- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-10-2011

According to preliminary estimates, the developer iPhone, iPad, and iPod, Apple’s earnings for the quarter grew by 57.5% compared to the previous quarter and 342.4% for the year. Positive forecasts relate to the activities of Intel Corp. (INTC), it is expected to increase earnings by 17.3% compared with the previous quarter.

Fed officials remained cautious about economy's prospects. Officials cited caution over stock prices, fiscal uncertainty

Тhe yen erased its gain versus the dollar after the Nikkei newspaper reported that the government and central bank will form a team of senior officials to oversee steps designed to address the currency’s strength.

The Australian dollar rose against the U.S. currency as a rally in stocks and commodities spurred demand for higher-yielding assets.

The euro erased its drop as Germany’s Chancellor Angela Merkel said the Oct. 23 summit of European leaders will send a signal to defend the currency.

While policies to ensure financial stability are now as important as monetary policy, and the latter can be used to support the former. But the Fed will rarely use balance sheet policy 'in more normal times'

European stocks fell as concern that France may lose its top credit rating added pressure on the region’s leaders to find a solution to the debt crisis and as China’s economy grew at the slowest pace in two years. While Group of 20 finance ministers and central bankers are pressing European Union leaders to set out a strategy by the end of the week, divisions are flaring over an emerging plan to avoid a Greek default, bolster banks and curb contagion. China’s economy grew 9.1 percent in the third quarter from a year earlier, the slowest pace since 2009.

National benchmark indexes retreated in 7 of the 18 western European markets. The U.K.’s FTSE 100 dropped 0.4 percent and France’s CAC 40 fell 0.7 percent, while Germany’s DAX advanced 0.5 percent.

BHP Billiton, the world’s biggest mining company, lost 1 percent to 1,891.5 pence, while Rio Tinto, the second-largest, sank 4.2 percent to 3,162 pence. Copper slumped for a second day in London amid concern demand from China may slow as the economy cools. Lead, tin and zinc also fell.

Xstrata Plc retreated 1.3 percent to 936.3 pence even after the largest exporter of power-station coal said total third- quarter production of the fuel rose 8.1 percent. Copper output fell 4 percent, the company said.

BNP Paribas, France’s biggest bank, declined 4.4 percent to 29.69 euros. Societe Generale sank 5.2 percent to 19.19 euros.

France’s Aaa credit rating is under pressure from deterioration in debt metrics and the potential for additional liabilities from Europe’s debt crisis, according to Moody’s. The nation’s financial strength has weakened because of the global economic crisis, making the nation’s debt measures the weakest among its Aaa-rated peers, the New York-based company said in a statement late yesterday that it called a markets update.

Air France-KLM Group slid 2.6 percent to 5.46 euros after the airline ousted Pierre-Henri Gourgeon as chief executive officer amid slumping earnings and questions regarding the role of pilots in a fatal crash.

Aixtron SE, a supplier to the semiconductor industry, sank 5.3 percent to 9.99 euros. The company’s third-quarter results are likely to be “disastrous,” CA Cheuvreux analyst Klaus Ringel wrote in a report.

Danone, the owner of the Evian and Volvic bottled-water brands, rose 2.4 percent to 46.48 euros as three people familiar with the matter said the company is in talks to sell water assets to Japan’s Suntory Holdings Ltd. Danone also reported third-quarter revenue that beat estimates as it sold more baby food and medical nutrition products in China and Indonesia.

Continental AG added 4.4 percent to 53.08 euros, paring yesterday’s declines. The world’s fourth-largest tiremaker said Schaeffler Beteiligungsholding GmbH & Co.’s voting rights rose to 36.14 percent on Sept 30.

-- ECB never acts as a substitute for governments: newspaper interview

-- Financial stability is the responsibility of governments

-- Surveys say euro will deliver price stability over long term

-- EMU has price stability today; inflation expectations firmly anchored

-- Primary goal of price stability is the needle in our compass

-- Strict separation between monetary policy, non-standard measures

-- Trichet rejects assertion that ECB has overstepped its limits

-- Treaty must let us impose rules on EU Stability Pact violators

-- Euro will exist in 10 years

U.S. stocks rose, erasing an early decline, as German Chancellor Angela Merkel said lender recapitalizations will be discussed this weekend and Bank of America Corp. (BAC) rallied as it swung to a third-quarter profit.

Stocks fell earlier as Moody’s Investors Service said France’s Aaa credit rating is under pressure from deterioration in debt metrics and the potential for additional liabilities from the Europe’s debt crisis. Data showed that China’s economy grew 9.1 percent in the third quarter from a year earlier, the slowest pace since 2009.

In the U.S., wholesale prices rose more than forecast in September, boosted by gasoline, food and trucks.

The S&P 500 fell yesterday, after the biggest weekly gain since 2009, as financial shares slumped and the German government damped optimism of a quick fix to Europe’s debt crisis.

Dow 11,461.37 +64.37 +0.56%, Nasdaq 2,629.67 +14.75 +0.56%, S&P 500 1,211.03 +10.17 +0.85%

Financial shares gained the most in the Standard & Poor’s 500 Index among 10 industries, adding 1.7 percent as a group. Bank of America rose 5.7 percent to $6.38. Chief Executive Officer Brian T. Moynihan has presided over a 55 percent drop in the stock this year.

A gauge of homebuilders in S&P indexes jumped 4.4 percent as data showed that industry sentiment increased more than forecast. Homebuilder Toll Brothers Inc. added 5.4 percent to $15.95, while Lennar Corp. advanced 4.6 percent to $15.24.

IBM slumped 4.7 percent to $177.82. Revenue showed slowing growth in IBM’s software, hardware and services businesses. Chief Executive Officer Sam Palmisano is focusing on areas such as business analytics, emerging markets and cloud computing to boost sales amid sluggish economic expansion.

Market sentiment soured amid renewed worries over sovereign debt crisis in the Eurozone, stubbornly-high inflation in the UK and weaker-than-expected growth in China. Shares in Asia weakened while European bourses opened lower. Commodities fell across the board with oil, gold and base metals sliding on deterioration in market sentiment.

Gold futures fell on 2.4% tо $1636.50 per ounce on the COMEX in New-York.

Crude oil fluctuated as China’s economy grew at the slowest pace in two years and as U.S. stocks rebounded from early decline.

Oil swung between gains and losses after China’s statistics bureau said the economy grew 9.1 percent in the third quarter from a year earlier, the slowest pace since 2009. The Standard & Poor’s 500 Index erased losses as financial shares rallied after better-than-estimated earnings at Bank of America Corp.

Crude for November delivery rose to $87.18 a barrel on the New York Mercantile Exchange. Prices fell as much as 1 percent earlier to $85.55.

Brent oil for December settlement fell 81 cents, or 0.7 percent, to $109.35 a barrel on the London-based ICE Futures Europe exchange.

USD/JPY Y76.30, Y76.85, Y77.00, Y77.25, Y78.00

AUD/USD $1.0200, $1.0000

EUR/JPY Y105.80

EUR/CHF Chf1.2400

GBP/USD $1.5800

EUR/GBP stg0.8765, stg0.8750

U.S. and European markets closed heavily down yesterday and Asian markets are off this morning as investors grow increasingly wary about Europe's debt crisis.

U.S. stock-index futures erased losses as financial companies climbed after Bank of America Corp. (BAC) swung to a third-quarter profit.

China's Q3 GDP rose 9.1% Y/Y, shy of expectations for 9.3%, and down from 9.5% in Q2.The world's major stock indexes are traded or have already closed the session lower: Nikkei -1.55%, Hang Seng -4.23%, Shanghai Composite -2.33%, FTSE -1.20%, CAC -1.66%, DAX -0.44%.

"Growth may be even softer over the next couple of quarters as tighter financial and credit conditions weigh on economic activity."

Data:

08:30 UK HICP (September) 0.6%

08:30 UK HICP (September) Y/Y 5.2%

08:30 UK HICP ex EFAT (September) Y/Y 3.3%

08:30 UK Retail prices (September) 0.8%

08:30 UK Retail prices (September) Y/Y 5.6%

08:30 UK RPI-X (September) Y/Y 5.7%

09:00 Germany ZEW economic expectations index (October) -48.3

The euro fell for after Moody’s Investors Service said France’s top credit rating is under pressure, adding to concern that European leaders will find it difficult to resolve the region’s debt crisis.

France’s Aaa credit rating is under threat from worsening debt metrics and the potential for additional liabilities from the regional crisis, Moody’s said late yesterday. The nation’s financial strength has weakened because of the global financial crisis, making its debt measures the worst among its Aaa rated peers, Moody’s said.

EUR/USD: the pair showed low in $1,3660 area then retreated.

GBP/USD: the pair fell in $1.5720 area.

USD/JPY: the pair showed at least in areas Y76,60, but than retreated.

At 1230GMT, producer prices are expected to rise 0.3% in September. Energy prices are expected to rise in the month after falling in the previous three months, while food prices are expected to post another gain. The core PPI is expected to rise 0.1%. This is followed at 1255GMT by the weekly Redbook Average and then at 1300GMT with the

Treasury International Capital System (TICs) data. This is followed at 1400GMT by the NAHB Housing Market Index.

Johnson & Johnson (JNJ): expected to report third-quarter earnings of $1.20 a share on revenue of $16 billion.

Coca-Cola (KO): seen reporting third-quarter net income of $1.02 a share on revenue of $12 billion.

Resistance 3: Y77.90 (Sep 9 high)

Resistance 2: Y77.50 (Oct 12 high)

Resistance 1: Y76.90 (Oct 12 high)

Current price: Y76.65

Support 1:Y76.60 (Oct 17 low)

Support 2:Y76.30 (Oct 12 low)

Support 3:Y76.10 (area of September lows)

Comments: the pair comes nearer to support Y76.60. Below losses may extend to Y76,30.

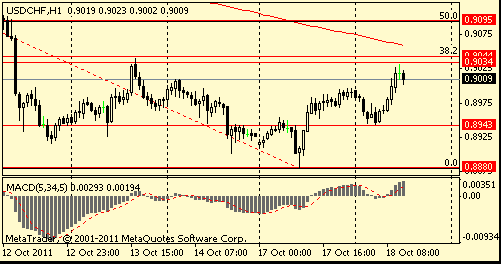

Resistance 2: Chf0.9095/00 (50,0 % FIBO Chf0,9310-Chf0,8880, psychologic mark)

Resistance 1: Chf0.9030/40 (area of session high, Oct 13 high, 38,2 % FIBO Chf0,9310-Chf0,8880)

Current price: Chf0.9009

Support 1: Chf0.8940 (session low)

Support 2: Chf0.8880 (Oct 17 low)

Support 2: Chf0.8800 (psychological mark, area Sep 19-20 lows)

Comments: the pair tries to be fixed above Chf0,9000. Strong resistance - Chf0,9030/40.

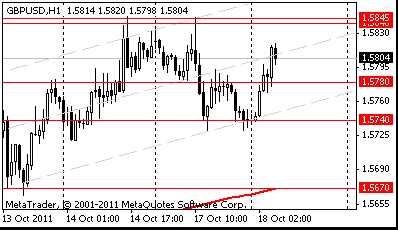

Resistance 2: $ 1.5850 (Oct 14-17 highs)

Resistance 1: $ 1.5820 (session high)

Current price: $1.5730

Support 1 : $1.5690 (session low, Oct 10 high)

Support 2 : $1.5660 (Oct 13 low)

Support 3 : $1.5630 (38,2 % FIBO $1.5270-$ 1.5850)

Comments: the pair receded from session low - strong area of support.

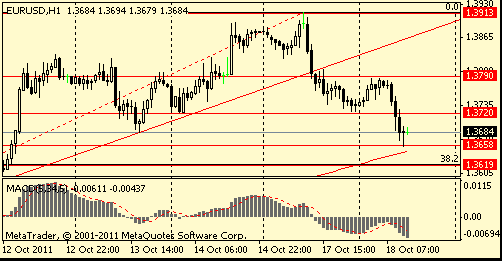

Resistance 2: $ 1.3790 (session high)

Resistance 1: $ 1.3720 (earlier support, Oct 14-17 low)

Current price: $1.3682

Support 1 : $1.3660 (session low, МА (200) for Н1)

Support 2 : $1.3620 (38.2 % FIBO $1,3360-$ 1,3910)

Support 3 : $1.3560 (Oct 11 low)

Comments: the pair decreases. Updating of a session low may open way to $1,3620.

Currently FTSE 5,377 -59.65 -1.10%, CAC 3,110 -56.20 -1.78%, DAX 5,822 -37.48 -0.64%.

European stocks fell as concern that France may lose its top credit rating added pressure on the region’s leaders to find a solution to the debt crisis and as China’s economy grew at the slowest pace in two years.

USD/JPY Y76.30, Y76.85, Y77.00, Y77.25, Y78.00

AUD/USD $1.0200, $1.0000

EUR/JPY Y105.80

EUR/CHF Chf1.2400

GBP/USD $1.5800

EUR/GBP stg0.8765, stg0.8750

Hang Seng 18,105 -769.30 -4.08%

S&P/ASX 4,187 -88.51 -2.07%

Shanghai Composite 2,383 -56.96 -2.33%

02:00 China GDP y/y Quarter III +9.1%

02:00 China Industrial Production y/y September +13.8%

02:00 China Retail Sales y/y September +17.7%

On Asia session the euro restored, but weakened later, after Germany dismissed speculation European policy makers would resolve their debt crisis as early as this weekend. Euro declines after German Chancellor Angela Merkel’s office knocked down what it called “dreams” that the Oct. 23 summit will be the last word in taming the crisis. Christian Noyer, head of France’s central bank, ruled out a ramping up of the European Central Bank’s bond-buying program as part of a multi-pronged strategy to shield countries like Italy.

China, the world’s second-biggest economy, reported today that industrial production increased 13.8 percent in September from a year earlier.

New Zealand’s currency erased an earlier advance as Asian stocks declined.

EUR/USD: on Asian session the pair restored, but fell later.

GBP/USD: on Asian session the pair gain.

USD/JPY: on Asian session the pair hold in range Y76.75/85.

On Tuesday UK data sees the Consumer Price Index for September at 0830GMT. Core-European data leads with the 0900GMT release of the latest ZEW survey. US data at 1230GMT, producer prices are expected to rise 0.3% in September. A late but lead focus also comes at 1715GMT, when Fed Chairman Ben Bernanke delivers a speech to the Boston Fed Bank conference.

Yesterday the euro weakened after German Chancellor Angela Merkel’s spokesman said Europe’s leaders won’t provide the quick resolution to the region’s debt crisis that global policy makers are pushing for at a summit this weekend.

The 17-nation currency retreated from a one-month high against the dollar, following last week’s biggest advance in more than two years.

The pound declined versus the dollar and the yen on concern the Bank of England’s additional stimulus measures won’t be enough to revive growth.

Group of 20 finance ministers and central bankers concluded weekend talks in Paris endorsing parts of the emerging plan to avoid a Greek default, bolster banks and curb contagion. They set the Oct. 23 summit of European leaders in Brussels as the deadline for it to be delivered.

The yen and the dollar strengthened against major currencies as European stocks erased gains.

EUR/USD: yesterday the pair fell.

GBP/USD: yesterday the pair decreased.

USD/JPY: yesterday the pair was under pressure and closed day below Y77.00.

On Tuesday UK data sees the Consumer Price Index for September at 0830GMT. Core-European data leads with the 0900GMT release of the latest ZEW survey. US data at 1230GMT, producer prices are expected to rise 0.3% in September. A late but lead focus also comes at 1715GMT, when Fed Chairman Ben Bernanke delivers a speech to the Boston Fed Bank conference.

The MSCI Asia Pacific Index advanced 1.9 percent. Japan’s Nikkei 225 Stock Average climbed 1.5 percent and Australia’s S&P/ASX 200 Index gained 1.7 percent. Hong Kong’s Hang Seng Index advanced 2 percent while Shanghai’s Composite Index added 0.4 percent.

Commodity and consumer stocks led advances among the Asian benchmark’s 10 industry groups. BHP Billiton rallied 2.1 percent in Sydney, while rival Rio Tinto Group added 2.4 percent. S-Oil Corp., South Korea’s third-largest crude refiner, surged 8.9 percent, and Korea Zinc Co., which also produces gold and silver, advanced 2.5 percent.

Mitsubishi Corp., a Japanese commodities trading company, surged 3.5 percent to 1,615 yen. Cnooc Ltd. rose 3.3 percent in Hong Kong after the state-run Xinhua News Agency said the company finished cleaning up an oil spill in China’s Bohai Bay, prompting the government to lift its emergency response to earlier leakages.

Esprit surged 7.9 percent in Hong Kong, leading Asia’s exporters higher. Sony rose 5 percent to 1,607 yen after Sony Ericsson Mobile Communications AB posted third-quarter sales and pretax profit that exceeded analysts’ estimates as sales climbed in Asia.

Nissan Motor Co., a carmaker that gets about 80 percent of its sales overseas, gained 2.1 percent to 728 yen. Rival Honda Motor Co. added 3.6 percent to 2,329 yen. James Hardie Industries SE, a building-materials supplier that gets more than 70 percent of its sales from the U.S, climbed 2 percent to A$5.70 in Sydney.

Asian financial shares also climbed. National Australia Bank gained 1.9 percent and Commonwealth Bank of Australia, the nation’s largest by market value, climbed 1.9 percent in Sydney. HSBC Holdings Plc, Europe’s biggest lender, rose 2 percent in Hong Kong, while in Tokyo, Nomura Holdings Inc., Japan’s largest brokerage, jumped 3.4 percent to 301 yen.

Mitsubishi UFJ Financial Group Inc. advanced 1.8 percent after its Mitsubishi UFJ Morgan Stanley Co. joint venture said it plans to quadruple job cuts in Japan after the number of staff who accepted early retirement offers exceeded the brokerage’s initial estimate.

Among stocks that fell today, Olympus plunged 24 percent to 1,555 yen in Tokyo. At least six brokerages cut their ratings on the optical-equipment maker after Michael C. Woodford was dismissed as president on Oct. 14 amid a row with the board over fees paid during the 2008 purchase of Gyrus Group Plc.

European stocks fell as a German government spokesman said that euro-area leaders will not provide a complete fix to the debt crisis at their next meeting.

G-20 finance ministers and central bank governors concluded weekend talks in Paris endorsing parts of the emerging plan to avoid a Greek default, bolster banks and curb contagion. Stocks erased earlier gains after Steffen Seibert, German Chancellor Angela Merkel’s chief spokesman, told reporters in Berlin that European leaders won’t fulfill “dreams” of a quick end to the debt crisis at the Oct. 23 summit.

National benchmark indexes fell in all of the 18 western- European markets. France’s CAC 40 Index slipped 1.6 percent. Germany’s DAX Index lost 1.8 percent and the U.K.’s FTSE 100 Index fell 0.5 percent. Greece’s ASE Index plunged 3 percent.

National Bank of Greece sank 10 percent to 1.63 euros. Piraeus Bank SA retreated 9.1 percent to 26 euro cents. EFG Eurobank Ergasias tumbled 9.5 percent to 66.1 euro cents.

G4S Plc slumped 22 percent to 219.9 pence for its biggest slump in seven years. The world’s largest security provider agreed to acquire ISS for about 5.2 billion pounds ($8.2 billion), of which 3.7 billion pounds is assumed debt, to add cleaning and other facilities-management services and accelerate expansion in emerging markets.

BP Plc rose 2.2 percent to 425.55 pence. BP, Europe’s second-largest oil company, said Anadarko will pay to settle all claims over the world’s largest accidental oil spill.

SGL Carbon SE soared 13 percent to 42.75 euros, its highest price since August 2008. Bayerische Motoren Werke AG plans to buy a stake in the German maker of carbon and graphite materials, Spiegel said, citing an unidentified manager at the automaker.

Air France-KLM Group, Europe’s second-largest airline by sales, increased 1.4 percent to 5.61 euros. The company’s board meets today to vote on ousting Chief Executive Officer Pierre- Henri Gourgeon, according to two people with knowledge of the proposals.

U.S. stocks declined, after the biggest weekly gain in the Standard & Poor’s 500 Index since 2009, as financial shares slumped and the German government damped optimism of a quick fix to Europe’s debt crisis.

Dow 11,397.00 -247.49 -2.13%, Nasdaq 2,614.92 -52.93 -1.98%, S&P 500 1,200.86 -23.72 -1.94%

Banks in the S&P 500 tumbled 6.3 percent as a group. Wells Fargo dropped 8.4 percent to $24.42. Investors shrugged off the record profit posted by Wells Fargo today and focused on a 6 percent decline in revenue to $19.6 billion. That missed the $20.2 billion estimate of analysts as low interest rates cut into profit on loans.

Citigroup retreated 1.7 percent to $27.93, even as its quarterly profit beat analysts’ estimates, helped by an accounting gain and a reduction in losses tied to soured loans. Excluding the accounting adjustment, revenue fell 8 percent.

Alcoa, the largest U.S. aluminum producer, slumped 6.6 percent to $9.58. The shares had the biggest decline in the Dow. Caterpillar retreated 3.1 percent to $81.52.

Gannett slumped 8.7 percent to $9.99. The owner of 82 newspapers and 23 television stations reported third-quarter profit decreased 1.6 percent as publishing revenue, including advertising and circulation, declined 5.3 percent.

Halliburton Co., the world’s second-largest oilfield services provider, fell 7.9 percent to $34.48 on concern for oil-price volatility and the slower than expected growth in its international business.

El Paso Corp. surged 25 percent, the most since 2002, to $24.45, as Kinder Morgan Inc. agreed to buy the company for $21.1 billion. The cash and stock offer is valued at $26.87 per El Paso share, or 37 percent more than the Oct. 14 closing price, Houston-based Kinder Morgan said in a statement yesterday.

Resistance 2: Y77.45 (Oct 14 high)

Resistance 1: Y77.00 (50.0% FIBO Y76.60-Y77.45)

The current price: Y76.82

Support 1:Y76.60 (Oct 17 low)

Support 2: Y76.30 (Oct 12 low)

Support 3: Y76.10 (Sep 21-22 low)

Comments: the pair has receded from week’s high.

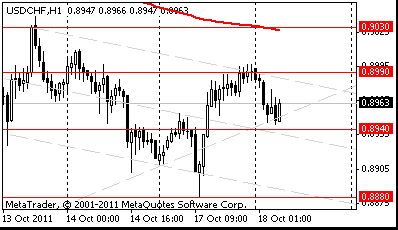

Resistance 2: Chf0.9030 (MA (233) H1)

Resistance 1: Chf0.8990 (session high)

The current price: Chf0.8963

Support 1: Chf0.8940 (session low)

Support 2: Chf0.8880 (Oct 17 low)

Support 3: Chf0.8790/00 (area of Sep 19-20 low)

Comments: the pair is on downtrend. In focus resistance Chf0.8990.

Resistance 2: $ 1.5870 (Sep 15 high)

Resistance 1: $ 1.5840/45 (area of Oct 17 high)

The current price: $1.5804

Support 1 : $1.5780 (MA (21) H1)

Support 2 : $1.5740 (session low)

Support 3 : $1.5670 (Oct 13 low, MA (233) H1)

Comments: the pair is on uptrend. In focus resistance $1.5840/45.

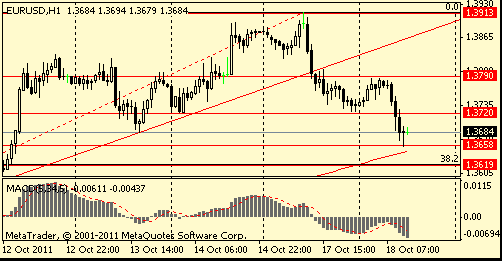

Resistance 2: $ 1.3900/10 (area of Oct 17 high)

Resistance 1: $ 1.3825 (middle line of the channel from Oct 13)

The current price: $1.3775

Support 1 : $1.3730 (session low)

Support 2 : $1.3660 (MA (233) H1)

Support 3 : $1.3580 (Oct 12 low)

Comments: the pair is on uptrend. In focus support $1.3730.

Nikkei 225 8,880 +131.64 +1.50%

Hang Seng 18,874 +372.20 +2.01%

S&P/ASX 200 4,275 +69.76 +1.66%

Shanghai Composite 2,440 +9.03 +0.37%

FTSE 100 5,437 -29.66 -0.54%

CAC 40 3,166 -51.83 -1.61%

DAX 5,859 -107.77 -1.81%

Dow 11,397.00 -247.49 -2.13%

Nasdaq 2,614.92 -52.93 -1.98%

S&P 500 1,200.86 -23.72 -1.94%

10 Year Yield 2.16% -0.08 --

Oil $86.47 -0.33 -0.38%

Gold $1,672.30 -10.70 -0.64%

02:00 China GDP y/y Quarter III +9.1%

02:00 China Industrial Production y/y September +13.8%

02:00 China Retail Sales y/y September +17.7%

08:30 United Kingdom Retail Price Index, m/m September +0.6%

08:30 United Kingdom RPI-X, Y/Y September +5.2%

08:30 United Kingdom RPI-X, Y/Y September +5.3%

08:30 United Kingdom HICP, m/m September +0.6% +0.4%

08:30 United Kingdom HICP, Y/Y September +4.5% +4.9%

08:30 United Kingdom HICP ex EFAT, Y/Y September +3.1%

09:00 Germany ZEW Survey - Economic Sentiment October -43.3 -44.7

09:00 Eurozone ZEW Economic Sentiment October -44.6 -45.2

12:30 U.S. PPI, m/m September 0.0% +0.3%

12:30 U.S. PPI, y/y September +6.5% +6.4%

12:30 U.S. PPI excluding food and energy, m/m September +0.1% +0.2%

12:30 U.S. PPI excluding food and energy, Y/Y September +2.5% +2.3%

13:00 U.S. Total Net TIC Flows August -51.8

13:30 U.S. Net Long-term TIC Flows August 9.5 27.8

14:00 U.S. NAHB Housing Market Index September 14 15

17:15 U.S. Fed Chairman Bernanke Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.