- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 31-10-2011

● Currently all analytical information of the website is available as one newsline – “ News and Analytics Feed “, where you can use filter (search function) to choose any kind of information You are looking for, such as: currency market, stock markets, primary markets etc. as well as access archives block to review Your analytics history.

● In “ Analytics “ section we have added a new information block called “ Market Focus “ which contains information about the major factors that determine actual currency pair dynamics, stock indexes and raw materials prices;

● The subsection “Reviews and Forecasts” is divided into two more subsections: “ Forecasts and Experts’ Trade Ideas“ (where independent experts assess the current market situation and express trade recommendations) as well as “ Analysts’ reviews” (that represent the current market situations analyzed by our company analysts);

● We have also increased the amount of information related to stock and primary markets, that will allow more effective use of commercial instruments provided by TeleTRADE Company.

● The automatic update function has become available for the “News and Analytics Feed “ and “ Market Focus” sections, what makes the page reload unnecessary.

We hope that the provided changes will help Your prompt and objective assessment of international trading floors situations for maximally effective funds investments.TeleTRADE team continues to develop Analytics section in the effort to make it maximally convenient for our clients. Any new changes to be advised. Please follow our news!

European stocks dropped, paring their biggest monthly gain since July 2009, as some investors remain reluctant to buy equities before the euro area’s leaders explain how they will fund their expanded bailout facility. The G-20 leaders convene on Nov. 3-4 in Cannes, France, a week after the euro area’s authorities pledged to magnify the capacity of their rescue fund to 1 trillion euros ($1.4 trillion). The euro area has already sought financial help from China and cooperation from the International Monetary Fund.

National benchmark indexes declined in all 18 western- European markets. The U.K.’s FTSE 100 Index slid 2.8 percent, while France’s CAC 40 Index and Germany’s DAX Index both retreated 3.2 percent.

Vestas slumped 24 percent to 84.35 kroner for its biggest slide since 2002. The wind-turbine maker predicted revenue of 6.4 billion euros in 2011, down from the 7 billion euros it had forecast in August. Vestas said its 2011 Ebit margin will decline to 4 percent. The company projected a margin of 7 percent in August. Vestas said further delays at the facility remain possible. Gamesa Corp. Tecnologica SA, the Spanish wind-turbine maker, plunged 9.6 percent to 3.52 euros.

Banks were among the worst performers of the 19 industry groups on the Stoxx 600. HSBC lost 3.6 percent to 544.9 pence. BNP Paribas SA sank 9.6 percent to 32.85 euros. UniCredit SpA slipped 5.7 percent to 84.8 euro cents as La Stampa reported that Italy’s largest bank plans to raise 6 billion euros to 8 billion euros. The newspaper didn’t say where it got the information.

Rio Tinto, the world’s second-biggest mining company, lost 6.5 percent to 3,385 pence. BHP Billiton Ltd., the world’s largest, declined 6.4 percent to 1,967.5 pence. Copper, nickel and tin prices slumped on the London Metals Exchange.

Homeserve Plc tumbled 28 percent to 350 pence for the biggest slump on the Stoxx 600 after the U.K.-based emergency- repair service provider suspended all telephone sales and marketing because a review showed sales processes didn’t meet standards.

TNT Express NV rallied 5 percent to 6.17 euros as Europe’s second-largest express-delivery service posted an unexpected third-quarter profit after increasing prices in Europe and Asia.

The yen slumped the most since 2008 against the dollar as Japan stepped in to foreign-exchange markets to weaken the currency for the third time this year after its gain to a postwar record threatened exporters. The yen fell against all of its most-traded counterparts tracked by Bloomberg after Japan’s Finance Minister Jun Azumi ordered the intervention. The yen and franc have climbed to records this year as investors sought havens from fiscal crises in the U.S. and Europe. The yen and franc tend to strengthen in periods of financial turmoil because current-account surpluses in the nations make them less reliant on foreign capital. A stronger local currency hurts the overseas competitiveness of exporters and cuts the value of their overseas income when repatriated.

The dollar rose against all its major peers after MF Global Holdings Ltd. filed for bankruptcy after making bets on European sovereign debt, driving stocks down and boosting refuge demand.

The euro fell versus the dollar today after rising 1.8 percent last week as China’s official Xinhua News Agency said the nation can’t play the role of “savior” to Europe. Euro-region’s leaders agreed on Oct. 27 to increase their bailout fund to 1 trillion euros ($1.4 trillion) and recapitalize financial institutions. They convinced banks to write down their holdings of Greek debt by 50 percent. Italian bond yields have remained elevated, with the 10- year yield rising today as much as 16 basis points, or 0.16 percentage point, to 6.18 percent, the highest level since Aug. 5. Spanish yields increased as much as 15 basis points to 5.66 percent, matching the level Aug. 8.

The pound is turning into the must- have currency for investors seeking to get in on the world’s biggest government-bond rally. The combination of Prime Minister David Cameron’s fiscal austerity and Bank of England Governor Mervyn King’s efforts to bolster the economy with record-low interest rates and bond purchases are attracting investors seeking a haven from Europe’s debt crisis and political gridlock in the U.S. Reserves invested in pounds rose 12 percent in the first half, compared with a 9.6 percent gain for the euro and a 3.5 percent increase in the dollar.

U.S. stocks declined, trimming the biggest monthly advance since 1987 in the Standard & Poor’s 500 Index, on concern European leaders will struggle to raise funds to contain the region’s sovereign debt crisis. Stocks rose last week after European leaders agreed to expand the region’s bailout fund and American economic growth accelerated. China can’t play the role of “savior,” the official Xinhua news agency said yesterday, as investors awaited the country’s response to Europe’s request for money to boost its bailout fund. Japanese Finance Minister Jun Azumi said today the government took unilateral steps to weaken the yen. Group of 20 leaders will gather Nov. 3-4 in Cannes, France, while central bankers from Australia, the U.S. and Europe will hold interest- rate policy meetings this week.

The Institute for Supply Management-Chicago Inc. said today its business barometer decreased to 58.4 in October from 60.4 the prior month. A level of 50 is the dividing line between expansion and contraction. Economists forecast the gauge would drop to 59, according to the median of 55 estimates in a Bloomberg News survey. Projections ranged from 56 to 62.5.

Dow 12,076.22 -154.89 -1.27%, Nasdaq 2,707.84 -29.31 -1.07%, S&P 500 1,267.85 -17.24 -1.34%

European stocks slumped, paced by losses in banks, as Italian and Spanish bonds declined. Morgan Stanley fell 5.2 percent to $18.30. Citigroup dropped 4.6 percent to $32.59.

MF Global Holdings Ltd., the holding company for the broker-dealer run by former New Jersey governor and Goldman Sachs Group Inc. co-chairman Jon Corzine, filed for bankruptcy after making bets on European sovereign debt.

Alcoa, the largest U.S. aluminum producer, dropped 5.4 percent to $10.95. Caterpillar erased 2.2 percent to $94.71.

Yahoo! decreased 4.9 percent to $15.75. The Asian asset sale is emerging as the most likely option for Yahoo and would let the Internet company eventually pay a special dividend or buy back shares, according to five people familiar with the situation, who declined to be identified because the talks are private.

Chevron Corp. erased 3.2 percent to $106.15 after being cut to “neutral” from “buy” at Bank of America Corp., which cited valuation concern.

SanDisk Corp., the biggest maker of flash-memory cards, lost 4.4 percent to $51.02. Sterne Agee & Leach Inc. downgraded its recommendation for the shares to “neutral” from “buy.”

growth forecast parallels boc/fin dep't predictions

concerned re Canadian household debt, house prices

bank of Canada's low rate 'appropriate for some time'

approves Canada fiscal policy shifting to restraint

Switzerland's Aaa ratings reflect government's prudent policies, robustness of balance sheet

Strong swiss franc is creating some problems for exporters

Switzerland has a long history of fiscal prudence

Gold prices continued to decline after the Japanese authorities decided to make anintervention in the foreign exchange market to limit yen appreciation, according to data exchanges. News from Japan helped strengthen the dollar, to which the price of gold usually moves in different directions.

At the same time, support for gold prices has statistics eurozone, which turned out worse than expected, and the lack of details of the plan by EU leaders at the conclusion of the region's debt crisis. The unemployment rate in the 17 eurozone countries in September 2011 increased compared with August, up 0.2 percentage points to 10.2%, while analysts expected a saving rate of 10%. Annual inflation in the 17 euro zone countries, according to preliminary data, in October remained at the level of last month at 3%, although the expected slowdown in consumer prices up 2.9%.

On the Comex Exchange in New York, gold for December delivery fell to $1705.50 per troy ounce.

Crude oil dropped in New York as the dollar climbed and equities fell, trimming the biggest monthly gain in more than two years.

Futures fell as much as 2.1 percent after Japan stepped in to foreign-exchange markets to weaken the yen against the dollar, making commodities priced in the U.S. currency less attractive to investors. Stocks retreated from a three-month high on concern European leaders will struggle to raise funds to contain the region’s debt crisis.

Crude oil for December delivery declined to $91.36 a barrel on the New York Mercantile Exchange. Futures are up 16 percent this month, the biggest gain since May 2009. Oil settled at $93.96 on Oct. 27, the highest level since Aug. 1.

Brent oil for December settlement dropped $1.10, or 1 percent, to $108.81 a barrel on the London-based ICE Futures Europe exchange.

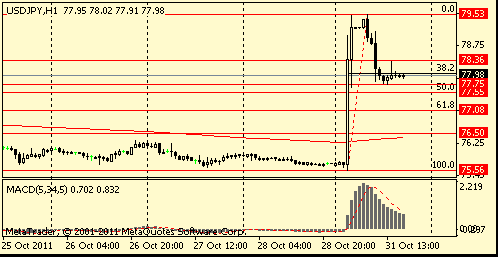

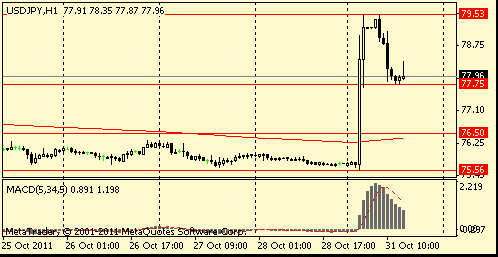

Resistance 3: Y80.30 (a maximum of August) Resistance 2: Y79.50 (a sessional maximum) Resistance 1: Y78.40 (a maximum of the American session) The current price: Y77.98 Support 1:Y77.75 (low of the European session) Support 2:Y77.55 (50.0 % FIBO of today's growth) Support 3:Y77.10 (61.8 % FIBO of today's growth)

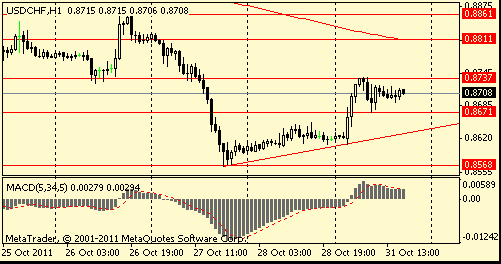

Resistance 3: Chf0.8860 (Oct 26 high)

Resistance 2: Chf0.8810 (МА (200) for Н1)

Resistance 1: Chf0.8740 (session high)

Current price: Chf0.8708

Support 1: Chf0.8670 (low of european session)

Support 2: Chf0.8640 (support line from Oct 27)

Support 3: Chf0.8570 (Oct 27 low)

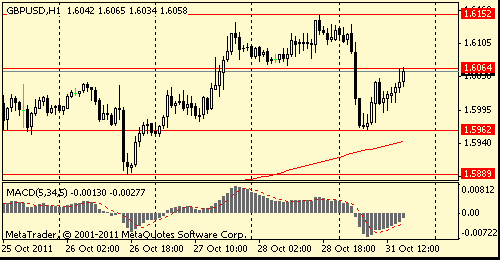

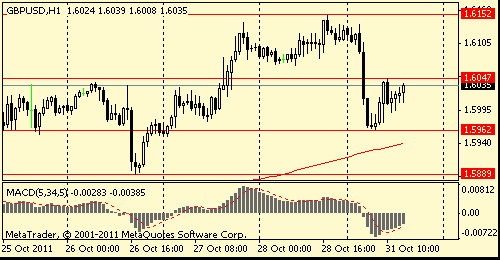

Resistance 2: $ 1.6150 (Oct 28 high)

Resistance 1: $ 1.6140 (high of american session)

Current price: $1.6057

Support 1 : $1.5960 (session low)

Support 2 : $1.5890 (Oct 26 low)

Support 3 : $1.5850 (Oct 14, 17 and 19 high)

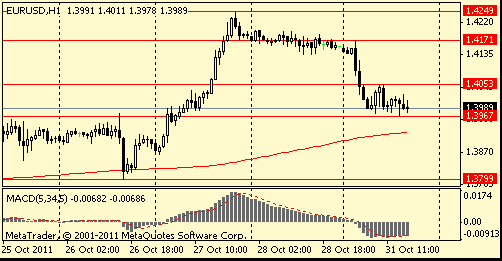

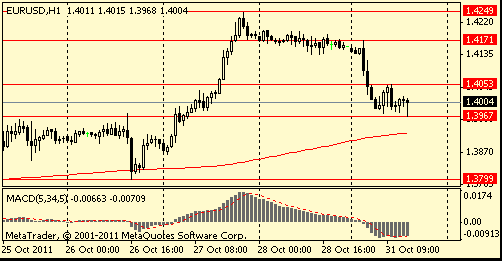

Resistance 2: $ 1.4170 (session high)

Resistance 1: $ 1.4050 (high of european session)

Current price: $1.3989

Support 1 : $1.3960/70 (earlier resistance, area Oct 24-26t highs, 61,8 % FIBO $1,3795-$ 1,4240, session low)

Support 2 : $1.3930 (МА (200) for Н1)

Support 3 : $1.3800 (Oct 26 low)

USD/JPY Y78.00, Y77.50

AUD/USD $1.0500, $1.0690

USD/CHF Chf0.8825

GBP/USD $1.6000, $1.5935, $1.5900

World markets: Nikkei -0.69%, Hang Seng -0.77%, Shanghai Composite -0.21%, FTSE -1.21%, CAC -1.68%, DAX -1.90%.

Data:

07:00 Germany Retail sales (September) real adjusted 0.4%

07:00 Germany Retail sales (September) real unadjusted Y/Y 0.3%

07:45 France PPI (September) 0.2%

07:45 France PPI (September) Y/Y 6.1%

09:30 UK M4 money supply (September) final -0.4%

09:30 UK M4 money supply (September) final Y/Y -1.7%

09:30 UK Consumer credit (September), bln 0.6

10:00 EU(17) Harmonized CPI (October) Y/Y preliminary 3.0%

10:00 EU(17) Unemployment (September) 10.2%

10:00 Italy CPI (October) preliminary 0.6%

10:00 Italy CPI (October) preliminary Y/Y 3.4%

10:00 Italy HICP (October) preliminary Y/Y 3.8%

11:00 Italy PPI (October) 0.2%

11:00 Italy PPI (October) Y/Y 4.7%

The yen slumped against the dollar as Japan stepped into foreign-exchange markets to weaken the currency for the third time this year after its gains to a postwar record threatened exporters.

The euro fell the most in four weeks versus the dollar amid speculation Europe’s leaders will struggle to garner financial support for their revamped crisis-fighting plan.

The dollar rose against all its major peers on refuge demand.

The euro pared last week’s advance versus the dollar as China’s official Xinhua News Agency said the nation can’t play the role of “savior” to Europe.

European Bailout

Euro-region’s leaders agreed on Oct. 27 to increase their bailout fund to 1 trillion euros, recapitalize banks and convinced banks to write down their holdings of Greek debt by 50 percent. While the help of China and cooperation of the International Monetary Fund were immediately sought, pledges of hard cash are proving hard to come by as Group of 20 members press for more details of the plan.

EUR/USD: the pair lead the European session in area $1.3970-$ 1,4050.

GBP/USD: the pair showed low in $1.5960 area then returned back above $1.6000.

USD/JPY: the pair decreased in Y78,00 area.

EUR/USD:

Offres $1.4120/30, $1.4100, $1.4070/80, $1.4050/55, $1.4020

Bids $1.3970, $1.3950, $1.3940, $1.3925/20, $1.3905/00

- Eurozone growth to slow to 0.3% in 2012

- Euro summit decisions need quick implementation

- Major central banks should pursue accommodative policies

- ECB should lower interest rates

Currently FTSE 5,642 -59.79 -1.05%, CAC 3,290 -58.94 -1.76%, DAX 6,260 -86.14 -1.36%.

European stocks dropped as some investors remain reluctant to buy equities before the euro area’s leaders explain how they will fund their expanded bailout facility

In the effort to improve the presentation and accessibility of the analytical information we have made the following changes to the “Analytics” section structure of the website.

● Currently all analytical information of the website is available as one newsline – “ News and Analytics Feed “, where you can use filter (search function) to choose any kind of information You are looking for, such as: currency market, stock markets, primary markets etc. as well as access archives block to review Your analytics history.

● In “ Analytics “ section we have added a new information block called “ Market Focus “ which contains information about the major factors that determine actual currency pair dynamics, stock indexes and raw materials prices;

● The subsection “Reviews and Forecasts” is divided into two more subsections: “ Forecasts and Experts’ Trade Ideas“ (where independent experts assess the current market situation and express trade recommendations) as well as “ Analysts’ reviews” (that represent the current market situations analyzed by our company analysts);

● We have also increased the amount of information related to stock and primary markets, that will allow more effective use of commercial instruments provided by TeleTRADE Company.

● The automatic update function has become available for the “News and Analytics Feed “ and “ Market Focus” sections, what makes the page reload unnecessary.

We hope that the provided changes will help Your prompt and objective assessment of international trading floors situations for maximally effective funds investments.

TeleTRADE team continues to develop Analytics section in the effort to make it maximally convenient for our clients. Any new changes to be advised. Please follow our news!

- Partial write-off of a sovereign duty of Greece should not repeat for any other country of an eurozone

- Greece is necessary for considering as a special case.

- in duty of the separate countries enters completely to observe what they have declared

USD/JPY Y78.00, Y77.50

AUD/USD $1.0500, $1.0690

USD/CHF Chf0.8825

GBP/USD $1.6000, $1.5935, $1.5900

Hang Seng 19,865 -154.37 -0.77%

S&P/ASX 4,298 -55.15 -1.27%

Shanghai Composite 2,468 -5.16 -0.21%

00:30 Australia Private Sector Credit, m/m September +0.5%

The yen dropped by the most in three years against the dollar as Japan stepped into foreign-exchange markets to weaken the currency for the third time this year after its gains to a postwar record threatened exporters. “I’ve repeatedly said that we’ll take bold action against speculative moves in the market,” Japanese Finance Minister Jun Azumi told reporters today after the government acted unilaterally. “I’ll continue to intervene until I am satisfied.”

The Australian dollar fell against its U.S. counterpart amid prospects that ebbing price pressures will allow Reserve Bank of Australia Governor Glenn Stevens to cut interest rates as soon as tomorrow’s policy meeting.

The so-called Aussie declined against 14 of its 16 major peers as investor demand for riskier assets abated before a report forecast to show business activity in the U.S. weakened. The Australian and New Zealand dollars rallied against the yen as Japan intervened to weaken its currency.

EUR/USD: on Asian session the pair fell, being corrected after significant growth on Thursday.

GBP/USD: on Asian session the pair weakened.

USD/JPY: on Asian session the pair gain.

On Monday EMU data at 1000GMT sees flash HICP for October and also unemployment data for September. Later on, at 1800GMT, Bundesbank Board member Rudolf Boehmler is due to give a speech entitled "The Debt Crisis as a Test for the Euro". US data at Chicago Purchasing Managers' Index October.

On Monday the 17-nation euro erased its drop versus the dollar and yen as European politicians attempted to craft an effective response to the region’s sovereign debt crisis.The yen rose versus the dollar as Japan’s exports increased 2.4 percent in September from a year earlier as demand for cars and auto parts advanced. Japanese Finance Minister Jun Azumi and Chief Cabinet Secretary Osamu Fujimura signaled today Japan is ready to intervene in the currency market to stop a yen appreciation to post-World War II highs that may stunt shipments as overseas demand slows.

On Tuesday canada’s dollar fell to C$1.0154 versus the U.S. currency after the Bank of Canada said the nation’s economy will grow more slowly than projected and removed a reference to withdrawing stimulus. The target lending rate was held at 1 percent, where it has been since September 2010. New Zealand’s dollar declined 1.2 percent to 79.74 U.S. cents as the South Pacific nation’s consumer prices increased 0.4 percent in the third quarter after rising 1 percent in the prior three months. The data fueled speculation the Reserve Bank of New Zealand will signal a willingness to keep its benchmark interest rate at a record low.

On Wednesday the euro fell versus the dollar and yen after reports that talks on bondholder losses of Greek debt were deadlocked added to concern efforts to remedy the European crisis are stalling. The European Union is seeking voluntary participation by banks in a second bailout package for Greece, though a forced solution can’t be ruled out. But the 17-nation euro touched the strongest in more than six weeks on news Germany’s lower house of parliament voted to expand the region’s bailout, later. The pound snapped five days of gains against the dollar as waning confidence in the euro-area and business optimism plunged to the lowest level in 2 1/2 years.

On Thursday the euro rallied to a seven-week high against the dollar after European leaders agreed to an expansion of a rescue fund for indebted nations and reached an accord with lenders on writedowns for Greek debt. The euro rose after European leaders meeting for the second time in four days persuaded bondholders to take 50 percent losses on Greek debt and boosted the firepower of a rescue fund for indebted nations to 1 trillion euros ($1.4 trillion). The yen rose to a record versus the dollar for the fourth time in five days day on speculation Bank of Japan measures announced today will fail to contain the currency’s rally. The yen strengthened even after the Bank of Japan expanded its credit and asset-purchase programs to a total of 55 trillion yen ($724 billion) from 50 trillion yen to damp the currency’s appreciation, which harms exporters.

On Friday the euro declined from almost a seven-week high against the dollar and yen as a rise in Italian borrowing costs raised concern European Union leaders haven’t done enough to stem the region’s debt crisis. Europe’s currency weakened after posting its biggest gain in a year against the greenback yesterday, when leaders announced a way to prevent a Greek default and safeguard banks. Italian Prime Minister Silvio Berlusconi conducted the first test of investor enthusiasm for Europe’s debt since the summit’s plan was announced, selling bonds today at euro-era record borrowing costs.

Asian stocks rose as the fastest U.S. economic growth in a year and Europe’s debt deal boosted the outlook for exporters. U.S. economy grew in the third quarter at the fastest pace in a year as gains in consumer spending and business investment helped support a recovery that had been on the brink of faltering. Household purchases, the biggest part of the economy, rose at a 2.4 percent pace, beating estimates. Global stocks rallied yesterday after European leaders talked bondholders into accepting 50 percent writedowns on Greek debt and boosted their rescue fund’s capacity to 1 trillion euros ($1.4 trillion) in a crisis-fighting package intended to shield the euro area.

Nikkei 225 9,050 +123.93 +1.39%, Hang Seng 20,019 +330.54 +1.68%, S&P/ASX 200 4,353 +5.09 +0.12%, Shanghai Composite 2,473 +37.80 +1.55%

Asian exporters advanced. Honda Motor Co., Japan’s second-largest carmaker by market value that gets 83 percent of its revenue abroad, rose 4.4 percent after U.S. household purchases beat estimates. Samsung Electronics Co., South Korea’s biggest exporter of consumer electronics, rose 2.3 percent to 945,000 won. Li & Fung Ltd., a supplier of toys and clothes to Wal-Mart Stores Inc., jumped 5.4 percent to HK$15.56. Nintendo Co., Japan’s maker of video-game players that gets 39 percent of its sales in the Americas, jumped 6 percent to 11,780 yen.Banks rose. HSBC Holdings Plc, Europe’s biggest lender, advanced 4.2 percent as Europe’s announcements eased concerns about the global financial system. Sumitomo Mitsui Financial Group Inc., Japan’s second-biggest lender, added 0.9 percent to 2,253 yen.

Industrial & Commercial Bank of China Ltd., the world’s biggest lender by market value, rose 2 percent to HK$5.02 after saying third-quarter profit climbed 28 percent. China Construction Bank Corp., the nation’s second-largest lender that reports earnings today, gained 3 percent to HK$5.85.

Mining companies advanced after copper in London jumped as much as 1.7 percent to $8,280 a metric ton. Three-month copper on the London Metal Exchange has increased about 14 percent this week. BHP Billiton Ltd., Australia’s No. 1 mining company, added 0.9 percent to A$38.69. Jiangxi Copper Co., China’s No. 1 producer of the metal by market value, increased 1.4 percent after metal prices gained.

American depositary receipts of Baidu Inc., China’s biggest Internet company by market value, soared 11 percent to $150 in Singapore after saying third-quarter profit rose 80 percent, beating analysts’ estimates, as revenue from search-engine advertising surged.

European stocks declined from a 12- week high as investors waited to discover how the euro area plans to fund its enlarged bailout facility. In the U.S., a report showed that consumer confidence unexpectedly rose in October from September. The Thomson Reuters/University of Michigan final index of consumer sentiment climbed to 60.9 from 59.4 the previous month. The preliminary reading for the month was 57.5.

National benchmark indexes declined in 13 of the 17 western-European markets that were open today. The U.K.’s FTSE 100 Index slipped 0.2 percent and France’s CAC 40 Index retreated 0.6 percent. Germany’s DAX Index gained 0.1 percent.

Petroleum Geo-Services fell 14 percent to 61.25 kroner, after reporting third-quarter net income of $13.5 million, compared with a loss of $40.4 million a year earlier. That missed the $32.6 million average of analysts’ estimates compiled by Bloomberg.

Wacker Chemie sank 9.8 percent to 76 euros. The Munich- based chemicals company reported third-quarter sales that trailed analysts’ estimates and forecast lower revenue in the fourth quarter.

YIT Oyj, Finland’s biggest builder, plunged 12 percent to 12.45 euros after posting third-quarter net income of 18.6 million euros. That missed the 38.1 million-euro mean estimate of eight analysts surveyed by Bloomberg.

Renault jumped 4.5 percent to 31.67 euros. The carmaker said revenue increased to 9.75 billion euros from 8.71 billion euros a year earlier. That beat the 9.63 billion-euro average of four analyst estimates compiled by Bloomberg. Societe Generale SA upgraded its stance on the shares to “buy” from “hold.”

Electrolux AB rallied 6.8 percent to 126.50 kronor. The Swedish maker of household appliances said third-quarter net income fell to 826 million kronor ($130 million) from 1.38 billion kronor a year earlier. Sales dropped to 25.65 billion kronor from 26.33 billion kronor. Both profit and sales exceeded analysts’ estimates in a Bloomberg survey.

SSAB AB surged 7.4 percent to 67.50 kronor after posting third-quarter net income and sales that topped estimates. The stock has rallied 28 percent this week, its largest advance since 1992.

Most U.S. stocks fell as data on consumer confidence and spending failed to boost equities a day after European leaders expanded the region’s bailout plan. Stocks rose yesterday as European leaders agreed to expand a bailout fund and U.S. economic growth accelerated. German Chancellor Angela Merkel said that the debt crisis won’t be over “in a year.” Italy’s borrowing costs rose to a euro-era record at a sale of three-year bonds, driving yields higher amid concern that efforts to contain the sovereign crisis won’t be enough to safeguard the region’s third-largest economy. Fitch Ratings said part of the plan to contain debt turmoil amounts to a Greek default. European leaders may struggle to maintain the euphoria that drove the euro to its biggest one-day gain in more than a year as scrutiny deepens on their latest attempt to stem the region’s turmoil.

Consumer confidence unexpectedly rose in October from the previous month, indicating the biggest part of the economy will help keep the U.S. recovery intact. The Thomson Reuters/University of Michigan final index of consumer sentiment climbed to 60.9 from 59.4 in September. The preliminary reading for the month was 57.5. A separate report showed that consumer spending in the U.S. accelerated in September. Still, incomes rose less than projected, sending the savings rate down to the lowest level in almost four years.

Dow 12,231.11 +22.56 +0.18%, Nasdaq 2,737.15 -1.48 -0.05%, S&P 500 1,285.09 +0.50 +0.04%

Hewlett-Packard Co. (HPQ) rallied 3.5 percent, the most in the Dow, to $27.94. Chief Executive Officer Meg Whitman is backing away from a spinoff proposal made by former CEO Leo Apotheker, who raised the idea in August as part of a sweeping overhaul. Moody’s Investors Service placed the company’s credit ratings on review for possible downgrade.

Whirlpool Corp., the world’s largest maker of household appliances, slumped 14 percent after saying it will cut more than 5,000 jobs. Profit this year will be in a range of $4.75 to $5.25 a share, down from a previous forecast of $7.25 to $8.25, the company said.

Cablevision Systems Corp. tumbled 13 percent to $15.14 after the fifth-largest U.S. cable-TV provider by subscribers said profit declined 65 percent. The company said it boosted spending on programming and on promoting its video, phone and broadband services.

Resistance 3: Y81.45 (Jul 8 high)

Resistance 2: Y80.80 (Jul 11 high)

Resistance 1: Y80.20 (Aug 4 high)

The current price: Y79.30

Support 1:Y78.60 (23.6 % FIBO Y79.50-Y75.55)

Support 2: Y78.00 (38.2 % FIBO Y79.50-Y75.55)

Support 3: Y77.55 (50.0 % FIBO Y79.50-Y75.55)

Comments: the pair grows.

Resistance 3: Chf0.8860 (Oct 26 high)

Resistance 2: Chf0.8810 (MA(233) H1)

Resistance 1: Chf0.8745 (61.8 % FIBO Chf0.8565-Chf0.8860)

The current price: Chf0.8721

Support 1: Chf0.8675 (MA(233) M15)

Support 2: Chf0.8620 (middle line from Oct 20)

Support 3: Chf0.8565 (Oct 27 low)

Comments: the pair is corrected remains on downtrend. In focus support Chf0.8675.

Resistance 3: $ 1.6150 (Oct 28 high)

Resistance 2: $ 1.6100 (middle line from Oct 6)

Resistance 1: $ 1.6010 (MA(233) M30)

The current price: $1.5981

Support 1 : $1.5930/40 (MA(233) H1, 23.6 % FIBO $1.5270-$ 1.6150)

Support 2 : $1.5890 (Oct 26 low)

Support 3 : $1.5820 (38.2 % FIBO $1.5270-$ 1.6150)

Comments: the pair is corrected remains on uptrend. In focus support $1.5930/40.

Resistance 3: $ 1.4245 (Oct 27 high)

Resistance 2: $ 1.4130 (middle line from Oct 4)

Resistance 1: $ 1.4020 (MA(233) M30)

The current price: $1.4003

Support 1 : $1.3970 (61.8 % FIBO $1.3800-$1.4245)

Support 2 : $1.3920 (MA(233) H1)

Support 3 : $1.3800 (Oct 26 low)

Comments: the pair is corrected remains on uptrend. In focus support $1.3970.

00:30 Australia Private Sector Credit, y/y September +3.0% +3.1%

00:30 Australia Private Sector Credit, m/m September +0.2% +0.3%

07:00 Germany Retail sales, real adjusted September -2.9% +1.1%

07:00 Germany Retail sales, real unadjusted, y/y September +2.2% +1.6%

09:00 Italy Unemployment Rate September 7.9% 7.9%

09:30 United Kingdom Consumer credit, bln September 0.5 0.4

10:00 Eurozone Harmonized CPI, y/y, preliminary October +3.0% +2.8%

10:00 Eurozone Unemployment Rate September 10.0% 10.0%

10:00 Italy CPI (Prelim), m/m October 0.00% +0.2%

10:00 Italy CPI (Prelim), Y/Y October +3.0% +2.9%

12:30 Canada Gross Domestic Product (MoM) August +0.3% +0.2%

12:30 Canada Raw Material Price Index September -3.2% -2.7%

12:30 Canada Industrial product prices, m/m September +0.5% +0.1%

13:45 U.S. Chicago Purchasing Managers' Index October 60.4 59.3

23:50 Japan Monetary Policy Meeting Minutes

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.