- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-11-2011

The euro fell against the dollar, poised for its biggest weekly loss in almost two months, as Group of 20 leaders failed to agree on funding to support European governments’ efforts to contain their debt crisis. The euro pared its declines as commodities reversed a retreat.

The dollar rose against 13 of its 16 most-traded counterparts after the Commerce Department reported the U.S. unemployment rate fell while nonfarm payrolls expanded less than forecast. The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major trade partners including the euro and yen, rose 0.4 percent to 77.067. The U.S. currency has strengthened 2.6 percent against the euro this week, its biggest five-day gain in almost two months, as investors sought safety amid concern Greece is headed for default and the sovereign-debt crisis will cause euro-area growth to contract.

Canada’s currency tumbled after the nation’s employers unexpectedly eliminated jobs. Employment in Canada fell by 54,000 jobs last month after an increase of 60,900 in September, the nation’s statistics agency reported today. Two days ago, Bank of Canada Governor Mark Carney reiterated the outlook for the Canadian economy has weakened since July.

The Australian dollar fell for the first time in three days after the Reserve Bank lowered its forecasts for economic growth and inflation forecasts for the next two years as global financial turmoil makes businesses more reluctant to hire.

European stocks fell, capping the first weekly decline in six weeks, after the Group of 20 failed to agree on boosting the International Monetary Fund’s resources and German factory data fueled concern the region is slipping into recession.

Global policy makers are awaiting more details of a week- old rescue package before they commit fresh cash to the IMF which could then lend to Europe’s bailout facility, German Chancellor Angela Merkel said at the end of a G-20 summit in Cannes, France. French President Nicolas Sarkozy said it may take until February for a deal.

German factory orders unexpectedly plunged in September as demand from the euro region slumped, adding to signs the debt crisis is damping growth in Europe’s largest economy. Orders, adjusted for seasonal swings and inflation, fell 4.3 percent from August, when they dropped 1.4 percent, the Economy Ministry in Berlin said in a statement today. It’s the third straight month orders have declined.

National benchmark indexes retreated in all but three of the 18 western European markets. France’s CAC 40 dropped 2.3 percent and Germany’s DAX declined 2.7 percent. The U.K.’s FTSE 100 slid 0.3 percent.

Alcatel-Lucent SA, France’s largest telecommunications equipment maker, slumped to the lowest price in more than two years as it cut its full-year profit margin forecast.

Commerzbank AG dropped 6.3 percent after reporting a bigger- than-estimated quarterly loss on Greek-debt writedowns.

Fiat SpA, Italy’s biggest automaker, lost 5.5 percent to 4.14 euros as a gauge of European carmakers was the worst performer of the 19 industry groups in the Stoxx 600, sliding 3.5 percent.

Hermes International SCA, the French maker of Birkin bags and silk scarves, advanced 3.1 percent to 252.20 euros after raising its full-year revenue growth target to a range of 15 percent to 16 percent at constant exchange rates, from its previous forecast for an increase of as much as 14 percent.

Lundin Petroleum AB rose 2.6 percent to 173.50 kronor, the highest price since at least September 2001.

Rheinmetall AG, the maker of defense equipment and car parts, jumped 5.8 percent to 37.15 euros after Juergen Pieper, an analyst at Bankhaus Metzler, upgraded the company’s shares to “buy” from “sell.”

U.S. stocks fell, sending the Standard & Poor’s 500 Index toward its first weekly drop since September, as concern about European financing offset an unexpected decrease in the American unemployment rate.

Global stocks slumped as the Group of 20 nations failed to agree on increasing the resources of the International Monetary Fund, dashing the hopes of European governments keen to tap more foreign aid. In the U.S., the unemployment rate fell to a six- month low of 9 percent from 9.1 percent, even as the labor force expanded. The 80,000 increase in payrolls followed gains in the prior two months that were revised up by 102,000.

Dow 11,886.60 -157.87 -1.31%, Nasdaq 2,670.43 -27.54 -1.02%, S&P 500 1,244.37 -16.78 -1.33%

All 10 groups in the S&P 500 retreated as financial and industrial companies had the biggest declines. A measure of financial stocks had the biggest decline in the S&P 500 among 10 industries, falling 2.1 percent, as European lenders sank. Bank of America dropped 4.1 percent to $6.63. JPMorgan Chase & Co. declined 2.5 percent to $33.53.

AIG tumbled 4.9 percent to $23.42. The quarterly loss casts doubt on the insurer’s ability to benefit from more than $25 billion in assets that can be used to lower future tax bills. The company posted a $4.11 billion third-quarter loss that wiped out profit from the first six months of the year.

LinkedIn Corp. tumbled 9.1 percent to $79.52 as spending on research and development drove the professional-networking website to a loss. The company, which first sold shares to the public in May, is increasing spending on research, sales and marketing, and office expansions to boost the company’s global presence and attract more recent college graduates to the site.

Starbucks Corp. rallied 7 percent to $44.30. The world’s largest coffee-shop operator, said fourth-quarter profit rose 29 percent as U.S. sales increased. Chief Executive Officer Howard Schultz has sought to boost sales by selling Via instant coffee that customers can brew at home.

Oil fell from a three-month high as the Group of 20 nations failed to agree on boosting the resources of the International Monetary Fund to fight Europe’s debt crisis and as U.S. payrolls rose less than expected.

Oil declined as much as 1.2 percent after German Chancellor Angela Merkel said governments are awaiting further details of Europe’s week-old rescue package before they commit cash. Nonfarm payrolls increased 80,000 in October according to a Labor Department report, less than the 95,000 median estimate by economists surveyed by Bloomberg News.

Crude oil for December delivery fell to $92.87 a barrel on the New York Mercantile Exchange. Earlier, futures touched $94.93, the highest intraday price since Aug. 2. Prices have risen 1.9 percent this year.

Brent oil for December settlement slipped 26 cents to $110.57 a barrel on the London-based ICE Futures Europe exchange.

EZ bank recap has been recognized and will be resourced. US gave ideas, stands ready to assist.

EZ agrees with US need to send clear signal they are committed to the Euro, begins with agreeing action plan

G20 efforts mirror US dom efforts. Jobs numbers were positive but econ is growing way too slow.

Europe remains on track, FinMins to carry the work forward next wk. US will do our part to support Europe partners. Agreed to remain focused on growth and each do their part.

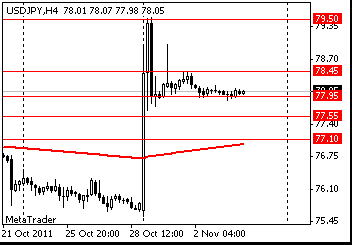

Offers seen at Y78.45/50, more at Y78.65/70. Support on the downside remains at Y77.90 where talk of large

bids are forming.

USD/JPY Y77.00, Y77.50, Y78.00, Y78.25, Y78.65, Y78.75

AUD/USD $1.0350, $1.0565

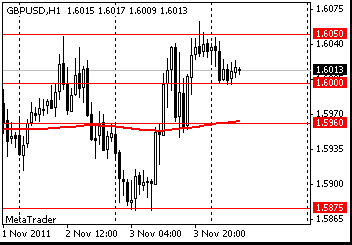

GBP/USD $1.6100, $1.6155, $1.6250

USD/CHF Chf90.00

EUR/JPY Y106.00

U.S. stock futures fell as concern about European funding offset an unexpected decrease to in the American unemployment rate.

World markets are mixed: Nikkei +1.86%, Hang Seng +3.12%, Shanghai Composite +0.81%, FTSE +0.45%, CAC -0.20%, DAX -0.82%.

Crude oil: $94.55 per barrel (+0,5%).

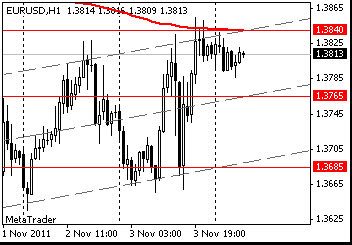

Offers $1.3950, $1.3930, $1.3900/10

Bids $1.3785/80, $1.3765/60, $1.3740/35, $1.3710/00, $1.3640/35

08:45 Italy PMI services (October) 43.9

08:50 France PMI services (October) 44.6

08:55 Germany PMI services (October) seasonally adjusted 50.6

09:00 EU(17) PMI services (October) 46.4

10:00 EU(17) PPI (September) 0.3%

10:00 EU(17) PPI (September) Y/Y 5.8%

11:00 Germany Manufacturing orders (September) seasonally adjusted -4.3%

11:00 Germany Manufacturing orders (September) not seasonally adjusted, workday adjusted Y/Y 2.4%

The dollar headed for a weekly gain versus all its major counterparts before a U.S. labor market report forecast to show hiring slowed last month, boosting demand for safer investments.

The jobless rate was 9.1 percent for a fourth month, the figures may show.

The Swiss franc declined after central bank Governing Board member Jean-Pierre Danthine said the currency remains “high” and policy makers are ready to weaken it further.

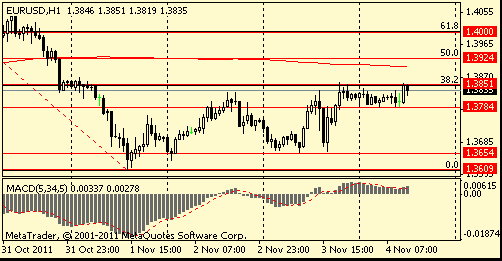

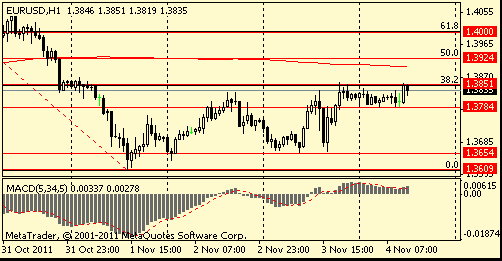

EUR/USD: the pair holds in $1,3785-$ 1,3855 area.

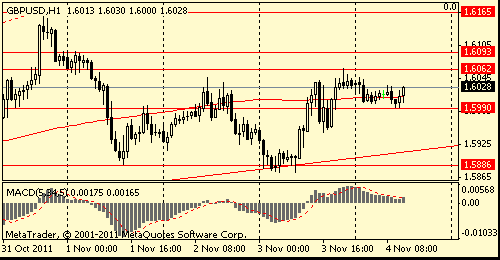

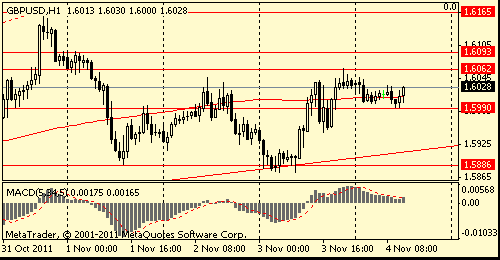

GBP/USD: the pair holds in $1,5990-$ 1,6040 area

USD/JPY: the pair holds in Y78,00-Y78,10 area.

The main data release comes at 1230GMT when US non-farm payrolls are forecast to rise 95,000 in October after the stronger than expected

September reading and upward revisions to July and August payrolls. The unemployment rate is forecast to stay at 9.1% for the fourth straight

month.

"Econ is growing as reflected in reising sales and lower unemploy claims.

Currently FTSE 5,579 +33.04 +0.60%, CAC 3,193 -2.41 -0.08%, DAX 6,105 -28.02 -0.46%.

Resistance 3: Y79.50 (Oct 31 high)

Resistance 2: Y79.00 (Nov 1 high)

Resistance 1: Y78.40 (Nov 2 high)

Current price: Y78.02

Support 1:Y77.90 (Nov 3 low)

Support 2:Y77.55 (50.0 % FIBO Y75.55-Y79.55)

Support 3:Y77.10 (61.8 % FIBO Y75.55-Y79.55)

Resistance 2: Chf0.8950/60 (area of МА (200) for Н4, Oct 21 and Nov 1 highs)

Resistance 1: Chf0.8860 (session high, resistance line from Nov 1)

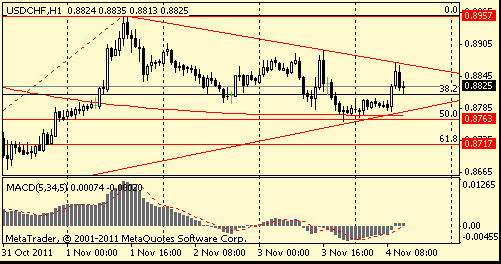

Current price: Chf0.8825

Support 1: Chf0.8790 (support line from Oct 27)

Support 2: Chf0.8760 (50,0 % FIBO Chf0,8570-Chf0,8960, Nov 3 low, МА (200) for Н1)

Support 3: Chf0.8720 (61,8 % FIBO Chf0,8570-Chf0,8960)

Resistance 2: $ 1.6090 (Nov 1 high)

Resistance 1: $ 1.6060 (Nov 3 high)

Current price: $1.6025

Support 1 : $1.5990 (session low)

Support 2 : $1.5920 (support line from Oct 12)

Support 3 : $1.5890/70 (area of Oct 26, Nov 1 and 3 low)

Resistance 2: $ 1.3920 (50,0 % FIBO $1,4240-$ 1,3610)

Resistance 1: $ 1.3850 (38,2 % FIBO $1,4240-$ 1,3610, session high, Nov 3 high)

Current price: $1.3835

Support 1 : $1.3780 (session low)

Support 2 : $1.3650 (Nov 4 low)

Support 3 : $1.3610 (Nov 1 low)

USD/JPY Y77.00, Y77.50, Y78.00, Y78.25, Y78.65, Y78.75

AUD/USD $1.0350, $1.0565

GBP/USD $1.6100, $1.6155, $1.6250

USD/CHF Chf90.00

EUR/JPY Y106.00

Nikkei 225 8,801 +160.98 +1.86%

Hang Seng 19,843 +600.29 +3.12%

S&P/ASX 4,281 +109.31 +2.62%

Shanghai Composite 2,528 +20.20 +0.81%

The 17-nation euro yesterday advanced after Papandreou scrapped a referendum on an accord with the European Union after it split his party, roiled markets and drew warnings from euro leaders that it may cost Greece its membership in the 17-nation currency area.

The dollar held a two-day drop versus the euro before data forecast to show U.S. jobs growth slowed and the unemployment rate remained unchanged, supporting the case for the Federal Reserve to consider monetary easing.

U.S. payrolls expanded by 95,000 workers last month after a 103,000 increase in September, according to the median forecast of economists surveyed by Bloomberg News ahead of today’s data from the Labor Department. The jobless rate was 9.1 percent for a fourth consecutive month, the report may also show.

EUR/USD: on Asian session the pair the pair falling.

GBP/USD: on Asian session the pair decreased.

USD/JPY: on Asian session the pair holds above Y78.00.

On Friday the G20 Summit continues in Cannes today and focus will also continue on the unfolding situation in Greece, while the US data

highlight of the week takes center-stage later in the session. This morning also sees the release of the final services PMI releases from the main European states, with France at 0848GMT, Germany at 0853GMT and the main EMU release at 0858GMT.UK data is limited on Friday with just the 0900GMT release of SMMT New Car Registrations and the 0930GMT release of Q3 Insolvency Data. The main data release comes at 1230GMT when US non-farm payrolls are forecast to rise 95,000 in October after the stronger than expected September reading and upward revisions to July and August payrolls. The unemployment rate is forecast to stay at 9.1% for the fourth straight month.

Asian stocks declined as European leaders withheld aid to Greece after the country said it will hold a referendum on a bailout package and the U.S. Federal Reserve cut its forecast for the world’s biggest economy.

The Federal Open Market Committee yesterday kept policy unchanged, saying they would lengthen the maturity of the Fed’s bond portfolio and hold the benchmark interest rate near zero through at least mid-2013 if unemployment remains high and the inflation outlook is “subdued.”Australia’s S&P/ASX 200 lost 0.3 percent. Japanese markets were closed today for a holiday. Hong Kong’s Hang Seng Index dropped 2.5 percent as property developers slid after home sales fell. China’s Shanghai Composite Index added 0.2 percent, extending gains for a third day, on speculation the government will accelerate measures to boost the economy after a report on non-manufacturing industries signaled tight monetary policies are hurting businesses.

Financial stocks were the biggest drag on the MSCI Asian gauge as European leaders kept an aid installment of 8 billion euros ($11 billion) for Greece on hold until Greek voters approve the bailout package in a referendum next month.

HSBC Holdings Plc, Europe’s biggest lender, dropped 2.9 percent in Hong Kong on speculation a default by Greece will threaten bank earnings. United Overseas Bank Ltd., Singapore’s No. 3 lender by market value, sank 3 percent after posting profit that missed estimates. Standard Chartered Plc, the U.K.’s second-biggest lender by market value, declined 4 percent to HK$172.80.

Exporters dropped as officials cut their U.S. growth forecasts for next year and predicted unemployment will average between 8.5 percent to 8.7 percent in the final quarter of 2012.

Li & Fung Ltd., a supplier of toys and clothes that counts the U.S. as its biggest market, sank 5.6 percent to HK$14.50. Yue Yuen Industrial Holdings Ltd., a supplier of Nike Inc.’s shoes, fell 2.5 percent to HK$21.60. Compal Communications Inc., the maker of mobile phones that gets more than half of sales from the Americas, slumped 7 percent to NT$40.60 in Taipei.

Property developers in Hong Kong declined after a report showed home sales in the Chinese city fell for a 10th straight month, dropping by half in October from a year ago as buyers put off purchases. The government introduced new housing curbs in June and banks increased mortgage rates in September.

Sun Hung Kai Properties Ltd., the world’s biggest developer by market value, slipped 3.3 percent to HK$103.60. Cheung Kong Holdings Ltd., a real estate company controlled by billionaire Li Ka-shing, sank 3.7 percent to HK$92. Hang Lung Properties Ltd., Hong Kong’s third-largest developer, declined 4.3 percent to HK$26.85.

United Overseas Bank dropped 2.6 percent to S$16.26 in Singapore after a report showed third-quarter net income fell 24 percent from a year earlier, missing analyst estimates.

Australia & New Zealand Banking Group Ltd., the worst performer among Australia’s four largest bank stocks this year, fell 2 percent after posting second-half profit that missed analyst forecasts as volatile markets eroded trading profit.

LG Electronics Inc., the world’s third-biggest mobile phone maker, slumped 14 percent in Seoul as the company is said to plan a 1 trillion won ($885 million) share sale.

European stocks advanced after the euro-area central bank unexpectedly cut the benchmark interest rate and Greek Prime Minister George Papandreou signaled he won’t call a referendum on the latest bailout package.

The ECB unexpectedly cut interest rates as Italian and Spanish borrowing costs soared after euro-area leaders raised the prospect of Greece leaving the monetary union. ECB officials, meeting under the presidency of Mario Draghi for the first time, cut the benchmark interest rate by 25 basis points to 1.25 percent.

Papandreou signaled he won’t call a referendum calling into question Greece’s membership of the euro, saying he will reach out to the opposition about forming a transitional government.

The Greek prime minister said the country belongs in the currency bloc and welcomed support shown by the main opposition New Democracy party for last week’s rescue agreement agreed with EU leaders in Brussels.

National benchmark indexes gained in 17 of the 18 western European markets. France’s CAC 40 rallied 2.7 percent and Germany’s DAX climbed 2.8 percent. The U.K.’s FTSE 100 added 1.1 percent.

National Bank of Greece SA led the country’s lenders higher, it rose 11 percent to 1.80 euros. Alpha Bank SA climbed 15 percent to 1.07 euros. Piraeus Bank SA rallied 10 percent to 23.6 euro cents. Banks rose throughout Europe, with BNP Paribas SA, France’s biggest bank, advancing 7.5 percent to 31.92 euros. Commerzbank AG, Germany’s second-largest lender, added 5.5 percent to 1.75 euros.

Swiss Re Ltd. and Man Group Plc gained more than 2 percent after reporting better-than-expected earnings.

Swiss Re rose 6.1 percent to 49 Swiss francs. The world’s second-biggest reinsurer said third-quarter profit more than doubled to $1.35 billion. That beat the $539 million average estimate of nine analysts surveyed by Bloomberg.

Man Group gained 2.4 percent to 144.7 pence. The biggest publicly traded hedge-fund manager reported a smaller-than- forecast decline in pretax profit in the fiscal first half. Pretax profit dropped to $195 million in the six months through September from $227 million in the year-earlier period, the London-based company said. Man forecast pretax profit of $185 million.

Cable & Wireless Communications jumped 7.8 percent to 39.33 pence. The company said first-half net income before exceptional items rose 9 percent to $163 million. The company also said restructuring is ahead of schedule.

Aker Solutions ASA surged 10 percent to 67.15 kroner. Norway’s biggest oil platform maker said third-quarter net income more than tripled to 1.12 billion kroner ($200 million) as it booked a gain after separating out Kvaerner ASA.

ING Groep NV rallied 9.4 percent to 6.18 euros. The biggest financial-services company in the Netherlands said it plans to cut 11 percent of the jobs at its Dutch bank and posted third- quarter earnings that surpassed analysts’ estimates.

Tenaris SA soared 15 percent to 12.85 euros. The world’s largest maker of seamless pipes said third-quarter profit rose 7 percent on higher demand in the U.S. and Europe and increased prices.

Rheinmetall AG tumbled 7.6 percent to 35.12 euros. The maker of KS Kolbenschmidt engine pistons and a partner in Germany’s Puma battle tank said it won’t stage an initial public offering of its automotive unit, citing stock-market declines. Rheinmetall’s third-quarter earnings before interest and taxes rose to 76 million euros, missing analyst estimates.

U.S. stocks advanced, sending the Standard & Poor’s 500 Index higher for a second straight day, as Greece moved closer to accepting a bailout and the European Central Bank unexpectedly lowered interest rates.

Greek Finance Minister Evangelos Venizelos, speaking to party lawmakers in Parliament in Athens today, said the nation won’t hold a referendum. Just hours after saying Greeks need to decide on whether their future is in the euro, Papandreou said the country belongs in the currency bloc.

Global stocks also rose as ECB officials unanimously lowered the benchmark interest rate by 25 basis points to 1.25 percent. ECB President Mario Draghi said the rate cut happened partly because “what we’re observing now is slow growth heading toward a mild recession.”

Earlier today, benchmark gauges erased a rally as a report showed that service industries in the U.S. expanded at a slower pace and consumer confidence plunged, supporting Federal Reserve Chairman Ben S. Bernanke’s forecast yesterday that the economic recovery will be “frustratingly slow.” A Labor Department report today showed first-time claims for unemployment benefits declined last week to a one-month low of 397,000. Employment probably cooled in October, indicating the U.S. recovery remains too weak, economists said before a report tomorrow.

All 10 groups in the S&P 500 rallied as energy and industrial shares had the biggest gains, adding at least 2.4 percent. Gauges of utility, health care and consumer staples companies advanced less than the benchmark gauge.

Qualcomm Inc. jumped 7.5 percent as the biggest maker of mobile-phone chips forecast sales that beat analysts’ projections. The company, which gets most of its profit from licenses on technology used in so- called 3G phones, is benefiting as more consumers switch to the technology -- especially in developing countries.

Kraft Foods Inc. (KFT) added 3.3 percent after raising its earnings estimate. Food companies such as Kraft, Sara Lee Corp. and General Mills Inc. have raised prices on many products this year to make up for higher costs for ingredients such as corn, coffee and sugar.

Estee Lauder jumped 18 percent, the biggest advance in the S&P 500, to $118.92. The company said it will split its common stock 2-for-1 in January, and raise the annual dividend to $1.05 a share. Sales in the fiscal first quarter gained 18 percent, helped by stronger demand in all of the company’s markets and a weaker U.S. dollar that aided results overseas.

Jefferies Group Inc. lost 2.1 percent to $12.01, paring an earlier decline as it said it has no “meaningful net exposure” to European sovereign debt. Its shares plunged as much as 20 percent, triggering stock-market circuit breakers. Egan-Jones Ratings Co. cut the firm’s credit grade, citing a “changed environment” after the collapse of MF Global Holdings Ltd. and concern that Jefferies’s $2.7 billion in “sovereign obligations” on Aug. 31 is large relative to equity.

Abercrombie & Fitch Co. tumbled 20 percent, the most in the S&P 500, to $59.26. The New Albany, Ohio-based teen-clothing retailer reported a slowing trend for same-store sales in Europe, including flagship stores that had declines. Japan and Canada same-store sales also dropped.

The euro rose versus the dollar and yen after Greek Prime Minister George Papandreou signaled he won’t call for a referendum on a bailout package, easing concern voters would reject it and send the nation into default. Papandreou reached out to his political opposition about setting up a transitional government, indicating an accord would secure aid and remove the need for a referendum on euro membership.

The 17-nation currency earlier approached a three-week low versus the greenback after the European Central Bank cut its key interest rate to 1.25 percent and said Europe is heading toward a “mild recession.”

The dollar dropped as stocks and commodities rallied, damping demand for haven assets.

The euro gained 0.8 percent to $1.3850 at 1:50 p.m. in New York, after falling as much as 0.7 percent. It dropped to $1.3609 on Nov. 1, the weakest since Oct. 12.

EUR/USD: yesterday the pair rose.

GBP/USD: yesterday the pair rose.

USD/JPY: yesterday the pair holds in range Y77.90-Y78.10.

On Friday the G20 Summit continues in Cannes today and focus will also continue on the unfolding situation in Greece, while the US data

highlight of the week takes center-stage later in the session. This morning also sees the release of the final services PMI releases from the main European states, with France at 0848GMT, Germany at 0853GMT and the main EMU release at 0858GMT.UK data is limited on Friday with just the 0900GMT release of SMMT New Car Registrations and the 0930GMT release of Q3 Insolvency Data. The main data release comes at 1230GMT when US non-farm payrolls are forecast to rise 95,000 in October after the stronger than expected September reading and upward revisions to July and August payrolls. The unemployment rate is forecast to stay at 9.1% for the fourth straight month.

Resistance 3: Y80.20 (Aug 4 high)

Resistance 2: Y79.50 (Oct 31 high)

Resistance 1: Y78.45 (session high)

The current price: Y78.03

Support 1:Y77.95 (Nov 2 low)

Support 2: Y77.55 (50.0% FIBO Y75.55-Y79.55)

Support 3: Y77.10 (61.8% FIBO Y75.55-Y79.55)

Comments: the pair holds in range.

Resistance 3: Chf0.8890 (Nov 3 high)

Resistance 2: Chf0.8855 (resistance line from Nov 1)

Resistance 1: Chf0.8820 (MA(233) H1)

The current price: Chf0.8790

Support 1: Chf0.8750 (support line from Nov 1)

Support 2: Chf0.8715 (61.8% FIBO Chf0.8960-Chf0.8565)

Support 3: Chf0.8670 (low of European session on Oct 31)

Comments: the pair is on downtrend. In focus resistance Chf0.8820.

Resistance 3: $1.6150/65 (area of Oct 28-31 high)

Resistance 2: $1.6095 (Nov 1 high)

Resistance 1: $1.6050 (session high)

The current price: $1.6012

Support 1 : $1.6000 (session low)

Support 2 : $1.5960 (MA(233) H1)

Support 3 : $1.5875 (Nov 3 low)

Comments: the pair advanced. In focus resistance $1.6050.

Resistance 3 : $1.4000 (61.8% FIBO $1.3605-$1.4245)

Resistance 2 : $1.3925 (50.0% FIBO $1.3605-$1.4245)

Resistance 1 : $1.3840 (session high)

The current price: $1.3815

Support 1 : $1.3765 (middle line of the channel from Nov 1)

Support 2 : $1.3685 (support line from Nov 1)

Support 3 : $1.3565 (Oct 11 low)

Comments: the pair is on uptrend. In focus resistance $1.3840.

Change % Change Last

Nikkei 225 8,640 -195.10 -2.21%

Hang Seng 19,243 -491.21 -2.49%

S&P/ASX 200 4,172 -12.83 -0.31%

Shanghai Composite 2,508 +3.98 +0.16%

FTSE 100 5,546 +61.54 +1.12%

CAC 40 3,195 +84.88 +2.73%

DAX 6,133 +167.55 +2.81%

Dow 11,836.04 +178.08 +1.53%

Nasdaq 2,639.98 +33.02 +1.27%

S&P 500 1,237.90 +19.62 +1.61%

10 Year Yield 2.01% +0.00 --

Oil $92.89 +0.38 +0.41%

Gold $1,738.70 +9.10 +0.53%

00:30 Australia RBA Monetary Policy Statement November

06:00 G20 Meetings

08:50 France Services PMI October 46.0 46.0

08:55 Germany Purchasing Manager Index Services October 52.1 52.1

09:00 Eurozone Purchasing Manager Index Services October 47.2 47.2

10:00 Eurozone Producer Price Index, MoM September -0.1% +0.3%

10:00 Eurozone Producer Price Index (YoY) September +5.9% +5.9%

11:00 Germany Factory Orders s.a. (MoM) September -1.4% +0.3%

11:00 Germany Factory Orders n.s.a. (YoY) September +3.9% +7.5%

11:00 Canada Employment October 60.9K 20.3K

11:00 Canada Unemployment rate October 7.1% 7.2%

12:30 Canada Building Permits (MoM) September -10.4% +2.7%

12:30 U.S. Nonfarm Payrolls October 103K 98K

12:30 U.S. Unemployment Rate October 9.1% 9.1%

12:30 U.S. Average hourly earnings October +0.2% +0.2%

12:30 U.S. Average hourly earnings October +0.2% +0.2%

12:30 U.S. Average workweek October 34.3 34.3

12:30 U.S. Average workweek October 34.3 34.3

14:00 Canada Ivey Purchasing Managers Index October 63.4

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.