- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-11-2021

- The discovery of a new COVID-19 variant in South Africa that could be harder to combat spurred risk-off market mood.

- The British pound fell on COVID-19 new variant though ended the day in the green, up 0.09%.

- GBP/USD upward move caused by US dollar weakness.

The British pound recovers from earlier losses during the day, despite risk-of-market sentiment clouding the financial markets due to discovering a new COVID-19 variant in South Africa. At the time of writing, the GBP/USD is trading at 1.3341, up some 0.14%.

In the overnight session, market sentiment dampened as South Africa announced the discovery of a new COVID-19 variant.

The World Health Organization (WHO) said that it is a variant of concern, posing a threat that could confound countries’ efforts to slow the spread of COVID-19. According to sources cited by CNBC, “that the variant contains a “unique constellation” of more than 30 mutations to the spike protein, the component of the virus that binds to cells. This is significantly more than those of the delta variant.”

The mutations found on the B.1.1.529 COVID-19 variant called omicron are linked to antibody resistance, affecting how the virus behaves regarding vaccines, treatments, and transmissibility. According to Tulio de Oliveira, a Scientist in South Africa, cited by CNBC, said the variant contains around 50 mutations.

Putting COVID-19 theme on the side, the latest development in Brexit could weaken the GBP. On Friday, UK Brexit Minister David Frost said that “while we would still like to find a negotiated solution with the EU on the Northern Ireland Protocol, the gap between our positions is significant, and we are ready to use Article 16.” Meanwhile, his counterpart Maros Sefcovic said that “a decisive push was needed to ensure predictability” in the case of supplying medicines.

Back to the GBP/USD, in the overnight session, the pair remained subdued, despite the risk-off mode that weakened most risk-sensitive currencies, versus safe-haven peers, except for the US dollar. The British pound dipped as low as the S2 daily pivot point at 1.3272 when the coronavirus news crossed the wires but bounced off, reclaiming the 1.3300 figure.

That said, GBP/USD traders would need to focus on the developments of Brexit, the Bank of England, and the new coronavirus variant. On Friday, GBP/USD bulls held their ground; however, coronavirus developments over the weekend could worsen market mood conditions that could favor USD bulls.

GBP/USD Price Forecast: Technical outlook

The GBP/USD pair keeps trading within a descending channel of 350 pips wide or so. The dip witnessed in the session on risk aversion briefly touched the bottom-trendline of the abovementioned. However, it rejected the downward move, forming a candle chart called “hammer” in the daily chart, indicating that bulls regain control in the near term. Nevertheless, the daily moving averages (DMA’s) with a downslope reside above the spot price, reinforcing the downtrend.

In the outcome of a corrective move to the upside, the November 12 swing low support-turned-resistance at 1.3352 would be the first resistance. A breach of that level would expose crucial resistance areas, like the September 29 cycle low support now resistance at 1.3411, followed by the November 18 high at 1.3513.

On the other hand, the 1.3300 psychological would be the first support, that once broken, could pave the way for further losses, finding key support levels on its way down. The next support would be the November 26 low at 1.3278, followed by the figure at 1.3200.

Developing story...

- EUR/GBP spiked towards 0.8500 on Friday as markets were rocked by the latest Covid-19 developments.

- The pair benefitted from a moderation of global central bank rate hikes.

EUR/GBP saw sharp upside on the final trading day of the week, surging from close to the 0.8400 level to print session highs near 0.8500. As trade draws to a close for the week a little earlier than usual thanks to the US Thanksgiving holiday weekend, the pair is trading in the 0.8480 area with on-the-day gains of about 0.85% or 72 pips. That marks the pair’s worst daily performance since 3 November, when the Bank of England surprised markets by opting to leave interest rates unchanged.

The latest rally only takes EUR/GBP back to as high as levels seen midway through the month, and the pair remains more than 1.3% below earlier monthly highs. The pair’s long-term downtrend is nowhere near yet under threat.

The reason for the heightened volatility on Friday was a combination of risk-off flows and dovish repricing of central bank expectations in light of the latest Covid-19 developments. Other analysts cited thin market liquidity conditions as exacerbating things due to the US holidays. GBP is typically more sensitive to swings in risk appetite than the euro, partially because the euro’s negative yield encourages traders to use it as a “funding currency” for risky bets, that then get unwound in times of strife (leading to “haven” flows back to the euro). Moreover, GBP is more exposed to dovish central bank repricing than the EUR given that markets near-term tightening from the BoE and not from the ECB (though, to be fair, the latter is set to end the PEPP in March).

The shift in central bank pricing that benefitted the euro versus the pound can be summed up by looking at by comparing movements in interest rate futures. The three-month December 2022 sterling LIBOR future was up over 10 points to 98.82 on Friday (implying 10bps less tightening expected by the end of 2022) versus a 4.5 point rise in the euro equivalent future (implying 4.5bps less tightening by the end of 2022).

Elsewhere, with focus very much on the macro story and the potential economic, fiscal and monetary implications of the newly discovered Covid-19 variant, Brexit headlines and BoE speak were ignored. In fairness, neither offered surprises; Brexit talks rumble on without signs of progress and while the BoE’s chief economist Huw Pill was understandably worried about the Covid-19 variant news.

- XAG/USD falls on the back of the discovery of a new COVD-19 variant in South Africa.

- Risk-off market mood spurred by the COVID-19 NU variant triggered a sell-off in the precious metals segment.

Silver (XAG/USD) extends its overnight session losses, plunges 1.91% in the day, trading at $23.14 during the New York session at the time of writing. The discovery of a new COVID-19 variant called NU in South Africa dented the market sentiment.

South Africa discovered a new COVID-19 variant, which dampened market sentiment

According to wires, the global scientific community is on alert. There is a chance that the new COVID-19 variant “NU” discovered in South Africa, could be more virulent than the Delta and vaccine-resistant. Scientists said that it has many mutations on the spike protein, and it is the “most evolved” variant yet discovered from the original virus.

In the overnight session, XAG/USD reached a daily high at $23.70. However, once the level was reached, COVD-19 news crossing the wires triggered a $0.40 drop that found some follow-through as the European and North American sessions progressed. In the last couple of hours, silver broke below $23.00 but bounced off Friday’s low at $22.87, reclaiming the $23.00 as of writing.

In the meantime, the US Dollar Index, which tracks the greenback’s performance against a basket of six rivals, falls 0.60%, sits at 96.15, underpinned by falling US T-bond yields, with the 10-year benchmark note, slides 14 basis points, down to 1.50%.

Therefore, COVID-19 developments would be the main drivers for silver and commodity traders. It is worth noticing that gold is trading with heavy losses, collapsed $15.00 in the day, standing at $1,785, at press time. Further, Western Texas Intermediate (WTI), US crude oil benchmark is down 11.63%, trading at $68.91.

XAG/USD Price Forecast: Technical outlook

Silver (XAG/USD) has a bearish bias, as depicted by the daily moving averages (DMA’s) residing above the spot price. That, alongside the Relative Strenght Index (RSI) at 36, indicates that the non-yielding metal still has enough room to print another leg-down.

In the outcome of extending the downtrend, the first demand zone would be the $23.00 figure. A breach of the latter would expose crucial support levels, like the October 12 swing low at $22.34, followed by the psychological $22.00.

UK Brexit Minister Lord David Frost said on Friday that, while we would still like to find a negotiated solution with the EU on the Northern Ireland Protocol, the gap between our positions is significant and we are ready to use Article 16. These comments are in line with remarks he made earlier in the week.

Frost’s EU counterpart Maros Sefcovic also made comments earlier. He said that a decisive push was needed to ensure predictability.

According to South African Scientist Ian Sanne, we have every indication that vaccines are still effective in preventing severe Covid-19 disease from the new variant. However, Sanne said that South African authorities would have conducted more tests by the middle of next week.

- Mexican peso under pressure amid global risk aversion due to new COVID variant.

- The retreat in USD/MXN found support above 21.65, now is approaching 22.00.

The USD/MXN is rising 1.50% on Friday, adding to weekly gains. It peaked during the Asian session at 22.15, the highest level since September 2020 and then pulled back finding support at 21.65. As of writing it is hovering around 21.90 as the market’s sell-off continues.

The concerns triggered by the new COVID-19 variant hits market sentiment. Equity markets tumbled in Europe and in the US, the Dow Jones is falling by 2.70% and the Nasdaq by 1.95%.

Emerging market currencies are falling sharply. The worst performers are the Turkish lira (USD/TRY +4.45%), the South African rand (USD/ZAR + 1.75%) and the Mexican peso.

The USD/MXN was already sharply higher for the week, not only boosted by global developments but also by domestic factors. The change in the nomination for the next head of the Bank of Mexico sent the Mexican peso lower earlier on the week.

The US dollar is up by almost 5% over the last five days versus the Mexican peso; the biggest rally since September of last year. It is about to post the highest close in more than a year. The rally could go on if market conditions remain negative.

Technical levels

- South African NU COVID-19 variant jitters spurred risk aversion.

- USD/CHF plummeted from 0.9350s towards 0.9230s as market sentiment dampened.

- USD/CHF broke the 50-DMA, bears eye the 100-DMA and the 0.9200 figure.

The USD/CHF plummets during the New York session, down 1.44%, trading at 0.9223 at the time of writing. In the overnight session, COVID-19 jitters, around a new virus variant called NU, found in South Africa, dented the market sentiment, as safe-haven currencies like the Swiss franc and the Japanese yen are rising against most G8 currencies, including the US dollar.

South African NU COVID-19 variant jitters spurred risk aversion

In the overnight session, the USD/CHF traded near the highs 0.9350s, but the news of the new COVID-19 NU variant found in South Africa spurred the downward move in the pair, breaking crucial levels on the way south. The 50-day moving average (DMA) at 0.9234 has been broken at press time, exposing the 100-DMA right around the 0.9200 figure.

Data coming out of South Africa keeps the global scientific community on alert. There is a chance that the NU variant might be more virulent than the Delta, and it could be vaccine-resistant. According to scientists, it has a high number of mutations on the spike protein, and it is the “most evolved” variant yet discovered from the original virus.

That said, in the near term, USD/CHF traders would lie on COVID-19 developments, alongside macroeconomic outlook and market sentiment, which could offer some fresh impetus to act on it.

USD/CHF Price Forecast: Technical outlook

The USD/CHF is south of the 50-DMA, approaching the 0.9200 figure, trading near two-week lows. Nevertheless, the fundamentals have not changed as the move was triggered by market sentiment, so the pair is tilted to the upside. Also, the October 26 swing high at 0.9226 resistance-turned-support, alongside the 50-DMA, capped the downside move at the moment, but a daily close over the levels mentioned above is needed to confirm a bottom.

On the way south, the confluence of the 100-DMA and the 0.9200 figure would be the first support area. A breach of the latter would expose crucial support levels, like the 200-DMA at 0.9168, followed by 0.9100.

On the flip side, in the outcome of reclaiming 0.9230, that would expose the July 2 swing high at 0.9274, followed by the 0.9300 figure.

South African Health Minister Mathume Phaahla asid on Friday that the reaction of the UK and other countries in Europe to the Covid-19 variant found in South Africa was unjustified, according to Reuters.

South Africa is acting with transparency, he insisted, and while preliminary studies do suggest variant may be more transmissible, the reaction of some countries by imposing travel bans are completely against norms and standards of the WHO. Phaahla continued that he is confident that vaccines remain major bulwark in terms of protecting us from the virus.

European Central Bank Governing Council member Hernandez de Cos said the PEPP should, in theory, end in March 2022, according to Reuters. He added that other programmes or instruments at ECB's disposal are linked to hitting to sustained 2% inflation target and that the conditions for interest rate hikes had not yet been met by ECB's forward guidance policy.

Market Reaction

The euro has not responded to the latest comments from ECB's de Cos, with FX markets much more focused on Friday on the concerning new South African Covid-19 variant.

- WTI has been under severe selling pressure in recent trade and is now under $70.00.

- That marks a more than 11% decline on the day, its worst session since last year’s negative prices.

Front-month WTI futures have been getting absolutely battered in recent trade and have recently dropped below the $70.00 level. That marks a more than $8.50 decline (over 11%) on the day, its worst such day since the front-month WTI futures contract swung deeply into negative territory in April 2020.

-637735401632457761.png)

The oil market’s implosion comes on a day when countries across the world have been implementing (or are considering implementing soon) travel restrictions to countries where cases of the new, highly concerning South African Covid-19 variant have been detected. As the new variant spreads, which it is expected to do over the coming weeks, it seems highly likely that further travel restrictions will be imposed. All of this could be catastrophic for jet fuel demand, a key component of global crude oil consumption.

The latest developments in oil markets have not gone unnoticed by OPEC+. According to sources cited by Reuters, the cartel is monitoring developments around the new, concerning Covid-19 variant and some members are expressing concern that it may worsen the outlook for oil markets. The group meets next week to decide on oil production policy and there is already speculation that they might implement new output cuts. The group was already rumoured to be mulling halting its recent run of consecutive monthly 400K barrel per day output hikes in response to the US and other nations' decision to release oil reserves.

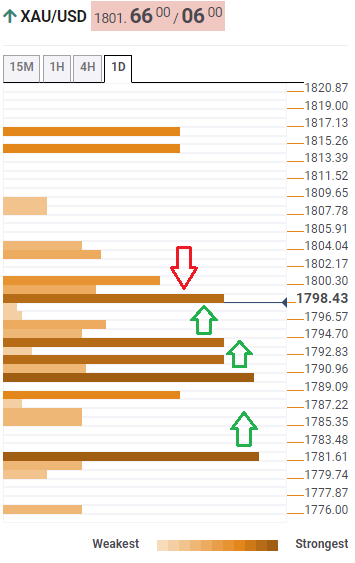

- XAU/USD retreats more than $10 from daily highs.

- Wall Street indices down more than 2%.

- US yields at lowest in two weeks, 10-year at 1.50%.

Gold prices are up for the day but off highs. XAU/USD jumped to $1815 during the European session but then turned to the downside, pulling back under 1800$. The risk aversion environment kept gains limited and favoured the retreat.

US Treasuries are sharply higher on the back of risk aversion. The US 10-year is at the lowest since November 10 at 1.49%, after being near 1.70% two days ago; the 30-year is down 6% at 1.84%.

Concerns about the new COVID-19 variant weighed on market sentiment and is looking to affect monetary policy expectations. The restrictions announcements across Europe pushed equity and crude oil prices sharply to the downside.

Initially, XAU/USD reacted to the upside, boosted by lower US yields. The rally was limited, and as of writing, it is retreating, affected by the global sell-off and a mixed US dollar. A firm recovery above $1810 could remove the negative tone in the short term; while a daily close under $1780 would suggest more losses ahead.

Technical levels

According to OPEC+ sources cited by Reuters, the cartel is monitoring developments around the new, concerning Covid-19 variant and some members are expressing concern that it may worsen the outlook for oil markets. This comes ahead of next week's OPEC+ policy meeting.

According to Reuters, an OPEC delegate said of the new variant that it was "not good as it adds bearishness to an already weak outlook". Another delegate reportedly noted the steep drop in oil prices on Friday, but said it was not yet clear how significant an impact the variant would have. "I am very concerned," Reuters quoted the delegate as saying. "There are many unknowns at the moment."

After falling to its lowest level since early November at $1,778 on Wednesday, gold has staged a decisive rebound ahead of the weekend and settled near $1,800. In the view of FXStreet’s Eren Sengezer, XAU/USD looks to extend rebound amid renewed coronavirus fears.

Gold's inverse correlation with US Treasury bond yields stays intact

“Although a better-than-expected increase in Nonfarm Payrolls could provide a boost to the dollar, the market reaction could remain limited unless vaccine producers reassure markets that they will be able to handle the new variant.”

“In case Fed officials refrain from suggesting that they will need to stay patient in the face of renewed coronavirus fears, US T-bond yields could regain traction and cap XAU/USD’s upside. On the other hand, gold could continue to gather strength if safe-haven flows continue to dominate the financial markets.”

“On the upside, $1,815 (Fibonacci 38.2% retracement of the latest uptrend) aligns as first resistance ahead of $1,825 (20-day SMA). In case the latter turns into support, XAU/USD could target $1,840 (Fibonacci 23.6% retracement).”

“The bearish pressure could increase with a daily close below $1,790 (50-day SMA, 100-day SMA, 200-day SMA) and cause gold to fall toward $1,780 (Fibonacci 61.8% retracement), $1,770 (static level).”

- AUD/USD is consolidating in the mid-0.7100s having nearly hit the 0.7100 level earlier in the session.

- The pair is on course for steep daily losses amid heightened pandemic fears.

- A break of 0.7100 could see the pair drop quickly to 0.7000.

AUD/USD tumbled below key support in the form of the late September low at 0.7170 on Friday and eventually fell as low as 0.71125, as risk assets were pummeled amid a spike in pandemic-related fears. The pair has since recovered back to close to 0.7140, but still trades with losses of about 0.7% or 50 pips on the day and is on course to end the week down 1.2%.

For now, dip-buying and profit-taking on previous short positions have kept AUD/USD above support in the 0.7100 area. Should this support break, a run towards the next key area of support around 0.7000 is likely.

Concerning new variant

The latest data out of South Africa regarding a recently discovered new Covid-19 variant has caused global health authorities and the scientific community highly concerned. There is a chance that 1) the variant might be more virulent than the delta variant and 2) the variant might be vaccine-resistant. According to the scientists who have sequenced the variant’s genome, it has a high number of mutations to the spike protein (the part the mRNA vaccines are designed to target). According to some in the scientific community, it is the “most evolved” variant yet discovered from the original virus.

Risk-off, Aussie lower

Thus, a major theme in the news on Friday has been various countries around the world reimposing travel restrictions to South Africa and other nations known to house the new variant. Market participants have been dumping risk assets out of fear that not only travel restrictions will hurt the global economic recovery, but also that the countries may be forced into further lockdowns again if the new variant is as dangerous as feared.

The Aussie is thus not a good asset to hold in these conditions, given its historic strong correlation to risk appetite and the Australian economy’s exposure to global economic conditions. Moreover, industrial metals took a beating on Friday amid fears of a global economic slowdown, with the Bloomberg Industrial Metals subindex (BCOMIN) lurching 3.8% lower. The export of industrial metals and their ingredients such as copper and iron ore are key for the Australian economy.

European Central Bank Vice President Luis de Guindos said on Friday that the new Covid-19 variant is worrying. We have to be patient even if markets are volatile, he added, before stating that it is his personal opinion that policy will remain accommodative. On the PEPP he said it will end in its expected size at the end of March.

Market Reaction

The euro has not reacted to the latest remarks from de Guindos, though it has in recent trade managed to pop back to the north of the 1.1300 level.

European Central Bank President Christine Lagarde said on Friday that she expects inflation to begin to slow from January, according to Reuters. We will take action if it becomes necessary, she added, before stating that, under the current conditions, she expects we will no longer need net bond purchases under the PEPP by the Spring.

- Concerns about the new COVID variant triggers sell off across financial markets.

- Japanese yen among top performers boosted by risk aversion and lower US yields

The USD/JPY is falling sharply on Friday, having the worst day in months after fears over a new COVID-19 variant trigger sharp declines across financial markets. The pair is losing more than 200 pips, trading around 113.30/40, the lowest level since November 10.

The pair opened the slightly below 115.50 and near multi-year highs but then it started to move lower and accelerated again during US hours boosted by risk aversion.

In Wall Street, the Dow Jones is losing 2.60% and the Nasdaq 1.65%. In Europe main indices lost more than 3%. The announcement of travel restriction from Africa to Europe weighed damaged considerably market sentiment boosting the demand for safe-haven assets.

US yields tumbled favoring even more the Japanese yen. The US 10-year that a few sessions ago was flirting with 1.70% is testing 1.50%, the 30-year yield dropped from above 2% to 1.85%.

If USD/JPY consolidates below 113.40, more losses seem likely. The next support level is seen around 113.20 that protects 113.00. Below attention would turn to the November low at 112.70.

Technical levels

- The COVID-19 NU variant found in South Africa, spurred a sell-off of assets with the “risk” word attached to it, boosting safe-haven currencies.

- USD/CAD advances sharply, up more than 1%, amid risk-off market sentiment.

- USD/CAD: A break above 1.2800 could expose a move towards the YTD high at 1.2948.

The USD/CAD rallies on the back of market participants’ concerns regarding the new COVID-19 variant found in South Africa, advance 1.01%, trading at 1.2777 during the New York session at the time of writing. Market sentiment has been the driver of the session, with the NU COVID-19 variant found in South Africa, which seems to have more mutations, evading vaccines. Countries like the UK, Singapore, and Israel, included some African nations on its red list. Further, Japan imposed tighter border restrictions.

In the overnight session, amid thin liquidity conditions, due to a shorter New York session, increased the volatility in the pair, which on Thursday closed near 1.2649. The news of the NU COVID-19 variant spurred the rally, which left behind all the daily pivot levels on its way north, trading at fresh two-month highs, approaching the 1.2800 figure.

USD/CAD Price Forecast: Technical outlook

The USD/CAD pair is accelerating the upward move. On the way up, broke the September 29 swing high resistance at 1.2774, leaving the year-to-date high around 1.2948 as the last line of defense of USD/CAD bears. Nevertheless, in overbought conditions, the Relative Strength Index (RSI) at 73 suggests the pair might consolidate before USD/CAD traders could determine which way the pair could be headed.

In the continuation of the upward move, the first resistance would be the psychological 1.2800. A breach of the latter would expose crucial supply zones, with the September 20 swing high at 1.2895, followed by the year-to-date August 20 cycle high at 1.2948.

On the flip side, the September 29 swing high-turned support at 1.2774 would be the first support. A break of that level would expose the 1.2700 round psychological, followed by the November 25 high at 1.2676.

- EUR/USD rebounded sharply on Friday to just below 1.1300 and is set for its best day since May.

- Dovish repricing in global central bank expectations has hit the hawkishly priced USD harder than the comparatively dovishly priced euro.

EUR/USD has rebounded sharply on the final trading day of the week amid a spike in broader market volatility owing to concerns about a new, potentially vaccine-resistant, Covid-19 variant in South Africa. The pair has rebounded to just below 1.1300 from early Friday Asia Pacific session lows just above 1.1200, a near 90 pip (roughly 0.8%) rally on the day. If the pair closes the week out at current levels, that would mark its best one-day performance since early May.

Some traders were perplexed by the pair’s strong performance. Typically, the US dollar is seen as more of a safe-haven asset than is the euro, so why is the euro outperforming the dollar by such a significant degree on a day characterised by risk-off flows?

Why the upside?

Some FX strategists said that the latest Covid-19 developments had encouraged market participants to take profit on short-euro positions, with the euro (before this Friday) heavily oversold. It is true that, until Thursday, EUR/USD’s Relative Strength Index score was 26.62, below the 30 level that technicians view as signifying oversold conditions.

But the story of euro outperformance versus the US dollar likely has more to do with an adjustment of central bank policy tightening expectations. In recent weeks, central banks have been a key driver of FX markets. Fed tightening expectations had been being brought forward amid strong US data, high inflation and hawkish Fed speak, benefitting the buck, while the ECB maintained a more dovish stance and the outlook for the Eurozone deteriorated amid rising Covid-19 infection rates.

If a nasty new Covid-19 variant does spread globally and damages the global economic recovery, this thus leaves the US dollar more vulnerable to a dovish repricing in Fed policy expectations than it does the euro. This seems to be the view of USD and EUR short-term interest rate markets on Friday.

Money market repricing

The December 2022 three-month eurodollar future (a proxy for where markets expect the Fed funds rate to be next December) jumped 17 points to 99.10 on Friday. In other words, markets reduced their Fed tightening expectations for 2022 by 17bps. Meanwhile, the December 2022 three-month Euribor future was up a much more modest 3 points to 100.38, though this was it highest in over a month.

Given that the December 2022 eurodollar future was trading at 99.50 as recently as the start of October, there is plenty more room for upside if the Covid-19 situation in the US deteriorates in the coming months. This would present as an upside risk to EUR/USD.

EUR/USD gains on short-covering and approaches 1.1300. As economists at Scotiabank note, December seasonal trends are bullish. Subsequently, the pair could race higher to the upper 1.13s/low 1.14s in the next few weeks.

EUR/USD is poised to close out the week on a bullish note

“The EUR is one of the better performers on the session but this probably reflects positioning – short-covering – rather than any particular reassessment of the EUR’s outlook.”

“The squeeze higher will serve to relieve the oversold condition on the shorter-term studies and we reiterate that seasonal trends do tend to be more USD-negative in December – the month that has delivered the strongest gain on average (+1.2%) for the EUR in the past 25 years.”

“A decent squeeze on EUR shorts could see spot rally to the upper 1.13s/low 1.14s in the next few weeks.”

European Commission President Ursula von der Leyen said on Friday that all air travel to countries with the new variant should be suspended until we have a clear understanding of it, as reported by Reuters.

The EU's contracts with vaccine manufacturers say that the vaccine must be adapted immediately to new variants as they emerge, von der Leyen further noted.

Market reaction

The shared currency continues to outperform its rivals following these comments. As of writing, the EUR/USD pair was up 0.72% on a daily basis at 1.1286.

USD/JPY is seeing a sharp pullback in line with the ‘risk-off’ phase emerging. Analysts at Credit Suisse see scope for a fresh correction to emerge with more important support seen at 112.80/73.

A ‘risk-off’ phase is now seen likely to delay the uptrend

“Whilst our broader outlook stays bullish, we see scope for a fresh correction/consolidation to emerge here in line with further equity weakness.”

“A closing break below the near-term uptrend from late September at 114.12/02 would confirm a deeper setback to the 113.59 recent reaction low, then more importantly at the 112.80/73 November low and rising 55-day average, with better support expected here.”

“Resistance is seen at 114.78 initially, above which can see a move back to 115.03, with better resistance now expected at 115.24/52.”

- EUR/JPY’s weakness hast retested recent lows around the 128.00 level.

- New strain of COVID heavily weighs on investors’ sentiment.

- The Japanese yen surges along with the risk aversion.

The strong buying interest around the Japanese yen puts EUR/JPY under extra pressure in the sub-129.00 levels so far on Friday.

EUR/JPY weaker on coronavirus headlines

EUR/JPY retreats for the third session in a row and challenged the area of recent tops in the 128.00 neighbourhood on Friday, although it managed to regain some upside traction soon afterwards.

The risk aversion mood irrupted into the markets at the end of the week in response to the resurgence of coronavirus concerns, all after a new variant appeared in Southern Africa. Fanning the flames, this new variant comes at a time where COVID cases are already increasing at quite an alarming pace in the old continent.

The prevailing risk aversion lends extra oxygen to the demand of the Japanese safe haven, while the moderate decline in US yields sponsors the daily pullback in the greenback.

In the euro docket, the German Import Prices rose more than estimated in October: 3.8% MoM and 21.7%. YoY. In addition, the ECB’s M3 Money Supply expanded at an annualized 7.7% during October.

EUR/JPY relevant levels

So far, the cross is losing 0.63% at 128.40 and a surpass of 129.59 (weekly high Nov.23) would expose 130.04 (100-day SMA) and then 130.54 (200-day SMA). On the downside, the next support comes at 127.97 (monthly low Nov.19) followed by 127.93 (monthly low Sep.22) and finally 125.08 (2021 low Jan.18).

Turkish President Recep Erdogan said that there is no turning back from the new economy programme on Friday, according to Bloomberg. Interest rates will decline, he continued, and the Turkish people will not be crushed under high interest rates.

Market Reaction

USD/TRY has spiked higher in response to the latest remarks from the Turkish President. The pair lept from around 12.40 to above 12.60 at one point, though has since moderated back to the 12.40s again.

Analysts were hoping that, following the lira's recent sharp depreciation in response to the CBRT's recent run of rate cuts, the Turkish President might reduce his pressure on the central bank to embark on further rate cuts. Needless to say, the President seems to be doubling down on what many view as a calamitous policy of pressuring/bullying to CBRT into cutting interest rates.

Prior to the ‘risk-off’ seen overnight economists at Credit Suisse had already been looking for a correction lower. This ‘risk-off’ phase has the potential to exacerbate this risk and they are alert to the potential formation of a bearish ‘reversal week’, which would be seen confirmed on a close below 4673 today.

Resistance moves to 4703 initially

“We are alert to the formation of a bearish ‘reversal week’, which would be seen on a close below 4673 today. This would then reinforce our call for a correction lower for a fall to our objective at 4568/66 – the 38.2% retracement of the October/November rally – and probably more likely the 63-day average and price support at 4524/20, which we would look to ideally hold for now.”

“A weekly close below 4520 would warn of a more serious correction lower with support seen next at 4448/38.”

“Resistance moves to 4703 initially, with 4732/50 ideally capping.”

European Central Bank Vice President Luis de Guindos said on Friday that, despite worry about the new Covid-19 variant, he thinks the impact on the economy will be smaller than in the past, according to Reuters. Luis de Guindos added that he didn't think the economic impact would be comparable to a year or two ago, as the economy has adjusted to pandemic restrictions.

On the economy, he said that uncertainty is much more elevated than in the past about inflation and that the Eurozone economy should grow about 5.0% this year and then very strongly in 2022.

Market Reaction

The euro did not react to de Guindos' comments.

- EUR/USD rebounds further and approaches 1.1300 .

- The next target of now for bulls emerges at 1.1374.

EUR/USD adds to the recovery witnessed in the second half of the week and looks to reclaim the 1.1300 barrier.

If 1.1300 is cleared, ideally in the short term, then the focus of attention is forecast to shift to 1.1374 (high November 18) before the 20-day SMA at 11415 and the weekly peak at 1.1464 (November 15).

The probability of further losses remains unchanged as long as EUR/USD trades below the 2-month resistance line (off September’s peak) near 1.1570. In the longer run, the offered stance in spot is expected to persist while below the 200-day SMA at 1.1836.

EUR/USD daily chart

Bank of England Chief Economist Huw Pill said on Friday that a resurgence of the pandemic would mean that the bank would have to be more cautious, according to Reuters. There are risks on two sides for the economy, he added.

Elsewhere, on QE, Pill said that the idea that there would not be any run-off might be optimistic and he hoped any impact would be modest. Moreover, Pill noted that he hoped the UK could return to having a positive real interest rate.

Market Reaction

GBP has not seen a reaction to Pill's comments. But they do highlight the fact that the latest Covid-19 developments are likely to strengthen the argument made by more dovish BoE members for patience when it comes to rate hikes.

"If the world is about to be engulfed by a new, potentially vaccine resistance variant of Covid-19, is now the time to be raising interest rates?" is a powerful argument that will likely be made against a rate hike next month.

UK money markets seem to be viewing the likelihood of a December rate hike as diminished. The three-month sterling LIBOR future contract for December 2021 (a proxy for where investors expect the BoE's interest rate to be next month) rose another 2.5 point on Friday to 99.84. That marks a 6 point rise on the week and it even hit highs at 0.9985 earlier in the session.

For reference, the December 2021 LIBOR future would need to be trading under 99.75 to imply that a 15bps rate hike (to 0.25%) was fully priced in by the market ahead of next week's policy decision. At 99.84, only a few bps of tightening is implied, implying a low likelihood of a rate hike in December.

According to vaccine-maker Pfizer, in case there was a "vaccine-escape" variant, the company expects to be able to develop and produce a new tailor-made vaccine against that variant within about 100 days.

AUD/USD has fallen sharply on the risk-off moves sparked by the new covid variant. Analysts at Credit Suisse believe that a weekly close below the 2021 low at 0.7106 would confirm a major top to suggest further sustained weakness, with scope for a move to retracement support at 0.6758.

Resistance moves lower to 0.7274

“We are now very confident that the market is in the process of forming a much larger long-term top, which would be confirmed by a weekly close below the 2021 low at 0.7106. If confirmed, this would turn the long-term risks lower and suggest that aggressive further weakness is likely, with the next supports seen at 0.7053/48, which is the 38.2% retracement of the 2020/21 rise, then 0.6991.”

“The size of the top suggests a move to 0.6758 is easily achievable over the medium-term.”

“Near-term resistance moves lower to 0.7200/10, with more important resistance staying at 0.7265/74, which should hold into the close to maintain a high degree of confidence in the breakdown.”

Bank of England Chief Economist Huw Pill said on Friday that provided the jobs market continues to be strong, interest rates will need to gradually increase in the coming months, according to Reuters. The economic picture is still uncertain, he added, saying that the BoE can’t give precise guarantees on what will happen to interest rates. Moreover, the BoE should take a cautious approach to policy, assessing each decision on a step-by-step basis, he noted, adding that, in his opinion, the burden of proof has now clearly shifted onto the rates decision.

In September, Pill said, I was seeking data to confirm my assessment of the strength of the post-pandemic recovery and accumulation of inflationary pressures. Now, he added, I scan incoming information for challenges to that view.

If the data evolves unfavourably and inflation is forecast to fall below target at the policy-relevant horizon, he said, the BoE can remain on hold, or even reverse course. However, he caveated, if the data strengthens and inflation is forecast to remain persistently above target, we can continue to raise rates. I do not see an immediate threat of UK inflation de-anchoring from its 2% target at the policy-relevant medium-term horizon, Pill noted.

In my view, Pill continued, the ground has now been prepared for policy action and given that the incoming data supports the conclusion that the recovery is continuing. However, the Monetary Policy Committee’s steer remains a conditional statement.

Market Reaction

Pill's comments suggest he supports a BoE rate hike next month. Though market participants already suspected that he supported this, they will now be more confident. Thus, his remarks might lend gentle support to the pound. But the overarching market focus of the day remains on the newly discovered and highly concerning new Covid-19 variant in South Africa.

- Crude oil battered as nations move to restrict travel amid fears of new South African Covid-19 variant.

- WTI drops all the way back to the $74.00 level, but are off lows in the $72.00s.

Crude oil markets have taken a battering on the final trading day of the week, with front-month WTI future prices trading around $74.00, a more near $4.00 or roughly 5.0% drop on the day. But WTI is well off earlier session lows around $72.75, where losses at the time stood at nearly 7.0% or over $5.0.

Risk appetite battered

Global risk appetite has taken a significant turn for the worse, with global equities under heavy selling pressure, risk-sensitive currencies and industrial commodities also being hit and safe-haven assets including sovereign bonds, safe-haven currencies and precious metals flying higher.

Market participants have been dumping risk assets in response to the latest news regarding a recently discovered Covid-19 variant in South Africa. Genomic analysis of the variant shows suggests that it might be the most evolved version of Covid-19 yet, with as many as 32 spike protein mutations. Early data on its spread in South Africa shows that it is rapidly outcompeting the delta variant. The scientific community and public health experts fear the new variant might be able to escape immunity acquired by past natural infection or vaccination, a notion which anecdotal evidence at this point supports.

Travel bans hit oil

In response to the raising of alarm bells in South Africa about this new variant, nations have been taking steps to implement travel restrictions. The UK and Singapore have put various African nations on their travel red lists and Israel has already implemented a travel ban to the region, while Japan is announced a general tightening of inbound travel restrictions. Market participants expect further restrictions to be forthcoming. The EU Commission is already mulling the proposal of an emergency travel ban on regions affected by the new variant, while the top US infectious disease export Anthony Fauci has said indicated that the US is in contact with South African scientists, though will not implement travel bans just yet.

Crude oil is highly vulnerable to travel bans as it would dent jet fuel consumption, which makes up a significant amount of global daily demand. This explains why the losses in crude oil markets have been comparatively more severe than in other asset classes such as equities. Various market commentators noted on Friday that the latest Covid-19 developments are likely to be a game-changer for OPEC+, who meet next week to decide on policy. The cartel is therefore highly unlikely at this point to continue with output hikes until there is more certainty with regards to the global health picture and regarding the level of restrictions that are going to placed on global travel.

- DXY accelerates the downside and revisits 96.20.

- Extra losses should be contained around 95.50.

DXY adds to Thursday’s losses and drops to the 96.20 region, or 4-day lows, on Friday.

If the selling pressure gathers further traction, then the index is likely to face initial contention in the 95.50 region (November 18) ahead of the minor down barrier at the 20-day SMA at 95.26.

In the meantime, while above the 2-month support line (off September’s low) around 94.00, extra gains in DXY remain well on the table. In addition, the broader constructive stance remains underpinned by the 200-day SMA at 92.41.

DXY daily chart

US National Institute of Allergy and Infectious Disease Director Anthony Fauci said on Friday that there were not yet any indications that the new Covid-19 variant was already in the US, according to Reuters. The US will decide on any potential travel bans after getting more information, Fauci added, saying that the US was in close communication with South African scientists.

Market Reaction

The latest comments from Fauci have not impacted the market's already very downbeat sentiment. Market participants eagerly await more information about the new variant and what the global policy response to it, if it is as dangerous as feared, might be.

- EUR/JPY adds to the recent pullback and retests 128.00.

- Further south comes the August/September lows at 127.93.

EUR/JPY extends the downside and revisits the 12800 region at the end of the week.

The continuation of the downtrend remains in the pipeline and therefore another visit to the monthly low at 127.97 (November 19) looks likely in the short-term horizon. A move further south should see the August and September low around 127.93 retested.

Looking at the broader picture, the outlook for the cross is expected to remain negative while below the 200-day SMA, today at 130.54.

EUR/JPY daily chart

A drop below 6.3750 is seen alleviating the upbeat momentum in USD/CNH, suggested UOB Group’s FX Strategists.

Key Quotes

24-hour view: “We highlighted yesterday that USD ‘could break 6.4000’. However, USD traded in a quiet manner and within a narrow range of 6.3866/6.3964. The quiet price actions offer no fresh clues and USD could continue to trade sideways, likely between 6.3830 and 6.3970.”

Next 1-3 weeks: “We continue to hold the same view from yesterday (25 Nov, spot at 6.3940). As highlighted, mild upward pressure could lead to USD edging higher to 6.4070. On the downside, a breach of 6.3750 (no change in ‘strong support’ level) would indicate that the current mild upward pressure has dissipated.”

ING's Global Head of Markets, Chris Turner, lays out three key things to watch out for in the FX world next year.

Three key FX themes for 2022

“The first thing to watch out for is a stronger dollar. The US economy continues to perform extremely well, so watch out for interest rate rises from the Fed.”

“Commodity currencies, those which are linked to a country's export of raw materials, are set to do well. We are thinking Canada, Norway and Russia here.”

“The final thing to look for is some weakness in the Chinese renminbi. It has been one of the strongest currencies in 2021 but we believe the authorities will be happy to see that drift lower next year.”

Brent Oil has embarked on a phase of pullback after retesting 2018 high of $86.70. On Friday, Brent is down more than 5% and has already pierced the $77.80/50 support. $75.60 is next and the 200-day moving average (DMA) at $73.00 is critical, according to strategists at Société Générale.

Brent looks poised to head lower towards $75.60

“MACD indicator is below its trigger within negative territory denoting prevalence of downward momentum.”

“Holding below last week's peak of $83.00, Brent looks poised to head lower towards $77.80/77.50 and perhaps even towards $75.60.”

“The 200-DMA near $73.00 could be a crucial support.”

Cable has drifted below 1.33 on risk-off. Next support is seen at the 1.3250 level. Holding above here, GBP/USD could stage a short-term bounce, economists at Société Générale report.

1.3250 is next support

“GBP/USD is in vicinity to the support of 1.3250 representing weekly Ichimoku cloud. Defending this can result in a short-term rebound.”

“1.3570/1.3600 will be a near term hurdle.”

Commenting on the coronavirus situation in Germany, German Health Minister Jens Spahn said on Friday that they will have to take drastic measures if they fail to take decisive action now, per Reuters. "Complete contact reductions could come into effect then," Spahn added.

Additional takeaways

"Coronavirus situation is dramatic, more serious than at any other time in pandemic so far."

"Wake-up call has not reached everyone in Germany."

"This wave will spread across Germany."

"Number of contacts between people must be reduced."

Market reaction

Safe-haven flows continue to dominate the financial markets on Friday and Germany's DAX 30 Index was last seen losing nearly 3% on a daily basis at 15,450.

The prospect for extra gains in USD/JPY now seems to have lost some momentum, commented FX Strategists at UOB Group.

Key Quotes

24-hour view: “We highlighted yesterday that ‘deeply overbought conditions suggest that USD is unlikely to strengthen much further’ and we expected USD to ‘consolidate and trade between 115.00 and 115.55’. USD subsequently traded between 115.22 and 115.45 but lurched lower during early Asian hours. The downside risk has increased but 114.60 is expected to offer solid support (next support is at 114.30). Resistance is at 115.20 followed by 115.40.”

Next 1-3 weeks: “We noted yesterday (25 Nov, spot at 115.35) that further USD strength appears likely but overbought conditions could lead to 1 to 2 days of consolidation first. While USD subsequently consolidated between 115.22 and 115.45, it lurched lower during early Asian hours. The sudden and sharp loss in momentum indicates that the odds for further USD strength have diminished considerably. A break of 114.60 (no change in ‘strong support’ level) would indicate that USD strength has come to an end.”

- USD/TRY resumes the upside above the 12.0000 mark.

- Earlier comments from deputy finmin hurts the lira.

- Spot recedes from all-time highs past 13.0000.

The Turkish lira resumes the downtrend and pushes USD/TRY back above the key barrier at 12.0000 the figure at the end of the week.

USD/TRY up on inflation-rates chatter

The Turkish currency depreciates on Friday in response to earlier comments from Deputy Finance Minister N.Nebati, who insisted on defending the low-interest-rate policy carried out in the country.

In line with President Erdogan’s latest speech, Nebati highlighted the “wrongness of the high interest, low inflation policy”, while added that there are no issues with the current policy of keeping the One-Week Repo Rate lower than inflation.

The lira might beg to differ on the latter, as it lost around 35% since the easing cycle started on September 23, when the Turkish central bank reduced the policy rate by 100bps to 18.00%.

USD/TRY key levels

So far, the pair is gaining 0.87% at 12.0569 and a drop below 11.5451 (low November 24) would expose 11.3370 (10-day SMA) and then 10.5292 (20-day SMA). On the other hand, the next up barrier lines up at 13.1105 (all-time high Nov.24) followed by 14.0000 (round level).

Sweden’s Riksbank has made two subtle, but notable shifts towards tightening at its November meeting. The impact on the krona proved quite contained and short-lived as external factors seem to matter more for the SEK now, according to economists at ING.

External factors simply matter more than the Riksbank now

“On Thursday, the Riksbank took two tentative steps to tightening – first, by introducing a hike in its rate forecasts (a 20bp increase in 2024), then by signalling they could start shrinking the size of their balance sheet in 2023. The move was a hawkish surprise even if it did not come anywhere close to the market’s tightening bets, which are now for 40bp in 2022 and 40bp more in 2024.”

“External drivers should remain dominant for SEK in the coming weeks and the risk is that – despite the krona having a positive seasonality in December – we could see a EZ growth re-rating capping the recovery.”

“We are currently forecasting 10.00 at the end of December, but given the worsening of the virus situation in Europe this is increasingly looking too optimistic for SEK.”

EUR/USD registered modest gains on Thursday and continues to edge higher toward 1.1250 on Friday. Economists at ING expect the world’s most popular currency pair to hold above 1.1200 into the weekend.

Holding above 1.1200 for now

“We see the euro as still vulnerable due to the Covid situation in Europe which is further widening US-EZ rate expectations.”

“A major question now is whether the new variant has already reached Europe (which is geographically closer to Africa). This could deal another blow to EZ sentiment and the EUR, which otherwise seems to have marginally benefited from its low-yielding status as the new variant shook markets and may hold above 1.1200 into the weekend.”

“We have heard some ECB members this week indicating that PEPP will end in March. Still, the EUR has been quite unreactive to policy comments with most of the focus on the current covid-related re-rating of EC growth expectations.”

EUR/GBP bounces off the base of its longer-term channel at 0.8376. As Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, notes, the pair is set to challenge initial resistance at the April 2021 low of 0.8471.

EUR/GBP to target 0.8239 on a break below 0.8376

“EUR/GBP recently sold off into new lows for the year of 0.8377 but this has not been confirmed by the daily RSI. So far the cross is holding the base of the 2021 down channel at 0.8376. This should hold the initial test. Below here attention should revert to the 0.8239 2019 low and the 200-month ma lies at 0.8167.”

“Initial resistance is 0.8471, the April 2021 low.”

“Only a move above 0.8596 (5th November high) will signal scope to revisit the 0.8659/73 highs since May.”

USD/JPY has reached the March 2017 high at 115.51 which capped. The pair is posting large losses below mid-114.00s on Friday and could extend its slump to the 112.73 early November low, Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, reports.

Initial support comes in at the uptrend line of 114.04

“Nearby support below the three-month support line at 114.04 lies at the 113.59 November 19 low and also at the 112.73 early November low. While it holds overall upside pressure should remain in play. Further down sits the 111.66 July high.”

“Above 115.60 is the 117.56 level, the 1998-2021 resistance line and 119.41, the downtrend from 1975.”

The December meeting of the Federal Reserve is expected to see a significant change in the Committee’s approach to policy, according to economists at Westpac. Subsequently, they expect AUD/USD to settle at 0.70 by June 2022.

FOMC to accelerate rate hikes

“At the December 14-15 meeting, we now expect the taper to be accelerated to conclude in March 2022, making room for three 25bp rate hikes at the June, September and December 2022 meetings.”

“From end-2022 to June 2024, we then see a further three rate hikes (one every six months) to a federal funds rate of 1.625%.”

“Our expectation that the economy can settle at trend growth with full employment is also behind our view that the US 10-year yield will hold above the federal funds rate over the entire forecast period, only retreating from a peak of 2.30% at September 2022 to 2.20% end-2023 and 2.00% end-2024 as inflation risks abate.”

“While divergent rate expectations and risks related to delta are set to weaken the euro to June 2022, once the first hike is delivered by the FOMC and prospects for Europe and the global economy, and Asia in particular, strengthen, the DXY index is forecast to fall back from 98.6 to 97.4 end-2022, and 95.9 end-2023.”

“We now see the low point in the AUD/USD at 0.70 by June lifting to 0.73 by end-2022 and sustaining that upswing in 2023 to 0.78.”

EUR/USD gathers upside traction and advances to 1.1230. The pair may find short-term support at the 1.1240/1.1180 zone, Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, reports.

A move above 1.1604 is needed to alleviate downside pressure

“EUR/USD continues to dig into the October and December 2019 highs at 1.1240/1.1180 which are still expected to offer support, especially since the new low has not been confirmed by the daily RSI and two Tom DeMark 13 counts.”

“Any bounces will find tough resistance at the 1.1604 five-month downtrend and while capped here, the overall bias remains negative.”

“Initial resistance is 1.1374, the November 18 high, followed by the 20-day ma at 1.1413.”

“Below 1.1160 (TD support) would target 1.1000, the 78.6% retracement of the move seen in 2020.”

AUD/USD remains poised to extend the ongoing downtrend in the near term, according to FX Strategists at UOB Group.

Key Quotes

24-hour view: “We expected AUD to ‘trade sideways between 0.7185 and 0.7225’ yesterday. AUD subsequently traded between 0.7181 and 0.7208 before breaking 0.7170 during early Asian hours. Downward momentum has improved and AUD is likely to weaken further. However, any further weakness is expected to encounter strong support at 0.7140. Resistance is at 0.7185 followed by 0.7200.”

Next 1-3 weeks: “Yesterday (25 Aug, spot at 0.7205), we highlighted that ‘a breach of 0.7170 would not be surprising but it is left to be seen if AUD could maintain a foothold below this level’. AUD cracked 0.7170 during early Asian hours and the rapid improvement in downward momentum suggests that there is room for AUD to weaken further. That said, it is too early to tell if AUD could move to the year-to-date low near 0.7105 (there is a rather strong support level at 0.7140). Overall, only a breach of 0.7235 (‘strong resistance’ level was at 0.7255 yesterday) would indicate that the current weakness has stabilized.”

Economists at Société Générale target the US 10-year Treasury yield at 2.25% by end-2022 as the trajectory for growth and employment remains strong.

The Fed is unlikely to let the yield curve flatten too much

“The trajectory for growth and employment remains strong, which supports our call for modestly higher yields.”

“We expect the 10y Treasury yield to rise to 2.25% by end-2022 and the yield curve to remain relatively range-bound.”

“The Fed is likely to err on the side of caution and not allow the yield curve to flatten too much.”

Here is what you need to know on Friday, November 26:

The intense flight to safety on Friday is weighing heavily on risk-sensitive currencies and global stock indexes while allowing the greenback to find demand despite falling Treasury bond yields. Reports of the new coronavirus variant, which was detected in South Africa, showing immune evasion and possibly rendering current vaccines ineffective is forcing investors to seek refuge. The economic calendar won't be featuring any high-tier data releases and market participants will remain focused on risk perception ahead of the weekend.

Japan's Nikkei 225 Index is down nearly 3%, the UK's FTSE and Germany's DAX 30 both look to open around 2% lower than Thursday's closing levels. Moreover, US stocks futures, which will close early due to the Thanksgiving holiday, are down between 1.6% and 1.3% and the 10-year US Treasury bond yield is falling more than 5%.

EUR/USD registered modest gains on Thursday and continues to edge higher toward 1.1250 on Friday. The shared currency is also attracting demand as a safe haven.

AUD/USD and NZD/USD pairs are both down nearly 1% amid risk aversion. The barrel of West Texas Intermediate (WTI) is down more than 4% amid the worsening energy demand outlook and USD/CAD is trading at its strongest level since late September near 1.2750.

GBP/USD is struggling to gain traction and stays around 1.3300 in the early European session. The UK has announced that it has suspended flights to six African countries.

USD/JPY is posting large losses below mid-114.00s on Friday as the JPY continues to gather strength.

Gold is capitalizing on falling US Treasury bond yields and trading above $1,800 following the steep decline witnessed earlier in the week.

Cryptocurrencies: After rebounding toward $60,000, Bitcoin turned south on Friday and was last seen losing 3% on the day around $57,300. Ethereum, which gained 6% on Thursday, is trading in the negative territory below $4,500.

USD/CHF has probed the 0.9368 September high which capped. Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, epxects the pair to correct lower towards the 0.9250 level initially.

Above 0.9373/75 will target the 0.9472 April high

“USD/CHF has reached 0.9368, the September high, and made its current November high at 0.9373 before coming off again. We would allow for further profit-taking in this vicinity.”

“Initial support is the 19th November low at 0.9250, but the downside should be contained by the 2020-2021 uptrend at 0.9112. We also have 0.9227, the 26th October high and 0.9150, 25th October low ahead of the 0.9112 uptrend.”

“If 0.9373 and the next higher early March high at 0.9375 were to be overcome, the April peak at 0.9472 would be next in line.”

- EUR/USD gathers upside traction and advances to 1.1230.

- Markets’ attention remains on the strong pick-up in COVID cases.

- ECB’s Lagarde, Schnabel, Panetta, De Guindos all due to speak later.

The single currency extends the optimism in the second half of the week and lifts EUR/USD to the 1.1230 area on Friday.

EUR/USD looks to yields, ECB

EUR/USD advances for the second session in a row on Friday on the back of the renewed knee-jerk in the dollar and amidst increasing risk-off sentiment sustained by coronavirus concerns.

Indeed, several European countries continue to report a fast rebound in COVID cases and open the door to fresh lockdown measures in the very near term and with the main impact expected on the economic activity just ahead of the Christmas festivities.

In the docket, German Import Prices surprised to the upside in October, rising 3.8% MoM and 21.7% from a year earlier. Later in the day, Chairwoman Lagarde is due to speak followed by Board members Schnabel, Panetta and De Guindos.

What to look for around EUR

EUR/USD seems to have found some contention in the 1.1190/85, or fresh cycle lows, so far this week. The pair continues to suffer the ECB-Fed policy divergence, while the sharp increase in COVID-19 cases in Europe also adds to the deteriorated outlook for the single currency in the last part of the year. Also weighing on the pair, the loss of momentum in the economic recovery in the euro area - as per some weakness observed in key fundamentals – is also seen pouring cold water over investors’ optimism on the economic recovery.

Key events in the euro area this week: ECB’s Lagarde (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the region. Increasing likelihood that elevated inflation could last longer. Pick-up in the political effervescence around the EU Recovery Fund in light of the rising conflict between the EU, Poland and Hungary on the rule of law. ECB tapering speculations.

EUR/USD levels to watch

So far, spot is gaining 0.25% at 1.1234 and faces the next up barrier at 1.1277 (10-day SMA) followed by 1.1374 (high November 18) and finally 1.1412 (20-day SMA). On the other hand, a break below 1.1186 (2021 low Nov.24) would target 1.1185 (monthly low Jul.1 2020) en route to 1.1168 (low Jun.19 2020).

- AUD/USD takes offers to refresh three-month low during a three-day downtrend.

- Oversold RSI conditions probe bears at the key support line, daily closing awaited.

- Bear cross keeps buyers away until crossing 100-DMA.

AUD/USD marks the heaviest daily fall in three weeks while taking offers around 0.7135, down 0.78% during Friday morning in Europe.

The Aussie pair bears cheer a sustained trading below a three-month-old support line, now resistance around 0.7260, as well as downbeat MACD signals and a bear cross of the 20-DMA to 100-DMA, to aim for the yearly bottom of 0.7105.

However, oversold RSI conditions may challenge the sellers around an ascending support line from November 2020, around 0.7140. Hence, a daily closing below the recently broken trend line becomes necessary to convince the bears.

Should the pair sellers conquer the key support line, a south-run towards the 2021 bottom surrounding 0.7100, marked in August, become imminent.

Meanwhile, corrective pullback remains elusive below the previous support line from August 20, near 0.7260.

Even so, bulls remain cautious until crossing the 20-DMA and the 100-DMA, respectively close to 0.7315 and 0.7345.

To sum up, AUD/USD sellers have some downside room to travel before hitting the key hurdle.

AUD/USD: Daily chart

Trend: Further downside expected

Gold is trading back around the $1,800 round-figure mark. XAU/USD could rise as high as $1,850, FXSTreet’s Haresh Menghani reports.

Renewed COVID-19 jitters provided a goodish lift

“In the absence of any major market-moving economic releases from the US, the focus will remain on developments surrounding the coronavirus saga. Apart from this, the US bond yields and the USD price dynamics will play a key role in influencing gold's intraday momentum on the last day of the week.”

“The support around the $1,783-82 zone would now act as a key pivotal point for short-term traders. A convincing break below will be seen as a fresh trigger for bearish traders and pave the way for additional losses. The XAU/USD could then accelerate the fall towards the $1,770-69 area en-route the monthly swing low, near the $1,759 region.”

“Momentum above the $1,800 mark is likely to confront resistance near the $1,807-08 region. Some follow-through buying could trigger a short-covering move and push gold prices beyond an intermediate hurdle near the $1,818 area, towards testing a static resistance near the $1,832-34 supply zone. A convincing breakthrough the latter will suggest that the corrective fall has run its course and lift the XAU/USD to the next relevant barrier near the $1,850 region.”

- Gold cheers risk-off mood, extends bounce off three-week low.

- US Trader’s return, virus woes and heavy yields to keep buyers hopeful.

- Gold Price Forecast: New COVID-19 variant boosts XAU/USD, hawkish Fed to cap gains

Gold (XAU/USD) pokes intraday high to mark the heaviest daily run-up in a week, up 0.55% around $1,799 heading into Friday’s European session. The yellow metal benefits from the plunge in US Treasury yields to extend the previous day’s recovery moves, mainly due to the covid variant woes.

That said, the 10-year bond coupon drops the most since July and its two-year counterpart marking the heaviest fall since March 2020 amid fears over the COVID-19 variant. The fall in the Treasury yields also weigh on the US Dollar Index (DXY), down 0.09% near 96.68 by the press time. It’s worth noting that the woes concerning the coronavirus strain don’t allow equities to benefit from the softer yields and receding chatters over the Fed rate hike.

With the US traders returning from the Thanksgiving Day holiday, although for a smaller session, the risk-off mood may get an additional boost, which in turn could propel the gold prices towards the north of the $1,800 hurdle. However, Fed policymakers haven’t yet stepped back from the rate hike calls, neither did inflation numbers. As a result, the gold buyers will need a stronger push to cross the immediate resistance.

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the gold price stays firmer above critical support around $1,790, which is the intersection of the SMA50 one-day, Fibonacci 61.8% one-day and previous low on four-hour. However, the bulls need to conquer the $1,800 resistance to retake the controls. The same includes upper Bollinger Band on one-hour, Fibonacci 23.6% one-month, as well as previous highs on 15-minute and one-hour.

Should buyers manage to conquer the $1,800 threshold, pivot point one-week S3 and previous high on four-hour will act as a validation point for the further upside around $1,802.

Following that, a smooth run-up towards Pivot point one-month R1 and previous month high, surrounding $1,816-17, can’t be ruled out.

On the contrary, $1,795 challenges the gold sellers on an immediate basis, the level comprises Fibonacci 23.6% one-day, SMA10 one-hour, Bollinger Band four-hour Middle and SMA100 one-day.

Also acting as short-term support is the $1,792 mark that holds together SMA50 one-hour, Fibonacci 38.2% one-day and SMA200 one-day.

Further, a clear break of $1,792 will need validation from the $1,790 support before fetching the quote towards $1,781 support including pivot point one-day S2.

Here is how it looks on the tool

About the Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

In opinion of FX Strategists at UOB Group, there is still room for Cable to breach 1.3300 and retest 1.3260 in the next weeks.

Key Quotes

24-hour view: “Yesterday, we held the view that GBP ‘has room to dip below the major support at 1.3300’. Our expectations did not materialize as GBP edged lower to 1.3308. While downward momentum is not exactly strong, we still see chance for GBP to dip below 1.3300 before a more sizeable rebound can be expected. That said, the next support at 1.3260 is unlikely to come into the picture. Resistance is at 1.3345 followed by 1.3365.”

Next 1-3 weeks: “There is no change in our view from yesterday (25 Nov, spot at 1.3335). As highlighted, in view of the improved downward momentum, GBP could break the major support at 1.3300. A break of this level would shift the focus to 1.3260. Overall, the downside risk is deemed intact as long as GBP does not move above 1.3390 (‘strong resistance’ level was at 1.3410 yesterday).”

- DXY comes under mild pressure following recent peaks.

- US markets return to activity post-Thanksgiving holiday.

- There will be no data releases in the US calendar on Friday.

The greenback, when tracked by the US Dollar Index (DXY), sheds some ground and revisits the 96.70 region on Friday.

US Dollar Index looks to yields

The index adds to Thursday’s small losses and retests the 96.70 region, as US markets are expected to return to the normal activity following the Thanksgiving holiday. It is worth recalling that the stock market and the bonds market will see a reduced activity on Friday and close at 6pm GMT and 7pm GMT, respectively.

In the meantime, the broad backdrop for the dollar remains constructive and supported by firm expectations of a lift-off in rates by the Federal Reserve at some point in H2 2022. In addition, the pace of the current QE tapering could be accelerated depending on the performance of the inflation.

The small drift lower in the buck comes despite the moderate drop in US yields, where the 10y note drops below 1.55% and the 30y breaks below 1.90%.

No data releases scheduled in the US calendar on Friday will leave the attention to the speech by the ECB’s C.Lagarde in the European morning.

What to look for around USD

The index clinched new cycle tops in the vicinity of 97.00 earlier in the week. The intense move higher in the buck remains well underpinned by the “higher-for-longer” narrative around current elevated inflation, which in turn lend wings to US yields and bolsters speculations of a sooner-than-estimated move on interest rates by the Federal Reserve. Further support for the dollar comes in the form of the solid recovery in the labour market, Biden’s infrastructure bill and positive results in US fundamentals.

Eminent issues on the back boiler: US-China trade conflict under the Biden’s administration. Debt ceiling issue. Geopolitical risks stemming from Afghanistan.

US Dollar Index relevant levels

Now, the index is retreating 0.10% at 96.68 and a break above 96.93 (2021 high Nov.24) would open the door to 97.00 (round level) and then 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 95.51 (low Nov.18) followed by 94.96 (weekly low Nov.15) and finally 94.56 (monthly high Oct.12).

- Asian shares see the red amid fears of the coronavirus variant.

- Japan weighs border closure for South Africa and five other nations.

- WHO and UKHSA calls special meetings to discuss virus strain.

- US Commission calls for tighter controls on money flow to China markets.

Asian equities print the heaviest fall in three months as the covid woes escalate. While portraying the mood, MSCI's index of Asia shares outside Japan drops 1.8%, the most since August whereas Japan’s Nikkei 225 print 2.5% by the press time of early European morning on Friday.

It should be observed that Japan’s Nikkei fail to cheer news that Prime Minister Fumio Kishida pushed for a wage hike policy. The reason could be linked to the chatters, spotted by Jiji news, suggesting border controls for South Africa and five other nations due to the virus resurgence.

Stocks in China and Hong Kong have additional concerns to worry about as the Financial Times (FT) cites the US-China Economic Security Review Commission to signal challenges for funds flowing from Washington to Beijing. The same drowns shares in Australia and New Zealand, by around 2.0% at the latest, whereas markets in Indonesia and South Korea are down nearly 1.5% by the press time.

India’s BSE Sensex drops over 2.0% tracking the broad risk-off mood even as India Finance Secretary T. V. Somanathan said, per Reuters, “Year will end with Capex at or close to budget estimates.”

It’s worth noting that the World Health Organization (WHO) and the UK Health Security Agency (UKHSA) have both called for a special meeting to discuss the new version of the virus and any fears emanating from it to confirm its status as a “variant of concern.” The chatters over the virus version spotted from South Africa, with a formal name of B.1.1.529, grow stronger and weigh on the risk appetite as it is said to be immune to the vaccines.

On a broader front, yields dropped sharply with the 10-year bond coupon declining the most since July and its two-year counterpart marking the heaviest fall since March 2020. Additionally, US stock futures are also down over 1.0% whereas prices of oil slump 3.0% but those of gold gain 0.50% by the press time.

Given the virus fears back to the table, covid updates are the key to follow for fresh impulse.

Read: Yields drop the most in a week, S&P 500 Futures down too amid risk-off mood

- USD/JPY witnessed aggressive long-unwinding trade on Friday amid the risk-off impulse.

- The new COVID-19 variant spooks investors and triggers a sharp fall in the equity markets.

- Retreating US bond yields kept the USD bulls on the defensive and added to the selling bias.

The USD/JPY pair maintained its heavily offered tone heading into the European session and was last seen hovering near the lower end of its daily trading range, around the 114.70-65 region.

The detection of a new and possibly vaccine-resistant coronavirus variant triggered a fresh wave of the global risk-aversion trade. This was evident from a sharp drop in the equity markets, which forced investors to take refuge in traditional safe-haven assets, including the Japanese yen. This, in turn, was seen as a key factor that led to aggressive long-unwinding trade around the USD/JPY pair.

Meanwhile, The global flight to safety led to a steep decline in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond fell over 5% and kept the US dollar bulls on the defensive and dragged the USD/JPY pair further away from a near five-year top set in the previous day. However, expectations for an early policy tightening by the Fed could help limit further losses.

The markets seem convinced that the Fed would be forced to raise interest rates sooner rather than later to contain stubbornly high inflation. The bets were reinforced by hawkish FOMC minutes on Wednesday, which revealed that policymakers were open to speeding up the tapering of the bond-buying program and moving quickly to raise interest rates if high inflation persists.

Even from a technical perspective, the USD/JPY pair, so far, has shown some resilience below the 200-hour SMA. In the absence of any major market-moving economic releases, traders might refrain from positioning for any further depreciating move. This makes it prudent to wait for a strong follow-through selling before confirming that the recent strong bullish trajectory has run out of steam.

Technical levels to watch

FX Strategists at UOB Group suggested the downtrend in EUR/USD could reach the 1.1160 level in the next weeks.

Key Quotes

24-hour view: “We highlighted yesterday that EUR ‘could weaken further but oversold conditions suggest 1.1160 is likely out of reach’. However, EUR traded in a relatively quiet manner between 1.1196 and 1.1230 before closing little changed at 1.1206 (+0.08%). Momentum indicators are turning neutral and EUR is likely to consolidate and trade sideways. Expected range for today, 1.1190/1.1235.”

Next 1-3 weeks: “Our update from yesterday (25 Nov, spot at 1.1200) still stands. As highlighted, while conditions remain oversold, the breach of 1.1200 has opened up the way for EUR to weaken to 1.1160. All in, EUR is expected to stay weak as long as it does not move above 1.1270 (no change in ‘strong resistance’ level from yesterday). Looking ahead, the next support level of note below 1.1160 is at 1.1100.”

- USD/INR takes the bids to refresh intraday high, rises the most in two weeks.

- Clear upside break of six-week-old trend line, 200-SMA joins upbeat RSI to favor buyers.

- 50% Fibonacci retracement will validate the run-up towards 75.00.

USD/INR jumps the most in a week, refreshes intraday high to 74.70 during Friday’s European morning.

The Indian rupee (INR) pair’s run-up could be linked to the successful break of a descending trend line from October 12 and 200-SMA. Given the absence of overbought RSI, the upside momentum has further room towards the north.

However, 50% Fibonacci retracement (Fibo.) of October-November declines, around 74.75, acts as a validation point for the quote’s run-up towards the 75.00 threshold.

Following that, a monthly high of 75.20 and an October 18 peak of 75.37 may entertain USD/INR bulls before directing them to the last month’s top near 75.65.

On the contrary, a daily closing below the stated resistance-turned-support line of 74.58 will aim for the weekly support line near 74.45.