- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-10-2011

In Canada, the economic expansion is proceeding largely as projected, although the expected rotation of demand is somewhat slower than had been anticipated. Household spending remains solid and business investment robust.

Net exports remain weak, reflecting modest U.S. demand and ongoing competitiveness challenges, particularly the persistent strength of the Canadian dollar.

Despite increased global risk aversion, financial conditions in Canada remain very stimulative and private credit growth is strong.

The euro fell versus the dollar and yen after reports that talks on bondholder losses of Greek debt were deadlocked added to concern efforts to remedy the European crisis are stalling. The European Union is seeking voluntary participation by banks in a second bailout package for Greece, though a forced solution can’t be ruled out, an EU official said in Brussels today on condition of anonymity because the talks are private. The dispute centers on how much of the risk of any newly issued Greek bonds should be insured, the official said. The 17-nation euro earlier touched the strongest in more than six weeks on news Germany’s lower house of parliament voted to expand the region’s bailout. Germany’s lower house of parliament approved a plan to increase the capacity of the European bailout fund, sending Chancellor Angela Merkel to Brussels with a mandate to clinch a plan to enhance the European Financial Stability Facility.

The yen reached a post-World War II high versus the dollar and gained against most of its most-traded counterparts, even as Finance Minister Jun Azumi ordered staffers to be prepared to take action against the currency gains. Bank of Japan officials will discuss more monetary easing at a meeting tomorrow, the Nikkei newspaper reported. Measures to mitigate the impact of the strong yen on Japan’s economy may include expanding a 50-trillion yen ($660 billion) asset purchase program by 5 trillion yen and purchasing bonds with maturities longer than two years, the Nikkei said without citing anyone.

Canada’s dollar was the best performer against the euro as U.S. durable goods orders were stronger than expected. Orders for U.S. durable goods excluding transportation equipment rose in September by the most in six months, showing manufacturing is supporting the expansion. Demand for goods meant to last at least three years, outside of airplanes and automobiles, climbed 1.7 percent, figures from the Commerce Department showed today in Washington. The U.S. is the largest trading partner of Canada

The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, rose 0.4 percent to 76.52 after earlier falling 0.4 percent to the lowest in six weeks.

The pound snapped five days of gains against the dollar as waning confidence in the euro-area and business optimism plunged to the lowest level in 2 1/2 years. The pound was 0.6 percent weaker at $1.5909 and was little changed against the shared currency at 86.92 pence per euro.

European stocks advanced as the region’s leaders gathered in Brussels for the second summit in four days to address the debt crisis and after U.S. durable- goods orders and home sales topped forecasts. European leaders are meeting in Brussels for the 14th crisis summit in 21 months to discuss Greece’s second bailout, the recapitalization of banks and strengthening the 440 billion- euro ($612 billion) rescue fund into a more potent weapon. German lawmakers backed increasing the bailout fund’s capacity today, removing one hurdle in the path of a regional agreement. EU leaders may ask national finance ministers to determine the firepower of the expanded European Financial Stability Facility by the end of November, an EU official said. In the U.S., orders for durable goods excluding transportation equipment rose in September by the most in six months, showing manufacturing is supporting the expansion. Purchases of new houses gained more than forecast as discounted prices lured buyers in some parts of the country.

National benchmark indexes climbed in 10 of the 18 western European markets. The U.K.’s FTSE 100 rose 0.5 percent, while Germany’s DAX declined 0.5 percent and France’s CAC 40 slipped 0.2 percent.

Merck KGaA advanced 8.5 percent to 65.07 euros, the biggest gain since January 2009. The German maker of cancer drug Erbitux reported third-quarter profit that beat analysts’ estimates because of growth at the Merck Serono pharmaceutical and Millipore equipment businesses.

Pandora, the Danish jewelry maker that plunged 65 percent on Aug. 2 after cutting its full-year forecast, advanced 12 percent to 47.90 kroner. About 8.6 percent of Pandora shares are on loan, an indication of short-sellers’ interest, according to research firm Data Explorers.

Telenor ASA climbed 5.3 percent to 97.40 kroner as the largest phone company in the Nordic region boosted its outlook for full-year sales and profitability after third-quarter earnings increased.

Nyrstar declined 8.5 percent to 6.14 euros in Brussels, the biggest drop in two months. The zinc producer lowered its forecast for output from mines because of lower-than-expected deliveries from Talvivaara Mining Co.’s Finnish site, where it has an offtake agreement.

Adidas AG, the world’s second-biggest sporting goods maker, slid 3 percent to 49.68 euros as Morgan Stanley cut its recommendation on the shares to “equal weight” from “overweight.” The brokerage said the company faces an increase in costs as it expands, while a slowdown in China is a “potential risk” to momentum.

Areva SA declined 3.2 percent 21.38 euros as the world’s largest builder of atomic plants said its FBFC International subsidiary may progressively close its nuclear fuel fabrication site in Dessel, Belgium, citing overcapacities on western European markets.

U.S. stocks rose and fall as better-than-forecast economic reports offset concern that European debt-crisis talks were stalling. Stocks erased gains as a European Union official said EU leaders may ask national finance ministers to determine the capacity of the expanded European Financial Stability Facility by the end of November. The leaders meet in Brussels today and will back two EFSF leveraging options set out last week, the official said on condition of anonymity because the meeting hasn’t taken place yet. Earlier today, Germany’s lower house of parliament approved a plan to increase the capacity of the European bailout fund. European leaders hold the 14th crisis summit in 21 months today to discuss the Greek bailout, shoring up banks and strengthening the 440 billion-euro ($613 billion) rescue fund.

Stock futures extended gains as orders for U.S. durable goods excluding transportation equipment rose in September by the most in six months. A separate report showed purchases of new houses increased more than forecast in September as discounted prices lured buyers in some parts of the country.

Dow 11,752.79 +46.17 +0.39%, Nasdaq 2,625.61 -12.81 -0.49%, S&P 500 1,229.70 +0.65 +0.05%

Financial stocks in the S&P 500 rose 0.9 percent, the most among 10 industry groups, after dropping as much as 0.1 percent.

Boeing (ВА) gained 4.3 percent to $66.45. The company topped profit estimates for the quarter when it delivered the first 787 Dreamliner and said the new model’s production costs will be spread over 1,100 planes, matching analysts’ projections.

Amazon.com tumbled 12 percent to $200.96. The company is sacrificing profit margins in search of sales volume and market- share gains. Amazon will sell its Kindle Fire tablet for as low as $199, less than half the price of Apple Inc.’s cheapest iPad.

Ford Motor Co. dropped 5.6 percent to $11.73. The company said its automotive operating profit margin may fall this year to 5.7 percent from 6.1 percent last year and 6.5 percent in the first nine months of the year, primarily because of a loss on commodity hedges.

MetLife Inc. slumped 1.4 percent to $32.37. The largest U.S. life insurer said its plan to increase the dividend and resume share repurchases was rejected by the Federal Reserve. “We are disappointed that we cannot commence increased capital actions now,” Chief Executive Officer Steven Kandarian said in a statement yesterday.

Gold futures advanced above $1,700 an ounce to a one-month high as concerns about Europe’s debt crisis spurred demand for the metal as a protection of wealth.

European Union talks with banks on bondholder losses as part of a second Greek rescue package are deadlocked, an EU official said on condition of anonymity. European leaders hold a summit today in a bid to reach agreement on measures to solve what U.S. Treasury Secretary Timothy F. Geithner called the “catastrophic risk” posed by the turmoil. Gold exchange-traded product

Gold for December delivery gained as much as $25.20, or 1.5 percent, to $1,725.60 an ounce, the highest price since Sept. 23, and now at $1,720.50 on the Comex in New York.

Oil traded near its highest in 12 weeks in New York on speculation China’s government will boost the economy of the world’s second-biggest crude consumer, while European leaders prepared to tackle the region’s debt crisis. Prices gained as much as 0.8 percent after China’s industry ministry said it is studying “stimulative policies” for smaller companies.

Crude oil for December delivery was at $93.56 a barrel, up 39 cents, in electronic trading on the New York Mercantile Exchange at 1:07 p.m. London time. The contract yesterday increased 2.1 percent to $93.17, the highest settlement since Aug. 2. Prices are up 2.4 percent this year.

Demand seen into Y75.70 with reported postal bids, stops set on a break.

USD/JPY Y75.80, Y75.85, Y76.10, Y76.25, Y76.30, Y77.00. Y74.70

GBP/USD $1.6000, $1.5850, $1.5600

EUR/JPY Y110.20

Global stocks swung between gains and losses as European leaders hold the crisis summit today to discuss Greece’s second bailout, shoring up banks and strengthening the 440 billion-euro ($613 billion) rescue fund.

10:00 UK CBI industrial order books balance (October) -18

The yen rose to a post-World War II high versus the dollar as concern U.S. growth is slowing and European leaders will fail to resolve the region’s debt crisis boosted demand for the safety of Japan’s currency.

The dollar dropped before U.S. reports that economists said will show durable goods orders fell in September and new-home sales stagnated, adding to speculation policy makers will resume asset purchases.

Europe’s summit today comes after six days of haggling among finance ministers, central and commercial bankers, chancellors, presidents and prime ministers over the shape of a second bailout for Greece, the recapitalization of banks and the retooling of the 440 billion-euro bailout fund into a more potent weapon.

EUR/USD: the pair was consolidated in $1,3950 area.

GBP/USD: the pair showed high in $1,6040 area then decreased.

USD/JPY: the pair updated a historical low, reached Y75,70 and grown later.

The main focus for Wednesday will continue to be the EU Summit.

US data starts at 1100GMT with the weekly MBA Mortgage Application Index. At 1230GMT, durable goods orders are expected to fall 0.7% after the 0.1% decline in August. Boeing reported 59 aircraft orders in the month, down sharply from 127 orders in August. At 1400GMT, new homes sales are expected to rise slightly to a 300,000 annual rate after four straight declines. The weekly EIA Crude Oil Stocks data is due at 1430GMT.

EUR/USD

Offers $1.4065, $1.4025/50, $1.4000, $1.3970/75

Bids $1.3860/50, $1.3840, $1.3820, $1.3820/790

Resistance 3: Y77.10 (Okt 20 high)

Resistance 2: Y76.50 (Oct 24 high)

Resistance 1: Y76.00 (resistance line from Oct 24)

Current price: Y75.86

Support 1:Y75.70 (historical low)

Support 2:Y75.50 (psychological mark)

Support 3:Y75.00 (psychological mark)

Комментарии: дальнейшее снижение пары повышает шансы вмешательства правительства Японии на валютный рынок с целью ограничить рост национальной валюты.

Resistance 2: Chf0.8850 (Oct 25 high)

Resistance 1: Chf0.8790 (session high)

Current price: Chf0.8744

Support 1: Chf0.8730 (session low)

Support 2: Chf0.8700/680 (38.2 % FIBO Chf0,7700-Chf0,9310, the bottom border of the down channel from Oct 6)

Support 3: Chf0.8640 (Sep 15 low)

Resistance 2: $ 1.6100 (61,8 % FIBO $1,6620-$ 1,5270)

Resistance 1: $ 1.6040 (session high)

Current price: $1.5985

Support 1 : $1.5960 (Oct 25 low)

Support 2 : $1.5900 (Oct 24 low)

Support 3 : $1.5850 (earlier resistance, Oct 14, 17 and 19 highs)

Resistance 2: $ 1.4090 (МА(200) and МА (100) for D1)

Resistance 1: $ 1.3950 (area of session high and Oct 24-25 highs)

Current price: $1.3920

Support 1 : $1.3890 (session low)

Support 2 : $1.3850/20 (area of Oct 24-25 lows, support line from Oct 4 and МА (200))

Support 3 : $1.3700 (Oct 20 low)

European stocks fluctuated as the region’s leaders prepared to gather in Brussels for the second summit in four days to address the debt crisis.

Currently FTSE 5,528 +2.19 +0.04%, CAC 3,173 -1.34 -0.04%, DAX 6,040 -7.12 -0.12%.

- Germany EFSF contribution won't exceed E211bln.

- Germany EFSF contribution won't exceed E211bln.

- ECB continues to ensure banks not liquidity-constrained;

- all ECB non-standard measures are temporary.

USD/JPY Y75.80, Y75.85, Y76.10, Y76.25, Y76.30, Y77.00. Y74.70

GBP/USD $1.6000, $1.5850, $1.5600

EUR/JPY Y110.20

Hang Seng 18,972 +3.93 +0.02%

S&P/ASX 4,243 +14.62 +0.35%

Shanghai Composite 2,428 +18.66 +0.77%

00:00 New Zealand NBNZ Business Confidence October 13.2

00:30 Australia CPI, q/q Quarter III +0.6%

00:30 Australia CPI, y/y Quarter III +3.5%

The yen held gains after Europe’s debt turmoil spurred demand for refuge, boosting the currency to a post-World War II record versus the dollar yesterday. The Japanese currency traded 0.3 percent from the high after Finance Minister Jun Azumi said today his ministry will take “decisive” measures to stem the yen’s rise.

The euro holds in range before European Union leaders will hold an emergency summit today in a bid to reach agreement on measures to solve the region’s debt crisis.

The Australian dollar declined for a second day against its U.S. counterpart after a report showing slower growth in consumer prices fueled speculation that the Reserve Bank will cut interest rates.

New Zealand’s dollar held losses against the yen from yesterday after a private report showed business confidence declined in October.

EUR/USD: on Asian session the pair holds in range $1.3890-$1.3930.

GBP/USD: on Asian session the pair advanced and showed new week’s high.

USD/JPY: on Asian session the pair is under pressure.

The main focus for Wednesday will continue to be the EU Summit, although European data starts at 0645GMT. In the UK, the CBI Industrial Trends Survey is due. The manufacturers' order book balance fell sharply in September to -9 from 1 in August and analysts' median forecast is for a further decline in October to -11. At 1230GMT, durable goods orders are expected to fall 0.7% after the 0.1% decline in August. The weekly EIA Crude Oil Stocks data is due at 1430GMT.

Asian stocks swung between gains and losses as investors await the results of a European summit tomorrow where leaders are expected to hammer out details on enhancing the region’s bailout fund. German Chancellor Angela Merkel and fellow European leaders will meet in Brussels tomorrow for a second summit in four days to find ways to enhance the firepower of a regional rescue fund. European leaders are still negotiating with banks over the size of losses they take on Greek bonds while deliberating over whether the region’s rescue fund will guarantee losses for banks that lend to debt-stricken countries in the region.

Japan’s Nikkei 225 Stock Average fell 0.9 percent today, while South Korea’s Kospi Index lost 0.5 percent. Australia’s S&P/ASX 200 slipped 0.6 percent. Hong Kong’s Hang Seng Index rose 1.1 percent after a late surge.

Asian exporters to Europe fell. Esprit Holdings lost 3.2 percent to HK$10.42. Canon Inc., second only to Nippon Sheet Glass Co. on the benchmark Nikkei 225 Stock Average in percentage of revenue generated in Europe, slid 1.8 percent to 3,490 yen. Mazda Motor Corp., the Japanese carmaker that gets 18 percent of sales from Europe, declined 3.1 percent to 157 yen.

NGK Insulators plunged in Tokyo trading after the Nikkei newspaper reported the company asked customers not to use some of its batteries following a fire at a Mitsubishi Materials plant. The stock slid 17 percent to 926 yen after slumping as much as 27 percent, the biggest drop since at least 1974.

Makers of building equipment rose today after Caterpillar topped earnings estimates. Komatsu rose 3.1 percent to 1,833 yen, while Hitachi Construction Machinery Co. gained 2.7 percent 1,433 yen. Kubota Corp. increased 1.6 percent to 635 yen.

Energy firms advanced after crude oil prices increased. Cnooc rose 5.4 percent to HK$14.42 in Hong Kong. Inpex Corp., Japan’s biggest energy explorer, climbed 1.9 percent to 528,000 yen in Tokyo.

European stocks slid from an 11-week high as canceled finance ministers’ meeting fueled concern that the region’s leaders may struggle to resolve the debt crisis at a summit tomorrow. Chancellor Angela Merkel and fellow leaders return to Brussels tomorrow for a second summit in four days to discuss Europe’s bailout fund. Policy makers are jousting with banks over the size of losses they take on Greek bonds while deliberating over leveraging the fund after ruling out tapping the European Central Bank’s balance sheet. Stocks extended losses after the U.K. government said a meeting of EU finance ministers scheduled for tomorrow to decide on bank recapitalization was canceled. They pared some of their decline as it was confirmed that summits of the 27 EU leaders and 17 euro-area heads of government will take place in Brussels as planned. The gathering of finance ministers was canceled because the bank-recapitalization issue cannot be decided before other elements of the rescue package, a person familiar with the matter said on condition of anonymity.

National benchmark indexes fell in 15 of the 18 western European markets today. The U.K.’s FTSE 100 declined 0.4 percent and France’s CAC 40 retreated 1.4 percent. Germany’s DAX Index slipped 0.1 percent.

STMicroelectronics tumbled 7.4 percent to 5.06 euros in Milan after saying net revenue will range from $2.15 billion to $2.3 billion. That compared with an average analyst estimate of $2.52 billion, according to Bloomberg data. Forecasts for gross margin, the percentage of sales remaining after costs of production, were also below projections.

Meyer Burger lost 13 percent to 20.55 Swiss francs as Europe’s biggest solar-panel equipment maker said it will temporarily halt output at its MB Wafertec unit in Switzerland amid “high uncertainties” in the solar industry.

Reckitt Benckiser Group Plc retreated 3.4 percent to 3,330 pence, the biggest drop in a month. The maker of Lysol cleaners forecast lower sales and profit at its pharmaceutical division in the fourth quarter because of U.S. health-care reforms and a price increase for Suboxone tablets.

Novartis AG, Europe’s second-biggest pharmaceutical company, lost 3.3 percent to 50.10 francs after saying it plans to eliminate 2,000 jobs in Switzerland and the U.S. and add employees in China and India to offset the effect of drug-price reductions.

BP, the operator of the Macondo well in the Gulf of Mexico that caused the worst accidental U.S. oil spill last year, climbed 4.4 percent to 457.2 pence as profit beat analysts’ estimates. Earnings adjusted for one-time items and changes in inventory were $5.3 billion, down from $5.5 billion a year earlier. The average estimate of 12 analysts surveyed by Bloomberg was for income of $5 billion on that basis.

BG Group rose 3.8 percent to 1,378 pence. The U.K.’s third- largest natural-gas producer said third-quarter earnings rose 25 percent as energy-price gains countered output constraints.

Neste Oil Oyj surged 13 percent to 9.06 euros, the biggest gain since 2008. Finland’s only oil refiner was boosted by the improving outlook for its renewable fuels unit.

Swedbank AB, the largest lender in the Baltic states, rose 3.7 percent to 90.05 kronor as it reported a 34 percent jump in third-quarter profit and said costs will decline in 2012 as it adjusts to the European economic slowdown.

U.S. stocks fell, halting a three- day gain in the Standard & Poor’s 500 Index, after United Parcel Service Inc. sank and economic reports missed estimates as investors awaited tomorrow’s European summit. Stocks extended losses after consumer confidence unexpectedly slumped in October to the lowest level since March 2009, when the U.S. economy was in a recession, as Americans’ outlooks for employment and incomes soured. Separate data showed that home prices in 20 U.S. cities dropped more than forecast in August, highlighting one of the obstacles facing the economic recovery in its third year. European leaders will hold a summit tomorrow as they seek to bolster the region’s rescue fund, recapitalize banks and provide debt relief to Greece. Boosting the effectiveness of the European Financial Stability Facility will require further talks with investors as German lawmakers prepare to vote on its new powers, a European Union document showed.

Dow 11,706.62 -207.00 -1.74%, Nasdaq 2,638.42 -61.02 -2.26%, S&P 500 1,229.05 -25.14 -2.00%

All 10 groups in the S&P 500 retreated as a gauge of conglomerates stocks slid 3.4 percent. Alcoa, Inc. (AA), the largest U.S. aluminum producer, gained 4.2 percent to $10.14.

UPS, the largest package- delivery company and a proxy for the economy, retreated 1.9 percent after international shipping growth began to cool while U.S. expansion stagnated. The company’s total U.S. volume was flat in the third quarter because of “the slow U.S. economy,” Atlanta-based UPS said today in a statement. A 4.6 percent increase in shipments outside the U.S. trailed the 6.2 percent gain in the previous three months.

3M Co. (MMM)lost 6.3 percent to $77.04. Electronics sales are slowing after several quarters of what 3M called “very good growth.” The company, whose stock rallied 14 percent this month before today, is seeing the effect of a slowdown in developed countries earlier than other manufacturers because some of its products, such as components for liquid-crystal-display TVs, are tied to consumer demand.

Netflix plunged 35 percent, the biggest decline since 2004, to $77.37. The company faces rising content costs, a customer revolt over a price increase and startup costs as it expands into Latin America, followed by the U.K. and Ireland in early 2012. Other new markets will have to wait, Chief Executive Officer Reed Hastings said.

Amazon.com tumbled 14 percent to $195.11 at 4:30 p.m. New York time. The world’s largest Internet retailer reported a plunge in third-quarter profit after it ramped up spending on new products such as the Kindle Fire tablet.

AK Steel Holding Corp. declined 14 percent to $7.47. The third-largest U.S. steelmaker by volume reported less revenue than analysts projected and a decline in shipments.

First Solar Inc., the biggest maker of thin-film solar panels, sank 25 percent to $43.27 as Chairman and founder Mike Ahearn was named interim chief executive officer, replacing Rob Gillette. The company didn’t give a reason for Gillette’s departure.

MF Global Holdings Ltd. tumbled 48 percent, the most since 2008, to $1.86. The futures broker that had its credit rating cut yesterday to the lowest investment grade reported its largest-ever quarterly loss.

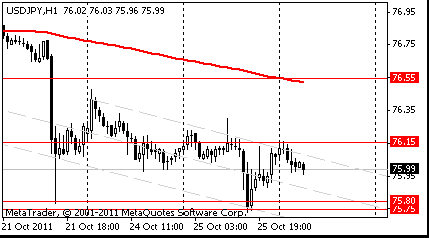

Resistance 3: Y77.10 (Oct 20 high)

Resistance 2: Y76.55 (MA (233) H1)

Resistance 1: Y76.15 (session high)

The current price: Y76.00

Support 1:Y75.80 (Oct 25 low)

Support 2: Y75.30 (138.2 % FIBO Y75.80-Y77.10)

Support 3: Y75.00 (psychological mark)

Comments: the pair is on downtrend.

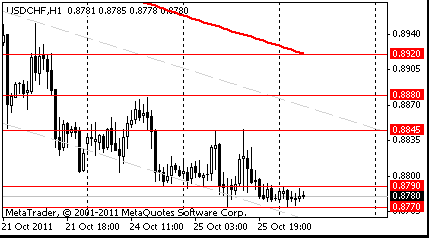

Resistance 3: Chf0.8880 (Oct 24 high)

Resistance 2: Chf0.8845 (Oct 25 high)

Resistance 1: Chf0.8790 (session high)

The current price: Chf0.8780

Support 1: Chf0.8770 (session low)

Support 2: Chf0.8700 (Sep 20 low)

Support 3: Chf0.8645 (Sep 15 low)

Comments: the pair is on downtrend. In focus support Chf0.8770.

Resistance 3 : $1.6200 (Sep 6 high)

Resistance 2 : $1.6100 (61.8 % FIBO $1.5270-$ 1.6615)

Resistance 1 : $1.6035/40 (area of session low)

The current price: $1.6030

Support 1 : $1.5990 (session low)

Support 2 : $1.5955 (Oct 25 low)

Support 3 : $1.5900 (Oct 24 low)

Comments: the pair is on uptrend. In focus resistance $1.6035/40.

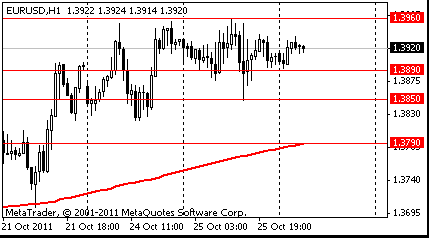

Resistance 3 : $1.4090 (Sep 8 high)

Resistance 2 : $1.4000 (61.8 % FIBO $1.3140-$ 1.4550)

Resistance 1 : $1.3960 (Oct 25 high)

The current price: $1.3915

Support 1 : $1.3890 (session low)

Support 2 : $1.3850 (Oct 25 low)

Support 3 : $1.3790 (MA (233) H1)

Comments: the pair trades in range. In focus resistance $1.3960.

Change % Change Last

Nikkei 225 8,762 -81.67 -0.92%

Hang Seng 18,968 +196.38 +1.05%

S&P/ASX 200 4,228 -27.16 -0.64%

Shanghai Composite 2,410 +39.34 +1.66%

FTSE 100 5,526 -22.52 -0.41%

CAC 40 3,174 -46.17 -1.43%

DAX 6,047 -8.52 -0.14%

Dow 11,706.62 -207.00 -1.74%

Nasdaq 2,638.42 -61.02 -2.26%

S&P 500 1,229.05 -25.14 -2.00%

10 Year Yield 2.13% -0.11 --

Oil $92.77 -0.40 -0.43%

Gold $1,704.10 +3.70 +0.22%

00:00 New Zealand NBNZ Business Confidence October 30.3 13.2

00:30 Australia CPI, q/q Quarter III +0.9% +0.7% +0.6%

00:30 Australia CPI, y/y Quarter III +3.6% +3.5% +3.5%

08:00 Eurozone EU Economic Summit

10:00 United Kingdom CBI industrial order books balance October -9 -7

12:30 U.S. Personal Income, m/m September -0.1% -1.2%

12:30 U.S. Durable Goods Orders ex Transportation September -0.1% +0.2%

12:30 U.S. Durable goods orders ex defense September -0.1%

14:00 U.S. New Home Sales September 295 302

14:30 U.S. EIA Crude Oil Stocks change неделя по 21 октября -4.7

14:30 Canada Bank of Canada Monetary Policy Report October

18:00 United Kingdom MPC Member Posen Speaks

20:00 New Zealand RBNZ Interest Rate Decision 2.50% 2.50%

21:00 Canada BOC Gov Carney Speaks

21:45 New Zealand Trade Balance September -0.641 -0.421

23:50 Japan Retail sales, y/y September -2.6% 0.0%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.