- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-12-2021

- USD/CAD remains pressured after two-day downtrend, sidelined of late.

- 50% Fibonacci retracement, RSI rebound challenge sellers around the key moving average.

- Buyers will wait for a successful run-up beyond previous support line.

USD/CAD sellers keep reins around 1.2775, despite recently sidelined performance during Friday’s Asian session.

In doing so, the Loonie pair takes rounds to 50% Fibonacci retracement (Fibo.) of December 08-15 upside as the RSI line improves from oversold territory.

However, the corrective pullback has limited room to the north as a convergence of the 100-HMA and 38.2% Fibo. near 1.2815 will be a tough nut to crack for intraday buyers.

Even if the USD/CAD buyers manage to cross the 1.2815 hurdle, the support-turned-resistance line surrounding 1.2845 will challenge the advances before highlighting the 1.2900 threshold and the multi-month top of 1.2937 marked on Wednesday.

Meanwhile, a clear downside break of the 50% Fibonacci retracement level close to 1.2770 will be challenged by the 200-HMA and 61.8% Fibo., respectively around 1.2750 and 1.2730.

In a case where USD/CAD prices remain bearish past 1.2730, the December 10 swing low near 1.2680 can offer an intermediate halt during the fall to the monthly low near 1.2600.

USD/CAD: Hourly chart

Trend: Sideways

- GBP/USD grinds higher after posting the biggest daily gains in a month.

- BOE announced 0.15% rate hike, while giving more importance to inflation target.

- UK reports record daily covid infections, signs FTA deal with Australia but to drop key ECJ demand on NI.

- UK Retail Sales for November, risk catalysts will be important to follow.

GBP/USD defends the post-BOE run-up past 1.3300, near 1.3325 during Friday’s Asian session. While the “Old Lady” pleased bulls with a rate hike the previous day, coronavirus woes and Brexit jitters stay on the table to challenge the immediate upside.

The UK, unfortunately, reports the second consecutive day with all-time high daily covid infections, recently up by 88,376. The government has already levied activity restrictions but the faster spread of the South African covid variant seems to trouble the authorities ahead of the holiday period. “England's Chief Medical Officer warned daily hospital admissions could also hit new peaks due to the fast-spreading Omicron coronavirus variant,” said Reuters.

Elsewhere, London and the European Union (EU) recently made good progress on the Brexit talks as the UK eases its stance on fishing for Fresh and pushed back the border checks on the goods from Ireland beyond January 01 deadline. On the same line is the Financial Times (FT) news saying, “The UK government is on Friday expected to drop its demand to remove the European Court of Justice as the ultimate arbiter of trade rules in Northern Ireland as it seeks to de-escalate tensions with Brussels.”

FT also mentions that the European Commission will on Friday propose a law to ensure Northern Ireland continues to receive medicines from the UK.

Not only with the EU, but the Brexit talks with Australia are also positive as Britain and Canberra recently signed a Free Trade Agreement (FTA) deal. “It is described as the first post-Brexit deal negotiated from scratch and not "rolled over" from trade terms that the UK enjoyed while in the EU. The government estimated it would unlock £10.4bn of additional trade while ending tariffs on all UK exports,” said the BBC.

Markets remain cautious amid the faster spread of Omicron and rethink over the recent central bank actions. That said, the Bank of England (BOE) announced a 0.15% hike in the benchmark rate and favored the bulls. “Relative to the November Report projection, there has been significant upside news in core goods and, to a lesser extent, services price inflation…The MPC’s remit is clear that the inflation target applies at all times, reflecting the primacy of price stability in the UK monetary policy framework," per the BOE MPC Statement.

Amid these plays, equities closed negative and the S&P 500 Futures struggle for fresh clues by the press time.

Looking forward, UK Retail Sales for November, prior -1.3% YoY, will be important for the GBP/USD traders to watch. It should be noted, however, that the BOE has already announced the much-awaited rate hike and hence the data may have a little positive impact but negative surprises can join the covid woes to recall short-term sellers.

Technical analysis

A clear upside break of a five-week-old descending trend line needs validation from early November’s swing lows, near 1.1.3355-60, before targeting September’s bottom surrounding 1.3410 and 50-DMA level of 1.3483. Alternatively, a downside break of 1.3270 should recall the short-term sellers targeting the yearly low of 1.3160.

Reuters has reported that the remaining parties to the 2015 Iran nuclear deal plan to meet on Friday at 1300 GMT to adjourn talks on salvaging the deal, three diplomats said on Thursday.

''The indirect US-Iran talks on bringing both back into full compliance with the deal are in their seventh round. One of the diplomats said they were due to resume on Dec. 27, while another gave a time frame between Christmas and the New Year.''

The news agency has explained that ''under the agreement, Iran had limited its nuclear program in return for relief from U.S., European Union and United Nations economic sanctions.''

Marke implications

Iran has been the wild card for the oil markets before Omicron came along. However, an unconstrained return of Iranian barrels remains a significant downside risk for the new year.

- The New Zealand dollar retreats amid a risk-aversion mood, post-Federal Reserve monetary policy meeting.

- NZD/JPY Technical Outlook: Tilted to the upside so that any dips could be opportunities for NZD bulls.

After printing a new weekly high at around 78.00, the NZD/JPY slumps as the Asian session begins, trading at 77.31 at the time of writing. Since Wall Street closed, market sentiment has not improved, as depicted by Asian equity futures indices mixed, fluctuating between gainers and losers.

During Thursday’s overnight session, the NZD/JPY pair jumped towards 78.00 as the market mood improved, once Fed’s monetary policy decision crossed the wires, which came as some investors expected. The US central bank decided to increase its QE’s reduction by $30 Billion beginning in mid-January 2022, while the dot-plot, which represents the 18 Federal Reserve members’ expectations of the Federal Fund Rates (FFR), foreseen three hikes in 2022.

The market’s reaction to that initially was towards a stronger dollar. Nevertheless, the greenback’s move was faded, to the detriment of other safe-haven peers like the JPY, spurring a rally in US equities, while risk-sensitive currencies like the AUD and the NZD climbed.

In the case of the NZD/JPY, the pair advanced sharply, peaking around 78.00, then retreated the upward move towards 77 flat, once market mood worsened throughout the New York session.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY daily chart depicts the cross-currency trading near a 13-month old upslope trendline, briefly pierced four times, though at the end respected by NZD/JPY traders, lying around 76.80s. The daily moving averages (DMAs) reside above the spot price, and in fact, the upward move was capped at the 200-DMA at 79.42.

From a market structure perspective, as long as it remains above the August 19 low at 74.55, the NZD/JPY is tilted to the upside, but in the near term it is downwards.

On the downside, the first support would be the upslope trendline around 76.80. A break of the latter would open the way for a test of the structure low around 74.55, but firstly crucial support levels would need to be broken. The next demand zone would be the December 14 low at 76.43, followed by December 3 low at 75.95, and then the July 20 cycle low at 75.26.

Any dips could be viewed as an opportunity for NZD bulls, though cautions remain, as the NZD is subject to market sentiment, so-any risk aversion looming in the financial markets could spur some downside pressure on the New Zealand dollar.

-637752927594608550.png)

“In the face of a pandemic, the economy remains resilient, said New Zealand’s Finance Minister (FinMin) Grant Robertson during early Friday morning in Asia.

FinMin Robertson adds, “New Zealand is almost at the peak of inflation.”

FX reaction

NZD/USD cheers broad US dollar weakness, in the face of major central bank actions, while keeping the 0.6800 threshold, up 0.10% intraday by the press time. It's worth noting that China's dislike for the US actions against Chinese entities over Xinjiang-related issues and the record daily COVID-19 infections in the UK challenges the market sentiment and the Kiwi pair of late.

Read: NZD/USD holding ground sub 0.68 the figure

- EUR/USD holds onto biggest daily gains in a week around monthly high.

- Clear break of seven-week-old falling trend line, bullish MACD signals favor buyers.

- One-month-old horizontal area challenges further upside, ascending trend line from late November restricts short-term declines.

Although 200-SMA probe EUR/USD bulls around a monthly peak, a clear break of the short-term key resistance line, now support, joins bullish MACD signals to favor the further upside. That said, the major currency pair trades around 1.330 during early Friday morning in Asia.

In addition to the 200-SMA hurdle around 1.1360, a horizontal region comprising multiple tops marked since mid-November, around 1.1380-85, also tests the near-term upside of the pair.

Should EUR/USD prices rally beyond 1.1385, 50% Fibonacci retracement (Fibo.) of late October-November declines, around 1.1500, will probe the EUR/USD advances targeting the last month’s high near 1.1616.

Meanwhile, pullback moves remain elusive beyond the previous resistance line near 1.1290.

Also acting as a downside filter is an upward sloping support line from November 24, near 1.1260.

During the EUR/USD weakness past 1.1260, the 1.1230 level and the yearly low of 1.1186 will entertain the bears.

EUR/USD: Four-hour chart

Trend: Further upside expected

“Omicron is here and going to start spreading more rapidly”, said US President Joe Biden crossed wires while speaking from Roosevelt Room in the White House.

US President Biden adds “It's past time for people to get booster shots, which they should do as quickly as possible.”

US looking at a winter of severe illness and death for those not vaccinated against COVID-19.

It’s worth noting that the UK reported, unfortunately, another day of record-breaking covid infections with a daily count of 88,376 new coronavirus cases.

FX implications

Omicron fears probe the major central banks’ that have recently tightened their monetary policy stance, which in turn challenge optimists.

Read: Forex Today: Central banks’ marathon coming to an end

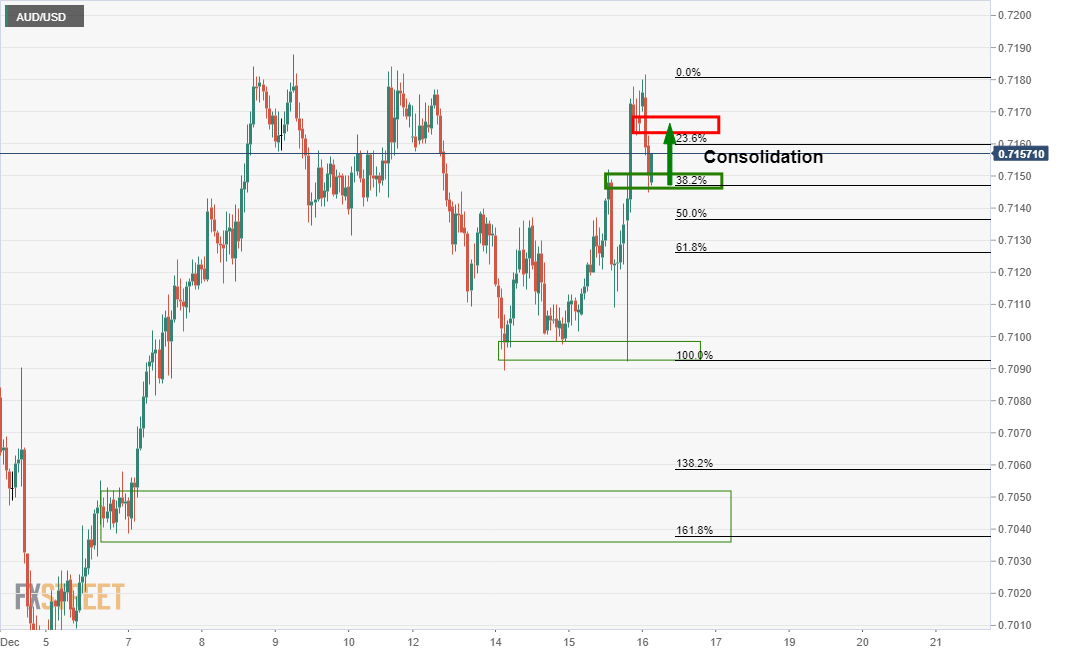

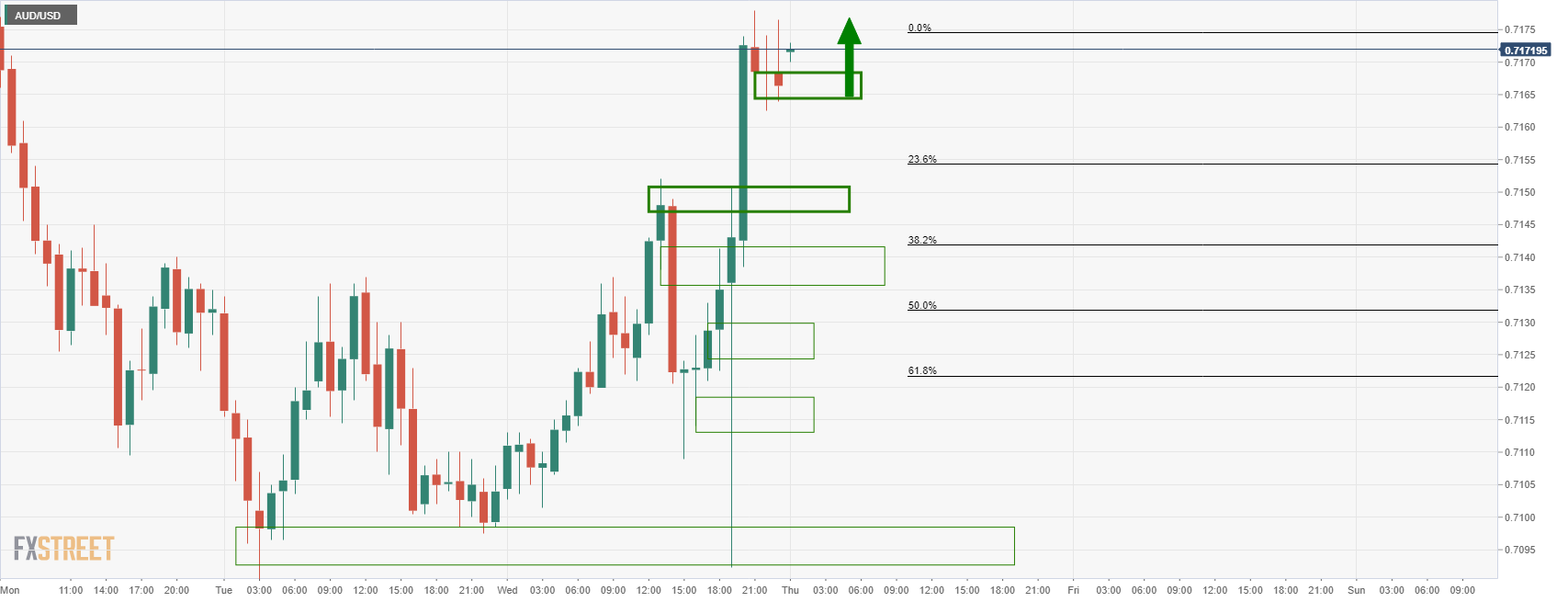

- AUD/USD bulls are back in play into the Asian open.

- Bulls eye an extension on the hourly and daily time frames for the end of this and the start of next week.

AUD/USD was ending the day higher by some 0.3% and had moved between a low of 0.7145 and a high 0.7223. The central banks were in focus again and both the BoE and ECB turned more hawkish overnight. Nevertheless, equities saw the glass as half full and sold off which hurt the higher beta currencies, such as AUD.

AUD/USD was falling throughout the New York session until the final hours where it met a key technical support area and started to correct, as illustrated in the technical analysis below. The US dollar was also making a come back which did not help the commodity bloc as traders began to question the reaction to the Federal Reserve, putting it down to holiday irregular markets and profit-taking.

Buy the rumour sell the fact

Many analysts believe that the US dollar can continue higher despite yesterday's setback. ''The dollar is clearly suffering from some “buy the rumour, sell the fact” price action right now. Looking ahead, we believe the underlying trend for a stronger dollar remains intact,'' analysts at Brown Brothers Harriman argued.

Meanwhile, in a speech yesterday, the Reserve Bank of Australis's Governor, Phillip Lose, laid out three options in terms of the timing for the end of QE, as analysts at ANZ Bank spelt out as follows:

''Once option was to end QE altogether in February. For that to happen he flagged that stronger-than-expected data and an upgrade to the RBA’s November forecasts would be needed. With the November labour market data coming in much stronger than the RBA expected and a revision in other forecasts likely, an end to QE altogether in February is the most likely option in our view,'' analysts at ANZ Bank explained.

AUD/USD technical analysis

- AUD/USD Price Analysis: Bulls looking for H1 continuation from daily support

As per the earlier analysis, the price has met hourly support and is now turning higher. This could lead to a continuation in the daily charts northerly trajectory as follows:

AUD/USD H1 chart

The hourly chart is moving in the right direction, as illustrated by the price action in the chart above from hourly support.

- Gold extends gains as the market continues to trade the central banks and lower real yield environment.

- A break of $1,180 opens the risk to $1,850 for the weeks ahead.

The price of gold is stronger again on Thursday which highlights the asymmetry present in precious metal markets to the hawkish Federal Reserve outlook. At the time of writing, XAU/USD is trading 1.21% higher on the day and has rallied from a low of $1,775.60 to a high of $1,799.46.

The Federal Reserve delivered on the expected doubling of the taper pace and said Wednesday it will begin reducing its asset purchases by $30 billion per month starting in January, up from the current $15 billion pace, amid rising inflation and continued recovery in employment. The central bank's Federal Open Market Committee said after its two-day meeting it would cut monthly Treasury securities purchases by $20 billion and agency mortgage-backed securities acquisitions by $10 billion per month.

Meanwhile, Fed policymakers lifted their projections for core inflation, expecting to finish this year at 5.3%, up sharply from the 4.2% average forecast in September. Next year, inflation is expected to slow to 2.6%, but that was higher than the 2.2% seen three months ago.

However, the dot plot was far more hawkish than the market had expected and above where it was priced. The dot plot now shows a 75bp increase in 2022, above the 50bp consensus, and the Chairman also made it clear that officials are ready to start raising rates well before the labor market returns to its pre-COVID state.

Nonetheless, the stock market rallied. 'The idea that a gradual tightening in policy can put the economy on a smooth glide-path back to growth and inflation equilibrium is implausible, but after 20 years of ‘buy the dip' the equity market is trained to look on the bright side of life,'' analysts at Societe Generale argued.

This sank the US dollar which has been unable to crack the 97 figure as measured by the DXY index. Real yields falling also culminated in gold prices rising. ''We continue to see the balance of risks tilted towards the upside for the near-term precious metals outlook as positioning that has skewed mainly to the short side in recent weeks is unwound somewhat,'' analysts at TD Securities said.

''With that said, while marginal CTA selling is underway, if the yellow metal can hold the post-FOMC rally north of the $1,787/oz range, systematic funds are likely to target net long positions once again.''

Gold technical analysis

The price would be expected to continue to $1,810 but a restest of the prior resistance near $1,790 could be on the cards imminantly. A break of $1,180 opens the risk to $1,850 for the weeks ahead.

- A risk-off market mood favors the safe-haven Japanese yen, the Aussie falls.

- The AUD/JPY rally was capped around the 200-DMA, around 82.50

- AUD/JPY Technical Outlook: In consolidation, respecting the current downward market structure.

As the New York session winds down, the risk-sensitive Australian dollar falls, against the Japanese yen, trading at 81.65 at the time of writing. Market mood is risk-off, as witnessed by US stock indices recording losses between 0.04% and 2.37%.

On Thursday during the overnight session, the AUD/JPY rallied strongly amid a risk-on environment triggered by the Fed, which, as expected, will taper faster than previously thought, while most of their members expect at least three rate hikes in 2022. Despite the fact of being a “hawkish” monetary policy statement, the event was a “buy the rumor, sell the fact.” Why? Because equities rallied, while risk-sensitive currencies like the AUD, the NZD, and the CAD, followed their footsteps, to the detriment of safe-haven peers.

That said, the pair peaked around mid 82.00s, to then as the American session progressed, the market mood dampened, as market participants reshuffle their portfolios as the year-end looms.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY daily chart depicts the pair is in consolidation, trapped around the 77.88-86.25 range, sideways, without threatening to break the prevailing market structure since November 2020. Furthermore, Thursday’s upward move capped at the 200-day simple moving average (SMA) showed that AUD bulls do not have the strength of breaking to the upside so that we could be eyeing a downward move ahead of the year-end.

On the downside, the first support would be December 14 pivot low at 80.47. A breach of the latter would extend AUD/JPY losses. The next support would be the December 1 cycle low at 78.78, followed by the August 20 low at 77.89.

-637752867760564469.png)

- NZD/USD comes back under pressure as the fade plays out.

- The Fed surprised markets but the US dollar was sold off due to stubbornly bullish US stocks.

NZD/USD is up on the day following a slide from the lows of 0.6833 to a low of 0.6757 from where the price has started to recover, currently trading near 0.6798. The bulls have been pressured as the greenback attempts to recover the Federal reserve aftermath losses.

The Federal reserve, despite being uber hawkish on Wednesday, has led to a sell-off in the US dollar. This has been put down to a ''buy the rumour sell the fact'' outcome of the event in irregular holiday markets conditions. Volatility in the forex space is at a year's high, so this to might have played into the counterintuitive outcome for the greenback and stocks.

''The idea that a gradual tightening in policy can put the economy on a smooth glide-path back to growth and inflation equilibrium is implausible, but after 20 years of ‘buy the dip' the equity market is trained to look on the bright side of life,'' analysts at Societe Generale argued.

The Fed's Chair Powell noted the economy is “making rapid progress toward maximum employment” and all committee members see that test being met next year. (The unemployment rate is now expected to fall to 3.5% in late-2022, matching the past cycle’s low.)

The most hawkish of all was the significant shift in the dot plot—whereas committee members were previously evenly split on raising rates once next year, today’s projections show most now expect three rate hikes in 2022 and another three in 2023. This means that there is a clear risk of earlier liftoff than what markets had been anticipating. Nevertheless, the slump in the USD saw the Kiwi rise above 0.68 the figure before it was quickly sold off from there in what was a bearish engulfing candle.

Meanwhile, analysts at ANZ Bank explained that now we are past the halfway mark in December and in past years that have been associated with seasonal NZD strength (even if that should be priced in). ''Having bounced nicely off 0.67, the technical picture is also looking a bit more composed as we head into the holidays.''

What you need to know on Friday, December 17:

Following the US Federal Reserve announcement on Wednesday, the Swiss National Bank, the Bank of England and the European Central Bank, have announced their monetary policy decisions, and except for the SNB, all of them announced tighter monetary policies.

The European Central Bank announced a cautious taper pretty much in line with the market’s expectations. The ECB kept rates on hold and confirmed the Pandemic Emergency Purchase Program will end in March 2022. The Government Council also decided to expand its Assets Purchase Program to €40 billion per month in the second quarter and to €30 billion in the third quarter, to partially compensate the end of the monthly €60 billion bond-buying through PEPP

The Bank of England Monetary Policy Committee voted by a majority of 8-1 to increase the benchmark rate to 0.25% and by a majority of 9-0 to maintain the amount of quantitative easing at £895b.

The SNB maintained its expansionary monetary policy to ensure price stability, and support the local economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at SNB at −0.75%.

A note of colour, Turkey’s central bank cut the main interest rate to 14% from 15%, pushing TRY to a new record low of 15.74.

The EUR/USD pair peaked at 1.3360, while GBP/USD reached 1.3374. Both retreated during US trading hours, to settle at 1.1320 and 1.3310 respectively. The AUD/USD pair trades around 0.7180 down from the 0.7220 region. The aussie benefited from upbeat local employment figures. The USD/CAD pair is down to 1.2780.

Finally, the USD/JPY pair trades at 113.70 ahead of the Bank of Japan monetary policy decision, widely anticipated to remain on hold.

Gold was among the best performers, advancing for a second consecutive day and currently trading around $1,795 a troy ounce. Crude oil prices were also up, with the barrel of WTI currently trading at $72.50.

European indexes posted substantial gains, but Wall Street was unable to follow the lead, and traded mixed. US Treasury yields spent the day consolidating, showing little reaction to central banks’ news.

Meanwhile, multiple countries continue to report record cases of coronavirus contagions, related to the Omicron variant. Tighter measures are being imposed in places such as the UK and South Korea, to try to curve the spread and prevent the collapse of health systems.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Cryptos ready for Christmas rally

Like this article? Help us with some feedback by answering this survey:

- USD/CAD stabilises the offer near 1.2790 as markets consolidate the volatility.

- The BoC is tipped for a more aggressive approach given the tight labour market and sky-high inflation.

USD/CAD is lower on the day but is stalling the decline in the New York session finding a bottom near 1.2763 after sliding from the day's high of around 1.2857. The bulls are stepping in although the greenback is better offered across the board as per the DXY index. At the time of writing, USD/CAD is trading 0.35% lower at 1.2787.

The greenback has been sliding in the middle of the month in what tends to be irregular market flows considering the holiday period. This might go some way to explaining why the US dollar was so heavily offered following what was a strongly hawkish outcome of the Federal Reserve. The DXY index, which measures the greenback vs a basket of major currencies, including the Canadian dollar, has been unable to cross the 97 figure and has since fallen to as low as 95.85. The weakness in the greenback is welcomed by the commodity complex and high beta currencies, breeding life into USD/CAD's downside of late.

Focus turns to the BoC

On the domestic front, earlier this week, the headline Consumer Price Index held at 4.7% YoY in November, in line with the market consensus. This is its highest level in 30-year high including 2 decimals. Core inflation saw a slight pickup, with the average of the Bank of Canada's measures edging higher to 2.73% YoY from 2.67% in October. ''This is unlikely to faze the BoC however given the stable headline print which leaves inflation tracking near MPR projections for 4.8% in Q4,'' analysts at TD Securities argued.

In other events, governor Tiff Macklem discussed the Bank of Canada's mandate renewal in his final speech of 2021 and provided more insight into the mandate renewal process. ''However'', analysts at TD Securities argued, ''the BoC's new mandate is unlikely to have any impact on policy in the near-term; as discussed on Monday, the Bank's assessment of maximum sustainable employment should not delay liftoff with inflation well above the target range, although it does raise the bar for hikes once inflation moderates (ie. 2023).''

The convergence of the Fed and BoC would be expected to keep the pair contained within familiar ranges, especially when taking into account the most recent LFS data that indicated a strong labour market being essentially at full employment. This would be expected to see wages push inflation even higher in the coming months as workers appear to have the bargaining power to demand higher compensation.

''Given this backdrop, the central bank appears to be late in its normalization of monetary policy,'' analysts at the National Bank of Canada said in a note at the start of the week. ''We expect five rate hikes next year with the kick-off occurring in March. Of course, this assumes that Omicron does not substantially undermine confidence and leads to more stringent health restrictions.

- EUR/CHF has reversed sharply back from earlier session highs in the 1.0460s and now trades in the 1.0410s.

- The pair may be moving lower amid focus on Swiss/Eurozone inflation differentials in wake of ECB and SNB policy announcements.

EUR/CHF has reversed back from earlier session highs in the 1.0460s and current trades at session lows in the 1.0410s, with the bears eyeing an imminent test of the psychologically important 1.0400 level. Its been an unusually choppy session for the pair given that both the Swiss National Bank and European Central Bank both announced monetary policy decision on the session.

Initially, the SNB meeting appeared to weigh on the Swiss franc, though in wake of the ECB meeting, this weakness reversed and CHF is now the best performing G10 currency on the day. For reference, interest rates were held as expected at -0.75% and Governor Thomas Jordan pledged that rates will remain there given comparatively modest inflationary pressures in Switzerland versus most other developed nations. The characterisation of CHF was maintained at “highly valued” and the SNB pledged to continue FX interventions where necessary

In terms of the ECB meeting; the bank confirmed as expected the end of the PEPP by the end of Q1 2022 and announced that, in order to avoid a cliff-edge drop off in bond purchases, the APP would be upped to EUR 40B in Q2 and EUR 30B in Q3 and then at a pace of EUR 20B indefinitely afterward. The ECB’s inflation forecast for 2022 was substantially upgraded (to 3.2% from 1.7%) but ECB President Christine Lagarde was keen to emphasise that a hike in 2022 was very unlikely. Why this weighed on EUR/CHF at the time was not quite clear, with some suggesting the upgrade to Eurozone inflation highlighted Eurozone/Swiss inflation differentials.

Indeed, inflation differentials between the Eurozone and Switzerland have seen EUR/CHF fall in recent months (i.e. as the value of the euro is eroded faster than the value of the Swiss franc), a phenomenon the SNB made a nod to in order to justify why they have let the pair fall so much since its pre-pandemic levels above 1.10. ING noted that “there seems to be a clear desire to justify why the SNB is allowing the franc to strengthen as much as it is now and to reinforce its credibility that it will continue to act” before adding that “the comment about the risk of negative inflation if the franc were to strengthen too much is for me a real signal about its intentions to act in the coming months.” That implies EUR/CHF’s ride lower from here might not be quite as easy.

- The USD/JPY retreats under the 114.00 figure, falls some 0.30%.

- The US 10-year Treasury yield falls three basis points, sitting at 1.429%.

- USD/JPT Technical Outlook: It has an upward bias, as long as it trades above 112.53.

After piercing the 114.00 figure on Wednesday, the USD/JPY slides, trading at 113.67 during the New York session at the time of writing. As the American session progresses, the market sentiment is mixed, as US equity indexes fluctuate between gainers and losers after the last Federal Reserve monetary policy meeting.

On Wednesday, the US central bank revealed that they would increase the speed of the bond taper, beginning by the middle of January 2022. Moreover, the dot-plot, which projects the Federal Funds Rate expectations among Fed policymakers, shows that the FFR is expected to be at 0.90% by the end of 2022, meaning that the Fed would hike at least three times in 2022.

The USD/JPY reacted upwards after the monetary policy statement. However, the upward move was faded, as investors were fully priced in, per the market’s reaction.

In the meantime, US T-bond yields in the short-term are falling, led by 2s, 5s, and t0s, sliding between three and seven basis points, sitting at 0.6269%, 1.1848%, and 1.429%, respectively, a headwind for the greenback.

Meanwhile, the US Dollar Index, which measures the greenback’s performance against six peers, slumps 0.47%, cling to 96.05.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is trading under the 50-day moving average (DMA), at 113.80. Furthermore, as long as the spot price is above the 100 and the 200-DMAs, alongside the November 13 cycle low at 112.53, the bias is upward, so any retracement towards the aforementioned support level should be viewed as opportunities for USD bulls.

The first demand on the way down would be the December 10 cycle low at 113.22, followed by the figure at 113.00. The breach of the latter would expose the November 13 swing low at 112.53.

-637752791509631205.png)

- GBP/USD corrects the BoE rallies imbalance towards daily support.

- 1.3380/90 confluence targets are compelling from an hourly basis.

GBP/USD has been accumulating and broke higher on the daily chart following today's surprise hike of 15bp from the Bank of England. At the same time, the US dollar has been unable to break the 97 levels in the DXY index.

As illustrated on the daily chart, below, the price has rallied strongly in a correction of the dominant bear trend and is leaving a wick on the daily candle.

GBP/USD daily chart

This wick represents short selling on the lower time frames as the market mitigates the imbalance of the price action. This gives rise to an opportunity to buy the dip.

GBP/USD H1 charts

We can see the fade on the hourly time frames and where the price might be expected to stall within the correction. Zooming out, we can see that the price could rally as high as 1.3380/90 which is where the next point of control is on the sessions 22nd Nov and high 23rd Nov. This also has a confluence of the -272% Fibo of the correct correction's range.

We have a similar scenario on the US dollar chart:

DXY H1 chart

The price has hit the 61.8% Fibonacci retracement and the resistance could lead to the price action to continue south. This would play into the hands of the cable bulls seeking the upside continuation on the hourly chart.

- WTI challenged weekly highs at $73.00 on Thursday, havig rebounded from mid-week lows under $70.00.

- A bullish Fed outlook and evidence of strong US demand are being touted as supportive of prices.

Oil prices have been on the front foot over the course of the last two sessions and, on Thursday, WTI challenged weekly highs at $73.00 before pulling back a little to the low-$72.00s. Oil prices are up just under $1.0 on the day, taking the two-day run of gains to over $2.0 per barrel (roughly 3.0%), with traders seemingly having aggressively bought into the mid-week dip below $70.00 per barrel.

Market commentators said that Fed Chair Jerome Powell’s bullish view of the US economy heading into 2022 (which seemed to help equities) has helped support energy market sentiment on Wednesday and Thursday. Traders were also citing Wednesday’s official US inventory report as bullish, in that it implied that crude oil consumption in the US had risen to 23.2M barrels per day, significantly above the 2020 average of just over 18M barrels per day. Analysts at oil broker PVM said that “these figures suggest a healthy economic backdrop”.

But oil markets continue to monitor risks to the outlook, including the prospect of rising supply in 2022 from OPEC+ and non-OPEC+ nations alike and the spread of Omicron. The UK and South Africa both reported record daily infections on Thursday and other countries will surely be following suit soon. The big question now is whether these high infection rates will translate into high hospitalisation and death rates, which hasn’t yet been the case in South Africa.

Recent upside hasn’t been enough for oil to mount a serious challenge of the top of recent ranges above $73.00. Some traders suspect that into the year-end, oil markets may remain rangebound in the $70.00-$73.00 area as traders balance Omicron/pandemic risks, fears of oversupply in 2022 against high inflation and economic bullishness, particularly with regards to the US.

- EUR/GBP is back to just below the 0.8500 level from earlier near 0.8450 lows.

- Markets are digesting Thursday’s ECB and BoE rate decisions.

EUR/GBP was under scrutiny to an unusual degree this Thursday given both the BoE and ECB set policy, though one of the rate decisions proved more consequential/of a market mover than the other. EUR/GBP dipped as low as 0.8450 after the BoE surprised markets with a 15bps rate hike, breaking to the south of this month’s prior triple bottom in the 0.8490 area in the process.

But most of Thursday’s losses have been pared in wake of the ECB policy announcement, with EUR/GBP now trading back just under 0.8500 and down only about 0.15% on the day. For reference, the ECB delivered few surprises by confirming the end of the PEPP in March, though reinvestments would continue to the end of 2024, whilst also unsurprisingly announcing a temporary increase in APP purchases in Q2 and Q3 to compensate somewhat for the end of the PEPP. The ECB’s 2022 inflation forecast got a big upgrade which may have spurred some upside in the pair.

With the last major risk event out of the way for the year for both the euro and pound sterling, focus will likely now return to the evolution of the pandemic. The UK appears to be the European Omicron hotspot (for now), with France banning tourist travel as cases there rise sharply. The risk of lockdowns being toughened again ahead of Christmas is high and weakness in the economy is already being seen creeping in via the UK December PMIs. Perhaps Europe will follow suit in a few weeks. For now, bearish UK Omicron developments will likely be a tailwind for EUR/GBP, which already relinquished the bulk of its post-surprise BoE rate hike gains.

- Silver rallies for the second day in a row, up some 1.79%, amid falling US T-bond yields.

- Fed announces a faster bond taper, and its policymakers project three interest rates hikes by 2022.

- XAG/USD Technical Outlook: The break of a downslope trendline can send the white-metal towards $23.00

Silver (XAG/USD) rallies during the New York session, up some |.79%, trading at $22.46 at the time of writing. The market sentiment is upbeat, as portrayed by European equity indices finishing in the green. Contrarily in the US, stocks fluctuate between gainers and losers, after on Wednesday, the Federal Reserve announced a faster bond-taper, and the median of its members penciled three rate hikes in 2022

Fed’s increase the speed of the bond-taper, projects three rate hikes in 2022

Fed’s last monetary policy of the year came as widely expected by markets. The US central bank announced that it would increase the pace of its QE reduction from $15 to $30 Billion, double the amount agreed in November’s meeting, meaning that they would end by March of 2022. Furthermore, it revealed its Summary of Economic Projections (SEP), which shows that the board expects inflation as high as 2.6% in 2022, 2.3% in 2023, and 2.1% in 2024, a tick higher than the September projections.

Apart from this, Fed’s policymakers expect that the Federal Fund Rate (FFR) will end at 0.90% in 2022, meaning the US central bank would hike three times. By 2023, they expect the FFR at 1.6%, and in 2024 at 2.1%.

In the meantime, the US 10-year Treasury yield slides four basis points, sits at 1.422%, a headwind for the greenback, thus favoring precious metals. The US Dollar Index, which tracks the buck’s performance against a basket of six peers, edges lower 0.48%, currently at 96.05.

XAG/USD Price Forecast: Technical outlook

Silver is trading above the hourly simple moving averages (SMAs), so XAG/USD has an upward bias in the near term. Additionally, the break of a slight down-slope trendline around $22.25 confirmed the aforementioned, exposing crucial resistance levels to the upside.

The first resistance would be the R2 daily pivot at $22.54, followed by the R3 daily pivot at $22.983, and then $23.00.

On the flip side, the first support would be the 200-hour SMA at $22.19, followed by the 100-hour at $22.09, and the 50-hour SMA at $21.99.

-637752753691093977.png)

- AUD/USD bulls are looking for a deceleration of the downside in New York.

- The session's ahead could see the price evolve into a bullish structure on the hourly chart leading to a daily continuation.

AUD/USD has made a well deserved meanwhile comeback this week, falling from a low of 0.7090 to a high of 0.7223 so far. This is in light of the US dollar being unable to break the 97 levels in the DXY index and some good domestic news in the Aussie jobs market.

As illustrated on the daily chart, below, the price has rallied strongly in a correction of the dominant bear trend, corrected, and then rallied again as follows:

AUD/USD daily chart

The price move din towards the 50-day moving average and would be expected to continue higher in the coming sessions to fill, at least, the wick that it is leaving behind as the price sinks back to mitigate the imbalance left behind on the recent rally through 0.7180.

AUD/USD H1 chart

From an H1 perspective, the bulls will be looking for a deceleration of the bearish correction as follows:

Should the price decelerate and turn higher from the expected support (old daily resistance), then there is a high probability that the price will move higher to fill the daily wick and move in on the 0.7240s.

We have a similar scenario on the US dollar chart:

DXY H1 chart

The price has hit the 61.8% Fibonacci retracement and should this hold, as it looks like it is doing currently, then the price would be expected to continue south. This would play into the hands of the Aussie bulls seeking an upside continuation on the hourly chart.

At their latest meeting, the Federal Reserve decided to increase the pace of the QE tapering and the projections of the FOMC staff showed a potential of three rate hikes for next year. Analysts at Wells Fargo, point out the bar for rate hikes now rests squarely on the labor market, with the statement indicating that the inflation threshold even under the Fed's new flexible regime has been met.

Key Quotes:

“With inflation expected to run further above target through next year and the labor market making steady progress toward full employment, the projected path of the fed funds rate moved higher relative to the September dot plot. Based on the median projection, participants have now penciled in three 25 bps increases over 2022 after having been evenly torn between zero and one hike in September. The median projection among Committee members calls for 75 bps of tightening in 2023 followed by another 50 bps in 2024. If realized, that would put the fed funds target range at2.00-2.25% at the end of 2024, a touch below where the FOMC estimates policy would become restrictive.”

“Market pricing over the next two years is roughly in line with the median projection for six cumulative rate hikes through year-end 2023, but beyond that markets are priced for very little additional tightening. We are skeptical of this market pricing, and this is one reason we look for the 10-year Treasury yield to steadily move toward 2% as 2022 progresses.”

- Spot gold is hovering just below $1800, having rallied from Wednesday’s lows just above $1750.

- Bond markets have seen dovish post-Fed moves, even though many analysts did not judge the Fed as hawkish.

- Upside is for now being capped by the presence of the 21, 50 and 200DMAs.

Spot gold (XAU/USD) has continued to advance as the US session has gotten underway, recently breaking out to fresh one-month highs above $1792 and nearly testing the psychologically important $1800 level. The precious metal has seen choppy two-way trade since Wednesday’s Fed policy announcement, initially dropping to multi-week lows in the low $1750s, before reversing to current levels near $1800.

The reversal higher comes despite what most analysts agreed was a slightly more hawkish than consensus expectation tone to the Fed on Wednesday. Most importantly, the bank indicated three rate hikes in 2022, doubled the pace of its QE taper and Fed Chair Jerome Powell was bullish on the economic outlook for 2022. Nonetheless, gold is up as the dollar weakens in what appears to have been a “buy the rumour, sell the fact” reaction to Fed hawkishness. XAU/USD has run into significant resistance in the form of its 21, 50 and 200-day moving averages, all of which reside in the $1790s.

The fluctuation in precious metal markets is a function of volatility in US government bond and Short-Term Interest Rate (STIR) markets. In the former, real yields have been getting a battering, with the 5-year TIPS yield now back to around -1.57% having nearly hit -1.30% in its initial post-Fed reaction. Meanwhile, the implied yield on the December 2022 three-month eurodollar future has pulled back from as high as 1.10% in the aftermath of the Fed meeting to under 1.0% again.

For whatever reason (perhaps because Powell alluded to a slower pace of rate hikes if the economy slows), bond and STIR markets seem to be reacting dovishly to the Fed and this is helping gold. As markets get more time to digest what happened this week, this bias may be dropped. For those expecting a strong US economy and hawkish Fed in 2022, near-$1800 might be a good entry point for shorts.

After the rate hike announcement on Thursday from the Bank of England, analysts at Rabobank held on to their forecast of a much less aggressive tightening cycle than what is currently priced in front-end rates. They expect another 25 bps hike early next year.

Key Quotes:

“The Bank of England MPC confounded expectations of traders and economists once again as it decided to raise its policy rate by 15 bps to 0.25%. The vote was split 8-1.”

“Even though 15 bps is just a small step, the Bank of England is the first of the major central banks to raise its policy rate in order to limit upside risks to inflation (expectations). Given that the market had come round to the idea the MPC would delay its first hike to February, it was a surprising move.”

“Along with the Fed’s pivot to inflation fighting, it illustrates that virus risks are not the central banks’ primary concern anymore. We do, however, hold on to our forecast of a much less aggressive tightening cycle than what is currently priced in front-end rates. We forecast another 25 bps rate hike in the next few months, but expect Bank rate to end the year at 0.50%.”

- The US dollar is under heavy selling pressure, down some 0.55% against the Loonie.

- The Fed hawkish monetary policy decision was seen as a “buy the rumor, sell the fact” event, as shown by US equities at all-time highs.

- USD/CAD Technical Outlook: A double-top in the daily chart looms with a target of 1.2400.

After a spike towards 1.2937 on Wednesday, the USD/CAD grinds lower during the New York session, trading at 1.2770 at the time of writing. The market sentiment has improved as witnessed by European equities rising, while stock indices fluctuate between gainers and losers on the US.

On Wednesday, the Federal Reserve unveiled its monetary policy meeting, where policymakers decided to increase the bond taper speed, eyeing March of 2022 as the end of the coronavirus-pandemic stimulus. Further, it released the dot-plot, a part of its Summary of Economic Projections (SEP), which depicts that the board members’ median expects at least three rate hikes in 2022, in line with market participants’ expectations.

That said, the Federal Reserve monetary policy decision turned to a “buy the rumor, sell the fact event,” with equities rallying to all-time-highs post-Fed. At the same time, risk-sensitive currencies like the GBP, the CAD, and the antipodeans climbed against the greenback.

In the meantime, Western Texas Intermediate (WTI) irises some 1.60%, trading at $72.85, a tailwind for the oil-linked Canadian dollar.

The US 10 year Treasury yield is down almost three basis points, sitting at 1.433%, a headwind for the greenback, with the US Dollar Index, which measures the buck’s performance against a basket of six rivals, slips 0.42%, currently at 96.10.

In the US economic docket, the Initial Jobless Claims for the week ending on December 11 rose to 206K, more than the 200K, a tick higher than the previous one. Concerning Continuous Claims, fell to 1.845M, from 1.999 on the week previous, and better than the 1.934M estimated.

Further, US Housing Starts rose to 11.8% yearly based, while Building Permits increased by 3.6%.

USD/CAD Price Forecast: Technical outlook

USD/CAD Wednesday’s upward move faced strong resistance at the August 20 high at 1.2948, then retreated the move to close below the December 3 high at 1.2853. That said, as shown by the daily chart, it formed a double-top chart pattern with bearish implications.

However, to confirm its validity would need a sustained break under 1.2605, which will target a move towards the October 23 high at 1.2400.

-637752718090648444.png)

The rallied modestly off the back of a more hawkish European Central Bank (ECB), argue analysts at TD Securities. They think EURUSD is likely to respect the 1.12/14 range into year-end, with the "risk of slippage below 1.12 non-trivial next year".

Key Quotes:

“There is probably not enough here to change strategic short positions in EUR. EUR/crosses could see some unwind but ultimately contained. At the end of the day, Lagarde is still committing the EUR to being the most liquid and largest funder next year. Tactically, we're not reading much into price action as we think investors are just hoping to get to year-end after a volatile Oct/Nov. EURUSD likely consolidates; we have highlighted 1.12/14 as the likely range and within that, 1.1385 will be a key resistance marker. Above the range, downtrend resistance established from the May highs comes in around 1.15. This could be the capitulation point for EUR shorts.”

“Given the cyclical forces at play, the USD still seems to be the currency to beat next year. A faster taper by the Fed also means the TIPS market loses a big buyer of 10Y equivalents. That means that US real rates are likely to rise faster than their German counterparts, leaving another key anchor, alongside 1y1y rate spreads, capital divestment and inferior carry as key anchors for EURUSD early next year. As such, we think 1.12 in EURUSD is vulnerable to break then.”

- The Mexican peso rises across the board on Thursday.

- Banxico meeting ahead: rate hike of 25bps expected.

- USD/MXN could post the lowest close in almost a month.

The USD/MXN is falling for the second day in a row on Thursday with Banxico’s decision ahead. The combination of a stronger Mexican peso and a weaker dollar versus commodity and emerging market currencies pushed the pair further to the downside. It is hovering around 20.87, near monthly lows.

After making a run to 21.35 on Wednesday, immediately after the FOMC meeting, the USD/MXN turned to the downside and it has been falling since then. Currently, it is trading under 20.90, looking at the December low of 20.83. A consolidation under 20.85/90 should add more strength to the Mexican peso. The next barrier stands at 20.65.

If USD/MXN manages to hold above 20.85/90 a rebound toward 21.05 initially seem likely in the sessions ahead. Above the next resistance stands at 21.20 that also contains the 20-day moving average.

Banxico set to hike again

Among emerging market currencies, the Mexican peso is a top performs on Thursday ahead of Banxico’s decision. Market participants expect the Bank of Mexico to hike the key interest rate by 25 basis points to 5.25%. Some mentioned a potential for a 50 bps hike. The inflation rose further above 7%; and together with the new message of the Fed poses a challenge to Banxico.

Technical levels

Still beset by supply chain constraints and labor shortages, industrial production grew just 0.5% in November, a marked slowdown from the upwardly revised 1.7% pick-up in October, mentioned analysts at Wells Fargo. They point out that slight improvements in supplier deliveries suggest things are at least not getting worse.

Key Quotes:

“U.S. industrial production increased 0.5% in November, a tenth of a percentage point shy of the consensus expectation; though after accounting for a slight upward revision to October's increase, the level of industrial output is essentially right in line with expectations.”

“There was not much in the way of new developments in today's report; the country's industrial output is limited by the availability of raw materials and workers. While both will improve over time, any meaningful change is still several months away. The fact that ISM supplier deliveries came down a few points in November suggests it is at least not getting worse.”

“Overall capacity utilization rose to 76.8% in November, which is the highest reading since November 2019. That said, it might be premature to worry about a meaningful inflation push from tight capacity, at least if history is any guide. At it's highest point in the prior cycle, capacity utilization topped out at 79.9%, and in the 1990s it rose as high at 85%.”

The European Central Bank (ECB) introduced changes to its QE programs on Thursday. According to analysts at Danske Bank, the ECB could have delivered a more hawkish calibration, but retain flexibility and optionality for now.

Key Quotes:

“During today’s press conference, Lagarde conveyed that optionality and flexibility were key components of ECB’s calibration. The calibration has both something for the hawks and the doves and must be seen as a compromise. In our view, the calibration of instruments could also have been more hawkish given the staff projections, both on core inflation and wage growth, which serves as part of the realised progress in underlying inflation.”

“For ECB, it seems to be somewhat of a discussion about if the supply chain shock will be temporary (or not) and ECB sees it as temporary. Thus, in H2, the ECB expects a large demand shock from both pent-up demand (savings) as well as via the easing of supply chains. This is quite different from how Fed and others view global macro at the moment.”

“To us, the ECB macroeconomic expectations are a risk scenario but certainly not the main one. As such, equally, if ECB proves right then we would expect to see a very EUR-bullish macro narrative, steeper global yield curves and possibly also a step back in the hawkishness of other global CBs. We continue to forecast a lower EUR/USD, at 1.10 in 12M and highlight ECB's expectations being fulfilled as a risk to such.

- US dollar recovers strength versus G10 currencies, still negative for the day.

- EUR/USD fails to break recent range after being rejected from above 1.1350.

- ECB meeting: no major surprises.

The EUR/USD spiked at 1.1360, the highest level in two weeks, but it was unable to hold above 1.1350 and pulled back. The retreat is challenging the 1.1300 zone during the American session after the US dollar recovered ground across the board.

Between data, central banks and expectations

US economic data released on Thursday came mostly below expectations, particularly PMIs. Market participants ignored the numbers. In Europe, the key event was the European Central Bank meeting.

The euro initially reacted positively to the ECB meeting. The central bank left interests rate unchanged and reduced its bond purchases, mostly in line with expectations. ”With today’s decision, the ECB has entered into a very cautious tapering process. The details of the taper are less clear-cut than we had expected. The ECB did not announce a (third) transitional asset purchase programme. It decided instead to ensure the same level of PEPP flexibility in the asset purchases, including allowing it to purchase Greek bonds, and with the reinvestment of PEPP purchases”, explained analysts at ING.

Later the common currency lost momentum and started to pullback, trimming gains. At the same time, the US dollar gained strengths, pushing EUR/USD further to the downside. So far, the correction found support at 1.1300.

The EUR/USD is back at the previous trading range between 1.1350 and 1.1250. The euro needs a firm break above 1.1350/60 to clear the way to more gains. On the flip side, a slide below 1.1250 would point to further losses.

Technical levels

- Euro's momentum fades after ECB spike.

- Yen soars across the board amid a retreat in US yields.

The EUR/JPY peaked during the American session at 129.63, the highest level since November 19, following the European Central Bank meeting. During the last hour, it reversed sharply and dropped to 128.60, turning negative for the day amid a rally of the Japanese yen.

The JPY strengthened amid a decline in US yields. Despite Wednesday’s Fed signs about three potential rate hikes for 2022, Treasuries are up on Thursday. Over the last hours, the 10-year hit a fresh low at 1.42% and weighed on USD/JPY.

Earlier the ECB left interest rates unchanged and reduced its bond purchases, mostly in line with expectations. The euro rose moderately but then lost momentum.

Bullish but…

The EUR/JPY continues to move away from the recent low but the current reversal shows the recovery is bumpy. If the euro slides back under 128.30 it would weaken the short-term outlook. On the upside, EUR/JPY needs a daily close above 129.20 in order to clear the way to more gains.

Technical levels

- The USD/CHF edges down during the New York session, losing 0.35%.

- The market sentiment is upbeat, as the Fed delivered as expected.

- USD/CHF Technical Outlook: Neutral-bullish, as long as it remains above the 200-DMA.

After rallying for three consecutive days, the USD/CHF pierced the 61.8% Fibonacci retracement, then retreated towards December 14 lows, trading at 0.9214 during the New York session at the time of writing. The market sentiment is upbeat once the Federal Reserve unveiled its monetary policy decision, in line with investors’ expectations.

The Fed delivered a faster bond taper, decreasing its bond purchases by $30 Billion, double the November monetary policy meeting’s agreed. Also, in the Summary of Economic Projections (SEP) with the dot-plot, Federal Reserve board members expect at least three rate hikes in 2022, as projections estimate that the Federal Funds Rate would end at 0.90%.

The USD/CHF remained trapped in the 0.9225-50 range in the overnight session. However, once American traders got to their desks, the pair broke support at the December 15 pivot low 0.9224, slumping towards 0.9198.

In the meantime, US Bond yields in the short term of the curve fall between one and seven basis points, led by 2s, 5s, and 10s at 0.6310%, 1.1848%, and 1.42%, each, a headwind for the buck, with its US Dollar Index back under the 96 handle, down 0.53%, at 95.98.

USD/CHF Price Forecast: Technical outlook

After piercing the 61.8% Fibonacci retracement, drawn from the November 24 swing high to the November 30 swing low, the USD/CHF pair fell under the 38.2% Fibonacci retracement, and at press time is trading under the 50-DMA, which lies at 0.9215.

That said, to the upside, the first resistance would be the 50-DMA at the abovementioned level. A break above that level would expose the 38.2% Fibonacci retracement at 0.9239, followed by the 50% Fibonacci retracement at 0.9265.

On the other hand, the first support level would be the 100-DMA at 0.9202. A breach of the latter would expose crucial support levels, as the December 14 low at 0.9188, followed by the 200-DMA at 0.9177.

-637752653551411470.png)

The Bank of Japan (BoJ) will announce its policy decision on Friday, December 17 at 03:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of six major banks. The BoJ is seen standing pat on its main stimulus while weighing an extension to its covid aid program.

Standard Chartered

“We expect it to maintain the policy balance rate at -0.1% and the 10Y yield target at c.0%. Japan’s economy suffered weak growth in Q3 due to production disruptions as a result of COVID-19 restrictions. We expect the BoJ to maintain its current policy stance for some time, unlike other central banks. This is largely because the BoJ faces a very different inflation backdrop to peers, with headline CPI inflation still close to 0%. If the Fed and ECB tighten liquidity, the BoJ may come under pressure to join global policy coordination.”

Deutsche Bank

“Although there had been an expectation that the bank would revise their special pandemic corporate financing support program at this meeting, the emergence of the Omicron variant has changed the situation. Given the next meeting is only a month later, the view is now that they’ll maintain a wait-and-see stance in this meeting and adjust the policy in January, although a revision remains possible this week if more positive evidence is found on the new variant.”

BBH

“Some reports suggest the bank is considering an announcement that it will allow its emergency corporate lending programs to expire in March as scheduled. However, other reports suggest some policymakers would rather delay the announcement until the impact of omicron is better known, perhaps at the next meeting on January 18. New macro forecasts will be released then as well, perhaps offering a better opportunity to tweak policy. This week, it should be steady as she goes for the BoJ.”

SocGen

“The BoJ will apply -0.1% to the policy rate balance in the current accounts. It will purchase the necessary amount of JGBs without setting an upper limit so that 10-year JGB yields will remain at around 0%. The BoJ will maintain the current rate guidance that it will continue with QQE with YCC, aiming to achieve the price stability target of 2%, as long as is necessary to maintain that target in a stable manner. The BoJ will maintain the current economic assessment that Japan's economy has picked up as a trend, although it has remained in a difficult situation due to the impact of COVID-19 at home and abroad.”

BMO

“The BoJ will wrap up a hectic week with its announcement on Friday. Nothing meaningful will change.”

ING

“Recent history suggests little to no impact from BoJ rate decisions on the yen and this time should be no different. All policy tools are set to remain untouched, while we think (and this seems to be the consensus) that the BoJ will extend the emergency corporate funding programmes as the Omicron variant generates new risks to the outlook.”

According to anonymous sources at the European Central Bank, some hawkish members of the governing council were unhappy about extending reinvestments from the Pandemic Emergency Purchase Portfolio (PEPP) to 2024. Moreover, some were unhappy about the fact that the ECB did not set an end date to its Asset Purchase Programme.

ECB policymakers also reportedly disagreed on the inflation outlook, with some stressing upside risks to the new forecasts, the sources added. Apparently, according to the sources, it was the governors of the Belgian, Austrian and German central banks that disagreed.

- NZD/USD surged back above 0.6800 on Thursday, as the dollar weakens post-Fed.

- A smaller than expected decline in Q3 NZ GDP didn’t seem to impact FX markets much.

NZD/USD has been choppy over the last two sessions, in fitting with a broader uptick in volatility across G10 FX markets. On Wednesday, in wake of the Fed’s hawkish policy announcement that the pace of the QE taper would be doubled and there could be as many as three rate hikes in 2022, NZD/USD lurched as low as 0.6700. The pair has since surged as high as the 0.6830s, though has eased back to around the 0.6800 level.

While most agree the Fed on Wednesday was hawkish, with Fed Chair Jerome Powell painting a bullish picture for the economy in 2022, FX market participants have seemingly been closing out their bullish dollar positions. Some have referred to the market reaction as “buy the rumour (of Fed hawkishness), sell the fact”. Whatever the cause, USD weakness on Thursday is providing a lift to the majority of its G10 counterparts, NZD included, hence how NZD/USD has recovered back to the north of the 0.6800 level.

A smaller than expected decline in economic activity in New Zealand in Q3, as revealed by a release at the start of Thursday’s Asia Pacific session, is good news for the RBNZ, but does not seem to have impacted FX markets. The economy contracted just 3.7% QoQ in Q3 amid strict lockdowns for much of the quarter in key city Auckland. This was less than the 4.5% QoQ decline markets had expected and well below the decline forecast by the RBNZ. NZD on Thursday is up about 0.3% versus the US dollar, a similar margin to the gains seen in AUD, CHF and JPY and less so than the EUR (+0.4%) and sterling (+0.6%).

The European Central Bank (ECB) paved the way out of the pandemic-era support measures but at the same time retained flexibility to react to unforeseen developments. Economists at Nordea see more upside potential for EUR bond yields and downside for the EUR/USD.

Net asset purchases to end in H1 2023, first hike in late 2023

“The ECB will end net PEPP by the end of March 2022 and introduced a path for tapering its bond purchases, albeit not quite to zero.”

“The path for asset purchases basically excludes the chance of rate hikes already next year – we expect net asset purchases to end in H1 2023 and see the first rate hike in late 2023.”

“We see falling ECB bond purchases supporting a gradual rise in longer euro-area bond yields, and see steepening potential on the EUR curve and room for some widening in euro-area bond spreads.”

“We find there is more room to reprice the Fed outlook compared to the ECB, and expect EUR/USD to fall further next year.”

- The British pound printed a 100-pip gain after the Bank of England (BoE) delivered an unexpected rate hike.

- The Federal Reserve meeting event turned to a “buy the rumor, sell the fact event,” delivering the market expectations.

- GBP/USD Technical Outlook: Tilted upwards, but a clear break of 1.3353 would send the pair rallying towards 1.3400; otherwise, a move back to 1.3300 is on the cards.

At the time of writing, the British pound extends its Thursday rally, trading at 1.3336 during the New Tork session. Early in the European session, the Bank of England (BoE) surprisingly pulled the trigger and hiked 15 basis points its overnight interest rates up to 0.25% in an 8-1 vote, with Sylvana Tenreyro as the only dissenter. Additionally, on Wednesday, the Federal Reserve increased its bond taper speed to double the agreed in November, and per dot-plot depicted, its policymakers eye at least three hikes in 2022.

That said, the Federal Reserve monetary policy decision turned to a “buy the rumor, sell the fact event,” with equities rallying to all-time-highs, while risk-sensitive currencies like the GBP, the CAD, and the antipodeans climbed against the greenback.

BoE’s decision comes amid a COVID-19 outbreak with cases in the UK as of December 15, topping around 78,610 new cases as the Omicron variant spread worldwide continues. Furthermore, UK’s central bank said that “modest” tightening would probably be needed, as they expect inflation to peak at 6% by April of 2022.

In the meantime, US Bond yields in the short term of the curve fall between one and four basis points, led by 2s, 5s, and 10s at 0.6431%, 1.2092%, and 1.458%, each, a headwind for the buck, with its US Dollar Index back under the 96 handle, down 0.64%, at 95.89.

In the US economic docket, the Initial Jobless Claims for the week ending on December 11 rose to 206K, more than the 200K, a tick higher than the previous one. Concerning Continuous Claims, fell to 1.845M, from 1.999 on the week previous, and better than the 1.934M estimated.

Further, US Housing Starts rose to 11.8% yearly based, while Building Permits increased by 3.6%.

GBP/USD Price Forecast: Technical outlook

The GBP/USD daily chart shows a downward bias in the mid-term, as depicted by the daily moving averages (DMAs) above the spot price. At press time, the pair jumped off the 61.8% Fibonacci retracement, which lies at 1.3273, piercing the November 12 swing low-turned-resistance at 1.3353.

To the upside, a clear breach of the latter would expose 1.3400, followed by the 50% Fibonacci retracement at 1.3458.

Failure at 1.3353 would open the door for a retest of the 61.8% Fibonacci retracement under 1.3300 at 1.3273, followed by a challenge of the YTD low at 1.31600 that, it gives way, could send the pair tumbling to the 78.6% Fibonacci retracement at 1.3009.

- Manufacturing PMI dropped to 57.8 in December from 58.3 in November.

- "Barring the initial price slide seen at the start of the pandemic, December saw the steepest fall in factory input price inflation for nearly a decade."

According to IHS Markit's flash PMI survey, the US Manufacturing PMI Index dropped to 57.8 in December from 58.3 in November. That was below expectations for a small rise to 58.5. The Services PMI Index fell to 57.5 in December from 58.0 last month, below expectations for a rise to 58.5. As a result, the Composite PMI Index also fell on the month to 56.9 from 57.2 in November.

Additional Takeaways from the survey

“The survey data paint a picture of an economy showing encouraging resilience to rising virus infection rates and worries over the Omicron variant. Business growth slipped only slightly during the month and held up especially well in the vulnerable service sector. Manufacturing output growth even picked up slightly amid a marked easing in the number of supply chain delays, which also helped to take pressure off raw material prices. Barring the initial price slide seen at the start of the pandemic, December saw the steepest fall in factory input price inflation for nearly a decade."

Market Reaction

Despite signs of easing supply chain problems and easings associated costs, FX markets did not react to the latest report.

The Bank of England's MPC hiked Bank Rate to 0.25% with an 8-1 vote. As a result, GBP/USD is entertaining a nice intraday rally. But as TD Securities’ dashboard shows the USD looks overbought in the short-term, analysts at the bank like fading rallies ahead of 1.35.

MPC to hike Bank Rate three times next year

“The BoE defied expectations, delivering the 15bp rate hike. The 8-1 vote was probably a bit of a surprise to boot - it seems markets expected a hold with 7-2.”

“We expect the MPC to hike rates three times in 2022, in Feb, May, and Aug (previously just two 25bps hikes by end-2022 after the initial 15bps lift-off).”

“USD positioning and valuation models screen overbought, underscoring scope for a relief rally. Given GBP's correlation to risk, that would be supportive in the very short-term. That said, our dashboard shows GBP is trading where it should, so there isn't a big discount to price out.”

“Sterling needs to see growing confidence in another rate hike early next year alongside some steadying of the COVID-19 news. HFFV sits at 1.33 so expect some resistance ahead of 1.35.”

The S&P 500 Index surged higher on Wednesday following the FOMC. A break above 4714 is needed to end thoughts of further short-term consolidation to open up a move to 4744/50 next, analysts at Credit Suisse report.

A break above 4750 would open up 4838

“The S&P 500 is now testing near-term resistance at the highs from late last week/Monday at 4713/14. Above would end thoughts of a consolidation period for a retest of 4744/50, reinforced by the quick turn back higher in daily MACD momentum, which now seems to be in more sustainably bullish territory.”

“Whilst the key 4744/50 resistance area should clearly be respected again, we look for an eventual sustained break higher in due course to clear the way for a move to 4780/82, ahead of the psychological 4800 barrier.”

“Support stays at 4607, then the price gap from last week, which stretches down to 4592/88. This should continue to provide a good floor, however a break would suggest a slightly deeper turn lower towards 4556/54, which is the 63-day average and 2020/21 uptrend. We would have a high level of confidence in finding a floor here if reached.”

In her usual post-meeting press conference, ECB President Christine Lagarde said that under the current economic circumstances, a rate hike in 2022 is very unlikely.

Additional Takeaways:

"Omicron might have a dampening impact."

"A few members did not agree."

"Really making progress towards the inflation target."

"2023, 2024 projections not at target."

"There is possible upside risk in inflation."

"Not seeing second-round effects in wages."

"Energy prices probably going to stabilise."

"PEPP resumption would need a council vote."

Bank of England Governor Andrew Bailey said on Thursday that the labour market is very tight right now and there are signs of more persistent price pressures, which is concerning to the BoE, according to Reuters. Bailey added that wholesale gas prices are likely to push up inflation further as new price caps are set.

Omicron is a very important economic development, Bailey added, and it certainly can have quite an effect on activity in the economy. However, its not clear what the impact of Omicron will be on inflation, he cautioned. Thus, we have to take the action needed to address inflation pressures, he added.

Market Reaction

Bailey's comments come after the BoE surprised markets earlier in the session by opting to hike interest rates by 15bps to 0.25% versus the consensus expectation for a rate hold. That surprise lifted GBP/USD significantly from around 1.3280 to the mid-1.3300s. GBP/USD continues to trade within a 1.3340-1.3370ish range and hasn't reacted to Bailey's latest remarks.

The new ECB staff economic projections for December were recently released in wake of the ECB's latest monetary policy decision. The bank now forecasts HICP inflation of 2.6% in 2021 (versus prior forecast of 2.2%), of 3.2% in 2022 (versus prior forecast of 1.7%), of 1.8% in 2023 (versus prior forecast of 1.5%), while the inflation forecast for 2024 was left unchanged at 1.8%.

Meanwhile, the ECB forecasts that GDP will grow 5.1% in 2021 (versus prior forecast of 5.0%), at a pace of 4.2% in 2022 (versus prior forecast of 4.6%), at a pace of 2.9% in 2023 (versus prior forecast of 2.1%) and then at a pace of 1.6% in 2024, which was unchanged from the prior estimate.

In her usual post-meeting press conference, ECB President Christine Lagarde said that inflation will be above 2% for most of 2022.

Additional Takeaways:

"Slower growth likely to extend into the early part of next year."

"Economy to exceed pre-pandemic level 1Q 22."

"Containment measures could delay recovery."

"Rising energy costs a headwind."

"Bottleneck will be with us for some time, should ease in 2022."

"Expects growth to rebound strongly in 2022."

"Uncertainty about how long for issues to be resolved."

"In course of 2022, expect energy prices to stabilize."

"Risks to outlook are balanced."

In her usual post-meeting press conference, ECB President Christine Lagarde said that Euro area growth had moderated, but was expected to pick up strongly in 2022.

Additional Takeaways:

"The labour market is improving."

"Shortages are restraining activity, and are a headwind in the near term."

"The public health crisis is ongoing."

"High inflation is largely due to energy."

"Inflation is to decline next year."

"Inflation will remain elevated in the near term."

"Continue to see inflation in medium-term below target."

"Inflation projected to settle below target."

"Progress towards target permits step by step reduction in QE."

"Accommodation is still needed."

"Need flexibility, optionality."

There were 206,000 initial claims for unemployment benefits in the US during the week ending December 11, data published by the US Department of Labor (DoL) revealed on Thursday. This reading followed last week's print of 188K (revised up from 184K), which was the lowest reading since 1969, and came in a tad above market expectations for 200K. Continued jobless claims fell to 1.845M in the week ending December 4, the data showed, below expectations for a drop to 1.936M from 1.999M the week prior.

- AUD/USD gained strong positive traction for the second straight day and shot to a three-week high.

- Upbeat Australian employment data, the USD selling bias and the risk-on mood remained supportive.

- Mostly upbeat US economic data failed to impress the USD bulls or stalled the intraday positive move.

The AUD/USD pair maintained its strong bid tone through the early European session and was last seen trading around the 0.7215-20 region, or a near three-week high.

A combination of supporting factors assisted the AUD/USD pair to capitalize on the overnight bounce from the 0.7090 support and scale higher for the second successive day on Thursday. Upbeat employment figures from Australia, along with the prevalent risk-on mood acted as a tailwind for the perceived riskier aussie.

On the other hand, the US dollar extended the post-FOMC retracement slide from the vicinity of a 16-month high and remained depressed through the major part of the European session. This, in turn, provided an additional boost to the AUD/USD pair and allowed bulls to clear the 0.7180-85 strong resistance zone.

Meanwhile, data released from the US showed that the Initial Weekly Jobless Claims rose to 206K last week as against 195K anticipated and 188K previous. Separately, the Philly Fed Manufacturing Index fell more than expected and overshadowed upbeat housing market data – Building Permits and Housing Starts – and failed to lend any support to the USD.

Meanwhile, the ongoing positive move could further be attributed to some technical buying, though the upside potential still seems limited amid fresh COVID-19 jitters. A sharp rise in daily coronavirus cases in Australia's largest state by population – New South Wales – might hold back bulls from placing aggressive bets.

Apart from this, the RBA Governor Philip Lowe's efforts to push back against expectations for a rate hike in 2022 could keep a lid on any meaningful gains for the AUD/USD pair. This warrants some caution before positioning for an extension of the recent recovery move from sub-0.7000 levels, or a one-year low touched earlier this month.

Technical levels to watch

According to a report from the Federal Reserve Bank of Philadelphia released on Thursday, the headline Manufacturing Activity Index of the Manufacturing Business Outlook Survey fell to 15.4 in December from 39.0 in November. That was a much bigger drop than the expected decline to 30.0.

- Housing Starts jumped 11.8% in November, taking the 12-month rolling number to 1.679M, above expected.

- FX markets did not react, as with central banks currently in focus.

Housing Starts in the US rose by 11.8% on a monthly basis in November after falling at a 3.1% rate in October, data published jointly by the US Census Bureau and the US Department of Housing and Urban Development showed on Thursday. That lifted the 12-month rolling number of Housing Starts to 1.679M in November, up from 1.502M in October and above expectations for a 1.568M reading.

Further details of the publication revealed that Building Permits, which rose by 4.2% in October, rose by 3.6% in November. That lifted the 12-month rolling number of Building Permits to 1.712M, up from 1.653M in October and above expectations for a rise to 1.663M.

Market Reaction

US data went under the radar on Thursday with central banks stealing the limelight.

- USD/JPY is consolidating just above 114.00 ahead of Friday’s BoJ policy decision, which is not expected to yield any surprises.

- Market focus is current elsewhere in G10 FX markets on Thursday, given the bonanza of European banks announcing policy.