- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-12-2021

- Gold consolidates recent losses after consecutive two-day declines.

- Omicron woes escalate as WHO, Imperial College of London and US CDC support market fears.

- Deadlock over US President Biden’s BBB, US-China tussles and Fed’s rate-hike concerns also favor risk-off mood.

Gold (XAU/USD) licks its wounds near $1,790 during Tuesday’s Asian session, after declining from two consecutive days from the monthly high.

The yellow metal’s latest weakness could be linked to the market’s fresh fears over the South African covid variant, dubbed as Omicron. Adding to the risk-aversion are the chatters surrounding the US Federal Reserve’s (Fed) rate hike, deadlock over US President Joe Biden’s Build Back Better (BBB) plan and the Sino-American tussles.

After an initial rejection of the Omicron fears, global leaders are all worried over the COVID-19 variant that pushes some of the leading economics, like the UK and Europe, to recall strict activity restrictions during the holiday season.

The fears of Omicron were recently backed by the World Health Organization (WHO) while saying, “The Omicron variant of the coronavirus is spreading faster than the Delta variant and is causing infections in people already vaccinated or who have recovered from the COVID-19 disease,” per Reuters. On the same line were the Researchers at Imperial College London and the US Centers for Disease Control and Prevention (CDC). The UK scientists said, per Reuters, Infections caused by the Omicron variant of the coronavirus do not appear to be less severe than infections from Delta. On the other hand, Reuters said that Omicron is now the most common coronavirus variant in the US, accounting for nearly three-quarters of COVID-19 cases, per US CDC.

US President Joe Biden’s much-awaited BBB stimulus plan gets a rejection from Senator Joe Manchin, making it hard to cross the House considering the Republicans’ readiness to avoid favoring the plan and Democrats’ wafer-thin majority. Even so, House Speaker Nancy Pelosi and US President Biden stay hopeful of getting the aid package through during early 2022.

Adding to the risk-off catalysts are the US-China tussles that escalated of late. On Monday, Chinese foreign minister Wang Yi said, per Reuters, "If there is confrontation, then (China) will not fear it, and will fight to the finish." China’s Wang Yi adds, "There is no harm in competition but it should be ‘positive’”. On the same line were fears of the Fed rate-hike, backed by Fed Board of Governors member Christopher Waller

Against this backdrop, the US Treasury yields posted 2.3 basis points (bps) of an upside to 1.42% after declining to the monthly lows. Further, the Wall Street benchmarks also posted losses but the S&P 500 Future print mild gains by the press time.

Looking forward, a light calendar will restrict gold’s short-term moves but risk catalysts can keep the bears hopeful until the yields keep the latest rebound.

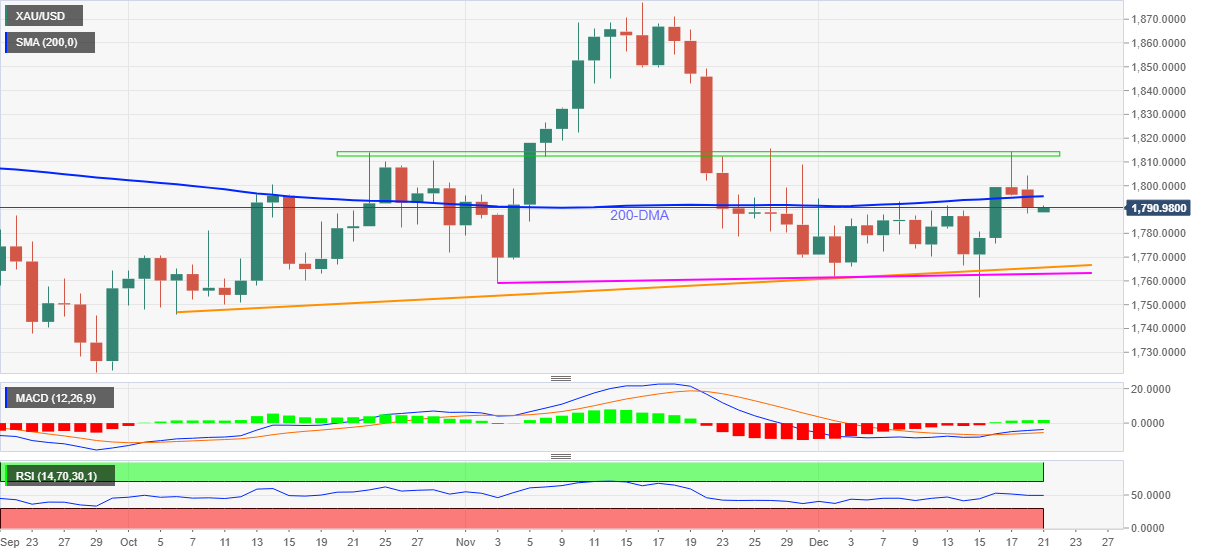

Technical analysis

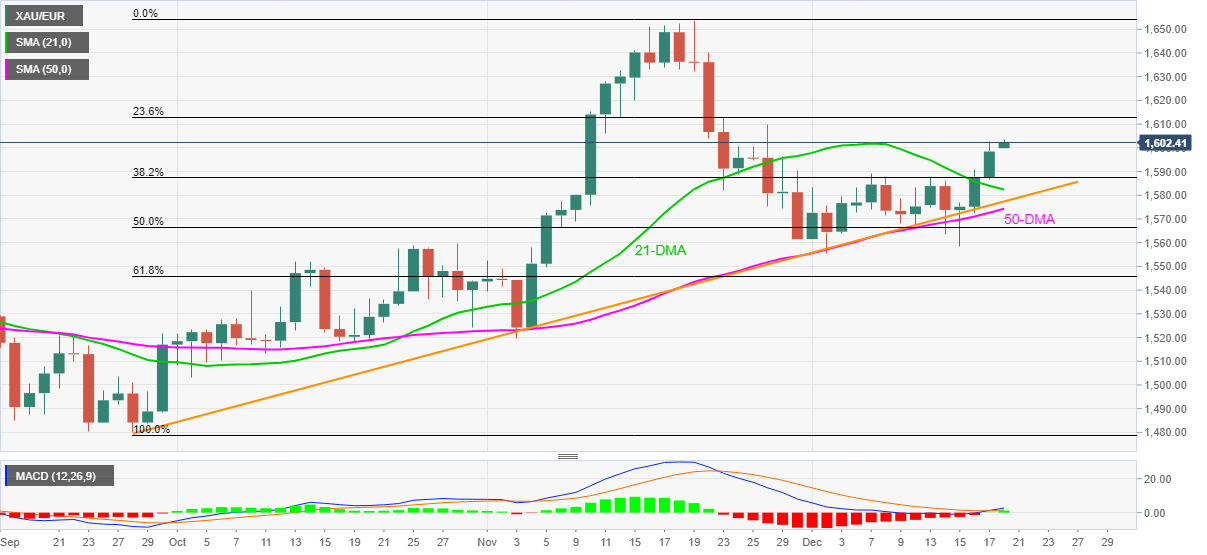

Failures to cross a two-month-old horizontal resistance area precede the metal’s latest break of the 200-DMA, around $1,795, to keep gold sellers hopeful.

That said, an ascending support line from early October, close to $1,765 will be challenging the bears, a break of which will have another support line from early November, near $1,760, to challenge the gold bears.

In a case where the gold prices decline below $1,760, September’s bottom surrounding $1,721 should become their favorite.

On the contrary, a clear upside break of the stated horizontal hurdle around $1,813-15, will aim for tops marked during July and September near $1,834 and then to multiple lows marked during mid-November close to $1,845.

In a case where gold buyers successfully cross the $1,845 resistance, November’s peak of $1,877 and the $1,900 round figure will be in focus.

Gold: Daily chart

Trend: Further weakness expected

- The British pound falls amid a risk-off environment, down some 0.31%.

- On Monday, US equities fell amid risk-aversion, which gains follow-through as the Asian session begins.

- GBP/JPY Technical Outlook: Bearish bias as long as it persists below 152.30.

At the time of writing, cable edges slightly downas the Asian Pacific session begin, trading at 150.09 during the day. Risk aversion in the financial markets continues, as Asian equity futures are in the red, led by the Hang-Seng down almost 2%, following US stocks indices footsteps, which ended the session with losses.

In the overnight session, the British pound dipped to 149.52. However, as the European session opened, it bounced off the daily lows towards the 200-hour simple moving average (SMA), stalling the upward move, hovering around the Tuesday central daily pivot at 150.02.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY daily chart depicts that the cross-currency pair has a downward bias, as shown by the daily moving averages (DMAs) residing 200-pips above the spot price. Additionally, the price action from December 15 to December 17 formed a candlestick pattern called an evening star. This bearish signal could propel the GBP/JPY towards the most recent swing low, the December 3 daily low at 148.96.

In the event of accomplishing the abovementioned, the next support would be the July 20 daily low at 148.45, followed by the February 26 at 147.40.

On the flip side, the first resistance would be the December 20 high at 150.55. The breach of the latter would open the door for further gains. The following resistance would be the December 17 daily high at 151.71, followed by 152.00, and the confluence of the 100 and the 200-DMA around the 152.30-50.

-637756389472443383.png)

One-month risk reversal on USD/CAD, a measure of the spread between call and put prices, prints the highest level in December for Monday per data source Reuters.

A call option gives the holder the right but not obligation to buy the underlying asset at a predetermined price on or before a specific date. A put option represents a right to sell.

That being said, the daily difference between them snaps a two-day downtrend to rise to +0.138 at the latest.

The options market scenario matches the USD/CAD price rally that refreshed 2021 top the previous day, mainly on the downbeat performance of Canada’s key export item WTI crude oil. It’s worth noting that the Loonie pair grinds higher around 1.2940 by the press time of the early Asian session on Tuesday.

Read: USD/CAD hits annual highs in 1.2960s as crude oil tanks amid Omicron concerns

- EUR/USD struggles to keep the previous day’s corrective pullback.

- Seven-week-old descending trend line, 200-SMA restrict immediate recovery.

- Channel support, yearly low test short-term declines before 61.8% FE level.

- Steady RSI line keeps sellers hopeful, bulls have a bumpy road to return.

EUR/USD grinds lower around 1.1280 amid the initial Asian session on Tuesday, despite the week-start rebound.

In doing so, the major currency pair stays inside a three-week-old downward sloping trend channel, needless to mention about trading below the 200-DMA and a descending resistance line from late October. Given the steady RSI conditions, the EUR/USD pair’s weakness is likely to prevail.

The same gradually directs the pair prices towards the stated channel’s support line, around 1.1215 by the press time.

Should the EUR/USD sellers reject stepping back from 1.1215, the yearly low near 1.1185 will be in focus ahead of the 61.8% Fibonacci retracement level of November 09-30 moves near 1.1120.

On the flip side, the stated resistance line restricts immediate advances near 1.1290, a break of which will challenge the 200-SMA and the channel’s upper line, respectively around 1.1340 and 1.1355.

Even if the EUR/USD bulls cross the 1.1355 hurdle, 1.1375, the 1.1400 threshold and mid-November peak close to 1.1465 should flash on their radars.

EUR/USD: Four-hour chart

Trend: Further weakness expected

- NZD/USD remains pressured around yearly low, recently sidelined.

- Risk sentiment remains sour as virus variant spread fears of fresh activity measures during holiday season.

- Delay in US stimulus, Sino-American tussles add to risk-off mood, PBOC fails to placate fears.

- Light calendar ahead, qualitative catalysts are crucial for fresh impulse.

NZD/USD defends 0.6700 threshold, teasing the yearly low while retreating to 0.6710 during early Tuesday morning in Asia. The kiwi pair dropped for the second consecutive day on Monday as fears over the South African covid variant, Omicron, escalated while the deadlock over the US Build Back Better (BBB) plan adds to the risk-aversion, weighing on the Antipodeans.

After an initial rejection of the Omicron fears, global leaders are all worried over the COVID-19 variant that pushes some of the leading economics, like the UK and Europe, to recall strict activity restrictions during the holiday season. The fears of Omicron were recently backed by the World Health Organization (WHO) while saying, “The Omicron variant of the coronavirus is spreading faster than the Delta variant and is causing infections in people already vaccinated or who have recovered from the COVID-19 disease,” per Reuters.

In New Zealand, the weather conditions are a bit favorable but the cases are gradually rising. “As of Monday there were 22 cases of Omicron in MIQ in New Zealand,” said NZ Herald. The Pacific nation targets Australia’s 90% vaccination rate to battle the virus strain.

Elsewhere, US President Joe Biden’s much-awaited BBB stimulus plan gets a rejection from Senator Joe Manchin, making it hard to cross the House considering the Republicans’ readiness to avoid favoring the plan and Democrats’ wafer-thin majority. Even so, House Speaker Nancy Pelosi and US President Biden stay hopeful of getting the aid package through during early 2022.

It’s worth noting that the US-China tussles escalated and offer another negative for the NZD/USD prices, considering New Zealand’s close trade ties with Beijing. Recently, Chinese foreign minister Wang Yi said, per Reuters, "If there is confrontation, then (China) will not fear it, and will fight to the finish." China’s Wang Yi adds, "There is no harm in competition but it should be ‘positive’”. On the same line were fears of the Fed rate-hike, backed by Fed Board of Governors member Christopher Waller, also weigh on the NZD/USD.

Amid these plays, US Treasury yields posted 2.3 basis points (bps) of an upside after declining to the monthly lows. Further, the Wall Street benchmarks also posted losses but the commodities traded mixed, with oil down and gold up.

Looking forward, New Zealand’s Credit Card Spending for November, expected -2.1% YoY versus -5.6% prior, will entertain NZD/USD traders but major attention will be given to risk catalysts for clear direction.

Technical analysis

NZD/USD pullback from 100-EMA joins bearish MACD signal and downbeat RSI line, not oversold, to keep sellers hopeful of refreshing the yearly bottom, currently around 0.6700.

In doing so, 61.8% Fibonacci Expansion (FE) of November 23 to December 16 moves, around 0.6670, will offer an intermediate halt during the likely slump towards November 2020 low near 0.6590.

Meanwhile, an upside clearance of the 100-EMA level of 0.6800 isn’t a green pass to the NZD/USD bulls as a one-month-old horizontal line near 0.6860 and the 200-EMA close to 0.6870 will be crucial hurdles before welcoming the bulls.

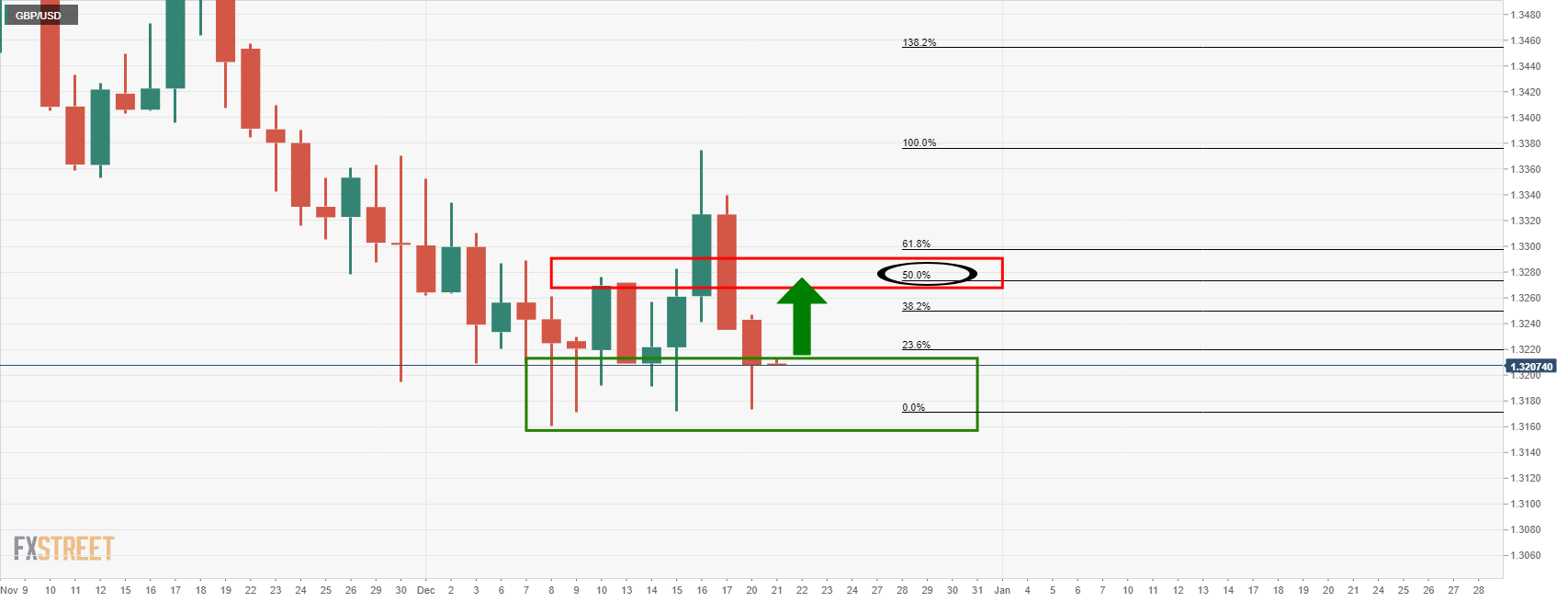

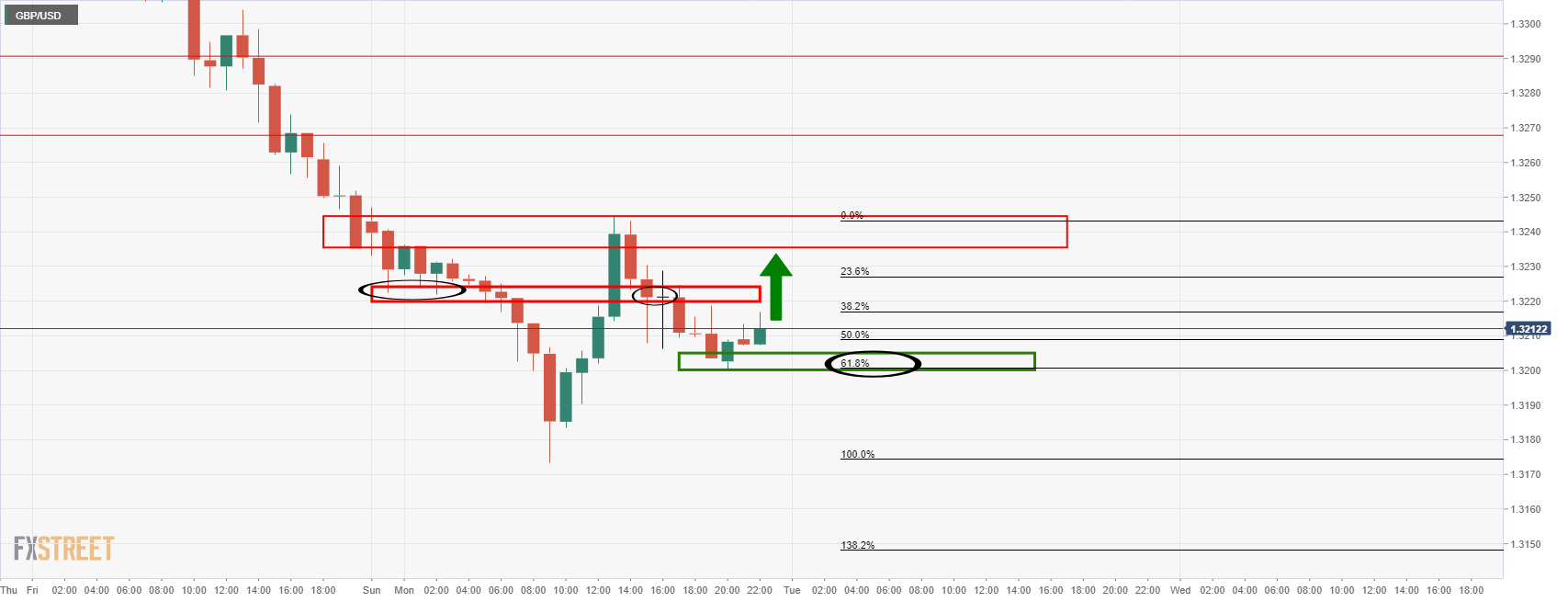

- GBP/USD is on the way to test daily resistance and eye son 1.3250.

- The bears will need to see a break below 1.3150.

GBP/USD, for the most part, is consolidating. There is little prospect of a breakout, one way or another until the parameters of the sideways price action are broken. The following illustrates the outlook from a long=term to a nearer-term perspective.

GBP/USD daily chart

The price is stalling in support and there is the potential for it to climb back to a 50% mean reversion level in the coming sessions if the bulls commit.

There are bearish headwinds from the fundamental side, so a quick recovery in the absence of positive news on the Brexit or Omricon front will be unlikely. With that being said, holiday then markets can go either way, so traders will be wary of the potential for volatility.

Moving down to the hourly chart, there is certainly an upside bias:

The 61.8% Fibonacci was hit and the bulls have moved in. The question now is whether they can stay the course and penetrate 1.3220 resistance? In doing so, then the daily 1.3240/50s will be a target.

Should the support of the dynamic trendline give out, then there is a risk of a test of the daily support and a run to 1.3150 and below.

GBP/USD weekly chart

As illustrated, below 1.3200 and 1.3100, there is an imbalance in price towards 1.2850 where the market could fall into should the support structure give out.

- The NZD/JPY edges lower some 0.42% during the day.

- Market sentiment dynamics and commodity prices linked to the kiwi would be the drivers for the pair.

- NZD/JPY Technical Outlook: Bearish in the near term, as market sentiment has remained downbeat in the last three days.

The NZD/JPY continues its free-fall as the year’s end looms, trading at 76.31 as the Wall Street session ends at the time of writing. Wall Street closed in the red, with US equity indices posting losses between 1.10% and 1.55%. Asian equity futures point to a lower open, thus weighing on risk-sensitive currencies like the NZD, in benefit of the safe-haven status of the Japanese yen.

Monday's session gainers were the low yielders EUR, CHF, and JPY, while the NZD lost 0.22% during the day against its counterpart, the USD dollar.

On Monday, the New Zealand economic docket reported Exports, Imports, and the Trade Balance for November. Exports and Imports on a monthly basis were higher than the previous figure, came at $5.86 Billion and $6.73 Billion, respectively. Meanwhile, the Trade Balance on an annual basis came at $-6.04B, lower than the $-6.047B estimated.

That said, the NZD/JPY pair would lie in the dynamics of market sentiment. Any risk-aversion in the financial markets would witness Japanese yen strength, in turn, drops in the NZD/JPY pair. On the other hand, any rallies in stocks would favor risk-sensitive currencies like the NZD, the GBP, and the AUD.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY daily chart shows that the pair re-tested the December 3 daily low at 75.95, but the downward move stalled, bouncing back above the 76.00 figure.

The bias in the cross-currency pair is bearish, as shown by the daily moving averages (DMAs) residing well above the spot price, despite the fact of being almost horizontal and would be crucial resistance levels, in the event of the NZD/JPY breaking to the upside.

That said, the first support would be the December 3 swing low at 75.95. A decisive breach of the latter would open the door for further losses. The next line of defense downwards would be the July 20 swing low at 75.25, followed by the August 19 low at 74.55

-637756353213974068.png)

What you need to know on Friday, December 21:

On a broadly risk off day that would normally be expected to benefit the traditional forex safe havens like USD and JPY, the euro was the standout performer. EUR/USD rallied 0.4% after bouncing at support in the form of recent lows, though was not able to hold to the north of the 1.1300 level. CHF also performed well, rallying 0.3% versus the buck, while USD/JPY was about 0.1% lower but remained close to the 113.50 level.

As a result of the strong euro and modestly stronger yen, the DXY was lackluster, dropping 0.1% on the day, though remaining close to 96.50 and recent highs. But losses in risk and commodity-sensitive currencies (as a result of risk-off conditions) cushioned the DXY somewhat.

The Canadian dollar was the worst performer of these amid selling pressure and choppiness in crude oil markets and dropped 0.4% on the day versus the dollar. USD/CAD even managed to print fresh annual highs in the 1.2960s, surpassing the previous annual high set back in August close to 1.2950, though has since pulled back to consolidate in the 1.2940 area.

AUD/USD, meanwhile, was down about 0.1% on the session and content to spend most of it consolidating just to the north of the 0.7100 level. Aussie traders will be looking ahead to the release of the minutes of the last RBA meeting at 0030GMT on Tuesday, with traders are on notice for further hints from the RBA that it will pivot in a hawkish direction.

It seems to be a fairly consensus view now that the RBA will completely axe its QE programme in February in wake of last week’s much stronger than expected Australia November labour market report. The timing of rate hike is also a key theme, with markets expecting the RBA at some point to indicate that a first post-pandemic hike might come as soon as 2022 rather than the current 2023 guidance.

NZD/USD, meanwhile, was down 0.3% after probing, but ultimately remaining supported above, support in the form of annual lows at the 0.6700 level, whilst GBP was down about 0.2% on the day versus the buck. GBP/USD again found support at recent monthly lows in the 1.3170s area and closed out US trade slightly to the north of 1.3200 as speculation intensifies about impending UK lockdowns to stem the rising Omicron tide. It seems a lockdown this side of Christmas (on Saturday) is unlikely, but after that, anything goes and UK PM Boris Johnson in a speech earlier in the day made clear nothing was off the table.

Finally, in emerging market FX, the standout currency was the Turkish lira, which saw an immense 25% intra-day pull back from session highs in the 18.30s to end the US session around 13.50. The rapid appreciation of the currency was prompted as President Recep Erdogan announced unorthodox new policies to alleviate the impact of exchange rate volatility on Turkish savers.

Most importantly, the President announced that the government would offset losses to domestic TRY accounts as a result of the depreciation of the TRY/USD exchange rate. Some analysts and traders have said that these anti-dollarisation measures amount to a “hidden” interest rate hike, funded via the public purse.

- EUR/JPY is at risk of a downside correction should 128.10 give way to bearish pressures.

- 127.90 guards a deeper resumption of the dominant bear trend.

The daily chart shows that the price is consolidating and has reached a 38.2% Fibonacci retracement level. This would be expected to hold on to initial tests and then potentially lead to a downside test of support once again.

The following illustrates the market's structure and the downside bias from both a daily and shorter-term perspective:

EUR/JPY daily chart

EUR/JPY H1 chart

From this hourly perspective, we can see that the price is struggling at a meanwhile resistance and given the temperament of the market, that is to say consolidative with a risk-off tone, the bias is to the downside. A break of the current trendline opens risk to test the prior hourly support near 127.90. If this were to give, then the daily support will be vulnerable near to 127.50.

- Erdogan announced an unorthodox new policy to compensate losses on domestic TRY accounts due to TRY/USD depreciation.

- Traders said the policy amounted to “hidden” rate hikes, funded via the public purse, and USD/TRY crashed 25% from highs.

- The pair is now trading in the 13.50 area having been as high as the 18.30s earlier in the session.

The Turkish lira underwent a jaw-dropping recovery on Monday after Turkish President Recep Erdogan announced unorthodox new policies to alleviate the impact of exchange rate volatility on Turkish savers. The President announced a raft of new economic measures, but the one that got the most attention was a mechanism where the government will offset losses to domestic TRY accounts as a result of the depreciation of the TRY/USD exchange rate. Some analysts and traders have said that these anti-dollarisation measures amount to a “hidden” interest rate hike, funded via the public purse.

According to Bloomberg, the USD/TRY spot rate is currently at 13.50 a staggering near 20% decline from last Friday’s closing levels around 16.40. The decline is even more impressive given that USD/TRY was at one point trading in the 18.30s. That means the lira has gained 25% in value from its intraday lows.

Judging by the market reaction, President Erdogan appears to have pulled a rabbit out of the hat with his latest policy of essentially paying additional interest to Turkish savers via the public purse. But Turkey is very much in unprecedented territory when it comes to monetary policy right now. The government has taken on a potentially huge liability in promising to insure savers against exchange rate losses and analysts will be wondering how this impacts the government’s fiscal position going forward. Some have pointed out that the Turkish government has now exposed itself to a vicious cycle where, if the value of the lira falls too much, they will have to borrow ever more of it to fund the losses of investors.

- The Australian dollar drops as the Wall Street session approaches the end, down 0.14%.

- The US 10-year Treasury yield reclaims the 1.40% threshold, underpins the greenback.

- AUD/USD Technical Outlook: It has a downward bias, though upside risks remain.

During the New York session, the AUD/USD edges lower, trading at 0.7111 at the time of writing. The market sentiment remains downbeat, spurred by the Omicron outbreak worldwide. The UK and some European countries reimpose social restrictions as health government offices scramble to contain the fourth wave.

In the meantime, the US Dollar Index recovers some of its losses, almost flat at 96.55, as US Treasury yields with the 10-year benchmark note, reclaim the 1.40% threshold, up to two basis points, sitting at 1.423%.

An absent economic docket leaves the AUD/USD pair at the mercy of market sentiment and greenback’s dynamics, including political domestic developments and demand for US Treasuries.

AUD/USD Price Forecast: Technical outlook

The AUD/USD daily chart depicts that the pair has a downward bias. The double-top formed in the month, still in play as long as the 0.7186 December swing high is decisively broken to the upside. Nevertheless, despite Australian dollar weakness across the board, Monday’s price action pierced the “neckline” around the December 14 swing low at 0.7090. However, it failed to gain follow-through, pushing the AUD/USD around 0.7111.

If USD bulls achieve to break clearly below the neckline, the first support would be the 0.7000 figure, followed by the 0.6900, and then the June 12, 2020 pivot low at 0.6799.

To the upside, the first resistance would be the December 17 daily high at 0.7184. A sustained break above that level could pave the way for further gains, with the 0.7200 figure as the next resistance, followed by the confluence of the 50 and the 100-day moving averages (DMAs) at 0.7290-0.7300 area.

- EUR/USD rebounded strongly to near 1.1300 on Tuesday, with the euro outperforming in the G10 space.

- Technical buying after the pair bounced from the bottom of its recent ranges in the 1.1220-1.1230 area likely played a role.

Its not quite clear why the euro has been the best performing G10 currency on the session so far this Monday but regardless, robust demand for the single currency has been enough to lift EUR/USD about 50 pips from earlier session lows in the 1.1230s to current levels near 1.1280. The pair, which momentarily went above 1.1300 earlier in the session, has been consolidating in the upper 1.1200s amid quiet markets characterised by slow newsflow and with the 21-day moving average (at 1.12846) acting as a magnet.

In terms of fundamentals, amid a lack of any major economic data releases or Fed speak, the main driver in markets on Monday has been 1) concerns about the spread of Omicron and 2) worries that the Biden administration will fail to pass its economic agenda. Perhaps this latter concern, which presents a downside risk to US economic growth in 2022 and subsequent years, is one factor lifting the pair. Some may also point to very vocal hawks on the ECB governing council as lifting EUR/USD.

Pierre Wunsch of the Belgium central bank said the ECB is not sufficiently recognising upside inflation risks and Robert Holzmann of the Austrian central bank said over the weekend that the ECB is ready to adjust its policy if inflation doesn’t fall. But the hawks remain in the minority at the ECB. ECB President Christine Lagarde and Chief Economist Philip Lane are the better bellwethers for where sentiment/consensus thinking at the bank resides.

Technical buying is an alternative reason why EUR/USD may have bounced. The 1.1220-1.1230 area has been a key zone of support for the pair in recent weeks, just as the upper 1.1300s (the 1.1350-1.1380 area) has been a key area of resistance. Monday’s price action could purely be a reflection of the fact that traders were not prepared to force a break to the south of recent ranges, especially at the start of a week expected to be characterised by thin pre-holiday liquidity conditions.

- The USD/CHF falls some 0.32% during the day, underpinned by the US Dollar Index, losing 0.09%.

- USD/CHF Technical Outlook: It has a neutral bias, remains range-bound amid the lack of a catalyst.

At the time of writing, the USD/CHF drops during the New York session, trading at 0.9213. Risk-aversion in the financial market, spurred by the Omicron outbreak and US domestic political issues, boosted the safe-haven status of the Swiss franc, weighing on the greenback.

In the meantime, the US Dollar Index, which tracks the buck’s value versus six rivals, drops 0.09%, sitting at 96.48, undermined by falling US bond yields, with the 10-year unmoved at 1.40% in the last couple of hours.

During the overnight session, the USD/CHF began the trading week around the daily highs of the day at 0.9250. Nevertheless, as the American session got underway, the price collapsed through the 200, the 100, and the 50-hour simple moving averages (SMAs) towards the S1 daily pivot at 0.9196.

As of the last couple of hours, the pair jumped as US Treasury yields recovered some ground, but it faces resistance at the 50-hour SMA at 0.9214.

USD/CHF Price Forecast: Technical outlook

The USD/CHF daily chart depicts that the pair have remained in consolidation for the last 16 trading days, in the 0.9160-0.9265 range, sometimes piercing through price extremes, like the December 15 high at 0.9293. At press time, the USD/CHF pair has a neutral bias.

To the upside, the first support would be 0.9290. A clear break of that level would expose the 78.6% Fibonacci retracement at 0.9327, followed by the November 24 high at 0.9373.

On the flip side, the confluence of the 50 and the 100-day moving averages (DMAs) around the 0.9205-15 range would be the first demand area. A sustained breach of the latter would expose the 0.9200 figure, immediately followed by the 200-DMA at 0.9176.

-637756223698239254.png)

- EUR/GBP price action is at the hands of the omicron variant.

- The UK is facing the worst wave but UK's PM Boris Johnson says that there will be no new restrictions, for now.

Since a month ago when the World Health Organization (WHO) announced that Europe was once again "at the epicentre" of the Covid pandemic as cases soared across the continent, the UK, France and many other nations are still at the peak of their infection curves.

In response, Europe’s biggest countries are introducing more curbs to fight the surges in Covid-19 infections as the highly-transmissible omicron variant slams already weary populations. Germany, which is reported to be 67% of the peak of its infection curve, designated the UK as a virus variant area from Monday, the highest risk category.

As omicron cases surge in the UK, the country faces the politically perilous decision of whether to tighten restrictions. Total Covid infections rose by about 50% in a week to touch a record 93,000 on Friday. However, on the day where the UK reported its second-highest daily covid tally, the UK's PM Boris Johnson says that there will be no new restrictions in England for now. On the other hand, he said that ''we have to reserve the possibility of taking further action on covid.''

The markets are of the mind that new restrictions are inevitable. Plan B is argued by some as not enough to control the spread of Omicron. SAGE is advocating for new stricter measures as soon as possible as they forecast that hospital admissions would likely reach 3,000-10,000 per day with Plan B restrictions (peak in Jan-2021 was 4,500).

However, regardless of new restrictions, if implemented. voluntary social distancing could have a similar effect, with fewer people travelling or using public services, eating out in restaurants and so forth. This is already happening in London for example.

''In a best-case scenario where no new restrictions are introduced and Omicron causes far fewer hospital admissions than Delta, the models estimate that UK GDP will fall around 0.6% by January,'' analysts at TD Securities explained. ''In a worst-case scenario with strict restrictions and high hospital admissions, GDP is estimated to fall around 5.8%.''

Meanwhile, European nations have taken a varied approach to counter the winter Covid wave. The Dutch have imposed the strictest of lockdowns which mean schools and non-essential shops are closed and fewer visitors will be allowed in households.

Germany, France and Cyrpus are imposing stricter rules for travellers from Britain from outright banning to 14-quarantine upon arrival. France is curbing outdoor revelry on New Year's Eve and is turning up the pressure on people to get vaccinated whereby immunized people will be able to get a health pass that gives access to bars, restaurants, medical facilities and cultural venues.

''French Labor Minister Elisabeth Borne will meet with business and labour leaders Monday to discuss the possibility of requiring health passes at work. Unions say such a move would effectively make vaccines mandatory in France,'' Bloomberg reported. Spain and Italy's governments will convene will hold emergency meetings to analyze their own nation's epidemics and the evolution of the disease to determine their own call to action and adaptations of new measures to curb the spread.

It's muddy waters for now with regards to EUR/GBP's direction. It has been stuck in the weekly range since March of this year between a peak of around 0.8720 and a low of 0.8380 and there are little signs of a breakout one way or the other. There was a strong weekly bearish bar printed in the middle of November but that was met by an equally strong recovery from the lows of the weekly range. 0.8450 and 0.8600 looks to be the parameters for the near future.

EUR/GBP technical analysis

The daily chart is leaving a W-formation as follows:

The daily chart's W-formation is a reversion pattern and the price would be expected to revert back to test the neckline support of the pattern in due course. This is a price action that would be anticipated to evolve on a bearish hourly chart in the coming sessions.

- The US Dollar Index edges down some 0.21% as US bond yields fall.

- The US 10-year Treasury yield losses some two basis points at 1.388%.

- DXY Technical outlook: An upside break above an ascending triangle target 98.00.

The US Dollar Index, also known as DXY, which measures the greenback’s performance against a basket of six rivals, drops some 0.33%, sitting at 96.48 during the day as the New York session at the time of writing. The market sentiment is downbeat, with major US equities falling between 1.51% and 2.86%.

Factors like US President Biden’s failure to get his $2 trillion tax-and-spend backed by Democrat Senator Joe Manchin dampened the prospects of the greenback, among falling US bond yields. That said, Goldman Sachs reduced US economic growth forecasts after Senator Manchin’s decision.

In the US bond market, the Treasury yields fall with 2s, 5s, and 10s dropping between one and four basis points, sitting at 0.6155%, 1.1391%, and 1.388%. The long maturity of the yield curve, with the 20s, and 30s, fluctuate. The 20s are flat at 1.8585%, while the 30-year rise is almost one basis point, at 1.823%

Last week, the main event for the US dollar was the Federal Reserve monetary policy decision. The US central bank kept their interest rates unchanged at the 0 to 0.25% range while increasing the speed of the bond taper, from the $15 Billion agreed initially up to $30 Billion, beginning in mid-January of 2022.

Additionally, it released its Summary of Economic Projections, also known as SEP. Inside of that report lies the “famous” dot-plot, which displays the 18 Federal Reserve Board members’ projections for the Federal Fund Rates (FFR) in the current year, and subsequent ones. In this report, the US central bank policymakers expect three rate hikes by the end of 2022, projecting the FFR at 0.90%.

US Dollar Index (DXY) Price Forecast: Technical outlook

The US Dollar Index daily chart depicts the strong dollar narrative keeps in place. The price is above the central Pitchfork’s uptrend channel, which confluences with the ascending triangle on an uptrend. At press time, the DXY is testing the top-trendline of the ascending triangle on an uptrend, though earlier pierced the abovementioned reaching a daily low at 96.33.

To the upside, the first resistance would be the figure at 97.00. A breach of the latter would expose the June 30 high at 97.80, followed by the ascending triangle target at 98.00.

-637756187254922205.png)

- USD/CAD hit fresh annual highs on Monday, spiking above the August high at 1.2949 and reaching as high as 1.2964.

- The pair has since dropped back to the 1.2940s area, but still trades with gains of about 0.4% on the day.

- CAD is underperforming amid steep downside in crude oil amid a broadly risk-off market feel.

USD/CAD hit fresh annual highs on Monday, spiking above the 20 August high at 1.2949 and reaching as far as 1.2964, before backing off to the 1.2940 area. That means the pair is currently trading higher on the day by about 0.4%, reflective of a sharp deterioration in the market’s broader appetite for risk and substantial losses in crude oil markets. Concerns about the rapid spread of Omicron in Europe and moves being taken by nations there to tighten restrictions have triggered fears the US may be only a few weeks behind. Traders are also disappointed by fading US fiscal stimulus hopes are moderate Senate Democrat Joe Manchin nuked the Biden administration's flagship $1.75T Build Back Better spending package by announcing he would not support it.

These factors have combined to send the S&P 500 nearly 2.0% lower on the day and to send WTI more than $3.0 lower to the low-$67.00s. That oil’s worst one-day performance since the 26 November $10.00 drop on the initial Omicron news. In that regard, it is perhaps surprising that USD/CAD’s gains are even more. But traders will note that the pair has come a long way in recent sessions (the pair is up over 2.5% since the December lows near 1.2600) and is currently probing a key area of resistance.

Aside from the potential for them to be buffetted by broader shifts in risk appetite, FX markets were supposed to have a calm week this week, and yet still may. Given the proximity to Christmas and year-end holidays, FX volumes will be thinner than usual with many market players away. The only notable US economic event in November Core PCE on Thursday. It's already expected to be high and the Fed is known to be concerned about inflation, so isnt likely to move markets much unless there is a big miss/beat on expectations. In terms of Canadian events, the most notable are October Retail Sales on Tuesday followed by October GDP numbers on Thursday. Otherwise, the pair will follow broader risk appetite, which will be driven by Omicron news.

The pound will likely weaken in the near future as market participants expect too much from the Bank of England (BoE) according to analysts at CIBC. They forecast GBP/USD at 1.31 by the end of Q1 and at 1.29 by Q2 of next year.

Key Quotes:

“The labour market data met the conditions for tightening, and the Bank felt it prudent to hike, in large part in order to preclude inflationary pressures from becoming deanchored. The BoE was clearly spooked by outsized and broadening CPI pressures. The MPC has now conceded that CPI looks set to test 6% into spring. As a consequence, the Bank clearly felt the need to act now to show its colours. But in reality, the 15bps move was largely symbolic, and aimed at sending a signal to dampen inflation expectations, as only around 25% of mortgage holders will be immediately impacted by an increase in floating mortgage rates.”

“While the Bank has clearly underlined its determination to adhere to its CPI mandate, we would not expect a material degree of 2022 policy tightening. Moderating growth, and a topping out in energy prices, should limit the inflation upside, and preclude the BoE from being pressed to aggressively tighten in the year ahead.”

“The combination of a moderating growth backdrop, ongoing UK/EU trade frictions, and a less aggressive UK rate cycle than that currently discounted, underlines scope for Sterling headwinds to persist.”

UK Prime Minister Boris Johnson said on Monday that we have to reserve the possibility of taking further action on Covid-19. We will rule out nothing in the fight against Covid-19, he said, adding that we will go further if we need to.

Additional Takeaways:

"Nobody wanted things to go this way but Omicron has exploded so fast."

"The situation is extremely difficult, arguments are finely balanced."

"Omicron hospitalisations are rising steeply in London."

"In view of the balance of risks/uncertainties on Omicron hospitalisations, we agreed to keep the data under constant review, hour by hour."

"We're looking at all kinds of things to keep omicron under control."

"We regret the impact on the economy."

"Important we look after the hospitality industry and other sectors."

"We will keep the economic side of this under constant review."

Market Reaction

GBP has not seen any reaction to the latest remarks, with sterling traders on notice for a potential tightening of lockdown curbs before the end of the year.

Turkish President Recep Erdogan said on Monday that he would introduce a new financial instrument to ease the burden from volatile forex rates. The financial fluctuations and price hikes, he said, have no basis in economic fundamentals and Turkey will not bow to attacks and plots against it.

Citizens would not have to convert lira savings into foreign exchange due to volatility, he reassured, adding that he would encourage saving in the lira. Erdogan added that he was planning a 1.0% cut in corporation taxes and that credits would be given to support employment. There is no need to turn back from free market economy rules, Erdogan added, saying that in a few months, interest rate cuts would bring about a fall in inflation.

Market Reaction

In recent trade, USD/TRY has accelerated to the north of the 18.00 level, where it trades higher by nearly 10% on the day. Erdogan has been doubling down as of late on his assistance on the fact that there is "no going back" on his new economic agenda, which is characterised by attempts to lower inflation by lowering interest rates rather than hiking them.

Many view this policy as misguided (economists are near-unanimous in their agreement that rates need to be lifted to reign in inflation, not lowered) and putting the Turkish economy at risk of hyperinflation and financial crisis. The YoY CPI rate is already above 20% as of November. Speaking of rate cuts, that is exactly what the CBRT did last week. The bank lowered interest rates to 14.0% from 15.0% in a move that has, along with Erdogan's rhetoric, weighed heavily on the lira in recent sessions.

- After probing 0.6700 earlier in the session, NZD/USD has stabilised spent the last few hours ranging in the 0.6710-0.6730 area.

- Sentiment is weighed by concerns about Omicron, a significant setback to US President Joe Biden’s economic agenda and Fed hawkishness.

After probing the 0.6700 level earlier in the session, NZD/USD has stabilised and has spent the last few hours going sideways within the 0.6710-0.6730 area. Seemingly, last Wednesday’s post-Fed low at bang on 0.6700 has offered sufficient support for now. At current levels around 0.6715, the pair is trading lower by about 0.3% on the day, meaning it is one of the worse, though not the worst, performing G10 currencies on the day (CAD is the worst down 0.5%). NZD’s underperformance has everything to do with the fact that it is a risk-sensitive currency and thus its appeal is being undermined by the very much risk-off market tone that is prevailing on Monday.

Long story short, global equity markets, though the losses are worst in the US at present (S&P 500 -2.0%), are being pummeled by a cocktail of negatives. These include negative news about the pandemic in Europe, where countries are locking down (Netherlands) or on the cusp of tightening restrictions (the UK, Italy, Germany, France) as Omicron cases surge. US market participants fear that the US is just a few weeks behind. Elsewhere, moderate Senate Democrat Joe Manchin, whose vote is crucial for any piece of Democrat legislation to pass if there is no bipartisan support, appeared to nuke the flagship legislation of the Biden administration. Manchin announced on Sunday he wouldn’t support the $1.75T Build Back Better (BBB) bill, though some think negotiations will continue in January on a slimmed-down version.

If Congress fails to pass BBB, this is being taken as a negative for US growth prospects over the coming years. Some are also citing fears about the fact that, despite the above, the Fed looks set to press ahead with the removal of easy monetary policy. Recall last week that the Fed doubled the pace of its QE taper, which Fed member Christopher Waller said on Friday indicated that the March meeting was live for a rate hike. The Fed’s new dot plot pointed to three rate hikes in 2022, so support for a March lift-off is unlikely to be far from the bank’s consensus view.

Whilst it is debatable as to the degree that the theme of a hawkish Fed is weighing on sentiment, it has clearly support the US dollar in recent days, hence the retracement lower in NZD/USD since last Thursday’s highs just shy of the 21-day moving average at the time in the 0.6830s. The roughly 120 pip drop amounts to about a 1.8% decline in NZD/USD from these levels in just two sessions, which is quite something and shows that the bears remain in control (in the short to medium-term) in the pair. If that remains the case, the 0.6700 level is vulnerable. If the pair were to dip below this level, that would mark fresh lows since early November 2020. The medium-term bears would be eyeing a move back down to the 0.6500 area, amid a lack of any notable support in the interim.

Analysts at CIBC forecast the USD/JPY pair at 115 by the end of the first quarter and at 116 by the end of the second quarter. They see the Bank of Japan (BoJ) as a limitation for the yen.

Key Quotes:

“Contingent to the unwind in JPY shorts and rebound in Yen valuations has proved to be the correction in USTJGB spreads. Beyond external risk sentiment which risks influencing risk barometers such as AUD/JPY, we would continue to view UST-JGB dynamics as remaining integral to USD/JPY performance.”

“We do not anticipate that the unwind in foreign asset purchasing appetite will persist. Indeed, we expect continued interest in exporting capital across the year ahead, omicron risks notwithstanding.”

“We expect the BoJ, in line with the ECB and SNB, to remain as a policy laggard. Indeed, it seems increasingly likely that rates will remain at current levels through 2023. While the BoJ stand ready to do more in terms of stimulus, in reality the onus for stimulus is more likely to fall on fiscal action from the new Kishida administration. Look for the government to approve a new JPY 36trn supplementary fiscal budget in the current Parliamentary session. Those measures should provide at least some support against external headwinds, but are unlikely to be sufficient to boost JPY valuations.”

According to analysts from Danske Bank, Turkish President Erdogan needs to either tighten monetary policy or close its capital account through capital controls in order to stop the rally of USD/TRY. They think Erdogan will be persistent this time around and not easily persuaded, but there are some potential game-changers: pressure from business community, emerging signs of a bank run and the threat of a snap election.

Key Quotes:

“With limited buffers, the CBRT’s recent interventions are nothing short of a sign of desperation and, hence, more likely to undermine their credibility rather than halt lira’s slide. More extreme measures, such as capital controls, cannot be ruled out.”

“For now, there are no signs of a policy reversal, and unless Erdogan is deterred by the threat of a bank run or a snap election, we think lower real rates, weakening fundamentals and tighter global financial conditions will drive lira further down.”

“Basically President Erdogan is trying to fight the “impossible trinity” which states that a small open economy like Turkey’s cannot run an independent monetary policy with an open capital account and also have a stable exchange rate. So unless Erdogan wants to see the USD/TRY keep rising (generating higher or even hyperinflation) Turkey needs to either tighten monetary policy i.e. abandon its independent monetary policy or close its capital account through capital controls (or implement price controls, which would lead to goods shortage in the economy).”

- The white-metal falls some 0.54% at press time during the New York session.

- Falling US Treasury yields and US domestic political issues undermine the US dollar.

- XAG/USD Price Forecast: Neutral-bearish bias, as long as it remains below the December 13 high at $22.40.

Silver (XAG/USD) is failing to capitalize on falling US bond yields, retreating below the December 17 daily low, trading at $22.26 during the New York session at the time of writing. An hour after Wall Street’s opening, the market sentiment is downbeat, as depicted by US stock indices falling. At the same time, the Build Back Better US President Biden agenda got torpedoed by Democrat Senator Joe Munchin, backpedaling his support of a $2 trillion tax-and-spending package as year’s end looms, pushing discussion towards next year.

That said, US Treasuries are losing during the day, with the 10-year Treasury yield dropping 1.7 basis points, currently at 1.385%, weighing on the US Dollar Index, falling 0.24%, sitting at 96.34.

Despite the abovementioned, XAG/USD failed to capitalize an upward move, which could be attributed to a technical move, as the white-metal faced strong resistance around $22.60.

XAG/USD Price Forecast: Technical outlook

Silver 1-hour chart depicts the non-yielding metal has a neutral-bearish bias, as long as it remains below the December 13 swing high at $22.40, even though it faced support around the confluence of the 100 and 200-hour simple moving averages (SMAs) around the $22.18-20 region. The last 1-hour candle attempted a break above the December 17 swing at $22.34, fading the move and retreating below the S1 daily pivot.

The lack of a catalyst would keep XAG/USD subdued in the $22.18-35 range. In the event of further downside, the first support would be the 200-hour SMA at $22.20. A decisive breach of the latter would open the door towards $22.00, followed by a challenge of the S3 daily pivot at $21.93.

-637756133710924264.png)

- US indices are lower across the board on Monday, with each down more than 1.5% on the session.

- Sentiment is weighed by concerns about Omicron, a significant setback to US President Joe Biden’s economic agenda and Fed hawkishness.

US equities are lower across the board on the first trading day of the new week. The S&P 500, Nasdaq 100 and Dow all down more than 1.0% on the session, amid concerns about the rapid spread of the Omicron variant in Europe, a significant setback to US President Joe Biden’s economic agenda and a hawkish Fed. The S&P 500 gapped below the 4600 level on Monday and has since dropped all the way below the 4550 mark where it trades lower on the day by about 1.8%.

Equity bears will be eyeing a test of monthly lows in the 4500 area if things continue as is. The next major support below that would be the October lows all the way down under 4300, another nearly 6.0% below current levels. A drop back to these lows would mark a near-10% pullback from the November record intra-day highs close to 4750. A pullback from highs of over 10% in US equities is seen as a “correction”.

Looking at the other major indices; the Nasdaq 100 gapped below 15.6K at the open and is now flirting with monthly lows in the mid-15.5K area, where it trades about 1.6% lower on the day. The Dow, meanwhile, has slumped all the way towards the 34.7K area from opening levels closer to 35.25K, where it trades lower by about 1.9% on the session. Amid the surge in selling, the S&P 500 CBOE Volatility Index (often referred to as the VIX) spiked back above 25.00, up more than 4.0 points on the day and at two-week highs.

Driving the day

On of the key drivers of risk-off on Monday has been an escalation of the Covid-19 situation in Europe. In a surprise move, the Netherlands on Sunday announced a full lockdown. As speculation swirls elsewhere on the continent, other countries are expected to follow suit straight after Christmas (as cancelling people’s Christmas plans is politically untenable in many countries). The UK is rumoured to be planning a lockdown from 27 December.

US markets are clearly worried that the US is headed in the same direction as Europe when it comes to the pandemic and is just a few weeks behind. According to analysts at Independent Advisor Alliance, "typically what happens in Europe is a bit of a preview for what we see in the United States. So, if we see a lot more infections in the U.S., it could stress hospitals, make people less reluctant to get out, spend, and partake in the economy. That's definitely a cause of concern."

Sentiment in the US was dealt a further blow by news over the weekend that moderate Democrat Senator Joe Manchin would oppose the Biden administration’s $1.75T Build Back Better (BBB) social spending package, the flagship policy of his economic agenda. There is speculation that negotiations on a further stripped-down version of BBB will continue in the new year, with some interpreting Manchin’s “no” as a negotiating tactic. But it has nonetheless dented confidence in US growth prospects, reflected in Monday’s underperformance of the S&P 500 GICS materials, financials, energy and industrials sectors, each of which are lower by more than 2.0% on the day.

Another factor being cited as weighing on sentiment is the hawkish signals sent from the Fed in recent days. Recall last week that the Fed doubled the pace of its QE taper, which Fed member Christopher Waller said on Friday indicated that the March meeting was live for a rate hike. The Fed’s new dot plot pointed to three rate hikes in 2022, so support for a March lift-off is unlikely to be far from the bank’s consensus view.

Some traders expressed hope on Monday that if Omicron gets really bad in the US and more Congress fails to pass further fiscal stimulus, the Fed might delay their tapering plans. But the Fed seems very much focused on combatting elevated inflation now that the labour market has made good recovery. If Omicron causes further inflationary pressures, this would likely make the Fed more hawkish rather than anything else.

The EUR/SUD pair will likely trade to the downside during the next months according to analysts at CIBC. They forecast EUR/USD at 1.11 by the end of the first quarter and at 1.10 by the end of the second quarter of next year.

Key Quotes:

“Despite the moderation in bond purchases, ongoing balance sheet expansion underlines that the doves remain in the ascendancy at the ECB. The new ECB staff forecasts, reaching out to 2024 for the first time, show a materially firmer inflation profile compared to the September estimates.”

“The market is currently pricing nearly 10bp of tightening in Q4 2022, which appears mispriced and prone to correct if, as we expect, growth and inflation results in 2022 leave the ECB on hold.”

“Unless fiscal policy proves significantly more expansive than anticipated, a long period of ECB policy inertia, set against firming expectations for Fed hawkishness, underlines our bias for the EUR to remain on the defensive in 2022.”

- Turkish lira continues to tumble, down 9% on Monday.

- USD/TRY holds near recent highs, likely to trigger more inflation ahead and caos.

The Turkish lira is unable to find a pause and continues to slide. The USD/TRY reached at 17.95, a fresh record high. It is hovering around 17.85, up 9% for the day. In a week, the dollar rose almost 30%, creating a currency crisis in Turkey.

Turkey’s President Erdogan continued to support his policy during the weekend of cutting interest rates. The Turkish lira opened with declines, and it accelerated the sell-off during the last hours. USD/TRY opened the day below 16.50 and now is looking at 18.00.

The sharp devaluation of the currency will likely boost inflation and could lead even to a major macroeconomic crisis. The current administration is holding onto its speech that is adding fuel to the USD/TRY rally.

“Even a shock rate hike of 10 percentage points or so is unlikely to turn sentiment around near-term. What Turkey needs now is an IMF to help stabilize sentiment but will not happen until things get even worse. As we know all too well, a currency crisis can quickly morph into a solvency crisis as external debt becomes impossible to service”, mentioned analysts at Brown Brothers Harriman.

Domestic factors drive the moves in USD/TRY. Emerging market currencies are posting mixed results as the Turkish crisis so far remains contained.

- The GBP/USD is trading at 1.3225 at the time of writing.

- Brexit UK’s top negotiator David Frost resign unexpectedly on Saturday in the middle of negotiations.

- Political domestic issues in the US propel some USD weakness, as Democrat Senator Munching back-off supporting US President Biden’s agenda.

- GBP/USD Technical Outlook: Neutral-bearish, but a gravestone-doji in the daily chart, could propel the pound towards 1.3400.

The British pound recovers from earlier losses reclaim 1.3200 amid global concerns on the Omicron variant, and surprising resignations over negotiations with the EU, as British negotiator David Frost unexpectedly stepped down, blaming the direction of PM Boris Johnson party. Further, per the political editor at the Sun, UK Boris Johnson is not preparing to announce further Covid-19 this Monday, despite that the UK reported 82,886 new coronavirus cases.

Additionally, USD weakness prevails on the back of lower US T-bond yields, amid domestic political issues, with Democrat Senator Joe Manchin rejecting the US President Biden Build Back Better program. According to Bloomberg, the White House called the senator’s decision “sudden and inexplicable reversal.” As year-end looms, negotiations would re-start at the beginning of the following year, before the midterm elections.

In the meantime, as Wall Street opens, the US 10-year T-bond benchmark note drops one and a half basis points, sitting at 1.388%, undermining the US Dollar Index, which measures the greenback’s value against its peers, losing 0.18%, down to 96.39 at the time of writing.

The UK economic docket featured the Rightmove House Price Index for December in the European session. On a monthly basis shrank to 0.7%, more than 0.6% on the previous read, while the yearly basis stood at 6.3%, unchanged.

GBP/USD Price Forecast: Technical outlook

After dipping to 1.3174, cable trimmed some overnight losses, reclaiming the 1.3200 figure despite the coronavirus outbreak in the UK, as US Senator Manchin rejected President Biden’s agenda. That said, at press time, the GBP/USD daily chart depicts a gravestone doji, a bullish signal, that could propel the prospects of Sterling. However, a daily break above 1.3289 resistance is needed to challenge the 1.3400 figure before the year’s end.

If GBP bulls reclaim 1.3289, the next resistance would be December’s 17 daily high at 1.3339. A clear break of that level could witness a jump towards December’s 16 daily pivot high at 1.3374, followed by 1.3400.

- Spot gold is struggling to make use of risk-averse market conditions on Monday and remains subdued under $1800.

- An on-the-day rise in real yields is the main reason why gold is struggling.

Despite a broadly risk-off market tone and an underperforming US dollar, spot gold (XAU/USD) prices are struggling to make headway on Monday. Prices are currently flat on the session but have slipped back from earlier session highs in the $1805 area to current levels around $1797 in recent trade. The 50-day moving average at $1795 provided support earlier in the session, but if this level goes, XAU/USD is likely to slip back to test early/mid-December highs and the 200DMA in the $1790 area.

Gold’s lackluster performance on Monday owes itself to the fact that real yields in the US have been advancing. 10-year TIPS yields, to which gold is very sensitive, are up about 2bps on the day and back to the north of the -1.0% level. But that still leaves the 10-year TIPS yield well within recent late-November/December ranges of about -1.1% to -0.9%. 5-year TIPS yields are current up about 4bps but are also within recent week’s ranges. Whether the most recent rally in real yields can build into a broader move higher is the key question – that of course would be bad for gold. Remember that as real yields rise, the opportunity cost of holding non-yielding gold also rises.

The recent hawkish shift on the Fed has some strategists betting on a move higher in real yields. Recall last week that the Fed doubled the pace of its QE taper, which Fed member Christopher Waller said indicated that the March meeting was live for a rate hike, and recall that the bank pointed to three rate hikes in 2022. Longer-term nominal yields have remained subdued in recent weeks despite this hawkish shift amid concerns for the longer-term outlook for growth. It only takes inflation expectations to fall at a greater rate than long-term growth expectations for this to cause real yields to rise (something a hawkish Fed could trigger). Gold traders should thus be on notice that market conditions could turn increasingly bearish for the precious metal in 2022.

According to the Political Editor at The Sun, UK PM Boris Johnson is not preparing to announce any further Covid-19 restrictions this Monday. Johnson is at present hosting a meeting with his Cabinet. He is under pressure from scientific advisors to tighten restrictions with immediate effect, though there is significant political pushback against further measures from within the Cabinet and Conservative Party.

However, a journalist at the UK's Daily Mirror recent tweeted that the UK PM is considering a return to "Step Two" measures from 27 December.

Market Reaction

GBP hasn't seen much of a reaction given that there was already plenty of speculation about further restrictions swirling.

- Oil prices are lower on Monday, with WTI down over $2.50 as traders cite worries about Omicron and associated lockdowns/restrictions.

- The next notable area of support is the early December lows in the $62.00s.

Oil prices are substantially lower on the first day of the week, with front-month WTI futures currently trading lower by more than $2.50 as traders cite worries about the spread of Omicron and associated lockdowns/restrictions. During Asia Pacific trade, WTI fell below the $70.00 level and a key area of support from last week in the mid-$69.00s. The selling pressure has since continued to cascade with WTI recently dipping as low as beneath $67.00, though the US benchmark for sweet light crude oil has since stabilised slightly below $68.00.

The Netherlands announced a return to lockdown on Sunday, putting pressure on its European peers to follow suit. Local newspapers in Italy reported that new restrictions are possible there as well and there is plenty of chatter in the UK about the possibility of further restrictions as government officials refuse to rule anything out. Meanwhile, in the US, health officials are urging Americans to get booster shots, wear masks and reconsider holiday travel plans. The fear is that greater restrictions on people movement, either placed by governments or imposed by individuals on themselves out of caution, will restrict near-term crude oil demand.

Crude oil-specific newsflow hasn’t exactly been supportive either, with the US Baker Hughes weekly rig count number (released on Friday) reaching its highest since April 2020, a lead indicator of higher US output in the coming months. This seems to be contributing to concerns that oil markets will quickly revert to being in a supply surplus versus the supply deficit that supported prices so much over the last year.

From a technical standpoint, things arent very reassuring. The next notable area of support is really just the early December lows in the $62.00s, a further $5.0 or roughly 7.5% drop from current levels. There are a few lows in the $64.00-$66.00 area that could offer some support. But if the bears really want it, there isn't much to prevent a retest of monthly lows. Much will depend on Omicron/lockdown developments over the coming weeks. Politically, countries in Europe, North America and elsewhere in the developed culturally Christian world may find it difficult to lockdown ahead of Christmas on Saturday. But after Christmas day has been and gone, a broad international tightening of lockdowns may soon follow. Monday’s price action seems to reflect this elevated risk.

- AUD/USD has managed to recover from earlier session lows in the 0.7080s to back above 0.7100.

- But the pair remains lower on the day amid risk-off due to Omicron worries, which will be a key driver this week.

- Traders will be watching the release of RBA minutes on Tuesday.

AUD/USD continues to trade on the back foot on the day, with the pair currently down about 0.2%, though has managed to bounce from earlier session lows in the 0.7080s back to the north of the 0.7100 level in recent trade. The 0.7100 area has been a decent zone of support over the last few weeks and a break below it this week could open the door to a run lower towards annual lows in the 0.7000 area.

Worries about the economic impact of the fast-spreading Omicron Covid-19 variant amid news of lockdowns in Europe (the Netherlands announced a full lockdown and other countries may follow suit) has been weighing on sentiment and commodity prices are decisively lower, which is a double whammy for the risk/commodity-sensitive Aussie. The theme of Omicron and lockdowns will remain the major driver of risk appetite for the remainder of the week (and year), amid thinned liquidity conditions owing to the proximity of Christmas and New Year holiday celebrations. Subsequently, there will be a lack of key macro data releases until the new year, though traders would do well to keep an eye on Tuesday’s RBA minutes and Thursday’s US Core PCE inflation data for November.

Regarding the former, traders are on notice for further hints from the RBA that it will pivot in a hawkish direction. It seems to be a fairly consensus view now that the bank will completely axe its QE programme in February in wake of last week’s much stronger than expected Australia November labour market report. The timing of rate hike is also a key theme, with markets expecting the RBA at some point to indicate that a first post-pandemic hike might come as soon as 2022 rather than the current 2023 guidance.

Regarding this week’s Core PCE inflation data, which is the Fed’s favoured guage of inflation faced by US consumers, should confirm that inflationary pressures rose in November, as the Consumer Price Inflation report indicated the week before last. One factor weighing on AUD/USD on Friday was hawkish remarks from Fed Board of Governors member Christopher Waller, who said that the March meeting was “live” for a first rate hike.

European Central Bank governing council member Mario Centeno said on Monday that there is uncertainty about inflation that must be monitored, but played down the idea that new Covid-19 restrictions in Europe would lead to an increase in inflation. The economic and financial consequences of the Covid-19 pandemic will only manifest themselves later, he added.

His comments come after sources on Monday told Reuters that some ECB policymakers had been pushing at last week's meeting for the bank to acknowledge greater upside risks to its inflation forecast, but were shot down by ECB Cheif Economist Philip Lane.

Market Reaction

The euro has not reacted to Centeno's latest comments.

- USD/CAD is trading in the positive territory above 1.2900 on Monday.

- Crude oil prices are falling sharply amid worsening demand outlook.

- US Dollar Index consolidates Friday's losses around 96.50.

Following Friday's upsurge, the USD/CAD pair started the new week on a firm footing and came within a couple of pips of the multi-month high it set at 1.2938 last week. As of writing, the pair was up 0.25% on a daily basis at 1.2917.

Slumping oil prices hurt CAD

The sharp decline witnessed in crude oil prices seems to be weighing on the commodity-sensitive loonie on Monday. The barrel of West Texas Intermediate was last seen losing nearly 3% on the day at $68,35 as investors are pricing a worsening energy demand outlook amid the surging number of Omicron cases and tighter restrictions globally.

On the other hand, the US Dollar Index, which gained 0.7% on Friday, is consolidating its gains around 96.50, limiting USD/CAD's upside for the time being.

In the second half of the day, investors will remain focused on risk perception and crude oil prices as the North American economic docket won't be featuring and high-tier data releases.

Meanwhile, Wall Street's main indexes look to open sharply lower with S&P Futures losing more than 1% ahead of the opening bell. In case markets remain risk-averse, USD/CAD should not have a hard time holding in the positive territory.

Technical levels to watch for

Arjen van Dijkhuizen, Senior Economist at ABN AMRO, notes that Chinese banks unexpectedly cut the 1-year loan prime rate by 5bps, to 3.80%, for the first time since the initial covid-19 shock in early 2020.

Key quotes

"This will imply a marginal reduction in funding costs for Chinese corporates, as the 1-year loan prime rate functions as a benchmark for the bulk of corporate loans. The 5-year loan prime rate – a benchmark for mortgage rates – was left unchanged, at 4.65%."

"This mini cut fits within our expectation of a further piecemeal policy easing to stabilise growth. Given remaining risks from real estate and covid-19 policy/omicron, policy inaction would mean that full-year growth in 2022 would fall below Beijing’s preferred trajectory."

"We expect further targeted mini cuts of 1-year loan prime rate and some other policy interest rates in early 2022 and have pencilled in another 50bp RRR cut for next year as well. We also expect Beijing to take further measures to contain the drags from real estate."

- USD/JPY is trading in a tight range on Monday.

- Safe-haven flows dominate the financial markets at the start of the week.

- Wall Street's main indexes remain on track to open deep in the negative territory.

Despite the renewed dollar strength, the USD/JPY pair closed flat on Friday and started the new week in a calm manner. With safe-haven flows dominating the financial markets on Monday, the pair is having a tough time gaining traction as it continues to move in a tight range around 113.50.

Global equity indexes plunge

The Nikkei 225 Index lost more than 2% on Monday as investors remain increasingly concerned that the Coronavirus Omicron variant could weigh on the global economic activity by forcing strict restrictions.

On the flip side, Japan's parliament approved a $317 billion budget, which will include cash payouts for families with children, to support the economy. This development seems to be limiting the JPY's gains despite the fact that the currency's safe-haven status.

The US economic calendar won't be featuring and high-tier data releases in the remainder of the day and investors will pay close attention to the performance of US stocks. Currently, S&P 500 Futures are down 1.75% on the day, suggesting that risk-off flows will dominate the markets in the second half of the day.

In the meantime, the benchmark 10-year US Treasury bond yield is down more than 1% and additional losses in yields could cause USD/JPY to come under renewed bearish pressure in the American session.

Technical levels to watch for

"The explosive spread of the Omicron-variant of COVID is raising the risks of more severe restrictions," note Societe Generale Analysts. "These would once again depress economic activity, but much depends on how many people develop severe symptoms."

Key quotes

"Reliable evidence will take some weeks to emerge. That said, what is evident is that in the face of rampant inflation and the clear evidence that successive waves of restrictions have less and less of an impact on the economy, many central banks have finally woken up."

"The resulting pattern is increasingly looking like the most abrupt policy shift in monetary policy history - from outright easing to outright tightening in a single moment. The data calendar is thin, but not without stars such as US income and consumption data and durable goods orders - both of which are likely to be firm."

"The FOMC meeting results were in line with expectations and very much so with policy forecasts for the next few years. Ultimately, however, realized policy depends on the course of the economy. Household spending is recovering but confidence remains weak, and normalisation looks distant."

- EUR/USD trades in the positive territory early Monday.

- Major European equity indexes are suffering heavy losses.

- Investors eye Omicron headlines in the absence of high-tier data releases.

The EUR/USD pair is staging a technical recovery after falling sharply on Friday and was last seen posting small daily gains at 1.1265. Modest dollar weakness during the European trading hours seems to be helping the pair edge higher ahead of the American session.

Market mood sours on Monday

The risk-averse market environment at the start of the week is causing US Treasury bond yields to push lower and making it difficult for the greenback to preserve its strength. The US Dollar Index was last seen losing 0.12% on a daily basis at 96.55.

Meanwhile, Germany's DAX Index is losing more than 2% and the Euro Stoxx 50 Index is losing 1.7% after the opening bell on Monday as investors seek refuge amid the surging number of confirmed coronavirus cases in Europe. Following the Netherlands' decision to go into another lockdown ahead of the Christmas holiday, market participants remain concerned over the potential impact of additional restrictions on the economic activity.

In the second half of the day, the risk perception is likely to remain the primary driver of financial markets. Even if US T-bond yields continue to fall, a selloff in US stocks could help the dollar limit its losses.

Technical levels to watch for

The European Central Bank (ECB) policymakers wanted explicit acknowledgment of upside risks to inflation in the policy meeting last week but were rebuffed by Chief Economist Phillip Lane, Reuters reports, citing sources close to the debate.

Additional takeaways

"Quite a few wanted to acknowledge the upside risks but Philip (Lane) pushed back hard.”

"After a lengthy debate we appeared to agree on a 'small upside risks', but even that was nowhere to be found in the statement."

The closest ECB President Christine Lagarde came to such an acknowledgment was when she said "there is possibly an upside risk" in response to a reporter's question.

"The statement didn't quite give back the flavor of our debate."

“Several people questioned the quality of the ECB's forecasts, which have been subject to large revisions for years.”

Market reaction

EUR/USD has quickly pulled back from daily highs of 1.1274, now trading at 1.1263, up 0.22% so far.

- GBP/USD extends losses, with 1.3200 at risk amid intensifying risk-off trades.

- Uncertainties around Omicron restrictions in the UK pound the pound.

- USD fails to benefit from risk-off flows, as Treasury yields sink across the curve.

GBP/USD is trading close to 1.3200, meandering near daily lows, as the sentiment around the pound remains weighed down by the growing uncertainties surrounding the Omicron covid variant-induced restrictions in the UK.

The latest selling wave was triggered by the comments from the UK Deputy Prime Minister Dominic Raab, citing that he cannot guarantee further restrictions, as the Kingdom nears the festive period.

Meanwhile, Germany and France have already imposed border control for travelers from the UK. Britain reported 82,886 new coronavirus cases, bringing the total number of coronavirus cases in the country to 11,361,387. Out of these 82,886 cases, 12,133 were Omicron infections.

British Health Secretary Sajid Javid is expected to announce on Monday whether social mixing will be curtailed over the Christmas period.

On the latest Brexit update, UK Foreign Secretary Liz Truss is likely to take over negotiations with the EU on the Northern Ireland Protocol following the dramatic resignation of David Frost. Frost stepped down, blaming the “current direction of travel” of the PM’s party.

Looking ahead, the Omicron stats from the UK will continue to impact the GBP valuation amid a sparse calendar. Meanwhile, the risk-off flows will continue to boost the US Treasuries while weighing heavily on the yields, which will eventually cap the dollar’s bullish potential. Although, Javid’s announcement and Brexit news will play a bigger role on cable’s trades on Monday.

GBP/USD: Technical levels to consider

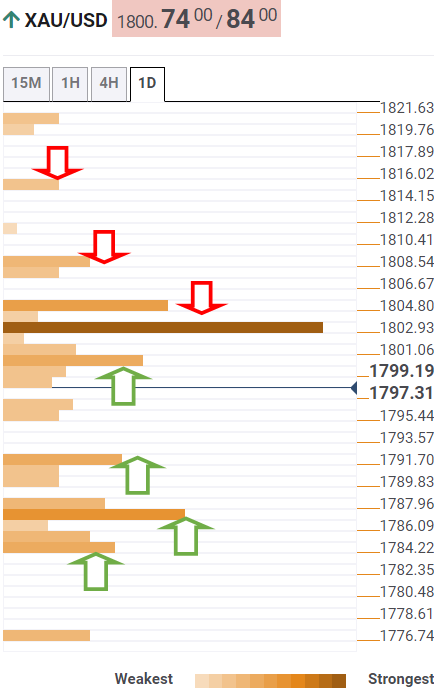

- Gold price underpinned by the risk-off mood as US’ Manchin rejects BBB.

- Treasury yields keep falling, caps the US dollar’s upside despite risk-aversion.

- Gold price set to retest key $1,815 supply zone amid risk-aversion.

Gold price is off the three-week highs but remains buoyed by the risk-off market profile. Uncertainties surrounding the Omicron covid variant sap investors’ confidence. Meanwhile, US Senator Joe Manchin left Democrats hanging with Biden Bill rejection, jeopardizing the $1.75 fiscal sending plan. Falling Treasury yields continue to undermine the US dollar, offering additional support to gold. Amid a light calendar, the broader market sentiment will continue to play a pivotal role in gold’s price action.

Read: Gold 2022 Outlook: Correlation with US T-bond yields to drive yellow metal

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the gold price seems to have found some support at $1,797, the convergence of the SMA50 one-day, SMA5 four-hour and Fibonacci 23.6% one-week.

A failure to resist above the latter will trigger a drop towards $1,791, where the Fibonacci 38.2% one-week coincides with the SMA100 one-day.

Further south, strong support awaits at $1,787, the intersection of the SMA5 one-day and Fibonacci 23.6% one-month.

The last line of defense for gold buyers is seen at $1,783. At that point, the SMA10 one-day meets with the pivot point one-day S2.

Alternatively, fresh buying opportunities will arise only on a sustained break above $1,803-$1,804 supply zone, which is the confluence of the Fibonacci 38.2% one-month, Fibonacci 38.2% one-day and previous high four-hour.

The Fibonacci 61.8 one-day at $1,807 will offer powerful resistance on the upside. The previous day’s high of $1,814 will be next on the buyers’ radars.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

UK Deputy Prime Minister Dominic Raab said on Monday that he cannot guarantee further restrictions.

Health Secretary Sajid Javid is expected to announce whether social mixing will be curtailed over the Christmas period.

Javid said, “We are assessing the situation; it’s very fast-moving.”

Meanwhile, Politico tweeted out, earlier on, “Boris Johnson is stuck between his scientific advisers and an increasingly disaffected Conservative Party over the seismic decision of whether to bring in new COVID measures over the Christmas Period.”

In an interview with Expansion, European Central Bank (ECB) Governing Council member and Spanish central bank chief Pablo Hernandez de Cos said that rate hikes are unlikely in 2022.

Additional quotes

"There are no conditions to raise rates in 2022."

“Support the decision to end the pandemic stimuli.”

“Ensure that monetary policy will continue to be expansionary.”