- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 09-08-2022

Analysts from Morgan Stanley (MS) conveyed their hopes from the US inflation ahead of the key US Consumer Price Index (CPI) figures for July. It’s worth noting that the MS signalled the risk of the EUR/USD pair’s fall towards the 0.9700 mark the previous day.

Also read: EUR/USD risks falling towards 0.9700 – Morgan Stanley

Important findings

We think the market is underestimating the stickiness of US inflation, the Fed's resolve in tackling it, and the necessary tightening required to achieve lower inflation.

US CPI on August 10 may be a critical market catalyst for the next leg of the USD rally should it exceed market expectations.

It should be noted that the the headline US CPI is expected to ease to 8.7% YoY from 9.1% market forecasts whereas the CPI ex Food & Energy (Core CPI) is likely to rise from 5.9% to 6.1%.

- A Double Top formation near 200-EMA bolstered the downside gestures.

- Greenback bulls are lacking confidence above the demand zone placed around 0.9500.

- A drop below 40.00 by the RSI (14) will trigger the downside momentum.

The USD/CHF pair is displaying topsy-turvy moves after dropping below the critical support of 0.9560 on Monday. Broadly, the asset is declining after failing to surpass the crucial hurdle of 0.9640. The major refreshed its weekly low at 0.9511 on Tuesday.

The formation of a Double Top on a four-hour scale has already underpinned the bearish mood. A failure in overstepping the critical hurdle of 0.9650 resulted in a steel fall in the asset. Also, the 200-period Exponential Moving Average (EMA) at 0.9650 acted as a roadblock for the greenback bulls.

The asset has surrendered the cushion of 50-EMA at 0.9572 and is declining towards the demand zone, which is placed in a 0.9470-0.9500 range.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, which indicates a consolidation ahead. A drop below 40.00 by the RSI (14) will trigger the downside momentum.

Should the asset drop below the above-mentioned demand zone, the Swiss franc bulls will drag the asset towards the round-level support at 0.9400, followed by March 24 high at 0.9344.

On the flip side, the asset may display an upside move towards July 22 high at 0.9704 and July 7 high at 0.9743 after violating the double top resistance.

USD/CHF four-hour chart

-637956859051165835.png)

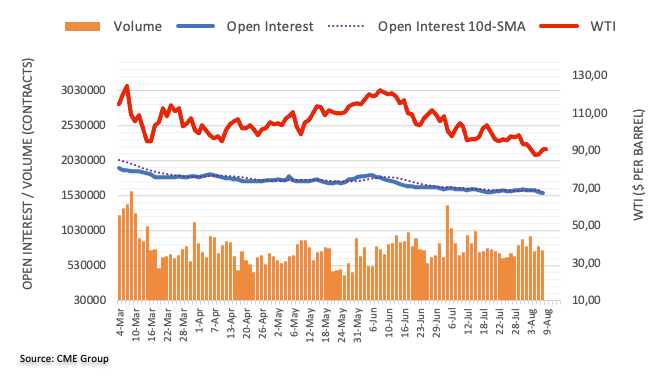

- WTI picks up bids to reverse the pullback from weekly high.

- Energy prices struggle to please bulls as softer weekly API oil inventories battle risk-aversion wave.

- Russia’s suspension of oil supplies through Druzhba pipeline, hopes of higher demand per US oil refiners, pipeline companies favor bulls.

- Official Oil Stocks Change from EIA, US/China CPI for July will be crucial for clear directions.

WTI remains sidelined around $90.00 during Wednesday’s Asian session, after failing to impress bulls the previous day despite Russia’s another blow to European energy demand. The oil buyers should have also cheered upbeat demand forecasts from the US refiners and pipeline companies. However, fears of recession and a cautious mood ahead of the headline inflation data from China and the US seem to challenge the energy buyers of late.

That said, the weekly prints of the American Petroleum Institute’s (API) Crude Oil Stock data for the period ended on August 05 flashed an increase of 2.156 million barrels versus the previous addition of 2.165M.

On the other hand, “US oil refiners and pipeline operators expect energy consumption to be strong for the second half of 2022, even though analysts and industry watchers have worried that demand could falter if the global economy enters a recession or high fuel prices deter travelers,” said Reuters.

Also bullish for the prices could be comments from Russian pipeline monopoly Transneft that said, per Reuters, “Ukraine has suspended Russian oil pipeline flows to parts of central Europe since early this month because Western sanctions prevented it from accepting transit fees from Moscow.”

Alternatively, firmer US data and hawkish Fedspeak renewed the US dollar strength and weighed on the prices of black gold. On Tuesday, US Nonfarm Productivity improved to -4.6% during the second quarter (Q2), -4.7% expected and -7.4% prior, whereas the Unit Labor Cost increased to 10.8% from 12.7% prior and 9.5% market consensus during the said period. It’s worth noting that Fed's St. Louis president James Bullard said on Tuesday, per Reuters, that he wants rates at 4% by the end of the year. This joins recently firmer interest rate futures suggesting nearly 70% odds favoring the 75 basis points (bps) of a Fed rate hike in September.

The risk-off mood could be witnessed in Wall Street’s downbeat performance and the rebound in the US Treasury yields, which in turn weighed on the WTI crude oil prices.

Moving on, China’s Consumer Price Index (CPI) and Producer Price Index (PPI) data for July will offer immediate directions but major attention will be given to the US CPI, expected to ease to 8.7% from 9.1% on YoY, as well as the CPI ex Food & Energy which is likely to rise from 5.9% to 6.1%. Following that, the official weekly oil inventory data from the Energy Information Administration (EIA) for the week ended on August 05, expected -0.4M versus 4.467M, will be important to watch for the oil prices forecast.

Technical analysis

Although a sustained break of the weekly resistance line, now support around $87.45, keeps WTI crude oil buyers hopeful, Tuesday’s Doji candlestick teases bears until the quote stays below the $92.00 immediate hurdle.

- AUD/USD extends Tuesday’s downbeat performance, stays pressured around intraday low.

- Fears of economic slowdown, pre-inflation anxiety weigh on the risk-barometer pair.

- Aussie NAB data failed to impress bulls amid downbeat equities, rebound in yields.

- Firmer China CPI may offer intermediate help but US inflation is crucial amid strong jobs report, hawkish Fedspeak.

AUD/USD remains depressed around the intraday low near 0.6955 as sellers keep reins for the second consecutive day ahead of the key US inflation data. In addition to the US Consumer Price Index (CPI), headline inflation numbers from Australia’s key customer China also adds to the pre-data caution. Additionally, fears of economic slowdown and the hawkish Fed bets are extra catalysts that weigh on the Aussie pair during the early Asian session on Wednesday.

Market sentiment turned sour after the firmer US data joined Russia’s further tightening of energy supplies, which in turn weighed on the AUD/USD prices during the European session on Tuesday.

That said, US Nonfarm Productivity improved to -4.6% during the second quarter (Q2), -4.7% expected and -7.4% prior, whereas the Unit Labor Cost increased to 10.8% from 12.7% prior and 9.5% market consensus during the said period. On Tuesday, Russia reportedly suspended oil flows via the southern leg of the Druzhba pipeline, amid transit payment issues.

It’s worth noting that Fed's St. Louis president James Bullard said on Tuesday, per Reuters, that he wants rates at 4% by the end of the year. This joins recently firmer interest rate futures suggesting nearly 70% odds favoring the 75 basis points (bps) of a Fed rate hike in September.

Against this backdrop, the US 10-year Treasury yields regained upside momentum while closing the day around 2.779% while the Wall Street benchmarks also posted losses by the day’s end.

Earlier on Tuesday, National Australia Bank’s Business Conditions and Business Confidence data for July printed upbeat results as the former rose to 20, versus 15 market consensus and 13 prior. Further, Business Confidence matched 7 forecasts while rising past 1 prior. On the contrary, Australia’s Westpac Consumer Confidence Index for August eased to 81.2, below 83.8 prior. Also, China marked a 20.1% YoY gain in passenger car sales during July, per china auto industry body CPCA.

Looking forward, AUD/USD may witness an intermediate rebound should China’s CPI and Producer Price Index (PPI) data for July match upbeat forecasts. However, major attention will be given to the US CPI, expected to ease to 8.7% from 9.1% on YoY, as well as the CPI ex Food & Energy which is likely to rise from 5.9% to 6.1%. Given the hawkish expectations from the Core CPI, the US dollar may witness further upside in case of the firmer inflation print.

Also read: US CPI Preview: It is the hard core that counts, five scenarios for critical inflation data

Technical analysis

AUD/USD holds onto the pullback from a downward sloping resistance line from April 20, close to 0.7015 by the press time. The same joins the impending bear cross of the MACD and steady RSI to direct sellers towards the 50-DMA retest, around 0.6850 at the latest.

- GBP/USD is juggling in a 28-pip range as investors await UK GDP data.

- The BOE is worried over soaring consensus for price pressures.

- Japan’s administration is eyeing measures to paddle up the labor cost index.

The GBP/JPY pair is displaying back and forth moves in a narrow range of 163.00-163.28 from the New York session as investors are shifting their focus toward the UK economic data, which will release on Friday.

The UK economy is facing various headwinds for the past few months. Right from the soaring price pressures to the lower Labor Cost Index and now to political instability after the resignation of UK PM Boris Johnson. Broadly, the cross is facing barricades around 163.50 and is likely to remain vulnerable ahead.

The Bank of England (BOE) is going through the tedious task of handling the roaring price rise index. The inflation rate is 9.4% in the pound zone on an annual basis and BOE Governor Andrew Bailey in his commentary on monetary policy announcement cleared that the inflation rate could go to 13%. So, a consensus of galloping inflation is sufficient to scare out the market participants. In addition to that, de-growth in paychecks by the UK households is an additional mess for the BOE.

On the economic data front, a preliminary estimate for the UK GDP is 2.8% vs. 8.7% the former release on an annual basis. While the quarterly data is expected to report a shrink in economic activities by 0.2% against the expansion of 0.8%.

Meanwhile, the yen bulls are dancing to the tunes of Japan’s cabinet re-shuffle. Japanese Prime Minister Fumio Kishida is set to retain Finance Minister Shunichi Suzuki in a cabinet reshuffle this week. Now, eyes will remain on measures to be taken by the Japanese administration to step up the labor cost index, which is critical to keep the inflation rate above 2%.

- DXY, on the 4-hour time frame, the price is consolidated along a rising support line as markets await US CPI, July.

- 105.05 is a key structure that guards a significant correction to the downside.

- On the upside, an area of price imbalance between 106.40 and near 108 the figure could be targetted.

Financial markets retreated, but so did the US dollar and US yields remain around lower levels of late ahead of the release of the day's US July Consumer Price Index data in the New York open. The greenback was just above holding onto the 106 level overnight and is flat for the day so far in Asia.

US CPI eyed

The US inflation data could be pivotal for the US dollar, although there will be another report before the next Federal Reserve meeting. Nevertheless, officials to pay close attention to core inflation this time around. ''A continuation of recent trends would be unwelcomed and likely tilt the Fed toward another substantive rate increase at the 20‑21 September FOMC meeting,'' analysts at ANZ Bank said:

''The consensus expectation anticipates headline inflation slowed to 0.2% MoM vs 1.3% Mom in June owing largely to weaker energy and food prices. That would see the annual rate of inflation ease slightly to 8.7% from 9.1% in June. Core inflation, however, is expected to remain sticky at 6.1% YoY (vs 5.9% in June) – still way in excess of the Fed’s 2.0% target. Core inflation, in particular, core services inflation which accounts for almost 60% of the CPI, must demonstrate signs of moderating before inflation can return sustainably to target.''

The data will follow recent job data in last week's Nonfarm Payrolls blockbuster outcome. This was highlighting solid wage growth and combined with the US productivity data that is highlighting another surge in labour costs, investors fear that this will complicate the Federal Reserve's efforts to control inflation.

nevertheless, WIRP is now showing over 75% odds of a 75 bp hike at the September 20-21 FOMC meeting which would be expected to keep the greenback in the hands of the bulls. However, markets are still pricing in a quick turnaround by the Fed into an easing cycle in H1 2023, as analysts at Brown Brothers Harriman explained. ''It's pretty clear that the Fed doesn't see it that way and the data bear that out, at least for now.''

Beyond the CPI data and ahead of the September 20-21 FOMC meeting, the next big Fed event will be its Jackson Hole Economic Symposium scheduled for August 25-27. Fed Chairs often use this symposium in August to announce or hint at policy shifts ahead of the September FOMC meetings and the analysts at BBH explained that ''by late August, we will have seen all the major July data and some of the early August surveys such as the preliminary S&P Global PMI readings and regional Fed surveys. The Fed will also have a good idea of how the economy is doing in Q3. That said, we do not think the Fed will make any major policy announcements or paint itself into a corner ahead of next month’s FOMC meeting.''

US dollar technical analysis

This brings us to the technical picture for the US dollar. On the 4-hour time frame, the price is consolidated along a rising support line. If this were to break, then 105.05 is a key structure that guards a significant correction to the downside. On the upside, we have a greyed-out area of price imbalance as illustrated on the chart between 106.40 and near 108 the figure. Beyond there, 109.294 highs couldbe targetted and a break thereof could be blue skies for the greenback.

- Silver price drops as US bond yields escalate while the US dollar weakens.

- Sentiment remains fragile, shifting sour since the European equities close.

- Silver’s price action to remain choppy ahead of the US CPI report.

Silver price retreats from weekly highs reached on Monday at $20.74 but is exchanging hands near the August 9 lows at $20.42 as the Asian Pacific session starts. At the time of writing, XAGUSD is trading at $20.52, slightly up 0.15%.

Silver drops albeit a soft US dollar

Wall Street ended Tuesday’s session in the red, while Asian equities point to a lower open. The greenback weakens, as shown by the US Dollar Index at 106.302, down 0.07%, while the US 10-year bond yield rises two bps at 2.783%.

Sentiment shifted sour due to several reasons. Firstly, last Friday’s strong US jobs report remains in traders’ minds, putting recession fears away, as shown by money market futures STIRs, portraying a 88% chance of a Federal Reserve 75 bps rate hike. That said, alongside hawkish Fed commentary, policymakers have reiterated the Fed’s commitment to bringing inflation down. Most members have been vocal about going 75 bps in the next meeting, while Cleveland’s Fed Mester and Chicago’s Fed Evans remain open to 50 or 75 bps.

Furthermore, the US inflation figures looming keeps investors uneasy. The US Consumer Price Index (CPI) for July is expected at 8.7% YoY, less than June’s 9.1%, while core CPI figures are foreseen at 6.1% YoY vs. 6.2% in the previous reading.

After Wednesday’s main event, XAGUSD traders should expect feedback from the Chicago Fed President Charles Evans and Minnesota Fed’s Neil Kashkari, which would cross the wires after the release. By Thursday, the San Francisco Fed President, Mary Daly, will cross wires on Bloomberg.

Silver (XAGUSD) scenarios for Wednesday’s US CPI

Therefore, XAGUSD traders should be aware of important US economic data. If the CPI tops expectations, we could see a reaction of US bond yields rising, underpinning the greenback higher, consequently precious metals prices falling. Otherwise, if US inflation shows signs of tempering, silver and commodity prices could increase, while US bond yields and the greenback fall.

Silver (XAGUSD) Key Technical Levels

Late on Tuesday, Bloomberg conveyed comments from JPMorgan Chase & Co. economists suggesting that the Inflation Reduction Act will have “almost no effect” on price growth that’s currently running at the fastest pace in four decades.

Key quotes

The landmark tax, climate and health-care bill, which passed the Senate on Sunday and is headed for the House on Friday, puts a slimmed-down version of President Joe Biden’s domestic agenda on a path to becoming law after a year of Democratic infighting that the White House was unable to control.

The nonpartisan Congressional Budget Office, the Committee for a Responsible Federal Budget and the Penn Wharton Budget Model all found that the legislation will have a minimal influence on inflation, which climbed an annual 9.1% in June.

‘The aggregate demand impulse is trivial,’ Michael Feroli, JPMorgan’s chief US economist, wrote in a note Tuesday. ‘Moreover, we believe the drug-pricing provisions will have little near-term impact on the CPI,’ he said, referring to the consumer price index.

‘If there are longer-run beneficial effects for the supply side of the economy -- as its backers claim -- that’s a growth issue, not an inflation issue: in the long-run inflation is determined by Fed policy,’ Feroli wrote.

The law is estimated to reduce the federal budget deficit by about $300 billion over the next decade. For the fiscal year that starts Oct. 1, the narrowing in the gap is seen at $18 billion, or less than 0.1% of gross domestic product, Feroli said.

Also read: Forex Today: Market players on their toes ahead of US inflation data

- USD/CAD retreats from 21-DMA, reverses the previous day’s corrective bounce.

- Sluggish MACD, steady RSI hint at further grind towards the south.

- Monthly resistance line adds to the upside filters, key Fibonacci retracement levels offer extra challenges to bears.

USD/CAD remains pressured around 1.2885 as it steps back from the 21-DMA hurdle during Wednesday’s Asian session. In doing so, the Loonie pair portrays the failure to keep the bounce off the 100-DMA, marked during the last week.

Given the sluggish MACD and the steady RSI supporting the recent grinding towards the south, the USD/CAD Price are likely to remain softer.

However, the 50% Fibonacci retracement level of April-July upside, near 1.2815, could challenge short-term sellers of the Loonie pair before directing them to the 100-DMA re-test, at 1.2795 by the press time.

In case of the USD/CAD remains pressured below 1.2795, the monthly low and the 61.8% Fibonacci retracement, respectively around 1.2767 and 1.2717, might lure the pair bears.

Alternatively, the 21-DMA level near 1.2895 and the 1.2900 threshold guard the quote’s recovery moves.

Following that, the one-month-old descending resistance line, close to 1.2940 at the latest, appears important for the USD/CAD buyers to watch.

If the quote manages to successfully cross the 1.2940 hurdle, the odd of witnessing a run-up towards the 1.3000 round figure and then to the multiple highs marked around 1.3080 since May can’t be ruled out.

USD/CAD: Daily chart

Trend: Pullback expected

- GBP/USD is expecting a downside below 1.2060 as the Fed will keep a hawkish stance intact.

- Pessimism in UK economic data has weakened the pound bulls.

- The UK Industrial Production is seldom expected to display an improvement.

The GBP/USD pair has faced selling pressure around 1.2080 and is likely to display more losses on dropping below the major cushion of 1.2060. On a broader note, the cable has auctioned in a 1.2063-1.2138 range for the previous two trading sessions after a modest rebound from a low near the psychological support of 1.2000.

Investors are not finding optimism in the sterling as the preliminary estimate for quarterly Gross Domestic Product (GDP) displays that the economy shrunk in July. The economic data is expected to land at -0.2% vs. 0.8% in the prior release. Also, the annual data is indicating a downward shift to 2.8% against the prior release of 8.7%.

Also, the estimates for Manufacturing Production data are not displaying a rosy picture. The economic data is likely to tumble to 1.3% from the former print of 2.3%. Whereas, Industrial Production is expected to improve to 1.6% in comparison with the former release of 1.4%. Therefore, a broader pessimism in the consensus for UK economic data is keeping the pound bulls on the back foot.

Meanwhile, the US dollar index (DXY) has sensed barricades at around 106.40, however, the upside looks favorable ahead of US Inflation. Despite, a lower consensus for the price pressures at 8.7%, investors believe that a single downward shift is not sufficient for prosperity. A spree of downward print in the US Consumer Price Index (CPI) will scale down troubles for Federal Reserve (Fed) policymakers.

- EUR/USD remains pressured towards 1.0200 after a two-day uptrend.

- Firmer US data, fears of more pain for Europe due to the Russian energy crisis join pre-CPI anxiety to tease sellers.

- Final readings of Germany’s HICP inflation data for July are also important to watch.

- July month China CPI, PPI could offer immediate directions.

EUR/USD fades the corrective pullback from 1.0202 around 1.0215 as traders turn cautious ahead of the key US Consumer Price Index (CPI) during the initial hour of Wednesday’s Asian session. Also exerting downside pressure on the major currency pair are the economic fears surrounding the Eurozone.

US Dollar Index (DXY) recovered late Tuesday after the firmer US data joined downbeat equities and mildly positive US Treasury yields. Also keeping the greenback positive were fears of the bloc’s recession after Russia’s extra tightening of oil flow.

On Tuesday, US Nonfarm Productivity improved to -4.6% during the second quarter (Q2), -4.7% expected and -7.4% prior, whereas the Unit Labor Cost increased to 10.8% from 12.7% prior and 9.5% market consensus during the said period.

Additionally, Fed's St. Louis president James Bullard said on Tuesday that he wants rates at 4% by the end of the year. This joins nearly recently firmer interest rate futures suggesting nearly 70% odds favoring the 75 basis points (bps) of Fed rate hike in September.

Elsewhere, Russia reportedly suspended oil flows via the southern leg of the Druzhba pipeline, amid transit payment issues.

Amid these plays, the US 10-year Treasury yields regained upside momentum while closing the day around 2.779% while the Wall Street benchmarks also posted losses by the day’s end.

Moving on, China’s CPI and Producer Price Index (PPI) data for July will offer immediate directions to the markets ahead of the final readings of Germany’s Harmonized Index of Consumer Prices (HICP) Inflation data for the said month. However, major attention will be given to the US CPI, expected to ease to 8.7% from 9.1% on YoY, as well as the CPI ex Food & Energy which is likely to rise from 5.9% to 6.1%. Given the hawkish expectations from the Core CPI, the US dollar may witness further upside in case of the firmer inflation print.

Also read: US July CPI Preview: What is the base effect and why it matters

Technical analysis

Despite the latest softness, EUR/USD remains above the 21-DMA and a two-week-old support line, respectively around 1.0175 and 1.0150, which in turn keeps buyers hopeful of refreshing the monthly high near 1.0300. However, a downward sloping resistance line from March, close to 1.0330 at the latest, appears a tough nut to crack for the bulls.

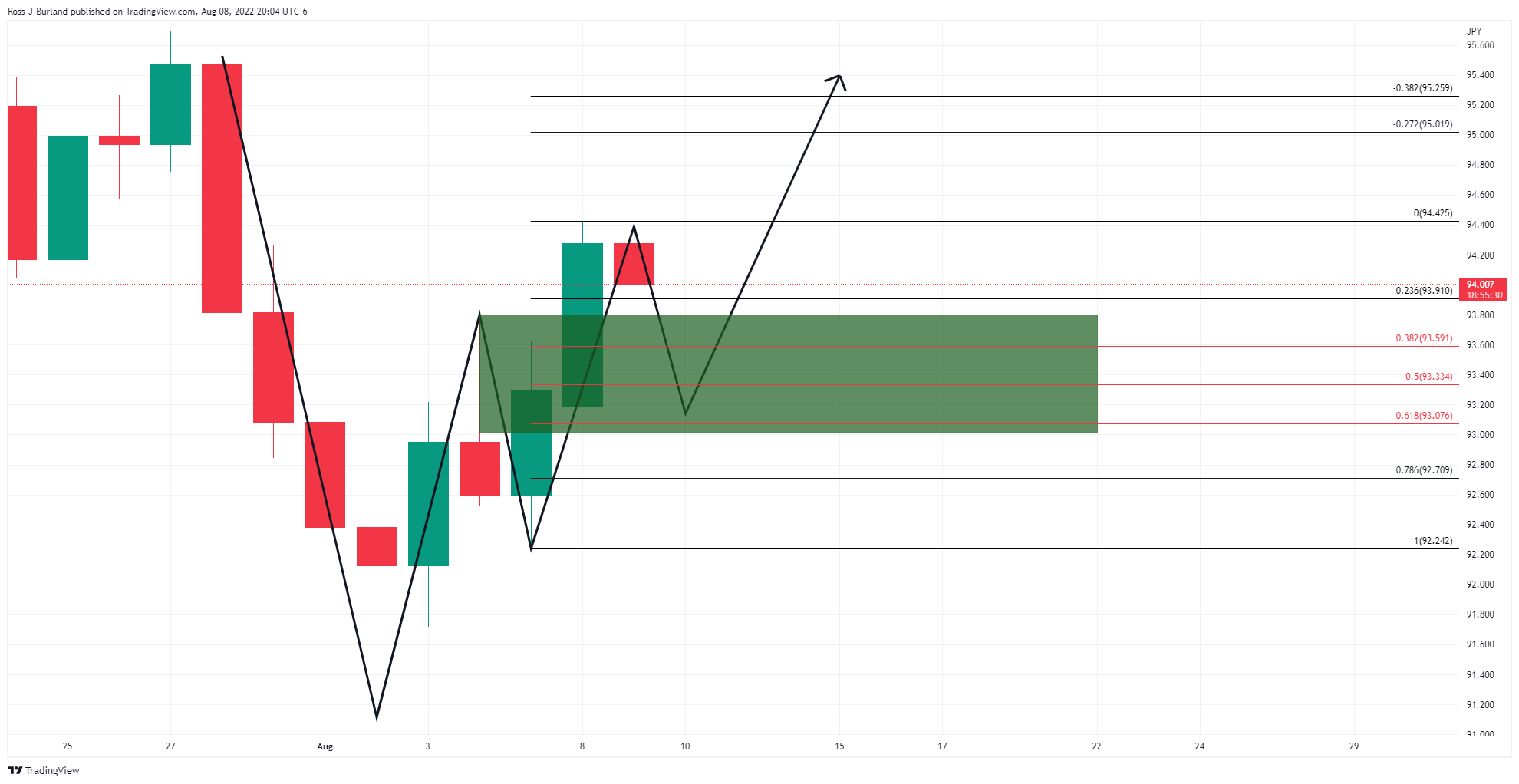

- The AUD/JPY advanced on Tuesday, despite a pessimistic market sentiment.

- From a daily chart perspective, the AUD/JPY is neutral biased, in a narrow range.

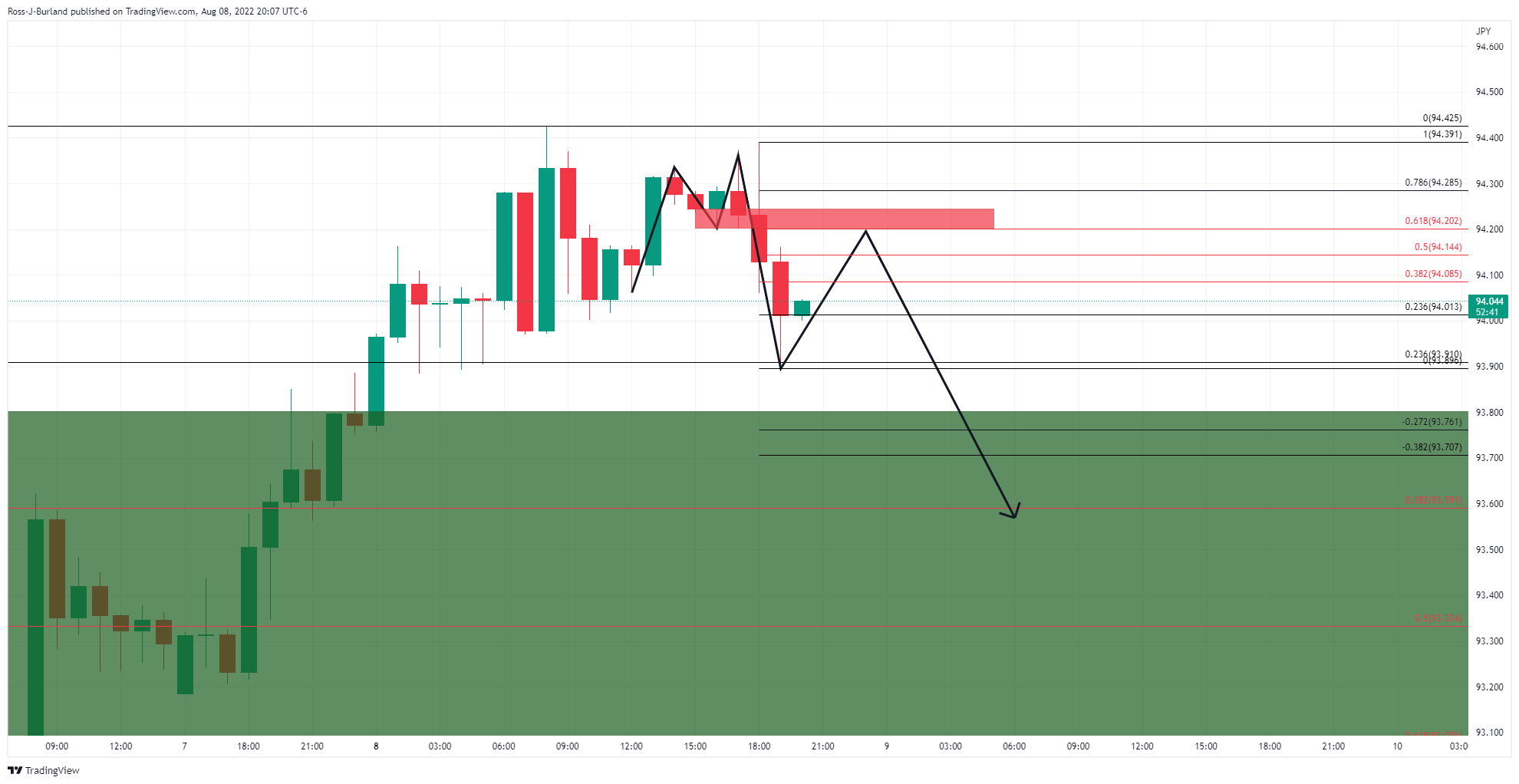

- AUD/JPY Price Analysis: Favors bulls above 94.40; otherwise, a break below 93.90 keeps bears in charge.

The AUD/JPY edges lower as the Asian Pacific session begins, spurred by a risk-off impulse spurred by a US inflation data release on Wednesday. That alongside recession fears reignited by Micron, a US semiconductor company, says company profits would be at the low end or below its guidance. At the time of writing, the AUD/JPY is trading at 94.07, slightly down 0.08%.

AUD/JPY Tuesday’s price action opened near the day’s highs, reached at 94.39 after the cross-currency hit 93.90, its daily low.

AUD/JPY Price Analysis: Technical outlook

Analyzing the AUD/JPY daily chart, the pair’s bias is still neutral-to-upwards, even though all the daily EMAs are below the spot price. Nevertheless, the AUD/JPY market structure indicates the cross-currency as downward biased, as successive series of lower highs and lows emerged after reaching its YTD high at 96.88. Therefore, the AUD/JPY is neutral biased, with neither buyers nor sellers being in total control.

Zooming into the 1-hour scale, the AUD/JPY is range-bound, within the boundaries of 93.90-94.40. Meanwhile, the Relative Strength Index (RSI) is pushing towards the 50-midline, meaning it has no clear bias.

If the AUD/JPY breaks the top of the range at 94.40, its first resistance would be the 95.00 figure. Once cleared, the next resistance would be the July 27 daily high at 95.70, followed by 96.00. On the flip side, a breach of 93.90 would send the pair sliding towards the 100-hour EMA at 93.50. A decisive break will expose the 200-hour EMA at 93.05.

AUD/JPY Hourly chart

AUD/JPY Hourly chart

AUD/JPY Key Technical Levels

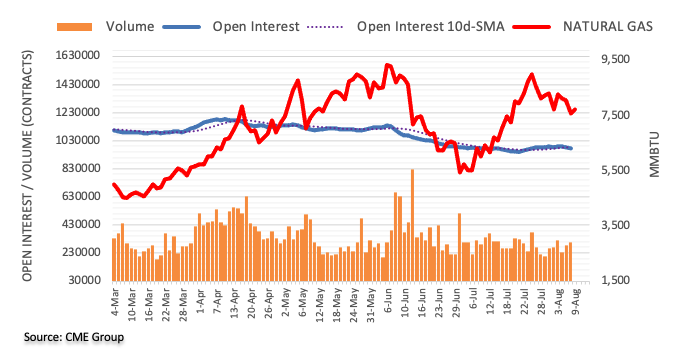

- Gold price is aiming to recapture its fresh monthly high at $1,800.00 on lower consensus for US CPI.

- Vulnerable oil prices are responsible for US CPI's downward consensus.

- The precious metal is set for a smooth ride as RSI (14) has shifted into a 60.00-80.00 range.

Gold price (XAU/USD) is displaying a volatility contraction after printing a fresh monthly high at around $1,800.00 on Tuesday. The precious metal witnessed a decent north-side move on Tuesday and later on turned sideways ahead of US Consumer Price Index (CPI). The street estimates are indicating a decent drop in the inflation rate by 40 basis points (bps) to 8.7% from the prior release. However, a surprise move by the price rise index is highly expected.

The investing community is aware of the fact that soaring oil prices remained responsible for driving the price pressures to the sky. Now, fixed supply worries and a gloomy demand outlook on the oil front resulted in a steeper fall in oil prices. And, its multiplier effect will be witnessed in the inflation rate.

Also, the upbeat US Nonfarm Payrolls (NFP) revealed last week indicates that the inflation rate could surprise on the higher side. The US economy has created 528k fresh jobs in July against the print of 372k recorded in June. Well, the troublesome job for Federal Reserve (Fed) policymakers will continue to remain until the dust settles for a longer period.

Gold technical analysis

Gold prices are advancing sharply after a strong rebound from the lower portion of the Rising Channel at around $1,765.00. The upper portion of the above-mentioned chart pattern is placed from July 22 high at $1,739.37 while the lower portion is plotted from July 27 low at $1,711.55.

The 20-and 50-period Exponential Moving Averages (EMAs) at $1,785.15 and $1,772.00 respectively are scaling higher, which adds to the upside filters.

Also, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates more upside ahead.

Gold four-hour chart

- The EUR/JPY daily chart illustrates the pair as neutral-to-downwards biased.

- In the short term, the EUR/JPY might test the 20-day EMA at 138.20 before tumbling to 137.00.

On Tuesday, the EUR/JPY finished the session with minimal gains of 0.28%. However, as the Wednesday Asian session begins, the JPY appreciates while Asian stocks are set for a lower open. At the time of writing, the EUR/JPY is trading at 137.96.

The financial markets narrative remains the same. A US company reported that its economic outlook looks worse than estimated, adding to recession fears. The US bond market shows signs of an impending recession, with the yield curve inversion between the 2s-10s year bond yields further deepening. Despite the previously mentioned factors, the euro stood tall and edged higher vs. the yen.

EUR/JPY Price Analysis: Technical outlook

From a daily chart perspective, the cross-currency is neutral-to-downward biased. A series of successively lower highs/lows confirms the latter. Meanwhile, the 20, 50, and 100-day EMAs above the exchange rate further cement the bias. Therefore, EUR/JPY traders should be aware that unless buyers reclaim the 100-day EMA at 139.84, further selling pressure is on the cards.

The 1-hour EUR/JPY chart portrays the pair advancing steadily, with the hourly Mas below the spot price, while the RSI, albeit below its 7-RSI SMA, signals that buyers are in control. Therefore, don’t discount a leg-up before the one-hour chart aligns with the daily chart’s overall bias.

Therefore, the EUR/JPY first resistance would be the 138.00 figure. A breach of the latter will send the EUR/JPY towards the August 9 high at 138.31, followed by the R2 daily pivot point at 138.92.

EUR/JPY Hourly chart

EUR/JPY Hourly chart

EUR/JPY Key Technical Levels

- Bears remain below the counter-trendline resistance which leaves the focus on the downside.

- AUD/USD bears could be about to move in for a run to 0.6800.

AUD/USD bulls have so far committed but the counter trendline resistance is keeping them in check. The following illustrates the price structures on a 4-hour time frame and the prospects of a breakdown of the same for the coming sessions.

AUD/USD H4 chart

As illustrated, the price is being rejected by the counter trendline resistance and is forking the makings of an M-formation in the process. A break to the downside will open the risk of a test to 0.6920/10 which could leave the price trapped between there and the neckline of the M-pattern around 0.6965. A break of 0.6900, on the other hand, opens the risk of a continuation of the bearish breakout towards 0.68 the figure for the days ahead.

The Federal Reserve will be prepared to hold interest rates "higher for longer" should inflation continue to surprise to the upside, and market pricing will need to adjust accordingly, Fed's St. Louis president James Bullard said on Tuesday who wants rates at 4% by the end of the year.

US CPI in focus

Meanwhile, investors will be fixated on the US inflation data coming out in the \us session later today. Prices likely rose by a level that will prompt further interest rate hikes from the Federal Reserve. Combined with last week's NFP report, the Fed is expected to hike interest rates by another 75 basis points at the next Fed meeting in September.

''While a slowing headline reading could lead some investors to believe the Fed can stop hiking, we expect the Fed to take rates to 3.75% by December,'' analysts at TD Securities argued, given that the consensus is that CPI will have risen less in July by comparison to what June's reading showed, 9.1% vs. 8.8% expected whereas tomorrow's data is expected to come below 9%.

The US 10-year yield, illustrated on the daily chart above, has corrected towards the neckline of the W-formation on the daily chart within the lower boundary of the broadening formation.

In turn, should the price hold above the flagged levels on the chart above, then a break of the trendline resistance could result in a rally in yields

- NZD/USD sits tight in a range ahead of today's key US CPI data.

- 0.6350 is key to the upside while the bears need to get below 0.6190.

NZD/USD is flat on the day, trapped between a familiar support and resistance range on the daily chart as markets await in anticipation of the next major catalyst being the US inflation data. Ahead of the forex roll-over, NZD/USD is trading at 0.6280 and has stuck to a 0.6270 and 0.6302 range so far.

''The Kiwi starts the day a tad softer amid a lukewarm rebound in the USD DXY, with slightly higher US bond yields denting risk appetite across many bellwether markets,'' analysts at ANZ bank said in the early Asian open note on Wednesday.

US CPI data will be key

''US unit labour cost data doesn’t usually rate much of a mention, but such was the upside surprise (up 2.6% q/q to be up 9.5% YoY) that it put a bit more inflation fear into US short-end bonds, with the 2-year bond yield back above Friday’s post-job data levels. But the next 24 hours will be all about US Consumer Price Index.''

''It’ll be bad in level terms, we know that, so it’s a case of how bad, and whether there are signs of persistence (elevated monthly core measures) or signs of moderation (excluding fuel, which we know softened). It all speaks to a period of potentially higher volatility after what has been a period of relative calm.''

prices likely rose by a level that will prompt further interest rate hikes from the Federal Reserve. Combined with last week's NFP report, the Fed is expected to hike interest rates by another 75 basis points at the next Fed meeting in September.

''While a slowing headline reading could lead some investors to believe the Fed can stop hiking, we expect the Fed to take rates to 3.75% by December,'' analysts at TD Securities argued, given that the consensus is that CPI will have risen less in July by comparison to what June's reading showed, 9.1% vs. 8.8% expected whereas tomorrow's data is expected to come below 9%.

-637956636349656826.png)

Historical data chart

'The market needs to decide whether the slowing headline is more important than the sticky and strong core,'' analysts at TD Securities said. ''The USD remains sensitive to US data surprises. ''We will be short-term focused on whether this number shakes resilient risk sentiment, as that will also help inform near-term USD price action.''

NZD/USD technical analysis

NZD/YSD remains stuck between key resistance and support on the daily chart and has not managed to break the seal of 0.63 the figure so far this week.

0.6350 is key to the upside while the bears need to get below 0.6190. On a break higher, here is an area of price imbalance that could well be targetted once 0.6550 resistance is overcome. That area is between 0.6645 and 0.6720.

- Long-term, the USD/JPY is neutral-to-upward biased, facing solid resistance at 135.50.

- The USD/JPY hourly chart portrays a 40 pip narrow trading range ahead of Wednesday’s US CPI report.

The USD/JPY is almost flat amidst a calmed North American session ahead of July’s US inflation report, which could shed light on further Federal Reserve tightening in the September meeting. At the time of writing, the USD/JPY is trading at 135.12, slightly up 0.14%.

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart portrays the pair as neutral-to-upward biased. In the last couple of days, the pair’s price action faced solid resistance around the 135.50 area, putting a lid on the USD/JPY, while the Relative Strength Index (RSI) at 50.32 sideways illustrates the consolidation in the pair.

If the USD/JPY breaks above 135.50, the next resistance would be the 20-day EMA at 135.83. Once cleared, the next resistance would be the July 28 high at 136.57, followed by 137.00. On the flip side, the USD/JPY first support would be the 50-day EMA at 135.12. Break below will expose the 135.00 figure, followed by the August 5 daily low at 132.52.

USD/JPY Daily chart

USD/JPY Daily chart

From a near-term perspective, the one-hour USD/JPY chart illustrates Tuesday’s price action’s narrow 40 pip range. The 20 and 50-hour EMAs around the 134.95-97 area cement the previously mentioned, signaling that USD/JPY traders remain at bay, waiting for fresh US economic data, namely inflation. Therefore, a break above/below that range would determine the faith of the major.

Upwards, the USD/JPY’s first resistance would be the 135.50 mark. A breach of the latter will expose the July 27 daily high at 136.58, followed by 137.00. Downwards, the USD/JPY’s first support will be the August 8 daily low at 134.75. Once cleared, the next support will be the 200-hour EMA at 133.57.

USD/JPY Hourly chart

USD/JPY Hourly chart

USD/JPY Key Technical Levels

What you need to take care of on Wednesday, August 10:

The American currency extended its weekly decline throughout the first half of the day but managed to recover some ground during the US session. Nevertheless, volatility across financial markets was limited amid lingering US inflation figures.

Market players await the US Consumer Price Index, hoping prices pressure have started receding in July. Still, the core annual reading is foreseen advancing to 6.1% from the current 5.9% level. At the end of the day, speculative interest will rush to price in whatever they believe the Federal Reserve will do with the monetary policy. China and Germany will also publish inflation data ahead of the US figures.

The EUR/USD pair flirted with the 1.0250 level but shed some 50 pips ahead of the close. The shared currency was weighed by headlines indicating that Russia reportedly suspended oil flows via the southern leg of the Druzhba pipeline, amid transit payment issues.

The energy crisis affecting Europe has led to the UK government planning potential organised energy blackouts this winter for industry and households as a worst-case scenario. GBP/USD eased and trades at around 1.2060 ahead of the Asian opening.

Commodity-linked currencies turned red against the greenback by the end of the day, although losses are limited. AUD/USD trades around 0.6950 while USD/CAD hovers around 1.2890.

Gold was among the best performers, hitting an intraday high of $1,800.49 a troy ounce. It finished the day at $1,795. Crude oil prices were up at the beginning of the day but finished the day with modest gains. WTI trades at $90.70 a barrel.

Wall Street edged lower, following the lead of its European counterparts, although losses were moderated. US Treasury yields, on the other hand, ticked higher with that on the 10-year note, currently at 2.79%.

Ethereum Price Prediction: Get ready for a Wall Street discount

Like this article? Help us with some feedback by answering this survey:

- WTI is correcting the day's supply and is meeting daily resistance.

- US CPI data will come on Wednesday and could be pivotal for oil.

- The wild card in the energy sector is the Iran Nuclear Deal.

Oil prices have pared back gains that were made early on Tuesday despite the news that Russia has halted exports on a pipeline to Europe. Markets lack a directional bias ahead of tomorrow's US inflation report due to mixed sentiment surrounding the health of the global economy. At the time of writing, WTI spot is trading at $90.43bbls and has been stuck in a relatively narrow range of between $89.06 and $92.62.

Oil was initially benefitting from supply concerns. The news that Russia halted oil shipments on the southern leg Druzhba pipeline on Aug.4 lifted prices. cutting 250,000 barrels per day of oil supply to Czechia, Hungary and Slovakia were reported to be taken offline after sanctions prevented transit payments, as Bloomberg reported. The suspension of Russian shipments on the line has been regarded as the country's weaponization of energy exports to the continent in retaliation for the coming European embargo on some oil shipments from Russia.

Meanwhile, traders are going to be glued to the screens for the US Consumer Price Index data on Wednesday as they assess the prospects of a recession in the United States and the wider global economy. Analysts are looking for inflation to have risen less than it had done in July, at around 8.7% or lower on an annualized basis. Nevertheless, such a number would be expected to shore up expectations for the Federal Reserve to hike by 75 basis points next month.

Nevertheless, recessions or not, the Energy Information Administration on Tuesday said it expects US oil production to rise to a record next year while expecting a rise in global oil demand next year. The agency said it expects US oil production to rise to an average 12.7-million barrels per day in 2023, down from its July forecast of 12.77-milion bpd but up from 11.9-million bpd this year and topping the record 12.4-million bpd set in 2019.

The great uncertainty in the energy sector comes with the Iranian Nuclear Deal. Analysts at TD Securities explained that ''the bull market in oil is facing its most significant challenge yet, as negotiators are putting together a final draft for a potential Iranian Nuclear deal agreement in front of Washington and Tehran.

''This is a wildcard for oil markets, given that a resumption of Iranian flows would add a substantial amount of spare capacity to the world, effectively buying some time for other producers to potential catch-up in terms of capital expenditures over the medium-term.''

''In this context, our return decomposition framework highlights that our gauge of supply risk has tumbled in the last week amid the latest round of negotiations. This pins the weakness in oil prices primarily on the supply side amidst fears that a potential deal could change the game in oil markets.''

- GBP/JPY exchanges hands around familiar levels, above 163.00.

- From a long-term perspective, the cross is neutrally biased, waiting for a catalyst.

- The GBP/JPY hourly chart is neutral-biased but tilted downwards as sellers gather momentum, as shown by the RSI.

The GBP/JPY seesaws during the North American session amidst a dull trading day. Investors are bracing for the release of US inflation data, which would be scrutinized by them, aiming to predict the next move of the FOMC in the September meeting. At the time of writing, the GBP/JPY is trading at 163.15.

The market sentiment is downbeat. US equities are trading with losses, while in the FX space, safe-haven peers begin to recover some ground, except for the US dollar. The GBP/JPY is trading near its opening price, after bouncing from daily lows at 162.62, before hitting the daily high at 163.67. However, risk aversion weighed on the pound, so the cross dived.

GBP/JPY Price Analysis: Technical outlook

From a daily chart perspective, the GBP/JPY is neutral-biased. For the second straight day, buyers’ inability to breach the 20-day EMA at 136.64 increased selling pressure in the cross, with bears piling around the 163.60 area, pushing the exchange rate towards the 163.00 figure.

Hence, the GBP/JPY’s first support would be the August 8 low at 162.56. The break below will expose the August 5 low at 161.11, followed by the August 2 swing low at 159.44. Otherwise, if buyers reclaim the 20-day EMA at 163.64, that would open the door for a test of the 50-day EMA at 164.21.

GBP/JPY Daily chart

GBP/JPY Daily chart

In the one-hour scale, the GBP/JPY is neutral biased, trapped within the 161.11-163.84 area. However, the Relative Strength Index (RSI) shows that sellers are gathering momentum, with the RSI at 47.26 and crossing below the 7-RSI SMA, meaning that bears are in control. Therefore, the GBP/JPY first support would be the 100-hour EMA at 162.68. Once cleared, the next support would be the S2 pivot point at 162.43, followed by the S1 daily pivot at 161.85. On the flip side, a break above 163.84 could send the pair towards the August 4 high at 163.97, which, once cleared, could open the door for further gains

GBP/JPY Hourly chart

GBP/JPY Hourly chart

GBP/JPY Key Technical Levels

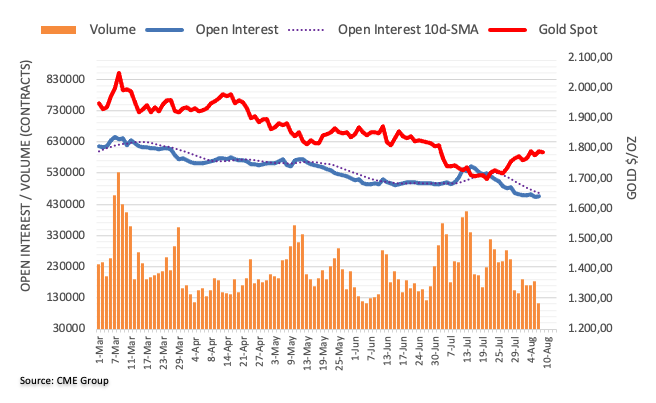

- Gold could depend on the outcome of Wednesday's US CPI data.

- The current price is a few bucks shy of the golden ratio, 61.8% level.

- If CPI were to disappoint, then a subsequent break of $1,815 would be significant.

The gold price is higher on Tuesday by some 0.35% at the time of writing in the afternoon of the New York session. Gold is trading at $1,795.55, just below the highs of the day. Gold has moved higher from a low of $1,783.31 and reached the psychological $1,800 mark at the start of Wall Street.

Gold is firm due to a softer US dollar at the start of the week. The greenback, as measured by the DXY index fell to a low of 105.97, reversing all of the gains made on the blockbuster Nonfarm Payrolls report when it rallied to a high of 106.93.

Additionally, gold is enjoying some relief in lower US yields. Waining yields are bullish for gold since it offers no interest. The US 10-year note made a fresh corrective low of 2.746% on Tuesday but they have since recovered to a high of 2.816%. Nevertheless, yields are way off their 52-week range high of 3.497% printed in mid-June 2022.

US CPI data will be key

Markets are fixated on the US inflation data coming on Wednesday where prices likely rose by a level that will prompt further interest rate hikes from the Federal Reserve. Combined with last week's NFP report, the Fed is expected to hike interest rates by another 75 basis points at the next Fed meeting in September.

''While a slowing headline reading could lead some investors to believe the Fed can stop hiking, we expect the Fed to take rates to 3.75% by December,'' analysts at TD Securities argued, given that the consensus is that CPI will have risen less in July by comparison to what June's reading showed, 9.1% vs. 8.8% expected whereas tomorrow's data is expected to come below 9%.

-637956636349656826.png)

Historical data chart

''The market needs to decide whether the slowing headline is more important than the sticky and strong core,'' analysts at TD Securities said. ''The USD remains sensitive to US data surprises. ''We will be short-term focused on whether this number shakes resilient risk sentiment, as that will also help inform near-term USD price action.''

Consequently, for gold, the data will be a driver. A stronger-than-expected reading could be the catalyst for a final shake-out of stubborn and stale shorts within the volatility ahead of the next significant move to the downside. On the other hand, if the US dollar were to sell off on a lower reading, then a deeper bullish correcting in gold prices would be expected.

Analysts at TD Securities note that gold prices are ''flirting with the threshold for CTA short covering, but have thus far failed to sustainably break through key trigger levels associated with a significant buying program, which could point to informed participants on the offer.''

''Meanwhile, prop traders are still holding a massive amount of complacent length, suggesting we have yet to see capitulation in gold, which argues that the pain trade remains to the downside.''

Gold technical analysis

As per this week's pre-market open analysis Gold, Chart of the Week: The bulls are up against strong headwinds, and yesterday's New York session commentary, Gold Price Forecast: XAU/USD bulls stay the course but bears are lurking, the weekly gold chart and the daily 10-year yields remain as compelling features in the overall picture for gold.

The yield has corrected towards the neckline of the W-formation on the daily chart within the lower boundary of the broadening formation.

In turn, should the price hold above the flagged levels on the chart above, then a break of the trendline resistance could result in a rally in yields, a weight for gold prices.

On the other hand, the weekly chart's correction is yet to reach a 61.8% golden ratio as follows:

The current price is a few bucks shy of the level, but should the data reconfirm the sentiment in the market, then gold would be expected to come under pressure as illustrated in the weekly chart above.

If the price were to move higher, however, then a break of $1,815 would be significant and likely lead to a deeper correction of the weekly bearish impulse with the 78.6% Fibonacci eyed near $1,836 that has a confluence with the neckline resistance of the M-formation.

- Despite a dismal market mood, EUR/USD edges higher in a choppy trading session.

- US, Germany, and Italy’s inflation data are eyed on Wednesday.

- EUR/USD Price Analysis: Range-bound, but US economic data might rock the boat.

The shared currency advances during the New York session, taking advantage of a soft US dollar, which is falling despite US bond yields rising, ahead of the release of July’s US inflation figures. Alongside the aforementioned, risk-aversion keeps safe-haven peers in the driver’s seat, except for the greenbacks vs. the euro.

EUR/USD unable to capitalize on overall greenback weakness

The EUR/USD is trading at 1.0216, above its opening price but below its daily high, reached during the day at 1.0247. Nevertheless, buyers could not hold the fort or booked profits with US economic data looming.

US equities are trading with minimal losses. A light US calendar keeps investors reassessing last week’s US jobs report, with the US Nonfarm payrolls doubling expectations, increasing by 528K. Nevertheless, traders’ focus has shifted towards the Consumer Price Index (CPI). Estimations of headline inflation lie at 8.7% YoY, less than June’s 9%, while core-CPI, which excludes food and energy, is expected to rise by 6.1% YoY, vs. 6.2% in last month’s reading.

Across the pond, headlines that Russia’s halted oil pumping through the Druzbha pipeline since Thursday added to an already negative mood, weighing on the EUR/USD. The Russian oil company Transneft blamed problems with payment to UkrTransNafta, the operator of the Ukrainian side.

What to watch

The EU economic calendar will feature inflation figures for Germany and Italy. On the US docket, the US Consumer Price Index (CPI), core CPI, and Fed commentary after inflation data’s release will give further forward guidance of the Fed’s tightening path.

EUR/USD Price Analysis: Technical outlook

From a daily chart perspective, the EUR/USD is neutral-biased. It has been trading since July 28, above the 20-day EMA, which has been solid support, with sellers unable to break the moving average (MA) decisively. On the flip side, EUR/USD buying pressure remains constrained, with the major exchanging hands within the 1.0096-1.0293 range for at least 21-days.

However, with US data looming, investors should expect some volatility, on Wednesday’s session. Break above the top of the range will expose resistance levels at 1.0300, followed by the 50-day EMA at 1.0350 and 1.0400. On the other hand, the EUR/USD first support would be 1.0200. Once cleared, the next support would be the August 3 low at 1.0122, followed by July 27 low at 1.0096.

EUR/USD Daily chart

EUR/USD Daily chart

- The Australian dollar remains heavy and exchanges hands amidst a narrow range.

- Investors brace for the US Consumer Price Index for July.

- Better-than-expected Australian business confidence data capped further downside pressures.

The AUD/USD retraces from weekly highs, but trades in a choppy trading range as traders prepare for the US inflation report. That, alongside geopolitical tussles between China-Taiwan, after the visit of US House Speaker Pelosi and expectations of further Fed tightening, weighed on the mood.

At the time of writing, the AUD/USD is trading at 0.6965, below its opening price, after hitting a daily high at 0.6994. Nevertheless, buyers’ failure to pierce the 0.7000 figure exposed the major to selling pressure.

AUD/USD slides on risk-aversion

EU and US equities are registering losses. Last Friday’s solid US job report fueled expectations of a 75 bps Federal Reserve rate hike, which could happen if confirmed by inflation data. Estimations of headline inflation are at 8.7% YoY vs. 9% in June. The so-called core CPI, which excludes volatile items like food and energy, is foreseen at 6.1% YoY, a tick lower than June’s 6.2%.

Nevertheless, the greenback has been unable to capitalize on risk aversion. The US Dollar Index, a gauge of the buck’s value vs. a basket of rivals, sits at 106.189, down 0.18%. Contrarily, US bond yields are rising ahead of the US inflation report.

The Australian dollar remains bolstered by a better-than-expected China exports report. That, alongside Iron ore prices pushing to the upside, capped the AUD/USD from further losses. Meanwhile, the Australian NAB Business Confidence rebounded in July, bolstered by sales and profits. However, businesses reported rising costs in purchases and labor.

Geopolitics-wise could be harmful to the AUD/USD. With China’s military drills extending beyond their due date and breaching international waters, risks surrounding Taiwan keep investors uneasy. Further escalation might be positive for the US dollar and negative for the Australian dollar.

What to watch

The Australian economic calendar will feature Private House Approvals and Building Permits. On the US front, inflation readings, alongside further Fed-speaking after US CPI, will shed some light on the Fed’s next move.

AUD/USD Key Technical Levels

- Quiet session on Tuesday ahead of US CPI.

- DXY drops modestly, remains above 106.00.

- GBP/USD flat for the day, holding above the 20-day SMA.

The GBP/USD is hovering slightly below 1.2100, in a quiet session. The pair peaked at 1.2130 and then pulled back to 1.2077. The US dollar is mixed as market participants await the July print of the US CPI.

Quiet session, inflation data on the radar

Stocks in Wall Street are falling on Tuesday, with the Dow Jones down by 0.09% and the Nasdaq by 1.44%. Treasuries are modestly lower. The US 10-year yield rose to 2.81% and then retreated to 2.78%, and the 30-year peaked at 3.03% and is back below 3.0%.

In the currency market pairs move sideways, in small ranges. The US Dollar Index is falling by 0.19%; it remains above 106.00.

On Wednesday, the July US CPI index will be released. Market consensus is for a decline from 9.1% to 8.7% in the annual rate. An upside surprise could trigger a rally of the US dollar considering it would favor expectations about an aggressive Federal Reserve, particularly following the upbeat July employment report.

In the UK, attention remains on the Tory race to succeed Boris Johnson. The favorite is Liz Truss. She said she does not want to give handouts to families and prefers to prioritize tax cuts. The rise in energy bills continues to pressure the government.

Regarding the Bank of England, the deputy governor, Dave Ramsden said they would probably have to hike interest rates again to help curb inflation. The question is how much it will raise it: 25 or 50 basis points.

From a technical perspective, GBP/USD failed to hold above 1.2100, showing a lack of strength. A break above 1.2130 should point to more gains, targeting 1.2180. The bias for the next hours appears titled to downside while under 1.2110. The critical support may be seen at 1.2065.

Technical levels

The world oil demand is expected to rise by 2.08 million barrels per day (bpd), down from 2.23 million in the previous forecast, to 99.43 million bpd in 2022, the US Energy Information Administration said in its latest monthly report, as reported by Reuters.

Additional takeaways

"World oil demand to rise 2.06 million bpd to 101.49 million bpd in 2023 (vs rise of 2.00 million bpd forecast last month)."

"US crude output to rise 610,000 bpd to 11.86 million bpd in 2022 (vs rise of 720,000 bpd forecast last month)."

"US crude output to rise 840,000 bpd to 12.70 mln bpd in 2023 (vs rise of 860,000 bpd forecast last month)."

"US total petroleum consumption to rise 560,000 bpd to 20.34 million bpd in 2022 (vs rise of 700,000 bpd last month)."

"US petroleum demand to rise 410,000 bpd to 20.75 million bpd in 2023 (vs rise of 320,000 bpd last month)."

Market reaction

Crude oil prices continue to push lower after this report. As of writing, the barrel of West Texas Intermediate was down 0.45% on a daily basis at $90.10.

- USD/CAD erases some of Monday’s losses and gains some 0.24%.

- A dampened market mood keeps safe-haven currencies like the greenback in the driver’s seat.

- Investors brace for US Consumer Price Index for July, with headline inflation estimated to fall.

The USD/CAD slightly advances from around Monday’s lows amidst a downbeat market sentiment due to traders preparing for July’s US inflation report. Also, geopolitical jitters, spurred by US House Speaker Pelosi’s trip to Taiwan, caused an aggressive reaction from China, extending its military drills beyond the due date.

The USD/CAD is trading at 1.2884 above its opening price after hitting a daily low at 1.2843 early in the North American session.

USD/CAD climbs on dismal sentiment

USD/CAD Tuesday’s price action is driven by investors preparing for US CPI. Last Friday’s US jobs report poured cold water on recession fears after creating 528K new jobs in the economy, consequently driving down the unemployment rate to 3.5%.

Meanwhile, investors quickly reacted to the US Department of Labor data, with money market futures odds of a 75 bps rate hike by the Fed sitting at 88%. Nevertheless, odds could be diminished if inflation numbers come lower than estimated, could influence the Fed to tighten at a slower rate.

In the meantime, according to analysts, a dismal Canada job report, slashing 30.6K jobs from the economy, is not seen as a factor to deter the Bank of Canada from hiking rates. Given that the BoC surprised markets by raising rates by 100 bps last month, analysts at Scotiabank commented that although July’s employment report disappointed, the BoC would continue tightening policy.

What to watch

An absent Canadian economic docket will leave USD/CAD traders adrift to US dollar dynamics. Meanwhile, the US docket will reveal July’s US Consumer Price Index, alongside a tranche of Fed speakers, led by Chicago’s Fed President Charles Evans and Minneapolis Fed Neil Kashkari, after the US inflation report.

USD/CAD Key Technical Levels

- NZD/USD keeps moving in a familiar range.

- US Dollar posts mixed results on Tuesday ahead of US CPI data.

- Stocks decline in Wall Street, US yields pullback.

The NZD/USD pair is hovering around 0.6275, within the 0.6300-0.6270 range. It continues to move sideways with a modest upside bias, without momentum.

A mixed US Dollar, market participants await CPI

The greenback is posting mixed results on Tuesdays. Prices across financial markets are moving sideways, ahead of key data. On Wednesday, the July US CPI is due. The annual rate is expected to drop from 9.1% to 8.7%. The numbers will be critical for expectations about Fed’s monetary policy.

“The market needs to decide whether slowing headline is more important than sticky and strong core. The USD remains sensitive to US data surprises”, explained analysts at TD Securities.

The DXY is falling 0.15% on Tuesday. It managed to remain above 106.00. At the same time US yields are modestly higher. The US 10-year yield peaked at 2.81% and returned to 2.79%.

The NZD/USD is moving sideways with immediate support at 0.6270. A break lower would expose 0.6250 and then the last week's low at 0.6210, which if broken should change the short-term bias from modestly bullish to neutral/bearish.

On the upside, a consolidation above 0.6300 should strengthen the kiwi. The next strong resistance is seen at 0.6350 (Aug high).

The USD continues to show a high correlation to US data surprises, so the Consumer Price Index (CPI) report should signal the direction. Economists at TD Securities will be short-term focused on whether this number shakes resilient risk sentiment, as that will also help inform near-term USD price action.

EUR/USD to remain in its broad 1.0150/1.0290 range

“A stronger CPI print, particularly in the details, could alter pricing (in a hawkish direction) beyond September, while a downside surprise will likely shake pricing for next month.”

“We are inclined to see EUR/USD remain in its broad 1.0150/1.0290 range though a break of that is more likely on the downside than the upside.”

“USD/JPY should trade closer to 136 based on spreads, and we think a positive surprise should get it there.”

“We are focused on the impact on risk sentiment as that should also inform near-term pricing for FX markets in what otherwise is thinner liquidity at this time of year.”

See – US CPI Preview: Forecasts from nine major banks, soaring inflation to ease off in July

The US Bureau of Labor Statistics will release the July Consumer Price Index (CPI) data on Wednesday, August 10 at 12:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of nine major banks regarding the upcoming US inflation print.

Economists expect inflation to have decelerated from 9.1% to 8.7% YoY. Monthly, a modest increase of 0.2% is projected after a leap of 1.3% in June. What’s more, Core CPI is expected to have accelerated from 5.9% to 6.1% YoY, owing to a more modest increase of 0.5% in monthly underlying inflation, down from 0.7% recorded in June.

Deutsche Bank

“We expect the headline YoY rate to finally dip after energy prices have fallen of late. We are looking for 8.8% (from 9.1%) with consensus a tenth lower. Core however is expected to increase two-tenths to 6.1% YoY. If we see such an outcome it’ll be interesting if the market cheers what could be the start of a decline from the peak in the headline rate or remains concerned that core continues to edge up. Core should be more important to the Fed but the market has been known to take the dovish interpretation to events of late, payrolls notwithstanding.”

NBF

“The food component likely remained very strong given severe supply constraints globally, but this increase should have been partially compensated by lower gasoline prices. As a result, headline prices could have increased 0.2% MoM, the least since January 2021. If we’re right, the year-on-year rate should come down to 8.7% from a 40-year high of 9.1%. Core prices, meanwhile, may have continued to be supported by rising rent prices and advanced 0.5%. This would translate into a one-tick increase of the 12-month rate to 6.0%.”

TDS

“Core prices likely stayed strong in July, with the series registering a 0.5% MoM gain. Shelter inflation likely maintained strong momentum, though we look for airfares to retreat for a second straight month. Importantly, gasoline prices likely brought notable relief for the headline series, declining a sharp 8% MoM. Our MoM forecasts imply 8.7%/6.1% YoY for total/core prices.”

RBC Economics

“US inflation numbers are expected to edge lower, dropping to 8.8% in July. There are reasons to believe that inflation will continue to slow. Global supply chain pressures have eased more sustainably since late spring, as shipping times and costs fall. Commodity prices, though very high, have also been trending lower. And with high inflation and rising borrowing costs squeezing consumers’ real buying power, there are already early signs of slowing domestic consumer demand. Still, a bigger pullback in consumer demand will likely be necessary to get inflation moving back toward the Federal Reserve’s 2% target rate. Overall, we look for the Fed to hike rates to 3.25%-3.5% range by end of this year.”

Commerzbank

“We expect consumer prices excluding energy and food (‘core rate’) to have risen by 0.6% month-on-month in July, only slightly less than in June (0.7%). On balance, we expect consumer prices to rise by 0.3% month-on-month, significantly less than in June (1.1%). The year-on-year rate would then fall from 9.1% to 8.8%. If the price of gasoline remains at the current level, the headline inflation rate is likely to remain at about this level for the next few months. After that, inflation is likely to fall but remain very high for a long time. After all, the core inflation rate has probably not yet reached its peak. It is likely to rise from 5.9% in June to 6.2% in July and reach 6.8% in September. A slight decline in headline inflation in July could fuel speculation that the Fed will raise rates by only 50 basis points at its next meeting in September, less than the last two decisions (75 bps each). However, we caution against underestimating medium and longer-term inflation risks because of the persistence of core inflation.”

CIBC

“Consumers saw some relief from lower prices at the pump in the US in July, which will help total annual inflation decelerate to 8.8% YoY, along with base effects. Although global food price indices have softened lately as wheat harvests in the northern hemisphere have begun, that will take some months to feed through to consumer prices. Another strong increase in categories outside of energy and food likely resulted in an acceleration in core inflation to 6.2% YoY, magnified by base effects. Indeed, higher rents are still feeding through to the CPI’s shelter index. We are slightly above the consensus which could lift bond yields and the USD.”

Citibank

“US July CPI MoM – Citi: 0.2%, prior: 1.3%; CPI YoY – Citi: 8.8%, prior: 9.1%; CPI ex Food, Energy MoM – Citi: 0.5%, prior: 0.7%; CPI ex Food, Energy YoY – Citi: 6.1%, prior: 5.9%. We expect a 0.52% MoM increase in core CPI in July, a softer increase than 0.7% in June but with still-strong underlying details, in particular shelter prices. Services prices may also pick up, largely reflecting months of consistently strong wage gains amidst a still-tight labor market. Meanwhile, the pullback in headline CPI from 9.1% YoY in June could suggest a ‘peak’ of inflation is reached.”

ING

“The headline rate of CPI may rise just 0.2% month-on-month, which would be the smallest monthly increase since January 2021 and result in the annual rate of inflation slowing to 8.7% from 9.1%. However, the core rate is still expected to post a 0.4% MoM gain with housing costs continuing to boost the index. This would mean the ex-food and energy annual rate of inflation rises to 6% from 5.9%, reinforcing the message that it is still a long battle to get inflation back to the 2% target.”

ANZ

“We expect US core CPI to rise by 0.5% MoM in July and headline to rise by 0.1%, as sharply lower energy and food prices drag headline below core. Our supply-side dashboard suggests cost pressures and bottlenecks continued to ease in July. This development along with weaker commodity prices and a stronger USD should see core goods inflation ease relative to June. Wages as measured by the Employment Cost Index are running at record pace and are well above a level consistent with 2% inflation. As wages comprise a significant chunk of the cost of service-based industries, core services inflation is expected to continue to be elevated. We expect Fed officials to pay close attention to core inflation. A continuation of recent trends would be unwelcomed and likely tilt the Fed toward another substantive rate increase at the 20‑21 September FOMC meeting.”

Cable is trading on a firm note. Nonetheless, economists at Scotiabank expect GBP/USD to turn back lower towards the daily low at 1.2065.

The broader downtrend remains intact

“With markets generally consolidating, gains through 1.2135/40 will be a stretch for the GBP and we rather look for prices to edge back towards the intraday low for spot around 1.2065.”

“The broader downtrend in place since the start of the year remains intact which should serve to reinforce resistance in the 1.2175/00 zone.”

EUR/NOK is trading slightly below the 10 level. Economists at Rabobank expect the pair to tick down towards the 9.40 mark over the coming months.

Strong demand for Norway’s energy products to keep NOK well supported

“We favour selling EUR/NOK into rallies and expect the currency pair to trend moderately lower towards the 9.40 area on a 12-month view.”

“Strong demand for Norway’s energy products is likely to keep the NOK well supported. The absence of an energy crisis of the sort facing the eurozone should also allow for a moderate downward trend in EUR/NOK.”

USD/CAD has traded sideways over the past 24 hours essentially. Economists at Scotiabank expect the pair to stage another leg lower.

Break below 1.2835/40 to trigger more losses through the 1.28 area

“After falling sharply from the Friday peak just under 1.30, the consolidation could be seen as a technical pause ahead of another leg lower – a bear flag pattern, in other words.”

“USD losses below 1.2835/40 should trigger more USD losses through the 1.28 area.”

“Resistance on the session is 1.2875/80.”

Is the Chinese bid in gold running on fumes? Economists at TD Securities expect the yellow metal’s rally to run out of steam.

Global macro points to potential exhaustion of the rally

“Shanghai traders have contributed to the rally in precious metals, adding nearly 12.3k SHFE lots of gold and 11.2k SHFE lots of silver in the last two weeks alone. This has likely exacerbated price action amid a short covering rally. Notwithstanding, price action across global macro points to potential exhaustion of this move, with duration-sensitive assets approaching their trendline resistance once again.”

“We see signs that the Chinese bid in gold is exhausted, with Shanghai traders starting to liquidate some of their recently added length. In this context, gold prices are flirting with the threshold for CTA short covering, but have thus far failed to sustainably break through key trigger levels associated with a significant buying program, which could point to informed participants on the offer.”

EUR/USD pushes higher in quiet and rather featureless dealing. Economists at Scotiabank expect the world’s most popular currency pair to remain confined within its recent range.

Resistance aligns at 1.0285/95

“EUR/USD has been trading in a sideways range since the middle of Jul and, despite the EUR’s intraday gains, there is little sign of that range breaking down any time soon.”

“Short-term support is 1.0135/40.”

“Resistance is 1.0285/95.”

- USD/TRY adds to Monday’s gains near the 18.00 mark.

- The lira sheds more than 25% so far this year.

- Türkiye Unemployment Rate will come next in the docket.

The Turkish lira depreciates for the second session in a row and encourages USD/TRY to flirts once again with the key 1800 hurdle on Tuesday.

USD/TRY remains focused on 18.00

USD/TRY records gains for the second consecutive session on Tuesday, extending the auspicious start of the week at the same time.

The move higher in the pair comes in contrast with the prevailing selling pressure in the greenback and the generalized upbeat mood in the risk complex ahead of the release of key US inflation figures on Wednesday.

The lira, in the meantime, sheds further ground following gains recorded in the second half of last week, particularly in response to Friday’s news that the country’s FX reserves increased to 2-month highs around $9.12 billion in the week to July 29.

In the domestic calendar, the focus of attention remains on the publication of the jobless rate and the End Year CPI Forecast on Wednesday and Friday, respectively.

What to look for around TRY

The upside bias in USD/TRY remains unchanged and stays on course to revisit the key 18.00 zone.

In the meantime, the lira’s price action is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent. In addition, there seems to be no Plan B to attract foreign currency in a context where the country’s FX reserves dwindle by the day.

Key events in Türkiye this week: Unemployment Rate (Wednesday) – Current Account (Thursday) – End year CPI Forecast, Industrial Production, Retail Sales (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.16% at 17.9302 and faces the immediate target at 17.9874 (2022 high August 3) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.1903 (weekly low July 15) would pave the way for 16.1867 (100-day SMA) and finally 16.0365 (monthly low June 27).

- Gold regains positive traction on Tuesday and climbs to a fresh multi-week high.

- The USD edges lower for the second straight day and offers support to the metal.

- Recession fears weigh on investors’ sentiment and benefit the safe-haven XAU/USD.

- Hawkish Fed expectations could cap gains ahead of the US CPI report on Wednesday.

Gold attracts some dip-buying near the $1,783 area on Tuesday and climbs to a five-week high during the early North American session.

Bulls now await sustained strength beyond the $1,800 mark amid modest US dollar weakness, which tends to underpin the dollar-denominated commodity. The New York Fed's monthly survey on Monday showed that the outlook for US inflation fell sharply in July. This, in turn, suggests that inflation in the US may have peaked last month, which turns out to be a key factor exerting pressure on the buck for the second straight day.

Apart from this, the prevalent cautious mood offers additional support to the safe-haven gold. The market sentiment remains fragile amid growing worries about a global economic downturn. Furthermore, the US-China tensions over Taiwan keep investors on edge. This is evident from a generally weaker tone around the equity markets, which further benefits the precious metal, though hawkish Fed expectations could cap any further gains.

Against the backdrop of the recent hawkish remarks by several FOMC officials, Friday's upbeat US jobs data fueled speculations that the Fed would retain its aggressive policy tightening path. In fact, the current market pricing points to a 70% chance for a larger, 75 bps Fed rate hike move at the September meeting. This, along with a goodish pickup in the US Treasury bond yields, could cap the upside for the non-yielding yellow metal.

Investors might also refrain from placing aggressive bets and prefer to move on the sidelines ahead of the crucial US consumer inflation figures, due on Wednesday. The US CPI report would provide fresh clues about the Fed's policy outlook, which should influence the USD and gold prices in the near term. This, in turn, warrants caution before positioning for any further gains amid absent relevant market-moving US economic data on Tuesday.

Technical levels to watch

- EUR/USD advances further north of the 1.0200 hurdle on Tuesday.

- The continuation of the uptrend could see 1.0300 retested near term.

EUR/USD flirts with the area of multi-day highs around 1.0250, posting gains for the second straight session on Tuesday.

The so far August high at 1.0293 (August 2) emerges as the magnet for bulls for the time being. Above this level, spot is expected to see its uptrend reinvigorated and could challenge the temporary 55-day SMA in the near term, today at 1.0386.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0913.

EUR/USD daily chart

- USD/JPY struggles to gain any meaningful traction and remains confined in a narrow band.

- The Fed-BoJ policy divergence acts as a tailwind amid a goodish pickup in the US bond yields.

- Recession fears offer support to the safe-haven JPY and cap gains amid modest USD weakness.

The USD/JPY pair refreshes its daily high during the early North American session, though the uptick seems lacking any strong follow-through buying. The pair quickly retreats a few pips and slips back below the 135.00 psychological mark in the last hour.

A big divergence in the monetary policy stance adopted by the Federal Reserve and the Bank of Japan continues to weigh on the Japanese yen, which, in turn, offers some support to the USD/JPY pair. Against the backdrop of the recent hawkish remarks by several FOMC officials, Friday's upbeat US jobs data fueled speculations that the US central bank would stick to its aggressive policy tightening path. In contrast, the BoJ has repeatedly said that it will stick to its ultra-easy policy settings and its commitment to keep the 10-year Japanese government bond yield around 0%.

Apart from this, a goodish pickup in the US Treasury bond yields widens the US-Japan yield differential and undermines the JPY, offering additional support to the USD/JPY pair. That said, a modest US dollar weakness is holding back bulls from placing aggressive bets and capping gains for the major. The New York Fed's monthly Survey showed that inflation in the US may have peaked last month. This turns out to be a key factor dragging the USD lower for the second successive day amid some repositioning trade ahead of the crucial US CPI report, scheduled for release on Wednesday.