- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-11-2011

- Fiscal policy is inevitably more important than monetary policy

The euro pared its advance versus the dollar after Italian Prime Minister Silvio Berlusconi won a vote today in parliament on last year’s budget report without an absolute majority, fueling more calls for him to quit. Italy’s 630-seat Chamber of Deputies approved the routine budget report today with 308 votes, Speaker Gianfranco Fini said in Rome. Berlusconi’s failure to muster an absolute majority spurred further calls for his resignation as Italy struggles to convince investors it can fund itself. The chamber had failed to pass the report in an initial ballot last month, prompting a confidence motion won by Berlusconi on Oct. 14 with 316 votes. Since then he has faced defections that reduced his majority.

The yen gained to its strongest level against the dollar since Japan intervened Oct. 31 to stem its rise. The yen reached a post-World War II high of 75.35 on Oct. 31, threatening exporters, and the Bank of Japan sold the currency to weaken it.

The franc rose versus the euro as Swiss National Bank Vice President Thomas Jordan said the SNB is not weakening it to gain export advantage. The franc appreciated 0.4 percent to 1.2359 per euro and gained 0.4 percent to 89.65 centimes per dollar.

Australia’s dollar fell against the greenback after the nation’s trade surplus shrank more than forecast. Australia’s dollar weakened after statistics bureau data showed exports exceeded imports by A$2.56 billion ($2.64 billion), compared with a revised A$2.95 billion surplus in August.

FOMC should tell how react to change in economic variables

Pursuing higher than 2% inflation 'very risky'

Break of that level to open a look at the overnight low at $1.3724. Flows remain light and traders still note euro remains broadly rangebound inside $1.3600/1.3850.

European stocks rose, with the Stoxx Europe 600 Index rebounding from two days of losses, as Italy’s Prime Minister Silvio Berlusconi won a parliamentary vote on the budget yet still lost his absolute majority.

Berlusconi won 308 votes out of 630 on a routine report on Italy’s 2010 budget, Speaker Gianfranco Fini said in Rome. The yield on 10-year Italian bonds rose to 6.7 percent today after yesterday climbing to a euro-era record. European stocks dropped over the past two days, as two Berlusconi allies defected to the opposition and a third one quit.

In Greece, Prime Minister George Papandreou said a Greek national-unity government will be named “soon” and told his ministers to prepare to resign, spokesman Elias Mosialos said.

In Germany, a report from the Federal Statistics Office in Wiesbaden showed that the country’s exports unexpectedly rose for a second month in September, helping Europe’s largest economy weather the sovereign-debt crisis. Exports, adjusted for work days and seasonal changes, increased 0.9 percent, the report said. Economists had forecast a drop of 0.8 percent, according to the median of 14 estimates.

National benchmark indexes gained in every western-European market except Luxembourg and Portugal. France’s CAC 40 Index advanced 1.3 percent, Germany’s DAX Index rose 0.6 percent and the U.K.’s FTSE 100 Index (UKX) added 1 percent.

Vodafone advanced 1.8 percent to 176 pence. Europe’s third- largest phone company by sales predicted full-year adjusted operating profit of 11.4 billion pounds ($18.3 billion) to 11.8 billion pounds, the upper half of the range indicated in May. First-half earnings before interest, taxes, depreciation and amortization gained 2.3 percent to 7.53 billion pounds in the six months through September. Analysts had predicted profit of 7.42 billion pounds.

Repsol surged 6.3 percent to 22.23 euros after its YPF SA unit in Argentina raised estimates for the Loma La Lata field in northern Patagonia to 927 million barrels of shale oil.

Lloyds jumped 4.4 percent to 28.9 pence after posting smaller-than-estimated provisions for bad loans in the third quarter and saying it may miss its income target for 2014.

Societe Generale SA shares advanced 7.3 percent to 18.77 euros after the bank said it won’t pay a dividend for 2011, a decision that will reduce its capital needs under European Banking Authority requirements.

According to market research firm Redbook Research, taking into account the parametersof the order of 9,000 stores, sales at U.S. retailers from 1 to 5 November rose by 1.4% overthe same period in October, sales at retail stores for the week ending November 5, grew up in annualized rate of 3.1%.

U.S. stocks fell, erasing an early gain, amid concern over who will lead Italy out of its debt crisis after Prime Minister Silvio Berlusconi won a budget vote without an absolute majority.

Berlusconi won 308 votes in the 630-seat Chamber of Deputies, Speaker Gianfranco Fini said in Rome. By failing to muster a majority, he may face a confidence vote that will decide his fate. Yesterday, Berlusconi denied a report in Il Foglio that he is on the verge of resigning to make way for an Italian unity government with a budget-cutting mandate.

In Greece, Prime Minister George Papandreou said a national unity government will be named “soon” and told his ministers to get ready to resign, spokesman Elias Mosialos said today in Athens. Both state-run NET TV and To Vima newspaper said the new prime minister will be former European Central Bank vice president Lucas Papademos, without saying how they got the information.

Dow 12,018.02 -50.37 -0.42%, Nasdaq 2,691.10 -4.15 -0.15%, S&P 500 1,257.90 -3.22 -0.26%

Financial stocks in the Standard & Poor’s 500 Index reversed an earlier advance, falling 0.1 percent as a group. Hewlett-Packard Co. and Alcoa Inc. dropped at least 0.7 percent, pacing declines among the largest U.S. companies. Toll Brothers Inc. climbed 4.1 percent as the largest American luxury-home builder said revenue jumped 6 percent.

Leading video game developer Activision Blizzard adds 0.6% on the background of favorable comments to analysts on the sales of the new game Modern Warfare 3.

The pharmaceutical company Amylin Pharmaceuticals has collapsed by 17.9% on news of end of partnership with Eli Lilly & Co. Amylin will be responsible for developing the new drug Byetta and Lilly will pay a certain amount of revenue for the drug.

Clothing retailer Urban Outfitters went to minus 5.3% reported a decline of comparable sales for the third quarter by 7%.

Gold grows against the background of maintaining a high investment demand for gold bullion because of financial instability in countries of the eurozone. The increased demand for gold on the eve of Germany's leadership led to the statement that the gold reserves of the Central Bank may not be used to restore financial stability in the euro area or as a "foundation" of the new European Financial Stability Fund. Central Bank of Germany is the second largest after the United States holder of gold in the world. Gold reserves of the Central Bank of Germany exceeds 3.4 tonnes and up nearly 75% of the reserves of the country.

The dollar index for the six major world currencies on the eve established at around 76.962 points (the lowest figure for the five trading days), which further ensured profitable purchasing gold on COMEX.

Investment demand for physical gold before also increased significantly. Thus, the assets of gold, held by ETFs SPDR Gold Trust, which is the world's largest holder of gold among investment institutions, November 7, increased by 10.6 tons and was officially made a mark that is 255.7 thousand 1.255 thousand tons of this figure exceeded for the first time in two and a half months (after 23 August).

Today, December gold futures on the COMEX traded in a range 1787,1-1796,4 dollar / oz. Interest in buying gold somewhat weakened after the eve of his quotes for the first six weeks are very close to the psychological resistance level of $ 1,800 / oz.

Crude oil climbed to a three-month high in New York as Italian lawmakers prepared to vote on Prime Minister Silvio Berlusconi’s budget and Greece moved closer to a unity government.

Futures rose as much as 1.4 percent before the ballot that will show whether Berlusconi retains a majority in the Chamber of Deputies. Greek Prime Minister George Papandreou has said a new government will be named “soon,” Elias Mosialos, his spokesman, said in Athens. Prices also gained on speculation Iran’s nuclear plans may threaten Middle East stability.

A report this week may show International Atomic Energy Agency inspectors have concluded for the first time that Iran is working toward making nuclear weapons, which could increase the risk of a military attack on Iran’s nuclear facilities, according to analysts at Commerzbank AG.

Iran is the second-largest oil producer, behind Saudi Arabia, in the Organization of Petroleum Exporting Countries.

OPEC raised estimates for global oil demand to 2015 after a swifter-than-forecast economic rebound. Worldwide consumption will increase by 5.3 percent to 92.9 million barrels a day in the next four years, led by emerging Asian economies, the group said today in its annual World Oil Outlook. The 2015 estimate is 1.9 million barrels more than last year’s forecast.

Crude oil for December delivery rose to $96.87 a barrel on the New York Mercantile Exchange, the highest intraday level since Aug. 1. Futures are up 5.4 percent this year.

Brent oil for December settlement increased $1.14, or 1 percent, to $115.70 on the London-based ICE Futures Europe exchange. The European benchmark touched $116.48, the highest price since Sept. 8.

Euro still likely to face stop risk below $1.3750 area, as noted earlier, with bids at $1.3725.

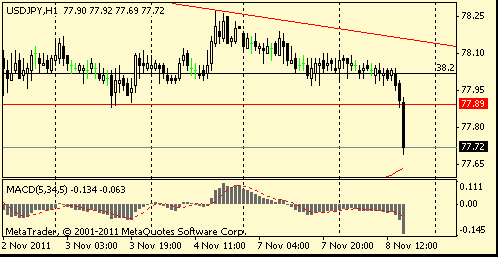

USD/JPY Y77.75, Y77.80, Y78.00, Y78.50

AUD/USD $1.0250, $1.0300, $1.0350, $1.0400

USD/CHF Chf0.8940

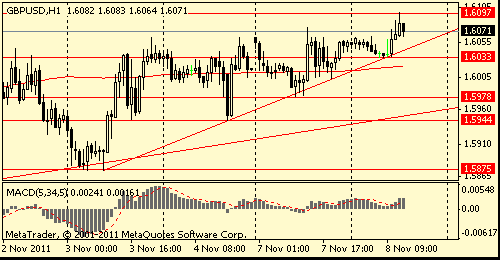

GBP/USD $1.5950

EUR/JPY Y107.00, Y106.00, Y110.15

Currently the pair at Y77.72.

Below Y77.70 bids seen at Y77.50 with more stops.

U.S. stock futures advanced as Italian lawmakers prepare to vote on Prime Minister Silvio Berlusconi’s budget.

At 1700GMT Philadelphia Fed President Charles Plosser delivers a policy speech at award ceremony in his honor, before at 1800GMT, Minneapolis Fed President Narayana Kocherlakota delivers a speech.

World markets: Nikkei -1.27%, Hang Seng 0.00%, Shanghai Composite -0.24%, FTSE +1.58%, CAC +2.20%, DAX +2.16%.

Crude oil: $96.29 per barrel (+1,0%).

Gold: $1792,00 (+0,1%).

Company news:DuPont (DD) was initiated with Overweight and a target price of $62 at Piper Jaffray. Shares of DD +0.76% premarket.

- assuring price stability must remain key SNB mandate

- financial stability arsenal of SNB needs to be enhanced

- assuring price stability must remain key SNB mandate

- financial stability arsenal of SNB needs to be enhanced

Data:

07:00 Germany Trade balance (September) unadjusted, bln 17.4

09:30 UK Industrial production (September) 0.0%

09:30 UK Industrial production (September) Y/Y -0.7%

09:30 UK Manufacturing output (September) 0.2%

09:30 UK Manufacturing output (September) Y/Y 2.0%

The euro fluctuated before Italian Prime Minister Silvio Berlusconi faces a budget vote and amid speculation that Greece is close to forming a national government.

The franc rose against the euro as Swiss National Bank Vice President Thomas Jordan said the SNB is not weakening the nation’s currency to gain export advantage.

In Greece, Prime Minister George Papandreou resumed talks with his opposition rival in Athens as they moved closer to agreement on naming the premier of a Greek unity government.

The franc depreciated earlier against most of its major counterparts after the SNB’sJordan said the franc “must” weaken further. It reversed declines after he said the central bank will not pursue a competitive devaluation policy.

EUR/USD: the pair holds in $1.3720-$ 1,3800.

GBP/USD: the pair holds in $1.6030-$ 1,6100.

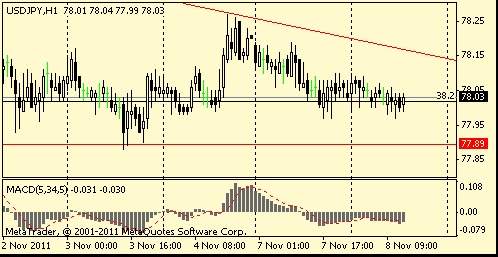

USD/JPY: the pair was trading in Y78,00 area.

At 1700GMT Philadelphia Fed President Charles Plosser delivers a policy speech at award ceremony in his honor, before at 1800GMT, Minneapolis Fed President Narayana Kocherlakota delivers a speech.

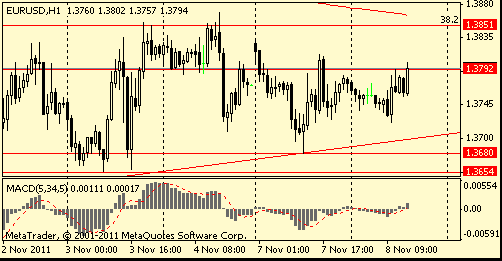

EUR/USD:

Offers $1.3870/80, $1.3840/50, $1.3800/05

Bids $1.3725/20, $1.3685/80, $1.3660/50, $1.3610/00

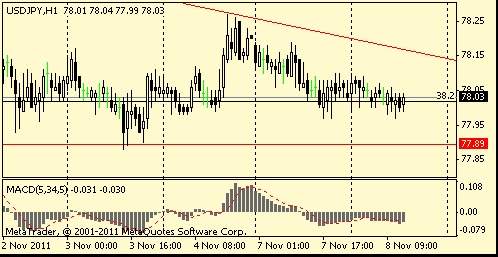

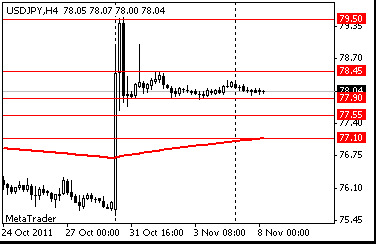

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.40 (Nov 2 high)

Resistance 1: Y78.15 (resistance line from Nov 2)

Current price: Y78.03

Support 1:Y77.90 (Nov 3 low)

Support 2:Y77.55 (50.0 % FIBO Y75,55-Y79,55)

Support 3:Y77.10 (61.8 % FIBO Y75,55-Y79,55)

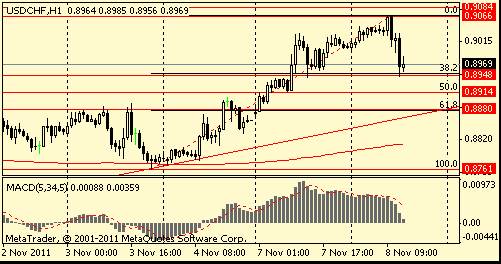

Resistance 3: Chf0.9300 (area of high of October)

Resistance 3: Chf0.9120 (Oct 11 high)

Resistance 1: Chf0.9070/80 (area of session high and Oct 20 high)

Current price: Chf0.8969

Support 1: Chf0.8950 (38,2 % FIBO Chf0,8760-Chf0,9070)

Support 2: Chf0.8910 (50,0 % FIBO Chf0,8760-Chf0,9070)

Support 3: Chf0.8880 (61,8 % FIBO Chf0,8760-Chf0,9070, support line from Oct 27)

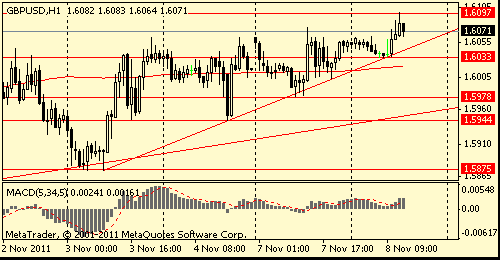

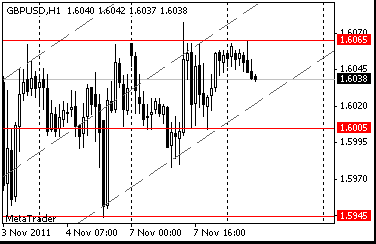

Resistance 3: $ 1.6200 (Sep 6 high)

Resistance 2: $ 1.6165 (Oct 31 high)

Resistance 1: $ 1.6100 (area of Nov 1 high and session high)

Current price: $1.6071

Support 1 : $1.6060 (support line from Nov 3)

Support 2 : $1.6030 (session low)

Support 3 : $1.5980 (Nov 7 low)

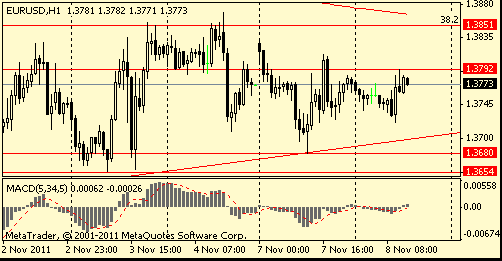

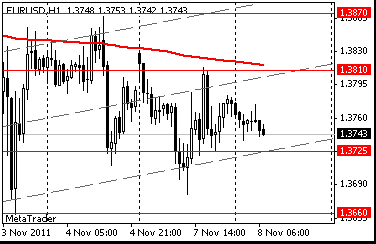

Resistance 3: $ 1.3920 (50,0 % FIBO $1,4240-$ 1,3610)

Resistance 2: $ 1.3850 (area of 38,2 % FIBO $1,4240-$ 1,3610, Nov 3-7 highs)

Resistance 1: $ 1.3790 (session high)

Current price: $1.3773

Support 1 : $1.3700 (support line from Nov 1)

Support 2 : $1.3680 (Nov 7 low)

Support 3 : $1.3650 (Nov 3 low)

Currently:

FTSE 5,577.07 +66.25 +1.20%

DAX 6,011.96 +83.28 +1.40%

Shares of Vodafone Group Plc gained 2.3 percent after increasing its full-year earnings forecast as profit beat analysts’ estimates.

USD/JPY Y77.75, Y77.80, Y78.00, Y78.50

AUD/USD $1.0250, $1.0300, $1.0350, $1.0400

USD/CHF Chf0.8940

GBP/USD $1.5950

EUR/JPY Y107.00, Y106.00, Y110.15

- Calls For Creation Of European Budget Office

- Recent EU Decisions Only One Step On Path To Stability

- Mustn't Use Excess Liquidity To Solve Structural Problems

- Central Banks Must Fulfil Mandate Independently

- Euro Zone Needs Effective Fiscal Policy Coordination

- Money Markets Remain Tense, Lack Of Trust Among Banks

- Will Continue Extra Liquidity Measures As Long As Needed

- Some Banks Still Have Too Little Capital

- National Govts Must Push Weak Banks To Recapitalize

- Long-Term Low Rates Can Create New Imbalances

- Inflation Expectations Are Well-Anchored

- New Fiscal Oversight Rules Don't Go Far Enough

- Calls For Creation Of European Budget Office

- Recent EU Decisions Only One Step On Path To Stability

- Mustn't Use Excess Liquidity To Solve Structural Problems

- Central Banks Must Fulfil Mandate Independently

- Euro Zone Needs Effective Fiscal Policy Coordination

- Money Markets Remain Tense, Lack Of Trust Among Banks

- Will Continue Extra Liquidity Measures As Long As Needed

- Some Banks Still Have Too Little Capital

- National Govts Must Push Weak Banks To Recapitalize

- Long-Term Low Rates Can Create New Imbalances

- Inflation Expectations Are Well-Anchored

- New Fiscal Oversight Rules Don't Go Far Enough

Nikkei 225 8,656 -111.58 -1.27%

Hang Seng 19,676 -1.41 -0.01%

S&P/ASX 4,294 +20.43 +0.48%

Shanghai Composite 2,504 -5.96 -0.24%

00:01 United Kingdom RICS House Price Balance October -24%

00:30 Australia Trade Balance September 2.56

00:30 Australia National Australia Bank's Business Confidence October 2

The euro fell for a third day before Italian Prime Minister Silvio Berlusconi faces a budget vote amid pressure to quit and a surge in borrowing costs, stoking concern the region’s debt crisis is spreading.

The dollar and yen advanced as Asian stocks dropped for a second day, increasing demand for haven assets.

The franc reached its lowest level in almost three weeks against the euro on speculation the Swiss National Bank will weaken its currency to support growth.

Australia’s dollar fell for a third day against the yen after data showed the nation’s trade surplus narrowed more than economists forecast, exports exceeded imports by A$2.56 billion ($2.64 billion), from a revised A$2.95 billion surplus in August.

Canada’s dollar rose against all of its 16 most-traded counterparts as crude oil, the nation’s largest export, touched the highest level in three months.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair decreased.

USD/JPY: on Asian session the pair holds in range Y78.05-Y78.20.

European data for Tuesday starts at 0700GMT with the German trade balance for September, which is followed by France foreign trade data at 0745GMT. At 0940GMT, Swiss National Bank SNB Board member Thomas Jordan delivers a speech on government debt and monetary policy. Later, at 1900GMT, ECB Executive Board member Juergen Stark delivers a speech at a conference on "the ESRB at 1", in Berlin. UK data includes Manufacturing Output and Industrial Production for September, at 0930GMT. US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales. US data continues at 1355GMT with the weekly Redbook Average and then at 1500GMT with the IBD/TIPP Economic Optimism Index. At 1800GMT, Minneapolis Fed President Narayana Kocherlakota delivers a speech to the South Dakota Chamber of Commerce Economic Outlook Seminar in Sioux Falls.

The refusal of major economies to offer more aid reflected irritation with Europe’s failure to resolve its crisis and foiled investor hopes that the summit would mark a turning point. The turmoil instead flared again with Berlusconi’s allies pressuring him to step aside as the contagion from the region’s sovereign-debt crisis pushed Italy’s borrowing costs to euro-era records.

Japan’s Nikkei 225 (NKY) Stock Average lost 0.4 percent. Hong Kong’s Hang Seng Index slipped 0.8 percent, while China’s Shanghai Composite Index dropped 0.7 percent. South Korea’s Kospi Index retreated 0.5 percent and Australia’s S&P/ASX 200 fell 0.2 percent. No

Financial stocks were the biggest drags on the Asia-Pacific index. European finance chiefs return to Brussels today on a mission to convince global leaders that they can shield countries such as Italy and Spain from the spreading debt crisis by bulking out their bailout fund. Greek leaders are also meeting today to pick a new prime minister after Papandreou said he won’t lead the new government.

HSBC Holdings Plc, Europe’s biggest lender by market value, slipped 1 percent in Hong Kong on speculation bank earnings will be hurt if Europe fails to contain its sovereign-debt crisis. Standard Chartered Plc, the U.K.’s second-biggest lender by market value, dropped 1.9 percent to HK$174.30. Macquarie Group Ltd., the Australian investment bank that gets 16 percent of revenue from Europe, fell 1.3 percent to A$23.04.

Takeda Pharmaceutical Co. declined 2.3 percent after the Japanese drugmaker slashed its full-year profit outlook. The company cut its full-year net income forecast by 32 percent to 170 billion yen ($2.18 billion) on costs related to the acquisition of Swiss rival Nycomed in September.

Furukawa Electric Co., a Japanese cable maker, dropped 12 percent to 192 yen in Tokyo trading, the most since October 2008, after forecasting a full-year net loss of 5 billion yen.

Cnooc fell 2.2 percent to HK$14.92. The company’s deal to buy BP’s $7.1 billion stake in Pan American Energy collapsed, 10 days after Argentina’s president ordered oil companies to repatriate export revenue.

Among stocks that advanced, Osaka Securities Exchange Co. climbed 7.3 percent to 391,500 yen in Tokyo, the biggest advance since August. The Nikkei newspaper said Tokyo Stock Exchange Group Inc. entered late-stage takeover talks to buy the bourse operator next year, uniting Japan’s largest markets.

Computershare Ltd., an Australian share registrar, surged 16 percent to A$8.44 in Sydney, the most in seven years, after receiving U.S. antitrust clearance for its purchase of Bank of New York Mellon’s shareowner services unit.

European stocks dropped, extending last week’s selloff, as Italian Prime Minister Silvio Berlusconi struggled to hold power before a budget vote and Greece worked on plans to form a new government.

In Italy, Berlusconi’s majority is unraveling before a key parliamentary vote tomorrow on the 2010 budget report as contagion from Europe’s sovereign debt crisis pushed the country’s borrowing costs to euro-era records. The yield on Italy’s 10-year bonds surged to as much as 6.68 percent today. Stocks pared losses as Berlusconi’s former spokesman Giuliano Ferrara said the Italian premier is likely to decide on his political future “within hours,” with his formal resignation coming next week after he secures parliamentary approval of austerity and economic-growth measures. Reports of his resignation were “totally unfounded,” Berlusconi said in an interview with newspaper Libero.

The Stoxx 600 dropped 3.7 percent last week after a failed attempt by Greek Prime Minister George Papandreou to hold a referendum on the latest bailout package spurred concern Greece may default. Papandreou yesterday agreed to step down to allow the creation of a new national unity government intended to secure international financing and avert a collapse of the country’s economy.

National benchmark indexes fell in 10 of the 18 western European markets today. The U.K.’s FTSE 100 slipped 0.3 percent while France’s CAC 40 and Germany’s DAX Index lost 0.6 percent.

European retail sales fell more than forecast in September as the debt crisis prompted households to cut spending. Sales in the 17-nation euro region decreased 0.7 percent from August, the European Union’s statistics office said today. Carrefour SA fell 2.6 percent as euro-region retail sales fell and Citigroup Inc. downgraded the shares. Carrefour SA fell 2.6 percent as euro-region retail sales fell and Citigroup Inc. downgraded the shares., Germany’s largest retailer, lost 2.1 percent, while Hennes & Mauritz AB slid 1.1 percent to 209.30 kronor in Stockholm.

PostNL NV slid 7.4 percent as the biggest Dutch postal operator said third-quarter operating profit fell 22 percent as domestic mail deliveries declined.

National Bank of Greece SA and Piraeus Bank SA advanced more than 4 percent in Athens.

Sandvik AB lost 3.2 percent to 86.55 kronor after the world’s largest maker of metal-cutting tools offered 6.19 billion kronor ($933 million) to buy the remaining shares of its subsidiary Seco Tools AB to expand its new machine solutions business area. Seco rose 27 percent to 103.30 kronor.

Ryanair Holdings Plc added 5.1 percent to 3.52 euros after Europe’s largest discount airline raised its full-year profit forecast by 10 percent to 440 million euros ($606 million) as higher ticket prices offset a slowdown in growth.

Bayer AG advanced 2.5 percent to 46.03 euros after its blood thinner Xarelto won approval in the U.S. to prevent strokes in people with atrial fibrillation, an irregular heartbeat that affects more than 2 million Americans.

U.S. stocks rose, following the first weekly retreat in the Standard & Poor’s 500 Index since September, as the European Central Bank’s Juergen Stark said the region’s debt crisis will be under control in two years. Italian 10-year borrowing costs surged to a euro-era record amid concern the region’s third-largest economy is struggling to manage its debt loads, while growth in Europe is faltering. Investors are betting Prime Minister Silvio Berlusconi may be forced to resign if he fails to win majority support in tomorrow’s vote on the 2010 budget report.

Greek Prime Minister George Papandreou agreed yesterday to step down, paving the way for the creation of a new government to get international aid and avert a default. European finance chiefs meet in Brussels today to work on a plan to raise the region’s bailout fund.

Home Depot Inc. (HD) and Hewlett-Packard Co. (HPQ) gained at least 2.6 percent, for the biggest advances in the Dow Jones Industrial Average.

Amgen Inc., the largest biotechnology company, jumped 5.9 percent after saying it is planning to buy back as much as $5 billion in shares.

First Solar Inc., the world’s largest maker of thin-film solar panels, dropped 3.7 percent as two Chinese solar companies cut forecasts for shipments.

Jefferies Group Inc. added 1.4 percent to $12.24. The New York-based firm cut gross holdings in sovereign securities of Portugal, Italy, Ireland, Greece and Spain by almost 50 percent since last week’s close of trading, to show how easily it can reduce funds at risk.

The euro fell versus the yen and dollar as Italian Prime Minister Silvio Berlusconi faces a budget vote amid pressure to resign, stoking concern the region’s third-largest economy will struggle to manage its debt. Yields on Italy’s 10-year bonds jumped to as high as 6.68 percent, approaching the 7 percent level that drove Greece, Ireland and Portugal to seek bailouts. The rise in Italian yields pushed the spread with the German securities to 491 basis points, also a euro-era record.

The shared currency briefly erased losses versus the greenback as the European Investment Bank told European finance ministers it could boost lending to businesses through banks. Italian government bonds dropped, pushing 10-year note yields to a euro-era high. The euro pared losses earlier after Il Foglio reported Berlusconi may step down and push for early elections. The prime minister later denied the report.

The franc fell after Swiss National Bank President Philipp Hildebrand said the central bank expects the currency to weaken further. Swiss inflation unexpectedly slowed to a negative rate in October, data yesterday showed. Consumer prices decreased 0.1 percent from a year earlier after rising 0.5 percent in September, the Federal Statistics Office in Neuchatel said today. Economists forecast prices to rise 0.2 percent.

Sterling approached its strongest level in a month against the euro as investors sought an alternative investment to the 17-nation currency. The pound gained 0.3 percent to 85.74 pence per euro after rising 2 percent last week, the biggest increase since the five days through Jan. 7. It touched 85.59 cents, after reaching 85.48 on Nov. 1, the strongest since Oct. 4.

EUR/USD: the pair decreased

GBP/USD: the pair has fallen, but restored losses later.

USD/JPY: the pair traded in range Y78.00-Y78.20.

European data for Tuesday starts at 0700GMT with the German trade balance for September, which is followed by France foreign trade data at 0745GMT. At 0940GMT, Swiss National Bank SNB Board member Thomas Jordan delivers a speech on government debt and monetary policy. Later, at 1900GMT, ECB Executive Board member Juergen Stark delivers a speech at a conference on "the ESRB at 1", in Berlin. UK data includes Manufacturing Output and Industrial Production for September, at 0930GMT. US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales. US data continues at 1355GMT with the weekly Redbook Average and then at 1500GMT with the IBD/TIPP Economic Optimism Index. At 1800GMT, Minneapolis Fed President Narayana Kocherlakota delivers a speech to the South Dakota Chamber of Commerce Economic Outlook Seminar in Sioux Falls.

Resistance 3: Y80.20 (Aug 4 high)

Resistance 2: Y79.50 (Oct 31 high)

Resistance 1: Y78.45 (session high)

The current price: Y78.03

Support 1:Y77.90 (Nov 3 low)

Support 2: Y77.55 (50.0% FIBO Y75.55-Y79.55)

Support 3: Y77.10 (61.8% FIBO Y75.55-Y79.55)

Comments: the pair holds in range.

Resistance 3: Chf0.9110 (Oct 12 high)

Resistance 2: Chf0.9080 (Oct 20 high)

Resistance 1: Chf0.9045 (session high)

The current price: Chf0.9037

Support 1: Chf0.9000 (session low)

Support 2: Chf0.8945 (low of the American session on Nov 7)

Support 3: Chf0.8865 (Nov 7 low)

Comments: the pair is on uptrend. In focus resistance Chf0.9045.

Resistance 3: $1.6150/60 (area of Oct 28-31 high)

Resistance 2: $1.6095 (Nov 1 high)

Resistance 1: $1.6065 (session high)

The current price: $1.6040

Support 1 : $1.6005 (low of American session on Nov 7)

Support 2 : $1.5945 (Nov 4 low)

Support 3 : $1.5875 (Nov 3 low)

Comments: the pair is corrected but remains in uptrent. In focus support $1.6005.

Resistance 3: $1.3925 (50.0% FIBO $1.3610-$1.4245)

Resistance 2: $1.3870 (Nov 4 high)

Resistance 1: $1.3810 (MA(233) H1)

The current price: $1.3745

Support 1 : $1.3725 (low of the American session on Nov 7)

Support 2 : $1.3660 (Nov 3 low)

Support 3 : $1.3610 (Nov 1 low)

Comments: the pair is corrected but remains in uptrent. In focus support $1.3725.

Change % Change Last

Nikkei 225 8,767 -34.31 -0.39%

Hang Seng 19,678 -164.90 -0.83%

S&P/ASX 200 4,273 -7.71 -0.18%

Shanghai Composite 2,510 -18.49 -0.73%

FTSE 100 5,511 -16.34 -0.30%

CAC 40 3,104 -19.95 -0.64%

DAX 5,929 -37.48 -0.63%

Dow 12,068.39 +85.15 +0.71%

Nasdaq 2,695.25 +9.10 +0.34%

S&P 500 1,261.12 +7.89 +0.63%

10 Year Yield 1.99% -0.06 --

Oil $95.86 +0.34 +0.36%

Gold $1,796.40 +5.30 +0.30%

00:01 United Kingdom RICS House Price Balance October -23% -23% -24%

00:30 Australia Trade Balance September 3.10 3.04

00:30 Australia National Australia Bank's Business Confidence October -2

06:45 Switzerland SECO Consumer Climate Quarter III -17 -20

07:00 Germany Trade Balance September 13.8 14.4

07:45 France Trade Balance, bln September -5.0 -5.2

08:50 Eurozone ECB’s Juergen Stark Speaks 0

09:00 Eurozone ECOFIN Meetings 0

09:30 United Kingdom Industrial Production (MoM) September +0.2% +0.1%

09:30 United Kingdom Industrial Production (YoY) September -1.0% -0.8%

09:30 United Kingdom Manufacturing Production (MoM) September -0.3% +0.2%

09:30 United Kingdom Manufacturing Production (YoY) September +1.5% +1.9%

13:00 Canada BOC Gov Carney Speaks 0

13:15 Canada Housing Starts October 205.9K 201.0K

13:30 Switzerland SNB Chairman Hildebrand Speaks 0

15:00 United Kingdom NIESR GDP Estimate October +0.5%

18:00 U.S. FOMC Member Narayana Kocherlakota 0

18:30 U.S. FOMC Member Charles Plosser Speaks 0

23:30 Australia Westpac Consumer Confidence November 97.2

23:50 Japan Current Account Total, bln September 407.5 1452.2

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.