- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-10-2011

According to preliminary estimates, American Express Co. (AXP) learnings for the quarter grew by 6.7% compared to the previous quarter and 158.4% for the year.

Today’s main news related to the emerging information on the decisions of the European leaders of the agreement to extend the fund EFSF. The euro rose on speculations of reaching agreement between France and Germany on the expansion ESFS to 2 trillion euros. Then the Financial Times Deutschland published a statement by the Minister of Finance of Germany Schäuble that ESFS size can be increased to a maximum of one trillion euros, and Chancellor Merkel said today that there is “no magic wand” to solve the region’s fiscal crisis. Euro down when lawmakers rejected direct guarantees to fund EFSF.

Sterling rose for the first time in three days, advancing 0.6 percent to $1.5805 on speculation a resolution to Europe’s debt crisis will help boost Britain’s economy. Bank of England policy makers voted unanimously to expand the size of their asset-purchase stimulus this month, according to minutes of their Oct. 6 meeting released today. Strains related to Europe’s debt crisis created a “compelling” case to add to the program, according to the minutes.

- Although many Districts described the pace of growth as 'modest' or 'slight' and contacts generally noted weaker or less certain

- outlooks for business conditions.

- Cost pressures down and wages 'subdued.'

- Fin activity weaker, loan dmd down.

- Competitn for qualified borrowers cutting rates, fees.

European stocks advanced for the first time in three days amid conflicting reports that France and Germany have reached a deal on expanding the euro area’s rescue fund. German Chancellor Angela Merkel said yesterday that the euro-area summit on Oct. 23 will mark an “important step,” though not the final one, in solving the debt crisis. The comments marked the second time in two days that she sought to lower expectations. The Guardian newspaper reported that Germany and France have agreed to boost the region’s rescue fund, known as the European Financial Stability Facility, to 2 trillion euros ($2.8 trillion) from 440 billion euros. In contrast, the Financial Times Deutschland said German Finance Minister Wolfgang Schaeuble told lawmakers in Berlin that the EFSF’s firepower may be increased to a maximum of 1 trillion euros.

National benchmark indexes climbed in 11 of the 18 western European markets. The U.K.’s FTSE 100 Index gained 0.7 percent, France’s CAC 40 Index increased 0.5 percent and Germany’s DAX Index advanced 0.6 percent.

A gauge of bank shares rebounded from a four-day decline as the cost of insuring against default on European corporate debt retreated. France’s Natixis rallied 2.8 percent to 2.25 euros, while Commerzbank, Germany’s second-largest lender, rose 4.7 percent to 1.63 euros.

Software AG surged 12 percent to 30.45 euros, its biggest gain since 2009. Germany’s second-largest maker of business software confirmed its full-year sales target after third- quarter operating profit rose to 71 million euros.

BSkyB gained 5.1 percent to 710 pence after the U.K.’s biggest pay-TV broadcaster reported a 16 percent increase in first-quarter operating profit to 295 million pounds ($466 million) as the company sold more products to its existing subscribers. That beat the average analyst estimate of 286.5 million pounds.

Diageo Plc jumped 4 percent to 1,331 pence after the world’s largest distiller reported first-quarter sales that topped analyst forecasts, boosted by growth in Latin America, Asia and Africa.

Аccor SA advanced 2.5 percent to 22.62 euros after Europe’s largest hotel company reported a 2.7 percent gain in third- quarter sales to 1.62 billion euros, matching estimates, as more guests stayed at its economy hotels.

Hochtief rallied 3.7 percent to 52.98 euros after Goldman Sachs raised its recommendation for the company to “conviction buy” from “neutral.”

Alcatel-Lucent SA sank 7.7 percent to 1.96 euros as Oddo Securities and Jefferies Group Inc. lowered their recommendations for the French phone-equipment maker to “neutral” and “underperform,” respectively.

Home Retail Group Plc sank 17 percent to 99.5 pence after the owner of U.K. Homebase outlets said first-half profit fell 70 percent as Britons spent less at its Argos catalog unit.

BOE not given up on inflation target. Syas fall in pound has taken time to work thru import costs.

U.S. stocks were little changed, a day after the Standard & Poor’s 500 Index rallied to the highest level since August, as a decline in Apple Inc. shares offset better-than-estimated housing data. U.S. stock futures pared losses before the start of regular trading as a Commerce Department report showed that builders began work on more U.S. homes than forecast in September on rising demand for apartments and condominiums as more Americans become renters. The cost of living in the U.S. rose in September at the slowest pace in three months, signaling inflation may moderate as Federal Reserve officials have predicted.

German Chancellor Angela Merkel is in “intense” talks with all partners on a debt-crisis solution for a European Union summit on Oct. 23, deputy government spokesman Georg Streiter said. German Finance Minister Wolfgang Schaeuble hasn’t specified how much additional firepower the European bailout fund may have, ministry spokesman Martin Kotthaus told reporters today in Berlin.

Dow 11,610.50 +33.45 +0.29%, Nasdaq 2,643.44 -13.99 -0.53%, S&P 500 1,225.16 -0.22 -0.02%

Apple, the world’s largest technology company, slumped 3.9 percent after profit missed estimates for the first time in at least six years.

Citigroup Inc. rose 2.6 percent as it agreed to pay $285 million in a Securities and Exchange Commission settlement.

Morgan Stanley, owner of the world’s largest brokerage, gained 1.7 percent as earnings beat forecasts.

If euro fails, Europe will fail. All won't let that happen.

Gold may fall for a third day in New York as reports that France and Germany are nearing an accord to boost the size of Europe’s rescue fund curbs demand for the metal as a protection of wealth.

Gold for December delivery fell to $1,644.30 an ounce on the Comex in New York. Immediate-delivery gold was 0.5 percent lower at $1,649.60 in London.

Earlier dollar-Swiss buying by Swiss banks apparently drying up, along with the earlier weak talk of another possible ramp up in the Euro-Swiss target band, talk that had circulated ahead of the US session. Light support expected around Chf1.2400 area but stops noted below.

Crude oil futures gained after the U.S. Energy Department reported an unexpected decline in inventories.

Supplies dropped 4.73 million barrels to 332.9 million last week, the Energy Department said today. Inventories were forecast to gain 2 million barrels, according to the median of 13 analyst estimates in a Bloomberg News survey.

Crude oil for November delivery rose to $89.5 on the New York Mercantile Exchange, topped a prior session high of $89.38.

Futures also rose after builders began work on more U.S. homes than forecast in September on rising demand for apartments and condominiums as more Americans become renters.

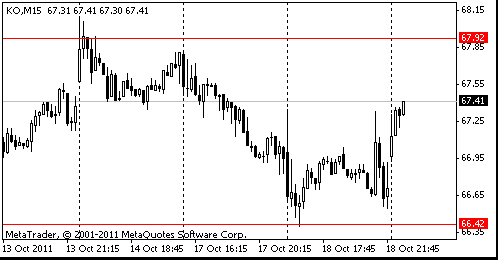

Gabelli tags shares of Coca-Cola (KO) with a Buy rating, pointing to an extra boost the company might see in Europe when the Olympics and Euro soccer championship are hosted in 2012. Shares of KO +1.08%

The pair slips back to $1.3800 area as recent reports downplaying the scale of a eurozone rescue deal undercut the pair.

Bids seen at $1.3780/85 area (low of european session). Below losses may extend to $1.3720 (session low).

USD/JPY Y76.00, Y77.20, Y77.50

AUD/USD $1.0150, $1.0155, $1.0200, $1.0335

EUR/JPY Y107.00

USD/CHF Chf0.8985, Chf0.9100

EUR/GBP stg0.8700

Builders began work on 658,000 houses at an annual rate, up 15 percent from August and the most since April 2010, Commerce Department figures showed today in Washington. The median forecast was for for a 590K.

The S&P rose yesterday after the Guardian newspaper reported that Germany and France have agreed to boost the region’s rescue fund, the European Financial Stability Facility, to 2 trillion euros ($2.8 trillion) from 440 billion euros. German Finance Minister Wolfgang Schaeuble hasn’t specified how much additional firepower the European bailout fund may have, ministry spokesman Martin Kotthaus told reporters today in Berlin.

Company news:

The Apple uggernaut continued unabated in FQ4 as net profit jumped 54% to $6.62B, or $7.05 a share, and revenue climbed 39% to $28.3B. However, shares tumbled 5.1% post-market as the results missed analyst forecasts for the first time in years.

Intel (INTC) EPS rose 17% to $0.65 a share and revenue surged 28% to a record $14.2B. Intel also gave Q4 guidance and boosted a stock buyback program by $10B. Shares rose 3.9% premarket.

08:00 EU(17) Current account (August) unadjusted, bln -6.3

08:00 EU(17) Current account (August) adjusted, bln -5.0

08:30 UK BoE meeting minutes (05-06.10)

The euro strengthened as reports that France and Germany are nearing a deal to boost the size of Europe’s rescue fund to counter the debt crisis spurred demand for the region’s assets.

The shared currency rose versus major peers after the Guardian newspaper reported the two nations have agreed to increase the 440-billion euro ($609 billion) European Financial Stability Facility to 2 trillion euros before a summit this weekend.

The dollar, yen and Swiss franc fell as stocks advanced.

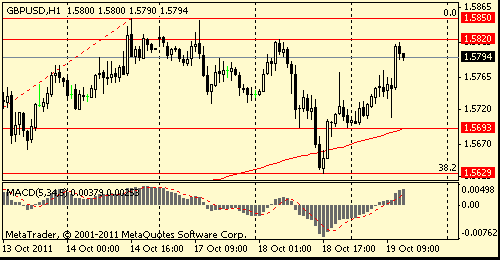

The pound strengthened amid European optimism even as the Bank of England said the case for additional monetary stimulus was “compelling.”

The pound snapped a two-day declined versus the dollar amid speculation a resolution to Europe’s debt crisis will help boost the U.K economy.

Bank of England policy makers voted unanimously to expand the size of their asset-purchase program this month, according to minutes of their Oct. 6 meeting released today.

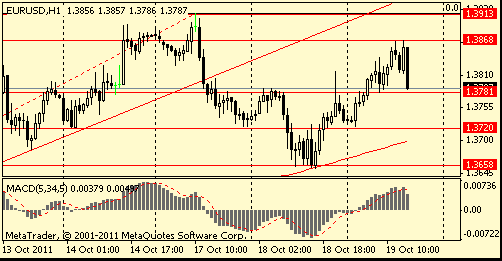

EUR/USD: the pair showed high in $1,3870 area then receded.

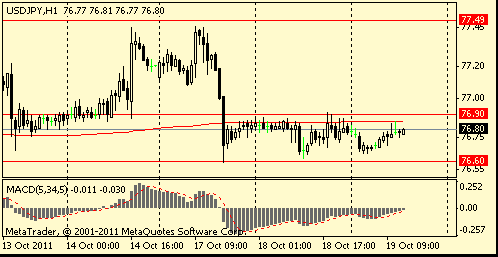

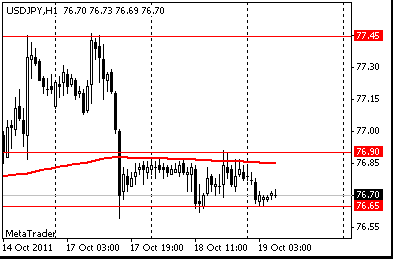

Resistance 3: Y77.90 (Sep 9 high)

Resistance 2: Y77.50 (Oct 12 high)

Resistance 1: Y76.90 (Oct 18 high)

Current price: Y76.80

Support 1:Y76.60 (area of Oct 17-18 lows and session low)

Support 2:Y76.30 (Oct 12 low)

Support 3:Y76.10 (area of low of September)

Resistance 2: Chf0.9045 (area of Oct 13 and 18 highs, 38,2 % FIBO Chf0,9310-Chf0,8880)

Resistance 1: Chf0.9025/45 (area of session high and МА (200) for Н1)

Current price: Chf0.8980

Support 1: Chf0.8940 (session low, Oct 18 low)

Support 2: Chf0.8880 (Oct 17 low)

Support 3: Chf0.8800 (psychological mark, area of Sep 19-20 low)

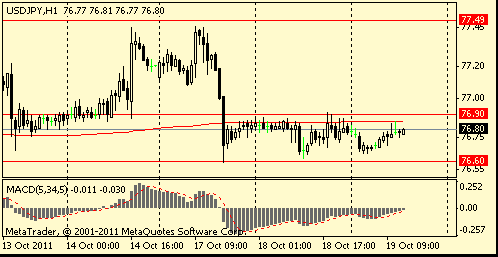

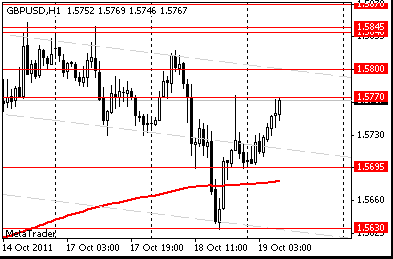

Resistance 2: $ 1.5850 (Oct 14-17 highs)

Resistance 1: $ 1.5820 (session high, Oct 18 high)

Current price: $1.5794

Support 1 : $1.5690 (session low)

Support 2 : $1.5630 (Oct 18 low, 38,2 % FIBO $1.5270-$ 1.5850)

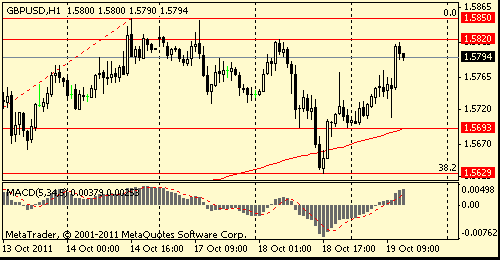

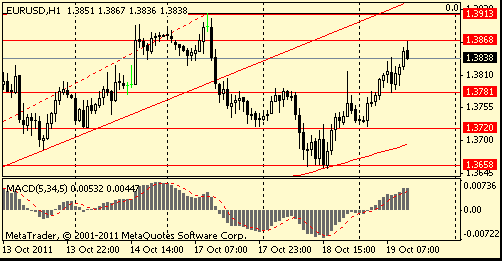

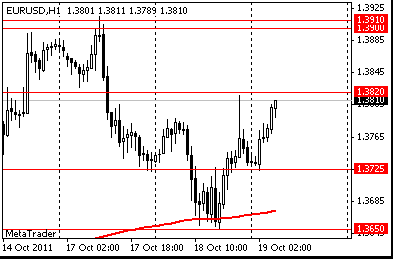

Resistance 2: $ 1.3910/30 (Oct 17 and Sep 15 highs)

Resistance 1: $ 1.3870 (session high)

Current price: $1.3838

Support 1 : $1.3780 (low of european session)

Support 2 : $1.3720 (session low)

Support 3 : $1.3660 (Oct 18 low)

- QE slightly less accurate than interest rates;

- Bank underestimated inflation path in 2009.

- QE slightly less accurate than interest rates;

- Bank underestimated inflation path in 2009.

Currently FTSE 5,475 +64.78 +1.20%, CAC 3,177 +36.07 +1.15%, DAX 5,966 +88.23 +1.50%.

European stocks rose amid conflicting reports that France and Germany have reached a deal on expanding the region’s rescue fund.

USD/JPY Y76.00, Y77.20, Y77.50

AUD/USD $1.0150, $1.0155, $1.0200, $1.0335

EUR/JPY Y107.00

USD/CHF Chf0.8985, Chf0.9100

EUR/GBP stg0.8700

- Considered Asset Purchases Between stg50bn to stg100bn

- Size of QE Can Be Adjusted in Light of Euro Zone Events

- Downside Risks Point to Larger QE Than Otherwise

- Differences in QE Size Outweighed by Inflation Uncertainty

Hang Seng 18,306 +229.04 +1.27%

S&P/ASX 4,214 +26.82 +0.64%

Shanghai Composite 2,378 -5.97 -0.25%

On Asia session the euro rose against most of its major counterparts before European Union leaders hold a summit on Oct. 23 to deal with the region’s debt crisis. The common currency extended a gain from yesterday, which came as the Guardian newspaper reported that Germany and France support quadrupling the size of Europe’s rescue fund. The dollar and the yen fell against most of their peers as Asian stocks advanced.

The Australian and New Zealand dollars gained against their U.S. counterpart as Asian stocks extended a rally in global equities, boosting demand for riskier assets.

EUR/USD: on Asian session the pair restored, after falling yesterday.

GBP/USD: on Asian session the pair gain.

USD/JPY: on Asian session the pair hold in range Y76.65/80.

On Wednesday at 1230GMT, the pace of housing starts is expected to rise to a still weak 588,000 annual rate in September after falling to 571,000 in August. Soft new home sales continue to keep a lid on resurgence in home building. At the same time, US consumer prices are expected to rise 0.3% in September, with food and energy prices forecast to post further gains. Core CPI is expected to rise 0.2%.

Yesterday the euro erased its drop as Germany’s Chancellor Angela Merkel said the Oct. 23 summit of European leaders will send a signal to defend the currency.

The Australian dollar rose against the U.S. currency as a rally in stocks and commodities spurred demand for higher-yielding assets.

The yen erased its gain versus the dollar after the Nikkei newspaper reported that the government and central bank will form a team of senior officials to oversee steps designed to address the currency’s strength.

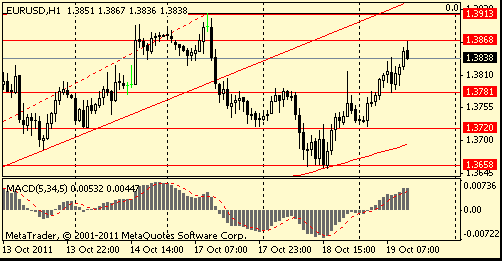

EUR/USD: yesterday the pair fell, but restored later.

GBP/USD: yesterday the pair decreased.

USD/JPY: yesterday the pair holds in range Y76.65-Y76.90.

On Wednesday at 1230GMT, the pace of housing starts is expected to rise to a still weak 588,000 annual rate in September after falling to 571,000 in August. Soft new home sales continue to keep a lid on resurgence in home building. At the same time, US consumer prices are expected to rise 0.3% in September, with food and energy prices forecast to post further gains. Core CPI is expected to rise 0.2%.

Asian stocks fell, driving the regional benchmark index toward its biggest drop in two weeks, as China said its economy grew at the slowest pace in two years, feeding global growth concerns after Germany damped expectations of a fast resolution to Europe’s debt crisis. The Asia-Pacific measure deepened declines today after a report showed China’s economy grew 9.1 percent in the third quarter from a year earlier, the slowest pace since 2009, as the central bank tightened monetary policy and export demand weakened. Policy makers have raised interest rates five times over the past year, curbed lending and imposed limits on home purchases to rein in property and consumer prices.

Financial stocks were the biggest drag on the Asia-Pacific gauge today after U.S. banks Citigroup Inc. and Wells Fargo & Co. said quarterly revenue dropped. Mitsubishi UFJ declined 1.8 percent to 335 yen in Tokyo, while, in Sydney, National Australia Bank Ltd. slid 2.1 percent to A$24.23. HSBC Holdings Plc, Europe’s biggest lender, lost 3.2 percent to HK$62.85 in Hong Kong.

Aluminum Corp. dropped 11 percent to HK$3.72, while China Coal Energy Co. slumped 6.2 percent to HK$8.05. China Merchants Holdings (International) Co., which operates container terminals, lost 7.5 percent to HK$21.70 and Industrial & Commercial Bank of China Ltd., the world’s largest lender by market value, dropped 6.1 percent to HK$4.04.

BHP Billiton Ltd., the world’s No. 1 mining company, slipped 3.3 percent to A$36.40 in Sydney. Rio Tinto, which makes more than 40 percent of revenue from China and Europe, slid 5.3 percent to A$66.25. Korea Zinc Co., which also produces gold and silver, fell 3.6 percent to 311,500 won. Mitsubishi Corp., a Japanese commodities trading company, retreated 2.5 percent to 1,574 yen in Tokyo.

Esprit Holdings Ltd., a Hong Kong-listed clothing retailer that gets 83 percent of its revenue from Europe, plunged 6.4 percent to HK$11.72 in Hong Kong. Sony Corp., which gets about 70 percent of its revenue overseas, dropped 1.2 percent to 1,588 yen in Tokyo. Nissan Motor Co., a carmaker that gets about 80 percent of its sales from overseas, fell 1.7 percent to 716 yen.

European stocks fell as concern that France may lose its top credit rating added pressure on the region’s leaders to find a solution to the debt crisis and as China’s economy grew at the slowest pace in two years. While Group of 20 finance ministers and central bankers are pressing European Union leaders to set out a strategy by the end of the week, divisions are flaring over an emerging plan to avoid a Greek default, bolster banks and curb contagion.

National benchmark indexes retreated in 7 of the 18 western European markets. The U.K.’s FTSE 100 dropped 0.4 percent and France’s CAC 40 fell 0.7 percent, while Germany’s DAX advanced 0.5 percent.

BHP Billiton, the world’s biggest mining company, lost 1 percent to 1,891.5 pence, while Rio Tinto, the second-largest, sank 4.2 percent to 3,162 pence. Copper slumped for a second day in London amid concern demand from China may slow as the economy cools. Lead, tin and zinc also fell.

Xstrata Plc retreated 1.3 percent to 936.3 pence even after the largest exporter of power-station coal said total third- quarter production of the fuel rose 8.1 percent. Copper output fell 4 percent, the company said.

BNP Paribas, France’s biggest bank, declined 4.4 percent to 29.69 euros. Societe Generale sank 5.2 percent to 19.19 euros.

France’s Aaa credit rating is under pressure from deterioration in debt metrics and the potential for additional liabilities from Europe’s debt crisis, according to Moody’s. The nation’s financial strength has weakened because of the global economic crisis, making the nation’s debt measures the weakest among its Aaa-rated peers, the New York-based company said in a statement late yesterday that it called a markets update.

Air France-KLM Group slid 2.6 percent to 5.46 euros after the airline ousted Pierre-Henri Gourgeon as chief executive officer amid slumping earnings and questions regarding the role of pilots in a fatal crash.

Aixtron SE, a supplier to the semiconductor industry, sank 5.3 percent to 9.99 euros. The company’s third-quarter results are likely to be “disastrous,” CA Cheuvreux analyst Klaus Ringel wrote in a report.

Danone, the owner of the Evian and Volvic bottled-water brands, rose 2.4 percent to 46.48 euros as three people familiar with the matter said the company is in talks to sell water assets to Japan’s Suntory Holdings Ltd. Danone also reported third-quarter revenue that beat estimates as it sold more baby food and medical nutrition products in China and Indonesia.

Continental AG added 4.4 percent to 53.08 euros, paring yesterday’s declines. The world’s fourth-largest tiremaker said Schaeffler Beteiligungsholding GmbH & Co.’s voting rights rose to 36.14 percent on Sept 30.

U.S. stocks gained, sending the Standard & Poor’s 500 Index to the highest level since August, as Bank of America Corp. paced a rally in financial shares and optimism grew over progress on expanding Europe’s rescue fund. France and Germany are engaged in “intensive talks” on bolstering the European Financial Stability Facility. In the U.S., data showed that homebuilders were less pessimistic than forecast in October, as near record-low borrowing costs and price decreases raised hopes the market will turn for the better over the next six months. In another report, wholesale prices rose more than forecast in September, boosted by gasoline, food and trucks.

Bank of America (ВАС) climbed 10 percent after it swung to a profit as credit quality improved. The provision for loan losses dropped to $3.4 billion from $5.4 billion a year earlier as credit improved in the card unit and commercial lending, the bank said. The card unit swung to a profit in the quarter, while income rose at the deposit unit, global wealth and investment management, and global commercial banking.

A gauge of homebuilders in S&P indexes jumped 9.6 percent, the most since March 2009, as data showed that industry sentiment increased more than forecast.

Alcoa (АА) gained 5.9 percent to $10.14. Caterpillar (САТ) climbed 3.9 percent to $84.72. PulteGroup Inc., the largest U.S. homebuilder by revenue, rallied 11 percent to $4.46.

International Business Machines Corp. (IBM) tumbled 4.1 percent to $178.90. The biggest computer-services company missed sales estimates for the first time in five quarters. Revenue showed slowing growth in IBM’s software, hardware and services businesses.

Resistance 2: Y77.45 (Oct 14 high)

Resistance 1: Y76.90 (Oct 18 high)

The current price: Y76.70

Support 1:Y76.65 (session low)

Support 2: Y76.30 (Oct 12 low)

Support 3: Y76.10 (Sep 21-22 low)

Comments: the pair holds in range Y76.65-Y76.90.

Resistance 2: Chf0.9040/50 (area of Oct 13 and 18 high)

Resistance 1: Chf0.9000 (session high)

The current price: Chf0.8966

Support 1: Chf0.8945 (Oct 18 low)

Support 2: Chf0.8880 (Oct 17 low)

Support 3: Chf0.8790/00 (area of Sep 19-20 low)

Comments: the pair is on downtrend. In focus support Chf0.8945.

Resistance 2: $ 1.5800 (resistance line from Oct 18)

Resistance 1: $ 1.5770 (Oct 18 high)

The current price: $1.5769

Support 1 : $1.5695 (session low)

Support 2 : $1.5630 (Oct 18 low)

Support 3 : $1.5540 (Oct 12 low)

Comments: the pair is restored remains in downtrend. In focus resistance $1.5800.

Resistance 2: $ 1.3900/10 (area of Oct 17 high)

Resistance 1: $ 1.3820 (Oct 18 high)

The current price: $1.3810

Support 1 : $1.3725 (session low)

Support 2 : $1.3650 (Oct 18 low)

Support 3 : $1.3580 (Oct 12 low)

Comments: the pair is restored after two-day falling. In focus resistance $1.3820.

Nikkei 225 8,742 -137.69 -1.55%

Hang Seng 18,076 -797.53 -4.23%

S&P/ASX 200 4,187 -88.50 -2.07%

Shanghai Composite 2,383 -56.92 -2.33%

FTSE 100 5,410 -26.35 -0.48%

CAC 40 3,141 -24.96 -0.79%

DAX 5,877 +17.98 +0.31%

Dow 11,577.05 +180.05 +1.58%

Nasdaq 2,657.43 +42.51 +1.63%

S&P 500 1,226.65 +25.79 +2.15%

10 Year Yield 2.15% -0.00 --

Oil $88.35 +0.01 +0.01%

Gold $1,661.40 +8.60 +0.52%

08:00 Eurozone Current account, adjusted, bln August -12.9 -7.3

08:30 United Kingdom Bank of England Minutes

12:30 U.S. Building Permits, mln September 0.620 0.610

12:30 U.S. Housing Starts, mln September 0.571 0.594

12:30 U.S. CPI, m/m September +0.4% +0.3%

12:30 U.S. CPI, Y/Y September +3.8% +3.8%

12:30 U.S. CPI excluding food and energy, m/m September +0.2% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y September +2.0% +2.1%

12:30 Canada Leading Indicators, m/m September 0.0% +0.3%

14:30 U.S. EIA Crude Oil Stocks change неделя по 14 октября 1.344

18:00 U.S. Fed's Beige Book October

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.