- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 09-12-2021

- USD/CAD bulls are committing which could lead to upside correction in the coming hours.

- The daily chart and hourly time frame mary for a continuation towards the 61.8% ratio.

USD/CAD has been making tracks to the upside in recent sessions and is now on the verge of a bullish extension. The hourly support is currently holding up so bulls are looking for an optimal entry at this juncture. However, there is the possibility of another test of the bullish commitments near 1.27 the figure.

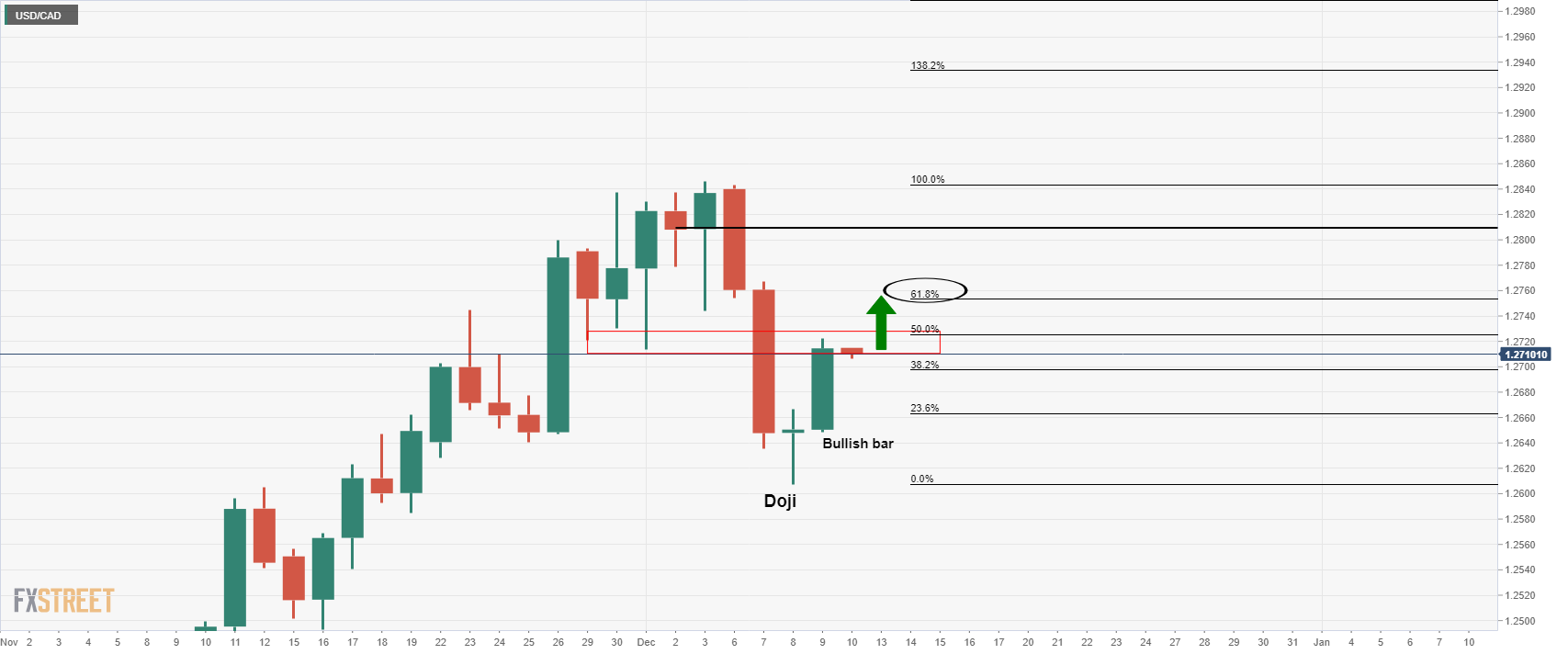

USD/CAD daily chart

The daily chart shows that the price stalled on the downside with a dojo reversal candle followed by a strongly bullish candle and close the next day. This is a bullish prospect and the price would be expected to move through a 50% mean reversion to target the 61.8% ratio or even as high as the neckline of the M-formation. That comes in near to 1.28 the figure.

USD/CAD hourly chart

From an hourly perspective, the price is testing hourly support which includes the dynamic trendline, the 10-EMA and the prior resistance of the last bullish impulse. However, while the price has already reached a 38.2% Fibonacci level, there is still potential for a deeper correction to the 61.8% that meets structure also, as follows:

USD/CAD M15 chart

Should the hourly support give out, then the next layer to the downside comes in just below 1.27 the figure and it will be critical that the bulls commit there.

- GBP/USD portrays corrective pullback around yearly low, seesaws after three-day downtrend.

- UK says France won’t get full 104 fishing licenses, Ireland to raise Brexit concerns with Britain.

- British Health Minister Javid tried to placate ‘Plan B’ fears, BOE rate hike expectations were pushed back.

- UK data dump for November precedes US CPI to decorate calendar.

GBP/USD licks its wounds near 1.3220 amid a quiet Asian session on Friday. The cable pair dropped during the last three days as Brexit and coronavirus updates offered a double whammy of attacks towards the south, which refreshed yearly low. However, the traders seem to turn cautious ahead of the key data releases from the UK and the US.

Having announced the re-introduction of the virus-led activity measures and promoting the work-from-home culture, the UK policymakers tried to tame pessimism spreading from their actions. In doing so, the UK Health Minister Sajid Javid said that ‘Plan B’ is designed to slow down the spread of the Omicron variant.

However, the markets did believe in them as the CME’s BOEWatch Tool signals the delayed rate hike in 2022 than the previously conveyed. On the same line were Goldman Sachs and Reuters’ poll.

Not only the virus-linked fears but Brexit chatters are also weighing on the GBP/USD prices. After initial peace, the UK and France are again at loggerheads over the fishing terms as the UK Daily Telegraph quotes Britain rejecting the French demand to approve all 104 licenses. Additionally, iTV conveyed the news that the ex-Irish PM Leo Vardakar mentioned Ireland’s likely push to the UK for altering Brexit terms that negatively affect the nation.

On a broader front, mixed updates concerning the South African covid variant, namely Omicron, joined geopolitical fears surrounding China and Iran to weigh on the market sentiment. However, the US dollar benefits from the increasing bets on the Federal Reserve’s faster tapering.

That said, Wall Street benchmarks closed in the red while the US 10-year Treasury yields drops 1.2 basis points to 1.497% by the end of Thursday’s North American session.

Looking forward, a heavy economic calendar will entertain the GBP/USD traders even if the bulls have little hope of return. “October GDP is expected to have risen 1.0%mth, with industrial production up 0.1%. The trade deficit is expected to narrow slightly in October, but significant uncertainty remains given Brexit and COVID-19 (market f/c: -£2.4bn),” Westpac said ahead of the events.

Read: US Consumer Price Index November Preview: Inflation is the new cause celebre

Technical analysis

GBP/USD bears remain hopeful as a downward sloping trend line from October 28 restricts immediate upside around 1.3230.

- The NZD/JPY pares some of Wednesday’s gains, down some 0.01%.

- A seven-month-old downslope trendline around 77.30-50, reclaimed on Thursday.

- NZD/JPY Price Forecast: Failure to break resistance around 77.30-50, opened the door for further losses.

As the Asian Pacific session begins, the NZD/JPY starts on the wrong foot down some 0.01%, trading at 77.09 during the day at the time of writing. Factors like newly imposed COVID-19 restrictions across Europe, with the UK adding its name to the list, and Omicron variant’s spread, dented market sentiment, thus favoring safe-haven currencies like the JPY.

On Thursday, the NZD/JPY pair remained subdued within the 77.30-50 range, around the seven-month-old trendline. However, the pair dropped to the daily low at 76.88 amid a risk-off market mood as the European session began.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY failure to break the seven-month-old downslope resistance trendline could open the way for further downside. As mentioned yesterday, the daily moving averages (DMA’s) remain well above the spot price, supporting the bearish bias.

That said, the first support on the way down would be the December 9 swing low at 76.88. A breach of the latter would expose the December 8 cycle low at 76.69, followed by the December 3 low at 75.95.

On the other hand, the NZD/JPY first resistance would be the 77.30-60 area, respected on Thursday, followed by the 200-day SMA, at 78.07, immediately followed by the 100-day SMA at 78.26.

-637746890155731942.png)

- EUR/USD pares the biggest daily loss in two weeks inside a choppy range.

- Steady RSI, bullish MACD signals keep buyer hopeful.

- Six-week-old descending trend line joins nearby horizontal hurdle to challenge upside.

- Ascending triangles formation could offer fresh yearly low on break of 1.1240.

EUR/USD grinds lower around 1.1300 after posting the biggest daily fall in a fortnight. The major currency pair reversed from the 21-day EMA the previous day but stays inside a bearish chart pattern during early Friday morning in Asia.

It’s worth noting that the bullish MACD signals and firmer RSI favor the buyers but 21-day EMA, around 1.1340, acts as an immediate hurdle to recovery moves.

Adding to the upside filters, actually being a major hurdle, is the joint of a descending trend line from late October and the upper line of the stated three-week-long ascending triangle, around 1.1370.

Should the quote jumps past 1.1370, odds of its run-up to a descending resistance line from September, near 1.1520 can’t be ruled out.

Alternatively, a downside break of the triangle’s support, at 1.1240 by the press time, will initially attack the yearly low of 1.1186 during the theoretical slump towards 1.1050.

To sum up, EUR/USD struggles for a clear direction but bears have the upper hand.

EUR/USD: Daily chart

Trend: Sideways

"US and its allies would respond to Russia's aggression," said the White House (WH) during early Friday.

The news came after chatters that Russia rejected Ukraine's proposal to strengthen the July 2020 ceasefire.

The White House communiqué also mentioned that US President Joe Biden reaffirmed the United States’ unwavering commitment to Ukraine’s sovereignty and territorial integrity.

“The leaders called on Russia to de-escalate tensions and agreed that diplomacy is the best way to make meaningful progress on conflict resolution,” said the WH document covering talks between US President Biden and his Ukrainian counterpart Volodymyr Zelenskyy.

Fx implication

The news should have weighed on the risk appetite and commodity prices but the market’s cautious mood ahead of the key US inflation data dims the reaction.

Read: US Consumer Price Index November Preview: Inflation is the new cause celebre

- NZD/USD braces for the first weekly gain in six, snapped two-day uptrend before steadying.

- Market’s anxiety ahead of key weekly events joins mixed updates over Omicron and China to weigh on sentiment.

- New Zealand Business NZ PMI eased to three-month low in November, Electronic Card Retail Sales came in mixed.

- Risk catalysts may offer intermediate direction during the likely dull day ahead of US CPI.

NZD/USD struggles for clear direction around 0.6800 during early Friday morning in Asia, after stepping back from the weekly top the previous day. The Kiwi pair dropped for the most in a week on Thursday as risk appetite soured amid a light calendar. That said, the quote’s latest performance could be linked to the market’s cautious mood ahead of the US Consumer Price Index (CPI) for November.

Mixed updates concerning the South African covid variant, namely Omicron, joined geopolitical fears surrounding China and Iran to weigh on the market sentiment the previous day. The economic calendar was also light with the US Initial Jobless Claims preceding the recently released New Zealand NZ Business PMI and Electronic Card Retail Sales. Further, China's CPI came in firmer but PPI eased from a multi-year high.

US Initial Jobless Claims dropped to the lowest levels since 1969, 184K versus 215K expected and 227K forecast, raising odds of the faster tapering by the US Federal Reserve (Fed) ahead of today’s key inflation data and the next week’s Federal Open Market Committee (FOMC) meeting. China’s Consumer Price Index (CPI) jumped the most since August 2020, by 2.3% YoY and 0.4% MoM in November whereas the Producer Price Index (PPI) crossed 12.6% forecasts to arrive at 12.9% YoY in November, easing from a 26-year high posted the last month.

At home, NZ Business PMI eased below 56.7 market consensus and 54.3 previous readings to 50.6 while Electronic Card Retail Sales recovered to +2.9% YoY from -7.6% prior but eased on MoM to 9.6% from 10.0% printed in October.

Elsewhere, the return of lockdowns in Europe and the UK, as well as protective measures in parts of the US, renew COVID-19 fears even as global policymakers followed scientists suggesting three vaccine shots as effective against the virus variant. The fears could be linked to the Japanese study saying Omicron is four-time more transmissible than the other covid strains.

On the other hand, Fitch termed China’s Evergrande as “restricted default” and pushed the People’s Bank of China (PBOC) to raise the reserve requirement ratio (RRR) on banks' foreign currency holdings.

Additionally, the US-Russia and the Sino-American tussles join the latest one between Washington and Tehran to weigh on the risk appetite.

Above all, the market’s indecision ahead of the key US inflation data and the next week’s super-pack central bank actions portray a risk-off mood and challenge the NZD/USD prices.

Amid these plays, Wall Street benchmarks closed in the red while the US 10-year Treasury yields drops 1.2 basis points to 1.497% while gold and crude prices also weakened.

Looking forward, a lack of major data/events will keep NZD/USD traders at the mercy of the US CPI.

Read: US Consumer Price Index November Preview: Inflation is the new cause celebre

Technical analysis

A convergence of monthly and fortnightly resistance lines challenged NZD/USD rebound on Thursday. The receding bullish bias of MACD and RSI retreat supports the following pullback moves, which in turn suggests further declines towards immediate horizontal support near 0.6765. On the contrary, recovery moves will get validation on crossing the weekly top of 0.6824.

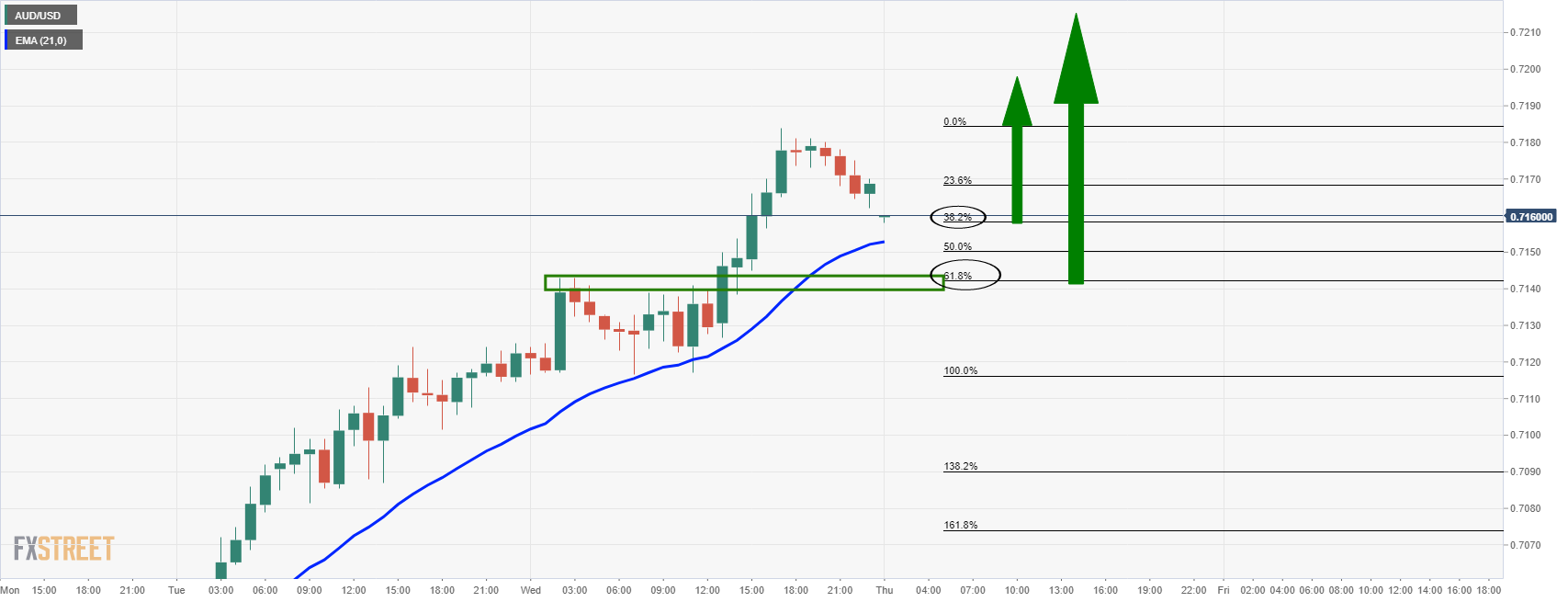

- AUD/USD is correcting a sharp bullish daily rally.

- The bulls will be looking for a discount in the coming sessions.

AUD/USD is stalling on the bid, for the moment, and forming a bearish structure on the lower time frames which would be expected to equate to an extension of the correction. However, the daily chart offers a bullish outlook and bulls would be expected to engage again in the coming days.

AUD/USD H1 chart

AUD/USD has failed to move higher as dip-buying ran out of steam in London, breaking below the 21 EMA and the focus has flipped back to the downside. The dynamic support meets the prior resistance area near 0.7130.

However, the bulls have taken charge as seen on the daily chart which is now correcting towards a 38.2% Fibonacci retracement level near 0.7110.

Given the strength of the rally, the correction would be texted to stall in the coming days and lead to a continuation to the upside.

- Gold slides on COVID-19 restrictions spurred by the omicron variant’s rapid spread.

- The German 10-year bund is flat at -0.3530%.

- XAU/EUR Price Forecast: Doji in the daily chart opens the door for further upside.

Gold (XAU/EUR) vs. the euro is barely down during the day, trading at €1,572.06, down some 0.01% at the time of writing. Concerns about COVID-19 restrictions and the omicron variant’s rapid spread dented investors’ mood, thus, in this case, favoring the low-yielding euro.

COVID-19 restrictions around the Eurozone led by Germany and Austria also kept the EUR under pressure against the greenback, but it seems that gold bulls were absent, failing to push prices higher. Additionally, the 10-year German bund is flat during the day, at -0.353%, which dragged XAU/EUR prices slightly down despite being static.

XAU/EUR Price Forecast: Technical outlook

XAU/EUR has an upward bias depicted by the daily moving averages (DMA’s) residing below the spot price, which is approaching the confluence of the 50-day moving average and the June 1 pivot low around the €1,565-45 area, that in this case acts as support. At press time, gold is forming a candle pattern called “doji” meaning that the downside move could be exhausted, but the lack of buyers failed to push the price higher.

If gold aims higher, the first resistance would be the December 7 high at €1,589.26. A breach of that level, the XAU/EUR would aim towards the November 26 high at €1,609.65, followed by the robust resistance area around €1,640-50.

Contrarily, if XAU/EUR edges down, the first support is the confluence of the 50-DMA and the June 1 low around the €1,565-45 range. A break below that demand zone would send gold towards the December 2 low at €1,555.31, followed by the 100-DMA at €1,538.52.

-637746823604532613.png)

- AUD/NZD bulls look to the 1.06 area should support holds.

- Hourly support keeps the bears off and bulls charged for the days ahead.

As per the prior analysis, AUD/NZD Price Analysis: Bulls are taking on the 1.05's, the pair has extended higher in an inverse head and shoulders breakout.

AUD/NZD prior analysis

AUD/NZD update

As illustrated, the price filled the wick of the prior daily candlestick and moved into resistance.

AUD/NZD C1 chart

The price is consolidating at this juncture and awaits the next catalyst for direction. Should the support hold, then the bulls will be looking to the 1.06 in the coming week:

- GBP/JPY was subdued on Thursday, trading roughly at the midpoint of this week’s 149.00-151.00ish range.

- UK GDP data on Friday will be watched, but the main themes driving the pair remains Omicron and the BoE.

GBP/JPY saw subdued trading conditions on Thursday, in fitting with the broadly subdued conditions also witness over the past two days. The pair has spent the session trading either side of the 150.00 level and is currently changing hands close to 149.90, down about 0.1% on the day. That puts it roughly at the midpoint of this week’s 149.00-151.00ish range.

Looking ahead to Friday’s session, UK GDP data for October is set for release at 0700GMT. The data will be closely watched by traders, but the main interest they will have is in trying to guage how the BoE will interpret the data. Most likely, even if growth did start off Q4 stronger than expected (markets expected 0.4% MoM growth), this wouldn’t factor into the BoE’s thinking much with regards to whether or not it is going to hike rates at next week’s meeting.

Indeed, the emergence of Omicron, which triggered GBP/JPY’s initial tumble from close to 154.00 on November 26, has seen BoE members adopt a more dovish tone. Most economists now expect the bank to hold interest rates steady in December and kick the can down to the road until February (regarding rate hikes) as they await further information about the Omicron variant and observe the UK government response. The fact that the UK government announced Covid-19 “Plan B” on Wednesday, where people will be ordered to work from home (where possible), amongst other restrictions on hospitality sectors/public spaces, will give the BoE further cause for caution.

BoE dovishness in face of Omicron and the winding down of expectations for a rate hike at next week’s meeting is likely one key reason why GBP/JPY has been unable to sustain any reasonable attempt at a recovery back towards its pre-Omicron levels. At present, the pair is about 2.4% below pre-Omicron news levels. By comparison, USD/JPY (which is not weighed by a dovish central bank, rather, the Fed has since turned more hawkish) is down about 1.6%.

For now, GBP/JPY is being held up by decent support in the 148.50-149.00 area. Should Omicron/pandemic woes worsen in the coming weeks as cases in places like the UK and US spike and hospitalisation start to rise, this could exacerbate the yen’s safe-haven bid. If that further deters BoE hawkishness and further suppresses UK/Japan yield differentials as a result, a good medium-term target for GBP/JPY could the next area of key support around 145.00.

Bank of Canada Deputy Governor Toni Gravelle said on Thursday that concerns about upside inflation risks are heightened much more than usual. We are likely to react a little bit more readily to the upside risk given it's already above our inflation-control range, Gravelle added. For reference, the bank's inflation-control range is 1.0%-3.0%.

Market Reaction

The comments come in wake of remarks from Gravelle earlier in the session. His comments are hawkish-leaning (hinting at a proactive BoC response to upside inflation risks), but the loonie does not seem to have reacted.

According to Reuters, the Bank of Canada will leave its inflation target at 2.0%, the mid-point of a 1.0%-3.0% range, in a soon-to-be-announced review of its monetary policy framework. However, the bank will include new language on the importance of employment to the economy.

According to the source cited by Reuters, "the upcoming announcement will be a very clear reaffirmation of the centrality of the inflation target". "But it's not a photocopy of last time" the source continued, "there's a little bit of updating to reflect what the bank is already doing - some updating of the language to reflect the consideration the bank is already giving to employment factors".

Market Reaction

The loonie did not see any notable reaction to the story reported by Reuters.

- Crude oil prices fall during the day after rallying for six weeks, down in the day 2.82%.

- COVID-19 restrictions, and the spread of the omicron variant, dented market mood as oil demand decreased, dragging prices lower.

- WTI Price Forecast: In the near-term has a downward bias, though a break of the 200-DMA is needed so that WTI bears could target December 2 low at $62.34.

The US crude oil benchmark WTI falls during the New York session, trading at $70.34 at the time of writing. Concerns about COVID-19 restrictions and the omicron variant’s rapid spread dented investors’ mood and hit oil prices as lockdowns loom. That, alongside countries tapering some crude reserves, helped ease energy prices.

According to sources cited by Bloomberg, “the market is still in calibration mode around the virus.” At the beginning of the week, global equities and oil rallied, on the back that the newly discovered strain, although highly transmissible, caused mild symptoms. However, 19,842 new cases reported from South Africa on December 8 increased market participants’ worries, which flew through safe-haven assets as they waited for additional omicron information.

During the day, Western Texas Intermediate peaked above December 8 cycle high at $73.17, retreating towards the $70.50s area amid dented market sentiment.

In the meantime, the US Dollar Index, which price influences commodities quoted in US dollars, is up 0.34%, sitting at 96.24, a headwind for WTI.

WTI Price Forecast: Technical outlook

WTI is approaching the 200-day moving average (DMA) at $70.06, which would be the first line of defense for oil bulls. Crude oil has a downward bias, as failure to break above the 100-DMA at $73.72 could push WTI towards a re-test of December 2 low at $62.34. If WTI bears reclaim the 200-DMA, the first support would be September 1 swing low at $67.01, followed by the aforementioned December 2 low.

To the upside, a bounce at the 200-DMA could push crude oil prices higher. The December 7 high at $72.81 would be the first supply zone, followed by the 100-DMA at $73.72.

-637746782876273150.png)

What you need to know on Friday, December 10:

The market’s mood remained sour, amid Omicron uncertainty and as top central banks’ decisions loom.

According to Reuters and citing sources familiar with the matter, the European Central Bank Governing Council members are converging on a debate over a limited and temporary increase of Asset Purchases Programme (APP) in the December meeting. The ECB and the US Federal Reserve will announce their decisions on monetary policy next week. The Fed is seen speeding up tapering, moving in the opposite direction from the ECB. EUR/USD trimmed its recent gains and settled in the 1.1280 price zone.

The GBP/USD pair hovers around 1.3200, as odds for a rate hike in the UK had been pushed back amid the uncertainty caused by the coronavirus Omicron variant and the resulting decision of applying Plan B in the UK.

Not only the UK is announcing tighter coronavirus measures, unnerving market participants. Most European and American indexes closed in the red, weighing on commodity-linked currencies, which pulled back from their weekly highs vs the greenback. USD/CAD trades around 1.12710, while AUD/USD quotes at around 0.7150.

The USD/JPY is marginally lower in the 113.40 region, as government bond yields ticked lower.

Gold eased despite the worsening mood, now trading at around $1,776 a troy ounce. Crude oil prices also head lower, with WTI at $70.50 a barrel.

Shiba Inu buyers disappear as SHIB falls towards $0.00003

Like this article? Help us with some feedback by answering this survey:

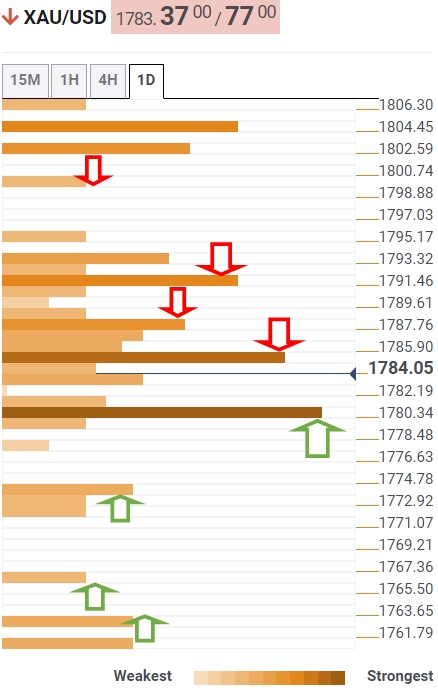

- Gold remains in familiar ranges in the countdown to the Fed.

- US CPI is the next potential catalyst for gold.

Gold, XAU/USD, has been pressured on Thursday as the greenback corrects the prior day's slump ahead of the US Consumer Price Index data on Friday. The yellow metal is down some 0.4% at the time of writing after travelling from a high of $1,787 and reaching a low of $1,773.31 so far.

The greenback, as measured vs. six major currency rivals in the DXY index, is up by 0.3% at the time of writing. The index finding support near 96 the figure as investors position for a stronger inflation outlook into next week's Federal Reserve meeting.

Analysts at TD Securities explained that they expect inflation to slow significantly as fiscal stimulus fades and supply constraints ease, but we don't expect the data to be validated in the near term. ''The CPI likely surged in Nov, with a drop in oil coming too late to avert another large gain in gasoline and core prices boosted by rapidly rising used vehicle prices and post-Delta strengthening in airfares and lodging.''

Fed in focus

The Fed next week is expected to open the gates to a second-quarter rate rise if needed. The tightness in the labour market is becoming more evident and that was seen in the Initial Claims for the latest week.

The data climbed just 184k, the lowest increase since 6 September 1969, signalling labour hoarding amid strong demand for labour is at play. Analysts at ANZ Bank explained. ''Available slack in the labour market is low and constrained by high levels of early retirees and ongoing jobs displacement (childcare etc) from the pandemic. Wage pressure look set to intensify further.''

However, while inflation prints are expected to remain elevated into the early months of the new year, suggesting that the market's pricing for Fed hikes could still become more aggressive, analysts at TD Securities said that they ultimately expect that it will prove to be far too hawkish.

''In fact, with both an accelerated taper and more than three rate hikes already priced in for 2022, the balance of risks for gold positioning remains to the upside, as geopolitical risks and virus risk could catalyze a positioning reshuffling.''

Meanwhile, the wild card for financial markets stays with the new variant of the Covid-19 disease. Omicron is sweeping its way through the world. The epicentre is once again in Europe. However, while the increased number of people vaccinated against Covid had inspired hopes that Americans would be able to avoid a fresh wave of the illness, the rise in Covid cases; holiday gatherings; and unanswered questions about the Omicron variant have sparked fresh concerns. Nonetheless, the Fed has turned uber hawkish despite the risks which is undermining the greenback and weighing on the price of gold.

Gold technical analysis

The yellow metal remains within a familiar territory and the monthly chart illustrates that space is running out for the bulls. A break of the symmetrical triangle opens the risk of a breakout to the downside which could be potentially significant if $1,700 gives out

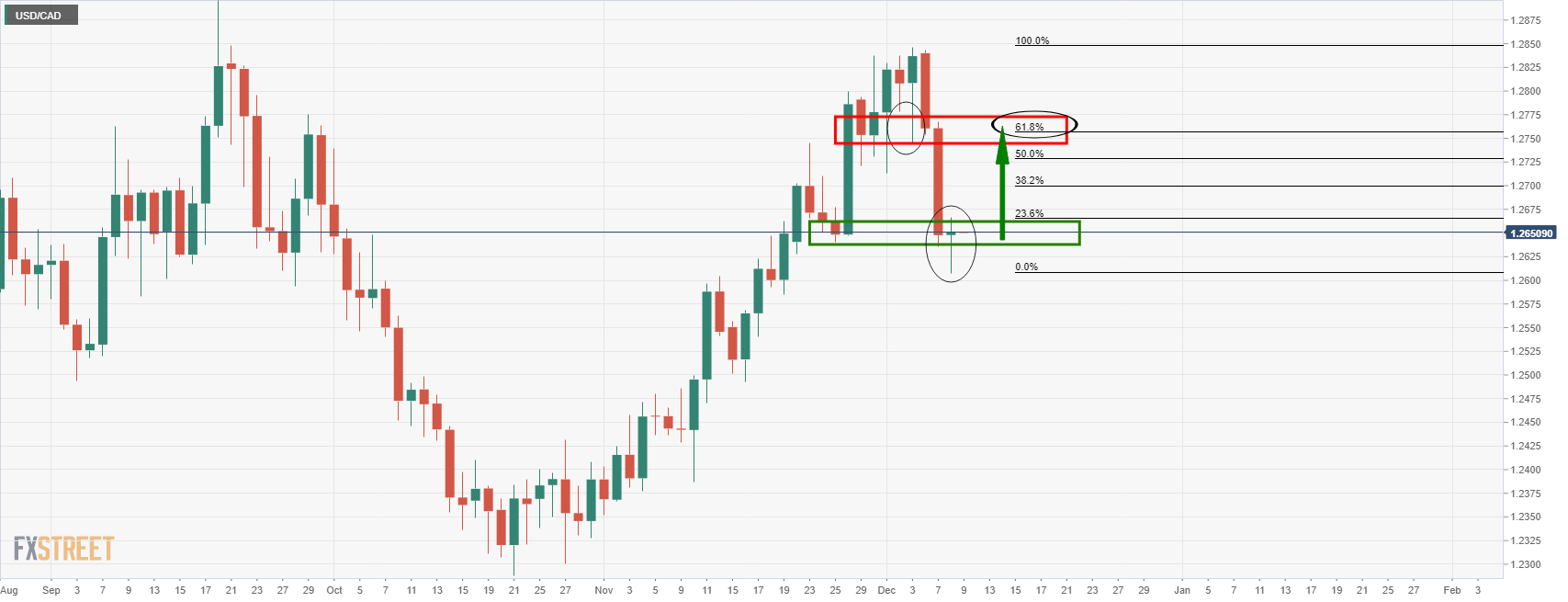

- USD/CAD moved back above 1.2700 on Thursday as oil prices came under selling pressure.

- BoC’s Gravelle spoke and largely stuck to the bank’s script after it held policy settings/guidance as expected on Wednesday.

USD/CAD has been on the front foot on Thursday, gaining about 0.4% to move back to the north of the 1.2700 level. That marks a 0.8% turnaround from Wednesday’s lows close to 1.2600, though the pair still trades lower on the week by about 1.0%, having opened Monday trade to the north of the 1.2800 level.

Thursday’s upside means USD/CAD is back above its 21-day moving average and the pair is now probing an area of resistance around the 1.2810 mark (the December 1 low). The next level of upside resistance is around 1.2750. Beyond that, there isnt much by way of technical barriers to stop the pair from retracing all of this week’s losses and returning to last Friday’s highs at 1.2850.

Driving the day

The main driver of upside in USD/CAD on Thursday has been a downturn in crude oil prices. WTI has been slipping in recent trade and is now down more than $2.0 on the day and under the $71.00 level. Risk appetite has deteriorated broadly on Thursday, not especially due to any one headline or piece of news, but likely more due to profit-taking ahead of risk events (like US inflation on Friday). This is likely the main driver of crude oil’s downside, though concerns about Covid-19 restriction reimposition after UK PM Boris Johnson announced new restrictions for England on Wednesday may be contributing to the caution.

Elsewhere there has been plenty of focus on the Bank of Canada over the last two days. The bank on Wednesday held interest rates at 0.25% as expected and maintained guidance for a first rate hike as soon as April 2022. There was something for both the hawks and doves to clutch at in the statement, which noted the risk presented by Omicron, whilst also noting the growing upside inflation risks.

Deputy Governor Toni Gravelle was on the wires on Thursday but largely stuck to the bank’s script in terms of economic commentary and thus didn’t move the loonie. Indeed, the latest BoC meeting seems not to have really had any noticeable impact on the loonie at all. Things should spice up next year from a BoC/FX reaction point of view when the bank has more certainty about the impact of the Omicron variant and potential rate hikes are closer.

- The S&P 500 looks on course to snap a three-day win streak, having dropped a modest 0.3%.

- Investors weighed up recent Omicron news and are looking ahead to key US inflation data on Friday.

US equities appear on course to snap a three-day win streak, amid a more tentative feel to trade on Thursday as investors weigh up recent Omicron news and look ahead to key US inflation data on Friday ahead of a bonanza of major central bank activity next week. The S&P 500 shed a modest 0.3% to trade around 4690, while the Dow gained about 0.25% to move above 35.8K. The Nasdaq 100 was down about 0.8% and the CBOE S&P 500 Volatility Index, often referred to as “Wall Street’s fear guage” rose about half a point to move back above 20.00.

In terms of the pandemic news, investors are weighing positive recent news that Omicron infections tend to be milder than infection by previous variants and that a third shot of the Pfizer vaccine is effective in neutralising the Omicron variant (according to Pfizer themselves) against a continued trend towards tighter global health restrictions. Much was made yesterday of UK PM Boris Johnson’s announcement that the UK would move to Covid-19 “Plan B”, which would see restrictions reimposed on everyday life and people encouraged to work from home.

Elsewhere, US equity markets weren’t particularly reactive to Thursday’s much stronger than expected weekly jobless claims report. In the week ending on November 4, just 184K people signed up for unemployment insurance, the lowest such weekly tally since 1969. This prompted calls by some for the Fed to respond to “full employment” with immediate rate hikes, not that this troubled equity markets much at the time.

Separately, in notable individual stock news; there was a fair amount of attention on Apple, as the company’s market capitalisation approaches $3T. Shares need only rally about another 4.5% for the company to reach the significant milestone. At present, AAPL shares are trading around $175.50, which gives the company a market cap of about $2.87T.

- The shared currency gives way against the British pound, down some 0.43%.

- EUR/GBP Price Forecast: It has an upward bias, but as long as bears keep the spot under the 200-DMA, they are in charge.

The EUR/GBP retreats after printing a new eight-week high around 0.8598, down to 0.8540 during the New York session at the time of writing. Financial markets sentiment is downbeat, as shown by US equities recording losses, except for the Dow Jones Industrial, up some 0.11%. Factors like COVID-19 restrictions across Europe, particularly in Germany, Austria, Netherlands, and on Wednesday the UK, weighed on risk appetite as omicron infections rise, despite its recently reported mild symptoms.

The EUR/GBP pair remained subdued around 0.8570-0.8598 during the overnight session. However, through the mid-European session, it dropped below the bottom of the range, stopping between the 50 and the 100-hourly simple moving averages (SMA’s), at 0.8540. The downward move helps GBP bulls to reclaim the 200-day SMA lying at 0.8555.

At press time, the cross-currency pair has an upward bias, despite the fact of trading below the 200-DMA. If EUR bulls get a daily close above the 200-DMA, the first resistance would be 0.8600. A breach of the latter would send the pair upwards to the September 29 swing high at 0.8658, followed by the figure at 0.8700.

On the other hand, If GBP bulls want to reclaim control, they will need a daily close around the 100-DMA at 0.8511. Once that happens, the first support would be the December 7 swing low at 0.8488, followed by the 50-DMA at 0.8480.

EUR/GBP Daily chart

-637746737094014420.png)

- AUD/USD now depends on o the US CPI outside this Friday/

- The divergence between the Fed and RBA would be expected to keep AUD/USD hamstrung.

At 0.7150, AUD/USD is lower by some 0.25% on the day and sat between a range of 0.7186 and 0.7135. The greenback continues to recover within a wider consolidative phase ahead of Friday's Consumer Price Index and next week's Federal Reserve meeting.

The central bank divergence between the Fed and Reserve bank of Australia has undermined the Aussie of late due to the dovish tones of the RBA. Beyond the Fed, attention is already turning to the RBA February policy meeting. The Bank has made it clear that it will be considering its QE programme in the new year and speculation is already mounting that an end to the programme could be a favoured outcome for the Bank. A better tone in risk appetite more generally has allowed AUD/USD to pull back some ground.

''On the back of decent economic data including the improved current account position we see scope for AUD/USD to recover modestly to the 0.72 area on a 3-month view,'' analysts at Rabobank said.

US CPI eyed

Looking ahead for the week, the uS Consumer Price index will be key. Analysts at TD Securities explained that they expect inflation to slow significantly as fiscal stimulus fades and supply constraints ease, but we don't expect the data to be validated in the near term. ''The CPI likely surged in Nov, with a drop in oil coming too late to avert another large gain in gasoline and core prices boosted by rapidly rising used vehicle prices and post-Delta strengthening in airfares and lodging.''

Meanwhile, in the third quarter, Australian underlying CPI inflation has registered 2.1% YoY and at the bottom of the RBA’s 2% to 3% target and below the average of the past 30 years. This clearly contrasts with some of the high inflation prints for other G10 economies especially that of the US which is likely to helo AUD/USD remain underpinned should the US CPI come in hot.

''The RBA is not expecting underlying inflation to reach the middle of its target until the end of 2023 and Lowe maintains that the first increase in the Cash rate may not be before 2024,'' analysts at Rabobank explained. ''Even if this target slips, it is clear that the RBA will be well behind the Fed when it comes to hiking rates in the forthcoming cycle.''

In a speech on Thursday, Bank of Canada Deputy Governor Toni Gravelle warned that supply disruptions and related cost pressures could last longer than expected, boosting the likelihood of Consumer Price Inflation (CPI) remaining above the bank's control range, according to Reuters. This could feed into inflation expectations and contribute to wage pressures, Gravelle added, leading to second-round price increases.

Additional Remarks

"Although there is much to be hopeful for as we approach full recovery, materialization of upside risks to CPI is of greater concern."

"The risk that supply disruptions last longer than expected figured prominently in our decision leading up to the December 8 rate announcement."

"We believe inflation will ease over time as supply catches up and that medium to long-term inflation expectations remain well-anchored."

"While there are signs some supply constraints are easing, most remain largely unresolved and it is hard to pinpoint when impact of supply disruptions will peak."

"There is a risk the Omicron variant of Covid-19 could hold back services consumption and exacerbate upward pressure on goods suffering from supply constraints."

"The degree of excess supply and demand varies across sectors, which means our typical measure of slack comes with a higher degree of uncertainty."

"Only recently have we seen a meaningful increase in services consumption, but it is still 4% below where it was before the pandemic."

"Customers can be expected to resume spending on a more typical share of their income on services."

Market Reaction

CAD did not see any notable reaction to the comments at the time.

- EUR/USD corrects a steep decline in the New York sessions.

- Bears seek a downside continuation below 1.12 the figure.

EUR/USD has been pressured in a risk-off environment on Thursday. The pair is down by some 0.45% as it attempts to correct the supply that has arisen on the back of concerns of economic risks from measures to regulate the new coronavirus variant.

In its early stages, the coronavirus variant called Omicron is said to be 4.2 times more transmissible than the Delta version, according to research. The European Centre for Disease Prevention and Control has predicted that the Omicron variant could become the dominant variant in Europe within months. Seventy-nine cases of the new Omicron variant of Covid-19 have been reported in 15 European countries so far, according to the EU's European Centre for Disease Prevention and Control.

Germany's fourth wave of Covid is it's most severe so far, with another 388 deaths recorded in the past 24 hours. Omicron is causing renewed restrictions on public life and Germany's national and regional leaders have agreed to bar unvaccinated people from much of public life in a bid to fend off the fourth wave of Covid-19.

Meanwhile, as for data today, Initial Jobless Claims in the US fell by 43,000 to 184,000 during the week ended Dec. 4, the lowest level since 1969. Analysts in a survey compiled by Bloomberg had expected claims to come in at 220,000.

Looking ahead, the Consumer Price Index in the US is forecast to grow at an annualized rate of 6.9% in November, up from a 6.2% recorded in the previous month, according to data compiled by Trading Economics. The November cycle high in the US dollar index, DXY, near 96.938 remains in sight as the 2-year rate differentials continue to move in the dollar’s favour. The CPi data could add further upside pressure in the yields to support the greenback in the coming days.

ECB in focus

Meanwhile, next week's European Central Bank meeting is going to be critical, especially with the emergence of the Omicron variant is putting more downward pressure on European economies. Traders note that inflation is on the rise, although the re-entering of carry trades amid a recovery in risk sentiment has been weighing on the euro.

''Inflation has picked up quicker than anticipated while the growth outlook is murky, which we expect will result in a patient approach to monetary policy in 2022, but with the optionality to recalibrate in 2023,'' analysts at Danske Bank said. ''We expect the first staff projection for 2024 inflation to land around 1.8%. This combined with real rates hovering around historic lows, allows room for a recalibration.''

EUR/USD may prove sensitive to any hawkish surprise, whether that be on the timing of unwinding asset purchases or on staff projections. There is room for the pair to catch up with the unfavourable widening of USD-EUR short-term rates.

EUR/USD technical analysis

The price is attempting to correct but the downside is dominant and would be expected to overpower resulting in a bearish continuation below the counter trendline and 1.13 the figure's resistance.

- The risk-sensitive New Zealand dollar falls as market mood dampened linked to COVID-19 woes.

- US Initial Jobless Claims rose to 184K, better than the 215K estimated by analysts.

- NZD/USD Price Forecast: Threatening of breaking below the YTD low at 0.6736, which would expose November’s 2020 low at 0.6589.

The NZD/USD shed Wednesday’s gains, trading at 0.6785, during the New York session, amid risk-off market mood attributed to COVID-19 restrictions across Europe while investors assess the economic impact of the newly discovered omicron variant. Furthermore, according to Bloomberg, the omicron variant is four times more transmissible than delta in a new study.

In the meantime, during the overnight session, the NZD/USD pair peaked around the December 8 high at 0.6818, retreating below the 0.6800 figure down to 0.6780s, as market mood conditions dampened by the abovementioned causes, increasing demand for safe-haven assets.

In the US, the Department of Labor reported that the Initial Jobless Claims for the week ending on December 3 rose to 184K, lower than the 215K, declining the most since 1969, beating economists’ estimations. Meanwhile, the US Dollar Index, which tracks the greenback’s performance against a basket of six rivals, is recovering from Wednesday’s losses, up 0.31%, sitting at 96.19, a headwind for the New Zealand dollar.

Therefore, the NZD/USD trader's focus turns to Friday’s release of US inflation figures, which in case of being higher, would increase the odds of a faster bond-taper by the Federal Reserve.

NZD/USD Price Forecast: Technical outlook

After facing strong resistance at 0.6818, the NZD/USD pair is approaching the December 8 cycle low around 0.6766. The pair has a downward bias, with the daily moving averages (DMA’s) located well above the spot price. Despite the previously mentioned, the NZD/USD is approaching November’s monthly low at 0.6772, which could lead to further losses if it is broken.

In that outcome, the first support would be the YTD low, December 7 at 0.6736, followed by the 0.6700 figure. A break below that level could send the pair tumbling towards November’s 2020 monthly low at 0.6589

- GBP/USD has spent the majority of Thursday’s session chopping either side of the 1.3200 handle.

- The 38.2% Fibonnacci retracement back from the post-pandemic high to the post-pandemic low is offering some.

- A break below this support would open the door to a swift move to the psychologically important 1.3000 level.

GBP/USD has spent the majority of Thursday’s session chopping either side of the 1.3200 handle and currently trades with losses of slightly more than 0.1% on the session around the 1.3190 mark. The pair is holding up rather well in light of the downside being seen in risk assets (stocks and oil), risk-sensitive currencies (NZD, AUD and CAD) and its European peers (EUR and CHF) that would normally also weaken sterling. For reference, all of these currencies are between 0.3-0.7% lower on the day versus the buck.

One reason for sterling’s resilience could be technical; the 38.2% Fibonacci retracement back from the post-pandemic high at 1.4250 to the post-pandemic low at just above 1.1400 is offering the pair some support in the 1.3170 area. Meanwhile, according to the 14-day Relative Strength Index, GBP/USD is fast approaching oversold territory and currently sits just above the 30.00 (below which an asset is viewed as oversold).

As positioning becomes stretched - GBP/USD has lost over 3.5% since the start of last month versus EUR/USD’s 2.3% - some profit-taking on shorts makes sense, especially given that key UK and US data looms on Friday. At 0700GMT, UK October GDP and activity data is out, while at 1330GMT, US November Consumer Price Inflation data will be released. Both will be closely scrutinised by central bankers ahead of next week’s Fed and BoE meetings. Caution ahead of these key events is another reason for GBP/USD selling pressure to ease – for now.

One factor weighing on sterling in recent weeks has been markets revising lower their expectations for the BoE to hike rates next week due to Omicron uncertainty, whilst Fed tightening expectations have remained largely intact (with this week’s strong US labour market data helping). According to Refinitiv data cited by Reuters earlier in the session on Thursday, the implied probability of a 15bps rate hike from the BoE next week had dropped to 40% versus 46% on Wednesday and nearly 70% at the start of last week.

Technically speaking, things aren't looking great for GBP/USD unless the pair can break above a recent downtrend that has been capping the price action going all the way back to the end of October. If for whatever reason (surprise BoE hike or dovish Fed…?) it was able to do that, then a move back to test resistance in the 1.3400 area could be on the cards. But if the pair does break below support in the mid-1.3100s, a swift move to the psychologically important 1.3000 level would be on the cards.

French President Emmanuel Macron criticised the British government on Thursday, saying post-Brexit relationships with the UK are difficult because the government does not do what it says. I hope Britain will re-commit to proper relations, he said.

His comments come against the backdrop of ongoing negotiations with France and the EU over access for the former's fishing fleet to UK waters and over the implementation of the Northern Ireland Protocol (NIP). France has threatened retaliatory trade and legal measures against the UK if more fishermen aren't granted licenses, while the EU has threatened to retaliate against the UK if it triggers Article 16 of the NIP.

The UK maintains that if an agreement cannot be found with the EU on the implementation of the NIP, triggering Article 16, which would allow it to unilaterally make changes to trade arrangements with Northern Ireland, remain on the table.

Market Reaction

Sterling is unmoved following the latest comments from Macron. GBP/USD continues to trade close to recent lows around 1.3200.

- The USD/CHF grind higher, up some 0.62%, as the greenback safe-status outweighed the Swiss franc.

- Market sentiment hit by COVID-19 restrictions amid the fourth wave in Europe.

- COVID-19 omicron variant transmissibility threatens to overwhelm hospitals.

- USD/CHF Price Forecast: Range-bound waiting for US inflation figures.

After reaching a double-top chart pattern target on Wednesday, the USD/CHF has reversed its course, is advancing sharply, trading at 0.9255 during the New York session at the time of writing. Investors’ mood is downbeat as participants assess COVID-19 restrictions in countries being hit by the fourth wave, threatening a slowdown in the economic recovery. Furthermore, omicron increased transmissibility, increased worries that hospitals could be overwhelmed, despite the less severe symptoms caused by the strain.

That said, the greenback has regained its safe-haven status, with the US Dollar Index rising 0.38%, sitting at 96.26, a tailwind for the USD/CHF pair, gaining 0.62% in the day.

In the overnight session, the USD/CHF dipped as low as 0.9190, then bounced immediately, reclaiming the 0.9200. Then, the pair edged slightly up around the central daily pivot at 0.9215, followed by a climb towards the December 8 high at 0.9252.

USD/CHF Price Forecast: Technical outlook

In the 4-hour chart, the USD/CHF has been seesawing around the 200 and the 100-simple moving average in a range-bound environment. The lack of catalyst would keep the pair trading at familiar levels, around 0.9190s-0.9260, waiting for Friday’s release of the US Consumer Price Index for November.

At press time, the spot price is near the 100-SMA, which lies at 0.9258, facing strong resistance. If the USD/CHF breaks to the upside, it will find resistance levels around 0.9270s; an area respected by traders since November 29, followed by the figure at 0.9300.

On the flip side, the first support would be the R1 daily pivot at 0.9234, followed by a strong confluence of support levels with the 50, the 200-SMA’s, and the central daily pivot point at 0.9214.

- WTI has dipped back under $72.00 after printing weekly highs above $73.00 earlier in the session on Thursday.

- Whilst a little lower on the day, oil prices remain largely rangebound as it awaits further Omicron/lockdown/pandemic headlines.

Oil prices have pulled back a little after printing fresh weekly highs this Thursday, though remain comfortably within recent intra-day ranges and holding on to impressive weekly gains. Front-month WTI futures managed to pip the $73.00 level during Asia Pacific hours and have since pulled back under $72.00, where they trade with losses on the day of close to $1.0. But that leaves them comfortably above Wednesday’s sub-$71.00 lows, and still over $5.0 (roughly 8.0%) up on the week.

Oil prices have eroded about 60% of their decline in wake of the emergence of the Omicron variant that saw prices tumble from around $78.00 on November 25 to the $62.00s on December 2. Price action over the past two days, which has seen broadly seen oil prices stabilise in the $71.00-$73.00 region, suggests that oil market participants deemed the initial sell-off as overdone, especially in light of evidence showing that Omicron is milder than previous variants. But recent price action suggests that (unlike in equity markets), there isnt yet the confidence to drive oil prices back to pre-Omicron levels. Countries around the world continue to tighten restrictions aimed at slowing the spread of the virus – UK PM Boris Johnson announced Covid-19 “Plan B” for England on Wednesdays and there are fears that parts of the US may follow suit.

Global infection rates, still mainly driven by delta (though likely to be rapidly accelerated by Omicron), are rising and it would be wise to expect more light lockdown measures. According to analysts at ING, “the UK has moved back to work from home as the norm... Other countries will doubtless follow”. “At the very least,” the bank continues, “the F&B industry and leisure will suffer from this at the most critical time of the year for them... So I'd be hesitant before piling back into risk assets at this time of the business year”.

In other oil-related news on Thursday, talks between the Iranians and Western powers over a return to the 2015 nuclear deal are scheduled to resume, though expectations remain low amid maximalist Iranian demands. Whilst Iran nuclear talks will be worth following (any signs of substantive progress would be bearish for oil), the main driver will remain headlines about Omicron, lockdowns and, more broadly, the state of the global pandemic.

- Spot silver slumped to $22.00 on Thursday amid a bout of technical selling.

- Strong US macro data is likely not helping and eyes will be on US inflation numbers on Friday.

Spot silver (XAG/USD) saw a pickup in volatility on Thursday, after a bout of technical selling sent it to its lowest level since early October under $22.00. Spot prices had been supported by an uptrend over the course of the last week and when that short-term uptrend was broken on Thursday, selling pressure increased. With XAG/USD now trading around the $22.00 level, its losses on the day stand at nearly 2.0%. Its losses on the week are closer to 2.5%, whilst its losses since the emergence of the Omicron variant back on November 26 are above 7.0%.

Unlike spot gold prices, FX and bond markets, which have been more rangebound this week ahead of Friday’s key US inflation numbers and ahead of next week’s central bank bonanza, silver prices have continued the recent bearish run. Silver has outperformed gold by a significant margin since mid-November when it topped out close to $25.50 at its 200-day moving average. Perhaps this rejection of the 200DMA have made things worse for the precious metal over the last few weeks.

-637746625064475382.png)

In light of another very strong US labour market report, which showed weekly initial jobless claims falling to their lowest since 1969, and comes after JOLTs data showed job openings moving above 11M again at the end of October and official BLS data showing the unemployment rate dropping to 4.2% in November, downside makes sense.

The Fed is becoming increasingly attuned to just how tight the labour market is, and is very aware that inflation is currently running at more than three times its target. On that note, if the YoY rate of Consumer Price Inflation (expected to rise to 6.8% in November) is revealed to have surpassed 7.0% in November, that would add further selling pressure to precious metals like silver on expectations for a more hawkish Fed. The bears will be targetting a test of late-September lows around $21.50.

Gold might well be more supported this winter than previously forecast, but the ‘pain trade’ baseline still seems bearish bullion in 2022 and 2023, according to strategists at Citibank. They forecast XAU/USD around $1,685 in 2022.

XAU/USD to sink towards $1,500 in 2023

“We forecast average gold prices around ~$1,685/oz in 2022, declining to $1,500/oz in 2023, versus 2020/2021 annual mean prices near ~$1,800/oz.”

“We hold a 60% conviction for our bearish base case gold price outlook and concedes that prices could spike again to $1,825-1,850 this winter. But on balance, macro and micro factors tilt negative for the yellow metal next year.”

“We assign a 30% bull case scenario that gold prices post fresh nominal highs north of $2,100 by the middle of 2022. The team is sympathetic to the gold bulls’ (monetary) inflation narrative, concerns about persistent government and private debt loads, and bloated fiscal balance sheets. But ultimately, this should lift the long-term price floor for XAU/USD as opposed to buttressing an ongoing bull cycle rally, particularly if real yields are to rise and Fed tightening continues.”

See – Gold Price Forecast: XAU/USD to sink towards $1,600 by end-2022 – ANZ

- The Loonie losses during the New York session amid risk-off market mood as countries impose COVID-19 restrictions.

- Crude oil prices are down, as COVID-19 restriction measures could impact demand for black gold.

- USD/CAD Price Forecast: The pair is mild-bearish, facing strong resistance around 1.2700.

At the time of writing, the USD/CAD advances up some 0.42% on Thursday, trading at 1.2703 during the New York session. On Thursday, imposing restrictions in the UK and the increased transmissibility of the omicron variant worsened market mood amid the optimism of the vaccine’s effectiveness. That, along with good US employment figures, and the safe-haven status of the buck, weighed on the Loonie..

US Initial Jobless Claims drops the most since 1969

On Thursday, the Bureau of Labor Statistics (BLS) reported that the Initial Jobless Claims for the week ending on December 3 rose to 184K, lower than the 215K, declining the most since 1969, beating economists’ estimations.

During the overnight session, the USD/CAD seesawed around Wednesday’s high at 1.2666. However, as market sentiment has worsened, due partly to the omicron news, the pair edged higher, near the 1.2700 figure, retreating to current levels. Furthermore, the US Dollar Index, which tracks the greenback’s performance against a basket of six rivals, is recovering from Wednesday’s losses, up 0.31%, sitting at 96.19, a tailwind for the USD/CAD.

In the meantime, US crude oil benchmark WTI is down almost 0.77%, trading at $71.80, exerting additional pressure on the oil-linked Canadian dollar.

That said, USD/CAD trader’s focus would turn to Friday’s US inflation figures, as Fed policymakers have expressed the need for a faster bond taper, so the US central bank has room to maneuver.

USD/CAD Price Forecast: Technical outlook

The USD/CAD 4-hour chart depicts the bias as mild-bearish, as the spot price is below the 50 and 100-simple moving averages (SMA’s). Furthermore, it is trading near the confluence of the 100-SMA and the 38.2% Fibonacci retracement, around 1.2700, which would be a difficult resistance to overcome. Nevertheless, in the outcome of breaking upward, the next resistance would be the confluence of the 50% Fibonacci retracement and the trendline break, around 1.2720-30 area.

On the downside, the first support would be the December 8 high at 1.2666, followed by the central daily pivot at 1.2640, and then the December 8 low at 1.2605.

After trading at a one-week high on Wednesday of 1.1355, the EUR/USD has just slipped below the 1.13 level as yield differentials edge wider. Economists at Scotiabank think the world's most popular currency pair is set to decline towards the 1.10 level.

Upside scope remains limited

“Today, the spread of US over European debt yields has moved again in favour of the USD. Yesterday’s narrowing may have reflected the reaction to news on the vaccines/virus front, but we would generally advise to look past EUR upside on moves in rates ahead of tomorrow’s US CPI release and especially prior to next week’s Fed decision.”

“In a quarter where the Fed may begin hiking rates, that the ECB is still working through net purchases of government bonds is a solid trigger for continued EUR losses.”

“In the near-term, we see EUR downside to 1.10 on the policy outlook and the possibility of further virus limits with cases surging even before the full arrival of the Omicron strain.”

- USD/JPY slipped under its 50DMA but well within this week’s ranges.

- The pair is trading in a relatively cautious manner on Thursday ahead of US inflation data.

USD/JPY slipped back below its 50-day moving average, which resides just above 113.50, on Thursday, with FX markets trading in tentative, rangebound fashion ahead of Friday’s key US November inflation report and next week's central bank bonanza. The pair currently trades lower by about 0.2% on the day, with the yen sitting at the top of the G10 performance table amid a slightly more risk-averse tone to broader trade. Stocks in Europe and the US are mostly a little lower, as is oil. But at current levels just under 113.50, the pair is trading roughly at the mid-point of this week’s 113.00-114.00 range.

USD/JPY continues to trade largely as a function of movements in US bond markets, particularly in the 10-year yield. 10-year yields started the week under 1.40% but rallied to hit 1.54% on Wednesday, before pulling back to around 1.50%. That broadly mirrors USD/JPY’s rally from 113.00 to 114.00 at the start of the week than more recent retracement back to the mid-113.00s.

Technical factors have also been in play for USD/JPY, however, with the 21-day moving average on Wednesday providing solid resistance just under 114.00 and in the end capping this week’s price action. Much stronger than expected US initial weekly jobless claims numbers on Thursday, which dropped to their lowest since 1969 at 184K, failed to stir the price action on Thursday with focus on Friday’s inflation data. US Consumer Price Inflation is seen rising to 6.8% and some are calling for an above 7.0% reading.

The Fed

The Fed has grown increasingly uncomfortable with inflation at such elevated levels, hence why Fed Chair Jerome Powell said the description “transitory” would be dropped and said it would be appropriate to discuss speeding the QE taper at next week’s meeting. Markets now fully expect the bank to announce plans to accelerate the pace of its QE taper next week, while the tone on inflation and the potential path for rates will be closely eyed, as will the bank’s updated economic projections and dot-plot. As inflation persists at elevated levels, and with FOMC members for now seeing Covid-19 variant risks as more inflationary than anything else, risks are clearly tilted towards the bank opting to start hiking rates sooner rather than later.

USD/JPY is more sensitive to longer-term US yields, which is more sensitive to long-term growth and inflation expectations, rather than the short-end, which is more sensitive to short-term interest rate expectations. If high inflation on Friday triggers hawkish Fed vibes and then the Fed backs this up next week, the US treasury curve is at risk of further flattening (short-end yields up, long-end yields down) like was seen last week – a potential reflection of investor concern that a more prompt Fed tightening to tackle near-term inflation will damage the already shakey (as a result of Omicron) long-term economic outlook. This could weigh on USD/JPY and send it back to recent 112.50 lows.

GBP/USD retains a soft tone amid Omicron covid concerns. The cable aims for the 1.30 level amid limited support markers, economists at Scotiabank report.

Bank of England’s rate hike expectations pushed back

“Uncertainty remains around the severity and speed of contagion of omicron in the UK and thus the BoE will likely hold fire next week. In combination with a hawkish Fed, we see the GBP possibly heading back toward the low 1.30s before gains resume in Q1 as the BoE tightens.”

“The PM’s waning popularity within the Tory ranks (as he announced the virus measures earlier possibly to distract from a staff Christmas party in 2020) risks political anxiety in the UK that will likely weigh on the GBP in the weeks ahead with a slight chance that he faces a confidence vote.”

“The 38.2% Fibonacci retracement of its 2020-21 climb at 1.3165 stands as support followed by a psychological trigger at 1.31.”

“Intraday resistance is 1.3200/15 and then 1.3240/60.”

The S&P 500 Index has essentially held above the 63-day average at 4532 and after a wobbly couple of sessions, the market has surged back higher. Economists at Credit Suisse look for a resumption of the core bull trend and a move to new 2021 highs.

Near-term support moves to 4632/4588

“We look for a break above 4703 to reinforce this further for strength back to the current high and our Q4 objective at 4744/50. Whilst this should again be respected, we look for a break in due course, with resistance then seen next at 4800 and with trend resistance from April now at 4822.”

“Near-term support moves to 4632/4588 initially, which now ideally holds. Only a weekly close below 4529 though would raise the prospect of a lengthier and more damaging correction and ‘risk off’ phase, with support seen next at 4448/38 and then more importantly at the 200-day average at 4313.”

Following a rapid, post-lockdown recovery in 2021, uncertainty has come back to cloud the outlook. Economists at ABN Amro summarise their key judgment calls and assumptions for macro and financial market developments in 2022.

COVID-19

“The pandemic will remain a headwind in the first half of the year, but will not cause further outright contractions in the eurozone or US economies. This assumes that the Omicron variant does not cause more severe disease than prior variants and that vaccination and prior infection still affords some immune protection.”

Inflation

“Supply chain bottlenecks will gradually ease in the course of the year, with pandemic-related disturbances likely to be less significant in 2022 than in 2021. Inflation will fall significantly, coming in below the ECB’s 2% target by year-end in the eurozone, but remaining somewhat above target in the US.”

Interest rates and FX

“The Fed will start raising rates from June, with a total of three 25bp hikes during the course of the year. The ECB will maintain an accommodative policy stance, with purchases under the APP continuing and policy rates remaining on hold. This will create a significant policy divergence with the Fed. Rising US yields will put some upward pressure on eurozone bond yields, and drive a weakening in the euro.”

Emerging Markets

“Tighter global financial conditions could put significant stress on some emerging market economies, but for EMs in aggregate, the impact of this will likely be significantly offset by strong external demand from advanced economies and a further catch-up recovery from the pandemic.”

Economists at Nomura maintains a bearish bias targeting a move towards 1.10 in EUR/USD. They believe the trigger level for a material de-risking is around 1.1434.

Europe faces a tougher winter ahead than the US

"We suspect that buying pressure may already be over as Europe faces a tougher winter ahead than the US and UK with higher levels of naturally acquired immunity. Positioning amongst CTAs is short EUR/USD, but we believe the trigger level for a material de-risking is around 1.1434."

"We doubt EUR/USD will get to 1.1434 as US inflation data this week could yield another positive surprise. We remain short in EUR/USD in spot, looking for a move towards 1.10."

The USD/CAD continues to drift higher but the upside is limited to low 1.27s, in the view of economists at Scotiabank.

Support is seen at 1.2670/60

“After solid gains earlier in the week, some retrenchment in the CAD is not too surprising but we still rather view USD upside potential against the CAD as limited.”

“Short-term price signals suggest the USD rebound from Wednesday’s low can extend modestly after cracking minor resistance (inverse Head & Shoulders trigger) at 1.2665; upside potential extends to the 1.2720 zone (near the 50% retracement of the early week USD drop at 1.2730) in the next day or so.”

“Support is 1.2660/70.”

- Gold witnessed some selling for the second successive day on Thursday amid a stronger USD.

- A weaker tone around the equity markets could limit deeper losses for the safe-haven metal.

- The market focus remains glued to the US consumer inflation figures, due for release on Friday.

Following a brief consolidation through the early part of the trading action, gold witnessed a fresh selling on Thursday and retreated further from a one-week high touched in the previous day. The intraday selling picked up pace during the early North American session and dragged the XAU/USD back closer to the weekly low, below the $1,775 level in the last hour. This marked the second successive day of a negative move and was sponsored by renewed US dollar buying interest, which tends to drive flows away from the dollar-denominated commodity.

The USD was back in demand and reversed a part of the overnight profit-taking slide amid hawkish Fed expectations. Investors seem convinced that the Fed would be forced to tighten its monetary policy sooner rather than later to contain stubbornly high inflation. This was seen as another factor that undermined demand for non-yielding gold. That said, the risk-off impulse – as depicted by a generally weaker tone around the equity markets – extended some support to traditional safe-haven assets and helped limit losses for the XAU/USD.

Mixed headlines on the Omicron variant of the coronavirus kept a lid on the recent optimism. BioNTech and Pfizer said on Wednesday that a three-shot course of their COVID-19 vaccine was able to neutralise the Omicron variant in a laboratory test. This, however, was overshadowed by the fact that the UK Prime Minister Boris Johnson on Wednesday imposed fresh COVID-19 restrictions in England to slow the spread of the new variant. This, along with escalating geopolitical tensions, tempered investors' appetite for perceived riskier assets.

Investors might also refrain from placing aggressive bets, rather prefer to wait for a fresh catalyst from Friday's release of the latest US consumer inflation figures. The US CPI report will be looked upon for fresh clues about the Fed's next policy move strategy on interest rate hikes. This, in turn, will influence the USD price dynamics and gold prices heading into next week's FOMC monetary policy meeting. Hence, it will be prudent to wait for a strong follow-through selling before positioning for any further depreciating move.

Technical outlook

From a technical perspective, the overnight rejection near a technically significant 200-day SMA and the subsequent downfall favours bearish traders. Gold seems poised to prolong its recent corrective slide from a multi-month high and retest the monthly swing low, around the $1,762 area touched last week.

On the flip side, a sustained strength beyond the 200-DMA, which coincides with 100-day SMA, is needed to support prospects for any meaningful upside. Spot prices could then surpass the $1,800 mark and test the next relevant resistance near the $1,810-15 supply zone. The momentum could further get extended towards the $1,832-34 strong horizontal barrier, which should act as a key pivotal point for short-term traders.

Gold daily chart

Key levels to watch

- Spot gold broke below a near-term uptrend on Thursday and subsequent technical selling saw it dip under the $1780 level.

- But gold remains within this week's ranges amid caution ahead of key risk events, including US inflation and the Fed.

Spot gold (XAU/USD) prices have been under pressure in recent trade, with the precious metal dipping from the mid-$1780s to current levels below the $1780 mark over the past few hours. Spot prices are now down about 0.3% on the day, with the selling mainly driven by technical factors and perhaps some dollar strength as opposed to anything happening in US bond markets.

Spot gold recently broke below a short-term uptrend that had been in play since this time last week, and the associated technical selling was enough to push prices under $1780, though not enough to test earlier weekly lows around $1772. The dollar has also seen a modest pick up on Thursday, with the DXY able to recover back above 96.00, though recent upside momentum has stalled in recent trade despite the strong initial weekly jobless claims number since 1969. A stronger US dollar makes dollar-denominated spot gold more expensive for purchase by the holders of foreign currencies, thus reducing its demand.

Key risk events loom

Both the US dollar and spot gold prices have remained within this week’s ranges on Thursday, which is not overly surprising given the important events coming up that will shape the macro narrative. First up, US Consumer Price Inflation data is set to be reported on Friday, with the headline YoY rate of inflation seen rising to 6.8%. The Fed has grown increasingly uncomfortable with inflation at such elevated levels, hence why Fed Chair Jerome Powell said the description “transitory” would be dropped and said it would be appropriate to discuss speeding the QE taper at next week’s meeting.

Speaking of, that will be the next key event on the macro horizon (for gold, the dollar and US yields, anyway). Markets now fully expect the bank to announce plans to accelerate the pace of its QE taper next week, while the tone on inflation and the potential path for rates will be closely eyed, as will the bank’s updated economic projections and dot-plot.

As inflation persists at elevated levels, and with FOMC members for now seeing Covid-19 variant risks as more inflationary than anything else, risks are clearly tilted towards the bank opting to start hiking rates sooner rather than later. The gold bears will be hoping for a hawkish surprise in the coming days, which would likely see the precious metal test recent lows in the $1760 area.

- Initial Jobless Claims fell to 184K last week according to the DoL

- That marked the lowest such reading since 1969.

There were 184,000 initial claims for unemployment benefits in the US during the week ending December 4, data published by the US Department of Labor (DoL) revealed on Thursday. That marked a new post-pandemic low. and, indeed, was the lowest such reading since 1969. This reading followed last week's print of 227K (revised from 222K) and came in well below market expectations for 215K.

Continued jobless claims rose to 1.992M in the week ending November 27, the data showed, above expectations for a drop to 1.90M from 1.954M the week prior. As a result, the insured unemployment rate rose to 1.5% in the week ending November 27 from 1.4% the week prior.

Market Reaction

The Dollar Index (DXY) saw some positive ticks in wake of the stronger than expected data, rising from 96.06 to above 96.10. The data further strengthens the narrative that the US labour market is very strong/tight at the moment, in wake of last Friday's mostly strong jobs report and Wednesday's much higher than expected job openings number.

The electronic and solar sectors are set to support silver throughout the next year. Economists at ANZ Bank expect XAG/USD to find a floor around $20.80 and outperform gold in 2022.

Silver to outperform gold in 2022

“Silver is likely to largely follow gold, but the market balance looks supportive through 2022.”

“We expect fabrication demand to increase by 3% YoY to 572moz, supported by electronic and solar sectors.”

“Automotive industry demand for silver is rising and is estimated to increase from 61moz to 88moz by 2025, according to Metal Focus.”

“We expect silver to outperform gold in 2022, with prices finding a floor near $20.8/oz.”

See – Gold Price Forecast: XAU/USD to sink towards $1,600 by end-2022 – ANZ

- GBP/USD witnessed some selling on Thursday and was pressured by a combination of factors.

- Reduced BoE rate hike bets, Brexit woes continued acting as a headwind for the British pound.

- A softer risk tone benefited the safe-haven greenback and also contributed to the selling bias.

The GBP/USD pair remained on the defensive heading into the North American session, albeit has managed to recover a few pips from the daily swing low. The pair was last seen trading just below the 1.3200 mark, still down over 0.20% for the day.

The pair struggled to capitalize on the overnight bounce from the 1.3160 area, or the lowest level since November 2020 and witnessed fresh selling on Thursday. The imposition of strict COVID-19 restrictions in the UK forced investors to scale back their bets for an imminent interest rate hike by the Bank of England. This, along with persistent Brexit-related uncertainties, continued acting as a headwind for the British pound.

On the other hand, the US dollar attracted fresh buying and reversed a part of the overnight profit-taking slide amid a generally weaker tone around the equity markets. Apart from this, hawkish Fed expectations further underpinned the greenback and exerted some downward pressure on the GBP/USD pair. The downside, however, remains cushioned as investors preferred to wait on the sidelines ahead of Friday's release of the US consumer inflation figures.

The markets have been pricing in the possibility for an eventual Fed liftoff in May 2022 amid worries about rising inflationary pressures. Hence, the US CPI report would influence the Fed's decision to taper its stimulus at a faster pace and set the stage for a rate hike. This, in turn, will drive the USD demand and provide a fresh impetus to the GBP/USD pair.

In the meantime, traders might take cues from Thursday's release of the US Weekly Initial Jobless Claims data. Apart from this, developments surrounding the coronavirus saga and the broader market risk sentiment would allow traders to grab some short-term opportunities around the GBP/USD pair.

Technical levels to watch

- EUR/USD has been ebbing lower on Thursday, though still trades to the north of 1.1300.

- The pair rejected a test of a key long-term downtrend, with markets in wait-and-see mode ahead of key upcoming events.

After its impressive run higher on Wednesday, which was at the time triggered by short-term technical buying as after cross broke above a short-term downtrend, EUR/USD faltered at 1.1350 and has, ever since, been ebbing lower. The pair on Thursday is still trading to the north of the 1.1300 level for now, but has in recent trade dipped under its 21-day moving average again (which resides at 1.1317).

It appears that, ahead of key US inflation data later in the week and next week’s Fed and ECB monetary policy meetings, traders lacked the conviction to send EUR/USD back to the north of a key long-term downtrend. For reference, in mid-November, EUR/USD broke below a downwards trendline that had been supporting the price action all the way back to June. Since then, it has failed twice to break back above this downtrend.

A break above this downtrend would likely signal a shift in EUR/USD’s near-term momentum and a push towards the 1.1400s area to 1.1500 level, but traders and analysts seemingly remain unconvinced that the fundamental backdrop warrants such a move. At the very least, the rejection of the key downtrend suggests that markets want to wait and see what happens with the upcoming key Fed and ECB events.

-637746519563699048.png)

The Fed is unanimously expected to announce an accelerated pace of QE taper as of January, as Chair Jerome Powell hinted last week. If US inflation data this Friday comes out above 7.0%, this will up pressure on the bank to be hawkish, and there are already some outside calls that the bank may start hiking as soon as March, though this is not what markets are currently pricing.

In terms of the ECB next week, it's all about what the bank will do with its pre-pandemic APP to make up for the sudden drop off in monthly QE purchases when the PEPP ends in March. Various ECB sources this morning told the financial press that the bank is converging on a view to increasing APP purchases from March, though in a limited and ideally flexible manner. Meanwhile, separate sources said the ECB might tweak its PEPP reinvestment guidance – reinvestments currently run to the end of 2023. These comments didn’t have any impact on EUR/USD.

Ahead, aside from the release of US weekly jobless claims figures at 1330GMT, it's set to be a quiet day calendarwise. That means Omicron-related headlines will likely continue to dictate the action, from a macro-perspective, at least.

The pound’s relative underperformance this week was partly driven by the announcement of new covid restrictions in the UK. These measures have pushed back Bank of England’s (BoE) rate hike expectations. Subsequently, economists at MUFG Bank expect the GBP/USD pair to edge lower towards the 1.30 level.

BoE rate hike expectations delayed to early 2022

“The UK government will move to the next stage of tighter COVID-19 restrictions in response to the spread of the Omicron variant. The dampening near-term impact on the growth outlook has further encouraged market participants to scale back BoE rate hike expectations. When combined with recent more cautious comments from BoE officials, we now expect the BoE to delay raising rates until at least February. In contrast, we still expect the Fed to speed up the pace of their QE programme this month.”

“The time gap between the first BoE and Fed rate hikes is likely to be much shorter now than initially expected which should keep downward pressure on cable heading into year-end and moving it closer to the 1.3000-level.”

- Silver dropped closer to a one-week-old trading range support on Thursday.

- The recent range-bound price action points to a bearish consolidation phase.

- RSI on the daily chart warrants some caution for aggressive bearish traders.