- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-12-2021

- GBP/USD fails to extend corrective pullback from weekly low, pressured around 2021 bottom.

- UK NHS denies pharmacists’ requests for rapid test kits, citing supply issues, cabinet warned for jump in virus cases, hospitalizations.

- IMF pushes BOE for rate hike, cites more Brexit problems ahead, UK jobs report for November came in firmer.

- UK CPI, PPI may offer more clarify for BOE but Fed is the key.

GBP/USD struggles to keep the bounce off the weekly bottom, easing to 1.3220 during Wednesday’s Asian session.

While upbeat UK data and comments from the International Monetary Fund (IMF) favored the cable pair’s bulls, fresh fears concerning the coronavirus and Brexit recall the bears on a key day.

With a reduction in the UK’s Claimant Count Change and Unemployment Rate, not to forget firmer Average Earnings, odds of the Bank of England’s (BOE) hawkish performance on Thursday can’t be ruled out. The IMF urged, per Reuters, the Bank of England on Tuesday to avoid an "inaction bias" when it comes to raising interest rates as it forecast British inflation would hit a 30-year high of around 5.5% next year.

It should be noted, however, that IMF Chief Kristalina Georgieva cited Brexit fears as a challenge to the UK’s economy. “Brexit dealt significant damage to trade with the European Union and there would be further difficulties when Britain implements customs checks on EU imports on Jan. 1, Georgieva said,” per Reuters. Alternatively, the UK Express quotes Irish Foreign Minister Simon Coveney saying, “The EU is anxious to move ahead unilaterally if the UK does not agree on medicine supply to Northern Ireland this month.”

Elsewhere, the UK’s National Health Service (NHS) told, per the UK Telegraph, to the Pharmacies that they cannot have any more extra rapid Covid tests - even though entire cities have run out. The UK policymakers are also warned over a flood of virus-led hospitalization as the cases jump. Reuters said, “Infections from the Omicron variant of the coronavirus have risen in the United Kingdom with the number of new cases reaching 59,610 on Tuesday, the highest figure since early January.”

The UK isn’t the only one suffering from the virus variant as Omicron spreads across the board and challenges the policy hawks as the Fed braces for a crucial day, with faster tapering and rate hike clues eyed.

For now, the UK Consumer Price Index (CPI) for November, expected 4.7% YoY versus 4.2% prior, will be the key for the GBP/USD traders.

Read: Fed Interest Rate Decision Preview: Can the FOMC satisfy and mollify the markets?

Technical analysis

GBP/USD remains on the way to refresh yearly low of 1.3160 even if the weekly support line tests short-term sellers around 1.3200. Meanwhile, the 10-DMA level near 1.3245 guards immediate upside.

- WTI, US crude oil benchmark falls some 1.41%, as COVID-19 infections rise.

- In Europe, Italy, and Scotland, among other countries, impose restrictions as COVID-19 infections climb.

- WTI Technical Outlook: In the near-term has a downward bias, though the upside risks remain.

US crude oil benchmark, also known as Western Texas Intermediate (WTI), is falling during the day as the Asian Pacific session begins, trading at $70.00 at the time of writing. Market conditions had not improved since the early European session when it crossed the wires that two doses of the Pfizer-BioNTech vaccine provided a 70% protection against the newly Omicron variant. The sentiment got follow-through in the New York session, as investors appeared to be sidelined despite the aforementioned, waiting for the Federal Reserve’s last monetary policy meeting decision.

Additionally, some countries started to impose restrictions amid the outbreak of the Omicron variant. Italy will require travelers from other EU countries to provide a negative COVID-19 prove, and Scottland urges no more than three households to mix.

On Tuesday in the overnight session, the black gold peaked at around $71.75, then plunged two dollars, as market mood remained sour, as market participants weighed on central banks, hosting their last monetary policy meetings of the year. Then, it jumped up to $70.75, some $0.50 above the 200-hour simple moving average (SMA), which was reclaimed by oil bears, pushing the price near the $70.00 psychological level.

On the crude-oil-related macroeconomic front, on Tuesday, the American Petroleum Institute reported that US supplies fell 815K barrels last week, according to sources cited by Bloomberg. Data showed that stockpiles increased, though the US government will release its inventory on Wednesday.

Moreover, the Organization of Petroleum Exporting Countries and its allies (OPEC+) increased its outlook for oil consumption in the Q1 of 2022, up to 1.1 million barrels a day, equivalent to an annual world consumption growth in a “typical” year before the pandemic, according to Bloomberg.

On its 2022 outlook, OPEC mentioned that the Omicron variant is expected to have a mild impact as the world gets used to dealing with the COVID-19 pandemic.

WTI Price Forecast: Technical outlook

WTI’s daily chart shows that oil had been in consolidation since Tuesday last week. WTI has a downward bias in the near-term, as WTI bears reclaimed the 200-DMA, which lies at $70.18, piercing under the latter, threatening of breaking below the $70.00 figure.

Failure of WTI bulls to reclaim the 200-DMA would expose the December 14 low at $69.33. A break below that level would expose the figure at $69.00, followed by a retest of September 1 low at $67.01

To the upside, the first resistance would be the 200-DMA. The breach of the latter would expose the December 14 high at $71.79, followed by the psychological $72.00 figure. With a clear break to the upside, the next supply zone would be $73.00.

-637751222313188782.png)

- EUR/USD stays depressed inside bearish chart after two-day downtrend.

- MACD conditions, lower highs favor sellers to aim for fresh 2021 low.

- 200-SMA adds strength to the upside barrier, double tops guard immediate recovery.

- Fed Preview: Dollar hinges on 2022 rate hike dots, guide to trading the grand finale of 2021

EUR/USD holds lower ground after two-day declines, challenging the support line of a short-term ascending triangle near 1.1250 during the early Asian session on Wednesday.

The bearish MACD signals and the major currency pair’s double top formation around 1.1330, not to forget the lower highs portrayed since November 30, also back the EUR/USD bears to conquer the 1.1250 immediate support.

Following that, the 1.1200 threshold and the yearly low of 1.1186 may become imminent for the pair sellers before targeting the 61.8% Fibonacci Expansion (FE) level of October 28 to November moves, near 1.1120.

Meanwhile, an upside clearance of the 1.1330 immediate hurdle will direct EUR/USD prices towards the 1.1375-87 region comprising 200-SMA, also the upper-end of the stated triangle.

Should the EUR/USD prices remain firm past 1.1375, odds of witnessing numbers past 1.1500 can’t be ruled out.

EUR/USD: Four-hour chart

Trend: Further weakness expected

- The New Zealand dollar, as well as risk-sensitive currencies, keeps accumulating losses against safe-haven peers.

- On Tuesday, the trading range was between 76.43-88.

- NZD/JPY Technical Outlook: It has a downward bias, but upside risks remain.

On Tuesday, the NZD/JPY pair remained subdued, trading at 76.56 during the day at press time. The market mood stills dampened, attributed to central banks hosting monetary policy meetings, though investors mainly focus on the Federal’s Reserve decision.

The cross-currency fluctuated around the 76.43-88 range during the overnight session, between the S1 and the R1 Tuesday’s daily pivot points, with no clear bias. Nevertheless, the hourly-simple moving averages (SMAs) reside above the spot price, confirming the short-term bearish bias.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY has a neutral-bearish bias. The daily moving averages (DMAs) are located above the spot price with a flattish slope and would be challenging resistance levels to overcome once the price hovers around that area. Additionally, as mentioned in Monday’s piece, the NZD/JPY failed to break above a seven-month-old downslope trendline, which opened the door for further losses.

On the downside, the first support would be the December 3 swing low at 75.95. A breach of the latter would add downward pressure on the NZD/JPY, pushing the price towards July 20 low at 75.25, followed by the August 19 low at 74.55

On the flip side, the first resistance would be the December 9 low previous support-turned-resistance at 76.88, followed by the figure at 77.00. A clear break of the latter would expose 77.30-60 area.

-637751197357490281.png)

Amid widespread coronavirus breakout and after reporting the first Omicron-linked death, the UK’s National Health Service (NHS) told, per the UK Telegraph, to the Pharmacies that they cannot have any more extra rapid Covid tests - even though entire cities have run out.

“Millions of kits are in warehouses across the country, but officials say it is ‘not possible logistically’ to increase supplies,” adds Telegraph.

On the same line is the tweet from Sam Coates Sky saying, “Boris Johnson trapped between his party and scientists as he faces unhappy Christmas. More restrictions had been on the agenda for next week.”

FX reaction

GBP/USD holds on to the corrective pullback from the yearly low, defending 1.3200 level of late, irrespective of the news. The reason could be linked to the market’s increased expectations of the Bank of England’s (BOE) hawkish performance following an upbeat jobs report.

Read: GBP/USD bears back in play, pressure in the 1.3220's

- AUD/USD stays depressed around weekly bottom, further downside hinges on monthly support break.

- Mixed updates of Omicron and stimulus hopes battle fears of Fed rate hike, China news.

- Wall Street closed lower but yields, DXY benefit from risk-off mood.

- Aussie Westpac Consumer Sentiment, China economics may entertain traders but it’s all about Fed today.

AUD/USD extends the two-day downtrend to 0.7100, again challenging fortnight-long support during early Wednesday morning in Asia.

Market’s risk-off mood joins the latest covid outbreak in Australia and challenging details from China and the US to weigh on the Aussie pair of late. Above all, anxiety ahead of today’s Federal Open Market Committee (FOMC) and key data from top customer China weigh on the risk barometer pair.

Sentiment sours as markets brace for the US Federal Reserve’s (Fed) verdict with hopes of faster tapering and a higher dot-plot suggesting sooner rate hikes. Adding to pessimism, which in turn weighs on the AUD/USD prices, was the strong reading of the US Producer Price Index (PPI) for November that refreshed the record top to 9.6% YoY, versus the previous 8.6%.

Other than the Fed-linked fears, mixed updates concerning the virus outbreak also roil the risk appetite and favor the AUD/USD sellers. Australia’s most populous state New South Wales (NSW) registered a 50% jump in daily covid cases for Monday, also marking the Omicron case with a flyer at Brisbane airport. The UK reported the first Omicron-linked death while China also conveyed the presence of the COVID-19 variant at home. Alternatively, vaccine news was positive and so did the market talks signaling that the current coronavirus strain, Omicron, is less harmful and can be overcome.

Elsewhere, the US Senate approved a bill to raise the debt ceiling by $2.5 trillion whereas President Joe Biden also sounds hopeful of getting his Build Back Better (BBB) plan through the House in 2021.

Furthermore, China’s Shimao Group fired another bolt to worry for the Beijing-based markets, adding more pains for the Chinese real-estate and economy. On the same line were recently worsening geopolitical ties among the US-China and the Washington-Tehran.

Amid these plays, Wall Street closed in red and the US Treasury yields helped the US Dollar Index (DXY) to print gains ahead of the key day.

Before the Fed’s verdict, Australia’s Westpac Consumer Confidence for December and China’s data dump, including mainly the Retail Sales and Industrial Production, will entertain the AUD/USD traders. Given the mixed expectations from the scheduled data and likely pre-Fed caution, the quote may remain lackluster, pressured though, heading into today’s FOMC.

Read: Fed Interest Rate Decision Preview: Can the FOMC satisfy and mollify the markets?

Technical analysis

AUD/USD defends 0.7090 support, comprising a 15-day-old horizontal line, amid bearish MACD signals and downbeat RSI. Given the quote’s multiple failures to rise past September’s low surrounding 0.7175, sellers are likely firming grips. That said, the 100-SMA level of 0.7135 acts as an immediate upside hurdle.

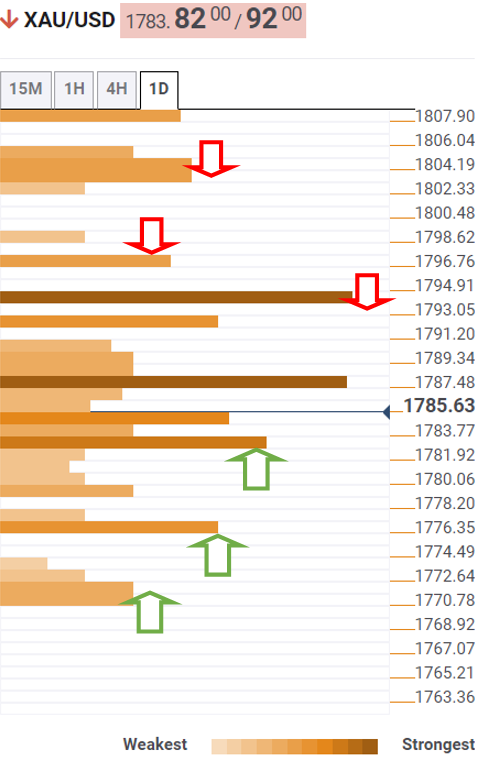

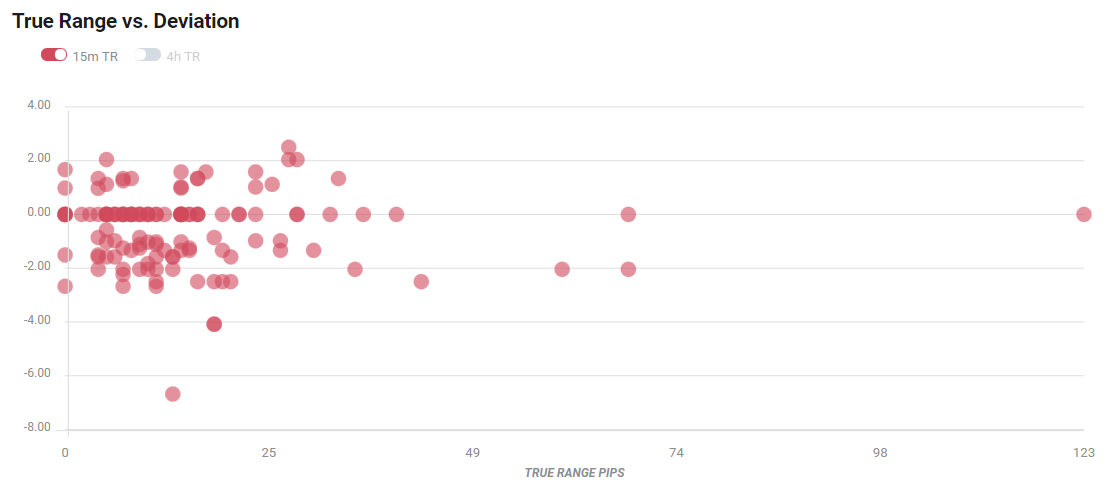

- Gold is on the verge of a downside breakout while below $1,790.

- The Fed is the main event for the day and a hawkish outcome could weigh on gold.

- The price is below bearish leaning daily 10 and 20 EMAs.

The price of gold, XAU/USD, is down some 0.90% on the day trading near $1,770 and falling from a high of $1,789.54 to a low of $1,766.58. The greenback has done well in a slightly risk-off market environment which has favoured the greenback over its other safe haven peers, such as gold.

All eyes on the Fed

The US dollar, as measured by the DXY index and vs a basket of major currencies, rallied from a low of 96.10 to a high of 96.59 so far. The Federal Reserve is eagerly awaited today which weighed on equities that traded on the defensive, aiding the greenback to move higher. The S&P 500 dropped 0.8% to 4,634.09 and the Nasdaq Composite fell 1.1% to 15,237.64, while the Dow Jones Industrial Average slipped 0.3% to 35,544.18. The 10-year US Treasury yield rose 2 basis points to 1.44%.

The Federal Reserve began a two-day policy meeting at which it could decide to pare its asset purchases faster than previously planned. The Fed is expected to show a higher dot plot and to double the pace of tapering from USD15bn to USD30bn. ''Fed fund futures are currently pricing 68bps of tightening for next year with fed funds at 1.40% by the end of 2023,'' analysts at ANZ Bank explained.

''Anything in excess of that, or a higher terminal rate (currently 2.5%), will be seen as hawkish. It will also be important to watch the inflation and unemployment forecasts,'' the analysts added. ''In September the FOMC forecast inflation at 2.2% in Q4 2022 and 2023 with the unemployment rate at 3.8% and 3.5% respectively. If inflation forecasts are raised it would show greater uncertainty about the FOMC’s confidence in meeting its inflation target.''

Gold technical analysis

Technically, from a daily perspective, the price is below bearish leaning 10 and 20 EMAs and it could be on the verge of breaking the daily support. However, failures to do so could lead to an upside breakout as follows:

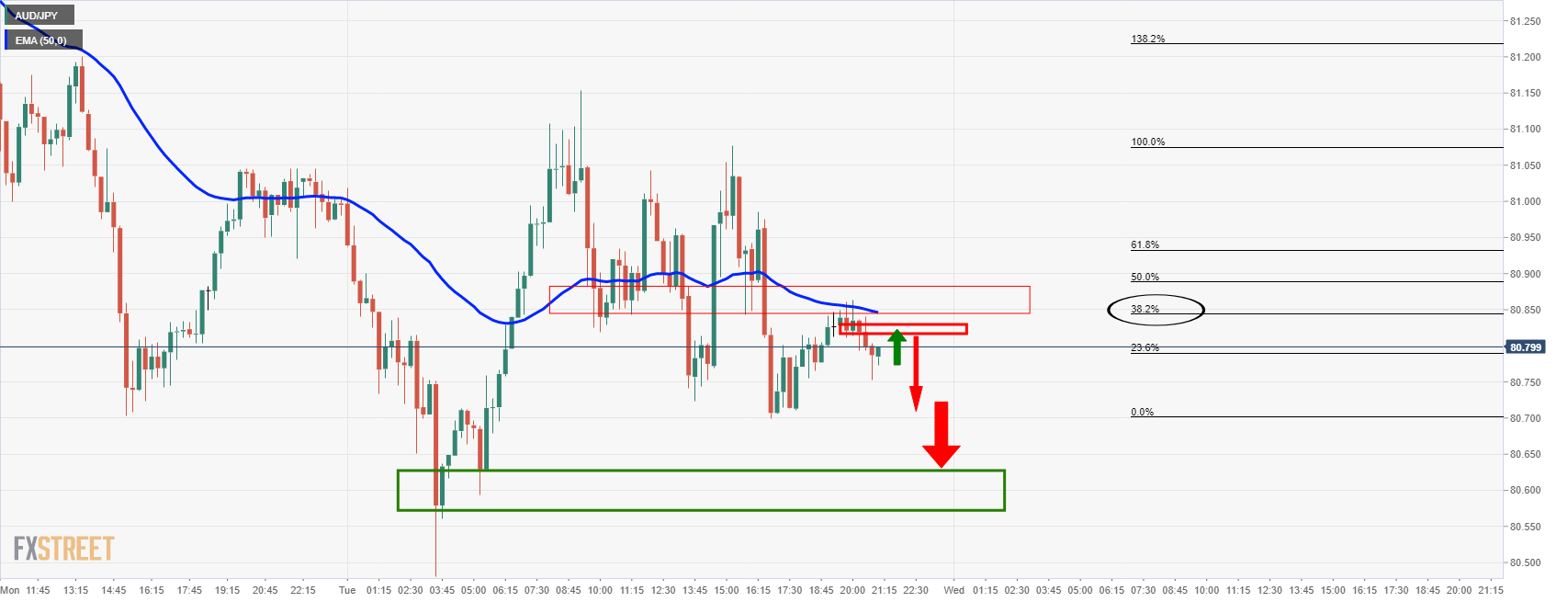

- AUD/JPY bears look to support near to 80.50 for the day ahead.

- Bulls need to get back above 80.90 to hold off the pressures.

The price of AUD/JPY has been forming a bearish engulfing candle in the last hour which would be expected to be followed by bearish price action and a low in the next candles.

AUD/JPY H1 chart

This opens the risk of a downside extension to the test the prior support near to 80.50.

The 15-min chart sees the price headed for a restest of the prior support that would be expected to act as resistance lead to a move to the downside again, as per the outlook for the hourly chart.

- USD/CAD rallied above prior monthly highs in the 1.2850s to hit its highest level since mid-September.

- Market commentators and analysts cited worries about the Omicron variant as weighing on the loonie.

- The pair is now focused on Wednesday’s Canada CPI, US Retail Sales and the Fed policy announcement.

USD/CAD surpassed its earlier monthly highs in the 1.2850s to hit its lowest levels since mid-September on Tuesday. That marked a roughly 0.4% rally from earlier session lows around the 1.2800 level and opens the door to an extended push toward’s the next key area of resistance around 1.2900 (the mid-September high) and then the 1.2950 mark just above it (the mid-August high).

Market commentators and analysts cited worries about the Omicron variant as weighing on the loonie in fitting with a broader downturn in risk appetite on the session. Michael Goshko, corporate risk manager at Western Union Business Solutions, told Reuters that “the increased concerns from public health officials are weighing on sentiment, not only here in Canada but abroad… There's so much uncertainty... It's not surprising to see commodity currencies like the Canadian dollar get harmed in an environment like this.”

But hotter than expected US Producer Price Inflation (PPI) figures released earlier in the session have also contributed to USD/CAD’s upside. Indeed, the dollar broadly strengthened against most of its G10 counterparts on Tuesday (apart from GBP which is likely deriving support from good UK labour market figures) after the annual rate of US PPI hit 9.6% in November, well above expectations.

Coming up at 2100GMT, Canadian PM Justin Trudeau is set to announce the government’s latest economic and fiscal forecasts in the so-called “fall economic statement”. Sources last week told Reuters that any new spending announcements would be “limited in scope”, which makes sense given already high inflation in Canada and pressure from the Canadian business community to exercise greater restraint with further government spending.

Speaking of inflation, the Canada November Consumer Price Inflation report will be released at 1330GMT on Wednesday alongside the US November Retail Sales report, which coud make for choppy conditions for the USD/CAD. BoC Governor Macklem is then scheduled to speak at 1700GMT ahead of the most important event of the week for USD/CAD, Fed policy announcement at 1900GMT and press conference with Jerome Powell at 1930GMT thereafter.

- The USD/JPY climbs during the New York session, up some 0.15%.

- A risk-off market mood as the Federal Reserve monetary policy meeting looms.

- USD/JPY Technical Outlook: The pair has an upward bias, though range-bound around the 113.21-113.95 range.

The USD/JPY barely advances during the New York session, trading at 113.75 at press time. The financial markets sentiment is downbeat as investors seem to be waiting on the Federal Reserve monetary policy decision, to be unveiled on Wednesday.

Before Wall Street opened, the US Bureau of Labor Statistics (BLS) reported the Producer Price Index for November. The numbers came at 9.6% on an annual basis, higher than the 9.2% expected. The Core PPI rose by 7.7%, up from the 7.2% foreseen by analysts.

That data would mount additional pressure on the Federal Reserve to tighten economic conditions faster than expected. Money market futures have fully priced in at least three rate hikes by the end of 2022.

USD/JPY Price Forecast: Technical outlook

The USD/JPY has remained range-bound within the 113.21-113.95 area in the last six days. Further, the pair has been seesawing in each side of the 50-day moving average (DMA), showing that market participants do not have a clear bias as the year-end approaches. Nevertheless, the Japanese yen looks vulnerable, as the greenback, supported by the recent hawkish rhetoric led by Chair Jerome Powell, diverges from the Bank of Japan’s current monetary policy.

That said, the USD/JPY has an upward bias, though it would need to break above 113.95 to cement an upward move towards 2021 year-to-date highs, around 115.52.

In the event of breaking to the upside, the first resistance would be 114.00, followed by the October 20 cycle high at 114.70. A breach of the latter would expose 115.00.

On the other hand, any downward moves would be capped at the 113.00 figure. A break below that level would expose the November 30 pivot low at 112.53, then the 100-DMA at 111.87.

-637751106987829920.png)

- EUR/GBP is being pressured into a key level of demand on the daily chart.

- Bulls looking for a restest of M-formation neckline in due course.

EUR/GBP has been offered this week so far ahead of critical central bank meetings. Technically, the price is forming a compelling chart pattern on the daily time frame as follows:

EUR/GBP daily chart

The price is creating an M-formation on the daily chart and bulls will be looking to target the 0.8530s which is the neckline of the formation. However, there could be some more downside to come yet to test 0.85 the figure first.

There is plenty of data coming out of the UK and Super Thursday will be an important event for the cross with both the Bank of England and the European Central banks meeting.

''It is our view that the market will unwind some of the BoE rate hikes expected for next year and we have revised higher our 6-month EUR/GBP forecast to 0.86 from 0.84,'' analysts at Rabobank argued.

- EUR/JPY has reversed lower again from a test of the 128.50 level and is back to the 128.00 area.

- The pair is tentative ahead of ECB and BoJ rate decisions as well Eurozone flash PMIs and Japan Industrial Production.

EUR/JPY has reversed lower again from a test of the 128.50 level earlier in the session and is back to trading close to the 1.2800 level. The pair ran into resistance in the form of its 21-day moving average which sits just above 128.60 and this unsurprisingly acted as a ceiling to the price action, given that traders have expected FX markets to trade with a lack of conviction ahead of key events later in the week. These include the looming ECB and BoJ rate decision on Thursday and Friday, as well as the release of Eurozone, flash PMIs for December and Japan Industrial Production data for October.

Ahead of these risk events, EUR/JPY is likely to continue to struggle to find meaningful direction. The 128.50 area is likely to continue to cap the price action and recent lows around 1.12750 to the downside are likely to act as a floor. In the scenario that 128.50 and the 21DMA just above it are broken, last week’s high at 129.00 is the next area to look at for resistance. Meanwhile, any break below 127.50 would be significant as it would mean EUR/JPY was back to its lowest levels since February. Given a lack of immediate support, a swift move towards the 125.00 area could be on the cards.

What you need to know on Wednesday, December 15:

The greenback is up against most of its major rivals, rising during US trading hours on the back of higher yields and weaker stocks. The US published November PPI, which jumped to a record of 9.6% YoY, much higher than the previous 8.6%, while the core reading jumped from 6.8% to 7.7%. The news spurred risk aversion ahead of the US Federal Reserve monetary policy decision on Wednesday.

Some positive news from the pandemic front helped high-yielding currencies to advance during the European session. Pfizer-BioNTench reported that two shots of its vaccine provide 70% protection against Omicron hospitalization and 33% protection against infection. So far, only the UK reported one death related to the newly discovered variant. Pfizer also reported that its experimental COVID-19 pill, Paxlovid, appears to be effective against Omicron and the previous variants.

The EUR/USD pair is down to a fresh weekly low of 1.1256, trading nearby heading into the Asian opening. The GBP/USD pair posted modest gains, helped by upbeat UK employment figures. The UK Office for National Statistics reported that the number of people claiming unemployment-related benefits declined by 49.8K in November. Adding to this, the ILO Unemployment Rate edged lower to 4.2% during the three months to October.

Commodity-linked currencies extended their weekly declines, with AUD/USD struggling around 0.7100 and USD/CAD up to 1.2850. The dollar posted modest gains against safe-haven CHF and JPY.

The US Federal Reserve will announce its decision on monetary policy. The central bank will also offer fresh updates on inflation and growth forecasts and a dot-plot which may hint at a sooner rate hike. Additionally, Chief Powell is anticipated to announce a faster pace of tapering, although it’s unclear on whether to which extent in the middle of the Omicron outbreak.

Gold fell, now trading around $1,772 a troy ounce, while crude oil prices also shed ground, with WTI trading at around $70.40 a barrel.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Cryptos rebound after finding support

Like this article? Help us with some feedback by answering this survey:

- USD/CHF bears face a tough time ahead in light of covid-19.

- Super Thursday will be an important day for CHF.

USD/CHF is trading higher by some 0.16% at the time of writing and between a low of 0.9188 and a high of 0.9244. The price action is in favour of the bulls as we head towards the Federal Reserve on Wednesday.

US dollar the favourite safe haven

Meanwhile, there is a bullish bias in the greenback. ''Growth, inflation and the global backdrop are all still helping the dollar,'' Kit Juckes at Societe Generale explained in a note. Touching on the Omicron risks as well, he notes that the US dollar is a favourable safe-haven instrument in this regard as well. ''The first signs from China that further yuan strength will be resisted also helps the dollar as does concern about the Omicron variant.''

Omicron is becoming the dominant coronavirus variant in European nations, which could leave a spanner in the works for the swiss franc that is otherwise favoured for its safe-haven qualities. Switzerland has imposed further restrictions on public and private gatherings and has advised people to work from home.

Health Minister Alain Berset warned the Delta variant is still not under control while the country is now facing an outbreak of Omicron. “The situation is very serious,” said Berset. “We didn't want this, but we have to work with reality. Some hospitals have already reached their capacity limits."

Overall, the popular economist in the forex space explained,'' the dollar is increasingly seen by some investors as the best hedge against a risk shock, given that the bond market no longer performs this task adequately,'' Kit Juckes at Societe general explained.

All eyes on Super Thursday and the SNB

Meanwhile, the CHF net short positions edged lower last week. In the spot market, we also have seen the CHF edge higher at times of risk-off. However, there is always the risk of the Swiss National Bank intervening and investors are quick to take profits.

“Super Thursday” will be interesting where the SNB will kick things off at 8:30AM (GMT) with a rate announcement. However, the focus will mostly be on CHF-related comments. Traders will look to see if the SNB will stay with its familiar narrative that the franc is “highly valued”.

The jawboning effect could have a negative impact on the currency a the bank attempts to defy speculation that it is prepared to let it run higher to curb stagflationary risks. The EUR/CHF will be an important gauge in this respect with the cross coming under pressure again amid Omicron-related concerns. A less dovish European Central Bank will also be a risk that traders will need to gauge as to how this will impact the CHF.

- AUD/NZD has consolidated within this week’s this week’s thin 1.0520-1.0560ish ranges on Tuesday.

- The pair is awaiting key New Zealand Q3 GDP figures and the Austrlia November jobs report, both out on Thursday.

AUD/NZD has continued to consolidate within this week’s thin 1.0520-1.0560ish ranges on Tuesday as the pair awaits the release of key data out of both Australia and New Zealand later in the week. The main resistance for traders to keep an eye on comes in at 1.0560, while the 1.0500 level is the main area to watch to the downside.

Thursday’s Asia Pacific session will see the release of New Zealand Q3 GDP growth figures, followed by the release of the Australia November jobs report. Both data releases will be watched closely by AUD/NZD traders as both might influence the timeline for RBNZ and RBA policy tightening. The RBNZ has already delivered two 25bps rate hikes to take rates to 0.75%, with more hikes expected to come in 2022 and beyond, while the RBA remains a long way off even lifting rates for the first time since the pandemic.

FX markets have had ample time to price in the large divergence in policy (which drove AUD/NZD much of the weakness in the summer months). Focus has now shifted to whether the RBNZ can live up to market expectations (some fear it can’t/won’t) and on when the RBA’s first rate hike will be coming. Last week’s RBA rate decision was a little more hawkish in tone than anticipated and had analysts speculating that the bank may want to move on rate hikes as soon as mid-2022 – this helped propel AUD/NZD back above 1.0500.

A strong labour market report on Thursday may infuse further hawkish speculation that may further underpin the Aussie. But this may be counteracted if the decline in Q3 NZ GDP isn't as bad as feared (remember, much of the country was in lockdown at the time). A smaller Q3 contraction would embolden the RBNZ to press ahead with the monetary tightening that it knows it needs to do in order to reign in above-target inflation and a hot labour market.

The main point is that AUD/NZD will be highly sensitive to the data on Thursday. Other data out this week, like Tuesday’s release of NZ Q3 Current Account numbers (2145GMT) and Australian December Westpac Consumer Sentiment survey (at 2330GMT), Thursday’s speech from RBA Governor Philip Lowe and Friday’s NZ December ANZ Business Confidence survey, will all also be of note but is unlikely to dictate the broader narrative.

- The Australian dollar continues to fall for the second day in a row, sliding 0.30%.

- The US PPI increased by almost 10%, the most in eleven years, as pressure mounts on the Fed.

- On Wednesday, US Retail Sales and the Federal Reserve monetary policy decision would guide the AUD/USD pair.

The Australian dollar grinds lower against the greenback during the New York session, trading at 0.7103 at the time of writing. On Tuesday, the market sentiment is tepid, as investors await the Federal Reserve monetary policy decision. Additionally, the odds of the US central bank reducing its bond-purchasing program faster as estimated increased when the US Bureau of Labor Statistics (BLS) reported that prices paid for producers rose the most in eleven years.

The AUD/USD tumbled below the 0.7100 figure in the overnight session, as Monday’s Wall Street market mood influenced Asian markets. However, upbeat news that two doses of the Pfizer BioNTech vaccine would provide 70% protection against the COVID-19 Omicron strain improved the market mood during the European session, pushing the pair towards 0.7135.

However, as the American session began, positive US macroeconomic data spurred demand for the greenback, which pushed the AUD/USD back towards the daily lows.

On Tuesday, the US Producer Price Index for November rose to 9.6% annually, higher than the 9.2% expected. The so-called Core PPI, excluding volatile items like food and energy, increased by 7.7%, higher than the 7.2% foreseen by analysts.

On Wednesday, the Australian economic docket will unveil the Westpac Consumer Confidence for December. In the US docket, Retail Sales for November are expected at 0.8%, while excluding Autos, the consensus estimates are at 1%. Later on, the Federal Reserve monetary policy decision, with consensus expecting a reduction of $30 billion on its bond asset purchases, beginning in January 2022.

- GBP/JPY hasn’t moved much on Tuesday and continues to consolidate in the low 150.00s area.

- The pair has formed a pennant this month, suggesting a technical break in either direction is on the cards.

- The main events to watch this week for the pair are Thursday’s BoE meeting and Friday’s BoJ meeting.

GBP/JPY hasn’t moved much on Tuesday, with the pair rising by about 0.2% on the day but remaining within recent ranges as it consolidates just to the north of the 150.00 level. It's been six sessions since the pair saw any meaningful volatility and trading conditions on Tuesday were subdued despite the release of the latest UK labour market report, which showed employers hiring a record number of staff in November. It also showed the unemployment rate in October dropping to 4.2% as expected, in a further sign that the UK labour market weathered the end of the government’s furlough scheme in September well.

Subdued trading conditions are not surprising given that FX markets are waiting for a barrage of central bank events later in the week before finding some direction again. The BoE sets rates on Thursday and the BoJ on Friday, with neither likely to alter policy stance. Whilst that is nothing new when it comes to the BoJ, it is a much more interesting story for the BoE; the bank was expected to hike rates by 15bps as recently as the end of November.

But since the emergence of Omicron, BoE policymakers have turned dovish, a shift that weighed on GBP/JPY and contributed to its drop from the 153.00-154.00 area to current levels around 150.00. Amid Omicron uncertainty, UK data has been largely ignored and will likely continue to be for the rest of the week; following Tuesday’s solid jobs report, UK November CPI is out on Wednesday and November Retail Sales is out on Thursday.

The technicals suggest a breakout, either to the upside or downside is on the cards. GBP/JPY has formed a pennant over the course of the month so far, with prices constricted between a downtrend linking the late November, 7 and 13 December highs and an uptrend linking the 3, 8, 9, 10 and 13 December lows. A downside break for whatever reason (like a dovish BoE surprise on Thursday) would likely see the 149.00 level tested, while an upside break would trigger a push towards the 152.00 level and the 21-day moving average just below it.

- GBP/USD bears await a less hawkish outcome from the BoE.

- The US dollar is a favourite in times of uncertainty, to weigh on the pound.

GBP/USD is back under pressure and has been sold off from the post Employment report data hoghs scored in London's trade. At the time of writing, the pound is 0.12% higher on the day but below the 1.3256 highs and testing lower into the 1.3220s. The low of the day was 1.3190.

Risk sentiment remains muted, ahead of this week's flurry of central bank meetings and FX markets are moderately quiet. However, it is a busy week for UK macro and markets await the major event risk of the Federal Reserve and the Bank of England.

BoE to tread carefully

We had the first of a string of events in today's labour market data that comes before tomorrows inflation report and the BoE on Thursday. The data today suggested that the end of the furlough programme went smoothly. The Unemployment Rate improved a tick to 4.2%, better than the MPC's recent forecast of 4.4%.

However, even continued improvement in the labour market is unlikely to push the MPC to hike this week given the threat of the Omicron variant. After all, the MPC signalled in November that it is comfortable with waiting for more data and the spread of the Omicron variant offers a good reason to walk a line of caution.

The consensus is for the Bank of England to hold which could hurt the pound further which has been declining since June of this year. The weakness is suggestive of mounting malaise among GBP investors with concerns over the coronavirus and headwinds to UK growth.

Additionally, the lack of reassurances around the post-Brexit UK economic outlook has been an additional weight. The market is still positioned for a fair amount of tightening next year, according to the latest CFTC data. However, if investors continue to reposition for a less hawkish BoE for 2022, the pound in the spot market will continue to feel the pressures.

Meanwhile, the focus will be on a) how many members will vote to remain on hold, and b) forward-looking language. If the door is left open for, say, a Feb rate hike, then the pound can find some stability on that given how short the market is already, at least as compared to the 2021 average, and having already priced out a rate hike this time around.

Bullish bets on the US dollar

Meanwhile, there is a bullish bias in the greenback. ''Growth, inflation and the global backdrop are all still helping the dollar,'' Kit Juckes at Societe Generale explained in a note.

He explained that the US initial jobless claims data showed the lowest number of claimants since 1969, and he and his colleagues now await the November CPI report with trepidation. He also added that ''the first signs from China that further yuan strength will be resisted also helps the dollar as does concern about the Omicron variant.''

Overall, the popular economist in the forex space explained,'' the dollar is increasingly seen by some investors as the best hedge against a risk shock, given that the bond market no longer performs this task adequately.''

- The EUR/USD slides during the New York session, down 0.08%.

- Fed and ECB monetary policy decisions would be crucial on the direction of the EUR/USD.

- Fed: A faster bond taper and signals of the possibility of hiking rates, would be bullish for the USD.

- ECB: An increase in its bond-purchasing program and further pushing back of rates, would be bearish for the EUR.

The EUR/USD slides for the second-consecutive day, trading at 1.1275 during the New York session at press time. The market sentiment has remained downbeat since Wall Street opened. The rise in prices paid by US producers and last week’s consumer inflation topping 1982 highest level puts pressure on the Federal Reserve, as the US central bank heads to its two-day monetary policy meeting.

In the last hours, the EUR/USD pares some of its early gains, which were spurred on positive reports on the Pfizer-BioNTech vaccine giving 70% protection against the Omicron variant after two doses. As of lately, the 1.1300 figure gave way for USD bulls, as US macroeconomic data increased the odds of a Fed faster QE reduction, attributed to consumer and producer elevated prices.

The US economic docket will feature Retail Sales for November and the FOMC monetary policy decision on Wednesday. On Thursday, Markit PMI’s will be revealed on the Eurozone economic docket, alongside the ECB monetary policy decision.

Central bank divergence between the European Central Bank (ECB) pushing back against higher rates and the Fed in the process of tightening monetary policy seems to favor further EUR/USD weakness. That can be witnessed with US Treasury yields rising during the day, with the 10-year benchmark note rate at 1.44%, edges up one and a half basis points, a tailwind for the greenback.

That said, the EUR/USD might be headed for a retest of the YTD low around 1.1186 in the week if the Fed decreases the number of purchases by double of what initially decided on its November monetary policy meeting. Contrarily, the EUR could strengthen, sending the pair above 1.1300.

EUR/USD Price Forecast: Technical outlook

The EUR/USD has a downward bias, depicted by the daily moving averages (DMAs) residing above the spot price. Additionally, the descending triangle formation opens the door for a fall towards 1.1040, but it would find some hurdles on the way south.

The first support would be 1.1200. A breach of the figure would expose the year-to-date low at 1.1186. A clear break of that level would expose the 1.1100 area, followed by the 1.1000 figure.

On the other hand, the first resistance is 1.1300, followed by the November 30 high at 1.1382, then the 1.1400 figure, and the 50-DMA at 1.1453.

-637751017189911555.png)

- Mexican peso drops across the board during the American session.

- After giving signs of a bottom, USD/MXN jumps above 21.00 erasing most of last week’s losses.

The USD/MXN is sharply higher on Tuesday after staging a rally during the American session. The pair climbed from 21.00/05 to 21.20, reaching the highest level in a week. It remains near the top, supported by a stronger US dollar and also by a broad decline of the Mexican peso.

The greenback gained momentum following US IPP data and particularly ahead of the FOMC decision. On Wednesday, the central bank will announce its decision. It is expected to accelerate the tapering of its purchase program.

Higher US yields and a decline in equity prices is weighing on emerging market currencies. The Mexican peso was holding well, until USD/MXN broke decisively above 21.05. The next resistance stands at 21.30, followed by 21.45. On the flip side, a slide back under 21.05 should alleviate the current bullish pressure.

On Thursday, the Bank of Mexico will have its monetary policy meeting with the most analysts looking for a 25 bp rate hike. Analysts at TD Securities expect Banxico to hike by 25bps and continue to present a hawkish stance, though they warn about some risk of a 50bps rate hike. “MXN still presents reasonably good yield, though competition in Latam is heating up, and risk surrounding the monetary policy and fiscal trajectory are increasing.”

Technical levels

- NZD/USD spent Tuesday trading sideways in the 0.6750 area after printing fresh YTD lows in the 0.6730s earlier.

- FX markets are in wait-and-see mode ahead of the Wednesday Fed meeting and Thursday’s NZ GDP release.

NZD/USD has spent the majority of Tuesday's session trading sideways in the 0.6750 area, with a hotter than expected US Producer Price Inflation report failing to provide a boost to the pair in the run-up to Wednesday’s Fed meeting. The data should seal the deal for the Fed to announce a hawkish pivot on its QE taper timeline and outlook for rate hikes, but expectations heading into the meeting were already very hawkish even prior to the release of the PPI report.

Notably, NZD/USD did print a fresh annual low during Asia Pacific trade on Tuesday, dipping under the 6 December lows at 0.67366 to hit 0.67353. It seems likely that any meaningful push lower on towards the next area of support around 0.6700 will have to wait until after the conclusion of the Fed meeting, as trading conditions enter wait-and-see mode. The pair’s failure to sustain a rally back above 0.6800 was telling that the recent bear-run that has seen it drop nearly 6.0% since the start of November isn’t yet over and a hawkish Fed plus more strong US data this week could cement this.

New Zealand GDP data in focus

But focus will also be on the NZD side of the equation this week with a few key data points due. Later during Tuesday’s session, ahead of the start of the Wednesday Asia Pacific trade, RBNZ Governor Adrian Orr is slated to speak at 1900GMT ahead of the release of New Zealand Q3 Current Account data at 2145GMT. Then, Q3 GDP growth data is due during Thursday’s Asia Pacific session, with a 4.5% QoQ contraction expected given the harsh lockdowns imposed for much of the quarter.

Given that this lockdown was temporary in nature and did not seemingly have any negative impact on the labour market or inflation, it won’t alter the RBNZ’s stance that gradual monetary tightening over the coming years is appropriate. Indeed, some strategists have noted that if the recession in Q3 wasn’t as bad as feared, this could have hawkish implications for RBNZ rate-setting decisions in the coming months. Whether that would be enough to turn the bearish tide weighing on NZD/USD is another thing.

- The S&P 500 falls 1.11%, sits currently at 4,615.85.

- The Nasdaq and the Dow Jones Industrial lose between 0.44% and 1.74%, down at 15,802.13 and 36,494.29, respectively.

- S&P 500 Technical Outlook: Remains bullish, but a negative divergence between price action and the RSI could send the S&P lower.

The S&P 500 falls during the New York session, is at 4,615.85, down 1.02%, after the US Producer Price Index for November rose the most since 2010, following the last week’s CPI footsteps, as pressures mount on the Federal Reserve to tighten monetary conditions, faster than expected.

US Producer Price Index rises the most in eleven years

The market sentiment is downbeat, as the cycle of easy money is about to end. Today, the Department of Labor revealed that producer prices jumped by 9.6%, more than the 9.2% foreseen. Also, the so-called Core Producer Price Index rose by 7.7%, higher than the 7.2% estimated by analysts.

The markets reacted negatively. Following the S&P 500 footsteps, the Nasdaq falls 1.74%, down at 15,802.13. The Dow Jones Industrial could not be left behind, losing 0.44%, currently at 36,494.29.

In the meantime, the so-called “fear index,” the CBOE Volatility Index (VIX), rises almost 12%, currently at 22.70, as investors scramble to get out of stocks, moving towards cash or other assets, as the Fed last monetary policy meeting looms.

Sector-wise, the gainers are led by financials, energy, and materials, each rising 0.61%, 0.29%, and 0.02%. The biggest losers are technology, communication, and real-estate, down 2.18%, 1.39%, and 1.37%, respectively.

On Wednesday, the US economic docket will feature the Retail Sales for November, alongside the critical Federal Reserve monetary policy decision.

S&P 500 Price Forecast: Technical outlook

The S&P 500 remains in an uptrend, as shown by the daily chart, with the 50, 100, and 200-day moving averages (DMAs) below the price action. However, it appears to be forming a double-top around 4,700, which coincides with a negative-divergence in the Relative Strength Index (RSI), which at press time is below the 50 mid-line, at 49.

In the event of breaking to the downside, the first support would be the 50-DMA at 4,591.13. A breach of the latter would expose the confluence of the December 3 low and the 100-DMA around the 4,500-4,515.84 range, followed by the intersection of October 13 low and the 200-DMA around the 4,325-4,341.31 area.

-637750962857477942.png)

- USD/JPY is contained close to its 50DMA around 113.70 ahead of Wednesday’s all-important Fed announcement.

- For the pair to enjoy a sustained rebound towards recent highs above 115.00, the US 10-year yield needs to rally.

USD/JPY is currently probing weekly highs in the 113.70 area, though the presence of the 50-day moving average at 113.70 continues to cap the price action, as has been the case for most of the last four sessions. Above the 50DMA resides the 21DMA at 113.90, a level which was well respected last week when the pair attempted a push on towards the 114.00 level.

A hotter than expected US Producer Price Inflation report gave USD/JPY some momentary support and is helping keep the pair supported to the north of the 113.50 level and above earlier session lows near 113.40, but has not been enough to stir a lasting move higher. The pari is taking its cue from the subdued tone being observed in US bonds markets, where most of the curve is flat. The 10-year yield, which USD/JPY is most sensitive to, is up about 1bps but remains below 1.45% and well below pre-Omicron levels nearer 1.70%.

The subdued tone of US bond markets and thus also of USD/JPY is unsurprising given the proximity of Wednesday’s Fed meeting. The bank is expected to pivot hawkishly by announcing a faster QE taper and indicate sooner lift-off with its updated dot plot. Ahead of the meeting, USD/JPY and bond markets may be a little jumpy on the release of the US November Retail Sales report and December NY Fed Manufacturing survey, but things are likely to remain contained.

That implies that USD/JPY will continue to trade within the 113.30-113.80ish ranges estabilished over the last few sessions. Whilst a more hawkish than expected Fed outcome might spur USD strength versus other G10 currencies, if it prompts further flattening of the US treasury curve and downside in longer-duration bond yields, JPY may hold up much better. If USD/JPY is to rally back to challenge recent highs in the 115.00s, US 10-year yields will need to push into the 1.60s% again.

- WTI is currently trading above a key area of support in the $70.00 region and its 200DMA at $70.37.

- Prices are down about 50 cents on the day, with market commentators citing concerns about the impact of Omicron.

Front-month WTI futures are currently trading above a key area of support in the $70.00 region, a psychologically important level that also coincides with WTI’s 200-day moving average (which resides at $70.37). In recent trade, WTI dipped under the $70.00 level and the 200DMA to print session lows in the $69.70s, but has since bounced back above the big figure and into the mid-$70.00s. On the day, WTI’s losses currently stand at just over 50 cents, taking losses on the week to about $1.50.

Market commentators have been citing concerns about the impact of Omicron on the global demand outlook as weighing on sentiment in the energy complex in wake of recent Covid-19 restriction tightening across Europe. There is also focus on China, health authorities in the Tainjin region picked up the country’s first Omicron case on Monday, whilst the Zhejiang province, a key manufacturing hub, is said to be fighting its first major Covid-19 cluster of the year. China, one of the world’s major oil consumers, maintains a zero-Covid-19 policy which will be put to the test by Omicron, which is slated to be multiple times more transmissible than the previously dominant delta variant.

The IEA and OPEC released their monthly oil market reports this week. The former warned on Tuesday that Omicron is set to hit the global recovery and, as a result, revised lower their expectations for oil demand growth in 2021 and 2022 by 100K barrels per day due to new travel curbs. That contrasted to the more upbeat tone of the OPEC monthly report, which revised higher its expectations for demand in Q1 2022 and said Omicron would only have a mild, brief impact. Thus, market participants expect the group to agree to press ahead with another 400K barrel per day output hike from February next when they meet at the start of January.

Looking ahead for oil markets, weekly private US inventories will be out at 2130GMT on Tuesday ahead of Wednesday’s official US inventory report at 1530GMT. Oil markets will be focused on the broader macroeconomic story this week, the major moment being the Fed’s policy announcement at 1900GMT on Wednesday. The US economy is experiencing significantly higher inflation pressures that the Fed anticipated just a few months ago (case in point was Tuesday’s much hotter than expected PPI report which briefly weighed on oil prices) and markets expect a hawkish pivot.

The bias in the USD/JPY pair is to the upside, according to analysts at MUFG Bank. They see the pair moving in the range of 110.00 and 116.00 over the next weeks.

Key Quotes:

“We see scope for USD/JPY slowly retracing the Omicron drop on the back of an FOMC meeting confirming market expectations of a more active FOMC next year. The market could feasibly contemplate pricing more than three rate hikes next year – we don’t expect the Fed to deliver that but the initial phase of pricing such action is likely to see USD/JPY grind higher again.”

“General levels of volatility will need to subside in order for conditions to be conducive for a renewed grind higher in USD/JPY. G10 FX volatility should subside once we are through this busy week of key central bank meetings. But with year-end approaching there is a risk this move higher for USD/JPY might not happen until the new year.”

“Increased China uncertainty with additional property companies now coming under selling pressure (Shimao Group Holdings Ltd.) and the rapid spread of the Omicron covid variant suggest further reservations over the quick re-establishment of USD/JPY carry positions. Overall though, we assume the Fed induced demand for dollars will help lift USD/JPY although our bullishness is somewhat lower than in previous months and the move higher may be curtailed to a degree by broader volatility and elevated levels of uncertainty globally.”

- The USD/CAD rises 0.08%, as the Federal Reserve’s last meeting looms.

- Falling crude oil prices weighed on the commodity-linked Canadian dollar amid a dull FX market session.

- USD/CAD Technical Outlook: Has an upward bias, and a break above 1.2850 would expose the YTD high around 1.2940s.

At the time of writing, the USD/CAD advances for the fifth consecutive day, trading at 1.2831 during the New York session, as the Federal Reserve begins its last monetary policy meeting of 2021. Financial markets mood is risk-off or perhaps cautious as investors await if the Fed would taper faster than foreseen, while money market futures discount three rate hikes of the US central bank by the end of 2022.

In the meantime, European equities drop, except for the FTSE 100, while US stocks indices fall between 0.03% and 0.48% across the pond at the open of Wall Street.

Falling crude oil prices, and rising US PPI weighs on the CAD

In the commodities complex, Western Texas Intermediate (WTI), which is linked to the Loonie, drops 1.11%, down at $70.50, weighs on the Canadian dollar, after the OPEC+ stuck to its 2022 outlook increase of 1.11 Million barrels amid a fourth-wave of COVID-19 infections worldwide.

In the macroeconomic docket, the US Department of Labor reported that the Producer Price Index (PPI) for November rose by almost 10% annually, more than the 9.2% estimated. The so-called Core PPI, excluding volatile items like food and energy, increase by 7.7&, higher than the 7.2% foreseen by analysts.

That reading would put the Federal Reserve under pressure, as it is the highest figure since 2010. According to the report, some businesses have passed those added costs to customers through higher prices, and this report suggests additional increases in the coming months.

That said, the USD/CAD might reverse all its losses from December of 2020, when it began its drop from 1.2956, down to the YTD low at 1.2006, as the Fed’s eyes the end of the easy money cycle, after US Consumer Prices rose the most since 1982, as reported on Friday’s of last week.

USD/CAD Price Forecast: Technical outlook

The USD/CAD daily chart depicts that the USD/CAD has recovered most of its losses, and it has an upward bias, confirmed by the daily moving averages (DMAs) residing well below the spot price. At press time, the pair approaches strong resistance around 1.2850, which in the event of being broken could send the USD/CAD rallying towards the year-to-date high at 1.2948, followed by a test of December 21, 2020, cycle high at 1.2956.

On the other hand, failure at 1.2850 would form a double-top pattern that could send the USD/CAD tumbling towards the December 8 low at 1.2605, followed by the 100-DMA at 1.2583, and then the 50-DMA at 1.2546.

- Gold under pressure after US data, ahead of FOMC meeting.

- XAU/USD break short-term barrier of $1780.

- US dollar remains mostly in recent ranges versus most of its rivals.

Gold prices are under pressure on Tuesday following US data and ahead of the Federal Reserve decision. The yellow metal broke below the $1780 support and tumbled to $1766, reaching the lowest level since December 3.

From the bottom, XAU/USD rebounded to as highs at $1777 and as of writing it is moving toward $1770, still facing a negative momentum. The decline started after the release of US PPI numbers that sent US yields higher.

The US 10-year rose from 1.44% to 1.47% and the 30-year to 1.86% from 1.82%. The move in the bond market weakened gold. At the same time, the dollar gained momentum but posted limited gains. The greenback still remains in negative ground for the day against most of its main rivals, although trading in the recent range.

Market participants await the outcome of the FOMC meeting. On Wednesday the central bank will announce its decision on monetary policy. The central bank is expected to announce a faster reduction of its bond-buying program.

From a technical perspective, XAU/USD still is under pressure. A recovery above $1780 would alleviate the pressure. The next support stands at $1760 followed by $1745. On a wider perspective, $1795 is the critical resistance; a daily close clearly above should open the doors to a recovery above $1800 and more.

Technical levels

- Spot silver prices tumbled to print fresh multi-month lows under $21.80 amid a sharp pullback from session highs above $22.20.

- Silver was hit by a hot US PPI report, which showed prices rising 9.6% YoY versus expectations for 9.2%.

Spot silver (XAG/USD) prices tumbled to print fresh multi-month lows under $21.80 on Tuesday, amid a sharp pullback from earlier session highs above $22.20 in wake of a hotter than expected US Producer Price Inflation (PPI) report. At current levels in the $21.80s, XAG/USD is down more than 2.0%. That takes the precious metal’s losses on the month to nearly 5.0%.

Spot prices have been in a pattern of posting lower highs and lower lows since mid-November, during which time spot prices have dropped back from highs near $25.50 to current levels, a near 15% drawdown. Weighing on prices has been a broadly strengthening dollar (though the DXY has been consolidating for the past two weeks) and a build-up in expectations that the Fed will fight the current surge in inflation being felt in the US economy by tightening monetary policy sooner rather than later.

That is why silver was hit by Tuesday’s PPI report, which showed headline factory gate price inflation in the US hitting 9.6% YoY, well above expectations for a 9.2% reading. The latest numbers pile further pressure onto the Fed to act and act they are expected to do at Wednesday’s policy announcement. Markets expect the bank to announce a doubling of the pace of its QE taper to $30B per month from the current $15B per month pace, which would see net QE buying end by March, and for the bank’s new dot plot to point to multiple hikes in 2022.

Aside from Wednesday’s Fed meeting, there is also the release of the November Retail Sales report and the December NY Fed survey earlier in the session that will be worth keeping an eye on. Then, on Thursday, after the ECB, BoE, SNB and Norges Bank all set policy, US weekly jobless claims figures and the December Philly Fed survey will be released.

As far as this week’s US data is concerned, expectations are for the data to reflect a strong US economy that has picked up pace into the year’s end, though is still struggling with supply-side imbalances and high inflation, a story which argues in favour of Fed tightening. Clearly, precious metals like silver and gold face futher downside risks as the week draws on.

- AUD/USD struggled to capitalize on its intraday recovery from a one-week low.

- Hawkish Fed expectations acted as a tailwind for the USD and capped gains.

- The technical setup favours bearish traders amid renewed COVID-19 jitters.

The AUD/USD pair attracted some buying near support marked by the 50% Fibonacci level of the 0.6993-0.7188 recent move up and stalled the previous day's pullback from the 0.7175-80 area. The attempted intraday recovery from a one-week low touched early this Tuesday, however, lacked bullish conviction and remained capped near the 0.7135-40 horizontal support breakpoint.

The US dollar trimmed a part of its intraday losses following the release of the hotter-than-expected US Producer Price Index, which reinforced hawkish Fed expectations. Apart from this, concerns about the potential economic fallout from the Omicron variant underpinned the safe-haven greenback. This, along with the cautious market mood, acted as a headwind for the perceived riskier aussie.

Meanwhile, technical indicators on the daily chart – though have been recovering from lower levels – are still holding in the bearish territory. Moreover, oscillators on the 1-hour chart have again started gaining negative traction and favour bearish traders. That said, it will be prudent to wait for acceptance below the 0.7100 mark before positioning for any further downfall.

The AUD/USD pair might then turn vulnerable to accelerate the slide towards intermediate support near the 0.7060 region. The downward trajectory could further get extended towards challenging the key 0.7000 psychological mark, or the YTD low set earlier this month. Some follow-through selling should pave the way for the resumption of the bearish trajectory witnessed since late October.

On the flip side, the 0.7135-40 region might continue to act as immediate resistance. Any further move up could still be seen as a selling opportunity near the 0.7175-80 zone, which if cleared decisively might negate the bearish bias. The AUD/USD pair might then surpass the 0.7200 mark and test the 0.7225 resistance before eventually aiming to reclaim the 0.7300 round number level in the near term.

AUD/USD 1-hour chart

Key levels to watch

- The YoY rate of PPI hit 9.6% in November, a fresh record high going back to 2011.

- Risk appetite took a knock, though the US dollar was little moved in response to the data.

The headline US Producer Price Index (PPI) rose at an annual pace of 9.6% in November, according to the latest report from the US Bureau of Labor Statistics on Tuesday. That marked a new series record high (PPI was first reported back in 2011) and was above the median economist forecast for 9.2%. MoM, PPI came in at 0.8% in November, also well above expectations for a 0.5% MoM gain.

In terms of the core measures of PPI, the YoY rate rose to 7.7% in November, well above expectations for 7.2% and last month's 6.8% reading. That was driven by a 0.7% MoM pace of core price growth, which exceeded expectations for a 0.4% rise and marked an acceleration from last month's 0.4% reading.

Market Reaction

Risk appetite has taken a hit in the aftermath of the latest, concerning PPI report, which shows inflationary pressures on the supply side running significantly hotter than forecast. S&P 500 futures dropped from above 4660 to current levels under 4650 and are now down about 0.7% in pre-market trade, WTI slipped under $70.50 and hit its lowest point since December 7 in the $70.20s.

The DXY has seen a two-way reaction, despite the hawkish implications the report is likely to have on Fed policymaking decisions (it will up the pressure on them to tighten policy faster). For now, the DXY continues to trade in the low-96.00s and in the red by about 0.2% on the day.

According to an article from the UK's The Sun newspaper, the UK government was warned that hospitals in the UK could be overwhelmed within four weeks and some could be forced to close and turn away patients.

- GBP/JPY regained traction on Tuesday amid a strong pickup in demand for the British pound.

- Omicron fears extended some support to the safe-haven JPY and might cap gains for the pair.

- Reduced BoE rate hike bets also warrant some caution before placing aggressive bullish bets.

The GBP/JPY cross maintained its bid tone through the mid-European session and was last seen hovering near the daily tops, around mid-150.00s.

Following the previous day's two-way price moves, the GBP/JPY cross attracted fresh buying on Tuesday and was supported by a goodish pickup in demand for the British pound. Against the backdrop of Upbeat UK employment data, a modest US dollar pullback provided a goodish lift to the sterling. Apart from this, signs of stability in the equity markets undermined the safe-haven Japanese yen and contributed to the pair's intraday move up.

Reports that two doses of Pfizer-BioNTech vaccine give 70% protection against the Omicron variant boosted investors' confidence. That said, concerns about the potential economic fallout from the spread of the new variant and the imposition of fresh restrictions in Europe and Asia kept a lid on any optimistic move in the markets. This, in turn, warrants some caution before positioning for any further appreciating move.

Apart from this, diminishing odds for an imminent interest rate hike by the Bank of England (BoE) in December, along with Brexit uncertainties should cap gains for the GBP/JPY cross. Investors might also refrain from placing aggressive bets ahead of the key central bank event risks. The BoE will announce its monetary policy decision on Thursday and the Bank of Japan meetings is scheduled on Friday. This further warrants some caution before positioning for any further appreciating move.

Even from a technical perspective, the GBP/JPY cross has been oscillating in a range over the past one week or so. This marks a consolidation phase, making it prudent to wait for a convincing break in either direction before confirming that the pair has bottomed out in the near term.

Technical levels to watch

- Spot gold prices remain capped at the $1790 area ahead of Wednesday’s Fed event.

- Precious metals will likely take their cue from the bond market reaction to the rate decision.

Spot gold (XAU/USD) prices continue to trade in a subdued manner at the start of the week, with prices remaining within this week’s pre-established $1780-$1790ish ranges. The $1790 level and the 200 and 50-day moving averages just above it (at $1793 and $1796 respectively) provide substantial resistance, as has been the case for the whole of the month so far. The $1790ish ceiling to the price action is likely to remain in place with precious metals markets now in wait-and-see mode ahead of Wednesday’s FOMC policy announcement. The bank is expected to announce plans to quicken the pace of its QE taper, whilst the updated dot plot will likely indicate multiple hikes are expected by Fed policymakers in 2022.

Ahead of the Fed meeting, there are a few key US data releases worth noting, including Tuesday’s November PPI release at 1330GMT, followed by Wednesday’s November Retail Sales release, also at 1330GMT. The former should likely show that US producers continue to face heavy inflationary pressures, with the YoY headline rate seen above 9.0%. Some are touting the risk of an upside surprise perhaps having the ability to spur some upside in US yields, which are currently mostly flat on the session, with this potentially weighing on gold.

For reference, the US 10-year nominal yield is up about 1bps on the day but remains under 1.45% and well below its pre-Omicron levels, reflecting bond market participant’s seemingly bleak outlook for the US economy’s long-term growth and inflation prospects. The US 10-year TIPS yield (the real 10-year yield) continues to trade broadly within recent ranges and is close to the -1.0% level. Data ahead of the Fed meeting is unlikely to shift the macro narrative (i.e. of a bullish, high inflation US economy) much, unless of course there is a big miss on expectations.

Should a more hawkish than expected Fed outcome on Wednesday prompt upside in real yields (and likely also the US dollar), then spot gold prices may find themselves in trouble. For now, any further rallies to $1790 likely remain a sell, with bears likely to target recent lows in the $1760s-$1770 area.

- USD/CHF witnessed some selling on Tuesday and dropped to over a one-week low.

- A modest USD profit-taking slide was seen as a key factor exerting some pressure.

- The cautious mood underpinned the safe-haven CHF and added to the selling bias.

- Hawkish Fed expectations should help limit the USD losses and lend some support.

The USD/CHF pair dropped to over one-week low in the last hour, with bears now looking to extend the downward trajectory further below the 0.9200 round-figure mark.

Following a brief consolidation earlier this Tuesday, the USD/CHF pair met with a fresh supply during the European session and extended the previous day's retracement slide from the 0.9255-65 hurdle. The US dollar witnessed a modest pullback from a one-week high, which, in turn, was seen as a key factor that exerted downward pressure on the USD/CHF pair.

On the other hand, the prevalent cautious mood around the equity markets benefitted the Swiss franc's safe-haven status and further contributed to the USD/CHF pair's intraday slide. Concerns about the potential economic fallout from the imposition of fresh restrictions in Europe and Asia turned out to be a key factor that weighed on investors' sentiment.

This, to a larger extent, overshadowed reports that two doses of the Pfizer-BioNTech vaccine give 70% protection against the new Omicron variant. That said, growing market acceptance that the Fed would tighten its monetary policy sooner rather than later to contain stubbornly high inflation helped limit the downside for the greenback and the USD/CHF pair.

The markets have been pricing in the possibility for an eventual liftoff by June 2022 and another rate hike as early as November. Investors might also refrain from placing aggressive bets, rather prefer to wait on the sidelines ahead of the highly-anticipated FOMC policy decision on Wednesday. This, in turn, warrants some caution for aggressive bearish traders.

Market participants now look forward to the release of the US Producer Price Index (PPI) for some impetus during the early North American session. Traders will take cues from developments surrounding the coronavirus saga, which will influence the broader market risk sentiment and produce some meaningful trading opportunities around the USD/CHF pair.

Technical levels to watch

- EUR/GBP is trading sideways just under 0.8550 on Thursday, the pair having ignored strong UK jobs numbers.

- The pair is in wait-and-see mode ahead of Super Thursday, when both the ECB and BoE will set policy.

EUR/GBP has been moving sideways just to the south of the 0.8550 level throughout the duration of Tuesday’s sessions as the pair enters wait-and-see mode ahead of super Thursday, a day which sees both the BoE and ECB decide on policy in quick succession. The 200-day moving average resides at 0.8560 and, in the run up to the two major central bank events, is likely to act as a ceiling, whilst support in the form of this week’s earlier lows around 0.8500 will likely act as a floor.

To recap what markets are expecting from the BoE and ECB; most expect the BoE to leave rates unchanged at 0.1% amid the recent uptick in uncertainty about the UK’s near-term outlook as the Omicron variant spreads and Covid-19 curbs are tightened. That despite calls on Tuesday from the IMF for the BoE to avoid inaction bias and get on with modest policy tightening with a focus on the 12-24 month time horizon so as to minimise the costs associated with tackling second-round inflation effects. The ECB, meanwhile, is expected to confirm that the PEPP will end in March and that the APP will have its monthly purchase rate upper on a temporary basis to avoid a cliff-edge drop in net monthly bond purchases that could roil European bond markets.

Back to EUR/GBP, the pair largely ignored Tuesday morning’s data releases. The latest UK jobs report showed employers hiring a record number of staff in November and the unemployment rate in October dropping to 4.2% as expected, in a further sign that the UK labour market weathered the end of the government’s furlough scheme in September well. Eurozone Industrial Production saw a decent 1.1% MoM recovery in output in October, only slightly below the expected 1.2% MoM pace of growth.

- EUR/USD attracted some buying on Tuesday and rallied over 50 pips from the daily low.

- The USD witnessed some profit-taking and provided a modest intraday push to the pair.

- Divergent ECB-Fed policy outlooks should cap gains ahead of the central bank meetings.

The EUR/USD pair rallied nearly 60 pips from the early European session low and was last seen trading around the 1.1320 region, up 0.35% for the day.

Reports that two doses of Pfizer-BioNTech vaccine give 70% protection against the Omicron variant prompted some selling around the safe-haven US dollar. This was seen as a key factor that assisted the EUR/USD pair to reverse an intraday dip to the 1.1265 region. That said, the prevalent cautious market mood, along with hawkish Fed expectations should help limit any deeper USD losses and cap any further gains for the major.

Investors remain concerned about the potential economic fallout from the spread of the new variant and the imposition of fresh restrictions in Europe and Asia. This, in turn, should keep a lid on any optimistic move in the financial markets. Apart from this, the prospects for an early policy tightening by the Fed should act as a tailwind for the greenback and keep a lid on any meaningful upside for the EUR/USD pair.

In fact, the money markets indicate the possibility for an eventual liftoff by June 2022 and another rate hike as early as November. Conversely, the European Central Bank (ECB) has been pushing back against bets for a tighter policy and talked down the need for any action to counter inflation. The divergence in the Fed and ECB monetary policy outlooks should further hold back traders from placing bullish bets around the EUR/USD pair.

Moreover, investors might also prefer to wait on the sidelines ahead of this week's key central bank event risks. The Fed will announce its monetary policy decision on Wednesday and the ECB meeting is scheduled on Thursday. This further makes it prudent to wait for a strong follow-through buying before traders start positioning for any meaningful appreciating move for the EUR/USD pair.

Technical levels to watch

According to a report by the IMF, UK GDP is expected to grow 6.8% in 2021, followed by 5.0% in 2022. The international financing institution said it sees inflation in the UK peaking at about 5.5% in spring 2022 in the UK. The IMF added that, due to recently imposed curbs to contain the spread of Omicron, a small slowdown is expected in UK growth in Q1 2022.

Thus, the institution said that the BoE should begin to pare back on policy stimulus, though tightening would still keep policy mostly accommodative. The BoE needs to withdraw exceptional monetary stimulus and focus on the 12-24 month time horizon rather than near-term Covid-19 trends, the IMF added. Moreover, the IMF said that because of the cost of minimising second rounds inflation impacts, the bank must avoid inaction bias. Thus, the BoE should take advantage of the earliest chance to implement a quantitative tightening programme on a pre-planned track and should provide framework guidelines for this, the IMF urged.

Market Reaction

GBP/USD has not reacted to the latest IMF report, despite the institution urging the BoE to avoid inaction bias and to get on with monetary policy tightening to curb inflationary pressures. The pair continues to trade well within recent ranges in the 1.3250 area, though up from earlier session lows around 1.3200.

- GBP/USD reversed an intraday dip to sub-1.3200 levels amid a modest USD pullback.

- Upbeat UK jobs data further underpinned the British pound and remained supportive.

- The upside seems limited ahead of the highly-anticipated FOMC/BoE policy meetings.

The intraday USD selling bias pushed the GBP/USD pair to a fresh daily high, closer to mid-1.3200s during the mid-European session.

The pair continued showing some resilience below the 1.3200 round-figure mark and attracted fresh buying on Tuesday amid a modest US dollar pullback from a one-week high. The market concerns over the spread of the Omicron eased on the back of reports that two doses of Pfizer-BioNTech vaccine give 70% protection against the new variant. This, in turn, undermined the greenback's relative safe-haven status and provided a goodish lift to the GBP/USD pair.

The British pound was further benefitted from Tuesday's upbeat UK employment details. The UK Office for National Statistics reported that the number of people claiming unemployment-related benefits declined by 49.8K in November. Adding to this, the ILO Unemployment Rate edged lower to 4.2% during the three months to October. This was seen as another factor that contributed to the GBP/USD pair's intraday positive move of over 50 pips.

That said, a further appreciating move still seems elusive amid the imposition of fresh COVID-19 restrictions in the UK and persistent Brexit uncertainties. The latest development surrounding the coronavirus saga might have forced investors to push back their expectations for an imminent interest rate hike by the Bank of England in England. This, in turn, should hold back traders from placing aggressive bullish bets around the GBP/USD pair.

Meanwhile, growing acceptance that the Fed would tighten its monetary policy sooner rather than later to contain stubbornly high inflation should limit any meaningful USD decline. In fact, the money markets indicate the possibility of an eventual liftoff by June 2022 and another hike as early as November. This could further keep a lid on any meaningful upside for the GBP/USD pair ahead of this week's key central bank event risks.

The Fed will announce the outcome of a two-day monetary policy meeting on Wednesday, while the BoE MPC is scheduled to meet on Thursday. This further makes it prudent to wait for a strong follow-through buying before confirming that the GBP/USD pair has bottomed out in the near term. Conversely, bearish traders are likely to wait for acceptance below the 1.3200 mark before positioning for an extension of the recent downward trajectory.

Market participants now look forward to the release of the US Producer Price Index (PPI) for some impetus later during the early North American session. This, along with the broader market risk sentiment, will influence the USD price dynamics and produce some short-term trading opportunities around the GBP/USD pair.

Technical levels to watch

According to a study released by South Africa's largest private health insurance administrator, Discovery Health, two doses of Pfizer-BioNTech vaccine give 70% protection against Omicron hospitalisation, as reported by Reuters.

Additional takeaways

"Two doses of Pfizer-BioNTech vaccine give 33% protection against infection during current wave."