- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-12-2021

- GBP/USD struggles to extend week-start rebound, stays near yearly bottom marked the last Tuesday.

- UK braces for more fishing permits to France, EU helps Ireland to overcome Brexit woes.

- BOE’s Broadbent expects UK inflation to comfortably rise past 5.0% by Spring.

- Risk catalysts are the key amid a light calendar at home and abroad.

GBP/USD treads water around 1.3255-60 during the early Asian session on Tuesday, following a positive daily performance.

The cable pair fades the recovery strength as sluggish market sentiment and a lack of major catalysts challenge the buyers’ previous optimism surrounding Brexit and the Bank of England’s (BOE) next move. Also positive for the quote were receding fears of the South African covid variant, dubbed as Omicron, as well as hopes of finding a cure to the virus strain.

The UK Telegraph quotes sources to signal that the British diplomats are ready, even hesitantly, to offer more fishing licenses to the French fishermen to ease the Brexit drama surrounding Channel. The anticipated British move could be in response to the news, shared by the UK Express, that says, “Ireland is to receive €920 million from an EU fund set up to mitigate the impact of Brexit.”

Elsewhere, Sky News quotes the UK’s leading scientist, Professor Francois Balloux, director of the University College London Genetics Institute to mention, “The outbreak was now well underway, doubling every three to four days, adding it will quickly put the NHS under pressure.” As per the latest official figures, shared by Reuters, 51,459 further cases of COVID-19 and 41 more deaths within 28 days of a positive test were reported versus 43,992 cases and 54 deaths marked the previous day. “Britain's Health Security Agency said it found 90 new cases of the Omicron variant of COVID-19, taking the total number identified so far to 336,” said the news.

It should be noted that the Bank of England (BOE) Deputy Governor Ben Broadbent’s hawkish comments also strengthened the GBP/USD prices. “Inflation is likely to soar “comfortably” above 5% next spring when the energy regulator Ofgem raises a price cap affecting millions of households,” said BOE’s Broadbent.

On a broader front, receding fears of the virus variant and hopes of finding a cure joined an absence of Fed rate hike chatters to favor the GBP/USD bulls. However, sluggish market conditions challenge the pair’s moves of late, highlighting the need for fresh catalysts. As a result, second-tier UK data concerning Retail Sales and housing may gain attention. Though, headlines covering Brexit and Omicron will be the key.

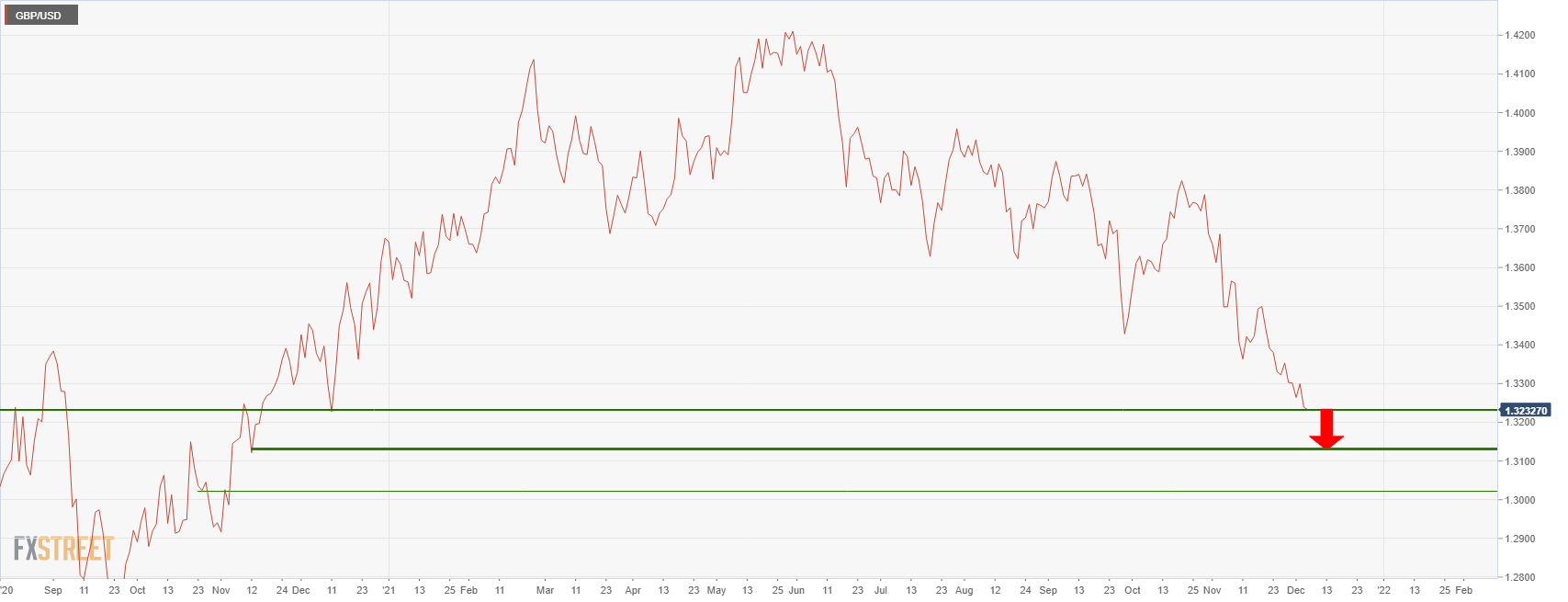

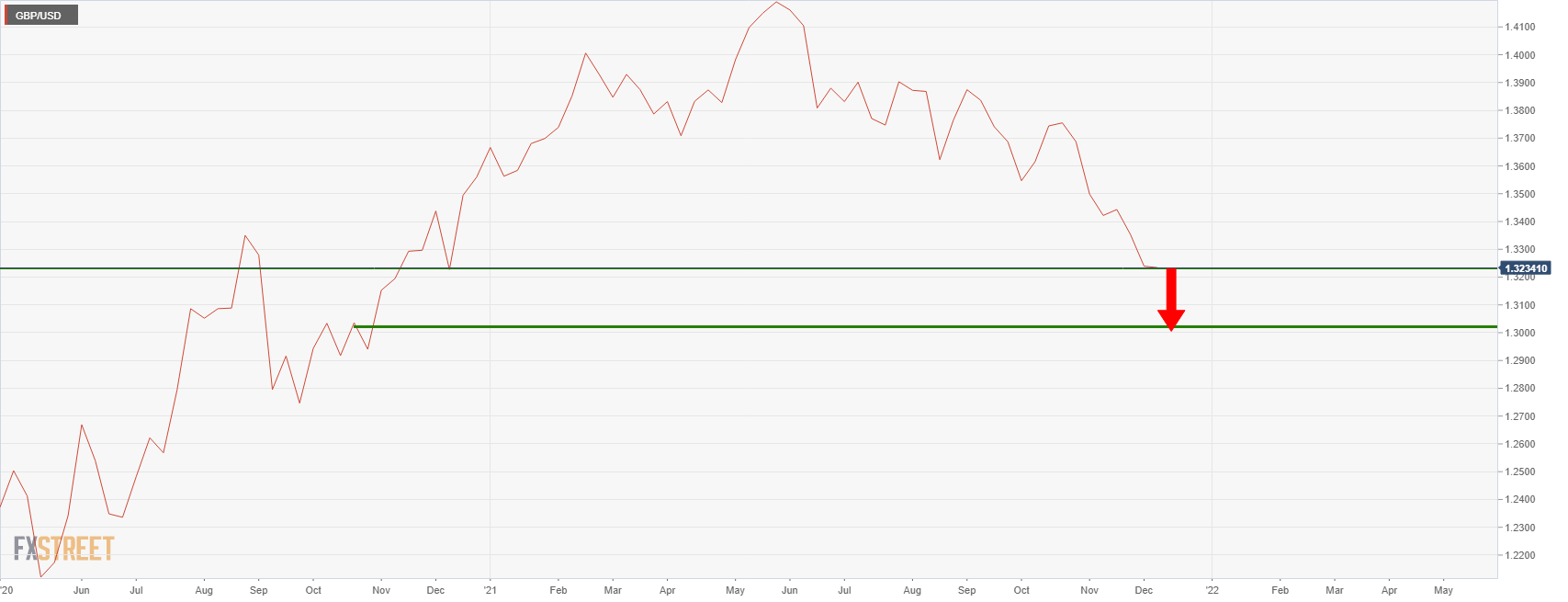

Technical analysis

A downward sloping trend line from late October, near 1.3280 at the latest, directs GBP/USD prices towards December 2020 lows near 1.3135. During the fall, the yearly bottom surrounding 1.3200 my offer an intermediate halt.

- The NZD/JPY recovered some of Friday’s losses but lost traction towards 77.00.

- NZD/JPY Price Forecast: In the near-term neutral-bearish, as bears eye 76.00.

The NZD/JPY advances as the Asian Pacific session begins, trading at 76.60 during the day at the time of writing. On Monday, the market sentiment was upbeat, with US equity indices posting gains between 0.85% and 2.06%, amid positive news from South Africa. Although highly contagious, the omicron variant’s cases are mild compared to previous COVID-19 strains.

On Monday, the NZD/JPY climbed steadily from low 76s towards the 50-hour simple moving average (SMA) around the 76.60 area, where it settled. Nevertheless, it failed to gain traction towards the 100-hour SMA at 76.87, a level that, once broken, could’ve accelerated an upward move towards 77.00.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY pair has a downward bias in the daily chart, depicted by the daily moving averages (DMA’s) with a flattish slope, residing above the spot price. Furthermore, bulls are probing the confluence of the November 30 low and an upslope trendline of the previous support-turned-resistance around 76.65. In the outcome of a break above that level, it would expose crucial supply zones, like the December 3 high at 77.17, followed by the downslope trendline around 77.25-40. A breach of the latter would expose the confluence of the 200-day moving average (DMA) and the psychological 78.00 figure.

On the other hand, if the NZD/JPY extends its previous losses, the first support would be December 3 low at 79.95. A break under that level could send the cross-currency tumbling towards the August 19 low at 74.55.

-637744291938167053.png)

“COVID-19 variants amid inflation pressures test US consumer resilience,” said the global rating giant Moody’s during Monday, per Reuters.

“Although growth in consumption in H1 unlikely to repeat itself in months ahead, expect consumer spending to continue to fuel US economic growth,” adds Moody’s.

Market reaction

The news challenges the Fed's rate-hike concerns ahead of the key US Consumer Price Index (CPI) data scheduled for release on Friday, also adding to the recent optimism in the market. While portraying the same, the Wall Street benchmarks closed positive and reversed Friday’s losses.

Read: S&P 500 extends on earlier gains, eyes 4600 mark as US session draws to a close

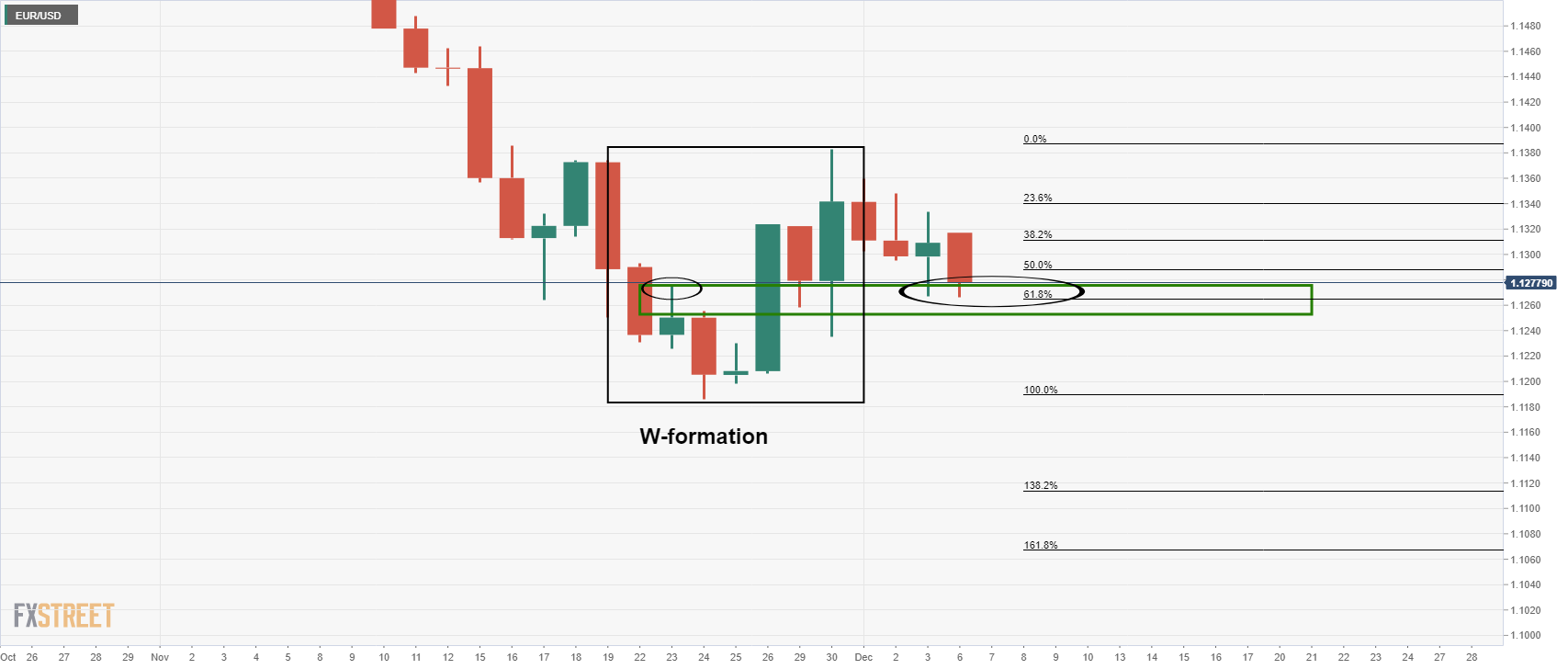

- EUR/USD remains pressured within short-term bearish chart pattern.

- Downbeat MACD signals, break of two-week-old previous support adds to the bearish bias.

- Horizontal area from November 22 offers immediate support, descending trend line from late October, 200-SMA add to the upside filters.

EUR/USD struggles to keep the latest rebound from 1.1266 around the support-turned-resistance line during the initial Asian session on Tuesday. That said, the major currency pair stays inside a nearby descending trend channel formation around 1.1285 by the press time.

In addition to the quote’s downside break of a short-term support line, now resistance, as well as a falling channel formation, bearish MACD signal also keep EUR/USD sellers hopeful.

The current weakness, however, may take a breather around a fortnight-long horizontal zone surrounding 1.1235-30 before directing the EUR/USD bears to the yearly low near 1.1186.

Given the pair’s declines past 1.1186, June 2020 low near 1.1170 and March 2020 peak of 1.1147 will be in focus.

Alternatively, the stated channel’s resistance line around 1.1310 guards short-term advances of the EUR/USD pair.

On a clear break of 1.1310, a descending resistance line from October 28 and 200-SMA, respectively near 1.1385 and 1.1440, will be crucial hurdles to follow for witnessing a change in the current bearish trend.

EUR/USD: Four-hour chart

Trend: Further weakness expected

- AUD/JPY keeps corrective pullback from late August, picks up bids of late.

- Risk-on mood, firmer Aussie data and PBOC RRR cut add to the bullish bias.

- RBA is expected to announce no change in interest rate, bond purchases, MPC Statement will be the key.

- Aussie House Price Index, China trade numbers may offer intermediate moves, virus updates, stimulus news are important too.

AUD/JPY holds onto the week’s start rebound from over three-month lows, firmer around 80.05 during early Tuesday morning in Asia. The risk barometer pair portrays upbeat market sentiment as traders await monetary policy meeting decision of the Reserve Bank of Australia (RBA).

Be it the market’s consolidation of Friday’s risk-aversion or cautious optimism surrounding the South African variant of the coronavirus, not to forget monetary policy easing from the People’s Bank of China (PBOC), AUD/JPY had it all to post the biggest daily jump in two months. Also adding to the pair’s strength were the firmer prints of the second-tier Aussie data and Japan’s push for record fiscal stimulus.

Market sentiment improves at the week’s start even as the US Treasury yields remained firmer. The reason could be linked to the ex-Fed group of central bankers’ readiness to extend easy money policies due to the South African covid strain, dubbed as Omicron. Also positive were the absence of more deaths compared to the rapid increase in the virus variant, as well as global scientists’ hopes of finding a cure to the fresh challenge.

Elsewhere, the PBOC announced RRR cut and propelled multi-billion dollars into the market while Japan’s policymakers are debating the record stimulus to battle the covid-linked economics losses.

On the same lines were the upbeat Australia TD Securities Inflation and ANZ Job Advertisements for November. While the former data rose past 0.2% to 0.3% MoM, the latter rallied beyond 6.2% previous readouts to 7.4%.

Alternatively, Japanese PM Fumio Kishida’s comments suggest that the virus-led lockdowns can return to the nation if the conditions worsen join the Fed rate hike concerns to weigh on the AUD/JPY prices.

Amid these plays, the US 10-year Treasury yields rose over nine basis points (bps) to 1.43%, after Friday’s 13 bps fall, whereas the Wall Street benchmarks also recovered the losses made during the last week.

While risk-on mood underpins the AUD/JPY prices, the cross-currency pair is likely to remain sidelined ahead of the RBA verdict. The Aussie central bank is likely to keep its benchmark rate at 0.10% and the weekly bond purchases of $4.0 billion intact. However, discussion surrounding the bond tapering and Omicron in the RBA Statement will be important to watch for clear direction. Above all, risk catalysts are crucial for the quote traders to follow for fresh impulse.

Read: Reserve Bank of Australia Preview: Market players looking for tightening hints

Technical analysis

A clear upside break of a weekly resistance line enables AUD/JPY buyers to aim for a 10-DMA level surrounding 80.75 but December 01 swing top and five-week-old resistance line near 81.90 will challenge the bulls afterward. Meanwhile, September’s low around 78.85 holds the for fresh downside targeting the yearly bottom surrounding 77.90.

- NZD/USD is consolidating in a risk-on environment.

- The covid fears are abating and focus now turns to yield.

NZD/USD is ending the North American session as the laggard amongst commodity-forex as the Aussie and Cad play catch-up in a risk-on environment pertaining to positive news on the covid-front.

At the time of writing, NZD/USD is trading at 0.6753 between 0.6740 and 0.6764 as the range for Monday. That’s despite US equities, bond yields, oil, CAD, AUD and Bitcoin all higher.

''It’s difficult to attribute the lack of a bounce to anything in particular, but it does seem like the market is fatigued with the NZ good news story, and is less willing to reward currencies heading for higher interest rates,'' analysts at ANZ Bank argued.

The US dollar was firm on the day mostly against safe-haven currencies such as the yen and Swiss franc after reassuring news on the Omicron COVID-19 variant. US Treasury yields climbed and stocks gained after news that initial observations suggested Omicron patients had only mild symptoms, reversing some of Friday's rout in risk-related asset classes and FX.

The coronavirus Omicron variant has now been detected in at least 24 countries around the world, according to the World Health Organization (WHO). However, there is a sentiment that it is not more severe than other variants as of now.

Since the World Health Organization designated the new Covid omicron variant as being “of concern” less than two weeks ago, preliminary results are starting to emerge that are “a bit encouraging,” the White House’s chief medical advisor, Dr. Anthony Fauci, said Sunday.

He is referring to early figures from South Africa that suggest it may not be as bad as initially feared. While Omicron has spread to about one-third of US states as of Sunday, Dr. Anthony Fauci, the top US infectious disease official, told CNN that "thus far it does not look like there's a great degree of severity to it," though he cautioned that it's too early to be certain.

- The British pound weakens against the crude-oil-related Canadian dollar as the GBP/CAD breaks below the 200-hour SMA.

- GBP/CAD Price Forecast: Tilted to the downside, as long as the price remains below the 200-hour SMA.

After failing to break below the 50-day moving average (DMA), on Friday, the GBP/CAD finally broke the former, trading at 1.691625 down 0.46%, during the day at the time of writing. Monday market risk-on mood attributed to positive news from South Africa that showed that the COVID-19 omicron variant, despite being contagious, cases are mild compared to the delta variant.

In the overnight session, the GBP/CAD traded sideways underneath the 50 and the 100-hour simple moving averages (HSMA’s), seesawing around the 200-HSMA. However, as the Wall Street session opened, the cross-currency pair slumped 30-pips, as the USD/CAD pair dropped amid an absent economic docket in Canada, dragging with it the GBP/CAD pair, based in CAD strength.

GBP/CAD Price Forecast: Technical outlook

At press time, the GBP/CAD is trading 30-pips above Friday’s low. The near-term bias is tilted to the downside, as the hourly SMA remains above the spot price. Furthermore, the 50-hour SMA crossed under the 100-hour SMA, implying that the pair could print another leg-down.

In the outcome of further downside, the GBP/CAD first support would be December 3 low at 1.6897. A breach of the latter would expose the November 26 cycle low at 1.6837, followed by the 1.6800 figure.

On the other hand, the first resistance would be the 200-hour SMA at 1.6973. If GBP bulls break that level, the next resistance would be the 50-hour SMA at 1.6986, immediately followed by the 100-hour SMA at 1.6995.

-637744234532699991.png)

- EUR/JPY rallied 0.4% on Monday but was capped at 128.00 by a key down-trend.

- The pair was supported by an upturn in broad risk appetite on more positive Covid-19 news.

- But technicians note that EUR/JPY has formed a descending triangle in recent sessions, which could signal a bearish breakout.

EUR/JPY rallied on Monday to test a key down-trend that has been capping the price action going all the way back to the start of November. The downtrend has been providing resistance close to the 128.00 level and has been capping the price action so far on the session. On the day, the pair is up 0.4%.

EUR/JPY has been suppressed in recent sessions by concerns about the implications that the emergence of Omicron will have on the global economic outlook. This compounded concerns about the short-term economic outlook for the Eurozone, which is already suffering from an unprecedented surge in Covid-19 (delta) infections which has seen countries move to reimpose various lockdown/health restrictions.

But the tone of the news since the weekend has been more optimistic on Omicron. As more data/anecdotal evidence comes from South Africa, momentum is building behind the idea that the new variant is much milder than past variants such as delta. Over the weekend, top US infectious disease export Anthony Fauci said on CNN that it doesn’t look like Omicron has a “great degree of severity”.

The shift in the tone of news has helped support a broad-based improvement in risk appetite on Monday that is helping global equity and commodity markets and risk-sensitive currencies. By the same token, demand for safe-haven currencies like the yen has been undermined, hence why EUR/JPY has been able to recover.

Should the tone of news continue to improve, the pair might be able to break to the north of its recent downtrend, which could open the door to a run towards key resistance in the 128.80 area and then above that in the 129.50 area. However, technicians would note that EUR/JPY has formed a descending triangle in recent sessions, with support coming in in the 127.50 area. These patterns are often a sign that a bearish break is upcoming. A break below the key 127.50 area could open the door to an extension of losses all the way to the next significant area of support around 125.10.

- AUD/USD is correcting higher as risk-on kicks in.

- The RBA meeting will be a key event for traders.

After what has been a waterfall sell-off in the commodities sphere pertaining to central bank divergences and the latest coronavirus variant seeing its way to all corners of the globe, AUD is finally putting a floor down around 0.70 the figure and making its way back up the leaderboard. At the time of writing, AUD/USD is 0.63% higher towards the close on Wall Street after climbing from a low of 0.6998 and reaching a high of 0.7054 on the day.

Risk is on which means commodities are bouncing back along with US stocks and yields which have been supporting the greenback and commodity-FX. Additionally, the People’s Bank of China has cut the reserve requirement ratio for banks by 50bps.

''That should provide a welcome 1.2 trillion yuan (USD188bn) boost in liquidity for an economy that has been slowing as the property sector continues to be of concern,'' analysts at ANZ Bank said. While the CNH weakened vs the greenback, the Aussie managed to rally on the news as it improved risk sentiment around global markets for AUD trades as a proxy.

RBA in focus

However, the main focus for the day ahead will be with the Reserve bank of Australia. Considering that net AUD short positions lurched higher again last week and are elevated reflecting the dovish tone of the RBA, the risk is if there will be any firm hints towards next February's meeting as the start of the wind-down of its bond-buying programme. Westpac, however, said that the RBA ''is unlikely to provide any significantly new guidance.''

''The Governor’s decision statement will be scrutinised for any assessments of the latest round of economic data, including the Q3 GDP, and the shifting external environment, particularly with respect to inflation in developed economies. Governor Lowe continues to emphasise the Board’s patience with respect to the timing of the initial rate increase.'' Westpac remains comfortable with our view that the bank’s first move will come in February 2023 although markets are anxious for a mid-2022 move while the Governor himself is still open to waiting till 2024.

- The S&P 500 has built on earlier gains and is eyeing the 4600 level.

- The Nasdaq 100, though still lagging the S&P 500 and Dow, has seen an impressive recovery from lows.

US equities have continued to recover in the second half of the US session, with the recovery now more broad-based with tech and growth stocks joining the party despite continued elevation in yields. The S&P 500 index is now up by nearly 1.5% and is eyeing a test of the 4600 level. The Dow continues to lead and is now up closer to 2.0%. The Nasdaq 100, meanwhile, is up about 1.0%, meaning it has reversed more than 1.8% from prior session lows.

There haven't been any fresh fundamental catalysts to drive the extension of gains in the second half of the US session. Market participants continue to cite an easing of Omicron fears (cases in South Africa seem mild thus far) as supportive of the equity complex. As for the modest outperformance of value stocks versus growth on Monday amid sharp upside in US bond yields, market commentators have cited expectations that the Fed will announce an acceleration of its QE tapering at next week’s meeting, which should open the door to a swifter start to rate hikes.

Brian Pietrangelo, managing director of investment strategy at Key Private Bank explained to Reuters that there have been six periods since the 1990s marked by rising rates when value did better than growth. “Looking at those six different eras, generally speaking, value-oriented stocks performed better” he continued.

Some cited Monday’s price action as evidence that the Santa rally was not yet dead. Over the weekend, top US infectious disease export Anthony Fauci said on CNN that it doesn’t look like Omicron has a “great degree of severity”. Traders also cited surprise 50bps reserve ratio requirement cut by the PBoC that will release as much as CNY 1.2T from the Chinese banking system as supportive to the global mood.

But analysts caution that high inflation in the US has removed a key pillar of support for equity markets; the idea of the Fed put. "By severely limiting the FOMC's ability to respond to downside risks posed by Omicron, inflation has effectively destroyed the Fed put” said analysts Jefferies. Ahead of this Friday’s key US Consumer Price Inflation report, analysts at the bank said that inflation is “now the dominant driver of not only rates but all risk assets”.

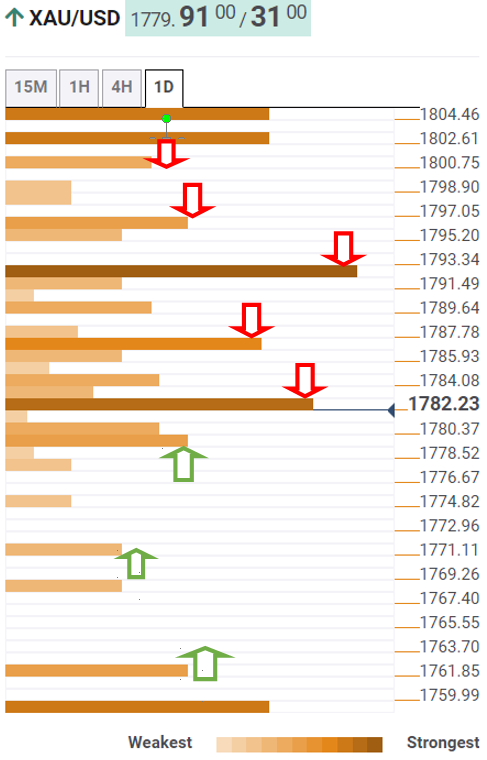

- Gold slides down some 0.25% amid an improved market sentiment during the day.

- The Federal Reserve’s recent hawkish tone impacted the prospects of the non-yielding metal, as US T-bond yields rise, on hiking rates expectations.

- XAU/USD Price Forecast: In the near term is tilted to the upside, though a break of $1,800, could open the door to $1,834.

Gold (XAU/USD) edges lower during the New York session, trading at $1,779, down some 0.25 %, at the time of writing. The market sentiment is positive due to good news regarding the omicron variant; even though it is highly transmissible, cases are mild, thus hurting safe-haven non-yielding assets, like precious metals.

Additionally, the sudden shift of the Federal Reserve led by Chair Jerome Powell, who said that inflation is no longer “transitory” and favoring a fast bond-taper, boosted the greenback. That alongside higher US T-bond yields with the 10-year benchmark note rate rising almost ten basis points, up to 1.436%, lifts the US dollar against the yellow-metal.

During the day, XAU/USD recovered some of Friday’s losses. However, it has failed to break above the high of the previous-mentioned day at $1,786, which confluences with the 200-hour simple moving average (HSMA), which acted as dynamic resistance, sending gold sliding towards $1,777. Nevertheless, upside risks are mounting lately, as the non-yielding metal broke the 50 and the 100-HSMA, as gold bulls threaten to re-test the $1,800 figure.

XAU/USD Price Forecast: Technical outlook

In the last hour, gold seesawed around the $1,779-87 area, which coincided with the 100 and the 200-hour simple moving averages (HSMA’s), respectively. It looks like this consolidation phase could break to the upside, even though the 200-HSMA is above the spot price, but it is worth noting that XAU/USD broke above the 50 and the 100-HSMA in the last couple of hours.

In the outcome of breaking above the range, the first resistance would be the Monday R1 daily pivot at $1,792. A breach of the latter would expose $1,800, but it will find on its way up, the R2 daily pivot at $1,798.60

On the flip side, a break below the bottom of the range would expose the S1 daily pivot at $1,771, followed by the December 3 swing low at $1,766 and then the December 2 low at $1,762.

-637744192319778984.png)

Reserve Bank of New Zealand Deputy Governor Geoff Bascand said on Monday that while longer-term inflation expectations in the country remain well anchored, short-term inflation expectations have increased.

Additional Remarks:

"The RBNZ will take considered steps for now."

"Predicts unemployment rate to drift up to about 4%."

"More confident that the labour market is tight and that will build inflation pressures."

"Central Bankers must continue to look forward to guard against the unpredictable."

"Confident our financial stability approach has strengthened, the foundations are more solid."

"RBNZ should not be held responsible for the housing market."

"RBNZ's job is to limit financial stability risks and keep overall inflation under control."

"RBNZ can lean against house prices by increasing cost & restricting the availability of credit."

Market Reaction

The kiwi has not seen any reaction to the latest comments from Bascand, which do not seem to have altered RBNZ tightening expectations.

What you need to know on Tuesday, December 7:

The dollar ends Monday mixed as speculative interest aims to digest the latest developments. On Friday, the US published the Nonfarm Payrolls report, which showed the country added just 210K new jobs in November, missing the market’s expectations, and putting at doubt further aggressive tapering in the US.

Generally speaking, the greenback followed the lead of US government bond yields. The 10-year Treasury note started the day yielding 1.37%, later jumping to 1.44% in the American afternoon.

Regarding the Omicron coronavirus variant, reports hint at community transmission in several countries, although, at the same time, there are no deaths related to the variant so far, which lift hopes of a milder illness that will prevent lockdowns and restrictions, and hence, avoid an economic slowdown.

The EUR was among the weakest dollar’s rivals, down to 1.1265 vs the greenback. Other high-yielding currencies posted modest gains, with commodity-linked currencies gaining the most. The JPY and the CHF lost some ground, although all major pairs held within familiar levels. A scarce macroeconomic calendar helped to maintain volatility low.

Gold edged marginally lower, with spot ending the day at $1,778 a troy ounce. Crude oil prices, on the other hand, advanced alongside equities with WTI settling at $69.70 a barrel.

Dogecoin price correction slows down as DOGE bears book profits

Like this article? Help us with some feedback by answering this survey:

- USD/CAD is pulling back in a strong daily move that leaves the outlook consolidative.

- Risk appetite has returned to markets as the Covid-19 variant fears abate.

- Commodity currencies are bid and the CAD is supported on higher oil.

USD/CAD is sliding as risk sentiment improves as the VIX falls into more average levels in the 27s, US stocks on Wall Street rally and commodities get a lift from good news on the Covid-19 omicron variant front. At the time of writing, USD/CAD is trading down around 0.60% in the late New York session as commodity currencies rally towards the finish line.

Oil is supporting the bid in CAD with West Texas Intermediate crude last seen up US$2.06 to US$69.13 per barrel spot. Talks to revive the 2015 nuclear deal with Iran are said to be floundering which is helping to support the oil price with fewer barrels expected to flood the market in the absence of Iranian crude oil. At the time of writing, USD/CAD is printing fresh lows of 1.2756 as the pair extended its losses from 1.2842, the high of the day.

The coronavirus Omicron variant has now been detected in at least 24 countries around the world, according to the World Health Organization (WHO). However, there is a sentiment that it is not more severe than other variants as of now.

Since the World Health Organization designated the new Covid omicron variant as being “of concern” less than two weeks ago, preliminary results are starting to emerge that are “a bit encouraging,” the White House’s chief medical advisor, Dr. Anthony Fauci, said Sunday.

He is referring to early figures from South Africa that suggest it may not be as bad as initially feared. While Omicron has spread to about one-third of US states as of Sunday, Dr. Anthony Fauci, the top US infectious disease official, told CNN that "thus far it does not look like there's a great degree of severity to it," though he cautioned that it's too early to be certain.

Iran nuclear deal are also not going well

Meanwhile, indirect talks to renew the 2015 Iran nuclear deal are also not going well, which is boosting the price of crude oil at the same time that fears over new covid lockdowns are abating. US Secretary of State Antony Blinken said Iran's government does not seem to be serious about renewing the accord, according to a Reuters report.

This is putting off the prospect of the return of the country's oil exports to the international market, Reuters explained. In other related news, Saudi Arabia raised its selling price to US and Asian customers on the weekend by US$0.60 per barrel.

Looking ahead, the Bank of Canada will be the focus for forex traders. Analysts at TD Securities are looking for a relatively quiet BoC meeting, with limited scope for a meaningful change in tone.

''The BoC will maintain that the outlook is evolving as expected and that inflation strength is largely transitory,'' the analysts argued. 'We do not expect any change to guidance, as the statement balances rising uncertainty over COVID & supply chain disruptions from BC floods against labour market strength.''

The Reserve Bank of Australia is having a monetary policy meeting and will announce the resulting decision on Tuesday, December 7 at 03:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of seven major banks regarding the upcoming central bank's decision. Policymakers are expected to, hold their fire and keep the current policy on hold after abandoning the yield-curve control in November.

ING

“We do not expect the RBA to change policy at this meeting. The RBA has been back-pedalling a bit from its insistence that rates will not rise until 2024, and it at least now acknowledges that a 2023 hike is a possibility. But there has been nothing recently to require them to make further shifts or to stake out a new approach to asset purchases when the current policy is reviewed before mid-February. More relevant will be the 3Q21 house price data released on the same day as the rate decision. Annual house price inflation in 2Q was 16.8% year-on-year. That is high by any standard, so any additional increase will put pressure on the central bank to respond, though until the labour market and wages data fall into line, we believe the RBA will stick to the current playbook.”

Westpac

“The RBA is expected to keep policy settings unchanged at its last meeting of 2021. As such, the focus will again be on the wording of the Governor’s decision statement, particularly any assessments of the latest round of economic data, including the Q3 national accounts, and the shifting external environment, particularly with respect to price inflation in developed economies. The Bank’s following meeting, on February 1 next year, will likely see more meaningful shifts with a scheduled review of the bond-buying program expected to see purchases scaled back from AUD4 B/week to AUD2 B/week prior to a wind-down of the program by mid-May. The Governor continues to emphasise the Board’s patience with respect to the timing of the initial rate increase.”

Standard Chartered

“We do not expect much new from the RBA given the slew of major changes announced at the last meeting. Our current forecast is for the RBA to start normalising in Q4-2022. At 0.1%, the policy rate is excessively accommodative for an economy that may return to trend by mid-2022. Moreover, both growth and inflation data have surprised to the upside, with the latest Q3 GDP contraction much milder than expected. On balance, we do not expect the RBA to change its tune again so quickly; if anything, it may stress the Board’s patience, bringing up the example of Omicron as an uncertainty.”

TDS

“We don’t expect the RBA to announce any policy changes, retaining the target rate at 0.10%, the rate on ES Balances at 0% and QE continuing at a weekly rate of AUD4 B/wk through to Feb. While the Omicron variant poses downside economic risks, expect the Bank to strike an upbeat note on the post lockdown recovery.”

BBH

“Reserve Bank of Australia is expected to keep policy on hold and maintain its dovish tone. At the last meeting, the bank abandoned Yield Curve Control but maintained its dovish tone. Rates were kept steady at 0.10% and QE was maintained at the current weekly pace of AUD4 B until the planned review at the next meeting on February 1. However, the bank pushed back against the market’s aggressive tightening expectations by stressing again that it was unlikely to hike rates until 2024 at the earliest. Yet the swaps market is still pricing in nearly 75 bp of tightening over the next twelve months. We expect it to push back again this week, citing omicron as a major factor to remain cautious.”

Citibank

“RBA Board Meeting: Citi cash rate forecast: no change, Previous: no change. We do not expect RBA to make any policy shifts in its final meeting of 2021. This means the cash rate will remain at 0.1%, and the Board will persist with purchasing AUD4 B worth of bonds per week, until its next review in February 2022.”

SocGen

“We expect the RBA to maintain its current monetary policy settings, maintaining a cash rate target of 0.10% and continuing the government bond purchase programme at a rate of AUD4 B a week until at least mid-February 2022. As market participants seem to agree that there could be further tapering in February of next year, they are likely to focus on whether the RBA maintains its still-dovish forward guidance or not. We now suspect that the policymakers want to keep the timing of the first-rate hike a little vague. We do not think that there will be any allusions to a change in forward guidance and expect the concluding paragraph of the policy statement to be much the same as it was in November. We see the rising uncertainty on the growth and inflation outlook due to the emergence of COVID-19 variant of concern, Omicron, as the main reason why the RBA is likely to maintain a cautious (and even vague) approach on its policy actions in the future.”

See – Reserve Bank of Australia Preview: Market players looking for tightening hints

- USD/JPY is trading at the highs of the day as the US dollar catches a bid.

- Covid fears are abating and inflationary pressures are now the focus.

- US CPI will be a key data event this week ahead of the Fed later this month.

The US dollar and yields are firmer as the new York session progresses into the last third of the day. The DXY, an index that measures the performance of the greenback vs. a select few major currency rivals is now 0.19% higher on the day.

The US 10-year yield is also on the bid, rallying in the last two hours of the session and higher by over 6.9% to 1.4365 at the time of writing. US stocks are also flying higher with the S&P 500 up 1.51% on the day so far. The Dow Jones Industrial Average climbed 1.9% to 35,231.31 and the Nasdaq Composite 0.6% higher in trading midday on Monday. Utilities, real estate and financials led gainers, with all sectors in the green.

As a consequence, USD/JPY is 0.68% higher printing 113.52 at the time of writing, a touch below the highs of the day of 113.55 after moving up from a low of 112.82 earlier in the day. Early indications show the severity of omicron, the newest COVID-19 strain that contributed to a recent selloff, is likely to be milder than previously anticipated. The safe-haven currencies are pressured on the back of the improved risk sentiment and the greenback is catching the carry trade flows as investors search for yield.

Omicron has now been detected in at least 24 countries around the world, according to the World Health Organization (WHO). While Omicron has spread to about one-third of US states as of Sunday, Dr. Anthony Fauci, the top US infectious disease official, told CNN that "thus far it does not look like there's a great degree of severity to it," though he cautioned that it's too early to be certain.

US CPI will be critical this week

Eyes will now turn to consumer prices in the United States, which are projected to show the greatest annual increase in decades. The divergence between the Federal Reserve and other central banks is fuelling the bid in the greenback. risks of persistent inflation have forced the Fed to rethink its outlook and remove the transitory language from its communications to the outside world. The threat of longer-lasting inflation is putting additional pressure on the Federal Reserve to tighten policy more quickly.

On December 10, US Consumer Price Index will be released and analysts at TD Securities explained that they expect inflation to slow significantly as fiscal stimulus fades and supply constraints ease. 'We don't expect the data to be validating in the near term,'' they said. ''The CPI likely surged in Nov, with a drop in oil coming too late to avert another large gain in gasoline and core prices boosted by rapidly rising used vehicle prices and post-Delta strengthening in airfares and lodging.''

- The Swiss franc weakens as market sentiment improves, boosting riskier assets.

- High US T-bond yields boost the greenback against its safe-haven counterparts like the CHF and the JPY.

- USD/CHF Price Forecast: Has an upward bias, as all the hourly SMA reside below the spot price.

The USD/CHF is surging during the New York session, up 1%, trading at 0.9264 at the time of writing. Positive market sentiment amid reports that the COVID-19 omicron variant cases are mild keeps market participants looking for riskier assets in detriment to safe-haven currencies, like the Swiss franc and the Japanese yen.Additionally, higher US T-bond yields underpin the buck, with the US Dollar Index measuring the greenback’s performance against a basket of six rivals, advancing 0.23%, at 96.34.

An absent economic docket in the US and the lack of Fed speak as the US central bank is in its blackout period ahead of the December FOMC meeting maintain investors focused on the release of the Consumer Price Index (CPI) on Friday. That in part, as Fed Chief Powell commented in the last week that the word “transitory” needs to be removed when talking about inflation, triggering a spike on US bond yields and to the US Dollar Index, which rose near the 97.00 handle on the US central bank Chair words.

Therefore, the USD/CHF pair would lean in US macroeconomic data and market sentiment dynamics.

USD/CHF Price Forecast: Technical outlook.

At press time in the 1-hour chart, the USD/CHF pair has an upward bias. On its way north, the pair has broken the resistance-daily pivot levels, with the R3 daily pivot previous resistance-turned-support at 0.9261.

According to price action, accumulation occurred around the 0.9213-0.9223 area before breaking higher. That area would be strong support in the outcome of USD/CHF bears trying to push prices lower. Nevertheless, the 1-hour simple moving averages (HSMA’s) reside below the spot price, confirming the bullish bias, with the 50-HSMA crossing over the 100-HSMA.

In the outcome of extending the upward move, the first resistance would be the 0.9300 figure. The breach of the latter would expose the November 29 high at 0.9359, followed by the 0.9400 psychological level.

-637744130610862562.png)

- GBP/JPY saw a solid bounce on Monday in tandem with a broad upturn in risk appetite.

- The pair bounced at the key 149.00 area and a more dovish sounding BoE may keep the gains capped.

- Technicians will be eyeing a key area of resistance in the mid-152.00s.

GBP/JPY has seen a solid recovery on Monday from the multi-month lows its posted last Friday under 149.00 and is currently trading close to session highs in the 150.40s, up about 0.8% on the session. The 149.00 are has been a key zone of support over the last few months. The pair has been choppy in recent weeks, falling sharply at the end of November as the news of the emergence of the new Omicron Covid-19 variant dented global risk appetite. Risk-on/risk-off has been the main driver of the pair since then and this remains the case on Monday.

Stocks and other risk assets like crude oil are higher amid hopes that the Omicron variant will prove much milder than previous Covid-19 variants like delta and this is weighing on safe-haven currencies like the yen. If fears about the new variant and any disruption it may cause to the global economic recovery do continue to ebb, it wouldn’t be surprising to see risk assets continue to press higher and GBP/JPY continues to recover as a result. Near-term bulls may target a retest of the key mid-152.00s area which has acted as both resistance and support on numerous occasions in recent months.

One interesting theme in FX markets will be whether the theme of central bank divergence will return as a major driver of price action. Prior to the re-emergence of risk-off at the end of November, a key driver of GBP/JPY has been shifts in BoE monetary tightening expectations and associated moves in UK bond yields. The rhetoric from BoE members in recent days has lent more dovish. BoE Monetary Policy Committee member Michael Saunders, who voted in favour of a 15bps rate hike back in November, said he wanted more information about the impact of the new Omicron coronavirus variant before deciding how to vote this month. The message from BoE Deputy Governor Ben Broadbent on Monday was similar.

As a result, a 15bps rate hike this month from the bank has now been nearly completely priced out by the market. As a result, in the run-up to next Thursday's BoE meeting, the 152.50 area may well act as a ceiling for the price action. Over the short-medium term, it seems likely that a 149.00-152.50ish range may prevail.

-637744127296615769.png)

- EUR/USD bears are taking on the bullish commitments as the greenback strengths.

- Coronavirus risk is abating and that is translating to a risk-on environment in markets.

- The euro is tracking the yen and CHF which are both being offloaded as flows move back into risk.

EUR/USD is back under pressure in the mid-New York session as bears fade the corrective attempts on the day. The pair trades near 1.1280 at the time of writing and is down some 0.27%. The single currency fell from a high of 1.1313 to print a session low earlier on Monday of 1.1266.

The US dollar and commodity currencies are fairing the best reassuring news on the Omicron COVID-19 variant. At the start of the week, Bloomberg reported that ''initial data from a major hospital complex in South Africa’s omicron epicentre show that while Covid case numbers have surged, patients need less medical intervention.''

Meanwhile, Omicron has now been detected in at least 24 countries around the world, according to the World Health Organization (WHO). While Omicron has spread to about one-third of US states as of Sunday, Dr. Anthony Fauci, the top US infectious disease official, told CNN that "thus far it does not look like there's a great degree of severity to it," though he cautioned that it's too early to be certain.

Nevertheless, the sentiment is more positive which is giving the US dollar a boost as markets stablise and risk currencies, such as the yen and Swiss franc bare the brunt. The euro is also pressured having picked up a bid throughout last week's turmoil which is being unwound.

The focus now shifts to consumer prices in the United States, which are projected to show the greatest annual increase in decades, putting additional pressure on the Federal Reserve to tighten policy more quickly. On December 10, US Consumer Price Index will be released and analysts at TD Securities explained that they expect inflation to slow significantly as fiscal stimulus fades and supply constraints ease. '

'We don't expect the data to be validating in the near term,'' they said. ''The CPI likely surged in Nov, with a drop in oil coming too late to avert another large gain in gasoline and core prices boosted by rapidly rising used vehicle prices and post-Delta strengthening in airfares and lodging.''

In contrast, Euro zone inflation is still seen as temporary and may have already peaked, soon beginning a decline that will continue through next year, European Central Bank President Christine Lagarde said on Friday.

"I see an inflation profile that looks like a hump," Lagarde said in an interview at the Reuters Next conference. "And a hump eventually declines." "We are firmly of the view, and I'm confident, that inflation will decline in 2022," she said. Lagarde's comments came despite the eurozone hitting a record-high 4.9% last month, more than twice the ECB's 2% target. Other indicators are implying that it will only fall below that mark in late 2022, at the earliest.

This month will hold both the Federal Reserve and the European Central Bank meetings. The Fed has been clear that it is about to discuss a faster pace of tapering due to the risk of persistent inflation risks. Meanwhile, high inflation will likely complicate the ECB's crucial Dec. 16 policy meeting. Policymakers will almost certainly end a 1.85 trillion euro emergency stimulus scheme but also will consider ramping up other support measures to fill the void.

EUR/USD technical analysis

The price at this juncture would be expected to hold as this is a firm area of support. However, following a breakdown of consolidation, the bears will be seeking a move towards the 1.1250s.

Austrian central bank governor and European Central Bank governing council member Robert Holzmann said on Monday that it was very unlikely that inflation in the Eurozone would return to or fall below 2.0% in 2022, according to Reuters citing Handelsblatt. Holzmann added that inflation is set to reach its peak sometime around the turn of the year.

On rate hikes, Holzmann said that the ECB should keep open the option of raising interest rates prior to the end of its net bond purchases. "In certain situations," he said, "it may make sense to increase interest rates, but still provide the markets with liquidity through bond purchases."

On the outlook for the economy, Holzmann sees uncertainty as elevated right now due to the new emergence of the new Omicron Covid-19 variant. "In the next two to three weeks," he said, "we may already know more what it means from a medical point of view... But I remain optimistic that we are only seeing a dent in the economic recovery and not a broad downturn."

Market Reaction

The euro has not seen any reaction to the latest comments from ECB's Holzmann. The main theme regarding the ECB right now is what the bank will opt to do with its QE programme once the PEPP expires in March next year. ECB officials have signaled that an extension of the PEPP is not on the cards, despite a recent worsening of the Covid-19 (delta variant) infection rate in the Eurozone and the emergence of Omicron.

- The British pound is up but has failed to capitalize an attempt towards 1.3300 amid a risk-on market.

- BoE’s Broadbent is unclear how he will vote in December’s meeting.

- GBP/USD Price Forecast: In the short-term, to the upside, but GBP bulls need to reclaim 1.3264.

The British pound continues advancing during the New York session, up some 0.12%, trading at 1.3255 at press time. Market mood has improved throughout the weekend, as data from South Africa points out that the omicron variant is more contagious than alpha and delta; nevertheless, the variant cases have been relatively mild.

In the European session, Bank of England’s (BoE) Governor Ben Broadbent said that the tight labor market will add pressure on inflation and expects it to “comfortably exceed” 5% in April of 2022. He further said that he did not know he would vote to raise rates in December but made it clear that UK’s central bank forecasts showed a need for higher rates.

Despite the aforementioned, money market futures have scaled back the possibility for a BoE’s rate hike in December’s meeting, blamed on omicron-related uncertainty risks. Contrarily, in the US, investors are expecting at least two rate hikes by 2022, once the bond-taper process is completed by March of the same year.

In the last week, the market witnessed a change of Fed Chief Jerome Powell’s neutral-dovish stance towards a hawkish one when he said that he would favor a faster QE’s reduction amid “removing” the word “transitory” to inflation.

Apart from this, the UK economic docket featured the Construction PMI for November, improving to 55.5 from 54.6 In the previous month. On the US front, an absent economic docket, and Fed’s blackout, would keep traders focused on the Consumer Price Index (CPI), which will be unveiled on Friday.

GBP/USD Price Forecast: Technical outlook

The GBP/USD dipped to 1.3225 amid the London fix in the last couple of hours, followed by a bounce above the daily central pivot at 1.3249. The pair is approaching strong resistance at the 50-hour simple moving average (HSMA) at 1.3264, which, if broken, would give way for GBP bulls as they aim towards the 100-HSMA at 1.3282. Additionally, the Relative Strength Index (RSI) points upward at 51.50, meaning that GBP still have the upper hand in the short term, unless they fail to reclaim the 100-HSMA

On the flip side, if USD bulls hold their ground against pound ones, the first support would be 1.3208, which, once broken, would expose the year-to-date low just 15 pips below of it at 1.3194.

-637744099147397366.png)

- EUR/GBP has been on the back foot for most of Monday’s session, perhaps weighed by poor Eurozone data.

- The pair has dropped back from close to 0.8550 to current levels just above 0.8500.

- Technical selling ahead of the 200DMA has likely also played a part, with the key downside support the 50DMA.

EUR/GBP has spent most of Monday’s session gradually ebbing lower and currently trades around 0.8510, down from Asia Pacific session highs close to 0.8550. The selling pressure isn't too surprising from a technical standpoint given the proximity of the pair’s 200-day moving average at 0.8506. The 200DMA has been a key level of resistance over the last few months. To the downside, the 0.8500 level is for now offering support but, below that, the key support that traders will be keeping an eye on is the 50DMA at 0.8487.

On the day, EUR/GBP trades lower by about 0.4% at present. Its underperformance is probably mostly technical, though poor Eurozone data released early during Monday’s European session probably hasn’t helped. German Factory Orders saw a massive 6.9% MoM decline versus expectations for a much more modest decline of 0.5%. Economists framed the data as not as bad as it seemed, however, as it pointed to an uptick in actual production in the months ahead. Elsewhere, Eurozone Sentix Investor Confidence took a bigger knock than expected in December, dropping to 13.5 from 18.3 last month, its lowest level since April.

Elsewhere, recent rhetoric from BoE members has seen markets almost completely price out any risk of a 15bps rate hike from the bank later in the month. The implied yield on the December 2021 three-month sterling LIBOR future currently sits at 12.5bps (the current BoE bank rate is 10bps). BoE Monetary Policy Committee member Michael Saunders, who voted in favour of a 15bps rate hike back in November, said he wanted more information about the impact of the new Omicron coronavirus variant before deciding how to vote this month. The message from BoE Deputy Governor Ben Broadbent on Monday was similar.

In terms of the main factors for traders to keep an eye on for the rest of the week, there will be a few ECB policymakers speaking on Wednesday and Friday. In the UK, meanwhile, the main event of the week will be the release of monthly GDP growth and economic activity numbers on Friday. Until then, any incoming news on Omicron that might swing the BoE back in favour of hiking next Thursday would be of note, although the bar for this is likely quite high.

- The white-metal drops as the US 10-year bond yield rise nearly six basis points, underpinning the greenback.

- The US Dollar Index, which measures the buck’s performance against six rivals, advances almost 0.25%.

- XAG/USD 1-hour chart has a downward bias, as shown by hourly simple moving averages (SMA’s) residing above the price.

Silver (XAG/USD) retreats from Friday’s gains, slumps almost 1%, trading at $22.22 during the New York session at the time of writing. Safe-haven assets like silver extend their losses amid reports that the COVID.19 omicron variant, although contagious, seems to cause mild symptoms, propelling equity prices higher.

Additionally, US bond yields, which correlates inversely with precious metals prices, are rising, a headwind for non-yielding assets. The US 10-year Treasury yield advances five basis points, up to 1.397%, underpins the greenback, with the US Dollar Index rising 0.23%, at 96.414.

In the overnight session, the white metal peaked around the 1-hour 100-simple moving average (SMA) at $22.58, then throughout the day extended its losses, dropping as low as $22.10, rebounding up to the current price.

XAG/USD Price Forecast: Technical outlook

Silver (XAG/USD) in the 1-hour chart depicts a bearish bias, attributed to the 1-hour simple moving averages (SMA’s) residing above the spot price. Also, the confluence of the 50-SMA and the daily central pivot point at $22.37, unsuccessfully tested three times, appears to be a strong selling level for XAG/USD bears.

In the outcome of extending further down, the first support would be the S1 daily pivot at $22.16. A break below that level would expose crucial support levels. Friday’s low at $22.01, followed by S2 daily pivot at $21.81.

On the flip side, the confluence of December 3 and the 100-SMA around the $22.51-56 would be the first resistance, followed by the R1 pivot at $22.72, followed by the R2 daily pivot at $22.92.

-637744054592240396.png)

- The S&P 500 has bounced over 1.0% higher on Monday driven by gains in cyclical stocks.

- Growth names have performed comparatively worse, with the Nasdaq up less than 0.5%.

The S&P 500 has seen a decent bounce this Monday and currently trades higher by over 1.0% on the session around the 4580 level, as investors continue to buy the dip in light of the index testing its 21-day moving average at 4525 last week. Economically sensitive “cyclical” stocks outperformed on Monday, with the S&P 500 value index rallying 1.8%. That compares to a comparatively downbeat performance for the US “growth” sector, which rose just 0.1%.

Value stocks were bid higher as traders bet that the US economy would perform better than feared in 2022 as the tone of news regarding Omicron improved over the weekend. There was further commentary from South African health officials pointing out that Omicron infection appears to be associated with comparatively mild symptoms versus past variants. Value stocks also performed better as a rise in US bond yields undermined the appeal of duration-sensitive growth stocks. Growth stock valuation is disproportionately based on expectations for future earnings growth rather than present earnings, leaving valuations more vulnerable to a rise in opportunity cost (i.e. in bond yields).

As a result of the above divergence, the Dow has put in a strong performance, gaining over 1.5% to reclaim the 35K level, while the Nasdaq 100 is only up about 0.3% and just above 15.7K. Equity markets look set to remain sensitive to pandemic-related headlines in the run-up to the new year. As infection rates continue to pick up in the US to match what has happened in Europe over the last few months, a trend that is likely to also be accelerated by the spread of the highly transmissible Omicron variant, traders ought to be on watch for the risk of potential sporadic lockdown reimpositions across the US. This presents a downside risk to growth in particularly Q1 2022.

US macro data will also be worth keeping an eye on this week. The most interesting data points will be October JOLTs job opening on Wednesday, weekly jobless claims on Thursday and November Consumer Price Inflation and preliminary December University of Michigan Consumer Sentiment data on Friday. The Fed is now in blackout ahead of the 15 December monetary policy announcement, but members will be keeping a close eye on the inflation data in particular.

Data released on Friday, showed the NFP rose by 210K below the 550K expected. According to analysts from Danske Bank, the weak jobs report is a sign of supply side problems, not lack of demand. They see the Fed increasing the tapering pace next week.

Key Quotes:

“In our view, employment growth is unlikely to be much stronger until we see more people returning back to the labour force. Labour demand remains high with still many job openings (especially within "leisure & hospitality", many businesses reporting hiring plans, consumers thinking it is easy to find a job and wage growth is still running at a high level.”

“The Federal Reserve is leaning more and more into the story that the labour market is hotter than what they thought just a few months back amid still high inflation. That is the reason why the Fed is turning gradually more and more hawkish. The most recent shift is Fed Chair Jerome Powell's signal that the Fed is considering hiking the tapering pace.”

“We recently changed our Fed call now expecting an increase of the tapering pace to USD25bn per month (from USD15bn per month currently) so that QE bond buying is set to end in April. We expect three 25bp rate hikes in 2022 (in June, in September and in December). We still see case for the Fed tightening sooner and faster than our base case.”

Despite the recent decline in AUD/USD, analysts at MUFG Bank, consider there is still scope for some further downside over the short-term. The see the Reserve Bank of Australia (RBA) is set to remain dovish.

Key Quotes:

“While we believe the RBA will have to hike sooner than the RBA’s current guidance of 2024, we doubt there is a compelling need to shift the guidance at this stage.”

“The market remains priced for around three rate hikes in 2022 and we do not expect the RBA outcome next week to be consistent with that. As well as mixed labour market conditions and limited evidence of wage growth picking up, Australia’s terms of trade has taken a negative hit with iron ore and coal prices both taking a tumble. With the RBA set to persist with QE until the February review and while the RBA could end QE at that stage, the contrast with the Fed over the coming months will keep downward pressure on AUD/USD.”

“AUD/USD is now down 8.25% year-to-date and at these levels is beginning to look stretched. However, with such a stark monetary stance, there is scope for some further downside over the short-term.”

- Mexican peso holds onto recent gains versus the US dollar.

- USD/MXN consolidating with a bearish bias, more downside under 21.30.

- The primary trend remains bullish, next strong support at 20.90.

The USD/MXN is falling again on Monday but it remains above the 21.00 zone, but is under the 21.30 relevant technical support. It is hovering around 21.20, so another test at 21.15 should not be ruled out for the coming sessions.

A slide under 21.15 would expose two strong support levels: 21.05 and 20.90 that are likely to hold, favoring a rebound to 21.30. A close under 20.90 would be a positive technical development for the Mexican peso that could drop further to test the uptrend line at 20.50.

On the upside, a firm recovery above 21.45 would alleviate the negative pressure. No signs of a resumption of the primary uptrend are seen at the moment. The USD/MXN continues to from a consolidation range likely between 21.15 and 21.65. A break above 21.70, would expose the 22.00 zone.

USD/MXN daily chart

-637744025644915785.png)

- EUR/JPY hold in range, with key levels at 127.50 and 128.00.

- Dominant trend points to the downside, but some positive sign for the euro emerge.

- Gains below 129.00 should be seen as corrective.

The EUR/JPY is rising on Monday, trading in a familiar range. The main trend is to the downside. In the very short-term the consolidation could continue as technical indicators are moving away from oversold levels, still not showing much strength on the upside.

The key level to watch on the downside is 127.50. A daily close below should point to more losses, targeting initially 127.00 and then 126.70; a move in line with the dominant trend. The yen still looks set to drops further. The weekly chart shows the euro has fallen over the last seven weeks, and the RSI is starting to turn to the upside, a positive sign for the common currency.

On the upside a recovery above 128.00 would alleviate the bearish pressure. The up move could extend to 129.00; even a recovery toward the mentioned level should be seen as a correction. A daily close above 130.00 would suggest the euro has probable established an interim bottom.

EUR/JPY daily chart

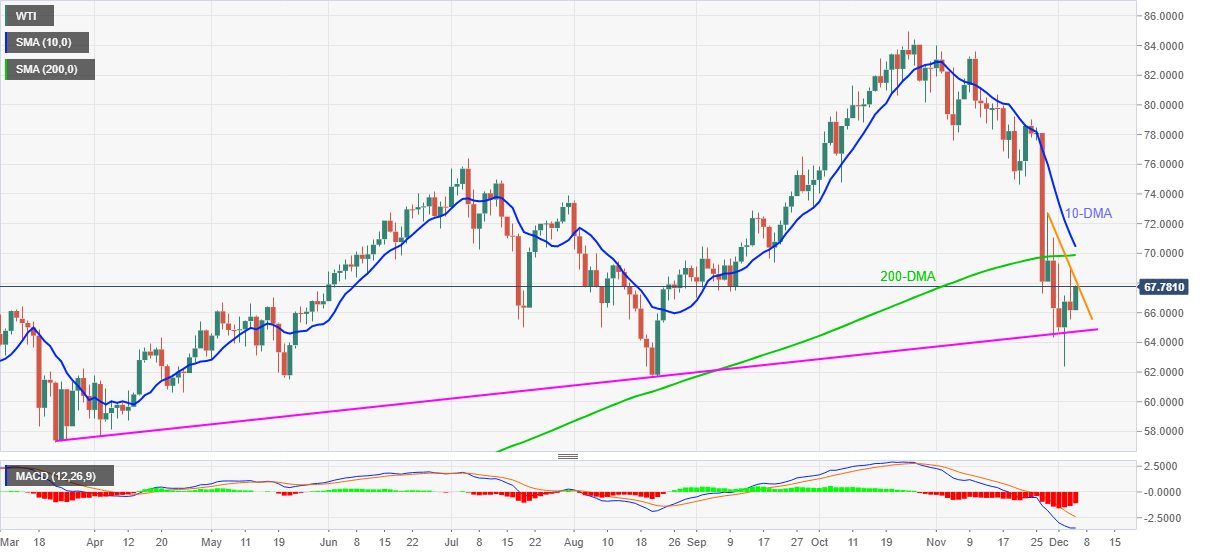

- WTI recovers some of Friday’s losses, reclaims $67.50 amid a positive market mood.

- Saudi Arabia increased the crude-oil barrel to a median of $0.50 to different customers, and oil rose on the news.

- WTI Price Forecast: Has a downward bias, but a break above the 200-DMA paves the way towardsthe 100-DMA at $74.00.

As the New York session begins, the US crude oil benchmark, Western Texas Intermediate, also known as WTI, advances some 2.55%, is trading at $67.86 at the time of writing. A risk-on market mood turned investors toward riskier assets due to some factors. Reports of the omicron variant show that although it is highly transmissible, cases have been relatively mild. Additionally, Saudi Arabia adjusted its oil crude prices, signaling confidence in the demand outlook, despite the spread of the new coronavirus variant.

According to Bloomberg, Saudi Aramco increased its prices by $0.60 for customers in Asia, while in the US, the range is between $0.40-$0.60.

The rise in prices comes after the Organization of Petroleum Exporting Countries, and its allies (OPEC+) decided to increase crude output. The cartel agreed to add 400K of crude to global markets in January, caught investors off-guard amid the discovery of the COVID-19 omicron variant. However, the decision leaves the opportunity to adjust the production after assessing the omicron variant impact.

On the other hand, Iran’s opportunities to rejoin nuclear talks are slim. Iran wants the previous sanctions removed, saying that it violates the deal and prevents the country from gaining economic benefits. According to US officials, even Iranian allies like Russia and China were disappointed by the country’s stance.

That said, coronavirus developments, alongside Iran nuclear talks, would be the drivers for WTI’s price action.

WTI Price Forecast: Technical outlook

In the daily chart, crude oil has a downward bias, depicted by the daily moving averages (DMA’s), which reside above the spot price. Nevertheless, a significant hammer on December 2, when the market witnessed a $6 dip, rebounding to close at $67.50, would keep the black-gold prices within the $62.40-$69.00 range.

That said, in the outcome of breaking above the range, the first resistance would be the 200-DMA at $70.09. The breach of the latter would open the door for further gains. The next resistance would be December 6 at $73.11, followed by the 100-Dma at $74.01.

On the flip side, the first support would be the September 1 at $67.11, followed by the November 30 at $64.42, and then the December 2 low at $62.40

- NZD/USD has seen a subdued start to the week and trades just off annual lows in the 0.6750 region.

- In the absence of any important New Zealand economic events, the pair will this week be driven by USD flows.

NZD/USD has seen rangebound trading conditions thus far on Monday, with the pair for the most part sticking within tight 0.6740-0.6760 ranges over the course of the session so far. The pair did marginally squeeze out a fresh annual low at 0.67407 to just pip out last Friday’s low. At current levels just above 0.6750, the kiwi is trading very close to its weakest versus the US dollar since November 2020. The pair is currently down more than 6.0% from its early November highs close to 0.7200.

NZD/USD’s subdued price action at the start of the week is not overly surprising given the absence of any key New Zealand of US economic events on Monday and the proximity of important data releases later in the week. The most interesting US data will be October JOLTs job opening on Wednesday, weekly jobless claims on Thursday and November Consumer Price Inflation and preliminary December University of Michigan Consumer Sentiment data on Friday.

Whilst CPI will garner the most interest given the Fed’s growing concern about a more persistent inflation overshoot, the weekly jobless numbers and December Consumer Sentiment data will be closely eyed to see whether the recent rise in US Covid-19 infections is weighing on the economy yet. There are no notable economic events in New Zealand this week, meaning the NZD/USD price action is likely to be driven primarily by USD flows, risk appetite and movements in commodity prices.

- USD/JPY has recovered back to the north of the 113.00 level on Monday.

- Positive Omicron news is being touted as weighing on the demand for safe-haven/low-yielding currencies.

USD/JPY moved modestly higher on Monday, but continues to trade to the south of its 50-day moving averages at 113.43, which has acted as a lid to the price action since the start of the month. The pair on Monday bounced from close to last Friday’s near-112.50 lows and is now trading comfortable back to the north of the 113.00 mark in the 113.10s, with on-the-day gains of about 0.3%.

According to market commentators, the pair is being supported by positive Omicron-related news which is weighing on safe-haven and low-yielding currencies (like the yen) which have benefitted recently from the idea that Omicron would hurt the global economy. According to South African health officials, the severity of most symptoms in hospitalised patients with Omicron (including infants) has thus far been mild. But the variant is known to be highly transmissible, and it remains to be seen how badly health authorities in countries like the USA, UK and in Europe panic when infection rates there inevitably accelerate sharply in the coming weeks. The risk of an over-reaction to high infection rates (that doesn’t take into account mild symptoms and low hospitalisations) is a risk to the near-term economic outlook.

For now, continued uncertainty about how the next few weeks and months will shape up regarding the spread of Omicron and reaction to it seems to be enough to keep the gains in USD/JPY capped. This is mainly due to the fact that long-term US government bond yields (US/Japan rate differentials are USD/JPY’s most important driver) remain subdued and close to recent lows. One factor capping longer-term yields, aside from concerns about Omicron, are apparent fears that the Fed’s eagerness to press ahead with monetary tightening in 2022 to tame inflation despite pandemic risks may dampen the longer-term economic outlook.

For USD/JPY to break above the 50DMA and press on towards the 21DMA just under 114.00 and then recent highs in the 115.50 area beyond that, long-term US yields will need to recover. In a scenario where states in the US respond to rising infection rates (driven partially by Omicron) with tighter economic measures, this might further weigh on long-term yields. Between 112.50 and 112.00 there are a lot of key support levels going all the way back to April 2019, but if these are broken, that could open the door to a swift move lower towards 109.00, the next area of key support.

- A combination of factors prompted some short-covering around USD/CHF on Monday.

- Easing Omicron fears boosted investors’ confidence and undermined the safe-haven CHF.

- The USD drew support from hawkish Fed expectations and rebounding US bond yields.

The USD/CHF pair shot to a four-day high during the early North American session, albeit quickly retreated a few pips thereafter. The pair was last seen trading around the 0.9220 region, still up nearly 0.45% for the day.

The pair once again showed some resilience below the very important 200-day SMA and attracted fresh buying near the 0.9160 area on the first day of a new week. The risk-on impulse in the financial markets undermined the safe-haven currency. This, along with sustained US dollar buying interest, provided a goodish lift to the USD/CHF pair.

Reports that Omicron patients only had relatively mild symptoms eased fears about the potential economic fallout from the new variant of the coronavirus and boosted investors' confidence. This was evident from a generally positive tone around the global equity markets, which, in turn, drove flows away from traditional safe-haven currencies.

On the other hand, the prospects for a faster policy tightening by the Fed continued acting as a tailwind for the USD and provided an additional lift to the USD/CHF pair. In fact, the markets have been pricing in the possibility for an eventual interest rate hike by May 2022 amid worries about stubbornly high inflationary pressures.

Apart from this, a solid rebound in the US Treasury bond yields further benefitted the greenback and pushed the USD/CHF pair beyond the 0.9215-20 supply zone. This could be seen as a fresh trigger for bullish traders, though the lack of a strong follow-through buying warrants some caution before positioning for any further appreciating move.

There isn't any major market-moving economic data due for release from the US, leaving the USD/CHF pair at the mercy of the USD price dynamics and the broader market risk sentiment. Nevertheless, the fundamental backdrop supports prospects for additional near-term gains and a move towards testing the next relevant hurdle near the 0.9265-70 region.

Technical levels to watch

- EUR/USD dipped back under 1.1300 in recent trade.

- Trading conditions are quiet on Monday ahead of more interesting US data later in the week.

EUR/USD has been trading with a slightly negative bias and recently swung back to the south of the 1.1300 level, where it currently trades lower by about 0.2% on the day. Risk appetite has improved on Monday amid better news on the Covid-19 front and following a surprise PBoC 50bps RRR cut. This is helping underpin Fed tightening expectations and thus supporting the US dollar versus low yields currencies like the euro; December 2022 three-month eurodollar futures have moved a few bps higher to price an FFR of above 1.0% again (implying at least three 25bps rate hikes are expected in 2022).

Eurozone data released on Monday morning is likely not helping the euro’s cause. German Factory Orders saw a massive 6.9% MoM decline versus expectations for a much more modest decline of 0.5%. Economists framed the data as not as bad as it seemed, however, as it pointed to an uptick in actual production in the months ahead. Elsewhere, Eurozone Sentix Investor Confidence took a bigger knock than expected in December, dropping to 13.5 from 18.3 last month, its lowest level since April.

Trading conditions for the remainder of the session are likely to be subdued amid a lack of notable calendar events on either side of the Atlantic. The second estimate of Eurozone jobs and GDP data for Q3 will be out on Tuesday but is unlikely to prove market moving. Rhetoric from ECB members including President Christine Lagarde, Vice President Luis de Guindos and Executive Board member Isabel Schnabel on Wednesday and Friday will likely prove more interesting amid uncertainty about what the ECB will decide on in December. The most interesting US data will be October JOLTs job opening on Wednesday, weekly jobless claims on Thursday and November Consumer Price Inflation and preliminary December University of Michigan Consumer Sentiment data on Friday.

New York City Mayor Bill de Blasio announced a Covid-19 vaccine mandate for all private-sector employers which will go into effect as of 27 December. de Blasio framed the mandate as a "pre-emptive strike" against the Omicron variant in an interview on MSNBC. There will also be new restrictions placed on the ability of unvaccinated 5 to 11-year-old children to access indoor dining, fitness and entertainment venues.

Market Reaction

Risk assets have not reacted to the latest announcement. But in the weeks ahead, as US Covid-19 infection rates rise, markets may become more sensitive to Covid-19 restriction headlines as market participants assess the expected impact, if any, on the US economy.

- USD/CAD witnessed a corrective pullback on Monday amid a pickup in crude oil prices.

- Rising Fed rate hike bets continued underpinning the USD and helped limit the downside.

- The fundamental backdrop supports prospects for the emergence of some dip-buying.

The USD/CAD pair maintained its offered tone heading into the North American session and was last seen hovering near the daily low, just below the 1.2800 round-figure mark.

Crude oil prices kicked off the new week on a positive note amid easing fears about the Omicron variant of the coronavirus and underpinned the commodity-linked loonie. This, in turn, failed to assist the USD/CAD pair to capitalize on the previous day's intraday rally of over 100 pips to the highest level since September 20, instead prompted fresh selling on Monday.

The downside, however, remains cushioned, at least for the time being, amid sustained US dollar buying, bolstered by the prospects for a faster policy tightening by the Fed. The markets have been pricing in the possibility of liftoff by May 2022. This, along with a strong recovery in the US Treasury bond yields, continued acting as a tailwind for the greenback.

The fundamental backdrop favours the USD bulls and supports prospects for the emergence of some dip-buying around the USD/CAD pair. There isn't any major market-moving economic data due for release from the US or Canada. This makes it prudent to wait for a strong follow-through selling before confirming that the recent positive move has run out of steam.

Technical levels to watch

- GBP/USD managed to defend and attract buying in the vicinity of the 1.3200 mark on Monday.

- Remarks by BoE’s Broadbent provided an additional boost, though stronger USD capped gains.

- Hawkish Fed expectations, rebounding US bond yields continued underpinning the greenback.

The GBP/USD pair continued gaining traction through the mid-European session and shot to a fresh daily high, around the 1.3285 region in the last hour.

Having defended the 1.3200 mark, the GBP/USD pair witnessed some short-covering move on the first day of a new week and reversed a major part of Friday's decline back closer to the YTD low. The UK's move to gran a new batch of licenses for French ships seeking to work in British waters was seen as a sign of progress on a broader trade agreement. This, in turn, was seen as a key factor that extended some support to the British pound.

The intraday buying picked up pace in reaction to the Bank of England (BoE) Deputy Governor Ben Broadbent's remarks, saying that inflation is likely to rise further over the next few months. During a scheduled speech on the outlook for growth, inflation, and monetary policy Broadbent further noted that inflation will comfortably exceed 5% in April and added that there are good reasons to think that this rapid rise in prices is likely to fade.

Nevertheless, the comments seem to have lifted market expectations for an imminent interest rate hike by the BoE at its upcoming policy meeting on December 16. That said, the UK-EU standoff over how to regulate trade in Northern Ireland held back bulls from placing aggressive bets. This, along with sustained US dollar buying, might keep a lid on any meaningful upside for the GBP/USD pair amid absent relevant market-moving economic releases.

The greenback continued drawing support from the prospects for a faster policy tightening by the Fed amid growing worries about rising inflationary pressures. In fact, the Fed funds futures indicate that investors have been pricing in the possibility of a liftoff by May 2022. This, along with the risk-on impulse in the markets, triggered a solid recovery in the US Treasury bond yields and underpinned the greenback, capping gains for the GBP/USD pair.

Even from a technical perspective, the uptick stalled near the 100-hour SMA resistance. This further makes it prudent to wait for a strong follow-through buying before confirming that the GBP/USD pair has formed a base near the 1.3200 area and positioning for a further near-term appreciating move.

Technical levels to watch

- Spot gold has slipped back from earlier session highs near $1790 and is now under $1780 again.

- The yield environment is unfavourable for precious metals at the start of the week.

- Focus will be on US inflation data on Friday.

Spot gold (XAU/USD) prices have been waning from Asia Pacific session highs throughout the European Monday morning ahead of the US open, with spot prices now back below $1780, having at one point been as high as $1787. The precious metal has been largely unable to benefit from its safe-haven status in recent weeks despite Omicron-inspired risk-off flows that have brought global equity markets down from record peaks reached as recently as mid-November.

One of the main reasons for this has been the fact that 1) US macro data has remained strong and 2) the Fed has pivoted hawkishly and is now expected to accelerate its QE taper from January. The hawkish turn has seen short-end and real US yields higher, increasing the opportunity cost of holding non-yields gold.

On Monday, nominal US yields are higher across the curve, though rather than having anything to do with US data or the Fed, this is more a reflection of a more risk-on market tone. The news out of South Africa regarding the severity of illness associated with Omicron Covid-19 variant infection continues to look good (it looks very mild compared to other variants) and the PBoC surprised market participants with a 50bps RRR cut. This will release CNY 1.2T in liquidity from the Chinese banking system and should shore up slowing global growth.

Higher yields mean that, for now, market participants are viewing rallies towards the 200 and 50-day moving averages just above $1790 as a selling opportunity in spot gold. If more positive Omicron newsflow continued to support risk appetite, longer-term yields (which have been under significant pressure recently) could start recovering back towards recent peaks and global equities may start to grind back towards recent record levels.