- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-10-2011

Most members were in favor of increasing monpol transparency. Most members did not see monpol as any panacea but nevertheless agreed more should be done. Without effective European action, they saw some spillover to the US. The global uncertainty part of what was dragging on the U.S. econ.

He warns must not be "sanguine" that high unemployment makes necessary low inflation and that in the UK, there is both high unemp and high inflation. The recovery will continue and gradually strengthen.

European stocks climbed to a two- month high as the European Commission’s Olli Rehn said the debt crisis can be resolved, outweighing earnings from Alcoa Inc. that missed estimates.

FTSE 100 5,442 +46.10 +0.85%, CAC 40 3,230 +76.24 +2.42%, DAX 5,994 +129.46 +2.21%

National benchmark indexes climbed in all of the 18 western-European markets, except Iceland. Germany’s DAX advanced 2.2 percent and France’s CAC 40 increased 2.4 percent. The U.K.’s FTSE 100 gained 0.9 percent to a two-month high.

Greek banks rallied, with Alpha Bank SA and National Bank of Greece SA soaring at least 15 percent. Burberry Group Plc, the U.K.’s largest luxury-goods maker, climbed 3.5 percent as sales topped forecasts. ASML Holding NV added 6.3 percent after Europe’s biggest semiconductor-equipment maker reported income that beat projections. YIT Oyj, Finland’s largest builder, slid 4.1 percent after cutting its profit outlook.

The euro rose to three-week highs against the dollar and yen as European Commission President Jose Barroso called for a “coordinated approach” to recapitalize the region’s banks. The 17-nation currency extended gains after policy makers in Slovakia, the only nation yet to approve a retooled bailout fund, reached an agreement on another vote to ratify the plan.

New Zealand’s dollar rose the most in two months against the dollar as stocks and commodities advanced, buoying higher- yielding currencies.

The dollar weakened against the majority of its most-traded counterparts before the release of minutes from the most recent Federal Open Market Committee meeting.

U.S. stocks advanced, sending the Standard & Poor’s 500 Index to the highest level in almost a month, as the European Union released a roadmap of its plans to recapitalize banks and halt the debt crisis.

Dow 11,543.22 +126.92 +1.11%, Nasdaq 2,617.24 +34.21 +1.32%, S&P 500 1,212.69 +17.15 +1.43%

All sectors of S&P 500 traded at a promotion. The maximum growth is in the financial sector and the sector of basic materials - by 2.4% and 2.1% respectively. The minimum increase is in utilities sector (+0.3%).

Bank of America Corp. and Morgan Stanley added at least 1.5 percent, following a rally in European lenders. Freeport-McMoRan Copper & Gold Inc. and Apple Inc climbed more than 1.5 percent to pace gains among companies most-reliant on economic growth. PepsiCo Inc., the world’s largest snack-food maker, increased 2.9 percent as profit beat analysts’ estimates. Alcoa Inc. slumped 3.1 percent as earnings trailed projections.

Gold futures rose to a two-week high as equities and commodities rallied amid optimism that European officials will tame the region’s debt crisis.

Physical demand was “decent” yesterday, UBS AG said in a report. Consumption in India, the world’s biggest gold buyer, may climb on purchases for the Diwali religious festival later this month, followed by the wedding season.

Gold futures for December delivery reached $1,693.90, the highest for a most- active contract since Sept. 23. Аt the moment futures traded at $1679.6 on Comex in New York.

- Italy must boost growth to keep loyal to Europe

- Need to act quickly on Italian economic reform

Oil fluctuated in New York after the International Energy Agency cut its 2012 global oil demand forecast and the euro advanced on speculation that European Union proposals on bank recapitalization will boost growth.

Futures swung between gains and losses after the Paris- based IEA reduced estimates for world demand in 2012 by 210,000 barrels a day and said Libya would pump about 600,000 barrels a day by year’s end. The euro rose to a three-week high before a presentation on recapitalization

Oil for November delivery fell 3 cents to $85.78 a barrel at 9:37 a.m. on the New York Mercantile Exchange. Prices have risen 13 percent since Oct. 4. Futures are down 6.1 percent in 2011.

Brent oil for November settlement rose $1.45, or 1.3 percent, to $112.18 on the London-based ICE Futures Europe exchange.

USD/JPY Y76.00, Y76.95, Y78.00

EUR/GBP Stg0.8720

AUD/USD $1.0000

USD/CAD C$1.0350

USD/CHF Chf0.8810

European Economic and Monetary Affairs Commissioner Olli Rehn said the region is moving toward a consensus on resolving the “calamity” of the debt crisis. Slovakia, the only country that hasn’t ratified a revised bailout fund, was poised for a second vote after failing to approve the package yesterday.

Company news:

- Chevron expects Q3 results to beat analyst forecasts and come in at the same level as Q2, when it reported EPS of $3.85;

- Alcoa got the Q3 earnings season off to a poor start after reporting that EPS more than doubled to $0.15 but came in way below reduced expectations of $0.22.

Data:

05:30 France CPI (September) unadjusted Y/Y 2.2%

08:30 UK Claimant count (September) 17.5K

08:30 UK Claimant count rate (September) 5.0%

08:30 UK Average earnings (3 months to August) Y/Y 2.8%

08:30 UK Average earnings ex bonuses (3 months to August) Y/Y 1.8%

08:30 UK ILO Jobless rate (August) 8.1%

09:00 EU(17) Industrial production (August) 1.2%

09:00 EU(17) Industrial production (August) Y/Y 5.3%

The euro rose to three-week highs against the dollar and yen before European Commission President Jose Barroso presents proposals on recapitalizing banks after Germany and France pledged to draw up a plan by early November.

The euro extended its advance after European industrial production unexpectedly rose in August, and the European Union and International Monetary Fund officials indicated Greece will get an 8 billion-euro ($11 billion) loan next month.

The dollar and the yen slumped against higher-yielding currencies such as the Australian and New Zealand dollars as stock gains sapped demand for safer investments.

EUR/USD: the pair showed high in the field of $1.3820 then returned back below $1.3800.

GBP/USD: the pair rose in area $1.5780.

USD/JPY: the pair retreated from session low and rose is Y76,75 area.

At 1730GMT, Philadelphia Fed President Charles Plosser delivers a speech on the economic outlook at Wharton in Philadelphia. Later on, just after the release of the FOMC

minutes, Cleveland Fed President Sandra Pianalto delivers a speech at 1815GMT on leadership in challenging times at the University of Akron (Ohio).

Resistance 2: Y76.90 (Oct 7 high)

Resistance 1: Y76.75 (area of session high and Oct 11 highs)

Current price: Y76.69

Support 1:Y76.30 (session low)

Support 2:Y76.10 (area of low of September)

Support 3:Y75.90 (area of historical low)

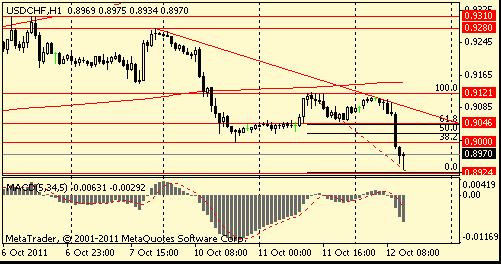

Resistance 2: Chf0.9050 (61,8 % FIBO Chf0,9120-Chf0,8930, resistance line from Oct 7)

Resistance 1: Chf0.9000 (psychological mark, 38,2 % FIBO Chf0,9120-Chf0,8930, Oct 10 low)

Current price: Chf0.8970

Support 1: Chf0.8930/20 (area of Sep 27-29 lows and session low)

Support 2: Chf0.8800 (psychological mark, area of Sep 19-20 low)

Support 3: Chf0.8750 (Sep 16 close price , МА (200) for Н4)

Comments: the pair come nearer to strong support in Chf0,8930/20 area.

Resistance 2: $ 1.5890/80 (area of Sep 12 and 15 high)

Resistance 1: $ 1.5780 (session high, МА(200) for Н1)

Current price: $1.5752

Support 1 : $1.5690/10 (38,2 % FIBO $1.5540-$ 1.5780, Sep 27, 29 and Oct 10 high)

Support 2 : $1.5600 (support line from Oct 6)

Support 3 : $1.5540/25 (area of 50.0 % FIBO $1.5270-$ 1.5780, session low and Oct 10 low)

Comments: the pair receded from the high reached today. The immediate purpose of correction $1,5690.

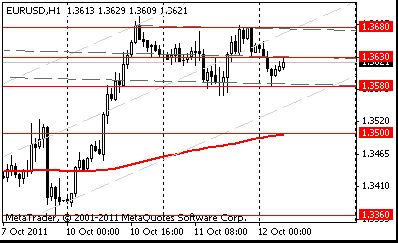

Resistance 2: $ 1.3850 (50,0 % FIBO $1,4550-$ 1,3150)

Resistance 1: $ 1.3800/20 (Sep 21 high, session high)

Current price: $1.3785

Support 1 : $1.3690/80 (earlier resistance, area of Sep 10-11 high, support line from Oct 6)

Support 2 : $1.3580/60 (area of session low and Sep 11 low, 38.2 % FIBO $1,3360-$ 1,3820)

Support 3 : $1.348 0 (50.0 % FIBO $1,3360-$ 1,3820)

Comments: growth of the pair stopped by strong resistance in $1,3800/20 area. The immediate strong support - $1,3690/80.

Currently FTSE 5,428 +32.24 +0.60%, CAC 3,202 +48.02 +1.52%, DAX 5,957 +92.36 +1.57%.

European stocks gained as European Union Commissioner Olli Rehn said the debt crisis a can be resolved, outweighing earnings from Alcoa Inc. (AA) that missed estimates.

USD/JPY Y76.00, Y76.95, Y78.00

EUR/GBP Stg0.8720

AUD/USD $1.0000

USD/CAD C$1.0350

USD/CHF Chf0.8810

06:00 Japan Core Machinery Orders September +20.3%

The euro was 0.5 percent from a three-week high before European Commission President Jose Barroso presents proposals on bank recapitalization after Germany and France pledged to devise a plan by early November.

The Swiss franc is still overvalued and needs to weaken further in order to prevent “serious” damage to Switzerland’s economy

The Australian dollar fell for a second day against its U.S. and Japanese counterparts amid concern Europe’s sovereign debt crisis will worsen and hamper global economic growth. But later the Australian and New Zealand dollars strengthened, erasing earlier declines versus their U.S. and Japanese counterparts.

The pound held a decline from yesterday versus the dollar before a report today forecast to show U.K. unemployment claims increased for a seventh month.

EUR/USD: on asian session the pair decreased, however was restored later.

GBP/USD: on asian session the pair decreased, however was restored later.

USD/JPY: on asian session the pair holds at Y76.70.

On Wednesday UK data continues at 0830GMT with labour market data. The September claimant count is expected to come in at 25k, with the rate at 5.0%. European data continues at 0900GMT with EMU industrial output for August. Finally, at 1830GMT,

ECB President Jean-Claude Trichet gives an address at the AFME annual dinner, in London.At 1730GMT, Philadelphia Fed President Charles Plosser delivers a speech on the economic outlook at Wharton in Philadelphia.

But later the euro rose against the majority of its most-traded counterparts as Slovakian lawmakers prepared to vote on a proposal to retool the euro region’s bailout fund. The 17-nation currency erased its decline versus the dollar as U.S. stocks reversed losses on third-quarter earnings optimism. The euro rallied yesterday the most in a year after Germany and France pledged to deliver a plan to support banks.

The pound weakened as U.K. manufacturing production contracted for a third month.

New Zealand’s dollar fell as the nation’s budget deficit was wider than forecast.

EUR/USD: yesterday essential changes hasn't occurred.

GBP/USD: yesterday the pair decreased

USD/JPY: yesterday holds in range Y76.60-Y77.75.

On Wednesday UK data continues at 0830GMT with labour market data. The September claimant count is expected to come in at 25k, with the rate at 5.0%. European data continues at 0900GMT with EMU industrial output for August. Finally, at 1830GMT,

ECB President Jean-Claude Trichet gives an address at the AFME annual dinner, in London.At 1730GMT, Philadelphia Fed President Charles Plosser delivers a speech on the economic outlook at Wharton in Philadelphia.

The MSCI Asia Pacific Index gained 1.7 percent. Japan’s Nikkei 225 Stock Average advanced 2 percent today as the nation’s markets resumed trading following a public holiday. Hong Kong’s Hang Seng Index jumped 2.4 percent, while Australia’s S&P/ASX 200 Index gained 0.6 percent and South Korea’s Kospi Index climbed 1.6 percent.

Bank of China surged 7.7 percent to HK$2.65 in Hong Kong after Central Huijin began buying shares in the nation’s four biggest banks following a drop in valuations to below levels reached during the global financial crisis. Agricultural Bank of China Ltd. jumped 13 percent to HK$2.99. Industrial and Commercial Bank of China Ltd. rose 6.7 percent to HK$4.31 and China Construction Bank Corp. rallied 5.8 percent to HK$5.11.

Mitsubishi Corp., Japan’s biggest commodities trader, gained 1.8 percent to 1,508 yen in Tokyo. Rio Tinto Group, the world’s second-largest mining company for sales, rose 0.9 percent to A$68. Korea Zinc Co., which producer zinc as well as gold and silver, surged 4.4 percent to 296,500 won in Seoul and Cnooc added 3.9 percent to HK$13.72 in Hong Kong.

Esprit Holdings Ltd., a Hong Kong-listed global clothing retailer, advanced 12 percent to HK$11 after hedge fund Lone Pine Capital LLC increased its stake to become the company’s second-biggest shareholder.

European stocks fell, snapping a four-day rally, as investors awaited the start of the U.S. earnings season amid uncertainty that Slovakia will ratify the euro area’s revised bailout fund.

FTSE 100 5,396 -3.30 -0.06%, CAC 40 3,154 -7.95 -0.25%, DAX 5,865 +17.72 +0.30%

National benchmark indexes fell in 15 of the 18 western European markets. The U.K.’s FTSE 100 declined 0.1 percent and France’s CAC 40 slipped 0.3 percent, while Germany’s DAX added 0.3 percent.

The four biggest Greek lenders fell more than 16 percent. National Bank of Greece sank 16 percent to 1.60 euros and EFG Eurobank Ergasias SA retreated 20 percent to 56 euro cents. Piraeus Bank SA tumbled 20 percent to 25.4 euro cents, while Alpha Bank SA dropped 19 percent to 83 euro cents.

ASML Holding NV and STMicroelectronics NV led semiconductor shares lower after analyst downgrades. Remy Cointreau SA, the maker of Remy Martin, advanced after Berenberg Bank recommended buying the shares.

Actelion Ltd., Switzerland’s largest biotechnology company, increased 5.1 percent to 32.46 francs after Jefferies Group Inc. upgraded the shares to “buy” from “hold.”

Most U.S. stocks advanced, following the biggest rally since August for the Standard & Poor’s 500 Index, as optimism about third-quarter corporate earnings overshadowed concern about Europe’s debt crisis.

Dow 11,416.30 -16.88 -0.15%, Nasdaq 2,583 +16.98 +0.66%, S&P 500 1,195.54 +0.65 +0.05%

Alcoa Inc., the biggest U.S. aluminum producer, rose 3 percent ahead of its quarterly results today. Mosaic Co. jumped 5.4 percent, pacing gains in fertilizer producers, as Credit Suisse Group AG said the industry’s valuations “look highly compelling.” Apple Inc., the largest technology company, climbed 3 percent. AMR Corp. rallied 8.4 percent as American Airlines joined its bigger U.S. peers with deeper seating cuts.

Resistance 2: $ 1.5650/60 (area of Oct 11 high)

Resistance 1: $ 1.5600 (session high)

The current price: $1.5565

Support 1 : $1.5540 (session low)

Support 2 : $1.5480 (50.0 % FIBO $1.5690-$ 1.5270)

Support 3 : $1.5430 (61.8 % FIBO $1.5690-$ 1.5270)

Comments: the pair decreased. In focus support $1.5540.

Resistance 2: $ 1.3680 (Oct 11 high)

Resistance 1: $ 1.3630 (middle line from Oct 10)

The current price: $1.3617

Support 1 : $1.3580 (session low)

Support 2 : $1.3500 (MA (233) H1)

Support 3 : $1.3360 (Oct 7 low)

Comments: the pair holds in range. In focus resistance $1.3630.

Nikkei 225 8,774 +168.06 +1.95%

Hang Seng 18,142 +430.53 +2.43%

S&P/ASX 200 4,228 +26.60 +0.63%

Shanghai Composite 2,349 +3.73 +0.16%

FTSE 100 5,396 -3.30 -0.06%

CAC 40 3,154 -7.95 -0.25%

DAX 5,865 +17.72 +0.30%

Dow 11,416.30 -16.88 -0.15%

Nasdaq 2,583 +16.98 +0.66%

S&P 500 1,195.54 +0.65 +0.05%

10 Year Yield 2.16% +0.08 --

Oil $85.48 -0.33 -0.38%

Gold $1,667.40 +6.40 +0.39%

05:30 France CPI, m/m September +0.5% +0.3%

05:30 France CPI, y/y September +2.2% +2.5%

06:00 Japan Core Machinery Orders September +15.3%

08:30 United Kingdom Claimant count September 20.3К 24.4К

08:30 United Kingdom Claimant Count Rate September 4.9% 5.0%

08:30 United Kingdom ILO Unemployment Rate September 7.9% 7.9%

08:30 United Kingdom Average Earnings, 3m/y August +2.8% +2.7%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y August +2.1% +1.9%

09:00 Eurozone Industrial production, (MoM) August +1.0% -0.8%

09:00 Eurozone Industrial Production (YoY) August +4.2% +2.1%

12:30 Canada New Housing Price Index August +0.1% +0.1%

17:30 U.S. FOMC Member Charles Plosser Speaks

18:00 U.S. FOMC meeting minutes

18:30 Eurozone ECB Trichet's Speech

23:01 United Kingdom Nationwide Consumer Confidence September 52.9

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan Tertiary Industry Index August -0.1% -0.3%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.