- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-10-2011

The dollar fell to a post-World War II low against the yen and dropped versus most currencies on speculation Europe is moving closer to resolving its debt crisis and the Federal Reserve may seek further monetary easing. Investors sold dollars before meetings in Europe this weekend after increasing bets last week to the most in more than a year that the U.S. currency would rally. Fed Chairman Ben S. Bernanke told a congressional committee on Oct. 4 that policy makers stand ready to take additional steps to bolster the “sluggish” economic recovery.

The euro advanced for a fourth day against the dollar, in the longest stretch of gains since July, before two European summits over the next five days. The euro rose against the dollar today as German officials said there are several possible ways of involving the International Monetary Fund to boost the firepower of the European Financial Stability Facility, the region’s rescue fund, to fight the euro-region debt crisis.

Australia’s dollar rallied as stocks and commodities increased, boosting demand for riskier assets.

Canada’s dollar rose for a second straight day, advancing 0.6 percent to C$1.0097 versus the greenback as the nation’s annual inflation rate unexpectedly rose last month. The consumer price index increased 3.2 percent in September from a year earlier, Statistics Canada said. The median forecast of economists was for another 3.1 percent rise.

The yen’s surge today came after it set a record on Aug. 19, which followed a 4.51 trillion-yen ($59 billion) intervention earlier in the month by Japan. The nation has intervened in the foreign-exchange markets three times in the past 13 months to weaken the yen. The currency is up 6.6 percent against the dollar in 2011.

The pound strengthened to a six-week high against the dollar after a government report showed the nation’s budget deficit narrowed in September more than economists forecast.

- it appears that the Committee is now more tolerant of the risk of higher-than-2-percent inflation than it was in 2010 and is putting more weight on short-term outcomes than before

- Financial system calls for bold reform, more regulation

- Euro zone is fundamentally solid

- the Federal Reserve is exhausting the limits of prudent monetary policy

- Congress must act responsibly on fiscal side

- US "need not remain" in low-gear growth of H1

- Sees 'slow but steady' improvement in econ in '12 and worries about inflation ahead

European stocks advanced, with the Stoxx Europe 600 Index completing its longest stretch of weekly gains this year, as policy makers discussed deploying $1.3 trillion in funds to help contain the euro area’s debt crisis. The benchmark measure extended gains after Fitch Ratings said it has no plans to change France’s AAA sovereign credit rating. U.S. stocks erased losses in late afternoon trading yesterday and the euro rose after two people familiar with the matter said the euro area may combine its temporary and permanent rescue funds to pool as much as 940 billion euros ($1.3 trillion). That option may be one way out of the impasse between the euro region’s two biggest economies. Finance ministers are meeting in Brussels today to lay the groundwork for the Oct. 23 meeting of government leaders. A second summit for Oct. 26 was set yesterday after Germany and France said the European Union needs more time to seal a “global and ambitious” accord. In Greece, Prime Minister George Papandreou won a parliamentary vote on further austerity measures designed to secure more aid under the 2010 bailout.

National benchmark indexes rallied in every western- European market, except Luxembourg. The U.K.’s FTSE 100 Index climbed 1.9 percent, France’s CAC 40 Index increased 2.8 percent and Germany’s DAX Index jumped 3.6 percent.

Banks and mining companies rebounded from their biggest selloffs in more than two weeks. UniCredit SpA surged 6.6 percent to 90.2 euro cents, Banco Santander SA rose 2.9 percent to 6.03 euros and Societe Generale SA gained 5.6 percent to 18.97 euros as a gauge of Europe’s lenders rebounded from yesterday’s 4 percent selloff which was the biggest decline since Oct. 4.

Kazakhmys Plc added 3.1 percent to 856.5 pence, Rio Tinto Group climbed 4.5 percent to 3,151 pence and Antofagasta Plc increased 5.5 percent to 1,096 pence as copper rose for the first time in five days in London. Zinc and lead also climbed. A gauge of commodity companies tumbled 3.6 percent yesterday, its steepest retreat since Oct. 4.

Valeo advanced 6.6 percent to 35.85 euros after France’s second-largest auto-parts maker confirmed its 2011 guidance and reported a 14 percent increase in third-quarter revenue to 2.66 billion euros. Chief Executive Officer Jacques Aschenbroich said the company forecasts continued growth in 2012.

Lundin surged 9.8 percent to 156.20 kronor after Statoil doubled its estimate for a North Sea discovery. The Aldous Major South find may hold 900 million to 1.5 billion barrels of recoverable oil equivalent, twice as much as Statoil’s previous estimate. Combined with Lundin’s neighboring Avaldsnes, the field holds as much as 3.3 billion barrels of recoverable resources.

Neste Oil Oyj rallied 5.7 percent to 7.83 euros after Credit Suisse Group AG raised its recommendation for the Finnish oil refiner to “outperform” from “neutral.”

Thomas Cook Group Plc, Europe’s second-largest tour operator, soared 13 percent to 51.5 pence after the company’s banks relaxed loan conditions and agreed to provide additional short-term funds.

Scania AB gained 5 percent to 107.60 kronor after the Swedish truckmaker reported a 2 percent increase in third- quarter profit to 2.34 billion kronor ($356 million), beating analysts’ estimates. Sales rose 14 percent.

Safran SA plunged 8 percent to 22.20 euros, for the biggest drop in the Stoxx 600, after demand for spare parts came in at the bottom end of its forecast for the full year of 10 percent to 15 percent. The maker of jet engines today reported a 5.2 percent gain in third-quarter sales to 2.73 billion euros.

Ericsson AB lost 2 percent to 66.75 kronor after Evolution Group Plc lowered its recommendation for the world’s largest maker of wireless networks to “neutral” and Svenska Handelsbanken AG said Ericsson’s shares lack “meaningful upside.”

U.S. stocks advanced, sending the Standard & Poor’s 500 Index toward the highest level since August, on speculation European leaders are moving closer to an agreement to contain its sovereign debt crisis.

European finance ministers meet in Brussels today to lay the groundwork for an Oct. 23 gathering of government leaders that had been the deadline for a solution to the debt crisis. A further summit was scheduled for Oct. 26 yesterday after Germany and France said the European Union needs more time to seal a “global and ambitious” accord. In the U.S., Federal Reserve Governor Daniel Tarullo said the central bank should consider resuming purchases of mortgage bonds to boost growth.

Dow 11,755.82 +214.04 +1.85%, Nasdaq 2,633.99 +35.37 +1.36%, S&P 500 1,235.09 +19.70 +1.62%

American banks rallied following gains in European lenders. Bank of America (ВАС) added 1.4 percent to $6.56. Morgan Stanley rose 2.1 percent to $16.97.

Investors also monitored third-quarter earnings reports. McDonald’s added 2.7 percent to $91.38. Chief Executive Officer Jim Skinner has sought to draw American diners with low- priced menu items, such as the $1 McDouble burger, as the nation’s 9.1 percent unemployment rate saps consumer confidence. Sales in the U.S. were driven by fruit smoothies, Chicken McNuggets and breakfast foods, the company said.

Honeywell climbed 5.1 percent to $50.93 as the company also increased its full-year forecast. Honeywell and other U.S. manufacturers have posted earnings growth this year amid a slowing economy by keeping costs in check and expanding abroad. Aerospace sales rose 8 percent in the quarter, the company said.

Seagate Technology Plc surged 22 percent to $14.74. The world’s largest maker of computer disk drives reported first- quarter earnings excluding some item of 34 cents a share, beating the average analyst estimate by 8.3 percent, Bloomberg data show. The company had its rating raised at ThinkEquity Partners and Robert W. Baird & Co.

Energy and raw material producers gained as the S&P GSCI Index of commodities advanced 1.6 percent. Alcoa Inc. (AA), the largest U.S. aluminum producer, rose 2 percent to $10.15. ConocoPhillips added 2.2 percent to $71.78.

General Electric Co. (GE) dropped 1.4 percent to $16.40 as tighter profit margins in industrial businesses from energy to aviation overshadowed third-quarter growth led by the finance unit.

Gold rose the most in more than a week as a drop in the dollar and renewed optimism that Europe will act to tame the debt crisis boosted investor demand.

The greenback slumped as much as 0.9 percent against a basket of six major currencies, declining for the fourth straight day. European leaders meet this weekend in Brussels as they seek to contain the region’s fiscal crisis. Before today, gold dropped 12 percent since the end of August as escalating debt woes threatened global growth and commodity demand.

Gold futures for December delivery gained to $1,649.80 an ounce on the Comex in New York. A close at that level would be the biggest advance since Oct. 10. Before today, the metal was down 4.2 percent this week, heading for the first weekly drop in three.

Bullion slipped to $1,604.70 yesterday, the lowest since Oct. 5.

Crude oil rose for the first time in three day on hopes that European leaders will reach a deal to contain the region’s debt crisis. Futures gained as much as 3.3 percent as European finance ministers meet in Brussels today to lay the groundwork for an Oct. 23 gathering of government leaders for a solution to the debt crisis. Oil also rose after McDonald’s Corp. and Honeywell International Inc. reported profits that beat analyst estimates.

Crude for December delivery rose to $88.89 a barrel on the New York Mercantile Exchange. Prices are up 10 percent from a year earlier.

Brent oil for December settlement gained $1.74, or 1.6 percent, to $111.50 a barrel on the London-based ICE Futures Europe exchange. The North Sea crude’s premium to the U.S. benchmark narrowed to $22.90 amid speculation that Muammar Qaddafi’s death will increase Libyan output. The spread reached a record of $27.88 on Oct. 14.

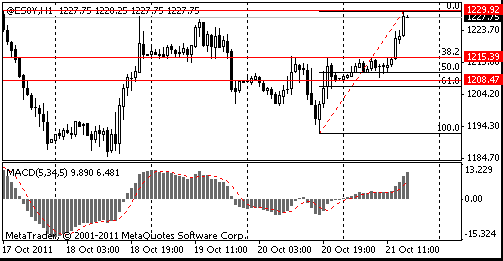

S&P futures showed grown on 1,5% and reached area of strong resistance $1226,90/00 (area of maxima of October). Above growth is possible to $1240/50 (area of lows of March and June).

The immediate support - $1215,40 area (38,2% FIBO $1192,20-$ 1229,90, Oct 20 high).

Currently the future at $1227.75.

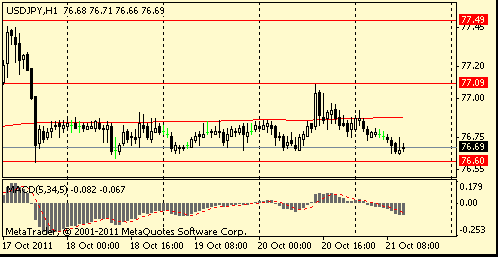

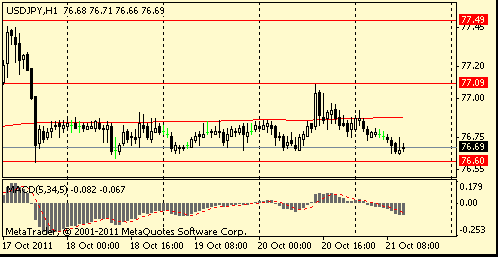

USD/JPY Y76.00, Y76.50, Y76.65, Y77.10, Y77.25, Y77.65, Y78.00

AUD/JPY Y78.00

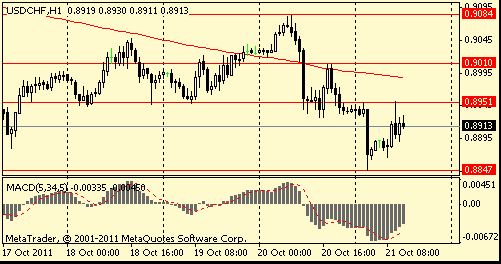

EUR/CHF Chf1.2200, Chf1.2205, Chf1.2300, Chf1.2325USD/CHF Chf0.8985, Chf0.8950

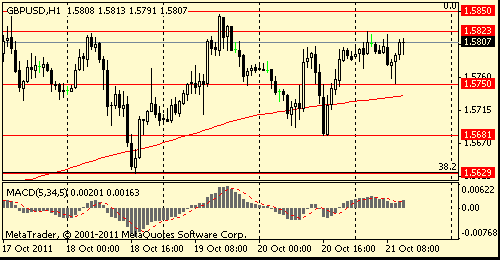

GBP/USD $1.5695, $1.5820, $1.5850

U.S. stock futures advanced as euro- area leaders intensified negotiations to boost the region’s rescue funds before meeting in Brussels this weekend to discuss how to end the debt crisis.

France and Germany yesterday pledged to forge another definitive eurozone rescue scheme not by an EU summit on Sunday - as originally planned - but by Wednesday.

Company news:

GE and Microsoft profits meet expectations. GE (GE) has reported profit that was in line with forecasts and revenue that exceeded predictions, although while Q3 EPS rose to $0.31 from $0.29, revenue dipped slightly to $35.4B. The conglomerate ended the quarter with a record-high order backlog of $191B and predicted double-digit operating EPS growth for next year.

08:00 Germany IFO business climate index (October) 106.4

08:30 UK PSNCR (September), bln 19.9

08:30 UK PSNBX (September), bln 14.1

The pound strengthened against the dollar after a government report showed the nation’s budget deficit narrowed in September more than economists forecast.

The dollar fell versus major counterparts as stocks rose amid optimism European policy makers are moving closer to agreement on a plan to help contain the region’s debt crisis.

European governments may unleash as much as 940 billion euros ($1.3 trillion) to fight the debt crisis, seeking to break a deadlock between Germany and France that is forcing leaders to hold two summits within four days, people familiar with the discussions said.

EUR/USD: the pair grown in $1,3800 area.

GBP/USD: the pair grown in $1.5900 area.

USD/JPY: the pair holds Y76,65-Y76,90.

Currently the pair tests support at C$1,0130 (Oct 20 low). Below losses may extend to С$1,0080 (Oct 19 low).

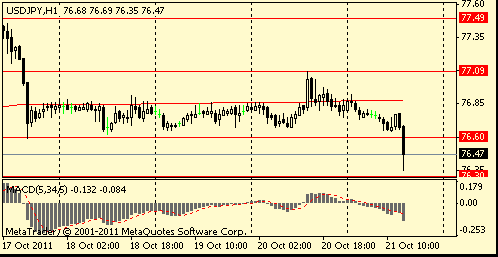

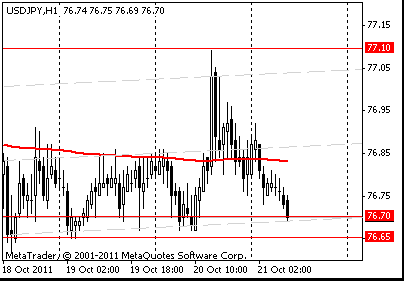

Resistance 3: Y77.90 (Sep 9 high)

Resistance 2: Y77.50 (Oct 12 high)

Resistance 1: Y76.90 (Oct 20 high)

Current price: Y76.69

Support 1:Y76.60 (area of Oct 17-2 lows and session low)

Support 2:Y76.30 (Oct 12 low)

Support 3:Y76.10 (area of low of September)

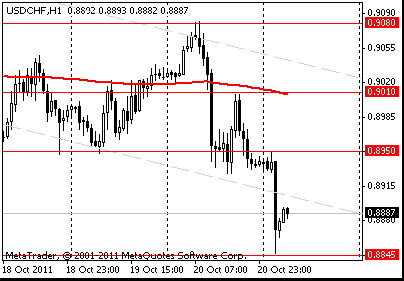

Resistance 2: Chf0.9000/10 (area of high of american session on Oct 20)

Resistance 1: Chf0.8950 (session high)

Current price: Chf0.8913

Support 1: Chf0.8850 (session low)

Support 2: Chf0.8800 (psychological mark, area of Sep 19-20 lows)

Support 3: Chf0.8700 (38.2% FIBO Chf0,7700-Chf0,9310)

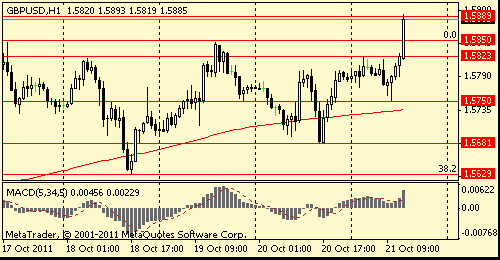

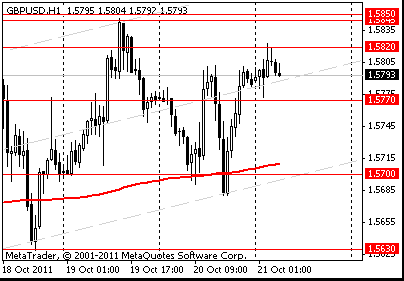

Resistance 2: $ 1.5850 (Oct 14-17 highs)

Resistance 1: $ 1.5820 (session high)

Current price: $1.5807

Support 1 : $1.5750 (session low)

Support 2 : $1.5680 (Oct 20 low)

Support 3 : $1.5630 (Oct 18 low, 38,2 % FIBO $1.5270-$ 1.5850)

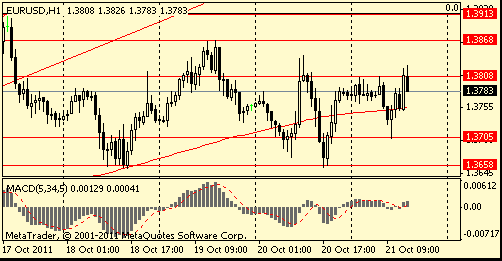

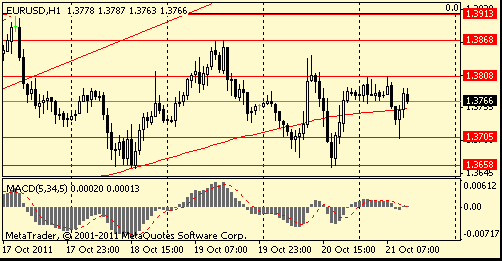

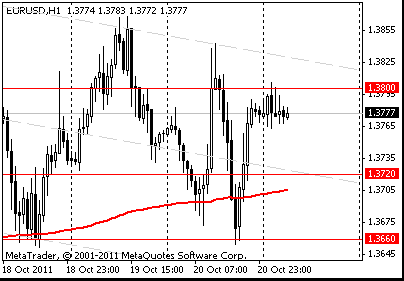

Resistance 2: $ 1.3870 (Oct 19 high)

Resistance 1: $ 1.3810 (session high)

Current price: $1.3766

Support 1 : $1.3700 (area of session low)

Support 2 : $1.3660 (Oct 18 and 20 lows)

Support 3 : $1.3620 (38,2 % FIBO $1,3150-$ 1,3910)

Currently FTSE 5,425 +40.38 +0.75%, CAC 3,113 +29.24 +0.95%, DAX 5,802 +35.34 +0.61%.

European stocks advanced as policy makers discussed unleashing $1.3 trillion in funds to help contain the euro area’s debt crisis as they seek to break a deadlock between Germany and France.

USD/JPY Y76.00, Y76.50, Y76.65, Y77.10, Y77.25, Y77.65, Y78.00

AUD/JPY Y78.00

EUR/CHF Chf1.2200, Chf1.2205, Chf1.2300, Chf1.2325USD/CHF Chf0.8985, Chf0.8950

GBP/USD $1.5695, $1.5820, $1.5850

Hang Seng 18,053 +69.82 +0.39%

S&P/ASX 4,142 -3.04 -0.07%

Shanghai Composite 2,317 -14.09 -0.60%

Asian stocks declined for a third- straight week, with the regional benchmark index within a percent of erasing October’s gains, amid concern about China’s property sector and evidence that Europe’s debt crisis is infecting major economies.

Stocks declined this week as Fitch Ratings said the creditworthiness of U.S. banks will deteriorate if Europe’s debt crisis spreads beyond the Europe’s five most-troubled nations. In the U.S., Republicans and Democrats on a congressional committee are struggling to find a compromise before a Nov. 23 deadline to produce a U.S. deficit-cutting plan.

The sovereign-debt crisis has stirred political turmoil across Europe, with Italy and Greece replacing their leaders this month. Spain may speed up the timetable for forming a new government after the election on Nov. 20 so the first Cabinet meeting can be held on Dec. 23, ABC reported, citing officials in the People’s Party it didn’t name.

Hong Kong’s Hang Seng Index declined 3.4 percent this week, while China’s Shanghai Composite Index fell 2.6 percent. Japan’s Nikkei 225 (NKY) Stock Average fell 1.6 percent. Australia’s S&P/ASX 200 dropped 2.8 percent.

HSBC, Europe’s largest bank, fell 4 percent to HK$59.25 in Hong Kong. Commonwealth Bank, Australia’s No. 1 lender, retreated 3.8 percent to A$47.73 in Sydney and was the biggest drag on a measure of financial companies in the Asia-Pacific index. Standard Chartered Plc, a London-based bank that makes most of its revenue in emerging markets, declined 7.5 percent to HK$159.40.

Exporters to Europe also dropped after the Bank of England said on Nov. 16 Britain’s economy faces a “markedly weaker” outlook and Spain cut its economic forecast.

Esprit Holdings Ltd., the clothier that counts Europe as its biggest market, tumbled 8.5 percent to HK$9.10 in Hong Kong. Canon Inc., the camera maker that gets about 32 percent of sales from Europe, dropped 2.5 percent to 3,350 yen in Tokyo. Mazda Motor Corp., the Japanese carmaker most dependent on Europe, declined 2.8 percent to 137 yen.

Chinese property developers and lenders fell as a government report showed home prices fell in 33 of 70 cities monitored by the government in October. The China Banking Regulatory Commission told lenders last week to step up debt restructuring for struggling local government financing vehicles and cut “high-risk” loans to developers, a person with knowledge of the matter said.

China Overseas Land sank 6.9 percent to HK$12.38. China Resources Land Ltd., a state-owned developer, slumped 5.3 percent to HK$10.70. Industrial & Commercial Bank of China Ltd., the nation’s biggest lender, dropped 8.3 percent to HK$4.44.

Gauges of raw material and energy producers led declines among the 10 industry groups in the MSCI Asia Pacific as copper futures decreased for a second week and a six-week rally in crude oil fizzled out.

BHP Billiton fell 4.4 percent to A$36.13 in Sydney. Rio Tinto Group, the world’s second-biggest mining company by sales, slid 3.4 percent to A$67.05. Cnooc Ltd., China’s largest offshore oil producer, dropped 3.8 percent to HK$14.82 in Hong Kong.

European stocks declined for a second day as a spat between Germany and France over the role of the region’s central bank in ending the debt crisis outweighed better-than-forecast U.S. economic data. German Chancellor Angela Merkel yesterday rejected French calls to deploy the ECB as a crisis backstop, defying global leaders and investors calling for more urgent action to halt the turmoil. Merkel listed using the ECB as lender of last resort alongside joint euro-area bonds and a “snappy debt cut” as proposals that won’t work.

Europe is running out of options to fix its debt crisis and it is now up to Italy and Greece to convince markets they can deliver the necessary austerity measures, Finnish Prime Minister Jyrki Katainen said. Greek Prime Minister Lucas Papademos won approval for the final 2012 budget designed to regain the confidence of creditors and secure resumption of international financing. The budget forecasts Greece’s debt as a proportion of gross domestic product will fall to 145.5 percent in 2012 from 161.7 percent this year.

In Italy, Prime Minister Mario Monti won a final parliamentary confidence vote, granting full power to his new government after pledging to attack the euro-region’s second- biggest debt and spur growth.

National benchmark indexes fell in 15 of the 18 western- European markets today, with Italy, Portugal and Spain the only gainers. U.K.’s FTSE 100 Index slid 1.1 percent, while France’s CAC 40 Index fell 0.4 percent. Germany’s DAX Index lost 0.9 percent.

Kemira Oyj, the Finnish maker of water-treatment chemicals, sank 14 percent after cutting its forecasts. Annual revenue will probably reach the same level as last year and operating profit excluding one-time items will be at or slightly below the level in 2010, the Helsinki- based company said.

Chemring Group Plc, the U.K. maker of missile-avoidance gear, slumped the most in 14 years as profit missed estimates. The company said full-year revenue was 745 million pounds ($1.18 billion), 5 percent less than management expectations, leaving operating profit below analyst estimates.

ARM Holdings Plc fell 3.9 percent to 498 pence. The maker of processor chips for Apple Inc.’s iPhone expects slower growth in research spending in 2012, the Wall Street Journal reported, citing an interview with President Tudor Brown.

SGL Carbon rose 1.2 percent to 43.68 euros after BMW, the world’s largest maker of luxury cars, bought a 15 percent stake in the maker of carbon products. BMW said it’s “satisfied” with its current holding, though can’t rule out additional share purchases in the future.

Deutsche Boerse AG, the operator of the Frankfurt exchange, added 2.8 percent to 42.52 euros. Deutsche Boerse and NYSE Euronext offered to sell overlapping single-equity derivatives businesses and give access to clearing services to soothe European regulators’ concerns over their proposed merger.

Holcim Ltd., the world’s second-biggest cement maker, jumped 2.2 percent to 51.30 francs after Paul Roger, an analyst at Exane BNP Paribas SA, raised the stock to “outperform” from “underperform.”

U.S. stocks fell, with the Standard & Poor’s 500 Index completing its biggest weekly drop in two months, as a decline in technology and energy companies overshadowed optimism that the economy is accelerating. Stocks swung between gains and losses as investors watched developments in Europe. The Conference Board’s index of U.S. leading indicators rose more than forecast, signaling the largest economy will keep growing in 2012. The U.S. economy may end 2011 expanding at its fastest pace in 18 months as analysts increase their forecasts for the fourth quarter.

Technology and energy shares had the biggest declines in the S&P 500 among 10 industries, falling at least 0.4 percent. Chevron decreased 2.2 percent to $97.88. Halliburton lost 2.9 percent to $35.96.

Chevron Corp. (CVX) and Halliburton Co. slumped at least 2.2 percent as oil fell for a second day.

Salesforce.com Inc., the largest maker of online customer-management software, lost 10 percent as billings missed some estimates. Billings rose 29 percent in the fiscal third quarter from a year earlier, said Pat Walravens, an analyst at JMP Securities LLC, who has an “outperform” rating on the shares. That missed his 33 percent growth estimate. The figure is seen as a benchmark of momentum at the company, whose shares had climbed more than 10 percent in the past six weeks before today.

Clearwire Corp. plunged 21 percent to $1.47 after the Wall Street Journal reported the unprofitable wholesale wireless carrier is evaluating whether to make a Dec. 1 debt payment, citing its chief executive officer. Susan Johnston, a Clearwire spokeswoman, declined to comment on the interest payment or the Wall Street Journal’s story.

H.J. Heinz Co. fell 3.3 percent to $51.07. The biggest ketchup maker affirmed its forecast for current fiscal year earnings of no more than $3.32 a share. Analysts on average estimated $3.34 a share, according to a Bloomberg survey.

Hewlett-Packard Co. (HPQ) rallied 2.6 percent after adding Relational Investors LLC’s Ralph Whitworth to its board.

Boeing Co. (BA) advanced 2.1 percent after winning a provisional order for 230 planes from Lion Air. The order from Indonesian budget carrier Lion Air would be worth $21.7 billion at list prices, making it a record transaction for Boeing.

The euro weakened versus the dollar as concern the impasse will prevent an agreement at the meetings. The franc climbed to a two-week high against the 17-nation euro. German Chancellor Angela Merkel and French President Nicolas Sarkozy agreed to ask euro-region leaders to assess a “comprehensive and ambitious” package of measures to solve the region’s debt crisis at a leaders’ summit on Oct. 23 in order to agree on the measures at a second meeting by Oct. 26 at the latest.

The yen and the dollar headed for weekly advance against most major counterparts as European stocks headed for a loss this week, boosting demand for the safest assets.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair declined.

USD/JPY: on Asian session the pair fell.

On Friday european data begin at 0800GMT with the German IFO business survey where the business climate index is expected to decline to 106.2 with the current assessment at 116.5 and expectations index at 97.0.US data is limited to the 1400GMT release of the BLS State Unemployment data. At 1700GMT, Minneapolis Fed President Narayana Kocherlakota delivers a speech to the Harvard Club of Minnesota in Minneapolis. Shortly after, at 1720GMT, Dallas Fed President Richard Fisher delivers a speech on the economy to The Friday Group in Dallas.

The Swiss franc rose against all of its major counterparts on demand for a refuge as European leaders struggled to agree on a solution to the region’s debt crisis before a summit this weekend.

The dollar rose versus the yen after the Federal Reserve Bank of Philadelphia’s general economic index increased to 8.7 in October from minus 17.5 last month in the biggest one-month rebound in 31 years.

Japan plans to spend an extra 4 trillion yen ($52 billion) to cope with a surging yen that could damp an export-led recovery in the world’s third-largest economy. The yen’s appreciation of almost 6 percent this year versus the dollar has prompted the government to adopt a multipronged approach to currency policy. While threatening intervention, Japanese authorities have offered aid to companies hit by the yen’s gain and highlighted the lower cost of making overseas acquisitions. Japan imports about 80 percent of its energy needs. The Bank of Japan has intervened in the currency market three times in the past 13 months.

EUR/USD: yesterday the pair rose.

GBP/USD: yesterday the pair advanced.

USD/JPY: yesterday the pair rose.

On Friday european data begin at 0800GMT with the German IFO business survey where the business climate index is expected to decline to 106.2 with the current assessment at 116.5 and expectations index at 97.0.US data is limited to the 1400GMT release of the BLS State Unemployment data. At 1700GMT, Minneapolis Fed President Narayana Kocherlakota delivers a speech to the Harvard Club of Minnesota in Minneapolis. Shortly after, at 1720GMT, Dallas Fed President Richard Fisher delivers a speech on the economy to The Friday Group in Dallas.

Asian stocks slid, with the benchmark regional index headed to its lowest close in more than a week, amid uncertainty about European bailout-fund talks and as U.S. companies grew more Europe’s leaders have pledged to use a meeting this weekend to develop a plan to tackle the crisis. Luxembourg Prime Minister Jean-Claude Juncker, who chairs the group of euro-area finance ministers, indicated an Oct. 19 meeting of European leaders in Frankfurt failed to resolve differences ahead of a summit scheduled for this weekend. French Finance Minister Francois Baroin said the region’s bailout fund could be improved with help from the European Central Bank, a position opposed by the ECB and Germany. The Fed’s Beige Book survey showed companies reported more doubt about the recovery even as the economy maintained its expansion last month.

Australia’s S&P/ASX 200 slid 1.6 percent after a report from National Australia Bank Ltd. showed the nation’s third- quarter business confidence fell to a three-year low. Japan’s Nikkei 225 Stock Average retreated 1 percent. Hong Kong’s Hang Seng Index lost 1.8 percent as Chinese companies fell amid slower economic growth and signs that tighter monetary policy will persist while inflation remains high.

Builder Supalai Pcl sank 4.2 percent to 11.30 baht, while L.P.N. Development Public Co. retreated 1 percent to 9.80 baht as KGI Securities (Thailand) Pcl cut Thai residential property to “underweight” from “overweight” to reflect the impact of the global economic slowdown and prolonged flooding.

Sharp slid 2.1 percent to 667 yen in Tokyo, while Nintendo Co., the maker of Wii game consoles which gets about 41 percent of its revenue from Europe, sank 1.8 percent to 11,800 yen in Osaka. Esprit slumped 7.8 percent to HK$10.48 in Hong Kong.

BHP slid 2.5 percent to A$35.48 in Sydney. Jiangxi Copper Co., China’s No. 1 producer of the metal, fell 3.7 percent to HK$15 in Hong Kong. Korea Zinc Co., a producer of precious metals, plunged 10 percent to 279,000 won in Seoul.

Newcrest Mining sank 6.4 percent to A$33.45 in Sydney. The Melbourne-based company said its gold output for the three months ended September fell to 587,296 ounces from 674,219 ounces a year earlier.

Nanya Technology Corp., a Taiwanese memory-chip maker, tumbled 6.8 percent to NT$3.58 after its third-quarter net loss widened to NT$12 billion ($398 million) from NT$2.27 billion a year earlier.

Chinese shares slumped after Liu Mingkang, chairman of the China Banking Regulatory Commission, said risks stemming from private lending must be “strictly controlled,” and such loans will be curbed. Agricultural Bank of China Ltd., the nation’s third-biggest lender by market value, sank 1.4 percent to HK$2.84 in Hong Kong, while China Citic Bank Corp. slumped 2.1 percent to 4.25 yuan in Shanghai.

Among stocks that rose, Huabao International Holdings Ltd., a supplier of flavors for tobacco and food, climbed 8.2 percent to HK$4.73 in Hong Kong. The company said controlling stockholder Chu Lam Yiu entered into a derivative transaction related to a long position equivalent to 94.7 million company shares.

In Japan, Tokyo Electric Power Co., the utility at the center of the worst nuclear disaster in 25 years, surged 36 percent to 292 yen. The shares have fallen 86 percent since the March 11 earthquake and tsunami caused meltdowns at the utility’s Fukushima Dai-Ichi nuclear plant.

European stocks declined the most in two weeks amid concern the euro area’s leaders are far from agreeing on a plan to end the region’s debt crisis. Euro-area leaders are scheduled to meet on Oct. 23, with disagreement over the European Central Bank’s role threatening to hinder progress on the banking and economic questions needed to deliver the comprehensive strategy demanded by global policy makers. The German government hasn’t excluded postponing the summit because of stalling negotiations on boosting the firepower of the region’s rescue fund, Die Welt said, citing unidentified people close to the country’s governing coalition.

French President Nicolas Sarkozy flew to Frankfurt for an impromptu meeting last night with German Chancellor Angela Merkel, ECB President Jean-Claude Trichet and International Monetary Fund Director Christine Lagarde. Luxembourg Prime Minister Jean-Claude Juncker, who chairs the group of euro-area finance ministers, indicated the gathering failed to resolve differences. “We are still meeting,” he said as he departed.

National benchmark indexes fell in 16 of the 18 western European markets. The U.K.’s FTSE 100 dropped 1.2 percent, France’s CAC 40 retreated 2.3 percent and Germany’s DAX slipped 2.5 percent.

Banks led losses as the cost of insuring against default on European corporate debt climbed and the yield on Italian 10-year government bonds rose to more than 6 percent for the first time since August. Intesa Sanpaolo, Italy’s second-biggest bank, dropped 9.8 percent to 1.20 euros and UniCredit, the nation’s largest lender, tumbled 12 percent to 84.6 euro cents. France’s Societe Generale SA lost 7.6 percent to 17.97 euros in Paris.

Actelion plunged 9.7 percent to 30.70 Swiss francs, the biggest slump since March 2010, after it said product sales will fall in the low- to mid-single digit range next year in local currencies. The company cited increased pricing pressure and competition in the U.S.

Schneider Electric tumbled 7.6 percent to 41.22 euros. The company trimmed its 2011 profit target for the second time in four months on rising labor costs in emerging economies and said it may cut jobs. Earnings before interest, taxes and amortization will probably account for about 14 percent of revenue this year, down from a July forecast of about 15 percent, it said.

Nokia Oyj rallied 5.5 percent to 4.73 euros after the Finnish maker of mobile phones reported a smaller-than-estimated loss and forecast a profitable quarter for the handset business.

Ericsson AV, the world’s largest maker of wireless network equipment, rose 4 percent to 68.10 kronor after saying third- quarter net income climbed to 3.82 billion kronor ($580 million) from 3.68 billion kronor a year earlier. That topped the 3.66 billion-krona estimate of 21 analysts in a Bloomberg survey.

Home Retail Group Plc climbed 3.9 percent to 103.4 pence after a report showed U.K. retail sales unexpectedly rose 0.6 percent in September, the most in five months. Debenhams Plc, which reported better-than-estimated earnings today, advanced 7.7 percent to 67.6 pence.

Husqvarna AB gained 6.7 percent to 32.02 kronor, the biggest increase since July 2010. The world’s largest maker of powered gardening tools has solved U.S. production problems that have sapped profits this year, acting Chief Executive Officer Hans Linnarson said.

U.S. stocks rose, erasing earlier losses, after European governments considered deploying $1.3 trillion in funds to tame the sovereign debt crisis as France and Germany asked officials to agree on plans by Oct. 26. Stocks rebounded as two people familiar with the matter said Europe may combine the temporary and permanent rescue funds to unleash as much as 940 billion euros to fight the crisis. German Chancellor Angela Merkel and French President Nicolas Sarkozy said in a joint statement they want euro-region leaders to agree on a “comprehensive and ambitious” plan by Oct. 26 at the latest. In the U.S., manufacturing in the Philadelphia area unexpectedly expanded in October at the fastest pace in six months, signaling factories are helping support a U.S. economy weighed down by weakness in the housing and labor markets.

Dow 11,541.78 +37.16 +0.32%, Nasdaq 2,598.62 -5.42 -0.21%, S&P 500 1,215.39 +5.51 +0.46%

Among component of Dow Jones Industrial Average two-thirds of companies have improved their results. Bank JPMorgan Chase & Co.(JPM) and aluminum giant Alcoa, Inc. (AA) substantial increased.

The world's largest maker of microprocessors Intel (INTL), said yesterday increasing by 3.6% after positive reporting, today demonstrated a maximum drop among the Dow components (-2.6%).

All industry sectors of the S& P 500 showed gains, led by conglomerates sector (+1.5%). Majority financial companies ended in the plus. Bank of America Corp. (BAC) has increased its market capitalization by 1.1%, while the other three largest U.S. banks, Wells Fargo, JPMorgan and Citigroup added more than 2.3%.

Philip Morris International Inc. added 3.6 percent to $68.38. The world’s largest publicly traded tobacco company reported third-quarter profit that topped analysts’ estimates, helped by higher shipments and increased cigarette prices in Asia.

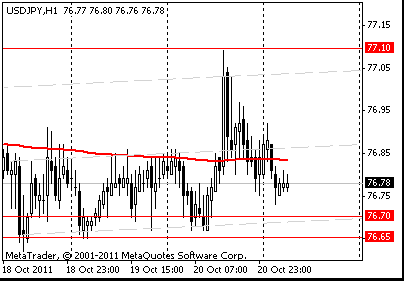

Resistance 2: Y77.45 (Oct 14 high)

Resistance 1: Y77.10 (Oct 20 high)

The current price: Y76.78

Support 1:Y76.65/70 (area of Oct 18-20 low)

Support 2: Y76.30 (Oct 12 low)

Support 3: Y76.10 (Sep 21-22 low)

Comments: the pair advanced.

Resistance 2: Chf0.9010 (MA (233) H1)

Resistance 1: Chf0.8950 (session high)

The current price: Chf0.8887

Support 1: Chf0.8845 (session low)

Support 2: Chf0.8770 (support line from Oct 7)

Support 3: Chf0.8700 (Sep 20 low)

Comments: the pair is on downtrend. In focus support Chf0.8845.

Resistance 2: $ 1.5845/50 (area of Oct 14-19 high)

Resistance 1: $ 1.5820 (session high)

The current price: $1.5793

Support 1 : $1.5770 (session low)

Support 2 : $1.5700 (support line from Oct 18)

Support 3 : $1.5630 (Oct 18 low)

Comments: the pair advanced. In focus resistance $1.5845/50.

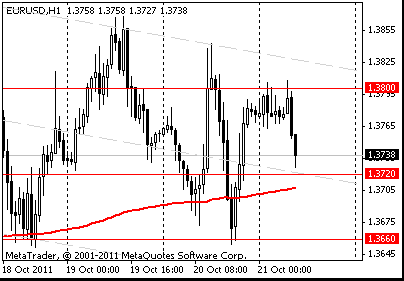

Resistance 2: $ 1.3900/10 (area of Oct 14-17 high)

Resistance 1: $ 1.3800 (session high)

The current price: $1.3777

Support 1 : $1.3720 (middle line from Oct 17)

Support 2 : $1.3660 (area of Oct 18-20 low)

Support 3 : $1.3580 (Oct 12 low)

Comments: the pair is on downtrend. In focus support $1.3720.

Nikkei 225 8,682 -90.39 -1.03%

Hang Seng 17,983 -326.12 -1.78%

S&P/ASX 200 4,145 -68.78 -1.63%

Shanghai Composite 2,331 -46.15 -1.94%

FTSE 100 5,385 -65.81 -1.21%

CAC 40 3,084 -73.27 -2.32%

DAX 5,766 -147.05 -2.49%

Dow 11,541.78 +37.16 +0.32%

Nasdaq 2,598.62 -5.42 -0.21%

S&P 500 1,215.39 +5.51 +0.46%

10 Year Yield 2.18% +0.02 --

Oil $85.98 +0.68 +0.80%

Gold $1,623.20 +10.30 +0.64%

06:00 Japan BOJ Governor Shirakawa Speaks

07:40 Eurozone ECB Trichet's Speech

08:00 Germany IFO - Business Climate October 107.5106.3

08:00 Germany IFO - Current Assessment October 117.9 116.5

08:00 Germany IFO - Expectations October 98.0 97.0

08:30 United Kingdom PSNCR, bln September 11.8

08:30 United Kingdom PSNB, bln September 15.9 15.0

11:00 Canada Bank of Canada Consumer Price Index Core, y/y September +1.9% +1.9%

11:00 Canada Consumer Price Index m / m September +0.3% +0.1%

11:00 Canada Consumer price index, y/y September +3.1% +3.0%

11:00 Canada Bank of Canada Consumer Price Index Core, m/m September +0.4% +0.2%

17:00 U.S. FOMC Member Narayana Kocherlakota

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.