- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-12-2021

- GBP/USD consolidates recent losses, picks up bids around yearly low.

- Bearish chart pattern, absence of oversold RSI keep sellers hopeful.

- Key SMAs, monthly resistance line adds to the upside filters.

GBP/USD grinds lower despite picking up bids to 1.3250 during Wednesday’s Asian session.

The cable pair remains pressured for the last one week around the 20221 bottom. In doing so, it forms a bearish chart pattern called pennant and keeps the sellers hopeful. Also favoring the bears is an absence of the oversold RSI.

However, a clear downside break of 1.3220 becomes necessary for the GBP/USD sellers to aim for the theoretical target surrounding 1.2900.

During the fall, the yearly low near 1.3190 and the 1.3000 psychological magnet will act as intermediate halts.

Meanwhile, 50-SMA adds strength to the pennant’s resistance line, around 1.3290, to challenge the recovery moves.

Even if the quote rises past 1.3290, a convergence of the 100-SMA and one-month-old descending trend line near 1.3350 will be a tough nut to crack for the GBP/USD buyers.

To sum up, GBP/USD bears keep reins and await a clear break of 1.3220 for further dominance.

GBP/USD: Four-hour chart

Trend: Bearish

- USD/CAD stays pressured near 12-day low after declining the most since late August.

- Oil retreats from weekly top despite price-positive EIA inventories.

- Risk-on mood, expectations of hawkish halt from BOC favor bears.

- Virus updates, China news are also important, US inflation is the key.

USD/CAD remains on the back foot around 1.2650, following the heavy fall to refresh a two-week low. That said, the quote seesaws of late as Asian traders brace for Wednesday’s Bank of Canada (BOC) Interest Rate Decision.

The Loonie pair dropped the most since August 23 on Tuesday as risk-on mood joins upbeat prices of Canada’s main export WTI crude oil.

Market sentiment improved amid receding fears of the South African coronavirus variant, dubbed as Omicron, as well as hopes of more stimulus from China after Beijing pledged to safeguard the financial system. Adding to the risk-on mood could be mixed data from the US and an absence of Fedspeak ahead of next week Federal Reserve (Fed) monetary policy meeting.

WTI cheered upward revision to 2022 demand forecast by the US Energy Information Administration (EIA) and growing tension between Russia and Ukraine. As per Reuters, “The Biden administration is in ‘intensive consultations’ with the new German government over its response if Russia invades Ukraine and believes Germany would be ready to take significant action if Russia launches an attack, a senior U.S. State Department official said on Tuesday.”

Elsewhere, firmer prints of Canada’s International Merchandise Trade for October and Ivey Purchasing Managers Index for November add to the Canadian dollar’s (CAD) strength.

Amid these plays, the US 10-year Treasury yields remained firmer the previous day while Wall Street benchmarks also had a good day for bulls.

Moving on, USD/CAD traders will pay close attention to how the BOC hints at the possible rate hike after the bond purchases were ended in October. That said, the benchmark interest rate is likely to remain unchanged at 0.25%.

“The BoC will maintain that the outlook is evolving in line with the October MPR, and we expect it to repeat that inflation strength is largely transitory,” said TD Securities ahead of the event.

Technical analysis

A clear downside break of 20-DMA level of 1.2680 and an ascending support line from November 16, now resistance around 1.2790, directs USD/CAD bears toward an upward sloping trend line from late October, near 1.2570.

As per the latest report from Reuters Tankan Survey, “Japanese manufacturers' business confidence index rose to a four-month high in December as supply constraints began to ease.”

The sentiment poll adds, “offering policymakers some hope the economy was headed for a moderate recovery.”

Key quotes

The monthly poll, which tracks the Bank of Japan's (BOJ) closely watched Tankan quarterly survey next due on Dec. 13, showed the manufacturers' sentiment index improved to 22 in December, following three straight months of declines to 13 in November. That compared with a reading of 18 in the BOJ's latest October survey.

Sentiment among non-manufacturers also improved in December, suggesting consumption was gradually recovering after the lifting of social curbs by end-September to contain the spread of coronavirus cases.

On outlook, both manufacturers and services companies were more optimistic, with the three-month forward index among manufacturers rising to 26 from 19 and for services companies to 21 from 15.

FX reaction

USD/JPY retreats from weekly top to 113.55 during the pre-Tokyo open trading amid Wednesday’s Asian session. The yen pair previously cheered the risk-on mood but the firmer US dollar challenges buyers of late.

Read: USD/JPY bears are moving in as the US dollar grows weary

- The NZD/USD begins the Asian session in the right foot, up some 0.46%.

- A candlestick morning-star formation in the daily chart opens the door for 0.6900.

The NZD/USD bounced off year-to-date lows, is rising as the Asian session begins, trading at 0.6789 during the day at the time of writing. On Tuesday in the overnight session, the NZD/USD pair dipped as low as 0.6736, then rallied on the back of positive omicron COVID-19 news, up to high 0.6770s. Then, through the rest of the day, the pair advanced steadily, leaving behind the 50 and the 100-hour simple moving average (SMA), below the spot price, but the upside move stalled around the R3 daily pivot point around 0.6784.

NZD/USD Price Forecast: Technical outlook

Daily chart

The NZD/USD chart depicts the pair has a downward bias after posting losses on 11 of the last 13 days. Furthermore, the 50-day moving average (DMA) crossed below the 100-DMA, leaving the DMA’s correctly positioned in bearish order with the 200 on top and the 50-DMA on the bottom. Nevertheless, as shown by the candlesticks, the price action of the last three days is forming a morning star, a chart pattern with bullish implications that would need another bullish candle to confirm its validity.

Hence, the bias in the near term is tilted to the upside. The first resistance would be 0.6800. The breach of the latter exposes crucial resistance levels, with the September 28 cycle low-turned-resistance at 0.6859, followed by the figure at 0.6900.

-637745129811412987.png)

1-hour chart

The NZD/USD broke to the upside of the 100-hour simple moving average (SMA) in the last four hours but stalled around 0.6785. As previously mentioned, the 50 and the 100-hour SMA’s lie below the spot price, so the upward bias is in place, but a break above the 200-hour SMA at 0.6802, could pave the way for further gains.

The first resistance on the way up would be the confluence of the 200-hour SMA and the R1 Wednesday’s daily pivot at 0.6806. A break above that level would expose the R2 pivot at 0.6827, followed by the R3 daily pivot at 0.6862.

-637745131577396817.png)

- WTI retreats from weekly high, prints mild gains as Asian session picks up.

- Upbeat sentiment, doubts over OPEC+ verdict favored oil buyers but firmer USD, EIA news probe advances.

- API Weekly Crude Oil Stock dropped more than -0.747M.

- EIA data, risk catalysts eyed, US inflation, China and Omicron are the key.

WTI crude oil prices ease from a weekly high to $71.50 after a two-day run-up, marking 0.40% intraday gains during early Wednesday morning in Asia. The black gold’s latest pullback part ways from the lesser-than-previous private oil stocks change figures from the American Petroleum Institute (API).

As per the latest API Weekly Crude Oil Stocks data for the period ended on December 03, the inventories shrank 3.089M versus the previous depletion of 0.747M.

The commodity prices jumped to more than a week’s high the previous day as the market’s risk appetite improved amid receding fears of the South African coronavirus variant, dubbed as Omicron. Adding to the market’s risk-on mood were hopes of China’s additional monetary policy easing after the People’s Bank of China’s (PBOC) Reserve Ratio Requirement (RRR) cut.

Furthermore, the US Energy Information Administration (EIA) energy demand forecast and firmer equities, not to forget the geopolitical tensions in the Middle East, could be cited as additional catalysts behind the commodity’s strength.

In the latest monthly Short-Term Energy Outlook (STEO) report, the EIA raised its forecast for 2022 world oil demand growth by 200K barrels per day (BPD) on Tuesday, and now demand growing 3.55M BPD YoY next year. The EIA STEO cut its forecast for 2021 world oil demand growth by 10K BPD to a 5.1M BPD YoY increase. Moving on, S&P 500 posted the biggest daily gains since March whereas Iran still refrains to abide by the nuclear deal.

Additionally, the US thinks over plans to manage the oil flows if Russia attacks Ukraine and the same fuel the oil prices. "The Biden administration is in 'intensive consultations' with the new German government over its response if Russia invades Ukraine and believes Germany would be ready to take significant action if Russia launches an attack, a senior U.S. State Department official said on Tuesday," per Reuters.

It’s worth noting, however, that the recently escalated tussles between the US and China join firmer US Treasury yields to challenge the oil prices.

Looking forward, weekly official oil inventory data from the US Energy Information Administration (EIA), -0.91M prior, will be important for fresh direction. Also on the radars will be macros from China and Omicron updates. However, more important will be Friday’s US Consumer Price Index (CPI) and the next week’s Fed meeting.

Technical analysis

A clear upside break of 200-DMA, around $70.00 by the press time, directs WTI crude oil prices towards a five-month-old horizontal resistance of around $74.80.

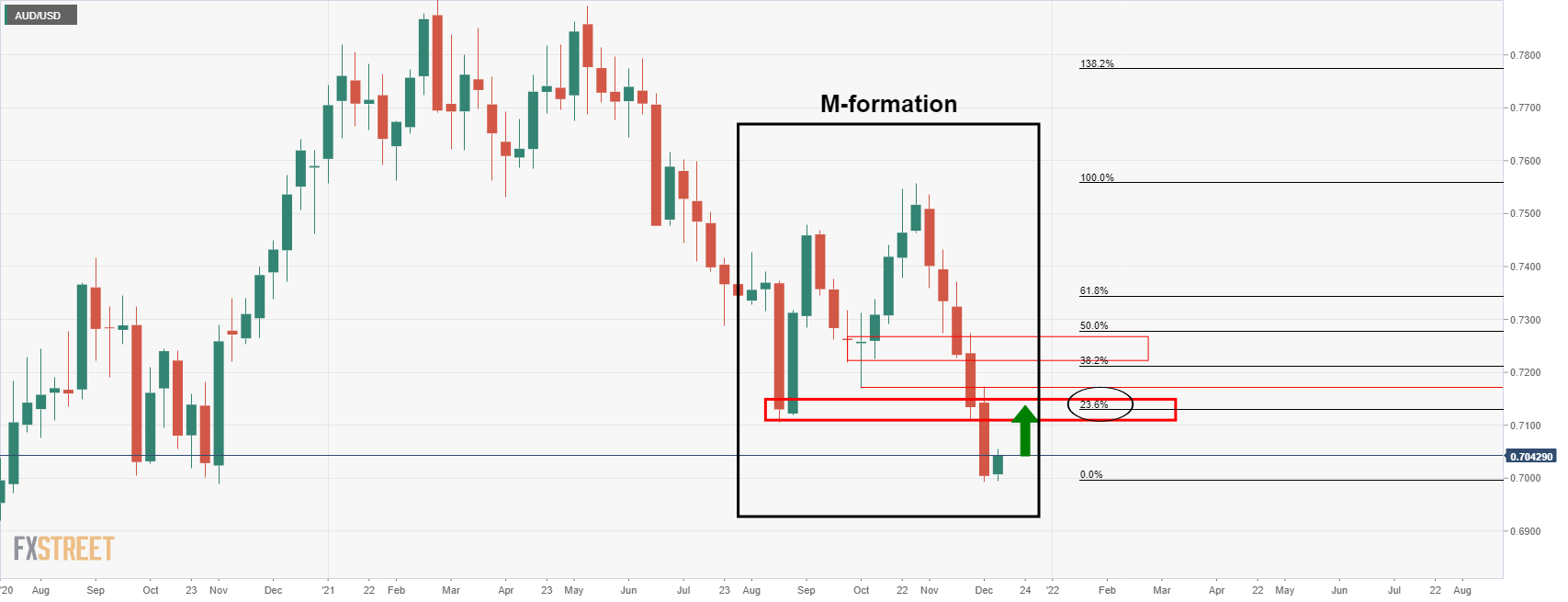

- AUD/USD is making its way through critical volumes towards 0.7025 breakout territory.

- Bulls are moving in on resistance in solid correction.

AUD/USD has been correcting in the wake of a positive risk environment this week. The pair is now loving in on critical resistance, piecing it in recent trade. This would now be expected to act as support for the forthcoming sessions.

AUD/USD H1 chart

The bulls are engaging in this area and will likely push for a test to the midpoint of the 0.71 area. If this is broken, then 0.7180 will be the next likely target.

With that being said, the daily chart illustrates that there is a level of resistance here that could see the price rejected from.

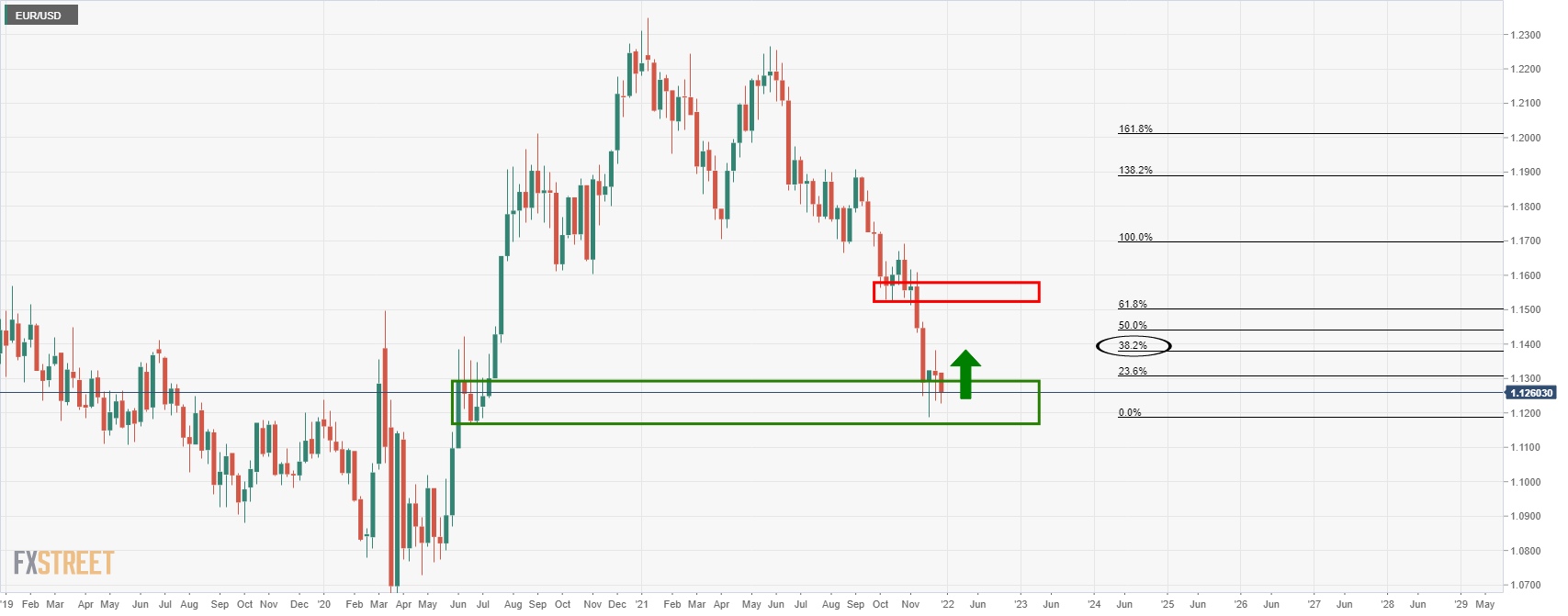

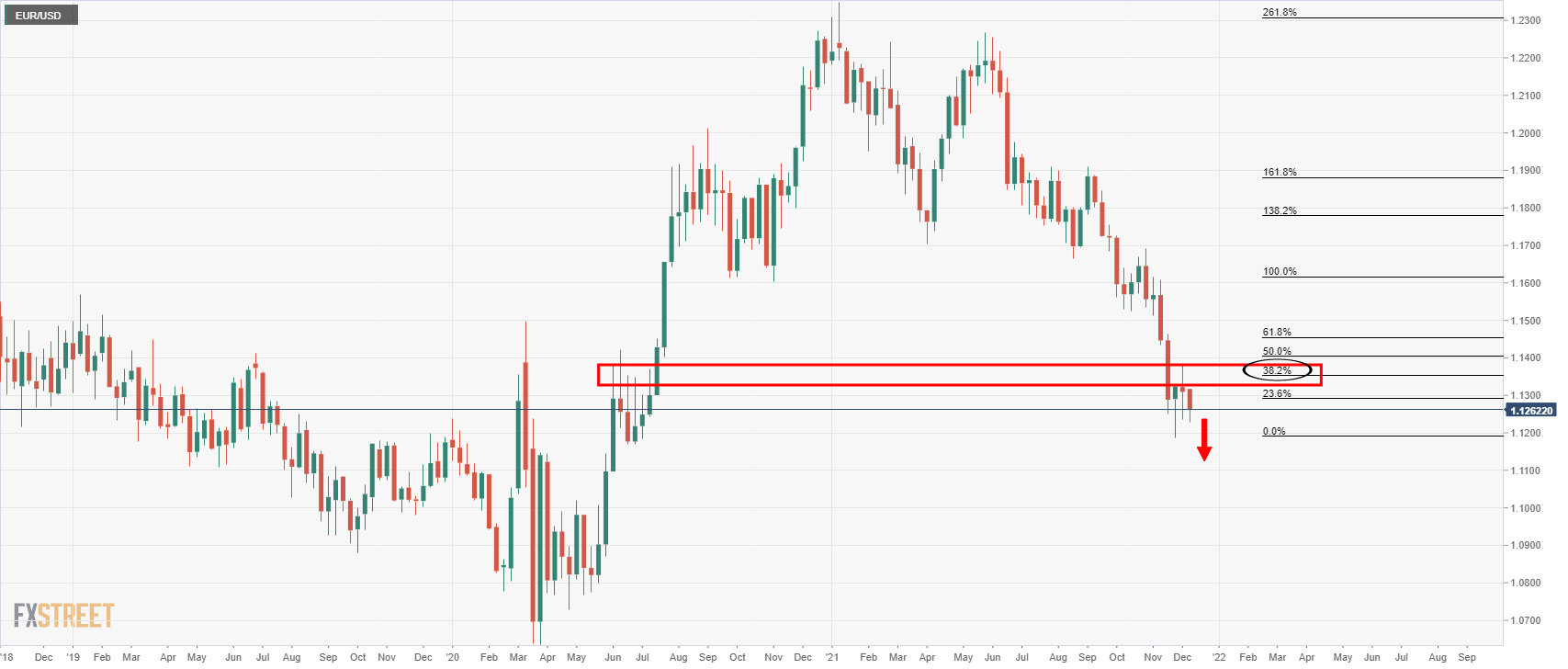

- EUR/USD is testing bullish commitments and there are prospects of more to go to the downside.

- Bears are looking to the 1.12 figure as a target.

EUR/USD is attempting to correct higher but is facing pressure from the bears. The following is a top down analysis that arrives at a bearish conclusion while below weekly resistance.

EUR/USD weekly charts

The weekly chart above sees the price attempting to dig deeper into the demand zone although the path of least resistance could well be for a bullish correction in the coming days.

EUR/USD weekly chart

On the other hand, the outlook is bearish while below the resistance.

EUR/USD daily chart

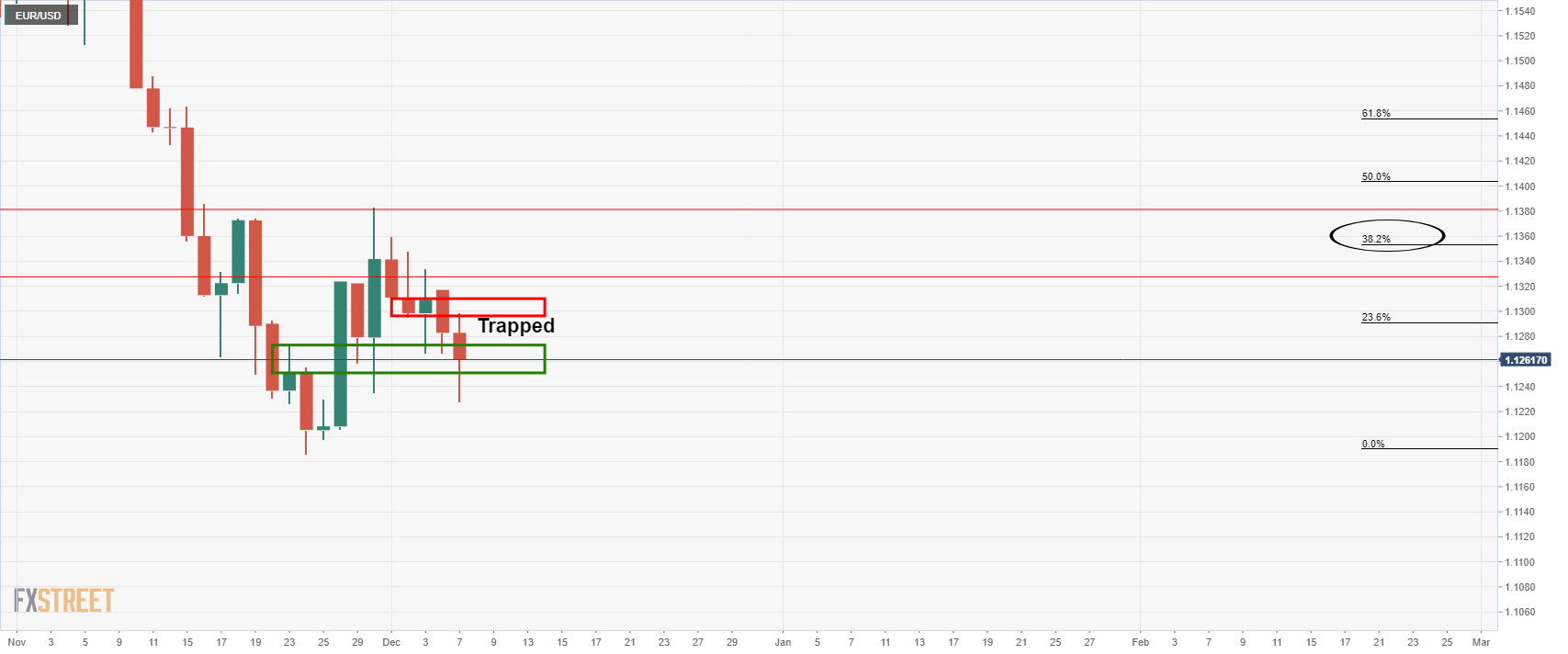

From a daily perspective, the price is trapped between the W-formation and the M-formation's necklines. A break of their of these areas would likely encourage flow into the direction of the price action and potentially lead to a breakout one way or another. 1.1250 and 1.1303 are support and resistance. Given that the lows of the day was 1.1227, there is a bias to the downside for the upcoming sessions.

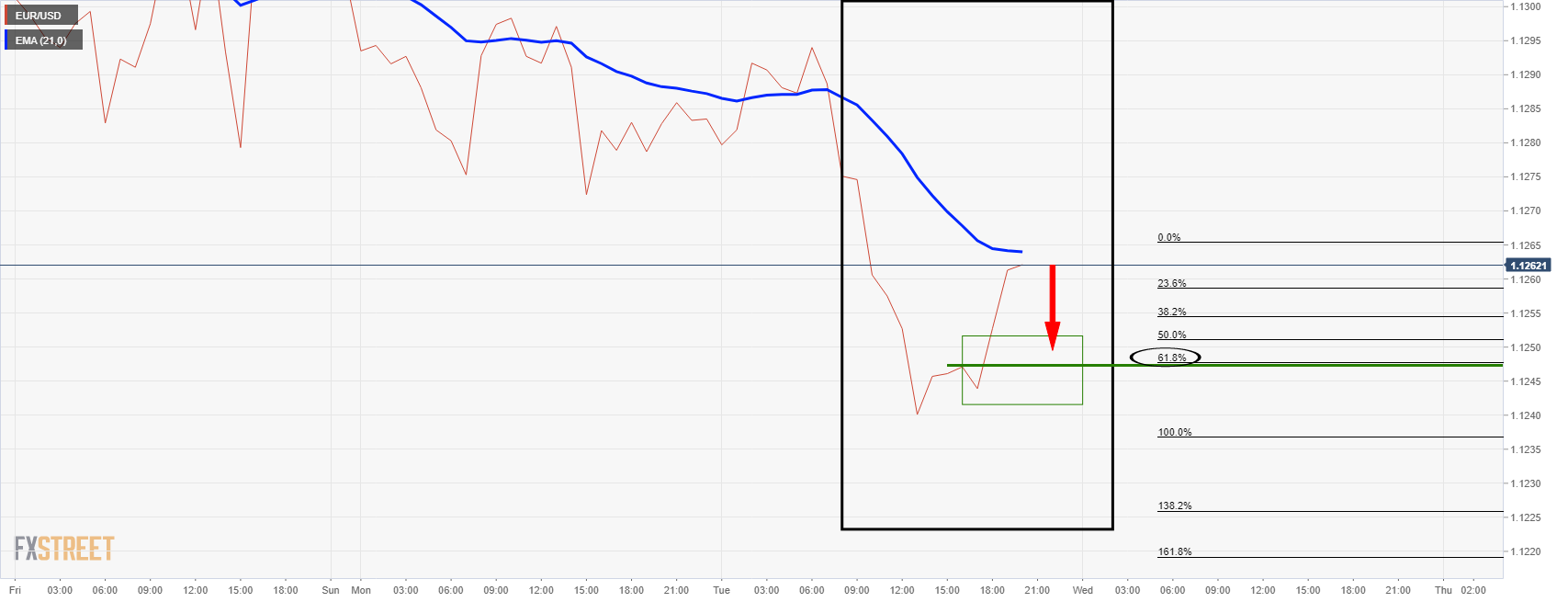

EUR/USD hourly charts

The price has formed a W-formation on the hourly time frame, as seen more clearly on a line chart as follows:

The W-formation is a reversion and bearish chart pattern. The price would be expected to move in on the neckline of the W-formation. This has a correlation with the 61.8% Fibonacci of the latest bullish hourly impulse near to 1.1245. A break there opens risk of a run towards 1.1202, or the -61.8% retracement of the recent bullish correction's range.

- AUD/JPY continues its impressive run of gains on the week on Tuesday that has taken it from under 79.00 to near 81.00.

- The pair was boosted by a risk-on/hawkish RBA combination.

AUD/JPY continued its impressive bounce that began on Monday through to the end of Tuesday US session. The pair has now bounced roughly 2.3% since the start of the week from under 79.00 to close to 81.00. The gains have been spurred so far this week as investors rush back into risk assets (like stocks, commodities and risk-sensitive currencies like the Aussie) as Omicron fears fade. The hawkish interpretation of many analysts, who read between the lines of the latest RBA monetary policy decision that the bank was opening the door to earlier rate hikes, also offered the Aussie support.

Whilst the recent run of gains is impressive, the pair still trades about 2.6% below its pre-Omicron emergence levels of close to 0.8300. But the fact that the pair was able to bounce so well at the September low around 79.00 is promising and if risk-on/hawkish RBA vibes continue, there is room for the pair to go higher. Technicians may target an eventual move back towards 82.00, which is roughly in line with the 50% Fibonacci retracement back from the October high to the August low, as well as the 21-day moving average.

- GBP/CAD slumped from above 1.6900 to under 1.6750 on Tuesday for its worst one-day performance since April.

- A combination of technical selling, higher oil prices and central bank policy divergence drove the move.

GBP/CAD slumped to within a whisker of its lowest levels since March 2020 on Tuesday, slipping from above 1.6900 at the start of Asia Pacific trade to lows under 1.6750. In more recent trade, the selling pressure has abated and the pair has stabilised close to 1.6750, but is still down about 1.0% on the day and is down over 2.0% from last week’s highs just above 1.70. Tuesday’s drop is set to be the pair’s worst one-day performance since April.

The main catalyst for the move was a sharp rise in crude oil prices on the day amid a broadly risk-on market vibe that, net-net, benefitted the risk/commodity-sensitive loonie to a much greater degree than the pound. As Omicron-related fears have subsided in the market this week, risk-assets have broadly rallied, reflecting a positive shift in medium-term expectations for economic growth.

In FX markets, central bank divergence has also been an important play. Central banks have split themselves into two camps; those that do not see the emergence of Omicron as a risk worth altering their monetary tightening timeline for (like the Fed and RBA) and those that are more cautious. Communications from BoE officials in recent days has suggested that they are more likely to favour a patient approach to rate hikes in the coming month just in case Omicron weighs on the near-term economic outlook.

Money markets have largely priced out expectations for a rate hike next wee. The BoC, meanwhile, may want to instead follow in the footsteps of the Fed and acknowledge Omicron as a risk, but not one that materially alters its economic forecasts in light of last week’s stronger-than-expected jobs report. Technical selling was also a catalyst for the downside on Tuesday. The pair broke below an uptrend that had been supporting the price action going back to mid-November.

What you need to know on Wednesday, December 8:

Markets were more active on Tuesday, with optimism leading the way. Hopes that the Omicron coronavirus variant is milder and won’t interrupt the economic comeback sent global equities well into the green. Nevertheless, it’s too early to say how things will turn out with the new COVID-19 strain.

The EUR was the weakest USD rival, while the AUD and the CAD were the strongest. EUR/USD fell to 1.1227, its lowest for December, following the release of unimpressive EU data. The GBP/USD pair neared its yearly low, bouncing modestly ahead of the close to settle at around 1.13230.

EU data failed to impress, as the EU Q3 Gross Domestic Product was confirmed at 2.2% QoQ. On the other hand, the German ZEW showed that Economic Sentiment improved in Germany and the EU in December, although the assessment of the current situation plummeted to -7.4 vs the 5 anticipated by markets.

AUD/USD trades around 0.7110, underpinned by rallying equities and an optimistic RBA. USD/CAD is down to 1.2650, as oil prices kept rallying, with WTI near $72.00 a barrel.

The dollar advanced modestly against safe-haven CHF and JPY, with the pairs confined to tight intraday ranges.

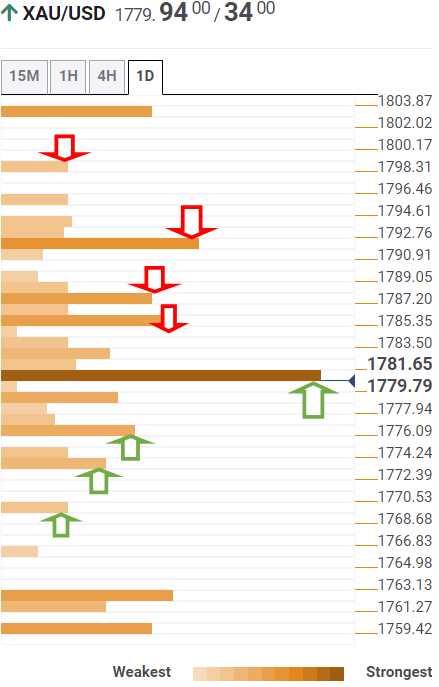

Gold ticked higher but held within familiar levels at around $1,785 a troy ounce.

US Treasury yields surged on the back of the market’s optimism, with the 10-year Treasury note yielding 1.48% by the end of the day.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Crypto market dazed post flash crash

Like this article? Help us with some feedback by answering this survey:

- Despite a risk-on market mood, the shared currency losses ground against the safe-haven Japanese yen.

- The EUR/JPY faced strong resistance at 128.50, retreated around the S1 daily pivot at 127.66.

- EUR/JPY Price Forecast: Despite retreating, it seems poised to the upside, as the 50-hour SMA is about to cross over the 100-hour SMA.

The EUR/JPY retreats from daily highs around 128.47, trading at 127.9 during the New York session at the time of writing.

On Tuesday in the overnight session, the EUR/JPY surged up to the daily high at 128.50, twenty pips above the 200-hour simple moving average (SMA). However, as market sentiment improved due to factors like the omicron variant causing mild symptoms in people infected by, and the creation of an antibody boost effective against the newly discovered variant spurred a sell-off of EUR that sent the pair tumbling towards 127.60.

That said, at press time in the 1-hour chart, the EUR/JPY pair is facing strong resistance at the confluence of the 50, the 100-hour SMA’s, and the daily central pivot point at 127.87. During the New York session, the EUR/JPY pair has remained subdued, within a 21-pip range, but it is worth noting that most of the last eight 1-hour candles have a very long bottom wick, which shows that buying pressure, could be accumulating around that area.

In the outcome of breaking to the upside, the first resistance would be the December 6 high at 128.08. A breach of the latter would expose the 200-hour SMA at 128.14, followed by the R1 daily pivot at 128.24, and then the R2 daily pivot at 128.44.

On the flip side, in the case of falling further, the first support would be the S1 daily pivot at 127.66, followed by the December 6 low at 127.50 and then the S2 pivot at 127.29.

EUR/JPY 1-HOUR CHART

-637745040606427883.png)

Russia's Kremlin said on Tuesday that the talks held between US President Joe Biden and Russia President Vladimir Putin earlier in the day were open and business-like, according to Reuters. The Kremlin said that Putin told Biden about Ukraine's destructive attitude towards settlement in Eastern Ukraine and that it was wrong to put all of the responsibility on Russia's shoulders for current tensions. According to the statement put out by the Kremlin, the Ukraine crisis was the prevailing topic for discussion during the talks and Putin expressed concerns about Kyiv's allegedly provocative actions towards the Ukrainian region controlled by Russia-backed separatists (the Donbas region).

The Kremlin confirmed that Putin and Biden had agreed to continue contacts and have ordered subordinates to start consultations on "sensitive questions" around Ukraine. As expected, Putin told Biden he wanted reliable legally-binding guarantees ruling out any further Eastward expansion of NATO, as well as guarantees that offensive strike systems would not be deployed in countries close to Russia.

Separately, the US State Department said on Tuesday that it had intense consultation with the new German government over the response to a Russian invasion of Ukraine and that the US believes Germany will take significant action. It was earlier reported that an understanding was reached between US and German officials that the Nord Stream 2 pipeline would be shut down in response to any invasion.

Market Reaction

Judging by the reaction in FX markets, talks went as expected and did not yield any significant progress towards a de-escalation of tensions. USD/RUB continues to trade well within the 73.50-74.50ish range that has prevailed over the past week or so.

- GBP{/USD trapped within the 1.32's, eyes on a significant upside correction.

- The central bank divergences are laying into the hands of the GBP/USD bears.

GBP/USD is under pressure but remains within a 50 pip range with support within the 1.3200 vicinities. At the time of writing, cable is down some 0.25% trading between 1.3208 and 1.3289 on the day.

Risk sentiment rebounded further on Tuesday as markets become more optimistic that Omicron will not impede the global economic recovery. Also, pledges from China to support economic growth also helped alleviate some of the fears. Markets now expect further monetary policy easing in China after the People’s Bank of China said it will reduce bank reserve requirements.

The US dollar is holding up with the DXY index trading just shy of the one-week high of 96.592 printed earlier today. However, the pound is the worst-performing currency on the CSI for Tuesday as central bank divergence plays out.

While the Federal Reserve sent some hawkish signals of late despite the covid variant risks, as it is focused on spiking inflation. However, the Bank of England saw even some of its more hawkish voices such as Michael Saunders taking a more cautious tone. Saunders, one of two members of the nine-strong Monetary Policy Committee who voted to raise Bank Rate to 0.25% in November, said on Dec. 3 there "could be particular advantages in waiting to see more evidence" of Omicron's impact.

BoE expectations

The Bank of England is now expected to hold off again next week on becoming the world's first big central bank to raise interest rates from their pandemic lows. On Tuesday, investors were pricing in a roughly 50% chance of the BoE raising Bank Rate to 0.25% on Dec. 16, down from around 75% last week but higher than just a one-on-three chance immediately after the speech by Saunders on Friday.

This divergence in policy expectations may keep cable pinned to the floor in the 1.32 area in the run-up to the BoE meeting despite the upbeat risk sentiment. Meanwhile, a possible catalyst for volatility i the pair before then could come from the Dec 10 monthly Gross Domestic Product report for October.

''Manufacturing likely pulled down on growth with a relatively sharp fall, driven in part by a decline in motor vehicle production, but we see upside risks elsewhere (including for the Index of Services), as consumers pulled forward demand over fears of end-of-year shortages, '' analysts at TD Securities said. ''This would leave GDP growth roughly on track for the BoE's recent forecast of 1.0% QoQ.

GBP/USD technical analysis

The price appears to be trapped in the 1.32's. From a longer-term perspective, the price could be headed for an upside correction prior to further downside. This opens prospects of a correction back to test the old support near the 61.85 Fibonacci retracement level around 1.34 the figure:

- NZD/USD recovered to the 0.6775 area on Tuesday amid a broad rally in risk appetite.

- But the kiwi continues to severely lag the Aussie and Loonie, weighed by unfavourable divergence in central bank policy expectations.

NZD/USD has seen a tentative rally on Tuesday, rebounding to around the 0.6775 area after printing fresh annual lows under 0.6740 earlier in the session. The broad risk-on market tone which is seeing global equities, commodities and risk/commodity-sensitive currencies perform well across the board is the main driver of the upside in the pair on Tuesday.

Looking ahead, there are no notable New Zealand economic events for the remainder of the week so focus will be on US-related themes and risk appetite. If the latter can remain supported as Omicron variant fears ease then that might be enough to keep NZD/USD from plunging back to annual lows under 0.6750. But is US macro data comes in strong and US inflation data hot (as is expected), this may keep USD underpinned in anticipation that the Fed will announce an acceleration of the pace of its QE taper next Wednesday.

Looking at the pair from a technical standpoint, the descending trendline that has guided NZD/USD lower in recent weeks looks to still be very much intact. “NZD rallies remain selling opportunities,” said analysts at ANZ.

NZD underperforms as markets dial down hawkish RBNZ bets

Tuesday’s recovery only amounts to an on-the-day gain of about 0.4%, which is not particularly impressive in light of the 0.9% and 0.8% gains being seen in the kiwi’s fellow non-US dollars the Aussie and the loonie. Equally, NZD’s on the week gains versus the US dollar only stand around 0.5%, versus a more than 1.6% gain for AUD and a roughly 1.4% gain for CAD.

Recent NZD underperformance versus its peers and the US dollar (NZD/USD is down over 5.5% since the start of last month) owes itself to divergence in central bank policy expectations. In the last few days, money markets have rebuilt hawkish bets for the Fed, BoC and RBA (with a surge of hawkish RBA bets coming in wake of Tuesday’s policy decision), but the same cannot be said for the RBNZ. Indeed, over the past few weeks, markets have been dialing down their hawkish RBNZ bets.

Since mid-November’s not as hawkish as expected RBNZ meeting, the implied yield on the December 2022 NZ Bank Bill future has dropped from above 2.8% to current levels in the 2.50s%. Over the same time period, the implied yield on the December 2022 three-month eurodollar future has remained steady close to 1.10%.

- Silver trims some of its Monday losses, up some 0.63%.

- Omicron coronavirus worries abate, as cases appear to cause mild symptoms.

- Investors pile towards riskier assets, putting a lid on an upward move in silver.

- XAGF/USD Price Forecast: Tilted to the upside but facing strong resistance around $22.60.

Silver (XAG/USD) advances during the New York session, paring Monday losses, trading at $22.54 at the time of writing. Financial market upbeat sentiment, attributed to reports that COVID-19 omicron variant cases only causes mild symptoms, spurred a rally on US stocks, the biggest since March. Also, Glaxo’s development of antibody treatment for COVID-19 showed that it is effective against the new coronavirus strain, abating investors’ worries of an economic slump.

The greenback rises, courtesy of higher US bond yields

In the meantime, US equities are printing gains while US bond yields are up. The 2s are rising four basis points up to 0.6792%, while the 10-year benchmark note is up to three basis points, sitting at 1.467%, a tailwind for the greenback. The US Dollar Index, which measures the buck’s performance against six peers, is up 0.11%, currently at 96.43.

Last week, Fed’s Chair Jerome Powell, alongside some US central bank policymakers, expressed that a faster bond-taper would be needed due to elevated prices. In fact, Chair Powell said that the word “transitory” has to be removed when speaking about inflation, reflecting that it is stickier than expected. That keeps XAG/USD traders focused on the Consumer Price Index for November, to be revealed on Friday.

In the overnight session, the white metal remained subdued, in a $22.23-47 range, fluctuating between the 100 and the 50-hour simple moving averages (SMA’s). In the last three hours or so, silver broke to the upside and left both previously mentioned SMA’s under the spot price at $22.39 and $22.38, respectively. Nevertheless, it failed to break above solid resistance at the December 6 high at $22.58, retreating towards $22.40s

XAG/USD Price Forecast: Technical outlook

Silver (XAG/USD) in the 1-hour chart depicts a bullish bias, attributed to the 1-hour 50 and 100-simple moving averages (SMA’s) residing below the spot price. Despite that fact, the non-yielding metal faces strong resistance at press time, at the confluence of the R1 daily pivot and the December 6 high at $22.58, a strong line of defense of USD bulls.

In the outcome of breaking to the upside, the first resistance would be $22.80, immediately followed by $23.00.

On the flip side, the first support would be the central daily pivot at $22.35. A break below that level would expose crucial support levels, as the S1 daily pivot at $22.10, followed by the psychological $22.00.

- USD/JPY is stalling on the bid although the backdrop is one of risk-on.

- USD/JPY bears are looking for a downside extension the daily time frame.

Risk has been on and Wall Street's main indexes were sharply higher in early trade on Tuesday following the gains in Asian stocks at the start of the week after a reserve ratio cut by China's central bank bolstered sentiment.

Easing Omicron COVID-19 variant worries and the timely booster shot of Chinese stimulus has helped lift riskier currencies and has weighed on the yen this week so far. However, the US dollar is growing weary in recent trade. Nevertheless, at the time of writing, USD/JPY is trading 0.2% higher at 113.72 within the 113.40 and 113.77 range of the day so far.

Markets have taken confidence from the reports in South Africa that Omicron cases there had only shown mild symptoms. The top US infectious disease official, Anthony Fauci, told CNN on Sunday "it does not look like there's a great degree of severity" so far.

Developments in China contributed to the risk-on tone, as the People's Bank of China (PBOC) said it would lower the amount of cash that banks must hold in reserve. This was its second such move this year. Investors are cheering the measure to release liquidity to support economic growth. The PBOC also cut the rates on its relending facility by 25 basis points to support the rural sector and small firms.

Data on Tuesday has also shown that the US trade deficit narrowed sharply in October as exports soared, potentially setting up trade to contribute to economic growth this quarter. The combination of these factors has helped the US dollar to firm versus its major currency peers, with the US dollar Currency Index DXY higher 0.21% at 96.499, just shy of the one-week high of 96.592 printed earlier today. Additionally, supporting the greenback, the US 10-year yield is higher by some 2.37% today, trading between 1.429% and 1.470%.

''We believe the underlying trend for a stronger dollar remains intact as the Fed is moving closer and closer to liftoff sooner than markets previously thought,'' analysts at Brown Brothers Harriman argued.

There will be no Fed speakers given the pre-FOMC blackout period so the focus will be on the US Consumer Price Index data on December 10. ''We expect inflation to slow significantly as fiscal stimulus fades and supply constraints ease, but we don't expect the data to be validating in the near term,'' analysts at TD Securities said. ''The CPI likely surged in Nov, with a drop in oil coming too late to avert another large gain in gasoline and core prices boosted by rapidly rising used vehicle prices and post-Delta strengthening in airfares and lodging.''

Russian tensions

Investors will also keep an eye on developments on the US-Russia diplomatic tensions, as Biden is reportedly considering sanctions on Russian banks if Russia invades Ukraine. Russia wants guarantees that Ukraine will not try to seize areas captured by Russian-backed separatists in 2014 and has warned the West not to cross "red lines" by adding Ukraine to Nato's military alliance. ''More than 90,000 Russian troops are believed to be massed near Ukraine's borders,'' the BBC reported.

The talks between the two nation's, leaders Vladimir Putin and US President Joe Biden, began at 10:07 US Eastern time (15:07 GMT; 18:07 Moscow time), the White House said. They were held on a secure video link set up under previous administrations but never used before, Russian news agency Tass said.

In a conference call on Monday night, the White House said the leaders of the US, UK, France, Germany and Italy had formed a joint strategy "to impose significant and severe harm on the Russian economy" should Russia launch an invasion. President Biden is expected to speak to the four European leaders again after his talks with Mr Putin.

The BBC has reported that ''possible measures include restrictions on Russia's banks converting roubles into foreign currencies, or even disconnecting Russia from the Swift global financial payment system, reports say.'' Bloomberg News reported that the US would seek to halt Russia's Nord Stream 2 pipeline to Germany.

USD/JPY technical analysis

The price is unable to get over the counter trendline resistance or away from the 21-EMA on the hourly chart. The market is moving into a consolidation of US dollar strength and the yen is closing the gap on the Currency Strength Index on an hourly basis.

Moreover, from a daily perspective, the price is stalling at a 38.2% Fibo and could easily flip to the downside at this juncture:

- The USD/CHF continues advancing for the second straight day, up 0.09%.

- A risk-on market mood weakens safe-haven currencies except for the USD, which gains against the CHF.

- USD/CHF Price Forecast: Failure at 0.9268 would form a double-top pattern that would open the way for further losses.

The USD/CHF extends to two-consecutive days of gains, trading at 0.9265 during the New York session at the time of writing. In the overnight session, the USD/CHF edged lower to re-test the 200-hour simple moving average (SMA) around 0.9230s, then bounced off amid positive market mood, as the omicron variant, although contagious, cases linked to the newly discovered strain cause mild symptoms in patients. Additionally, treatment of an omicron-effective antibody boost created by Glaxo abates market participants’ worries, as global equities have risen on Tuesday.

Apart from that, the US Dollar Index, which tracks the greenback’s performance against a basket of rivals, advances 0,12%, sitting at 96.45, a tailwind for the USD/CHF, as safe-haven currencies, like the JPY and the CHF, weaken against the buck.

The US 10-year Treasury yield follows the DXY footsteps, rising almost two-basis points, up to 1.45%.

USD/CHF Price Forecast: Technical outlook

In the 1-hour chart, the USD/CHF is re-testing the November 30 high at 0.9266, resulting from a 100-pip upward move on that day. Furthermore, the December 6 high at 0.9268 coincided with the abovementioned, making that price level a crucial line of defense for CHF bulls.

At press time, the pair is testing the resistance abovementioned, which in the outcome of being broken would expose the figure at 0.9300. The breach of the latter would exert upward pressure on the pair. The following resistance would be the November 25 support-turned-resistance at 0.9324, followed by the November 26 high at 0.9360.

On the flip side, failure at 0.9260s would form a double top chart pattern that could send the USD/CHF tumbling lower. The first support would be the 200-hour SMA at 0.92323. A break of that level would expose crucial support areas like the confluence of the 50-hour SMA and the central daily pivot at 0.9229, followed by the 100-hour SMA at 0.9214.

-637744962691329608.png)

- AUD/USD has reclaimed 0.7100 status on Tuesday amid a broad surge in risk appetite.

- But strong Chinese trade data and hawkish interpretations of the latest RBA policy decision are also supporting the Aussie.

- AUD/USD is threatening to break to the north of a key descending trend channel.

The Aussie dollar has continued to power higher throughout the session on Tuesday, moving to the north of the $0.7100 level in recent hours as risk appetite has continued to improve. That marks a more than 1.5% recovery from last Friday’s lows of just under 0.7000, with 0.9% of those gains coming on Tuesday.

AUD/USD is now challenging the upper bounds of a descending trend channel that has been suppressing the price action going all the way back to early November. A break above this descending trendline, which the pair is currently flirting with just above 0.7100, would open the door to a sharp rally to the next area of resistance around 0.7170, ahead of the 21-day moving average just under 0.7220.

Driving the day

The main driver of the recovery in broad risk appetite on Tuesday appears to be markets pricing out prior pessimism about the impact of Omicron on the economic outlook in light of growing evidence that infections are comparatively “mild”. But sentiment is likely also receiving a helping hand as Chinese authorities signal intent to provide support to the economy in 2022.

After its 50bps reserve ratio requirement cut on Monday, which is expected to release CNY 1.2T in liquidity from the Chinese banking system, the PBoC cut rates on its re-lending facility by 25bps with the aim of supporting the rural sector and small firms. Meanwhile, the powerful Chinese politburo pledged on Tuesday to keep economic operations within a reasonable range in 2022, whilst also promoting healthy developments in the property sector.

Chinese economic optimism is helpful for the Aussie given that China is Australia’s largest export destination. On which note, the Aussie also got a boost from the release of strong November trade figures out of China during Tuesday’s Asia Pacific session. Both imports and exports beat expectations “thanks to stronger demand and easing semiconductor shortages”, said Capital Economics, who added that the emergence of Omicron might offer further support for Chinese exports in the near term.

Hawkish RBA

Perhaps the most important factor boosting AUD on Tuesday has been hawkish interpretations of the latest RBA rate decision. As expected the bank held interest rates at 0.1% and pledged to continue buying bonds at a A$4B weekly pace until February. But the bank, whilst conceding that Omicron was a risk to the outlook, said it did not think the new variant would derail the recovery.

“The RBA has clearly positioned itself among those central banks (like the Fed) that do not currently see the new variant as likely to truly dampen the recovery and policy plan,” said ING. “With still a lot of short positions to be unwound, this is a notion that can continue to offer support to the Aussie dollar in the coming weeks” the bank added.

Meanwhile, a reference to inflation being expected to sit within the bank’s 2.0-3.0% range in 2023 was removed from the statement, which some analysts saw as the bank opening the door to an earlier rate hike. Famed RBA watcher Terry McCrann said “it is clear Australia is moving closer to a rate rise, not just potentially in 2023 but possibly even relatively early next year.”

In its monthly Short-Term Energy Outlook (STEO) report, the US Energy Information Administration (EIA) raised its forecast for 2022 world oil demand growth by 200K barrels per day (BPD) on Tuesday, and now demand growing 3.55M BPD YoY next year. The EIA STEO cut its forecast for 2021 world oil demand growth by 10K BPD to a 5.1M BPD YoY increase.

Market Reaction

Crude oil prices have not reacted to the latest EIA STEO, but have been trading on the front foot throughout the day amid the broad risk-on market vibe.

The US trade balance deficit narrowed by $14.3 billion in October, which is only the second time such a gain has occurred in data going back to the early 1990s, explained analysts at Wells Fargo. They add the narrowing was driven by the largest gain in exports since coming out of lockdown in mid-2020, a welcomed development after imports have largely outpaced exports over the past year and a half.

Key Quotes:

“U.S. exports surged 8.1% in October outpacing a more-modest 0.9% gain in imports. This pop in exports caused the trade balance to narrow by $14.3 billion, a gain outpaced only once during the financial crisis of 2008 in data going back to the early-1990s. This narrowing left the U.S. trade balance at its lowest deficit in six months.”

“Throughout the pandemic, imports have rebounded much faster than exports as U.S. domestic demand has outpaced many international economies. While the trade balance has widened sharply since the onset of COVID, trade flows have been highly volatile from month-to-month. Our best read is that today's narrowing in the trade deficit is likely more a story of monthly volatility rather than the start of a sustained narrowing in the deficit.”

“We still believe imports should cool off a bit as domestic demand transitions back to services, but the timeline of this eventual reprieve has grown more uncertain due to potential hiccups in the sector associated with the Omicron variant.”

The Atlanta Fed's GDPNow estimate for the annualised QoQ pace of GDP growth in the US economy in Q4 fell to 8.6% on Tuesday from 9.7% last Wednesday (1 December). In light of releases from the US Census Bureau, the US Bureau of Economic Analysis, and the Institute for Supply Management, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth decreased from 9.6% and 13.1%, respectively, to 8.6% and 11.3%, respectively. The next update to the forecast will be on Thursday.

Market Reaction

FX markets did not react to the latest update from the Atlanta Fed.

Data released on Tuesday, showed the trade surplus in Canada widened from CAD 1,86 billion to 2.09 billion in October. Analysts at the National Bank of Canada point out it is the highest level in 10 years.

Key Quotes:

“The merchandise trade surplus expanded at a pace consistent with consensus expectations in October and reached a 10-year high. This gain was explained by exports benefiting from higher commodity prices and increased demand while supply chain disruptions started to ease. The growth of both exports and imports to an all-time high were led by motor vehicles and parts as shortages of semi-conductor chips relented.”

“Exports of energy products were the second-largest contributor to the growth for trade in the month as they reached a record high at C$13.9 bln.”

“Largely because of lower supply chain disruptions, exports to the United States grew 6.9% to a record high of C$42.2 bln, while imports from our largest trade partner also surged (+9.1%) to their second highest print on record. As a result, the trade surplus with the U.S. remained essentially unchanged (C$-0.1 bln) from its highest level in 13 years in October.”

“A deterioration for the trade balance in November is likely due to the events of last month on the west coast of the country.”

According to analysts from Rabobank, the AUD/USD, encouraged by domestic data, should rise toward 0.73 in a three to six-month view. They don’t see the Reserve Bank of Australia asbeing in any rush to hike interest rates.

Key Quotes:

“The release of Australian Q3 GDP was old news even as it hit the newswire. The -1.9% q/q contraction referred to a period when many Australian were impacted by lockdowns and contrasts with the optimism for a strong bounce back starting in Q4. Despite a slow start to its vaccine rollout at the start of the year, the strength of recent progress on this front has underpinned confidence in the ability of the Australian economy to once again demonstrated that it can bounce back strongly from lockdowns. This, however, does not mean that the RBA will be in any rush to hike interest rates.”

“The RBA is not expecting underlying inflation to reach the middle of its target until the end of 2023 and Lowe maintains that the first increase in the Cash rate may not be before 2024. Even if this target slips, it is clear that the RBA will be well behind the Fed when it comes to hiking rates in the forthcoming cycle.”

“The downtrend in AUD/USD since the start of last month suggests that Lowe’s guidance on policy has had an impact. CFTC data suggest that speculators are holding sizeable short net AUD positions. In view of the RBA’s expectation that the Australian economy can bounce back sharply into 2022, we expect that better domestic data is likely to encourage a modestly better tone in AUD/USD on a 3 to 6 mth view back towards the 0.73 area.”

- Gold advances during the day, benefitted by US T-bond yields flat.

- Despite Fed’s recent hawkishness rhetoric, the non-yielding metal advances 0.45%.

- XAU/USD Price Forecast: Meanders above the 200-HSMA, as bull’s eye $1,800.

Gold (XAU/USD) recovers some of Monday’s losses, advances during the New York session, trading at $1,785 at the time of writing. As portrayed by global equity markets, the market sentiment is upbeat, pointing to the upside, due to positive news on the COVID-19 omicron variant. The newly discovered strain, albeit being more contagious, patients infected with it have shown only mild symptoms. Additionally, during the European session, an antibody treatment by Glaxo works on the omicron variant, easing investors’ worry about the possibility of an economic slowdown.

That said, US equity markets are rising between 1.55% and 3.02%. Meantime, US bond yields, which correlates inversely to the non-yielding metal, with the 10-year are flat at 1.44%, a headwind for the greenback, with the US Dollar Index, barely up 0.08%, sitting at 96.41.

Last week, Fed’s Chair Jerome Powell, alongside some US central bank policymakers, expressed that a faster bond-taper would be needed due to elevated prices. In fact, Chair Powell said that the word “transitory” has to be removed when speaking about inflation, reflecting that it is more stickier than expected. That keeps XAU/USD traders focused on the Consumer Price Index for November, to be unveiled on Friday.

XAU/USD Price Forecast: Technical outlook

In the 1-hour chart, XAU/USD seesawed around $1,772-$1,783, within a narrow-trading-range, as the 200, 50 and the 100-hour simple moving averages (SMA’s) lie at $1,784.27, $1,780.55 and $1,778.11, respectively. From a technical perspective, gold is neutral, though the fact that the 50-HSMA could cross over the 200-HSMA that would form a golden cross that could spur a gold rally.

However, in the short term, in the outcome of breaking above the 200-HSMA, the first resistance would be December 6 high at $1,787.64. The breach of the latter would expose the confluence of a downslope trendline and the R2 daily pivot level around $1,793, followed by an R3 daily pivot at $1,798.

On the flip side, a break below the 100-HSMA would open the door for further losses. The first support would be December 6 low at $1,775.63, followed by S1 daily pivot at $1,773.27, and then the S2 daily pivot at $1,768.44.

- Canadian dollar accelerates to the upside versus the US dollar.

- Stocks sharply higher in Wall Street, oil gains more than 3%.

- Key event ahead: Bank of Canada meeting on Wednesday.

The combination of a rally in crude oil prices, positive market sentiment and a weaker US dollar are pushing USD/CAD sharply lower, the day before the Bank of Canada meeting. The pair is trading near 1.2630, at the lowest level since November 25.

The pair is falling for the second day in a row and fell under the 20-day moving average for the first time in a month. It is down more than a hundred pips so far on Tuesday, having the worst day in weeks.

A stronger CAD before the BoC

The loonie is among the top performers of the American session, supported by many factors, including crude oil prices. The WTI barrel is up by 4.55% at $72.65. At the same time, the Dow Jones is up by 1.50% and the Nasdaq 2.83%.

Despite falling against the loonie, the dollar is up against CHF, EUR, GBP and JPY supported by higher US yields, ahead of next week FOMC meeting. This week's key economic number will be on Friday with US inflation figures.

In Canada, on Wednesday, the Bank of Canada will announce its decision on monetary policy. No change in interest rates is expected. Analysts at TD Securities look for a relatively quiet meeting, with limited scope for a meaningful change in tone. “The BoC will maintain that the outlook is evolving as expected and that inflation strength is largely transitory (…) A quiet BoC meeting shifts CAD drivers to the world at large. In turn, covid uncertainty, heightened risk aversion, and a relatively poor local growth and mobility backdrop should keep USD/CAD hanging around 1.28 for a bit longer.”

Technical levels

US National Institute of Allergy and Infectious Diseases Director Anthony Fauci said on Tuesday that the Omicron Covid-19 variant was "almost certainly" not more severe than the delta variant, according to AFP. These remarks come after Fauci was quoted on CNN over the weekend as saying that it does not look like Omicron has a "great degree of severity".

Market Reaction

US equities and other risk assets continue to surge as markets, in light of increasing evidence that this variant will not be as severe as delta, move to price out pessimism about the economic outlook.

- The S&P 500 surged around 2.0% on Tuesday to close to 4700, bringing it back to pre-Omicron levels.

- Investors rushed to price out prior pessimism about the economic outlook amid the emergence of Omicron, with symptoms looking mild.

US equity markets have been enjoying a broad-based rally on Tuesday as investors continue to price out the Omicron-related economic pessimism that had weighed heavily on the market in recent weeks. Over the past few days, information out of South Africa (the current epicenter of the Omicron Covid-19 variant outbreak) has continued to point to much milder symptoms associated with infection. This lowers the risk of a sharp spike in hospitalisations in the US (and elsewhere) that might weigh on economic growth in Q1 2022.

Thus, investors seem to have come around to the view that last wee’s panicked downside was an overreaction and have instead opted to pile back into risk in what some commentators called a “melt-up”. The S&P 500 currently trades roughly 100 points above Monday’s close at just under 4700 and is now trading back at pre-Omicron levels. The index trades just over 1.0% below record highs printed back on 22 November.

The Dow, meanwhile, was up 1.5% and also back to pre-Omicron levels, though still trade some 2.0% below early November’s record highs. The Nasdaq 100 was up closer to 3.0% despite a further rise in yields across the US treasury curve and leapfrogged the 16K level to hit 16.3K again. For reference, the index trades about 2.7% below November’s record highs just above 16.7K. The CBOE S&P 500 Volatility Index (often referred to as the VIX) was down more than 5.0 points to around 22.0 and near its lowest since the emergence of the Omicron variant.

Outperformance in tech stocks was helped by a surge in Intel’s shares price of more than 4.0% on Tuesday. Investors cheered the news that the co. plans to take its self-driving car unit public in mid-2022 at an estimated valuation of more than $50B. The news helped push the Philadelphia SE Semiconductor index higher by nearly 5.0%.

Ahead, US equity market focus is set to remain on the theme of Omicron. When cases start to spike in the US in the coming weeks, this might cause some volatility, especially if it sparks an overreaction from state governors/health authorities when reimposing economic restrictions. But so long as the severity of illness associated with infection doesn’t surprisingly worsen, investors will likely continue to assume that Omicron doesn’t pose a severe threat to the economic outlook. As long as investors remain confident in the health of the US economy, a high US inflation print on Friday (which would solidify expectations that the Fed will agree to accelerate their QE taper next year) shouldn’t cause equity markets any problems.

The Bank of Canada (BoC) will announce its monetary policy decisions on Wednesday, December 8 at 15:00 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of seven major banks, regarding the upcoming announcement. No change is expected in the 0.25% overnight rate target but there is a big asterisk now relating to the uncertain impacts of Omicron.

ING

“No policy changes are expected after policymakers decided to end QE in October and brought forward guidance for the timing of the first rate hike to mid-2022. Given less spare capacity than most other economies, we immediately shifted to forecasting four 25bp rate hikes in 2022 after the October announcements, with one hike per quarter. We are reluctant to make any changes to this view right now given the uncertainty over Omicron, but the obvious risk is that the BoC ends up delaying the first hike until 2Q should consumer caution kick in on Covid anxiety. The BoC is also mulling changing its inflation target that could be more explicit about tolerating inflation overshoots in a move that would follow the US. However, the BoC already has a framework that is well understood and already contains flexibility so there seems little need for any radical changes.”

TDS

“We look for a relatively quiet BoC meeting, with limited scope for a meaningful change in tone. The BoC will maintain that the outlook is evolving as expected and that inflation strength is largely transitory. We do not expect any change to guidance, as the statement balances rising uncertainty over COVID-19 and supply chain disruptions from BC floods against labour market strength. A quiet BoC meeting shifts CAD drivers to the world at large. In turn, covid uncertainty, heightened risk aversion, and a relatively poor local growth and mobility backdrop should keep USD/CAD hanging around 1.28 for a bit longer.”

RBC Economics

“The BoC might still be able to point to pockets of weakness in labour markets—long-run unemployment is still elevated, for example. But arguments to keep policy interest rates at emergency low levels are getting thin. The BoC is expected to reiterate that, barring significant further disruptions from the new virus variant, the economy is on track to fully recover by mid-2022, and that interest rate hikes will be warranted at that point. We expect the first rate hike next year to come in April.”

NBF

“We had initially anticipated the rate announcement to be a rather muted affair, there being no accompanying Monetary Policy Report or press conference. But the release of November’s employment data laid waste to these expectations. The sheer strength of the report – 153K jobs were added in the month – calls for a change of tone at the BoC, especially in a context where inflation continues to drift further above the central bank’s target. While we still expect the BoC to maintain the overnight target rate at its lower bound, the language of the statement will have to be tweaked to take into account what has proven to be a much stronger recovery than what the central bank had expected just a few months ago. Granted, this renewed optimism could be tempered by growing uncertainty – the Bank is likely to mention the risks associated with the emergence of the Omicron variant – but that probably won't stop it from setting the stage for a possible rate hike in the first quarter of 2022. Barring a catastrophic surge in COVID-19 hospitalizations, the days of stable interest rate policy are numbered. We see the first BoC rate hike arriving by March of next year.”

Citibank

“We expect the BoC to leave rates unchanged at 0.25% though we will watch for signs the BoC could be considering a rate rise even earlier than the latest guidance for the ‘middle quarters of 2022’. After the hawkish October surprise, we expect a slightly hawkish tone to this meeting with risks tilted to an even more hawkish shift, with BoC perhaps signaling openness to a Q1 hike.”

BofA

“We expect the BoC to keep the policy rate at 0.25% and to maintain its current forward guidance. We expect liftoff in April. But a red-hot labor market means the risk is BoC moves the ‘live’ meetings forward to 1H from the middle quarters of 2022. Hawkish tone may not translate to further front-end selloff or CAD downside due to aggressive BoC pricing and global risks."

CIBC

“Bank of Canada’s meeting would be an opportunity to reinforce the message that rate hikes are on the table for no later than April 2022. It can offer up an even more positive outlook, and signal rate hikes are coming, but the language surrounding that forecast should sound much less certain until we have more information about Omicron, the mutated elephant in the room.”

- EUR/JPY continues to move in ranges, with a bearish bias.

- Dominant trend points to the downside, more losses seen under 127.50.

- Gains below 129.00 should be seen as corrective.

The EUR/JPY is rising on falling on Tuesday, giving back Monday’s gains. The euro peaked near 128.50, and then pulled back. It was unable to remain above 128.00, showing that it continues to face pressure.

The main trend is bearish and EUR/JPY looks poised to test the lower bottom area. The key level to watch on the downside is 127.50. A daily close below should point to more losses, with an immediate target at 127.00, followed by 126.70.

Technical indicators are giving mixed signs, affected by the consolidation moves in a small range. RSI is turning south, but Momentum keeps a positive slope. Despite being unable to confirm levels above 128.00, so far the decline has been limited.

If the euro, breaks and posts a close above 128.00, it would gain momentum for a test of 128.50. A daily close above 130.00 should be a potential sign the euro has probable established an interim bottom.

EUR/JPY daily chart

-637744883429120800.png)

- EUR/GBP is trading just under 0.8500 where it is finding support in the form of last week’s lows and the 50DMA.

- The pair has been weighed this week by improving risk appetite but faces high BoE and ECB policy uncertainty.

EUR/GBP is currently trading marginally lower on the session slightly to the south of the 0.8500 level, though support in the form of last week’s low at 0.8490 and the 50-day moving average at 0.8485 is keeping a floor under the price action for now. Risk appetite has been improving since the start of the week which generally favours the comparatively risk-sensitive GBP versus the euro. This has helped the pair reverse back under 0.8500 from this week’s opening levels near 0.8550.

Eurozone data

Eurozone data largely did not impact FX market sentiment on Thursday. German Industrial Production saw a much bigger than expected 2.8% bounce in October, though analysts warned that supply chain disruptions would continue to hamper the recovery in output in the months ahead. The December German ZEW survey was mixed, with current conditions (amid lockdowns) posting a surprise drop into negative territory versus overall economic sentiment posting a smaller than expected drop. Finally, the final estimates of Eurozone GDP growth and employment change in Q3 were left unchanged at 2.2% and 0.9% QoQ respectively.

Central bank uncertainty

Seeing EUR/GBP stall at resistance in the 0.8500 area is not to surprising given the current environment of uncertainty regarding ECB and BoE policy in the coming months. With regards to the Bank of England, the more cautious tone from policymakers on the risks posed by the Omicron outbreak has resulted in money markets pricing out a rate hike later this month. But traders, many of whom were wrong-footed when the bank opted to go against market expectations and not hike rates by 15bps last month, will be wary that another BoE surprise might be in store. Policymakers have unanimously signaled that rates will need to begin gradually rising in the coming months – it is just a question of when.

Meanwhile, ECB policymakers seem in two minds about what to do with the bank’s pre-pandemic Asset Purchase Programme when the PEPP expires in March. Prior orthodoxy had been that the APP would be bumped higher to make up for the ending of the PEPP next March. But amid high inflation and load calls from hawkish governing council members, ECB members seem to now be leaning towards leaving the APP unchanged.

Ahead

In terms of the rest of the week, euro traders will be on notice for a barrage of ECB speak on Wednesday and Friday, but there is otherwise not any further important data releases for the region. Sterling traders, meanwhile, will be keeping an eye on October's monthly GDP and economic activity numbers out on Friday.

- The NZD/USD pair is advancing 0.27%, amid a positive risk appetite.

- The omicron variant, even though highly transmissible, seems mild based on cases so far.

- NZD/USD Price Forecast: Tilted to the upside in the near term, but downside risks remain.

After reaching a new year-to-date low on Monday, the NZD/USD is staging a comeback on Tuesday’s New York session, trading around 0.6772 at the time of writing. The market sentiment is upbeat, as portrayed by global equity markets, which are making gains. Although the newly discovered omicron variant is more contagious than other strains, COVID-19 patients with that variant have only shown mild symptoms. Also, crossing the wires, an antibody treatment created by Glaxo works on the omicron variant, as reported by studies.

In the overnight session, the NZD/USD dipped to a new year-to-date low at 0.6735, then rebounded towards the 100-hour simple moving averages (SMA), dynamic resistance that stalled the upside move triggered by US dollar weakness. In the last couple of hours, the greenback regained some demand, pushing the pair towards the 50-SMA at 0.6754 to stabilize at current levels.

An absent economic docket in New Zealand and the US left the NZD/USD pair relying in the dynamics of market sentiment, the USD, and China’s news.

During the Asian session, China reported that its Exports increased by 22% dollar-denominated up to $326 billion, while imports grew almost 32% to about $254 billion. Estimates were in the range of 20.3% and 21.5%, respectively. According to sources cited by Bloomberg, “exports picked up in line with seasonality in November and suggest still pretty solid momentum in external demand.”

NZD/USD Price Forecast: Technical outlook

On the 1-hour chart, the NZD/USD pair is trading to the upside in the near term, but downside risks remain. The 100-SMA at 0.6782, which confluences around the R3 daily pivot level, could stall any upward move, as previously done three times throughout the day. That, alongside the 50-SMA at 0.6754, might keep the pair trading sideways due to the lack of a catalyst other than pure market sentiment.

In the event that it should break above the 100-hour SMA, the first line of resistance would be the 200-hour SMA at 0.6805. A breach of that level would expose the December 2 high at 0.6830.

On the other hand, a break below the 50-hour SMA would expose the year-to-date low at 0.6736, followed by the figure at 0.6700.

-637744861273573951.png)

- Ivey PMI stayed at 61.2 in November, indicating strong business conditions in Canada.

- USD/CAD was unreactive but continued to trade close to session lows in the mid-1.2600s, weighed amid risk-on and higher crude prices.

Canada's Ivey PMI, which is released by the Richard Ivey School of Business each month and captures business conditions in Canada, remains at 61.2 in November after also printing 61.2 in October. As with other PMI indicators, a result above 50 is generally associated with MoM growth in economic activity. Thus, Canada's Ivey PMI suggests business conditions in the country remained strong last month.

Market Reaction

USD/CAD did not see any notable reaction to the latest Ivey PMI data, just as it ignored positive trade figures earlier in the session. The pair is currently trading close to session lows in the 1.2660s just above the 21-day moving average at close to 1.2650 and is down about 0.7% on the day. Risk-on and an associated rebound in crude oil prices, as markets price out recent Omicron-related pessimism, is helping the loonie to appreciate on Tuesday ahead of Wednesday's BoC rate decision.

- EUR/USD dipped below 1.1250 in recent trade as risk appetite recovers and traders up their hawkish Fed bets.

- Bears will be eyeing a move back towards recent annual lows under 1.1200.

EUR/USD has been under pressure in recent trade as the market’s broader appetite for risk has continued to pick up. The pair slipped below 1.1250 in recent trade and even managed to momentarily eclipse last Tuesday’s post-hawkish Fed Chair Jerome Powell testimony lows at 1.1235. At its current levels, EUR/USD is now trading lower by about 0.4% on the day, making the euro the joint-worst performing G10 currency on the day alongside the Swedish krona. The bears will likely be looking for a retest of recent annual lows under 1.1200 in the coming sessions.

Driving the day

Improving risk appetite has been the major driver of EUR/USD downside move on Tuesday. Traders and analysts have been citing receding Omicron fears and Chinese stimulus hopes as driving the broad rebound in sentiment that saw the S&P 500 open 1.2% higher and the Stoxx 600 index trading nearly 2.0% higher on Tuesday. Market participants appear to be coming around to the idea that the Omicron variant causes milder symptoms than past Covid-19 variant, thus posing less of a threat to the economic outlook.

Thus, expectations for Fed monetary policy tightening in 2022 have broadly returned to pre-Omicron levels. The implied yield on the December 2022 three-month eurodollar future rose back to 1.05% on Tuesday, up from under 1.0% at the start of the week and as low as 0.8% at the end of December. In the absence of any important US data releases or Fed speak (Fed members are in blackout ahead of next week’s meeting), this recent repricing has clearly been a function of improvement in the market’s broader risk appetite.

Central bank policy divergence remains the main theme driving EUR/USD in the medium-term. Another rise in US Consumer Price Inflation (CPI) numbers at the end of the week ought to solidify market expectations for the Fed to agree to accelerate the pace of their QE taper from January, which could further weigh on EUR/USD. Recent ECB-related newsflow is noteworthy, however.

Hawkish ECB member Robert Holzmann recently remarked that inflation will probably exceed the bank’s 2.0% target in 2022, well above the bank’s current forecast of inflation of 1.7% next year. Fellow hawk Madis Muller also raised similar concerns. Meanwhile, according to ECB sources, policymakers at the bank are second-guessing prior commitments made to ongoing stimulus amid higher-than-expected inflation. Regarding QE, some policymakers are reportedly reluctant to commit to anything beyond the end of Q2 2022. If it does emerge that the ECB is not going to increase the APP to make up for the end of the PEPP in March next year, as seems increasingly likely, this may support the euro against the low-yielding yen and Swiss franc, but probably not against USD, given that the Fed will, in any case, remain well ahead of the ECB in terms of monetary normalisation.

USD/CAD has broken under 1.27. Economists at Scotiabank think the pair could plunge as low as the 1.2571 mark.

USD/CAD set to suffer additional losses

“Fundamental drivers suggest some modest scope at least for additional CAD gains in the near-term and should reinforce USD resistance around the 1.28 point.”

“After six solid weeks of USD gains, a fairly firm CAD reversal seems to be developing on the charts, even if it remains very early in the week to draw too many conclusions from the longer run charts. Shorter-term CAD technicals are clearly more positive, however; retracement potential extends to 1.2638 (38.2% Fibonacci retracement of the Oct/Dec USD rise) intraday, with the 50% retracement support at 1.2571 perhaps in reach over the next 24 hours or so.”

EUR/USD drifted into the negative territory for the second successive day on Tuesday. Economists at Scotiabank note that a slump below the 1.12 level would open up the 1.10 mark.

Initial resistance seen at 1.1280

“Downward pressure towards a retest of 1.12 remains firmly in place (albeit at a relatively slow pace).”

“The EUR faces limited support past the 1.12 area, with a break under the level liable to extend to 1.10.”

“Intraday resistance stands at ~1.1280 and then the 1.1300/10 zone stands as the main obstacle for the EUR.”

- GBP/USD witnessed an intraday turnaround from the vicinity of the 1.3300 mark on Tuesday.

- Hawkish Fed expectations continued underpinning the USD and exerted pressure on the pair.

- Some follow-through selling below the 1.3200 mark will set the stage for additional losses.

The USD caught some bids during the early North American session and dragged the GBP/USD pair to a fresh daily low, around the 1.3220-15 region in the last hour.

The pair struggled to capitalize on its modest intraday gains, instead met with a fresh supply near the 1.3290 area on Tuesday amid a modest pickup in the US dollar demand. Growing market acceptance that the Fed would hike interest rates sooner rather than later to contain stubbornly high inflation continued acting as a tailwind for the USD.

Apart from this, a further recovery in the US Treasury bond yields underpinned the buck and exerted downward pressure on the GBP/USD pair. Bulls failed to gain any respite from the prevalent risk-on mood – which tends to undermine the safe-haven greenback – and largely shrugged off the prospects for an imminent rate hike by the Bank of England.

With the latest leg down, the GBP/USD pair has now eroded a major part of the overnight recovery gains and moved well within the striking distance of the 1.3200 mark. A convincing break below the latter will be seen as a fresh trigger for bearish traders and set the stage for additional losses amid persistent Brexit-related uncertainties.

In the absence of any major market-moving economic releases, the USD price dynamics will continue to play a key role in influencing the GBP/USD pair and produce some short-term trading opportunities. Traders will further take cues from the US bond yields, developments surrounding the coronavirus saga and the broader market risk sentiment.

Technical levels to watch

AUD/CAD’s break under the base of the recent range around 0.91 likely condemns the AUD to more weakness moving ahead. Economists at Scotiabank expect the pair to drop towards 0.88.

Technical indicators are aligned bearishly for the AUD

“The daily, weekly and monthly DMI oscillators are aligned bearishly for the AUD which will limit its powers of recovery for now and maintain focus on the downside.”

“We expect solid resistance now on AUD gains to the 0.91 area and feel risks have tipped quite a bit more strongly towards a drop in the AUD to 0.88.”

- USD/JPY climbed to a one-week high on Tuesday and was supported by a combination of factors.

- The risk-on mood undermined the safe-haven JPY and extended some support to the major.

- Rising Fed rate hike bets, recovering US bond yields benefitted the USD and remained supportive.

The USD/JPY pair traded with a positive bias through the early North American session and was last seen trading around the 113.65-70 region, or a one-week high set earlier this Tuesday.

A combination of supporting factors assisted the USD/JPY pair to build on the previous day's positive move and gain some follow-through traction for the second successive day on Tuesday. Easing concerns about the economic fallout from the new Omicron variant remained supportive of the prevalent risk-on environment. This, in turn, undermined the safe-haven Japanese yen and acted as a tailwind for the major.

On the other hand, the US dollar drew some support from rising bets for a faster Fed liftoff and a further recovery in the US Treasury bond yields. In fact, the markets have been pricing in the possibility for an eventual Fed rate hike move in May 2022 amid worries about stubbornly high inflation. This provided an additional lift to the USD/JPY pair, though the uptick lacked strong bullish conviction.

The fundamental backdrop seems tilted in favour of bullish traders, though the lack of follow-through buying warrants some caution before positioning for any further appreciating move. In the absence of any major market-moving economic releases, the US bond yields would play a key role in influencing the USD price dynamics. Apart from this, the broader market risk sentiment should provide some impetus to the USD/JPY pair.

Technical levels to watch

- Canada posted a stronger than expected trade surplus in October.

- USD/CAD largely ignored the data, though the loonie continues to perform well on Tuesday amid risk-on and higher oil prices.

Canada's merchandise trade surplus with the world widened to C$2.09 billion in October from C$1.42 billion in September, monthly data published by Statistics Canada revealed on Tuesday. This reading beat market expectations for a surplus of C$2.00 billion. Canadian exports in October rose to C$56.18B from C$52.8B in September, whilst imports rose to C$54.9B from C$51.39B.

Market Reaction

The loonie largely ignored the strong trade figures. USD/CAD has been under selling pressure on Tuesday as the loonie benefits from risk-on vibes and higher oil prices ahead of Wednesday's BoC rate decision and the release of November Ivey PMI data later in the session. The pair is now trading under 1.2600 and is already down over 1.0% on the week.

- The US trade deficit shrunk in October, though not by quite as much as expected.

- The DXY did not react to the data, though did recently break back to the north of the 96.50 level.

The US goods and services trade deficit shrank to $67.1B in October from $81.4B in September, the US Census Bureau reported on Tuesday. That was larger than the expected trade deficit on the month of $66.8B. Monthly imports rose to $290.70B from $288.20B in September, whilst monthly exports surged to $233.60B in October from $206.80B the month prior.

Market Reaction

The DXY has moved to session highs above 96.50 in recent trade, though the bulk of this move happened prior to the data release and seems to be more a function of broader risk appetite.

European Central Bank governing council member Madis Muller said on Tuesday that it is not obvious that the bank should be adding to its Asset Purchase Programme purchase volumes beyond March in light of high inflation and the uncertainty outlook. It would not be wise to commit to any specific level of purchases for more than a few quarters ahead, he added.

Muller said that inflation will take longer to come down than expected and risks remain tilted to the upside, echoing the tone of other concerned ECB policymakers. Eurozone inflation may be above target next year, he added (a point which fellow ECB member Holzmann recently made) and that longer-term projections may need to be raised. Finally, Holzman said that each new wave of the pandemic has a lower impact on the economy and that the medium-term growth outlook for the Eurozone is broadly unchanged.

Market Reaction

The hawkish tone of remarks from ECB's Muller have been unable to give the euro a lift in recent trade, with the currency continuing to trade close to session lows in the 1.1250 area.

- WTI has continued to rally on Tuesday and was at one point probing $72.00.

- Receding Covid-19 fears, signs of strong demand and continued impasse in talks with Iran are all being cited as supportive.

The oil market’s impressive rebound has continued this Tuesday. After surging more than 5.0% on Monday from the $66.00s to the psychologically important $70.00 level, front-month WTI futures have pushed on to probe the $72.00 area on Tuesday. With WTI currently trading close to $71.50, that translates into on-the-day gains of nearly $1.50. WTI is now nearly up $10 from last week’s near-$62.00 lows. The next significant area of resistance for WTI is at $73.00 and then, above that, around $75.00. To the downside, any dips back towards the 200DMA at $70.00 remain subject to being bought.

Driving the day

Traders/analysts are citing receding Omicron fears, indicators of strong oil demand (the Saudis raised their official selling price to Asian customers over the weekend) and continued impasse in Iran/US/EU nuclear deal negotiations as supportive of the price action.

Referring to comments made by top US infectious disease expert Anthony Fauci on CNN over the weekend about the apparent mildness of Omicron infection symptoms, Jeffrey Halley, senior market analyst at OANDA, told Reuters that “the Fauci comments… saw more fast money returning to the long oil trade as markets started pricing a resumption of the global recovery and higher oil consumption”. “This (mildness of Omicron symptoms) lowers the probability of the worst-case scenario that the oil markets have been pricing in over the past couple of weeks” analysts at ANZ added.

Referring to Iran nuclear negotiations, CBA analysts Vivek Dhar said that while the talks could still find success when they recommence later this week, “markets may need to consider a more prolonged delay to Iranian oil exports”. This is a “positive for oil prices and supports OPEC+ plans to boost oil production through 2022” he added. Elsewhere, Chinese trade data overnight showed that imports had rebounded in November.