- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 13-12-2021

Global rating agency Moody’s highlights the delicate decision the US Federal Reserve (Fed) will have to make during Wednesday’s monetary policy meeting.

The rating giant initially states, “If the market perceives that the Fed is behind the curve in controlling inflation, it would lead to higher inflation expectations and long-term interest rates, potentially weakening the dollar and affecting asset values.” Before mentioning that while, on the other hand, if the Fed overreacts to inflation, ‘it could result in tightening monetary policy too much, in turn dampening economic growth.’

Additional key quotes

Even if the FOMC were to announce a quickening taper and an earlier end to bond purchases, the committee will likely stress data dependency with regards to the timing and pace of rate increases.

If the Fed announces faster tapering to end the bond purchase program, possibly by March 2022, it would more strongly signal that monetary policy is turning.

A faster taper would give the Fed the flexibility to begin raising rates anytime in the second half of 2022.

Read: Fed Preview: Dollar hinges on 2022 rate hike dots, guide to trading the grand finale of 2021

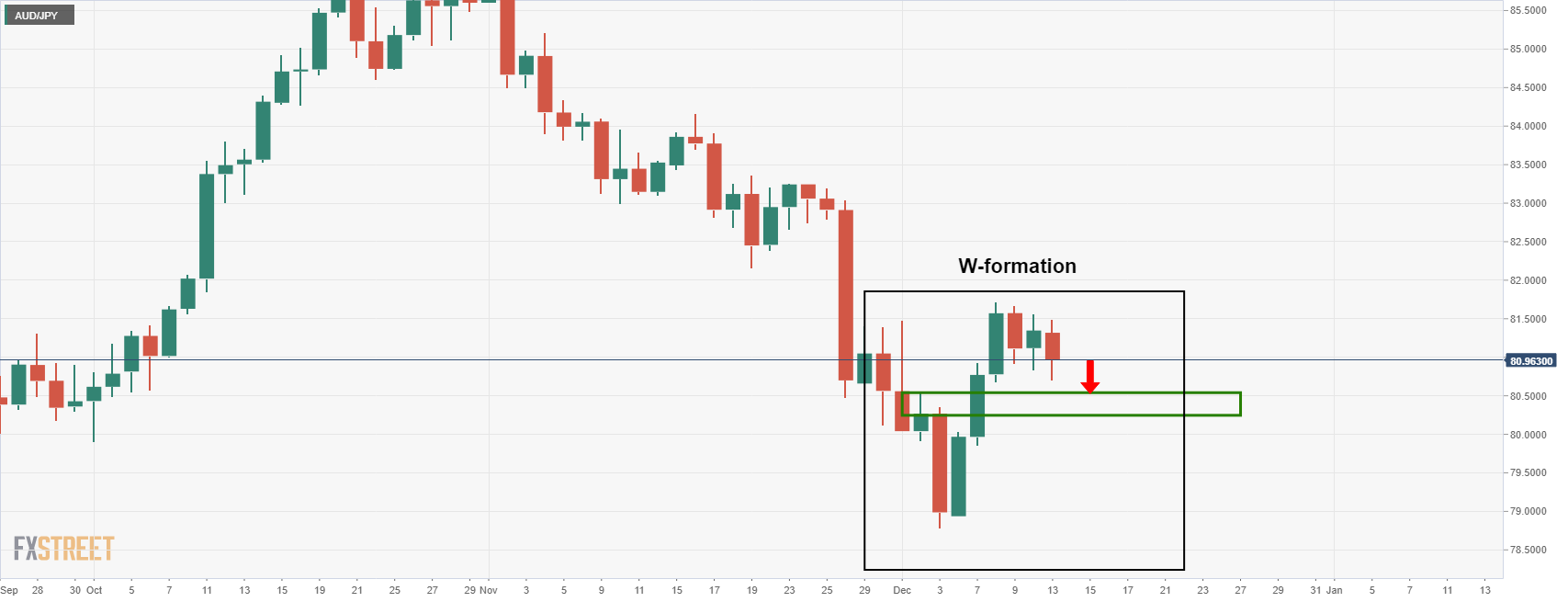

- AUD/JPY 15-min double top opens risk of a break below the 50-EMA.

- The daily chart's W-formation has a neckline target near to 80.60.

AUD/JPY is stalling in hourly resistance leaving the focus on the downside for the sessions ahead. The following illustrates the progress the price is making as per the prior analysis, AUD/JPY Price Analysis: H1 bears moving into gear:

AUD/JPY H1 chart

AUD/JPY M15 chart

The bulls will be expecting a phase of distribution which brown down on the 15-min chart, there is the prospect of this retest of prior support failing and resulting in the start of a potential downside continuation. A break of the 50-EMA should be encouraging for the bears following the double top of the correction.

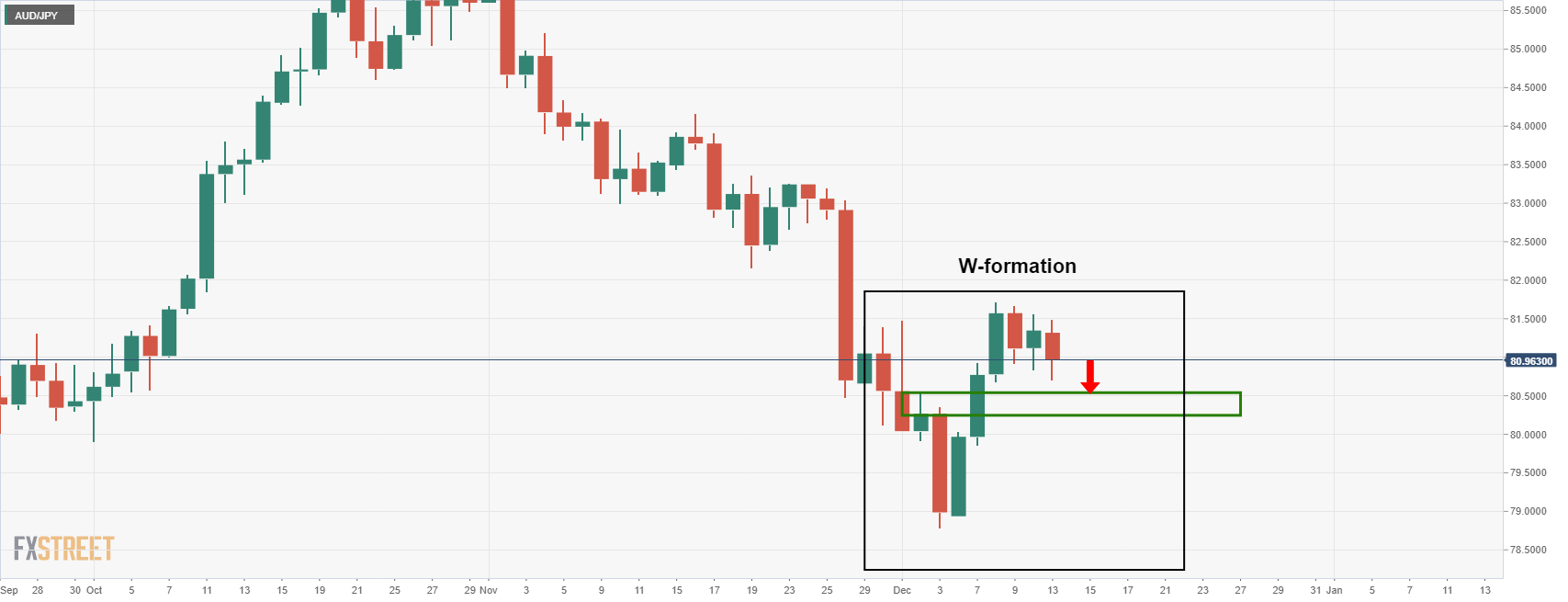

AUD/JPY daily chart

From a daily perspective, the downside is a captivating prospect as well. The W-formation is a high completion price reversion pattern and the price would typically retest the neckline of the formation, which in this case, is located near 80.60.

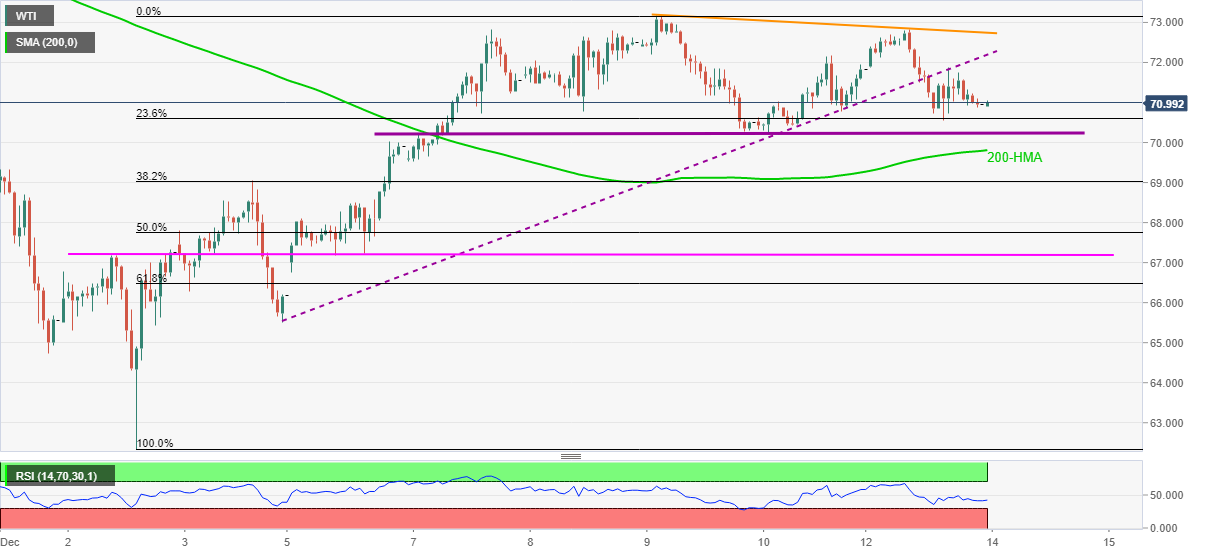

- WTI consolidates recent losses after breaking short-term support.

- Descending RSI, not oversold, adds to the bearish bias targeting 200-HMA.

- Immediate descending trend line challenges buyer’s return ahead of $73.20.

WTI crude oil defends the $71.00 threshold during a quiet Asian session on Tuesday. Even so, the energy bears remain hopeful as the quote broke an upward sloping trend line from December 03 the previous day.

Adding to the bearish bias is the descending RSI line, not oversold, as well as a falling trend line from the last Thursday.

That said, a one-week-old horizontal support area around $70.20 may offer an intermediate halt to the oil sellers before directing them to the 200-HMA level of $69.80.

In a case where the black gold drops below $69.80, the 38.2% Fibonacci retracement (Fibo.) level of December 02-09 upside will precede an eight-day-long horizontal line, respectively around $69.00 and $67.20, to challenge the WTI’s further downside.

On the flip side, the previous support line and descending resistance line from December 12, around $72.20 and $72.80 in that order, restrict the short-term upside of the WTI crude oil prices.

Adding to the resistance is the monthly top near $73.20, a break of which will highlight the late November swing low near $74.65 for the bulls.

WTI: Hourly chart

Trend: Further weakness expected

- The US Dollar Index pares Friday’s losses, up 0.39%.

- The US 10-year Treasury yield plunges to 1.414%, but the greenback rises.

- DXY Technical outlook: Has an upward bias, threatening of breaking above the ascending triangle, which targets 98.00.

The US Dollar Index, also known as DXY, which measures the greenback’s performance against a basket of six rivals, climbs 0.29%, sits at 96.37 during the day as the New York session winds down, at the time of writing. The risk-off market mood was spurred from reports of the UK of the first COVID-19 Omicron-related death. Further, three of the most important central banks worldwide will host their last monetary policy meeting of 2021, adding fuel to the weak sentiment.

In the US bond market, Treasury yields in the long-term maturity of the curve fell with 10s, the 20s and 30s dropping between seven to eight basis points, ended at 1.414%, 1.84%, and 1.80%, each.

On Monday, there is nothing to report on the economic docket. By Tuesday, the Department of Labors would release the Producer Price Index for November. Apart from that, the market participants’ focus is on the Federal Reserve monetary policy meeting, which begins on Tuesday. At the same reunion, the Fed will unveil its Summary of Economic Projections (SEP), which has the famous “dot-plot,” a chart that shows policymakers interest rates expectations. A Bloomberg poll predicts that all US central bank policymakers (18) would expect two rate hikes by 2022.

Money market futures show around 66 basis points of tightening by the end of next year.

Further, two weeks ago, a parade of Fed policymakers, led by Chairman Jerome Powell, expressed their interest in a “faster” QE’s reduction. The same Bloomberg poll sees an increase to $30 billion reduction, beginning in January of 2022.

US Dollar Index (DXY) Price Forecast: Technical outlook

The US Dollar Index started the week above 96.00 and approached the top-trendline of the ascending triangle. The DXY is in a clear uptrend, and through the last couple of weeks, price action consolidated around the 95.50-96.50 range, forming an ascending triangle in an uptrend.

In the event of breaking to the upside of the formation, the ascending-triangle target would be 98.00, but it would find some hurdles on the way up.

The first resistance would be 97.00, followed by June 30 high at 97.80, followed by the bullish flag 98.00 targets.

-637750351515026313.png)

JP Morgan retains bearish bias for the prices for gold and silver during its latest forecast, projecting an average price of $1,630 per ounce for gold and $20.48 for silver in 2022.

“Expect rebasing higher in long end us nominal yields to weigh on gold over medium-term,” said the US bank in the recent analysis.

On the same line were comments from Kitco that quotes analysts tracking the Commodity Futures Trading Commission (CFTC) data to mention, “Hawkish comments from Federal Reserve Chair Jerome Powell continue to drive hedge funds away from gold and silver.”

“The latest data shows that sentiment in gold is at its lowest point since late-October as funds liquidate their bullish bets,” said Kitco News.

Market implications

Although precious metal bears are bracing for more gains into 2022, this week’s US Federal Reserve (Fed) monetary policy meeting will be the key to follow for clearer directions.

Read: Fed Preview: Dollar hinges on 2022 rate hike dots, guide to trading the grand finale of 2021

- AUD/USD dropped the most in a week before the day-end corrective pullback.

- Cautious mood ahead of the key central bank meetings, Omicron woes offered a negative start to the week.

- China’s readiness for more stimulus fails to save the bulls but 10-DMA does.

- Aussie NAB figures, US PPI will decorate calendar but risk catalysts are more important.

AUD/USD consolidates the heaviest daily fall in a week around 0.7130 during early Tuesday morning in Asia. Market’s fears at the start of the crucial week could be linked to the Aussie pair’s declines the previous day, after failing to cross an important resistance amid late last week.

Anxiety over the US Federal Reserve’s (Fed) next step amid the fears emanating from the South African covid variant, dubbed as Omicron, becomes the cornerstone of the latest sour sentiment. Not only the Fed but the concerns relating to the European Central Bank (ECB) and the Bank of England (BOE) were on the same line that roiled the mood of late.

Friday’s US Consumer Price Index (CPI) for November matched market consensus and the US inflation expectations, portrayed by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, slumped to the 10-week low on Monday. In addition to receding inflation woes, the UK’s first Omicron-linked death and return of the mask mandate in California also makes it tough for the Fed has to match hawkish expectations.

Also challenging the AUD/USD buyers is a lack of confidence in China’s vow to stabilize the economy in 2022 with monetary and fiscal measures. During the 2021 Central Economic Work Conference, Chinese officials showed readiness to use monetary and fiscal policy tools to stabilize the world’s second-largest economy in 2022.

Furthermore, the recently escalating tensions between the US and China could also be cited as the factor to back the latest risk-off mood.

On the contrary, hopes of faster progress on the US President Joe Biden’s $1.75 trillion aide package join a pullback in the US dollar to probe the AUD/USD bears.

Amid these plays, the Wall Street benchmarks posted losses while the US 10-year Treasury yields also dropped amid the rush to risk safety that propelled traditional safe-havens like gold and US bonds.

Moving on, National Australia Bank’s (NAB) Business Confidence and Business Conditions for November can initially entertain AUD/USD traders ahead of the US Producer Price Index (PPI). It should be noted, however, that major attention will be given to the risk catalysts, mainly concerning the inflation and the South African covid variant named Omicron, for fresh impulse.

Technical analysis

Despite crossing 10-DMA, AUD/USD bulls failed to pierce an 11-week-old horizontal hurdle surrounding 0.7175-80 that also includes the 21-DMA. Even so, bullish MACD signals and firmer RSI keeps buyers hopeful. That said, short-term sellers may aim for the 10-DMA level near 0.7110 but the 0.7060 and the 0.7000 support levels will challenge the pair’s further downside.

“The White House is scrambling to salvage its plans to pass Joe Biden’s $1.75 trillion Build Back Better bill by the end of the year, with time running out to win over Democratic holdouts worried about excessive spending and persistent inflation.” said Financial Times (FT) during the late Monday news.

Following the update, CNN’s Manu Raju quotes a spokesperson of Democratic senator Joe Manchin as saying, “Senator Manchin and President Biden had a productive conversation this afternoon. They will continue to talk over the coming days.”

“After talking with Biden, Manchin tells a group of us he’s not walking away from talks. And when we asked if he thinks bill can get done this year, he said: ‘anything is possible’ and he’s still ‘engaged’ in talks,” also tweeted CNN’s Manu Raju.

“Manchin, the most conservative Democrat in the Senate, has for months raised concerns about the size and scope of Build Back Better, and has recently tied his objections to rising inflation,” said the FT news.

The Financial Times also said, “Because Democrats control the chamber by the narrowest of margins — 50-50, with vice-president Kamala Harris able to cast the tiebreaking vote — they need the support of all 50 Democratic senators.”

FX reaction

Although the news should have helped the risk barometers, cautious sentiment ahead of the key central bank meetings and the latest spread of the Omicron fears weigh on the mood of late.

Read: Forex Today: Risk-aversion at the start of the week

- The first Omicron-linked death in the UK dented the market sentiment.

- NZD/JPY Technical outlook: The pair has a downward bias as long as it remains under the 200-DMA.

As Wall Street closes, the NZD/JPY pair is trading at 76.65 during the day at the time of writing. As the trading session in the day ends, the market sentiment is downbeat. Omicron variant woes, and central bank monetary policy meetings, keep investors at bay.

In the European session in the UK, the first Omicron-linked death was reported amid raising the COVID-19 alert from three to four. Also, according to a University of Oxford study, two shots of vaccines showed a “substantial drop in neutralizing antibodies” when in contact with the new variant.

In the overnight session, the NZD/JPY pair seesawed around the Monday central daily pivot at 77.05, coinciding with the 50 and the 100-hour simple moving average (SMA). However, as the market sentiment worsened, market participants flew towards safe-haven assets, leaving adrift risk-sensitive currencies.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY pair failed to break a seven-month-old downslope trendline, opening the door for further downside. Additionally, the daily moving averages (DMAs) reside well above the spot price, supporting the bearish bias.

That said, the first support on the way down would be the December 8 cycle low at 76.69, followed by the December 3 low at 75.95. A breach of the latter would expose the August 19 cycle low at 74.57.

On the other hand, the NZD/JPY first resistance would be the 77.30-60 area, respected on Thursday, followed by the 200-day SMA, at 78.07, immediately followed by the 100-day SMA at 78.26.

-637750305143322594.png)

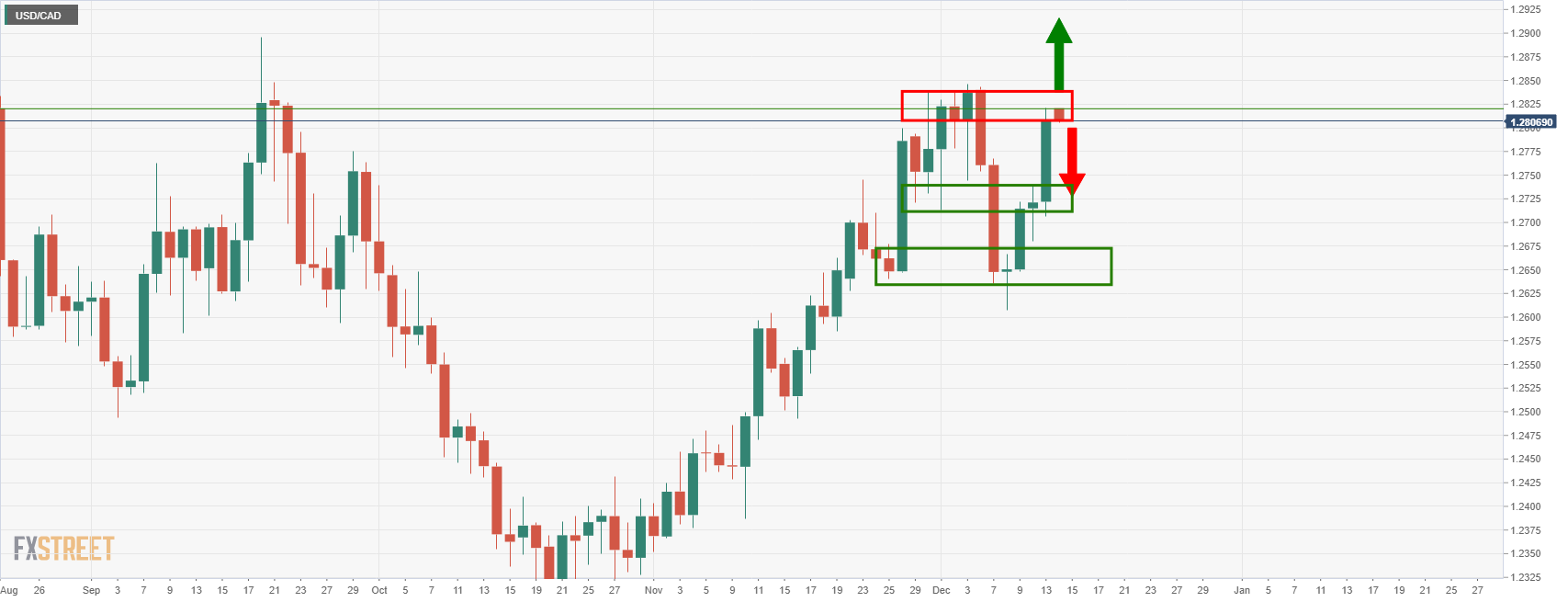

- USD/CAD is testing an important resistance area.

- Bears are moving in with a focus on 1.2720.

USD/CAD is consolidating the recent bullish impulse as it meets an important resistance area on the weekly and daily chart as illustrated below:

USD/CAD weekly chart

The bulls have stepped in after making a 38.2% Fibonacci retracement Cleveland taking on the bears to weekly resistance.

USD/CAD daily chart

However, the bulls could be on the verge of throwing in the towel at this juncture and keen to take off some risk as the price meets both weekly and daily resistance structures near 1.2850. An imminent retracement will likely home in on 1.2710/40.

- In a subdued start to the week, EUR/JPY consolidated within thin ranges just to the north of 128.00.

- The lack of conviction isnt overly surprising given the looming ECB and BoJ rate decision on Thursday and Friday.

- Ahead of these events, the pair could also be volatile on any further swings in risk appetite.

It was a subdued start to the week for EUR/JPY, with the pair consolidating within thin ranges just to the north of the 128.00 level. The lack of conviction isn't overly surprising given the looming ECB and BoJ rate decision on Thursday and Friday, as well as the release of Eurozone, flash PMIs for December and Japan Industrial Production data for October.

Ahead of these risk events, it would be surprising to see EUR/JPY find meaningful direction. Traders will thus be looking to resistance in the 128.50 area to cap the price action and to recent lows around 1.12750 to act as a floor. Should 128.50 be broken, there is the 21-day moving average at 128.70 just above it and then last week’s high at 129.00 to act as resistance.

One thing to keep an eye out for ahead of these key macro events later in the week would be if Wednesday’s Fed meeting or any Omicron-related developments spurred a broad shift in the market’s appetite for risk. It seems that the risks here tilt to the downside (perhaps the Fed spooks markets by being too hawkish, or lockdown fears are rekindled), which arguably means the risks to EUR/JPY lay to the downside also. Out of the two currencies, the yen is seen as more of a safe haven.

Indeed, the 127.50 level is highly significant and a break below it would see EUR/JPY hit its lowest levels since February. Given a lack of immediate support, a swift move towards the 125.00 area could be on the cards if this was to be the case.

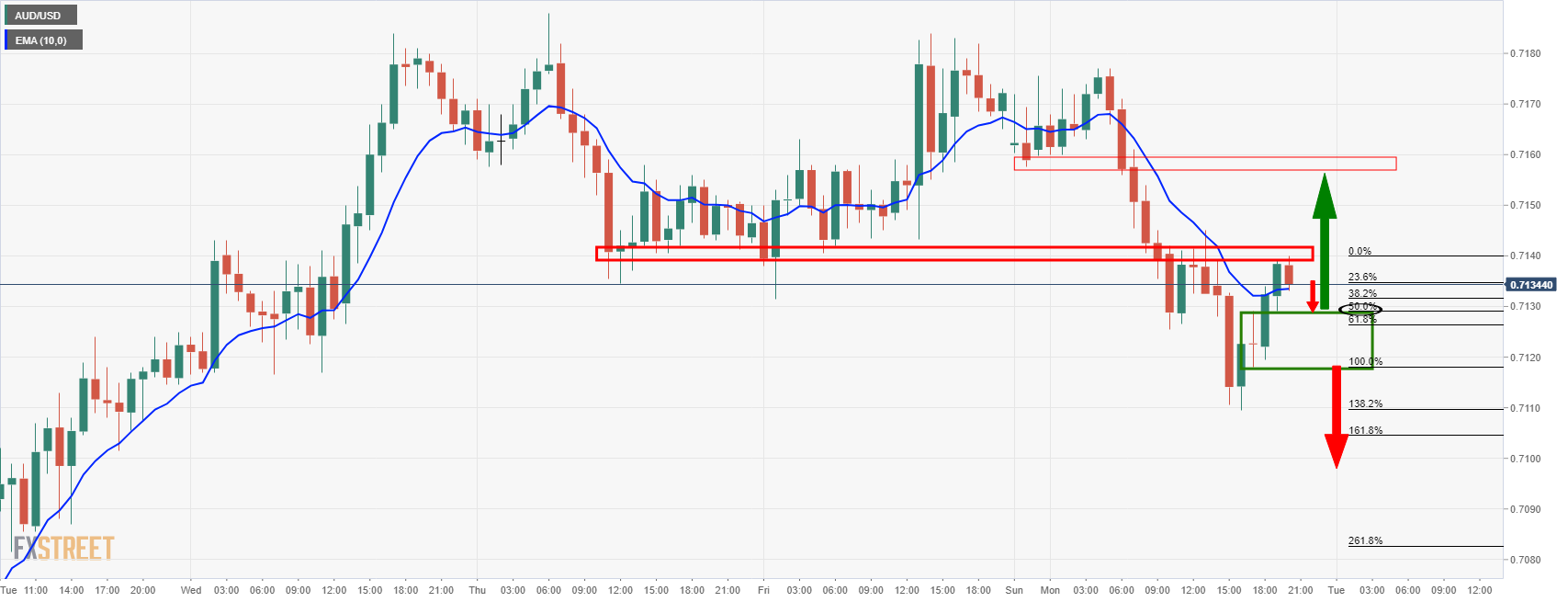

- AUD/USD bulls tun into a wall of resistance across the time frames.

- Bears can aim for a test of 0.70 the figure for the week ahead.

The price is moving in on the support zone between 0.7120/30 and if bulls commit then the price can head beyond the 0.7140s in the coming sessions towards 0.7160 /80.

AUD/USD H1 chart

However, should the bulls give way, then 0.7080 will be a potential target met early this week:

AUD/USD daily chart

From a daily perspective, the price is meeting resistance below 0.72 the figure and the focus is on a break of 0.7000 for the week ahead.

- EUR/USD was capped by its 21DMA and the 1.1300 level on Monday.

- Some traders attributed this to markets prepositioning for a more hawkish lean from the Fed later this week.

- There will also be attention on the ECB’s policy decision on Thursday.

EUR/USD upside was capped by the psychologically important 1.1300 level and its 21-day moving average just below it on Monday. At present, the pair trades around the 1.1290 mark and is set to end the day around 0.2% lower, a decent recovery from earlier session lows close to 1.1260 when the pair was, at the time, down about 0.5% on the day.

Monday’s weakness was driven by a stronger dollar rather than any idiosyncratic euro weakness. Some market commentators framed this as reflective of markets pricing in expectations for a more hawk Fed policy announcement on Wednesday. But looking at EUR/USD over a broader time horizon, Monday’s trading conditions are in fitting with the broadly consolidative conditions that have dominated in recent sessions, during which time EUR/USD has carved out an approximate 1.1250 to 1.1350ish range.

For EUR/USD to establish some directional momentum again, it is likely going to need to see a sustained breakout of these recent ranges. Perhaps this week’s Fed meeting can provide such impetus. But some dollar bulls worry that, in wake of recent hot US inflation and labour market reports and the hawkish tone of Fed Chair Jerome Powell when he last spoke earlier in the month, it will be hard for the Fed to match already very hawkish expectations for this week’s meeting.

Perhaps this impetus can come from the ECB policy announcement on Thursday. The bank is expected to announce its post-PEPP QE plans, with a temporary lift to the pre-pandemic APP QE scheme likely. Markets will likely be more sensitive to the bank’s updated economic forecasts and how ECB rate hike expectations react to these.

- AUD/NZD pushed back above 1.0550 on Monday to challenge last week’s highs on Monday.

- External central bank events will dictate FX action this week, but Australia and New Zealand data will be of note.

AUD/NZD pushed back towards last week’s highs above 1.0550 on Monday, up about 0.1% on the day, as the Aussie dollar tentatively continued its run of outperformance versus its kiwi counterpart. The pair has rallied about 2.0% from lows earlier in the month close to 1.0350 and in doing so crossed back above both its 21 and 50-day moving averages which both currently reside close to the 1.0450 mark. To the upside lays the 200DMA almost bang on the 1.0600 level, which is also roughly in line with the October highs, while, to the downside, the 1.0500 area is a key zone of support.

The main theme in FX markets this week is central bank meetings, though neither the RBA or RBNZ are setting policy. But that doesn’t mean the pair can’t still derive some external tailwinds; one strategist suggested that if the Fed’s dot-plot this week is more hawkish than expected, then hawkish RBA bets could be boosted in tandem with more hawkish Fed bets. This could provide AUD/NZD with tailwinds.

But there will also be plenty of domestic Australia/New Zealand data for FX markets to sink their teeth into, as well as some central bank speak. RBNZ Governor Adrian Orr orates on Tuesday ahead of the release of NZ Q3 Current Account numbers and the Australia December Westpac Consumer Sentiment survey. Then, during Thursday’s Asia Pacific session, NZ Q3 GDP numbers are out, ahead of a speech from RBA Governor Philip Lowe and the release of the Australian November Labour Market report. On Friday, ANZ Business Confidence data is scheduled for release.

- US crude oil prices fall 1.20%, as the first omicron-related death looms the impact of the new COVID-19 strain.

- Crude oil demand might decrease if the Omicron variant causes severe illness than the first ones.

- WTI Technical outlook: Has an upward bias, but the 200-DMA is at risk.

The US crude oil benchmark, Western Texas Intermediate (WTI), edges lower during the New York session, trading at $70.96 at the time of writing. Since the mid-European session, the market mood has been in risk-off mode. The increase in COVID-19 cases, linked to the newly discovered omicron variant, and the first death caused by the strain in the UK, kept investors nervous. Alongside that, the impact on people’s mobility and the UK’s weighing on imposing stricter restrictions pushed crude oil prices down.

In the overnight session, WTI’s peaked at around $72.75, then tumbled towards $70.50 amid the impact of the omicron variant and mobility restrictions that could decrease oil demand. That, alongside technical resistance levels with the 100-hour simple moving average (SMA) at $71.70 and the 50-hour SMA at $71.36, put a lid on WTI’s prices.

Furthermore, the Organization of Petroleum Exporting Countries and its allies (OPEC+) increased its outlook for oil consumption in the Q1 of 2022, up to 1.1 million barrels a day, equivalent to an annual world consumption growth in a “typical” year before the pandemic, according to Bloomberg.

On its 2022 outlook, OPEC mentioned that the Omicron variant is expected to have a mild impact as the world gets used to dealing with the COVID-19 pandemic.

WTI Price Forecast: Technical outlook

WTI’s daily chart shows that oil had been in consolidation since Tuesday last week. WTI has an upward bias, with the 200-DMA below the price, acting as a dynamic support area. However, downside risks remain unless oil bulls reclaim the 100-DMA at $73.77.

To the upside, the first resistance level would be the psychological $72.00 figure. A breach of the latter would send US crude oil towards the 100-DMA but need to break above $73.00.

On the other hand, a break below the 200-DMA would expose the figure at $70.00. If WTI bears break that level, the following demand area would be the September 1 low at $67.01, followed by the December 2 cycle low at $62.34.

-637750224009960620.png)

- The focus is on central banks and the Covid-19 torment.

- The price is running into hourly resistance below a bearish 10/21 EMA crossover.

NZD/USD is off by some 0.45% at the time of writing and is correcting the bearish hourly impulse within the day's range of 0.6801 to 0.6745 so far. A series of central bank meetings are scheduled for this week which is weighing on risk appetite and the higher beta currencies such as the kiwi.

Central banks on focus

With a shift from the transitory language, inflation risks are the driving force on a week where more than 20 central banks are expected to meet this week including the Federal Reserve, the European Central Bank, the Bank of England and the Bank of Japan.

Besides inflation, Omicron will be a top priority on these central bank's mandates at a time where the first publicly confirmed death globally was announced at the start of this week from the swiftly spreading strain. Case numbers have started to soar – particularly in Europe and risk-off flows are a weight for the kiwi despite the fact that Markets are positioning for multiple further rate rises by the RBNZ next year.

''Given the busy domestic and international event schedule, we’re keeping an open mind, especially given that the NZD and AUD “wore it” disproportionally last night,'' analysts at ANZ Bank said. 'Volatility seems to be the order of the day, with most traders likely watching correlated markets rather than data. Food price data today isn’t likely to perturb the Kiwi much.''

NZD/USD technical analysis

The price is running into hourly resistance below a bearish 10/21 EMA crossover. The pressures would be expected to move in from the bears around the 38.2% Fibonacci retracmenet level resulting in a downside continuation of the bearish trend.

What you need to know on Tuesday, December 14:

Major pairs seesawed between gains and losses in a risk-averse environment, with volatility subdued and majors confined to familiar levels, as market participants await central banks’ announcements. The US Federal Reserve will announce its monetary policy decision on Wednesday, while the Bank of England and the European Central Bank will do the same on Thursday.

Concerns rotate around how the ongoing Omicron outbreak may affect such decisions and global economic growth. Meanwhile, the UK reported the first death related to the Omicron variant.

The EUR/USD pair trades a handful of pips below the 1.1300 level, while the British Pound fell against the greenback towards the 1.3200 region. Commodity-linked currencies came under selling pressure as Wall Street edged lower, recovering modestly ahead of the close. Safe-haven CHF and JPY are little changed against the dollar on a daily basis, trimming losses in the last trading session of the day.

The yield on the 10-year US Treasury note peaked at 1.50%, but retreated to 1.41%, finishing the day near the latter.

Gold managed to advance, with spot trading around $1,787 a troy ounce, while crude oil prices were weighed by the poor performance of equities, and WTI ended the day at $71.00 a barrel.

Dogecoin price to return to $0.09 as DOGE enters bear market

Like this article? Help us with some feedback by answering this survey:

- The S&P 500 dropped 0.6% on Monday in a cautious start to the week as Omicron fears persist.

- Travel-related companies performer the worst in the US, whilst defensive names did better.

US equities markets have come under pressure on the first trading day of the week after the S&P 500 managed a record high close last Friday at 4712. The index has dropped more than 25 points to current levels in the 4680s, a decline of over 0.5%. Still, the S&P 500 continues to trade within the ranges carved out during the latter part of last week, so Monday’s selling pressure is hardly catastrophic. But it is indicative of markets beginning the week with a sense of caution as worries about the Omicron variant persist and ahead of a deluge of key central bank meetings (most important of which is the Fed) and G10 economic data releases.

The Nasdaq 100 is the worst performing of the major indices, down about 0.9% on the session, though the index looks set to find support above the 16.1K level for a fifth consecutive session. The Dow, meanwhile, is down about 0.7%, while the VIX is up about 1.50 and back above the 20.00 mark, indicative of traders deeming it too soon to completely unwind post-Omicron volatility expectations. Speaking of the new variant, news from the UK seems to have triggered some concern after the UK PM warned of a “tidal wave” of infections, which now apparently already account for around a fifth of the infections in the whole country.

“Creeping headlines about the Omicron variant are weighing on traders' minds”, said analysts at Equiti Capital. Meanwhile, according to analysts at Charles Schwab, “the big unknown is still the Omicron variant and we don't know just yet how that may affect markets and the economy, but as long as that uncertainty exists the volatility is probably going to remain higher”.

Covid-19 fears weighed heavily on the Transportation (-1.2%) and Airline (-3.9%) sectors, with traders citing the possibility that parts of the US follow in the footsteps of Europe in the coming weeks and reimpose restrictions. The uncertain start to the week also weighed on US yields, particularly at the long-end (given that the short-end remains underpinned by expectations for a hawkish Fed midweek), but this has not come to Big Tech’s aide. The S&P 500 Communication Services and Information Technology GICS sectors were down about 0.5% and 0.9% respectively. The more defensive sectors held up better. The Consumer Staples sector was up more than 1.0%, while the S&P 500 Healthcare sector was up 0.9%.

- AUD/JPY bulls are in charge, for now, while bears get ready to move in.

- The hourly chart's price action is forming a bearish structure, in line with the meanwhile daily outlook.

As illustrated below, the price of AUD/JPY is with the bulls for the time being, but the prior support would be expected to act as a resistance and failure on the retest opens risk to the downside.

AUD/JPY H1 chart

The 61.8% ratio is in confluence with this area of potential resistance located near 81 the figure. Before there, however, 80.95 is under pressure and could hold up as a 50% mean reversion level.

AUD/JPY daily chart

From a daily perspective, the downside is compelling considering the W-formation which is a high completion rate reversion pattern. The price would typically retest the neckline of the formation, which in this case, is located near 80.56.

- The euro recovers some ground against cable, up some 0.32%.

- EUR/GBP Technical outlook: The daily chart, has a downward bias, as long as the 200-DMA and a downslope trendline hold.

- EUR/GBP Technical outlook: The 1-hour chart has an upward bias, but it would face strong resistance around 0.8550s.

The shared currency grinds higher, recovering from Friday’s losses, is trading at 0.8543 during the New York session at press time. The market sentiment stills downbeat since the Wall Street open, as portrayed by European stock indices recording losses, while across the Atlantic, the US indices are down between 0.71% and 1.55%.

In the European session, the UK informed the death of the first omicron-linked COVID-19 case that spurred the switch in market mood. That triggered a move from 0.8500 up to 0.8520 in the cross-currency pair, as investors look for low-yielding peers as safe-haven flows. The British pound continued weakening against the euro in the last couple of hours, though the EUR/GBP pair will face strong resistance around 0.8550.

EUR/GBP Price Forecast: Technical outlook

Daily chart

From the daily chart perspective, the pair still tilted to the downside, as long as the 200-day moving average (DMA) remains respected. However, during today’s price action, the cross-currency bounced at the 100-DMA at 0.8511, so the EUR/GBP could be range-bound unless a catalyst hits the market.

To the upside, the first resistance would be the 200-DMA at 0.8555. If the 200-DMA gives way to EUR bulls, then the next resistance would be a downslope trendline that travels from April highs through July’s one, around the 0.8575-95 area, followed by the figure at 0.8600.

On the other hand, the first support would be the 100-DMA at 0.8511. A break of that level would expose 0.8500, followed by the 50-DMA at 0.8480.

-637750183027626125.png)

1-hour chart

In the 1-hour chart, the EUR/GBP is tilted to the upside, though it would face strong resistance at a downslope trendline that travels from December 9 highs, passing around the 0.8550-60 area. In the event of breaking to the upside, the first resistance would be 0.8588, followed by 0.8600.

On the flip side, the first support would be the 100-hour simple moving average (SMA) at 0.8541, followed by the 50-hour SMA at 0.8534 and then the 200-hour at 0.8527.

-637750183203190109.png)

- GBP/JPY bulls are in play from critical support.

- 152.40s are eyed from the longer-term analysis. Nearer term,150.20 is compelling on the 4-hour chart.

GBP/JPY is meeting a critical area of support and the focus is on the upside across the time frames and various structures as follows:

GBP/JPY weekly chart

The weekly chart is compelling as per the M-formation. The price will typically revert for a test of the neckline, which in this case, is located near 152.40.

GBP/JPY daily chart

The daily support is so far holding up and zooming in, there are prospects for a test the upside as follows:

GBP/JPY H4 chart

From a 4-hour perspective, the price could be destined for a test of the prior lows and the confluence of the 38.2% Fibonacci retracement of the prior bearish impulse. This comes in near 150.20. Should the resistance hold at this area, then the downside will be in play and a break of the dynamic support opens risk towards 149 the figure.

- Spot silver continued to rise on Monday amid risk-off and a favourable yield environment.

- The main event of the week will be the Fed and their hawkishness might hurt precious metals.

Spot silver (XAG/USD) prices are higher on Monday, building on last Friday’s rebound from just under $22.00 per troy ounce to current levels close to current levels around $22.30 amid a favourable yield environment. To the upside, XAG/USD faces resistance in the $22.60 area in the form of last week’s highs, whilst to the downside, there is support around $21.80. A bullish break would open the door to a move towards the $23.00 level, which has been an important balance area in recent months. A bearish break would bring the $21.50 level in focus, which coincides roughly with September’s low.

Driving the day

US yields have been falling gradually for most of the session, particularly at the long end of the curve, amid a risk-off market feel that is favouring safe havens assets like US bonds (thus suppressing yields) as risk assets (stocks, commodities, risk-sensitive currencies) decline. There is a sense of caution in the market ahead of a week jam-packed with important central bank events, the most important of which is Wednesday’s Fed policy announcement, and G10 data releases.

Meanwhile, worries about the impact of Omicron on the near-term economic outlook remain elevated after UK PM Boris Johnson sounded the alarm about a coming “tidal wave” of infections in the UK over the weekend. US 10-year yields are down about 6bps and back under 1.45%, still well below pre-Omicron emergence levels (near 1.70%), while US 10-year TIPS yields are down about 3bps on the day and remain under -1.0%. The dollar is a little firmer, which some market commentators have attributed to pre-FOMC meeting positioning (on expectations of a hawkish outcome), though the dominant driver of markets on Monday remains risk appetite.

In terms of the outlook for silver this week, if risk appetite continues to be the main driver (perhaps on more bad Omicron news), then the prospect for further upside is good. However, if central banks and the theme of their reaction functions to economic conditions is the main driver, then things look less positive for precious metals. There is a bonanza G10 and EM central banks this week, but the most important of which is the Fed on Wednesday and they are going to pivot hawkishly – recall that Chairman Jerome Powell indicated this in his Congressional testimony earlier in the month when he said it might be appropriate to hasten the pace of QE tapering and to drop the term “transitory” to describe inflation.

For precious metals to see a sustained rebound, there is going to have to be a notably dovish change in tone from the Fed that weighs on short-end and real yields and causes inflation bets to rise. With inflation at 6.8%, as the latest Consumer Price Inflation report revealed last Friday and with the Fed now framing inflation as a greater threat to the labour market as opposed to pre-emptive policy tightening, such a shift seems highly unlikely.

- Gold bulls rake control at the start of the week and eye $1,1815 resistance.

- The Fed is the key focus this week and markets weigh aggressive tightening.

On Monday, the price of gold has started off in the hands of the bulls eyeing a breakout to test the familiar daily resistance near $1,815. At the time of writing, the yellow metal is higher by some 0.3% and has travelled between a low of $1,781.89 and a high of $1,791.65.

The start of the week is active ahead of a flurry of central bank announcements amid fears about inflation and the economic threats posed by the Omicron. The precious metals are customary to such a climate and can avail where volatility and risk-off themes dictate the flows.

With respect to the Covid-19 variant, Omicron, while it has been noted as a concern by the World Health Organization and the U.S. Centers for Disease Control and Prevention, scientists say preliminary data suggests it may cause milder cases of covid-19 than the delta variant. Nevertheless, news of the first death from the variant is troublesome for risk appetite, supporting the demand for gold. At least one person has died in the United Kingdom after contracting Omicron cPrime Minister Boris Johnson said on Monday, the first publicly confirmed death globally from the swiftly spreading strain.

Meanwhile, the Federal Reserve is anticipated to accelerate the withdrawal of stimulus on Wednesday, perhaps opening the door to earlier interest-rate hikes in 2022 if price pressures remain near a four-decade high. Therefore, US yields will be a major driver on the outcome. On Monday, the US 10-year Treasury yield as fallen hard by over 4% which has sunk the greenback, as measured by the DXY index, by 0.19%.

However, should the pace of the Fed's taper be doubled to $30bn per month, then a generally more hawkish tone from the central bank could play into the hands of the US dollar bulls.

''This could once again weigh on the yellow metal in the near term, particularly as a reversal of the liquidity premium in breakeven markets, driven by tapering, could also catalyze a change in sentiment across precious metals as its impact ripples through into market pricing for Fed hikes,'' analysts at TD Securities argued.

''Beyond the near-term, our macro strategists expect enough slowing in inflation and growth to delay rate hikes until 2023. In this scenario, amid an increasingly clean positioning slate, gold would be set to recover in 2022 as markets would be forced to reprice aggressive Fed hikes.''

Gold technical analysis

From a technical standpoint, the price remains in familiar territory but is pining for a breakout, one way or the other. We are seeing some upside pressure built into the consolidation phase for the month of December and there is room to test the $1,815 level as follows:

Failing that, a break of $1,770 opens risk to the downside:

$1,720 comes as the next area of support:

- The British pound falls some 0.32%, as market participants head to US and UK central bank meetings.

- UK’s COVID-19 first omicron-linked death dampened the market sentiment, as depicted by global equities falling.

- GBP/USD Techincal outlook: Mild-bearish, as long as the spot price remains below the 200-hour SMA.

The GBP/USD pares some of its last Friday’s gains, slide some 0.32%, trading at 1.3226 during the New York session at the time of writing. Investors’ mood is downbeat, as portrayed by European equities ending in the red, while major US stock indexes are losing between 0.65% and 0.85%.

Factors like the first death linked to the omicron variant in the UK dented the market mood amid its fast global spread. In response to increasing COVID-19 cases in the country, Borish Johnson, PM, raised the COVID alert to four. That, alongside the Federal Reserve and Bank of England’s last monetary policy meetings in the year, keep GBP/USD traders at bay, waiting for more clues.

Since the overnight session, the British pound has failed to capitalize a move towards 1.3300, courtesy of increased demand for the greenback. Further, the Fed’s “hawkish” pivot for the last two weeks keeps USD in charge against most G8 currencies, with the US Dollar Index rising 0.16%, sitting at 96.25, a headwind for sterling, which retreated from 1.3270s down to 1.3220s.

US bond yields from mid to longer-term maturities in the bond market are plunging between 7 to 8 basis points. The 10-year Treasury yield, a barometer for interest rates, is down seven basis points, at 1.419%, while the 20s and 30s are down to 1.85% and 1.80%, respectively.

The absent UK and US economic docket left GBP/USD traders leaning on the dynamics of market sentiment and US dollar macroeconomic data. However, on Wednesday, the UK would report the Consumer Price Index. On the US front, the Federal Open Market Committee will unveil its monetary policy. The market expects an increase in the bond taper, at least by double of the original $15 billion amount of reducing purchases.

GBP/USD Price Forecast: Technical outlook

The GBP/USD 1-hour chart depicts the pair is neutral, though mild-bearish, as it has failed to sustain a clear break above the 200-hour simple moving average (SMA), 14-days before, which at press time lies at 1.3251. Also, GBP bears reclaimed the 50-hour SMA and threaten to break below the 100-hour SMA at 1.3227.

In the event of breaking the abovementioned level, the first support would be the S1 daily pivot around the 1.3200-08 range. A breach of the latter would expose the December 10 low at 1.3287, followed by the December 8 cycle low at 1.3160.

On the flip side, the first resistance is the 200-hour SMA at 1.3251. A break above that resistance would open the door for further gains, with the December 10 high at 1.3275. The breach of the latter would send the pair rallying towards 1.3300.

- USD/TRY has reversed back under 14.00 and is lower on the day after printing record highs close to 15.00 earlier.

- The CBRT intervened for the fourth time in two weeks to shield TRY from post-S&P rating downgrade selling.

- The CBRT is expected to press ahead with a widely criticised 100bps rate cut on Thursday, despite inflation above 20%.

USD/TRY has seen an explosion of volatility this Monday. Early in the European session, the pair surged above the 14.00 level (that the CBRT had spent last week defending) for the first-ever time and then came within a whisker of hitting 15.00. The surge was initially triggered after S&P Global lowered its outlook for Turkey’s sovereign credit rating to negative. The lira then rebounded after the CBRT announced a fourth FX market intervention in two weeks and USD/TRY now trades to the south of the 14.00 level once again and is actually trading in the red on the day by a small margin.

But traders will be cautious that the lira remains highly vulnerable to selling pressure. Turkish President Recep Erdogan remains as intransigent as ever on his determination to bully the CBRT into lowering rates (despite inflation surpassing 21% in November) and his Finance Ministry is on board. Just this morning, the newly appointed pro-Erdoganomics Finance Minister said that the government was determined not to raise interest rates. This ahead of an expected 100bps rate cut from the CBRT on Thursday to take rates to 13.0% from 14.0%, which would amount to over 500bps in easing since September.

Credit Suisse “still expect the MPC to cut the repo rate by 100bps next week on the back of political pressure despite the recent Lira sell-off and rising inflation pressures”, in line with the Bloomberg consensus. The bank is skeptical about the market assigning a higher probability of an unchanged interest rate following a recent call between the CBRT and investors. Thus, they maintain their long USD bias. Meanwhile, according to analysts at Commerzbank, "last week's apparent relative stability of lira was artificial and non-sustainable”. “Now we see the build-up pressure unfolding, driving lira weakness to the next level,” the bank continued, adding that “any further attempts ... to stabilize lira by interventions is probably bound to fail.”

Bank of Canada Governor Tiff Macklem said on Monday that the BoC was currently focused on bringing inflation back down to target without choking off Canada's economic recovery, in a post-Framework Review speech alongside Canadian Finance Minister Chrystia Freeland. We are not in a situation right now where we could probe for maximum sustainable employment, added Macklem.

Market Reaction

USD/CAD has pulled back from highs in recent trade but continues to trade to the north of the 1.2800 level, having seemingly not taken much notice of Macklem's remarks.

Industrial Production (IP) in Turkey increased by 8.5% in October from a year earlier, in line with consensus. Analysts at BBVA point out GDP growth in 2021 will be around 10.5-11%, above their current forecast of 9.5%. All these took place before the recent devaluation of the lira.

Key Quotes:

“IP still doesn’t indicate a clear slowdown in economic activity given the slight recovery in monthly growth of 0.6% which was a -1.5% previous month.”

“Our Big Data demand proxies and other high frequency indicators still displayed solid momentum in November and December. Hence, our monthly GDP indicator nowcasts a yearly growth rate of 8.1% for November (52% of info) and 8.5% yoy for December (33% of info), indicating a quarterly growth rate of 2% for 4Q.”

“Current strong momentum, looser economic policies, remaining robust global activity would support the economy. However the latest currency shock , uncertainties tied to new Covid-19 variant and tighter financial conditions will likely be downside factors on 2022 GDP growth.”

According to the latest New York Fed survey, median one-year-ahead inflation expectations rose to 6.0% in November from 5.7% in October. Median three-year-ahead inflation expectations fell to 4.0% from 4.2%. Median uncertainty regarding future inflation outcomes rose at both the short and medium-term horizons, both teachings their highest levels since the survey was launched in 2013.

Meanwhile, the median one-year-ahead expected earnings growth dropped to 2.8% in November from 3.0% in October. That means consumers expected inflation over the course of the next year to outpace their earnings growth by 3.2%, the widest such gap since the launch of the survey. Elsewhere, the median one-year-ahead expected rise in home prices decreased to 5.0% from 5.7%.

Market Reaction

Markets have not reacted to the survey, with attention firmly on key US data and the Fed meeting later this week.

- The Mexican peso remains among the top weekly performers across the globe.

- US dollar mixed on Monday, between risk aversion and lower US yields.

- USD/MXN holds near the recent bottom, supported around 20.85.

The USD/MXN is rising marginally on Monday supported by a deterioration in market sentiment during the American session. Still it remains under 21.00 and near the three-week low it reached on Friday at 20.83.

The greenback is up across the board despite lower US yields. The Dow Jones is falling by 0.89% and the Nasdaq 0.78%. The slide in equity prices favored the demand from the dollar.

FOMC and Banxico at the same week

The key focus of the week will be on central bank. Their decisions are likely to impact on prices across all financial assets.

On Tuesday, the Federal Reserve will start its two-day meeting. “Fed officials are likely to strike a much more hawkish tone at this week's FOMC meeting than they did in November, although a major shift is now widely anticipated by markets participants”, mentioned analysts at TD Securities. Analysts expected an increase in the pace of tapering and some signs that interest rate might rise sooner than previously expected.

The Bank of Mexico will meet on Thursday. It is expected to hike the key interest rate 25 basis point to 5.25%; some analysts consider the possibility of a 50 bp hike. “November CPI rose 7.37% y/y, the highest since January 2001 and further above the 2-4% target range. Swaps market is pricing in a peak policy rate of 7.25% by end-2022 and remaining there through 2023”, said BBH analysts.

Technical levels

- USD/CAD has been pushing higher in recent trade as broad risk appetite takes a turn for the worse.

- The pair, which is now above 1.2800, is also being pushed higher as the dollar strengthens pre-Fed.

USD/CAD has been gunning to the upside on Monday and has recently moved above the 1.2800 level, having started the week only just above 1.2700. That amounts to a 0.7% move to the upside and means that most of last week’s losses have now been eroded. Recall that USD/CAD fell from around 1.2840 to lows just above 1.2600 last week. If the pair can break to the north of 1.2800, the next key area of resistance to watch out for is at 1.2850. Beyond that, it’s the summer highs in the 1.2900-1.2950 region.

The pair’s move higher comes amid a broad sell-off in risk-sensitive currencies - NZD and AUD are down by a similar amount to CAD, whilst NOK is down more than 1.2.% on the session – as risk appetite deteriorates. CAD’s downside doesn’t seem to have anything, in particular, to do with any Canada-specific news, though, notably, the BoC did announce the conclusion of its monetary policy framework review. The bank will keep its inflation target at the 2% midpoint of a 1-3% range and said it would keep rates lower for longer if needed to optimise employment outcomes, as expected.

Rather, it is selling pressure in global equities that is likely to be the main reason for the acceleration of CAD depreciation in recent trading. Since the open of US markets at 1430GMT, global equities have been under selling pressure. The S&P 500 posted a record close last Friday, so profit-taking ahead of what is going to be a busy week of central bank events and data is likely driving the downside. But even before stocks started dropping, USD/CAD was already higher amid broad USD strength.

The main event as far as USD/CAD is concerned this week is the Fed’s monetary policy decision on Wednesday, where the bank will likely announce an acceleration of the pace of its QE taper plans. The bank’s new dot plot and economic forecasts will also be key points of focus, as will (as usual) the updated policy statement and remarks from Chairman Jerome Powell in the post-meeting press conference. As noted, even prior to the deterioration in risk appetite, the US dollar was on the front foot on Monday, with markets seemingly positioning themselves for a more hawkish outcome. Whether the Fed can live up to the hawkish expectations already priced into money markets (three hikes are seen in 2022) is another question.

- The USD/CHF begins the week on the right foot, up some 0.26 %.

- A mixed-market mood has kept the pair range-bound within the 0.9200-0.9250 range.

- USD/CHF Technical outlook: Neutral at the lack of a catalyst, influenced by market sentiment plays.

The USD/CHF begins the week on the right foot, though fluctuating around the familiar 0.9200-50 range, for the fifth consecutive day, trading at 0.9230 at the time of writing. The market sentiment remains mixed, though slightly downbeat, as European equities fluctuate between gainers and losers. Contrarily, across the pond, US equities are down, ahead of the 2021’s Federal Reserve last monetary policy meeting, which also added to the ongoing dampened market mood.

That said, in the overnight session, the USD/CHF jumped off the 0.9200 figure towards the 0.9250 area, as demand for US dollars increased during the Asian and early European session. As of late, the pair retreated towards the central daily pivot point at 0.9219 amid an absent economic docket from Switzerland and the US, so the Swiss franc might only be influenced by market sentiment.

USD/CHF Price Forecast: Technical outlook

The USD/CHF hourly chart depicts that the pair has a neutral bias. At the time of publication, the spot price is approaching an upslope trendline around the 0.9210-15 region, a support level that, in the case of giving way, could send the pair towards the December 9 cycle low at 0.9191.

To the upside, the USD/CHF is firmly pressured by the 200-hour simple moving average (SMA) at 0.9220, followed by a key resistance area at the confluence of the 50-hour SMA and the 100-hour SMA at 0.9230. Once that region gives way, it would open the door for the December 10 high at 0.9252.

On the flip side, the 0.9200 figure is the first line of defense for USD bulls. The breach of the latter exposes essential support levels, with the December 9 low at 0.9191, followed by December 3 low at 0.9165.

-637750079700751910.png)

- Lower US yields boost EUR/USD from near 1.1250 toward 1.1300.

- A decline in equity prices in Wall Street favors the greenback against commodity currencies.

- Market participants with focus on central banks.

The EUR/USD recovered from the lowest level in almost a week at 1.1259 and climbed to 1.1297. Near the 1.1300 area the euro lost momentum and the pair pulled back to 1.1270. It continues to move sideways, with a bearish bias.

The slide in US yields weighed on the greenback. The 10-year fell to 1.44% and the 30-year to 1.83%. The Dow Jones is falling by 0.85% and the Nasdaq by 0.65%.

Looking at central Banks

On Tuesday, the Federal Reserve will start its two-day meeting. “Fed officials are likely to strike a much more hawkish tone at this week's FOMC meeting than they did in November, although a major shift is now widely anticipated by markets participants. We expect the taper pace to be doubled and "transitory" dropped, with the median dot showing a 50bp increase in 2022. We expect enough slowing in inflation and growth in 2022 to delay rate hikes until 2023, but, for now, strong data are encouraging hawkishness”, explained analysts at TD Securities.

On Thursday, the “We expect that the ECB will continue to assess inflation as ‘transitory’. Unlike the US there are few signs of second order wage inflation in the region. Against this backdrop, we expect the size of the standard asset purchase programme (APP) to be increased to EUR 40 bln/mth”, mentioned analysts at Rabobank.

The divergence regarding expectations from the Fed and the ECB has been a key driver in the slide of EUR/USD. The meeting should be a critical even having a significant impact on the market.

Technical levels

- USD/JPY continues to trade close to its 50DMA and the 113.50 level as key market events are awaited.

- The most important event this week will be the Fed meeting, which should see the bank pivot hawkishly.

USD/JPY is trading in subdued fashion amid a quiet start to what will ultimately be a very busy week. The pair has been undulating just to the north of the 113.50 level and close to its 50-day moving average in the 113.60s, levels which have acted as a magnet for the price action for most of the last week. Ahead of key events later in the week, subdued trading conditions are likely to persist and, thus, playing the pair’s recent 113.25-114.00 ish range might be the way to go.

If long-term US yields continue to push lower (the 10-year is down about 5bps on the day and back below 1.45%), USD/JPY may well test the bottom of this range in the near future. Beyond these nearest levels of support and resistance, there is the 112.50 area to the downside, which is a double bottom from late November/early December, and there is the November (annual) high at 115.50.

Week Ahead

In terms of the major events in store this week, the highlights will be the Fed’s monetary policy decision on Wednesday, followed by the BoJ’s decision on Friday. There are also plenty of important economic data releases for FX market participants to sink their teeth into, including November PPI on Tuesday, November Retail Sales and the December NY Fed survey on Wednesday, weekly jobless claims numbers, November housing data, November Industrial production and the December Philly Fed and flash Markit PMI surveys on Thursday. Japan sees the release of November Industrial Production figures on Tuesday and then trade numbers on Thursday.

In terms of how markets might react to all of the above; the Fed meeting will be far and away the most important FX market driver of the week. US data is likely to by and large reinforce well-established narratives on the US economy such as high inflation pressures, coupled with strong growth, but supply chain disruptions still hurting output in some sectors (and contributing to higher prices). This is likely to feed into a stronger dollar, whilst it doesn’t seem there is much that the BoJ or Japanese data can do to help the yen, whose fate is likely to be determined more by broader risk sentiment/rate differentials. Case in point, the widely followed Tankan survey of large manufacturers saw its headline index improve for a sixth successive quarter and hit its highest since late 2018, but failed to stir any movement in FX.

- AUD/USD edges lower some 0.56%, as the Fed’s last monetary policy meeting looms.

- Risk sentiment dampens as the UK reported its first COVID-19 omicron-related death, increasing restrictions.

- AUD/USD Technical outlook: Below 0.7200 bearish, otherwise could challenge an important confluence of technicals around 0.7300.

After closing the last week in the green, the AUD/USD slides during the New York session, trading at 0.7132 at the time of writing. As shown by European equities fluctuating between gainers and losers, financial markets are mixed. At the same time, US indices begin the day in the red, as the UK reported the first omicron-related death, as the spread of the new strain continues worldwide. Furthermore, some of the most important central banks would hold their last monetary policy meetings of the year, adding to the cautious tone of investors.

At the beginning of the trading week in the Asian session, the Australian dollar remained subdued, peaking at the daily high at 0.7174, then slumping as the market sentiment spurred a flow towards the safe-haven status of the greenback, weighing on the commodity-related currency.

In the meantime, the US Dollar Index advances 0.19%, sitting at 96.27, while US bond yields with the 10-year benchmark note are down four basis points (bps), at 1.448%, as the FOMC’s last monetary policy meeting looms.

An absent Australian economic docket left the Australian dollar at the mercy of dynamics surrounding the US dollar. Additionally, suppose the Federal Reserve decides to increase the speed in the bond taper in their last monetary policy meeting. In that case, it could trigger another leg-down in the pair ahead of the end of the year.

AUD/USD Price Forecast: Technical outlook

As the AUD/USD daily chart depicted, the 0.7186 barrier would still be difficult to overcome as the pair retreated towards the 0.7130s area since Wednesday of the last week. That said, the pair is mild-bearish, as long as the daily moving averages (DMAs) remain above the spot price, with a slightly-downslope direction. Nevertheless, upside risks remain unless the pair breaks below 0.7105.

At press time, on the downside, the first support would be the August 20 cycle low at 0.7105. A break of that level would exert downward pressure on the AUD. The next support would be the YTD low at 0.6992.

On the other hand, AUD bulls will need to reclaim 0.7200. In that event, the next resistance would be the confluence of the 50 and the 100-DMAs around the figure at 0.7300.

The Bank of Canada announced on Monday that it had agreed with the government to leave its inflation target at the 2.0% midpoint of a 1.0%-3.0% range for the next five year, as expected, according to Reuters.

Additional Takeaways:

“Will sometimes hold policy rate at a low level for longer than usual to address challenges of structurally low interest rates, will use other tools as well.”

“The bank will use a broad set of monetary policy tools to deal with likelihood bank's policy rate will more often be at its lowest possible rate, given circumstances at the time.”

“Agrees with the government that primary objective of monetary policy is to maintain low, stable inflation over time.”

“Agrees with the government that monetary policy should continue to support maximum sustainable employment while recognizing this is not directly measurable and is determined largely by non-monetary factors.”

“Neutral interest rates are likely to be lower than in the past, which means central banks will have less room to lower policy rates in case of shocks.”

“Evolving forces are having major effects on the Canadian labor market, increasing uncertainty about the level of maximum sustainable employment.”

“The bank will continue to use the flexibility of 1-3% control range to actively seek the maximum sustainable level of employment when conditions warrant.”

“The bank will use the flexibility of the 1 to 3% range only to the extent that it is consistent with keeping medium-term inflation expectations well anchored at 2%.”

“The bank will explain when it is using flexibility in the framework.”

“Because monetary policy can exacerbate financial vulnerabilities, the bank will continue to be mindful that such vulnerabilities can lead to worse outcomes down the road.”

“Strong and inclusive labor market helps reduce income inequality and supports robust demand for goods and services.”

“The bank will consider a broad range of labor market indicators and systematically report to Canadians how labor market outcomes have factored into policy decisions.”

“The government will work with relevant agencies to ensure arrangements for financial regulation and supervision are fit for purpose and consider changes if and where appropriate.”

Market Reaction

There has not been a notable market reaction to the announcement, which did not come as a surprise.

- Spot gold prices failed to break above their 50DMA at $1,793 again on Monday.

- The precious metal is back to trading within recent ranges as this week’s Fed meeting is eyed.

Spot gold (XAU/USD) prices are a touch higher at the start of the week, but have once again failed to break to the north of the 50-day moving average, which currently resides at $1,793. Spot prices moved above $1,790 and came within a whisker of testing the level earlier in the session, but have since ebbed lower again to trade in the mid-$1,780s. At current levels, spot gold is about 0.25% higher on the day, aided by a drop in long-term US government bond yields which has helped to shield gold against a modest strengthening of the US dollar.

Spot gold prices have spent the whole of December unable to rally to the north of the 50DMA and Monday’s failure is not too surprising given the proximity of key central bank events later in the week. The most important of these for spot gold is, of course, the FOMC meeting on Wednesday, where the Fed is expected to announce a doubling in the pace of its QE taper to $30B per month from the current $15B per month. Of most interest to markets will be the tweaks to the language of the statement (the word transitory is set to be dropped), the Fed’s new dot plot and the updated economic forecasts. The dot plot is likely to show as many as two forecasts are expected by Fed members in 2022.

With the Fed likely to lean hawkish, most strategists suspect that the dollar, as well as short-end and real yields, can expect to remain well supported this week. This is likely not a good recipe for gold and the bears will be eyeing a move lower to test recent lows in the $1,770 area. In wake of last Friday’s hot US Consumer Price Inflation report, this Tuesday’s Producer Price Inflation report is likely to re-emphasise the uncomfortable inflationary backdrop for the Fed the day before they announce policy. This is unlikely to offer gold much support as an inflation hedge if it reinforces the idea that a hawkish Fed pivot is coming/already in motion.

USD/CAD’s rebound from the low 1.26 area looks poised to extend somewhat. Economists at Scotiabank expect the pair to reach the 1.28 neighborhood.

Support is seen at the 1.2725 mark

“The steady bid for the USD looks set to probe the upper 1.27s/low 1.28s.”

“We now expect better resistance to emerge around the 1.28 zone where USD gains have tended to falter this year.”

“Intraday support is 1.2725.”

EUR/CHF has paused around 1.0400. Nevertheless, economists at Credit Suisse expect this pause to end this week for a move to the 1.0254/35 area.

Above 1.0455/59 would suggest a correction back to 1.0500/14

“The short-term momentum picture is concerning, as daily MACD has crossed higher and there is a large and growing divergence on the daily RSI. Despite these signals, we expect this pause to end this week, in line with our view that a medium-term trending phase to the downside has begun.”

“We look for a renewed turn back lower, which would be confirmed below 1.0373/65, with further minor supports at 1.0314 and 1.0280. More important medium-term support is seen at the 2015 corrective low and 50% retracement of the recovery from the peg removal spike low at 1.0254/35.”

“Short-term resistance stays at 1.0455/59, above which would instead elongate the pause and suggest a correction back to the point-of-breakdown at 1.0500/14.”

EUR/USD is pressured by Omicron spread and energy concerns. Additionally, the European Central Bank (ECB) monetary policy is set to contrast the path of the Federal Reserve, dragging the pair down towards the 1.10 level, economists at Scotiabank report.

EUR/USD to head towards 1.10

“Over the weekend, Germany’s Foreign Minister Baerbock noted that the Nord Stream 2 pipeline (through the Baltic Sea) cannot be certified as it does not meet requirements of European energy law. Today, Belarus’ Lukashenko warned that his country may halt gas transit through it to Europe if the G-7 deploys new sanctions on Russia over its military threat in Ukraine (the other key path for Russian gas transports to Europe).”

“The ECB meeting this week will likely see the bank hold back on signaling clearly how (and by how much) it intends to replace the PEPP (read: supplement the APP) once it expires in March. Prior to the emergence of Omicron, the bank looked set to deliver a less dovish decision and express optimism in the economic recovery. However, the new virus wave and more restrictions that look set to depress output over the next few weeks and perhaps months will see the ECB punt a clearer decision to the new year.”

“The ECB’s contrast to the Fed, which is expected to accelerate its reduction of asset buying this week, will weigh on the EUR toward the 1.10 zone in the near-term.”

- Resurgent USD demand prompted fresh selling around NZD/USD on Monday.

- Hawkish Fed expectations continued acting as a tailwind for the greenback.

- Traders might refrain from aggressive bets ahead of the key FOMC decision.

The NZD/USD pair maintained its bid tone through the early North American session and was last seen trading near a multi-day low, around the 0.6775-70 region.

Having struggled to find acceptance above the 0.6800 mark, the NZD/USD pair met with a fresh supply on the first day of a new week and was pressured by resurgent US dollar demand. Friday's US consumer inflation figures reinforced expectations for an early policy tightening by the Fed, which, in turn, continued acting as a tailwind for the USD.

Hence, the market focus will remain glued to the outcome of a two-day FOMC monetary policy meeting, scheduled to be announced on Wednesday. In the meantime, anxiety ahead of the key central bank event risk kept a lid on any optimistic move in the markets and further benefitted the greenback's relative safe-haven status against the perceived riskier kiwi.

The US central bank is expected to quicken the pace of tapering the bond purchases. Hence, investors would look for clues about the Fed's strategy on interest rate hikes amid worries about the persistent rise in inflation pressures. This will influence the near-term USD price dynamics and provide a fresh directional impetus to the NZD/USD pair.

Meanwhile, retreating US Treasury bond yields could hold back the USD bulls from placing aggressive bets and extend some support to the NZD/USD pair, at least for the time being. This warrants some caution before positioning for any further depreciating move amid absent relevant market moving economic releases from the US.

Technical levels to watch

- WTI has slipped back to the low-$71.00s from earlier session highs at $73.00.

- But continues to trade within recent ranges as more clarity regarding the impact of Omicron is awaited.

Front-month futures of the American benchmark for sweet light crude oil, West Texas Intermediary or WTI, slipped back from earlier session highs close to $73.00 on Monday and currently trade in the low-$71.00s. Despite finding some support at the $71.00 level in recent trade, prices are still down more than 50 cents on the day.

WTI prices continue to trade with the $70.50-$73.00ish ranges established towards the back end of last week, so Monday’s losses should be viewed in that context and not read into too much. Indeed, as markets await more clarity about the impact of Omicron on the global demand picture, rangebound trade makes sense. On which note, in its latest Short-Term Energy Outlook (STEO), OPEC said it expected the impact of the Omicron Covid-19 variant to be mild as the world continues to adapt to the presence of the pandemic. Meanwhile, the group left its oil demand growth forecasts for 2021 and 2022 unchanged at 5.65M barrels per day and 4.15M barrels per day respectively.

In terms of other crude oil-relevant news, Iranian nuclear negotiators sounded positive on the prospect for progress in negotiations with Western powers on a return to the 2015 nuclear accord. Western nations involved in the talks (UK, France, etc.) are yet to reciprocate this optimism, market commentators have noted. But if substantial progress were to be made, this would bring closer the prospect of a return of millions of barrels per day in Iranian crude oil exports to global markets as US sanctions are lifted.

This may compound worries that some in the industry have about global market oversupply in 2022. Indications from OPEC+ oil ministers is that the cartel will again agree to press ahead with a 400K barrel per day output increase from February when they meet at the start of the new year. According to analysts at Commerzbank, “the oil market risks facing a sizeable oversupply in the first quarter of 2022… We, therefore, envisage potential setbacks for the oil price in the coming weeks”.

Economists at Credit Suisse continue to look for support at 1.3189/35 to hold for now. As they note, GBP/USD needs to surpass the 1.3280/90 zone to see a deeper recovery.

Support zone of 1.3189/35 to remain a floor

“Whilst below 1.3280/90 the immediate risk stays seen lower for another move into our core objective support zone of 1.3189/35, which includes the 38.2% retracement of the 2020/21.”

“Although our broader bias for the USD stays firmly bullish, we continue to look for 1.3189/35 to try and remain a floor for now for the unfolding of a consolidation range.”

“A break below 1.3135 would warn of further significant weakness with support seen next at 1.3109/06 but with the next more meaningful support not seen until the 50% retracement of the 2020/2021 uptrend and November 2020 low at 1.2855/29.”

“A close above 1.3280/90 remains needed to suggest a deeper recovery can emerge for a retest of the recent ‘outside day’ high at 1.1371 which we would look to then ideally cap to define the upper end of a potential consolidation range.”

EUR/USD remains in its tight converging range above the 1.1186/68 price support from June 2020. An eventual break below 1.1168 should confirm a resumption of the core bear trend for a move to the 1.1019/02 region, economists at Credit Suisse report.

Close above 1.1387 needed to clear the way for a deeper recovery to 1.1433

“We maintain our core negative view and look for a break below 1.1265 for a fall back to 1.1237/27 initially, then a retest of 1.1186/68.”

“An eventual break below 1.1186/68 would confirm the resumption of the core bear trend to the measured ‘head & shoulders’ top objective at 1.1075 then our 1.1019/02 core objective – the 78.6% retracement of the 2020/2021 uptrend and ‘neckline’ to the April/May 2020 base. With the long-term uptrend from 2000 just below, our bias remains to look for a major floor here.”

“Near-term resistance moves to 1.1325, with 1.1356/60 ideally capping to keep the immediate risk lower.”

“A close above 1.1387 remains needed to see a small base complete instead to clear the way for a deeper recovery to 1.1433, potentially what we would expect to be much tougher resistance at 1.1464.”

- A combination of supporting factors pushed USD/CAD to a near one-week high on Monday.

- Hawkish Fed expectations acted as a tailwind for the USD and provided a goodish boost.

- Retreating crude oil prices undermined the loonie and remained supportive of the move.

The USD/CAD pair continued scaling higher heading into the North American session and climbed to a fresh four-day high, around the 1.2765 region in the last hour.

The pair attracted some dip-buying in the vicinity of the 1.2700 mark on Monday and built on last week's post-BoC bounce from the 1.2600 neighbourhood. The US dollar made a strong comeback on the first day of a new week and remained well supported by the prospects for a faster policy tightening by the Fed. Adding to this, retreating crude oil prices undermined the commodity-linked loonie and provided a modest lift to the USD/CAD pair.

Investors seem convinced that the Fed would be forced to adopt a more aggressive policy response to contain stubbornly high inflation and have been pricing in the possibility of liftoff in May 2022. The bets were reinforced by Friday's data, which showed that the headline CPI accelerated to the highest level since 1982 in November. Adding to this, the core CPI – excluding food and energy prices – recorded the sharpest pickup since mid-1991.

On the other hand, the Canadian dollar was weighed down by a weaker trading sentiment around the oil markets. This was seen as another factor that acted as a tailwind for the USD/CAD pair and contributed to the intraday move up. That said, easing concerns that the Omicron variant would have a limited impact on the fuel demand should help limit losses for the black liquid. In fact, OPEC on Monday raised its world oil demand forecast for the first quarter of 2022.

Apart from this, the prevalent risk-on environment might hold back traders from placing aggressive bullish bets around the safe-haven greenback. Investors would also prefer to move on the sidelines heading into this week's key central bank event risk – the FOMC monetary policy decision on Wednesday. The combination of factors could keep a lid on any further gains for the USD/CAD pair amid absent relevant market-moving economic releases on Monday.

Technical levels to watch

- GBP/USD rebounded above 1.3250 on Monday from earlier session lows in the 1.3220s.

- Sterling has been holding up well despite an increasingly alarming Omicron backdrop in the UK.

GBP is holding up comparatively well versus a broadly stronger US dollar versus its G10 peers on Monday, with GBPUSD currently trading only very slightly in the red on the session close to the 1.3250 level. GBP is the second best performing G10 currency on the day after the US dollar. The rebound from earlier session lows in the 1.3220s comes despite the UK PM and health authorities sounding the alarm about Omicron over the weekend.

Technical buying could be lending GBP/USD some support. The pair broke to the north of a long-term downtrend at the end of last week and appeared to retest this downtrend earlier on Monday’s session. Short-term technical speculators may have seen this as a good entry point to ride the pair back towards last week’s highs in the 1.3270s.

UK Update

Over the weekend, UK PM urged British citizens to get their booster jabs amid an incoming “tidal wave” of Omicron Covid-19 infections, which the health secretary Sajid Javid said now account for about 40% of infections in London. The UK Health Security Agency also advised that the UK have its Covid-19 alert level lifted to four from its current three and the PM on Monday ruled out the prospect of further restrictions being imposed ahead of Christmas.

Against the deteriorating backdrop in the UK, it seems highly unlikely that the BoE will press ahead with a rate hike. Policymakers have in recent weeks expressed concerns about the impact of Omicron on the UK’s economic outlook and these concerns will have only risen. Against that backdrop, Tuesday’s UK labour market report and Wednesday's UK Consumer Price Inflation report will be seen as holding less sway over policy-making decisions. If it wasn’t for Omicron, strategists would likely argue that strong labour market and inflation data would have been enough to swing in favour of a rate hike.

In its latest Short-Term Energy Outlook (STEO), the Organisation of Petroleum Exporting Countries (OPEC) left its oil demand growth forecasts for 2021 and 2022 unchanged at 5.65M barrels per day and 4.15M barrel per day respectively. The group said it expected the impact of the Omicron Covid-19 variant to be mild as the world continues to adapt to the presence of the pandemic.

Market Reaction

Crude oil prices continue to chop within recent ranges, with WTI moving lower towards $71.00, with eyes on this week's Iran/Western power discussions about a return to the 2015 nuclear deal.

- EUR/GBP witnessed some follow-through selling for the third successive day on Monday.

- A more ECB dovish was seen as a key factor behind the euro’s relative underperformance.

- Diminishing BoE rate hike bets should cap the upside for the GBP and help limit the slide.

The EUR/GBP cross dropped to a multi-day low during the mid-European session, with bears now awaiting a sustained break below the key 0.8500 psychological mark.

The cross extended last week's retracement slide from the 0.8600 neighbourhood, or the highest level since early October and remained under some selling pressure for the third successive day on Monday. The shared currency's relative underperformance could be attributed to a more dovish stance adopted by the European Central Bank (ECB).