- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-12-2021

- USD/JPY regains 113.50 amid improving market mood.

- US dollar consolidates post-inflation losses, with eyes on the Fed.

- Impending bear cross and bearish RSI to limit USD/JPY’s advances.

USD/JPY is trading better bid on the Tokyo open, having regained 113.50, finding support from an improvement in the market sentiment.

The positive open on the S&P 500 futures helps the bulls recover some ground in early dealings after a flat close on Friday.

The downbeat Japanese Tankan Large Manufacturing Index for the fourth quarter weighs on the yen, collaborating with the upside in the major.

The in-line with expectations US inflation data on Friday poured cold water on aggressive Fed rate hike expectations, which weighed on the Treasury yields alongside the US dollar, pressurizing USD/JPY towards 113.00.

On the other hand, the record rally in the US stocks amid easing fears over the new Omicron covid variant cushioned the downside in the spot.

All eyes remain on the Fed monetary policy decision for fresh hints on a potential 2022 rate hike, which will eventually impact the yields and the USD/JPY pair.

In the meantime, the Omicron updates and broader market sentiment will lead the way.

USD/JPY: Technical levels to consider

- WTI remains on the front foot after marking the best week since late August.

- Firmer RSI, sustained bounce off weekly support line keeps buyers hopeful.

- Two resistance lines from November guard immediate upside ahead of 200-SMA.

WTI rises 0.52% intraday while piecing the $72.00 threshold during Monday’s Asian session.

The black gold jumped the most on a weekly basis in over three months at the latest by keeping the rebound from a short-term support line. Adding to the bullish bias is the RSI line that stays firmer but not overbought, suggesting the market’s acceptance of the recent recovery.

That said, a clear break of the 100-SMA directs WTI towards a convergence of an ascending trend line from November 29 and a five-week-old downward sloping resistance line, around $73.50.

Should the oil buyers manage to cross the $73.50 hurdle, the 200-SMA level of $76.40 will act as a buffering the run-up targeting November 24 highs near $79.00 and the $80.00 threshold.

In a case where the WTI bulls step back, the stated support line from December 03, around $71.20 by the press time, will restrict short-term declines.

Following that, multiple supports near $70.30 and the $70.00 psychological magnet can entertain the bears before convincing them to knock $69.00 support, which holds the key for the quote’s further weakness.

WTI: Four-hour chart

Trend: Further upside expected

- USD/CAD struggles to extend three-day rebound from monthly low.

- WTI crude oil stretches Friday’s run-up as softer yields underpin commodities.

- US inflation matched market consensus for November but Fed fears prevail.

- Monday’s light calendar puts risk catalysts in the driver’s seat.

USD/CAD fades bounce off monthly low, marked on last Wednesday, while easing to 1.2725 during early Monday morning in Asia.

The Loonie pair snapped a seven-week uptrend the last week as prices of Canada’s key export item, WTI Crude Oil, registered the best week since late August. The oil benchmark takes rounds to $72.00, up 0.26% intraday by the press.

Even so, the USD/CAD pair marked positive daily closing on Friday amid the broad US dollar weakness after the US Consumer Price Index (CPI) matched market expectations. Also positive for the quote were the stable inflation expectations revealed via the University of Michigan Consumer Sentiment Index survey for December.

It’s worth noting that the Bank of Canada’s (BOC) cautious optimism and fears of the South African covid variant, dubbed as Omicron, joined escalating US-China tension to challenge the USD/CAD bears. Furthermore, chatters surrounding the virus-linked reduction in the energy demand and the OPEC+ output hike also kept the pair buyers hopeful.

Above all, the fears that the Fed will stay on course to the rate hike, with anticipated faster tapering, signals further upside of the USD/CAD prices unless any wild-card move.

Against this backdrop, the US 10-year Treasury yields remain sluggish around 1.48% while the S&P 500 Futures await fresh direction after the Wall Street benchmark refreshed all-time high the previous day.

Looking forward, a lack of major data/events scheduled for today will join the market’s anxiety ahead of the Fed decision to test the USD/CAD traders. However, virus updates and geopolitical headlines can offer intermediate moves to the pair.

Technical analysis

Although the recent swing low around 1.2605 restricts the short-term downside of the USD/CAD prices, 10-DMA guards immediate recovery moves near 1.2745.

- GBP/USD fades Friday’s rebound, remains pressured around yearly low.

- UK-EU Brexit talks remained lackluster, fishing rights, medicine supplies were the key hurdles of late.

- UK escalates covid alert level, PM Johnson pushes for booster shots for above 30s.

- Fed vs. BOE battle will be crucial, risk catalysts are also important as catalysts.

GBP/USD grinds near 1.3250, struggles to extend Friday’s rebound, as markets brace for the crucial week.

Alike other major currency pairs, the cable also cheered broad US dollar pullback after the US Consumer Price Index (CPI) refrained from providing any major blow to the markets than already feared. That said, the US CPI matched expectations of 6.8% YoY, versus 6.2% prior, while flashing the fresh 39-year high for November. Adding strength to the GBP/USD bounce were stable inflation expectations revealed via the University of Michigan Consumer Sentiment Index, to 70.4 for December.

Following the US data, global equities marked a relief rally while the US Treasury yields and the US Dollar Index (DXY) eased, helping the GBP/USD to portray a corrective pullback.

It should be noted, however, that an absence of breakthrough during the UK-EU talks over the medical supplies from the Northern Ireland (NI) border challenged the pair buyers. Also portraying the Brexit woes were news shared by the UK Express saying, “French fishermen are planning several blockades in Calais and other key ports in a bid to ruin Christmas for millions of Britons.”

Furthermore, rising COVID-19 cases pushed the UK government to announce an escalation in the virus alert levels, from 3 to 4. As per the latest official details, 1,239 fresh omicron cases took the national tally to 3,137, marking the biggest daily jump in the virus variant cases since its detection in Britain. Even so, UK Prime Minister (PM) Boris Johnson sounds hopeful to overcome the crisis and pushes for more vaccinations. The government recently advised citizens above 30 years to take booster doses of the coronavirus vaccine.

Looking forward, monetary policy meetings by the Bank of England (BOE) and the Federal Reserve (Fed) will be crucial to watch during the data-fest week. Also important will be the Brexit headlines and COVID-19 updates.

Overall, GBP/USD prices are likely to remain pressured as Omicron woes join Brexit fears and push the “Old lady” to refrain from the hawkish performance. However, the inflation remains hot and flashes fears of a wild card move.

Technical analysis

Although GBP/USD buyers remain absent unless witnessing a monthly descending trend line breakout, around 1.3295 at the latest, a downward sloping support line from September 29 near 1.3140 puts a floor beneath the prices.

According to the economists surveyed by Bloomberg, China is likely to begin expanding fiscal stimulus in early 2022 after the country’s top officials outlined counteracting growth pressures and stabilizing the economy as their key goals for the next year.

Key takeaways

“Curbs on the property industry are expected to remain while there could be fewer regulatory surprises.”

“Economists forecast growth to slow to 3.1% in the current quarter, a deceleration from 7.9% in the April-June period and 4.9% in the last quarter.”

“Beijing is also expected to guide banks to issue loans at a faster pace next year, after it omitted references to efforts to control debt levels in the economy from its summary of the meeting.”

Market reaction

USD/CNY was last seen trading at 6.3685, down 0.11% on the day.

- EUR/USD is defending 21-DMA starting out a key week on Monday.

- US dollar licks its inflation-inflicted wounds ahead of the Fed.

- The pair awaits a symmetrical triangle breakout for a clear direction.

EUR/USD is trading on the front foot on the first trading day of this week, having recaptured the 1.1300 level amid the extended weakness in the US dollar across the board.

Tame US inflation combined with looming uncertainty over the Omicron covid variant keep investors on the edge, as they brace for the Fed and ECB monetary policy decisions this week.

The Fed-ECB monetary policy divergence could check the rebound in EUR/USD going forward.

Technically, the spot is holding ground the 21-Daily Moving Average (DMA) at 1.1295 after yielding the weekly close above it.

The 14-day Relative Strength Index (RSI), however, remains flatlined below the 50.00 level, suggesting limited upside potential.

Therefore, a daily closing below the 21-DMA will reinforce the selling interest, opening the downside back towards the rising trendline support at 1.1245.

The next target for EUR bears is seen at the 1.1200 level. Further south, the yearly lows of 1.1185 could be put to test once again.

The bearish momentum would suggest a three-week-old symmetrical triangle breakdown.

EUR/USD: Daily chart

On the flip side, A test of the 1.1350 psychological level, if the 21-DMA support holds. That level is where the falling trendline resistance aligns.

A sustained move above the latter, EUR/USD will confirm an upside breakout from the symmetrical triangle formation.

Buyers could eye for a rally towards the 1.1400 round number.

EUR/USD: Additional levels to consider

- NZD/USD begins the key week without major surprises, steps back from short-term important resistance.

- Friday’s US inflation data improved market’s mood but Omicron fears restricted gains.

- Fed, NZ HYEFU and New Zealand GDP are crucial to watch.

NZD/USD refrains from providing any gaps, taking rounds to 0.6800, as traders turn cautious ahead of the key central bank decisions scheduled for the week.

The kiwi pair cheered risk-on mood the previous day even as the US Consumer Price Index (CPI) flashed a fresh 39-year high. The reason could be linked to the inflation gauge’s matching of the broad consensus, which rejected fears of an unusually high price pressure than forecasted. That said, the US CPI matched expectations of 6.8% YoY, versus 6.2% prior, for November.

Also helping the NZD/USD prices were stable inflation expectations revealed via the University of Michigan Consumer Sentiment Index, to 70.4 for December.

However, fears emanating from the South African covid variant, dubbed as Omicron, joined escalating US-China tussles to weigh on the NZD/USD prices. Also exerting downside pressure on the quote were the talks surrounding the likely shrink in the carry trade due to the Reserve Bank of New Zealand’s (RBNZ) recently less hawkish comments and the Fed rate hike woes.

It’s worth noting that equities rallied after the US inflation woes eased a bit while the Treasury yields and the US Dollar Index (DXY) marked daily losses to the close of the week.

Looking forward, NZD/USD traders will keep their eyes on the New Zealand (NZ) Q3 GDP and the HYEFU (Half Year Economic and Fiscal Update) for clearer decisions but the US Federal Reserve (Fed) monetary policy meeting on Wednesday will be above all as the catalysts. Adding to the watcher’s list are the covid updates and news concerning the Sino-American tension, not to forget the China data dump.

“GDP will be more noise than signal, but we and the consensus expect it to “only” fall by 4.5% q/q, whereas the RBNZ has -7% penciled in. If we are right, perhaps 0.6750 does become summer’s line in the sand?” said the ANZ.

Technical analysis

Despite snapping a five-week downtrend, NZD/USD is yet to overcome a descending resistance line from early November amid sluggish RSI. However, the MACD lines tease bullish cross and keep buyers hopeful to break the 0.6800 hurdle.

That said, a horizontal area from late September, around 0.6860-70 will act as an additional filter before directing buyers to the 0.6980 resistance comprising multiple levels marked in the last 11 weeks.

Meanwhile, a sustained downtrend could initially aim for the yearly low surrounding 0.6735 before challenging the 0.6700 threshold.

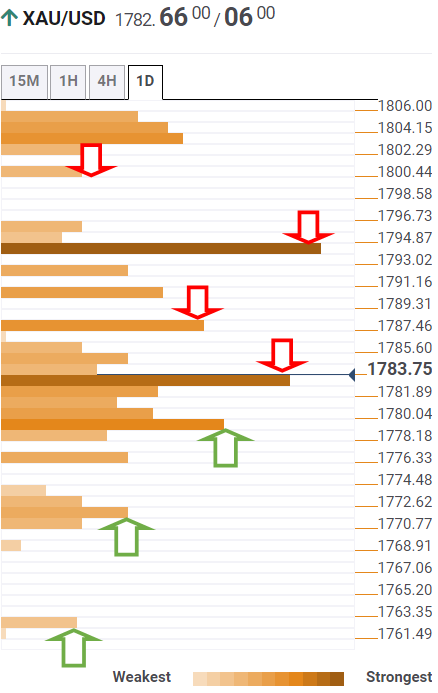

- Gold price rebound remains capped below the critical resistance.

- Fed decision to provide the next directional move in gold price.

- Gold at the mercy of the Fed, ascending triangle pattern in play.

Despite the record run in Wall Street indices and an uptick in the US Consumer Price Index (CPI) on Friday, gold price jumped last Friday. The jump in the US inflation was not as big as expected, which cooled off aggressive Fed rate hike bets, allowing gold price to stage a comeback amid a broad US dollar decline. Stepping into a big week, the Fed decision will provide the next big move in gold price, as it will throw fresh light on the world’s most central bank’s tightening plans. In the meantime, the Omicron covid variant-related updates and the Fed sentiment will keep gold traders on their toes.

Read: Attention shifts to the Fed as US CPI hits a 39-year high

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the gold price is looking to challenge support at $1,780, where the SMA10 one-day coincides with the Fibonacci 38.2% one-week and Fibonacci 61.8% one -day.

The next relevant cushion is envisioned at the Fibonacci 23.6% one week at $1,776. Further south, gold sellers will challenge a bunch of healthy support levels around $1,771, which is the confluence of the pivot point one-week S1, pivot point one-day R1 and Friday’s low.

A sustained move below the latter could trigger a drop towards $1,773-$1,772, the intersection of the Fibonacci 23.6% one-week, pivot point one-day S2 and the Fibonacci 161.8% one-day.

Sustained weakness below the latter will open up floors towards the pivot point one-day S2 at $1,762.

On the upside, gold bulls need to break above a dense cluster of significant resistance levels around $1,783. That price zone is the intersection of the Fibonacci 38.2% one-day, Fibonacci 61.8% one-week and SMA5 one-day.

Gold bulls will then aim for the Fibonacci 23.6% one-month at $1,787, above which powerful resistance awaits around $1,793.

At that point, the SMAs100 and 200 one-day converge with the previous week’s high. Immediate upside will then face a hurdle at the SMA50 one-day at $1,796.

Acceptance above that level will see a fresh advance towards the $1.800 psychological level.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

- AUD/USD kicks off the Fed week on the wrong footing.

- Investors remain cautious amid Omicron uncertainty, ahead of Fed decision.

- The aussie ended its five-week losing streak in the previous week.

Despite the record close on Wall Street indices last Friday, AUD/USD failed to extend its recovery momentum into the weekly opening,

The spot is currently trading at 0.7158, shedding 0.13% so far. The aussie witnessed a 10-pips bearish opening gap, warranting caution for the bulls after booking the first weekly gain in six weeks.

On Friday, the major extended its consolidation near ten-day highs of 0.7188, holding the higher ground amid a broad decline in the US dollar after the hotter inflation data failed to temper the market’s optimism over the new Omicron covid variant.

The US Consumer Price Index (CPI) rose by 6.8% YoY in November vs. 6.8% expected and 6.2% previous. Upbeat inflation readings were already priced-in alongside the Fed’s faster tapering bets for this week.

On the AUD side of the story, markets remain hopeful of the Reserve Bank of Australia (RBA) delivering a hawkish surprise in 2022, as Governor Phillip continued to remain optimistic on the country’s ability to bounce back from the latest hit due to the new variant.

Also, investors resorted to profit-taking on the aussie after the recent slide to 2021 lows of 0.6992, suggesting that the decline was excessive. The recovery in oil prices also helped the resource-linked AUD.

Looking ahead, the US dollar price action and the risk trends will have a significant influence on AUD/USD, as the US/Australian economic calendar remains data-dry this Monday.

AUD/USD: Technicals levels to consider

In a national address on Sunday night, the UK Prime Minister Boris Johnson warned the citizens against the “tidal wave” omicron infections while announcing an end-of-year deadline for the country’s booster vaccination program.

Key quotes

“Everyone eligible aged 18 and over in England will have the chance to get their booster before the New Year,”

“There is a tidal wave of Omicron coming, and I’m afraid it is now clear that two doses of vaccine are simply not enough to give the level of protection we all need.”

His comments came hours after the UK raised its covid alert level to four from three in light of the surge in cases.

Market reaction

As the final busy week of the year 2021 kicks in, markets seem to be in a tepid mood in early dealings, weighing on the GBP/USD pair.

The spot was last seen trading at 1.3236, down 0.23% on the day.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.