- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-10-2011

The Swiss franc rose against all of its major counterparts on demand for a refuge as European leaders struggled to agree on a solution to the region’s debt crisis before a summit this weekend.

The euro fell versus the dollar on speculation the Oct. 23 meeting may be delayed or a second session may be held. The franc remained 2.5 percent below the ceiling of 1.20 versus the euro imposed last month by the Swiss National Bank. The dollar advanced versus the yen for the first time in four days as Philadelphia manufacturing unexpectedly expanded.

The franc appreciated for the first time in three days versus the euro, rising 1 percent to 1.2298 at 1:03 p.m. in New York. The euro declined 0.4 percent to $1.3702 and decreased 0.3 percent to 105.41 yen. The U.S. currency rose 0.2 percent to 76.93 yen.

The Swiss currency was the biggest winner today among the 10 developed-nation currencies that are tracked by Bloomberg Correlation-Weighted Currency Indexes, rising 0.9 percent. The euro dropped 0.3 percent, and the yen fell 0.2 percent.

The dollar rose versus the yen after the Federal Reserve Bank of Philadelphia’s general economic index increased to 8.7 in October from minus 17.5 last month in the biggest one-month rebound in 31 years.

Japan plans to spend an extra 4 trillion yen ($52 billion) to cope with a surging yen that could damp an export-led recovery in the world’s third-largest economy. The yen’s appreciation of almost 6 percent this year versus the dollar has prompted the government to adopt a multipronged approach to currency policy. While threatening intervention, Japanese authorities have offered aid to companies hit by the yen’s gain and highlighted the lower cost of making overseas acquisitions. Japan imports about 80 percent of its energy needs. The Bank of Japan has intervened in the currency market three times in the past 13 months.

Apparently there will be a second Summit next week. Also will be fresh discussions on EFSF and PSI on Greek debt restructuring

European stocks declined the most in two weeks amid concern the euro area’s leaders are far from agreeing on a plan to end the region’s debt crisis. Euro-area leaders are scheduled to meet on Oct. 23, with disagreement over the European Central Bank’s role threatening to hinder progress on the banking and economic questions needed to deliver the comprehensive strategy demanded by global policy makers. The German government hasn’t excluded postponing the summit because of stalling negotiations on boosting the firepower of the region’s rescue fund, Die Welt said, citing unidentified people close to the country’s governing coalition.

French President Nicolas Sarkozy flew to Frankfurt for an impromptu meeting last night with German Chancellor Angela Merkel, ECB President Jean-Claude Trichet and International Monetary Fund Director Christine Lagarde. Luxembourg Prime Minister Jean-Claude Juncker, who chairs the group of euro-area finance ministers, indicated the gathering failed to resolve differences. “We are still meeting,” he said as he departed.

National benchmark indexes fell in 16 of the 18 western European markets. The U.K.’s FTSE 100 dropped 1.2 percent, France’s CAC 40 retreated 2.3 percent and Germany’s DAX slipped 2.5 percent.

Banks led losses as the cost of insuring against default on European corporate debt climbed and the yield on Italian 10-year government bonds rose to more than 6 percent for the first time since August. Intesa Sanpaolo, Italy’s second-biggest bank, dropped 9.8 percent to 1.20 euros and UniCredit, the nation’s largest lender, tumbled 12 percent to 84.6 euro cents. France’s Societe Generale SA lost 7.6 percent to 17.97 euros in Paris.

Actelion plunged 9.7 percent to 30.70 Swiss francs, the biggest slump since March 2010, after it said product sales will fall in the low- to mid-single digit range next year in local currencies. The company cited increased pricing pressure and competition in the U.S.

Schneider Electric tumbled 7.6 percent to 41.22 euros. The company trimmed its 2011 profit target for the second time in four months on rising labor costs in emerging economies and said it may cut jobs. Earnings before interest, taxes and amortization will probably account for about 14 percent of revenue this year, down from a July forecast of about 15 percent, it said.

Nokia Oyj rallied 5.5 percent to 4.73 euros after the Finnish maker of mobile phones reported a smaller-than-estimated loss and forecast a profitable quarter for the handset business.

Ericsson AV, the world’s largest maker of wireless network equipment, rose 4 percent to 68.10 kronor after saying third- quarter net income climbed to 3.82 billion kronor ($580 million) from 3.68 billion kronor a year earlier. That topped the 3.66 billion-krona estimate of 21 analysts in a Bloomberg survey.

Home Retail Group Plc climbed 3.9 percent to 103.4 pence after a report showed U.K. retail sales unexpectedly rose 0.6 percent in September, the most in five months. Debenhams Plc, which reported better-than-estimated earnings today, advanced 7.7 percent to 67.6 pence.

Husqvarna AB gained 6.7 percent to 32.02 kronor, the biggest increase since July 2010. The world’s largest maker of powered gardening tools has solved U.S. production problems that have sapped profits this year, acting Chief Executive Officer Hans Linnarson said.

U.S. stocks extended losses as German Chancellor Angela Merkel canceled a speech to parliament on the European bailout fund because of disagreements on the role of the region’s central bank.

Dow 11,408.73 -95.89 -0.83%, Nasdaq 2,562.38 -41.66 -1.60%, S&P 500 1,198.66 -11.22 -0.93%

Bank of America Corp. (ВАС) and Morgan Stanley declined at least 3.1 percent, following a decline in European lenders. EBay Inc. slumped 6.7 percent after the online marketplace forecast sales and profit that missed some analysts’ estimates. PulteGroup Inc. and Lennar Corp. paced losses in homebuilders, dropping more than 3.8 percent as sales of existing homes declined. Philip Morris International Inc. added 3.6 percent to $68.38. The world’s largest publicly traded tobacco company reported third-quarter profit that topped analysts’ estimates, helped by higher shipments and increased cigarette prices in Asia.

Gold falls on the fourth day in a row against the concerns of investors, the situation in the euro area and the economic slowdown in major economies around the world. The price of gold futures fell by 2% compared with yesterday at $ 1614.40 an ounce.

Crude oil fluctuated amid concern that European Union leaders won’t reach an agreement at a summit this weekend on strengthening the region’s rescue fund and on an unexpected expansion in Philadelphia manufacturing.

Futures were little changed after the newspaper Die Welt reported that Germany doesn’t rule out postponing the EU summit planned for Oct. 23. The delay would occur because of stalled negotiations about the so-called leveraging of the European Financial Stability Facility, the newspaper reported, citing unidentified people close to the country’s governing coalition. The Federal Reserve Bank of Philadelphia’s general economic index increased to 8.7 from minus 17.5 last month, the biggest one-month rebound in 31 years.

Crude oil for November delivery traded at $86.11 a barrel on the New York Mercantile Exchange.

We're looking 5-years ahead to make right decision.

USD/JPY Y76.45, Y76.65, Y76.75, Y76.85, Y77.00, Y77.25, Y77.50, Y77.75, Y78.00

AUD/USD $1.0040, $1.0220, $1.0230, $1.0235, $1.0300, $1.0390, $1.0405, $1.0450

EUR/JPY Y105.00, Y104.90

USD/CHF Chf0.8985, Chf0.8950

EUR/CHF Chf1.2250, Chf1.2200

GBP/USD $1.5700, $1.6000

- Greece govt debt dynamic extremely worrisome;

- EU Comm recommends 6-th tranche be paid ASAP.

06:00 Germany PPI (September) 0.3%

06:00 Germany PPI (September) Y/Y 5.5%

08:30 UK Retail sales (September) 0.6%

08:30 UK Retail sales (September) Y/Y 0.6%

The euro strengthened as draft guidelines showed planned changes to the euro- region’s bailout fund may open the door to increased credit lines for countries such as Italy and Spain.

The shared currency reversed earlier losses after European Commission President Jose Barroso said a “positive outcome” was possible at an Oct. 23 meeting of European leaders in Brussels. The European Financial Stability Facility may be able to offer loans up to 10 percent of a member states’ gross domestic product.

The Dollar Index fell as U.S. stock futures rose, damping demand for safer assets.

EUR/USD: the pair grown above $1,3800.

GBP/USD: the pair grown in $1.5800 area.

USD/JPY: the pair holds in Y76,65-Y76,85.

US data starts at 1230GMT when initial jobless claims are expected to rise 1,000 to 405,000 in the October 15 employment survey week after declining only 1,000 in the previous week. Claims were at a level of 428,000 in the September 17 employment survey week. This is followed at 1400GMT the Philadelphia Fed Survey, Existing Home Sales and

also the Sep Leading Indicator. The Philadelphia Fed index is forecast to rise to a reading of -10.0 in October, still indicating contraction. The pace of existing home sales is forecast to slow to a 4.95 million annual rate in September after jumping 7.7% in August to the strongest sales rate in over two years. The index of leading indicators is expected to rise 0.3% in September, with positive contributions from a steeper yield curve and an jump in the money supply. These should be offset by negative contributions from falling stock prices and building permits.

EUR/USD

Offers $1.3950, $1.3915, $1.3900, $1.3880/85, $1.3850

Bids $1.3805/00, $1.3785/80, $1.3760/50, $1.3715/10

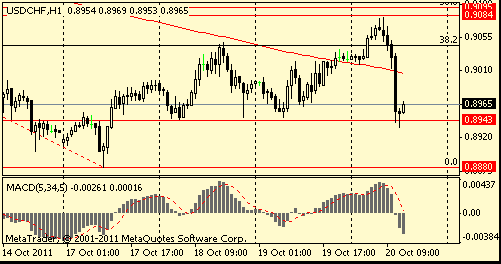

Resistance 2: Chf0.9080/00 (session high, 50,0 % FIBO Chf0,9310-Chf0,8880, psychological mark)

Resistance 1: Chf0.9000 (МА (200) for Н1)

Current price: Chf0.8965

Support 1: Chf0.8940 (session low, Oct 18-19 lows)

Support 2: Chf0.8880 (Oct 17 low)

Support 3: Chf0.8800 (psychological mark, area of Sep 19-20 lows)

Resistance 2: $ 1.5850 (Oct 14-17 highs)

Resistance 1: $ 1.5800 (session high)

Current price: $1.5785

Support 1 : $1.5690 (session low)

Support 2 : $1.5630 (Oct 18 low, 38,2 % FIBO $1.5270-$ 1.5850)

Support 3 : $1.5560/40 (50,0 % FIBO $1.5270-$ 1.5850

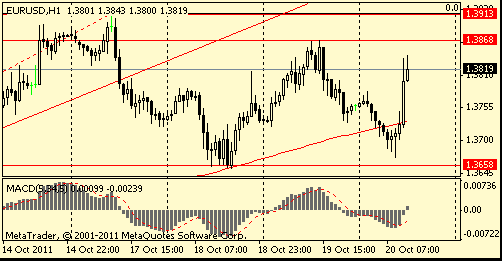

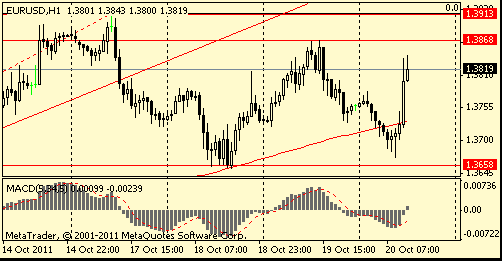

Resistance 2: $ 1.3910/30 (Oct 17 and Sep 15 highs)

Resistance 1: $ 1.3870 (Oct 19 high)

Current price: $1.3819

Support 1 : $1.3730 (МА (200) for Н1)

Support 2 : $1.3660/70 (Oct 18 low, session low)

Support 3 : $1.3620 (38,2 % FIBO $1,3150-$ 1,3910)

- cuts 2012 GDP forecast to 1.0% from 1.8%;

- sees 2011 inflation +2.3%, +1.8% in 2012;

- sees 2011 unemployment rate of 7.0%, 6.7% in 2012.

Currently FTSE 5,419 -31.68 -0.58%, CAC 3,129 -27.85 -0.88%, DAX 5,882 -31.66 -0.54%.

USD/JPY Y76.45, Y76.65, Y76.75, Y76.85, Y77.00, Y77.25, Y77.50, Y77.75, Y78.00

AUD/USD $1.0040, $1.0220, $1.0230, $1.0235, $1.0300, $1.0390, $1.0405, $1.0450

EUR/JPY Y105.00, Y104.90

USD/CHF Chf0.8985, Chf0.8950

EUR/CHF Chf1.2250, Chf1.2200

GBP/USD $1.5700, $1.6000

- confident can reach ambitious deal

- euro zone needs “effort of compromise”

- needs decisive, immediate Greece action

- confident can reach ambitious deal

- euro zone needs “effort of compromise”

- needs decisive, immediate Greece action

Hang Seng 17,870 -438.79 -2.40%

S&P/ASX 4,145 -68.82 -1.63%

Shanghai Composite 2,331 -46.15 -1.94%

On Asia session the euro declined against the dollar and the yen, halting a two-day advance, as a split between France and Germany over Europe’s rescue strategy surfaced before finance ministers meet in Brussels tomorrow.Demand for the euro waned after Standard & Poor’s cut Slovenia’s credit ratings and a Finnish lawmaker said plans to boost the region’s rescue fund through leverage could disguise potential costs.

Australia’s dollar fell after Asian stocks slid, spurring a flight to safer assets.

Gains in the yen were limited as a document showed Japan will increase a fund to help companies cope with a stronger currency.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair declined.

USD/JPY: on Asian session the pair hold in range Y76.65/85.

On Wednesday at 1230GMT, the pace of housing starts is expected to rise to a still weak 588,000 annual rate in September after falling to 571,000 in August. Soft new home sales continue to keep a lid on resurgence in home building. At the same time, US consumer prices are expected to rise 0.3% in September, with food and energy prices forecast to post further gains. Core CPI is expected to rise 0.2%.

Yesterday main news related to the emerging information on the decisions of the European leaders of the agreement to extend the fund EFSF. The euro rose on speculations of reaching agreement between France and Germany on the expansion ESFS to 2 trillion euros. Then the Financial Times Deutschland published a statement by the Minister of Finance of Germany Schäuble that ESFS size can be increased to a maximum of one trillion euros, and Chancellor Merkel said that there is “no magic wand” to solve the region’s fiscal crisis. Euro down when lawmakers rejected direct guarantees to fund EFSF.

Sterling rose for the first time in three days, advancing to $1.5845 on speculation a resolution to Europe’s debt crisis will help boost Britain’s economy. Bank of England policy makers voted unanimously to expand the size of their asset-purchase stimulus this month, according to minutes of their Oct. 6 meeting released yesterday. Strains related to Europe’s debt crisis created a “compelling” case to add to the program, according to the minutes.

EUR/USD: yesterday the pair rose, but lost later.

GBP/USD: yesterday the pair advanced.

USD/JPY: yesterday the pair holds in range Y76.65-Y76.85.

On Thursday President Sarkozy to fly to Frankfut for an meet with German Chancellor Merkel. UK data at 0830GMT includes SMMT Car Production and BOE Trends in Lending data as well as Retail Sales. At 0800GMT, German Finance Minister Wolfgang Schaeuble delivers a speech at an export industry conference, in Berlin. US data starts at 1230GMT when initial jobless claims are expected to rise 1,000 to 405,000 in the October 15 employment survey week after declining only 1,000 in the previous week. This is followed at 1345GMT by the weekly Bloomberg Comfort Index, while data at 1400GMT includes the Philadelphia Fed Survey, Existing Home Sales and also the Sep Leading Indicator.

Asian stocks rose on signs a global economic recovery may be strengthening after Bank of America Corp. swung to a profit and Intel Corp. forecast sales that beat analyst estimates, boosting the earnings outlook for Asia’s companies. France and Germany are engaged in “intensive talks” on bolstering the European Financial Stability Facility, said Steffen Seibert, a spokesman for German Chancellor Angela Merkel. Spain’s credit rating was cut for the third time since June 2010 by Moody’s Investors Service as Europe’s sovereign-debt crisis threatens to engulf the nation. Moody’s reduced Spain’s ranking to its fifth-highest investment grade, cutting it by two levels to A1 from Aa2, with the outlook remaining negative, the rating company said yesterday.

Banks increased after Bank of America climbed 10 percent in New York. Mitsubishi UFJ Financial Group Inc., Japan’s largest lender, advanced 0.9 percent. Commonwealth Bank of Australia, Australia’s biggest lender by market value, rose 1.2 percent to A$48.01.

Asian exporters rose with Canon Inc., the camera maker that gets 81 percent of its revenue abroad, increasing 1.9 percent to 3,475 yen. Korea’s Hankook Tire Co., which makes more than 60 percent of sales overseas, jumped 7.3 percent to 44,200 won in Seoul. James Hardie Industries SE, a building-materials supplier that gets 68 percent of sales from the U.S. rose 3.2 percent to A$5.76.

Energy producers rose after crude oil rose yesterday, the highest settlement price since Sept. 15. Oil was little changed today. Cnooc rose 1.1 percent to HK$13.18 in Hong Kong. Caltex Australia Ltd., a refiner and distributor of petroleum products, jumped 5.6 percent to A$13.53.

Suppliers of Apple Inc., fell after the maker of iPhones and iPads posted profit that missed analyst estimates. Largan Precision Co., which supplies camera lenses, lost 6.9 percent to NT$685 in Taipei. Catcher Technology Co., a casing maker of iPhones, fell 6.8 percent to NT$152. Foxconn Technology Co., which assembles Apple products, slipped 5.9 percent to NT$104.

European stocks advanced for the first time in three days amid conflicting reports that France and Germany have reached a deal on expanding the euro area’s rescue fund. German Chancellor Angela Merkel said yesterday that the euro-area summit on Oct. 23 will mark an “important step,” though not the final one, in solving the debt crisis. The comments marked the second time in two days that she sought to lower expectations. The Guardian newspaper reported that Germany and France have agreed to boost the region’s rescue fund, known as the European Financial Stability Facility, to 2 trillion euros ($2.8 trillion) from 440 billion euros. In contrast, the Financial Times Deutschland said German Finance Minister Wolfgang Schaeuble told lawmakers in Berlin that the EFSF’s firepower may be increased to a maximum of 1 trillion euros.

National benchmark indexes climbed in 11 of the 18 western European markets. The U.K.’s FTSE 100 Index gained 0.7 percent, France’s CAC 40 Index increased 0.5 percent and Germany’s DAX Index advanced 0.6 percent.

A gauge of bank shares rebounded from a four-day decline as the cost of insuring against default on European corporate debt retreated. France’s Natixis rallied 2.8 percent to 2.25 euros, while Commerzbank, Germany’s second-largest lender, rose 4.7 percent to 1.63 euros.

Software AG surged 12 percent to 30.45 euros, its biggest gain since 2009. Germany’s second-largest maker of business software confirmed its full-year sales target after third- quarter operating profit rose to 71 million euros.

BSkyB gained 5.1 percent to 710 pence after the U.K.’s biggest pay-TV broadcaster reported a 16 percent increase in first-quarter operating profit to 295 million pounds ($466 million) as the company sold more products to its existing subscribers. That beat the average analyst estimate of 286.5 million pounds.

Diageo Plc jumped 4 percent to 1,331 pence after the world’s largest distiller reported first-quarter sales that topped analyst forecasts, boosted by growth in Latin America, Asia and Africa.

Аccor SA advanced 2.5 percent to 22.62 euros after Europe’s largest hotel company reported a 2.7 percent gain in third- quarter sales to 1.62 billion euros, matching estimates, as more guests stayed at its economy hotels.

Hochtief rallied 3.7 percent to 52.98 euros after Goldman Sachs raised its recommendation for the company to “conviction buy” from “neutral.”

Alcatel-Lucent SA sank 7.7 percent to 1.96 euros as Oddo Securities and Jefferies Group Inc. lowered their recommendations for the French phone-equipment maker to “neutral” and “underperform,” respectively.

Home Retail Group Plc sank 17 percent to 99.5 pence after the owner of U.K. Homebase outlets said first-half profit fell 70 percent as Britons spent less at its Argos catalog unit.

U.S. stocks fell, following yesterday’s rally for benchmark gauges, amid concern about the strength of the economy and an impasse over European bailout talks, while Apple Inc. tumbled on disappointing results. Global stocks fell as France and Germany split on the role of the European Central Bank in leveraging a rescue fund as banks lobbied against forced recapitalizations and larger writedowns of Greek debt. French President Nicolas Sarkozy flew to Germany to join the talks as leaders assembled in Frankfurt in an effort to narrow divisions before an Oct. 23 summit. In the U.S., the Federal Reserve said consumer spending rose slightly last month and the economy maintained its expansion, even as companies reported more doubt about the strength of the recovery.

Intel Corp. (INTC) rose 3.6 percent to $24.24. The world’s biggest chipmaker forecast fourth-quarter sales that exceeded some analysts’ estimates, citing strong demand for laptop computers in emerging markets. Yahoo! Inc. gained 3 percent to $15.94 after demand for advertising helped third-quarter profit top analysts’ forecasts.

Travelers Cos. (TRV) rallied 5.7 percent, the most in the Dow, to $54.39, after the insurer reported an increase in third-quarter policy sales and said it was raising rates for clients.

Apple slumped 5.6 percent, the biggest decline since December 2008, after profit missed estimates for the first time in at least six years.

Alcoa Inc. (AA) and DuPont Co. (DD) slid more than 2.6 percent, pacing losses in companies most-dependent on economic growth.

Bank of America Corp. (BAC) and Wells Fargo & Co. dropped at least 2.6 percent, reversing earlier gains. Comerica Inc. slumped 11 percent and M&T Bank Corp. decreased 5.6 percent after reporting that net interest margins declined in the third quarter.

businesses.

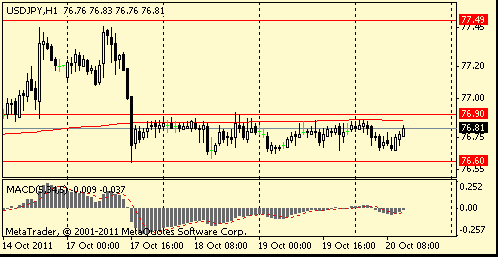

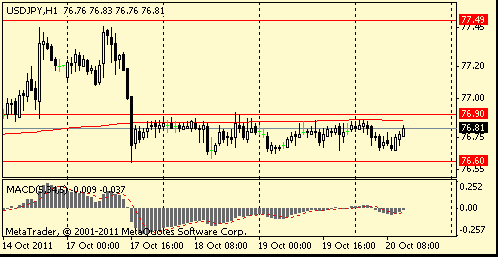

Resistance 2: Y77.45 (Oct 14 high)

Resistance 1: Y76.90 (Oct 18 high)

The current price: Y76.70

Support 1:Y76.65 (session low)

Support 2: Y76.30 (Oct 12 low)

Support 3: Y76.10 (Sep 21-22 low)

Comments: the pair holds in range Y76.65-Y76.90.

Resistance 2: Chf0.9150 (61.8 % FIBO Chf0.8880-Chf0.9310)

Resistance 1: Chf0.9100 (50.0 % FIBO Chf0.8880-Chf0.9310)

The current price: Chf0.9075

Support 1: Chf0.9020 (session low)

Support 2: Chf0.8950 (area of Oct 18-19 low)

Support 3: Chf0.8880 (Oct 17 low)

Comments: the pair is on uptrend. In focus resistance Chf0.9100.

Resistance 2: $ 1.5845 (Oct 19 high)

Resistance 1: $ 1.5780 (session high)

The current price: $1.5724

Support 1 : $1.5700 (MA (233) H1)

Support 2 : $1.5630 (Oct 18 low)

Support 3 : $1.5560 (50.0 % FIBO $1.5270-$ 1.5845)

Comments: the pair is corrected after yesterday's rise. In focus support $1.5700.

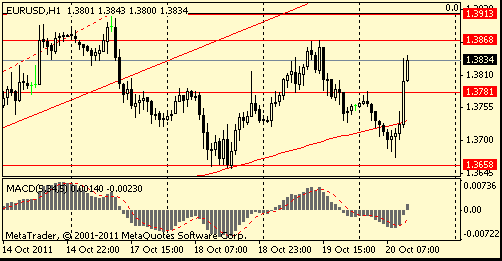

Resistance 2: $ 1.3870 (Oct 19 high)

Resistance 1: $ 1.3785 (session high)

The current price: $1.3718

Support 1 : $1.3700 (session low, MA (233) H1)

Support 2 : $1.3620 (38.2 % FIBO $1.3145-$ 1.3910)

Support 3 : $1.3530 (50.0 % FIBO $1.3145-$ 1.3910)

Comments: the pair is on downtrend. In focus support $1.3700.

Nikkei 225 8,773 +30.63 +0.35%

Hang Seng 18,309 +232.76 +1.29%

S&P/ASX 200 4,214 +26.82 +0.64%

Shanghai Composite 2,378 -5.97 -0.25%

FTSE 100 5,450 +40.14 +0.74%

CAC 40 3,157 +16.24 +0.52%

DAX 5,914 +36.12 +0.61%

Dow 11,504.62 -72.43 -0.63%

Nasdaq 2,604.04 -53.39 -2.01%

S&P 500 1,209.88 -15.50 -1.26%

10 Year Yield 2.16% +0.01 --

Oil $86.05 -0.06 -0.07%

Gold $1,643.10 -3.90 -0.24%

06:00 Switzerland Trade Balance September 0.81 1.37

06:00 Germany Producer Price Index (MoM) September -0.3% +0.3%

06:00 Germany Producer Price Index (YoY) September +5.5% +5.5%

08:30 United Kingdom Retail Sales (MoM) September -0.2% -0.1%

08:30 United Kingdom Retail Sales (YoY) September 0.0% +0.6%

12:30 Canada Wholesale Sales, m/m August +0.8% +0.5%

12:30 U.S. Initial Jobless Claims неделя по 15 октября 404K 408K

14:00 U.S. Philadelphia Fed Manufacturing Survey October -17.5 -9.0

14:00 U.S. Leading Indicators September 0.3% 0.2%

14:00 U.S. Existing Home Sales September 5.03 4.91

14:00 Eurozone Consumer Confidence October -19.1 -20.1

14:15 U.S. FOMC Member James Bullard Speaks 0

23:01 United Kingdom Nationwide Consumer Confidence September 48 50

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.