- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-10-2011

The euro fell against the majority of its most-traded counterparts after Fitch Ratings cut its rating on Spain and Italy, highlighting the potential for region’s debt crisis to spread.

The 17-nation currency erased gains versus the dollar as Fitch cited factors including vulnerability to the “euro-zone crisis.” The dollar pared losses against the Mexican peso and Australia’s dollar as demand increased for a refuge from the fallout of Europe’s debt crisis. The euro and other higher- yielding currencies gained earlier after a report showed U.S. employers added more jobs than forecast last month.

European stocks gained for a third day, posting a second weekly gain, as a report showed the

U.S. economy added more jobs than economists had estimated.

National benchmark indexes climbed in 12 of the 18 western- European markets. Germany’s DAX Index climbed 0.5 percent and the U.K.’s FTSE 100 Index gained 0.2 percent. France’s CAC 40 Index increased 0.7 percent.

FTSE 100 5,303 +12.14 +0.23%, CAC 40 3,096 +20.19 +0.66%, DAX 5,676 +30.45 +0.54%

BMW and Daimler, the world’s biggest makers of luxury cars, jumped 4.1 percent to 50.89 euros and 1.3 percent to 33.98 euros, respectively. Rio Tinto, the world’s second-largest mining company, rose 1.2 percent to 3,164 pence, while Xstrata Plc climbed 2.7 percent to 910 pence. Copper, lead, tin and zinc all rose on the London Metal Exchange. Continental AG surged 4.9 percent to 46.91 euros as the world’s fourth-largest tiremaker plans to spend more than $500 million to build a new tire factory at Sumter, South Carolina, to meet increasing demand.

Most U.S. stocks retreated as banks declined and faster-than-estimated growth in American jobs failed to support the market following the biggest three-day rally in the Standard & Poor’s 500 Index since August.

Dow 11,091.47 -31.86 -0.29%, Nasdaq 2,472.72 -34.10 -1.36%, S&P 500 1,154.32 -10.65 -0.91%

Financial stocks dropped the most among 10 groups in the S&P 500 after Federal Reserve Bank of Atlanta President Dennis Lockhart said regulators haven’t yet put in place a system that would allow orderly failures of the largest financial firms without taxpayer rescues. Bank of America Corp. and Goldman Sachs Group Inc. lost more than 3.2 percent. Home Depot Inc. and Boeing Co. rallied at least 1.6 percent, pacing gains among companies most-tied to the economy.

GOLD: COMEX prices flattening as traders decide "which hat to wear," one that follows stocks, or one that operates as a safe haven. Dec contract down $1.40 at $1,651.80.

Crude oil increased for a third day in New York after larger-than-forecast U.S. employment growth eased concern that the economy is slowing.

Futures rose as much as 1.7 percent as the Labor Department said payrolls climbed by 103,000 workers in September and 57,000 in August. Oil is headed for the first weekly advance in three as supplies fell and central banks announced stimulus plans.

Crude oil for November delivery rose 1 percent, to $84.00 a barrel on the New York Mercantile Exchange. The contract is heading for a 5.2 percent gain this week. Futures dropped as much as 1 percent to $81.79 before the release of the jobs data.

Brent oil for November settlement gained 9 cents to $105.82 a barrel on the London-based ICE Futures Europe exchange.

USD/JPY Y75.50, Y76.90, Y77.00, Y77.30, Y77.50

EUR/JPY Y105.00

AUD/USD $0.9725

EUR/CHF chf1.2245

GBP/USD $1.5650

U.S. stock-index futures rallied after larger-than-forecast growth in jobs tempered concern that the economy was slowing.

Payrolls climbed by 103,000 workers after a revised 57,000 increase the prior month that was more than originally estimated, Labor Department data showed today in Washington. The median forecast was for a rise of 50,000. The jobless rate held at 9.1 percent.

Before the employment data futures fell as Moody's has downgraded 12 U.K. financial institutions, citing the lowering or removal of government support.

Data:

08:30 UK PPI (Output) (September) unadjusted 0.3%

08:30 UK PPI (Output) (September) unadjusted Y/Y 6.3%

08:30 UK PPI Output ex FDT (September) adjusted 0.3%

08:30 UK PPI Output ex FDT (September) unadjusted Y/Y 3.8%

08:30 UK PPI (Input) (September) adjusted 1.7%

08:30 UK PPI (Input) (September) unadjusted Y/Y 17.5%

10:00 Germany Industrial production (August) seasonally adjusted -1.0% -1.0%

10:00 Germany Industrial production (August) not seasonally adjusted, workday adjusted Y/Y 7.7%

The euro headed for a weekly gain versus the dollar on speculation financial support for European banks will help stem the region’s debt crisis.

The euro rose after the European Central Bank said yesterday it will reintroduce yearlong loans and resume purchases of covered bonds to encourage lending.

The pound rose on optimism the Bank of England’s decision to reactivate its bond-purchase program will help revive the U.K.’s faltering economy.

Losses in the dollar and yen were tempered before U.S. reports today forecast to show a gain in unemployment in September was not enough to bring down the jobless rate.

Employment climbed by 55,000 workers after no change in August, according to the median forecast of economists. The jobless rate was 9.1 percent for a third month, according to the forecasts.

EUR/USD: the pair holds in $1.3400-$ 1,3460 range.

GBP/USD: the pair dore above $1.5500.

USD/JPY: the pair holds in Y76.55-Y76,75 range.

The main focus is on US data at 1230GMT when nonfarm payrolls are forecast to rise 80,000 in September after the flat August reading, but the unemployment rate is expected to rise to 9.2%. An absence of the Verizon strikers should be a key factor in the payrolls rebound. Hourly earnings are seen up 0.2% after see-sawing sharply in the last four months. The average workweek is expected to hold steady at 34.2 September. Wholesale Inventories follow at 1400GMT.

Resistance 2: Chf0.9310 (Oct 6 high)

Resistance 1: Chf0.9220 (session high)

Current price: Chf0.9203

Support 1: Chf0.9180 (session low)

Support 2: Chf0.9160/50 (area of Oct 4-5 low and 38,2 % FIBO Chf0,8920-Chf0,9310)

Support 3: Chf0.9090/75 (area of 50,0 % FIBO Chf0,8920-Chf0,9310)

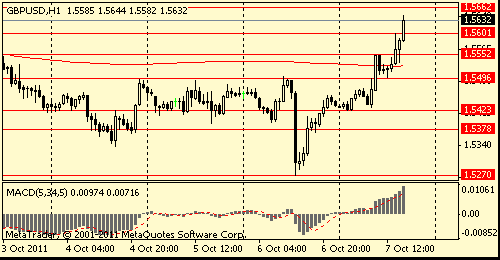

Resistance 2: $ 1.5580 (Oct 3 high)

Resistance 1: $ 1.5550 (session high)

Current price: $1.5507

Support 1 : $1.5500 (earlier resistance, area Oct 4-6 high)

Support 2 : $1.5420 (session low)

Support 3 : $1.5380 (61,8 % FIBO $1,5270-$ 1,5550)

Comments: the pair tries to be fixed above $1.5500 - currently the immediate support.

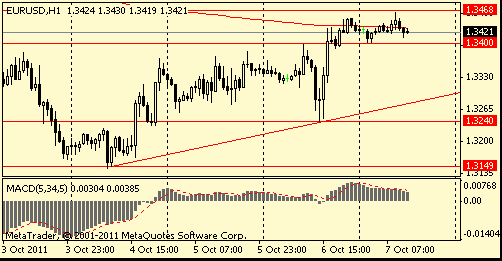

Resistance 2: $ 1.3480 (61,8 % FIBO $1,3690-$ 1,3150)

Resistance 1: $ 1.3450 (area of session high and Oct 6 high)

Current price: $1.3421

Support 1 : $1.3400 (session low)

Support 2 : $1.3290 (support line from Oct 4)

Support 3 : $1.3240 (Oct 6 low)

USD/JPY Y75.50, Y76.90, Y77.00, Y77.30, Y77.50

EUR/JPY Y105.00

AUD/USD $0.9725

EUR/CHF chf1.2245

GBP/USD $1.5650

Up to govt to get money to SMEs via credit easing.

Case for effectiveness of QE 'compelling'.

03:00 Japan BoJ Interest Rate Decision 0,00%-0,10%

05:00 Japan Leading Economic Index August 103,8

05:00 Japan Coincident Index August 107,4

The euro was set for its first five- day gain against the dollar in three weeks on prospects a capital backstop for European lenders will help stem the region’s debt crisisThe 17-nation euro held yesterday’s advance versus the yen after the European Central Bank reintroduced yearlong loans for banks and before a meeting between German Chancellor Angela Merkel and French President Nicolas Sarkozy. The Australian and New Zealand dollars were set to complete weekly gains as Asian stocks rose.

Losses in the dollar were limited before U.S. data today forecast to show unemployment failed to decline in September, supporting demand for refuge currencies.

EUR/USD: on asian session essential changes hasn't occurred

GBP/USD: on asian session the pair gain

USD/JPY: the pair decreased on asian session

On Friday UK data starts at 0830GMT with the Producer Price Index for September, which is expected to show output prices higher by 0.2% m/m, 6.3% y/y. The focus is on US data at 1230GMT when nonfarm payrolls are forecast to rise 80,000 in September after the flat August reading, but the unemployment rate is expected to rise to 9.2%

The pound slumped against all its major counterparts after the Bank of England expanded its bond-purchase plan and kept its benchmark interest rate at a record low. Sterling tumbled after U.K. policy makers said they would increase their bond-purchase program by 75 billion pounds.

The franc dropped for a third day against the euro on speculation the central bank will impose further measures to contain its strength after imposing the cap last month at 1.20 per euro.

EUR/USD: the pair is restored and showed new weekly high.

GBP/USD: the pair tested essential changes on yesterday's sessions of the Central Bank

USD/JPY: yesterday the pair holds in range Y76.55-Y76.85.

On Friday UK data starts at 0830GMT with the Producer Price Index for September, which is expected to show output prices higher by 0.2% m/m, 6.3% y/y. The focus is on US data at 1230GMT when nonfarm payrolls are forecast to rise 80,000 in September after the flat August reading, but the unemployment rate is expected to rise to 9.2%

Japan’s Nikkei 225 (NKY) Stock Average gained 1.7 percent. South Korea’s Kospi Index added 2.6 percent. Hong Kong’s Hang Seng Index climbed 5.7 percent, its biggest gain in more than two years. Australia’s S&P/ASX 200 advanced 3.7 percent, the biggest increase since December 2008.

Nikkei 225 8,522 +139.04 +1.66%, Hang Seng 17,172 +922.01 +5.67%, S&P/ASX 200 4,070 +143.40 +3.65%, Shanghai Composite 2,359 -6.12 -0.26%

Sony Corp., Japan’s No. 1 exporter of consumer electronics, advanced 4.7 percent in Tokyo. Cathay Pacific Airways Ltd., Asia’s largest international carrier, jumped 6.9 percent in Hong Kong. James Hardie Industries SE, a building-materials supplier that gets almost 70 percent of its sales from the U.S., climbed 8.2 percent in Sydney. BHP Billiton Ltd., the No. 1 global mining company, gained 3.3 percent as commodity prices advanced.

European stocks rose for a second day amid speculation policy makers will reach agreement to contain the sovereign-debt crisis and as the Bank of England expanded its bond-purchase program.

National benchmark indexes rose in every western-European markets except Denmark. France’s CAC 40 Index advanced 3.4 percent and the U.K.’s FTSE 100 Index rose 3.7 percent. Germany’s DAX Index added 3.2 percent.

FTSE 100 5,291 +189.09 +3.71%, CAC 40 3,075 +101.47 +3.41%, DAX 5,645 +172.22 +3.15%

BNP Paribas SA, Credit Agricole SA and Natixis surged after Le Figaro said the French government is working on a contingency plan to take stakes in the country’s lenders. BHP Billiton Ltd., the world’s biggest mining company, rallied 5.9 percent as metal prices increased. SABMiller Plc surged 7 percent after a report the brewer is in talks to be bought by Anheuser-Busch InBev NV. UBS AG gained 4.5 percent to 10.97 Swiss francs after Switzerland’s biggest bank said Francois Gouws and Yassine Bouhara resigned as co-heads of global equities following last month’s $2.3 billion loss from unauthorized trading.

U.S. stocks rose, giving the Standard & Poor’s 500 Index the biggest three-day gain since August, as the Europe took steps to control the region’s debt crisis.

Dow 11,121.82 +181.87 +1.66%, Nasdaq 2,507 +46.31 +1.88%, S&P 500 1,164.78 +20.75 +1.81%

Financial shares rose the most among 10 groups in the S&P 500. Bank of America Corp. and JPMorgan Chase & Co. added at least 5 percent. Alcoa Inc., the largest U.S. aluminum producer, climbed 5.4 percent as commodities jumped. Target Corp. rose 4.3 percent as sales beat estimates. Yahoo! Inc. tumbled 1.7 percent as people familiar with the matter said Microsoft Corp. isn’t close to making an offer for the company.

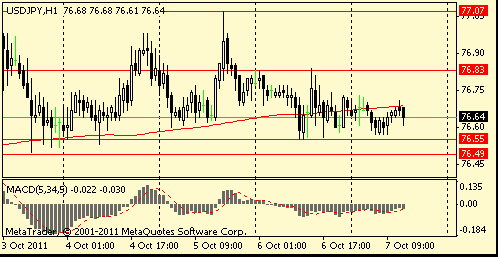

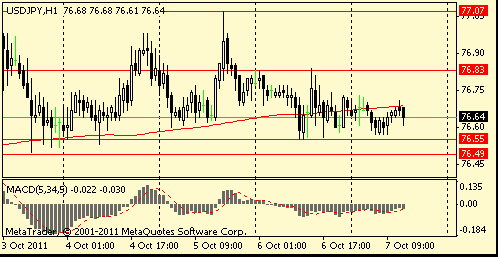

Resistance 2: Y77.10 (Oct 5 high)

Resistance 1: Y76.85 (Oct 6 high)

The current price: Y76.60

Support 1:Y76.50/60 (area of Oct low)

Support 2:Y76.10 (Sep 22 low)

Support 3: Y75.70 (123.6 % FIBO Y77.86-Y76.10)

Comments: the pair fell.

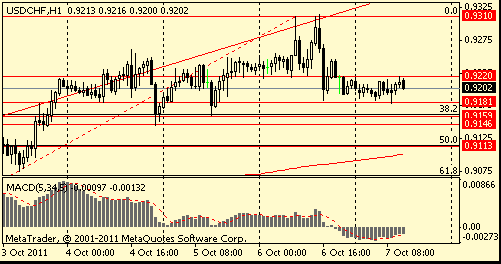

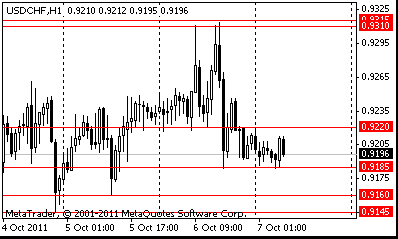

Resistance 2: Chf0.9310/15 (area of Oct 6 high)

Resistance 1: Chf0.9220 (session high)

The current price: Chf0.9190

Support 1: Chf0.9185 (session low)

Support 2: Chf0.9145/60 (area of Oct 4-5 low)

Support 3: Chf0.9100 (MA (200) H1)

Comments: the pair fell. In focus support Chf0.9185.

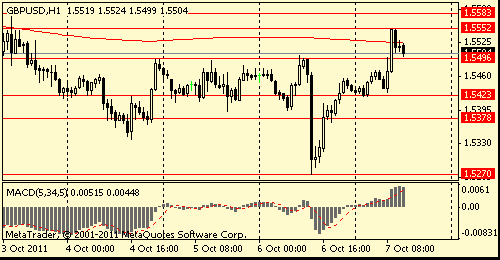

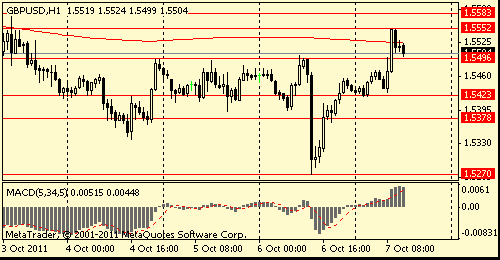

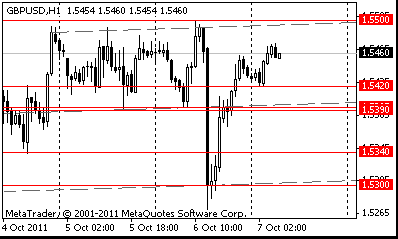

Resistance 2: $ 1.5530 (MA (200) H1)

Resistance 1: $ 1.5500 (Oct 6 high)

The current price: $1.5470

Support 1 : $1.5420 (session high)

Support 2 : $1.5390/95 (area of Oct 5 and 6 low)

Support 3 : $1.5340 (Oct 4 low)

Comments: the pair continues to restore. In focus resistance $1.5500.

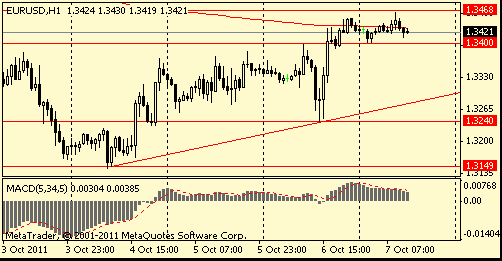

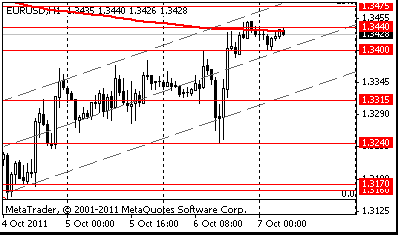

Resistance 2: $ 1.3475 (23,6 % FIBO $1.3144-$ 1.4549)

Resistance 1: $ 1.3440 (session high)

The current price: $1.3430

Support 1 : $1.3400 (session low)

Support 2 : $1.3315 (low of the Asian sessions on Oct 6)

Support 3 : $1.3240 (Oct 6 low)

Comments: the pair continues to restore. In focus resistance $1.3440.

Nikkei 225 8,522 +139.04 +1.66%

Hang Seng 17,172 +922.01 +5.67%

S&P/ASX 200 4,070 +143.40 +3.65%

Shanghai Composite 2,359 -6.12 -0.26%

FTSE 100 5,291 +189.09 +3.71%

CAC 40 3,075 +101.47 +3.41%

DAX 5,645 +172.22 +3.15%

Dow 11,121.82 +181.87 +1.66%

Nasdaq 2,507 +46.31 +1.88%

S&P 500 1,164.78 +20.75 +1.81%

10 Year Yield 1.99% +0.08 --

Oil $82.27 -0.32 -0.39%

Gold $1,647.50 -5.70 -0.34%

03:00 Japan BoJ Interest Rate Decision 0 0,00%-0,10% 0,00%-0,10% 0,00%-0,10%

05:00 Japan Leading Economic Index August 104,6 103,8 103,8

05:00 Japan Coincident Index August 107,1 107,4 107,4

05:45 Switzerland Unemployment Rate September 3,0% 3,0%

08:30 United Kingdom Producer Price Index - Output (MoM) September +0,1% +0,1%

08:30 United Kingdom Producer Price Index - Output (YoY) February +6,1% +6,2%

08:30 United Kingdom Producer Price Index - Input (MoM) September -1,9% +1,4%

08:30 United Kingdom Producer Price Index - Input (YoY) September +16,2% +17,2%

10:00 Germany Industrial Production s.a. (MoM) August +4,0% -1,0%

10:00 Germany Industrial Production (YoY) August +10,1% +6,8%

11:00 Canada Employment September -5,5К +19,5К

11:00 Canada Unemployment rate September 7,3% 7,3%

12:30 U.S. Average workweek September 34,2 34,3

12:30 U.S. Nonfarm Payrolls September 0К +50К

12:30 U.S. Unemployment Rate September 9,1% 9,1%

12:30 U.S. Average hourly earnings September -0,1% +0,2%

14:00 U.S. Wholesale Inventories August +0.8% +0.6%

14:45 U.S. FOMC Member Dennis Lockhart Speaks 0

19:00 U.S. Consumer Credit August 12.0 8.0

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.