- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-10-2011

Swiss exports surprisingly resilient to strong CHF

CHF overvaluation bordering on absurd this summer

Overvalued CHF posed risk of deflation, recession

SNB policy poses some risk for balance sheet

The dollar dropped against all of its major counterparts as equities rallied on better than expected corporate earnings and commodities advanced, sapping demand for a refuge. Raw materials rallied after a report showing China’s manufacturing may expand in October for the first time in four months, snapping the longest contraction since 2009.

The 17-nation euro erased its drop versus the dollar and yen as European politicians attempted to craft an effective response to the region’s sovereign debt crisis. European leaders meeting in Brussels yesterday outlined plans to assist banks, heading toward a revamped strategy to resolve the debt crisis. The 13th summit in 21 months excluded a forced restructuring of Greece’s debt, keeping with the policy of encouraging bondholders to accept “voluntary” losses to help restore the country’s finances. Leaders will meet again Oct. 26.

The yen rose versus the dollar as Japan’s exports increased 2.4 percent in September from a year earlier as demand for cars and auto parts advanced. Japanese Finance Minister Jun Azumi and Chief Cabinet Secretary Osamu Fujimura signaled today Japan is ready to intervene in the currency market to stop a yen appreciation to post-World War II highs that may stunt shipments as overseas demand slows.

European stocks climbed to their highest level in 11 weeks as signs of stronger growth in China and Japan outweighed a selloff in Greek lenders after a meeting of euro-area leaders discussed the region’s debt crisis. Leaders at yesterday’s summit in Brussels ruled out tapping the European Central Bank’s balance sheet to boost the euro area’s rescue fund, the European Financial Stability Facility, and excluded a forced restructuring of Greece’s debt. The politicians looked at strengthening the International Monetary Fund’s role and outlined plans to aid banks. The complete blueprint for the rescue fund won’t come together until a summit in two days. Like yesterday, it will start with all 27 European Union leaders before the 17 heads of the euro-area economies gather on their own.

Stocks rallied in Asia today after a report showed that China’s manufacturing may expand in October for the first time in four months, snapping the longest contraction since 2009. A separate release showed Japan’s exports increased in September more than economists had forecast.

Luxembourg’s Jean-Claude Juncker, who chairs the group of euro-area finance ministers, said talks on the private sector’s involvement in a second aid package for Greece have focused on losses of as much as 60 percent for bondholders. Reuters yesterday reported that lenders have offered to write down 40 percent of their Greek debt. Austrian Chancellor Werner Faymann told Austrian radio ORF he sees a “good chance” to convince Greece’s private creditors to accept a haircut of as much as 50 percent, while Ireland’s Transport Minister Leo Varadkar told Dublin-based RTE radio that discounts of between 40 percent and 60 percent were being discussed.

National benchmark indexes rose in 15 of the 18 western- European markets today. The U.K.’s FTSE 100 Index gained 1.1 percent. Germany’s DAX Index gained 1.4 percent and France’s CAC 40 Index increased 1.6 percent. Greece’s ASE Index dropped 4.5 percent.

Mining companies were the biggest gainers on the Stoxx 600 as copper rallied on the London Metal Exchange. BHP Billiton, the world’s largest mining company, gained 5.2 percent to 1,996 pence, Rio Tinto soared 7.1 percent to 3,373.5 pence and Xstrata Plc rose 6.8 percent to 1,016 pence.

TomTom surged 19 percent to 3.62 euros, its biggest advance since 2009, after Europe’s biggest maker of portable-navigation devices reported third-quarter net income of 28.9 million euros ($40 million). That beat the average analyst estimate.

Greek banks led declining shares as National Bank of Greece, the country’s largest lender, sunk 21 percent to 1.60 euros, its biggest drop since at least 1992. EFG Eurobank Ergasias, the second largest, slumped 20 percent to 63 euro cents, its biggest plunge since at least 1999.

Nobel Biocare Holding AG soared 14 percent to 11.38 Swiss francs, the largest jump since October 2002, after NZZ am Sonntag reported that EQT Partners AB and Bain Capital LLC are considering buying the world’s second-biggest dental- implant maker. The newspaper cited two unidentified sources.

Swatch Group AG climbed 4.8 percent to 373.50 francs, its highest price in a month, after NZZ also reported that the company’s sales this year will “clearly exceed” 7 billion Swiss francs ($7.9 billion), while growth adjusted for currency swings may reach 9 percent to 11 percent in 2012. The newspaper cited Chief Executive Officer Nick Hayek.

Faurecia SA rallied 12 percent to 19.76 euros as Europe’s largest maker of car interiors confirmed its 2011 targets after posting third-quarter sales that rose 16 percent.

U.S. stocks rose, following the longest weekly rally since February in the Standard & Poor’s 500 Index, amid takeover deals, as Caterpillar Inc.’s earnings beat estimates and Europe made progress taming its debt crisis.

European leaders outlined plans to aid banks and ruled out tapping the European Central Bank’s balance sheet to boost the region’s rescue fund. Europe’s 13th crisis-management summit in 21 months also explored how to strengthen the International Monetary Fund’s role. The complete blueprint won’t come together until a summit in two days.

China’s manufacturing may expand in October for the first time in four months, snapping the longest contraction since 2009, after a preliminary index of purchasing managers showed a rebound in new orders and output. The Chinese report, along with Japanese data today showing an increase in exports exceeding economists’ forecasts, signaled that Asia’s largest two economies are withstanding Europe’s sovereign debt crisis.

Dow 11,909.11 +100.32 +0.85%, Nasdaq 2,695.99 +58.53 +2.22%, S&P 500 1,253.22 +14.97 +1.21%

Gauges of technology, raw material and financial shares had the biggest gains in the S&P 500 among 10 groups, rising at least 1.9 percent.

Caterpillar (CAT) rallied 5.2 percent to $91.95. It said full- year profit will be $6.75 a share and sales will be at the top end of a previously forecast range of $56 billion to $58 billion. Revenue in 2012 will rise 10 to 20 percent, it said. Other companies rose after Caterpillar reported earnings. Deere & Co., the world’s largest farm-equipment maker, added 3 percent to $74.40. Joy Global Inc., the maker of P&H and Joy mining equipment, increased 6.4 percent to $87.02.

United Parcel Service Inc., the largest provider of package deliveries and a proxy for the economy, and Texas Instruments Inc., the largest maker of analog chips, are among companies scheduled to report results this week.

RightNow Technologies surged 19 percent to $42.86. Oracle Corp., the world’s second-largest software maker, agreed to buy the company for $1.5 billion, gaining customer-service expertise to bolster a new Internet-based product.

Healthspring Inc. jumped 34 percent to $53.63. Cigna Corp. agreed to buy health maintenance organization Healthspring for $3.8 billion in cash to expand the U.S. insurer’s Medicare business.

Sara Lee Corp. was unchanged at $17.77. J.M. Smucker Co., the maker of jams and Jif peanut butter, agreed to buy a majority of the company’s North American coffee and hot-beverage food-service business for about $400 million.

Alcoa (АА), the largest U.S. aluminum producer, gained 3 percent to $10.54. Freeport-McMoRan Copper & Gold Inc., the world’s largest publicly traded copper miner, advanced 6.9 percent to $39.11.

Gold rose for a second straight session on concern that Europe’s leaders won’t do enough to stem the region’s debt crisis, boosting demand for the metal as a haven investment.

Policy makers ruled out tapping the European Central Bank’s balance sheet to boost the region’s rescue fund and outlined plans to aid banks. Gold also rose on concern that U.S. monetary policy aimed at shoring up growth will spur inflation. Federal Reserve Vice Chairman Janet Yellen said on Oct. 21 that a third round of large-scale securities purchases may become warranted to boost the U.S. economy.

Gold futures for December delivery gained to $1,656.50 an ounce on the Comex in New York. On Oct. 21, the precious metal jumped 1.4 percent.

- See headline inflation trending toward 2% level

Crude oil rose for a second day on speculation that economic growth in China and Japan, the world’s second- and third-largest oil consumers, will boost energy demand.

Oil climbed as much as 1.7 percent after data showed China’s manufacturing may expand in October and Japan’s exports exceeded economists’ forecasts. Prices also gained as U.S. stocks moved higher after Caterpillar Inc. reported earnings that beat analyst estimates.

Crude for December delivery rose $1.29, or 1.5 percent, to $88.69 a barrel on the New York Mercantile Exchange. Prices are down 3 percent so far this year.

Brent oil for December settlement increased 59 cents, or 0.5 percent, to $110.15 a barrel on the London-based ICE Futures Europe exchange.

USD/JPY Y76.30, Y76.50

AUD/USD $1.0435

EUR/GBP stg0.8725

GBP/USD $1.5825, $1.5735

The world's major stock indexes are traded or have already closed the session mixed: Nikkei +1.90%, Hang Seng +4.14%, Shanghai Composite +2.29%, FTSE +0.34%, CAC -0.12%, DAX +0.22%.

Company news:

Shares of Caterpillar Inc. (CAT) climbed 4.8% as demand for shovels and drills used to dig up metals helped earnings beat estimates.

Data:

06:58 France PMI (October) flash 49.0

06:58 France PMI services (October) flash 46.0

07:28 Germany PMI (October) flash 48.9

07:28 Germany PMI services (October) flash 52.1

07:58 EU(17) PMI (October) flash 47.3

07:58 EU(17) PMI services (October) flash 47.2

09:00 EU(17) Industrial orders (August) 1.9%

09:00 EU(17) Industrial orders (August) Y/Y 6.2%

The euro weakened as European leaders struggled to convince investors they can craft an effective response to the region’s debt crisis.

The 17-nation currency fell after a report showed European services and manufacturing output contracted in October at the fastest pace in two years, adding to signs the economy is edging toward a recession.

European leaders meeting in Brussels yesterday outlined plans to assist banks, heading toward a revamped strategy to resolve the debt crisis. The 13th summit in 21 months excluded a forced restructuring of Greece’s debt, keeping with the policy of encouraging bondholders to accept “voluntary” losses to help restore the country’s finances. Leaders will meet again on Oct. 26.

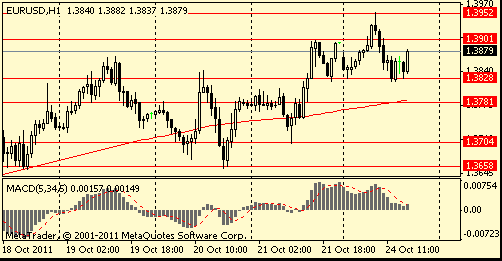

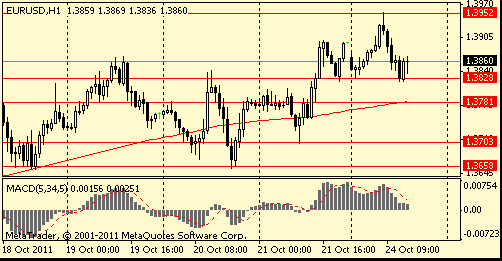

EUR/USD: the pair fell in $1,3860 area.

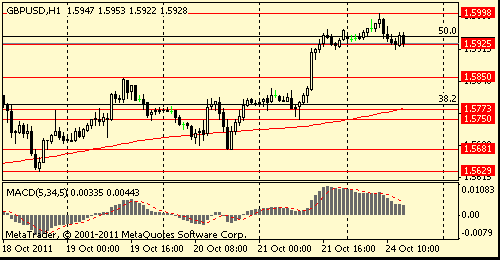

GBP/USD: the pair fell in $1.5920 area.

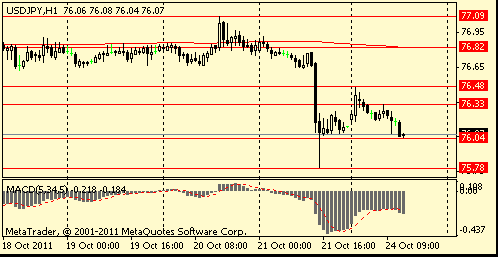

USD/JPY: the pair decreased in Y76,10 area.

EUR/USD:

Offers $1.4010/15, $1.4000, $1.3970, $1.3920, $1.3900/05, $1.3870/75

Bids $1.3820-790, $1.3785/80, $1.3750

- can't exclude restructuring of debt as ultimate resort;

- EFSF must be able to intervene in secondary market ASAP;

- banks must clean up their balance sheets ASAP.

- can't exclude restructuring of debt as ultimate resort;

- EFSF must be able to intervene in secondary market ASAP;

- banks must clean up their balance sheets ASAP.

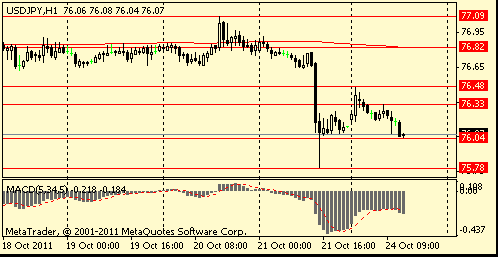

Resistance 3: Y76.80 (МА (200) for Н1)

Resistance 2: Y76.50 (session high)

Resistance 1: Y76.30 (high of european session)

Current price: Y76.05

Support 1:Y76.00 (area of session low)

Support 2:Y75.75 (historical low)

Support 3:Y75.00 (psychological mark)

Resistance 2: $ 1.6100 (61,8 % FIBO $1,6620-$ 1,5270)

Resistance 1: $ 1.6000 (session high)

Current price: $1.5931

Support 1 : $1.5930 (session low)

Support 2 : $1.5850 (earlier resistance, October 14, 17 and 19 highs)

Support 3 : $1.5770 (МА (200) for Н1)

Resistance 2: $ 1.4090 (МА (200) and МА (100) on D1)

Resistance 1: $ 1.3950 (session high)

Current price: $1.3859

Support 1 : $1.3830 (session low)

Support 2 : $1.3780 (МА (200) for Н1)

Support 3 : $1.3700 (Oct 21 low)

EUR/USD $1.3800, $1.3900(lge), $1.3970

USD/JPY Y76.30, Y76.50

AUD/USD $1.0435

EUR/GBP stg0.8725

GBP/USD $1.5825, $1.5735

Nikkei 225 8,844 +165.09 +1.90%

Hang Seng 18,772 +746.10 +4.14%

S&P/ASX 4,255 +113.17 +2.73%

Shanghai Composite 2,370 +53.06 +2.29%

00:30 Australia Producer price index, q / q Quarter III +0.6%

00:30 Australia Producer price index, y/y Quarter III +2.7%

02:30 China HSBC Manufacturing PMI October 51.1

The dollar and the yen fell as stocks rallied after Europe’s leaders inched toward a revamped strategy to contain the region’s debt crisis, sapping demand for the safest assets. The euro reached a six-week high against the dollar after French Finance Minister Francois Baroin said he’s “convinced” policy makers will reach a deal by Wednesday. For all the concern that European officials led by German Chancellor Angela Merkel and French President Nicolas Sarkozy may not be able to fix the region’s sovereign debt crisis, the $4 trillion-a-day currency market is signaling that the worst may be over for the euro. Leaders meeting yesterday outlined plans to aid banks and ruled out tapping the European Central Bank’s balance sheet to boost its rescue fund.

The yen jumped to a post-World War II high last week on speculation the Federal Reserve may seek further monetary easing while Japan’s government will struggle to stem its currency’s gains.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair advanced.

USD/JPY: on Asian session the pair fell.

On Monday European data includes the flash readings of manufacturing and services PMI data with France at 0558GMT, Germany at 0628GMT and the main EMU numbers at 0658GMT. European data then rounds off with the 0900GMT release of EMU industrial new orders. at 1300GMT, Dallas Fed President Richard Fisher delivers a speech on challenges to economic growth to the Toronto Forum for Global Cities in Toronto.

On Monday the euro weakened after German Chancellor Angela Merkel’s spokesman said Europe’s leaders won’t provide the quick resolution to the region’s debt crisis that global policy makers are pushing for at a summit this weekend. The pound declined versus the dollar and the yen on concern the Bank of England’s additional stimulus measures won’t be enough to revive growth.

On Tuesday the Australian dollar rose against the U.S. currency as a rally in stocks and commodities spurred demand for higher-yielding assets. The yen erased its gain versus the dollar after the Nikkei newspaper reported that the government and central bank will form a team of senior officials to oversee steps designed to address the currency’s strength.

On Wednesday main news related to the emerging information on the decisions of the European leaders of the agreement to extend the fund EFSF. The euro rose on speculations of reaching agreement between France and Germany on the expansion ESFS to 2 trillion euros. Sterling rose for the first time in three days, advancing to $1.5845 on speculation a resolution to Europe’s debt crisis will help boost Britain’s economy. Bank of England policy makers voted unanimously to expand the size of their asset-purchase stimulus this month, according to minutes of their Oct. 6 meeting released.

On Thursday the euro fell versus the dollar on speculation the Oct. 23 meeting may be delayed or a second session may be held. The Swiss franc rose against all of its major counterparts on demand for a refuge as European leaders struggled to agree on a solution to the region’s debt crisis before a summit this weekend. The dollar rose versus the yen after the Federal Reserve Bank of Philadelphia’s general economic index increased to 8.7 in October from minus 17.5 last month in the biggest one-month rebound in 31 years. Japan plans to spend an extra 4 trillion yen ($52 billion) to cope with a surging yen that could damp an export-led recovery in the world’s third-largest economy. The yen’s appreciation of almost 6 percent this year versus the dollar has prompted the government to adopt a multipronged approach to currency policy.

On Friday the dollar fell to a post-World War II low against the yen and dropped versus most currencies on speculation Europe is moving closer to resolving its debt crisis and the Federal Reserve may seek further monetary easing. Investors sold dollars before meetings in Europe this weekend after increasing bets last week to the most in more than a year that the U.S. currency would rally. The euro advanced for a fourth day against the dollar, in the longest stretch of gains since July, before two European summits over the next five days. The euro rose against the dollar today as German officials said there are several possible ways of involving the International Monetary Fund to boost the firepower of the European Financial Stability Facility, the region’s rescue fund, to fight the euro-region debt crisis.

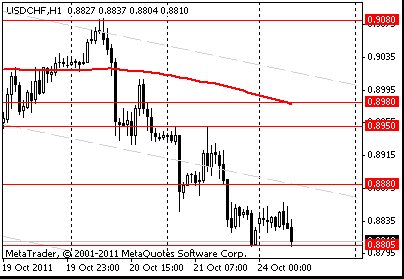

Resistance 3: Chf0.8980 (MA (233) H1)

Resistance 2: Chf0.8950 (Oct 21 high)

Resistance 1: Chf0.8880 (middle line from Oct 7)

The current price: Chf0.8810

Support 1: Chf0.8805 (Oct 21 low)

Support 2: Chf0.8745 (support line from Oct 7)

Support 3: Chf0.8700 (Sep 20 low)

Comments: the pair is on downtrend. In focus support Chf0.8805.

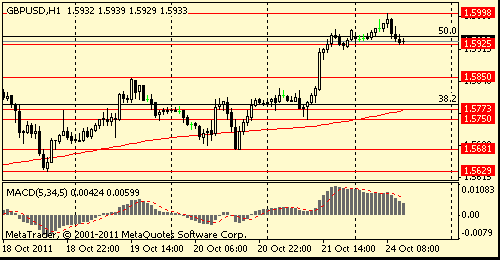

Resistance 3: $ 1.6100 (61.8 % FIBO $1.5270-$ 1.6615)

Resistance 2: $ 1.6050 (261.8 % FIBO $1.5680-$ 1.5820)

Resistance 1: $ 1.5985 (session high)

The current price: $1.5959

Support 1 : $1.5925 (session low)

Support 2 : $1.5870 (38.2 % FIBO $1.5985-$ 1.5680)

Support 3 : $1.5830 (50.0 % FIBO $1.5985-$ 1.5680)

Comments: the pair is on uptrend. In focus resistance $1.5985.

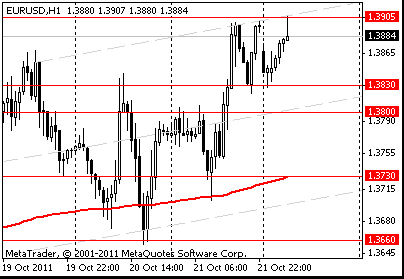

Resistance 3: $ 1.4000 (61.8 % FIBO $1.3140-$ 1.4550)

Resistance 2: $ 1.3935 (Sep 15 high)

Resistance 1: $ 1.3905 (session high)

The current price: $1.3884

Support 1 : $1.3830 (session low)

Support 2 : $1.3800 (middle line from Oct 19)

Support 3 : $1.3730 (MA (233) H1)

Comments: the pair is on uptrend. In focus resistance $1.3905.

00:30 Australia Producer price index, q / q Quarter III +0.8% +0.8% +0.6%

00:30 Australia Producer price index, y/y Quarter III +3.4% +2.9% +2.7%

02:30 China HSBC Manufacturing PMI October 49.9 51.1

07:00 France Manufacturing PMI October 48.2 48.1

07:00 France Services PMI October 51.5 50.6

07:28 Germany Purchasing Manager Index Manufacturing October 50.3 50.0

07:28 Germany Purchasing Manager Index Services October 49.7 49.8

07:58 Eurozone Purchasing Manager Index Manufacturing October 48.5 48.1

07:58 Eurozone Purchasing Manager Index Services October 48.8 48.6

09:00 Eurozone Industrial New Orders s.a., m/m August 2.1% +0.1%

09:00 Eurozone Industrial New Orders, y/y August +8.4% +5.8%

13:00 U.S. FOMC Member Richard Fisher Speaks

21:45 New Zealand CPI, q/q Quarter III +1.0% +0.%

21:45 New Zealand CPI, y/y Quarter III +5.3% +4.9%

22:00 Eurozone ECB Trichet's Speech

23:00 Australia Conference Board Australia Leading Index August -0.1%

23:00 Australia RBA Deputy Gov Battellino Speaks© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.