- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-11-2021

- EUR/USD bears take a breather after refreshing multi-day low.

- Clear break of the key Fibonacci retracement support hints at further downside.

- Late June 2020 low offers immediate support ahead of 78.6% Fibonacci retracement level.

- 1.1500, 200-week SMA adds to the upside filters.

EUR/USD picks up bids to refresh intraday high around 1.1215 during the initial Asian session on Friday. The major currency pair dropped to the fresh low since July 2020 before consolidating on Thursday.

The corrective pullback, however, remains below the 61.8% Fibonacci retracement (Fibo.) of March 2020 to January 2021 upside, which in turn suggests the pair’s further declines.

In addition to the stated key Fibonacci retracement level around 1.1295, a convergence of the 50% Fibo. and March 2020 high near 1.1500, as well as the 200-week SMA level of 1.1552, also challenge the EUR/USD buyers.

On the contrary, lows marked during the late June 2020, surrounding 1.1170, question the sellers before the re-entry.

Following that the 1.1100 round figure may act as a buffer during the south-run towards 78.6% Fibonacci retracement near 1.1000 round figure.

To sum up, EUR/USD bears keep reins until witnessing a weekly closing beyond 1.1552.

EUR/USD: Weekly chart

Trend: Bearish

Retail Sales overview

Early Friday, the market sees preliminary readings of the Australia Retail Sales for October month at 00:30 GMT. Market consensus suggests an upbeat MoM print of +2.5% versus +1.3% prior readings, suggesting the sustained improvement in economic activity after positing the first positive figure in the last four months during September.

Given the recently strong inflation data crossing roads with the Aussie jobs report, not to forget the Reserve Bank of Australia’s (RBA) cautious optimism, today’s Retail Sales figures become all the more important for AUD/USD traders.

Ahead of the data, TD Securities said,

We expect retail sales to extend its turnaround in Oct, rising by 2.2% m/m (cons: 2.2%). The reopening in NSW should give a strong boost to spending but we are cautious on extrapolating overall strength as Vic's restrictions only began to ease towards month-end. Nonetheless, we are optimistic on the consumer spending outlook over the next couple of months as year-end celebrations are likely to boost sales while further easing of restrictions and opening of international borders could give another leg up to spending domestically.

How could it affect AUD/USD?

AUD/USD remains on the back foot around a three-month low amid a quiet Asian session ahead of the key data. While an off in the US and a light calendar challenges momentum traders, the RBA v/s Fed battle keeps the Aussie pair sellers hopeful. Also weighing on the quote could be the recent coronavirus woes and the Sino-American tussles.

The Reserve Bank of Australia’s (RBA) intent to wait for further details before announcing rate hike plans will join the Aussie data disappointment and fresh covid fears to weigh on the quote should the Retail Sales reverse the previous month’s expansion. However, the recent unlocks in Australia tame fears of any such downbeat figures. Hence, a corrective pullback can be witnessed if the scheduled figure arrive as better than expected.

Technically, a sustained trading below a three-month-old support line, now resistance around 0.7260, joins downbeat MACD signals and a bear cross of the 20-DMA to 100-DMA to keep AUD/USD sellers hopeful.

Key Notes

AUD/USD bears head towards Oct daily lows

AUD/USD Forecast: Lower lows hint at a new leg south towards yearly lows

About Australian Retail Sales

The Retail Sales released by the Australian Bureau of Statistics is a survey of goods sold by retailers is based on a sampling of retail stores of different types and sizes and it''s considered as an indicator of the pace of the Australian economy. It shows the performance of the retail sector over the short and mid-term. Positive economic growth anticipates bullish trends for the AUD, while a low reading is seen as negative or bearish.

- GBP/USD struggles to overcome the 2021 bottom, stays inside bearish chart pattern.

- MACD conditions hint at seller’s exhaustion but bulls need validation from 50-SMA, falling resistance line from November 09.

- 61.8% FE guards immediate downside amid oversold RSI conditions.

GBP/USD defends the 1.3300 threshold, taking rounds to the recently flashed yearly low during the early Asian session on Friday. In doing so, the cable stays inside a one-week-old falling trend channel.

Although the bearish channel keeps sellers hopeful, MACD and RSI conditions signal a corrective pullback targeting the channel’s upper line near 1.3340.

It’s worth noting that the quote’s upside momentum past 1.3340 need not only cross the 50-SMA level of 1.3415 but a 13-day-old falling trend line near 1.3435 to recall the GBP/USD buyers.

Following that, a run-up to the mid-November’s swing high close to 1.3515 can’t be ruled out.

Alternatively, 61.8% Fibonacci Expansion (FE) of the pair’s moves between November 03 and 18, around 1.3300 offers strong immediate support to the GBP/USD prices.

Even if the sellers manage to conquer the psychological magnet, the stated channel’s lower line may act as an extra filter to the south, around 1.3275, before directing the quote towards the 78.6% FE level of 1.3240.

GBP/USD: Four-hour chart

Trend: Corrective pullback expected

- EUR/JPY is range-bound as the Asian session begins, within the 129.20-52 range.

- EUR/JPY has a downward bias, but a daily close below Thursday’s low at 129.19 would expose the 128.00 figure.

The EUR/JPY is flat as the Asian Pacific session begins, is trading at 129.19 during the day at the time of writing. On Thursday, during the overnight session, the EUR/JPY remained in a choppy trading range, within the 129.20-52 range, as the market is headed towards a thin liquidity session In the observance of the US Thanksgiving.

At press time, the market sentiment is a mixed bag. Asian equity futures fluctuate between gainers and losers, while European and US stock futures rise.

The Japanese economic docket featured the Coincident Index and the Leading Economic Index, both readings for September. The Coincident Index rose to 88.7, higher than the 87.5 foreseen, while the Leading Economic Index increased to 100.9, higher than 99.7, estimations.

Concerning the Eurozone economic docket, the Gfk Consumer Confidence Survey for December contracted more than the foreseen, dropping to 1.6, lower than the 0.5. In the meantime, the German Gross Domestic Product for the Q3 rose by 1.7%, a tick lower than the 1.8% estimated.

That said, the EUR/JPY pair would lean on market sentiment, as long as the monetary policy between the European Central Bank (ECB) and the Bank of Japan (BoJ) converges. On the other hand, if the ECB moves towards a more neutral stance, the EUR would be favored by flows, as it would be viewed as a hawkish signal for investors.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY pair has a bearish bias, confirmed by the daily moving averages (DMA’s), which have a downslope, and remain above the spot price. Furthermore, the Relative Strength Index (RSI) at 40 flattish suggests EUR/JPY bears are taking a breather, before resuming the downtrend.

In that outcome, the first demand area would be the November 24 cycle low at 128.68, followed by the October 6 swing low at 128.33, and then the November 19 low at 127.97.

- NZD/USD licks its wounds around lowest levels since August, eyes biggest weekly loss in three months.

- Post-RBNZ disappointment spreads amid light calendar, US holiday.

- RBNZ’s Hawksby sounds cautiously optimistic, ANZ – Roy Morgan Consumer Confidence eased for November,

- No major data/events in sight, Aussie Retail Sales may entertain traders.

NZD/USD sellers take a breather following the south-run to smash September’s bottom and test the lowest levels in three months. That said, the Kiwi pair stays sidelined around 0.6860 by the press time of early Friday morning in Asia.

The US Thanksgiving Day holiday offered no respite to the NZD/USD prices as the quote dropped for the fifth consecutive day on its way to register the biggest weekly fall since mid-August.

While tracing the catalysts, the fresh covid concerns and the market’s dislike for the Reserve Bank of New Zealand’s (RBNZ) 0.25% rate hike could be linked. Also on the negative side were hawkish statements from the Fed officials and Fed Minutes, before the US markets closed for the holiday.

Recently, RBNZ Assistant Governor Christian Hawkesby crossed wires via an interview with Bloomberg TV and tried to defend the tighter monetary policy despite citing downside risk from covid.

Read: RBNZ's Hawkesby: We need to continue removing stimulus

It’s worth noting that the Sino-American tussles slowly escalates following the virtual meeting between US President Joe Biden and his Chinese counterpart Xi Jinping. While China’s inability to perform the phase one deal terms sparked initial fears of another round of the US-China tussles, issues relating to Vietnam and Taiwan recently added fuel to the fire. The US invites Taiwan to one of its home events and keeps its warships moving in the troubled water surrounding the Asian nation, which in turn hints at political jitters with Beijing. Given China’s close trade proximity to New Zealand, as well as the status of the world’s largest commodity user, such events challenge the Antipodeans.

Additionally, the recent jump in the covid numbers in Europe and a steady rise in infections in the UK signals the returns of the pandemic and renews fears of lockdowns that crippled the global economy a few months back.

Amid these plays, Gilts and Bunds were mildly offered while the stocks in Europe and the UK printed softer gains amid a sluggish day. However, gold remained mostly unchanged and the NZD/USD kept declining.

Looking forward, a light calendar may not entertain the momentum traders but the return of the US traders and Aussie Retail Sales will be important for the NZD/USD. Above all, the RBNZ-led disappointment may weigh on the quote while covid woes, US-China tension and fears of the Fed action can exert additional downside pressure on the pair.

Technical analysis

Having conquered a 14-month-old support line, NZD/USD bears smashed 61.8% Fibonacci retracement (Fibo.) of September 2020 to February 2021 upside, which in turn suggests the quote’s further weakness towards the yearly bottom of 0.6805. Alternatively, 61.8% Fibonacci retracement level of 0.6875 and the previous support line near 0.6900 guards short-term NZD/USD upside.

“New Zealand's economy is quite resilient,” said RBNZ Assistant Governor Christian Hawkesby during an interview with the Bloomberg TV amid early Friday morning In Asia.

More to come..

- AUD/USD bears intent on the Oct lows on a strong USD theme.

- RBA and the Fed are a focus for this pair with a hawkish bias towards the latter.

AUD/USD is flat on the day in quiet Thanksgiving market conditions, although that did not prevent the pair from sliding deeper towards the daily 0.7191 lows printed back in October. The price fell from a high of 0.7209 to a low of 0.7179 on the day. The majority of the supply happening in the London open with lows made in the New York open from where the pair has drifted sideways ever since.

The greenback edged lower on the day. It was drifting from its highest level since July 2020 that was printed against the euro, despite the covid concerns in Europe and the expectations that the US Federal Reserve will raise rates sooner than other major central banks. The DXY index, a measure of the US dollar vs a basket of rival major currency pairs fell to 96.652 from a high of 96.806 on the day and 96.887 the cycle high post-FOMC minutes.

The minutes from the Fed's Nov. 2-3 meeting boosted the dollar as it was confirmed that the Fed had become more concerned about rising inflation. Various policymakers said they would be open to speeding-up the taper of their bond-buying programme, including Fed's Mary Daly who now also advocates for a faster pace.

Meanwhile, with the central banks in focus, the Reserve Bank of Australia's tightening could be elongated, analysts at ANZ Bank argued

''RBA Governor Phillip Lowe’s recent statements about the level of the neutral rate and the flatness of the Phillips curve could combine to imply a faster and more aggressive start to the tightening cycle when it eventually comes. If the RBA goes on slowly regardless of what it ‘should’ do, we may find that the tightening cycle is very elongated.''

- AUD/JPY slides for the second day in a row, despite risk-on market sentiment.

- On Thursday, the AUD/JPY remained subdued, without clear direction.

The AUD/JPY falls during the day, down some 0.15%, trading at 82.93 during the day at the time of writing. Despite thin liquidity conditions, the market sentiment remains upbeat as the US Markets remain closed in the observance of Thanksgiving. Major US equity futures indices rise between 0.11% and 0.23%, carrying on with the market mood witnessed in the European session.

On Thursday, during the overnight session, the AUD/JPY pair remained dull, trading in a choppy range, with the 50, the 100, and the 200-hour simple moving average (HSMA) are located within the 82.90-83.17 area, implying that in the near-term the AUD/JPY is range-bound.

That said, the AUD/JPY in the near term would lie mostly in pure market sentiment unless the Reserve Bank of Australia (RBA), which has been more dovish than expected, changes its dovish posture towards a hawkish one. That would originate flows towards the Australian dollar without considering as much the market sentiment.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY has an upward bias, despite the ongoing correction, that has witnessed a test of the 50-day moving average (DMA), which was pierced on Wednesday but regained by AUD bulls on Thursday. At press time, the 50-DMA sits at 82.98, a level that would need to be reclaimed by AUD bulls.

The outcome of a daily close above 83.00 could pave the way for further upside. The first resistance for AUD/JPY traders to overcome would be the November 19 swing high at 83.35, followed by the November 16 cycle high at 84.15.

On the other hand, failure to reclaim 83.00 would open the door towards the 100-DMA at 81.85, though it would find some hurdles on the way down, like the November 19 swing low at 82.15.

-637734710899580898.png)

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Retail Sales, M/M | October | 1.3% | 2.5% |

| 07:45 (GMT) | France | Consumer confidence | November | 99 | 98 |

| 08:00 (GMT) | Switzerland | Gross Domestic Product (YoY) | Quarter III | 7.7% | 3.2% |

| 08:00 (GMT) | Switzerland | Gross Domestic Product (QoQ) | Quarter III | 1.8% | 2% |

| 08:00 (GMT) | Eurozone | ECB President Lagarde Speaks | |||

| 09:00 (GMT) | Eurozone | Private Loans, Y/Y | October | 4.1% | |

| 09:00 (GMT) | Eurozone | M3 money supply, adjusted y/y | October | 7.4% | 7.4% |

What you need to know on Friday, November 26:

Little happened on Thursday, as US markets were closed due to the Thanksgiving holiday. Markets will work shortened hours on Friday, and muted trading is expected to continue. The bullish dollar's momentum took a breather, but the American currency maintained its leadership.

The EUR/USD pair surged to 1.1229, ending the day just above the 1.1200 figure. The coronavirus is taking its toll on the region, spurring concerns about the economic recovery.

So far, some Eastern European countries opted for strict lockdowns, while France announced on Thursday booster shots, refraining from imposing restrictions. Portugal declared a state of calamity and announced new restrictions due to the rise in cases, while Germany is expected to announce a decision on the matter on Friday, as cases in the country stand at record highs.

The GBP/USD fell to 1.3304, a fresh 2021 low, to end the day pretty much unchanged in the 1.3320 price zone, undermined by Brexit jitters. The French Fishing Association Body would be taking action on Friday to block French ports, and the Channel tunnel as the UK failed to grant fishing licenses.

USD/JPY trades in the 115.30 area, unchanged on a daily basis. Commodity-linked currencies remained unchanged vs the greenback, with the AUD being the weakest.

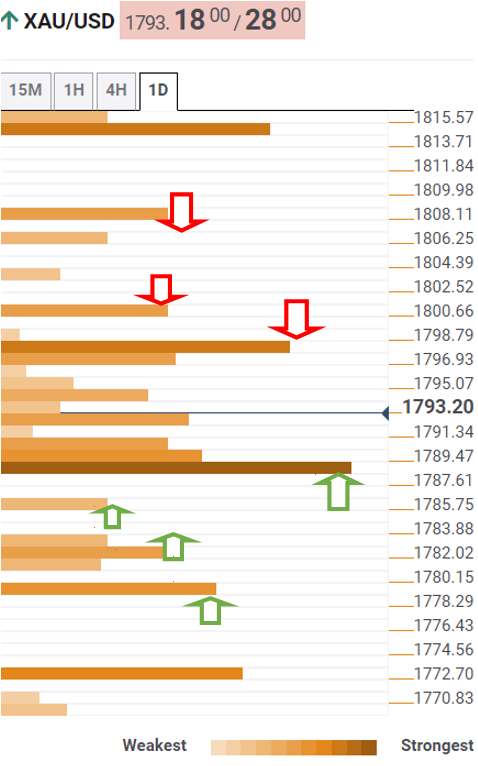

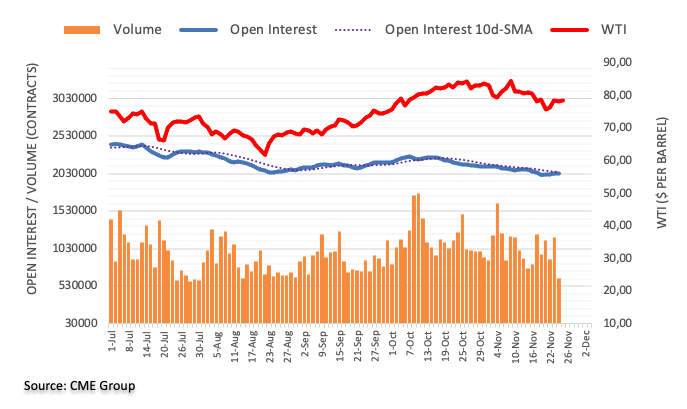

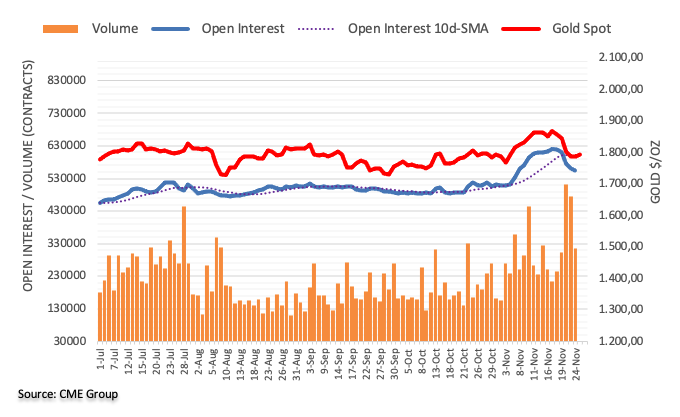

There was no activity in gold markets, with the bright metal steady around $1,790 a troy ounce. Crude oil prices ticked lower, although the barrel of WTI held above $78.00.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Money flows back into cryptos

Like this article? Help us with some feedback by answering this survey:

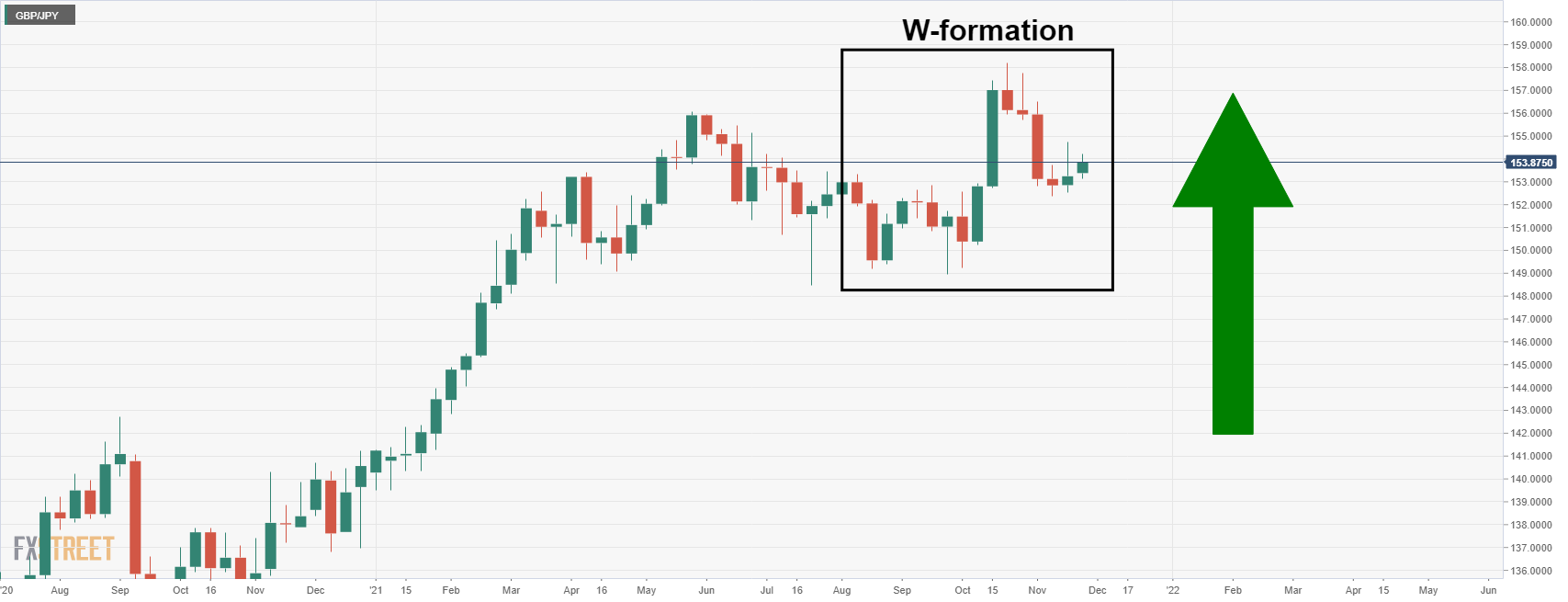

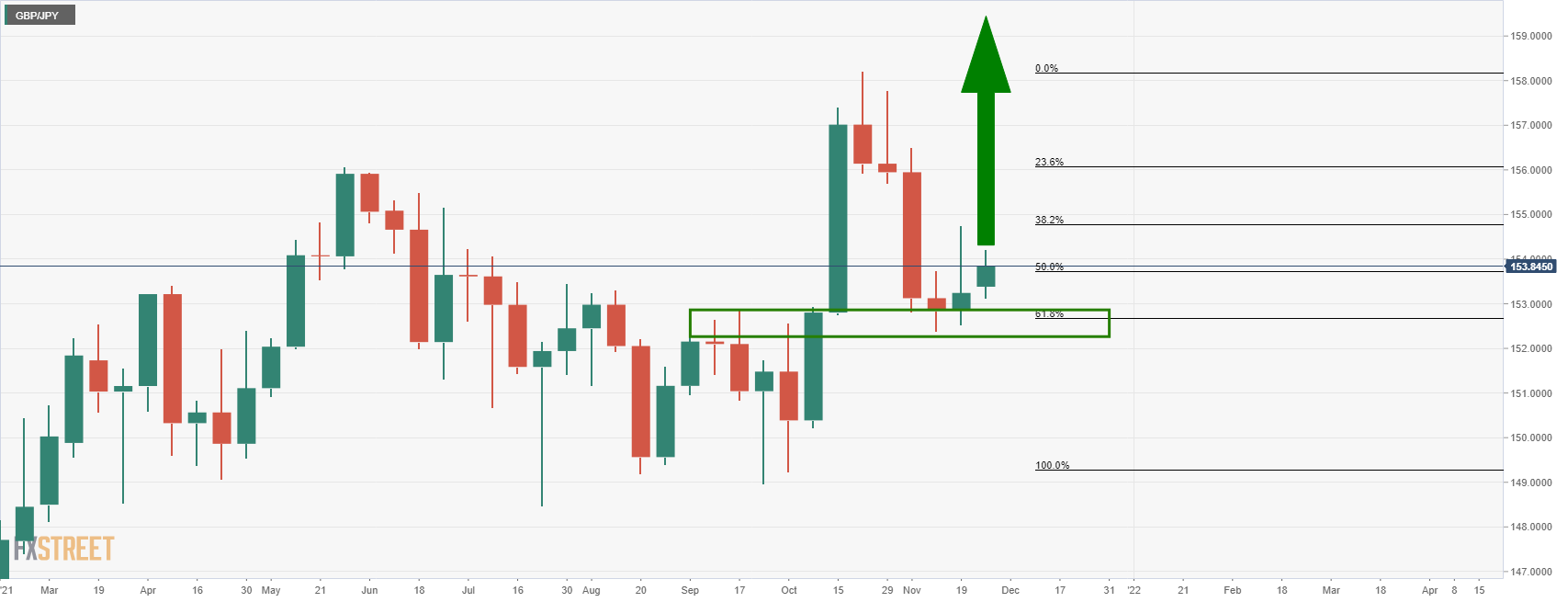

- GBP/JPY has traded within tight 153.50-154.00ish ranges on Thursday amid US market closures for Thanksgiving.

- The pair has formed a pennant, however, raising the risk of a technical break in the coming days.

GBP/JPY has remained stuck within recent ranges on Thursday, unable to surpass or even test weekly highs in the 154.10-20 area and finding good support below 153.50. FX market conditions have been tame on Thursday amid a lack of US market participants, with markets there closed for Thanksgiving. The pair continues to trade close to its 50-day moving average, which currently resides around 153.60. On the day, the pair trades broadly flat, despite further Brexit jawboning by the UK regarding triggering article 16 of the Northern Ireland protocol and despite news that French fishermen will be taking action to block UK/EU trade via sea and the channel tunnel on Friday.

Remarks from Bank of England Governor Andrew Bailey earlier in the session, who said that the supply chain problems causing inflation should be temporary, were broadly ignored by FX markets. Bailey added that the risk is that inflation expectations become embedded and, before noting that we have a very tight labour market in the UK. Policy guidance is more hazardous to give in times of elevated uncertainty, he said.

Technicians will note that over the past three days, GBP/JPY has formed a pennant structure. A break on the upside would likely see prices move back towards the 17 November highs on the 154.700s, while a break to the downside would open the door to a move towards recent lows around 152.50. This area also coincides with the 200DMA, and thus might present a good entry point for the dip buyers.

- USD/JPY bulls eye higher levels to come on Fed sentiment.

- The Fed is turning more and more hawkish as inflation fears ramp up.

USD/JPY is holding in the 115 area around 115.35 and sat in a Thanksgiving range of 115.24/45 as it consolidates the recent Federal Reserve sentiment as the hawks circle over 2051 Constitution Ave.

Some short-squeezing in JPY seemed warranted by some support to US 10-year yields in mid-November and also given how overstretched the yen’s net-short positioning was.

The US dollar slipped slightly on Thursday with traders away for the holidays, but it remains in a positive territory around the highest levels seen since July 2020 against the euro and in the DXY index. The greenback has strengthened due to the markets anticipating that the US Federal Reserve will hike rates sooner than other major central banks.

On Wednesday, the minutes of the Fed's Nov. 2-3 meeting were supporting the case for a higher US dollar but did little on the day to send it much higher. There could be a delayed reaction here, perhaps with investors taking profits on long positions overall ahead of the long weekend.

However, the minutes have indicated that board members had become more concerned about rising inflation. p The December meeting will be a significant meeting whereby the pace of tapering of their bond-buying programme could start as many members have already advocated. as such the markets are getting set for a sooner than first anticipated liftoff.

USD/JPY levels

The hawkish bias is expected to keep USD/JPY afloat. Analysts at Commerzbank expect more from the pair with the 115.60 61.8% Fibonacci retracement of the move down from 2015 being in focus. ''Above here is the 117.56 level, the 1998-2021 resistance line and 119.41, the downtrend from 1975. We have a near term uptrend at 113.92.''

- EUR/GBP remains trapped around the 0.8375-0.8430 range, with no clear direction.

- Eurozone: COVID-19 fourth wave could severely impact Europe, as Germany prepares for the possibility of enacting lockdowns.

- Brexit: The EU and the UK, seem far for getting an agreement in the near term.

The EUR/GBP cuts some weekly losses during the day, up some 0.06%, trading at 0.8411 at the time of writing. On Thursday’s overnight session, the euro gained some ground against the British pound, shrugging off COVID-19 fourth wave Europe woes, while negotiations between the EU and the UK seem stuck regarding Brexit.

The fourth wave of COVID-19 is impacting severely in Europe, with cases rising at record levels. Austria −which reimposed a two-week lockdown−, and Germany who’s started to impose tighter rules amid the country’s worst COVID-19 surge, are studying mandatory vaccines measures throughout both countries. Also, Slovakia, the Czech Republic, Netherlands, and Hungary reported new highs in daily infections as winter approaches Europe.

Talking about Brexit jitters that could weigh on the British pound, a UK government spokesperson said that the UK PM had told the Irish PM that he was concerned about a substantial gap that remained between the UK and EU on the implementation of the Northern Ireland Protocol. Furthermore, the French Fishing Association threatened to take action on Friday, blocking French ports and the Channel tunnel, as the UK has faltered to get what they wanted. That would exacerbate supply chain disruptions that are already plaguing the UK economy.

That said, alongside central bank policy divergence, it seems to favor GBP bulls as the Bank of England prepares to tighten monetary policy conditions. However, Brexit jitters could cap any downside moves on the EUR/GBP pair.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP daily chart depicts the pair is range-trading between the 0.8370-0.8430 region, failing to break over/under the range. According to the daily moving averages (DMA’s), favors a bearish bias, as the DMA’s reside well above the spot price, with a downward slope, indicating that selling pressure could be mounting.

Further, the candlesticks of Monday and Wednesday left two large wicks on top of the real bodies, suggesting that sellers are under control, despite the strong support found around the 0.8370s area.

In the continuation of the downtrend, the first support would be the November 22 swing low at 0.8380. A breach of the latter would expose the January 2020 swing lows around 0.8281

On the other hand, the first resistance would be the August 10 swing low-turned resistance at 0.8449, followed by the 50-DMA dynamic resistance at 0.8492.

- EUR/USD bears are testing bullish commitments at 1.12 the figure.

- EUR/USD is well on its way to the June 19 2020 lows of 1.1168.

- US Fed minutes are under review and divergence between Fed and ECB in play.

Despite the Thanksgiving holidays, markets have reacted in kind to the FOMC minutes of the Wednesday US session and we are seeing follow-throughs in currency trends. EUR/USD, however, is stubbornly holding above yesterdays low of 1.1186 although bears continue to pressure the 1.12 figure. At the time of writing, the single currency trades at 1.1209 and has travelled between a high of 1.1229 and 1.1193 on the day so far.

The greenback has gained around 2.8% this month, but the dollar index on the day is down 0.0.7% at 96.770 at compared to the 16-month high of 96.938 it reached late on Wednesday. in general, the greenback remains better bid but has been soft on the day, below the highest levels since July 2020 against the euro.

Minutes from the Fed's Nov. 2-3 meeting boosted the dollar on Wednesday as Fed members are showing concerns over rising inflation threats. A number of policymakers said they would be open to speeding up the taper of their bond-buying programme if high inflation held and move more quickly to raise interest rates.

Additionally, data on Wednesday showed that US jobless claims were at a 52-year low and consumer spending increased more than expected in October and inflation was rising. Also pressuring the pair, a surge in coronavirus infections in Germany and unusually high inflation rates are weighing on the consumer morale in Europe's largest economy, a survey showed on Thursday.

Medium-term, we continue to favour the USD., analysts at Rabobank said. ''However, with the market now long USD and short EUR and the money market very aggressively positioned for Fed rate hikes next year, there is scope for pullbacks in the currency pair.'

''Technically'', the analysts argue that, ''EUR/USD could recover back towards the 1.15 area and still remain in the downtrend that has been in play since early June. Potential triggers could be the next round of US data including the December 3 payrolls release. The guidance and tone of the December 15 FOMC meeting is also in view. While there is growing risk that EUR/USD will reach the 1.10 area next year, the risk of pullbacks means that we are holding off from changing our 1.12 target for the time being.''

- NZD/USD extends its losses to five days straight, hovering around 0.6850s.

- The disappointment of the RBNZ failing to hike 50 basis points spurred a sell-off of the NZD.

- NZD/USD: A break of an upslope trendline fueled the downward move further, down to 0.6940.

The New Zealand dollar extends its free-fall to five days in a row, down 0.28%, trading at 0.6854 during the day at the time of writing.

In the overnight session, the pair attempted to reclaim the 0.6900 but failed, retreating towards the mid 0.6800s for the fifth consecutive day. On Wednesday, the Reserve Bank of New Zealand (RBNZ) hiked 25 basis points to the Overnight Cash Rate, though it fell short of investors’ expectations. The NZD/USD reaction to the downside seemed like a “buy the rumor, sell the fact” event.

The market sentiment is upbeat on Thursday, so the risk-sensitive NZD should be headed to the upside. However, FOMC last meeting minutes unveiled on Wednesday showed that some Fed policymakers would like to increase the pace of the bond taper so that the US central bank could have room to maneuver, in the case of inflation running hot. That, alongside thin liquidity conditions in the FX market, due to the observance of the US Thanksgiving holidays, capped the NZD upside move.

Also, the greenback is trading barely down during the day, with the US Dollar Index losing 0.08%, sitting at 96.76.

On Friday, an absent economic docket from New Zealand and the US would let NZD/USD traders leaning on the greenback dynamics and market sentiment, which could offer some fresh impetus on the NZD/USD pair.

NZD/USD Price Forecast: Technical outlook

Wednesday’s price action, witnessing the NZD/USD pair breaking an upslope trendline around 0.6932, which once broken, accelerated the downtrend towards 0.6850s until printing a close at 0.6870. The NZD/USD is tilted to the downside, as depicted by the daily moving averages (DMA’s) remain above the spot price, with a downslope, confirming the bearish bias.

In the outcome of the NZD/USD extending its free fall, the first support would be the September 28 swing low at 0.6859. A daily close below the latter would expose the August 20 cycle low at 0.6805.

On the other hand, the psychological 0.6900 figure would be the first resistance on the way north. A breach of that level would expose 0.6932.

Bank of England Governor Andrew Bailey said on Thursday that the supply chain problems causing inflation should be temporary, according to Reuters. The risk, he continued, is that inflation expectations become embedded and we have a very tight labour market in the UK. Policy guidance is more hazardous to give in times of elevated uncertainty, he said.

Market Reaction

Pound sterling has not seen a notable reaction to these comments. Liquidity conditions are very thin amid US market closures. FX markets will close between 1800GMT and 2300GMT.

- USD/TRY is consolidating around the 12.00 level on Thursday.

- The CBRT minutes, as well as a meeting of CBRT, bank regulators and Turkish banks, was ignored.

- The bank isn't showing any signs of a hawkish policy shift just yet, but strategists remain hopeful.

After a highly volatile few weeks, USD/TRY is finally able to take a breather on Thursday amid thin liquidity conditions given US market closures. The pair has spent most of the day consolidating around the 12.00 level and current trades lower by about 0.5%.

The pair hit record highs close to 13.50 earlier in the week as Turkish President Recep Erdogan defended his pressure tactics on the CBRT, where he is essentially forcing them to cut interest rates despite surging inflation. But speculation has built that, amid the lira’s tumble (it is now lost nearly 40% of its value versus the US dollar this year), a policy response will be forthcoming.

The minutes of last week’s CBRT policy meeting were released on Thursday. To recap, the bank opted to cut interest rates by a further 100bps to 14.0% (taking total cuts since September to 400bps) last week. The minutes did not impact the lira and contained the usual empty promises; the CBRT said will continue to use all available instruments decisively until inflation falls back to the bank’s medium-term 5.0% target.

Meanwhile, officials from the CBRT, Turkish bank regulators and Turkish banks met on Thursday. Following the meeting, the CBRT governor said that the banking sector was very strong and that he had informed banking officials about recent rate cuts. The discussions were routine, governor Şahap Kavcıoğlu said and surrounded on general evaluations on the economy and banking sector.

Those hoping that the meeting might have resulted in an immediate hawkish turnaround in CBRT policy in wake of the lira’s recent sharp depreciation were left down. Still, many analysts expect that over the coming months, as inflation continues to accelerate in Turkey, the CBRT will have its hands forced and rate hikes will eventually be forthcoming.

- GBP/USD has tentatively bounced from annual lows at 1.3300 ahead of a short market closure for Thanksgiving.

- Markets have been keeping one eye on Brexit developments, with French fishermen port/tunnel blockades now expected.

- While the pair has been under heavy selling pressure recently, it isn't yet in oversold territory.

Ahead of a five-hour FX market closure lasting between 1800GMT and 2300GMT due to the Thanksgiving holiday in the US, GBP/USD is trying to tentatively regain some composure. The pair had hit fresh annual lows just to the north of the 1.3300 level earlier on during Thursday’s session but has since bounced to the 1.3320s.

On the day, the pair is now flat. The tone of Brexit developments seems to be tacking a tone for the worse again. A UK government spokesperson on Wednesday evening said that the UK PM had told the Irish PM that he was concerned about a substantial gap that remained between the UK and EU on the implementation of the Northern Ireland Protocol.

Meanwhile, the French Fishing Association Body was scathing of the UK on Thursday, saying that they had still not got what they wanted regarding licenses. The body said that French fishermen would be taking action on Friday to block French ports and the Channel tunnel. The blockades will disrupt UK/EU trade and are likely to exacerbate the supply chain disruptions already plaguing the UK economy.

Data from the ONS released earlier in the morning showed that 14% of businesses in the UK had reported a shortage of workers in late November. Further evidence of a strong UK labour market likely increases the chances that the BoE will hike interest rates by 15bps to 0.25% next month and this might be helping to negate the impact of negative Brexit newsflow for GBP.

But UK money markets don’t seem to have viewed the ONS data this way. Three-month sterling LIBOR futures for December 2021 (a proxy of the market’s expectations of the BoE’s Bank Rate next month) rose to their highest since late September on Thursday at 99.820, up from 99.765 at the start of the week. That implies markets only anticipate about 8bps of rate hikes next month, or are only pricing slightly above a 50% chance that the bank will hike rates.

Sterling losses have further to run

If the BoE does disappoint expectations next month by refusing once again to hike interest rates, then GBP will see a negative reaction as hawkish bets are unwound. Though GBP/USD has come under heavy selling pressure in recent weeks and is down 2.6% on the month, the pair isn't yet in oversold territory.

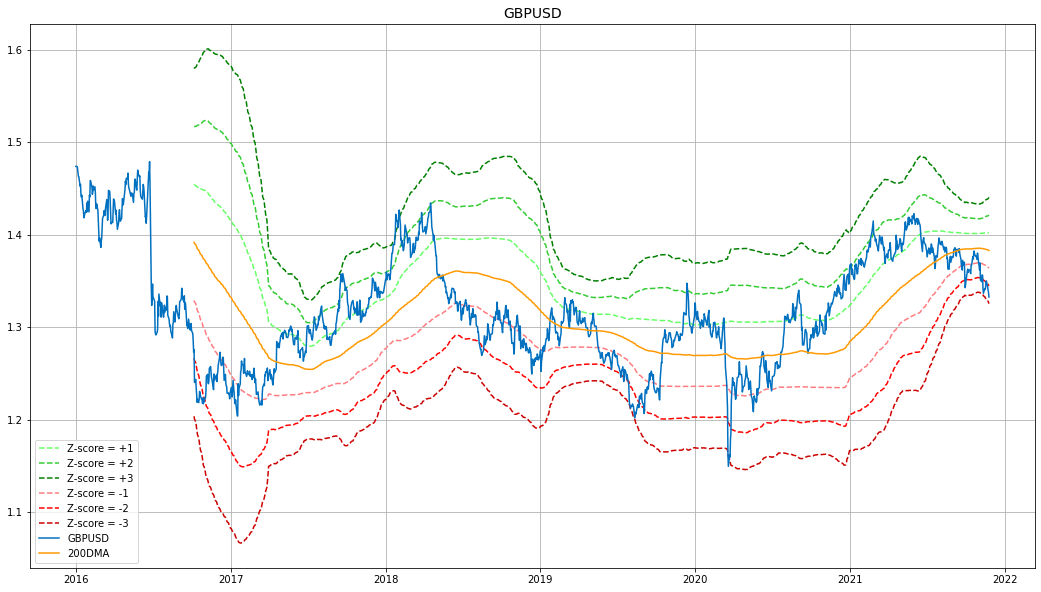

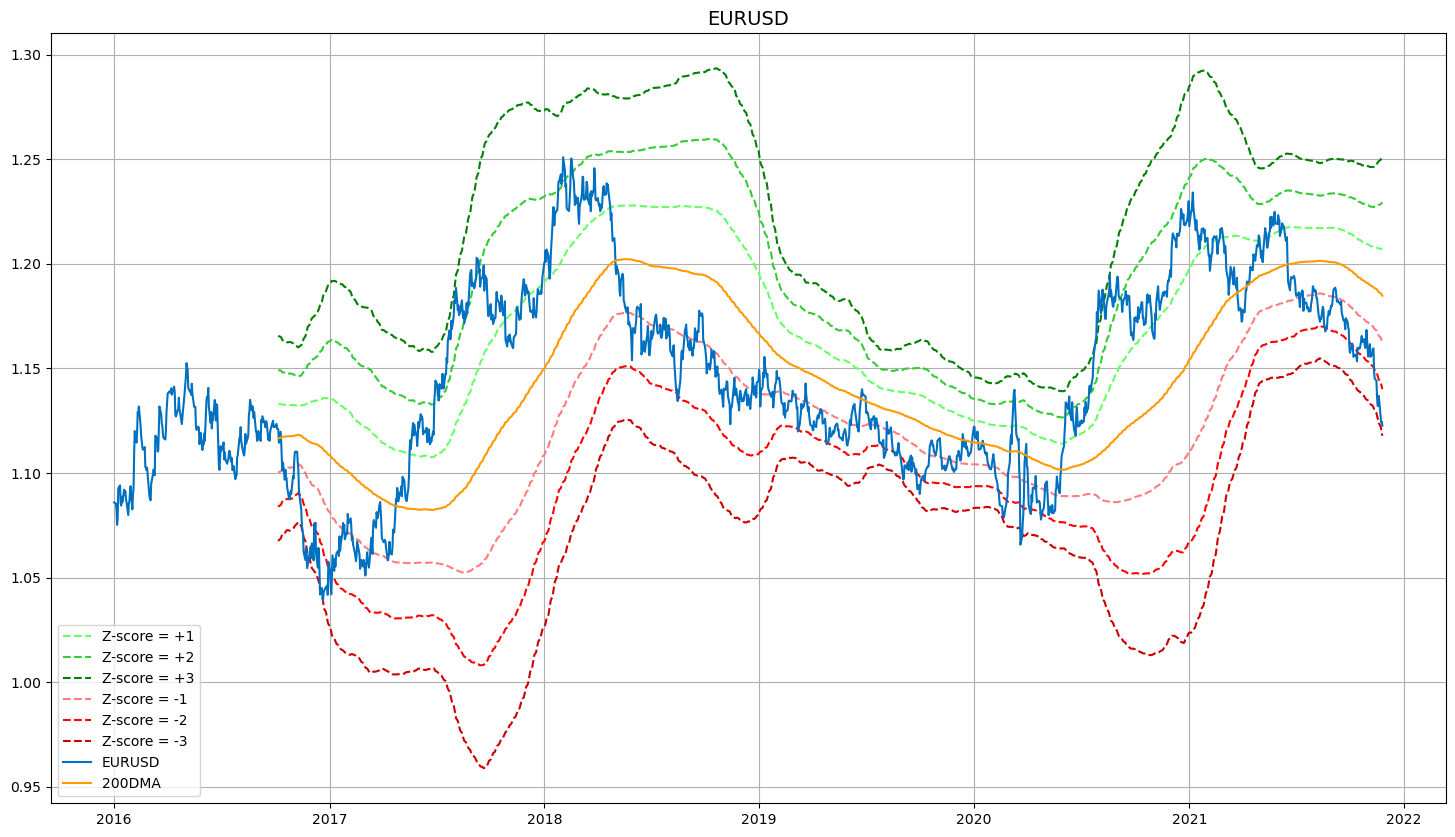

Its 14-day Relative Strength Index score is 33.3, above the oversold 30 mark, while its Z-score to its 200DMA (the number of standard deviations away) is at -2.61. In the last five years, the GBP/USD’s Z-score has only been under -2.50 on two occasions and on both those occasions it needed to fall under -3.0 before GBP/USD rebounded.

- USD/CHF extends its rally to five consecutive days.

- USD/CHF: A break of a 4-month old downslope resistance trendline opened the door for a renewed test of 2021 year-to-date high.

The USD/CHF extends its gains the fifth consecutive day, up 0.25%, trading at 0.9355 during the day at the time of writing. Thin liquidity conditions in observance of Thanksgiving in the US keep the pair subdued.

Despite the abovementioned, European bourses closed in the green depicting risk appetite towards equities. Further, US equity futures are trading in the green, while the US Dollar Index, which tracks the buck’s performance against a basket of six rivals, slides 0.11%, sitting at 96.74.

USD/CHF Price Forecast: Technical outlook

The USD/CHF has an upward bias in the daily chart, as shown by the daily moving averages (DMA’s) with an upslope, residing well beneath the spot price. Furthermore, the break of an eight-month-old downslope resistance trendline indicates that the USD/CHF is tilted to the upside, though it would need a daily close above the abovementioned.

In that outcome, the first resistance on the way up would be the psychological 0.9400 figure. A breach of the former would expose the April 1 swing high at 0.9473, followed by the June 29, 2020 cycle high at 0.9528.

On the other hand, failure to hold above 0.9330 would expose the 0.9300 figure. A break below that level would reveal the confluence of the 50-DMA and the November 19 swing low around the 0.9225-50 region, which, once giving way, would leave the 0.9200 as the last line of defense for USD bulls.

- XAU/EUR recovers some of its weekly losses, barely up 0.01.%.

- Falling German 10-year bunds and German Real Yields keep the EUR pressured to the downside.

- XAU/EUR: Tilted to the upside, as long as it remains above €1,575.

Gold (XAU/EUR) vs. the euro trims some of its weekly losses, advances 0.01%, trading at €1,596 during the day at the time of writing. Thin liquidity conditions with the US on Thanksgiving holiday, and an upbeat market, put a lid on the yellow-metal free fall. European stock indices are in the green, while US equity futures point to the upside.

Meanwhile, the German 10-year bund, which significantly influences the EUR, falls almost three basis points, sitting at -0.248%. Also, German Real Yields drop seven basis points, down to -1.93%, weighing on the EUR fall against the non-yielding metal.

Choppy trading conditions in the XAU/EUR keep gold trading in a narrow range of €1,594-€1,600; amid thin liquidity conditions, US Stock and Money Markets remain closed, in the observance of Thanksgiving.

On Thursday, the Eurozone economic docket featured the German GFK Consumer Confidence Survey for December showed a further contraction than expected. The number came at –1.6, lower than the -0.5 expected. Further, the Gross Domestic Product for Germany for the Q3 came at 1.7%, a tenth lower than the 1.8% expected, which caused no meaningful impact on XAU/EUR.

XAU/EUR Price Forecast: Technical outlook

The daily chart depicts that gold corrected beneath the top-trendline of the Pitchfork’s channel, from YTD tops around €1,650, down to around €1,580, near the middle-trendline of Pitchfork’s channel, which acted as support. Since then, gold has stabilized around the €1,575-€1,600 range, though XAU/EUR still tilted to the upside, per the daily moving averages (DMA’s) residing below the spot price with an upward slope.

On the upside, the first resistance would be €1,600. A breach of the latter would expose Pitchfork’s top-trendline to around €1,640. Otherwise, the first support would be Pitchfork’s middle-trendline around €1,575, followed by the confluence of the 50-DMA and the July 16 swing high at €1,550.

-637734542216934745.png)

The November US employment report will be released on the first Friday of December. At the moment, analysts at Wells Fargo expect an increase in jobs of around 600.000.

Key Quotes:

“Total nonfarm payrolls increased by 531K during October, a gain that was well ahead of expectations. The net revisions to the previous two months were also positive and added another 235K to job growth in August and September. Stronger job growth recently is evidence that some of the headwinds holding back employment growth, namely the Delta variant of COVID and labor shortages, are beginning to die down. Higher wages may be helping in this regard. Average hourly earnings rose 0.4% during the month, and earnings are now up 4.9% over the past year.”

“We expect labor availability to continue to be a constraint on hiring in the coming months. That noted, workers do appear to be slowly reentering the labor force. More discernable improvement should come next spring when COVID risks are lower and childcare issues are better resolved. The growing distance between fiscal support as well as inflation chipping away at individuals' spending power should provide the financial imperative to return to work. These factors should help hiring continue at a robust pace and keep the level of employment on track to recover around the end next year.”

“In terms of the November employment report, we look for a 600K gain, which as of this writing, is above consensus expectations.”

- USD/CAD continues to gradually push lower, with the price action capped by a downtrend from the weekly higher.

- At present, the pair trades around 1.2600, but if oil continues to recover next week the pair could return to 1.2600.

USD/CAD has slipped back under the 1.2650 level in recent trade from earlier session highs around 1.2680. The pair appears to have run into resistance in the form of a downtrend that has formed since the pair slipped back from earlier weekly highs close to 1.2750. Technicians will now eye a retest of earlier session lows around 1.2640, though market conditions are currently very thin amid the absence of US participants for Thanksgiving, meaning any decisive break lower will probably have to wait for next week.

At current levels around 1.2650, USD/CAD is nearly back to flat on the week. Given that the pair, when it was trading close to 1.2750, was nearly up by 1.0% on Monday, that is a pretty decent reversal lower. And that reversal lower comes despite a continued broad strengthening of the US dollar amid hawkish Fed vibes (comments from FOMC’s Mary Daly and the Fed minutes) and more strong US macro data.

The reason why CAD has been able to perform well is due to the recovery in oil prices after Tuesday’s underwhelming US (and global) crude oil reserve release. There is speculation that OPEC+ could shift output policy to compensate for the reserve releases at their meetings next week and this has helped oil markets recover. WTI is up more than 3.0% on the week.

Should OPEC+ refrain from further output hikes next week (to the anger of the US and other nations) and send oil prices shooting higher again, this could lend further support to the loonie and the recent bearish technical trend may continue. Traders would likely target a move back down towards the next key area of support at 1.2600.

The European Central Bank (ECB) will likely end the net purchases under PEPP to end March 2022, affirms Jan von Gerich, Chief Analyst at Nordea. They o not see the ECB going for a totally new asset purchase programme.

Key Quotes:

“The December meeting will be very interesting, especially as judging by the recent speeches, many Governing Council members have become more worried about the inflation outlook, and the voices to the monetary policy focus away from asset purchases has increased.”

“There is probably not much disagreements about signalling that rate hikes are very unlikely as early as next year. However, there are likely to be more disagreements on what to do with the asset purchases. Even amidst the weakened Covid-19 outlook, the net purchase pace of the Pandemic Emergency Purchase Programme (PEPP) still looks likely to end in March 2022.”

“We continue to expect the ECB to complement EUR 20bn monthly pace in the Asset Purchase Programme with a fixed-size envelope of around EUR 200bn, as a compromise between the doves and the hawks. The current forward guidance on the APP, stating that net purchases are expected to end shortly before rate hikes start, is likely to be retained for now.”

“An idea about a totally new bond purchase programme has also been floated – one that would be able to respond to market shocks and would not necessarily need to follow the capital key. We do not believe the ECB will introduce such a programme, but will rather opt at using the PEPP reinvestments for this purpose, which will continue at least until the end of 2023.”

- Mexican peso tumbles on Banxico’s headlines.

- USD/MXN overbought, but still no signs of correction.

- The 21.50 area is the key zone to watch.

Mexican President Andres Manuel Lopez Obrador added more fuel to the USD/MXN rally on Wednesday by changing his nominee for the next head of the central bank. It triggered a new leg higher that peaked at 21.62, the new high since March.

From the new top, USD/MXN pulled back, finding support above 21.35. Currently, the pair is hovering around 21.50, a key area. A consolidation above should lead the road open to more gains. The next strong resistance is located at 21.90 that should hold.

Technical indicators are at extreme readings but no signs of correction are seen. The RSI is above 70 but still looking north; a similar situation occurs with Momentum. Despite showing no signs, the 21.50 zone should limit the upside for the time being, particularly if overall market conditions help.

If USD/MXN fails to hold above 21.50, it could pullback initially to 21.20 and then to the more relevant and strong support seen at 20.90. A slide below would alleviate the bullish pressure.

The constructive outlook for USD/MXN will remain intact while price stays above the uptrend line, today at 20.35.

-637734504688983287.png)

- AUD/USD edges lower 0.14% amid thin liquidity conditions, in the observance of US Thanksgiving.

- AUD/USD remained subdued in the overnight session, within the 0-7170-0-7200 range.

- AUD/USD is tilted to the downside, as long as it remains below 0.7250.

The AUD/USD grinds lower versus the greenback, down 0.15%, trading at 0.7188 during the day at the time of writing. The market sentiment as the European session advances is upbeat, as European indices are in the green, despite thin liquidity conditions, attributed to the Thanksgiving celebration in the US.

However, it is crucial noticing that Europe is the new COVID-19 epicenter, with cases rising at record levels. Countries like Slovakia, the Czech Republic, Netherlands, and Hungary reported new highs in daily infections as winter approaches Europe. They added to Austria −that reimposed a two-week lockdown−, and Germany who’s started to impose tighter rules amid the country’s worst COVID-19 surge.

In the overnight session, the AUD/USD pair traded sideways within the 0.7170-0.7200 range, with a light economic docket our of Australia. The Private Capital Expenditure for the Third Quarter, which shrank 2.2%, more than the 2% contraction estimated by analysts, did not have any meaningful impact on the AUD/USD pair. On the US front, the observance of Thanksgiving would not offer new macroeconomic data until the following week.

On Friday, the economic docket for Australia would feature the Retail Sales for October. That data, alongside US dollar dynamics and market sentiment, would be the factors that could move the AUD/USD pair.

AUD/USD Price Forecast: Technical outlook

The AUD/USD has a downward bias, as the daily moving averages (DMA’s) are well located with a downslope, above the spot price. Also, the break of an upslope trendline on last week’s Friday, followed by intense selling pressure on Monday, dented the AUD bullish prospects, as AUD bulls have struggled to reclaim the 0.7250 level.

In the outcome of extending the downtrend, the first support would be the September 30 swing low at 0.7169. A breach of the latter would open the door for a retest of the 2021 year-to-date low at 0.7105.

- Spot silver prices are seeing subdued trade on Thursday and this is likely to remain the case for the rest of the week.

- XAG/USD is set to end the week around 4.0% lower, amid a hawkish shift in the market’s expectations for Fed policy.

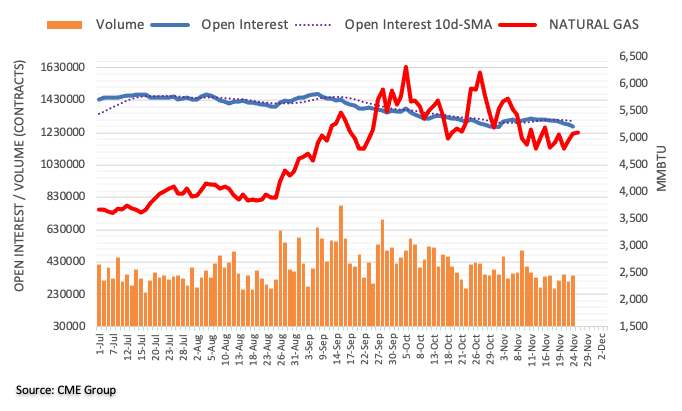

Financial markets are trading with a lack of conviction in the Thursday European afternoon, due to the lack of US market participants on account of market closures there for the Thanksgiving holiday. Conforming to the broadly subdued tone, spot silver (XAG/USD) prices have been going sideways for the majority of Thursday's session within a $23.50-70 range. Volumes and volatility seem unlikely to pick up too substantially on Friday, given that US markets shut early and, as a result, many US market participants will have taken the opportunity to get in a long-weekend holiday.

If XAG/USD does close down around current levels, that would have marked a roughly 4.0% decline on the week. The primary driver of this weakness has been 1) a stronger US dollar (the DXY is up about 0.7% on the week) and 2) higher real yields. The US 5-year TIPS rose about 9bps to just under -1.70% 10-year TIPS rose more than 10bps to above -1.0%. Driving the gains was a combination of further strong US macro data which supports the case for an accelerated monetary tightening timeline, as well as further indications from Fed members that they are increasingly open to accelerate monetary tightening.

Hawkish Fed

One of the highlights this week with regards to the Fed were comments from San Fransico Fed President Mary Daly on Tuesday saying she was open to a faster QE taper and earlier rate hikes, subject to the data. The minutes of the 3 November FOMC meeting, released on Wednesday, was another highlight and underlined the hawkish shift occurring within the Fed even prior to the release of the hot October inflation Consumer Price Inflation report.

Markets are now increasingly positioning themselves for a hawkish Fed shift. Goldman Sachs on Thursday said they expect the Fed to double the pace of its QE taper to $30B per month from January, meaning the QE taper would be complete by the end of Q1 2022. Moreover, the bank now sees the Fed hiking the Fed funds target range three times (by 25bps each time) in 2022, starting in June. Money markets seem to agree.

The Chicago Board of Trade (CBoT) 30-day Fed funds interest rate future for next June now trades at 99.68, nearly 10 points below where it ended last week. That implies a 25bps rate hike in June is nearly fully priced. The December Fed funds future, by comparison, trades around 99.27 and is also down about 10 points on the week, implying (roughly) 65bps of tightening by the end of 2022.

Chance for precious metal recovery

Some analysts suggested on Thursday that the scope for a further hawkish shift in the market’s expectations for Fed monetary policy in 2022 is now fairly limited. This implies the dollar may struggle to gain further ground. In such a scenario, precious metals like silver may be offered a chance to recoup recently lost ground. Short-term silver bulls would target a move back towards recent highs in the $25.40s.

EUR/USD breached the 1.12 level on Wednesday. In the view of economists at Rabobank, the momentum behind the recent move in the USD does raise the possibility of pullbacks.

Technically, EUR/USD could recover back towards the 1.15 area

“Medium-term, we continue to favour the USD. However, with the market now long USD and short EUR and the money market very aggressively positioned for Fed rate hikes next year, there is scope for pullbacks in the currency pair.”

“Technically EUR/USD could recover back towards the 1.15 area and still remain in the downtrend that has been in play since early June. Potential triggers could be the next round of US data including the December 3 payrolls release. The guidance and tone of the December 15 FOMC meeting is also in view.”

“While there is growing risk that EUR/USD will reach the 1.10 area next year, the risk of pullbacks means that we are holding off from changing our 1.12 target for the time being.”

- EUR/USD bounces off cycle lows and retests 1.1230.

- Below the YTD the pair should target 1.1168.

EUR/USD manages to find some dip buyers and advances further north of the 1.1200 mark on Thursday.

If spot breaches the 2021 low at 1.1186 (November 24) then the next target of note emerges at July’s 2020 low at 1.1185 (July 1) before 1.1168 (June 19 2020). The ongoing technical correction also comes in response to the current oversold condition of the pair.

The probability of further losses remains unchanged as long as EUR/USD trades below the 2-month resistance line (off September’s peak) near 1.1580. In the longer run, the offered stance in spot is expected to persist while below the 200-day SMA at 1.1840.

EUR/USD daily chart

- Oil markets are subdued on Thursday amid thin liquidity conditions.

- WTI has been trading close to the $78.00 level.

Oil markets are unsurprisingly subdued on Thursday amid thin liquidity conditions due to US market closures for Thanksgiving. Front-month WTI futures have spent most of what has thus far been a very quiet session ranging in the low-$78.00s/just under $78.00 area, with prices remaining well within recent ranges. Futures trade will halt at 1800GMT and then restart at 2300GMT. Ahead of the market closure, conditions are likely to remain subdued, especially once any remaining European market participants depart after European market closures from 1630GMT.

In terms of fresh fundamentals, the most notable development on Thursday was reports that the US continues to exert pressure on Russia to increase output. The news had little effect on crude oil markets at the time but might be a sign that the Biden administration remains frustrated with its inability to push prices lower. That might mean further reserve releases are on the cards. The main focus for markets remains the response by OPEC+ officials to this week’s oil reserve release announcement from the US and other major consumers.

A Wall Street Journal report on Wednesday suggested that Russia and Saudi Arabia, the two OPEC+ nations who produce the most oil each day, were mulling halting the cartel’s preplanned output hikes in December. But Reuters, citing three sources, subsequently reported that OPEC+ is not discussing slowing output hikes. The organisation meets next week.

Elsewhere, oil markets have broadly ignored pandemic updates. In terms of the latest with regards to the European Covid-19 outbreak and government response; health experts in the Netherlands have reportedly advised that the government order a closure of restaurants and non-essential stores. Outgoing German Chancellor Angela Merkel, meanwhile, has again reiterated her call for tighter restrictions, saying that every day counts to slow the spread. Her calls come after Italy on Wednesday approved new curbs on unvaccinated individuals.

GBP/USD pressures the 1.33 level. In the view of economists at Scotiabank, the cable could fall as low as 1.30.

The 1.3350/55 range will stand as resistance

“The GBP’s slide from its failed break of 1.35 last week is on track to a test of 1.33.”

“The five-day losing streak in the pound has left it trading just shy of oversold in the RSI with the eventual move likely to prevent a test of 1.32 in the coming days if losses past 1.33 extend.”

“Technical signals are still pointing to further losses ahead toward 1.30.”

“The 1.3350/55 range will stand as resistance ahead of the 1.3380 zone and then the figure.”

The EUR/USD pair corrects oversold conditions after its decline past 1.12. Nonetheless, the undertone remains bearish, in the view of economists at Scotiabank.

Break above 1.13 needed to alleviate downside pressure

“The overall trend in the EUR remains clearly bearish and it would take a cross of 1.13 to at least suggest that the EUR/USD will not continue its drop to 1.10/11.”

“After the 1.12 zone, yesterday’s low of 1.1186 is support followed by 1.1165/70 (summer 2020 lows).”

The French Fishing Association Body on Thursday said that it still does not have what it wanted regarding post-Brexit fishing licenses, according to Reuters. The body added that it would take retaliatory measures as soon as possible if its demands were not met regarding the licenses.

The body said that its fishermen will be taking action on Friday at 1400GMT at the port of Caen-Ouistreham, which may lead to the blockade of some boats. Protest action will also take place at St Malo and in the Eurotunnel, the body said.

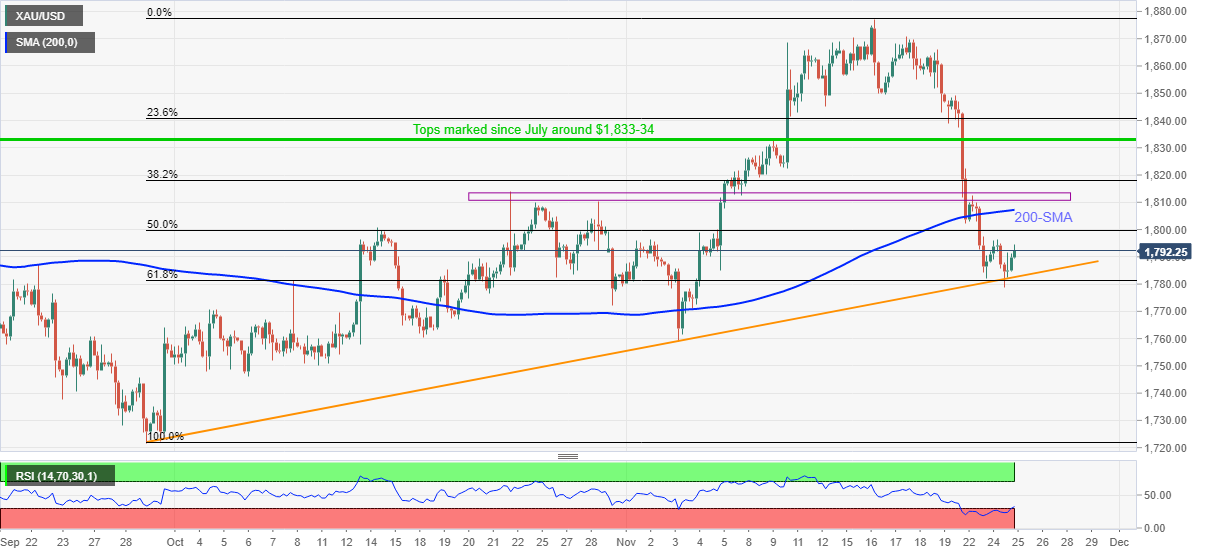

- Some USD profit-taking assisted gold to gain some positive traction on Thursday.

- Hawkish Fed expectations kept a lid on any meaningful gains for the commodity.

- Weakness below an ascending trend-line is needed to confirm a fresh breakdown.

- Gold Price Forecast: Thanksgiving Day unlikely to offer respite to XAU/USD bulls amid a bear flag

Gold gained some positive traction on Thursday, albeit lacked any follow-through and remained well within the striking distance of a three-week low touched in the previous day. The US dollar witnessed some profit-taking following the recent strong runup to the highest level since July 2020. This, in turn, was seen as a key factor that extended some support to the dollar-denominated commodity. Apart from this, concerns about the economic fallout from the rising number of COVID-19 cases and the imposition of fresh lockdown measures in Europe further underpinned the safe-haven gold. That said, stable performance in the equity markets, along with hawkish Fed expectations kept a lid on any further gains for the non-yielding yellow metal.

The markets seem convinced that the Fed would be forced to tighten its monetary policy sooner rather than later to contain stubbornly high inflation. The bets were reinforced by Wednesday's release of the US PCE Price Index, which accelerated to a 30-year high in October. Adding to this, the minutes of the November FOMC meeting revealed that were open to speeding up the tapering of the bond-buying program and moving quickly to raise interest rates if high inflation persists. The Fed funds futures indicate the possibility for an eventual rate hike move by mid-2022 and a high likelihood of another raise in November. This warrants some caution for bullish traders and before confirming that gold prices might have bottomed out in the near term.

The fundamental backdrop remains tilted firmly in favour of bears, though relatively thin liquidity conditions on the back of the Thanksgiving holiday in the US held back traders from placing fresh bets. Even from a technical perspective, gold, so far, has managed to defend a short-term ascending trend-line support extending from the September monthly swing low, around the $1,722 area. This further makes it prudent to wait for a convincing break below the mentioned support before positioning for any further depreciating move.

Gold daily chart

Technical levels to watch

- DXY gives away part of the recent gains, back near 96.70.

- Further upside is seen testing the 97.00 yardstick.

DXY corrects lower after hitting new cycle peaks in the area just below the 97.00 yardstick on Wednesday.

The continuation of the uptrend looks the most likely scenario despite the ongoing and temporary knee-jerk. That said, the round level at 97.00 now emerges as the immediate target for dollar bulls ahead of 97.80 (June 30 2020).

In the meantime, while above the 2-month support line (off September’s low) just below 94.00, extra gains in DXY remain well on the table. The broader constructive stance remains underpinned by the 200-day SMA at 92.38.

DXY daily chart

- EUR/USD continues to trade slightly to the north of the 1.1200 level and did not react to the ECB minutes.

- Technical indicators increasingly point to near-term consolidation following the pair’s recent run of losses.

EUR/USD has not seen any notable reaction to the release of the latest ECB minutes, which did not contain any surprises. The pair continues to consolidate slightly to the north of the 1.1200 level, with the euro one of the better performers in G10 FX markets on Thursday amid otherwise broadly subdued trading conditions. Volumes are thin given that US market participants are away for Thanksgiving and US markets shut.

Historic losses

EUR/USD’s 3.2% drop over the last 21 trading session ranks in the second from bottom percentile, when compared against the rolling 21-session change over the past five years. Moreover, the pair on Thursday was trading more than 5.0% below its 200DMA, which ranks in the bottom percentile when compared with EUR/USD’s rolling percentage differences to the 200DMA over the last five years.

Case for consolidation

But with the euro bears having thus far failed to push EUR/USD as low as the mid-June 2020 lows around 1.1170 this week and the euro looking increasingly oversold by most metrics. In all but one of the last nine-session, EUR/USD’s 14-day Relative Strength Index score has been under 30. A close at the end of this week abvoe 1.1200 might be taken as signal for short-covering.

Meanwhile, the pair’s Z-score to the 200DMA (the number of standard deviations away from it) is approaching -3.0. Over the last five years, a Z-score to the 200DMA at around -3.0 has been a good signal of near-term consolidation lays ahead, or in many instances, a substantial bounce. The mean five-day return in EUR/USD from days when its Z-score to 200DMA was below -2.5 is +0.4%, while the mean 21-day return is 0.3% and the mean 65-day return is 1.3%. The case for near-term consolidation is clearly growing.

- EUR/JPY leaves behind Wednesday’s negative session.

- Sellers could still drag the cross to the 128.00 area.

EUR/JPY regains the upside traction and returns to the positive territory near 129.50 on Thursday.

The resumption of the downside should not be ruled out yet and therefore another visit to the monthly low at 127.97 (November 19) remains well on the cards for the time being. A move further south should see the August and September low around 127.93 retested.

Looking at the broader picture, the outlook for the cross is expected to remain negative while below the 200-day SMA, today at 130.54.

EUR/JPY daily chart

The benchmark 10-year US Treasury bond yield has come close to the May and October highs at 1.71%. Above here, the April peak at 1.78% and also the 200-week moving average at 1.83% beckon, analysts at Commerzbank report.

Long-term bullish forecast while above 1.25%

“The US 10Y yield tested the eight-month resistance line at 1.70% and nearly probed the May and October highs at 1.71%, a rise above which would push the April peak at 1.78% and also the 200-week moving average at 1.83% to the fore. Further up the 55-month moving average can be found at 1.89% and the September 2017 low and November 2019 high at 1.98/2.01%.”

“The 1.98/2.01%target area will remain in play while the yield stays above the last reaction low at 1.51% on a daily chart closing basis Below it lies the 1.48/45% region, made up of the mid-October low, 200-day moving average and four-month support line. Further down sits the current November low at 1.41%.”

“Overall upside pressure should prevail while the August-to-mid-September highs at 1.39% continue to underpin on a daily chart closing basis. Further support is seen at the June low at 1.35%.”

“While the yield remains above the 1.25% mid-September low we will retain our long-term bullish forecast.”

- EUR/GBP regained positive traction on Thursday and recovered further from YTD low.

- Brexit uncertainties undermined the sterling and remained supportive of the move up.

- Some USD profit-taking benefitted the euro and further extended support to the cross.

- Dovish ECB outlook might hold back bulls from placing fresh bets and cap further gains.

The EUR/GBP cross continued gaining traction through the mid-European session and climbed to an over one-week high, around the 0.8430-35 region.

The cross caught fresh bids on Thursday and is now looking to build on this week's recovery move from the 0.8280 support area, or the lowest level since February 2020. The British pound's relative underperformance against its European counterpart comes amid the worsening row over the post-Brexit fishing rights between France and Britain.

This, to a larger extent, overshadowed the latest report, indicating that Britain would hold off suspending parts of the Brexit divorce deal relating to Northern Ireland for as long as talks with the EU remain constructive. Even the prospects for an imminent interest rate hike by the Bank of England did little to impress the GBP bulls.

On the other hand, the shared currency benefitted from some US dollar profit-taking from a 16-month peak. That said, the rising number of COVID-19 cases and the imposition of fresh lockdown measures might act as a headwind for the euro. This, in turn, could hold back bullish traders from placing aggressive bets around the EUR/GBP cross.

Fresh COVID-19 jitters have fueled concerns about a significant slowdown in the Eurozone economic activity, which could be another reason for the European Central Bank (ECB) to be more dovish. It is worth mentioning that the ECB officials have been pushing back against bets for tighter policy and talked down the need for any action to counter inflation.

This was reinforced by the accounts (minutes) of the October ECB monetary policy meeting, which stated: "It was deemed important for the governing council to avoid an overreaction as well as unwarranted inaction, and to keep sufficient optionality in calibrating its monetary policy measures to address all inflation scenarios that might unfold."

The fundamental backdrop warrants some caution before confirming that the EUR/GBP cross has bottomed out in the near term and positioning for any meaningful recovery. Hence, the move up might still be categorized as a short-covering bounce, which runs the risk of fizzling out rather quickly amid absent relevant fundamental catalyst.

Technical levels to watch

According to the accounts of the October European Central Bank monetary policy meeting, the view was held that, judging on the basis of the current developments, net purchases under the Pandemic Emergency Purchase Programme could be expected to come to an end by March 2022, according to Reuters.

Additional Takeaways:

"At the current juncture, the accommodative monetary policy stance had to be reconfirmed."

"Monetary policy had to be patient."

"The view was held that judging on the basis of the current developments, net purchases under the PEPP could be expected to come to an end by March 2022."

"It was highlighted that monetary policy decisions needed to be data-driven and all incoming data during the coming months needed to be taken into account."

"It was conjectured that there had been no fundamental changes in the underlying causes of the low growth and low inflation environment."

"It was cautioned that the data available in December would not resolve all the uncertainties around the medium-term inflation outlook."

"It was seen as important that the governing council should keep sufficient optionality to allow for future monetary policy actions, including beyond its December meeting."

"The remark was made that, at some point in the future, the very generous monetary policy support to the economy would need to be reassessed."

"It was deemed important for the governing council to avoid an overreaction as well as unwarranted inaction, and to keep sufficient optionality in calibrating its monetary policy measures to address all inflation scenarios that might unfold."

"Concerns were voiced that expectations regarding the future path of short-term money market interest rates."

"The uncertainty around the medium-term prospects was seen as elevated."

"By explicitly stressing the need for the durability of the underlying inflation developments, the governing council’s forward guidance was particularly well suited to looking through “cost-push”."

"Members agreed that price pressures were more persistent than had been foreseen in the September ECB staff projections."

"It was judged that second-round effects were not visible so far."

“It was pointed out that this was only a gradual move towards levels more in line with the new inflation target and that such re-anchoring should not be confused with an unanchoring on the upside.”

“Doubts were expressed about the use of typically downward-sloping oil price futures curves as projection assumptions when fossil fuel prices were bound to remain elevated or rise further.”

“Members widely agreed on the expected hump-shaped pattern in the shorter-term inflation outlook.”

“It was argued that price effects could be greater than currently estimated if labour force participation did not return to pre-crisis levels.”

“Likely that in the December 2021 Eurosystem staff projections the shorter-term inflation outlook for the euro area would once again be revised upwards.”

“Against this background, it was seen as likely that in the December 2021 Eurosystem staff projections the shorter-term inflation outlook for the euro area would once again be revised upwards.”

“Members discussed the notion of “stagflation” in relation to risks to the economic outlook.”

“It was recalled that stagflation experienced in the 1970s occurred in a different environment.”

Market Reaction

The euro has not seen any sustained reaction to the latest minutes.

- EUR/JPY has nudged higher on Thursday amid thin US holiday trade, but has again failed to brea above 129.50.

- Ahead, ECB minutes are set for release and ECB’s Lagarde is scheduled to speak.

EUR/JPY has been nudging higher on Thursday, with the euro outperforming in the G10 space as traders cite short-covering after its recent period of pandemic-related underperformance. The pair is currently trading slightly in the green in the 129.30s, but has run into resistance for a third day running in the 129.50 area.

Failure to break above a key short-term area of resistance this Thursday is not really too surprising given thin liquidity conditions on account of US markets being shut for the Thanksgiving holiday. When volumes come back next week, that is when technical breakouts are going to become more likely.

Pandemic

Focus in the Eurozone remains on the broad trend towards tighter lockdown restrictions, with Italy the latest to unveil curbs on the unvaccinated. This likely isn't helping the euro, though a lot of bad pandemic-related news is now arguably in the price.

Thursday morning saw a slightly larger than expected drop in GfK’s December German Consumer Climate index to -1.6 from 1.0 in November, versus an expected drop to -0.5. Survey data is likely to weaken/remain weak in the coming months as the pandemic situation worsens into the year’s end.

Ahead

Looking ahead to the rest of the session, the ECB releases the minutes of its latest policy meeting at 1230GMT. There is then a speech from ECB President Christine Lagarde at 1330GMT. After that, the calendar is empty and markets are set to be quiet.

- GBP/USD struggled to preserve modest intraday gains and refreshed YTD low on Thursday.

- Mixed Brexit signals attracted bears at higher levels despite some USD profit-taking slide.

- The fundamental backdrop supports prospects for a further near-term depreciating move.

The GBP/USD pair refreshed YTD low during the mid-European session, albeit lacked follow-through and so far, has managed to hold above the 1.3300 round-figure mark.

The British pound drew some support on Thursday from the latest signs that a further breakdown of the post-Brexit UK-EU relations is not imminent. Reports indicate that Britain would hold off suspending parts of the Brexit divorce deal relating to Northern Ireland for as long as talks with the EU remain constructive. This, along with the firming expectations for an interest rate hike by the Bank of England in December, assisted the GBP/USD pair to gain some positive traction during the early part of the trading action on Thursday.

On the other hand, the US dollar witnessed some profit-taking following the recent strong runup to a 16-month peak and contributed to the GBP/USD pair's early uptick. That said, the worsening row over the post-Brexit fishing rights between France and Britain kept a lid on any meaningful gains for the sterling. In the latest development, French fishermen were reportedly planning to block British vessels' access to French ports in protest against Britain's refusal to grant them more licences to operate in UK territorial waters.

Meanwhile, the USD corrective pullback remained cushioned amid growing market acceptance that the Fed would be forced to adopt a more aggressive policy response to contain rising inflationary pressures. The bets were reinforced by Wednesday's release of the US PCE Price Index, which accelerated to a 30-year high in October. Adding to this, the minutes of the November FOMC meeting revealed that were open to speeding up the tapering of the bond-buying program and moving quickly to raise interest rates if high inflation persists.

The fundamental backdrop favours bearish traders, though relatively thin liquidity conditions on the back of the Thanksgiving holiday in the US warrant some caution. This makes it prudent to wait for a sustained break through the 1.3300 round figure before positioning for an extension of the recent decline from levels just above the key 1.3500 psychological mark.

Technical levels to watch

Economist at UOB Group Lee Sue Ann reviews the latest RBNZ event, where the central bank hiked the OCR to 0.75%.

Key Takeaways

“The Reserve Bank of New Zealand (RBNZ), at its last meeting of the year, decided to increase the Official Cash Rate (OCR) to 0.75%. In the accompanying press release, the RBNZ stated that ‘the Committee agreed it remains appropriate to continue reducing monetary stimulus so as to maintain price stability and support maximum sustainable employment’, adding that ‘further removal of monetary policy stimulus is expected over time given the medium-term outlook for inflation and employment’.

“Today’s hike of 25bps reinforces our view that any further tightening is likely to occur in a steady approach, with incoming data key to determining future moves. The RBNZ now expects to raise its benchmark rate to 2.50% by the third quarter of 2023, according to the latest monetary policy statement (November 2021). Previously, it projected the cash rate plateauing at around 2.00% from late 2023. For now, we are comfortable with our call for follow-up 25bps hikes in February, May, August and November, taking the OCR to 1.25% by mid-2022, and for it to reach 1.75% by end-2022.”

French Health Minister Olivier Veran said on Thursday that they will not announce any new coronavirus-related lockdown or curfew, as reported by Reuters.

Additional takeaways

"COVID-19 is spreading again, quickly."

"We still have fate in our hands."

"The virus will continue to circulate actively in the coming weeks."

"France will roll out COVID vaccine booster shots for all aged 18 and over."

"Gap between earlier COVID vaccine jab and booster shot cut to 5 months."

Market reaction

These comments don't seem to be having a significant impact on the euro's performance against its rivals. As of writing, the EUR/USD pair was up 0.2% on the day at 1.1220.

UOB Group’s FX Strategists suggested USD/CNH could edge higher and visit the 6.4070 level in the next weeks.

Key Quotes

24-hour view: “USD traded between 6.3867 and 6.3984 yesterday, narrower than our expected sideway-trading range of 6.3800/6.4000. The underlying tone has improved somewhat and the bias for today is on the upside. A break of 6.4000 is not ruled but the major resistance at 6.4070 is unlikely to come under threat. Support is at 6.3890 followed by 6.3840.”

Next 1-3 weeks: “We have held the same view since Monday (22 Nov, spot at 6.3920) where ‘shorter-term momentum is beginning to build but any advance in USD is expected to face solid resistance at 6.4070’. However, USD has not been able to make any headway on the upside. That said, the underlying tone still appears to be a tad firm and we see chance for USD to edge higher to 6.4070. On the downside, a breach of 6.3750 would indicate that the current mild upward pressure has dissipated.”

USD/CHF has finally broken above the confirmed downtrend from 2019 at 0.9315. Economists at Credit Suisse look for further gains to 0.9473/97.

Near-term support moves higher to 0.9250/30

“We see scope for 0.9473/97 next, however, we now look for this area to prove a tougher barrier given the break lower in EUR/CHF, which means that USD/CHF is no longer viewed as a particularly efficient expression of USD strength.”

“Near-term support moves higher to 0.9250/30, which we look to hold to maintain the latest breakout.”

Should EUR/USD extend beyond 1.1019/02 (not our base case) or EUR/CHF reverse its breakdown, a move to 0.9672 over the medium-term would become more plausible again.”

- EUR/USD moves higher and approaches 1.1230.

- The dollar stays side-lined near recent tops.

- Inactivity in the US markets are likely to keep markets flat.

The single currency manages to regain the smile somewhat and lifts EUR/USD to the daily peaks around 1.1230 on Thursday.

EUR/USD bottomed out near 1.1180 on Wednesday

EUR/USD picks up some upside traction although the sentiment surrounding the pair stays largely tilted towards the bearish side and the door remains wide open for the continuation of the downtrend for the time being.

In the meantime, the pair is on the way to close the third consecutive week with losses, trading in levels last seen in June 2020, and always on the back of the unabated rally in the greenback.

The latter remains propped up by rising speculations of a Fed’s lift-off sooner than anticipated. Indeed, this view was supported further by the release of the FOMC Minutes on Wednesday, where the majority of members signalled that the Fed might need to trim its bond-purchase programme at a faster pace.

In the calendar, the German Gfk Consumer Confidence deteriorated to -1.6 in December, while the final Q3 GDP came in at 2.5% YoY. Later in the session, the ECB will release its Accounts of the latest meeting and Chairwoman Lagarde is due to speak.

What to look for around EUR

EUR/USD seems to have found some contention in the 1.1190/85, or fresh cycle lows, so far this week. The pair continues to suffer the ECB-Fed policy divergence, while the sharp increase in COVID-19 cases in Europe also adds to the deteriorated outlook for the single currency in the last part of the year. Also weighing on the pair, the loss of momentum in the economic recovery in the euro area - as per some weakness observed in key fundamentals – is also seen pouring cold water over investors’ optimism on the economic recovery.

Key events in the euro area this week: German GfK Consumer Confidence, German Final Q3 GDP, ECB Accounts, ECB’s Lagarde (Thursday) – ECB’s Lagarde (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the region. Increasing likelihood that elevated inflation could last longer. Pick-up in the political effervescence around the EU Recovery Fund in light of the rising conflict between the EU, Poland and Hungary on the rule of law. ECB tapering speculations.

EUR/USD levels to watch

So far, spot is gaining 0.22% at 1.1222 and faces the next up barrier at 1.1300 (10-day SMA) followed by 1.1374 (high November 18) and finally 1.1429 (20-day SMA). On the other hand, a break below 1.1186 (2021 low Nov.24) would target 1.1185 (monthly low Jul.1 2020) en route to 1.1168 (low Jun.19 2020).

- AUD/USD failed to preserve its modest intraday gains, or find acceptance above the 0.7200 mark.

- The divergent Fed-RBA monetary policy outlooks support prospects for additional near-term losses.

The AUD/USD pair witnessed some selling during the first half of the European session and dropped to a near three-month low, around the 0.7180 region in the last hour.