- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 11-10-2011

Alcoa forecast to kick off earnings season with profit rise. As always, Alcoa (AA) will unofficially kick off earnings season after the bell today, when it is expected to report that Q3 2011 EPS grew to $0.23 from $0.06 a year earlier and that revenue increased to $6.26B from $5.3B. Alcoa was optimistic in its Q2 report, when it forecast increased aluminum sales across a wide a range of sectors, although today's statement will show whether that upbeat view was justified or has since been undermined by the softening economy. In Q3, Alcoa's shares plummeted 40%, due to lower aluminum prices and weakening European demand

The euro rose against the majority of its most-traded counterparts as Slovakian lawmakers prepared to vote on a proposal to retool the euro region’s bailout fund.

The 17-nation currency erased its decline versus the dollar as U.S. stocks reversed losses on third-quarter earnings optimism. The euro rallied yesterday the most in a year after Germany and France pledged to deliver a plan to support banks.

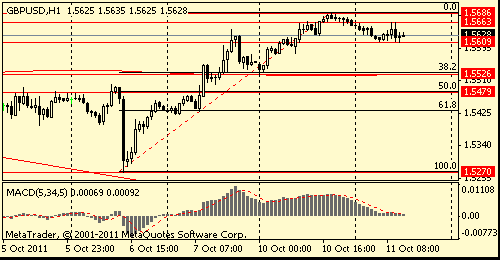

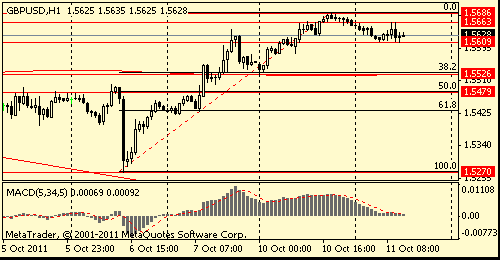

The pound weakened as U.K. manufacturing production contracted for a third month.

New Zealand’s dollar fell as the nation’s budget deficit was wider than forecast.

U.S. stocks were little changed, following the biggest rally since August for the Standard & Poor’s 500 Index, as optimism about third-quarter earnings overshadowed concern about Europe’s debt crisis.

Dow 11,425.53 -7.65 -0.07%, Nasdaq 2,579 +12.54 +0.49%, S&P 500 1,195.48 +0.59 +0.05%

Alcoa Inc., the biggest U.S. aluminum producer, rose 3 percent ahead of its quarterly results today. Mosaic Co. jumped 5.4 percent, pacing gains in fertilizer producers, as Credit Suisse Group AG said the industry’s valuations “look highly compelling.” Apple Inc., the largest technology company, climbed 3 percent. AMR Corp. rallied 8.4 percent as American Airlines joined its bigger U.S. peers with deeper seating cuts.

-- a credit event should be avoided

-- ECB fiercely independent,faithful to mandate

-- euro is credible,stable currency

-- EFSF to ensure emu financial stability

-- EFSF leverage via ECB not appropriate

-- europe must align fiscal policies

-- governments have means to leverage EFSF

-- full credible to deliver price stability

-- up to govts to get EFSF up and running soon

-- eurozone financial stability is at stake

-- banks must strengthen balance sheet quickly

-- fears that liquid measures add to inflation unfounded

-- calls for full implementation of july 21 decisions

-- must deal w/sovereign risks,bank situation

Gold declined from a two-week high as investors awaited a vote in Slovakia to approve the European bailout fund. Slovakia is the only country in the 17-nation euro area that hasn’t ratified a planned reinforcement of the European Financial Stability Facility. The nation’s four-part coalition yesterday failed to resolve a dispute with rebel lawmakers, threatening to delay measures to stem Europe’s debt crisis. U.S. stock futures declined and the euro was little changed after reaching a three-week high against the dollar yesterday as Slovakia’s parliament prepared to vote.

Futures for December delivery were little changed at $1,665.50 an ounce.

Oil fell from its highest level in more than two weeks in New York after European Central Bank President Jean-Claude Trichet said the region’s debt crisis threatens the financial system.

Futures dropped for the first time in five days as the euro weakened and equities declined after Trichet’s comments and before a government vote in Slovakia on the euro area’s bailout fund. OPEC cut its global oil demand forecast for this year on a weakening economic outlook in industrialized nations. The Organization of Petroleum Exporting Countries reduced its demand estimate for a third month on threats to the world economy. It predicts oil demand will grow 880,000 barrels a day this year, revised down from 1.06 million barrels a day in a report last month. An Energy Department report Oct. 13 may show U.S. crude supplies rose 775,000 barrels last week, according to the analyst estimates. The department is releasing the data a day later than usual because of yesterday’s Columbus Day holiday.

Crude for November delivery fell 56 cents, or 0.7 percent, to $84.85 a barrel at 10:17 a.m. on the New York Mercantile Exchange. Earlier, it touched $83.97. Prices are down 7.1 percent this year. Futures settled at $85.41 a barrel yesterday, the highest level since Sept. 21.

Brent oil for November settlement declined 26 cents to $108.69 on the London-based ICE Futures Europe exchange.

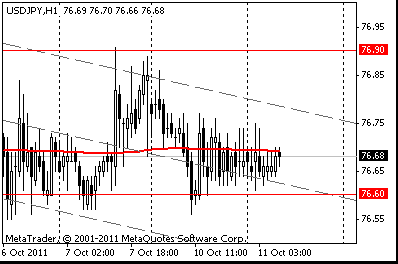

USD/JPY Y76.00, Y77.00

EUR/JPY Y100.00

AUD/USD $0.9865, $0.9900

GBP/USD $1.5505, $1.5600

Alcoa decreased. It is the first company of the Dow to report results for the third quarter.

Other commodity companies also fell amid concern of slower demand for raw materials. The copper producer Freeport declined 1.9%. Newmont slumped 1.4%.

08:30 UK Industrial production (August) 0.2% -0.1%

08:30 UK Industrial production (August) Y/Y -1.0%

08:30 UK Manufacturing output (August) -0.3%

08:30 UK Manufacturing output (August) Y/Y 1.5%

The euro dropped from the highest level in almost three weeks against the dollar as Slovakian lawmakers prepared to vote on a plan to retool the euro region’s bailout fund.

The nation’s largest opposition party, which pledged to reject the motion today, will back the revamped European Financial Stability Facility in a second vote if lawmakers fail to approve it today, Robert Fico, the group’s leader, told reporters today in the capital, Bratislava. That would give the measure a majority.

There is no date set for a repeated vote. The nation is the only member of the euro area that hasn’t ratified the measure, following approval in Malta yesterday.

The dollar rose against most of its major counterparts as falling stocks stoked demand for the most liquid assets.

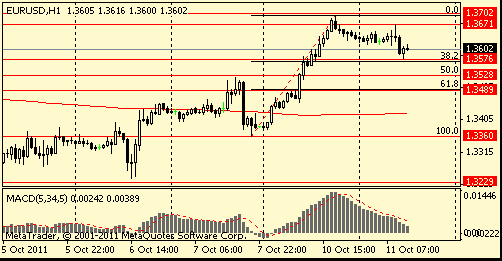

EUR/USD: the pair showed low in $1.3570 area then returned back above $1.3600.

GBP/USD: the pair holds in $1.5610-$ 1.5660 range.

USD/JPY: the pair holds in Y76.60-Y76,75 range.

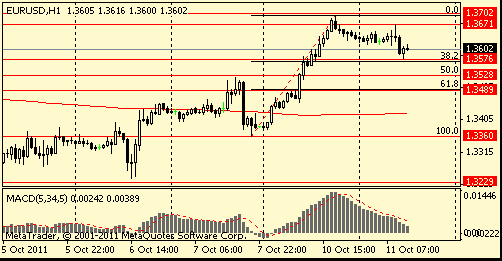

EUR/USD

Offers $1.3725/30, $1.3685/90, $1.3640/45Bids $1.3575/70, $1.3555/50, $1.3530/25, $1.3490/85

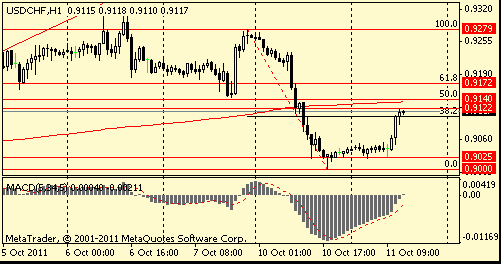

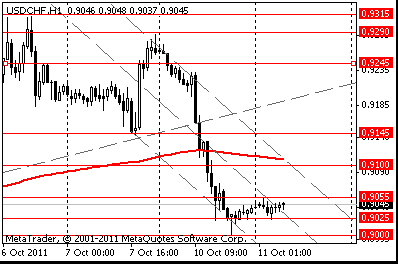

Resistance 2: Chf0.9140/50 (50.0 % FIBO Chf0.9280-Chf0.9000, МА (200) for Н1, area of Oct 4 and 7 lows)

Resistance 1: Chf0.9120 (session high)

Current price: Chf0.9115

Support 1: Chf0.9025 (session low)

Support 2: Chf0.9000 (psychological mark, Oct 10 low)

Support 3: Chf0.8920 (area of Sep 27-29 lows)

Comments: the pair holds in area of session high (the immediate resistance). Strong resistance - area of Chf0,9140/50.

Resistance 2: $ 1.5690/710 (area of Sep 27 and 29, Oct 10 highs)

Resistance 1: $ 1.5660 (session high)

Current price: $1.5628

Support 1 : $1.5610 (session low)

Support 2 : $1.5525 (38.2 % FIBO $1.5270-$ 1.5690, МА (200) for Н1)

Support 3 : $1.5480 (50.0 % FIBO $1.5270-$ 1.5690)

Comments: the pair receded from area of strong resistance $1,5690/750. Updating of session low may open way to to $1,5480.

Resistance 3: $ 1.3800 (Sep 21 high)

Resistance 2: $ 1.3700 (Oct 10 high)

Resistance 1: $ 1.3670 (session high)

Current price: $1.3602

Support 1 : $1.3575 (low of european session, 38,2 % FIBO $1,3360-$ 1,3700)

Support 2 : $1.3530 (50.0 % FIBO $1,3360-$ 1,3700)

Support 3 : $1.3490 (61.8 % FIBO $1,3360-$ 1,3700)

Comments: the pair returned above $1,3600. The immediate strong support - $1,3575.

Currently FTSE 5,348 -50.99 -0.94%, CAC 3,134 -27.63 -0.87%, DAX 5,793 -54.45 -0.93%.

European stocks fell as investors awaited a Slovak vote on the euro- area bailout fund.

A planned reinforcement of the European bailout fund, known as the EFSF, faces a vote today in Slovakia’s parliament, with one party in the governing coalition holding out against approval. Slovak Prime Minister Iveta Radicova’s party is seeking to pressure rebel lawmakers by tying the EFSF ratification to a no-confidence motion, two government officials said under condition of anonymity.

USD/JPY Y76.00, Y77.00

EUR/JPY Y100.00

AUD/USD $0.9865, $0.9900

GBP/USD $1.5505, $1.5600

Sovereign stress has moved to some larger eurozone countries

High interconnectedness has raised contagion risk.

Institutions, authorities must rise to challenge.

Credible fiscal policies must be enacted.

Urgent that all authorities act in unison for financial stability.

ECB measures aim to restore monpol transmission mechanism

Govts have all the capacity to leverage themselves.

Not appropriate for the ECB to leverage the EFSF

Responsibility of govts to leverage the EFSF.

Need to be ahead of the curve on sov debt crisis.

"We" have never been copmplacent.

Calls on banks to be very moderate in their renumeration

Hang Seng 18,173 +462.28 +2.61%

S&P/ASX 4,228 +26.58 +0.63%

Shanghai Composite 2,349 +3.73 +0.16%

The dollar dropped against all of its major counterparts as global stocks advanced, sapping demand for the greenback as a haven.

The Swiss franc strengthened against the euro, the day before the Swiss National Bank imposed a ceiling of 1.20 versus the common currency and resumed purchases of foreign currencies to curb the franc’s advance.

EUR/USD: yesterday the pair is grown

GBP/USD: yesterday the pair is grown and closed the day on week's high

USD/JPY: yesterday the pair decreased

On Tuesday UK data starts at 0830GMT with Industrial Production/Manufacturing Output data from the UK.

No European data expected Tuesday, but, at 0730GMT this morning, ECB President Jean-Claude Trichet speaks before the European

Parliament's Economic and Monetary Affairs Committee, in Brussels. UK at 1400GMT, the NIESR GDP estimate is due. In its August Inflation

Report the Bank of England's implied forecast was for 0.75% growth in Q3, with the Bank forecasting a rebound after Q2 growth was

depressed by one-off factors

The MSCI Asia Pacific Excluding Japan Index gained 1 percent to 386.23 as of 6:56 p.m. in Hong Kong. About four stocks gained for every three that fell. The measure sank as much as 0.3 percent after Hong Kong’s Hang Seng Index opened and Chinese equities resumed trade after a holiday. Australia’s S&P/ASX 200 Index gained 0.9 percent and South Korea’s Kospi Index added 0.4 percent. Japanese markets were closed for a public holiday.

Shares of Chinese companies fell on speculation the country will maintain tighter monetary policy. The Hang Seng Index closed little changed after reported that Chinese central bank adviser Zhou Qiren said the country should stick to a prudent monetary policy because small companies will have a better development environment only if inflation is thoroughly curbed. Separately, the official Xinhua News Agency reported yesterday that China’s home prices will gradually ease because of rising inventories and a drop in property-market transactions.

Samsung rose 1.6 percent to 874,000 won in Seoul. Hanjin Heavy surged 15 percent to 18,400 won. LG Display Co. jumped 6 percent to 21,250 won after Shinhan Investment Corp. said the world’s No. 2 maker of liquid-crystal displays would narrow its operating loss in the fourth quarter and return to profit in the second quarter of 2012.

Li & Fung Ltd., the world’s biggest supplier of clothes and toys to retailers, gained 1.5 percent to HK$13.20 in Hong Kong, while in Sydney, Billabong International Ltd., a global surfwear maker, advanced 0.6 percent to A$3.65.

Rio Tinto, the world’s No.2 mining company by sales, gained 1.5 percent to A$67.40. Australia’s biggest steelmakers also climbed, with BlueScope Ltd. advancing 3.1 percent to 84.5 Australian cents and OneSteel Ltd. rising 1.9 percent to A$1.34. Cnooc Ltd., China’s largest offshore oil explorer, added 2.8 percent to HK$13.20 in Hong Kong.

Among property developers, China Overseas slipped 3.5 percent to HK$12.24. Agile Property Holdings Ltd., which develops land in Guangdong province, tumbled 8.8 percent to HK$5.47. Guangzhou R&F Properties Co., the biggest developer in the southern Chinese city, dropped 2 percent to HK$6.29.

Some energy companies slumped in Hong Kong after China cut fuel prices for the first time this year. PetroChina Co., the country’s largest oil producer and Asia’s biggest company by market value, dropped 1.4 percent to HK$9.18. China Petroleum & Chemical Corp., the refiner known as Sinopec, fell 4.4 percent to HK$7.16. Separately, China Petrochemical Corp., parent of Sinopec, agreed to buy Daylight Energy Ltd. for about C$2.2 billion ($2.1 billion) in cash to add oil and gas assets in Canada, the Calgary, Alberta-based company said yesterday in a statement.

European stocks advanced, with the Stoxx Europe 600 Index posting its biggest four-day rally since November 2008, as the leaders of Germany and France gave themselves three weeks to create a plan to recapitalize banks. Angela Merkel and Nicolas Sarkozy, racing to stamp out the sovereign-debt crisis that threatens to engulf the financial system, set an end-of-October deadline to devise a plan to recapitalize banks, get Greece on the right track and fix Europe’s economic governance.

FTSE 100 5,399 +95.60 +1.80%, CAC 40 3,161 +65.91 +2.13%, DAX 5,847 +171.59 +3.02%.

National benchmark indexes rose in 15 of the 18 western European markets. The U.K.’s FTSE 100 Index gained 1.8 percent. France’s CAC 40 Index climbed 2.1 percent and Germany’s DAX Index jumped 3 percent. All three gauges posted their biggest four-day rallies since 2008.

BP Plc contributed the most to the gauge’s advance. Premier Oil Plc rose 3.3 percent after HSBC Holdings Plc upgraded its shares. Erste Group Bank AG plunged 9.2 percent after saying it will post a full-year loss because of writedowns at its units in Hungary and Romania. Dexia dropped 4.7 percent after earlier falling as much as 36 percent when trading in the shares resumed.

Maurel rallied 5.5 percent to 13.42 euros. The company said it has found oil sandstones at a well at the Sabanero license in Colombia and oil samples taken have confirmed the field extension to the north east. In a statement, Maurel said it will drill three more wells in 2011 and 2012.

ABB Ltd., the world’s largest maker of power-transmission gear, added 3.5 percent to 16.99 Swiss francs. Jefferies Group Inc. raised its recommendation on the company’s shares to “buy” from “hold.”

Erste Group, eastern Europe’s second-biggest lender, slumped 9.2 percent to 18.80 euros. The bank said it will post a full-year loss of as much as 800 million euros ($1.1 billion) after writedowns at its Hungarian and Romanian units.

Raiffeisen Bank International AG, eastern Europe’s third- biggest lender, plunged 4.7 percent to 21.20 euros.

U.S. stocks advanced, giving the Standard & Poor’s 500 its biggest rally since August, after the leaders of France and Germany pledged a plan to support European banks and stem the region’s debt crisis.

Dow 11,433.18 +330.06 +2.97%, Nasdaq 2,566.05 +86.70 +3.50%, S&P 500 1,194.89 +39.43 +3.41%

All 10 groups in the S&P 500 advanced. The S&P 500 advanced 3.4 percent to 1,194.89 at 4 p.m. New York time. It had the biggest rally over five days since March 2009, gaining 8.7 percent. The Dow Jones Industrial Average added 330.06 points, or 3 percent, to 11,433.18. The Russell 2000 Index of small companies surged 4.4 percent. About 6.9 billion shares changed hands on U.S. exchanges as of 4:27 p.m., the lowest volume since Aug. 2

Bank of America Corp. and JPMorgan Chase & Co. added more than 5.2 percent. Chevron Corp. and Alcoa Inc. climbed at least 3.9 percent. Caterpillar Inc. and Boeing Co. increased more than 3.5 percent, pacing gains in companies most-tied to the economy. Sprint Nextel Corp. tumbled 7.9 percent as at least seven analysts cut their ratings after the carrier’s investor meeting.

Resistance 2: Y77.10 (Oct 5 high)

Resistance 1: Y76.90 (Oct 7 high)

The current price: Y76.67

Support 1:Y76.50/60 (area of Oct low)

Support 2: Y76.10 (Sep 22 low)

Support 3: Y75.70 (123.6 % FIBO Y76.10-Y77.85)

Comments: the pair is on an downtrend. In focus support Y76.50/60

Resistance 2: Chf0.9100 (MA (233) H1)

Resistance 1: Chf0.9055 (session high)

The current price: Chf0.9040

Support 1: Chf0.9025 (session low)

Support 2: Chf0.9000 (Oct 10 low)

Support 3: Chf0.8920/25 (area of Sep 27-29 low)

Comments: the pair is on an downtrend. In focus support Chf0.9025.

Resistance 2: $ 1.5690 (Oct 10 high)

Resistance 1: $ 1.5650 (session high)

The current price: $1.5612

Support 1 : $1.5600 (middle line from Sep 22)

Support 2 : $1.5550 (MA (233) H1)

Support 3 : $1.5470 (support line from Sep 22)

Comments: the pair is corrected in uptrend. In focus support $1.5600.

Nikkei 225 8,606 +83.60 +0.98%

Hang Seng 17,711 +4.05 +0.02%

S&P/ASX 200 4,201 +38.16 +0.92%

Shanghai Composite 2,345 -14.43 -0.61%

FTSE 100 5,399 +95.60 +1.80%

CAC 40 3,161 +65.91 +2.13%

DAX 5,847 +171.59 +3.02%

Dow 11,433.18 +330.06 +2.97%

Nasdaq 2,566.05 +86.70 +3.50%

S&P 500 1,194.89 +39.43 +3.41%

10 Year Yield 2.08% +0.01 --

Oil $85.79 +0.38 +0.44%

Gold $1,678.00 +7.20 +0.43%

05:00 Japan Consumer Confidence September 37.0 37.4

05:00 Japan BoJ monthly economic report October

05:00 Japan Eco Watchers Survey: Outlook September 47.1

05:00 Japan Eco Watchers Survey: Current September 47.3 46.9

07:30 Eurozone ECB Trichet's Speech

08:30 United Kingdom Industrial Production (MoM) August -0.2% -0.2%

08:30 United Kingdom Industrial Production (YoY) August -0.7% -1.2%

08:30 United Kingdom Manufacturing Production (MoM) August +0.1% -0.1%

08:30 United Kingdom Manufacturing Production (YoY) August +1.9% +1.6%

12:15 Canada Housing Starts September 185К 186К

14:00 United Kingdom NIESR GDP Estimate September +0.2%

23:30 Australia Westpac Consumer Confidence October 96.9

23:50 Japan Core Machinery Orders August -8.2% +4.2%

Resistance 2: $ 1.3700 (Oct 10 high)

Resistance 1: $ 1.3650 (session high)

The current price: $1.3625

Support 1 : $1.3600 (middle line from Oct 6)

Support 2 : $1.3530 (50 % FIBO $1.3360-$ 1.3700)

Support 3 : $1.3470 (MA (233) H1)

Comments: The pair is on an uptrend. In focus resistance $1.3650.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.