- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 13-10-2011

Google is scheduled to report third-quarter earnings results after markets close on Thursday. Most analysts continue to expect a strong earnings report, based upon Google’s core business of search-related advertising and an expected growing market share within both search and mobile devices using the Android OS. Google has been under pressure over the last few months, along with the broader market, but its shares have increased about 10 percent since the start of October.

- FOMC has overestimated strength of economic recovery

- as economy recovers, FOMC should reduce monetary accommodation

- should have Troika's Greece report mid-next week

European stocks fell from a two- month high as Chinese exports slowed and the European Central Bank warned imposing further losses on holders of Greek debt posed a risk to the euro area’s financial stability. European banks extended losses as the European Central Bank said financial institutions’ involvement in euro-area bailouts through enforced investor losses posed a risk to financial stability and would have “direct negative effects” on lenders. China’s export growth slowed to its weakest pace in seven months. Officials said that trade faces “severe challenges” as the yuan strengthens and confidence slides in developed nations. Exports climbed a less-than-forecast 17.1 percent in September from a year earlier, customs bureau data showed in Beijing today. The trade surplus of the world’s second-largest economy fell to $14.51 billion last month from $17.76 billion in August. Imports rose 20.9 percent, also less than forecast.

FTSE 100 5,403 -38.42 -0.71%, CAC 40 3,187 -42.82 -1.33%, DAX 5,915 -79.63 -1.33%

National benchmark indexes fell in 16 of the 18 western- European markets. The U.K.’s FTSE 100 Index slid 0.7 percent. France’s CAC 40 Index and Germany’s DAX Index both slipped 1.3 percent.

Austria’s Raiffeisen Bank International AG dropped 3.2 percent to 22.50 euros and Commerzbank AG, Germany’s second- biggest lender, slipped 4.8 percent to 1.76 euros. UniCredit SpA plunged 12 percent to 92.7 euro cents, its largest slide since March 2009.

Carrefour SA retreated 5.9 percent after saying its profit may drop as much as 20 percent this year. Roche Holding AG slid 4.5 percent after posting third-quarter revenue that missed analysts’ estimates. Alcatel-Lucent surged 5.3 percent on a report France’s biggest telecommunications equipment maker will sell its corporate call-center business.

Rolls-Royce Group Plc jumped 9.9 percent to 688 pence after the jet-engine maker agreed to sell its share in a venture making engines for the Airbus A320 aircraft. Rolls-Royce sold its 32.5 percent stake in International Aero Engines to Pratt & Whitney for $1.5 billion and payments for 15 years.

The dollar and yen advanced versus most of their major counterparts after JPMorgan Chase & Co. reported a decline in profit and China’s export growth slowed, weakening stocks and spurring demand for a refuge.

The euro slid from the highest level in almost five weeks against the yen after the European Central Bank said the involvement of private-sector banks in bailouts would risk financial stability. The euro pared its drop versus the dollar after Slovakia approved Europe’s enhanced bailout fund, completing ratification across the currency region.

The yen rallied after yesterday’s 0.8 percent slide against the dollar as investors pared bets the Bank of Japan will introduce additional measures to weaken the currency.Japan’s currency tends to appreciate during economic and financial turmoil because the nation’s current-account surplus makes the nation less reliant on foreign capital.

The dollar benefits as the world’s main reserve currency. The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback versus the currencies of six major trading partners, rose 0.4 percent to 77.316.

U.S. stocks fell, following the biggest Standard & Poor’s 500 Index gain over seven days since 2009, amid a drop in JPMorgan Chase & Co.’s earnings and concern equities rallied too much on optimism about Europe’s crisis.

Dow 11,416.38 -102.47 -0.89%, Nasdaq 2,601.01 -3.72 -0.14%, S&P 500 1,194.97 -12.28 -1.02%

Financial shares had the biggest decline in the S&P 500 among 10 industries, falling 2.4 percent.

JPMorgan tumbled 4.9 percent after reporting a profit slump of about 33 percent, excluding a $1.9 billion accounting benefit, as earnings from investment banking and trading decreased. Bank of America Corp. and Citigroup Inc. fell at least 4.8 percent. General Electric Co. and Alcoa Inc. dropped more than 1.4 percent, pacing losses among companies most-dependent on economic growth.

Oil extended losses after the U.S. Energy Department said stockpiles rose 1.34 million barrels, more than the expected 800,000.

Crude for November delivery fell to $83.17 a barrel on the New York Mercantile Exchange before release of the weekly inventory report, a day later than usual because of the U.S. Columbus Day holiday Oct. 10.

Offers $1.5885/90, $1.5865/70, $1.5795/00, $1.5715/20

Bids $1.5670/60, $1.5640/35, $1.5620/10, $1.5605/00

USD/JPY Y76.50, Y76.65, Y77.00, Y77.25, Y77.50, Y78.00

EUR/GBP Stg0.8750

AUD/USD $0.9850, $0.9865, $1.0000, $1.0020, $1.0100, $1.0165, $1.0185, $1.0250

GBP/USD $1.5700

USD/CHF Chf0.8930

EUR/JPY Y105.00

06:00 Germany CPI (September) final 0.1% 0.1%

06:00 Germany CPI (September) final Y/Y 2.6%

06:00 Germany HICP (September) final Y/Y 2.9%

08:30 UK Trade in goods (August), bln -7.8

The yen and dollar strengthened after a Chinese report showed exports slowed last month and the customs bureau warned of “severe” challenges, adding to signs global growth is slowing.

The euro fell as Germany’s top economic institutes cut their 2012 forecast for growth by more than half as the spiraling debt crisis weighs on banks and spending. Growth will slow to 0.8 percent next year from 2.9 percent in 2011, according to a bi-annual independent report commissioned by the German government. In April, the group forecast 2 percent economic growth for 2012.

EUR/USD: the pair fell in $1.3720 area.

GBP/USD: the pair decreased below $1.5700.

USD/JPY: the pair decreased below Y77,00.

US data starts at 1230GMT with jobless claims and the international trade balance. Initial jobless claims are expected to increase by 9,000 claims to 410,000 in the October 8 week. Seasonal adjustment factors expect unadjusted claims to rise sharply in the current week, the first full week of the new quarter. The international trade gap is expected to rise to $45.5 billion in August after narrowing sharply in July on widespread import declines. In August, Boring reported 18 orders from foreign buyers and 34 deliveries to foreign

buyers, both up from July. The import price index fell 0.4% on a sharp decline in energy imports. Excluding the energy price drop, import prices were up 0.3%. At the same time, export prices rose 0.5%, boosted by agriculture prices.

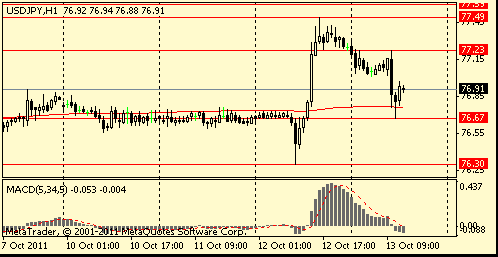

Resistance 2: Y77.50 (Oct 12 high)

Resistance 1: Y77.20 (high of european session)

Current price: Y76.89

Support 1:Y76.70 (session low)

Support 2:Y76.30 (Oct 12 low)

Support 3:Y76.10 (area of low of September)

Resistance 2: Chf0.9050 (61,8 % FIBO Chf0,9120-Chf0,8930, resistance line from Oct 7)

Resistance 1: Chf0.9000 (psychological mark, 38,2 % FIBO Chf0,9120-Chf0,8930, Oct 10 low, high of american session on Oct 12, session high)

Current price: Chf0.8981

Support 1: Chf0.8930/20 (area of Sep 27-29, Oct 12 lows and session low)

Support 2: Chf0.8800 (psychological mark, area of Sep 19-20 lows)

Support 3: Chf0.8750 (Sep 16 close price, МА (200) for Н4)

Comments: the pair remains in range of strong support/resistance Chf0,8930/20-Chf0.9000.

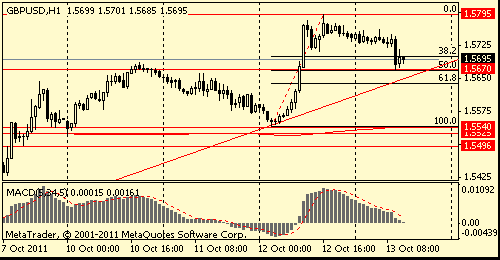

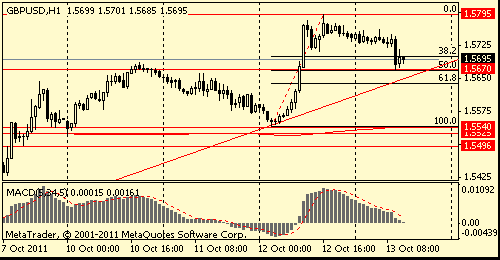

Resistance 2: $ 1.5890/80 (area of Sep 12 and 15 highs)

Resistance 1: $ 1.5800 (area of Oct 12 high and МА (200) for Н4)

Current price: $1.5695

Support 1 : $1.5670 (50,0 % FIBO $1.5540-$ 1.5795, session low, support line from Oct 6)

Support 2 : $1.5640 (61,8 % FIBO $1.5540-$ 1.5795)

Support 3 : $1.5540/25 (area of 50.0 % FIBO $1.5270-$ 1.5780, session low and Oct 10 low)

Comments: the pair is corrected after growth. In focus - support $1,5670.

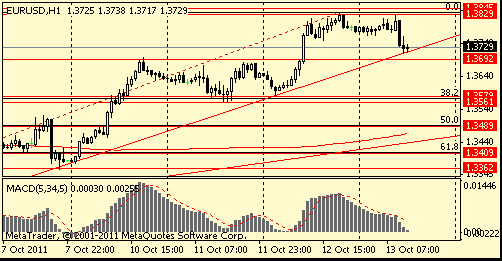

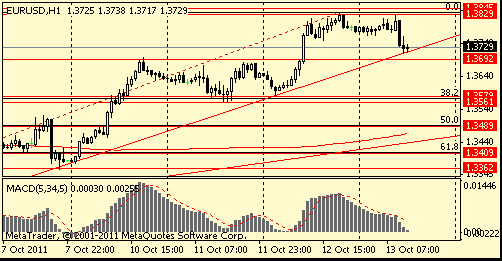

Resistance 2: $ 1.3930 (Sep 15 high)

Resistance 1: $ 1.3830/50 (Oct 12 high, session high, 50,0 % FIBO $1,4550-$ 1,3150)

Current price: $1.3729

Support 1 : $1.3710/690 (earlier resistance, area of Sep 10-11 highs, session low, support line from Oct 6)

Support 2 : $1.3580/60 (area of Sep 11-12 lows, 38.2 % FIBO $1,3360-$ 1,3830)

Support 3 : $1.3490 (50.0 % FIBO $1,3360-$ 1,3830)

Comments: the pair is corrected. The immediate strong support - $1,3710/690. Below the strong support is located in $1,3580/60 area.

Currently FTSE 5,392 -49.33 -0.91%, CAC 3,192 -37.94 -1.17%, DAX 5,935 -59.38 -0.99%.

European stocks fell as China’s export growth slowed.

USD/JPY Y76.50, Y76.65, Y77.00, Y77.25, Y77.50, Y78.00

EUR/GBP Stg0.8750

AUD/USD $0.9850, $0.9865, $1.0000, $1.0020, $1.0100, $1.0165, $1.0185, $1.0250

GBP/USD $1.5700

USD/CHF Chf0.8930

EUR/JPY Y105.00

00:30 Australia Changing the number of employed September +20.4K

00:30 Australia Unemployment rate September 5.2%

02:00 China Trade Balance, bln September 14.5

The euro was 0.3 percent from an almost four-week high before European Commission President Jose Barroso speaks in Brussels after calling yesterday for a “coordinated approach” to recapitalize the region’s banks. Demand for the euro was bolstered as Slovakia is set to approve Europe’s enhanced bailout fund today or tomorrow, completing the ratification process across the 17 euro countries.

Australia’s dollar gained after a report showed the nation’s jobless rate fell.

The yen rallied from its weakest level in a month against the dollar on speculation Japan’s exporters bought their currency.

EUR/USD: on asian session the pair trade in range $1.3765-$1.3815.

GBP/USD: on asian session the pair trade in range $1.5725-$1.5760.

USD/JPY: on asian session the pair fell.

On Thursday UK trade data is set for release at 0830GMT. While analysts' median forecast is for little change in the trade balances from July there are doubts over what impact the euro area's sovereign debt crisis will have on trade activity. US data at 1230GMT with jobless claims and the international trade balance. Initial jobless claims are expected to increase by 9,000 claims to 410,000 in the October 8 week. At 1830GMT, Minneapolis Fed President Narayana Kocherlakota is due to deliver a speech to Sidney (Montana) Area Business Leaders.

Hang Seng 18,589 +259.57 +1.42%

S&P/ASX 4,245 +40.17 +0.96%

Shanghai Composite 2,437 +16.76 +0.69%

New Zealand’s dollar rose the most in two months against the dollar as stocks and commodities advanced, buoying higher- yielding currencies.

EUR/USD: yesterday the pair is grown and showed new three-week high.

GBP/USD: yesterday the pair is grown.

USD/JPY: yesterday the pair is grown and showed new three-week high Y77.50.

On Thursday UK trade data is set for release at 0830GMT. While analysts' median forecast is for little change in the trade balances from July there are doubts over what impact the euro area's sovereign debt crisis will have on trade activity. US data at 1230GMT with jobless claims and the international trade balance. Initial jobless claims are expected to increase by 9,000 claims to 410,000 in the October 8 week. At 1830GMT, Minneapolis Fed President Narayana Kocherlakota is due to deliver a speech to Sidney (Montana) Area Business Leaders.

Resistance 2: Y77.50 (Oct 12 high)

Resistance 1: Y77.30 (session high)

The current price: Y77.08

Support 1:Y77.00 (session high)

Support 2: Y76.75 (MA (233) H1)

Support 3: Y76.30 (Oct 12 low)

Comments: the pair is grown. In focus resistance Y77.30.

Resistance 2: $ 1.5870 (Sep 15 high)

Resistance 1: $ 1.5800 (session high)

The current price: $1.5760

Support 1 : $1.5725 (session low)

Support 2 : $1.5670 (23.6 % FIBO $1.5800-$ 1.5270)

Support 3 : $1.5600 (MA (233) H1)

Comments: the pair is on uptrend. In focus support $1.5725.

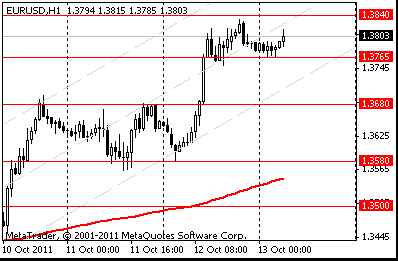

Resistance 2: $ 1.3935 (Sep 15 high)

Resistance 1: $ 1.3840 (session high)

The current price: $1.3805

Support 1 : $1.3765 (session low)

Support 2 : $1.3680 (23.6 % FIBO $1.3830-$ 1.3145)

Support 3 : $1.3580 (Oct 12 low)

Comments: the pair continues growth. In focus resistance $1.3840.

Nikkei 225 8,739 -34.78 -0.40%

Hang Seng 18,329 +187.87 +1.04%

S&P/ASX 200 4,204 -23.30 -0.55%

Shanghai Composite 2,420 +71.48 +3.04%

FTSE 100 5,442 +46.10 +0.85%

CAC 40 3,230 +76.24 +2.42%

DAX 5,994 +129.46 +2.21%

Dow 11,518.85 +102.55 +0.90%

Nasdaq 2,605 +21.70 +0.84%

S&P 500 1,207.25 +11.71 +0.98%

10 Year Yield 2.23% +0.07 --

Oil $84.80 -0.77 -0.90%

Gold $1,678.40 -4.20 -0.25%

00:30 Australia Changing the number of employed September +20.4K

00:30 Australia Unemployment rate September 5.2%

02:00 China Trade Balance, bln September 14.5

06:00 Germany CPI (final), m/m September +0.1% +0.1%

06:00 Germany CPI (final), y/y September +2.6% +2.6%

08:00 Eurozone ECB Monthly Report October

08:30 United Kingdom Trade in goods August -8.9 -8.8

12:30 Canada Retail Sales ex Autos, m/m August -0.75 -0.9

12:30 U.S. International trade, bln August -44.8 -46.2

12:30 U.S. Initial Jobless Claims неделя по 8 октября 401К 407К

14:30 U.S. EIA Crude Oil Stocks change неделя по 7 октября -4.7

18:00 U.S. Federal budget September -134.2 -65.0

18:30 U.S. FOMC Member Narayana Kocherlakota

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.