- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-10-2011

European stocks slid from an 11-week high as canceled finance ministers’ meeting fueled concern that the region’s leaders may struggle to resolve the debt crisis at a summit tomorrow. Chancellor Angela Merkel and fellow leaders return to Brussels tomorrow for a second summit in four days to discuss Europe’s bailout fund. Policy makers are jousting with banks over the size of losses they take on Greek bonds while deliberating over leveraging the fund after ruling out tapping the European Central Bank’s balance sheet. Stocks extended losses after the U.K. government said a meeting of EU finance ministers scheduled for tomorrow to decide on bank recapitalization was canceled. They pared some of their decline as it was confirmed that summits of the 27 EU leaders and 17 euro-area heads of government will take place in Brussels as planned. The gathering of finance ministers was canceled because the bank-recapitalization issue cannot be decided before other elements of the rescue package, a person familiar with the matter said on condition of anonymity.

National benchmark indexes fell in 15 of the 18 western European markets today. The U.K.’s FTSE 100 declined 0.4 percent and France’s CAC 40 retreated 1.4 percent. Germany’s DAX Index slipped 0.1 percent.

STMicroelectronics tumbled 7.4 percent to 5.06 euros in Milan after saying net revenue will range from $2.15 billion to $2.3 billion. That compared with an average analyst estimate of $2.52 billion, according to Bloomberg data. Forecasts for gross margin, the percentage of sales remaining after costs of production, were also below projections.

Meyer Burger lost 13 percent to 20.55 Swiss francs as Europe’s biggest solar-panel equipment maker said it will temporarily halt output at its MB Wafertec unit in Switzerland amid “high uncertainties” in the solar industry.

Reckitt Benckiser Group Plc retreated 3.4 percent to 3,330 pence, the biggest drop in a month. The maker of Lysol cleaners forecast lower sales and profit at its pharmaceutical division in the fourth quarter because of U.S. health-care reforms and a price increase for Suboxone tablets.

Novartis AG, Europe’s second-biggest pharmaceutical company, lost 3.3 percent to 50.10 francs after saying it plans to eliminate 2,000 jobs in Switzerland and the U.S. and add employees in China and India to offset the effect of drug-price reductions.

BP, the operator of the Macondo well in the Gulf of Mexico that caused the worst accidental U.S. oil spill last year, climbed 4.4 percent to 457.2 pence as profit beat analysts’ estimates. Earnings adjusted for one-time items and changes in inventory were $5.3 billion, down from $5.5 billion a year earlier. The average estimate of 12 analysts surveyed by Bloomberg was for income of $5 billion on that basis.

BG Group rose 3.8 percent to 1,378 pence. The U.K.’s third- largest natural-gas producer said third-quarter earnings rose 25 percent as energy-price gains countered output constraints.

Neste Oil Oyj surged 13 percent to 9.06 euros, the biggest gain since 2008. Finland’s only oil refiner was boosted by the improving outlook for its renewable fuels unit.

Swedbank AB, the largest lender in the Baltic states, rose 3.7 percent to 90.05 kronor as it reported a 34 percent jump in third-quarter profit and said costs will decline in 2012 as it adjusts to the European economic slowdown.

The yen rose to a post-World War II high against the dollar and rallied versus most of its other major counterparts as European sovereign debt concern before tomorrow’s summits spurred demand for a refuge. Bank of Japan policy makers will discuss steps to ease the impact of the strong yen on the nation’s economy at a two-day meeting beginning tomorrow. Measures may include expanding a 50 trillion yen ($660 billion) asset purchase program by 5 trillion yen and purchase bonds with maturities longer than two years, the newspaper reported without citing anyone.

Canada’s dollar fell 1.2 percent to C$1.0154 versus the U.S. currency after the Bank of Canada said the nation’s economy will grow more slowly than projected and removed a reference to withdrawing stimulus. The target lending rate was held at 1 percent, where it has been since September 2010.

New Zealand’s dollar declined 1.2 percent to 79.74 U.S. cents as the South Pacific nation’s consumer prices increased 0.4 percent in the third quarter after rising 1 percent in the prior three months. The data fueled speculation the Reserve Bank of New Zealand will signal a willingness to keep its benchmark interest rate at a record low.

US dollar fell after consumer confidence unexpectedly slumped in October to the lowest level since March 2009, when the U.S. economy was in a recession, as Americans’ outlooks for employment and incomes soured. Separate data showed that home prices in 20 U.S. cities dropped more than forecast in August, highlighting one of the obstacles facing the economic recovery in its third year.

U.S. stocks fell, halting a three- day gain in the Standard & Poor’s 500 Index, after United Parcel Service Inc. sank and economic reports missed estimates as investors awaited tomorrow’s European summit. Stocks extended losses after consumer confidence unexpectedly slumped in October to the lowest level since March 2009, when the U.S. economy was in a recession, as Americans’ outlooks for employment and incomes soured. Separate data showed that home prices in 20 U.S. cities dropped more than forecast in August, highlighting one of the obstacles facing the economic recovery in its third year. European leaders will hold a summit tomorrow as they seek to bolster the region’s rescue fund, recapitalize banks and provide debt relief to Greece. Boosting the effectiveness of the European Financial Stability Facility will require further talks with investors as German lawmakers prepare to vote on its new powers, a European Union document showed.

S&P 500 1,244 -10.47 -0.83%, NASDAQ 2,672 -27.27 -1.01%, Dow 11,839 -74.33 -0.62%

All 10 groups in the S&P 500 retreated as a gauge of financial stocks slid 2 percent.

UPS, the largest package- delivery company and a proxy for the economy, retreated 1.9 percent after international shipping growth began to cool while U.S. expansion stagnated. The company’s total U.S. volume was flat in the third quarter because of “the slow U.S. economy,” Atlanta-based UPS said today in a statement. A 4.6 percent increase in shipments outside the U.S. trailed the 6.2 percent gain in the previous three months.

3M Co. (MMM), the maker Scotch-Brite sponges, lost 5.2 percent after cutting its 2011 profit forecast. The maker of auto parts and Scotch-Brite sponges cut its 2011 profit forecast after reporting third-quarter profit that fell short of analysts’ estimates.

Netflix plunged 35 percent to $77.74. The company faces rising content costs, a customer revolt over a price increase and startup costs as it expands into Latin America, followed by the U.K. and Ireland in early 2012.

Gold climbed to a 5-week high against the lack of news on solving the debt crisis of the euro area and in anticipation of a new phase of quantitative easing measures from the Fed, which leads to increased demand for the metal.

Gold futures for December delivery gained to $1,694.40 an ounce on the Comex in New York.

Crude oil climbed to a 12-week high in New York on declining stockpiles at a U.S. storage hub. Oil pared gains after a meeting of European finance ministers set for tomorrow was canceled.

Futures erased this year’s loss after rising as much as 3.7 percent today. Supplies at Cushing, Oklahoma, the delivery point for West Texas Intermediate, the crude traded in New York, fell last week, according to a satellite survey. Brent oil in London traded at the lowest premium to WTI since July.

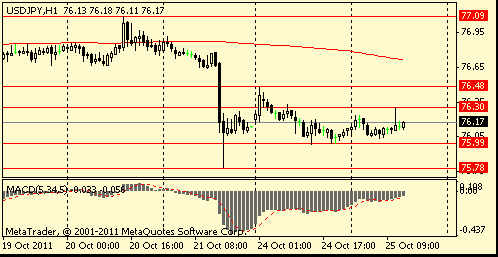

USD/JPY Y76.25, Y76.30, Y76.50, Y76.70

AUD/USD $1.0465, $1.0450, $1.0400, $1.0300, $1.0200

USD/NZD $0.7810

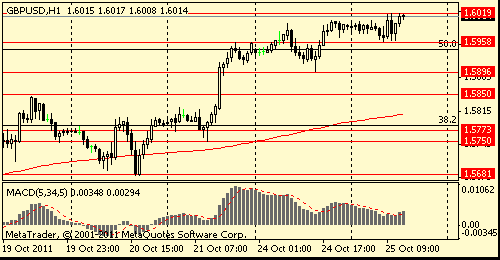

GBP/USD $1.6000, $1.5740, $1.5705, $1.5700, $1.5680

U.S. stock index futures pared earlier gains to trade flat on Tuesday following comments from Germany's Chancellor that the country is opposed to phrase in a final draft for the region's summit.

The comments, which heightened concerns that the summit may not produce fruitful results to tackle the region's debt crisis, offset the market's optimism after strong earnings from blue chip companies.

Germany opposes a phrase in a draft conclusion for Wednesday's EU summit that calls for the European Central Bank to continue buying bonds in the secondary market.

- cuts Canada 2011 GDP view to 2.1%, 2012 to 1.9%; ups 2013 view to 2.9%;

- Economy to return to capacity by end-2013 vs prior forecast of mid-2012;

- Core CPI to decline through 2012, return to 2% by end-2013;

- growth to rebound in 3Q, but economic momentum has slowed, to remain modest through mid-2012;

- domestic demand to stay principal driver of growth, but at more subdued pace.

06:45 France Consumer confidence (October) 82

08:00 Italy Retail sales (August) adjusted 0.0%

08:00 Italy Retail sales (August) Y/Y unadjusted -0.3%

08:30 UK Current account (Q2), bln -2.0

09:00 Italy Consumer confidence (October) 92.9

The euro reached a six-week high versus the dollar as European leaders prepared to meet tomorrow to complete a solution to the region’s debt crisis.

German Chancellor Angela Merkel and fellow EU leaders will return to Brussels tomorrow for a second summit in four days to discuss Europe’s bailout fund. European leaders are seeking an agreement on bolstering the region’s rescue fund, recapitalizing banks and providing debt relief to Greece to avoid contagion spreading to Italy and Spain.

Home prices in 20 U.S. cities probably fell at a slower pace and consumer confidence hovered near a two-year low, highlighting the obstacles facing the U.S. recovery in its third year, economists said before reports today.

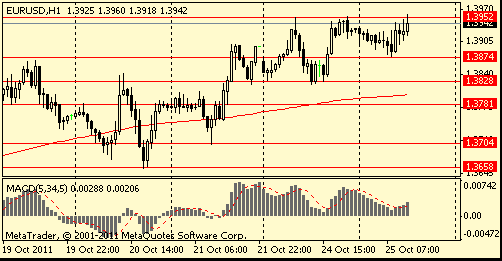

EUR/USD: the pair was consolidated in $1,3950 area.

GBP/USD: the pair holds in $1,5960-$ 1.6020 area.

USD/JPY: the pair holds in Y76,00-Y76,30 area.

At 1300GMT, the Bank of Canada delivers it's interest rate announcement. Every time for a year now that Bank of Canada watchers have predicted change, they have had to stand back and watch the BoC stand pat on its economy-stimulating 1.0% policy interest rate.

Raises full-year EPS estimate to $3.97-$4.05, from prior guidance of $3.90-$4.05.

Resistance 3: Y76.70 (МА(200) for Н1)

Resistance 2: Y76.50 (Oct 24 high)

Resistance 1: Y76.30 (session high)

Current price: Y76.17

Support 1:Y76.00 (area of session low and Oct 24 low)

Support 2:Y75.75 (historical low)

Support 3:Y75.00 (psychological mark)

Resistance 2: Chf0.8880 (Oct 24 high)

Resistance 1: Chf0.8850 (session high)

Current price: Chf0.8786

Support 1: Chf0.8770 (session low)

Support 2: Chf0.8700 (38.2 % FIBO Chf0,7700-Chf0,9310, the bottom border of down chanel from Oct 6)

Support 3: Chf0.8640 (Sep 15 low)

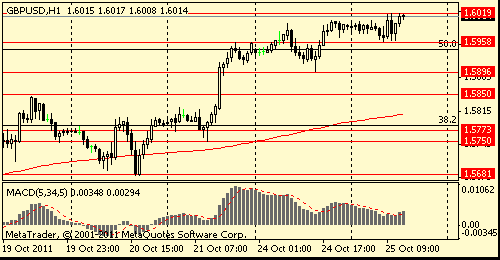

Resistance 2: $ 1.6100 (61,8 % FIBO $1,6620-$ 1,5270)

Resistance 1: $ 1.6020 (session high)

Current price: $1.6013

Support 1 : $1.5960 (session low)

Support 2 : $1.5900 (Oct 24 low)

Support 3 : $1.5850 (earlier resistance, Oct 14, 17 and 19 highs)

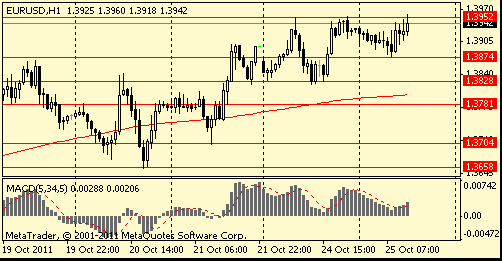

Resistance 2: $ 1.4090 (МА (200) and МА (100) on D1)

Resistance 1: $ 1.3950 (session high, Oct 24 high)

Current price: $1.3952

Support 1 : $1.3875 (session low)

Support 2 : $1.3830 (Oct 24 low)

Support 2 : $1.3800 (МА(200) for Н1)

European stocks fluctuated as the region’s leaders prepared for tomorrow’s summit on the euro-area debt crisis.

Currently FTSE 5,556 +8.27 +0.15%, CAC 3,207 -13.89 -0.43%, DAX 6,080 +24.56 +0.41%.

- QE2 could add 0.5pp to inflation;

- uncertain what impact QE2 will have on employment.

uncertain what impact QE2 will have on employment.

- МPC very close to voting for QE in Sep;

- MPC in Sep thought volatility may dampen down;

- MPC in Sep took view if nothing changed then Oct QE;

- not very enthusiastic over loan-to-value limits;

- saw real risks of inflation falling below target;

- BOE has not rejected Treasury demands on credit easing;

- suspects bank leverage will decline only slowly;

- QE does not guarantee positive lending to real economy;

- would like to see bank de-leveraging go further;

- must use existing banking system to boost SME credit;

- very little sign of rise in long-term inflation expectations.

- МPC very close to voting for QE in Sep;

- MPC in Sep thought volatility may dampen down;

- MPC in Sep took view if nothing changed then Oct QE;

- not very enthusiastic over loan-to-value limits;

- saw real risks of inflation falling below target;

- BOE has not rejected Treasury demands on credit easing;

- suspects bank leverage will decline only slowly;

- QE does not guarantee positive lending to real economy;

- would like to see bank de-leveraging go further;

- must use existing banking system to boost SME credit;

- very little sign of rise in long-term inflation expectations.

EUR/USD $1.3750, $1.3800, $1.3850, $1.3900, $1.3950, $1.3990, $1.4000 $1.4025

USD/JPY Y76.25, Y76.30, Y76.50, Y76.70

AUD/USD $1.0465, $1.0450, $1.0400, $1.0300, $1.0200

USD/NZD $0.7810

GBP/USD $1.6000, $1.5740, $1.5705, $1.5700, $1.5680

21:45 New Zealand CPI, q/q Quarter III +0.4%

21:45 New Zealand CPI, y/y Quarter III +4.6%

23:00 Australia Conference Board Australia Leading Index August -0.1%

23:00 Australia RBA Deputy Gov Battellino Speaks

The euro fell, snapping a five-day gain against the dollar and yen, before a report that economists say will show French consumer confidence deteriorated. The 17-nation currency weakened against a majority of its most-traded counterparts before a summit of European leaders tomorrow to resolve the region’s debt crisis.

The Dollar held onto a drop from yesterday after Federal Reserve Bank of New York President William C. Dudley said the central bank may do more to hold down borrowing costs.

The New Zealand dollar declined against all of its 16 major peers after a report showed inflation slowed by more than economists forecast. The so-called kiwi snapped a three-day advance against its U.S. counterpart on speculation the Reserve Bank of New Zealand will signal this week a willingness to keep its benchmark interest rate at record low for longer.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair holds in range $1.5965-$1.6005.

USD/JPY: on Asian session the pair fell.

On Tuesday UK data at 0830GMT is expected to see the BBA measure of Mortgage Approvals come in at 36k, while at the same time the UK Q2 Current Account Balance is expected to slip to -stg8.5 billion. Shortly after, at 0845GMT, Bank of England Governor Mervyn King and Deputy Governor Charles Bean Give Evidence on QE to the Treasury Committee. At 1300GMT with the S&P/Case-Shiller Home Price Index. US data at 1400GMT includes Consumer Confidence. At 1300GMT, the Bank of Canada delivers it's interest rate announcement.

The dollar dropped against all of its major counterparts as equities rallied on better than expected corporate earnings and commodities advanced, sapping demand for a refuge. Raw materials rallied after a report showing China’s manufacturing may expand in October for the first time in four months, snapping the longest contraction since 2009.

The 17-nation euro erased its drop versus the dollar and yen as European politicians attempted to craft an effective response to the region’s sovereign debt crisis. European leaders meeting in Brussels yesterday outlined plans to assist banks, heading toward a revamped strategy to resolve the debt crisis. The 13th summit in 21 months excluded a forced restructuring of Greece’s debt, keeping with the policy of encouraging bondholders to accept “voluntary” losses to help restore the country’s finances. Leaders will meet again Oct. 26.

The yen rose versus the dollar as Japan’s exports increased 2.4 percent in September from a year earlier as demand for cars and auto parts advanced. Japanese Finance Minister Jun Azumi and Chief Cabinet Secretary Osamu Fujimura signaled today Japan is ready to intervene in the currency market to stop a yen appreciation to post-World War II highs that may stunt shipments as overseas demand slows.

EUR/USD: yesterday the pair gain and showed new week’s high.

GBP/USD: yesterday the pair gain and showed new week’s high.

USD/JPY: yesterday the pair fell.

On Tuesday UK data at 0830GMT is expected to see the BBA measure of Mortgage Approvals come in at 36k, while at the same time the UK Q2 Current Account Balance is expected to slip to -stg8.5 billion. Shortly after, at 0845GMT, Bank of England Governor Mervyn King and Deputy Governor Charles Bean Give Evidence on QE to the Treasury Committee. At 1300GMT with the S&P/Case-Shiller Home Price Index. US data at 1400GMT includes Consumer Confidence. At 1300GMT, the Bank of Canada delivers it's interest rate announcement.

Asian stocks climbed for a second day as a report showed China’s manufacturing may expand for the first time in four months and after European leaders inched toward a revamped strategy to contain the region’s debt crisis.

Shares extended their gains as the Chinese manufacturing report, along with the Japanese export data, signaled that Asia’s largest two economies are withstanding Europe’s sovereign debt crisis.

European leaders in Brussels yesterday outlined plans to aid banks, heading toward a revamped strategy to contain the debt crisis. The 13th crisis-management summit in 21 months excluded a forced restructuring of Greece’s debt, sticking with the policy of enticing bondholders to accept “voluntary” losses to help restore the country’s finances. The complete blueprint for the rescue fund will be formed Oct. 26.

Japan’s Nikkei 225 Stock Average gained 1.9 percent after a report showed exports rose more than expected last month. Australia’s S&P/ASX 200 rose 2.7 percent. China’s Shanghai Composite Index advanced 2.3 percent after a report showed China’s manufacturing may expand in October. Hong Kong’s Hang Seng Index jumped 4.1 percent, the most among Asia-Pacific indexes.

Japanese exporters climbed after a report showed the nation’s shipments increased more than expected in September as demand for cars and auto parts rose, a sign the recovery in shipments is withstanding a weakening global economy.

Honda Motor advanced 2.6 percent to 2,355 yen. Toyota Motor Corp., the world’s biggest carmaker by market value, rose 1.3 percent to 2,580 yen and Suzuki Motor Corp., Japan’s No. 4 automaker by sales, climbed 2.7 percent to 1,682 yen.

Bridgestone Corp., a tiremaker, jumped 4.1 percent to 1,764 yen. The company aims to boost annual sales to 3.6 trillion yen ($47 billion) by 2012 as it expands production in China to meet rising demand, Chief Financial Officer Akihiro Eto said on Oct. 21.

Samsung Engineering Co., South Korea’s biggest construction and engineering company by market value, surged 6.3 percent to 237,500 won. The company’s third-quarter operating profit more than doubled to 212.9 billion won ($187.5 million).

Chinese banks rallied after Barclays said the Hong Kong- listed lenders may post 32 percent profit growth on average in the third quarter. Industrial & Commercial Bank of China surged 5.8 percent to HK$4.39. China Construction Bank Corp., the nation’s second-biggest lender, climbed 4.1 percent to HK$5.33. Bank of China Ltd. increased 6 percent to HK$2.81.

Raw material producers advanced as copper and oil futures extended gains. BHP Billiton gained 3.2 percent to A$36.85 in Sydney. Korea Zinc Co., South Korea’s biggest zinc smelter, surged 13 percent to 319,000 won in Seoul. Cnooc Ltd., China’s largest offshore oil producer, increased 6.5 percent to HK$13.68 in Tokyo.

European stocks climbed to their highest level in 11 weeks as signs of stronger growth in China and Japan outweighed a selloff in Greek lenders after a meeting of euro-area leaders discussed the region’s debt crisis. Leaders at yesterday’s summit in Brussels ruled out tapping the European Central Bank’s balance sheet to boost the euro area’s rescue fund, the European Financial Stability Facility, and excluded a forced restructuring of Greece’s debt. The politicians looked at strengthening the International Monetary Fund’s role and outlined plans to aid banks. The complete blueprint for the rescue fund won’t come together until a summit in two days. Like yesterday, it will start with all 27 European Union leaders before the 17 heads of the euro-area economies gather on their own.

Stocks rallied in Asia today after a report showed that China’s manufacturing may expand in October for the first time in four months, snapping the longest contraction since 2009. A separate release showed Japan’s exports increased in September more than economists had forecast.

Luxembourg’s Jean-Claude Juncker, who chairs the group of euro-area finance ministers, said talks on the private sector’s involvement in a second aid package for Greece have focused on losses of as much as 60 percent for bondholders. Reuters yesterday reported that lenders have offered to write down 40 percent of their Greek debt. Austrian Chancellor Werner Faymann told Austrian radio ORF he sees a “good chance” to convince Greece’s private creditors to accept a haircut of as much as 50 percent, while Ireland’s Transport Minister Leo Varadkar told Dublin-based RTE radio that discounts of between 40 percent and 60 percent were being discussed.

National benchmark indexes rose in 15 of the 18 western- European markets today. The U.K.’s FTSE 100 Index gained 1.1 percent. Germany’s DAX Index gained 1.4 percent and France’s CAC 40 Index increased 1.6 percent. Greece’s ASE Index dropped 4.5 percent.

Mining companies were the biggest gainers on the Stoxx 600 as copper rallied on the London Metal Exchange. BHP Billiton, the world’s largest mining company, gained 5.2 percent to 1,996 pence, Rio Tinto soared 7.1 percent to 3,373.5 pence and Xstrata Plc rose 6.8 percent to 1,016 pence.

TomTom surged 19 percent to 3.62 euros, its biggest advance since 2009, after Europe’s biggest maker of portable-navigation devices reported third-quarter net income of 28.9 million euros ($40 million). That beat the average analyst estimate.

Greek banks led declining shares as National Bank of Greece, the country’s largest lender, sunk 21 percent to 1.60 euros, its biggest drop since at least 1992. EFG Eurobank Ergasias, the second largest, slumped 20 percent to 63 euro cents, its biggest plunge since at least 1999.

Nobel Biocare Holding AG soared 14 percent to 11.38 Swiss francs, the largest jump since October 2002, after NZZ am Sonntag reported that EQT Partners AB and Bain Capital LLC are considering buying the world’s second-biggest dental- implant maker. The newspaper cited two unidentified sources.

Swatch Group AG climbed 4.8 percent to 373.50 francs, its highest price in a month, after NZZ also reported that the company’s sales this year will “clearly exceed” 7 billion Swiss francs ($7.9 billion), while growth adjusted for currency swings may reach 9 percent to 11 percent in 2012. Faurecia SA rallied 12 percent to 19.76 euros as Europe’s largest maker of car interiors confirmed its 2011 targets after posting third-quarter sales that rose 16 percent.

U.S. stocks rallied, almost wiping out this year’s decline in the Standard & Poor’s 500 Index, amid takeover deals, higher-than-estimated earnings at Caterpillar and progress in talks to tame Europe’s debt crisis. European leaders in debt-crisis talks this weekend outlined plans to aid banks and ruled out tapping the European Central Bank’s balance sheet to boost the region’s rescue fund. Europe’s 13th crisis-management summit in 21 months also explored how to strengthen the International Monetary Fund’s role. The complete blueprint won’t come together until a summit in two days.

China’s manufacturing may expand in October for the first time in four months, snapping the longest contraction since 2009, after a preliminary index of purchasing managers showed a rebound in new orders and output. The Chinese report, along with Japanese data today showing an increase in exports exceeding economists’ forecasts, signaled that Asia’s largest two economies are withstanding Europe’s sovereign debt crisis.

The U.S. economy probably grew in the third quarter at the fastest pace this year, economists said before a report this week. Nonetheless, Federal Reserve officials Janet Yellen and Daniel Tarullo last week said that more monetary stimulus may be needed. Fed Bank of New York President William C. Dudley today said the central bank has the option of starting a third round of asset purchases to stimulate growth.

Dow 11,913.62 +104.83 +0.89%, Nasdaq 2,699.44 +61.98 +2.35%, S&P 500 1,254.19 +15.94 +1.29%

Caterpillar (CAT) rallied 5 percent, the most in the Dow, to $91.77. The company said full-year profit will be $6.75 a share and sales will be at the top end of a previously forecast range of $56 billion to $58 billion. Revenue in 2012 will rise 10 to 20 percent, it said.

Some takeover deals helped lift equities today. RightNow Technologies surged 19 percent to $42.94. Oracle Corp. agreed to buy the company for $1.5 billion, gaining customer-service expertise to bolster a new Internet-based product. Healthspring jumped 34 percent to $53.71. Cigna Corp. agreed to buy the health maintenance organization for $3.8 billion in cash to expand the U.S. insurer’s Medicare business.

A gauge of raw material producers in the S&P 500 added 2.3 percent, the biggest gain within 10 industries, as the S&P GSCI Index of commodities rose 2.4 percent. Alcoa, Inc. (AA), the largest U.S. aluminum producer, gained 3.4 percent to $10.58. Freeport-McMoRan Copper & Gold Inc., the world’s largest publicly traded copper miner, advanced 8 percent.

Indexes of telephone, consumer staples and utility companies in the S&P 500, which are least-tied to the economy, retreated. Kimberly-Clark Corp. lost 4.6 percent, the most in the S&P 500, to $69.65. The maker of Scott toilet paper and Huggies diapers cut the high end of its annual profit forecast amid lower demand in North America and some developed markets.

Resistance 3: Y77.10 (Oct 20 high)

Resistance 2: Y76.65 (MA (233) H1)

Resistance 1: Y76.25 (session high)

The current price: Y76.10

Support 1:Y76.05 (session low)

Support 2: Y75.80 (Oct 21 low)

Support 3: Y75.00 (psychological mark)

Comments: the pair is on downtrend.

Resistance 3: Chf0.8950 (MA (233) H1)

Resistance 2: Chf0.8880 (Oct 24 high)

Resistance 1: Chf0.8820 (session high)

The current price: Chf0.8805

Support 1: Chf0.8790 (session low)

Support 2: Chf0.8720 (support line from Oct 7)

Support 3: Chf0.8645 (Sep 15 low)

Comments: the pair is on downtrend. In focus support Chf0.8790.

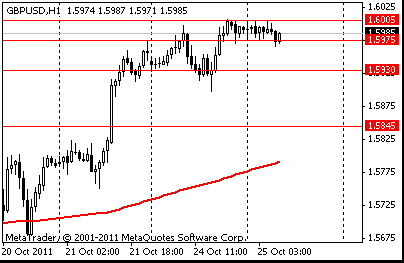

Resistance 3: $ 1.6100 (61.8% FIBO $1.5270-$ 1.6615)

Resistance 2: $ 1.6050 (261.8% FIBO $1.5680-$ 1.5820)

Resistance 1: $ 1.6005 (session high)

The current price: $1.5985

Support 1 : $1.5975 (session low)

Support 2 : $1.5930 (23.6% FIBO $1.6005-$ 1.5680)

Support 3 : $1.5845 (50.0% FIBO $1.6005-$ 1.5680)

Comments: the pair is on uptrend. In focus resistance $1.6005.

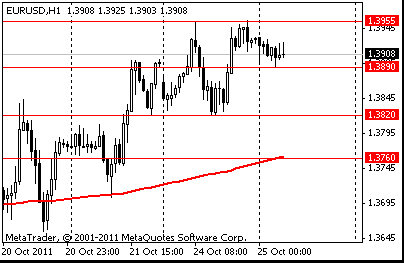

Resistance 3 : $1.4090 (Sep 8 high)

Resistance 2 : $1.4000 (61.8 % FIBO $1.3140-$ 1.4550)

Resistance 1 : $1.3955 (Oct 24 high)

The current price: $1.3907

Support 1 : $1.3890 (session low)

Support 2 : $1.3820 (Oct 24 low)

Support 3 : $1.3760 (MA (233) H1)

Comments: the pair is on uptrend. In focus resistance $1.3955.

Change % Change Last

Nikkei 225 8,844 +165.09 +1.90%

Hang Seng 18,772 +746.10 +4.14%

S&P/ASX 200 4,255 +113.12 +2.73%

Shanghai Composite 2,370 +53.06 +2.29%

FTSE 100 5,548 +59.41 +1.08%

CAC 40 3,220 +49.12 +1.55%

DAX 6,055 +84.31 +1.41%

Dow 11,913.62 +104.83 +0.89%

Nasdaq 2,699.44 +61.98 +2.35%

S&P 500 1,254.19 +15.94 +1.29%

10 Year Yield 2.23% +0.03 --

Oil $91.56 +0.29 +0.32%

Gold $1,654.80 +2.50 +0.15%

06:00 Switzerland UBS Consumption Indicator September 0.79

06:00 Germany Gfk Consumer Confidence Survey November 5.2 5.1

06:45 France Consumer confidence October 80 78

08:30 United Kingdom Current account, bln Quarter II -9.4 -9.9

08:30 United Kingdom Mortgage Approvals September 35.2 36.3

08:45 United Kingdom BOE Gov King Speaks

09:00 Italy Consumer confidence October 98.5 98.0

12:30 Canada Retail Sales, m/m August -0.6% +0.5%

12:30 Canada Retail Sales ex Autos, m/m August 0.0% +0.4%

13:00 Canada Bank of Canada Rate 1.00% 1.00%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y August -4.1% -3.6%

14:00 U.S. Consumer confidence October 45.4 46.2

14:00 U.S. Housing Price Index, m/m August +0.8% +0.1%

14:00 U.S. Richmond Fed Manufacturing Index October -6 2

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.