- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 01-11-2011

European stocks sank the most in five weeks, as Greece’s government called a referendum on its latest bailout package, spurring concern that the country may default. Papandreou’s gambit risks pushing the country into default if voters reject the financial accord. An opinion poll published on Oct. 29 showed most Greeks believe the euro area’s expanded bailout package and debt writedown are negative. Leaders from the Group of 20 meet at a summit on Nov. 3-4 in Cannes, France, a week after the euro area’s authorities pledged to expand their rescue fund to 1 trillion euros ($1.4 trillion). They have already sought financial help from China and cooperation from the International Monetary Fund. German Chancellor Angela Merkel and French President Nicolas Sarkozy will meet tomorrow in Cannes before the summit.

National benchmark indexes tumbled at least 2 percent in all 16 western European markets that were open today, except Iceland. France’s CAC 40 Index dropped 5.4 percent, Germany’s DAX Index lost 5 percent and Italy’s FTSE MIB Index plunged 6.8 percent. Greece’s ASE Index sank 6.9 percent.

Credit Suisse Group AG and Danske Bank A/S led a selloff in lenders, both sliding more than 6.5 percent, after posting earnings that fell short of analysts’ estimates. National Bank of Greece SA sank 15 percent to its lowest price since 1992 in Athens.

Barclays Plc dropped 9.5 percent to 176.8 pence after UBS AG lowered its recommendation for Britain’s second-largest bank by assets to “neutral” from “buy.”

Mining companies declined with copper prices as a report showed a drop in manufacturing in China, the world’s biggest consumer of the base metal. The Purchasing Managers’ Index fell to 50.4 in October from 51.2 in September, the China Federation of Logistics and Purchasing said in a statement. Xstrata Plc declined 6.6 percent to 976.1 pence, Antofagasta Plc retreated 4.5 percent to 1,114 pence and BHP Billiton Ltd., the world’s largest mining company, lost 2.7 percent to 1,915 pence.

Sandvik AB dropped 6.5 percent to 84.30 kronor. The world’s biggest maker of metal-cutting tools posted a 60 percent plunge in third-quarter profit to 626 million kronor ($94 million) after a writedown on goodwill for a business it plans to sell. The company also said it will cut 365 jobs in Sweden.

Daimler AG paced a selloff in carmakers, falling 5.9 percent to 34.81 euros after Barclays downgraded the world’s third-largest maker of luxury vehicles to “underweight” from “equal weight.”

The euro weakened for a third day against the dollar, touching the lowest in almost three weeks, as concern the currency region’s rescue plan will crumble and the European Central Bank will cut interest rates damped demand. The 17-nation currency fell the most in two weeks versus the yen after Greek Prime Minister George Papandreou pledged to put the European Union’s latest accord to a referendum, risking pushing the country into default if rejected by voters. Papandreou’s call for a referendum and a parliamentary confidence vote raised the prospect of derailing the European bailout effort and pushing Greece into default. An opinion poll published Oct. 29 showed most Greeks believe the accord on a new bailout package and a debt writedown is negative. Group of 20 leaders gather for a Nov. 3-4 summit in Cannes, France, to discuss the debt crisis. Greece’s referendum plan poses a threat to financial stability in the region, Fitch Ratings said in a statement.

The dollar and yen strengthened as stocks slid around the world and data showed Chinese manufacturing slowed. The Dollar Index, which IntercontinentalExchange Inc. uses to track the U.S. currency against those of six trading partners, gained for a third day, rising 1.2 percent to 77.416. The dollar advanced versus all of its 16 most-traded counterparts after the China Federation of Logistics and Purchasing said its Purchasing Managers’ Index fell to 50.4 in October, from 51.2 the previous month.

Australia’s dollar slid against most of its major peers after the Reserve Bank of Australia lowered its cash rate target by 25 basis points to 4.5 percent. It was the first cut since April 2009. Sixteen of 27 economists surveyed by Bloomberg News predicted the move. The rest forecast no change.

Euro overcoming offers to $1.3745 with further light supply eyed to $1.3770

U.S. stocks slumped on concern that a Greece referendum pledged by Prime Minister George Papandreou may threaten Europe’s bailout. Papandreou’s gambit risks pushing the country into default if rejected by voters, and raises the ante with dissidents in his own party. Equity futures extended losses after state-run Athens News Agency reported that six senior members of the ruling party called on Papandreou to step down. Papandreou will brief German Chancellor Angela Merkel, France’s President Nicolas Sarkozy and the heads of the European Central Bank and International Monetary Fund on developments in Greece in Cannes tomorrow, on the sidelines of a meeting of Group of 20 countries. Merkel and Sarkozy called for the implementation of a European deal to write down Greece’s debt.

Stocks also fell after data showed a Chinese manufacturing index dropped to the lowest level since February 2009. In the U.S., manufacturing grew less than forecast in October, depressed by a drop in inventories that may set U.S. factories up for stronger growth heading into 2012.

U.S. regulators are investigating whether hundreds of millions of dollars are missing from client accounts at MF Global Holdings Ltd., according to two people with knowledge of the matter. The firm, which filed for bankruptcy protection yesterday, was ordered by the enforcement division of the Commodity Futures Trading Commission to preserve records for the review, one of the people said.

Dow 11,694.78 -260.23 -2.18%, Nasdaq 2,613.30 -71.11 -2.65%, S&P 500 1,222.57 -30.73 -2.45%

All 10 groups in the S&P 500 fell as financial and commodity shares had the biggest declines. Morgan Stanley and Citigroup Inc. retreated more than 7.2 percent as a gauge of European lenders tumbled 6.7 percent.

Alcoa Inc. (AA), Boeing Co. (BA) and Cisco Systems Inc. (CSCO) decreased at least 3.4 percent, pacing losses among companies most-dependent on economic growth.

Baker Hughes tumbled 8.6 percent to $52.99. The oilfield contractor reported third-quarter earnings excluding some items of $1.18 a share, missing the analyst estimate.

Gold prices drop on Tuesday amid rising dollar on the eve of the referendum in the Greek economy on a new program. Gold usually moves to the dollar in different directions.

Greek Prime Minister George Papandreou on Monday night shocked the Greek and European politicians, demanding a referendum in Greece on new agreements with the EU providing for cancellation of the 360-billion-dollar Greek debt in exchange for a multi-year program of austerity. International rating agency Fitch, in turn, reported that the planned referendum in Greece threatens the stability of the single European currency zone.

On the eve of the international rating agency Standard & Poor's has assigned MF Global, one of the largest brokers in the world market of derivatives, credit default rating. Earlier, MF Global has filed papers in court to initiate bankruptcy proceedings.

The price of gold in September 2011 fell by 11%. At the same time for the third quarter of this year, gold has risen in price by 8%. In 2010, prices for precious metals was a record and up 30%.

Gold for December delivery today fell to 1681.20 dollars per troy ounce on on the New York Mercantile Exchange.

Oil fell for a third day after Greek Prime Minister George Papandreou’s pledge to hold a referendum raised the prospect of the failure of Europe’s bailout plan.

Futures dropped as much as 4.3 percent after Greece’s decision to call a vote on its five-day-old bailout sent equities and the euro lower. Crude climbed 6.8 percent last week, the biggest gain since February, on the European package. China’s Purchasing Managers’ Index fell for the first time in three months in October, a report showed.

Papandreou’s referendum risks pushing Greece into default if the plan is rejected by voters. An opinion poll published Oct. 29 showed most Greeks believe the accord on a new bailout package and a debt writedown is negative.

A rejection of the EU-IMF aid plan “would increase the risk of a forced and disorderly sovereign default” and raises the chance of Greece leaving the euro, Fitch Ratings said in a statement today.

U.S. regulators are investigating whether hundreds of millions of dollars are missing from client accounts at MF Global Holdings Ltd., according to two people with knowledge of the matter. The firm, which filed for bankruptcy protection yesterday, was ordered by the enforcement division of the Commodity Futures Trading Commission to preserve records for the review, one of the people said.

Oil output in the Organization of Petroleum Exporting Countries rose in October to the highest level in almost three years as gains in Libya and Angola outpaced a Saudi cut, a Bloomberg News survey showed yesterday. Production increased 0.4 percent to average 30.1 million barrels a day, the most since November 2008, according to the survey.

Iraq’s daily oil production capacity will increase by 100,000 barrels to a total of 3 million barrels in the “next few days”, Oil Minister Abdul Kareem Al-Luabi said. The nation produced oil at an average rate of 2.9 million barrels a day in October, he said in an interview in Baghdad today. The country is the only OPEC member without a production quota.

An Energy Department report tomorrow will probably show that U.S. crude oil supplies rose 500,000 barrels, or 0.1 percent, to 338.1 million last week, according to the median of 11 analyst responses in a Bloomberg News survey.

Crude oil for December delivery declined to $89.17 a barrel on the New York Mercantile Exchange. Futures climbed 18 percent in October, the biggest gain since May 2009.

Brent oil for December settlement dropped $2.25, or 2.1 percent, to $107.31 a barrel on the London-based ICE Futures Europe exchange.

EUR/USD $1.3650-55, $1.3750-55, $1.3800

USD/JPY Y78.00, Y77.10, Y76.50, Y76.30, Y76.00

AUD/USD $1.0450

USD/CHF Chf0.8950

GBP/USD $1.6035, $1.6145

EUR/JPY Y108.50

EUR/CHF Chf1.2200

In the effort to improve the presentation and accessibility of the analytical information we have made the following changes to the “Analytics” section structure of the website.

● Currently all analytical information of the website is available as one newsline – “ News and Analytics Feed “, where you can use filter (search function) to choose any kind of information You are looking for, such as: currency market, stock markets, primary markets etc. as well as access archives block to review Your analytics history.

● In “ Analytics “ section we have added a new information block called “ Market Focus “ which contains information about the major factors that determine actual currency pair dynamics, stock indexes and raw materials prices;

● The subsection “Reviews and Forecasts” is divided into two more subsections: “ Forecasts and Experts’ Trade Ideas“ (where independent experts assess the current market situation and express trade recommendations) as well as “ Analysts’ reviews” (that represent the current market situations analyzed by our company analysts);

● We have also increased the amount of information related to stock and primary markets, that will allow more effective use of commercial instruments provided by TeleTRADE Company.

● The automatic update function has become available for the “News and Analytics Feed “ and “ Market Focus” sections, what makes the page reload unnecessary.

We hope that the provided changes will help Your prompt and objective assessment of international trading floors situations for maximally effective funds investments.TeleTRADE team continues to develop Analytics section in the effort to make it maximally convenient for our clients. Any new changes to be advised. Please follow our news!

U.S. stock futures fell also as China's official PMI unexpectedly fell to 50.4 from 51.2 in September.

Company news:

Bank stocks are falling hard premarket on fears that Greece's referendum could scuttle the bailout deal: BAC -6.3%, JPM -5.3%. BAC’ shares also may be weighed by pressure to reverse its planned monthly debit card fee after more rivals decide to drop similar plans.

Jon Peddie Research estimates PC graphics chip shipments rose 18.4% Y/Y in Q3, and that Intel's (INTC) market share rose to 60.4%, Nvidia's and AMD’s share fell.

07:00 UK Nationwide house price index (October) 0.4%

07:00 UK Nationwide house price index (October) Y/Y 0.8%

09:30 UK CIPS manufacturing index (October) 47.4

09:30 UK GDP (Q3) preliminary 0.5%

09:30 UK GDP (Q3) preliminary Y/Y 0.5%

The euro weakened for a third day against the dollar, extending yesterday’s 2 percent slump, as renewed concern Greece will default and the European Central Bank will cut interest rates damped demand for the currency.

Papandreou’s call for a referendum and a parliamentary confidence vote raised the prospect of derailing the European bailout effort and pushing Greece into default.

The euro fell the most in two weeks versus the yen after Greek Prime Minister George Papandreou pledged to put the European Union’s latest accord to a referendum, risking pushing the country into default if rejected by voters.

The dollar strengthened as stocks slid around the world and a Chinese report showed manufacturing slowed.

The Dollar Index, which IntercontinentalExchange Inc. uses to track the U.S. currency against those of six trading partners, gained for a third day, rising 1 percent to 77.233.

EUR/USD: the pair fell in $1,3660 area.

GBP/USD: the pair showed low in $1,5900 area.

USD/JPY: during european session the pair holds an Y78,00-Y78,25 area.

US data at 1400GMT includes the ISM Index and Construction Spending. The ISM manufacturing index is expected to rise slightly to a reading of

52.0 in October.

Currently FTSE 5,389 -155.06 -2.80%, CAC 3,112 -131.21 -4.05%, DAX 5,848 -293.02 -4.77%.

European stocks dropped as the announcement of a Greek referendum spurred concern that the country may default.

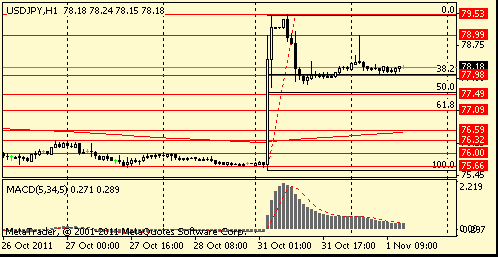

Resistance 3: Y80.30 (high of August)

Resistance 1: Y79.00 (session high)

Current price: Y78.18

Support 1:Y78.00 (session low)

Support 2:Y77.55 (50.0 % FIBO of yesterday's growth)

Support 3:Y77.10 (61.8 % FIBO of yesterday's growth)

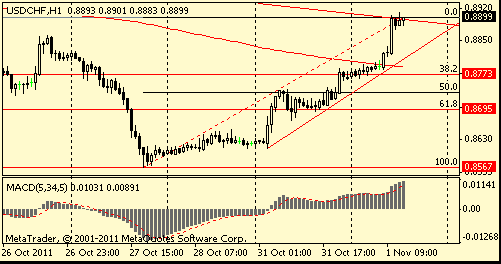

Resistance 2: Chf0.8940/50 (area of МА (200) for Н4 and Oct 21 high)

Resistance 1: Chf0.8900 (resistance line from Oct 6)

Current price: Chf0.8899

Support 1: Chf0.8830 (support line from Oct 31)

Support 2: Chf0.8780 (38.2 % FIBO Chf0,8570-Chf0,8910, МА (200) for Н1)

Support 3: Chf0.8700 (61,8 % FIBO Chf0,8570-Chf0,8910

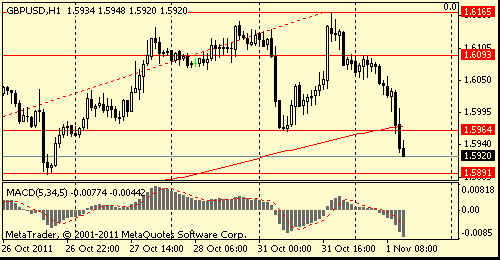

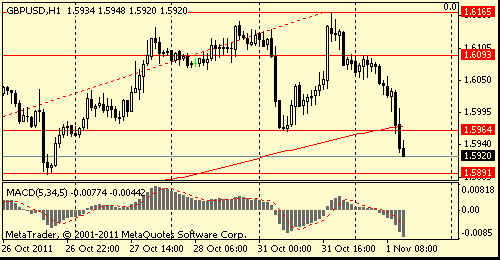

Resistance 2: $ 1.6090 (session high)

Resistance 1: $ 1.5960 (Oct 31 low)

Current price: $1.5920

Support 1 : $1.5890 (area of Oct 24 and 26 lows)

Support 2 : $1.5850 (earlier resistance, Oct 14, 17 and 19 lows, support line from Oct 12)

Support 3 : $1.5820 (38,2 % FIBO $1,5270-$ 1,6165)

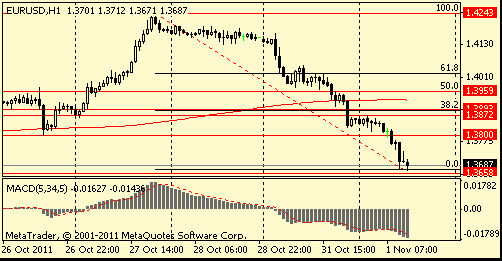

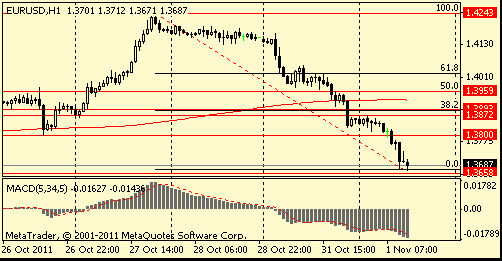

Resistance 2: $ 1.3870/90 (session high, 38,2 % FIBO $1,4240-$ 1,3670)

Resistance 1: $ 1.3950 (Oct 26 low)

Current price: $1.3687

Support 1 : $1.3660 (area of session low and Oct 18 and 20 lows)

Support 2 : $1.3560 (61,8 % FIBO $1,3150-$ 1,4240, Oct 11 low)

Support 3 : $1.3370 (low of September and Oct 10)

USD/JPY Y78.00, Y77.10, Y76.50, Y76.30, Y76.00

AUD/USD $1.0450

USD/CHF Chf0.8950

GBP/USD $1.6035, $1.6145

EUR/JPY Y108.50

EUR/CHF Chf1.2200

Nikkei 225 8,836 -152.87 -1.70%

Hang Seng 19,370 -494.91 -2.49%

S&P/ASX 4,233 -65.21 -1.52%

Shanghai Composite 2,470 +1.77 +0.07%

00:00 Australia HIA New Home Sales, m/m September -3.5%

00:30 Australia House Price Index (QoQ) Quarter III -1.2%

00:30 Australia House Price Index (YoY) Quarter III -2.2%

01:00 China Manufacturing PMI October 50.4

01:30 Japan Labor Cash Earnings, YoY September 0.0%

02:30 China HSBC Manufacturing PMI October 51.0

03:30 Australia Announcement of the RBA decision on the discount rate 4.50%

05:30 Australia Commodity Prices, Y/Y October +19.0%

06:00 Japan BOJ Governor Shirakawa Speaks

The euro fell versus the dollar and yen on speculation an economic slowdown in the region will pressure the European Central Bank to consider cutting interest rates.

The Australian dollar fell for a third day against its U.S. counterpart after the Reserve Bank cut interest rates for the first time in 2 1/2 years on signs global growth is moderating. The so-called Aussie declined against its 16 major peers after RBA Governor Glenn Stevens said inflation is close to the central bank’s target, adding to prospects policy makers may further reduce rates. Demand for the Australian and New Zealand dollars was limited after data showed manufacturing in China, the South Pacific nations’ major trading partner, slowed.

EUR/USD: on Asian session the pair continues yesterday's falling.

GBP/USD: on Asian session the pair weakened.

USD/JPY: on Asian session the pair receded from session high.

Tuesday’s events in the UK start at 0700GMT with UK Nationwide house price data, which is expected to remain unchanged for October, edging up 0.5% y/y. This is followed by the Markit/CIPS Manufacturing PMI just before 0930GMT, which is expected to show a decline to the 50.0 level for October. The first estimate of UK third-quarter GDP data is due at 0930GMT and is currently forecast to post a rise of 0.4% q/q, 0.4% y/y. US data starts at 1145GMT with the weekly ICSC-Goldman Store Sales data, which is followed by the weekly Redbook Average at 1255GMT. US data at 1400GMT includes the ISM Index and Construction Spending. The ISM manufacturing index is expected to rise slightly to a reading of 52.0 in October.

Asian stocks declined, with the MSCI Asia Pacific Index posting its biggest drop in almost a month, as companies from Acer Inc. to Tohoku Electric Power Co. reported losses and China vowed to maintain property lending curbs.

Japan’s Nikkei 225 Stock Average fell 0.7 percent. The gauge earlier advanced as much as 1.1 percent after the Japanese government sold the yen to weaken the currency, which had gained to a post-World War II high against the dollar. A stronger yen cuts the value of overseas earnings for Japan’s exporters.Australia’s S&P/ASX 200 dropped 1.3 percent. South Korea’s Kospi Index fell 1.1 percent. Hong Kong’s Hang Seng Index declined 0.8 percent, while China’s Shanghai Composite slid 0.2 percent.

Acer, the world’s fourth-largest computer maker, fell 2 percent in Taipei. The company last week reported a third-quarter net loss of NT$1.1 billion ($37 million), its second straight loss, and said global shipments this quarter will fall as much as 10 percent amid a slowing computer market and a shortage of disk drives.

Tohoku Electric slumped 6.4 percent to 869 yen in Tokyo after reporting a wider-than-expected first-half net loss of 108.3 billion yen ($1.4 billion).

Japan’s biggest shipping lines declined after predicting losses amid falling cargo rates. Mitsui O.S.K. Lines Ltd., Japan’s second-biggest shipping company, declined 4.1 percent to 308 yen. Nippon Yusen K.K., the nation’s No. 1 shipping line, fell 2.4 percent to 201 yen.

China Railway Group Ltd., the country’s biggest builder of train lines, tumbled 14.1 percent to HK$2.63, the most in the MSCI Asia Pacific Index. The company said third-quarter profit dropped 49 percent from a year earlier to 1.14 billion yuan ($179 million) after a 15-fold jump in borrowing costs and a decline in new orders as the government halted new projects following rail accidents.

Chinese lenders and property developers retreated after Premier Wen Jiabao said China will “firmly” maintain its property curbs. Local authorities should continue to strictly implement the central government’s real estate policies in the coming months to let citizens see the results of the curbs, Wen said, according to a statement on Oct. 29 following a State Council meeting chaired by the premier.

ICBC, the world’s biggest lender by market value, dropped 1.6 percent to HK$4.94. Agricultural Bank of China Ltd., the nation’s largest lender by number of branches, sank 1.4 percent to HK$3.55 in Hong Kong. China Overseas Land & Investment, the No. 1 mainland developer listed in Hong Kong, slumped 5.7 percent to HK$14.66. China Resources Land Ltd., a state-owned developer, declined 5.4 percent to HK$11.54.

Among stocks that advanced, Qantas Airways Ltd. jumped 4.4 percent to A$1.6125 in Sydney. Flights resumed today after the government intervened in a union dispute that grounded the airline’s fleet two days ago, stranding 80,000 passengers and costing the company more than $100 million.

European stocks dropped, paring their biggest monthly gain since July 2009, as some investors remain reluctant to buy equities before the euro area’s leaders explain how they will fund their expanded bailout facility. The G-20 leaders convene on Nov. 3-4 in Cannes, France, a week after the euro area’s authorities pledged to magnify the capacity of their rescue fund to 1 trillion euros ($1.4 trillion). The euro area has already sought financial help from China and cooperation from the International Monetary Fund.

National benchmark indexes declined in all 18 western- European markets. The U.K.’s FTSE 100 Index slid 2.8 percent, while France’s CAC 40 Index and Germany’s DAX Index both retreated 3.2 percent.

Vestas slumped 24 percent to 84.35 kroner for its biggest slide since 2002. The wind-turbine maker predicted revenue of 6.4 billion euros in 2011, down from the 7 billion euros it had forecast in August. Vestas said its 2011 Ebit margin will decline to 4 percent. The company projected a margin of 7 percent in August. Vestas said further delays at the facility remain possible. Gamesa Corp. Tecnologica SA, the Spanish wind-turbine maker, plunged 9.6 percent to 3.52 euros.

Banks were among the worst performers of the 19 industry groups on the Stoxx 600. HSBC lost 3.6 percent to 544.9 pence. BNP Paribas SA sank 9.6 percent to 32.85 euros. UniCredit SpA slipped 5.7 percent to 84.8 euro cents as La Stampa reported that Italy’s largest bank plans to raise 6 billion euros to 8 billion euros. The newspaper didn’t say where it got the information.

Rio Tinto, the world’s second-biggest mining company, lost 6.5 percent to 3,385 pence. BHP Billiton Ltd., the world’s largest, declined 6.4 percent to 1,967.5 pence. Copper, nickel and tin prices slumped on the London Metals Exchange.

Homeserve Plc tumbled 28 percent to 350 pence for the biggest slump on the Stoxx 600 after the U.K.-based emergency- repair service provider suspended all telephone sales and marketing because a review showed sales processes didn’t meet standards.

TNT Express NV rallied 5 percent to 6.17 euros as Europe’s second-largest express-delivery service posted an unexpected third-quarter profit after increasing prices in Europe and Asia.

U.S. stocks slumped amid concern European leaders will struggle to raise funds to contain the region’s sovereign debt crisis. China can’t play the role of “savior,” the official Xinhua news agency said yesterday, as investors awaited the country’s response to Europe’s request for money to boost its bailout fund. Japanese Finance Minister Jun Azumi said today the government took unilateral steps to weaken the yen. Group of 20 leaders will gather Nov. 3-4 in Cannes, France, while central bankers from Australia, the U.S. and Europe will hold interest- rate policy meetings this week.

Stocks extended losses in the final hour of trading after Greek Prime Minister George Papandreou said he will put the European Union’s new agreement on financing for Greece to a referendum.

European stocks slumped, paced by losses in banks, as Italian and Spanish bonds declined. Morgan Stanley fell 8.7 percent to $17.64. Citigroup dropped 7.5 percent to $31.59.

MF Global Holdings Ltd., the holding company for the broker-dealer run by former New Jersey governor and Goldman Sachs Group Inc. co-chairman Jon Corzine, filed for bankruptcy after making bets on European sovereign debt.

Gauges of energy and raw material producers in the S&P 500 slumped at least 4.1 percent on concern about slower demand and as the dollar rallied, reducing the appeal of commodities as an alternative investment. Alcoa dropped 7 percent to $10.76. Chevron erased 4.2 percent to $105.05.

Yahoo! Inc. slumped 5.6 percent to $15.64 as it is said to be leaning toward selling Asian assets and redistributing proceeds to shareholders. The Asian asset sale is emerging as the most likely option for Yahoo and would let the company eventually pay a special dividend or buy back shares, according to five people familiar with the situation.

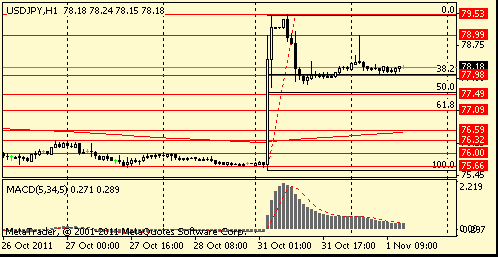

Resistance 3: Y80.20 (Aug 4 high)

Resistance 2: Y79.50 (Oct 31 high)

Resistance 1: Y79.00 (session high)

The current price: Y78.10

Support 1:Y77.55 (Oct 31 low)

Support 2: Y77.10 (61.8 % FIBO Y79.50-Y75.55)

Support 3: Y76.10 (MA (233) H1)

Comments: the pair decreased.

Resistance 2: Chf0.8940 (50.0 % FIBO Chf0.8565-Chf0.9310)

Resistance 1: Chf0.8860 (Oct 26 high)

The current price: Chf0.8824

Support 1: Chf0.8765 (session low)

Support 2: Chf0.8670 (low of American session on Oct 31)

Support 3: Chf0.8610 (Oct 31 low)

Comments: the pair advanced. In focus resistance Chf0.8860.

Resistance 3: $ 1.6200 (Sep 6 high)

Resistance 2: $ 1.6150/65 (area of Oct 28-31 high)

Resistance 1: $ 1.6090 (session high)

The current price: $1.6001

Support 1 : $1.5960 (Oct 31 low, MA (233) H1)

Support 2 : $1.5890 (Oct 26 low)

Comments: the pair is corrected remains in uptrend. In focus support $1.6025.

Resistance 3 : $1.4025 (high of American session on Oct 31)

Resistance 2 : $1.3920 (MA (233) H1)

Resistance 1 : $1.3870 (session high)

The current price: $1.3810

Support 1 : $1.3790 (session low)

Support 2 : $1.3720 (Oct 21 low)

Support 3 : $1.3655 (Oct 18-20 low)

Comments: the pair decreased. In focus support $1.3790.

Change % Change Last

Nikkei 225 8,988 -62.08 -0.69%

Hang Seng 19,865 -154.37 -0.77%

S&P/ASX 200 4,298 -55.15 -1.27%

Shanghai Composite 2,468 -5.16 -0.21%

FTSE 100 5,544 -158.02 -2.77%

CAC 40 3,243 -105.79 -3.16%

DAX 6,141 -204.85 -3.23%

Dow 11,955.01 -276.10 -2.26%

Nasdaq 2,684.41 -52.74 -1.93%

S&P 500 1,253.30 -31.79 -2.47%

10 Year Yield 2.18% -0.13 --

Oil $92.53 -0.66 -0.71%

Gold $1,716.20 -9.00 -0.52%

00:00 Australia HIA New Home Sales, m/m September +1.1% -3.5%

00:30 Australia House Price Index (QoQ) Quarter III -0.1% -1.4% -1.2%

00:30 Australia House Price Index (YoY) Quarter III -1.9% -1.8% -2.2%

01:00 China Manufacturing PMI October 51.2 51.9 50.4

01:30 Japan Labor Cash Earnings, YoY September -0.6% -0.3% 0.0%

02:30 China HSBC Manufacturing PMI October 51.1 51.0

03:30 Australia Announcement of the RBA decision on the discount rate 4.75% 4.50% 4.50%

05:30 Australia Commodity Prices, Y/Y October +26.6%

06:00 Japan BOJ Governor Shirakawa Speaks

07:00 United Kingdom Nationwide house price index October +0.1% +0.1%

07:00 United Kingdom Nationwide house price index, y/y October -0.3% +0.5%

07:00 United Kingdom Halifax house price index October -0.5% +0.1%

07:00 United Kingdom Halifax house price index 3m Y/Y October -2.3% -2.3%

08:15 Switzerland Retail Sales Y/Y September -1.9% +2.3%

08:30 Switzerland SVME PMI October 48.2 47.8

09:30 United Kingdom Purchasing Manager Index Manufacturing October 51.1 50.0

09:30 United Kingdom Preliminary GDP (QoQ) Quarter III +0.1% +0.4%

09:30 United Kingdom Preliminary GDP (YoY) Quarter III +0.6% +0.4%

14:00 U.S. ISM Manufacturing October 51.6 52.3

14:00 U.S. Construction Spending, m/m October +1.4% +0.4%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.