- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 17-10-2011

European stocks fell as a German government spokesman said that euro-area leaders will not provide a complete fix to the debt crisis at their next meeting.

G-20 finance ministers and central bank governors concluded weekend talks in Paris endorsing parts of the emerging plan to avoid a Greek default, bolster banks and curb contagion. Stocks erased earlier gains after Steffen Seibert, German Chancellor Angela Merkel’s chief spokesman, told reporters in Berlin that European leaders won’t fulfill “dreams” of a quick end to the debt crisis at the Oct. 23 summit.

National benchmark indexes fell in all of the 18 western- European markets. France’s CAC 40 Index slipped 1.6 percent. Germany’s DAX Index lost 1.8 percent and the U.K.’s FTSE 100 Index fell 0.5 percent. Greece’s ASE Index plunged 3 percent.

National Bank of Greece sank 10 percent to 1.63 euros. Piraeus Bank SA retreated 9.1 percent to 26 euro cents. EFG Eurobank Ergasias tumbled 9.5 percent to 66.1 euro cents.

G4S Plc slumped 22 percent to 219.9 pence for its biggest slump in seven years. The world’s largest security provider agreed to acquire ISS for about 5.2 billion pounds ($8.2 billion), of which 3.7 billion pounds is assumed debt, to add cleaning and other facilities-management services and accelerate expansion in emerging markets.

BP Plc rose 2.2 percent to 425.55 pence. BP, Europe’s second-largest oil company, said Anadarko will pay to settle all claims over the world’s largest accidental oil spill.

SGL Carbon SE soared 13 percent to 42.75 euros, its highest price since August 2008. Bayerische Motoren Werke AG plans to buy a stake in the German maker of carbon and graphite materials, Spiegel said, citing an unidentified manager at the automaker.

Air France-KLM Group, Europe’s second-largest airline by sales, increased 1.4 percent to 5.61 euros. The company’s board meets today to vote on ousting Chief Executive Officer Pierre- Henri Gourgeon, according to two people with knowledge of the proposals.

U.S. stocks fell, after the biggest weekly gain for the Standard & Poor’s 500 Index since 2009, as Wells Fargo & Co. slumped and a German government spokesman damped optimism of a quick fix to Europe’s debt crisis.

Dow 11,482.64 -161.85 -1.39%, Nasdaq 2,629 -39.12 -1.47%, S&P 500 1,209.10 -15.48 -1.26%

Gauges of financial and raw material companies had the biggest declines in the S&P 500 among 10 groups, falling at least 2.5 percent.

Wells Fargo, the largest U.S. home lender, lost 6.2 percent as third-quarter revenue dropped and margins narrowed. Alcoa Inc. and 3M Co. slumped more than 2.8 percent to pace losses among companies most-tied to the economy.

Citigroup Inc. rallied 0.6 percent to $28.58. The third- biggest U.S. bank said profit rose 74 percent, beating analysts’ estimates on a $1.9 billion accounting gain and a reduction in losses tied to soured loans.

Gannett slid 8.6 percent, the most in the S&P 500, to $10. The owner of 82 newspapers and 23 television stations reported third-quarter profit decreased 1.6 percent as publishing revenue, including advertising and circulation, declined 5.3 percent.

El Paso Corp. surged 24 percent to $24.26. The cash and stock offer is valued at $26.87 per El Paso share, or 37 percent more than the Oct. 14 closing price, Houston-based Kinder Morgan said in a statement yesterday. The combined company would have 67,000 miles (107,000 kilometers) of gas lines and eclipse Enterprise Products Partners LP as the biggest U.S. pipeline operator.

More Europe, not less, is the solution and need stricter control on national budgets.

Gold prices have repeated the movement of crude oil and stock markets: in the middle of the day rose to a three-week high as optimism after meeting leaders of G20, and then fell after a "cooling" Angela Merkel statement.

Today, December gold futures topped $ 1696.8, with the maximum of 23 September, andnow the futures price is $ 1682.9 on the Comex in New York.

Crude oil slipped from the highest level in a month after Germany said European Union leaders won’t provide a complete fix to the region’s debt crisis, damping hopes for a quick rescue plan.

Oil fell as much as 1.1 percent after climbing above $88 a barrel as Chancellor Angela Merkel said expectations that rescue plans to be announced at an Oct. 23 summit will speedily address Europe’s problems were “dreams.” Prices also weakened as data showed manufacturing in the New York region contracted in October at a faster pace than forecast.

Crude for November delivery fell 63 cents, or 0.7 percent, to $86.17 a barrel at 10:04 a.m. on the New York Mercantile Exchange. Earlier it gained as much as 1.6 percent to $88.18 a barrel, the highest since Sept. 16, on forecasts that China may say tomorrow its economy grew more than 9 percent last quarter.

Crude gained earlier on speculation China’s economy will maintain growth rates.

Gross domestic product in the nation, the world’s second- biggest consumer of crude, increased 9.3 percent in the third quarter from a year earlier, according to the estimate of economists.

Brent oil for December settlement fell $1.38, or 1.2 percent, to $110.85 a barrel on the London-based ICE Futures Europe exchange. Front-month futures rose 7.8 percent last week.

USD/JPY Y77.00, Y76.75, Y76.00

AUD/USD $1.0000

EUR/JPY Y105.00, Y104.50

EUR/CHF Chf1.2500

USD/CHF Chf0.9020, Chf0.9050, Chf0.9150

U.S. stock futures declined, as a German government spokesman damped expectations for a swift resolution to Europe’s debt crisis and a report showed New York- area manufacturing shrank more than forecast.

Germany said European Union leaders won’t provide the complete fix to the euro-area debt crisis that global policy makers are pushing for at an Oct. 23 summit. Group of 20 finance ministers and central bankers concluded weekend talks in Paris endorsing parts of an emerging plan to avoid a Greek default, bolster banks and curb contagion.

Company news:

- Citigroup: Q3 EPS of $1.23 beats by $0.42. Revenue of $20.8B (flat Y/Y) beats by $1.2B. Shares +2.4% premarket.

The euro weakened after German Chancellor Angela Merkel’s spokesman said Europe’s leaders won’t provide the quick resolution to the region’s debt crisis that global policy makers are pushing for at a summit this weekend.

The 17-nation currency retreated from a one-month high against the dollar, following last week’s biggest advance in more than two years.

The pound declined versus the dollar and the yen on concern the Bank of England’s additional stimulus measures won’t be enough to revive growth.

Group of 20 finance ministers and central bankers concluded weekend talks in Paris endorsing parts of the emerging plan to avoid a Greek default, bolster banks and curb contagion. They set the Oct. 23 summit of European leaders in Brussels as the deadline for it to be delivered.

The yen and the dollar strengthened against major currencies as European stocks erased gains.

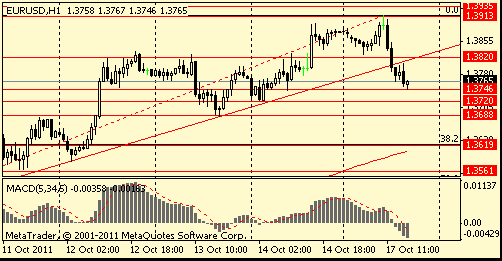

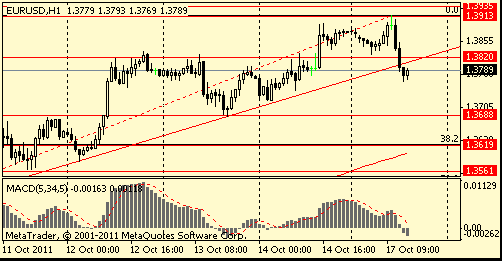

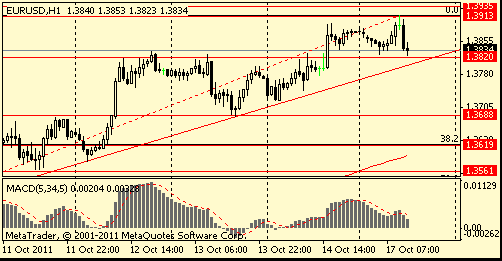

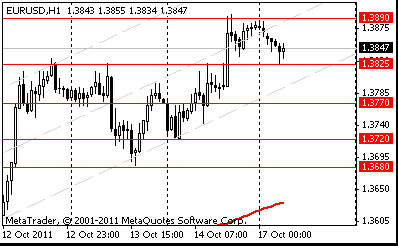

EUR/USD: the pair decreased below $1,3800.

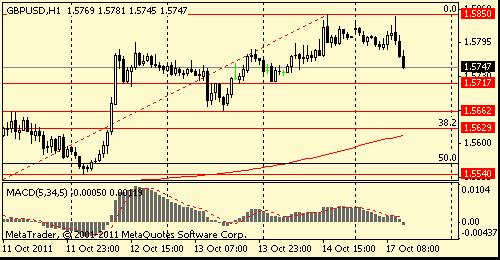

GBP/USD: the pair showed low in $1.5730 area then grown.

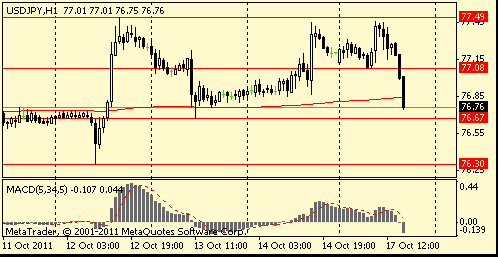

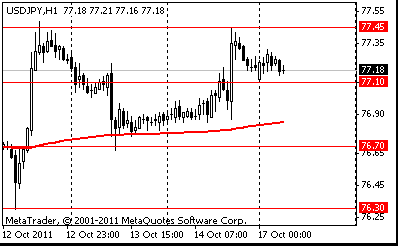

USD/JPY: the pair showed high in Y77,40 area, but receded later.

Resistance 2: Y77.90 (Sep 9 high)

Resistance 1: Y77.50 (Oct 12 high)

Current price: Y77.23

Support 1:Y77.10 (session low)

Support 2:Y76.70 (Oct 13 low)

Support 3:Y76.30 (Oct 12 low)

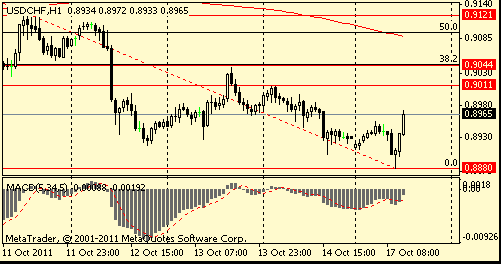

Resistance 2: Chf0.9040/50 (Oct 13 high, 38,2 % FIBO Chf0,9310-Chf0,8880)

Resistance 1: Chf0.9000/10 (Oct 10 low, session high)

Current price: Chf0.8965

Support 1: Chf0.8880 (session low)

Support 2: Chf0.8800 (psychological mark, area of Sep 19-20 low)

Support 3: Chf0.8750 (close price of Sep 16)

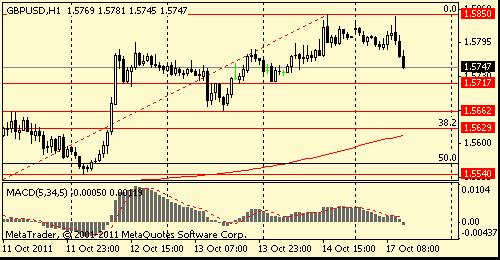

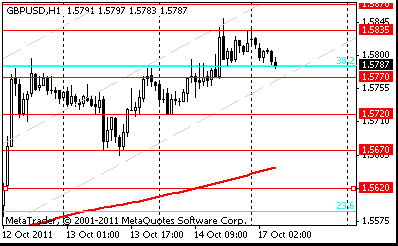

Resistance 2: $ 1.5880/90 (area of Sep 12 and 15 highs)

Resistance 1: $ 1.5850 (area of Oct 14 high and session high)

Current price: $1.5747

Support 1 : $1.5720 (Oct 14 low)

Support 2 : $1.5660 (Oct 13 low)

Support 3 : $1.5630 (38,2 % FIBO $1.5270-$ 1.5850)

Comments: the pair recedes from the reached high. The immdeate purpose of correction - $1,5720.

Resistance 2: $ 1.3930 (Sep 15 high)

Resistance 1: $ 1.3910 (session high)

Current price: $1.3834

Support 1 : $1.3820 (area of session low, support line from Oct 10)

Support 2 : $1.3690 (earlier resistance, area of Sep 10-11 highs, Oct 13 low)

Support 3 : $1.3620 (38.2 % FIBO $1,3360-$ 1,3910)

Comments: the pair receded from the reached high. In focus - support $1,3820.

Currently FTSE 5,508 +41.65 +0.76%, CAC 3,234 +15.94 +0.50%, DAX 6,017 +49.47 +0.83%.

European stocks advanced after Group of 20 finance chiefs endorsed parts of a plan to halt the region’s debt crisis.

G-20 finance ministers and central bank governors concluded weekend talks in Paris endorsing parts of the emerging plan to avoid a Greek default, bolster banks and curb contagion. They set an Oct. 23 summit of European leaders in Brussels as the deadline for the euro area to deliver a deal.

Company news:

BP Plc surged 4.8% after saying that Anadarko Petroleum Corp. will pay $4 billion to settle all claims for last year’s Gulf of Mexico oil spill.

USD/JPY Y77.00, Y76.75, Y76.00

AUD/USD $1.0000

EUR/JPY Y105.00, Y104.50

EUR/CHF Chf1.2500

USD/CHF Chf0.9020, Chf0.9050, Chf0.9150

17 Oct Wells Fargo & Co $0.720

18 Oct Bank of America Corp $0.200

18 Oct Goldman Sachs Group -$0.020

18 Oct Coca-Cola $1.015

18 Oct Johnson & Johnson $1.208

18 Oct Apple $7.280

18 Oct Intel $0.651

Hang Seng 18,784 +282.06 +1.52%

S&P/ASX 4,275 +69.76 +1.66%

Shanghai Composite 2,440 +8.41 +0.35%

04:30 Japan Industrial output final Y/Y August +0.4%

The euro declined from near the strongest in a month against the dollar as traders speculated European leaders will struggle to meet a deadline for this month on a plan to stem the region’s debt crisis.Group of 20 finance ministers and central bank officials concluded weekend talks in Paris endorsing parts of an emerging plan to halt the crisis. They set an Oct. 23 summit of European leaders in Brussels as the deadline for it to be delivered. G-20 leaders will meet Nov. 3-4 in Cannes, France.

The Australian dollar weakened before the Reserve Bank of Australia releases tomorrow minutes of its meeting on Oct. 4 when Governor Glenn Stevens signaled there’s more scope to cut interest rates if necessary.

EUR/USD: on asian session the pair fell, but restored later.

GBP/USD: on asian session the pair decreased, but restored later.

USD/JPY: on asian session the pair fell.

On Monday at 1435GMT, ECB Executive Board member Juergen Stark is due to give a speech entitled "Economic Governance and Crisis Management in the EU" at the European Parliament, in Brussels.US data starts at 1230GMT with the NY Fed Empire State Survey. At 1315GMT, US industrial production is expected to rise 0.2% in September. US data continues with the MNI Capital Goods Index at

1330GMT and the MNI Retail Trade Index at 1430GMT.

On Tuesday the euro dropped from the highest level in almost three weeks against the dollar as Slovakian lawmakers сcould not to vote on a plan to retool the euro region’s bailout fund. The pound weakened as U.K. manufacturing production contracted for a third month. New Zealand’s dollar fell as the nation’s budget deficit was wider than forecast.

On Wednesday the euro rose to three-week highs against the dollar and yen after European industrial production unexpectedly rose in August, and the European Union and International Monetary Fund officials indicated Greece will get an 8 billion-euro ($11 billion) loan next month. New Zealand’s dollar rose the most in two months against the dollar as stocks and commodities advanced, buoying higher- yielding currencies.

On Thursday the euro gain versus the dollar after Slovakia approved Europe’s enhanced bailout fund, completing ratification across the currency region. The dollar and yen advanced versus most of their major counterparts after JPMorgan Chase & Co. reported a decline in profit and China’s export growth slowed, weakening stocks and spurring demand for a refuge..

On Friday the euro extended its biggest weekly gain versus the dollar since January as Group of 20 finance ministers began a two-day meeting to discuss plans to tackle Europe’s debt crisis. The euro rose versus the dollar as Treasury Secretary Timothy F. Geithner said “Europe is clearly” moving to a crisis solution. The yen fell against the dollar on speculation Japanese authorities will take steps to curtail their currency’s gains.

Asian markets retreated after Spain had its long-term sovereign credit rating cut to AA- from AA by Standard & Poor’s with a negative outlook, the third reduction by S&P in three years.

Nikkei 225 8,748 -75.29 -0.85%, Hang Seng 18,502 -256.02 -1.36%, S&P/ASX 200 4,206 -38.90 -0.92%, Shanghai Composite 2,431 -7.42 -0.30%

Sino-Ocean Land Holdings Ltd., a developer of properties in China’s north, slumped 10 percent to HK$2.99. China Overseas Land & Investment Ltd., a builder controlled by the nation’s construction ministry, retreated 4.2 percent to HK$13.60 on concern China may continue with steps to slow inflation. Industrial & Commercial Bank of China Ltd., the nation’s biggest lender by market value, sank 4.3 percent to HK$4.25.

BHP Billiton lost 2.1 percent to A$36.86 in Sydney and rival Rio Tinto Group, the world’s No. 2 miner by sales, declined 1.5 percent to A$68.30. Cnooc Ltd., China’s largest offshore energy producer, slumped 4.6 percent to HK$13.28.

Esprit Holdings Ltd., a clothier that gets 83 percent of its revenue in Europe, dropped 1.5 percent in Hong Kong.

Carmaker Honda Motor Co. lost 2.4 percent to 2,248 yen in Tokyo, while Canon Inc., a camera maker that depends on Europe for about a third of its sales, slipped 2.6 percent to 3,445 yen.

Mitsubishi UFJ fell 1.5 percent to 335 yen in Tokyo, while HSBC Holdings Plc, Europe’s biggest lender, slipped 1.5 percent to HK$63.70 in Hong Kong.

European stocks climbed, extending the Stoxx Europe 600 Index’s longest stretch of weekly gains in six months, as Group of 20 finance ministers meet in Paris to discuss the euro area’s debt crisis.

G-20 finance ministers and central bankers meet in Paris today and tomorrow to outline a euro-area rescue plan that may include deeper investor losses on Greek bonds and increased firepower for the International Monetary Fund. Leaders may complete the plan at an Oct. 23 summit in Brussels to present to a gathering of G-20 chiefs Nov. 3-4.

Stocks climbed today even after Standard & Poor’s downgraded Spain’s credit rating for the third time in three years as slowing growth and rising defaults threaten banks. The rating company reduced Spain’s ranking by one level to AA-, S&P’s fourth-highest investment grade, with the outlook remaining negative, in a statement late yesterday. Separately, UBS AG, Lloyds Banking Group Plc and Royal Bank of Scotland Group Plc had long-term issuer default grades cut by Fitch Ratings, which put more than a dozen other lenders on watch negative.

National benchmark indexes rose in all 18 western European markets except Iceland and Denmark. The U.K.’s FTSE 100 Index rose 1.2 percent and Germany’s DAX Index gained 0.9 percent. France’s CAC 40 Index advanced 1 percent.

Syngenta AG led chemical makers higher, rising more than 1 percent after posting third-quarter sales that beat analysts’ estimates.

SAP AG rallied 2.1 percent after the software maker reported higher earnings. Xstrata Plc led mining shares higher as copper rebounded in London.

Wacker Chemie AG rallied 3.3 percent to 76.01 euros. Clariant AG, which said it raised 365 million euros ($506 million) by issuing three-year certificates, climbed 3 percent to 9.69 francs. Yara International ASA advanced 3 percent to 250.40 kroner.

Xstrata led mining shares higher, climbing 3.1 percent to 974.1 pence. Antofagasta Plc advanced 3.7 percent to 1,118 pence and Rio Tinto Group gained 1.9 percent to 3,345.5 pence. Copper rebounded in London, climbing as much as 3.7 percent after customs figures yesterday showed imports of the metal into China, the world’s largest consumer, reached a 16-month high. Zinc, tin and nickel also advanced.

BowLeven Plc soared 60 percent to 120.75 pence, its biggest gain since 2009, after the U.K.-listed oil explorer focused on Africa said it discovered oil from an exploration well. The Sapele-3 well in the Douala Basin at the Etinde permit encountered 11 meters of net pay and the reservoir appears to be of “good quality,” the company said.

Sulzer AG paced declining shares, falling 8.8 percent to 94.10 francs after the Swiss maker of pumps predicted a slowdown in order growth for the full year as customers hesitate to invest amid rising economic uncertainty.

UPM-Kymmene Oyj dropped 6.1 percent to 8.80 euros after Europe’s second-largest papermaker reversed its full-year earnings forecast and predicted operating profit will fall rather than rise.

Finmeccanica SpA lost 1.4 percent to 5.32 euros after HSBC Holdings Plc lowered its recommendation for Italy’s biggest military contractor to “underweight” from “neutral.”

U.S. stocks advanced, giving the Standard & Poor’s 500 Index its biggest weekly gain since July 2009, as retail sales beat economists’ estimates and the Group of 20 nations began discussions on Europe’s debt crisis.

U.S. equities gained as retail sales in the U.S. rose more than forecast in September, easing concern slumping confidence and scant hiring will derail the biggest part of the economy.

U.S. stocks also followed a rally in European shares as finance ministers and central bankers from the Group of 20 began talks in Paris. Nations from China to Brazil are considering increasing the International Monetary Fund’s lending resources to help stem the European debt crisis, Group of 20 and IMF officials said. European officials are considering writedowns of as much as 50 percent on Greek bonds, according to people familiar with the discussion.

Dow 11,644.49 +166.36 +1.45%, Nasdaq 2,667.85 +47.61 +1.82%, S&P 500 1,224.58 +20.92 +1.74%

Google Inc., the world’s biggest Internet-search company, jumped 5.9 percent after sales topped projections. Apple Inc. gained 3.3 percent as the company is poised to sell as many as 4 million units of its new iPhone 4S this weekend after customers lined up to buy one of the last products developed under Steve Jobs.

Amazon.com Inc. and Caterpillar Inc. added at least 3.2 percent, pacing gains among сompanies most-tied to the economy.

Energy and raw-material producers rose the most among 10 industry groups in the S&P 500, adding at least 2.5 percent. Exxon Mobil Corp. climbed 2.3 percent to $78.11. Chevron Corp. added 2.7 percent to $100.47. Freeport-McMoRan Copper & Gold Inc. gained 4.3 percent to $36.77. Stabilizing copper inventory worldwide and rising demand from China are “favorable” for the world’s largest publicly traded copper producer.

Resistance 2: Y77.85 (Sep 9 high)

Resistance 1: Y77.45 (Oct 14 high)

The current price: Y77.19

Support 1:Y77.10 (session low)

Support 2: Y76.70 (Oct 13 low)

Support 3: Y76.30 (Oct 12 low)

Comments: the pair tests week's high. In focus resistance Y77.45

Resistance 2: Chf0.9010 (Oct 14 high)

Resistance 1: Chf0.8955 (session high)

The current price: Chf0.8940

Support 1: Chf0.8900/10 (session low)

Support 2: Chf0.8855 (middle line of the channel from Oct 12)

Support 3: Chf0.8790/00 (area of Sep 19-20 low)

Comments: the pair is on downtrend. In focus resistance Chf0.8955.

Resistance 2: $ 1.5870 (Sep 15 high)

Resistance 1: $ 1.5835 (session low)

The current price: $1.5788

Support 1 : $1.5770 (support line from Oct 6)

Support 2 : $1.5720 (Oct 14 low)

Support 3 : $1.5670 (Oct 13 low)

Comments: the pair is on uptrend. In focus support $1.5770.

Resistance 2: $ 1.3935 (Sep 15 high)

Resistance 1: $ 1.3890 (session high)

The current price: $1.3847

Support 1 : $1.3825 (session low)

Support 2 : $1.3770 (61.8 % FIBO $1.3895-$ 1.3685)

Support 3 : $1.3720 (Oct 14 low)

Comments: the pair is on uptrend. In focus support $1.3825.

04:30 Japan Industrial output final Y/Y August +0.6%

12:30 Canada Canadian Investment in Foreign Securities August -1.28

12:30 Canada Foreign investment in Canadian securities August 11.78 9.23

12:30 U.S. NY Fed Empire State manufacturing index October -8.8 -4.0

13:15 U.S. Industrial Production (MoM) September +0.2% +0.2%

13:15 U.S. Capacity Utilization September 77.4 77.5

14:30 Canada Bank of Canada Senior Loan Officer Quarter III -49.6

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.