- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 27-10-2011

Greek banks face no problems from EU debt deal

Debt deal lightens debt burden on Greeks

European stocks rallied to the highest in 12 weeks after the region’s leaders agreed to expand a bailout fund to halt the sovereign debt crisis. European leaders persuaded bondholders to take 50 percent losses on Greek debt and resolved to increase the size of the rescue fund, responding to global pressure to step up the fight against the financial crisis. The euro area’s stewards said the plan points the way out of the debt quagmire, even if key details are lacking. Last- ditch talks with bank representatives led to the debt-relief accord, in an effort to quarantine Greece and prevent speculation against Italy and France from ravaging the euro area and wreaking global economic havoc. Measures include recapitalization of European banks, a potentially bigger role for the International Monetary Fund, a commitment from Italy to do more to reduce its debt and a signal from leaders that the European Central Bank will maintain bond purchases in the secondary market.

The U.S. economy grew in the third quarter at the fastest pace in a year as gains in consumer spending and business investment helped support a recovery on the brink of faltering. Gross domestic product rose at a 2.5 percent annual rate, matching the median forecast of economists surveyed by Bloomberg News and up from a 1.3 percent gain in the prior quarter, Commerce Department figures showed today in Washington. Household purchases, the biggest part of the economy, increased at a more-than-projected 2.4 percent pace.

National benchmark indexes gained in all of the 18 western European markets. Germany’s DAX jumped 5.4 percent, its biggest increase since April 2009. France’s CAC 40 climbed 6.3 percent and the U.K.’s FTSE 100 rose 2.9 percent.

BNP Paribas SA, France’s biggest bank, and Deutsche Bank AG, Germany’s largest, surged at least 15 percent as policy makers decided to boost the firepower of the European rescue fund to 1 trillion euros ($1.4 trillion). Societe Generale SA, France’s second-largest lender, jumped 23 percent to 23 euros. The bank said it will meet mid-2012 capital requirements “through its own means.” Credit Agricole SA, France’s third-biggest bank, soared 22 percent to 5.94 euros, its largest advance since September 2008.

National Bank of Greece SA, the country’s biggest lender, surged 6.1 percent to 1.91 euros. Alpha Bank SA soared 3.9 percent to 1.08 euros. EFG Eurobank Ergasias increased 7 percent to 76 euro cents. Greek Prime Minister George Papandreou said the government may buy shares in some Greek banks as a result of the planned writedown of the country’s debt and the European accord to recapitalize lenders. Papandreou didn’t give any details on the banks that would be targeted in any nationalization program or the size of any potential shareholdings.

Michelin & Cie. jumped 5.1 percent to 54.94 euros. The world’s second-largest tiremaker said third-quarter revenue rose 11 percent to 5.14 billion euros, spurred by a rebound in demand from U.S. automakers and strong sales of its winter tires in Europe.

Daimler AG added 3.1 percent to 39.07 euros. The world’s third-largest maker of luxury vehicles advanced after predicting higher fourth-quarter profit on gains at its trucks and vans divisions.

Logitech International SA, the world’s largest maker of computer mice, rallied 16 percent to 8.94 Swiss francs, its biggest increase since October 2007. The company confirmed its full-year guidance after three profit warnings in the past seven months.

The euro rallied to a seven-week high against the dollar after European leaders agreed to an expansion of a rescue fund for indebted nations and reached an accord with lenders on writedowns for Greek debt. The euro rose after European leaders meeting yesterday for the second time in four days persuaded bondholders to take 50 percent losses on Greek debt and boosted the firepower of a rescue fund for indebted nations to 1 trillion euros ($1.4 trillion), responding to global pressure. Yields on Italian 10-year bonds were up 34 basis points this month after dropping five basis points to 5.87 percent today. Spain’s yields decreased 15 basis points to 5.33 percent, paring its monthly advance to 19 basis points.

The yen rose to a record versus the dollar for the fourth time in five days day on speculation Bank of Japan measures announced today will fail to contain the currency’s rally. The yen strengthened even after the Bank of Japan expanded its credit and asset-purchase programs to a total of 55 trillion yen ($724 billion) from 50 trillion yen to damp the currency’s appreciation, which harms exporters. It also kept the overnight lending rate at zero to 0.1 percent.

IntercontinentalExchange Inc.’s Dollar Index, used to track the greenback against the currencies of six major U.S. trading partners including the euro and yen, decreased 1.6 percent to 75.014 on reduced demand for a refuge. It was below its 200-day moving average for the first time since

The pound fell to a seven-week low against the euro after European Union leaders agreed to expand a rescue fund for indebted nations, damping demand for the perceived safety of the British currency. Sterling weakened versus all but three of its 16 major counterparts as Bank of England Markets Director Paul Fisher said the U.K. economy may be shrinking. Gilts declined after EU leaders meeting in Brussels yesterday said their plan points the way out of the sovereign debt crisis, reducing appetite for safer assets. U.K and European stocks gained.

U.S. stocks rose, extending the biggest monthly rally since 1987 for the Standard & Poor’s 500 Index, as European leaders agreed to expand a bailout fund to $1.4 trillion and American economic growth accelerated. Global stocks rallied as European leaders cajoled bondholders into accepting 50 percent writedowns on Greek debt and boosted their rescue fund’s capacity to 1 trillion euros ($1.4 trillion) in a crisis-fighting package intended to shield the euro area. Measures include recapitalization of European banks, a potentially bigger role for the International Monetary Fund, a commitment from Italy to do more to reduce its debt and a signal from leaders that the European Central Bank will maintain bond purchases in the secondary market.

Stocks also rose after the U.S. economy grew in the third quarter at the fastest pace in a year as gains in consumer spending and business investment helped support a recovery on the brink of faltering. Separate data showed that fewer Americans filed applications for unemployment assistance last week, while those on benefit rolls dropped to a three-year low, signaling limited improvement in the labor market. The number of contracts to purchase previously owned U.S. homes unexpectedly fell in September as lower prices and borrowing costs failed to support demand, according to another report.

Dow 12,172.41 +303.37 +2.56%, Nasdaq 2,726.29 +75.62 +2.85%, S&P 500 1,277.83 +35.83 +2.88%

All 10 groups in the S&P 500 rose as gains were led by financial and commodity shares. Bank of America Corp. (BAC) and JPMorgan Chase & Co. (JPM) climbed at least 6.5 percent, following a rally in European lenders.

Alcoa Inc. (AA) and Caterpillar Inc. (CAT) jumped more than 4.8 percent to pace gains among companies most- dependent on economic growth. Alcoa, the largest U.S. aluminum producer, gained 7.8 percent to $11.17. Caterpillar increased 4.8 percent to $95.99.

Akamai Technologies Inc. climbed 14 percent to $27.22. The company, whose server network lets businesses speed data delivery, forecast fourth-quarter sales that topped some analysts’ estimates.

Aflac Inc. jumped 7.4 percent to $46.22. The world’s largest seller of supplemental health insurance reported profit that beat estimates and said sales were gaining in its largest market. The health insurer that gets more than 70 percent of its sales in Japan said third-quarter profit rose 7.8 percent as the yen strengthened against the dollar.

Avon Products Inc. erased 18 percent, the most in the S&P 500, to $18.89. The door-to-door cosmetics merchant said the U.S. Securities and Exchange Commission is investigating the company’s contacts with financial analysts. The company also reported profit that missed analysts estimates.

According to analysts, the theme of "second wave of crisis" in the markets worked, and finally closed. In the last day covered the wave of positive markets. Rising risk appetite led to the decline of the dollar to all types of assets. The increase in optimism are now playing at once three factors: the folding of concerns about the debt crisis in Europe, the improvement in the U.S. economy and expectations of the third round of quantitative easing, the Fed at the next meeting on November 2.

Relative to the U.S. economy, today's data confirmed the continued recovery and the absence of any signs of recession. As expected, the U.S. GDP growth in Q3 was 2.5% per annum against 1.3% in the second quarter and 0.4% in the first quarter. But the initial application for unemployment in the United States last week reached the level of 402 thousand and the fifth consecutive week at a level below 410 thousand, that is a long time figure demonstrates good value. It should also be recalled that the data for October are expected to well, including growth and employment from ADP and Nonfarm Payrolls at 100 thousand

With regard to possible Fed actions on Monday, deputy head of the Fed's Dudley said that "we made clear our interest to support the mortgage market." So the announcement on November 2 at the Fed's balance sheet buying two or three hundred billion dollars can be considered secure. And after the market close on topics of European debt crisis in the coming days will be worked out theme of the third round of quantitative easing. Therefore, even after strong growth in the past, the euro on expectations may QE-3, and take off up to $ 1.45. Today, the euro / dollar rate broke the $ 1.4080/90 - MA100 and MA200 for a time-frame D1.

Gold declined for the first week at the beginning of today's trading, as investors once again interested in risky assets after European leaders agreed to fight with the debt crisis. After the eight-hour negotiations between bankers, heads of state, central bank governors and representatives of the International Monetary Fund, European Union leaders agreed on a plan to combat the debt crisis in the eurozone. With this news the world's stock close to the maximum of two months, the euro reached its highest point since early September.

Stocks ETF-backed by gold funds rose in October to 700,000 ounces, pointing to high investment demand. Physical demand in Asia is also due to strong holiday season and weddings in India - the world's largest consumer of gold.

Gold for December deliveries fell to $ 1.707,2 per troy ounce, but the last few hours rebounded to 1.7345 dollars per ounce in trading in New York.

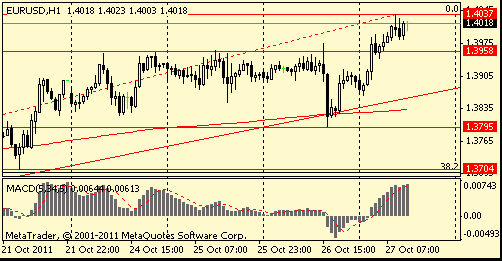

Possible potential to $1.4250 area of resistance that is a fibo level.

Oil advanced in New York after European leaders agreed on measures to tame a sovereign debt crisis that threatens to slow economic growth and curb demand for commodities. Futures climbed as much as 3.3 percent after falling 3.2 percent yesterday, the biggest decline this month. Officials in Europe persuaded bondholders to take 50 percent losses on Greek debt and boosted a bailout fund to 1 trillion euros ($1.4 trillion). The Commerce Department said today the U.S. economy grew at the fastest pace this year in the third quarter. U.S. supplies of fuels such as gasoline, diesel and heating oil fell last week, the Energy Department said yesterday.

Crude for December delivery rose as much as $2.99 to $93.19 a barrel in electronic trading on the New York Mercantile Exchange. It was at $92.92 at 1:36 p.m. London time. Yesterday, the contract declined the most since Sept. 30, losing $2.97 to $90.20. Prices have gained 1.7 percent this year.

Brent oil for December settlement on the London-based ICE Futures Europe exchange climbed as much as $2.29, or 2.1 percent, to $111.20 a barrel. The European benchmark contract was at a premium of $17.96 to New York crude, down from a record close of $27.88 on Oct. 14.

"-4.6% Sept pending home sales was the third decline and yet another warning that sales of existing homes will disappoint."

USD/JPY Y75.50, Y75.85, Y76.90-95, Y77.00, Y77.45, Y77.50

GBP/USD $1.6000, $1.5850, $1.5600

EUR/JPY Y105.50, Y105.20

EUR/GBP stg0.8700

USD/JPY Chf0.9005

EUR/CHF Chf1.2190, Chf1.2200, Chf1.2400

AUD/USD $1.0380

Global stocks rallied as European leaders cajoled bondholders into accepting 50 percent writedowns on Greek debt and boosted their rescue fund’s capacity to 1 trillion euros in a crisis-fighting package intended to shield the euro area. Measures include recapitalization of European banks, a potentially bigger role for the International Monetary Fund, a commitment from Italy to do more to reduce its debt and a signal from leaders that the European Central Bank will maintain bond purchases in the secondary market.

World Markets: Nikkei +2.04%, Hang Seng +3.26%, Shanghai Composite +0.34%, FTSE +2.82%, CAC +5.35%, DAX +4.81%.

08:00 EU(17) M3 money supply (September) adjusted Y/Y 3.1%

08:00 EU(17) M3 money supply (3 months to September) adjusted Y/Y 2.6%

09:00 EU(17) Economic sentiment index (October) 94.8

09:00 EU(17) Business climate indicator (October) -0.18

10:00 UK CBI retail sales volume balance (October) -11%

The euro strengthened after European leaders agreed to expand a rescue fund for indebted nations and reached an accord with lenders on writedowns for Greek debt.

The 17-nation currency rose on speculation the deal reached in Brussels points the way out of the debt crisis even if key details are lacking.

The dollar weakened as stocks rallied, damping demand for safer assets.

European leaders meeting yesterday for the second time in four days persuaded bondholders to take 50 percent losses on Greek debt and boosted the firepower of a rescue fund for indebted nations to 1 trillion euros, responding to global pressure to step up the fight against the financial crisis.

EUR/USD: the pair grown in $1,4040 area.

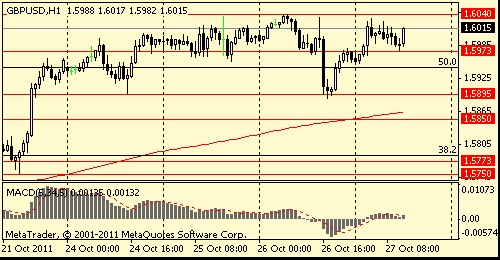

GBP/USD: the pair holds $1,5970-$ 1,6030.

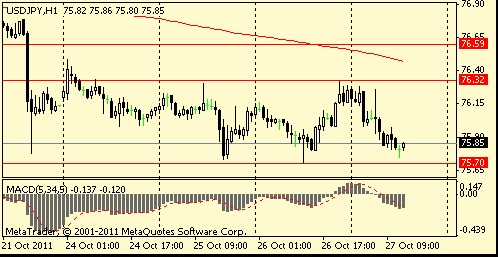

USD/JPY: the pair fell in Y75,80 area.

US data starts at 1200GMT with the September release of the Building Permits Revision. US data continues at 1230GMT with the weekly Jobless Claims and also Q3 GDP and Chain Price Index data. Initial jobless claims are expected to rise to 405,000 in the October 22 week after falling slightly in the previous week. The advance estimate for third quarter GDP is for a 2.5% rate of growth, up from 1.3% in the previous quarter. PCE is expected to post a stronger increase than in the previous quarter, while nonresidential fixed investment is forecast to be post another solid gain. The trade gap is expected to narrow,

while residential fixed investment is expected to improve slightly. Government spending, however, is expected to post another soft reading in the quarter. The chain price index is forecast to rise 2.4% in the quarter, down slightly from 2.5% in the previous two quarters.

EUR/USD

Ордера на продажу $1.4100, $1.4070/80, $1.4050

Ордера на покупку $1.3985/80, $1.3965/60, $1.3940, $1.3900

Resistance 3: Y77.10 (Oct 20 high)

Resistance 2: Y76.60/70 (earlier support, area of Oct 17-20 lows)

Resistance 1: Y76.30 (Oct 25-26 highs, session high)

Current price: Y75.85

Support 1:Y75.70 (historical low)

Support 2:Y75.50 (psychological mark)

Support 3:Y75.00 (psychological mark)

Комментарии: дальнейшее снижение пары повышает шансы вмешательства правительства Японии на валютный рынок с целью ограничить рост национальной валюты.

Resistance 2: Chf0.8850 (Oct 25 high)

Resistance 1: Chf0.8790 (session high)

Current price: Chf0.8739

Support 1: Chf0.8730 (Oct 26 low, session low)

Support 2: Chf0.8640 (the bottom border of the down channel from Oct 6, Sep 15 low)

Support 3: Chf0.8530 (Sep 7 low)

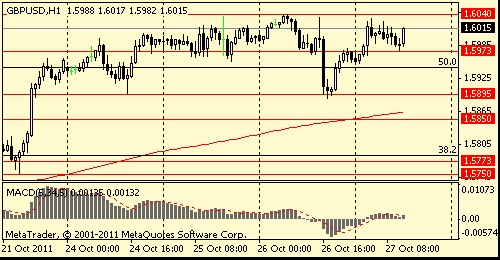

Resistance 2: $ 1.6100 (61,8 % FIBO $1,6620-$ 1,5270, Aug 11 low)

Resistance 1: $ 1.6040 (Oct 26 high, session high)

Current price: $1.6015

Support 1 : $1.5970 (low of european session)

Support 2 : $1.5900 (area of Oct 24 and 26 lows)

Support 2 : $1.5850 (earlier resistance, Oct 14, 17 and 19)

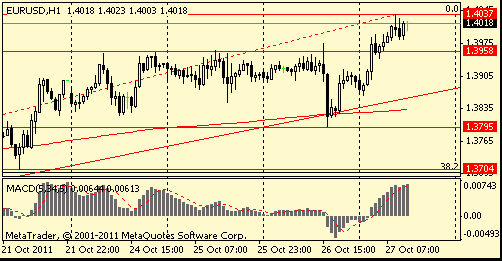

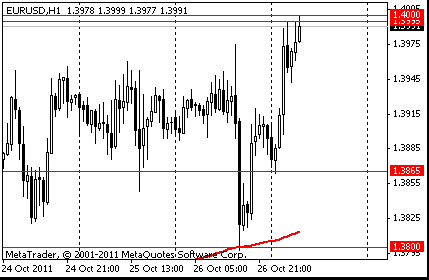

Resistance 2: $ 1.4090 (МА(200) and МА(100) for D1)

Resistance 1: $ 1.4040 (session high)

Current price: $1.4018

Support 1 : $1.3960 (earlier recistance, area of Oct 24-26 highs)

Support 2 : $1.3890 (support line from Oct 4)

Support 3 : $1.3800 (Oct 26 low)

Comments: the pair tries to be fixed above $1,4000. Strong resistance - area $1,4090/00

Currently FTSE 5,687 +133.88 +2.41%, CAC 3,305 +135.02 +4.26%, DAX 6,261 +244.81 +4.07%.

European stocks rallied after the region’s leaders agreed to expand a bailout plan to halt the sovereign debt crisis.

USD/JPY Y75.50, Y75.85, Y76.90-95, Y77.00, Y77.45, Y77.50

GBP/USD $1.6000, $1.5850, $1.5600

EUR/JPY Y105.50, Y105.20

EUR/GBP stg0.8700

USD/JPY Chf0.9005

EUR/CHF Chf1.2190, Chf1.2200, Chf1.2400

AUD/USD $1.0380

Hang Seng 19,591 +524.42 +2.75%

S&P/ASX 4,348 +105.66 +2.49%

Shanghai Composite 2,433 +5.18 +0.21%

21:45 New Zealand Trade Balance September -0.751

23:50 Japan Retail sales, y/y September -1.2%

03:00 Japan BoJ Interest Rate Decision 0.00%-0.10%

07:00 Japan BOJ Press Conference

The Bank of Japan expanded stimulus as Europe’s deepening sovereign-debt crisis caused an appreciation in the yen that may endanger a recovery from the March earthquake, tsunami and nuclear crisis. Governor Masaaki Shirakawa and his policy board expanded their credit and asset-purchase programs to a total of 55 trillion yen ($724 billion) from 50 trillion yen in an 8-1 majority vote, the central bank said in a statement in Tokyo today. It also kept the overnight lending rate between zero and 0.1 percent.

The euro rose and stocks advanced in Asian trading.European leaders persuaded bondholders to take 50 percent losses on Greek debt and boosted the firepower of the rescue fund to 1 trillion euros ($1.4 trillion), responding to global pressure to step up the fight against the financial crisis. Ten hours of brinkmanship at the second crisis summit in four days delivered a plan that the euro area’s stewards said points the way out of the debt quagmire, even if key details are lacking. Last-ditch talks with bank representatives led to the debt-relief accord, in an effort to quarantine Greece and prevent speculation against Italy and France from ravaging the euro zone and wreaking global economic havoc.

EUR/USD: on Asian session the pair gain and showed new week’s high.

GBP/USD: on Asian session the pair advanced, but receded from week’s high.

USD/JPY: on Asian session the pair is under pressure.

In Europe, today sees the German state inflation data, which will be followed by the German flash HICP data for October. EMU data includes the 0800GMT release of September M3 data, which is followed at 0900GMT by the October releases of the business climate indicator and also the economic sentiment survey. US data starts at 1200GMT with the September release of the Building Permits Revision. US data continues at 1230GMT with the weekly Jobless Claims and also Q3 GDP and Chain Price Index data. Initial jobless claims are expected to rise to 405,000 in the October 22 week after falling slightly in the previous week. The advance estimate for third quarter GDP is for a 2.5% rate of growth, up from 1.3% in the previous quarter. While at 1500GMT, the Kansas City Fed Production data is due. Late US data sees the 2030GMT release of M2 Money Supply.

The yen reached a post-World War II high versus the dollar and gained against most of its most-traded counterparts, even as Finance Minister Jun Azumi ordered staffers to be prepared to take action against the currency gains. Bank of Japan officials will discuss more monetary easing.

The pound snapped five days of gains against the dollar as waning confidence in the euro-area and business optimism plunged to the lowest level in 2 1/2 years. The pound was 0.6 percent weaker at $1.5909 and was little changed against the shared currency at 86.92 pence per euro.

EUR/USD: yesterday the pair fell, but restored later.

GBP/USD: yesterday the pair decreased.

USD/JPY: yesterday the pair showed new historical low, but restored later.

In Europe, today sees the German state inflation data, which will be followed by the German flash HICP data for October. EMU data includes the 0800GMT release of September M3 data, which is followed at 0900GMT by the October releases of the business climate indicator and also the economic sentiment survey. US data starts at 1200GMT with the September release of the Building Permits Revision. US data continues at 1230GMT with the weekly Jobless Claims and also Q3 GDP and Chain Price Index data. Initial jobless claims are expected to rise to 405,000 in the October 22 week after falling slightly in the previous week. The advance estimate for third quarter GDP is for a 2.5% rate of growth, up from 1.3% in the previous quarter. While at 1500GMT, the Kansas City Fed Production data is due. Late US data sees the 2030GMT release of M2 Money Supply.

Stocks fell earlier after the cancellation of a meeting of European Union finance ministers spurred concern that the region’s leaders will fail to agree on how to tame the sovereign-debt crisis. European leaders will hold a summit today in Brussels as they seek to bolster a rescue fund, recapitalize banks and provide debt relief to Greece.

Japan’s Nikkei 225 Stock Average fell 0.2 percent, paring a loss of as much as 1.4 percent. Australia’s S&P/ASX 200 rose 0.4 percent, reversing an earlier loss of as much as 1.3 percent after a report showed inflation slowed last quarter. Hong Kong’s Hang Seng Index rose 0.5 percent.

Asian exporters fell. Honda Motor Co., Japan’s second largest carmaker by market value, fell 0.6 percent to 2,329 yen. Samsung Electronics Co., South Korea’s biggest exporter of consumer electronics, retreated 1.2 percent to 934,000 won.

Aluminum Corp. advanced 3.9 percent to HK$4.05 in Hong Kong after saying it turned to profit in the third quarter.

Gold producers advanced as futures on the precious metal extended a 2.9 percent advance in New York yesterday. Newcrest Mining rose 3.5 percent to A$34.40. Rival St. Barbara Ltd. added 2.3 percent to A$2.23.

European stocks advanced as the region’s leaders gathered in Brussels for the second summit in four days to address the debt crisis and after U.S. durable- goods orders and home sales topped forecasts. European leaders are meeting in Brussels for the 14th crisis summit in 21 months to discuss Greece’s second bailout, the recapitalization of banks and strengthening the 440 billion- euro ($612 billion) rescue fund into a more potent weapon. German lawmakers backed increasing the bailout fund’s capacity today, removing one hurdle in the path of a regional agreement. EU leaders may ask national finance ministers to determine the firepower of the expanded European Financial Stability Facility by the end of November, an EU official said. In the U.S., orders for durable goods excluding transportation equipment rose in September by the most in six months, showing manufacturing is supporting the expansion. Purchases of new houses gained more than forecast as discounted prices lured buyers in some parts of the country.

National benchmark indexes climbed in 10 of the 18 western European markets. The U.K.’s FTSE 100 rose 0.5 percent, while Germany’s DAX declined 0.5 percent and France’s CAC 40 slipped 0.2 percent.

Merck KGaA advanced 8.5 percent to 65.07 euros, the biggest gain since January 2009. The German maker of cancer drug Erbitux reported third-quarter profit that beat analysts’ estimates because of growth at the Merck Serono pharmaceutical and Millipore equipment businesses.

Nyrstar declined 8.5 percent to 6.14 euros in Brussels, the biggest drop in two months. The zinc producer lowered its forecast for output from mines because of lower-than-expected deliveries from Talvivaara Mining Co.’s Finnish site, where it has an offtake agreement.

Adidas AG, the world’s second-biggest sporting goods maker, slid 3 percent to 49.68 euros as Morgan Stanley cut its recommendation on the shares to “equal weight” from “overweight.” The brokerage said the company faces an increase in costs as it expands, while a slowdown in China is a “potential risk” to momentum.

Areva SA declined 3.2 percent 21.38 euros as the world’s largest builder of atomic plants said its FBFC International subsidiary may progressively close its nuclear fuel fabrication site in Dessel, Belgium, citing overcapacities on western European markets.

U.S. stocks rose as Europe reached an agreement on plans to recapitalize banks and American economic reports surpassed forecasts.

European Union leaders said in a statement that they reached an agreement on a plan to recapitalize banks. The European leaders convened for the second summit in four days -- and the 14th in 21 months -- amid mounting global exasperation over their failure to extinguish the two-year-old crisis that now threatens to ravage Italy and France and brake the world economy. French President Nicolas Sarkozy and German Chancellor Angela Merkel want to meet Greek creditors in Brussels tonight to break a deadlock of the terms of a debt writedown, said a person familiar with the matter. Sarkozy plans to call Chinese leader Hu Jintao tomorrow to discuss China contributing to a fund European leaders may set up to bolster its debt-crisis fight, according to a person familiar with the matter.

Stocks also rose as a report showed that orders for U.S. durable goods excluding transportation equipment rose in September by the most in six months. Separate data showed purchases of new houses increased more than forecast in September as discounted prices lured buyers in some parts of the country.

Dow 11,706.62 -207.00 -1.74%, Nasdaq 2,638.42 -61.02 -2.26%, S&P 500 1,229.05 -25.14 -2.00%

Boeing (ВА) gained 4.5 percent, the most in the Dow, to $66.56. The company topped profit estimates for the quarter when it delivered the first 787 Dreamliner and said the new model’s production costs will be spread over 1,100 planes, matching analysts’ projections.

Amazon.com tumbled 13 percent, the biggest decline since 2008, to $198.40. The company is sacrificing profit margins in search of sales volume and market-share gains. Amazon will sell its Kindle Fire tablet for as low as $199, less than half the price of Apple Inc.’s cheapest iPad.

Ford Motor Co. dropped 4.5 percent to $11.87. The company said its automotive operating profit margin may fall this year to 5.7 percent from 6.1 percent last year and 6.5 percent in the first nine months of the year, primarily because of a loss on commodity hedges.

Resistance 3: Chf0.8880 (Oct 24 high)

Resistance 2: Chf0.8845 (Oct 25 high)

Resistance 1: Chf0.8790 (session high)

The current price: Chf0.8748

Support 1: Chf0.8700 (Sep 20 low)

Support 2: Chf0.8645 (Sep 15 low)

Comments: the pair is on downtrend. In focus support Chf0.8700.

Resistance 3 : $1.6200 (Sep 6 high)

Resistance 2 : $1.6100 (61.8 % FIBO $1.5270-$ 1.6615)

Resistance 1 : $1.6035/40 (area of session high)

The current price: $1.6012

Support 1 : $1.5950 (session low)

Support 2 : $1.5890 (Oct 26 low)

Support 3 : $1.5850 (MA (233) H1)

Comments: the pair advanced. In focus resistance $1.6035/40.

Resistance 3 : $1.4150 (Sep 7 high)

Resistance 2 : $1.4090 (Sep 8 high)

Resistance 1 : $1.4095/00 (session high, 61.8 % FIBO $1.3140-$ 1.4550)

The current price: $1.3994

Support 1 : $1.3865 (session low)

Support 2 : $1.3800 (Oct 26 low)

Support 3 : $1.3700 (Oct 21 low)

Comments: the pair is on uptrend. In focus resistance $1.4000.

Change % Change Last

Nikkei 225 8,748 -13.84 -0.16%

Hang Seng 19,067 +98.34 +0.52%

S&P/ASX 200 4,243 +14.65 +0.35%

Shanghai Composite 2,427 +17.81 +0.74%

FTSE 100 5,553 +27.70 +0.50%

CAC 40 3,170 -4.67 -0.15%

DAX 6,016 -30.68 -0.51%

Dow 11,869.04 +162.42 +1.39%

Nasdaq 2,650.67 +12.25 +0.46%

S&P 500 1,242.00 +12.95 +1.05%

10 Year Yield 2.20% +0.08 --

Oil $90.78 +0.58 +0.64%

Gold $1,723.40 -0.10 -0.01%

03:00 Japan BoJ Interest Rate Decision 0 0.00%-0.10% 0.00%-0.10%

07:00 Japan BOJ Press Conference 0

08:00 Eurozone M3 money supply, adjusted y/y September +2.8%

09:00 Eurozone Economic sentiment index October 95.0

09:00 Eurozone Business climate indicator October -0.06

10:00 United Kingdom CBI retail sales volume balance October -15 -15

12:00 Germany CPI preliminary October +0.1% +0.1%

12:00 Germany CPI preliminary Y/Y October +2.6% +2.5%

12:30 U.S. Initial Jobless Claims неделя по 22 октября 403 402

12:30 U.S. GDP, preliminary, y/y Quarter III +1.3% +2.4%

12:30 U.S. PCE price index, q/q Quarter III +3.3%

12:30 U.S. PCE price index ex food, energy, q/q Quarter III +2.3%

14:00 U.S. Pending Home Sales (MoM) September -1.2% +0.2%

23:01 United Kingdom Gfk Consumer Confidence October -30 -30

23:30 Japan Nationwide CPI September +0.1%

23:30 Japan National Consumer Price Index, y/y September +0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y September +0.2%

23:30 Japan Tokyo-area CPI October +0.2%

23:30 Japan Tokyo Consumer Price Index, y/y October -0.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y October -0.1%

23:30 Japan Household spending Y/Y September -4.1% -3.4%

23:30 Japan Unemployment Rate September 4.3% +4.5%

23:50 Japan Industrial Production (MoM) September +0.6% -2.0%

23:50 Japan Industrial Production (YoY) September +0.4% -2.3%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.