- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-10-2011

The euro is a "strange" currency

ECB is not acting as lender of last resort

The euro declined from almost a seven-week high against the dollar and yen as a rise in Italian borrowing costs raised concern European Union leaders haven’t done enough to stem the region’s debt crisis. Europe’s currency weakened after posting its biggest gain in a year against the greenback yesterday, when leaders announced a way to prevent a Greek default and safeguard banks. Italian Prime Minister Silvio Berlusconi conducted the first test of investor enthusiasm for Europe’s debt since the summit’s plan was announced, selling bonds today at euro-era record borrowing costs.

The yen climbed toward a postwar record against the dollar, spurring bets Japan will intervene to weaken its currency. The yen is the biggest gainer among 10 developed-nation currencies in the past six months, rising 11 percent, according to Bloomberg Correlation-Weighted Currency Indexes. Japanese Finance Minister Jun Azumi said he will take “bold” action against the strong yen if needed.

IntercontinentalExchange Inc.’s Dollar Index, used to track the greenback against the currencies of six major U.S. trading partners, was little changed at 75.040, having dropped 1.6 percent this week on reduced demand for a refuge.

European stocks declined from a 12- week high as investors waited to discover how the euro area plans to fund its enlarged bailout facility. In the U.S., a report showed that consumer confidence unexpectedly rose in October from September. The Thomson Reuters/University of Michigan final index of consumer sentiment climbed to 60.9 from 59.4 the previous month. The preliminary reading for the month was 57.5.

National benchmark indexes declined in 13 of the 17 western-European markets that were open today. The U.K.’s FTSE 100 Index slipped 0.2 percent and France’s CAC 40 Index retreated 0.6 percent. Germany’s DAX Index gained 0.1 percent.

Petroleum Geo-Services fell 14 percent to 61.25 kroner, after reporting third-quarter net income of $13.5 million, compared with a loss of $40.4 million a year earlier. That missed the $32.6 million average of analysts’ estimates compiled by Bloomberg.

Wacker Chemie sank 9.8 percent to 76 euros. The Munich- based chemicals company reported third-quarter sales that trailed analysts’ estimates and forecast lower revenue in the fourth quarter.

YIT Oyj, Finland’s biggest builder, plunged 12 percent to 12.45 euros after posting third-quarter net income of 18.6 million euros. That missed the 38.1 million-euro mean estimate of eight analysts surveyed by Bloomberg.

Renault jumped 4.5 percent to 31.67 euros. The carmaker said revenue increased to 9.75 billion euros from 8.71 billion euros a year earlier. That beat the 9.63 billion-euro average of four analyst estimates compiled by Bloomberg. Societe Generale SA upgraded its stance on the shares to “buy” from “hold.”

Electrolux AB rallied 6.8 percent to 126.50 kronor. The Swedish maker of household appliances said third-quarter net income fell to 826 million kronor ($130 million) from 1.38 billion kronor a year earlier. Sales dropped to 25.65 billion kronor from 26.33 billion kronor. Both profit and sales exceeded analysts’ estimates in a Bloomberg survey.

SSAB AB surged 7.4 percent to 67.50 kronor after posting third-quarter net income and sales that topped estimates. The stock has rallied 28 percent this week, its largest advance since 1992.

The euro is a "strange" currency

ECB is not acting as lender of last resort

U.S. stocks fell, trimming the longest weekly rally since January in the Standard & Poor’s 500 Index, as scrutiny deepens on Europe’s latest measures to contain the region’s sovereign debt crisis. Italy’s borrowing costs rose to a euro-era record at a sale of three-year bonds, driving yields higher amid concern that efforts to contain the sovereign crisis won’t be enough to safeguard the region’s third-largest economy. Fitch Ratings said part of the plan to contain debt turmoil amounts to a Greek default. German Chancellor Angela Merkel said that the debt crisis won’t be over “in a year.” European leaders may struggle to maintain the euphoria that drove the euro to its biggest one-day gain in more than a year as scrutiny deepens on their latest attempt to stem the region’s turmoil.

Consumer confidence unexpectedly rose in October from the previous month, indicating the biggest part of the economy will help keep the U.S. recovery intact. The Thomson Reuters/University of Michigan final index of consumer sentiment climbed to 60.9 from 59.4 in September. The gauge was projected to drop to 58, according to the median forecast of 66 economists surveyed by Bloomberg News. The preliminary reading for the month was 57.5. A separate report showed that consumer spending in the U.S. accelerated in September. Still, incomes rose less than projected, sending the savings rate down to the lowest level in almost four years.

Dow 12,192.81 -15.74 -0.13%, Nasdaq 2,725.50 -13.13 -0.48%, S&P 500 1,279.94 -4.65 -0.36%

Whirlpool, the largest maker of household appliances, slumped 12 percent to $53.28. The company’s plan, which also includes reducing factory capacity by 6 million units, will cost $500 million and $160 million will be booked in 2011, Whirlpool said. Profit this year will be in a range of $4.75 to $5.25 a share, down from a previous forecast of $7.25 to $8.25, the company said.

Cablevision Systems, the fifth-largest U.S. cable-TV provider by subscribers, tumbled 15 percent to $14.68. The company lost 19,000 video subscribers, fewer than the 26,000 average estimate of nine analysts surveyed by Bloomberg. Cablevision’s market has a 40 percent overlap with Verizon Communications Inc.’s FiOS, leading to a “hyper competitive dynamic” that makes it difficult for the company to grow, said Todd Mitchell, a Brean Murray Carret & Co. analyst in

Hewlett-Packard Co. (HPQ) rallied 3.6 percent, the most in the Dow, to $27.95. Chief Executive Officer Meg Whitman is backing away from a spinoff proposal made by former CEO Leo Apotheker, who raised the idea in August as part of a sweeping overhaul. The company’s evaluation found that being the world’s largest PC seller was too valuable to Hewlett-Packard’s brand, procurement power and customer relationships.

- Urges EU to make 'greater efforts' to resolve debt crisis

Gold declined from a five-week high on renewed concerns that Europe’s debt crisis will hamper global growth, damping prospects for commodity demand.

Gold also fell as the dollar rose as much 0.4 percent against a basket of six major currencies, reducing demand for the metal as an alternative asset.

Gold futures for December delivery fell to $1,733 an ounce on the Comex in New York. A close at that level would still leave prices up 6.6 percent this week, the most since January 2009.

Earlier, the metal reached $1,754, the highest since Sept. 23. European leaders agreed on new measures to tackle the region’s debt crisis yesterday.

Oil futures fell, paring the biggest weekly gain since March, as a drop in Japan’s industrial output prompted traders to lock in profits from yesterday’s rally.

Japan’s industrial production declined last month for the first time since the March earthquake, the country’s trade ministry data showed. The drop was bigger than all 28 forecasts of economists. Output had risen since April as companies made up for orders disrupted by the disaster. Japan is the world’s third-largest oil consumer after the U.S. and China, using 4.45 million barrels a day in 2010, according to the BP Statistical Review.

Crude for December delivery declined to $92.01 a barrel on the New York Mercantile Exchange.

Brent oil for December settlement slid $1.65, or 1.5 percent, to $110.43 a barrel on the London-based ICE Futures Europe exchange.

current conds 75.1 vs 73.8p

expectations 51.8 vs 47.0p

1y infl expectation 3.2%, 5y 2.7%

EUR/USD $1.4200, $1.4175, $1.4165, $1.4100, $1.4050, $1.4000, $1.3980, $1.3925

USD/JPY Y76.00, Y77.00

AUD/USD $1.0550, $1.0630, $1.0700

USD/CHF Chf0.8825, Chf0.9000

GBP/USD $1.6100$1.5800

EUR/JPY Y105.45

U.S. stock futures fell as scrutiny deepens on Europe’s latest measures to contain the region’s sovereign debt crisis.

Stock-futures maintained losses even as a report showed that consumer spending in the U.S. accelerated in September, helping the world’s largest economy skirt a recession. Purchases increased 0.6 percent, matching the median estimate of economists, after a 0.2 percent gain the prior month, Commerce Department figures showed today in Washington. Incomes rose less than projected, sending the savings rate down to the lowest level in almost four years.

Stocks rose yesterday as European leaders agreed to expand a bailout fund and American economic growth accelerated.

World Markets: Nikkei +1.39%, Hang Seng +1.68%, Shanghai Composite +1.55%, FTSE -0.17%, CAC -0.42%, DAX -0.08%.

06:45 France Consumer spending (September) -0.5%

06:45 France Consumer spending (September) Y/Y -1.3%

The euro fell against the dollar as Italy sold less than its maximum target at an auction today, reviving concern the region’s debt crisis has further to run.

The Treasury in Rome sold 7.93 billion euros ($11.2 billion), less than the maximum 8.5 billion-euro target, of four different bonds today. The yield on Italy’s benchmark 10-year bond rose 11 basis points, or 0.11 percentage point, to 5.98 percent after the auction.

Europe’s currency fell from a seven-week high reached yesterday after leaders announced a plan to prevent a Greek default, safeguard banks and stem contagion.

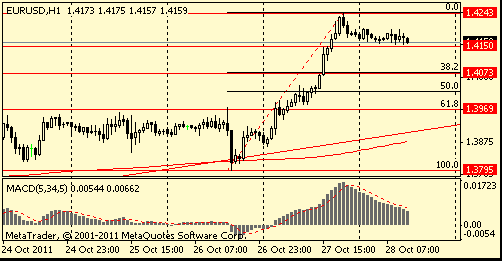

EUR/USD: the pair holds in $1,4150-$ 1,4200.

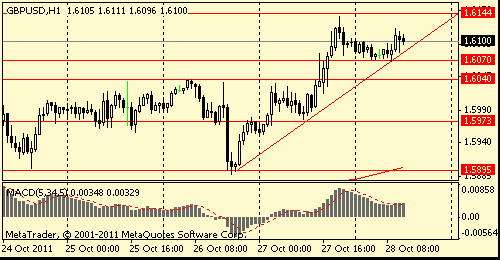

GBP/USD: the pair grown in $1,6100 area.

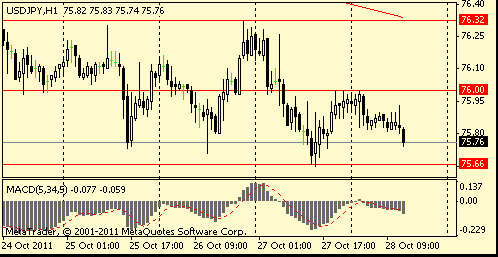

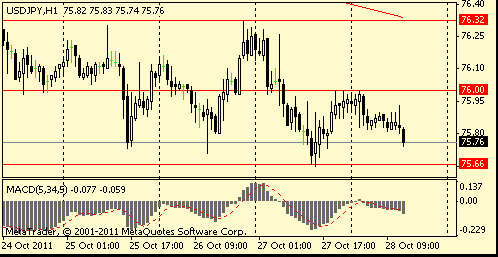

USD/JPY: the pair fell in Y75,70 area.

US data starts at 1230GMT with Personal Income & Expenditures data as well as the Employment Cost Index. Personal income is expected to rise 0.4% in September, as payrolls rose 103,000, hourly earnings rose 0.2% and the average workweek rose to 34.3 hours. PCE is forecast to rise 0.6%. Retail sales rose 1.1% in the month, and were up 0.6% excluding motor vehicle sales. The core PCE price index is expected to rise 0.1%. The Employment Cost Index is expected to rise 0.6% in the third quarter after the 0.7% rise in the second quarter. At 1355GMT, the Michigan Sentiment Index is expected to be revised up to a reading of 58.0 in October from the preliminary estimate of 57.5.

EUR/USD

Orders $1.4285/90, $1.4240/50, $1.4195/200

Bids $1.4140, $1.4120/10, $1.4100, $1.4090/70

Resistance 3: Y76.60/70 (earlier support, area of Oct 17-20 lows)

Resistance 2: Y76.30 (Oct 25-27 highs, МА (200) for Н1)

Resistance 1: Y76.00 (session high)

Current price: Y75.75

Support 1:Y75.65 (historical low)

Support 2:Y75.50 (psychological mark)

Support 3:Y75.00 (psychological mark)

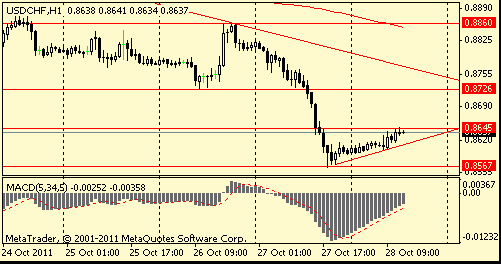

Resistance 2: Chf0.8730 (Oct 26 low)

Resistance 1: Chf0.8650 (session high)

Current price: Chf0.8637

Support 1: Chf0.8620 (support line from Oct 27)

Support 2: Chf0.8570 (Oct 27 low)

Support 3: Chf0.8530 (Sep 7 low)

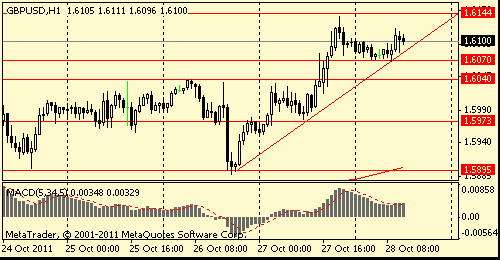

Resistance 2: $ 1.6200 (Sep 6 high)

Resistance 1: $ 1.6140 (МА(200) for D1, Oct 27 high)

Current price: $1.6100

Support 1 : $1.6090/70 (support line from Oct 26, session low)

Support 2 : $1.6040 (earlier resistance, Oct 26 high)

Support 2 : $1.5970 (low of european session on Oct 27)

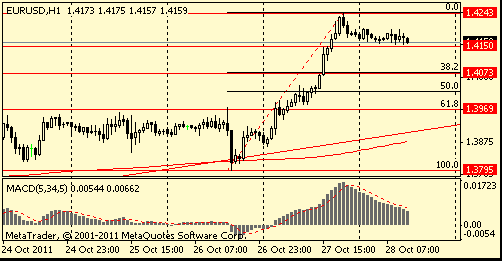

Resistance 2: $ 1.4280 (Sep 6 high)

Resistance 1: $ 1.4240 (Oct 27 high)

Current price: $1.4160

Support 1 : $1.4150 (session low)

Support 2 : $1.4070 (38,2 % FIBO $1,3795-$ 1,4240)

Support 1 : $1.3960/70 (earlier resistance, area of Oct 24-26 high, 61,8 % FIBO $1,3795-$ 1,4240)

Currently FTSE 5,721 +7.66 +0.13%, CAC 3,368 -0.72 -0.02%, DAX 6,359 +21.35 +0.34%.

European stocks corrected after yesterday’s growth. The region’s debt deal and results from some companies reassured investors that the global recovery is intact.

EUR/USD $1.4200, $1.4175, $1.4165, $1.4100, $1.4050, $1.4000, $1.3980, $1.3925

USD/JPY Y76.00, Y77.00

AUD/USD $1.0550, $1.0630, $1.0700

USD/CHF Chf0.8825, Chf0.9000

GBP/USD $1.6100$1.5800

EUR/JPY Y105.45

Hang Seng 120,018 +329.18 +1.67%

S&P/ASX 4,353 +5.09 +0.12%

Shanghai Composite 2,473 +37.80 +1.55%

23:30 Japan National Consumer Price Index, y/y September 0.0%

23:30 Japan National CPI Ex-Fresh Food, y/y September -0.4%

23:30 Japan Tokyo-area CPI October +0.2%

23:30 Japan Tokyo Consumer Price Index, y/y October -0.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y October -0.4%

23:30 Japan Household spending Y/Y September -1.9%

23:30 Japan Unemployment Rate September +4.1%

23:50 Japan Industrial Production (MoM) September -4.0%

23:50 Japan Industrial Production (YoY) September -4.0%

The yen appreciated against 13 of its 16 most-traded counterparts as expectations Japan will intervene to weaken its currency faded even after it rose to a record for the fourth time in five days this week. Japanese Finance Minister Jun Azumi reiterated today that he will take “bold” action against the strong yen if needed.

Canada’s dollar rose through par with the greenback after European leaders agreed to steps for checking the region’s debt crisis, sparking a risk-asset rally.The currency rose to the highest versus the greenback in more than a month, headed for the biggest two-day gain since May 2010, as the U.S. economy grew in the third quarter at the fastest pace in a year. Canada’s dollar fell relative to most of its major counterparts after the Bank of Canada cut its forecast this week for the nation’s economic growth.

EUR/USD: on Asian session the pair gain and showed new week’s high.

GBP/USD: on Asian session the pair advanced, but receded from week’s high.

USD/JPY: on Asian session the pair is under pressure.

On Friday US data starts at 1230GMT with Personal Income & Expenditures data as well as the Employment Cost Index.At 1355GMT, the Michigan Sentiment Index is expected to be revised up to a reading of 58.0 in October from the preliminary estimate of 57.5.

The yen rose to a record versus the dollar for the fourth time in five days day on speculation Bank of Japan measures announced today will fail to contain the currency’s rally. The yen strengthened even after the Bank of Japan expanded its credit and asset-purchase programs to a total of 55 trillion yen ($724 billion) from 50 trillion yen to damp the currency’s appreciation, which harms exporters.

The pound fell to a seven-week low against the euro after European Union leaders agreed to expand a rescue fund for indebted nations, damping demand for the perceived safety of the British currency. Sterling weakened versus all but three of its 16 major counterparts as Bank of England Markets Director Paul Fisher said the U.K. economy may be shrinking. Gilts declined after EU leaders meeting in Brussels yesterday said their plan points the way out of the sovereign debt crisis, reducing appetite for safer assets. U.K and European stocks gained.

EUR/USD: yesterday the pair gain to a seven-week high.

GBP/USD: yesterday the pair advanced.

USD/JPY: yesterday the pair showed new historical low, but restored later.

On Friday US data starts at 1230GMT with Personal Income & Expenditures data as well as the Employment Cost Index.At 1355GMT, the Michigan Sentiment Index is expected to be revised up to a reading of 58.0 in October from the preliminary estimate of 57.5.

Asian stocks rose, sending the benchmark index toward the highest close in almost eight weeks, after European leaders made a breakthrough in resolving the debt crisis and Chinese stocks surged on speculation the country may ease monetary policy. Asian stocks extended gains after the second summit in four days delivered a plan that the region’s leaders say points the way out of the sovereign-debt crisis, even if key details are lacking. Brokerages including Guotai Junan Securities Co., Mizuho Securities Asia Ltd. and Barclays Plc. said China may cut banks’ reserve requirements before the end of this year.

Australia’s S&P/ASX 200 jumped 2.5 percent after trading resumed at 2 p.m. in Sydney. Traders in Australia were unable to react to the European news for four hours because the market was halted by a technical glitch five minutes after the open. Japan’s Nikkei 225 Stock Average added 2 percent.

Asian exporters and banks gained, with Esprit Holdings advanced 6.8 percent to HK$12.02. Sony Corp., Japan’s No. 1 exporter of consumer electronics, rose 5.4 percent to 1,650 yen. Nissan Motor Co., Japan’s third-largest carmaker by market value, gained 4.2 percent to 719 yen.

Sumitomo Mitsui Financial Group Inc., Japan’s second- biggest lender, rose 5.1 percent to 2,234 yen. HSBC Holdings Plc, Europe’s biggest lender, gained 2.4 percent to HK$67.30. Commonwealth Bank of Australia, Australia’s biggest lender by market value, rose 1.8 percent to A$49.99.

Chinese property shares traded in Hong Kong surged on speculation the mainland’s will ease monetary policies to boost the economy. China Overseas Land & Investment soared 12 percent to HK$14.70. China Resources Land Ltd., also a state-controlled developer, jumped 14 percent. The stock was raised to “buy” from “hold” at BNP Paribas SA.

China may cut banks’ reserve requirements before the end of this year to stoke lending to small companies and boost the economy, according to Guotai Junan, Mizuho and Barclays.

Industrial & Commercial Bank of China Ltd. and China Construction Bank Corp. rose at least 4.6 percent.

U.S. durable goods excluding transportation equipment rose in September by the most in six months. Another report showed purchases of new houses increased more than forecast in September as discounted prices lured buyers in some parts of the country.

Machinery makers advanced. Komatsu added 4 percent to 1,916 yen, and Fanuc Corp., Japan’s No. 1 maker of controls used to run machine tools, added 4.6 percent to 13,080 yen.

Olympus Corp., an optical-equipment maker, surged 23 percent, the most since at least 1974, to 1,355 yen after company Chairman and President Tsuyoshi Kikukawa resigned yesterday amid a scandal related to $687 million in fees paid by the company during a $2 billion takeover of Gyrus Group Ltd. in 2008.

European stocks rallied to the highest in 12 weeks after the region’s leaders agreed to expand a bailout fund to halt the sovereign debt crisis. European leaders persuaded bondholders to take 50 percent losses on Greek debt and resolved to increase the size of the rescue fund, responding to global pressure to step up the fight against the financial crisis. The euro area’s stewards said the plan points the way out of the debt quagmire, even if key details are lacking. Last- ditch talks with bank representatives led to the debt-relief accord, in an effort to quarantine Greece and prevent speculation against Italy and France from ravaging the euro area and wreaking global economic havoc. Measures include recapitalization of European banks, a potentially bigger role for the International Monetary Fund, a commitment from Italy to do more to reduce its debt and a signal from leaders that the European Central Bank will maintain bond purchases in the secondary market.

The U.S. economy grew in the third quarter at the fastest pace in a year as gains in consumer spending and business investment helped support a recovery on the brink of faltering. Gross domestic product rose at a 2.5 percent annual rate, matching the median forecast of economists surveyed by Bloomberg News and up from a 1.3 percent gain in the prior quarter, Commerce Department figures showed today in Washington. Household purchases, the biggest part of the economy, increased at a more-than-projected 2.4 percent pace.

National benchmark indexes gained in all of the 18 western European markets. Germany’s DAX jumped 5.4 percent, its biggest increase since April 2009. France’s CAC 40 climbed 6.3 percent and the U.K.’s FTSE 100 rose 2.9 percent.

BNP Paribas SA, France’s biggest bank, and Deutsche Bank AG, Germany’s largest, surged at least 15 percent as policy makers decided to boost the firepower of the European rescue fund to 1 trillion euros ($1.4 trillion). Societe Generale SA, France’s second-largest lender, jumped 23 percent to 23 euros. The bank said it will meet mid-2012 capital requirements “through its own means.” Credit Agricole SA, France’s third-biggest bank, soared 22 percent to 5.94 euros, its largest advance since September 2008.

National Bank of Greece SA, the country’s biggest lender, surged 6.1 percent to 1.91 euros. Alpha Bank SA soared 3.9 percent to 1.08 euros. EFG Eurobank Ergasias increased 7 percent to 76 euro cents. Greek Prime Minister George Papandreou said the government may buy shares in some Greek banks as a result of the planned writedown of the country’s debt and the European accord to recapitalize lenders. Papandreou didn’t give any details on the banks that would be targeted in any nationalization program or the size of any potential shareholdings.

Michelin & Cie. jumped 5.1 percent to 54.94 euros. The world’s second-largest tiremaker said third-quarter revenue rose 11 percent to 5.14 billion euros, spurred by a rebound in demand from U.S. automakers and strong sales of its winter tires in Europe.

Daimler AG added 3.1 percent to 39.07 euros. The world’s third-largest maker of luxury vehicles advanced after predicting higher fourth-quarter profit on gains at its trucks and vans divisions.

Logitech International SA, the world’s largest maker of computer mice, rallied 16 percent to 8.94 Swiss francs, its biggest increase since October 2007. The company confirmed its full-year guidance after three profit warnings in the past seven months.

U.S. stocks rose, extending the biggest monthly rally since 1974 for the Standard & Poor’s 500 Index, as European leaders agreed to expand a bailout fund to $1.4 trillion and American economic growth accelerated. Global stocks rallied as European leaders cajoled bondholders into accepting 50 percent writedowns on Greek debt and boosted their rescue fund’s capacity to 1 trillion euros ($1.4 trillion) in a crisis-fighting package intended to shield the euro area. Measures include recapitalization of European banks, a potentially bigger role for the International Monetary Fund, a commitment from Italy to do more to reduce its debt and a signal from leaders that the European Central Bank will maintain bond purchases in the secondary market.

Stocks also rose after the U.S. economy grew in the third quarter at the fastest pace in a year as gains in consumer spending and business investment helped support a recovery on the brink of faltering. Separate data showed that fewer Americans filed applications for unemployment assistance last week, while those on benefit rolls dropped to a three-year low, signaling limited improvement in the labor market. The number of contracts to purchase previously owned U.S. homes unexpectedly fell in September as lower prices and borrowing costs failed to support demand, according to another report.

The Dow Jones Transportation Average, a proxy for the economy, jumped 4.5 percent. The index extended its October rally to 20 percent and is poised for its best monthly gain since 1939. Bank of America Corp. (BAC) and JPMorgan Chase & Co. (JPM) advanced at least 8.3 percent, following gains in European lenders. Alcoa Inc. (AA) and General Electric Co. (GE) climbed more than 6.2 percent to pace gains in companies most-dependent on economic growth.

A gauge of financial stocks in the S&P 500 jumped 6.2 percent today as all 81 of its companies rose. It has rebounded 25 percent from a two-year low on Oct. 3, entering a bull market.Akamai Technologies Inc. climbed 15 percent to $27.45. The company, whose server network lets businesses speed data delivery, forecast fourth-quarter sales that topped some analysts’ estimates.

Aflac Inc. jumped 8.7 percent to $46.77. The health insurer that gets more than 70 percent of its sales in Japan said third- quarter profit rose 7.8 percent as the yen strengthened against the dollar.

Avon Products Inc. tumbled 18 percent, the most in the S&P 500, to $18.81. The door-to-door cosmetics merchant said the U.S. Securities and Exchange Commission is investigating the company’s contacts with financial analysts. The company also reported profit that missed analysts estimates.

Resistance 3: Y77.10 (Oct 20 high)

Resistance 2: Y76.50 (50.0 % FIBO Y75.65-Y77.45)

Resistance 1: Y76.00 (session high)

The current price: Y75.87

Support 1:Y75.65 (Oct 27 low)

Support 2: Y75.30 (138.2 % FIBO Y75.80-Y77.10)

Support 3: Y75.00 (psychological mark)

Comments: the pair is on downtrend.

Resistance 3: Chf0.8745 (61.8 % FIBO $0.8565-$ 0.8855)

Resistance 2: Chf0.8680 (38.2 % FIBO $0.8565-$ 0.8855)

Resistance 1: Chf0.8635 (23.6 % FIBO $0.8565-$ 0.8855)

The current price: Chf0.8613

Support 1: Chf0.8565 (Oct 27 low)

Support 2: Chf0.8465 (May 27-31 low)

Support 3: Chf0.8380 (Jun 1 low)

Comments: the pair is on downtrend. In focus support Chf0.8565.

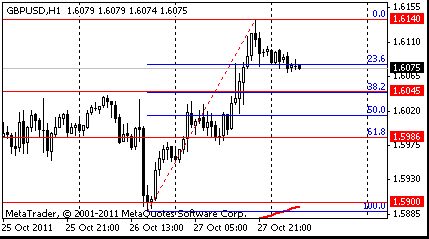

Resistance 3 : $1.6255 (Sep 2 high)

Resistance 2 : $1.6200 (Sep 6 high)

Resistance 1 : $1.6140 (Oct 27 high)

The current price: $1.6080

Support 1 : $1.6045 (38.2 % FIBO $1.6140-$ 1.5890)

Support 2 : $1.5985 (61.8 % FIBO $1.6140-$ 1.5890)

Support 3 : $1.5900 (MA (233) H1)

Comments: the pair is uptrend. In focus resistance $1.6140.

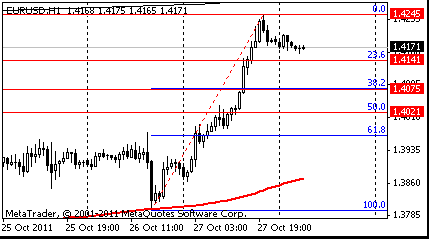

Resistance 3 : $1.4345 (resistance line from May 4 (D1))

Resistance 2 : $1.4280 (support line from Jun 7’2010 (D1))

Resistance 1 : $1.4245 (Oct 27 high)

The current price: $1.4171

Support 1 : $1.4140 (23.6 % FIBO $1.4245-$ 1.3800)

Support 2 : $1.4075 (38.2 % FIBO $1.4245-$ 1.3800)

Support 3 : $1.4020 (50.0 % FIBO $1.4245-$ 1.3800)

Comments: the pair is on uptrend. In focus resistance $1.4245.

Change % Change Last

Nikkei 225 8,927 +178.07 +2.04%

Hang Seng 19,689 +622.16 +3.26%

S&P/ASX 200 4,348 +105.70 +2.49%Shanghai Composite 2,436 +8.13 +0.34%

FTSE 100 5,714 +160.58 +2.89%

CAC 40 3,369 +199.00 +6.28%

DAX 6,338 +321.77 +5.35%

Dow 12,208.55 +339.51 +2.86%

Nasdaq 2,738.63 +87.96 +3.32%

S&P 500 1,284.59 +42.59 +3.43%

10 Year Yield 2.40% +0.19 --

Oil $93.82 -0.14 -0.15%

Gold $1,744.80 -2.90 -0.17%

06:45 France Consumer spending September +0.2% +0.1%

06:45 France Consumer spending, y/y September +0.3% -0.7%

09:30 Switzerland KOF Leading Indicator October 1.21 1.01

12:30 U.S. Personal Income, m/m September -0.1% +0.3%

12:30 U.S. Personal spending September +0.2% +0.6%

12:30 U.S. PCE price index ex food, energy, m/m September +0.1% +0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y September +1.6%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Final) October 57.5 58.2

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.