- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-10-2011

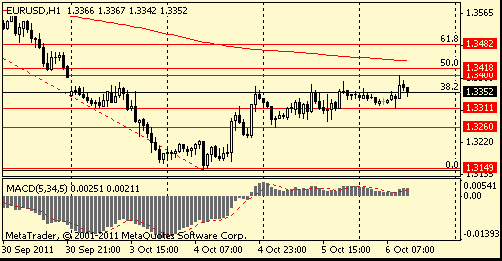

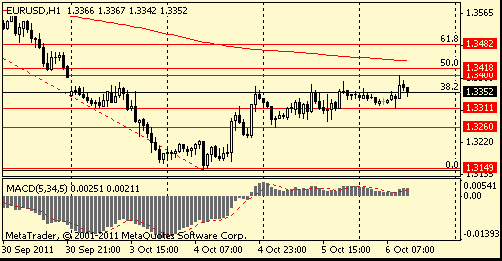

Offers at $1.3460/65, but the real test comes at $1.3480/85 (downtrend line and 61.8% Fibo retrace). Stops expected on a break above $1.3500. Euro resistance will go hand in hand with key technical levels in other instruments.

European stocks rose for a second day amid speculation policy makers will reach agreement to contain the sovereign-debt crisis and as the Bank of England expanded its bond-purchase program.

National benchmark indexes rose in every western-European markets except Denmark. France’s CAC 40 Index advanced 3.4 percent and the U.K.’s FTSE 100 Index rose 3.7 percent. Germany’s DAX Index added 3.2 percent.

FTSE 100 5,291 +189.09 +3.71%, CAC 40 3,075 +101.47 +3.41%, DAX 5,645 +172.22 +3.15%

BNP Paribas SA, Credit Agricole SA and Natixis surged after Le Figaro said the French government is working on a contingency plan to take stakes in the country’s lenders. BHP Billiton Ltd., the world’s biggest mining company, rallied 5.9 percent as metal prices increased. SABMiller Plc surged 7 percent after a report the brewer is in talks to be bought by Anheuser-Busch InBev NV.

The euro strengthened against the dollar and yen on speculation a reintroduction of loans to banks by the European Central Bank will buoy crisis-ridden markets.

The 17-nation currency weakened earlier as ECB President Jean-Claude Trichet said the region’s economy is facing “intensified downside risks.” The pound fell after the Bank of England unexpectedly expanded its bond-purchase plan.

The franc dropped for a third day against the euro on speculation the central bank will impose further measures to contain its strength after imposing the cap last month at 1.20 per euro.

U.S. stocks rose, giving the Standard & Poor’s 500 Index the biggest three-day gain since August, as the Europe took steps to control the region’s debt crisis.

Dow 11,029.14 +89.19 +0.82%, Nasdaq 2,491 +30.95 +1.26%, S&P 500 1,155.79 +11.76 +1.03%

Financial shares rose the most among 10 groups in the S&P 500. Bank of America Corp. and JPMorgan Chase & Co. added at least 3 percent. Alcoa Inc., the largest U.S. aluminum producer, climbed 6.6 percent as commodities jumped. Target Corp. rose 4.5 percent as sales beat estimates. Yahoo! Inc. tumbled 4.6 percent as people familiar with the matter said Microsoft Corp. isn’t close to making an offer for the company.

- Imbalances are at root of problems

- Not immune to the world economy

- Inflation will fall quite rapidly in 1st months 2012

- Inflation could fall well below target by 2013

- Isn't enough money in the economy

- Money underlying may be growing around 2% a year

- Money growth needs to rise faster

- Eurozone are having to find alternatives to devaluing fx

- Moves in fx are a 'safety valve' for imbalances

- Sterling fall has bolstered UK competitiveness

- Taken preemptive action to ease slowdown

- UK has credible plan to repay debts

Gold and silver futures rose for the second straight day on concern that Europe’s sovereign-debt crisis will hamper the global economy, bolstering demand for the precious metals as a store of value.

Gold futures for December delivery gained 0.6 percent, to $1,656.80 an ounce on the Comex in New York. Yesterday, the metal climbed 1.6 percent.

Crude oil increased after European Central Bank President Jean-Claude Trichet announced a bond- purchase program to stimulate economic growth.

Futures rose as much as 1.8 percent as Trichet said at a press conference in Berlin that the ECB will resume covered-bond purchases and reintroduce one-year loans for banks as the sovereign debt crisis threatens the region. Oil dropped earlier as Trichet said that euro-area economy faces

Crude oil for November delivery rose 51 cents, or 0.6 percent, to $80.19 a barrel at 10:49 a.m. on the New York Mercantile Exchange. Futures climbed to $81.15 and dropped to $79.08. Prices are down 12 percent this year.

Brent oil for November settlement increased 32 cents, or 0.3 percent, to $103.05 a barrel on the London-based ICE Futures Europe exchange.

USD/JPY Y75.50, Y76.65, Y77.15, Y77.25, Y78.00, Y78.50

EUR/GBP stg0.8700

AUD/USD $0.9640

EUR/CHF chf1.2250

- ECB to do 1-yr ltro in oct; and 13-mo LTRO in Dec

- inflation has remained elevated

- data confirms infl to stay above 2% in months ahead

- infl to fall thereafter

- int rates low

- to conduct 2 longer term refi ops

- inflation likely to fall back sharply next year

- to launch 3 auctions per week starting Oct 10

- underlying rate of uk growth has moderated

Data:

The pound slumped against all its major counterparts after the Bank of England expanded its bond-purchase plan and kept its benchmark interest rate at a record low.

At 1230GMT, US data starts with initial jobless claims, which are expected to rise 19,000 to 410,000 in the October 1 week after falling sharply in the previous week on seasonal adjustment difficulties. Claims usually decline in the last week of a quarter before surging in the

following week, though claims rose in last week of September in 2008-2010. At 1330GMT, the IMF gives it's regular biweekly briefing in Washington.

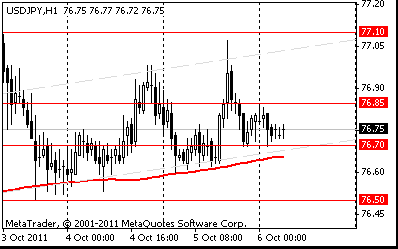

Resistance 3: Y77.30 (Sep 15 and Oct 3 high)

Resistance 3: Chf0.9500 (Feb 22 high)

Resistance 3: $ 1.5530 (area of Sep 29-30 lows and МА (200) for Н1)

Currently FTSE 5,194 +92.27 +1.81%, CAC 3,047 +72.96 +2.45%, DAX 5,596 +122.61 +2.24%.

USD/JPY Y75.50, Y76.65, Y77.15, Y77.25, Y78.00, Y78.50

EUR/GBP stg0.8700

AUD/USD $0.9640

EUR/CHF chf1.2250

Hang Seng 17,047 +796.97 +4.90%

S&P/ASX 4,070 +143.41 +3.65%

Shanghai Composite closed

The dollar and yen advanced against most of their major peers as a decline in U.S. stock futures supported demand for the haven currencies.

The 17-nation euro failed to rally versus its U.S. and Japanese counterparts before a European Central Bank meeting today, where 11 out of 52 economists survey predict policy makers will cut borrowing costs.

The Dollar climbed for the sixth time in seven days.

The euro held a two-day advance against the Swiss franc and the pound on speculation European leaders will step up efforts to aid the region’s banks in a bid to resolve the debt crisis.

The Bank of England is also due to announce a decision on its official bank rate today and will probably hold it at 0.5 percent, according to all 53 economists in another poll.

The Australian and New Zealand dollars held a two-day gain versus the U.S. currency as Asian stocks extended a worldwide rally, increasing demand for higher- yielding assets.

EUR/USD: on asian session the pair fell, but later restored

GBP/USD: on asian session the pair fell, but later restored

USD/JPY: the pair holds in range Y76.70/80

On Thursday at 1000GMT by German manufacturing orders, but this will also be overshadowed by the later ECB announcement at 1145GMT with it's policy announcement, followed as usual by the press conference, this time taking place in Berlin. This will be Jean-Claude Trichet's finale as ECB President with investors continuing to guess how the central bank will react to quickly deteriorating economic sentiment and ominous financial market tensions. At 1400GMT, the Insee, IFO, ISAE institutes deliver their 4Q Eurozone.

economic outlook. At 1230GMT, US data starts with initial jobless claims.

The euro erased a decline versus the dollar as stocks rose amid speculation European policy makers are looking at measures to shield banks from the region’s sovereign- debt crisis, boosting stocks and damping demand for safety. But later the euro fell against most of its major counterparts as concern the region’s debt crisis may spread led investors to shun the currency before a European Central Bank meeting.

The 17-nation euro weakened to almost a decade low against the yen after a spokesman for European Union Economic and Monetary Commissioner Olli Rehn said there’s no concrete plan to recapitalize banks. Speculation about the effect of euro area bank holdings of Greek debt has helped weaken the euro 5.5 percent in the past month.

The pound declined against the dollar and euro after a report showed U.K. economic growth slowed during the second quarter.

EUR/USD: the pair is restored after falling, bur weakened later.

GBP/USD: the pair holds in range $1.5410-$1.5480

USD/JPY: yesterday the pair is grown

During Thursday at 1000GMT by German manufacturing orders, but this will also be overshadowed by the later ECB announcement at 1145GMT with it's policy announcement, followed as usual by the press conference, this time taking place in Berlin. This will be Jean-Claude Trichet's finale as ECB President with investors continuing to guess how the central bank will react to quickly deteriorating economic sentiment and ominous financial market tensions. At 1400GMT, the Insee, IFO, ISAE institutes deliver their 4Q Eurozone.

economic outlook. At 1230GMT, US data starts with initial jobless claims.

Asian stocks dropped, led by exporters, as a downgrade of Italy’s credit rating overshadowed signs that Europe may reach consensus on measures to shield its banks from the sovereign-debt crisis.

Japan’s Nikkei 225 (NKY) Stock Average fell 0.9 percent. South Korea’s Kospi Index slumped 2.3 percent. Australia’s S&P/ASX 200 advanced 1.4 percent. The Hong Kong stock exchange is closed today for a public holiday.

Nikkei 225 8,383 -73.14 -0.86%, Hang Seng 16,250 -571.88 -3.40%, S&P/ASX 200 3,926 +54.38 +1.40%, Shanghai Composite 2,359 -6.12 -0.26%.

Toyota Motor Corp. the world’s biggest carmaker, fell 2 percent in Tokyo. Japanese utilities slumped on speculation the government will change the framework for pricing electricity. BHP Billiton Ltd., the largest mining company, gained 3.8 percent in Sydney as commodity prices rallied after the Financial Times reported Europe is nearing a plan to recapitalize its banks.

European stocks advanced for the first time in four days amid speculation policy makers are examining measures to shield banks from the region’s sovereign- debt crisis.

Benchmark indexes rose in all 18 western European markets, with the exception of Iceland. The DAX climbed 4.9 percent in Frankfurt. France’s CAC 40 rose 4.3 percent and the U.K.’s FTSE 100 advanced 3.2 percent.

FTSE 100 5,102 +157.73 +3.19%, CAC 40 2,974 +123.35 +4.33%, DAX 5,473 +256.32 +4.91%

Dexia SA snapped a four-day plunge after France and Belgium said a “bad bank” will be set up to hold its troubled assets. BNP Paribas SA and Societe Generale SA, France’s biggest lenders, climbed more than 8 percent. Rio Tinto Group led mining companies higher. European Aeronautic, Defence & Space Co. rose 5.7 percent after saying 2011 will be a “very good” year.

U.S. stocks rallied, sending the Standard & Poor’s 500 Index to its biggest two-day gain in more than a month, as economic data topped estimates and investors speculated Europe will act to contain the region’s debt crisis.

Dow 10,936.62 +127.91 +1.18%, Nasdaq 2,461 +55.69 +2.32%, S&P 500 1,144 +20.09 +1.79%

The S&P 500 advanced 1.8 percent to 1,143.87 at 4 p.m. New York time, according to preliminary closing data. The index has climbed 4.1 percent in two days, the most since Aug. 29.

Monsanto Co., the world’s largest seed company, rallied 4.7 percent after forecasting higher-than-expected profit. Halliburton Co. gained 6.1 percent, pacing gains in energy producers, as oil rose after the U.S. Energy Department reported an unexpected decline in inventories. Walt Disney Co. advanced 5.5 percent as Citigroup Inc. raised its recommendation for the shares.

Resistance 2: Y77.10 (Oct 5 high)

Resistance 1: Y76.85 (session high)

The current price: Y76.74

Support 1:Y76.10 (session low)

Support 2:Y76.50 (Oct 3 low)

Support 3: Y76.10 (Sep 22 low)

Comments: the pair remains in uptrend.

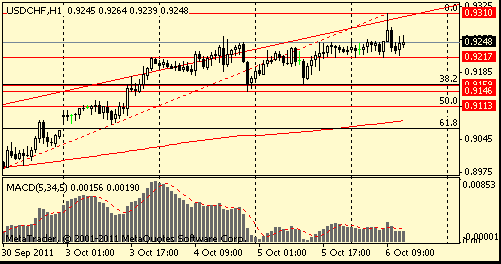

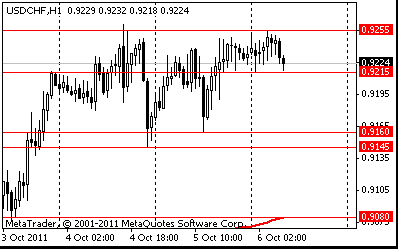

Resistance 2: Chf0.9340 (Apr 1 high)

Resistance 1: Chf0.9255 (session high)

The current price: Chf0.9224

Support 1: Chf0.9215 (session low)

Support 2: Chf0.9145/60 (area of Oct 4-5 low)

Support 3: Chf0.9080 (Oct 3 low, MA (200) H1)

Comments: the pair remains in uptrend. In focus resistance Chf0.9255.

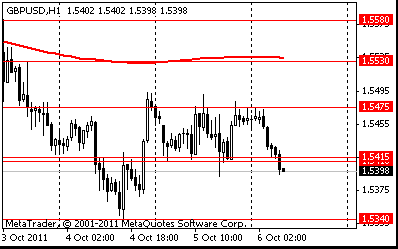

Resistance 2: $ 1.5530 (MA (200) H1)

Resistance 1: $ 1.5475 (session high)

The current price: $1.5420

Support 1 : $1.5410/15 (area of Oct 5 low, session low)

Support 2 : $1.5330/40 (area of Sep 22 low and Oct 4 low)

Support 3 : $1.5295 (Sep 7’2010 low)

Comments: the pair holds in range. In focus $1.5410.

Resistance 2: $ 1.3445 (MA (200) H1)

Resistance 1: $ 1.3385 (Oct 5 high)

The current price: $1.3332

Support 1 : $1.3280 (low of the American session on Oct 5)

Support 2 : $1.3230 (low of the American session on Oct 4)

Support 3 : $1.3160/70 (area of Oct 3-4 low)

Comments: the pair continues to restore. In focus resistance $1.3385.

Nikkei 225 8,383 -73.14 -0.86%

Hang Seng 16,250 -571.88 -3.40%

S&P/ASX 200 3,926 +54.38 +1.40%

Shanghai Composite 2,359 -6.12 -0.26%

FTSE 100 5,102 +157.73 +3.19%

CAC 40 2,974 +123.35 +4.33%

DAX 5,473 +256.32 +4.91%

Dow 10,936.62 +127.91 +1.18%

Nasdaq 2,461 +55.69 +2.32%

S&P 500 1,144 +20.09 +1.79%

10 Year Yield 1.90% +0.12 --

Oil $79.77 +0.09 +0.11%

Gold $1,641.40 -0.20 -0.01%

07:15 Switzerland Consumer Price Index (MoM) September -0,3% +0,1%

07:15 Switzerland Consumer Price Index (YoY) September +0,2% +0,3%

10:00 Germany Factory Orders s.a. (MoM) August -2,8% +0,1%

10:00 Germany Factory Orders n.s.a. (YoY) August +8,7% +4,7%

11:00 United Kingdom BoE Interest Rate Decision 0 0,50% 0,50%

11:45 Eurozone ECB Interest Rate Decision 0 1,50% 1,50%

12:30 U.S. Initial Jobless Claims неделя по 1 октября 391К 405К

12:30 Eurozone ECB Press Conference 0

14:00 Canada Ivey Purchasing Managers Index September 57,6 58,2

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.