. Some FX strategists touted last Friday’s moves in FX markets and Fed rate hike expectations as overly exaggerated and some seem to have seen Friday’s dip as a dollar buying opportunity. Indeed, if the global economy is about to be rocked by a newer, nastier Covid-19 variant, then buying USD for its safe-haven purposes likely makes sense. With respect to EUR/USD then, the recent bounce may well prove to be have been a great opportunity to reload short positions.

- The USD/CHF bounced off Friday’s daily lows around 0.9210 as the new coronavirus variant worries ease.

- Friday’s flight to safe-haven assets boosted the prospects of the CHF and the JPY, leaving adrift the greenback.

- USD/CHF Daily pivot point at 0.9271, found sellers around that area, pushing the pair towards 0.9230s.

After losing more than 100 pips on last week’s Friday, the USD/CHF trims some of those losses during the New York session, trading at 0.9248, bouncing off 0.9210s daily lows at the time of writing. The market sentiment has improved, as omicron COVID-19 variant worries scale back after last Friday’s collapse in the financial markets.

Information throughout the weekend has the USD/CHF subdued. Headlines that crossed the wires on Friday about the new COVID-19 variant spurred a flight to safe-haven assets, benefitting the Japanese yen, the euro, and the Swiss franc, based on its status of low-yielders. That hurt, the greenback, in the crosses against the Yen and the Swiss franc, in the latter collapsing 130 pips in the Friday’s session.

That said, initial reports from South African doctors suggest the variant is associated with milder symptoms than other COVID-19 variants though it appears to be more transmissible. However, Monday’s price action seems to reflect that investors are cautious, awaiting more clarity regarding the omicron’s ability to evade vaccine-induced immunity and the severity of its illness.

Hence, in the near term, as most of the financial assets as of today, USD/CHF traders would lean in pure risk-market sentiment and central bank speakers, leaving on the side macroeconomic data as investors assess the impact of the new variant.

USD/CHF Price Forecast: Technical outlook

The USD/CHF 1-hour chart depicts the pair’s downward bias in the near term, as the hourly simple moving averages (HSMA’s) reside well above the spot price, with a downslope, and will act as dynamic resistance levels. Despite the USD/CHF pair advancing at press time, it found strong resistance at the daily central pivot point at 0.9271, previously tested early in the European session.

In the outcome of extending last Friday’s decline, the first support would be the November 26 low at 0.9213. A breach of the latter would expose the 100-day moving average at 0.9195, followed by the S1 daily pivot at 0.9184.

On the flip side, if USD/CHF bulls break above the daily pivot, that would expose the 50-HSMA at 0.9282, followed by the 100-HSMA 0.9298.

-637737981840030589.png)

- Pound fails to hold above 1.3300 versus US dollar.

- Market sentiment deteriorates during the American session.

- GBP/USD heads for lowest daily close since December 2020.

The GBP/USD turned to the downside after hitting a daily high at 1.3363 and dropped to 1.3295, reaching a fresh daily low. It then bounced back above 1.3300 but remains under pressure.

The US dollar gained momentum during the American session as the recovery in equity markets lost strength. Main stock indices in Wall Street remain in sportive territory but far from the highs. The Dow Jones gains just 0.10%.

Treasury yields are pulling back from daily highs as market sentiment deteriorates. The slide in US yields could limit the advance of the US dollar versus major European currencies. The 10-year yield fell from 1.56% to 1.52% during the last hour. Still, GBP/USD is headed toward the lowest daily close in almost a year.

Short-term outlook

A daily close below 1.3300 suggests more losses ahead for the pound in line with the dominant trend. The next support stands at 1.3270. The negative tone remains intact after cable was unable to hold above 1.3350.

If GBP/USD manages to rise back above 1.3350 and posts a daily close clearly above 1.3370, it would alleviate the bearish pressure. The next resistance stands at 1.3390 followed by 1.3415.

Technical levels

- The S&P 500 is enjoying a relief rally on Monday, recovered from under 4600 to around 4630.

- Omicron remains the main market theme and Biden is to deliver a speech on the new variant at 1645GMT.

US equity markets are enjoying a relief rally this Monday, with the S&P 500 index higher by around 0.9%. The index dropped 2.3% on Friday to close under 4600 amid fears that the newly discovered Omicron Covid-19 variant would trigger travel restrictions and global lockdowns, hurting the outlook for global growth. That was the first sub-4600 close so far in November. The index has since reclaimed the 4600 level and currently trades around 4630.

But analysts said the decline was exacerbated given thin liquidity conditions due to the Thanksgiving holidays in the US, and some said the move lower was overdone. Thus, some dip-buying appetite has returned to the market, with investors hoping to clinch a good Black Friday deal. Preliminary reports in South Africa from doctors treating Omicron infected patients indicate the variant might be milder than older variants, which could also be helping risk appetite. But the latest numbers from the Gauteng province in South Africa showed a sharp jump in the number of hospitalised patients.

Given that the new variant is touted as being significantly more transmissible than the delta variant, if it does start to look as though it causes a severe disease, then risk-off may return to markets. US President Joe Biden will deliver a speech on the Omicron variant at 1645GMT, the White House announced earlier in the session.

Despite a rise in US government bond yields, which were also paring back on last Friday’s losses, the duration-sensitive US tech sector led the recovery in US equity markets on Monday, with the Nasdaq 100 gaining 1.5%. A more than 10% surge in Twitter’s share price on the news that CEO Jack Dorsey is expected to step down helped the sector.

- The market sentiment has moderately improved, as it seems the omicron variant symptoms tend to be mild, per South African health authorities.

- The US Dollar Index gains some traction as investors weigh the impact of the new variant.

- USD/CAD in the near term has an upward bias, would find resistance around 1.2800.

On Monday, in the Asian session, the USD/CAD edged lower as COVID-19 worries about the omicron variant scale back a touch after South African health authorities reported that symptoms tend to be mild to moderate, but it appears to be more transmissible. During the New York session, the USD/CAD recovers some earlier day losses, climbing up to 1.2757 at the time of writing.

Global equity indices rise as concerns about the COVID-19 omicron variant ease

The market sentiment is upbeat, as European equity indices trim some of last week’s Friday losses amid thin liquidity conditions, which exacerbated fluctuation across all the financial assets. The US Dollar Index, which retracted all the way nearby 96.00, advances 0.28%, sitting at 96.36. Also, the US 10-year Treasury yield spike seven basis points, up to 1.557%, as market sentiment improves, though the investors are still cautious awaiting more information regarding the omicron variant.

In the meantime, the US crude oil benchmark, Western Texas Intermediate (WTI), which has a strong correlation with the Canadian dollar, is trading at $72.00, nearly 50% of Friday’s decline, caused by COVID-19 worries.

The USD/CAD price action in the overnight session witnessed a dip towards the 1.2715 area, but the pair remains subdued as investors weigh on the severity of the illness that the COVID-19 omicron variant could cause.

That said, market participants focus would lean towards risk appetite. However, macroeconomic data and central bank speakers could move the needle on the USD/CAD pair.

On Monday, the Canadian docket featured the Current Account for the Q3, which increased by 1.37B, lower than the 1.9B expected. On the US front, Pending Home Sales for October on a monthly basis is expected to rise by 1%, which would be revealed at 15:00 GMT.

Turning to central bank speaking, the Bank of Canada Governor Macklem would cross the wires around 19:00 GMT, whereas Fed Chairman Jerome Powell would do it at 20:05 GMT.

USD/CAD Price Forecast: Technical outlook

In the 1-hour chart, the pair is consolidating around the 1.2715-60 range, above the hourly simple moving averages (HSMA’s), indicating the USD/CAD has an upward bias. A break above the 1.2760 range top would expose the November 26 high at 1.2798, 2 pips short of the 1.2800 figure. A breach of the latter would expose the R1 daily pivot point at 1.2842, followed by the R2 daily pivot at 1.2896.

On the other hand, the daily pivot point at 1.2743 is the first support, followed by the 50 and the 100-HSMA’s at 1.2726 and 1.2701, respectively.

Pending Home Sales in the US jumped by 7.5% on a monthly basis in October following September's 2.3% drop, data published by the US National Association of Realtors showed on Monday. That saw the Pending Home Sales index jump to 125.2 in October from 116.5 in September.

On a YoY basis, sales were down 1.4% in October, given the Pending Home Sales index in October 2020 scored 127.0.

Market Reaction

The US dollar has not reacted to the latest US housing numbers. The DXY continues to nudge higher as traders continue to unwind last Friday's steep drop. At present, the index is trading just under 96.40.

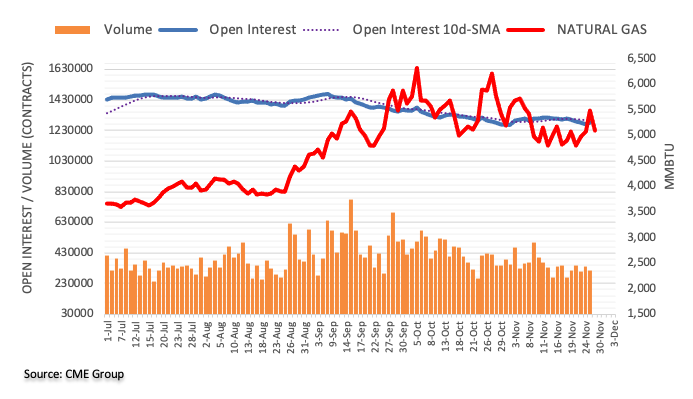

- WTI continues to press higher and is now about $72.00, and has nearly unwound 50% of Friday’s drop.

- Analysts saw last Friday’s Omicron variant fear triggered sell-off as overdone.

Oil prices continue to press higher, with front-month WTI futures now up more than $4.0 on the day and back in the $72.00s, meaning nearly 50% of Friday’s steep decline on Omicron variant concerns has now been unwound. To get above the 50% Fibonacci retracement of Friday’s slump, oil prices would need to remain the $73.00 level, which might be a bit of a stretch given how far prices have already come on the day. Beyond $73.00 to the upside, there is resistance around $75.00, while the 200-day moving average at $70.00 might offer decent support.

Oil prices surged at the Monday reopen of trade, with many market participants of the view that last Friday’s drop was overdone and exacerbated by thin liquidity conditions at the time due to the Thanksgiving holidays in the US. The latest global developments in response to Omicron (international travel bans) do justify a short-term drop in oil prices owing to expected lower jet fuel demand. But analysts reasoned that not enough is yet known about the new variant (like its vaccine resistance, transmissibility, associated severity of illness) to project a significant long-term hit to global oil demand.

That seemed to be the view of energy/oil officials from Saudi Arabia and Russia. The energy minister of the former was quoted on Monday saying he was not worried about the Omicron variant, while the Russian oil minister said he didn’t yet see the need for urgent action. The OPEC+ Joint Technical Committee will meet on Wednesday, followed by OPEC+ oil ministers (when output policy will be decided upon) on Thursday. Elsewhere this week, US inventory numbers will be watched as usual on Tuesday and Wednesday, while talks between JCPOA signatories (Iran, EU nations and the US) will restart discussions on returning to the 2015 nuclear deal. Strategists are not particularly hopeful that a deal that would allow Iranian oil exports to return to global markets will be struck.

- EUR/JPY bottomed out near 127.50 on Monday.

- The dollar regains ground and puts the cross under pressure.

- Fed’s Chair J.Powell speaks later in the NA session.

The recovery in the greenback keeps the euro under pressure and dragged EUR/JPY to fresh 9-month lows near 127.50 at the beginning of the week.

EUR/JPY struggles for direction, looks to risk trends

EUR/JPY attempts to leave behind three consecutive daily pullbacks amidst the rebound in the sentiment surrounding the greenback, higher US yields and rising cautiousness around the progress of the omicron variant.

Indeed, the US dollar regains the upside momentum and leaves behind part of Friday’s strong retracement, always helped by the pick-up in yields and the soft stance in the risk complex.

Earlier in the docket, the German flash inflation figures showed the CPI is seen contracting at a monthly 0.2% and rising 5.2% from a year earlier. In addition, the final Consumer Confidence in the euro area came in at -6.8 in November, matching the preliminary reading.

Across the Atlantic, Pending Home Sales and speeches by Powell, Clarida, Williams and Bowman should keep investors entertained later in the NA session.

EUR/JPY relevant levels

So far, the cross is gaining 0.02% at 128.27 and a surpass of 129.59 (weekly high Nov.23) would expose 130.01 (100-day SMA) and then 130.54 (200-day SMA). On the downside, the next support comes at 127.48 (monthly low Nov.29) followed by 126.00 (round level) and finally 125.08 (2021 low Jan.18).

EUR/USD is underperforming its major peers on Monday as selling emerges above 1.13. Economists at Scotiabank expect the world’s most popular currency pair to continue losing bullish momentum.

Imposition of new limits to contain new covid variant are likely

“The Eurozone, and the EUR, remain at risk of a tightening of restrictions in the coming weeks as contagions surge – even prior to the arrival of the new more contagious variant.”

“The longer-run EUR picture remains negative and the currency’s failure to hold above 1.13 is an initial suggestion that the EUR downtrend will resume in the days ahead.”

“Support is the overnight low of 1.1260 (the mid-figure zone more broadly) followed by 1.1230 and then the figure area. Resistance is 1.1300/10 and the Friday high of 1.1331.”

“We maintain a bearish view on the EUR toward the 1.10/1.11 zone amid very dovish ECB settings and elevated odds of widespread lockdowns in the continent.”

Economist at UOB Group Ho Woei Chen, CFA, reviews the latest monetary policy meeting by the Bank of Korea (BoK).

Key Quotes

“As widely expected, the Bank of Korea (BOK) raised its benchmark base rate by 25 bps to 1.00% on Thursday (25 Nov). This is the second rate increase following an earlier move in August, driven by concerns over financial imbalances and higher inflation. However, the rate decision was not unanimous with one member (out of seven) voting to hold interest rate.”

“Having hiked rates twice, Governor Lee Ju-yeol cited uncertainty over the next move but will not rule out another hike in 1Q22. The timing continues to be dependent on domestic economic conditions while Fed’s normalisation trajectory would also be a factor. But by not committing to a timeline, the rate hike in November is seen as a dovish one.”

“The benchmark rate is still below the neutral level. Barring a downturn in its economy, we continue to project the next BOK rate hike in 1Q22 that would have unwound the total 75 bps rate cut due to the COVID-19 pandemic. Further out, elevated inflation from demand recovery, higher raw material costs and wage growth may pressure the BOK to bring the base rate above 1.25%, the level before the pandemic.”

USD/RUB so far shot up to 75.92 below which it is likely to short-term stall, according to Axel Rudolph, Senior FICC Technical Analyst at Commerzbank. A rise above it would target 78.04.

Upside pressure while above November low at 70.52

“USD/RUB has overshot the July peak at 75.36 and so far risen to its current November high at 75.92 below which it is expected to short-term stabilize. If it were to be exceeded, we would target the next higher April peak at 78.04.”

“Minor support comes in along the breached resistance line and 200-day moving average at 73.64/57. Further support sits between the 55-day moving average and the September low at 72.26/22 as well as between the two-month support line and June low at 72.05/71.55.”

“While the current November low at 70.52 underpins, overall upside pressure should be maintained. Only if it were to unexpectedly be slipped through, would the October trough at 69.22 be back in the frame.”

- USD/JPY staged a modest recovery from a near three-week low touched earlier this Monday.

- The risk-on impulse undermined the safe-haven JPY and remained supportive of the move.

- Rebounding US bond yields revived the USD demand and further provided a boost to the pair.

The USD/JPY pair reversed an intraday dip to a near three-week low and was last seen hovering near the top end of its daily trading range, around the 113.75-80 region.

Following a modest bullish gap opening, the USD/JPY pair witnessed some selling and dropped to sub-113.00 levels during the early part of the trading activity on the first day of a new week. However, a combination of factors assisted the pair to attract some buying at lower levels and recover a part of Friday's heavy losses.

Investors considered that Friday's reaction in the financial markets to the discovery of the omicron coronavirus variant was overdone. This, in turn, led to a positive turnaround in the global risk sentiment, which undermined the safe-haven Japanese yen and was seen as a key factor that acted as a tailwind for the USD/JPY pair.

Bulls further took cues from rebounding US Treasury bond yields, which helped revive the US dollar demand and further extended some support to the USD/JPY pair. That said, worries about the potential economic fallout from the new vaccine-resistant coronavirus variant might hold back traders from placing aggressive bullish bets.

Moreover, the latest development surrounding the coronavirus saga might have forced investors to scale back their expectations for an early policy tightening by the Fed. This might keep a lid on any runaway rally for the greenback and collaborate to cap the USD/JPY pair, further warranting some caution for bullish.

Next on tap will be the release of the US Pending Home Sales data, which might do little to provide any meaningful impetus. That said, traders might take cues from the broader market risk sentiment. This, along with the US bond yields, might influence the USD price dynamics and provide some impetus to the USD/JPY pair.

Technical levels to watch

The S&P 500 has now completed a bearish “reversal week”. Anlaysts at Credit Suisse continue to look for a deeper setback to 4568/66 objective and potentially the 63-day average at 4524/20, which is set to hold.

Initial resistance moves to 4623

“Whilst we treat this ‘reversal week’ with a little caution given the US Thanksgiving holiday last week, we still maintain our call from the beginning of last week for a deeper correction lower. We thus stay bearish for our 4568/66 objective – the 38.2% retracement of the October/November rally.”

“Whilst we continue to look for the 4568/66 area to hold at first, we would still not rule out a test of the key 63-day average at 4524/20, which we look to prove a solid floor again. A weekly close below 4520 though would warn of a more serious correction lower with support seen next at 4448/38.”

“Resistance moves to 4623 initially, with the immediate risk seen lower whilst below 4665. Back above 4701/03 though is needed to suggest the worst of the setback is over and core uptrend resumed.”

- NZD/USD continues to trade heavily on Monday and is probing annual lows and support just above 0.6800.

- The pair remains vulnerable to an unwind of hawkish RBNZ bets.

Earlier attempts at recovery following last week’s intense selling pressure have faded, with NZD/USD dropping back towards 0.6800 having topped out just under 0.6840 earlier in Friday’s European morning. The pair, which is now down about 0.2% on the day, is probing last week’s annual lows around 0.6805 as the pair threatens a more convincing break below the 0.6800 level. A break below this level could usher in an acceleration of (technical) selling that could propel the pair lower towards the next area of significant support under 0.6600.

To recap recent price action; NZD/USD dropped more than 2.5% last week, its worst week since August when a snap lockdown caused the RBNZ to delay its first post-Covid-19 rate hike. The downside was initially triggered by a broad strengthening of the US dollar as momentum built behind the idea that, amid high inflation and a continued strong recovery, the Fed would quicken its QE taper and bring forward rate hikes. NZD was then a victim of its status as a risk/commodity-sensitive currency, as well as its exposure to hawkish central bank bets (given the RBNZ’s stance as one of the most hawkish G10 central banks) when markets tumbled on Friday. News about the Omicron Covid-19 variants high degree of mutations (vaccine resistant?) and high transmissibility triggered risk-off and a paring back on hawkish central bank bets, a negative combination of the kiwi.

This Monday, despite the broader market mood having improved a tad on hopeful early signs out of South Africa that the illness caused by Omicron infection is milder than with other strains of the virus, NZD continues to struggle. That could be due to dovish commentary from RBNZ Chief Economist Yuong Ha, who said that the bank might pause its rate hike plans should Omicron be a “game-changer”. As fears linger about the severity of the new variant, this is likely to weigh disproportionately on the kiwi, given its disproportionate exposure to an unwind in hawkish central bank bets (the build-up of which previously support the kiwi).

- EUR/GBP witnessed fresh selling on Monday and reversed a part of Friday’s strong gains.

- A combination of factors undermined the euro and exerted some pressure on the cross.

- Brexit-related uncertainties acted as a headwind for the GBP and helped limit the losses.

The EUR/GBP cross remained depressed, around the 0.8460-65 region through the mid-European session and had a rather muted reaction to the German consumer inflation figures.

Having struggled to reclaim the key 0.8500 psychological mark, the EUR/GBP cross opened with a bearish gap on the first day of a new week and eroded a part of Friday's strong gains to a near two-week high. The intraday move up quickly ran out of steam near the 0.8485 region amid the emergence of fresh selling around the shared currency.

Views that Friday's market reaction to the discovery of the omicron coronavirus variant was overdone led to a positive turnaround in the risk sentiment and drove flows away from funding currencies, including the euro. Apart from this, rebounding US Treasury bond yields revived the US dollar demand and further undermined the common currency.

On the other hand, expectations for an imminent interest rate hike by the Bank of England in December further contributed to the British pound's relative outperformance against its European counterpart. That said, persistent Brexit-related uncertainties acted as a headwind for the sterling and helped limit the downside for the EUR/GBP cross.

On the economic data front, hotter-than-expected German CPI print did little to influence the euro or provide any impetus to the EUR/GBP cross. In fact, the Harmonized Index of Consumer Prices (HICP) accelerated to a 6.0% YoY rate in November, surpassing consensus estimates pointing to a rise to 5.4% from the 4.6% reported in October.

Meanwhile, the lack of a strong follow-through selling warrants some caution before confirming that the recent recovery from the 0.8380 support zone, or the lowest level since February 2020 has run out of steam. That said, the EUR/GBP pair's inability to capitalize on Friday's strong move up should hold back bullish traders from placing aggressive bets.

Technical levels to watch

AUD/USD is so far holding major support at the 0.7106 low. Nevertheless, economists at Credit Suisse stay biased towards a closing breakdown to confirm a major long-term top.

AUD/USD is very close to confirming a major top below 0.7106

“Weekly MACD has seen a confirmed negative cross, which further exacerbates the downside risks and we are now very confident that the market is in the process of forming a much larger long-term top, which would be confirmed by a weekly close below the 2021 low at 0.7106.”

“A weekly close below 0.7106 would turn the long-term risks lower and suggest that aggressive further weakness is likely, with the next supports seen at 0.7053/48, which is the 38.2% retracement of the 2020/21 rise, then 0.6991.”

“The size of the top suggests a move to 0.6758 is easily achievable over the medium-term.”

“Near-term resistance moves lower to 0.7145/50, then 0.7200/10, with more important resistance staying at 0.7268/74, which should hold into the close to maintain a high degree of confidence in the breakdown.”

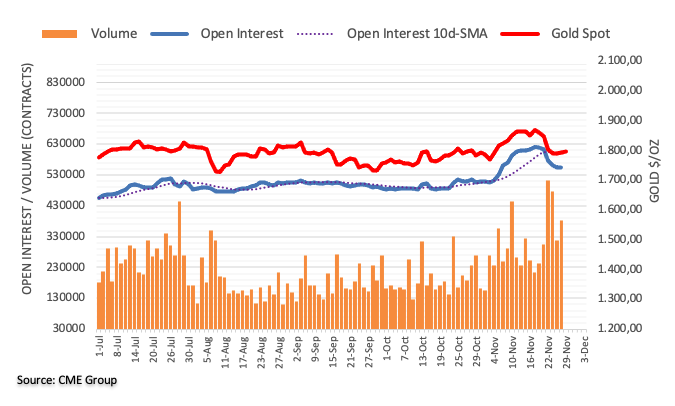

- Spot gold is stable on Monday close to its 50DMA near $1790.

- Gold traders await further information on Omicron, as well as Fed speak and US data this week.

Spot gold (XAU/USD) prices continue to stabilise close to the 50-day moving average, which currently resides just above $1790 and are broadly flat on the day, despite a modest pick up in the US dollar and US real yields. The pair has seen choppy trade since last Friday, in tandem with a pick-up in cross-asset volatility given worries about the newly discovered Covid-19 variant (Omicron) in South Africa. It swung as high as the $1815.00s last Friday as the US dollar and US yields dived as Omicron fears saw markets pull back on hawkish Fed bets, but then lost momentum and quickly pulled back under $1800 again. Shortly after the reopening of trade on Monday, it slid as low as $1770, but has since recovered.

Recent trade is indicative that market participants are in two minds about whether gold is an appropriate hedge against Omicron risk. Firstly, if the variant does prove a big problem to the global economic recovery, that likely means central banks remain more dovish than they otherwise would, which would be good for gold. Moreover, is global travel and lockdown restrictions to impact supply chains, inflationary pressures could remain at elevated levels for longer, increasing the precious metal’s appeal as an inflation hedge. But there is a lot of uncertainty about how bad this new variant actually is going to be, with initial reports from South African doctors suggesting the variant is associated with milder symptoms than other Covid-19 variants.

Markets need more clarity on Omicron; its ability to evade vaccine-induced immunity, its severity, its transmissibility etc. The picture should be clearer in a few weeks. Otherwise, gold traders will be on notice for a barrage of Fed speak and US data this week to gauge how the Fed feels about recent pandemic developments and whether underlying US economic momentum remains strong. Atlanta Fed President Raphael Bostic over the weekend did say that Omicron was a risk, but also that he could support a faster QE taper and more than one rate hike in 2022. Perhaps other Fed members will this week also play down Omicron risks. That might suggest the recent pullback in hawkish Fed bets may have been an over-reaction. That could mean higher short-end and real yields, which would be bad for gold.

The annual Harmonized Index of Consumer Prices (HICP), the European Central Bank's preferred gauge of inflation, rose to 6.0% from 4.6% in October, compared to analysts' estimate of 5.4%. MoM, the HICP was up 0.3%, above consensus expectations for a 0.5% drop.

Looking at the alternate Consumer Price Index numbers; the YoY number came in at 5.2%, above expectations for 5.0%, while the MoM change was -0.2%, above expectations for a larger 0.5% drop.

Market Reaction

The euro has not seen a reaction to the latest German inflation numbers, given that the state figures had been trickling out throughout the morning and did point to an upside surprise. But the hotter than expected German inflation numbers put pressure on the ECB not to be overly dovish and seem to support the consensus view that the PEPP should definitely end in March 2022.

- AUD/USD staged a goodish rebound from the 0.7100 neighbourhood, or over a three-month low.

- The risk-on impulse turned out to be a key factor that benefitted the perceived riskier aussie.

- A strong pickup in the US bond yields revived the USD demand and capped gains for the major.

The AUD/USD pair held on to its modest intraday gains heading into the North American session, albeit seemed struggling to capitalize on the move beyond mid-0.7100s.