- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-12-2021

- EUR/USD stays below a confluence of 200-EMA, monthly triangle’s resistance line.

- Downbeat Momentum line hints at a pullback, 100-EMA restricts immediate declines.

EUR/USD holds onto the monthly trading range, around the upper end of a symmetrical triangle during Friday’s quiet Asian session. That said, the quote eases to 1.1323 by the press time.

In doing so, the major currency pair steps back from 200-EMA and the stated monthly triangle’s resistance line, while also justifying the pullback in the Momentum line.

However, the 100-EMA level of 1.1300 is likely to challenge the immediate downside, if not then a subsequent fall towards 1.1270 becomes imminent.

Following that, the stated triangle’s support line and the yearly low, respectively around 1.1235 and 1.1185, will be in focus.

Alternatively, an upside clearance of 1.1350 will aim for late November’s peak around 1.1385.

In a case where the EUR/USD prices remain firmer past 1.1385, November 15 top of 1.1465 and early November’s low near 1.1515 should return to the chart.

EUR/USD: Four-hour chart

Trend: Sideways

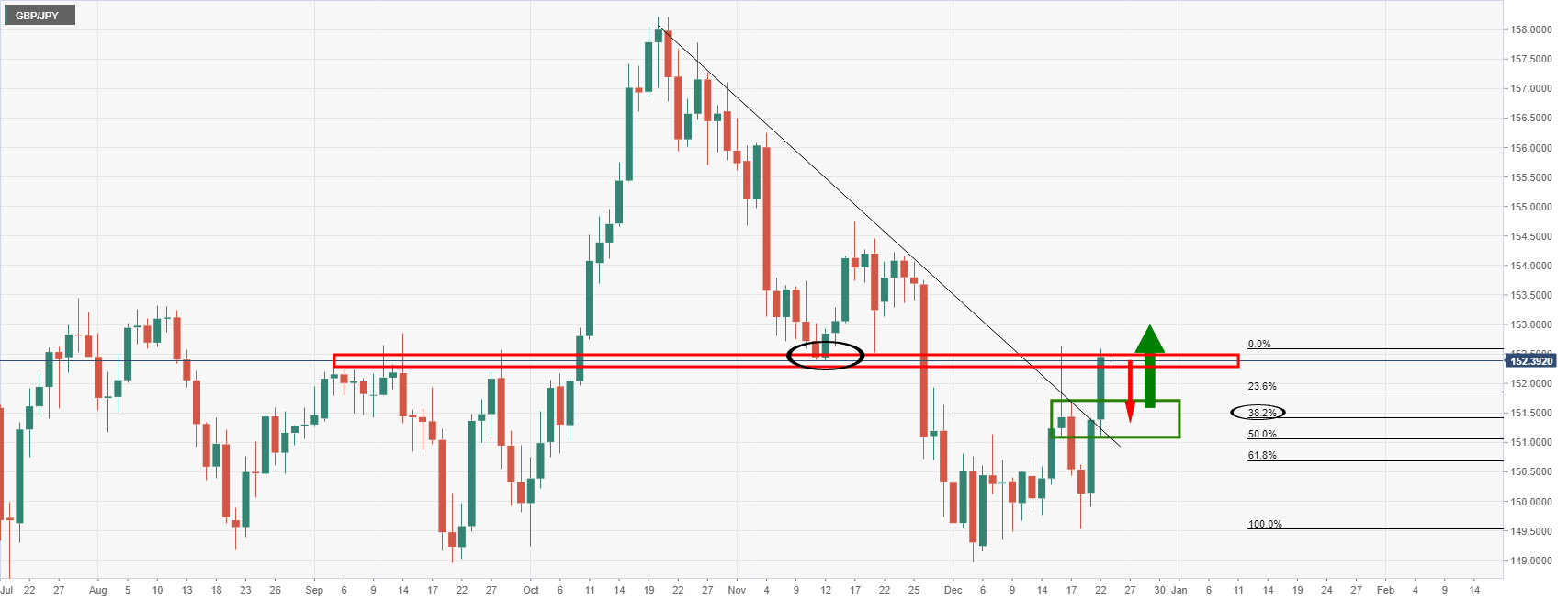

- The GBP/JPY continued its rally in the week, up some 2.54%.

- The market sentiment is upbeat, increasing demand in the FX market for risk-sensitive currencies like the British pound.

- GBP/JPY Price Forecast: Bullish biased, though it would need GBP bulls to hold the spot above the 200-DMA.

As the Asian session begins, the GBP/JPY rises some 0.66%, trading at 153.42 during the day at the time of writing. The market sentiment is upbeat, triggering demand for risk-sensitive currencies. Covid-19 news from the UK Health Secretary saying that people infected with the newly discovered Omicron strain were 50% to 70% less likely to require hospitalization, improved the market mood. Additionally, the US Food and Drug Administration (FDA) approved Pfizer and Merck Covid-19 treatment pills, which could be used in high-risk patients.

That increased market participants’ demand for riskier assets. In the FX market, appetite for AUD, NZD, GBP, and CAD, increased, as all are part of risk-sensitive currencies. The laggards of the session are the safe-haven and low-yielders like the USD, the CHF, and the JPY.

In the last three days, the British pound has appreciated some 2.45% against the Japanese yen, breaking on its upward move, crucial resistance levels, like the 200, the 100 and the 50-day moving averages (DMAs), which were previous resistance levels, now turned support, once the spot price is above them.

GBP/JPY Price Forecast: Technical outlook

Now that the GBP/JPY is trading above the 200-DMA, the pair is bullish biased, though downside risks remain. Nevertheless, the break of a downslope trendline on December 21, around the 150.00 area, gave GBP bulls enough strength to challenge the DMA’s above the spot price.

To the upside, the first resistance would be the psychological 154.00 level. A decisive break of that level would send the GBP/JPY pair upwards, with the November 17 swing high at 154.75, followed by the November 4 daily high at 156.25.

On the flip side, the GBP/JPY first support would be the psychological 153.00. The breach of the latter would expose crucial support levels like the December 16 daily high, previous resistance-turned-support at 152.63, followed by the December 22 daily low at 151.10.

-637758980834653758.png)

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, reprinted the 2.47% figure on Thursday, as per the official source.

In doing so, the inflation gauge seems to run out of steam to extend the last week’s rebound from a two-month low, taking rounds to the highest level since December 09.

It’s worth noting that the latest US data concerning the PCE Personal Consumption and Durable Goods Orders favored the last hawkish comments from the Fed policymaker, namely Christopher Waller.

Read: Forex Today: Risk appetite undermines demand for the greenback

That said, the latest pick-up in the inflation expectations and firmer US data may help the US Treasury yields to stay firmer, which in turn could challenge riskier assets like AUD/USD. However, holiday mood and thin volume could restrict the market moves.

Read: AUD/USD: Bulls battle monthly resistance around 0.7250 amid upbeat sentiment

- Silver buyers seem running out of steam inside a bearish chart pattern.

- Nearly overbought RSI also teases sellers for entry.

- 100-SMA, 23.6% Fibonacci retracement level becomes short-term key support, 200-SMA adds to the upside filters.

Silver (XAG/USD) prices grind higher around $22.90, near the monthly top, during Friday’s Asian session.

In doing so, the bright metal funnels down to the breaking point of a two-week-old ascending triangle bearish chart pattern.

Other than the failures to stay firmer and bearish formation, nearly overbought RSI conditions also signal the silver seller’s arrival. However, a clear downside break of $22.78 becomes necessary for that.

Even so, a convergence of the 100-SMA and 23.6% Fibonacci retracement (Fibo.) level near $22.35 and $22.00 threshold can test the XAG/USD bears before directing them to the monthly low around $21.40.

Meanwhile, the 38.2% Fibo. and the upper line of the stated triangle, near $22.95, restricts short-term advances of the metal.

Also acting as an upside filter is the $23.00 threshold and 200-SMA level of $23.30.

Silver: Four-hour chart

Trend: Pullback expected

Australia finally matched market expectations of shortening the gap between two vaccine doses and a booster, after staying silent over the move in Wednesday’s cabinet meeting.

Australia Health Minister Greg Hunt took the honor to announce the same on early Friday morning in the Asia-Pacific zone. It’s worth noting that the previous gap between the two shots of covid vaccines and booster dose was five months. ABC News first shared the comments as follows.

Key quotes

On the basis of advice of the Australian Technical Advisory Group on Immunisation (ATAGI), it's no surprise we will be bringing forward the eligibility for the booster dose to four months as of 4 January.

The planning behind that is that will open up a new cohort.

Currently that means that we will go from about 3.2 million people who are eligible today to approximately 7.5 million who will be eligible as 4 January. That means that the cohort has expanded.

It will be expanded again on the 31st of January to three months and that will take it out to 16 million Australians who will be eligible at that point in time.

192,000 booster doses were administered yesterday.

FX reaction

Despite the upbeat news, AUD/USD keeps taking round to the monthly ascending resistance line, near December’s high of 0.7253, amid a quiet session.

Read: AUD/USD: Bulls battle monthly resistance around 0.7250 amid upbeat sentiment

- AUD/USD seesaws near the highest level in December, bulls seem to have run out of steam.

- Market’s mood remains brighter as Omicron linked updates are positive.

- Strong US data favored yields but stocks stayed firmer.

- No major data, holiday season to restrict momentum.

AUD/USD prices have likely switched to the Christmas mood in advance, after refreshing the monthly high with 0.7253. That said, the Aussie pair seesaws around an upward sloping trend line from November 30 while taking rounds to 0.7250 during early Friday morning in Asia.

Positive updates concerning the milder fears from the South African covid variant, dubbed as Omicron, join upbeat signs of medical cure to the stated virus variant to favor the risk appetite. Adding to the firmer sentiment are the hopes of US stimulus, despite short-term bleak at the White House.

After approving Pfizer’s pill to battle the Omicron on Wednesday, the US Food and Drug Administration (FDA) also approved Merck's Covid-19 pill on Thursday. Earlier in the week, US Military also conveyed news of developing a single cure for covid and all variants. Also on the positive side were the studies showing Omicron has lesser scope hospitalization.

It should be noted, however, that French cancellation of orders for Merck’s pill, citing notably lesser effect than promoted, joins a steady rise in Omicron cases to challenge the market optimism.

On a different page, US President Joe Biden and House Speaker Nancy Pelosi remain hopeful of getting the Build Back Better (BBB) plan through the House even as Senator Joe Manchin opposes the bill. As per the latest news from CNN, “Sen. Joe Manchin effectively put an end to negotiations over the current version of the Build Back Better Act, in part over concerns that some provisions might exacerbate inflation. But many economists believe its effect on inflation would be marginal.”

Macroeconomics had little success in directing short-term AUD/USD moves. That said, firmer prints of US Durable Goods Orders and PCE Price Index for November couldn’t reverse the previous run-up of equities and riskier assets despite fuelling the US Treasury yields to a two-week high of 1.50% after the release. At home, Private Sector Credit grew more-than-prior in November.

Looking forward, an early close in Aussie markets and an off in the US, coupled with the light calendar and holiday mood, may restrict the AUD/USD pair’s moves. However, any surprises over Omicron covid variant or US stimulus, not to forget those from China, still can move the pair.

Technical analysis

Although a clear upside break of 20-DMA and bullish MACD signals favor AUD/USD bulls, an upward sloping trend line from November 30, around 0.7250, challenges the immediate advances.

Alternatively, pullback moves may initially aim for the 0.7200 round figure before challenging September’s low near 0.7170.

- The AUD/JPY appreciates during the day, on the back of an improvement in risk appetite.

- Covid-19: Positive news on the Omicron-related front, easied investors worries of a possible lockdown which could spur an economic slowdown.

- AUD/JPY Price Forecast: AUD bulls will need to hold the spot above the 200-DMA so that they can challenge 83.00.

On Thursday, the Australian dollar rallies for the third consecutive day, trading at 82.87 as Wall Street heads for a large weekend at the time of writing. Positive news in the Covid-19 front spurred demand for risk-sensitive currencies, like the AUD. In the UK, the Health Secretary reported that people infected with the Omicron variant were 50% to 70% less susceptible to requiring hospitalization. Additionally, in the last couple of days, the US Food and Drug Administration (FDA) approved Pfizer and Merck Covid-19 treatment pills, which could be used in high-risk patients, with the effectivity of 89% and 50%, each.

In the FX market, spurred demand for AUD, NZD, GBP, and CAD, all part of risk-linked currencies. The laggards of the session are the safe-haven and low-yielders like the USD, the CHF, and the JPY.

In the meantime, in the last three days, the AUD/JPY has enjoyed a 280-pip rally since Tuesday of this week. Of note, Thursday’s price action, punch-through the 200-daily moving average (DMA) lying at 82.65, though the upward move stalled at the 50-DMA at 82.93.

AUD/JPY Price Forecast: Technical outlook

That said, the AUD/JPY has an upward bias, though it would need that AUD bulls hold the spot above the 200-DMA. Nevertheless, in that event, the AUD/JPY would face crucial resistance levels to overcome, like the 61.8% Fibonacci retracement at 83.27. A breach of the latter would expose the November 16 swing high at 84.16, followed by the 78.6% Fibonacci retracement at 84.50.

On the flip side, the first support would be the 200-DMA at 82.65. A decisive break under that level would expose the 50% Fibonacci retracement at 82.42, followed by the 100-DMA at 81.80.

-637758940601080403.png)

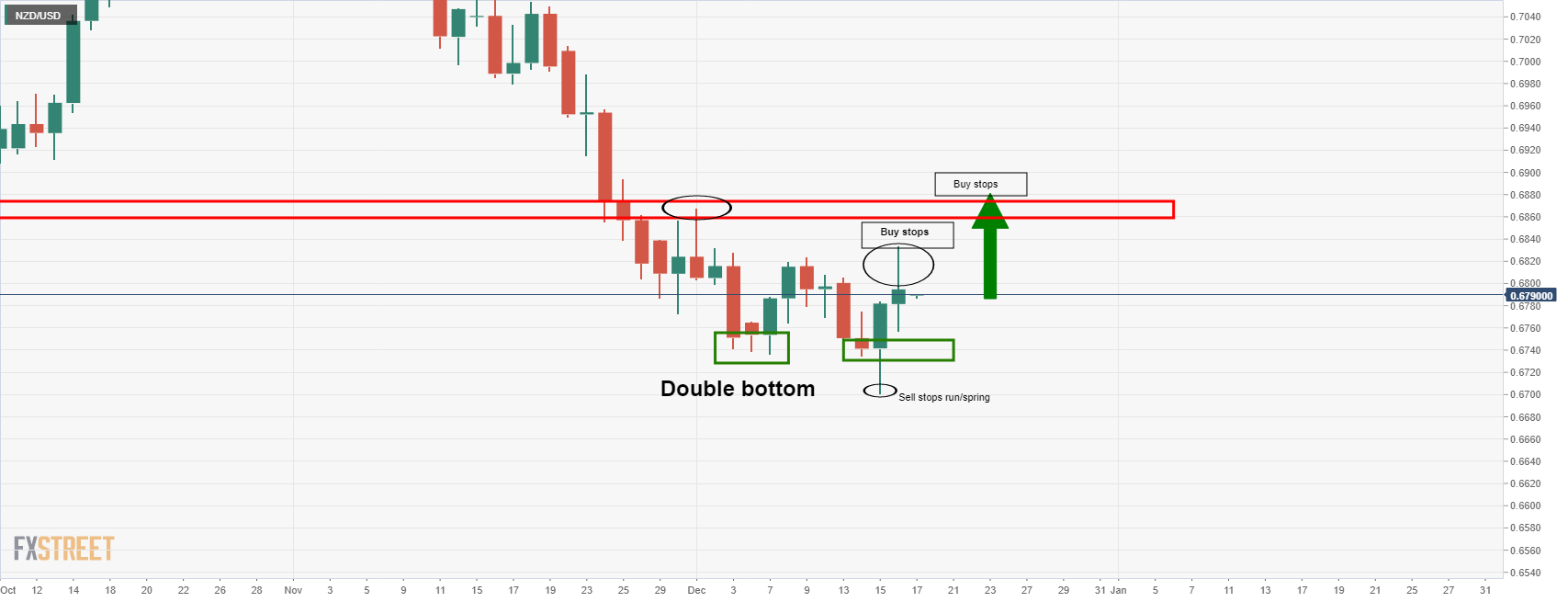

- NZD/USD bulls stepping in to take on daily resistance.

- Risk-on sentiment prevailed into the closing bell on Wall Street.

NZD/USD is holding in positive territory on Thursday with the bulls in charge in the main as we move over to the early Asian session in holiday thin markets. At the time of writing, NZD/USD is trading at 0.6828 and up 0.32% on the day following a rally from 0.6795 and reaching a high of 0.6842.

Risk sentiment has been on solid footing in the remaining days before Christmas, sending the greenback lower and away from the 97 figure, (as per DXY index), territory that was last seen mid-December when the index reached 96.90. The DXY is an index that measures the US dollar vs 6 major currencies. The kiwi is not one of them, but it tends to track the Aussie which has been performing well this week so far.

The US dollar, as measured by the DXY index, is losing ground as the day progresses into late trade in North America. The index made a low of 95.99 from a high of 96.277 within the sideways channel/daily wedge formation:

DXY daily chart

The recent covid-variant news has lifted investors' spirits where otherwise, markets have been worried by a combination of virus fears, tighter policy, and a bleak outlook for US fiscal stimulus.

Santa Claus rally plays out

US stocks, fuelled by more drug makers announcing that their COVID-19 preventives retained protection against the omicron variant, were closing all-time closing highs in the S&P 500.

The S&P rose 0.6% to 4,725.78, up 2.3% in the holiday-shortened week marking three straight daily gains reversing losses in three prior sessions. The Nasdaq Composite advanced 0.9% to 15,653.37 and the Dow Jones Industrial Average gained 0.6% to 35,950.63, but those indices remained below record highs set in November.

Meanwhile, the 10-year US Treasury yield rose to 1.50% on the last full day of trade in the bonds and stocks before Xmas Eve, (the bond market was to close at 2 pm ET ahead of a market holiday Friday, while the stock market was slated to remain open until 4 as usual but it seems it will be closed in observation of Xmas day that falls on a Saturday).

NZD/USD technical analysis

As per the prior analysis above, the daily chart is taking the shape of a Wycoff consolidation. It is yets t be seen if this is accumulation or redistribution, but we have seen further manipulation of the lows as follows:

This was followed by three higher closing candles which indicate that there are strong hands on the buy-side and there are expectations of a breakout:

- EUR/JPY printed fresh monthly highs above 129.70 on Thursday, supported by further improvements in broader risk appetite.

- FX market trade is likely to be subdued/low volume over the coming weeks amid year-end holidays.

EUR/JPY hit fresh monthly highs on Thursday, eclipsing the previous highs hit back on 16 December at 129.64 to momentarily trade above 129.70. The 129.60-70 area has been a significant area of resistance going all the way back to 23 November and if EUR/JPY can’t break above it on Thursday, further gains may have to wait until 2022. That’s because FX market trade on Friday will be very quiet/low volume given that it is Christmas Eve and liquidity conditions will be marred next week as well given the proximity to year-end celebrations.

If the 129.60-70 zone was convincingly broken to the upside, that would bring into focus the psychologically important 130.00 level, which happens to also coincide with EUR/JPY’s 50-day moving average. In the context of the more than 200 pip (or roughly 1.7%) rally from weekly lows at 127.50, another 30-40 pips doesn’t seem like too much of an ask, especially amid the backdrop of significantly improved risk appetite as the Omicron newsflow turned more positive.

After last week’s flurry of central bank activity, central bank policy divergence has taken a back seat as an FX market driver this week. But it is notable that a growing throng of ECB policymakers are calling for greater recognition of upside risks to the bank’s inflation forecasts. In 2022, EUR/JPY traders should recognise the upside risks that a hawkish ECB pivot (perhaps towards rate hikes in as little as 12 months and a sooner than anticipated end to QE) presents to EUR/JPY. Japan, by comparison, is not dealing with anything like the levels of inflation being witnessed in the Eurozone and no one expects the BoJ to alter its ultra-dovish monetary stance any time soon.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 (GMT) | Japan | Construction Orders, y/y | November | 2.1% | |

| 05:00 (GMT) | Japan | Housing Starts, y/y | November | 10.4% | 7.1% |

- EUR/CHF has been trading subdued on Thursday, at one point dipping under 1.0400, but subsequently recovering back above the big figure.

- Over the next few sessions, EUR/CHF will likely stick well within recent 1.0370-1.0470ish ranges amid the end of year holiday lull.

Having found resistance at its 21-day moving average at 1.0422 earlier in the session, EUR/CHF dipped back briefly under the 1.0400 level but in more recent trade, has recovered to just above the big figure. Market participants suspect the SNB has become more active in propping up the pair in recent weeks amid a pick-up in Swiss sight deposits over the last two weeks. That likely rules out any move under recent monthly lows in the 1.0370 area for the time being.

Recent selling pressure is somewhat surprising in light of the drastic improvement in the market’s appetite for risk over the course of the week. Positive updates from the scientific community that Omicron, as hoped, is significantly less likely to cause severe disease versus the delta variant, reducing the pressure on European governments to lockdown as aggressively, has been the main driver of the improvement in risk appetite. But on the week, EUR/CHF is only up about 0.2%.

Still, in light of the eleven weeks straight of negative returns seen between September and the end of November, that saw the pair drop from above 1.0900 to near current levels in around 1.0400, the EUR/CHF bulls should likely be thankful that the selling pressure in December has abated. Over the next couple of sessions, subdued trade that keeps EUR/CHF well within recent 1.0370-1.0470ish ranges is likely to continue amid the end of year holiday lull.

When 2022 kicks off and markets return to normal trading conditions, the big question for EUR/CHF will be whether improvements in global risk appetite as Omicron fears ease and the ECB’s comparatively hawkish stance versus the SNB will be enough to trigger a sustained rebound in the pair. Alternatively, inflation differentials between the Eurozone and Switzerland that continue to erode the purchasing power of the euro faster than the Swiss franc may continue to put downwards pressure on the pair.

- The DXY slides some 0.07% but stays above the 96.00 figure as the New York session winds down.

- Omicron-related positive news improved market mood weakened the greenback.

- US Dollar Index (DXY) Price Forecast: Upward bias, though testing the bottom-trendline of the ascending triangle.

The US Dollar Index (DXY), which measures the greenback’s performance against a basket of six peers, edges lower sone 0.07%, sitting at 96.02 during the New York session at the time of writing. Improvement in the market sentiment, spurred by positive news on the Covid-19 Omicron-related front, increased the appetite for riskier assets to the detriment of the US dollar safe-haven status.

In the last couple of days, the US Food and Drug Administration (FDA) approved Pfizer and Merck Covid-19 treatment pills, which would help the health system treat the disease on high-risk patients at home. Furthermore, a study in South Africa showed that people infected with the Omicron variant would be 80% less susceptible to requiring hospitalization. In the UK, the Health Security Agency reported that 50-70% of people testing positive for the Omicron strain would not need to be hospitalized.

That said, with two countries spreading positive news about the newly predominant Omicron variant, investors worries about possible economic slowdown ease.

In the meantime, the US T-bond 10-year benchmark note raises some three and a half basis points, sitting at 1.494%, closing to the 1.50% threshold.

The US macroeconomic docket featured a large bulk of data. The Fed’s favorite gauge of inflation the Core Personal Consumer Expenditure (PCE), increased some 4.7%, higher than the 4.5% expected, justifying the US central bank’s faster bond-taper decision revealed on its last meeting. In the labor market, Initial Jobless Claims for the week ending on December 17 rose to 205K in line with expectations.

Additionally, consumer confidence increased, with the UoM Consumer Sentiment Index for December at 70.6, higher than the 70.4 foreseen. At the same time, Durable Good Orders for November rose by 2.5%, higher than the 1.6% estimated.

US Dollar Index (DXY) Price Forecast: Technical outlook

The US Dollar Index daily chart depicts the strong dollar narrative keeps in place. The DXY broke below the central Pitchfork’s uptrend channel, which confluences with the ascending triangle on an uptrend.

At the time of writing, the DXY is testing the bottom-trendline of the ascending triangle on an uptrend, threatening to break to the downside, which would invalidate the triangle formation sending the DX tumbling towards November 30, 95.55.

To the upside, the first resistance would be the figure at 97.00. A breach of the latter would expose the June 30 high at 97.80, followed by the ascending triangle target at 98.00.

-637758880559643826.png)

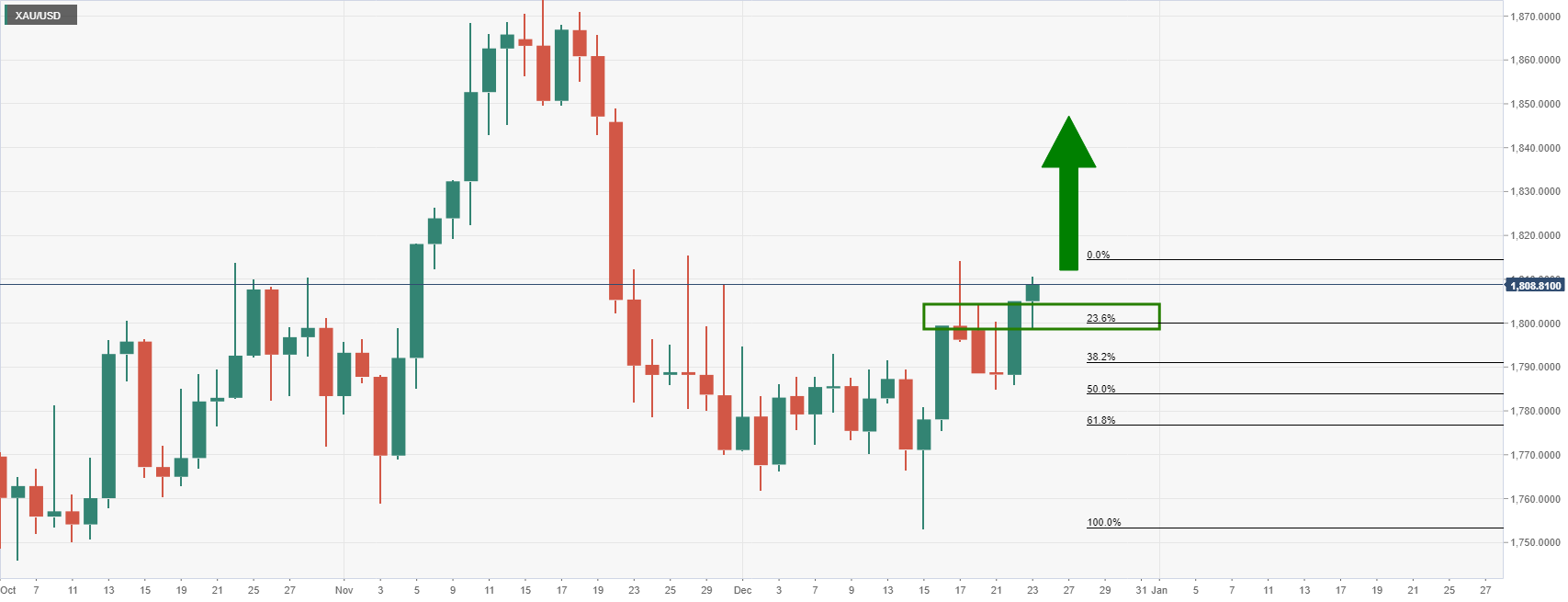

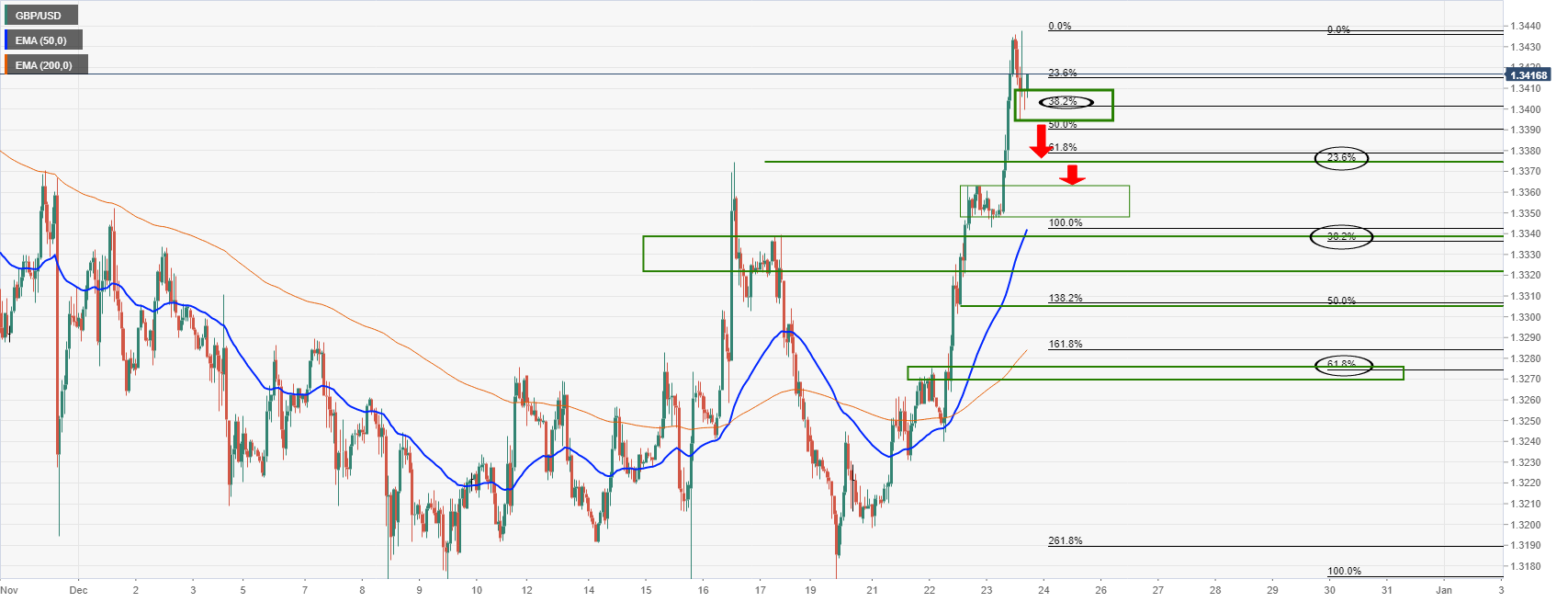

- Gold is holding in positive territory above $1,800 as the USD slides into the red.

- Wall Street positive Xmas vibes are fuelled by data and the risks of covid variants abating.

- The bulls are embarking on an upside extension with $1,830/50 eyed.

Risk sentiment is firm and the US dollar is on the backfoot, giving the yellow metal room to breath above water following the prior day's rally. Investors are betting that the latest COVID variants will not disrupt global development and this has given the bulls on Wall Street the shot in the arm they needed at this time of year.

In turn, this has promoted a bid in gold despite regulators' concerns about the spread of the new variant, Omicron. At the time of writing, gold is trading at $1,809 and is higher by some 0.35% on the day so far after travelling from a low of $1,798.91 to a high of $1,810.74.

Santa Claus rally underway

Looking around elsewhere on Wall Street, US stocks are on pace to close at new record highs, fuelled by more drug makers announcing that their COVID-19 preventives retained protection against the omicron variant. The S&P 500 rose 0.85% to 4737 the highs printed in the last hour of trade. The Nasdaq Composite advanced 0.97% to 16,343, and the Dow Jones Industrial Average gained 0.78% to print a high of 36,051 with still time to go until the close.

Meanwhile, the 10-year US Treasury yield rose to 2.47% on the last full day of trade in the bonds and stocks before Xmas Eve, (the bond market was to close at 2 pm ET ahead of a market holiday Friday, while the stock market was slated to remain open until 4 as usual but it seems it will be closed in observation of Xmas day that falls on a Saturday).

The US dollar, as measured by the DXY index is losing ground as the day progresses into late trade in North America. The index is now down some 0.11% and has moved from a flat position that was otherwise maintained in earlier trade. DXY is currently trading at 96.017 and has breached the figure to score a low of 95.99 from a high of 96.277 within the sideways channel/daily wedge formation:

DXY daily chart

The recent covid-variant news is a breath of fresh air for investors that have otherwise been concerned by a combination of virus fears, tighter policy, and a bleak outlook for US fiscal stimulus.

However, analysts at TD securities warn that ''the yellow metal could begin to lose steam so long as Fed expectations remain as status quo. In this sense, omicron fears and their potential impact on the economy will be a key focus in the near-term, and we would likely need to see economic weakness generate doubts that the Fed will be able to deliver on their hawkish stance for the yellow metal to maintain the recent momentum.''

''Indeed, prices will need to hold north of the $1,800/oz to prevent a hasty liquidation of a portion of the recently acquired length,'' analysts at TDS said.

US data fuelling positive Xmas vibes

Additionally, US data has shown that personal income and spending rose, with Consumer Sentiment improving and Jobless Claims keeping near recent lows.

The US Initial Jobless Claims totalled 205,000 during the week ended Dec. 18, in line with market expectations. Personal Consumption Expenditure Inflation rose 0.6% on a monthly basis in November and 5.7% annually, in line with market forecasts. However, excluding volatile food and energy costs, the measure was up 4.7% year-over-year, the most since 1989 which have helped to keep yield elevated and the US dollar supported.

Meanwhile, personal income rose 0.4% in November versus market expectations for a gain of 0.5%, while spending grew 0.6% in line with estimates. Lastly, the University of Michigan consumer sentiment index was revised up slightly Thursday to a reading of 70.6 for December from the 70.4 preliminary estimates.

Gold technical analysis

Following the correction to $1,785. The bulls are embarking on an upside extension with $1,830/50 eyed.

What you need to know on Friday, December 24:

The dollar edged lower amid a positive market’s mood with all global indexes posting daily gains. The exception was USD/JPY, as the pair edged higher and settled at 114.45, nearing its yearly high.

US Treasury yields advanced, with the 10-year note currently hovering near its daily high of 1.501%. The advance followed US inflation-related figures, as the core PCE Price Index jumped to 4.7% in November from 4.2% previously and above the 4.5% expected.

Other US macroeconomic figures were also encouraging, as November Durable Goods Orders, which rose 2.5%, beating expectations. Initial Jobless Claims for the week ended December 17 printed at 205K as expected. Also, the December Michigan Consumer Sentiment Index was upwardly revised to 70.6 from 70.4.

In the COVID-19 front, news indicated that the US Food and Drug Administration authorized a second medication, a Merck drug named Molnupiravir, to treat covid at home after clearing the Pfizer poll on Wednesday. However, Merck’s pill is less effective and carries more risks than the Pfizer one. The mood was underpinned by a research conducted in South Africa, which found that it is a milder strain than Delta.

The EUR is among the dollar’s weakest rivals, confined to familiar levels. The pair currently trades around 1.1330, after briefly piercing the 1.1300 level. The GBP/USD pair peaked at 1.3437, a fresh December high, retaining the 1.3400 level at the end of the day. The Pound kept rallying on the back of upbeat UK growth figures released on Wednesday.

Higher stocks backed underpinned commodity-linked currencies. AUD/USD hit 0.7250, while USD/CAD ell to 1.2797, both holding nearby at the end of the day.

Japan will operate normally, although other Asian markets are due to early closes. Most American and European markets will remain closed on Friday amid the Christmas Holiday.

Volatility is expected to remain subdued in the next few days, with chances of sudden short-lived movements in between.

Gold trades near an intraday high of $1,810 a troy ounce, poised to extend gains once beyond the 1,815 resistance. Crude oil prices maintained their positive tone, with WTI posting a modest advance and settling at $73.75 a barrel.

Cardano hidden reversal gives ADA longs early buy opportunity before $2

Like this article? Help us with some feedback by answering this survey:

- WTI hit fresh monthly highs at $73.78 on Thursday, eclipsing the prior monthly highs at $73.30.

- Optimism that the hit to demand from Omicron won’t be as bad as initially feared continues to support prices.

Oil prices hit fresh monthly highs on Thursday, with front-month WTI futures rallying above prior monthly highs at $73.30 to reach $73.78, before backing off slightly to the $73.50 area. At current levels, WTI is up slightly more than 50 cents on the session putting it one course for a third consecutive positive close. If WTI does close out Thursday trade around $73.50, that would mean it has rallied a staggering $7.30 from earlier weekly lows just above $66.00.

As has been well documented at this point, the rally over the past three sessions has been spurred by positive Omicron/pandemic developments, including studies showing the new variant to be less severe and the US FDA approving highly effective Covid-19 treatment pills. The former development, coupled with a slowdown in the acceleration of the transmission rate in parts of Europe including the UK, has taken the pressure off of authorities to implement tougher economic restrictions.

Crude oil-specific factors have also helped; US inventories were revealed to have seen much larger than expected stock drawdowns last week. In other crude oil news that got less attention, the weekly US Baker Hughes rig count was released one day earlier than usual given tomorrow is a US market holiday. Oil and gas rigs rose to their highest level since April 2020 last week, a leading indicator of increased US output in the coming months.

- The white metal extends its rally to three consecutive days, up 3.33% in the week.

- Good news on the Covid-19 Omicron variant narrative, increased demand for riskier assets.

- XAG/USD Price Forecast: In the near term, XAG/USD is upward, but it will need to break above $23,00 to open the door for further gains.

Silver (XAG/USD) has continued rallying in the last three days, climbing some 0.31%, trading at $22.89 during the New York session at the time of writing. A risk-on market mood prevails in the financial markets, as positive Covid-19 related news has crossed the wires in the last couple of days.

Summarizing the aforementioned, South Africa reported in a study that people infected with the Covid-19 Omicron strain are 80% less susceptible to being hospitalized. Furthermore, the US Food and Drug Administration (FDA) approved Pfizer and Merck Covid-19 treatment pills, which would help the health system treat the disease on high-risk patients at home. That said, market participants, scramble towards riskier assets as the Santa Rally continues.

In the meantime, the US T-bond 10-year benchmark note raises some three and a half basis points, sitting at 1.494%, closing to the 1.50% threshold, though failing to underpin the greenback, as the non-yielding metal appreciates some 0.57%, versus the buck.

The US macroeconomic docket featured a large bulk of data before Christmas. Durable Good Orders for November rose by 2.5%, higher than the 1.6% estimated. The Fed’s favorite gauge of inflation, the Core Personal Consumer Expenditure (PCE), increased some 4.7%, higher than the 4.5% expected, sounding the bells on the Fed and justifying the increase of QE’s speed reduction.

At the same time, Initial Jobless Claims for the week ending on December 17 rose to 205K in line with expectations, showing some consolidation in the labor market. Furthermore, at press time, the University of Michigan revealed its Consumer Sentiment Index for December, which came at 70.6 higher than the 70.4 estimated.

XAG/USD Price Forecast: Technical outlook

Silver (XAG/USD) daily chart shows that the white metal has a downward bias, confirmed by the daily moving averages (DMAs) located well above the spot price. Nevertheless, the short-term price action, after reaching a YTD low around the $21.50s, XAG/USD is closing to the $23.00 figure, as the Relative Strength Index (RSI) broke above the 50-midline, triggering a bullish signal.

To the upside, XAG/USD resistance levels would be the psychological $23.00 figure. A decisive break of that level would expose the 100 and the 50-DMAs at $23.39 and $23.50, respectively.

On the flip side, silver first support would be December’s 22 daily low at $22.40, followed by the December 21 cycle low at 22.18, and the $22.00 figure.

-637758828720451408.png)

- USD/CAD falls to fresh daily lows on the positive sentiment in markets.

- The covid-19 variants are now hoped to be less severe than first anticipated.

The commodity complex is bid on the day and oil prices are higher which is a supporting factor for the Canadian dollar. At the time of writing, USD/CAD is down some 0.2% and hovers around 1.128 the figure. The pair fell to a low of 1.2797 from a high of 1.2853 on the day for far.

Risk sentiment is solid as investors are betting that the latest COVID type will not disrupt global development. This in turn has promoted a bid in oil despite regulators' concerns about its spread. In recent news, a trio of studies suggested that Omicron may be less likely to land people in the hospital than Delta. Additionally, antiviral medicines and booster shots are becoming more widely available.

All in all, this is a positive backdrop for the markets and the Santa Claus rally is starting to take shape on Wall Street. It is a breath of fresh air for investors that have otherwise been concerned by a combination of virus fears, tighter policy, and a bleak outlook for US fiscal stimulus.

Consequently, US stocks are on pace to close at new record highs, fuelled more drug makers announcing that their COVID-19 preventives retained protection against the omicron variant. Additionally, US data has shown that personal income and spending rose, with Consumer Sentiment improving and Jobless Claims keeping near recent lows.

The S&P 500 rose 0.7% to 4733 the highs. The Nasdaq Composite advanced 0.9% to 16,339, and the Dow Jones Industrial Average gained 0.65% to print a high of 36,006 with still time to go until the close and last full day of trade in the bonds before Xmas Eve, (the bond market was to close at 2 pm ET ahead of a market holiday Friday, while the stock market was slated to remain open until 4 as usual).

Meanwhile, the 10-year US Treasury yield rose to 2.47%. DXY is around flat on the day but remains under pressure within the sideways channel/daily wedge formation:

DXY daily chart

In news on Thursday, AstraZeneca (ANZ) said its Evusheld preventive antibody retained its neutralizing activity against the omicron variant in clinical trials conducted by Oxford University in the UK and the University of Washington in the US.

US data keeps the bid going on wall Street

As for the data, the US Initial Jobless Claims totalled 205,000 during the week ended Dec. 18, in line with market expectations. Personal Consumption Expenditure Inflation rose 0.6% on a monthly basis in November and 5.7% annually, in line with market forecasts. However, excluding volatile food and energy costs, the measure was up 4.7% year-over-year, the most since 1989 which have helped to keep yield elevated and the US dollar supported.

Meanwhile, personal income rose 0.4% in November versus market expectations for a gain of 0.5%, while spending grew 0.6% in line with estimates. Lastly, the University of Michigan consumer sentiment index was revised up slightly Thursday to a reading of 70.6 for December from the 70.4 preliminary estimates.

- GBP/JPY recovered back to its pre-Omicron levels on Thursday, surging from around 152.50.

- That marks a more than 2.5% recovery from earlier weekly lows under 150.00.

GBP/JPY impressive turnaround from earlier weekly lows under the psychologically important 150.00 level kicked up a gear on Thursday, with the pair bursting above the key 152.50 balance area early during European trade to advance as high as the 153.50 area. On the day, that translates into gains of about 0.8%, meaning the pair is now up roughly 2.0% on the week and more than 2.5% versus Monday’s lows.

The pickup in volatility is surprising from a seasonal standpoint – typically in the last few weeks of December, volumes and volatility are lower than usual due to the Christmas and New Year’s holidays in Europe, the Americans and elsewhere. But given the backdrop of the Omicron wave currently engulfing the world, the volatility is not so surprising. From that perspective, Thursday’s move high is significant in that it saw GBP/JPY recover back to its pre-Omicron levels (in the mid-153.00s). The stunning recovery of the past three sessions is a reflection of positive Omicron developments including 1) numerous studies showing it to be significantly milder than the delta variant and 2) momentum swinging against the imposition of lockdown measures in the UK.

The fact that (at the moment) it looks unlikely that the UK government will implement tougher restrictions in England reduces economic uncertainty and perhaps allows markets to become a little more confident that the BoE will deliver further successive rate hikes in 2022. In other words, now that Omicron uncertainty in the UK is lessening, it seems as though GBP is finally benefitting from the recent hawkish pivot from the BoE. Recall that, last week, GBP was unable to sustain its post-surprise BoE rate hike gains.

- EUR/USD has fended off an earlier test of the 1.1300 level and is back to trading in the 1.1330s.

- The pair is eyeing a test of weekly highs just above 1.1340, though trade on Friday will be subdued.

It’s been a choppier session than some might have expected on the eve of Christmas eve. Having dipped to sub-1.1300 levels at one point earlier on during US trading hours, EUR/USD has now recovered back to the 1.1330s and is eyeing a test of weekly highs just to the north of 1.1340. The drop under 1.1300 was likely spurred by the release of a batch of broadly strong US data at 1330GMT.

To recap quickly; the November Core PCE report was hotter than expected at 4.7%, Durable Goods Orders saw solid MoM growth November and Personal Income and Spending both saw healthy MoM gains (though were slightly negative when adjusted for inflation). Meanwhile, the latest weekly jobless claims report showed initial claims remaining close to 200K, a level consistent with full employment. Thursday’s strong data came on the back of a stronger than expected Consumer Confidence release for December on Wednesday.

At current levels, the EUR/USD trades broadly flat on the day and conditions are likely to be subdued on Friday given expectations for very low market volumes and a complete lack of any notable data releases. But FX strategists are warning that this week’s dollar weakness, which saw EUR/USD rally above 1.1300 from earlier lows under 1.1250, may ultimately prove short-lived. The Fed’s hawkish pivot in December has opened the door for a potential rate hike in March, which leaves the Fed on course to outpace the ECB when it comes to monetary normalisation by a significant margin.

This means the dollar could well resume its gradual upwards march during Q1 2022. That would be bad news for EUR/USD bulls. In the meantime and until the end of 2022, a break out of recent 1.1240-1.1360ish ranges for the pair seems unlikely. If EUR/USD can push above recent monthly highs (a few other G10/USD pairs have managed it in recent days), then a test of 1.1400 would be on the cards. But it will be difficult for the pair to sustain any such rallies, given the above.

- The Swiss franc appreciates some 0.15% vs. the greenback, despite the risk-on mood in the markets.

- Covid-19 positive news flowing through wires, maintain the Santa Rally alive, to the detriment of the safe-haven status of the greenback.

- USD/CHF Price Forecast: Upward move stalled at the 50 and the 100-DMA intersection, bears eye the 200-DMA.

The USD/CHF fall continues for the second consecutive day, trading at 0.9177 during the New York session at the time of writing. The Santa Rally arrived, as shown by US equities gaining between 0.69% and 0.85%, as market mood improved. Since Wednesday, investors’ confidence rose when South Africa reported that people infected with the Omicron variant are 80% less likely to be hospitalized. Additionally, the US Food and Drug Administration (FDA) approved Covid-19 emergency treatments to Pfizer and Merck in the last two days, spurring another leg up in stocks.

Risk-sensitive currencies are the day’s gainers in the FX market, led by GBP, the AUD, and the NZD, while the laggards are the greenback and the JPY.

In the meantime, the US Dollar Index, which tracks the greenback’s performance against a basket of six rivals, falls 0.05%, down to 96.03.

USD/CHF Price Forecast: Technical outlook

The USD/CHF stills range-bound, even though it broke below the confluence of the 50 and the 100-day moving averages (DMAs) but so far has been unable to break below the 200-DMA at 0.9175.

On the downside, if the USD/CHF extends its declines, the first support would be the 200-DMA at 0.9176. the breach of the latter would expose the November 30 daily low at 0.9157, followed by a test of the 0.9100 figure.

To the upside, the USD/CHF first resistance would be 0.9200. A decisive break above that level could pave the way for further upside. The next resistance would be 0.9250, followed by the December 15 swing high at 0.9294 and the 0.9300 figure.

-637758797584560903.png)

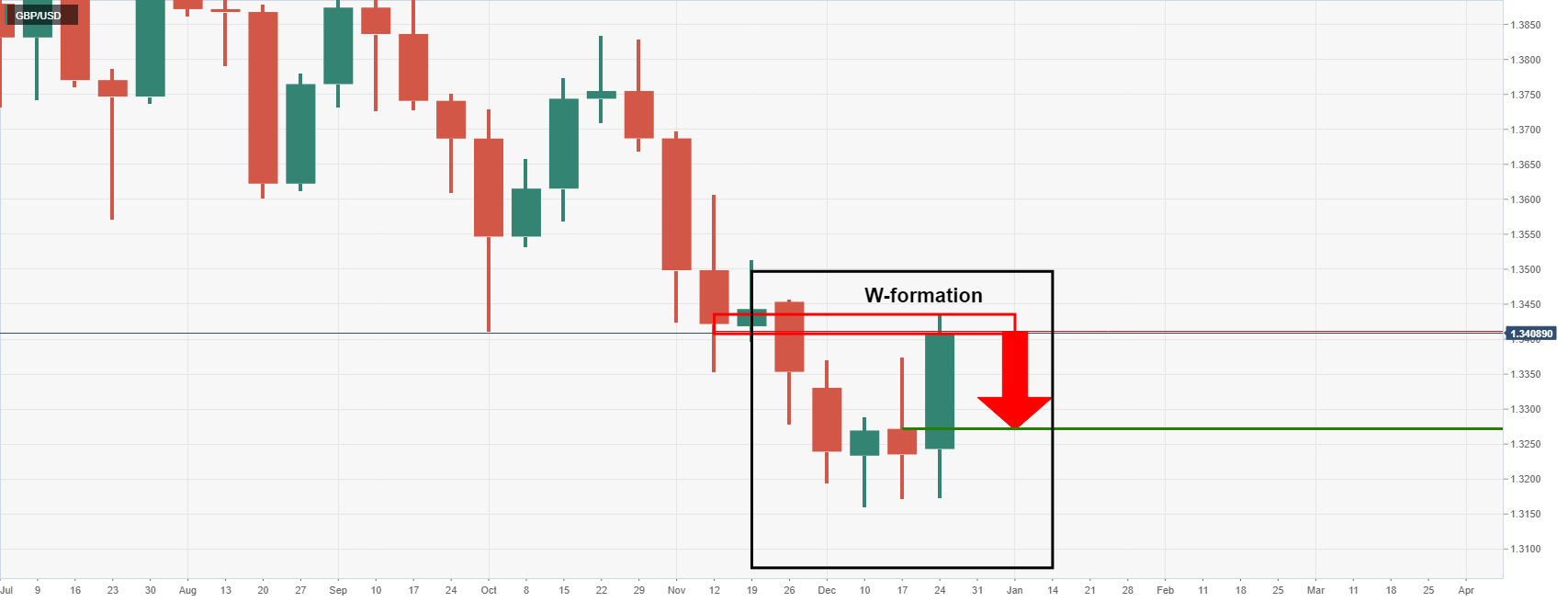

- GBP/USD is meeting a weekly area of resistance.

- The bears are engaging as seen on the lower term time frames.

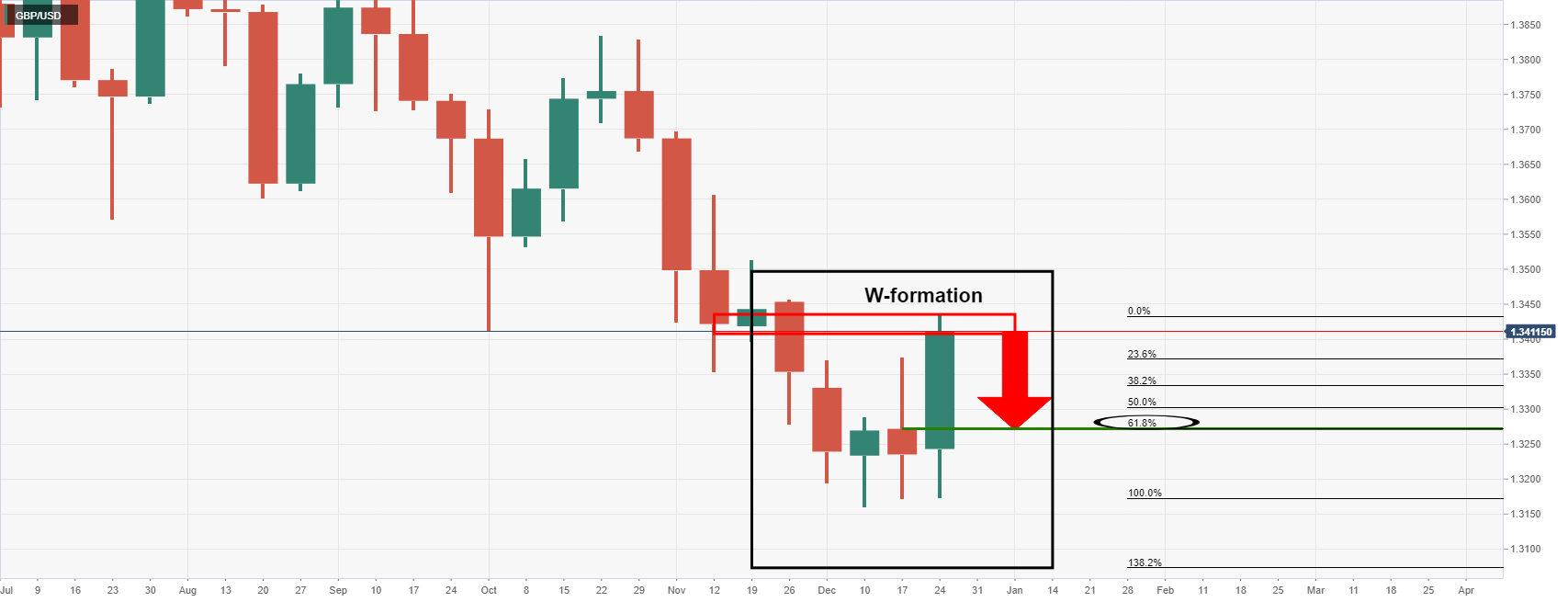

GBP/USD has rallied into a weekly order block from where some meanwhile consolidation would be expected to unfold in the coming sessions. The following illustrates the W-formation that has been left on the weekly chart which is a reversion pattern. The neckline of the W-formation would be expected to be retested.

GBP/USD weekly chart

Drawing the Fibonaccis and measuring the bullish impulse, the 61.8% Fibo aligns with the neckline which offers a confluence for which traders will note:

GBP/USD daily chart

The price on the daily chart, however, provides a structure that would be expected to act as support higher up the Fibo scale. For instance, there is a bullish spike, the true top of the W-formation's neckline, located at 1.3375. This aligns with the 23.6% Fibo. Lower, the next level of resistance 1.3320/35 aligns near to the 38.2% Fibo and structure, as illustrated above.

GBP/USD H1 chart

The hourly chart is full of various structures on the downside. In regular market conditions, these areas would be expected to act as support on the way to a test of the 50-EMA or on towards the 200-EMA, both of which align with the weekly chart's W-formation's structure and the daily chart's supports.

- The US dollar advances 0.59% in the week vs. the Japanese yen.

- Higher US T-bond yields rise three basis points to close to 1.50%.

- USD/JPY Price Forecast: It has an upward bias, though accelerating the trend would need a break above 114.70.

The US dollar extends its rally against the Japanese yen, advancing for the third consecutive day, trading at 114.36 during the New York session at press time. Positive news on the Covid-19 Omicron-variant front is cheered by investors as the Santa Rally finally kicked in. European equity indices rise between 0.93% and 1.42%, while US stock indices advance between 0.62% and 0.70%.

The US Food and Drug Administration (FDA) has authorized Covid-19 treatments in the last two days. On Wednesday, it approved Pfizer’s Plaxovid, treatment for high-risk patients. By Thursday, Molnupravir, a treatment pill developed by Merck, received the green light from the FDA. Both treatments would help to curb rising infections from overwhelming hospitals.

US T-bond yields rallied on the news, with the 10-year US Treasury yield rising three basis points, closing at 1.50%, and underpining the USD/JPY. In the meantime, the US Dollar Index, which tracks the buck’s performance against a basket of six rivals, is barely up 0.03%, at 96.10.

USD/JPY Price Forecast: Technical outlook

The USD/JPY daily chart depicts the pair has having an upside bias, supported by the daily moving averages (DMAs) residing below the spot price. Additionally, an upslope trendline drawn from the September swing lows towards the late November lows stalled sell-offs moves three times.

To the upside, the USD/JPY's first line of resistance would be the October 20 cycle high at 114.70. A breach of the latter could pave the way for further USD/JPY gains. The next resistance would be the psychological 115.00 figure, followed by the November 24 cycle high and YTD high at 115.52.

On the flip side, the USD/JPY's first demand zone would be the 50-DMA at 113.87. A break beneath that support would open the door for a test of the upsloping trendline around the 113.60-75 range, followed by the December 17 pivot low at 113.14.

-637758749278709639.png)

Regarding the Federal Reserve, analysts at Wells Fargo, in line with market consensus see a cumulative 125 bps of rate hikes during 2022 and 2023. They expect an initial 25 bps rate hike during the third quarter and a cumulative 125 bps of rate hikes being completed by the third quarter of 2023.

Key Quotes:

“The Federal Reserve has become increasing concerned about persistently high inflation pressures and, as a result, has initiated and accelerated the tapering of its bond purchases, as well as accelerating its rate hike intentions. For the December month, the Fed's overall bond purchases will amount to $90 billion. Consistent with its December announcement, we forecast the Federal Reserve will lower its bond purchases by $30 billion in each of January, February and March next year, bringing its quantitative easing to end by March 2022. In addition, we expect the Federal Reserve to begin raising interest rates by the second half of 2022, and we forecast a cumulative 125 bps of rate increase, in increments of 25 bps per quarter, starting in Q3-2022 through until Q3-2023.”

“The outlook for a steady, and quite timely, removal of monetary policy accommodation stems from ongoing above-trend GDP growth and continued improvement in the labor market. For U.S. GDP, we see growth of 5.7% in 2021, 4.4% in 2022, and 3.0% in 2023—though even that 2023 forecast is above the potential growth rate of the economy.”

“We expect PCE inflation and core PCE inflation—the Fed's preferred measured—to remain at or above the Fed's 2% target right up until late 2023. The combination of above-trend growth and above-target inflation underlies our outlook for the steady removal of monetary policy accommodation.”

Data released on Thursday showed GDP rose in Canada 0.8% in October. Analysts at RBC Capital Markets expect the Canadian economy to grow at a 6.5% rate during the fourth quarter.

Key Quotes:

“GDP in Canada rose 0.8% in October as supply chain disruptions eased, at least temporarily. Motor vehicle and parts manufacturing jumped 19% after falling sharply in September, but was still almost a quarter below levels in October a year ago with the global chip shortage restraining output.”

“Preliminary estimate that output grew another 0.3% in November, despite significant disruptions from flooding in BC.”

“The impact of the new Omicron variant on the economic outlook remains highly uncertain. The re-imposition of some restrictions to hospitality and travel industries will limit growth in the near-term. And health-related concerns might dampen services demand. But how long these restrictions last and how stringent they become are difficult to predict. Still, high rates of vaccination, extended government benefits and accelerated booster rollouts are all expected to help curb the threat. We continue to expect downward but at this time limited impact to our Q4 GDP growth tracking of 6.5%.”

- AUD/USD has run out of momentum at resistance in the 0.7250s but continues to trade higher on the day.

- Indeed, the risk-on market tone this week has powered the pair to a gain of more than 1.5%.

Since rebounding from the 0.7200 level during Asia Pacific trade, AUD/USD has advanced, though in recent hours, has been going sideways in the 0.7230s area, after running into resistance ahead of the 0.7250 mark. At current levels, the pair trades higher by about 0.3% on the session, taking its on-the-week gains to about 1.6%. That’s an impressive move higher given that the final week before Christmas is typically characterised by low volumes and volatility.

A pick-up in optimism that the Omicron variant won’t derail the global economic recovery amid indications it is significantly milder than Delta and the approval of two new pills in the US for at-home Covid-19 infection treatment have been the main factors driving risk appetite and helping to drive the Aussie higher this week. Iron ore prices have also been rising in China (a major Australian export) in recent weeks as Chinese authorities take steps to support the slowing economy there, which should support Australia's balance of payments going forward.

But many FX strategists and analysts suspect that the weakness seen in the US dollar this week (mostly due to risk-on) is set to be short-lived. According to analysts at MUFG, “while the recent improvement in risk sentiment on the back of reduced Omicron fears is currently weighing on the U.S. dollar, we expect the correction lower to prove shortlived”. “Hawkish comments from Fed officials over the past week including from Fed Governor Waller and San Francisco Fed President Daly have signalled that they are considering raising rates as soon as the March FOMC meeting” the bank noted.

Thursday’s hotter than expected November Core PCE inflation numbers, coupled with strong weekly jobless claims data (which shows how tight the labour market is), strong November Durable Goods Orders and strong December Consumer Confidence all point to a US economy with excellent underlying momentum. The fact that the DXY, though lower on the week, continues to trade comfortably within its December ranges and remains on course for substantial on-the-year gains of nearly 7.0% suggests that, from a technical perspective, long-term bullish momentum remains solid. In the absence of a hawkish pivot from the RBA, Fed hawkishness amid a hot economy could see AUD/USD slip back towards December lows in the 0.7000 next January.

- Emerging market currencies gain ground amid risk appetite.

- USD/MXN points further to the downside, particularly under 20.65.

- Data shows no surprises in the US and Mexico's highest inflation in decades.

The USD/MXN is trading around 20.65, at the lowest level in a month. A weaker greenback across the board and the risk-on tone across financial markets are supporting the Mexican peso.

The pair is testing levels under 20.70 and is on its way to the lowest close since November 27. A consolidation below 20.65 would point to more losses with the next strong support at 20.45/50. A recovery above 20.70 should alleviate the bearish tone, while on above 20.90, the US dollar could strengthen.

Data from Mexico and US

In the US, many economic reports were released. Personal spending rose 0.6% in November, in line with market consensus while the core PCE advanced to an annual rate of 4.7% above the 4.5% expected. The Labor Department reported Initial Jobless Claims came in at 205K, unchanged from the week before. The November Durable Goods Orders' preliminary reading showed a larger-than-expected gain of 2.5%. The University of Michigan’s December reading of Consumer Sentiment (final) came in at 70.6. New Home Sales soared 12.4% in November, recovering from a 8.4% decline in October.

The key number in Mexico was positive as the mid-December Consumer Price Index showed a lower-than-expected reading at 7.45% (annual), below the 7.70% of market consensus but still the highest in twenty years. The higher inflation pushed the Bank of Mexico to hike rates by 50bps last week.

“Next policy meeting is February 10 and another 50 bp hike to 6.0% seems likely if price pressures remain high. Swaps market sees the policy rate peaking at 7.50% by the end-2022 before falling slightly in 2023. This may understate Banxico’s need to tighten”, mentioned analysts at Brown Brother Harriman.

Technical levels

- The S&P 500 is up another 0.6% and now more than 4.0% up from Monday lows.

- The index was given a further boost as the FDA approved Merck’s Covid-19 treatment pill.

Just before the open of US equity market trade, the US Food and Drug Administration announced that it had approved a second Covid-19 treatment pill for at-home use. Early trials suggest that Merck’s molnupiravir could reduce mortality and hospitalisation rates in at-home patients by as much as 50%. The news comes after the FDA announced on Wednesday that they had approved Pfizer’s paxlovid pill, which early trails showed to have a superior up to 90% efficacy in preventing hospitalisation and death in at-risk patients.

Just as the news of the Pfizer approval helped stoke risk appetite on Wednesday, the announcement prior to the equity open was likely contributed to the S&P 500’s post-open surge. The index, which had moved a tad higher in pre-market trade (according to index futures) and managed to reclaim the 4700 level, opened at 4706 but has since surged into the 4720s. That means the index is up 0.6% on Wednesday’s close in the 4690s and trades just 0.4% below intraday highs printed back on 22 November in the 4740s.

The Nasdaq 100 index is up about 0.5% and the Dow is up about 0.6%, showing that the gains in equity markets are broad-based. The S&P 500 CBOE volatility index (or VIX) fell another half a point and trades at monthly lows close to 18.00. Alongside the news of the recent approval of two at-home Covid-19 treatment pills, risk appetite in US equities has been boosted in recent days by the release of three separate studies (from South Africa, Scotland and London) which all showed Omicron to be significantly milder than Delta.

The news has eased pressure on European authorities to lockdown their economies in order to curb transmission. The S&P 500 index is now more than 4.0% up versus Monday’s lows in the 4530s. If the S&P 500 closes at current levels, that would mark a record closing high just in time for Christmas – bear in mind that US equity markets are shut on Friday. After a bumpy, volatile December, where the S&P 500 index was at one point as much as 5.0% below recent record highs, the “Santa Rally” has finally arrived to save the day.

- Gold advances some 0.03% during the New York session, despite US T-bond yields rise.

- The 10-year benchmark note meanders around the 1.50% threshold.

- XAU/USD Price Forecast: In the near term, it is neutral-bullish, though it will need a decisive break above $1814 to extend its gains.

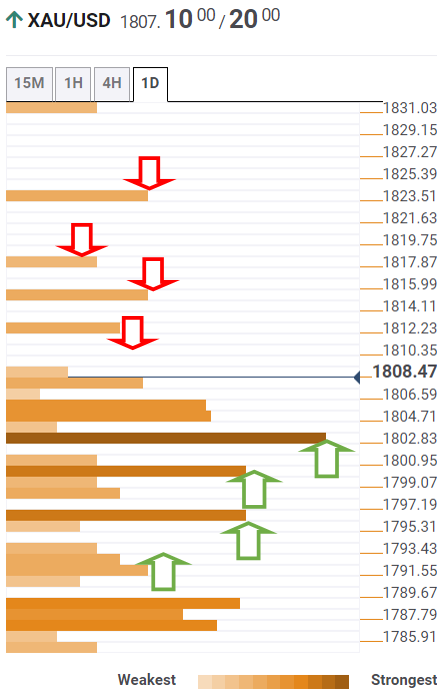

As the New York session begins, gold (XAU/USD) advances some 0.03%, trading at $1,805.65 at the time of writing. Global equity markets continue advancing during the week, as shown by the MSCI Asia Pacific Index up 0.9%, while European equities gain between 0.26% and 3.06%. Increased optimism over the Omicron Covid-19 variant spurred an appetite for riskier assets as the year-end approached. At the same time, the yellow metal finally broke above the $1,800 figure for the second time in the week.

In the US Treasuries complex, US T-bond yields are rising four basis points, with the 10-year Treasury yield at 1.499%, falling to weigh on the precious metal, with which it has a strong inverse correlation.

Macroeconomic data-wise, US Durable Good Orders rose by 2.5%, more than the 1.6% foreseen on a monthly basis. Meanwhile, the Fed’s favorite gauge of inflation, the Core Personal Consumer Expenditure (PCE), increased by 4.7%, higher than the 4.5%, justifying the Fed’s faster bond taper while opening the door for higher rates sooner than later.

At the same time, Initial Jobless Claims for the week ending on December 17 rose to 205K in line with expectations, showing some consolidation in the labor market. Furthermore, at press time, the University of Michigan revealed its Consumer Sentiment Index for December, which came at 70.6 higher than the 70.4 estimated.

XAU/USD Price Forecast: Technical outlook

The XAU/USD daily chart depicts that the yellow metal has a neutral-bullish bias in the near term, as the spot price is above the daily moving averages (DMAs), which are “flat” almost horizontal, acting as support levels. Furthermore, the break of a downslope trendline, drawn from mid-November to December 17 swing high, is being tested, that once broke, could pave the way for further gains.

To the upside, the XAU/USD first resistance would be the December 17 cycle high at $1,814. A breach of the latter would expose the September 3 cycle high at $1,834, followed by November’s 22 high at $1,849.

On the flip side, gold’s first support would be the 50-DMA at $1,799.50. A break beneath that level would expose the 200-DMA at $1,791, followed by the 100-DMA at $1,788.

-637758698100063281.png)

- EUR/JPY breaking range, looks to test 129.50 and 129.70/80.

- Slide back under 129.00 should alleviate the bullish pressure.

The EUR/JPY is rising for the fourth consecutive day on Thursday and is testing the 129.50 area. Technical indicators still point to the upside, favoring more gains ahead. Still, the euro needs to break and hold above 129.50 in order to open the doors to more gains.

On the upside, the next resistance stands at 129.70/80 (100-day simple moving average) followed by 130.10. The 20-day moving average is turning to the upside, supporting the euro.

The strong bullish tone will ease if EUR/JPY drops under 129.00 in the short term. The next support stands at 128.50, followed by 128.30 (20-day SMA). A slide below should negate the positive tone, exposing the next support at 127.85.

The rebound from 127.50 continues and is becoming a potential double bottom that could anticipate strength ahead. With the neckline at 129.00, the target of the pattern is 130.50.

EUR/JPY daily chart

-637758695257094558.png)

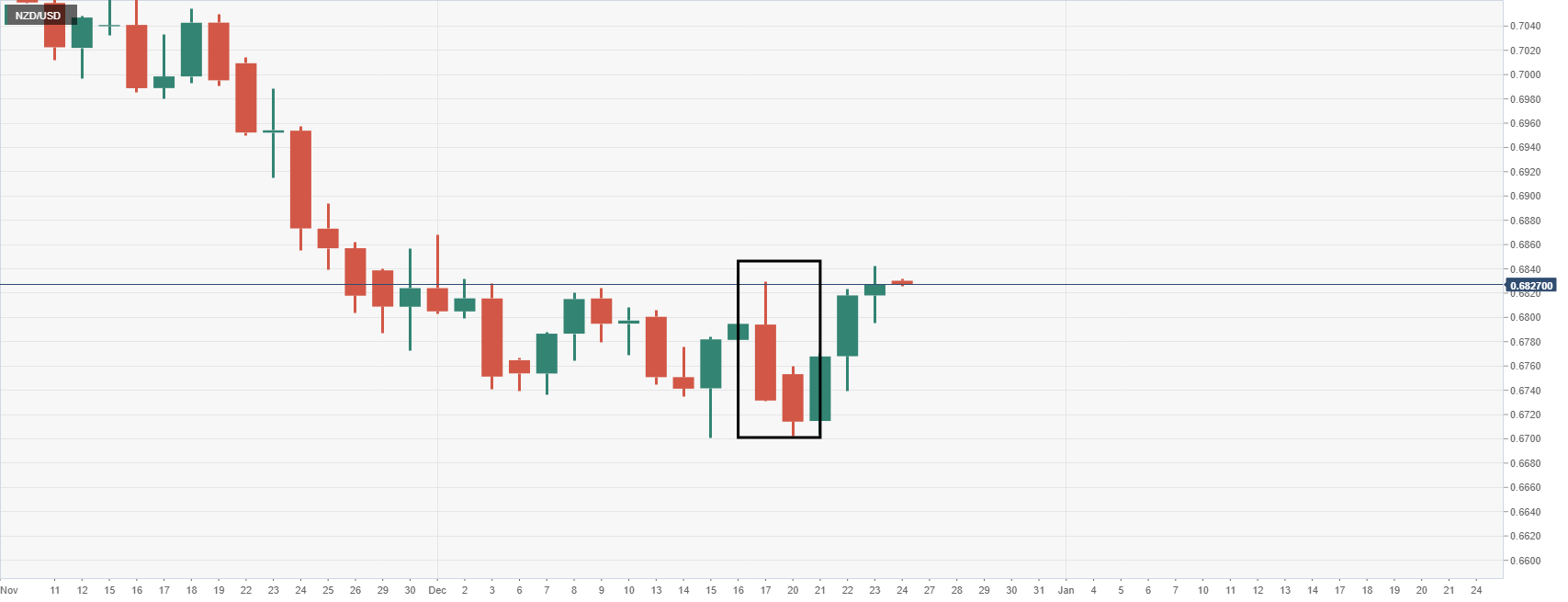

NZD/USD has rebounded strongly from support at 0.6703/6697. As analysts at Credit Suisse note, 0.6835/38 needs to cap into the close to avoid a base and to keep the risks directly lower.

Broader risks still seen lower

“With medium-term momentum still negative and the market holding well below falling medium-term moving averages, we still identify the market as in a clear downtrend and expect the 0.6823/38 resistances to cap for an eventual break below 0.6703/6697, which would open up a move to our core objective at 0.6511/6467.”

“A closing break above 0.6823/38 would signal a potentially important low and trigger an intraday base, particularly as it is occurring on the back of another hold above 0.6703/6697, with next resistance at 0.6869/72, then 0.6895/6900.”

The encouraging news about the severity of the new Omicron strain has been partly offset in Europe by the further spike higher in energy prices over the holiday period. Furthermore, the sour relationship between the West and Russia adds downside risks for European currencies, as reported by economists at MUFG Bank.

Natural gas prices continue to surge higher in Europe

“Recent price action has reinforced our view that the energy price shock will hit the European economies harder than the US and further boosts the relative appeal of the US dollar heading into early next year.”

“The upward pressure on European gas prices reflects in part the risk of disruption to supplies from Russia in response to risk of another invasion of the Ukraine.”

“It was reported yesterday by Reuters that the US is mulling imposing strict export controls on Russia which resemble Iran sanctions should they invade the Ukraine. It remains to be seen whether the risk of more severe sanctions proves sufficient to discourage Russia. The developments continue to pose downside risks for the rouble and other European currencies relative to the US dollar in the near-term.”

- New Home Sales surged 12.4% in November after October's 8.4% drop.

- The US dollar did not seem to react to the latest US data.

Following a hefty 8.4% decline (which was downwardly revised from a 0.4% gain) in sales in October, New Home Sales in the US surged by 12.4% in November, data published by the US Commerce Department showed on Wednesday.

Given the hefty downwards revision to the October figure and despite the solid 12.4% surge in sales in November, instead of rising to 770K, the number of New Home Sales over the past 12 months rose to just 744K in November. The number of New Home Sales over the past 12 months in October was revised lower to 662K from 745K.

Market Reaction

The dollar did not seem to react to the latest US data.

- The UoM's final Consumer Sentiment index rose to 70.6 in December from the 70.4 flash reading.

- The US dollar did not seem to react to the latest US data.

The University of Michigan's (UoM) final estimate of the Consumer Sentiment Index came in at 70.6 in December, slightly above the flash estimate of 70.4 released earlier in the month, and above November's reading of 67.4, which was the weakest reading since 2011 at the time.

The Current Conditions Index rose to 74.2, lower than the flash estimate of 74.6 but higher than last month's 73.6, while the Consumer Expectations Index rose to 68.3 from the flash estimate of 67.8, above last month's 63.5.

Market Reaction

The dollar did not seem to react to the latest US data.

USD/CAD has seen an initial rejection from the major band of resistance at 1.2950/3030. However, 1.2781/63 is expected to floor the market, according to the Credit Suisse analyst team.

Upside bias while above 1.2781/63

“USD/CAD has seen an initial rejection from very important medium-term resistance levels at 1.2950/1.3030. However, whilst the market holds above 1.2781/63, we lean towards a breakout above this zone, given that medium-term momentum remains firmly bullish and given that medium-term moving averages are all now rising.”

“Above 1.3030 would confirm that the medium-term risks are turning higher, with the next notable resistance at 1.3172 and eventually 1.3337 if a breakout is confirmed.”

“Near-term support stays at 1.2781/63, which we now look to hold to maintain the upward pressure. In contrast, a closing break below 1.2614/08 would turn the risks back lower within the range, however, this is not our base case.”

The S&P 500 extends its strong recovery. If the index breaks above 4744/50, analysts at Credit Suisse would look for a substantial rise 4970/75.

Price action looks like a bullish “triangle” continuation pattern

“The close above the top of the price gap from Monday morning at 4667/69 adds weight to the view we are seeing the formation of a potential bullish ‘triangle’ continuation pattern. We thus look for a test of the top of the range at 4728/32, beyond which is needed to suggest the consolidation phase is in the process of being resolved higher, for a test of the 4744/50 highs.”

“Beyond the 4744/50 highs should reinforce the ‘triangle’ and break higher with resistance seen next at 4768 ahead of 4782 and then 4800. Big picture, the ‘measured triangle objective’ (if confirmed) would be seen at 4970/75.”

“Support is seen at 4672 initially, with 4649/46 now ideally holding to keep the immediate risk higher. A break can see a fall back to key gap and 63-day average support at 4587/68.”

- GBP/USD has pulled back from monthly highs near 1.3440 printed earlier in the session and is trading around 1.3400.

- Strong US data has weighed on the pair recently after UK Omicron news earlier in the session supported sterling.

GBP/USD has pulled back a little in recent trade from earlier session highs close to 1.3440 and recently dipped back under the 1.3400 level. A raft of strong US data releases, including a hotter than expected November Core PCE report, a stronger than expected November Durable Goods Orders report and a solid weekly initial jobless claims number seem to have injected some strength into the buck, weighing on cable. But the pair still trades with gains of about 0.4% on the day and is still up about 1.7% from earlier weekly lows around 1.3170.

Sterling rallied shortly before Thursday’s European open after a broadly flat Asia Pacific session on the news that the UK was unlikely to implement tougher Covid-19 curbs after Christmas, as had been hinted at earlier in the week. It appears that following the recent string of positive Omicron studies released mid-week that showed the variant to be significantly milder than the Delta variant, and amid a plateauing of the Omicron transmission rate in London, developments have swung in favour of those in the government arguing against lockdown.

Looking ahead, the focus will return to US data at 1500GMT with the release of the final version of the University of Michigan December Consumer Sentiment survey and November New Home Sales figures. Thereafter, focus will return to pandemic developments. But it is likely that trading conditions become increasingly subdued given the proximity of Christmas and the New Year holidays.

According to analysts at ING, the couple of weeks either side of Christmas day usually see low volatility for currencies, though they caution that “this year some seasonal tendencies will be mixed with the Omicron variant threatening to force new restrictions and markets still processing a week full of key central bank decisions”. As far as GBP/USD is concerned, it may thus be a struggle for the pair to push on past the monthly highs near 1.3440 it printed earlier in the session.

AUD/USD surged back higher on Wednesday. However, whilst below 0.7292/7309, analysts at Credit Suisse view any strength as corrective.

Break below 0.7089/82 to confirm a resumption of the downtrend

“AUD/USD is now breaking above its recent corrective price high at 0.7225. This sharply increases the risk of a correction up to 0.7292/7309, with only a closing break above here negating the major recently highlighted top. However, our base case is that the market will find a cap below here and turn back lower.”

“With the broader downside risks in mind, an eventual break below the recent corrective price low at 0.7089/82 would confirm a resumption of the downtrend and a retest of next support at 0.6992/91.”

“Below 0.6992/91 would then open up 0.6806/02, with the size of the top suggesting a move to 0.6758 is easily achievable over the medium-term.”

USD/CAD falls towards 1.28 as crude continues to inch higher. In the view of economists at Scotiabank, it will take a break below 1.2760 – last week’s low – to drive the pair more convincingly lower from a chart perspective.

Resistance is seen at the 1.2840/50 zone

“The writing – in the form of the bearish, daily RSI divergence and the solid resistance above 1.29 in place all year – had been on the wall for the USD’s push higher so we are not too surprised to see USD/CAD weaken. But we need to see a break under 1.2760 in the next day in order to see losses extend towards 1.2600/10.”

“Resistance is 1.2840/50.”

The pound outperforms with markets pricing in four more Bank of England (BoE) hikes next year. This outlook is set to keep the EUR/GBP pair below 0.86 but a dive under 0.83 is not likely, in the view of economists at Scotiabank.

Markets are pricing in four 25bps BoE rate increases over the next twelve months

“Markets are pricing in four 25bps BoE rate increases over the next twelve months (in Feb, May, Aug, Nov/Dec, roughly) to take the bank’s terminal rate to 1.25% as they expect a slight overshooting to rein in inflation.”

“While the BoE’s tightening cycle will act as a key driver for GBP strength against the EUR over the medium-term, to keep the cross under 0.86, it may not provide much more ammunition for a move below 0.83 with markets already fully pricing in the feasible maximum of BoE hikes next year.”

As the Federal Reserve and foreign central banks become more active over the next several quarters, economists at Wells Fargo believe monetary policy differences will become increasingly important for currency performance during that period. Subsequently, they forecast EUR/USD at 1.05 and USD/JPY at 123.00 by early 2023.

Monetary policy divergence to be very consequential for the euro and the yen

“The ECB so far it sees that uptick in prices as temporary and has expressed less concern about inflation pressures than most other major central banks. That is reflected in the ECB's December monetary policy announcement, where it also gave no indication policy rates would rise any time soon. This divergence between the outlook for ECB policy and a faster acting Federal Reserve underpins our forecast for a weaker euro and for the EUR/USD to fall to 1.05 by early 2023.”

“We expect Bank of Japan monetary policy to remain on hold for the foreseeable future. As the Fed tightens policy and US bond yields rise over time, we target a USD/JPY exchange rate of 123.00 by early 2023.”

- USD/CAD edged lower for the third successive day on Thursday and dropped to a fresh weekly low.

- Rebounding US bond yields, the Fed’s hawkish outlook underpinned the USD and extended support.

- An intraday bounce in oil prices benefitted the loonie and continued capping the upside for the pair.

- The pair had a rather muted reaction to the top-tier US macro data and monthly Canadian GDP print.

The USD/CAD pair remained on the defensive near the 1.2825-30 region, just a few pips above the weekly low touched earlier this Thursday and moved little post-US/Canadian macro data.

The pair extended its retracement slide from the 1.2965 area, or the YTD high touched earlier this week and edged lower for the third successive day, though the slide lacked bearish conviction. Against the backdrop of the Fed's hawkish outlook, a modest pickup in the US Treasury bond yields helped revive the US dollar demand and acted as a tailwind for the USD/CAD pair.

That said, the prevalent risk-on environment kept a lid on any meaningful gains for the safe-haven greenback. Apart from this, an intraday uptick in crude oil prices underpinned the commodity-linked loonie and exerted some pressure on the USD/CAD pair. Traders reacted little to mostly upbeat US economic releases and largely shrugged off the Canadian monthly GDP report.

The US Census Bureau reported that the headline US Durable Goods Orders rose by 2.5% MoM in November, surpassing consensus estimates pointing to a 1.6% rise. Adding to this, the previous month's reading was also revised higher to show a modest 0.1% growth as against the 0.5% fall reported previously. Moreover, Core Durable Goods Orders rose 0.8% MoM as against the 0.6% rise anticipated.

Separately, data published by the US Department of Labor (DOL) revealed that Weekly Initial Jobless Claims held steady at 205,000 during the week ending December 18, matching expectations. Meanwhile, the US Personal Income rose by 0.4% MoM and the US Personal Spending recorded a growth of 0.6% in November, both marking a slight moderation from the previous months' readings.

From Canada, the monthly GDP print matched market expectations and showed a strong 0.8% MoM growth in November. The data, however, did little to provide any meaningful impetus to the USD/CAD pair as investors now seemed reluctant amid thin liquidity ahead into the year-end holiday. This, in turn, warrants some caution before placing aggressive directional bets.

Technical levels to watch

- Personal Income rose 0.4% MoM in November and Personal Spending rose 0.6%, both in line with forecasts.

- The dollar did not seem to react to broadly solid US macro data.

According to a report released on Thursday by the Bureau of Economic Analysis and Department of Commerce, US Personal Income rose by 0.4% MoM in November, in line with consensus forecasts for a 0.4% MoM rise. That marks a slight moderation in income growth rates since October's 0.5% reading.

Meanwhile, US Personal Spending rose by 0.6% MoM in November, also in line with consensus estimates for a MoM growth rate of 0.6% and following October's (upwardly revised from 1.3%) 1.4% MoM increase.

Market reaction

The dollar did not seem to react to the latest strong raft of US macro data.

- Canadian economy expanded by 0.8% on a monthly basis in October as expected.

- USD/CAD continues to move sideways above 1.2800 after the data.

Canada's Real Gross Domestic Product (GDP) expanded at a monthly rate of 0.8% in October following September's growth of 0.2%, the data published by Statistics Canada showed on Thursday. This reading came in line with the market expectation.

Further details of the report revealed that the flash estimate for November's monthly growth was left virtually unchanged at 0.3%.

"Leading the growth were accommodation and food services, wholesale trade, construction and the arts and entertainment sectors, while the mining, quarrying, and oil and gas extraction sector offset some of the gains," the publication read.

Market reaction

The USD/CAD pair showed no immediate reaction to these figures and was last seen trading flat on the day at 1.2830.

- US Durable Goods Orders rose 2.5% MoM in November, above expectations for 1.6%.

- The dollar did not seem to react to the latest strong raft of US macro data.

According to the latest release by the US Census Bureau, US Durable Goods Orders rose by 2.5% MoM in November compared to market expectations for a solid 1.6% rise in sales. It also marked an acceleration in the MoM growth rate of sales after October's 0.1% MoM reading, which was upwardly revised from -0.4%.

Core Durable Goods Orders rose by 0.8% MoM in November versus consensus forecasts for a 0.6% rise.

Market Reaction

The dollar did not seem to react to the latest strong raft of US macro data.

- Weekly Initial Jobless Claims in US stayed unchanged at 205K.

- US Dollar Index continues to move sideways above 96.00.

There were 205,000 initial claims for unemployment benefits in the US during the week ending December 18, the data published by the US Department of Labor (DOL) revealed on Thursday. This reading matched the market consensus.

Market reaction

This report doesn't seem to be having a significant impact on the dollar's market valuation. The US Dollar Index was last seen posting small daily gains at 96.15.

Key takeaways

"The 4-week moving average was 206,250, an increase of 2,750 from the previous week's revised average."

"The advance seasonally adjusted insured unemployment rate was 1.4% for the week ending December 11."

"The advance number for seasonally adjusted insured unemployment during the week ending December 11 was 1,859,000, a decrease of 8,000 from the previous week's revised level."

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, rose to 4.7% YoY in November, the US Bureau of Economic Analysis reported on Thursday. That was above the consensus forecast for an inflation rate of 4.5% and marked a substantial acceleration from October's inflation rate of 4.2%, which was upwardly revised from 4.1%

MoM, the Core PCE Price Index rose at a pace of 0.5% versus expectations for a 0.4% MoM growth rate and following October's 0.5% reading, which was upwardly revised from 0.4%.

Market Reaction

Despite hotter than expected November PCE figures and better than expected MoM growth in Durable Goods Orders, as well as still very solid growth in US Personal Income and Spending and another very low weekly initial jobless claims number, the DXY has not yet reacted to the latest US data release. But the data is broadly bullish for the dollar and strengthens the case for the Fed's increasingly hawkish stance.

- USD/TRY remained under intense selling pressure for the fourth successive day on Thursday.

- The recent measures announced by the Turkish government continued lending support to the lira.

- Extremely overstretched conditions prompted intraday short-covering move amid thin liquidity.

The USD/TRY pair extended its dramatic turnaround from a record high touched earlier this week and continued losing ground through the mid-European session on Thursday. This marked the fourth successive day of a negative move and dragged spot prices to a six-week low, around the 10.20 region in the last hour. The pair, however, found some support at lower levels and quickly bounced back above the 11.00 round-figure mark.

The Turkish lira's recent strong gains came after the government announced extraordinary measures on Monday, which include the introduction of a new program to protect savings from currency fluctuations. Adding to this, President Recep Tayyip Erdogan said the government and the Central Bank of the Republic of Turkey (CBRT) would guarantee certain local currency deposits against FX depreciation losses.

Erdoğan also reassured that citizens would not have to convert lira savings into foreign exchange due to volatility and emphasized that Turkey is committed to the free market economy. The President further underlined that Turkey is adamant about its new economic model and stuck to his unconventional policy to use lower interest rates to combat inflation.

Nevertheless, the lira remains on track to record its best weekly gains ever, around 40% and seemed rather unaffected by a modest pickup in the US dollar demand. That said, extremely overstretched conditions prompted some short-covering amid relatively thin liquidity conditions ahead of the year-end holiday season.

Aside from a brief move higher in late summer, EUR/CHF has been trending lower since March. Nonetheless, economists at Rabobank expect the pair to lurch higher towards 1.06 in the coming months.

Inflation to provide some interest for SNB watchers

“While inflation data in Switzerland may be a little more interesting in 2022 than it has been for some years, it would be a leap to assume that any SNB policy changes are likely.”