- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-10-2011

U.S. stocks advanced, sending the Dow Jones Industrial Average toward its longest streak of weekly gains since April, as retail sales beat economists’ estimates and the Group of 20 began discussions on Europe’s debt crisis. Equities pared gains as people familiar with the discussions said European officials are considering writedowns of as much as 50 percent on Greek bonds.

Dow 11,563.62 +85.49 +0.74%, Nasdaq 2,642.77 +22.53 +0.86%, S&P 500 1,214.38 +10.72 +0.89%

All sectors of S&P500 traded at a higher. The maximum increase in the basic materials sector (+1.7%), minimal increase in the financial sector (+0.1%).

Google Inc., the world’s biggest Internet-search company, jumped 5.9 percent after sales topped projections. Apple Inc. gained 1.8 percent as the company is poised to sell as many as 4 million units of its new iPhone 4S this weekend after customers queued to buy one of the last products developed under Steve Jobs.

The euro extended its biggest weekly gain versus the dollar since January as Group of 20 finance ministers began a two-day meeting to discuss plans to tackle Europe’s debt crisis. The euro rose versus the dollar as Treasury Secretary Timothy F. Geithner said “Europe is clearly” moving to a crisis solution.

The yen fell against the dollar on speculation Japanese authorities will take steps to curtail their currency’s gains. The yen slid 0.6 percent to 77.33 versus the dollar as Dow Jones Newswires reported government officials said they would take new steps against a strong yen as early as next week.

Dollar Index, which tracks the greenback against the currencies of six major U.S. trading partners, decreased today as much as 0.7 percent to 76.508, the lowest level since Sept. 16, on reduced demand for a refuge in the world’s main reserve currency.

Gold’s biggest slump in three years means traders and analysts are now the most bullish in three months, speculating that Europe’s debt crisis, slowing growth and a bear market in equities will drive demand for bullion.

Today, December gold futures topped $ 1685.5 and currently the futures price is $ 1675.8 on the Comex in New York.

Oil rose in New York, heading for a second weekly gain, as a rescue plan for Europe’s debt-laden economies took shape while better-than-forecast retail sales allayed concerns that the U.S. economy is slowing.

Prices rose as much as 2.7 percent, extending gains after the Commerce Department said that retail sales rose 1.1 percent last month, the biggest increase since February and higher than a 0.7 percent advance forecast by economists. Brent crude surged to its highest in a month. European officials are outlining a rescue plan that may include deeper investor losses on Greek bonds, higher bank capital levels and increased firepower for bailouts and the International Monetary Fund.

Brent oil for November settlement rose $2.29, or 2.1 percent, to $113.40 a barrel on the London-based ICE Futures Europe exchange.

- current conditions 73.8 vs 74.9 in Sep;

- expectations 47.0 vs 49.4 in Sep;

- inflation expectations 3.2 vs 3.3 in Sep;

- 5yr inflation expectations 2.7 vs 2.9 in Sep.

USD/JPY Y74.00, Y77.50

AUD/USD $0.9695, $0.9900 $0.9960, $1.0200

GBP/USD $1.5400, $1.5500, $1.5780

EUR/CHF Chf1.2220

U.S. stock futures rose as retail sales beat estimates and the Group of 20 began discussions on Europe’s debt crisis.

U.S. equities extended gains as retail sales in the U.S. rose more than forecast in September. The 1.1 percent advance, the biggest since February, followed a 0.3 percent gain for August, a stronger performance than previously estimated, Commerce Department figures showed today in Washington. The median forecast of economists was 0.5% rise in purchases last month.

Global stocks also rose as European officials are outlining a rescue plan that may include deeper investor losses on Greek bonds, higher bank capital levels and increased firepower for bailouts and the International Monetary Fund.

The plan’s elements emerged as finance ministers and central bankers from the Group of 20 began talks in Paris, seeking ways to end Europe’s two-year sovereign debt crisis.

Standard & Poor’s yesterday cut Spain’s credit rating for the third time in three years and new data showed the eight largest U.S. money-market funds almost halved their lending to French banks last month.

Company news:

Google Inc. jumped 7.7% after sales and EPS beat estimates.

09:00 Italy CPI (September) final 0.0%

09:00 Italy CPI (September) final Y/Y 3.0%

09:00 Italy HICP (September) final Y/Y 3.6%

09:00 EU(17) Harmonized CPI (September) final 0.8%

09:00 EU(17) Harmonized CPI (September) final Y/Y 3.0%

09:00 EU(17) Harmonized CPI ex EFAT (September) Y/Y 1.6%

09:00 EU(17) Trade balance (August) adjusted, bln -1.0

The euro strengthened as Group of 20 finance ministers began a two-day meeting to discuss plans to tackle Europe’s debt crisis.

The 17-nation currency approached a five-week high versus the yen as G-20 and International Monetary officials said the ministers meeting in Paris are working on a European rescue plan including boosting the IMF’s lending resources.

Gains in the euro were tempered after Standard & Poor’s cut Spain’s credit rating late yesterday. S&P downgraded Spain to AA- from AA with a negative outlook. The nation’s rating has been lowered by S&P three times since 2009, when the country lost its AAA status.

The Australian dollar headed for a weekly gain after data showed the inflation rate in China, the South Pacific nation’s biggest trading partner, increased 6.1 percent in September from a year earlier. Producer prices rose 6.5 percent.

EUR/USD: the pair tested area of strong resistance $1.3830/50 then receded in $1,3800 area.

August increase. Nonauto retail sales are forecast to increase 0.4%. At 1355GMT, the Michigan Sentiment Index is expected to increase slightly to a reading of 60.0 in early-October after a sharper increase in September. The Investor Business Daily Economic Optimism index saw a one percent increase in October, however it remains in negative

territory. Shortly after, at 1400GMT, business inventories are expected to rise 0.5% in August, as factory inventories were already reported down 0.2% and wholesale inventories up 0.4% in the month. Later data sees the 1800GMT release of the September Treasury Statement.

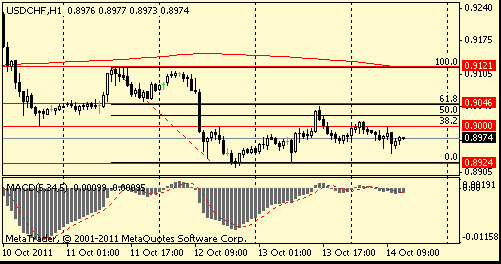

Resistance 2: Chf0.9040/50 (Oct 13 high, 61,8 % FIBO Chf0,9120-Chf0,8930)

Resistance 1: Chf0.9000 (high of european session, 38,2 % FIBO Chf0,9120-Chf0,8930, Oct 10 low, high of american session on Oct 12)

Current price: Chf0.8975

Support 1: Chf0.8930/20 (area of Sep 27-29 lows, Oct 12-13 lows and session low)

Support 2: Chf0.8800 (psychological mark, area of Sep 19-20 lows)

Support 3: Chf0.8750 (close price of Sep 16, МА (200) for Н4)

Comments: the pair remains above strong support in Chf0,8930/20 area.

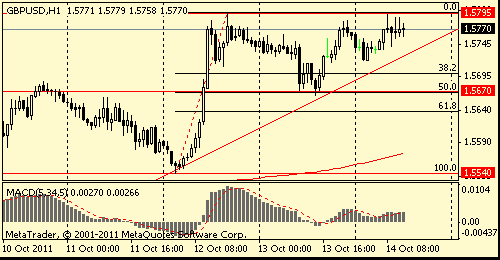

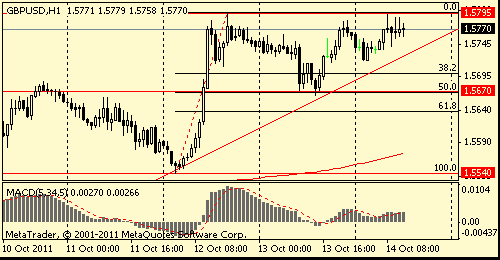

Resistance 2: $ 1.5880/90 (area of Sep 12 and 15 highs)

Resistance 1: $ 1.5800 (area of Oct 12 high, session high and МА (200) for Н4)

Current price: $1.5770

Support 1 : $1.5740 (support line from Oct 6)

Support 2 : $1.5670 (50,0 % FIBO $1.5540-$ 1.5795, Oct 13 low)

Support 3 : $1.5640 (61,8 % FIBO $1.5540-$ 1.5795)

Comments: the pair is consolidated. Overcoming of $1.5800 may open way to $1,5880/90.

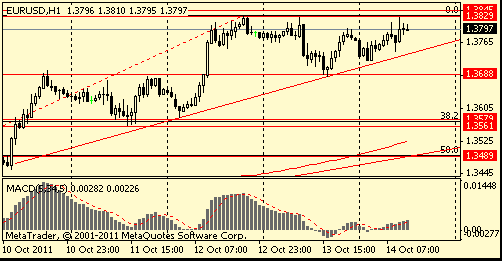

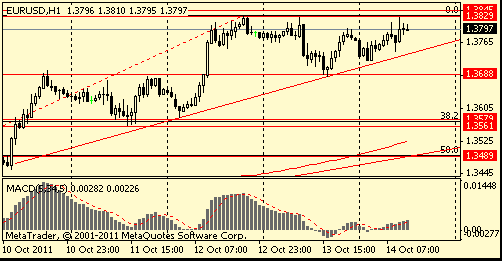

Resistance 2: $ 1.3930 (Sep 15 high)

Resistance 1: $ 1.3830/50 (Oct 12-13 high, session high, 50,0 % FIBO $1,4550-$ 1,3150)

Current price: $1.3797

Support 1 : $1.3750 (support line from Oct 10)

Support 2 : $1.3690 (earlier resistance, area of Sep 10-11 highs and Oct 13 low)

Support 3 : $1.3580/60 (area of Sep 11-12 lows, 38.2 % FIBO $1,3360-$ 1,3830)

Comments: the pair holds slightly below strong resistance $1,38030/50. Growth above may open way to $1,3930. The immediate support - $1,3750. It’s neck line of the figure "head & shoulders" on H1.

USD/JPY Y74.00, Y77.50

AUD/USD $0.9695, $0.9900 $0.9960, $1.0200

GBP/USD $1.5400, $1.5500, $1.5780

EUR/CHF Chf1.2220

Hang Seng 18,421 -336.66 -1.79%

S&P/ASX 4,206 -38.94 -0.92%

Shanghai Composite 2,431 -7.42 -0.30%

02:00 China PPI y/y September +6.5%

The euro fell against the yen for a second day after Standard & Poor’s cut Spain’s long-term sovereign credit rating to AA- from AA with a negative outlook. The nation’s rating has been lowered by S&P three times since 2009, when the country lost its AAA status. A jobless rate as high as 21 percent may weigh on private consumption. But later the euro advanced against the dollar and yen before Group of 20 finance ministers meet and policy makers discuss plans to tackle Europe’s debt woes.

The Australian and New Zealand dollars headed for weekly gains.

EUR/USD: on asian session the pair fell, but restored later.

GBP/USD: on asian session the pair fell, but restored later.

USD/JPY: on asian session the pair traded in range Y76.85-Y77.00.

On Friday main focus will be EU trade balance and HICP at 0900GMT and US retails sales at 1230GMT.

Yesterday the euro fell as Germany’s top economic institutes cut their 2012 forecast for growth by more than half as the spiraling debt crisis weighs on banks and spending. Growth will slow to 0.8 percent next year from 2.9 percent in 2011, according to a bi-annual independent report commissioned by the German government. In April, the group forecast 2 percent economic growth for 2012. But later the euro gain versus the dollar after Slovakia approved Europe’s enhanced bailout fund, completing ratification across the currency region.

The dollar and yen advanced versus most of their major counterparts after JPMorgan Chase & Co. reported a decline in profit and China’s export growth slowed, weakening stocks and spurring demand for a refuge.

The yen rallied after yesterday’s slide against the dollar as investors pared bets the Bank of Japan will introduce additional measures to weaken the currency.Japan’s currency tends to appreciate during economic and financial turmoil because the nation’s current-account surplus makes the nation less reliant on foreign capital.

EUR/USD: yesterday the pair fell.

GBP/USD: at first half of day the pair decreased, but restored later.

USD/JPY: yesterday the pair was under pressure.

On Friday main focus will be EU trade balance and HICP at 0900GMT and US retails sales at 1230GMT.

Asian stocks rose for a sixth day as European leaders edged closer to a plan for taming the debt crisis and the U.S. Federal Reserve said it discussed more asset purchases, reducing concern about the global economy.

The MSCI Asia Pacific Index climbed 1.3 percent. Japan’s Nikkei 225 Stock Average gained 1 percent. Australia’s S&P/ASX 200 Index also added 1 percent as a report showed the nation’s unemployment rate declined for the first time since March as employers added double the workers economists forecast. South Korea’s Kospi Index advanced 0.8 percent. Hong Kong’s Hang Seng Index climbed 2.3 percent and the Shanghai Composite Index added 0.8 percent.

Financial stocks surged after European Commission President Jose Barroso called for a reinforcement of crisis-hit banks, the payout of a sixth loan to Greece and a faster start for a permanent rescue fund to master Europe’s debt woes. HSBC gained 3.3 percent to HK$64.65. Standard Chartered Plc, U.K.’s third-largest lender, climbed 4 percent to HK$176.60. Mitsubishi UFJ Financial Group Inc., Japan’s biggest lender, advanced 2.1 percent to 340 yen.

Mining companies also climbed. BHP Billiton rose 1.5 percent to A$37.64 in Sydney. Rival Rio Tinto Group advanced 2.8 percent to A$69.34. Korea Zinc Co. gained 2.7 percent to 307,000 won in Seoul.

иsurged 4.5 percent to 163 yen in Tokyo. Construction-machinery maker Komatsu Ltd. climbed 4.4 percent to 1,770 yen and Fanuc Corp., a manufacturer of industrial robots, increased 3.4 percent to 11,970 after a report showed machine tool orders increased 20 percent in September from a year earlier.

Chinese automakers rose in Hong Kong after Citigroup Inc. analysts said China’s September car sales probably grew 9 percent from a year earlier. BYD Co., the automaker backed by billionaire investor Warren Buffett, jumped 14 percent to HK$14.98. Dongfeng Motor Group Co., which operates ventures with Nissan Motor Co. and Honda Motor Co. in China, climbed 7.1 percent to HK$12.98.

European stocks fell from a two- month high as Chinese exports slowed and the European Central Bank warned imposing further losses on holders of Greek debt posed a risk to the euro area’s financial stability. European banks extended losses as the European Central Bank said financial institutions’ involvement in euro-area bailouts through enforced investor losses posed a risk to financial stability and would have “direct negative effects” on lenders. China’s export growth slowed to its weakest pace in seven months. Officials said that trade faces “severe challenges” as the yuan strengthens and confidence slides in developed nations. Exports climbed a less-than-forecast 17.1 percent in September from a year earlier, customs bureau data showed in Beijing today. The trade surplus of the world’s second-largest economy fell to $14.51 billion last month from $17.76 billion in August. Imports rose 20.9 percent, also less than forecast.

FTSE 100 5,403 -38.42 -0.71%, CAC 40 3,187 -42.82 -1.33%, DAX 5,915 -79.63 -1.33%

National benchmark indexes fell in 16 of the 18 western- European markets. The U.K.’s FTSE 100 Index slid 0.7 percent. France’s CAC 40 Index and Germany’s DAX Index both slipped 1.3 percent.

Austria’s Raiffeisen Bank International AG dropped 3.2 percent to 22.50 euros and Commerzbank AG, Germany’s second- biggest lender, slipped 4.8 percent to 1.76 euros. UniCredit SpA plunged 12 percent to 92.7 euro cents, its largest slide since March 2009.

Carrefour SA retreated 5.9 percent after saying its profit may drop as much as 20 percent this year. Roche Holding AG slid 4.5 percent after posting third-quarter revenue that missed analysts’ estimates. Alcatel-Lucent surged 5.3 percent on a report France’s biggest telecommunications equipment maker will sell its corporate call-center business.

Rolls-Royce Group Plc jumped 9.9 percent to 688 pence after the jet-engine maker agreed to sell its share in a venture making engines for the Airbus A320 aircraft. Rolls-Royce sold its 32.5 percent stake in International Aero Engines to Pratt & Whitney for $1.5 billion and payments for 15 years.

U.S. stocks fell amid lower earnings from JPMorgan Chase & Co. and concern equities rose too much on optimism about Europe’s debt crisis.

Dow 11,478.13 -40.72 -0.35%, Nasdaq 2,620.24 +15.51 +0.60%, S&P 500 1,203.66 -3.59 -0.30%

JPMorgan dropped 4.8 percent after reporting a 33 percent profit decline, excluding a $1.9 billion accounting benefit, as investment banking and trading income slumped. Bank of America Corp., the largest U.S. lender by assets, dropped 5.5 percent to $6.22. Citigroup Inc. declined 5.3 percent to $27.64.

Technology shares in the S&P 500 rose 1 percent. At 4:29 p.m., following the close of exchanges, Google Inc. added 5.4 percent and Nasdaq-100 Index futures climbed 1.3 percent after the world’s most-popular search engine beat profit estimates.

Yahoo added 1 percent to $15.93 during the regular trading session. KKR and Blackstone may become part of a consortium that would pool the financing needed for a bid, said the people, who asked not to be identified because the review is preliminary and the firms may decide not to make an offer.

Resistance 2: Y77.20 (Oct 13 high)

Resistance 1: Y77.00 (session high)

The current price: Y76.88

Support 1:Y76.70 (Oct 13 low)

Support 2: Y76.30 (Oct 12 low)

Support 3: Y76.10 (Sep 21-22 low)

Comments: the pair is under pressure. In focus resistance Y76.70

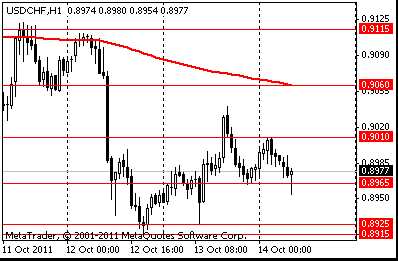

Resistance 2: Chf0.9060 (MA (233) H1)

Resistance 1: Chf0.9010 (session high)

The current price: Chf0.8977

Support 2: Chf0.8915/25 (area of Oct 12-13 low)

Support 3: Chf0.8880 (support line from Aug 9)

Comments: the pair has corrected and remains in an downtrend. In focus support Chf0.8965.

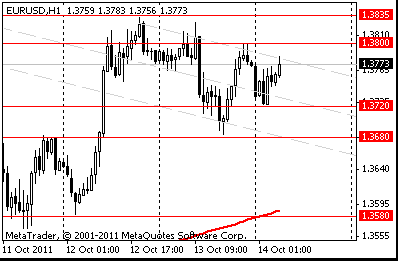

Resistance 2: $ 1.3835 (Oct 12 high)

Resistance 1: $ 1.3800 (high of the American session on Oct 13)

The current price: $1.3773

Support 1 : $1.3720 (session low)

Support 2 : $1.3680 (Oct 13 low)

Support 3 : $1.3580 (Oct 12 low, MA (233) H1)

Comments: the pair has corrected and remains in an uptrend. In focus resistance $1.3800.

Nikkei 225 8,823 +84.35 +0.97%

Hang Seng 18,758 +428.35 +2.34%

S&P/ASX 200 4,245 +40.21 +0.96%

Shanghai Composite 2,439 +18.79 +0.78%

FTSE 100 5,403 -38.42 -0.71%

CAC 40 3,187 -42.82 -1.33%

DAX 5,915 -79.63 -1.33%

Dow 11,478.13 -40.72 -0.35%

Nasdaq 2,620.24 +15.51 +0.60%

S&P 500 1,203.66 -3.59 -0.30%

10 Year Yield 2.17% -0.06 --

Oil $84.38 +0.15 +0.18%

Gold $1,668.50 0.00 0.00%

02:00 China PPI y/y September +6.5%

09:00 Eurozone Harmonized CPI September +0.2% +0.8%

09:00 Eurozone Harmonized CPI, Y/Y September +3.0% +3.0%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y September +1.2% +1.5%

09:00 Eurozone Trade Balance s.a. August -2.5 -1.1

12:30 Canada Manufacturing Shipments (MoM) August +2.7% +0.5%

12:30 U.S. Retail sales September 0.0% +0.5%

12:30 U.S. Retail sales excluding auto September +0.1% +0.2%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Prelim) October 59.4 60.2

14:00 U.S. Business inventories August +0.4% +0.4%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.