- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-11-2011

The euro rose versus the dollar and yen after Greek Prime Minister George Papandreou signaled he won’t call for a referendum on a bailout package, easing concern voters would reject it and send the nation into default. Papandreou reached out to his political opposition about setting up a transitional government, indicating an accord would secure aid and remove the need for a referendum on euro membership.

The 17-nation currency earlier approached a three-week low versus the greenback after the European Central Bank cut its key interest rate to 1.25 percent and said Europe is heading toward a “mild recession.”

The dollar dropped as stocks and commodities rallied, damping demand for haven assets.

The euro gained 0.8 percent to $1.3850 at 1:50 p.m. in New York, after falling as much as 0.7 percent. It dropped to $1.3609 on Nov. 1, the weakest since Oct. 12. The shared currency strengthened 0.6 percent to 107.97 yen. It slid earlier as much as 0.7 percent after the ECB announcement. The Japanese currency rose 0.1 percent to 77.97 per dollar.

European stocks advanced after the euro-area central bank unexpectedly cut the benchmark interest rate and Greek Prime Minister George Papandreou signaled he won’t call a referendum on the latest bailout package.

The ECB unexpectedly cut interest rates as Italian and Spanish borrowing costs soared after euro-area leaders raised the prospect of Greece leaving the monetary union. ECB officials, meeting under the presidency of Mario Draghi for the first time, cut the benchmark interest rate by 25 basis points to 1.25 percent.

Papandreou signaled he won’t call a referendum calling into question Greece’s membership of the euro, saying he will reach out to the opposition about forming a transitional government.

The Greek prime minister said the country belongs in the currency bloc and welcomed support shown by the main opposition New Democracy party for last week’s rescue agreement agreed with EU leaders in Brussels.

National benchmark indexes gained in 17 of the 18 western European markets. France’s CAC 40 rallied 2.7 percent and Germany’s DAX climbed 2.8 percent. The U.K.’s FTSE 100 added 1.1 percent.

National Bank of Greece SA led the country’s lenders higher, it rose 11 percent to 1.80 euros. Alpha Bank SA climbed 15 percent to 1.07 euros. Piraeus Bank SA rallied 10 percent to 23.6 euro cents. Banks rose throughout Europe, with BNP Paribas SA, France’s biggest bank, advancing 7.5 percent to 31.92 euros. Commerzbank AG, Germany’s second-largest lender, added 5.5 percent to 1.75 euros.

Swiss Re Ltd. and Man Group Plc gained more than 2 percent after reporting better-than-expected earnings.

Swiss Re rose 6.1 percent to 49 Swiss francs. The world’s second-biggest reinsurer said third-quarter profit more than doubled to $1.35 billion. That beat the $539 million average estimate of nine analysts surveyed by Bloomberg.

Man Group gained 2.4 percent to 144.7 pence. The biggest publicly traded hedge-fund manager reported a smaller-than- forecast decline in pretax profit in the fiscal first half. Pretax profit dropped to $195 million in the six months through September from $227 million in the year-earlier period, the London-based company said. Man forecast pretax profit of $185 million.

Cable & Wireless Communications jumped 7.8 percent to 39.33 pence. The company said first-half net income before exceptional items rose 9 percent to $163 million. The company also said restructuring is ahead of schedule.

Aker Solutions ASA surged 10 percent to 67.15 kroner. Norway’s biggest oil platform maker said third-quarter net income more than tripled to 1.12 billion kroner ($200 million) as it booked a gain after separating out Kvaerner ASA.

ING Groep NV rallied 9.4 percent to 6.18 euros. The biggest financial-services company in the Netherlands said it plans to cut 11 percent of the jobs at its Dutch bank and posted third- quarter earnings that surpassed analysts’ estimates.

Tenaris SA soared 15 percent to 12.85 euros. The world’s largest maker of seamless pipes said third-quarter profit rose 7 percent on higher demand in the U.S. and Europe and increased prices.

Rheinmetall AG tumbled 7.6 percent to 35.12 euros. The maker of KS Kolbenschmidt engine pistons and a partner in Germany’s Puma battle tank said it won’t stage an initial public offering of its automotive unit, citing stock-market declines. Rheinmetall’s third-quarter earnings before interest and taxes rose to 76 million euros, missing analyst estimates.

Tensions in financial markets is primarily due to sovereign risk in Europe

Volatility in exchange rates creates a risk to economic growth and financial stability

In the emerging markets show signs of vulnerability

Employment must be in the forefront of the implementation of actions to restore economicrostv

Rising commodity prices hurt economic growth

We intend to improve the stability of banks to the financial and economic shocks

Offers at $1.3850, the value of the 55d ma.

According to the International Labour Organization (ILO) unemployment rate in Germany, seasonally adjusted, in September fell to 5.8% from 5.9% in August, the number of unemployed at the same time in September fell by 30 thousand to 2.44 million.

U.S. stocks rose, sending the Standard & Poor’s 500 Index higher for a second day, as the European Central Bank unexpectedly cut rates and the region’s leaders increased pressure on Greece to accept a bailout.

The ECB unexpectedly cut interest rates at President Mario Draghi’s first meeting in charge after euro-area leaders raised the prospect of Greece exiting the monetary union, sending bond yields soaring in Italy and Spain. Stocks extended gains after the Associated Press reported that Greece’s plan to hold a referendum on its bailout has been scrapped.

European leaders for the first time raised the prospect of the euro area splintering, forcing debt-stricken Greece to decide whether it’s in or out when it holds a referendum on a bailout package next month. German and French leaders holding emergency talks on the eve of a Group of 20 summit today in Cannes, France, withheld 8 billion euros ($11 billion) of assistance.

Earlier today, stocks rose after BBC reported that Papandreou would step down and propose a coalition government headed by former European Central Bank vice-president Lucas Papademos, without saying how it got the information. Later, two officials with the ruling Pasok party said Papandreou won’t resign his post and plans to speak in Parliament in Athens today as scheduled.

Dow 11,951.23 +115.19 +0.97%, Nasdaq 2,667.70 +27.72 +1.05%, S&P 500 1,249.32 +11.42 +0.92%

Qualcomm jumped 6.6 percent to $55.65. The company, which gets most of its profit from licenses on technology used in so- called 3G phones, is benefiting as more consumers switch to the technology -- especially in developing countries. Widening use of smartphones fuels growth in royalty revenue and sales of cellular radio chips and processors.

Kraft Foods Inc. (KFT), the food company planning to split in two next year, added 3.7 percent after raising its earnings forecast. Chief Executive Officer Irene Rosenfeld plans to spin off the North American grocery business by the end of next year to focus on selling snack foods in emerging markets. Food companies such as Kraft, Sara Lee Corp. and General Mills Inc. have raised prices on many products this year to make up for higher costs for ingredients such as corn, coffee and sugar.

Estee Lauder Cos. jumped 14 percent to $114.71. The maker of Clinique and Bobbi Brown makeup lines announced plans for a 2-for-1 split. The New York-based company also said it will increase its annual dividend by 40 percent to $1.05 a share.

Jefferies Group Inc.pared its loss to 9.1 percent as it said it has no “meaningful net exposure” to European sovereign debt after its shares plunged as much as 20 percent earlier today, triggering stock-market circuit breakers. Egan-Jones Ratings Co. downgraded the firm’s creditworthiness to BBB- from BBB, citing “a changed environment” after the collapse of MF Global Holdings Ltd. and saying it was concerned about the size of Jefferies’ $2.7 billion in “sovereign obligations” relative to the investment bank’s equity.

Dollar prices to Buy Gold rose sharply to a six-week high of $1757 per ounce late on Thursday morning - though only 0.7% above last week's close - following reports that Greek prime minister George Papandreou was on the verge of offering his resignation.

Eurozone leaders were openly discussing a Greek exit from the Euro last night, while the Greek government was reportedly close to collapse, after another member of prime minister Papandreou's party indicated they will not support the government in a confidence vote scheduled for tomorrow - taking Papandreou's majority down to one.

Stocks and commodities gained, while the Euro dropped sharply following the European Central Bank's decision to cut interest rates. The ECB meantime cut its key interest rate Thursday by a quarter-point to 1.25%, following its first monetary policy meeting since Mario Draghi took over as president.

Gold futures for December delivery raised to $ 1.768,30 per troy ounce in New York

Oil rose for a second day in New York, reversing earlier losses as European leaders pressured Greece into proceeding with a rescue package that may stem the region’s debt crisis.

West Texas Intermediate futures rebounded from a 1.8 percent decline before a Group of 20 summit set to begin today in Cannes, France. Led by Germany and France, Europe’s economic and political anchors, the euro’s guardians yesterday cut off financial aid for Greece until an early December vote determines whether it deserves a fresh batch of loans.

European leaders raised the prospect of the euro area splintering, forcing Greece to decide whether it’s in or out when it holds a referendum on a bailout package next month.

On Thursday, the focus of market participants were meeting the European Central Bank, which was the first for the new ECB president Mario Draghi, who succeeded on 1 November, this post by Jean-Claude Trichet. At the end of this session the European Central Bank unexpectedly lowered the discount rate by 25 basis points to 1.25% level, which put pressure on the euro.

The main attention is focused on investors awaiting the outcome of negotiations, the G20 leaders in Cannes. Summit of the "Big Twenty" opens today at the French Cannes. The leaders of the "twenty" is expected to discuss the global economy, reforming the global financial system and regulation of financial markets, as well as the problems of volatility in commodity prices. The focus of the G20 will also be providing employment, enhancing social protection and anti-corruption, energy issues and climate change.

Crude for December delivery rose to $94.23 a barrel on the New York Mercantile Exchange. It earlier fell as low as $90.87 a barrel.

Brent for December settlement traded 34 cents higher at $109.68 a barrel on the London-based ICE Futures Europe exchange. Brent’s premium to New York crude was $16.61 a barrel, compared with settlements of $16.83 yesterday and a record-high $27.88 on Oct. 14.

employment 53.3 vs 48.7;

new orders 52.4 vs 56.5.

USD/JPY Y78.00, Y76.25, Y78.65

AUD/USD $1.0400, $1.0000

GBP/USD $1.5740, $1.6000, $1.6100, $1.6125

EUR/CHF Chf1.2200, Chf1.2100

EUR/JPY Y106.50

EUR/GBP stg0.8625, stg0.8850

- tensions in mkts to dampen growth in EMU 2H, beyond

- downward revision of fcasts very likely

- inflation risks still broadly balanced

- eurozone growth iin 2H to be 'very moderate'

- HICP above 2% for some months, but below 2% '12

- tensions in mkts to dampen growth in EMU 2H, beyond

- downward revision of fcasts very likely

- inflation risks still broadly balanced

- eurozone growth iin 2H to be 'very moderate'

- HICP above 2% for some months, but below 2% '12

European leaders for the first time raised the prospect of the euro area splintering, forcing debt-stricken Greece to decide whether it’s in or out when it holds a referendum on a bailout package next month.

A report today showed fewer Americans filed applications for unemployment benefits last week, signaling limited progress in the labor market. A separate report today may show that service industries in the U.S. grew at a faster pace in October, indicating the biggest World markets: Nikkei -2.21%, Hang Seng -2.49%, Shanghai Composite +0.16%, FTSE +1.36%, CAC +3.43%, DAX +3.45%.

09:30 UK CIPS services index (October) 51.3

The euro rose for a second day against the dollar on speculation Greek Prime Minister George Papandreou will withdraw his proposal for a referendum on the nation’s bailout, easing concern voters will reject the plan.

The euro advanced before Group of 20 leaders discuss the region’s debt crisis at a summit today and Mario Draghi addresses his first policy meeting as European Central Bank President.

The dollar weakened as European stocks gained.

The ECB lowered its benchmark interest rate at 25 bp to 1.25 percent today.

The Dollar Index, which IntercontinentalExchange Inc. uses to track the U.S. currency against those of six trading partners, dropped 0.4 percent to 76.743.

EUR/USD: the pair showed high in $1,3830 area and decreased below $1,3800 later.

GBP/USD: the pair grown in $1,6020 area.

USD/JPY: the pair holds in Y77,95-Y78,10 area.

US data continues with the 1400GMT ISM Non-Manufacturing Index (NMI) and Factory Orders. The ISM non-manufacturing index is forecast to rise to a reading of 54.0 in October after falling slightly in September.

EUR/USD

Offers $1.3900/10, $1.3850

Bids $1.3800, $1.3780, $1.3765/60, $1.3725/20, $1.3700, $1.3660/55, $1.3640/35

Currently FTSE 5,507 +22.82 +0.42%, CAC 3,169 +58.82 +1.89%, DAX 6,076 +110.39 +1.85%.European stocks advanced, Europen stocks erasing earlier losses after Greek Prime Minister George Papandreou’s ruling party split over his call for a referendum on the latest bailout package, sparking speculation the vote may not happen.

Resistance 3: Y79.50 (Oct 31 high)

Resistance 2: Y79.00 (Nov 1 high)

Resistance 1: Y78.40 (Nov 2 high)

Current price: Y78.01

Support 1:Y77.90 (Nov 2 low)

Support 2:Y77.55 (50.0 % FIBO Y75.55-Y79.55)

Support 3:Y77.10 (61.8 % FIBO Y75.55-Y79.55)

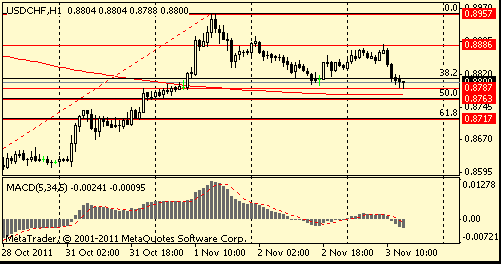

Resistance 2: Chf0.8950/60 (area of МА(200) for Н4, Oct 21 and Nov 1 high)

Resistance 1: Chf0.8890 (session high)

Current price: Chf0.8800

Support 1: Chf0.8810 (session low)

Support 2: Chf0.8760 (50,0 % FIBO Chf0,8570-Chf0,8960, МА(200) for Н1)

Support 3: Chf0.8720 (61,8 % FIBO Chf0,8570-Chf0,8960)

Resistance 2: $ 1.6090 (Nov 1 high)

Resistance 1: $ 1.6050 (Nov 2 high)

Current price: $1.6025

Support 1 : $1.6000 (earlier resistance)

Support 2 : $1.5890 (area of Oct 26 low, Nov 1 low and support line from Oct 12)

Support 3 : $1.5850 (earlier resistance, Oct 14, 17th and 19 highs)

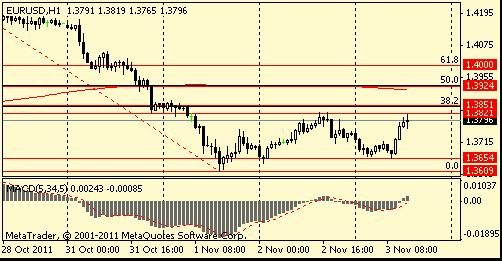

Resistance 2: $ 1.3850 (38,2 % FIBO $1,4240-$ 1,3610)

Resistance 1: $ 1.3820 (session high)

Current price: $1.3791

Support 1 : $1.3650 (session low)

Support 2 : $1.3610 (Nov 1 low)

Support 3 : $1.3560 (61,8 % FIBO $1,3150-$ 1,4240, Oct 11 low)

USD/JPY Y78.00, Y76.25, Y78.65

AUD/USD $1.0400, $1.0000

GBP/USD $1.5740, $1.6000, $1.6100, $1.6125

EUR/CHF Chf1.2200, Chf1.2100

EUR/JPY Y106.50

EUR/GBP stg0.8625, stg0.8850

Nikkei 225 closed

Hang Seng 19,215 -518.66 -2.63%

S&P/ASX 4,172 -12.83 -0.31%

Shanghai Composite 2,508 +3.98 +0.16%

00:30 Australia Retail Sales Y/Y September +2.4%

01:00 China Non-Manufacturing PMI October 57.7

The euro continues declined, trading 0.8 percent from a three-week low against the dollar, as European leaders said Greece will vote next month to determine whether it will stay in the 17-nation currency.

The euro dropped for a third day versus the yen after French President Nicolas Sarkozy said Greece won’t receive a “single cent” in aid without holding to the terms of its bailout agreement. The dollar and yen gained against most of their 16 major counterparts as Asian stocks declined, boosting investor appetite for safer assets.

New Zealand’s currency weakened after a statistics bureau report showed the unemployment rate unexpectedly rose to 6.6 percent in the third quarter from 6.5 percent in the previous period.

EUR/USD: on Asian session the pair the pair continues yesterday's falling.

GBP/USD: on Asian session the pair decreased.

USD/JPY: on Asian session the pair holds in range Y78.00-Y78.15..

Thursday sees the start of the G20 Summit, taking place in Cannes. France new car registrations data starts the European data at 0830GMT. The ECB policy decision at 1245GMT will be the main European focus for Thursday and is followed at 1330GMT by Mario Draghi's first press conference as ECB president following a rate decision meeting. US events start at 1230GMT, including Atlanta Fed President

Dennis Lockhart making opening remarks at a conference on "What Should We Really Expect from Monetary Policy," in Atlanta. US data also starts at 1230GMT with the weekly Jobless Claims, 3Q Non-farm Productivity and Unit Labor Costs. Initial jobless claims are expected to fall 2,000 to 400,000 in the October 29 week after small declines in the previous two weeks.US data continues with the 1345GMT weekly Bloomberg Comfort Index and then at 1400GMT by the ISM Non-Manufacturing Index (NMI) and Factory Orders.

The U.S. dollar offset the losses against the euro after the Federal Reserve raised its assessment of the economy. The Central Bank said here that "significant risks" remain, but, still, refrained from taking additional measures to ease monetary policy. The published statistics on the market yesterday, employment has also supported the dollar. As reported today, an independent U.S. recruiting and analytical agency ADP (Automatic Data Processing) in the private sector appeared 110 000 new jobs during the month of October. Data for September were revised up to 25 thousand items in a big way in the final count recorded 116 000 new employees of private firms and companies, not 91 thousand, as previously thought. In October, the vast majority of new positions, namely 114 000 was created in the service sector, while industrial workers, by contrast, have reduced staff by 4000 workers.

Earlier, the euro rose in the first time at this week after the cabinet of Greece supported the call of Prime Minister George Papandreou on the referendum on the plan of salvation of Greece. Greek Prime Minister George Papandreou secured the support of ministers on the issue submitted to referendum, the country assistance plan worth 130 billion euros, but he has to convince the leaders of the eurozone whether the referendum, did not expect such a decision.EUR/USD: yesterday the pair rose.

GBP/USD: the pair gain in first half of yesterday but lost later.

USD/JPY: yesterday the pair decreased to Y78.00.

Thursday sees the start of the G20 Summit, taking place in Cannes. France new car registrations data starts the European data at 0830GMT. The ECB policy decision at 1245GMT will be the main European focus for Thursday and is followed at 1330GMT by Mario Draghi's first press conference as ECB president following a rate decision meeting. US events start at 1230GMT, including Atlanta Fed President

Dennis Lockhart making opening remarks at a conference on "What Should We Really Expect from Monetary Policy," in Atlanta. US data also starts at 1230GMT with the weekly Jobless Claims, 3Q Non-farm Productivity and Unit Labor Costs. Initial jobless claims are expected to fall 2,000 to 400,000 in the October 29 week after small declines in the previous two weeks.US data continues with the 1345GMT weekly Bloomberg Comfort Index and then at 1400GMT by the ISM Non-Manufacturing Index (NMI) and Factory Orders.

Asian stocks fell for a third day as Greece’s plan for a referendum on Europe’s bailout stoked concern the sovereign-debt crisis won’t be contained. Hong Kong stocks rallied on speculation that China may act to stimulate its economy. This week’s slide in Asian stocks has almost erased gains that came last week as Europe appeared to have struck a deal to contain the debt crisis. Papandreou, whose hold on power is weakening, will fly to Cannes, France, today on the eve of a Group of 20 summit that starts tomorrow.

Japan’s Nikkei 225 (NKY) Stock Average decreased 2.2 percent. Australia’s S&P/ASX 200 slipped 1.1 percent. Hong Kong’s Hang Seng Index (HSI) gained 1.9 percent, erasing losses of as much as 1.8 percent. China’s Shanghai Composite Index advanced 1.4 percent, reversing a decline of as much as 1.5 percent.Macquarie sank 2.8 percent to A$23.62. Mitsubishi UFJ Financial Group Inc., Japan’s largest publicly traded bank, decreased 2.3 percent to 334 yen. Rival Sumitomo Mitsui Financial Group Inc. fell 2.2 percent to 2,144 yen.

James Hardie Industries SE, a supplier of building materials that counts the U.S. as its biggest market, sank 3.7 percent to A$5.81 in Sydney. Samsung Electronics Co., South Korea’s biggest exporter of consumer electronics, slipped 1.9 percent to 971,000 won in Seoul. Sony slid 3.6 percent to 1,520 yen in Tokyo.

Toyota Motor Corp. and Honda Motor Co. declined after a report showed U.S. sales for Japan’s top two carmakers declined last month. Toyota fell 3.5 percent to 2,505 yen. Honda dropped 4.2 percent to 2,304 yen.

Nomura Holdings Inc. fell 4.1 percent to 282 yen after the brokerage posted a second-quarter loss of 46.1 billion yen ($590 million) that’s wider than analysts’ estimated. The company said will consider eliminating jobs at home to cut costs

Samsung Heavy Industries Co., South Korea’s second-biggest shipbuilder by market value, dropped 3.4 percent to 32,600 won in Seoul after reporting a 53 percent slump in profit.

OneSteel Ltd., Australia’s second-largest producer of the metal, tumbled 18 percent to 98.5 Australian cents in Sydney, the most on record and the biggest decline on the MSCI Asia Pacific Index. The company cut its first-half profit forecast because of lower iron ore prices and gains in the local currency.

Among stocks that advanced, Chinese lenders and developers advanced on speculation the nation’s slowing inflation would convince authorities to ease monetary policy. China’s inflation may ease to 5.3 percent or 5.4 percent in October, said Zhu Jianfang, a Beijing-based economist at Citic Securities Co. The figure is due next week. Consumer prices rose 6.1 percent in September.

ICBC, as the world’s biggest lender by market value is known, jumped 4 percent to HK$4.94 in Hong Kong. China Construction Bank Corp., the nation’s No. 2 lender by market value, increased 3 percent to HK$5.83. China Overseas Land & Investment Ltd., the largest mainland developer listed in Hong Kong, surged 6.1 percent to HK$14.52. China Resources Land Ltd., a state-owned developer, climbed 3.9 percent to HK$11.64.

Builders of China’s rail infrastructure rallied after a report by Xinhua News Agency, which cited unnamed people from the railway ministry, said the government will get more than 200 billion yuan ($31.5 billion) as financial support to ensure payments for projects.

China Railway Group Ltd., China’s biggest builder of railway infrastructure, jumped 9 percent to HK$2.92 in Hong Kong. China Railway Construction Corp. surged 11 percent to HK$5.36.

European stocks rose, snapping the biggest three-day drop in almost two months, as U.S. companies hired more workers than forecast and Federal Reserve policy makers raised their assessment of the economy in a statement at the close of trading. Euro-area leaders, racing to prevent their week-old debt crisis strategy from unraveling, are holding emergency talks today to tell Greece there is no alternative to the budget cuts imposed in the bailout plan.

National benchmark indexes climbed in 11 of the 18 western European markets today. The U.K.’s FTSE 100 rose 1.2 percent and France’s CAC 40 advanced 1.4 percent. Germany’s DAX Index gained 2.3 percent.

Randgold climbed 7.4 percent to 7,235 pence, the highest price since it first started trading in 1997. The miner said it expects its gold production to increase as much as 22 percent next year as output in Mali and Ivory Coast rises. Output may jump to 850,000 ounces to 900,000 ounces in 2012 from a target of 740,000 ounces to 760,000 ounces this year, Chief Executive Officer Mark Bristow said today in an interview in London.

Rio Tinto, the world’s second-biggest mining company, advanced 3.8 percent to 3,375 pence as copper rose more than 1.5 percent on the London Metal Exchange. Antofagasta Plc advanced 5.4 percent to 1,174 pence as the copper producer controlled by Chile’s Luksic family reported a 17 percent increase in quarterly output.

Next Plc, the U.K.’s second-largest clothing retailer, advanced 6.5 percent to 2,723 pence after reporting growth in third-quarter brand sales that exceeded analyst estimates.

Lundin Petroleum AB, the oil explorer with a stake in the giant Avaldsnes-Aldous Major North Sea find, rose 6.5 percent to 163 kronor after forecasting higher production in 2012. The company reported third-quarter earnings before interest, taxes, depreciation and amortization of $262 million, beating the average analyst estimate of $223 million.

Volkswagen AG led a gauge of automakers to the biggest gain of all industry groups in the Stoxx 600, rallying 6 percent to 127.20 euros. China’s passenger-car market may grow 8 percent to 10 percent a year over the coming five years, Karl-Thomas Neumann, head of VW’s Chinese operations said today at a conference in Berlin.

Lloyds, Britain’s biggest mortgage, dropped 4.4 percent to 29.21 pence. Horta-Osorio is taking leave of absence from his duties as CEO following medical advice and will be replaced in the interim by Finance Director Tim Tookey.

Logica Plc sank 7.3 percent to 83 pence as the Anglo-Dutch computer services provider posted third-quarter sales that trailed analyst estimates and cut its annual earnings forecast.

Meda AB, Sweden’s largest publicly traded drugmaker, fell 7.6 percent to 59.30 kronor after saying its profit margin in northern Europe dropped in the third quarter.

U.S. stocks dropped, driving the Standard & Poor’s 500 Index to the biggest two-day U.S. stocks advanced, rebounding from a two-day drop in the Standard & Poor’s 500 Index, as the Federal Reserve said economic growth strengthened and it is prepared to take action if needed to safeguard the recovery.

The Federal Open Market Committee said “economic growth strengthened somewhat in the third quarter,” while also saying “significant downside risks” remain to the outlook. Stocks extended gains as Fed Chairman Ben S. Bernanke said additional purchases of mortgage-backed securities are a “viable option” if the state of the economy warrants further easing.

Fed officials lowered their outlook for U.S. economic growth in 2012 and forecast that unemployment will average from 8.5 percent to 8.7 percent in the final three months of next year. Forecasts for 2012 growth in U.S. gross domestic product from the five Fed Board members and 12 reserve bank presidents centered around 2.5 percent to 2.9 percent, measured from the fourth quarter of this year to the fourth quarter of next year. For this year, the central tendency forecast for U.S. growth was 1.6 percent to 1.7 percent.

Gauges of commodity and financial shares had the biggest gains in the S&P 500 among 10 industries, rising at least 2.2 percent. Bank of America Corp. (BAC), Chevron Corp. (CVX) and Alcoa Inc. (AA) rallied more than 2.4 percent.

MasterCard Inc. jumped 7 percent as profit beat analysts’ estimates.

MF Global Holdings Ltd. tumbled 79 percent in its first day of over-the-counter trading after the futures brokerage filed for bankruptcy, prompting the New York Stock Exchange to delist the shares.

Phone stocks gained after the U.S. House voted to bar new state and local taxes on wireless services. Sprint Nextel Corp. climbed 9.2 percent to $2.72. AT&T Inc. increased 1.3 percent to $29.08.

AOL Inc. rallied 13 percent to $15.02. The Internet company that’s struggling to halt a sales slide reported third-quarter earnings that exceeded analysts’ estimates by 65 percent.

Resistance 3: Y80.20 (Aug 4 high)

Resistance 2: Y79.50 (Oct 31 high)

Resistance 1: Y78.45 (session high)

The current price: Y78.03

Support 1:Y77.95 (Nov 2 low)

Support 2: Y77.55 (50.0% FIBO Y75.55-Y79.55)

Support 3: Y77.20 (MA(233) H1)

Comments: the pair holds in range.

Resistance 3: Chf0.9005 (high of the American session on Oct 20)

Resistance 2: Chf0.8960 (Nov 1 high)

Resistance 1: Chf0.8880 (session high)

The current price: Chf0.8878

Support 1: Chf0.8830 (session low)

Support 2: Chf0.8765 (50.0% FIBO Chf0.8960-Chf0.8565)

Support 3: Chf0.8715 (61.8% FIBO Chf0.8960-Chf0.8565)

Comments: the pair is on uptrend. In focus resistance Chf0.8905.

Resistance 3: $ 1.6150/65 (area of Oct 28-31 high)

Resistance 2: $ 1.6045 (Nov 2 high)

Resistance 1: $ 1.5970 (resistance line from Oct 31)

The current price: $1.5902

Support 1 : $1.5875 (session low)

Support 2 : $1.5770 (support line from Oct 31)

Support 3 : $1.5680 (Oct 20 low)

Comments: the pair is on downtrend. In focus resistance $1.5875.

Resistance 3 : $1.3925 (50.0% FIBO $1.3605-$ 1.4245)

Resistance 2 : $1.3830 (Nov 2 high)

Resistance 1 : $1.3755 (session high)

The current price: $1.3703

Support 1 : $1.3660 (session low)

Support 2 : $1.3565 (Oct 11 low)

Support 3 : $1.3500 (psychological mark)

Comments: the pair is on downtrend. In focus support $1.3660.

Change % Change Last

Nikkei 225 8,640 -195.10 -2.21%

Hang Seng 19,734 +363.75 +1.88%

S&P/ASX 200 4,185 -48.26 -1.14%

Shanghai Composite 2,504 +34.09 +1.38%

FTSE 100 5,484 +62.53 +1.15%

CAC 40 3,111 +42.26 +1.38%

DAX 5,966 +131.12 +2.25%

Dow 11,836.04 +178.08 +1.53%

Nasdaq 2,639.98 +33.02 +1.27%

S&P 500 1,237.90 +19.62 +1.61%

10 Year Yield 2.01% +0.00 --

Oil $92.89 +0.38 +0.41%

Gold $1,738.70 +9.10 +0.53%

00:30 Australia Retail sales (MoM) September +0.6% +0.5%

00:30 Australia Retail Sales Y/Y September 1.8%

01:00 China Non-Manufacturing PMI October 59.3 57.7

06:00 G20 G20 Meetings

09:30 United Kingdom Purchasing Manager Index Services October 52.9 51.9

12:30 U.S. Initial Jobless Claims 402 402

12:45 Eurozone ECB Interest Rate Decision 1.50% 1.50%

13:30 Eurozone ECB Press Conference

14:00 U.S. ISM Non-Manufacturing October 53.0 53.9

14:00 U.S. Factory Orders September -0.2% 0.0%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.