- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-10-2012

The euro rose against the dollar and the yen against the U.S. improve statistics on the labor market. The unemployment rate unexpectedly fell to 7.8% in September, mainly due to the increase of employment of Americans to work part time, and off-farm employment increased by 114 thousand (the August value was revised to 142 million). The average duration of the week and hourly wage also rose last month.

With regard to regional statistics, the German factory orders for August fell short of expectations: the indicator fell by 4.8% y / y after the July decline of 4.6% and -4.3% forecast. In monthly terms orders fell by 1.3% vs. -0.5%. In the 2nd quarter of eurozone GDP fell by 0.2% after falling 0.3% in the previous quarter. This result coincided with analysts' forecasts. Spanish industrial output came out better than expected, although it remained in negative territory (-3.2% vs. prev. -5.4% And -5.5% of the forecast).

The yen earlier rose against major currencies after the Bank of Japan decided not to change the course of monetary policy. The Bank of Japan on Friday left its benchmark interest rate in the range of 0-0.1%. The total amount of incentive programs Bank of Japan kept at 80 trillion yen (just over $ 1 trillion), including a program of emergency loans to banks - 25 trillion yen asset repurchase program, expanded in the past month - 55 trillion yen. CB solutions line with expectations of economists.

The Canadian dollar was higher against the U.S. dollar after the rate of employment in Canada increased more than five times faster than economists' forecasts, with increased job full-time, starting from the retail sector and to construction. However, the unemployment rate also rose, with increased labor force. Employment rose by 52,100 in September, after rising by 34,300 in August, according to statistics office today. Unemployment rate increased to 7.4% from 7.3%, and the labor force increased by 72,600.

European stocks climbed, with the Stoxx Europe 600 posting its first weekly advance in three, after a report showed the U.S. jobless rate unexpectedly declined in September.

The economy added 114,000 workers last month after a revised 142,000 gain in August that was more than initially estimated, Labor Department figures showed today in Washington. The jobless rate dropped from 8.1 percent and hourly earnings climbed more than forecast.

ECB President Mario Draghi reiterated during a press conference in Slovenia yesterday that the central bank won’t start intervening in bond markets until governments like Spain request a bailout and agree to conditions. He also ruled out allowing the ECB to take losses in any further Greek debt restructuring and damped speculation of another interest-rate cut.

National benchmark indexes rose in all of the 18 western European markets except Iceland. France’s CAC 40 advanced 1.6 percent, Germany’s DAX climbed 1.3 percent and the U.K.’s FTSE 100 added 0.7 percent.

Gauges of banks and automakers on the Stoxx 600 were the best performers of the index’s 19 industry groups. BNP Paribas, France’s biggest bank, rallied 3.5 percent to 39.39 euros. BMW advanced 2.1 percent to 60.99 euros.

Burberry rallied 2.8 percent to 1,028 pence. Morgan Stanley raised its recommendation on the stock to overweight, the equivalent of a buy rating, from equal weight.

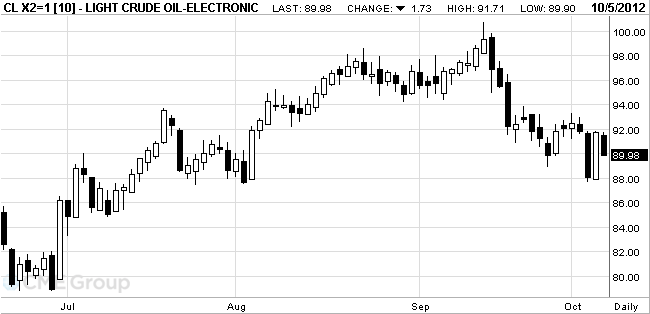

Oil headed for a third weekly drop in New York as signals that supply is exceeding demand outweighed an unexpected decline in the unemployment rate.

Futures are set to cap the longest run of weekly decreases since June after an Energy Department report on Oct. 3 showed U.S. crude output rose to 6.52 million barrels a day last week, the most since December 1996. Prices pared their descent earlier when government data showed the U.S. added 114,000 jobs last month as the jobless rate fell to 7.8 percent.

Crude oil for November delivery fell to $89.90 a barrel on the New York Mercantile Exchange. Prices are down 2 percent this week.

Brent oil for November settlement slipped 79 cents, or 0.7 percent, to $111.79 a barrel on the London-based ICE Futures Europe exchange.

Gold futures fell from the highest in almost 11 months after the unemployment rate in the U.S. unexpectedly dropped, easing pressure on the Federal Reserve to expand monetary stimulus. Silver also slid.

The jobless rate in September declined to 7.8 percent from 8.1 percent, government data showed today. Earlier, gold reached a 10-month high close to $1,800 an ounce on speculation that stimulus programs in the U.S., Europe and Japan enhanced the appeal of the metal as an alternative to currencies.

In India - the world's largest consumer of gold - an increased demand in the physical market by strengthening rupee, which caused lower domestic prices to a minimum of five weeks.

Stocks of gold-ETFs ETF on Thursday rose by 418,611 ounces, and the stocks of the largest ETF SPDR Gold Trust rose to a record level 1.333,44 tons.

October futures price of gold on COMEX today dropped to 1780.7 dollars per ounce.

EUR/USD $1.2900, $1.2950, $1.2975, $1.3000, $1.3020, $1.3050, $1.3100

USD/JPY Y78.00, Y78.50, Y79.00

GBP/USD $1.6125, $1.6100

EUR/GBP stg0.8050

USD/CHF Chf0.9200, Chf0.9370

EUR/CHF Chf1.2100

AUD/USD $1.0150, $1.0160, $1.0200, $1.0225, $1.0250

USD/CAD C$0.9845, C$0.9900

Data:

07:00 Switzerland Foreign Currency Reserves September 418.4 429.3

07:30 Japan BOJ Press Conference -

08:00 Switzerland KOF Institute Economic Forecast IV quarter

09:00 Eurozone GDP (QoQ) (finally) Quarter II -0.2% -0.2% -0.2%

09:00 Eurozone GDP (YoY) (finally) Quarter II -0.5% -0.4%

10:00 Germany Factory Orders s.a. (MoM) August +0.5% -0.4% -1.3%

10:00 Germany Factory Orders n.s.a. (YoY) August -4.5% -4.3% -4.8%

The euro held in a narrow range against the dollar in the standby power of statistics on the labor market in the U.S.. The market expects that the number of jobs outside agriculture in the U.S. in September rose by 111,000. The lower rate will revive fears that the economic slowdown world's largest economy is more stable than expected by some.

The euro has remained stable after the regional statistics. German Factory Orders for August fell short of expectations: the indicator fell by 4.8% y / y after July's decline of 4.6% and -4.3% forecast. In monthly terms orders fell by 1.3% vs. -0.5%.

In the 2nd quarter of eurozone GDP fell by 0.2% after falling 0.3% in the previous quarter. This result coincided with analysts' forecasts. Spanish industrial output came out better than expected, although it remained in negative territory (-3.2% vs. prev. -5.4% And -5.5% of the forecast).

The yen earlier rose against major currencies after the Bank of Japan decided not to change the course of monetary policy. The Bank of Japan on Friday left its benchmark interest rate in the range of 0-0.1%. The total amount of incentive programs Bank of Japan kept at 80 trillion yen (just over $ 1 trillion), including a program of emergency loans to banks - 25 trillion yen asset repurchase program, expanded in the past month - 55 trillion yen. CB solutions line with expectations of economists.

EUR / USD: the pair is trading in the range of $ 1.2993 - $ 1.3016

GBP / USD: the pair is trading in the range of $ 1.6172 - $ 1.6198

USD / JPY: the pair dropped to the level of Y78.26, then recovered to the level of Y78.51

At 12:30 GMT in Canada, there are data on changes in the volume of building permits issued in August, the unemployment rate, changes in the number of employees, change in the number of employed full-time and a change in the number of employed part-time in September. At 12:30 GMT, the U.S. announced the unemployment rate for September, changing the number of people employed in non-agricultural sector, changes in the number of employees in the private sector of the economy, changes in the number of employed in the manufacturing sector of the economy and changes in the average hourly wage for September.

EUR/USD

Offers $1.3100, $1.3030-50

Bids $1.2980/70, $1.2920/00

GBP/USD

Offers $1.6310, $1.6250/55, $1.6220/30, $1.6210

Bids $1.6170, $1.6150, $1.6135/30, $1.6100

AUD/USD

Offers $1.0350, $1.0315/20, $1.0300, $1.0290, $1.0275/80

Bids $1.0220, $1.0200

EUR/GBP

Offers stg0.8070/80

Bids stg0.8025/20, stg0.8005-995, stg0.7980/75, stg0.7945/40

EUR/JPY

Offers Y103.00, Y102.80, Y102.50

Bids Y101.50, Y101.00

USD/JPY

Offers Y79.20, Y79.00, Y78.60/70

Bids Y78.20, Y78.00, Y77.90, Y77.80/70

European stocks climbed, with the Stoxx Europe 600 Index heading for its first weekly gain in three, before a report that may show U.S. payrolls expanded at a faster pace last month.

The U.S. economy created 115,000 jobs last month, up from 96,000 in the prior period, economists forecast before today’s Labor Department report. Earlier this week, a release from ADP Employer Services said companies added 162,000 jobs last month, exceeding economists’ estimates.

ECB President Mario Draghi reiterated during a press conference in Slovenia yesterday that the central bank won’t start intervening in bond markets until governments like Spain request a bailout and agree to conditions. He also ruled out allowing the ECB to take losses in any further Greek debt restructuring and damped speculation of another interest-rate cut.

The prime ministers of Italy, Spain, and France meet at a summit of Mediterranean leaders in Malta today.

Gauges of automakers and oil companies on the Stoxx 600 were among the best performers of the index’s 19 industry groups. BMW advanced 1.3 percent to 60.52 euros. Technip, Europe’s second-largest oilfield-services provider, jumped 2.7 percent to 89.71 euros.

Burberry rallied 1.3 percent to 1,013 pence. Morgan Stanley raised its recommendation on the stock to overweight, the equivalent of a buy rating, from equal weight.

FTSE 100 5,852.21 +24.43 +0.42%

CAC 40 3,428.24 +27.04 +0.80%

DAX 7,348.81 +43.60 +0.60%

EUR/USD $1.2900, $1.2950, $1.2975, $1.3000, $1.3020, $1.3050, $1.3100

USD/JPY Y78.00, Y78.50, Y79.00

GBP/USD $1.6125, $1.6100

EUR/GBP stg0.8050

USD/CHF Chf0.9200, Chf0.9370

EUR/CHF Chf1.2100

AUD/USD $1.0150, $1.0160, $1.0200, $1.0225, $1.0250

USD/CAD C$0.9845, C$0.9900

Asian stocks rose, with the benchmark regional index set to gain for the first week in three, after European Central Bank President Mario Draghi said the bank stands ready to buy bonds to ease the region’s debt crisis and as U.S. economic data beat estimates. ECB PresidentDraghi said the central bank is ready to start buying government bonds of indebted euro nations as soon as the necessary conditions are fulfilled. The ECB yesterday kept its benchmark interest rate unchanged at a historic low of 0.75 percent.

Nikkei 225 8,863.3 +38.71 +0.44%

S&P/ASX 200 4,494.4 +42.05 +0.94%

Shanghai Composite 2,086.17 +29.85 +1.45%

Brother Industries Ltd., a Japanese office-equipment maker that gets 28 percent of sales in Europe, advanced 2.5 percent.

BHP Billiton Ltd., the world’s biggest mining company, rose 1 percent after a gauge of commodity prices yesterday climbed by the most in two months.

LG Display Co. slid 4.5 percent in Seoul after Korea Investment & Securities cut its rating on the stock, saying television and notebook panel prices may fall.

Watching if Japan prices move in right direction

Price view not linked automatically to policy

Japan govt understands BOJ policy stance

Always watching FX impact on econ, prices

can't buy foreign bonds that would affect fx rates

- To review if Japan can hit +1% CPI in Oct 30 report

Watching if Japan prices move in right direction

Price view not linked automatically to policy

Japan govt understands BOJ policy stance

Always watching FX impact on econ, prices

can't buy foreign bonds that would affect fx rates

- To review if Japan can hit +1% CPI in Oct 30 report

Yesterday the euro rose for a sixth day versus the yen, the longest run since March, as European Central Bank President Mario Draghi said the currency was irreversible and the ECB’s decision to start buying bonds helped ease tensions.

The 17-nation currency gained the most in almost three weeks versus the dollar after Draghi said the ECB was ready to start buying government bonds from nations such as Spain as soon as the necessary conditions are met.

The ECB is ready to undertake bond purchases under its plan known as Outright Monetary Transactions “once all the prerequisites are in place,” Draghi said at a press conference in Ljubljana, Slovenia. At last month’s conference, Draghi unveiled a program of unlimited debt buying to cap borrowing costs for debt-ridden nations.

The ECB left its benchmark rate at a record low of 0.75 percent.

Spain sold a combined 3.99 billion euros ($5.19 billion) of two-, three-and five-year notes today as investors debated whether the nation will ask for an international bailout. Prime Minister Mariano Rajoy this week denied he has any immediate plans to do so.

The greenback stayed lower versus most major peers as claims for U.S. jobless benefits rose less than forecast, encouraging investors to buy higher- returning assets. U.S. Labor Department data showed applications for jobless benefits increased 4,000 to 367,000 in the week ended Sept. 29. A survey forecast 370,000 claims.

The pound strengthened versus the dollar after the Bank of England left its asset-purchase target at 375 billion pounds ($604 billion) at its monthly gathering. The central bank kept its main interest rate at a record-low 0.5 percent.

Asian stocks rose, with a regional benchmark index heading for its highest close in a week, as reports on U.S. jobs and service industries beat expectations, easing concern the world’s biggest economy is slowing. The European Central Bank and the Bank of England also hold policy meetings today, after the Reserve Bank of Australia unexpectedly cut interest rates on Oct. 2.

Nikkei 225 8,824.59 +77.72 +0.89%

S&P/ASX 200 4,452.4 +13.84 +0.31%

Shanghai Composite 2,086.17 +29.85 +1.45%

Toyota Motor Corp., the world’s largest carmaker by market value, climbed 3 percent in Tokyo.

Fisher & Paykel Appliances Holdings Ltd. advanced 3.7 percent in Wellington after directors of the refrigerator maker rejected a bid from China’s Haier Corp., saying it is too low.

Woodside Petroleum Ltd., Australia’s second-biggest oil producer, slid 1 percent in Sydney as oil traded near a two-month low.

European stocks closed little changed as the European Central Bank and the Bank of England left their benchmark interest rates on hold.

The ECB kept its benchmark interest rate at a record low of 0.75 percent, as predicted by 48 of 52 economists in a survey. The central bank is ready to start buying government bonds as soon as the necessary conditions are fulfilled, President Mario Draghi said today at a press conference in Ljubljana, Slovenia.

The Bank of England maintained its bond-purchase target at 375 billion pounds ($604 billion) and held interest rates at 0.5 percent, as economists had forecast.

National benchmark indexes declined in 12 of the 18 western European markets. Germany’s DAX fell 0.2 percent and France’s CAC 40 declined 0.1 percent. Britain’s FTSE 100 was little changed while the Swiss Market Index rose 0.4 percent.

Nobel Biocare retreated 4.3 percent to 9.03 Swiss francs after saying a drop in the Japanese market in the third quarter is “materially impacting” full-year sales and profit. The world’s second-biggest maker of dental implants said annual earnings before interest and taxes will be in the range of 67 million euros to 70 million euros. While Japan represents 13 percent of sales, it contributes “disproportionately high profit,” the company said.

Gerresheimer AG lost 2.3 percent to 39.79 euros. The German producer of pharmaceutical and health-care equipment posted third-quarter adjusted earnings of 62 cents per share, missing the average analyst estimate of 70 cents.

Halfords surged 14 percent to 303.5 pence, the most since the company listed in 2004, after the company said it expects 2013 profit before tax in the upper half of its previously forecast range of 62 million pounds to 70 million pounds. The company also reported second-half same-store sales growth that beat analyst estimates.

Major U.S. stock indexes rose. Support indices have published data on the number of applications for unemployment benefits, which are for the most recent reporting week went slightly better than expected (367 vs. 371 thousand thousand).

Supported the positive sentiment statement by ECB President Mario Draghi, who at a press conference today noted the positive impact of the new bond-buying program and expressed readiness to resort to the program, as soon as this will be necessary.

Growth indices kept released after the start of trading data on factory orders in the United States, the decline in August of that expected at at -4.1% against growth of 2% in July, in fact, orders fell by 5.2%.

In the composition of the index DOW most components increased in price. Maximum growth showed stocks Alcoa (AA, +3.42%) and Bank of America (BAC, +3.40%).

All of the major economic sectors rose. Leading financial sector (+1.3%). The smallest increase in the tech sector (+0.3%).

NuVasive medical devices plummeted 33% after management lowered the forecast for sales in the third quarter due to "unusually high" number of customers switched to competitors.

U.S. retailer Costco Wholesale reported a 6% growth of same-store sales in September, and as a result its shares rose 1.9%.

00:00 China Bank holiday -

03:30 Japan BoJ Interest Rate Decision - 0.10% 0.10% 0.10%

03:30 Japan BoJ Monetary Policy Statement -

05:00 Japan Leading Economic Index August 93.0 93.6 93.6

05:00 Japan Coincident Index August 93.8 93.6 93.0

The yen strengthened versus most of its 16 major counterparts and pared a weekly decline versus the dollar, after BOJ officials kept the bank’s asset-purchase fund, its main policy tool amid near-zero rates, unchanged. The BOJ said today in a statement that its bond-buying program will remain at 55 trillion yen ($702 billion). The outcome was expected by all 20 economists surveyed by Bloomberg News. Officials will next meet on Oct. 30.

Today’s meeting was attended by Japanese Economy Minister Seiji Maehara, the first minister to do so for over nine years. Maehara said he went to the BOJ to express his concern about yen appreciation and prolonged deflation.

The euro was 0.1 percent from a two-week high after European Central Bank President Mario Draghi said the bank is ready to start buying government bonds as part of a program to help ease borrowing costs for debt-ridden nations in the region. ECB President Draghi said yesterday the bank is ready to undertake Outright Monetary Transactions “once all the prerequisites are in place.” He spoke at a press conference in Ljubljana, Slovenia, after policy makers left the benchmark rate at a historic low of 0.75 percent. The plan has “helped to alleviate tensions over the past few weeks” and “now it’s really in the hands of governments,” he said.

The dollar slid versus most of its major peers this week on prospects the Federal Reserve will continue measures supporting growth even as employment data is forecast to indicate improvement. In the U.S., payrolls rose by 115,000 in September, up from 96,000 in the prior month, the Labor Department may report today, according to the median projection of economists surveyed by Bloomberg News. The jobless rate is estimated at 8.2 percent, compared with 8.1 percent in August.

EUR/USD: during the Asian session, the pair traded in the range of $1.3010-20.

GBP/USD: during the Asian session, the pair traded in the range of $1.6180-95.

USD/JPY: during the Asian session the pair fell to Y78.25.

There is plenty on the calendar to keep traders interested Friday, although, without a doubt, the main feature will be the US employment report at 1230GMT. Early UK data sees the release of the John Lewis Sales numbers for the week to September 29. Back in Europe, at 0700GMT, Spanish August industrial output numbers are expected and will likely underline the depth of Spain's recession. At 0900GMT,the 3rd estimate of EMU second quarter GDP numbers will be released, followed at 1000GMT by the release of the German August manufacturing orders data.

Change % Change Last

Gold 1,793 +13 +0.74%

Oil 91.53 +3.39 +3.85%Change % Change Last

Nikkei 225 8,824.59 +77.72 +0.89%

S&P/ASX 200 4,452.4 +13.84 +0.31%

Shanghai Composite 2,086.17 +29.85 +1.45%

FTSE 100 5,827.78 +1.97 +0.03%

CAC 40 3,401.2 -4.82 -0.14%

DAX 7,305.21 -16.87 -0.23%

Dow 13,575 +80 +0.60%

Nasdaq 3,149 +14 +0.44%

S&P 500 1,461 +10 +0.69%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2955 +0,36%

GBP/USD $1,6192 +0,69%

USD/CHF Chf0,9305 -0,86%

USD/JPY Y78,49 0,00%

EUR/JPY Y102,16 +0,81%

GBP/JPY Y127,08 +0,70%

AUD/USD $1,0244 +0,24%

NZD/USD $0,8216 +0,27%

USD/CAD C$0,9804 -0,69%

00:00 China Bank holiday -

03:30 Japan BoJ Interest Rate Decision - 0.10% 0.10% 0.10%

03:30 Japan BoJ Monetary Policy Statement -

05:00 Japan Leading Economic Index August 93.0 93.6

05:00 Japan Coincident Index August 93.8 93.6

07:00 Switzerland Foreign Currency Reserves September 418.4

07:30 Japan BOJ Press Conference -

08:00 Switzerland KOF Institute Economic Forecast IV quarter

09:00 Eurozone GDP (QoQ) (finally) Quarter II -0.2% -0.2%

09:00 Eurozone GDP (YoY) (finally) Quarter II -0.5%

10:00 Germany Factory Orders s.a. (MoM) August +0.5% -0.4%

10:00 Germany Factory Orders n.s.a. (YoY) August -4.5% -4.3%

12:30 Canada Building Permits (MoM) August -2.3% -0.7%

12:30 Canada Unemployment rate September 7.3% 7.3%

12:30 Canada Employment September 34.3 11.9

12:30 U.S. Unemployment Rate September 8.1% 8.2%

12:30 U.S. Nonfarm Payrolls September 96 111

12:30 U.S. Average hourly earnings September 0.0% +0.2%

12:30 U.S. Average workweek September 34.4 34.4

17:00 U.S. FOMC Member Elizabeth Duke Speaks -

19:00 U.S. Consumer Credit October -3.3 6.3© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.