- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-12-2021

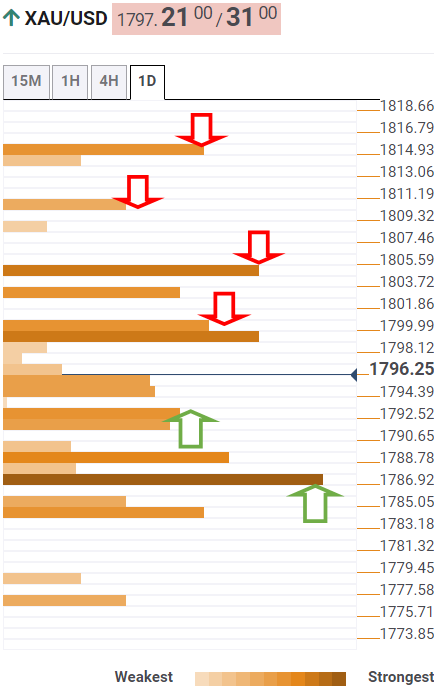

- Gold struggles to extend the previous day’s rebound despite recently picking up bids.

- Market sentiment improves as policymakers placate Omicron fears, US stimulus chatters also add to risk-on mood.

- US data eyed as bearish formation hints at seller’s return.

- Powell sent gold above $1,800: But only for a short while

Gold (XAU/USD) stays mildly bid around $1,790, up for the second consecutive day during Wednesday’s Asian session. Even so, the metal fails to track other risk barometers, like Antipodeans and WTI, to portray risk-on mood. The reason could be linked to the market’s cautious sentiment ahead of a slew of the US data as well as a bearish chart pattern.

Global policymakers’ rejections of the major lockdown measures ahead of the Christmas holidays, despite the latest spread of the South African covid variant, dubbed as the Omicron, seemed to have favored the sentiment. Also positive for gold were US President Joe Biden’s expectations of getting the “Build Back Better (BBB)” plan done as well as vaccine/treatment optimism.

Even as Texas reported the first Omicron-linked death in the US, President Joe Biden refrained from any national lockdowns, as already revealed, while also pushing for faster vaccinations. On the same line were cautious optimism emanating from Pacific nations and the UK. Furthermore, news that the US Food and Drug Administration (FDA) is up for authorizing a pair of pills from Pfizer and Merck to treat Covid-19 as soon as this week, per Bloomberg’s sources, also underpinned the risk-on mood.

Additionally, “President Biden on Tuesday said he thinks there is still a possibility that his Build Back Better agenda can get done, despite Sen. Joe Manchin’s opposition of the climate and social spending bill,” said The Hill.

On the contrary, a recovery in the US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, ahead of the key US data set for this week challenges the gold buyers. Furthermore, the Sino-American and the US-Russia tussles add to the bearish bias for gold prices.

That said, the US Treasury yields rose 4.8 basis points (bps) to 1.467% whereas the Wall Street benchmarks snapped a three-day downtrend by the end of Tuesday’s North American session. The S&P 500 Futures, however, drops 0.10% intraday by the press time.

Moving on, gold traders may reassess the latest market optimism despite the Omicron woes and firmer inflation expectations ahead of the US data.

Read: Conference Board Consumer Confidence December Preview: Where do Americans turn for optimism?

Technical analysis

Gold portrays a hidden bearish divergence pattern following its break of an ascending trend line from late September. Adding to the bearish bias is the failure to cross the 200-SMA and the downbeat MACD signals.

A hidden bearish divergence can be identified when the prices make lower high but the oscillator, here the RSI, makes higher high.

That said, the pullback moves can initially eye 61.8% Fibonacci retracement (Fibo.) level of September-November advances, near $1,781, a break of which will direct gold bears to 78.6% Fibo. surrounding $1,754.

In a case where gold prices remain weak past $1,754, the $1,745 and $1,733 may act as intermediate halts before highlighting September’s low of $1,721.

Meanwhile, recovery moves remain elusive below the support-turned-resistance line near $1,814. It’s worth noting that the 200-SMA level of $1,808 acts as an immediate upside barrier.

Following that, November 09 swing high around $1,833 and $1,845-50 region can challenge gold buyers ahead of favoring the run-up to the last month’s peak of $1,877.

Gold: Four-hour chart

Trend: Pullback expected

The Bank of Japan's Minutes of the Monetary Policy Meeting in October concluding on 28 2021 has been released.

Key notes

- Members discussed the impact of the weak yen on the economy.

- A few members said weak yen exerts positive effects on japan's economy as a whole even though the effects of pushing up exports are lower than before.

More to come...

Meanwhile, USD/JPY is trying to break higher:

The US dollar has been under pressure in recent trade in a risk-on environment, although the yen has been an underperformer as well.

The minutes are unlikely to impact the yen as traders have positioned for the holidays following the central bank conclusions and sentiment is unlikely to shift.

About the BoJ Minutes

The Bank of Japan publishes a study of economic movements in Japan after the actual meeting. These meetings are held to review economic developments inside and outside of Japan and indicate a sign of new fiscal policy. Any changes in this report tend to affect the JPY volatility. Generally speaking, if the BoJ minutes show a hawkish outlook, that is seen as positive (or bullish) for the JPY, while a dovish outlook is seen as negative (or bearish).

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, printed a two-day recovery after struggling around the early October lows. That said, the inflation gauge recently rose to the highest since December 10, while flashing a 2.44% level, per the FRED website.

It’s worth noting that the jump in inflation expectations back Friday’s comments from Federal Reserve Governor Christopher Waller who raised fears of a rate hike in March 2022, which in turn should propel the yields and challenge the latest run-up of Antipodeans, as well as commodities.

Read: Prepare now for “shock and awe” inflation, or suffer the consequences…

However, today’s slew of economics from the US, including the headlines CB Consumer Confidence for December and Q3 GDP, will be crucial for short-term market direction.

Read: Conference Board Consumer Confidence December Preview: Where do Americans turn for optimism?

- USD/CAD remains pressured inside a bearish chart pattern after stepping back from yearly top.

- RSI retreat, MACD conditions suggest further downside but 1.2690 becomes a tough nut to crack for bears.

- Bulls need to cross 1.2975 to keep the reins.

USD/CAD drops towards 1.2900, extending the previous day’s pullback from the yearly top, during Wednesday’s Asian session. In doing so, the Loonie pair post the second consecutive daily loss while staying inside a bearish chart pattern called a rising wedge.

Given the recently flashed bearish MACD signal and RSI retreat from the overbought zone, USD/CAD declines are likely to stretch longer.

While the 1.2900 may entertain intraday sellers, a downside break of the stated wedge’s support line near 1.2840, will open the door for the USD/CAD downturn towards the mid-November lows near 1.2490.

However, a convergence of the 200-SMA and a five-week-old support line, near 1.2690, is strong support to break for keeping the USD/CAD bears in the driver’s seat after 1.2840.

Alternatively, recovery moves remain elusive until staying below the wedge’s resistance line near 1.2975.

Even so, the 1.30000 psychological magnet will be crucial before USD/CAD bulls eye the November 2020 peak of 1.3172.

USD/CAD: Four-hour chart

Trend: Further weakness expected

- WTI grinds higher past $71.00 after posting the biggest daily gain in 12 days.

- API Weekly Crude Oil Stock posted surprise draw for the week ended on December 17.

- Risk-on mood, softer USD favor bulls but Omicron woes challenge further upside.

- EIA stockpile data, US economics to offer an active day.

WTI battles monthly resistance line after rising the most in over two weeks the previous day. That said, the oil benchmark retreats to $71.22 during early Wednesday morning in Asia.

The black gold benefited from the market’s optimism to overcome the virus woes. However, the weekly industry inventory report by the American Petroleum Institute (API) couldn’t much help the buyers despite marking a surprise draw of -3.67M versus -0.815M figures for the week ended on December 17.

Global policymakers’ rejections to panic due to the latest spread of the South African covid variant, dubbed as the Omicron, seemed to have favored the sentiment, as well as oil prices of late.

Even as Texas reported the first Omicron-linked death in the US, President Joe Biden refrained from any national lockdowns, as already revealed, while also pushing for faster vaccinations. On the same line were cautious optimism emanating from Pacific nations and the UK. Furthermore, news that the US Food and Drug Administration (FDA) is up for authorizing a pair of pills from Pfizer and Merck to treat Covid-19 as soon as this week, per Bloomberg’s sources, also underpinned the risk-on mood.

Elsewhere, rising geopolitical tensions between the West and Russia, as well as with Iran, hints at future challenges to the supply and favor oil prices. However, the weekly Baker Hughes Rig Count data jumped to the early 2020 levels and challenged the same.

While portraying the risk-on mood, which also helped NZD/USD prices, the US Treasury yields rose 4.8 basis points (bps) to 1.467% whereas the Wall Street benchmarks snapped a three-day downtrend by the end of Tuesday’s North American session.

Looking forward, the official oil inventory data from the Energy Information Administration (EIA) of the US, expected -0.031M versus -4.584M prior, will be important for WTI traders. Also, a slew of data including US Q3 GDP, Core Personal Consumption Expenditures for the third quarter and Chicago Fed National Activity Index will precede Existing Home Sales to direct short-term oil moves.

Technical analysis

The monthly resistance line challenges WTI bulls around $71.50, a break of which will direct the bulls towards a 200-SMA level of $74.00. However, bullish MACD signals and an upbeat RSI line hint at further upside moves. Meanwhile, pullback moves may aim for the 100-SMA level of $69.83.

- The NZD/JPY edges up some 1.18% during the day.

- Market sentiment dynamics and commodity prices linked to the kiwi would be the drivers for the pair.

- NZD/JPY Technical Outlook: Upwards in the near-term after piercing the 77.00 figure.

The NZD/JPY recovers from its free-fall as the year’s end looms, trading at 77.22 as the Wall Street session ends at the time of writing. Wall Street closed in the green, with US stock indices recording gains between 1.60% and 2.76%. Asian equity futures point to a higher open, thus weighing on the safe-haven status of the Japanese yen.

That said, the session’s gainers were the risk-sensitive currencies, like the NZD, the AUD, and the CAD, whereas the low yielders EUR, CHF, and the JPY dropped on Tuesday.

The NZD/JPY pair benefitted from the market mood improvement spurred by Covid-19 vaccines helping to tame the Omicron variant. Further, in the middle of Wall Street’s session, the US Food and Drug Administration (FDA) is set to approve Covid-19 treatment pills, developed by Pfizer and Merck.

Apart from this, any risk-aversion in the financial markets would witness Japanese yen strength, in turn, drops in the NZD/JPY pair. On the other hand, any rallies in stocks would favor risk-sensitive currencies like the NZD, the GBP, and the AUD.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY daily chart depicts the pair still in a downward bias, as the daily moving averages (DMAs) reside well above the spot price, slightly horizontal, and would be strong resistance to overcome for NZD bulls. Tuesday’s price broke aggressively after piercing the 76.00 figure, jumping some 120-pips upwards where it currently trades.

To the upside, the first resistance would be the December 8 high at 77.55. The breach of the latter would expose December’s 16 cycle high at 77.96, followed by the 200-DMA at 78.01.

On the flip side, the first support would be the December 3 swing low at 75.95. A decisive breach of the latter would open the door for further losses. The next line of defense downwards would be the July 20 swing low at 75.25, followed by the August 19 low at 74.55

-637757243211208561.png)

- NZD/USD led G10 currencies with the heavy gains before bulls take a breather at weekly top.

- Hopes of no harsh lockdowns before Christmas, hopes of US stimulus favor market optimism despite Omicron woes.

- Sino-America, US-Russia tussles continue, New Zealand virus cases ease.

- A slew of US data can offer a busy day, risk catalysts are important too.

NZD/USD seesaws around 0.6770 during early Wednesday morning in Asia, after a stellar bullish performance the previous day. The kiwi pair rallied the most among the G10 currencies, also posted the biggest daily gains in two months, before the latest sideways moves.

Receding fears of the South African covid variant, dubbed as Omicron, could be linked to the latest market optimism amid a quiet economic calendar. Adding to the upbeat sentiment could be US President Joe Biden’s expectations of getting the “Build Back Better (BBB)” plan done as well as vaccine/treatment optimism.

Despite teasing a push-back to the border re-opening plan to late February, versus previously signaled early January, Omicron fears abate in New Zealand. Receding virus numbers and hopes of faster vaccinations could be linked for the same. That said, Auckland’s seven-day average cases dropped to the lowest since late October. Further, the government eyes faster jabbing to match Australia’s 90% vaccinations. Additionally, the news that New Zealand will reduce booster gap wait to 4 months, from previously 6, also helps the NZD/USD bulls.

On a broader front, “President Biden on Tuesday said he thinks there is still a possibility that his Build Back Better agenda can get done, despite Sen. Joe Manchin’s opposition of the climate and social spending bill,” said The Hill. Additionally, US President Biden and UK PM Boris Johnson’s rejection of fresh lockdown measures before Christmas also underpins the risk-on mood.

Alternatively, the US appoints a new Tibet Coordinator amid tensions with China while the tension with Russia continues. “New export control measures being discussed by the US could halt Russia import of smartphones, key aircraft and automobile components,” said Reuters.

Talking about data, New Zealand’s Credit Card Spending improved in November from a revised down -5.2% to -0.1% versus -2.1% market forecast. Further, New Zealand ANZ – Roy Morgan Consumer Confidence (Dec) improved from 97 to 98.

While portraying the risk-on mood, which also helped NZD/USD prices, the US Treasury yields rose 4.8 basis points (bps) to 1.467% whereas the Wall Street benchmarks snapped a three-day downtrend by the end of Tuesday’s North American session.

Looking forward, Omicron updates will be crucial before the US market opens when a slew of data including US Q3 GDP, Core Personal Consumption Expenditures for the third quarter and Chicago Fed National Activity Index will precede Existing Home Sales to entertain the markets.

Technical analysis

NZD/USD buyers attack the monthly resistance line, near 0.6775 by the press time, amid bullish MACD and recovering RSI, suggesting further advances of the Kiwi pair. However, the 21-DMA level around 0.6790 adds to the upside filter before convincing even short-term buyers.

Alternatively, pullback moves will eye for the yearly low surrounding the 0.6700 mark. Following that, the 61.8% Fibonacci Expansion (FE) of November 23 to December 16 moves, around 0.6670, will offer an intermediate halt during the likely slump towards November 2020 low near 0.6590.

- The Dow Jones Industrial Average rose 1.5% to 35,441.21.

- The S&P 500 increased 1.6% to 4,639.79.

- The Nasdaq Composite was up 2.2% to 15,304.73.

Wall Street's equity markets rebounded from Monday's pullback as risk appetite returned and recovered from a three-day decline ahead of the Christmas holiday later this week.

The Dow Jones Industrial Average rose 1.5% to 35,441.21, the S&P 500 increased 1.6% to 4,639.79, and the Nasdaq Composite was up 2.2% to 15,304.73. The North American government bond markets continued to sell off and the 10-year US yields climbed 4.6bps. The DXY (-0.1%) weakened marginally while most other major FX markets strengthened against the dollar.

The relatively light data schedule for Tuesday included the current account deficit for Q3, the Philadelphia Fed's nonmanufacturing index for December and weekly Redbook retail sales.

A decline in the Philadelphia Fed's Mon-Manufacturing index to 28.3 in December from 46.1 in November highlighted the light data schedule. The other services data already released for December have shown solid growth despite rising COVID-19 cases. The ISM's national reading will be released on January 5.

Meanwhile, the current account deficit widened to $214.77 billion in the third quarter from $198.32 billion in the previous quarter. Redbook reported that US same-store Retail Sales were up 16.4% year-over-year in the week ended December 18, larger than a 16% gain in the prior week.

The data schedule will get busier on Wednesday and Thursday before the holiday on Friday. Looking ahead, Gross Domestic Product growth, Consumer Confidence and Existing Home Sales reports will be released on Wednesday. Personal income and spending, Initial Jobless Claims and New Home Sales releases are scheduled for Thursday.

Late in the day, US President Joseph Biden addressed the nation at 2:30 pm ET and detailed further efforts to combat the rise of COVID-19 cases. There were no surprises in the speech as the White House had already suggested that lockdown measures are not being considered at this point. Biden confirmed this and encouraged everyone to get vaccinated as soon as possible.

- The US Dollar Index edges down some 0.04% as US bond yields rally.

- The US 10-year Treasury yield advances sharply some five basis points at 1.47%.

- DXY Technical outlook: An upside break above an ascending triangle target 98.00.

The US Dollar Index, also known as DXY, which measures the greenback’s performance against a basket of six rivals, barely falls some 0.04%, sitting at 96.48 during the New York session at the time of writing. The market sentiment is upbeat, with major US equities rising between 1.60% and 2.80%.

The market mood improved as investors assessment that vaccines helped tame the Omicron virus outbreak. Additionally, per Bloomberg’s report, the US FDA is poised to authorize pills from Pfizer and Merck to treat Covid-19 as soon as this week.

In the US bond market, the Treasury yields rise in the whole curve. The 2s, 5s, and 10s increase between four and six basis points, sitting at 0.6685%, 1.2238%, and 1.474%. The long maturity of the yield curve, with the 20s, and 30s, rise between two and three basis points, currently at 1.9043% and at 1.875%.

US Dollar Index (DXY) Price Forecast: Technical outlook

The US Dollar Index daily chart depicts the strong dollar narrative keeps in place. The price is above the central Pitchfork’s uptrend channel, which confluences with the ascending triangle on an uptrend. At press time, the DXY is testing the top-trendline of the ascending triangle on an uptrend, though earlier pierced the abovementioned reaching a daily low at 96.33.

To the upside, the first resistance would be the figure at 97.00. A breach of the latter would expose the June 30 high at 97.80, followed by the ascending triangle target at 98.00.

-637757185112461963.png)

- Gold is flat during the New York session amid higher US T-bond yields.

- Appetite for riskier assets, dented investors interest in the precious metal, boost the greenback.

- XAU/USD Technical Outlook: Neutral-bearish, unless gold bulls reclaim $1,800.

Gold (XAU/USD) slides during the New York session, trading at $1,788 at the time of writing. Appetite for riskier assets spurred by vaccines helping tame the Omicron variant and the US FDA set to permit Pfizer, and Merck Covid-19 treatment pills boost the US dollar, to the detriment of the safe-haven gold.

In the meantime, the US Dollar Index, which measures the greenback’s value against a basket of six currencies, is barely down some 0.05%, clings to 96.50. Contrarily to that, US Treasury yields are rallying with the 10-year benchmark note rate at 1.487%, eight basis points higher than Monday’s session.

An absent US economic docket left the dynamics of the precious metal to market mood. However, on Wednesday, the US Gross Domestic Product release for the third quarter, alongside the Personal Consumption Expenditure prices (PCE), Fed’s favorite gauge of inflation, could generate movement in the XAU/USD.

In the overnight session, gold remained subdued in a narrow range, between $1,788-$1,795. As the European session began trended higher, stalling its upward move close to $1,800, confluence with the 50-hour simple moving average (SMA) retreating towards the 200-hour SMA at $1,786.32 amid a spike in US bond Treasuries. Furthermore, fell below the critical December 8 swing high at $1,792.95, opening the door for further losses that could push the yellow metal towards a re-test of $1,780.

XAU/USD Price Forecast: Technical outlook

The XAU/USD daily chart depicts indecision, as shown by the daily moving averages (DMAs) almost “horizontally” contained in the $1,787-$1,800 range. From a market structure perspective, unless gold bulls reclaim $1,792.95, the bias is bearish, though to resume the trend, USD bulls would need a daily close below the December 16 pivot low at $1,775.40.

On the way south, the first support would be the December 16 low at $1,775.40. A break beneath that level would exert downward pressure on the precious metal, exposing crucial support areas. The next one would be the December 2 low at $1,761.72, followed by the December 15 cycle low at $1,752.44

To the upside, the first resistance would be the December 8 cycle high at $1,792.95. A clear break of that level would immediately expose $1,800, followed by the September 3 swing high at $1,834.

-637757154434924569.png)

Here is what you need to know for Wednesday, 21 Dec:

The high beta forex space was bid on the day following strong gains in the European equities space that followed through into the US eventually. The antipodeans (AUD+0.61%, NZD +0.84%) and GBP (+0.45%) were performing well throughout early trade and continued to recover from the prior days of supply. The yen and CHF were the worst performers but still managed to end higher vs the greenback.

As for the US dollar, this was only modestly lower against its major trading partners as markets awaited a deluge of US data Wednesday and Thursday before the Friday holiday. The DXY index ended down 0.02% despite the US 10-year yields ending 3.7% higher.

Late in the day, US President Joseph Biden addressed the nation at 2:30 pm ET and detailed further efforts to combat the rise of COVID-19 cases. There were no surprises in the speech as the White House had already suggested that lockdown measures are not being considered at this point. Biden confirmed this and encouraged everyone to get vaccinated as soon as possible.

The relatively light data schedule for Tuesday included the current account deficit for Q3, the Philadelphia Fed's nonmanufacturing index for December and weekly Redbook retail sales.

A decline in the Philadelphia Fed's Mon-Manufacturing index to 28.3 in December from 46.1 in November highlighted the light data schedule. The other services data already released for December have shown solid growth despite rising COVID-19 cases. The ISM's national reading will be released on Jan. 5.

Meanwhile, the current account deficit widened to $214.77 billion in the third quarter from $198.32 billion in the previous quarter. Redbook reported that US same-store Retail Sales were up 16.4% year-over-year in the week ended Dec. 18, larger than a 16% gain in the prior week.

The data schedule will get busier on Wednesday and Thursday before the holiday on Friday. Looking ahead, Gross Domestic Product growth, Consumer Confidence and Existing Home Sales reports will be released on Wednesday. Personal income and spending, Initial Jobless Claims and New Home Sales releases are scheduled for Thursday.

In US equities, at 20.00GMT, the Dow Jones Industrial Average rose 1.5% to 35,505, the S&P 500 increased 1.67% to 4,645, and the Nasdaq Composite was up 2.22% to 15,975.

In the crypto space, upbeat risk drove investors to seek riskier assets whereby the bonds were sold-off. Subsequently, Bitcoin climbed above the 10-DMA, piercing the trend line of the November peak and adding 3.7% on the day to a high of $49,353.49.

However, the monthly chart leans bearish and the RSI drop implies that there is still downside momentum. With that being said, bulls will target a break above $53,000/$54,000 where the 100-DMA is located that will give longs greater control.

Commodities were bid with the CRB index higher by over 2% with US oil, the largest component of the index and as measured by WTI spot ended around 3.2% higher. Copper was 1% higher

- AUD/USD could be correcting towards the 0.7180s if the bears don't commit immediately.

- Bears will be looking for a downside weekly extension to mitigate the imbalance towards 0.68 the figure.

AUD/USD has caught a bid in the US sessions as risk flips to positive and the US stock market rallies. The price is moving through the mid-point of the 0.71 area and the bull eye 0.7180.

AUD/USD weekly chart

The bias is to the downside from a weekly perspective while the price has met a 38.2% Fibonacci level on a retest of the prior support that turned resistance. Meanwhile, should the bears take control, then the mitigation of the prior imbalance towards 0.68 the figure will be in play.

AUD/USD daily chart

The price is running up to test the firm double top resistance with 0.7180 eyed. If this holds, then the downside will be favoured as per the weekly chart.

President Joe Biden has said that the US is not going back to March 2020, in terms of lockdown.

Watch Live

- Biden says those not fully vaccinated have good reason to be concerned about omicron.

- Biden says all Americans have patriotic duty to get vaccinated.

- President Biden says we are not going back to March 2020.

- Biden says we can keep our K-12 schools open.

US markets are brushing the risk-off on Tuesday. Stocks have rallied in midday trading and was rebounding from a slump in the previous session as risk appetite improved.

The Dow Jones Industrial Average rose 1.5% to 35,505, the S&P 500 increased01.67% to 4,645, and the Nasdaq Composite was up 2.22% to 15,975.

- The USD/CHF rises some 0.34% during the day, boosted by risk appetite.

- USD/CHF Technical Outlook: It has a neutral bias, remains range-bound amid the lack of a catalyst.

During the New York session, the USD/CHF climbs some 0.34%, trading at 0.9242 at the time of writing. A risk-on market mood, as witnessed by the greenback strengthening against safe-have peers like the CHF and the JPY, boosts its prospects of higher prices.

Omicron-related news, with vaccines helping tame the previous-mentioned coronavirus strain improved investors’ mood. Furthermore, through the New York session, the US Food and Drug Administration (FDA) is set to authorize Pfizer and Merck Covid-19 treatment pills this week.

In the meantime, the US Dollar Index, which tracks the buck’s value versus six rivals, is flat, sitting at 96.55. at the same time, US bond yields are rising strongly, with the 10-year rallying six basis points at 1.48% in the last four hours.

USD/CHF Price Forecast: Technical outlook

The USD/CHF daily chart depicts that the pair have remained in consolidation for the last 17 trading days, in the 0.9160-0.9265 range, sometimes piercing through price extremes, like the December 15 high at 0.9293. At press time, the USD/CHF pair has a neutral bias.

Upwards, the first demand zone would be 0.9290. A decisive break of that level would expose the 78.6% Fibonacci retracement at 0.9327, followed by the November 24 high at 0.9373.

On the flip side, the confluence of the 50 and the 100-day moving averages (DMAs) around the 0.9205-15 range would be the first demand area. A breach of the latter would open the door towards the 0.9200 figure, immediately followed by the 200-DMA at 0.9176.

-637757111833717115.png)

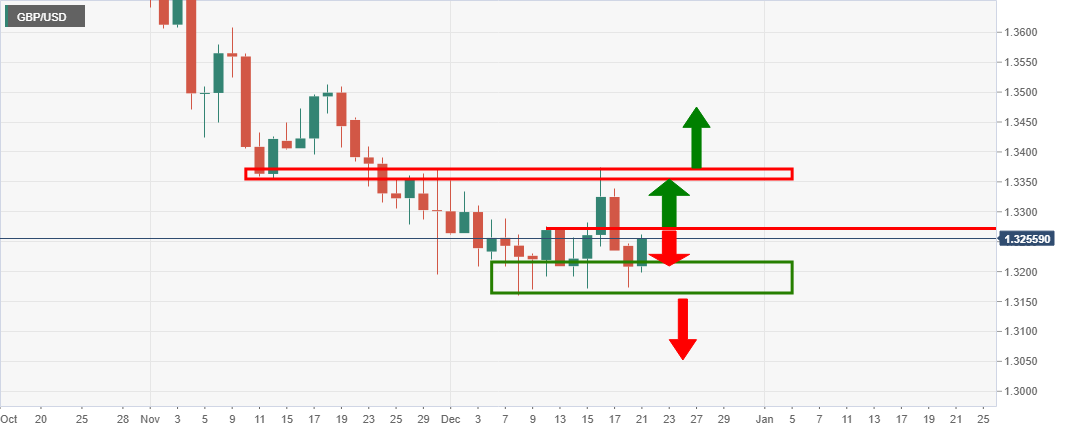

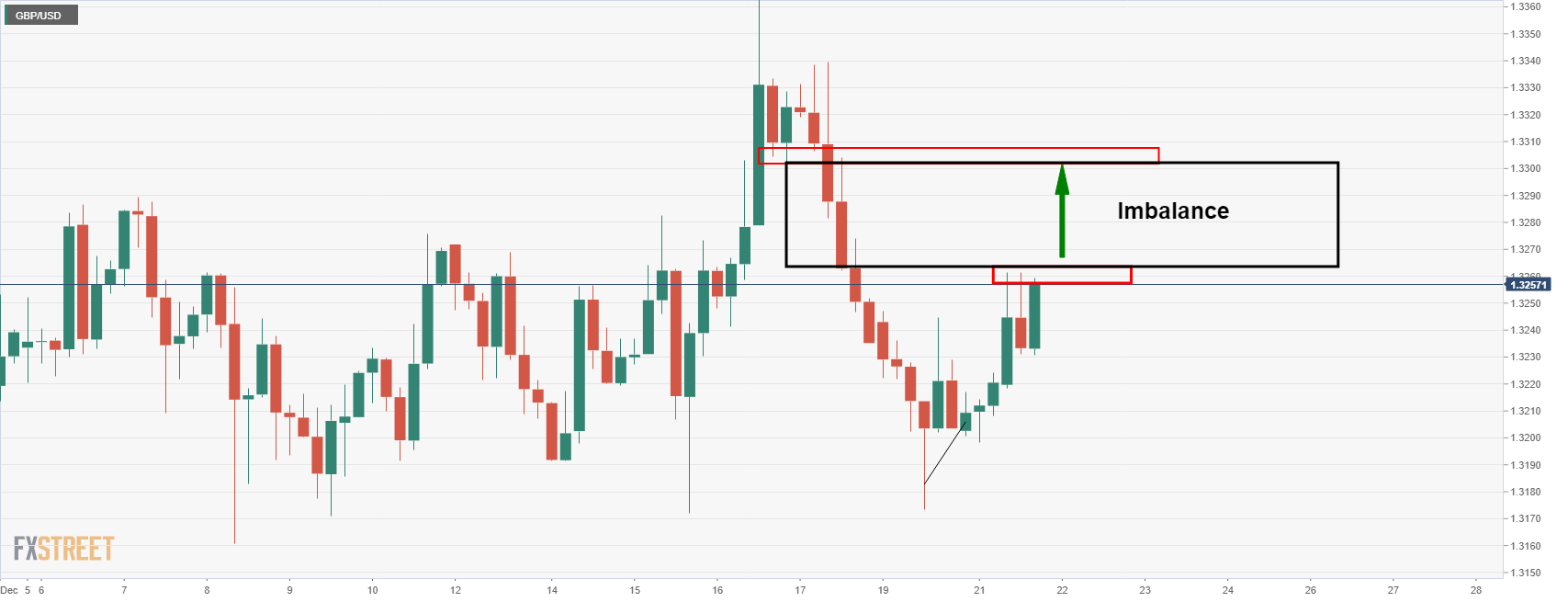

- GBP/USD bulls are looking for a run to test 1.33 the figure.

- Bears need to commit at this juncture or face continued pressures for the sessions ahead.

GBP/USD is not showing any signs of an imminent break of daily ranges. However, the 4-hour chart's imbalance between spot and 1.33 the figure is compelling.

The following illustrates the market structures from a weekly down to a 4-hour perspective.

GBP/USD daily chart

As illustrated, the price is not giving any signals from a daily perspective, trapped in a range of consolidation.

GBP/USD weekly chart

The weekly chart shows that there is a firm area of support at this juncture. Therefore, it is typical that the price will struggle to breakout to the downside before enough supply has been allocated in the market.

GBP/USD H4 chart

The 4-hour chart shows that the price is trying to mitigate the imbalance with today's spike to test resistance. On the break of resistance, there is room to go until 1.33 the figure and some change.

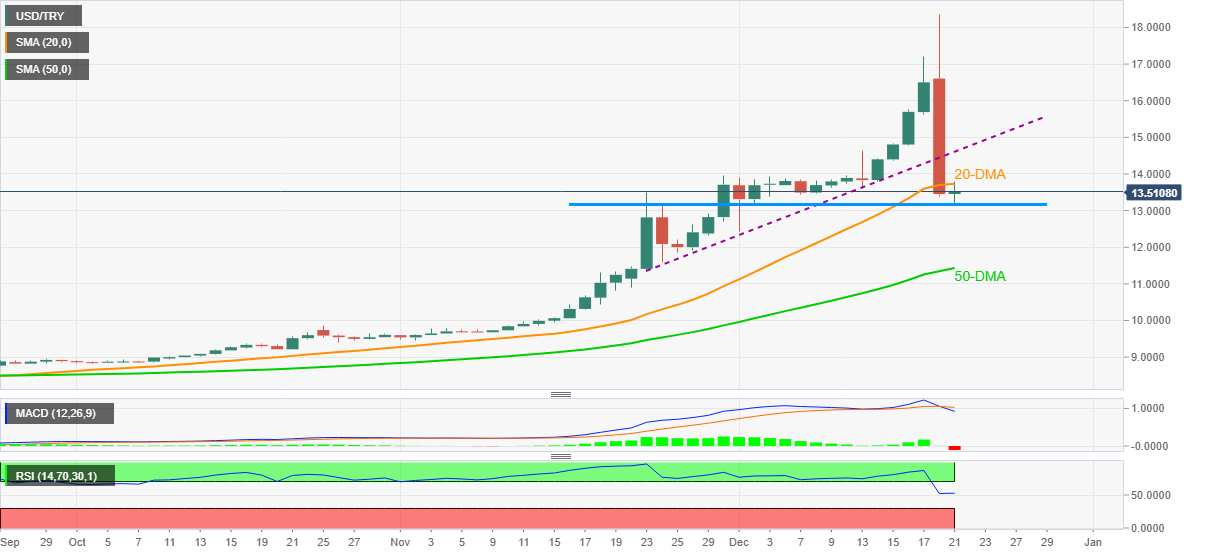

- The USD/TRY edges low during the New York session, down some1.96%.

- Erdogan’s revealed a program that protects savings from lira’s fluctuations vs. the greenback, the TRY slightly appreciates.

- USD/TRY Technical Outlook: Despite the recent dip spurred by measures to stabilize the Turkish lira, it has an upward bias.

The Turkish lira recovers some of its losses, is trading at 12.9561 during the New York session at the time of writing. The market sentiment is upbeat, as shown by risk-sensitive currencies rising, which benefits Emerging Markets peers. Nevertheless, the lira whipsawed between gains and losses in the last couple of trading days against the greenback, as the CBRT has made 500 basis points cut to its interest rates, despite heightened inflation meandering around the 20%.

Turkey’s President Recep Tayyip Erdogan revealed a program that protects savings from fluctuations in the lira. While that measure shored up the Turkish peer declines, the Borsa Istanbul Index continues its free-fall with a 7.5% decline, triggering another halt to its operations.

Analysts at TD securities commented that in the short term, “the government may have its way and enjoy the current currency rally.” Further added that it will be difficult for the government to maintain its credibility because the commitment will be too big to be sustainable.

That said, the USD/TRY will still be fluctuating within an extensive range, so traders should be aware of developments in Turkey.

USD/TRY Price Forecast: Technical outlook

The USD/TRY daily chart depicts that the pair has an upward bias. However, the downward move spurred by the news of Erdogan’s implementing measures to protect savers stalled around the 50-day moving average (DMA) at 11.3800, bouncing off towards current price levels, as market participants assess what would be the outcome of the Turkish lira in the near and mid-term.

To the upside, the first resistance would be the confluence of daily tops around 13.8722. A breach of the latter would open the door towards the December 13 swing high at 14.6064, followed by a test of December 17 high at 17.04.

- EUR/USD bears taking control and testing bullish commitments at critical daily support.

- Lower term time frames are bearish as bears move in below mitigation area.

EUR/USD is in a period of consolidation in thin holiday markets in what otherwise might be regarded as a phase of redistribution which leaves the bias to the downside. The following illustrates the potential for a meanwhile bullish correction on the lower time frames before a restest of the recent lows and the mid-point of the 1.12 area.

EUR/USD daily chart

Following a tweezer top, the price, from a daily perspective, is taking on the support structure and below the resistance formed on the breakout of distribution. The retest of the resistance failed and the bears have been moving in mid-week. This gives rise to the prospects of a downside continuation.

EUR/USD H1 chart

The price at this juncture could still have some upside to go to mitigate, from an hourly basis, the imbalance towards 1.1280.

However, this area was already filled on a 30-min time frame:

EUR/USD 30-min chart

Therefore, there is the risk of an imminent continuation to the downside. A stop above the mitigation area, aka, 1.1280, could protect shorts against the prospects of hourly mitigation prior to the anticipated run towards 1.1250/1.1215.

If, on the other hand, if bears fail to take out 1.1200, then the outlook from a medium-term perspective would turn bullish and the consolidation would be regarded as a phase of accumulation leaving 1.1400 vulnerable for the weeks ahead.

Analysts at CIBC forecast the AUD/USD pair will rise on the months ahead, reaching 0.73 by the end of the first quarter of next year and 0.74 by the end of the second quarter. They see the outlook of the Reserve Bank of Australia supporting the recovery of the Australian dollar.

Key Quotes:

“The Australian dollar has rebounded from a test of major support vs the USD at 0.7000, and while in a mode of correction to the decline of the last month, looks set to extend somewhat higher. A confluence of recent factors supports the near-term positive outlook. They include a more positive economic outlook from the RBA, and from China, a RRR cut, easing of property curbs, and strong trade data.”

“The trend of AUD/USD over the last six months has been for tests of support, as a stronger USD, divergence in the outlook for monetary policy normalisation between the Fed and the RBA, and concerns over supply chain disruptions, particularly as they relate to demand from China, have all had impacts. The stronger USD continues to be an influence, and the present move is seen in the form of consolidation, as other factors have turned somewhat in favour of the AUD.”

“Though market pricing for RBA hikes is still rich to RBA guidance on when inflation will sustainably reach target, and the lift off timing between the RBA and FOMC is uneven, the implied cash rates between Australia and the US in 1-years’ time are widening in favour of AUD. The latest levels are around 97bps vs 73bps. That widening has been supportive of the recovery in AUD/USD.”

The divergence between the easing of monetary policy in China and the tightening from the Federal Reserve should underpin a gradual turn of USD/CNY, explained analysts at Danske Bank.

Key Quotes:

“If indeed China manages to drive a moderate recovery in 2022, it should provide upside for Chinese offshore equities, which tend to be quite cyclical in nature. We also see quite attractive valuation in the offshore market after the sharp declines this year, which happened on the back of the double whammy from a sharp cyclical slowdown (...). Large tech companies listed on the Hong Kong stock exchange have also been directly hit by the regulation.”

“Developers have also been hit hard but should in our view stabilize and recover during 2022 as home sales climb slowly higher. We do expect equity volatility to stay quite high, not least in the short term, as the economy is yet to bottom. But as we see more clear signs of a recovery during 2022, we expect it to lift Chinese stocks. China is still a high-risk market, though, as 2021 has also proven.”

“For USD/CNY, we expect the easing of monetary policy alongside rate hikes by the Fed to finally lead to a turning point for the cross. CNY has been trading very strongly in 2021 on the back of a high trade surplus, but we also expect this to come down during 2022 as the US demand for goods is expected to moderate. We expect USD/CNY to move towards 6.80 in 12M from the current level of 6.37.”

Intervention in the currency market from the Swiss National Bank will likely keep a lid on the Swiss franc valuation ahead, according to analysts at CIBC. They forecast EUR/CHF at 1.05 by the end of the first quarter and at 1.07 by the second quarter of next year.

Key Quotes:

“The last two months have witnessed a substantive grind lower in EUR/CHF. Across that period, we have seen the CHF gain more than 4%. The broad-based CHF gain, against an increasingly beleaguered EUR, has seen the cross trade below 1.04 for the first time since mid-2015. Gains in the CHF came despite the fact that leveraged players moved substantially short of the CHF into early November.”

“Should the SNB encounter similar inflationary tendencies as that expected by the ECB, namely longrun price pressures are expected to be contained, not least as second-round wage effects remain limited, this underlines the scope for renewed intervention activity, to preclude a return of disinflationary tendencies.”

“The arrival of the omicron variant provides a new variable to throw into the CHF mix; this comes as the currency remains a primary risk-off beneficiary. Omicron risks notwithstanding, SNB inertia, in line with the ECB, allied to an acceleration in intervention, points towards potential underperformance against ongoing USD impetus into 2022.”

- The NZD/USD grinds higher on Tuesday, up some 0.52%.

- An improved market mood keeps the risk-sensitive currencies bid to the detriment of the US dollar.

- NZD/USD Technical Outlook: Bearish-biased but in the near-term is upwards.

After extending its losses to two consecutive days, the New Zealand dollar advances during the New York session, trading at 0.6749 at the time of writing. The market sentiment has improved, as witnessed by risk-sensitive peers rising, with the NZD gaining 0.52% against the buck, the most significant gain of the G8 currencies.

The market mood improved as investors assessment that vaccines helped tame the Omicron virus outbreak. Additionally, per Bloomberg’s report, the US FDA is poised to authorize pills from Pfizer and Merck to treat Covid-19 as soon as this week.

In the meantime, the US Dollar Index, which measures the greenback’s value versus its rivals, falls some 0.02%, sitting at 96.53, almost unchanged.

In the last hour or so, the US bond yields are rising strongly, with the 10-year benchmark note up six basis points, sitting at 1.480%, lifting the US dollar index.

Apart from this, an absent New Zealand and US economic docket would leave the NZD/USD traders lying in the dynamics of market sentiment. However, on Wednesday, the US economic docket would unveil the Personal Consumptions Expenditures (PCE), the Fed’s favorite inflation gauge, alongside the Gross Domestic Product, for the Q3.

NZD/USD Price Forecast: Technical outlook

The NZD/USD daily chart depicts that the NZD has recovered some ground against the greenback, at press time forming a bullish engulfing candle that could send the pair upwards. Nevertheless, the NZD/USD is bearish biased, as shown by the daily moving averages (DMAs) residing well above the spot price, near the 0.7000 figure.

If the NZD/USD extends its gains, the first resistance would be the December 17 high at 0.6800. A breach of the latter would expose the December 16 high at 0.6833, followed by the December 1 high at 0.6867.

On the flip side, the first support would be the YTD low, at 0.6700. A break beneath that level would expose crucial demand zones. The next one would be 0.6650, followed by the November 2, 2020, swing low at 0.6589.

The EUR/GBP will likely move to the upside over the next months according to analysts from Rabobank. They see the current state of UK politics not helping the pound.

Key Quotes:

“Despite this month’s 15 bps BoE rate rise, the pound is still not trading very well. After an initial push lower on the Bank’s policy announcement last week. EUR/GBP is again pressing up against the 200 day sma. Omicron is certainly a factor behind the inability of the pound to find traction in the BoE’s more hawkish tone.”

“A primary reason for PM Johnson not announcing further Covid restrictions this week, despite the exponential growth in UK Covid cases, is likely related to fear of his own backbenchers. Around 100 Tory MPs earlier this month rebelled against Johnson’s proposal to introduction Covid passports for large venues – a measure that was only passed with the support of the Labour opposition. The resignation letter of Brexit Minister Frost at the weekend expressed his concerns over the ‘direction of travel’ of Johnson’s government with respect to rising taxes and the recent Plan B of new Covid restrictions.

“Press reports suggesting that some in Westminster are openly talking about a potential leadership challenge. While there is no imminent general election in the UK, Johnson’s leadership is looking weak. This does nothing to strengthen confidence in post Brexit Britain and, on the margin, will undermine the pound We see EUR/GBP creeping up towards 0.87 during the course of next year.”

Data released on Tuesday showed Retail Sales rose in Canada 1.6% in October, surpassing expectations. According to analysts at the National Bank of Canada, the rebound at car dealers helps lift retail sales further above pre-crisis level. They see October’s retail sales report heralding a strong end of the year for consumer spending.

Key Quotes:

“Retail sales rose 1.6% in October, quite a bit more than the median economist forecast calling for a 1.0% gain. Adding to the good news, the prior month’s result was revised upwards, from -0.6% to -0.3%.”

“The near-term outlook also appeared encouraging; the federal statistics agency anticipated another healthy gain in retail sales in November, putting paid to fears of a decline caused by floods in British Columbia. As for the longer-term horizon, it has become a lot more uncertain, the unprecedented surge in COVID-19 cases in the country having forced the reintroduction of social distancing measures in several provinces. While this could weigh on consumer spending during the holiday season, we believe the bulk of the impact of these measures will be felt early in the first quarter of 2022.”

“Consumption on services is more at risk but a change in the composition of goods spending could also be observed, with households diverting their spending away from categories necessitating close contacts and towards those that do not require any interaction.”

Analysts at CIBC see a gradual recovery in the months ahead for the NZD/USD pair. They forecast it at 0.70 by the end of the first quarter of next year and at 0.71 by the second quarter.

Key Quotes:

“The RBNZ was amongst the first major central banks to begin monetary policy normalisation. Despite some initial support for the NZD, the outlook for the currency is now caught between support from higher yields and concerns that tighter policy will eventually be a headwind to activity.”

“We expect the RBNZ to continue hiking the cash rate through until 2023, based on the latest bank projections. Rate differentials should therefore be one factor in favour of the currency.”

“The question that now arises however, is when the monetary tightening becomes restrictive and activity slows. That looks to be a challenge for 2H 2022. Until that time, the expanding differential between New Zealand and other major economy yields, will support NZD gains.”

“NZD support against the USD is expected in the early months of the year as the initial pace of RBNZ hikes outpaces the Fed.”

The US Food and Drug Administration is poised to authorise Covid-19 pills from Pfizer and Merck this week, tweeted a Bloomberg reporter on Tuesday. According to Pfizer, their pill reduced Covid-19 hospitalization or death by 89% if taken within 3 days of symptom onset. The Merck pill isn't quite as effective but is still thought to reduce mortality by about 50%.

Market Reaction

There hasn't been much of a market reaction to the news, though the pills are very welcome in the fight against the pandemic and, from here out, are expected to reduce US mortality rates.

- Japanese yen weakened amid higher equity prices and US yields.

- USD/JPY breaks short-term resistance at 113.80 and gains momentum.

The USD/JPY broke above 113.75 and climbed to 113.98, reaching the highest level since last Thursday. It is hovering near the highs supported by higher US yields.

Dollar gains ground versus European majors and JPY

The combination of higher US yields and an improvement in risk sentiment boosted the USD/JPY pair. The dollar is higher versus European majors, but not against emerging market and commodity currencies due to the improvement in risk appetite.

The US 10-year yield stands at 1.48%, the highest in a week while the 30-year is at 1.91%, up more than 3% so far on Tuesday. In Wall Street, the Dow Jones gains 0.85% and the Nasdaq rises by 0.37%.

The short-term technical outlook for USD/JPY now is biased to the upside after breaking the 113.75/80 resistance area. Now it is looking at the 114.00 area. Above the next level stands at 114.20 that is the last protection to last week top at 114.27.

A daily close above 114.40 would increase the odds of more gains ahead. On the flip side, under 113.20 the yen should strengthen.

Technical levels

UK Prime Minister Boris Johnson is set to make an announcement on whether or not England will go into a circuit breaker lockdown or not within the next 48 hours, reported The Sun. According to the article and in line with some of the speculation in UK press over the last few days, 27 December is a potential date when the lockdown might begin. The report adds that MPs are going to be briefed on the latest Omicron data on Tuesday evening.

Market Reaction

GBP does not seem to have reacted to the latest reports.

- AUD/USD has run into resistance at its 21DMA in the 0.7130s after bouncing from APac lows at 0.7100.

- The RBA minutes delivered few surprises and the main driver for the pair this week will be US data on Thursday.

- Aside from that, Omicron remains a key market theme.

AUD/USD, which has spent most of the session gradually advancing since it found support during APac trade at the 0.7100 level, has now run into resistance in the 0.7130s at its 21-day moving average. That still leaves the pair trading higher by over 0.3% on the session. A break above the 21-day moving average could open the door to a further grind higher perhaps all the way as high as the 0.7200 level and last week’s highs at 0.7220 just above it. But traders will be cautious that it might be difficult for the pair to muster the strength for such a move over the coming session amid holiday-thinned liquidity conditions that look set to prevail into early January.

Indeed, across other G10 majors, range plays may well be the way to go and this might also be the story for AUD/USD. In that respect, recent lows just under the 0.7100 are likely to act as a floor. In terms of fundamental drivers, the main story is still Omicron as markets participants weigh up how much of an impact its spread is likely to have on the near-term economic outlook and how much, if at all, this will impact G10 central bank reaction functions in 2022. As far as the Fed and RBA are concerned, Omicron is not yet viewed as presenting a meaningful risk to long-term growth prospects in either the US or Australia. Indeed, it seems that although infection rates are picking up in both countries, authorities in both seem eager to avoid lockdown and stick to past pledges to “live with the virus”.

Sticking with the RBA, the minutes of the bank’s last confab were released during Asia Pacific hours. The minutes failed to stir a reaction in AUD amid a lack of surprises; the bank continues to support easy monetary policy and is mulling its options for the QE programme in February, which include a potential decision to axe it entirely. In terms of the rest of the week, the only data of note for AUD/USD traders will be a few releases on Thursday which include November Core PCE inflation, November Durable Goods Orders, the weekly jobless claims report and the preliminary University of Michigan estimate of US Consumer Sentiment in December. All of this should underly a strong, high inflation US economy, though the sentiment survey may reflect some creeping Omicron fears as the US braces for a wave of infections.

- The Loonie advances 0.12% versus the greenback amid a risk-on market mood.

- Rising crude oil prices underpin the Canadian dollar, the US dollar weakens.

- Canadian Retail Sales rose by 1.6%, more than the 1.0% estimated, the Loonie barely moved.

During the New York session, the USD/CAD grinds lower, trading at 1.2925 at the time of writing. The market sentiment has improved, as shown by risk-sensitive currencies like the CAD, the GBP, and the AUD got bid in the overnight session, while safe-haven peers drop.

Positive news regarding vaccines helping tame the Omicron variant improved investors’ mood. That alongside high crude oil prices, with Western Texas Intermediate (WTI), the US crude oil benchmark up some 2.55% trading at $70.36 a barrel, underpins the Loonie, which trims some of the last week’s losses, as appetite for the greenback has improved.

In the meantime, the US Dollar Index, which tracks the buck’s performance vs. a basket of six rivals, drops some 0.02%, sitting at 96.53.

The Canadian economic docket featured Retail Sales for November. Statistics Canada announced that sales rose by 1.6% on a monthly basis reading, higher than the 1.0% estimated and a strong rebound after September’s 0.6% decline. Retail Sales excluding Autos increased by 1.3%, also stronger than the 0.8% estimations.

Additionally, USD/CAD traders would lean in US macroeconomic data. On Wednesday, the Gross Domestic Product for the Q3 and Fed’s favorite gauge of inflation, the Personal Consumption Expenditures Prices (PCE) for the Q3, will be released. By Thursday, Initial Jobless Claims and Durable Good Orders would be scrutinized by market participants.

USD/CAD Price Forecast: Technical outlook

The USD/CAD broke strong resistance found at the December 3 high at 1.2853. In the last two days, the pair has been trading range-bound in the 1.2850-1.2960 area, and as the year-end looms, it could probably remain subdued.

In the event of breaking to the upside, the first resistance would be 1.3000. A clear break of that level would expose November 13, 2020, high at 1.3172.

On the flip side, failure at 1.2960 would open the door for further losses. The first support would be 1.2900. The breach of the latter could send the pair sliding towards the December 3 high previous resistance-turned-support at 1.2853, and then the 1.2800 figure.

- Eurozone Consumer Sentiment fell to -8.3 in December, down from -6.8 in November.

- The euro seemed to take a hit in wake of the day and EUR/USD fell to session lows.

The Eurozone Consumer Confidence index fell to -8.3 in December from -6.8 in November according to the flash estimate released by the European Commission on Tuesday. That was below expectations for a drop to -8.0.

The data to compile the index was collected in a survey conducted between December 1 to 20. The final estimate of December Consumer Confidence will be released on January 7.

Market Reaction

The euro seems to have taken a slight hit in recent trade, with EUR/USD recently dipping to session lows in the 1.1260s from earlier highs above 1.1300. The weakness of the Consumer Sentiment index likely reflects the impact of surging Omicron infection rates across the continent.

- GBP has recovered on Tuesday amid a broader pick-up in risk appetite, lifting GBP/USD to near 1.3250.

- Omicron risk continues to weigh on the pair, though holiday conditions may well prevail until the year’s end.

GBP has strengthened in tandem with other more risk-sensitive currencies on Tuesday, a function of a broader recovery in risk appetite across markets. GBP/USD has thus rallied from earlier session lows close to 1.3200 to current levels just under 1.3250, where the pair trades higher by about 0.3% on the day. The main support to the downside is the recent lows in the 1.3150-70 area, while to the upside, there is the 21-day moving average at 1.3280.

The latest reports from UK press suggest there will be no new lockdown announcement on Tuesday, though traders will remain on notice for an announcement that could come later in the week. It seems very unlikely that restrictions would be imposed this side of Christmas given the opposition UK PM Boris Johnson faces from within his Cabinet, with UK press speculating this week that a short “circuit-breaker” lockdown could be imposed as soon as the 27th to prevent the NHS from being overwhelmed.

The risk that Omicron presents to the UK economy was laid bare in a survey released earlier in the session on Tuesday. The CBI Distributive Trades Survey, out at 1100GMT, saw its headline index drop to 8 from 39 last month, much larger than the expected drop to 24. That marks the lowest reading since March, when the UK was still in a strict lockdown. If the UK is headed into lockdown at the end of the month, survey data in January looks set to reflect a further deterioration in sentiment.

All of this near-term risk for the UK economy has clearly weighed on GBP in recent sessions and is likely one reason why the currency was unable to hold onto its post-surprise BoE rate hike gains last week. Markets are clearly not particularly confident the bank will be able to follow up that first rate hike with another on in February. But there is some good news from South Africa; Omicron infections have now fallen for a third straight day and hospital admissions are also slowing, having never challenged peaks in last waves anyway. The hope is that Omicron will follow a similar path in the UK and, in the end, the outbreak will only cause temporary economic disruption rather than inflicting lasting damage.

But if this optimistic scenario is the case, that means the Omicron outbreak is also likely to be less severe in the US. Regardless, amid a strong US labour market recovery and with inflation sticky at elevated levels, the Fed seems eager to press ahead with monetary tightening. USD strength may have to wait until early next year, with FX markets likely to remain in holiday mode into the year-end, but things are looking bullish for the buck. GBP/USD looks vulnerable to break below recent lows in the 1.3150 area.

- Crude oil prices have chopped between the $68.50 and $70.00 levels on Tuesday.

- Prices are substantially higher versus Monday’s lows amid dip-buying, though Omicron remains a risk.

Front-month WTI crude oil future prices have been choppy on Tuesday, swinging between the $68.50 and $70.00 level and, in doing so, swinging between gains and losses. At present, oil is trading in the mid-$69.00s, in the top half of today’s trading range and with very modest gains of about 25 cents on the session. Again on Monday, it seems that oil prices over-reacted to the latest Omicron news, providing a dip-buying opportunity for the longer-term bulls. At current levels, WTI is up more than 5.0% or close to $3.50 per barrel versus its Monday lows just above $66.00.

In terms of the latest on Omicron, sequencing data released on Tuesday out of the US showed that Omicron now made up 73% of total Covid-19 infections in the country. Most expect that the US will soon follow the path of the UK and see the daily infection rate spike to record highs. This is likely to cause alarm, which is a risk that crude oil traders should watch out for over the coming sessions/weeks into early 2022. But the key factor in the US is whether it follows in the footsteps of Europe by states moving to lockdown and whether hospitalisations surge.

Given the above, just as sharp downturns might be seen as a market overreaction, any sustained crude oil rally in the coming days is vulnerable to be seen as a selling opportunity. Aside from tracking pandemic news/trends,US crude oil inventory data will also be worth watching. Private weekly API inventory figures will be released on Tuesday at 2130GMT ahead of official weekly US inventories on Wednesday. Expectations are currently for Wednesday’s official data to show a sizeable 2.6M barrel draw in stocks.

UK Foreign Minister Liz Truss, who is now in charge of Brexit negotiations after the resignation of former Brexit Minister Lord David Frost over the weekend, said on Tuesday that the UK's position on the implementation of the Northern Ireland Protocol (NIP) remains unchanged. We must end the role of the European Court of Justice as a final arbiter in the arrangement, she said, adding that if this does not happen, the UK remains prepared to trigger Article 16.

Truss reiterated the UK stance that the preference is for an agreed solution to be reached. We must pick up the pace of talks in the new year, she added.

Market Reaction

GBP has not seen any reaction to the latest remarks from Truss.

- The risk-on impulse undermined the safe-haven CHF and assisted USD/CHF to regain traction.

- Subdued USD demand held back traders from placing aggressive bets and capped the upside.

- Thin liquidity conditions further warrant some caution before positioning for any further gains.

The USD/CHF pair maintained its bid tone through the early North American session and was last seen hovering near the top end of its daily trading range, around the 0.9220-15 region.

Following the overnight pullback from mid-0.9200s, the USD/CHF pair regained positive traction on Tuesday, though the uptick lacked strong follow-through. A turnaround in the global risk sentiment – as depicted by a solid recovery in the equity markets – undermined the safe-haven Swiss franc and provided a goodish lift to the major. That said, a combination of factors could hold back traders from placing aggressive bullish bets and cap any further gains.

Investors remain concerned about the potential economic fallout from the rapid spread of the Omicron variant of the coronavirus and the imposition of fresh restrictions. Adding to this, a fatal blow to US President Joe Biden's massive $1.75 trillion spending bill might keep a lid on any optimistic move in the markets. In fact, US Senator Joe Manchin, a conservative Democrat who is key to Biden’s hopes of passing the investment bill, said on Sunday that he would not support the package.

Meanwhile, modest US dollar weakness was seen as another factor that acted as a tailwind for the USD/CHF pair, at least for the time being. That said, the Fed's hawkish outlook, along with a fresh leg up in the US Treasury bond yields support prospects for the emergence of some USD dip-buying and additional gains for the USD/CHF pair. It is worth recalling that the so-called dot-plot indicated that the Fed officials expect to raise the fed funds rate at least three times next year.

In the absence of any relevant economic releases, the mixed fundamental backdrop warrants caution before placing aggressive directional bets. Investors might also be reluctant amid relatively thin liquidity conditions heading into the year-end holiday season. Even from a technical perspective, the USD/CHF pair has been oscillating in a range over the past two weeks or so. This further makes it prudent to wait for a sustained strength beyond mid-0.9200s before positioning for any further gains.

Technical levels to watch

- Canadian Retail Sales rose 1.6% MoM in October and likely rose 1.2% MoM in November, according to Statistics Canada.

- The loonie was unmoved, with investors more focused on Thursday's GDP report.

According to a report released by Statistics Canada on Tuesday, Canadian Retail Sales rose 1.6% MoM in October, more than the expected 1.0% rise and a sharp acceleration from September's 0.6% MoM decline. Statistics Canada's flash estimate for November showed that Retail Sales most likely rose 1.2% MoM in November, suggesting continued strong momentum.

The Core measure that excludes auto purchases was up 1.3% MoM, also stronger than consensus estimates, which was for a 0.8% MoM gain. As with the headline readings, the ex. autos measure of Retail Sales also accelerated sharply on the month from September's 0.2% MoM drop.

Market Reaction

The loonie has not reacted to the latest retail sales report, with USD/CAD continuing to move sideways in the 1.2920 area. Loonie investors will be more interested in the release of October GDP numbers on Thursday, which will provide an early indication as to how the Canadian economy faired at the start of Q4.

UK Chancellor of the Exchequer Rishi Sunak announced on Tuesday that the UK Treasury would make £1B in support available to the businesses most impacted by Omicron, mainly in the hospitality and leisure sectors. Businesses will be eligible for one-off grants of up to £6,000 per premise, while the government will cover the costs of mandatory sick pay for Covid-19 related absences from small and medium-sized employers across the UK.

When asked about further support in the event of a post-Christmas lockdown, Sunak said the Treasury will respond to the situation proportionately and keep things under constant review. We can't rule anything out, he said.

Market Reaction

GBP has not seen any notable reaction to the latest announcement from Rishi Sunak, though it does raise the possibility of a more proactive fiscal stance from the UK government in the event of a stricter lockdown which would remove some downside risk to the economy.

- Omicron fears, weaker USD assisted gold to gain some positive traction on Tuesday.

- The Fed's hawkish outlook, rising US bond yields capped gains amid the risk-on mood.

- Relatively thin liquidity warrants some caution before placing aggressive directional bets.

Gold regained positive traction on Tuesday and reversed a major part of the previous day's losses, stalling its recent pullback from the $1,814-15 resistance zone or monthly high touched last week. The XAU/USD maintained its bid tone through the mid-European session, with bulls awaiting a sustained move back above the 200/100-day SMAs confluence hurdle near the $1,800 mark.

The precious metal drew some haven flows amid concerns about surging Omicron COVID-19 variant cases and a fatal blow to US President Joe Biden's massive $1.75 trillion spending bill. In fact, US Senator Joe Manchin, a conservative Democrat who is key to Biden’s hopes of passing the investment bill, said on Sunday that he would not support the package. The developments dashed hopes of a definitive vote before the end of the year, which, in turn, kept the US dollar bulls on the defensive and further benefitted the dollar-denominated gold.

Meanwhile, the global risk sentiment stabilized after Moderna said on Monday that a booster shot of its COVID-19 vaccine could protect against the new strain in laboratory testing. This led to a strong recovery in the global equity markets and held back traders from placing aggressive bullish bets around the safe-haven XAU/USD. Apart from this, the Fed's hawkish outlook and a fresh leg up in the US Treasury bond yields kept a lid on any further gains for the non-yielding gold, warranting some caution for aggressive bullish traders.

It is worth recalling that the Fed announced last Wednesday that it would double the pace of tapering to $30 billion per month. Moreover, the so-called dot plot indicated that officials expect to raise the fed funds rate at least three times next year. Investors might also be reluctant amid relatively thin liquidity conditions heading into the year-end holiday season. This makes it prudent to wait for a strong follow-through buying before positioning for any further gains amid absent relevant market moving economic releases from the US.

Technical outlook

From a technical perspective, any subsequent move beyond the $1,800 confluence might continue to face stiff resistance near the $1,814 region. Some follow-through buying might trigger a short-covering move and push gold prices back towards the $1,832-34 heavy supply zone. On the flip side, the $1,779-78 area now seems to protect the immediate downside. This is followed by support near the $1,772 horizontal level, below which the XAU/USD could slide back to the monthly swing low, around the $1,753 region.

Key levels to watch

- EUR/USD has been moving sideways in thin ranges just under 1.1300 and close to its 21DMA.

- Volumes are thinning ahead of Christmas/year-end holidays and are unlikely to pick up until January.

- Analysts do not expect EUR/USD to break out of 1.1250-1.1350ish ranges in the coming sessions.

Despite a broader turn-around in risk appetite on Tuesday, as US and European equities make good progress in recouping some of Monday’s risk-off fuelled losses, EUR/USD is trading in a highly subdued fashion. The pair seems content to amble within tight ranges on either side of its 21-day moving average around 1.1285, which seems to be acting as a magnet. At current levels just under 1.1290, the pair is trading with modest gains of about 0.1% on the day, though has been unable on Tuesday to test Monday’s 1.13037 highs, as the 1.1300 level acts as resistance.

Volumes, already thinner than usual this month, have been declining since last week’s central bank bonanza that included Fed and ECB policy announcements. This trend is likely to continue as Christmas/New Year holidays approach and is only set to rebound at the start of January. That suggests rangebound conditions are set to dominate in FX markets over the coming sessions, meaning that a EUR/USD break out of its already estabilished 1.1230-1.1360ish December ranges seems highly unlikely.

In terms of the fundamentals driving the pair, ING doubts that “we will see any idiosyncratic rally (for EUR) as the Eurozone appears more likely than many other regions (like the US) to tighten containment measures”. Indeed, on Sunday, the Netherlands announced a surprise lockdown and other European countries look likely to follow suit after Christmas. Many nations (including Germany) have already unveiled new restrictions on the ability of the unvaccinated to participate in public life. As a result, “the EUR is on average the least likely to benefit from any dollar weakness around the end of December”, ING states, noting that the dollar tends to underperform at the year-end, which may be “linked to US corporates moving money offshore before the end of the year for tax reasons”. The bank expects EUR/USD to consolidate around the 1.1300 level into the new year.

In a statement published on Tuesday, the Ministry of Treasury and Finance of Turkey explained the details of the new lira deposit tool. Below are key takeaways, as reported by Reuters.

"Any bank can join new economic measures."

"New deposit instrument to be used by individual investors."

"Minimum interest rate will be policy rate of the central bank."

"Maturity can be 3, 6 , 9 and 12 months."

"Work is being done to implement new instruments to Participation Banking."

"If forex change is above interest rate, the difference will be paid in lira to accounts."

"FX rate difference to be calculated between the lira deposit account open-close dates."

"FX rate will be announced every day at 0800 GMT by the central bank."

- Silver gained some positive traction and shot to a near three-week high on Tuesday.

- Strength beyond 100-period EMA on H4 supports prospects for additional gains.

- Bearish oscillators on the daily chart warrant some caution for aggressive traders.

Silver regained positive traction on Tuesday and snapped two successive days of the losing streak. The momentum pushed spot prices to a nearly three-week high, around the $22.65-70 region during the first half of the European session.

Bulls are now be looking to build on the momentum beyond the 100-period EMA on the 4-hour chart and extend the recent bounce from the YTD low, around the $21.40 area touched last week. That said, mixed technical indicators on hourly/daily charts warrant some caution.

Oscillators on the daily chart – though have been recovering from lower levels – are still holding in the bearish territory, while RSI on the 1-hour chart is already flashing overbought conditions. Nevertheless, the intraday set-up supports prospects for further gains.

From current levels, any subsequent move up is likely to confront stiff resistance near the $22.80-85 area. Some follow-through buying, leading to a move beyond the $23.00 mark could push the XAG/USD towards the next relevant hurdle near the $23.30-35 region.

On the flip side, the $22.20-15 area now seems to protect the immediate downside ahead of the $22.00 round-figure mark. A further decline would negate the positive bias and turn the XAG/USD vulnerable to slide back to restest YTD lows support, around the $21.40 region.

Silver 4-hour chart

Technical levels to watch

Japanese Prime Minister Fumio Kishida announced on Tuesday that they will be extending border control measures for the time being to slow the spread of the coronavirus.

"We will make arrangements so that Pfizer's coronavirus oral drugs will be available early next year," Kishida added.

Market reaction

This headline doesn't seem to be having a significant impact on market sentiment. As of writing, the S&P Futures were up 0.5% on a daily basis. Meanwhile, the USD/JPY pair was last seen trading at 113.70, where it was up 0.1% on the day.

- USD/TRY licks its wounds amid the recent whirlwind linked to the lira.

- Turkey to announce details of new economic measures at 1100 GMT.

- 50-DMA support remains at risk, lira could extend the correction.

USD/TRY is on a roller-coaster ride for the second consecutive day on Tuesday, as the beleaguered lira remains at the mercy of Turkish President Tayyip Erdogan’s whims and fancies.

At the time of writing, USD/TRY is losing about 6% on the day, trading around the 12.50 level, having rebounded firmly from monthly lows of 11.10 reached earlier today. Despite the sharp recovery, the pair is up nearly 50% from the levels seen in September this year.

On Monday, the lira tumbled to fresh record lows of 18.37 against the greenback, although staged a historic recovery of 25% and jumped to 13.37 after President Erdogan announced a rescue plan to protect citizens against the lira’s downfall.

The government is presenting a new financial alternative for citizens' savings to soothe their worries over exchange rates, which have reached record highs in recent days, said Erdogan.

Turkish Finance Minister Nureddin Nebati said he will announce the details of new economic measures aimed at halting further dollarization at 1100 GMT on Tuesday,

Banks will start implementing transactions of a new instrument on Tuesday, Nebati added.

Looking at USD/TRY’s technical chart, the bulls have bounced off a dip below the critical 50-Daily Moving Average (DMA) at 11.41.

A sustained break below the latter will call for a test of the ascending 100-DMA at 10.00, which also happens to be a key psychological magnet.

The 14-day Relative Strength Index (RSI) has pierced the midline for the downside, suggesting that further correction in USD/TRY cannot be ruled out.

USD/TRY: Daily chart

On the flip side, recapturing the upward-sloping 21-DMA at 13.64 is critical for initiating a meaningful recovery towards the 14.00 round figure.

Further up, the December 15 highs at 14.84 could be back in the buyers’ radars, above which the 15.00 figure will be probed once again.

- AUD/USD gained some positive traction on Tuesday and snapped two days of the losing streak.

- The risk-on mood undermined the safe-haven USD and benefitted the perceived riskier aussie.

- The Fed’s hawkish outlook should limit the USD downside and cap gains amid COVID-19 woes.

The AUD/USD pair maintained its bid tone through the first half of the European session and was last seen hovering near the daily top, around the 0.7125-30 region.

A turnaround in the global risk sentiment – as depicted by a generally positive tone around the equity markets – undermined the safe-haven US dollar. This, in turn, was seen as a key factor that benefitted the perceived riskier aussie and assisted the AUD/USD pair to reverse the overnight slide to a nearly two-week low.

The pair, for now, has snapped two successive days of the losing streak, though any further positive move still seems elusive amid the worsening COVID-19 situation in Australia. In fact, the number of cases in Australia's largest state by population – New South Wales – surged past 3,000 on Tuesday for the first time.

Moreover, concerns about the potential economic fallout from the new Omicron coronavirus variant might keep a lid on the optimistic move in the markets. Apart from this, the Fed's hawkish outlook should act as a tailwind for the greenback and hold back traders from placing aggressive bullish bets around the AUD/USD pair.

The fundamental backdrop favours bearish traders, though repeated failures to find acceptance below the 0.7100 mark and the subsequent move up warrants some caution. In the absence of any major market-moving economic releases, it will be prudent to wait for a strong follow-through buying before placing fresh bullish bets.

Technical levels to watch

“The talks between Britain and the European Union (EU) are on track for progress,” Irish Prime Minister Micheal Martin said in an interview with Newstalk radio on Tuesday.

Key quotes

"I was worried about it when I heard of the resignation because that was a potential destabiliser in terms of the Brexit chemistry that had been developing in the last month.”

"We were on a track - the European Union and the United Kingdom. I think we still are. I think Liz Truss gets it in terms of what is required.”

These comments come as UK Foreign Secretary Liz Truss took over negotiations with the EU on the Northern Ireland Protocol following the dramatic resignation of David Frost. Frost stepped down, blaming the “current direction of travel” of the PM’s party.

Market reaction

Amid a broad US dollar decline, risk-on mood and upbeat Brexit headlines, GBP/USD is holding its bounce above 1.3200. The spot was last seen trading at 1.3245, up 0.30% on the day.

European Central Bank (ECB) policymaker and Slovak central bank Governor Peter Kazimir said on Tuesday, “there is a risk that elevated inflation will stay for a longer time.”

“If inflation outlook changes for 2023, 2024, ECB will have to act,” he added.

Market reaction

EUR/USD Is battling 1.1300, finding demand amid a fresh decline in the US dollar across the board.

- GBP/USD gains some positive traction on Tuesday amid snapped two days of the losing streak.

- The risk-on impulse undermined the safe-haven USD and provided a goodish lift to the major.

- Hawkish Fed outlook should help limit the USD downside and cap gains amid COVID-19 jitters.

The GBP/USD pair caught fresh bids during the early European session and shot to a fresh daily high, around the 1.3245-50 region in the last hour.

Having shown some resilience below the 1.3200 mark on Monday, the GBP/USD pair attracted fresh buying on Tuesday and snapped two successive days of the losing streak. A turnaround in the risk sentiment – as depicted by a generally positive tone around the equity markets – undermined the safe-haven US dollar. This, in turn, was seen as a key factor that provided a modest lift to the major.

That said, the worsening COVID-19 situations could hold back traders from placing aggressive bullish bets around the British pound. In fact, Britain reported a record number of cases and 12 people have died with the new Omicron variant of the coronavirus. Adding to this, the UK Deputy Prime Minister Dominic Raab had refused to rule out a tightening of social restrictions before Christmas.

Meanwhile, concerns about the rapid spread of the new strain and a fatal blow to US President Joe Biden's massive $1.75 trillion spending bill should keep a lid on the optimistic move in the markets. Apart from this, the Fed's hawkish outlook and an uptick in the US Treasury bond yields should act as a tailwind for the greenback, which, in turn, should cap gains for the GBP/USD pair.

Moreover, investors might also be reluctant to place aggressive bets amid relatively thin liquidity conditions heading into the end-of-year holiday season. This warrants some caution before positioning for any further appreciating move for the GBP/USD pair amid absent relevant market-moving economic releases, either from the UK or the US.

Technical levels to watch

- Gold price rebounds as the US dollar dips amid risk recovery.

- Treasury yields stabilize, Omicron covid variant fears continue to loom.

- Defending 100-DMA is critical for gold bulls amid Omicron woes, thin trading.

Gold price is rebound in tandem with the risk-on trading, as the market sentiment recovery on Tuesday, knocking down the safe-haven US dollar. Meanwhile, the US Treasury yields stabilize at higher levels, aiding gold’s upside. However, investors remain wary and refrain from placing aggressive bets amid looming concerns over the Omicron covid variant contagion and its impact on the global economic recovery. Looking ahead, gold price will remain at the mercy of the broader market sentiment.

Read: Gold 2022 Outlook: Correlation with US T-bond yields to drive yellow metal

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the gold price is likely to challenge strong resistance around $1,800 on its road to recovery. That level is the convergence of the Fibonacci 61.8% one-day, Fibonacci 23.6% one-week and SMA50 one-day.

If the latter is taken out convincingly, then gold bulls will look to retest the previous day’s high at $1,804.