- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-09-2012

The euro rose against most of its 16 major peers after two central bank officials said European Central Bank President Mario Draghi will announce unlimited sterilized bond buying to quell the region’s debt crisis.

The 17-nation currency climbed to a two-month high against the dollar last week amid optimism Draghi would announce additional monetary stimulus at tomorrow’s ECB meeting.

Under the ECB blueprint, which may be called “Monetary Outright Transactions,” the ECB would refrain from setting a public cap on yields, according to the central bankers, and a third official, who spoke on condition of anonymity. The plan will only focus on government bonds rather than a broader range of assets and will target short-dated maturities of up to about three years, two of the people said.

German Chancellor Angela Merkel told lawmakers she can accept temporary ECB bond buying, according to a member of her party. German legislator Norbert Barthle said in Berlin that Merkel spoke in a closed-door meeting of Christian Democratic Union lawmakers.

Germany’s Constitutional Court is set to rule on the legality of the European Stability Mechanism, the euro region’s permanent bailout fund, on Sept. 12. The ECB may delay giving full details of Draghi’s bond-buying plan until after the ruling, two central bank officials said on Aug. 24.

Australia’s currency dropped to a seven-week low after the economy expanded less than forecast.

European stocks closed little changed, after swinging between gains and losses, as investors await tomorrow’s European Central Bank meeting.

Under Draghi’s proposed blueprint, which may be called “Monetary Outright Transactions,” the ECB would refrain from setting a public cap on yields, according to two central bank officials, and a third official, who spoke on condition of anonymity. The plan will only focus on government bonds rather than a broader range of assets and will target short-dated maturities of up to about three years, two of the people said.

National benchmark indexes advanced in 12 of the 18 western-European markets. The U.K.’s FTSE 100 Index fell 0.3 percent. France’s CAC 40 gained 0.2 percent and Germany’s DAX rose 0.5 percent.

Richemont added 1.5 percent to 60.05 Swiss francs after the world’s largest jewelry maker reported revenue that climbed 23 percent in the five months through August as the dollar’s strength boosted the value of sales in that currency.

BP, the owner of the Macondo well that caused the worst U.S. oil spill two years ago, slid 2.9 percent to 423.85 pence after the U.S. Justice Department reiterated it will pursue charges of gross negligence in the case. The company faces a trial with the DOJ after reaching a $7.8 billion settlement in March with victims of the spill.

STMicroelectronics NV declined 4.9 percent to 4.40 euros after UBS AG lowered its recommendation for the biggest European chipmaker to sell from neutral, saying its share price doesn’t take account of continuing challenges to the business. Exane BNP Paribas also downgraded the shares to underperform, the equivalent of a sell rating, from neutral.

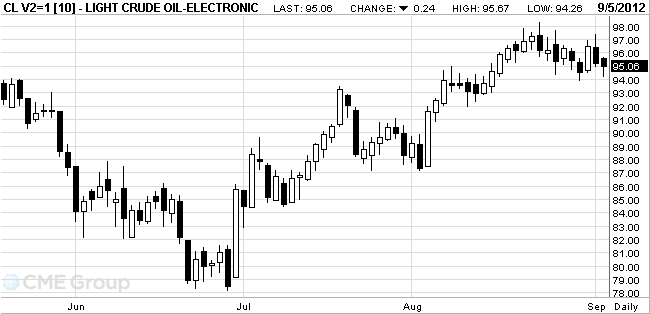

Oil fell before European Central Bank policy makers meet to discuss a plan involving unlimited purchases of government debt to ease the region’s debt crisis.

Futures dropped as much as 1.1 percent after two central bank officials said Germany’s Bundebank objected to the plan that involves sterilizing debt to assuage concerns about printing money. Prices initially rose on the proposal by ECB President Mario Draghi, who will announce a decision at a press conference tomorrow.

Oil also fell as euro-area services shrank more than initially estimated in August.

A gauge of euro-area service industries based on a survey of purchasing managers fell to 47.2 from 47.9 in July, London- based Markit Economics said today. That’s below an initial estimate of 47.5 published on Aug. 23. A composite index of both services and manufacturing fell to 46.3 from 46.5, also below an initial estimate.

An Energy Department report tomorrow will probably show U.S. crude supplies tumbled to a five-month low last week because of Hurricane Isaac.

Crude oil for October delivery dropped to $94.26 a barrel on the New York Mercantile Exchange. Prices rose as much as 37 cents to $95.67 earlier today. Futures have fallen 4.4 percent this year.

Brent oil for October settlement decreased 80 cents, or 0.7 percent, to $113.38 a barrel on the London-based ICE Futures Europe exchange.

- The ECB is to ensure that would be acting within its mandate

- Governments can not influence the decisions of the Central Bank

- Can not see a conflict between Draghi and Weidmann

- Refused to comment on the ECB

Gold prices held near a six-month high, as the recent U.S. macroeconomic indicators and Europe can count on new stimulus central banks.

European data suggest the possibility of a recession in the euro zone in the current quarter: PMI composite index in August fell to 46.3 points from 46.5 points in July, compared with a preliminary value of 46.6 points.

Manufacturing activity in the U.S. in August declined at the fastest rate in three years, giving investors hope for new stimulus the Fed.

The price of gold has doubled in the past four years, the Fed has held two rounds of purchases of government bonds, known as "quantitative easing."

Stocks of gold-ETF funds by Tuesday hit records 71.889 million ounces (2.038 tons), while the stocks of the largest ETF SPDR Gold Trust GLD totaled 1.293 tonnes.

September futures price of gold on the COMEX is now 1693.00 an ounce.

EUR/USD $1.2500, $1.2525, $1.2530, $1.2550, $1.2585, $1.2650

USD/JPY Y78.00, Y78.60

EUR/JPY Y99.00, Y97.70, Y97.60

GBP/USD $1.5825

EUR/GBP stg0.7940

AUD/USD $1.0250

EUR/SEK Sek8.40, Sek8.4240, Sek8.4390

U.S. stock futures were little changed as speculation Europe will act to tame its debt crisis offset disappointing economic data.

Stock futures retreated from session lows after two central bank officials briefed on the plan said European Central Bank President Mario Draghi’s bond-buying proposal involves unlimited purchases of government debt that will be sterilized to assuage concerns about printing money.

Global Stocks:

Nikkei 8,679.82 -95.69 -1.09%

Hang Seng 19,145.07 -284.84 -1.47%

Shanghai Composite 2,037.68 -5.97 -0.29%

FTSE 5,670.29 -1.72 -0.03%

CAC 3,422.33 +23.29 +0.69%

DAX 6,987.13 +54.55 +0.79%

Global Stocks $96.68 +0,22%

Gold $1695.30 -0.04%

Data

01:30 Australia Gross Domestic Product (QoQ) Quarter II +1.3% +0.9% +0.6%

01:30 Australia Gross Domestic Product (YoY) Quarter II +4.3% +3.7% +3.7%

07:15 Switzerland Consumer Price Index (MoM) August -0.5% +0.1% 0.0%

07:15 Switzerland Consumer Price Index (YoY) August -0.7% -0.4% -0.5%

07:50 France Services PMI (finally) August 50.2 50.2 49.2

07:55 Germany Services PMI (finally) August 48.3 48.3 48.3

08:00 Eurozone Services PMI (finally) August 47.5 47.5 47.2

09:00 Eurozone Retail Sales (MoM) July +0.1% -0.2% -0.2%

09:00 Eurozone Retail Sales (YoY) July -1.2% -1.7% -1.7%

The euro fell against the dollar on speculation that the measures to be announced by the European Central Bank tomorrow will not be able to restore confidence in the region.

At the beginning of the session the Euro was down against the dollar on speculation that the measures to be announced by the European Central Bank tomorrow will not be able to restore confidence in the region. The single currency also fell against the yen after a report on the euro area showed that retail sales fell in July, led by Germany. According to EU statistics, the volume of retail sales decreased by 0.2% in July, a separate report showed that the index of purchasing managers in the services sector fell to 47.2 in August from 47.9 in July, indicating a contraction. The dollar strengthened as investors sought safer assets.

But despite the decline, the euro managed to recover and showed a sharp rise amid comments by ECB President Draghi, who said that the ECB will refrain from setting a fixed yield.

The pound strengthened against the dollar since the published data showed that the index of business activity in the UK services sector rose to 53.7 in August, compared with expectations at 51.2 and the level of 51.0 in July.

The Australian dollar fell to a seven-week low after it became known that the GDP rose less than expected by analysts.

Gross domestic product expanded by 0.6% in the three months to June, compared with the previous quarter, when it rose a revised 1.4%. Economists average stood at 0.7%.

The dollar index (DXY), which is used to track the value of the dollar against six major currencies, added 0.2% to 81.472.

EUR/USD: during the European session the pair reached a low of $ 1.2500, followed by the rapid growth

GBP/USD: the pair grown, updating the yesterday's high, and is now approaching the maximum values in August

USD/JPY: the pair grown by updating yesterday's high, but then backed away from the values achieved and set a new low

At 12:30 GMT the United States will change in the level of labor productivity in the non-manufacturing sector for the 2nd quarter. At 13:00 GMT we will know the decision of the Bank of Canada Interest Rate will be done the accompanying statement of the Bank of Canada.

EUR/USD

Offers $1.2650, $1.2600

Bids $1.2500, $1.2495/90, $1.2470, $1.2450, $1.2430

GBP/USD

Offers $1.5980, $1.5950, $1.5920

Bids $1.5805/00, $1.5780/70, $1.5755/40, $1.5720, $1.5705/00

AUD/USD

Offers $1.0300, $1.0250, $1.0230/35

Bids $1.0150, $1.0125/20, $1.0100, $1.0080, $1.0050

EUR/GBP

Offers stg0.8015/20, stg0.8000, stg0.7980, stg0.7955

Bids stg0.7890, stg0.7875/70, stg0.7860/50

EUR/JPY

Offers Y99.45/50, Y99.00, Y98.80, Y98.55/60

Bids Y97.85/80, Y97.50, Y97.20, Y97.00

USD/JPY

Offers Y78.90, Y78.80, Y78.60, Y78.50/55

Bids Y78.20/15, Y78.10/00, Y77.80

European stocks rose ahead of a meeting of the European Central Bank, which will be held tomorrow, tomorrow, while data from the U.S., China and Australia show that the growth of the world economy is slowing down. U.S. index futures and Asian shares also fell.

Shares Cie. Financiere Richemont SA - manufacturer of jewelry Cartier, rose 1.7% after that for five months, sales grew by 23%.

The cost of BP Plc (BP /) fell 3.8 percent after a report that the U.S. Justice Department accused the oil company of gross negligence.

Shares of STMicroelectronics NV, Europe's largest chip maker, fell by 4.2%, against the fact that UBS AG and Exane BNP Paribas recommended selling shares.

Stoxx Europe 600 Index rose 0.3 percent to 266.22.

To date:

FTSE 100 5,671.23 -0.78 -0.01%

CAC 40 3,407.91 +8.87 +0.26%

DAX 6,984.07 +51.49 +0.74%

EUR/USD $1.2500, $1.2525, $1.2530, $1.2550, $1.2585, $1.2650

USD/JPY Y78.00, Y78.60

EUR/JPY Y99.00, Y97.70, Y97.60

GBP/USD $1.5825

EUR/GBP stg0.7940

AUD/USD $1.0250

EUR/SEK Sek8.40, Sek8.4240, Sek8.4390

Asian stocks fell, with the regional benchmark index headed for the longest losing streak in eight weeks, as economic reports from the U.S. to China and Australia stoked concern global growth is slowing.

Nikkei 225 8,679.82 -95.69 -1.09%

S&P/ASX 200 4,278.77 -24.75 -0.58%

Shanghai Composite 2,037.68 -5.97 -0.29%

Samsung Electronics Co., South Korea’s largest exporter of consumer electronics that gets 20 percent of its revenue in America, lost 2.4 percent in Seoul.

Westpac Banking Corp., Australia’s No. 2 lender by market value, slid 1.5 percent in Sydney as the country’s economy grew at a slower-than-estimated rate.

Fortescue Metals Group Ltd., Australia’s third-biggest iron-ore producer, plunged 8.5 percent as prices of the steelmaking material fell to a three-year low on slowing growth in China.

01:30 Australia Gross Domestic Product (QoQ) Quarter II +1.3% +0.9% +0.6%

01:30 Australia Gross Domestic Product (YoY) Quarter II +4.3% +3.7% +3.7%

The euro fell for second day before the European Central Bank meets tomorrow to discuss measures to tackle the region’s debt crisis. ECB President Mario Draghi told lawmakers in a closed-door session in Brussels this week the bank’s primary mandate compels it to intervene in bond markets to ensure the euro’s survival.

The 17-nation currency remained lower versus most of its major counterparts before data forecast to show retail sales declined and services contracted in the euro area. A final reading of an index based on a survey of purchasing managers in services industries in the euro area may confirm a drop to 47.5 in August from 47.9 a month earlier, below the 50 level which separates contraction from expansion, according to the median estimate of economists surveyed by Bloomberg before Markit Economics releases its figures today.

Germany’s Constitutional Court is set to rule on the legality of the European Stability Mechanism, the euro region’s permanent bailout fund, on Sept. 12. The ECB may delay giving full details of Draghi’s bond-buying plan until after the ruling, two central bank officials who spoke on condition of anonymity, said on Aug. 24.

The Australian dollar touched a six-week low after the government reported second- quarter gross domestic product grew less than analysts expected.

EUR / USD: during the Asian session the pair fell to $1.2520.

GBP / USD: during the Asian session the pair fell, approaching week’s low.

USD / JPY: during the Asian session, the pair rose to Y78.55.

This morning in Europe sees the services PMI releases from the main European states with Spain at 0713GMT, Italy at 0743GMT and final numbers from France at 0748GMT, Germany at 0753GMT and the main EMU data at 0758GMT. EMU data at 0900GMT is expected to see retail trade for July come in at -0.3% m/m, -1.8% y/y. UK Markit/CIPS Services PMI data was due at 0828GMT and was expected to come in at 51.0 with little boost expected from the Olympics. US data for Wednesday starts at 1100GMT with the MBA Mortgage Application Index, while at 1145GMT, the weekly ICSC-Goldman Store Sales data is due. At 1230GMT, US nonfarm productivity is forecast to be revised up to a 1.9% rise in the second quarter, as the output component should be adjusted up slightly. The weekly Redbook Average is due at 1255GMT. At 1300GMT, the Bank of Canada rate announcement is expected to deliver an unchanged decision but the market will be focused on any softening of recent language seen giving a tightening-bias.

Yesterday the euro fell versus the dollar and the yen amid speculation European Central Bank President Mario Draghi will announce measures as soon as this week to ease the region’s debt crisis.

Draghi said the bank’s primary mandate compels it to intervene in bond markets to wrest back control of interest rates and ensure the euro’s survival. The ECB announces its next policy decision on Sept. 6.

The 17-nation currency traded at almost the strongest in two months versus the dollar as European leaders stepped up shuttle diplomacy before erasing gains as global stocks declined.

European Union President Herman Van Rompuy traveled to Berlin for talks with German Chancellor Angela Merkel today as Italian Prime Minister Mario Monti hosts French President Francois Hollande in Rome.

The dollar briefly pared gains against major counterparts after a report showed manufacturing in the U.S. contracted for a third month.

Asian stocks fell, with the regional benchmark index poised for its longest losing streak in six weeks, as the European Union’s outlook was cut by Moody’s Investors Service ahead of policy makers’ meetings. Australian shares declined as the central bank left the key rate unchanged.

Nikkei 225 8,775.51 -8.38 -0.10%

S&P/ASX 200 4,303.5 -26.17 -0.60%

Shanghai Composite 2,040.09 -19.05 -0.93%

Hutchison Whampoa Ltd., an operator of retail chains that gets 55 percent of its revenue in Europe, fell 0.2 percent in Hong Kong.

Westpac Banking Corp., Australia’s second-biggest lender by market value, slid 2.3 percent.

Agile Property Holdings Ltd. declined 5.7 percent in Hong Kong as its rating was cut at DBS Vickers after its chairman was arrested.

European stocks retreated, paring yesterday’s biggest rally in a month, as investors awaited a report that may show U.S. manufacturing teetered between expansion and contraction in August.

The Institute for Supply Management’s factory index was little changed at 50 in August compared with 49.8 in July, according to the median estimate of 70 economists. A reading of 50 is the dividing line between contraction and expansion. Spending on construction projects probably rose in July, another release may show.

Euro-area countries will this week ask investors to stake more than 20 billion euros ($25 billion) on second-guessing the ECB, selling the most debt in more than three months before the central bank’s president, Mario Draghi, speaks on Sept. 6.

Spain, France, Austria and Belgium return to the market after a month-long pause, with Germany also selling debt. The auctions take place before the ECB’s meeting in Frankfurt, where Draghi may reveal details of a new bond-buying program.

The leaders of the single currency’s biggest economies hold further meetings this week as they brace for their central banker’s plan to defend the euro from bond-market turmoil. Draghi told the European Parliament yesterday he would be comfortable buying three-year government debt to bring down borrowing costs for nations in financial distress.

Vodafone slid 1.3 percent to 180.9 pence for the biggest contribution to the Stoxx 600’s retreat. Bernstein lowered the telecommunications company to market perform from outperform, meaning that investors should not buy more of the shares.

Ahold climbed 3 percent to 10.14 euros after the Dutch owner of the U.S. Stop & Shop grocery chain said it will take 6 to 12 months to review options for its stake in ICA. Ahold will probably return at least part of the proceeds from a sale to shareholders in the form of a buyback or special dividend, analysts at SNS Securities said in a note. They value the stake at 2.1 billion euros to 2.4 billion euros.

The Standard & Poor’s 500 Index fell, trimming steeper declines, as speculation European leaders will announce new steps to tame the debt crisis tempered concern the economic recovery is slowing.

ECB President Mario Draghi said the bank’s primary mandate compels it to intervene in bond markets to wrest back control of interest rates and ensure the euro’s survival.

Draghi is due to distribute his bond-purchasing plan to national banks after he was said to tell officials he would be comfortable buying three-year government bonds to lower borrowing costs.

Equities fell earlier as the Institute for Supply Management’s U.S. factory index showed U.S. manufacturing shrank for a third month in August in the longest decline since the recession ended in 2009, threatening to deprive the world’s largest economy of a driver of growth. A report over the weekend showed China’s manufacturing contracted at the fastest pace since March 2009.

Change % Change Last

Gold 1,698 +41 +2.49%

Oil 95.49 +0.87 +0.92%Change % Change Last

Nikkei 225 8,775.51 -8.38 -0.10%

S&P/ASX 200 4,303.5 -26.17 -0.60%

Shanghai Composite 2,040.09 -19.05 -0.93%

FTSE 100 5,672.01 -86.40 -1.50%CAC 40 3,399.04 -54.67 -1.58%

DAX 6,932.58 -82.25 -1.17%

Dow 13,036 -55 -0.42%

Nasdaq 3,075 +8 +0.26%

S&P 500 1,405 -2 -0.12%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2566 -0,17%

GBP/USD $1,5873 -0,06%

USD/CHF Chf0,9556 +0,18%

USD/JPY Y78,43 +0,18%

EUR/JPY Y98,56 +0,02%

GBP/JPY Y124,48 +0,12%

AUD/USD $1,0223 -0,20%

NZD/USD $0,7945 -0,38%

USD/CAD C$0,9859 +0,01%

01:30 Australia Gross Domestic Product (QoQ) Quarter II +1.3% +0.9% +0.6%

01:30 Australia Gross Domestic Product (YoY) Quarter II +4.3% +3.7% +3.7%

07:00 United Kingdom Halifax house price index August -0.6% +0.3%

07:00 United Kingdom Halifax house price index 3m Y/Y August -0.6% -0.8%

07:15 Switzerland Consumer Price Index (MoM) August -0.5% +0.1%

07:15 Switzerland Consumer Price Index (YoY) August -0.7% -0.4%

07:50 France Services PMI (finally) August 50.2 50.2

07:55 Germany Services PMI (finally) August 48.3 48.3

08:00 Eurozone Services PMI (finally) August 47.5 47.5

08:30 United Kingdom Purchasing Manager Index Services August 51.0 51.5

09:00 Eurozone Retail Sales (MoM) July +0.1% -0.2%

09:00 Eurozone Retail Sales (YoY) July -1.2% -1.7%

12:30 U.S. Nonfarm Productivity, q/q (revised) Quarter II +1.6% +1.8%

13:00 Canada Bank of Canada Rate - 1.00% 1.00%

13:00 Canada BOC Rate Statement -© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.