- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 10-10-2011

- QE likely to raise prices of corp bonds, equities

- bond buys needed to stop inflation undershoot

- bond buys ease credit conditions, stimulate demand

- MPC shouldn't make credit allocation decisions

European stocks advanced, with the Stoxx Europe 600 Index posting its biggest four-day rally since November 2008, as the leaders of Germany and France gave themselves three weeks to create a plan to recapitalize banks. Angela Merkel and Nicolas Sarkozy, racing to stamp out the sovereign-debt crisis that threatens to engulf the financial system, set an end-of-October deadline to devise a plan to recapitalize banks, get Greece on the right track and fix Europe’s economic governance.

FTSE 100 5,399 +95.60 +1.80%, CAC 40 3,161 +65.91 +2.13%, DAX 5,847 +171.59 +3.02%

National benchmark indexes rose in 15 of the 18 western European markets. The U.K.’s FTSE 100 Index gained 1.8 percent. France’s CAC 40 Index climbed 2.1 percent and Germany’s DAX Index jumped 3 percent. All three gauges posted their biggest four-day rallies since 2008.

BP Plc contributed the most to the gauge’s advance. Premier Oil Plc rose 3.3 percent after HSBC Holdings Plc upgraded its shares. Erste Group Bank AG plunged 9.2 percent after saying it will post a full-year loss because of writedowns at its units in Hungary and Romania. Dexia SA dropped 4.7 percent after earlier falling as much as 36 percent when trading in the shares resumed.

Maurel SA rallied 5.5 percent to 13.42 euros. The company said it has found oil sandstones at a well at the Sabanero license in Colombia and oil samples taken have confirmed the field extension to the north east. In a statement, Maurel said it will drill three more wells in 2011 and 2012.

ABB Ltd., the world’s largest maker of power-transmission gear, added 3.5 percent to 16.99 Swiss francs. Jefferies Group Inc. raised its recommendation on the company’s shares to “buy” from “hold.”

Erste Group, eastern Europe’s second-biggest lender, slumped 9.2 percent to 18.80 euros. The bank said it will post a full-year loss of as much as 800 million euros ($1.1 billion) after writedowns at its Hungarian and Romanian units.

Raiffeisen Bank International AG (RBI), eastern Europe’s third- biggest lender, plunged 4.7 percent to 21.20 euros.

The euro rose the most in more than a year against the dollar after French and German leaders pledged to deliver a plan to support banks and repeated a commitment to keep Greece in the single-currency bloc. The shared currency also advanced as Belgium agreed to buy the local consumer-lending unit of Dexia SA, ending a 15-year cross-border experiment with France after the European debt crisis deepened. The euro stayed higher even as a report showed European investor confidence fell to the lowest in more than two years.

The dollar dropped against all of its major counterparts as global stocks advanced, sapping demand for the greenback as a haven.

Currencies of commodity-exporting countries rallied as raw materials gained. Australia’s dollar advanced to the highest level in almost two weeks against its U.S. counterpart, rising to as much as 99.82 U.S. cents before trading up 2.2 percent at 99.79 cents. Canada’s dollar strengthened 1.3 percent to C$1.0257 per U.S. dollar.

The Swiss franc strengthened against the euro by the most since Sept. 5, the day before the Swiss National Bank imposed a ceiling of 1.20 versus the common currency and resumed purchases of foreign currencies to curb the franc’s advance. The franc rose 0.4 percent to 1.2361 per euro and was the best performer among the major currencies. The SNB may raise its ceiling for the franc to 1.30 per euro from 1.20 per euro, according to the private-banking unit of JPMorgan Chase & Co.

U.S. stocks rose, sending the Standard & Poor’s 500 toward its biggest rally in a month, as the leaders of France and Germany pledged a plan to support European banks and stem the region’s debt crisis in three weeks.

Dow 11,380.99 +277.87 +2.50%, Nasdaq 2,557.70 +78.35 +3.16%, S&P 500 1,188.97 +33.51 +2.90%

All 10 groups in the S&P 500 advanced today as gains were led by financial and commodity companies.

Bank of America Corp. and JPMorgan Chase & Co. added more than 4.5 percent. Chevron Corp. and Alcoa Inc. climbed at least 3.1 percent. Caterpillar Inc. and Hewlett-Packard Co. increased more than 3.5 percent, pacing gains in companies most-tied to the economy. Netflix Inc. jumped 4.9 percent after retreating from a decision to split its mail-order DVD service from its Internet streaming.

Sprint Nextel Corp. tumbled 7.7 percent to $2.23 as at least six analysts cut their ratings after the carrier’s investor meeting, citing concerns that rising spending will hurt liquidity.

- European bank stress tests haven't been tough enough

- must have realistic assessment of situation in Greece

Against the backdrop of excitement to the stock and commodity markets in connection with Sunday's statements by the leaders of France and Germany to curb the debt crisis and the recapitalization of the banking sector gold showed strong growth surpassing the four-day highs.

Today the price of December futures for gold has reached $1673.10 per ounce. Currently, the futures price on the Comex in New York is $1665.40 per ounce.

Crude oil climbed to the highest level in two weeks as the leaders of Germany and France pledged to stem the European sovereign-debt crisis. Futures rose as much as 2.3 percent after German Chancellor Angela Merkel and French President Nicholas Sarkozy said yesterday they will deliver a plan to recapitalize the region’s banks and address the Greek crisis by Nov. 3. The euro advanced after Merkel said yesterday in Berlin that European leaders will do “everything necessary” to ensure that banks have adequate capital. The euro gained 1.8 percent to $1.3623. A stronger European currency increases the appeal of raw materials as an alternative investment.

Crude oil for November delivery rose $86.09 a barrel on the New York Mercantile Exchange, the highest level since Sept. 22. Prices climbed 4.8 percent last week, the biggest gain since March. Oil is down 7.2 percent this year.

USD/JPY Y75.00, Y76.00, Y77.00

EUR/JPY Y105.00

AUD/USD $0.9700, $0.9800, $0.9900, $1.0000

EUR/CHF Chf1.2375

GBP/USD $1.5535

U.S. stock futures rallied after the leaders of Germany and France pledged a program to support European banks.

Angela Merkel and Nicolas Sarkozy yesterday made yet another pledge to take action to solve the eurozone's debt crisis, saying they would formulate a plan by early next month to recapitalize European banks and accelerate economic coordination in the currency bloc. However, the German and French leaders provided no details, with sources saying they still have to resolve differences over who will pay for the recapitalization and how deeply to restructure Greece's debts.

The Merkel-Sarkozy talks were given extra urgency by the woes of Dexia , whose rescue was agreed to by France, Luxembourg and Belgium last night. The latter's government will buy the bank's Belgian business for €4B ($5.4B) and all three countries have provided a combined guarantee of €90B to secure borrowing over the next 10 years.

06:00 Germany Current account (August) unadjusted, bln 7.0

06:00 Germany Trade balance (August) unadjusted, bln 11.8

06:45 France Industrial production (August) 0.5%

08:00 Italy Industrial production (August) adjusted 4.3% 0.5%

08:00 Italy Industrial production (August) Y/Y adjusted 4.7%

The euro rose to its strongest level this month against the dollar after French and German leaders pledged to deliver a plan to help banks and repeated a commitment to keep Greece in the single-currency bloc.

The Dollar Index slid as European stocks and U.S. index futures advanced, sapping demand for the greenback as a haven.

German Chancellor Angela Merkel and French President Nicolas Sarkozy said in Berlin yesterday that they had given themselves three weeks to devise a plan to recapitalize banks and find a “durable” solution for Greece’s debt load.

European leaders will deliver a plan by the Group of 20 summit on Nov. 3, Sarkozy said. They will do “everything necessary” to ensure banks have enough capital, Merkel said.

The euro stayed higher even as a report showed European investor confidence fell to the lowest in more than two years. An index measuring sentiment in the euro region declined to minus 18.5 in October from minus 15.4 in September, the Limburg, Germany-based Sentix research institute said in an e-mailed statement today. That’s the lowest since July 2009.

EUR/USD: the pair grown in $1.3600 area.

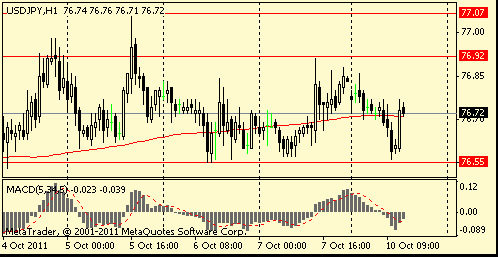

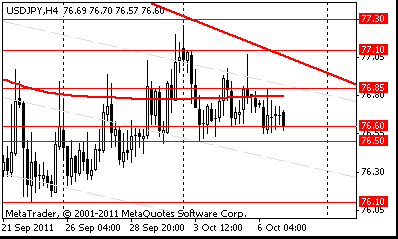

Resistance 2: Y77.10 (Oct 5 high)

Resistance 1: Y76.90 (Oct 7 high)

Current price: Y76.72

Support 1:Y76.55/50 (area of Sep 30, Oct 3, 4, 6 and 7 lows)

Support 2:Y76.10 (area of low of September)

Support 3:Y75.90 (area of historical low)

Resistance 2: Chf0.9230 (high of european session)

Resistance 1: Chf0.9150 (earlier support, Oct 4 and 7 low)

Current price: Chf0.9094

Support 1: Chf0.9070 (area of session low and 61,8% FIBO Chf0,8920-Chf0,9310)

Support 2: Chf0.9000 (psychological mark)

Support 3: Chf0.8920 (area of Sep 27-29 low)

Comments: the pair come near to strong support in Chf0,9070 area. Below loss may extend to Chf0,9000. The immediate resistane - area of Chf0,9150.

Resistance 2: $ 1.5700 (area of Oct 27 and 29 high)

Resistance 1: $ 1.5660 (Sep 30 high, session high)

Current price: $1.5651

Support 1 : $1.5580 (low of european session)

Support 2 : $1.5525 (session low, МА(200) for Н1)

Support 3 : $1.5500 (earlier resistance, area of Oct 4-6 high)

Comments: the pair comes near to resistance in $1,5660 area. Overcoming of this level may open way to $1,5700.

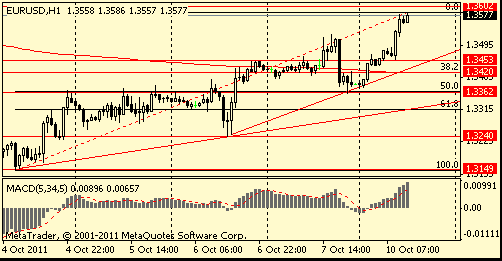

Resistance 2: $ 1.3680 (Sep 27-29 high, 38,2 % FIBO $1,4550-$ 1,3150)

Resistance 1: $ 1.3600 (Sep 30 high)

Current price: $1.3577

Support 1 : $1.3450 (low of european session, support line from Oct 6)

Support 2 : $1.3420 (38,2 % FIBO $1,3150-$ 1,3580)

Support 3 : $1.3360 (Oct 7 low, 50,0 % FIBO $1,3150-$ 1,3580)

Comments: the pair comes nearer to resistance in $1,3600 area. Overcoming of this level may open way to $1,3680.

USD/JPY Y75.00, Y76.00, Y77.00

EUR/JPY Y105.00

AUD/USD $0.9700, $0.9800, $0.9900, $1.0000

EUR/CHF Chf1.2375

GBP/USD $1.5535

00:00 U.S. Columbus Day

00:00 Canada Thanksgiving Day

00:30 Australia ANZ Job Advertisements (MoM) -2.1%

The yen and dollar fell against most of their major counterparts as speculation that Europe can contain its debt crisis spurred gains in U.S. equity futures, damping demand for haven currencies.The euro rose after French and German leaders pledged to deliver a plan in three weeks to recapitalize banks and reiterated their intention to keep Greece in the euro.The Australian and New Zealand dollars rose against the greenback and the yen after a report showed U.S. payrolls increased in September by more than economists forecast, boosting demand for higher-yielding assets.EUR/USD: on asian session the pair gain

GBP/USD: on asian session the pair gain

USD/JPY: the pair decreased on asian session

European data for Monday starts at 0600GMT with the German trade balance for August, which is followed at 0630GMT by the France BoF

business survey and at 0645GMT by France industrial output. Bundesbank Vice President Sabine Lautenschlaeger then gives a press conference from 0800GMT, while at the same time, ECB Vice President Vitor Constancio delivers a speech at Bank Competiveness in the Post-Crisis World in Milan. European data then rounds off with the 0900GMT release of the EMU OECD leading indicator. European speakers continue into the afternoon. At 1600GMT, ECB Governing Council member Ewald Nowotny is due to participate in a podium discussion entitled "Presence of Austrian Banks and Insurance in the CEE markets", in Vienna.

Hang Seng 17,565 -142.01 -0.80%

S&P/ASX 4,201 +38.14 +0.92%

Shanghai Composite 2,341 -18.03 -0.76

The European Commission is pushing for a coordinated capital injection for banks to shield them from the fallout of a potential Greek default. Banks in Europe rallied after European Central Bank President Jean-Claude Trichet said the ECB will resume purchases of mortgage-backed securities and reintroduce yearlong loans for banks. In London, the Bank of England boosted its asset-purchase program by more than a third to 275 billion pounds ($425 billion).

Japan’s Nikkei 225 Stock Average gained 1 percent, extending a 1.7 percent advance yesterday. South Korea’s Kospi Index added 2.9 percent and Australia’s S&P/ASX 200 rose 2.3 percent, to cap its biggest weekly gain in a year. Hong Kong’s Hang Seng Index advanced 3.1 percent.

National Australia Bank Ltd., the nation’s largest lender to businesses, gained 3.9 percent in Sydney. Hutchison Whampoa Ltd., which owns ports in Germany and Spain, surged 10.5 percent in Hong Kong after saying its operations in Europe are “very resilient.” Li & Fung Ltd., the world’s biggest supplier of clothes and toys to retailers, surged 7.6 percent. BHP Billiton Ltd., No. 1 mining company, jumped 2.5 percent in Sydney after commodity prices increased.

Among stocks that declined today, Sony Corp. dropped 3.7 percent to 1,415 yen in Tokyo. The consumer electronics manufacturer is getting closer to an agreement to buy Ericsson AB’s stake in their mobile-phone venture, the Wall Street Journal reported, citing people familiar with the matter. Nomura Holdings Inc. separately cut Sony’s rating to “neutral” from “buy.”

European stocks gained for a third day, posting a second weekly gain, as a report showed the U.S. economy added more jobs than economists had estimated.

National benchmark indexes climbed in 12 of the 18 western- European markets. Germany’s DAX Index climbed 0.5 percent and the U.K.’s FTSE 100 Index gained 0.2 percent. France’s CAC 40 Index increased 0.7 percent.

FTSE 100 5,303 +12.14 +0.23%, CAC 40 3,096 +20.19 +0.66%, DAX 5,676 +30.45 +0.54%

BMW and Daimler, the world’s biggest makers of luxury cars, jumped 4.1 percent to 50.89 euros and 1.3 percent to 33.98 euros, respectively. Rio Tinto, the world’s second-largest mining company, rose 1.2 percent to 3,164 pence, while Xstrata Plc climbed 2.7 percent to 910 pence. Copper, lead, tin and zinc all rose on the London Metal Exchange. Continental AG surged 4.9 percent to 46.91 euros as the world’s fourth-largest tiremaker plans to spend more than $500 million to build a new tire factory at Sumter, South Carolina, to meet increasing demand.

U.S. stocks retreated, trimming a weekly advance for the Standard & Poor’s 500 Index, as concern Europe’s debt crisis will worsen overshadowed faster-than forecast growth in American employment.

Dow 11,103.12 -20.21 -0.18%, Nasdaq 2,479.35 -27.47 -1.10%, S&P 500 1,155.46 9.51 -0.82%

The S&P 500 fell 0.8 percent, trimming its weekly gain to 2.1 percent. The index rose 6 percent over the previous three days. Financial stocks had the biggest decline in the S&P 500 among 10 industries, falling 3.7 percent, after Fitch Ratings downgraded the debt ratings of Italy and Spain.

Sprint Nextel Corp. tumbled 20 percent as the third- largest U.S. wireless carrier said it needs to raise additional capital as it spends on a network upgrade and new handsets.

Bank of America Corp. fell 6.1 percent, the most in the Dow, to $5.90. Goldman Sachs Group Inc. decreased 5.4 percent to $92.69. JPMorgan Chase & Co. lost 5.2 percent to $30.70.

Companies that are less reliant on an expanding economy outperformed the S&P 500. Wal-Mart Stores Inc. climbed 1.8 percent to $53.70. Pfizer Inc. added 1.2 percent to $18.44.

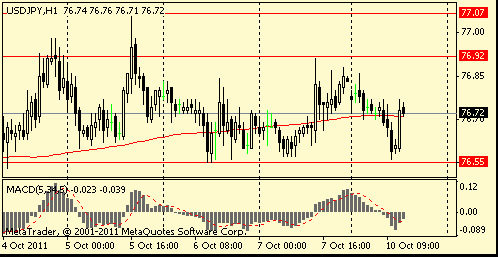

Resistance 2: Y77.10 (Oct 5 high)

Resistance 1: Y76.85 (session high)

The current price: Y76.73

Support 1:Y76.70 (session low)

Support 2:Y76.50/60 (area of Oct low)

Support 3: Y76.10 (Sep 22 low)

Comments: the pair fell.

Resistance 2: Chf0.9310/15 (area of Oct 6 high)

Resistance 1: Chf0.9220 (session high)

The current price: Chf0.9225

Support 1: Chf0.9220 (session low)

Support 2: Chf0.9145/60 (area of Oct 4-5 and 7 low)

Support 3: Chf0.9100 (a psychological level)

Comments: the pair fell. In focus support Chf0.9220.

Resistance 2: $ 1.5700 (area Sep 27-29 high)

Resistance 1: $ 1.5645 (Oct 7 high)

The current price: $1.5612

Support 1 : $1.5580 (support line from Oct 6 )

Support 2 : $1.5530 (session low)

Support 3 : $1.5500 (a psychological level)

Comments: the pair continues to restore. In focus resistance $1.5645.

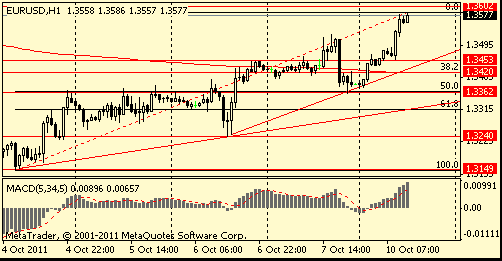

Resistance 2: $ 1.3525 (Oct 7 high)

Resistance 1: $ 1.3470 (session high)

The current price: $1.3458

Support 1 : $1.3420 (MA (200) H1)

Support 2 : $1.3360 (Oct 7 low)

Support 3 : $1.3300 (138.2 % FIBO $1.3525-$ 1.3360)

Comments: the pair continues to restore. In focus resistance $1.3470.

00:00 Canada Thanksgiving Day

00:30 Australia ANZ Job Advertisements (MoM) -0.7% -2.1%

06:00 Germany Trade Balance August 10.1 9.8

06:00 Germany Current Account August 7.5

06:45 France Industrial Production, m/m August -0.7% +1.5%

06:45 France Industrial Production, y/y August +2.3% +3.7%

08:00 Eurozone Sentix Investor Confidence October -15.4 -19.4

08:00 Eurozone ECB’s Vitor Constancio Speaks

23:01 United Kingdom RICS House Price Balance September -23 -23

23:50 Japan Trade Balance August 123.3 -692.3

23:50 Japan Current Account Total, bln August 990.0 453.5

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.