- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 02-11-2011

European stocks rose, snapping the biggest three-day drop in almost two months, as U.S. companies hired more workers than forecast and Federal Reserve policy makers raised their assessment of the economy in a statement at the close of trading. Euro-area leaders, racing to prevent their week-old debt crisis strategy from unraveling, are holding emergency talks today to tell Greece there is no alternative to the budget cuts imposed in the bailout plan.

National benchmark indexes climbed in 11 of the 18 western European markets today. The U.K.’s FTSE 100 rose 1.2 percent and France’s CAC 40 advanced 1.4 percent. Germany’s DAX Index gained 2.3 percent.

Randgold climbed 7.4 percent to 7,235 pence, the highest price since it first started trading in 1997. The miner said it expects its gold production to increase as much as 22 percent next year as output in Mali and Ivory Coast rises. Output may jump to 850,000 ounces to 900,000 ounces in 2012 from a target of 740,000 ounces to 760,000 ounces this year, Chief Executive Officer Mark Bristow said today in an interview in London.

Rio Tinto, the world’s second-biggest mining company, advanced 3.8 percent to 3,375 pence as copper rose more than 1.5 percent on the London Metal Exchange. Antofagasta Plc advanced 5.4 percent to 1,174 pence as the copper producer controlled by Chile’s Luksic family reported a 17 percent increase in quarterly output.

Next Plc, the U.K.’s second-largest clothing retailer, advanced 6.5 percent to 2,723 pence after reporting growth in third-quarter brand sales that exceeded analyst estimates.

Lundin Petroleum AB, the oil explorer with a stake in the giant Avaldsnes-Aldous Major North Sea find, rose 6.5 percent to 163 kronor after forecasting higher production in 2012. The company reported third-quarter earnings before interest, taxes, depreciation and amortization of $262 million, beating the average analyst estimate of $223 million.

Volkswagen AG led a gauge of automakers to the biggest gain of all industry groups in the Stoxx 600, rallying 6 percent to 127.20 euros. China’s passenger-car market may grow 8 percent to 10 percent a year over the coming five years, Karl-Thomas Neumann, head of VW’s Chinese operations said today at a conference in Berlin.

Lloyds, Britain’s biggest mortgage, dropped 4.4 percent to 29.21 pence. Horta-Osorio is taking leave of absence from his duties as CEO following medical advice and will be replaced in the interim by Finance Director Tim Tookey.

Logica Plc sank 7.3 percent to 83 pence as the Anglo-Dutch computer services provider posted third-quarter sales that trailed analyst estimates and cut its annual earnings forecast.

Meda AB, Sweden’s largest publicly traded drugmaker, fell 7.6 percent to 59.30 kronor after saying its profit margin in northern Europe dropped in the third quarter.

The U.S. dollar offset the losses against the euro after the Federal Reserve raised its assessment of the economy. The Central Bank said here that "significant risks" remain, but, still, refrained from taking additional measures to ease monetary policy. The published statistics on the market today, employment has also supported the dollar. As reported today, an independent U.S. recruiting and analytical agency ADP (Automatic Data Processing) in the private sector appeared 110 000 new jobs during the month of October. Data for September were revised up to 25 thousand items in a big way in the final count recorded 116 000 new employees of private firms and companies, not 91 thousand, as previously thought. In October, the vast majority of new positions, namely 114 000 was created in the service sector, while industrial workers, by contrast, have reduced staff by 4000 workers.

Earlier, the euro rose in the first time at this week after the cabinet of Greece supported the call of Prime Minister George Papandreou on the referendum on the plan of salvation of Greece. Greek Prime Minister George Papandreou secured the support of ministers on the issue submitted to referendum, the country assistance plan worth 130 billion euros, but he has to convince the leaders of the eurozone whether the referendum, did not expect such a decision.

Fed's not taking politics into account in decisions but Fed's fallen short on employment mandate.

2012 US GDP forecast revised to 2.5%-2.9% from 3.3%-3.7%

US GDP seen rising 3.0%-3.5% in '13, 3.0%-3.9% in '14

Still don't know Greek position on bailout

Will insist Greece provides clarity on bailout stance

Greece situation threatens stability of euro zone

Economic growth strengthened somewhat in 3Q

Labor market still weak, unemployment elevated

To continue extending maturity of securities

U.S. stocks gained, following a two- day drop in the Standard & Poor’s 500 Index, as investors awaited a Federal Reserve policy statement and a report showed companies added more workers to payrolls than estimated.

Stocks rose today after a private report based on payrolls showed U.S. companies added workers in October. The 110,000 increase followed a revised 116,000 gain the prior month that was larger than previously estimated, ADP Employer Services said today. The median forecast of economists surveyed by Bloomberg News called for a advance of 100,000.

Fed officials are probably engineering a third round of large-scale asset purchases, while they are unlikely to announce a decision today, according to economists in a Bloomberg News survey. The Federal Open Market Committee plans to release a policy statement at 12:30 p.m. in Washington. The FOMC will release economic forecasts at 2 p.m., and Bernanke is scheduled to hold a press conference beginning at 2:15 p.m.

Dow 11,844.37 +186.41 +1.60%, Nasdaq 2,636.40 +29.44 +1.13%, S&P 500 1,238.31 +20.03 +1.64%

Banks rallied after yesterday’s 4.7 percent drop in a gauge of financial companies in the S&P 500, the most among 10 industries. Bank of America added 3.9 percent to $6.65. Citigroup Inc. gained 3.5 percent to $30.20.

MasterCard rose 7.2 percent to $358.43. The world’s second- biggest payments network posted a third-quarter profit that beat analysts’ estimates as consumers increased spending with credit and debit cards.

Energy and raw material producers advanced as the S&P GSCI index of 24 commodities gained 1.8 percent. Alcoa Inc. jumped 3 percent to $10.68. Halliburton Co. climbed 2.7 percent to $36.20.

Oil rose for the first time in four days as a private report showed U.S. companies added more jobs than forecast and as the dollar weakened before a Federal Reserve statement on the economy. Oil gained as much as 1.7 percent after ADP Employer Services said companies added 110,000 workers in October, beating estimates. Oil pared gains briefly after the Energy Department reported a bigger-than-expected storage increase. Crude supplies rose 1.83 million barrels to 339.5 million in the week ended Oct. 28, the Energy Department said today.

Crude oil for December delivery rose to $93.79 a barrel on the New York Mercantile Exchange.

Brent oil for December settlement gained $1.63, or 1.5 percent, to $111.17 a barrel on the London-based ICE Futures Europe exchange.

The price of gold is rising against the euro and the strengthening of the problems of the debt crisis impact on production in the region.

Greek Prime Minister George Papandreou secured the support of ministers on the issue submitted to referendum, the country assistance plan worth 130 billion euros, but he has to convince the leaders of the eurozone whether the referendum, did not expect such a decision.

Another bad news was the results of Business Research, speaking on the reduction of manufacturing activity in the euro area in October. Nevertheless, the euro rose slightly, taking a breather after the sale.

Investors are waiting for a press conference U.S. Federal Reserve chairman Ben Bernanke tonight on the results of a two-day meeting of the Central Bank and European Central Bank decision on interest rates on Thursday.

Stocks ETF backed by gold funds in October increased by 852,000 ounces to 67.907 million ounces, after declining by 444,000 ounces in September, indicating increased investor interest.

Gold futures for December delivery rose $ 32.90 to $ 1.745,60 per troy ounce in New York

Fed officials are probably engineering a third round of large-scale asset purchases, while they are unlikely to announce a decision today.

European leaders racing to prevent their week-old debt crisis strategy from unraveling convene emergency talks today to tell Greece there is no alternative to the budget cuts imposed in the bailout plan.

World markets: Nikkei -2.21%, Hang Seng +1.88%, Shanghai Composite +1.38%, FTSE -0.25%, CAC +0.95%, DAX +0.92%.

Crude oil at $93.44 per barrel (+1,4%).

Gold at $1729,80 (+1,1%).

12:15 United States ADP Employment Change (Oct) 101K 91K

14:30 United States EIA Crude Oil Stocks change (Oct 28) 4.735M

16:30 United States Fed Interest Rate Decision (Nov 2) 0.25% 0.25%

18:15 United States Fed's Press Conference

21:45 New Zealand Unemployment Rate (Q3) 6.4% 6.5%

21:45 New Zealand Employment Change (Q3) 0.6% 0.0%

22:30 Australia AiG Performance of Services Index (Oct) 50.3

The dollar fell from a three-week high against the euro on speculation the Federal Reserve will signal today it is moving toward another round of asset purchases, or quantitative easing, to spur growth.

The U.S. currency declined versus the yen as economists said a manufacturing report tomorrow will add to signs the nation’s growth is slowing.

The euro gained after Greece’s Cabinet backed Prime Minister George Papandreou’s plan to put a bailout package to a referendum.

The euro advanced after a Greek official said the Cabinet gave Papandreou unanimous backing for his referendum plans. Government spokesman Elias Mosialos said the referendum will be held “as soon as possible,” and the vote of confidence in Parliament is also scheduled to begin today.

EUR/USD: the pair grown in $1,3770 area.

GBP/USD: the pair showed high in $1,6050 area then decreased.

USD/JPY: the pair fell in Y78,00 area.

US focus is the FOMC decision at 1630GMT, but US events start at 1100GMT with the weekly MBA Mortgage Application Index. This is followed at 1130GMT with Challenger Layoffs and then at 1215GMT by the ADP National Employment Report. US data continues at 1400GMT with Q3 Housing Vacancies and then at 1430GMT with the weekly EIA Crude Oil Stocks.

Resistance 3: Y79.50 (Oct 31 high)

Resistance 2: Y79.00 (Nov 1 high)

Resistance 1: Y78.40 (session high)

Current price: Y78.03

Support 1:Y77.90 (session low)

Support 2:Y77.55 (50.0 % FIBO Y75.55-Y79.55)

Support 3:Y77.10 (61.8 % FIBO Y75.55-Y79.55)

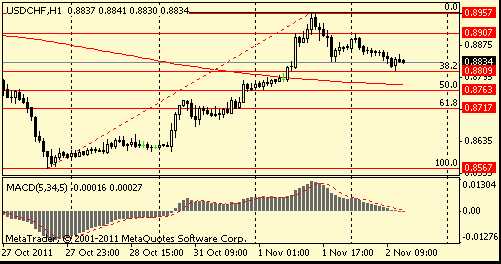

Resistance 2: Chf0.8950/60 (area of МА(200) for Н4, Oct 21 and Nov 1 high)

Resistance 1: Chf0.8910 (session high)

Current price: Chf0.8831

Support 1: Chf0.8810 (session low, 38.2 % FIBO Chf0,8570-Chf0,8960)

Support 2: Chf0.8760 (50,0 % FIBO Chf0,8570-Chf0,8960, МА(200) for Н1)

Support 3: Chf0.8720 (61,8 % FIBO Chf0,8570-Chf0,8960)

Resistance 2: $ 1.6090 (Nov 1 high)

Resistance 1: $ 1.6050 (session high)

Current price: $1.5989

Support 1 : $1.5970 (area of low of european session)

Support 2 : $1.5890 (area of Oct 26, Nov 1 lows and support line from Oct 12)

Support 3 : $1.5850 (earlier resistance, Oct 14, 17 and 19 highs)

Resistance 2: $ 1.3850 (38,2 % FIBO $1,4240-$ 1,3610)

Resistance 1: $ 1.3800 (Oct 26 low, session high)

Current price: $1.3772

Support 1 : $1.3700 (area of low of european session)

Support 2 : $1.3610 (Nov 1 low)

Support 3 : $1.3560 (61,8 % FIBO $1,3150-$ 1,4240, Oct 11 low)

Currently FTSE 5,401 -20.52 -0.38%, CAC 3,064 -4.69 -0.15%, DAX 5,836 +1.34 +0.02%.

USD/JPY Y77.00, Y77.15, Y78.00, Y78.50, Y79.30

AUD/USD $1.0350, $1.0675

USD/CHF Chf0.8700

GBP/USD $1.6000

EUR/CHF Chf1.2175

00:30 Australia Building Permits, y/y September -12.0%

The euro erased an earlier drop against the dollar as Greece’s Cabinet backed Papandreou. Papandreou will travel to Cannes, France today to brief German Chancellor Angela Merkel, French President Nicolas Sarkozy, European Central Bank President Mario Draghi and other officials on developments in Greece. Group of 20 leaders will meet in Cannes tomorrow to discuss the debt crisis.

The yen advanced against 14 of its 16 major counterparts as renewed speculation Europe’s debt crisis is worsening boosted appetite for safer assets. The yen extended a gain from yesterday versus the euro on concern Greek Prime Minister George Papandreou’s pledge to put the European Union’s financing package to a referendum risks a disorderly default if voters reject it. Japan’s currency rebounded from declines earlier this week, when the government intervened to weaken it, strengthening today as Asian stocks fell.

The dollar slid against 11 of its 16 major peers as economic reports this week may show the U.S. recovery is faltering, adding to speculation Federal Reserve policy makers will signal their willingness to embark on more asset purchases, or quantitative easing, as they conclude a two-day meeting today.

EUR/USD: on Asian session the pair grows after yesterday's falling.

GBP/USD: on Asian session the pair advanced.

USD/JPY: on Asian session the pair receded from yesterday’s high.

On Wednesday UK data at 0930GMT sees just the Markit/CIPS Construction PMI for October. European events for Wednesday start at 0700GMT with the ILO measure of German unemployment. This morning also sees the release of the final manufacturing releases, including France at 0848GMT, Germany at 0853GMT and the main EMU release at 0858GMT, all of which are expected to confirm the preliminary readings.The main German unemployment data is due in the meantime, at 0855GMT and is expected to show a -10k payroll figure with the unemployment rate at a SA rate of 6.9%. US focus is the FOMC decision at 1630GMT, but US events start at 1100GMT with the weekly MBA Mortgage Application Index. This is followed at 1130GMT with Challenger Layoffs and then at 1215GMT by the ADP National Employment Report. US data continues at 1400GMT with Q3 Housing Vacancies and then at 1430GMT with the weekly EIA Crude Oil Stocks.

The dollar and yen strengthened as stocks slid around the world and data showed Chinese manufacturing slowed. The Dollar Index, which IntercontinentalExchange Inc. uses to track the U.S. currency against those of six trading partners, gained for a third day, rising 1.2 percent to 77.416. The dollar advanced versus all of its 16 most-traded counterparts after the China Federation of Logistics and Purchasing said its Purchasing Managers’ Index fell to 50.4 in October, from 51.2 the previous month.

Australia’s dollar slid against most of its major peers after the Reserve Bank of Australia lowered its cash rate target by 25 basis points to 4.5 percent. It was the first cut since April 2009. Sixteen of 27 economists surveyed by Bloomberg News predicted the move. The rest forecast no change.

EUR/USD: yesterday the pair fell and lost two figures.

GBP/USD: yesterday the pair fell and lost one and half figures.

USD/JPY: yesterday the pair traded in range Y78.00-Y78.45.

On Wednesday UK data at 0930GMT sees just the Markit/CIPS Construction PMI for October. European events for Wednesday start at 0700GMT with the ILO measure of German unemployment. This morning also sees the release of the final manufacturing releases, including France at 0848GMT, Germany at 0853GMT and the main EMU release at 0858GMT, all of which are expected to confirm the preliminary readings.The main German unemployment data is due in the meantime, at 0855GMT and is expected to show a -10k payroll figure with the unemployment rate at a SA rate of 6.9%. US focus is the FOMC decision at 1630GMT, but US events start at 1100GMT with the weekly MBA Mortgage Application Index. This is followed at 1130GMT with Challenger Layoffs and then at 1215GMT by the ADP National Employment Report. US data continues at 1400GMT with Q3 Housing Vacancies and then at 1430GMT with the weekly EIA Crude Oil Stocks.

Asian stocks fell, with the regional benchmark index posting its biggest two-day drop in a month, as China’s manufacturing growth slowed and Greece proposed a referendum on the Europe’s latest aid package for the country. Group of 20 leaders will convene Nov. 3-4 in Cannes, France, a week after euro-area authorities pledged to magnify the capacity of their rescue fund to 1 trillion euros ($1.4 trillion) and look beyond their borders for help in combating the debt turmoil posing the biggest threat to global economic growth. Europe has the capability to overcome its difficulties, Chinese President Hu Jintao said at a briefing yesterday in Vienna.

BHP Billiton Ltd., the world’s biggest mining company, dropped 2.7 percent to A$36.77 in Sydney. Jiangxi Jiangxi Copper Co., China’s largest producer of the metal, declined 5.3 percent in Hong Kong. Aluminum Corp. of China Ltd., the nation’s biggest producer of the metal, slumped 5.5 percent to HK$4.10. Cnooc Ltd., China’s biggest offshore oil producer, slipped 4.3 percent to HK$14.60.SBC Holdings Plc, Europe’s biggest lender by market value, dropped 3.9 percent in Hong Kong on speculation a default by Greece will threaten bank earnings. Standard Chartered Plc, the U.K.’s second-biggest lender by market value, sank 4.5 percent to HK$179.50.

Panasonic Corp. sank 5.1 percent in Tokyo as the maker of Viera televisions predicted its worst annual loss in 10 years. The Osaka-based electronics maker said it expects a full-year loss of 420 billion yen ($5.4 billion), the biggest annual loss in 10 years, because of a stronger yen, declining sales and a one-time charge for restructuring its TV and chip operations.

DeNA Co. tumbled 20 percent after the Japanese website operator posted profit that missed its own forecast. JPMorgan Chase & Co. cut its rating on the stock to “underweight” after the company reported net income of 17.6 billion yen for the six months through Sept. 30, missing its own forecast by 5.1 percent.

Hyundai Development Co., South Korea’s second-biggest homebuilder by sales, plunged 12 percent to 20,650 won in Seoul. Citigroup Inc. lowered its rating on the stock to “neutral,” citing weaker-than-expected third-quarter earnings.

European stocks sank the most in five weeks, as Greece’s government called a referendum on its latest bailout package, spurring concern that the country may default. Papandreou’s gambit risks pushing the country into default if voters reject the financial accord. An opinion poll published on Oct. 29 showed most Greeks believe the euro area’s expanded bailout package and debt writedown are negative. Leaders from the Group of 20 meet at a summit on Nov. 3-4 in Cannes, France, a week after the euro area’s authorities pledged to expand their rescue fund to 1 trillion euros ($1.4 trillion). They have already sought financial help from China and cooperation from the International Monetary Fund. German Chancellor Angela Merkel and French President Nicolas Sarkozy will meet tomorrow in Cannes before the summit.

National benchmark indexes tumbled at least 2 percent in all 16 western European markets that were open today, except Iceland. France’s CAC 40 Index dropped 5.4 percent, Germany’s DAX Index lost 5 percent and Italy’s FTSE MIB Index plunged 6.8 percent. Greece’s ASE Index sank 6.9 percent.

Credit Suisse Group AG and Danske Bank A/S led a selloff in lenders, both sliding more than 6.5 percent, after posting earnings that fell short of analysts’ estimates. National Bank of Greece SA sank 15 percent to its lowest price since 1992 in Athens.

Barclays Plc dropped 9.5 percent to 176.8 pence after UBS AG lowered its recommendation for Britain’s second-largest bank by assets to “neutral” from “buy.”

Mining companies declined with copper prices as a report showed a drop in manufacturing in China, the world’s biggest consumer of the base metal. The Purchasing Managers’ Index fell to 50.4 in October from 51.2 in September, the China Federation of Logistics and Purchasing said in a statement. Xstrata Plc declined 6.6 percent to 976.1 pence, Antofagasta Plc retreated 4.5 percent to 1,114 pence and BHP Billiton Ltd., the world’s largest mining company, lost 2.7 percent to 1,915 pence.

Sandvik AB dropped 6.5 percent to 84.30 kronor. The world’s biggest maker of metal-cutting tools posted a 60 percent plunge in third-quarter profit to 626 million kronor ($94 million) after a writedown on goodwill for a business it plans to sell. The company also said it will cut 365 jobs in Sweden.

Daimler AG paced a selloff in carmakers, falling 5.9 percent to 34.81 euros after Barclays downgraded the world’s third-largest maker of luxury vehicles to “underweight” from “equal weight.”

U.S. stocks dropped, driving the Standard & Poor’s 500 Index to the biggest two-day slump in a month, on concern that a Greece referendum pledged by Prime Minister George Papandreou may threaten Europe’s bailout. Greece’s referendum poses a threat to financial stability in the euro region and increases the risk of a “disorderly” default, Fitch Ratings said. Stocks extended losses as government spokesman Angelos Tolkas said Papandreou will proceed with plans for a referendum on the Greek financing package. Papandreou’s announcement threatens to overshadow a Nov. 3- 4 Group of 20 summit in Cannes, France. German Chancellor Angela Merkel and French President Nicolas Sarkozy held emergency talks on Greece today and called on Europe to implement the package of measures thrashed out in Brussels last week. The plan, designed to aid Greece and stem the wider debt crisis, is “more necessary than ever today,” they said in a joint statement issued in Berlin and Paris.

Stocks also fell after data showed a Chinese manufacturing index dropped to the lowest level since February 2009. In the U.S., manufacturing grew less than forecast in October, depressed by a drop in inventories that may set U.S. factories up for stronger growth heading into 2012.

All 10 groups in the S&P 500 fell as gauges of financial, energy and industrial shares lost at least 3 percent.

Citigroup Inc. and Morgan Stanley retreated more than 7.6 percent, following a 6.2 percent tumble in European lenders. Exchange operators slumped after U.S. lawmakers said they will propose a tax on financial transactions such as stock and bond trades. The New York Stock Exchange plans to delist shares of MF Global Holdings Ltd., citing its bankruptcy filing, and the stock will probably move to an over-the-counter listing venue.

MetroPCS Communications Inc. fell 9.9 percent, the most in the S&P 500, to $7.66. The pay-as-you-go U.S. wireless carrier reported third-quarter profit that missed analysts’ estimates as subscriber growth slowed for the second consecutive quarter.

Baker Hughes Inc. tumbled 7.7 percent to $53.54. The oilfield contractor reported third-quarter earnings excluding some items of $1.18 a share, missing the average analyst estimate by 3 percent, according to Bloomberg data.

Advanced Micro Devices Inc. sank 9.1 percent to $5.30. The Sunnyvale, California-based maker of chips for Apple Inc.’s computers failed to persuade a U.S. judge to halt a patent dispute S3 Graphics Co. has against Apple at the U.S. International Trade Commission, according to a filing with the trade agency.

Resistance 3: Y80.20 (Aug 4 high)

Resistance 2: Y79.50 (Oct 31 high)

Resistance 1: Y78.45 (session high)

The current price: Y78.11

Support 1: Y78.00 (Nov 1 low)

Support 2: Y77.55 (Oct 31 low)

Support 3: Y77.00 (MA(233) H1)

Comments: the pair holds in range.

Resistance 3: Chf0.9005 (high of the American session on Oct 20)

Resistance 2: Chf0.8960 (Nov 1 high)

Resistance 1: Chf0.8905 (session high)

The current price: Chf0.8844

Support 1: Chf0.8815 (MA(233) H1)

Support 2: Chf0.8765 (50.0% FIBO Chf0.8960-Chf0.8565)

Support 3: Chf0.8715 (61.8% FIBO Chf0.8960-Chf0.8565)

Comments: the pair advanced. In focus resistance Chf0.8905.

Resistance 3: $ 1.6150/65 (area of Oct 28-31 high)

Resistance 2: $ 1.6060 (61.8 % FIBO $1.5890-$ 1.6165)

Resistance 1: $ 1.5995 (38.2 % FIBO $1.5890-$ 1.6165)

The current price: $1.5978

Support 1 : $1.5915 (session low)

Support 2 : $1.5890 (Nov 1 low)

Support 3 : $1.5825 (123.6% FIBO $1.6165-$1.5890)

Comments: the pair is corrected remains on the downtrend. In focus resistance $1.5995.

Resistance 3 : $1.3925 (50.0 % FIBO $1.3605-$ 1.4245)

Resistance 2 : $1.3850 (38.2 % FIBO $1.3605-$ 1.4245)

Resistance 1 : $1.3755 (23.6 % FIBO $1.3605-$ 1.4245)

The current price: $1.3715

Support 1 : $1.3635 (session low)

Support 2 : $1.3565 (Oct 11 low)

Support 3 : $1.3500 (psychological mark)

Comments: the pair is on uptrend. In focus support $1.3635.

Change % Change Last

Nikkei 225 8,836 -152.87 -1.70%

Hang Seng 19,370 -494.91 -2.49%

S&P/ASX 200 4,233 -65.20 -1.52%

Shanghai Composite 2,470 +1.77 +0.07%

FTSE 100 5,422 -122.65 -2.21%

CAC 40 3,068 -174.51 -5.38%

DAX 5,835 -306.83 -5.00%

Dow 11,657.96 -297.05 -2.48%

Nasdaq 2,606.96 -77.45 -2.89%

S&P 500 1,218.28 -35.02 -2.79%

10 Year Yield 2.00% -0.17 --

Oil $91.38 -0.81 -0.88%

Gold $1,720.20 +8.40 +0.49%

00:30 Australia Building Permits, m/m September +11.4% -4.5%

00:30 Australia Building Permits, y/y September -5.5% +0.1%

08:50 France Manufacturing PMI October 49.0 49.0

08:55 Germany Purchasing Manager Index Manufacturing October 48.9 48.9

08:55 Germany Unemployment Change October -26K -10K

08:55 Germany Unemployment Rate s.a. October 6.9% 6.9%

09:00 Eurozone Purchasing Manager Index Manufacturing October 47.3 47.3

09:30 United Kingdom PMI Construction October 50.1 50.2

12:15 U.S. ADP Employment Report October 91K 103K

14:03 U.S. EIA Crude Oil Stocks change неделя по 22 октября +4.7

16:30 U.S. Fed Interest Rate Decision 0.00%-0.25% 0.00%-0.25%

18:15 U.S. Federal Reserve Press Conference

21:45 New Zealand Unemployment Rate Quarter III 6.5% 6.4%

22:30 Australia AIG Services Index October 50.3

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.