- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 30-11-2021

- The NZD/JPY begins the Asian session in the right foot, up 0.17%.

- Wall Street’s risk-off market sentiment gained follow-through ahead of the Tokyo open.

- From a technical perspective, the break below 78.64 would exert downward pressure on the pair, as NZD bears eye 77.00 and beyond.

As the Asian Pacific session begins, the NZD/JPY moderately advances during the day, trading at 77.32 during the day at the time of writing. Factors like omicron strain vaccine effectivity comments by a pharmaceutical CEO and Fed’s Chair Jerome Powell hawkish comments dampened the market sentiment, thus favoring safe-haven currencies like the Japanese yen,

Furthermore, on Tuesday, at a hearing at the US Senate Committee on Banking and Housing, US central bank Chairman Jerome Powell switched from a neutral-dovish monetary policy stance towards a hawkish one. He said that the Fed’s target for inflation has been met and commented that inflation can not be longer considered “transitory.”

NZD/JPY Price Forecast: Technical outlook

From a technical perspective, the NZD/JPY daily chart depicts a downward bias, confirmed by the daily moving averages (DMA’s) residing above the spot price with a flattish slope. Further, the cross-currency pair broke below the September 3 high at 78.64 previous resistance-turned-support, a crucial level, as the 100 and the 200-DMA were exposed and broken, once the former gave way to JPY bulls.

In the outcome of extending the downward move, the first support would be the November 30 low at 76.65. A breach of the latter would expose the September 22 low at 76.33, followed by the August 19 low at 74.55.

On the other hand, the first resistance would be the November 30 high at 77.76. A break of that level would exert upward pressure on the pair, exposing the 100 and the 200-DMA’s around the 78.09-78.25 area. Once the abovementioned is broken, the next resistance would be the 50-DMA at 79.52.

-637739128699844816.png)

Australian GDP overview

Baffled by the pandemic-led local lockdowns and the Reserve Bank of Australia’s (RBA) cautious optimism, not to forget the latest Omicron woes and hawkish Fed, AUD/USD traders gear up for Australia’s third-quarter (Q3) Gross Domestic Product (GDP) figures, up for publishing at 00:30 GMT on Wednesday.

The recent data from Australia have been downbeat and lockdowns are likely to weigh on the Aussie GDP figures. However, the RBA defends bond purchase tapering while staying cautiously optimistic on the economic growth.

Other than being the headline economic data, today’s GDP figures may have little importance as the covid strain woes and comments from Fed’s Powell seem to already weigh on the quote. Additionally, the growth figures are likely to show the lockdown-led economic loss which has little importance of late as the Pacific major has already jumped on the unlock path.

Forecasts suggest the annualized pace of economic growth to come in at +3.0%, below the previous period's +9.6%, while the quarter-on-quarter (QoQ) numbers could mark the disappointment if easing to -2.7% versus 0.7% prior.

Ahead of the outcome, Westpac said:

The delta lockdowns in NSW and Vic have certainly harmed activity, but the damage is less than originally feared. A sharp fall in consumer spending and weakness in business investment is expected to be partially offset by support from home building and net exports. Westpac’s forecast of -2.5% broadly aligns with the market median.

TD Securities expects,

We expect the economy to contract sharply in Q3, with growth at -2.7% q/q, 3.0% y/y (forecast: -2.7%, 3.0%) due to the prolonged lockdowns in two of Australia biggest states (i.e., NSW and VIC). Based on RBA's Nov SoMP forecasts, the Bank sees Q3 GDP coming in at -2.2% q/q, +3.5% y/y. However, we think Q3 GDP is likely to be weaker than the Bank's expectations given a sharp plunge in consumption and lower fixed capital investments.

How could it affect the AUD/USD?

AUD/USD holds on to the previous day’s rebound from a one-year low of around 0.7130 ahead of the key data release on Wednesday.

The consolidation in the market sentiment and mixed concerns over the covid strain could best be cited as the main catalysts for the pair’s latest corrective pullback. On the latest basis, comments from China’s Vice Premier Liu He, expecting higher GDP growth for 2021, adds to the odds favoring recovery of the Aussie pair as it has dropped much since late October.

That said, today’s Aussie GDP is less likely to help the Reserve Bank of Australia (RBA) policymakers to make any key decision and hence may not help to forecast the AUD/USD prices much. However, a major positive surprise could offer a reason to the counter-trend traders as the quote struggles to drop below the yearly low.

While citing this, FXStreet’s Dhwani Mehta said, “Against the backdrop of the persistent covid worries, the reaction to the Australian GDP report could be limited, as broader market sentiment, yield dynamics and the influence of the greenback will continue to dominate the pair.”

Technically, AUD/USD holds onto corrective pullback from yearly low inside one-month-old bearish trend channel, taking rounds to an ascending trend line established since November 2020.

Although oversold RSI conditions triggered the much-awaited bounce, bearish MACD signals and downward sloping channel keeps sellers hopeful until the quote crosses the 0.7210 hurdle, including the stated channel’s upper line and 78.6% Fibonacci retracement (Fibo.) of November 2020 to February 2021 upside.

Key notes

Australian GDP Preview: September quarter contraction only a ‘setback’?

AUD/USD bears await for downside to resume again from 61.8% golden ratio

About the Aussie GDP release

The Gross Domestic Product released by the Australian Bureau of Statistics is a measure of the total value of all goods and services produced by Australia. The GDP is considered a broad measure of economic activity and health. A rising trend has a positive effect on the AUD, while a falling trend is seen as negative (or bearish) for the AUD.

- USD/CAD retreats from 10-week top, struggles to extend rebound from late October.

- Bullish MACD signals, two-week-old ascending trend line favor buyers.

- 61.8% Fibonacci retracement, tops marked in September, August also challenge buyers.

USD/CAD bulls take a breather around the highest levels since late September, easing to 1.2780 during the early Asian session on Wednesday.

In doing so, the Loonie pair steps back from a downward sloping trend line stretched from October 2020 amid overbought RSI signals. Adding to the hopes of a pullback are the multiple strong resistances that challenge the quote’s run-up beyond the stated resistance line around 1.2795.

That said, the 1.2800 threshold and 61.8% Fibonacci retracement of September 2020 to June 2021 fall, at 1.2880, offer short-term challenges to the USD/CAD pair’s upside moves.

Even if the quote rises past 1.2880, tops marked during September and August, respectively around 1.2900 and 1.2950, also offer a bumpy road to the north.

Alternatively, pullback moves remain less worrisome until staying beyond a two-week-old support line, close to 1.2690 at the latest. Before that, 50.0% Fibo. level of 1.2710 may offer nearby support.

In a case where the USD/CAD prices drop below 1.2710, April’s high around 1.2655 and the early November’s top near 1.2605 will be in focus.

USD/CAD: Daily chart

Trend: Pullback expected

- NZD/USD fails to extend bounce off one-year low.

- Market sentiment sours amid mixed concerns over South African covid variant, fears of Fed tapering.

- Fed Chair Powell confirms inflation not ‘transitory’, pushed for faster taper in testimony.

- Australia Q3 GDP, China Caixin Manufacturing PMI eyed for fresh impulse ahead of busy US calendar.

NZD/USD retreats towards the 0.6800 threshold, following a corrective pullback after refreshing the yearly bottom with 0.6772. That said, the Kiwi pair remains pressured around 0.6818 during the early hours of Wednesday morning in Asia.

With the varied opinion of the current vaccines’ ability to tame the South African strain for the coronavirus, dubbed as Omicron, markets remain jittery and rush to safe-haven assets like bonds and the US dollar. Adding to the bearish bias for the Kiwi pair were the hawkish comments from Federal Reserve (Fed) Chairman Jerome Powell, in his testimony on the CARES act before the Senate Banking Committee.

After a mildly positive start to Tuesday’s trading in Asia, risk appetite soured on comments from Moderna’s Chief Stéphane Bancel who said, per the Financial Times (FT), “that existing vaccines will be much less effective at tackling Omicron than earlier strains of Covid-19 and warned it would take months before pharmaceutical companies can manufacture new variant-specific jabs at scale.” It should be noted, however, that representatives of Pfizer and Oxford tried placating market fears citing no such evidence supporting the fact that the current jab will not be able to contain the virus strain.

It should be observed that nine-month low prints of the US CB Consumer Confidence and softer housing data helped bears to take a breather before Fed’s Powell pulled the US Dollar Index (DXY) back from the weekly low while saying, “It is time to retire the term ‘transitory’ for inflation." Also weighing on the mood and the NZD/USD were his comments suggesting the risk of more persistent inflation and signals for discussing faster taper in the December meeting.

Elsewhere, China’s official NBS Manufacturing PMI jumped past the 50.00 level for the first time in three months while New Zealand Building Permits for October recently dropped below -1.9% prior to -2.0% in October.

Amid these plays, Wall Street benchmarks posted losses and the US 10-year Treasury yields refreshed a two-month low before closing around 1.45%. Further, the DXY printed a four-day downtrend from the monthly high ahead of consolidating losses around 95.90.

Looking forward, the risk aversion wave may keep the NZD/USD prices pressured and hence highlight the headlines concerning the Fed and Omicron, which in turn emphasize on the second day of Powell’s testimony and US ISM PMI’s. On an immediate basis, Australia’s Q3 GDP and China’s Caixin PMI will be important to follow.

Technical analysis

Despite refreshing the yearly low, NZD/USD prices failed to offer a daily closing below the 0.6800-6790 region comprising the 61.8% Fibonacci retracement (Fibo.) level of June 2020 to February 2021 upside and multiple levels marked during September and November 2020. Failure to conquer the key support joins oversold RSI conditions to portray a corrective pullback targeting September’s low around 0.6860. However, any further advances will aim for July’s low of 0.6881 and the previous support line from June 2020 near the 0.6900 round figure.

Early Wednesday morning in Asia, China’s Vice Premier Liu He crossed wires, via Reuters, saying that the dragon nation’s 2021 GDP growth will exceed the goal.

The No. 2 also said that China must maintain continuity and stability in its macroeconomic policy.

It’s worth noting that Goldman Sachs cut China 2021 GDP forecasts to 7.8% from 8.0% while citing Evergrande and power cut problems in September.

Following that, China's annualized GDP figures for the third quarter of 2021 arrived at 4.9% vs. 5.2% expected and 7.9% previous, with the QoQ reading coming in at 0.2% vs. 0.5% expected and 1.3% last.

FX reaction

While the news should have favored AUD/USD buyers to defend the bounce from yearly low around 0.7130, cautious sentiment ahead of Australia’s Q3 GDP and risk-off mood in the market probe the Aussie pair by the press time.

Read: AUD/USD bears await for downside to resume again from 61.8% golden ratio

- On Tuesday, the EUR/JPY finished the day in the green amid risk-off market sentiment.

- Omicron COVID-19 concerns and Fed’s Chair Powell comments dampened the market sentiment, favoring the greenback and safe-haven currencies.

- EUR/JPY: Has an upward bias, above 128.17.

On Tuesday, the EUR/JPY is modestly advancing as the New York session wane, up some %, trading at 128.29 at the time of writing. Comments from an influential pharmaceutical CEO related to vaccine effectiveness against new coronavirus strains, and hawkish remarks of Federal Reserve Chair Jerome Powell, dented the market sentiment, favoring the greenback, the Swiss franc, and the Japanese yen.

However, in the case of the EUR/JPY, the shared currency has the upper hand against the Japanese yen, though in the overnight session, omicron woes caused a sharp drop in the pair, favoring JPY bulls, falling from 128.59 down to 127.89 amid the vaccine comments.

Additionally, on Tuesday, at a hearing at the US Senate Committee on Banking and Housing, Jerome Powell changed its monetary policy stance from neutral-dovish towards a hawkish one. He said that the Fed’s target for inflation has been met and commented that inflation can not be longer considered “transitory.” When those remarks crossed the wires, US equity indices plummeted, and the EUR/USD collapsed 130 pips on a free fall. The EUR/JPY followed its footsteps, but moderately witnessing a 70-pip fall, but as the New York session closed, the pair recovered most of the losses, finishing in the green,

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY 1-hour chart deícts the pair is range-bound between the 127.60-128.63 range, 100-pip wide. At press time, the pair tests the confluence of the 50-hour simple moving average (SMA) and Wednesday’s daily central pivot point at 128.17, acting as support. Also, November 30 high and low are higher, indicating that the EUR/JPY could be headed to the upside in the near term, but it would find some hurdles on the way up.

The first resistance would be November 30 high at 128.60. Breach of the latter would expose the 200-hour SMA at 128.86, followed by the R2 daily pivot point at 129.13.

On the other hand, a break below the daily central pivot point would exert downward pressure on the pair. The first support would be the S1 daily pivot at 127.74, followed by November 30 low at 127.64 and then the November 29 low at 127.48

- AUD/USD bears waiting to engage once again following a significant correction.

- All eyes will turn to the Aussie GDP data today.

AUD/USD is starting out the day down 0.2% from overnight trade following a strong bid in the US dollar. However, the pair has corrected which gives rise to the prospects of an opportunity for bears to move in at a discount. At the time of writing, the pair is trading at 0.7128 between 0.7062 and 0.7170.

The high beat currencies were tracking the performance of equities that sold off on the day. US bond yields lifted as Powell indicated the Federal Reserve might consider accelerating the taper of bond purchases as inflation persists. Consequently, US equities had plunged with the S&P500 down 1.9%. The Treasury curve flattened with the yield on the US 10-year Treasury down 6bps to 1.438%.

The sell-off in risk occurred on Tuesday following warning comments from the chief executive of vaccine developer Moderna who told the Financial Times that existing vaccines may not be as effective against the omicron variant.

"A remark in the Financial Times made by the CEO of a major pharmaceutical company is generating renewed selling pressure: he believes that the current vaccines will be less effective against the new variant of the virus, meaning that new vaccines will need to be developed. This, and then making such modified vaccines available, will take months in his view. This is raising concerns about far-reaching mobility restrictions to combat the "Omicron" variant," Commerzbank analyst Carsten Fritsch explained.

Meanwhile, markets will now look to today's key event for the Aussie in the Gross Domestic Product data.

- Australian GDP Preview: September quarter contraction only a ‘setback’?

AUD/USD technical analysis

AUD/USD bears will be looking to see if the price from here will start to deteriorate. If so, then there will be prospects of a downside continuation. The 61.8% Fibonacci retracement level is so far holding up as resistance.

From a 15-min perspective, the 0.7110 area will be important for bears looking to engage in a possible downtrend. A break there will likely be the last major defence for the bear trend to continue:

- AUD/NZD consolidates losses after refreshing one-week low, stays below previous key supports.

- 100-DMA, two-week-old rising trend line restrict recovery moves ahead of descending trend line from March.

- 23.6% Fibonacci retracement lures bears, for now, September’s bottom is a crucial support.

AUD/NZD licks its wounds around 1.0450-45 as Asia-Pacific traders brace for Australia’s Q3 GDP during early Wednesday morning.

That said, the cross-currency pair closed below the 100-DMA for the first time in a week while also breaking an ascending support line from November 18.

Given the steady RSI, coupled with a clear downside break of the previous key supports, the latest decline is likely to extend should the Australia GDP offer no major positive surprise, expected -2.7% versus prior +0.7% QoQ.

Read: Australian GDP Preview: September quarter contraction only a ‘setback’?

With this in mind, AUD/NZD traders aim for the 23.6% Fibonacci retracement (Fibo.) level of the March-November fall, around 1.0405, before attacking the 1.0400 threshold.

In a case where the quote remains bearish past-1.0400, 1.0330 and September’s bottom of 1.0278 will be crucial levels to watch before expecting a fresh low under 1.0240.

Meanwhile, the corrective pullback will aim for the support-turned-resistance levels of 1.0450 and 1.0480, comprising 100-DMA and a fortnight-long trend line.

Should AUD/NZD prices manage to stay firmer above 1.0480, the 38.2% Fibo. level of 1.0510 and a descending resistance line from March, at 1.0526 at the latest, will be critical for the bulls.

To sum up, AUD/NZD has already opened doors for the sellers ahead of the likely downbeat Aussie data.

AUD/NZD: Daily chart

Trend: Further weakness expected

- OIl bears took charge today on inflation fears, covid concerns and a hawkish Fed.

- Eyes turn to OPEC and will stay on the covid variant contagion risks.

West Texas Intermediate, WTI, crude oil dropped to the cheapest level in more than three months on Tuesday. There are worries over rising Covid-19 infections and concerns that the new variant will be resistant to the current vaccines. The Omicron variant is a fluid situation and only time will tell if this will pass without forcing the reimplantation of new quarantine measures, weighing on the demand side case for higher oil.

At the time of writing, WTI spot is trading down some 4.6% on the day at $66.78 after sliding from a high of $71.18 to a low of $64.45. The sell-off occurred on Tuesday following warning comments from the chief executive of vaccine developer Moderna who told the Financial Times that existing vaccines may not be as effective against the omicron variant.

"A remark in the Financial Times made by the CEO of a major pharmaceutical company is generating renewed selling pressure: he believes that the current vaccines will be less effective against the new variant of the virus, meaning that new vaccines will need to be developed. This, and then making such modified vaccines available, will take months in his view. This is raising concerns about far-reaching mobility restrictions to combat the "Omicron" variant," Commerzbank analyst Carsten Fritsch explained.

Meanwhile, The Federal Reserve was an additional risk that sent the greenback higher on the day due to the Feds chairman, Jerome Powell's hawkish testimony to the US Senate. Powell conceded inflation can no longer be considered “transitory” as the risks of persistently higher inflation have grown.

''Despite the market uncertainty caused by the emergence of the Omicron variant of COVID, Powell indicated it may be time to further curb the rate of bond purchases,'' analysts at ANZ bank explained.

''While this form of monetary policy tightening had previously been announced, Powell now says the bond purchase programme may need to end sooner than previously signalled. He stated that the economy is very strong and inflationary pressures are strong therefore it is appropriate to consider wrapping up the taper of asset purchases a few months early, and this will be discussed at the next Fed meeting. This indicates the bond purchase programme may be wrapped up by March 2022 with the final purchases occurring in February.''

In other news, supply is on the rise, with OPEC+ raising quotas by a scheduled 0.4-million barrels per day on Wednesday. '' It already postponed its technical meetings to allow more time to assess the impact of Omicron. However, it remains unconcerned, with both Saudi Arabia and Russia waiting for more information. The official ministerial meeting is still scheduled for 2 December,'' analysts at ANZ bank explained. ''However the release of 60-million barrels of strategic reserves from the United States and five other nations and concerns over the impact of the omicron variant in a quarter where demand is already seasonally weak may convince the group to forgo adding supply,'' Reuters wrote in a note.

- GBP/JPY dipped briefly under 150.00 on Tuesday, but has since recovered back to the mid-150.00s.

- The bears will now be targetting a test of the April-October lows in the 148.50-149.50 region.

- The pair continues to suffer amid heightened demand for safe haven assets as markets fret about Omicron-related uncertainties.

GBP/JPY continued to head lower on Tuesday, picking up where it left off with things last Friday after Monday’s flat session. The pair dipped under 151.00 during the Asia Pacific session as heightened demand for safe havens boosted the yen after comments from the CEO of Moderna triggered concerns about vaccine efficacy and triggered risk-off flows. The pair momentarily dipped under the key 150 level in earlier trade, but has since recovered back to around 150.30.

Since slipping under key support in the 152.50 area in the form of a string of recent lows and the 200DMA at the end of last week as Omicron fears first hit the market, GBP/JPY hasn’t looked back. The pair has now backed off over 5.0% from October’s highs above 158.00 and the bears now eye an imminent test of the April-October lows in the 148.50-149.50 area. However, with the pair’s Relative Strength Index fast approaching oversold territory at 32.00 (oversold is classified as under 30.00), this may be a tough area to crack in the coming days.

But markets remain very much driven by Omicron-related headlines. There is still a high degree of uncertainty regarding how well the variant will be able to evade vaccine-induced and natural immunity, as well as regarding its transmissibility and symptoms. The answer to these questions will determine whether the emergence of Omicron turns out to be just a “storm in a teacup” or whether it is a meaningful threat to the global economy and central bank tightening plans. As long as uncertainty remains elevated, GBP/JPY is likely to remain a sell on rallies.

- USD/TRY recently hit record highs above 14.00 in wake of further calls for rate cuts from President Erdogan.

- The Turkish President said interest rates would fall significantly ahead of the 2023 election.

USD/TRY vaulted above prior record highs at 13.50 in recent trade and printed fresh record levels above 14.00 for the first time. The pair has since dipped back under 14.00, but continues to trade in an extremely volatile manner in wake of the latest round of monetary policy commentary from Turkish President Erdogan.

Erdogan comments

Erdogan said in an interview with on State TV that interest rates would fall significantly ahead of the 2023 election as Turkey continues to push back against high interest rates with the “back of its hand”. Erdogan reiterated his stance that it is high interest rates that are the cause of inflation, and that by lowing rates, he can boost investment, employment, growth and production. He added that in 2022 he would protect workers from price hikes in 2022 with a new minimum wage.

Things going from bad to worse for the lira

Over the past three weeks, during which time USD/TRY has surged from under 10.00 to current levels close to 14.00, the lira has lost roughly 25% of its value against the US dollar. That takes losses on the year to close to 45%, making TRY far and away the worst performing of the major EM currencies this year, worse even than the Argentinian peso, which has lost about 17% of its value versus the US dollar. Remember that Argentina is a country where the Consumer Price Inflation is currently running close to 50%.

The eye-watering losses for the lira have come as President Erdogan has tightened his control over the CBRT’s monetary policy decision making by continually firing dissenters that oppose his wishes to lower rates in the face of rising inflationary pressures. As a result, any notion of CBRT independence and credibility has now gone largely down the drain and markets increasingly view monetary policy commentary from Erdogan as akin to commentary being made by the governor of the CBRT.

Thus, when Erdogan talks about further rate cuts ahead of the 2023 election, despite Consumer Price Inflation nearing 20% in October, investors within Turkey are becoming fearful that the President is driving the country towards hyperinflation. Hence the capital flight that is putting the lira under such pressure. Erdogan shows no signs of realising that it is his unorthodox economic policy (Erdoganomics, as some have called it) that is the primary cause of high inflation and continues to blame others (such as speculators for lira weakness and companies for “price hikes”).

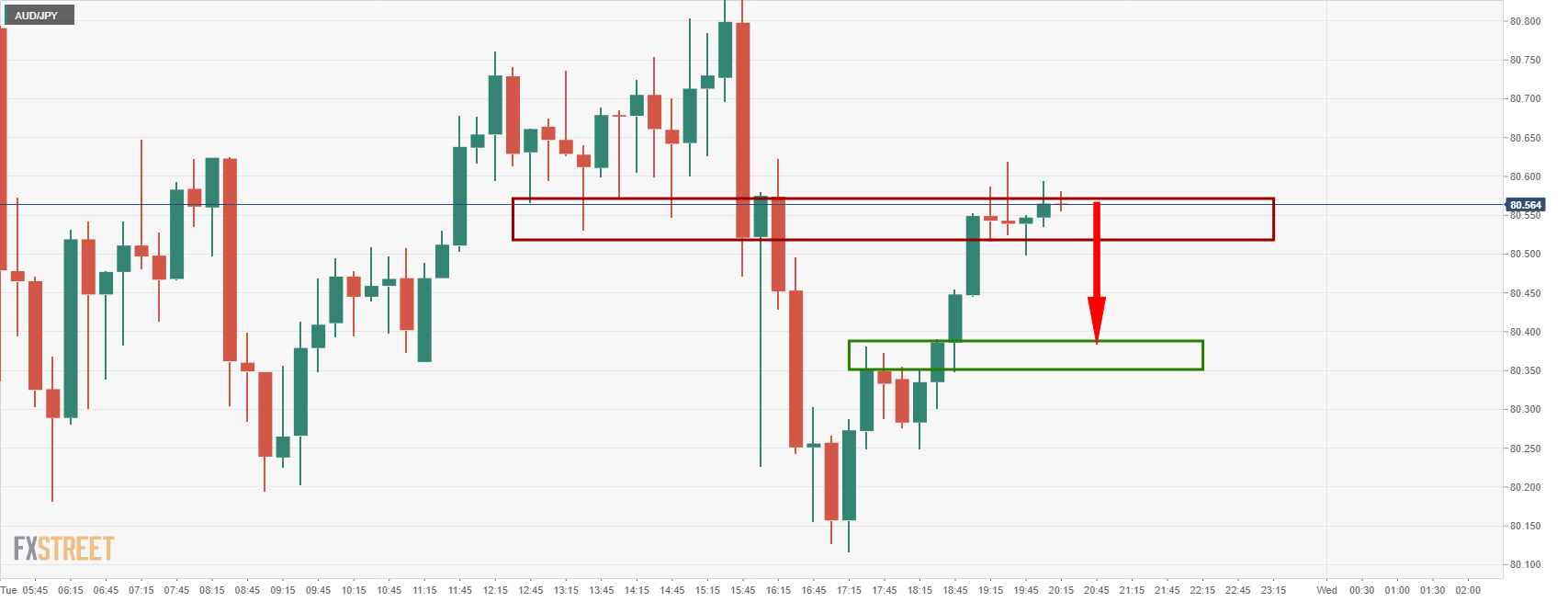

- AUD/JPY is forming a head and shoulders pattern on the hourly chart.

- AUD/JPY has reached a 61.8% Fibonacci retracement level as well.

From an hourly perspective, the forex market's risk barometer has been on the offer mid-week considering the risks related to the coronavirus variant, Omicron, as well as inflation pressures that are upsetting global equities.

The following illustrates the recent price action and the chart formation taking shape that could be regarded as a bearish prospect for the forthcoming sesisons.

AUD/JPY H1 chart

AUD/JPY daily chart

The bears are looking to tap into the liquidity to sell into and take profits between 78.50 and 80 the figure for the coming days.

AUD/HPY 15-min chart

From a short term perspective, the W-formation's neckline around 80.40 is compelling should the cross be rejected in the current support territory.

- XAU/EUR slumps almost 1%, following XAU/USD and XAG/USD footsteps.

- Worries about vaccine effectiveness on new COVID-19 strains, and Fed’s Chair Powell comments, spurred a flight to safe-haven assets, except for precious metals.

- XAU/EUR found strong support at June 1 swing high previous resistance-turned-support at €1,567.

Gold (XAU/EUR) versus the euro slides in the day, trading at €1,568 in the New York session at the time of writing. A risk-off market mood in the financial markets caused a flight to safe-haven assets. In the case of the XAU/EUR spot, the shared currency has the upper hand, advancing 0.83% against the non-yielding metal.

Comments of a pharmaceutical company CEO regarding vaccine effectiveness against new coronavirus strains dented the market sentiment along with hawkish comments made by Federal Reserve Chair Jerome Powell that favors the greenback, to the detriment of precious metals.

That said, XAU/USD is falling 0.55% in the precious metal segment, while silver (XAG/USD) slumps 0.08% during the day.

XAU/EUR Price Forecast: Technical outlook

The XAU/EUR daily chart depicts gold’s upward bias, as long as the daily moving averages (DMA’s) with an upslope reside below the spot price. Furthermore, it is essential to notice that at press time, the June 1 swing high previous resistance-turned-support price level at €1,567, that if it is broken, it will expose the November 3 cycle low at €1,519 by a test of the 200-DMA at €1,515.

On the flip side, if the June 1 support at €1,567 holds, that would help gold bulls push the price towards higher readings, with the €1,600 figure being the first resistance area. A breach of the latter would expose crucial supply zones, like November 18 low previous support-turned-resistance at €1,632, followed by the YTD high at €1,654.

-637739003089587138.png)

- After hawkish Fed Chair Powell remarks, USD/JPY attempted to recover towards 114.00 on Tuesday, but the momentum faded.

- The pair is now back under its 50DMA at 113.20 as long-duration US yields remain subdued.

USD/JPY was choppy on Tuesday, pushing as high as the 113.60s in the immediate aftermath of hawkish remarks from Fed Chair Jerome Powell in his Congressional testimony from prior lows under 112.60, before pulling back towards 113.00 more recently. That means the pair is on course to post on the day losses of 0.3%, with the session lows under 112.60 actually marking seven-week lows at the time.

USD/JPY’s failure to rally back to Monday’s highs close to 114.00 and the 21-day moving average just above it is a sign that, for now, bullish momentum is weak. That suggests the 50DMA 113.20, which was supported as recently as last Friday and this Monday, may continue to cap the price action, or at least act as a magnet to it. Now that prices have dipped below previous monthly lows and to as low as the 112.50s, a push back lower towards the 112.00 level could be on the cards, so long as recent downside momentum in US government bond yields doesn’t reverse.

Yield update

As is normally the case, USD/JPY price action on Tuesday was to a large extent driven by fluctuations in US bond yields and its impact on US/Japan rate differentials. The US yield curve saw notable bull flattening on Tuesday, with the 2-year yield actually up about 2bps on the day to around 0.52%, the 10s down nearly 9bps to 1.44% after printing its lowest level since September. The 30s, meanwhile, was down over 9bps to under 1.80% and printed its lowest since January of this year.

While short-end yields were given a lasting boost by Fed Chair Powell’s hawkish message, the boost to longer-term yields quickly faded. Traders cited concerns about the Fed turning more hawkish at a time when the economic outlook is unusually unclear given uncertainties to do with the Omicron variant as a reason why longer-duration US bonds were able to retain a decent safe-haven bid.

USD/JPY tends to be more sensitive to rate differentials on longer-term bonds, thus, if the 10 and 30-year yields do make important downside breaks, this would weigh heavily on the pair. The risk of further safe-haven bids into long-term US bonds in wake of more bad news on the Covid-19 Omicron front remains elevated and until there is more certainty, USD/JPY may remain a sell on rallies.

Turkish President Erdogan on Tuesday said that Turkish interest rates will fall significantly before the 2023 election and inflation will fall too, according to Reuters. Erdogan said earlier in the session that Turkey is pushing back the policy of high interest rates with the "back of its hand", before adding that recent volatility in the exchange rate is not based on economic fundamentals.

Moreover, he also said that there is no going back from the current economic model and that the economy will no longer live in the trap of inflation, high interest rates and the exchange rate. Those attacking the Turkish economy will not succeed, he added. Erdogan also said that he hoped Turkey would post a current account surplus in 2022 and that stability in the exchange rate can only be possible with exports and tourism income.

Market Reaction

It's been a volatile session for the ever beleaguered lira, with the pair up around 5.0% on the day just below 13.50, having briefly hit the half-round figure to match the record high printed last week. In wake of the latest inflammatory remarks from President Erdogan, who seems intent on worsening the CBRT credibility/currency crisis, a break above 13.50 seems likely.

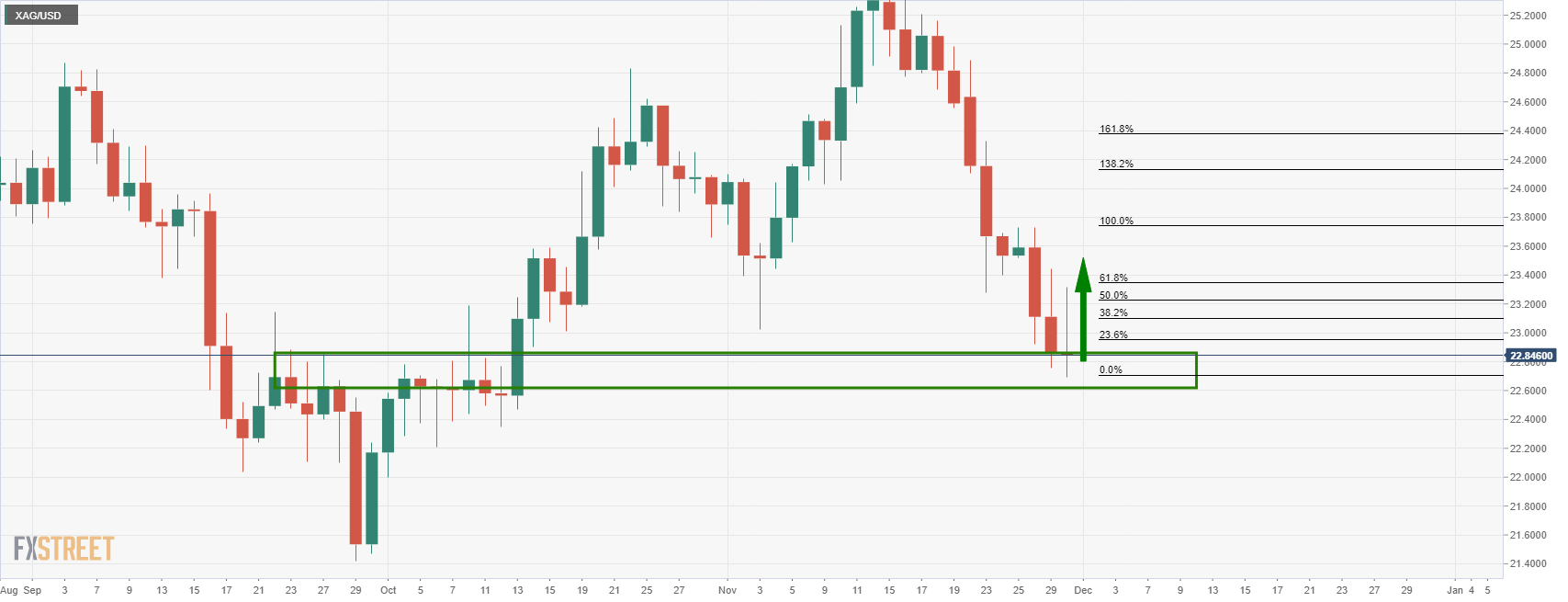

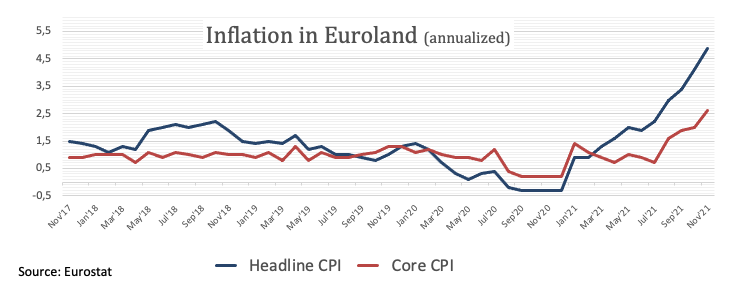

- Silber bulls are stepping in as the greenback gives back territory to the stubborn euro.

- Eurozone data arrived hot and put the ECB's dovishness into question.

- if the ECB is seen to align with the Fed, euro can rally and the dollar will be pressured, helping commodities recover.

The price of silver was a touch lower on the day despite a strong rally in the US dollar. Equities sold off and bond yields lifted as Fed Chair Jerome Powell indicated the Fed might consider accelerating the taper of bond purchases as inflation persists. At the time of writing, the white metal is down some 0.33% after falling from a high of $23.312 to a low of $22.6935.

The greenback did not manage to stay on top for long as the eurozone data came in hot. This enabled the euro to correct a strong sell-off considering the European Central Bank may not be able to ignore the risks of higher inflation for longer. Inflation in Europe hit a record in November with the headline inflation up 4.9% YoY and core inflation up 2.6% YoY. At this point, the ECB continue to insist the current high rate of inflation will not persist. On the same day, there was better news on the Unemployment Rate in Germany as well. The Unemployment rate fell in Germany by 0.1% to 5.3% in November as claims decreased by 34k. This data was slightly better than expected but ''Germany’s labour market still has some way to go to fully recover'', analysts at ANZ Bank argued.

Meanwhile, this morning the Fed Reserve Chair Jerome Powell conceded that it is time to talk about a fast rate of tapering. he noted that inflation can no longer be considered “transitory” as the risks of persistently higher inflation have grown.

''Despite the market uncertainty caused by the emergence of the Omicron variant of COVID, Powell indicated it may be time to further curb the rate of bond purchases,'' analysts at ANZ Bank explained.

''While this form of monetary policy tightening had previously been announced, Powell now says the bond purchase programme may need to end sooner than previously signalled. He stated that the economy is very strong and inflationary pressures are strong therefore it is appropriate to consider wrapping up the taper of asset purchases a few months early, and this will be discussed at the next Fed meeting.''

The analysts argued that this indicates the bond purchase programme may be wrapped up by March 2022 with the final purchases occurring in February.''

Consequently, the DXy shot higher to test the 96.65 territories. The euro, however, was above to battle back in a 61.8% Fibonacci retracement and this weighed don the greenback that fell back to test 96 the figure towards the close on Wall Street.

Meanwhile, analysts at TD Securities explained that the selling flow from China Smart Money funds has continued to weigh on silver, with the group substantially growing their short during the commodity carnage in last Friday's session.

''Interestingly, the recently added Shanghai gold length has remained resilient to the technical failure, but Shanghai silver traders' growing short fits with our view of a more vulnerable fundamental outlook for the white metal, despite the resiliency thus far observed in price action.''

Silver technical analysis

As the dust settles, the bulls will be looking for a correction, potentially as far as a test of the 61.8% golden ratio and into the prior support structure near $23.60. A break of the current support, however, opens risk to a run into the $21.50 regions.

What you need to know on Wednesday, December 1:

Financial markets are all about risk-aversion. The American dollar initially fell but changed course during US trading hours to reach weekly highs against most major rivals.

Concerns rotated around the coronavirus pandemic during the first half of the day, with the focus on the newest COVID-19 variant. News suggested that the current vaccines and antibody drugs' cocktails are likely to be less effective against the Omicron strain, although it is still unclear to which extent.

The University of Oxford noted that there's no evidence existing vaccines won't provide some protection against it, although Moderna's CEO said he believes the vaccine effectiveness would probably drop. Mandatory vaccination and borders' closure are spreading rapidly across the globe. At this time, it's unclear how this new strain will affect the ongoing economic recovery. Meanwhile, it would likely exacerbate supply chain issues, one of the main reasons for skyrocketing inflation.

US Treasury yields were sharply lower, weighing on the American currency. US Federal Reserve Chair Jerome Powell testified on the CARES act before the Senate Banking Committee and surprised investors with his words. Firstly, he said that it is time to retire the term "transitory" for inflation." Risk of more persistent inflation has risen," Powell said. Additionally, he noted that it is appropriate to talk about speeding up tapering in the upcoming December meeting. Market participants rushed into the greenback, helping yields to bounce from their intraday lows.

The shared currency is among the best performers against the greenback, now trading at around 1.1310. GBP/USD, on the other hand, plummeted to a fresh 2021 low of 1.3194 2hile AUD/USD traded as low as 0.7062. The greenback also posted gains vs the CAD, with the pair now hovering around 1.2800.

The dollar's late recovery left safe-haven currencies pretty much flat vs the dollar on a daily basis.

Gold plummeted after briefly advancing beyond 1,800, now trading at $1,775 a troy ounce. Crude oil prices also fell, with WTI at $66.00 a barrel.

Wall Street came under strong selling pressure, with all indexes closing in the red.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Leading cryptos take the back seat

Like this article? Help us with some feedback by answering this survey:

- The NZD modestly falls amid risk-off market sentiment and Fed’s Chair Powell hawkish comments.

- The market sentiment is downbeat, as Moderna’s CEO said that current vaccines would not be effective against the omicron variant.

- NZD/USD found strong resistance at the confluence of the 50-hour SMA and the daily central pivot point.

The NZD/USD is barely down during the day, fluctuating between gaining and losing amid risk-on and then the risk-off market sentiment, trading at 0.6816 at the time of writing. In the overnight session, the comments of Moderna’s CEO said that current vaccines would not be effective against the last week’s discovered omicron strain, dampening the market sentiment, as the NZD, a risk-sensitive currency, dropped to 0.6789 but bounced off those lows later.

Fed’s Chair Jerome Powell said that inflation can no longer be considered “transitory”

That said, it seemed that the NZD/USD was poised for further upside, but then Fed’s Chair Jerome Powell crossed the wires, triggering an 80 pip drop in the pair, from 0.6850s, down to 0.6772.

On Tuesday, at a hearing at the US Senate Committee on Banking and Housing, Jerome Powell said that inflation could no longer be considered “transitory.” He added that the COVID-19 recent strain, the omicron poses “downside risks to employment, economic activity and increasing uncertainty for inflation.”

Fed’s Chair Powell added that higher prices are related to supply-demand issues, reiterating that price increases have spread more broadly. He further noted that the risk of higher inflation has increased.

Powell favors a faster “wrapping up” of the bond purchasing program and commented that he would talk about the need of “speeding up taper” at the 2021’s last meeting.

On Wednesday, the New Zealand economic docket will feature Building Permits s.a. for October on a month-over-month reading. On the US front, the economic docket will unveil the ADP Employment Change for November. Further, the ISM Manufacturing PMI for November and Fed speakers, with the Federal Reserve Chair Powell, testifying before the US Congress.

NZD/USD Price Forecast: Technical outlook

The NZD/USD 1-hour chart depicts the pair has no “strong” bias, but as long as the spot price remains below the 100 and the 200-hour simple moving averages (SMA’s), it favors USD bulls. At press time, the pair has found strong resistance at the confluence of the 50-hour SMA and the daily central pivot point at 0.6817.

Failure at 0.6817 could send the NZD/USD pair tumbling lower, potentially towards new YTD lows. The first support on the way down would be the S1 daily pivot at 0.6795, followed by the November 29 low at 0.6787 and then the S2 daily pivot at 0.6765.

On the flip side, if NZD bulls reclaim the 50-hour SMA, that would expose the 100-hour SMA as the first resistance at 0.6832. A breach of the latter would expose the R1 daily pivot at 0.6845, followed by the R2 daily pivot at 0.6867.

Turkish President Recep Erdogan, speaking on State TV in Turkey, said that he will boost investment, employment, growth and production by lowering interest rates on Tuesday. Interest rates are the cause and inflation is the result, he continued, adding that he thinks economic growth in 2021 will be about 10%. Hopefully we will soon see inflation falling too, he added.

Market Reaction

USD/TRY has not seen a reaction to Erdogan's remarks in recent trade, but did on Tuesday rally back to record highs in the 13.50 area, despite most other EM currencies appreciating versus the US dollar on the day.

- The S&P 500 dropped 1.3% on Monday and printed fresh monthly lows just in time for month-end.

- The downside was triggered by concerns over vaccine efficacy versus Omicron and hawkish Fed vibes.

US equity markets more than reversed Monday’s gains on what looks set to be a classic turnaround Tuesday, with the S&P 500 dropping back below 4600 to print fresh monthly lows in the 4570s. That marks a 1.8% drop for the index on the final trading day of the month and sets the S&P 500 on course to post a monthly loss of 0.6%. Technicians will be eyeing a test of resistance in the 4550 area.

In terms of the other major US indices; the tech-heavy Nasdaq 100 index is currently nursing losses of about 1.7% while the more value/cyclical stock exposed Dow is down 1.8%. In other words, the losses across US equity markets are pretty evenly/broadly spread. The CBOE S&P 500 Volatility Index, often referred to as the VIX or Wall Street’s fear guage, was up nearly 5 points to 27.70, only a few points below last Friday’s highs at 29.00.

Driving the downside

Driving the selling pressure on Tuesday was a duo of factors. Firstly, global equities (including US index futures) fell sharply towards the end of the Asia Pacific session on remarks from the CEO of Moderna that he expected the new Covid-19 variant to significantly erode vaccine efficacy. Despite numerous other vaccine makers, developers, scientists and public health authorities offering a more reassuring take that they still expect the vaccine to be fairly effective, the damage to sentiment was already done. The reaction to the comments made by the Moderna CEO demonstrates just how twitchy markets are right now to news regarding the new variant. Further information about the variant’s transmissibility, vaccine-escape capabilities and severity of symptoms caused will be important drivers of risk appetite in the weeks ahead.

The second factor to weigh on risk appetite on Wednesday was remarks by Fed Chair Jerome Powell, who testified before Congressional Committee on Banking, Housing, and Urban Affairs. Powell’s introductory statement at the hearing, which was released on Monday but largely ignored at the time, came across as bullish on the state of the economy (on growth, inflation and the labour market). This hawkishness, which (as mentioned) was initially ignored, was then built upon by Powell in the Q&A section of the hearing, with Powell saying that the word “transitory” should be retired as a description for inflationary pressures.

Meanwhile, while Powell did reemphasise that he expects inflationary pressures to moderate in mid-2022, he placed heavy emphasis on the fact that upside risks to inflation had grown and remarked that inflation was now a risk to the labour market. When pressed by Senators on the ongoing need for more monetary stimulus in light of underlying US economic strength and high inflation, Powell then revealed that he thought it might be appropriate to end QE purchases sooner. Acceleration of the Fed QE taper would be a topic of discussion at the 15 December FOMC meeting, he said.

Powell’s hawkish remarks triggered a sharp rally in short-end and real US bond yields, as well as upside in the US dollar. The upside in longer-term US yields was much more modest. Indeed, on the day nominal 30-year yields are down nearly 9bps, while the 30-year TIPS yield was down by a similar margin. As a result, US tech/duration-sensitive growth stocks have been “spared” from the kind of underperformance that would typically be seen if yields had risen across the board.

Fed Vice Chair Richard Clarida said on Tuesday that the labour market right now is a lot tighter than it was following the previous two recessions and that wages gains are healthy but not out of line with productivity, according to Reuters. Adverse supply shocks can be a challenge for monetary policy, he added, because they push up both inflation and unemployment.

Clarida will be replaced by Fed Governing Board member Lael Brainard as Vice Chairman of the Fed in Q1 2022.

Market Reaction

Clarida's remarks have not provoked any meaningful market reaction, given they don't add anything new to the policy debate.

- AUD/USD reached a new 2021 low at 0.7062 amid Fed’s Chair Powell hawkish comments.

- US short-term bond yields advance, while the 10-year benchmark note falls to 1.449%.

- The US Dollar Index reclaims the 96.00 but keeps in the red, down 0.24%.

After trimming some of last Friday’s losses on Monday, the AUD/USD falls sharply during the day, down 0.34%, trading at 0.7107 at the time of writing. The market sentiment is in risk-off mode, as portrayed by US equities falling sharply on comments of Federal Reserve Chair Jerome Powell, weighed on risk appetite, with the US Dollar Index recovering some earlier losses in the day, down some 0.24%, but reclaimed the 96.00 figure. Meanwhile, the US short-term yields advance, while the US 10-year Treasury yield edges lower, down to 1.449%, a drop of eight basis points.

Investors priced in 50 basis points hikes, after Fed's Chair Powell comments

Money markets futures show almost 59 basis points of rate hikes priced in by the end of the following year. On Friday of last week, investors scaled back some of those bets on the discovery of the new COVID-19 variant as market participants assessed what’s its impact on the economy.

Summarizing some of Fed Chair Powell’s remarks, he said that inflation could no longer be considered “transitory.” He noted that the COVID-19 recent strain the omicron pose “downside risks to employment, economic activity and increasing uncertainty for inflation.”

Powell favors a faster “wrapping up” of the QE’s program and reiterated that he would talk about the need of “speeding up taper” at the December meeting.

That said, in the overnight session, the market sentiment dampened on the back of Moderna’s CEO warning that existing vaccines would be less effective against the South African discovered variant than earlier strains, spurring a drop in equity futures around 5:00 AM London time.

Therefore, AUD/USD trader’s focus would turn to Wednesday economic docket, though throughout the week, the US economic docket could favor USD bulls after Fed’s Chief Powell remarks. On Wednesday, the US docket will unveil the ADP Employment Change for November, a prelude of the Nonfarm Payrolls, to be released on Friday. Further, the ISM Manufacturing PMI for November and Fed speakers, with the Federal Reserve Chair Powell, testifying before the US Congress.

The Australian economic docket will feature the AiG Performance of Manufacturing Index for October and the Gross Domestic Product for the Q3 quarterly and yearly.

- EUR/USD bears looking to step in again as the price corrects 50% of the drop.

- The single currency refuses to stay down as traders take profits resulting in a sharp correction.

EUR/USD has been a rollercoaster of a ride since last week's market rout and the resurfacing of coronavirus contagion fears in the emergence of the new Omricon variant. This has seen the single currency rally vs the greenback. The expectations that the Federal Reserve would no longer be willing to speed up the pace of tapering were negated today. Despite the fears of contagion of the variant that, so far, has not had enough time to show whether current vaccines are effective or not, the Fed could step on the gas after all.

Today, the Fed's chairman, Jerome Powell, said it is time to talk about speeding up the pace of tapering. This has led to a major sell-off in the euro for which it is attempting to recover a significant portion at the time of writing.

The following is an analysis of the hourly chart that illustrates the volatility of the euro vs the US dollar and arrives at a consolidative conclusion for the time being.

EUR/USD H1 chart

As can be seen, the price has corrected over 50% of the drop in the New York session and would be expected to start to decelerate at this juncture. That being said, there is room to go for a test of the M-formation's neckline lows near 1.1340. However, the bias is to the downside below there for the forthcoming sessions mid-week, although the sharpness of the correction likely means that bears are not entirely committed which likely leaves the price sideways between the recent lows near 1.1230 and highs near 1.1385.

- GBP/USD plummets on risks of contagion and a hawkish Federal Reserve.

- Vaccines may not be effective against the new covid Omicron variant.

Sterling fell to a one-year low versus the US dollar Tuesday due to the sentiment of divergence between the Federal Reserve and the Bank of England following hawkish comments from Fed's chairman Jerome Powell. At the time of writing, GBP/USD is trading at 1.3250 and down around 0.5% on the day so far, falling from a high of 1.3370 and crash landing at 1.3194.

Fed's Powell, who was making a testimony before the Senate, said that it is time to retire the term "transitory" for inflation. Additionally, he considers it appropriate to talk about speeding up tapering in the upcoming December meeting. On that, the US dollar took off and the euro plunged, dragging the pound along for the ride as investors weigh the risks of the contagion of the Omicron coronavirus variant and the concerns that there is no effective vaccine solution, yet.

Risk assets were under pressure after Moderna Chief Executive Stéphane Bancel told the Financial Times that existing COVID-19 vaccines are unlikely to be as effective against the newly detected variant as they have been previously. On the other hand, there are mixed messages with the CEO of BioNTech saying the current generation of Covid-19 vaccines will probably still protect against severe disease in people infected by the omicron variant. However, drugmaker Regeneron Pharmaceuticals Inc said on Tuesday its COVID-19 antibody treatment could be less effective against Omicron.

Nevertheless, the uncertainty has rocked the socks off risk assets. The markets have also got what they were waiting for in Powell's testimony today, firming the belief that the Fed may still have to hike sooner than first expected despite the threat of the virus. However, it is yet to be seen as to what the Bank of England's bias will now be.

BoE in focus

Inflation has moved sharply higher in the UK, but the BoE has remained firmly with the opinion that inflation will be transitory whereby the three components, food, energy, and autos price has been affected by the supply chain blockages and re-opening of the economy.

Wage data is also mixed, analysts at TD Securities argued. ''Headline wages are distorted by furlough and compositional effects, but underlying pay growth is still rising. Flash October PAYE pay data shows the first drop in median pay since the early days of COVID, as the furlough scheme ended.''

''The BoE's Dec meeting remains finely balanced. A single hike before March is all but certain, but Omicron may hold the MPC off until February.''

- The USD/CAD reached a new weekly high at 1.2836.

- Fed’s Chair Powell: “Time to retire the word Transitory to inflation.”

- Jerome Powell favors a faster bond taper and would talk about speeding up the QE’s reduction on the next meeting.

The USD/CAD pair is rallying during the New York session, trading at 1.2820 at the time of writing. In the overnight session, the CAD had the upper hand against the greenback, amid a recovery in crude oil prices, after an overextended fall on Friday’s of last week that witnessed a drop of 12% in the day. Nevertheless, Moderna’s CEO comments that a drop in current COVID-19 vaccines efficacy spurred a spike from 1.2740 to 1.2790, ultimately gaining follow-through on Federal Reserve Chair Jerome Powell’s remarks during a hearing at the US Senate Committee on Banking and Housing.

Fed’s Chair Powell said that elevated prices are blamed on supply-demand issues, though reinforced that those increases have spread broadly. Furthermore, he noted that “risks” of higher inflation have increased and said it is time to retire the word “Transitory” when talking about inflation.

Powell added that it is “appropriate to consider wrapping up taper in a few months sooner” and said he would talk about speeding up the retirement of the bond purchasing pandemic stimulus in the next FOMC meeting.

When he was asked about the COVID-19 omicron variant, he said that he “will know within a week or 10 days, can only assess the impact on the economy then.”

The US macroeconomic docket so far featured the S&P/Case-Shiller Home Price Index (MoM) for September, which rose by 19,1%, more than the 19.3% expected. Meanwhile, the Chicago Purchasing Managers Index for November increased to 61.8, lower than the 67 estimated.

USD/CAD Price Forecast: Technical outlook

The USD/CAD 1-hour chart shows the pair has an upward bias, as confirmed by the hourly simple moving averages (SMA’s) with an upslope, residing below the spot price. At press time, the upward move triggered once Fed’s Powell said that it’s time to retire the Transitory word from inflation was capped around the R2 daily pivot point at 1.2822.

In the outcome of extending the rally, the first resistance would be the New York session daily high, reached at 1.2836, followed by the R3 daily pivot at 1.2852, followed by the figure at 1.2900.

On the other hand, the confluence of November 29 around the 1.2800 figure would be the first demand zone. A breach of the latter would expose the R1 daily pivot at 1.2780, followed by the 50-hour SMA at 1.2761.

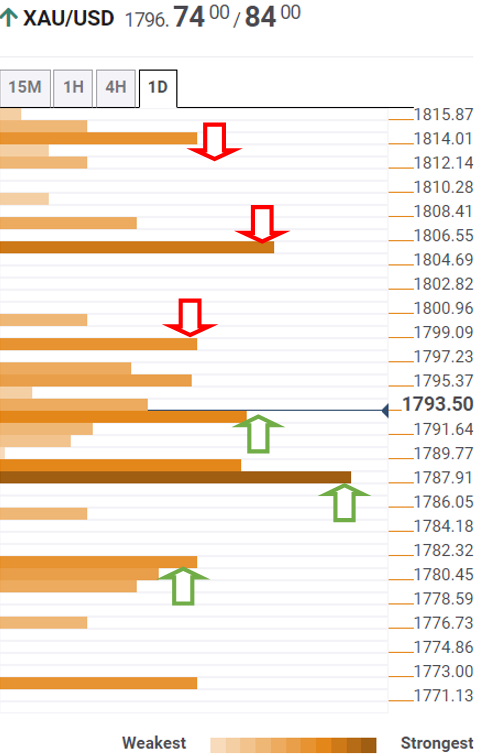

- Spot gold prices fell sharply from close to $1810 to the low-$1770s amid hawkish comments from Fed Chair Powell.

- Powell said that a faster QE taper might be appropriate and will be discussed at the December FOMC meeting.

Spot gold (XAU/USD) prices have turned sharply lower in recent trade following hawkish remarks from Fed chair Jerome Powell that sent the US dollar and short-end and real US yields lurching higher. The precious metal pulled back abruptly from earlier session highs close to $1810 and now trades in the low-$1770s, a near 2.0% turnaround from earlier session highs. Spot gold is now trading down by mover than 0.5% on the day, though has not yet broken below weekly lows printed on Monday at almost bang on $1770.

Should this level break, that would open the door to a swift drop to the next significant area of resistance close to $1760, though such a move would likely require further USD and US bond yield upside. This is far from guaranteed as markets continue to fret about the Omicron variant; the market reaction to Omicron fears so far has been to send yields and the dollar lower. Therefore, fresh Omicron-related risk-off, if it kneecaps any further hawkish Fed moves like the one seen on Tuesday, may offer some much-needed support to gold.

For reference, Powell’s remarks sent the US 2-year yield nearly 10bps higher from prior session lows under 0.45% to trade close to 0.55% for a gain of about 5bps on the day. Meanwhile, the 10-year only recovered around 4bps off prior session lows to still trade down about 5bps on the day around 1.45% versus a 1bps gain in the 10-year TIPS yield, implying a roughly 6bps decline in 10-year breakeven inflation expectations (to now under 2.50%).

Shorter-duration real yields saw a bigger bounce, with the 5-year TIPS yield now up about 8bps on the day to above -1.70%, while 5-year breakeven inflation expectations dropped about 7bps to close to 2.90%. Recall that this was above 3.30% as recently as 16 November. The moves higher in short-end and real yields helped propel the dollar higher, with the DXY now flat on the day in the 96.30s, having been as low as the 95.50s prior to Powell’s comments.

Hawkish Powell

To quickly recap the main points from Powell’s remarks; in the Q&A section of the testimony, he said that it may be appropriate to accelerate the pace of the bank’s QE taper and the FOMC will discuss this at its 15 December meeting. Moreover, he said it is time to drop the characterisation of inflationary pressures as transitory.

This added to the somewhat hawkish tone to his economic commentary in his statement to Congress, which had been pre-released to the public on Monday. In the pre-released remarks, Powell highlighted the strength of the economy, noted higher inflation (and did not use the phrasing “transitory”) and the tight labour market. Moreover, he noted how, if anything, the Omicron variant may hold back labour supply, which could exaccerbate inflationary pressures.

- EUR/USD collapsed from 1.1370s down to 1.1240s on Jerome Powell’s hawkish remarks against the US Senate Committee on Banking and Housing.

- Fed’s Powell: “I will talk about speeding up taper at the coming Fed meeting.”

The EUR/USD plummeted during the New York session, on Federal Reserve Chairman Jerome Powell, remarks against the Senate Committee on Banking and Housing.

Market reaction on Fed’s Chair Jerome Powell remarks

At the beginning of the Q&A session, the EUR/USD pair was trading around the 1.1370s but plummeted to 1,1240s on remarks of Jerome Powell.

Jerome Powell said that higher prices are related to supply-demand issues, reiterating that price increases have spread more broadly. He further noted that the risk of higher inflation has increased and commented that it is time to retire the word Transitory when talking about elevated prices.

Regarding a faster QE’s reduction, he said that it is “Appropriate to consider wrapping up taper in a few months sooner.” Further noted that he “will talk about speeding up taper at the coming Fed meeting.” He added that recent data showed elevated inflationary pressures, rapid labor market improvement, and strong spending.

When he was asked about the COVID-19 omicron variant, he said that he “will know within a week or 10 days, can only assess the impact on the economy then.”

EUR/USD Price Forecast: Technical outlook

The 1-hour chart leaves us with a 130 pip sizeable bearish candle on the remarks of retiring the “T” word for inflation. The price plunged through the R3, R2, R1, central daily pivot, S1, and found support around the S2 area at 1.1233, where it bounced towards 1.1270.

At press time, EUR/USD bulls are having a tough time, trying to break above the 200-hour simple moving average (SMA) at 1.1270. Meanwhile, EUR/USD bears, on the other side, are battling the 100-hour SMA at 1.1261, at the confluence of the S1 daily pivot.

On the way up, the first resistance would be the central daily pivot point at 1.1286, followed by the 50-hour SMA at 1.1300, and November 29 high at 1.1311. On the flip side, the S1 daily pivot at 1.1261 would be the first support, followed by the S1 daily pivot at 1.1233 and then the S3 pivot at 1.1208.

The US dollar surged on Tuesday following comments from Fed Chair Jerome Powell, who indicated it would be appropriate to consider wrapping up the bank's QE taper a few months sooner. Powell, speaking before the Committee on Banking, Housing, and Urban Affairs of the US Senate alongside US Treasury Secretary Janet Yellen, added that the Fed would discuss speeding the QE taper at the 15 December FOMC meeting.

Powell also said that it was time to retire the word "transitory" as a description of inflation in the US. On inflation, he said that the risk of higher inflation had increased, that price increases have spread more broadly and that the risk of high inflation could undermine the Fed's efforts to get the US back to full employment.

Powell's remarks were interpreted hawkishly and, as a result, the US dollar and US yields (particularly real yields and short-end nominal yields) shot higher. The DXY, which had been trading around 95.50 prior to Powell's remarks, at one point rallied to the north of the 96.50 level, a more than 1.0% turnaround from prior session lows at the time. Profit-taking has since seen this gains moderate somewhat, with the DXY now trading around 96.40, where it trades higher on the day by about 0.2%.

For reference, US 2-year yields saw a more than 10bps surge from prior session lows under 0.45% to above 0.55% and the 5-year TIPS yield also surged more than 10bps to above -1.70% from previously under -1.80%.

- Dollar jumps after Powell’s comments, reaching fresh YTD highs.

- NZD/USD tumbles more than 80 pips from the top to the lowest since November 2020.

The NZD/USD peaked at 0.6855, the highest level since Thursday and then collapsed amid a rally of the US dollar across the board. It bottomed so far at 0.6771, the lowest since November of last year. It remains near the lows, amid rising volatility.

It all changed in one minute

The US dollar was under pressure across the board amid lower US yields. Comments from Fed Chair Powell changed it all. The dollar jumped and is testing recent cycle highs versus it main rivals. It erased in a few minutes recent losses.

The NZD/USD tumbled and is testing the 0.6770 zone. A break lower should clear the way to more losses. The change in the direction of the dollar was abrupt and took place after Powell mentioned it is time to remove the word “transitory” from inflation. His comments boosted US yields from monthly lows and sent equity prices lower.

The combination of risk aversion and a rebound in yields favor the dollar. If the situation does not change, the rally of the dollar could continue. On the contrary, a recovery of NZD/USD back above 0.6800 could suggest a potential interim bottom.

Technical levels

Fed Chair Jerome Powell, who is currently testifying before the Committee on Banking, Housing, and Urban Affairs of the US Senate alongside US Treasury Secretary Janet Yellen, said it may be appropriate to consider wrapping up the bank's QE taper a few months sooner.

Additional Takeways:

"Most recent data show elevated inflation pressures, rapid improvement in the labor market, strong spending."

"At this point, the economy is very strong, inflationary pressures high."

"Appropriate to consider wrapping up taper a few months sooner."

"Will talk about speeding up taper at coming Fed meeting."

"Will know more about Omicron within a week or 10 days."

"Only then can assess impact on economy."

"For now Omicron is a risk and is not baked into forecasts."

- Mexican peso among top performers on Tuesday, amid lower yields.

- USD/MXN breaks under 21.60 and tumbles to 21.27, the lowest since last Wednesday.

The USD/MXN broke under 21.60 and tumbled to 21.27 reaching the lowest level in almost a week. Recently it rebounded rising back above 21.40 and trimmed losses following some hawkish remarks from Fed Chair Powell.

MXN up, but losing strength

The Mexican peso went from oversold to overbought levels in a few days. The USD/MXN is falling sharply however it trimmed losses. A weaker US dollar across the board was the key event, and also a stronger MXN.

During the last hour, Powell at the Senate mentioned that it is time to retire “transitory” as a description of inflation, triggering a decline in Treasuries. The rebound in yields boosted the greenback across the board, sending USD/MXN back above 21.40.

Volatility appears to be set to continue during the next hours. Price moves were also exacerbated prior to Powell’s comments on the back of end-of-month flows.

A recovery above 21.60 would weaken the Mexican peso while a consolidation under 21.45 would keep the 21.30 support area exposed.

Technical levels

Fed Chair Jerome Powell is testifying before the Committee on Banking, Housing, and Urban Affairs of the US Senate alongside US Treasury Secretary Janet Yellen.

Key takeaways:

"It is very surprising that labor force participation has moved sideways."

"A big part of the flat labor force participation rate is the pandemic."

"It will take longer to get labor force participation back."

"Risk of high inflation is a risk to getting back to full employment."

"The threat of higher inflation has grown."

"My baseline expectation is that inflation will move back down over course of next year."

"Risk of more persistent inflation has risen."

"You have seen our policy adapt and you will see it continue to adapt."

"We will use our tools to make sure higher inflation doesn't become entrenched."

"Expect high inflation to continue through to the middle of 2022."

Market Reaction

Powell comments citing high inflation as a risk to the full employment part of the Fed's dual mandate, combined with his earlier remarks that it is time to drop the word "transitory" to describe inflation, are being interpreted hawkishly. The DXY has recently crossed to the north of 96.00 as US yields recover from earlier session lows.

- Gold advances firmly, as US-10 year T-bond yields drop ten basis points, down to 1.43%.

- Risk-off market sentiment boosted the prospects of the XAU/USD, as the COVID-19 omicron variant threatens to derail the economic growth.

- XAU/USD Technical outlook: A break above $1,807 would expose $1,815, followed by $1,834.

Gold (XAU/USD) edges high during the New York session, jumping from $1,780 daily low earlier in the day towards $1,807 at press time, amid comments of Moderna’s CEO in an interview with the Financial Times, predicted a drop in existing vaccines efficacy, spurring a flight to safe-haven assets, as portrayed by US equity futures indices falling, ahead of the Wall Street’s open.

That boosted the prospects of the yellow metal, which has strengthened on the back of falling US T-bond yields, acting as a headwind for the greenback. The US 10-year Treasury yield is plummeting ten basis points, sitting at 1.43%, while the US Dollar Index, which measures the greenback’s value against a basket of its peers, falls sharply 0.74%, breaking below the 96.00 threshold, sitting at 95.65 at press time.

It seems that market participants are focused on the coronavirus omicron developments and its impact on the global economy. The fall in US bond yields reflects investors’ postures, scaling back bets of Fed hiking rates from three to two increases, depending on the ongoing COVID-19 developments.

Therefore, gold has and will keep benefitting from the abovementioned, unless data of the omicron variant show that despite being contagious, it would not be as dangerous as another COVID-19 variant.

The US macroeconomic docket so far featured the S&P/Case-Shiller Home Price Index (MoM) for September, which rose by 19,1%, more than the 19.3% expected. Meanwhile, the Chicago Purchasing Managers Index for November increased to 61.8, lower than the 67 estimated.

XAU/USD Price Forecast: Technical outlook

Gold in the 1-hour chart is approaching resistance at the R2 daily pivot level at $1,807. The 50 and the 100-hour simple moving averages (SMA’s) were left behind around the $1,796 area, while the 200-hour SMA lies in the confluence of the R3 daily pivot at $1,815, which is also the November 26 high.

On the way up, $1,815 would be the most robust line of defense for USD bulls, which in the case to be broken, would expose the September 3 high at $1,834.

On the flip side, failure to break above the former would expose the $1,800 figure, followed by the confluence of the 50 and the 100-hour SMA’s around the $1,892-94 range.

-637738830274137412.png)

Fed Chair Jerome Powell is testifying before the Committee on Banking, Housing, and Urban Affairs of the US Senate alongside US Treasury Secretary Janet Yellen.

Key takeaways:

"Higher prices are generally related to supply-demand issues."

"Also the case that price increases have spread more broadly."

"Risk of higher inflation has increased."

"It's a good time to retire 'transitory' for inflation."

Market Reaction

The US dollar, short-end and real US yields all popped higher in response to Powell's hawkish comment that it is time to retire the word "transitory" to describe inflation.

According to the latest Consumer Confidence survey conducted by the US Conference Board, US Consumer Confidence fell to 109.5 in November from 113.8 in October. That was a larger drop than the expected decline to 111.0.

The Present Situation index fell to 142.5 in November from October's downwardly revised reading of 145.5 from 147.4. Meanwhile, the US Consumer Expectations index fell to 87.6 in November from 89.0 in October.

The Jobs Plentiful versus Hard to Get ratio hit a record high at 46.90.

Market Reaction

FX markets have not seen any notable reaction to the latest CB consumer confidence data, as markets await comments from Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen in a testimony before the Senate Committee on Banking, Housing, and Urban Affairs.

- USD/TRY moves further north of the 13.0000 mark.

- The lira remains depressed as bets on extra rate cuts raise.

- Investors’ attention shifts to the CPI release on Thursday.

The Turkish lira extends the drop and lifts USD/TRY to fresh all-time highs near 13.2000 on Tuesday.

USD/TRY now looks to data, CBRT

USD/TRY advances for the third session in a row on Tuesday and records new all-time peaks near the 13.2000 mark, always on the back of the intense depreciation of the Turkish currency.

Indeed, President Erdogan’s recent defence of the low-rates policy from the Turkish central bank did nothing but put the lira under extra downside pressure, pushing spot to fresh tops.

In the meantime, all the attention is expected to be on the release of the Turkey’s inflation figures on Thursday, with consensus already pointing to a reading above 20% in November.

USD/TRY key levels

So far, the pair is gaining 2.59% at 13.1069 and a drop below 11.5451 (low November 24) would expose 10.8767 (20-day SMA) and then 9.7214 (55-day SMA). On the other hand, the next up barrier lines up at 13.1838 (all-time high Nov.24) followed by 14.0000 (round level).

- The Chicago PMI dropped to its lowest level since February in November at 61.8.

- The dollar came under some modest selling pressure.

The Chicago Purchasing Managers Index (PMI) fell to 61.8 in November from 68.4 in October, data released by ISM-Chicago, Inc revealed on Tuesday. That was a bigger decline than the expected drop to 67.0 and took the Chicago PMI to its lowest level since February.

Market Reaction

The dollar index appears to have seen some modest weakness on the data, with the DXY slipping to fresh session lows in the 95.50s in recent trade.

US pharmaceutical giant Merck said on Tuesday that it expected its antiviral pill to show similar activity against any new Covid-19 variant, including Omicron, according to Reuters. The company's remarks come after the Regeneron CEO said live on CNBC earlier in the session that he thought Merck's pill would no longer work.

Market Reaction

Markets do not seem to have reacted to the latest headlines much. Merck's pill does not yet form an important part of the global prevention/Covid-19 treatment regime. Markets are more sensitive right now to headlines about vaccine efficacy, the transmissibility of Omicron and the severity of illness when infect by the new variant.

ECB governing council member and Bank of Spain governor Pablo Hernandez de Cos said on Tuesday that recent developments anticipate a significant downward revision to the 2021 economic growth outlook, plus a more moderate slowdown in 2022. The recent inflation spike, supply bottlenecks and rise in Covid-19 infections in Europe, he added, could lead to a slight downwards revision to Spanish GDP growth forecasts for Q4 and early 2022.

Market Reaction

The euro has not seen a significant reaction to the latest comments from de Cos.

According to the latest data from the Federal Housing Finance Agency, the monthly House Price Index rose to 354.6 in September from 351.5 in August, a 0.9% MoM rise. That took the YoY rate of house price increase to 17.7% on the month.

The S&P/Case-Shiller Home Price Index, released by Standard & Poor's, showed prices rising at a YoY rate of 19.1% in September, slightly below the expected pace of 19.3% and a tad down from August's YoY rate of 19.6%.

Market Reaction

FX markets have not responded to the latest US house price numbers.

FOMC Chairman Jerome Powell will be testifying before the Committee on Banking, Housing, and Urban Affairs of the US Senate alongside US Treasury Secretary Janet Yellen on Tuesday, November 30, at 1500 GMT.

The hearing is entitled “CARES Act Oversight of Treasury and the Federal Reserve: Building a Resilient Economy.”

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

Bank of England Monetary Policy Committee member Catherine Mann said on Tuesday that it was premature to talk about the timing of potential BoE rate hikes, much less how much. If Omicron puts us back into lockdown, Mann continued, some of the underpinnings in the moderation of goods price pressure may fade.

Market Reaction

Pound sterling has not seen a notable reaction to BoE's Mann's remarks. The implied yield on the December 2021 three-month sterling LIBOR future remained steady at around 0.16%, implying only a few bps of hikes are expected next month, suggesting a low probability of a BoE rate hike.

- EUR/USD resumes the upside and revisits the 1.1370 zone.

- Further upside is seen initially challenging the 1.1374/89 band.

EUR/USD gathers extra pace and surpasses the 1.1300 barrier on quite a convincing fashion on Tuesday.

In case the recovery picks up further impulse, then the pair is forecast to test 1.1374 (November 18) ahead of the minor hurdle at the 20-day SMA at 1.1389.

The probability of further losses remains unchanged as long as EUR/USD trades below the 2-month resistance line (off September’s peak) near 1.1560. In the longer run, the offered stance in spot is expected to persist while below the 200-day SMA at 1.1828.

EUR/USD daily chart

- A combination of factors dragged USD/JPY to the lowest level since October 11 on Tuesday.

- COVID-19 woes, the risk-off mood benefitted the safe-haven JPY and exerted heavy pressure.

- A steep decline in the US bond yields weighed on the USD and contributed to the downfall.

The USD/JPY pair maintained its heavily offered tone through the early North American session and was last seen trading around the 112.75-70 region, or the lowest level since October 11.

Following the previous day's two-way price moves, the USD/JPY pair met with fresh supply on Tuesday and prolonged its retracement slide from a near five-year peak, around mid-115.00s touched last week. The risk-off impulse in the markets provided a strong boost to the safe-haven Japanese yen. This, along with a broad-based US dollar weakness contributed to the pair's ongoing decline.

The global risk sentiment took a hit amid growing concerns about the potential economic fallout from the spread of the new coronavirus variant. The market worries were exacerbated further after The chief executive of drugmaker Moderna warned that existing vaccines will be much less effective at tackling Omicron than earlier strains of COVID-19.

Meanwhile, the developments surrounding the coronavirus saga pushed back market expectations about the likely timing when the Fed would begin tightening its monetary policy. In fact, the money markets now indicate a 25 bps rate hike in September 2022 as against July 2022 already priced in. This, along with the global flight to safety, triggered a steep decline in the US Treasury bond yields.