- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 11-08-2022

Reuters reports that San Francisco Federal Reserve Bank President Mary Daly said on Thursday that a 50 basis point interest rate hike in September "makes sense" given recent economic data including on inflation, but that she is open to a bigger rate hike if data warrants.

''Saying that she does not want to be 'headfaked' by the recent improvement in inflation readings, Daly told Bloomberg TV in an interview that she has an "open mind" on the possibility of a 75 basis point hike.

Financial conditions need to remain tight to continue to bridle economic growth and bring down inflation, she said.''

Earlier, Daly had already been reported by the FT saying that she did not rule out a third consecutive 0.75 percentage point rate rise at the central bank’s next policy meeting in September, although she signalled her initial support for the Fed to slow the pace of its interest rate increases, the Financial Times reported.

"We have a lot of work to do. I just don’t want to do it so reactively that we find ourselves spoiling the labour market," the central banker said while also indicating that she would be watching the next consumer price and non-farm payroll reports to better calibrate her decision.

Meanwhile, Thursday's data showed US producer prices (PPI) unexpectedly fell in July amid a drop in the cost of energy products. This followed Wednesday's surprise news that consumer prices (CPI) were unchanged in July due to a drop in gasoline prices. Both the greenback and US Treasury yields rallied after dropping sharply earlier. DXY is back trading around 105.10.

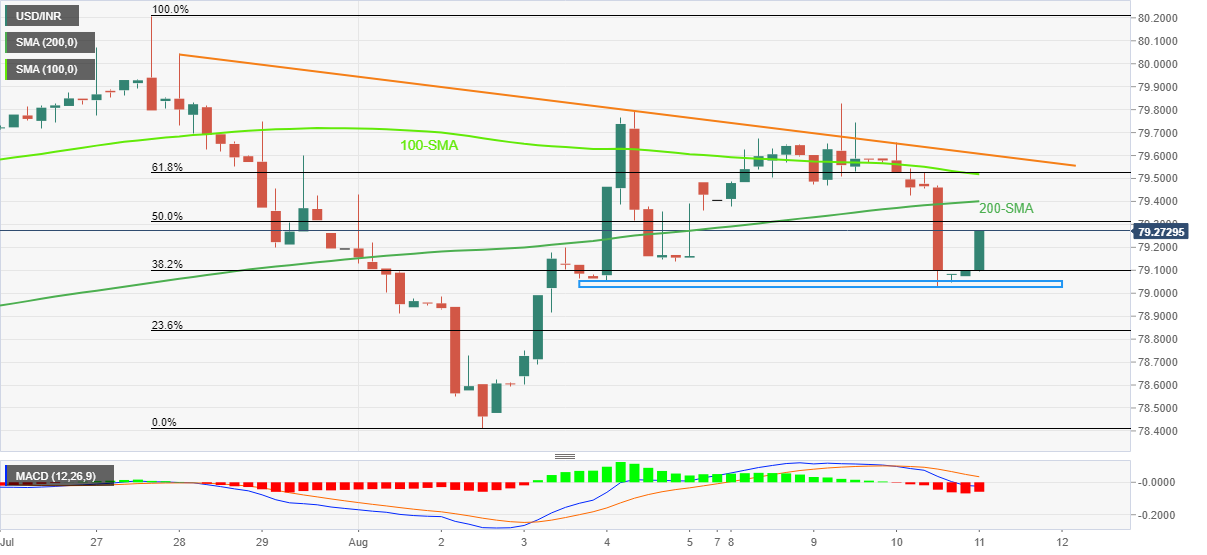

- USD/CAD bulls are lurking and the US dollar is firmer.

- Bulls need to commit to a break of 1.2780 and then 1.2790/00.

As per the prior analysis, USD/CAD Price Analysis: Bulls could be about to clean up, the price is in a phase of accumulation currently and a resurgence in the greenback would be expected to see USD/CAD rally in due course.

The following is an update of the prior analysis.

USD/CAD daily chart, prior analysis

The price extended a touch lower on Thursday, but the bullish thesis remains in play, as per the following hourly and 15-minute charts:

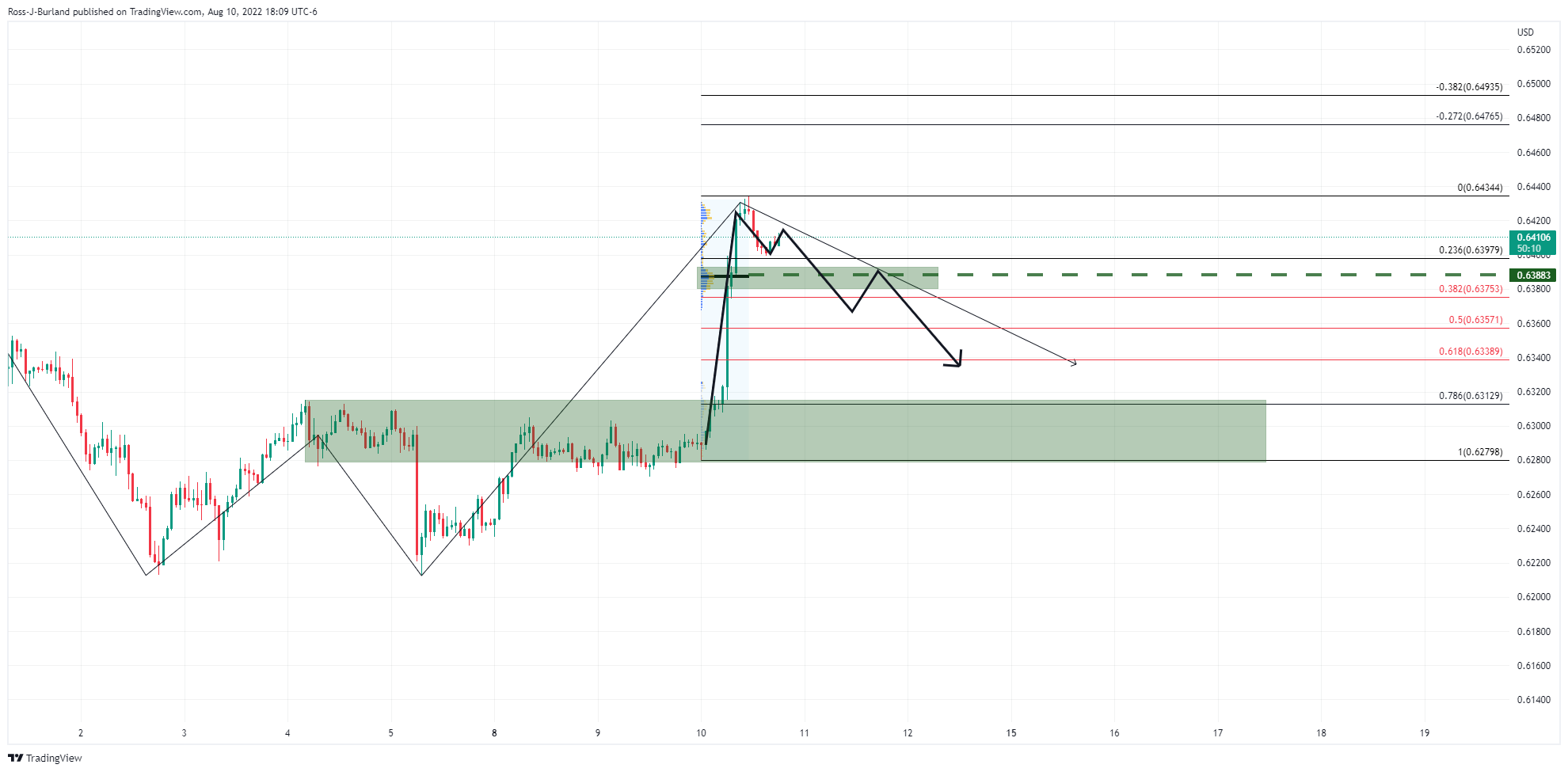

USD/CAD 15-min chart, live market

The price has been moving sideways within a consolidation price discovery phase of accumulation. This was flagged as a possibility in the prior analysis:

''From a 15-min perspective, the price action could develop over the coming sessions as follows. In a fast market, the price would be expected to correct steeply, but in a long drawn-out process in which there is a lack of commitment from the bulls, the ride could be a bumpy one along the support area as illustrated above. This would potentially result in an even lower low yet to come before the bulls fully commit to the correction in a phase of accumulation.''

The sentiment surrounding the greenback is turning more positive towards the end of the week so we could now start to see more commitment from the bulls over the coming sessions:

A break of 1.2780 and then 1.2790/00 will be key.

- AUD/NZD is expected to display significant losses after surrendering the cushion of 1.0300.

- The RBNZ is likely to announce a half-a-percent rate hike for the fourth time consecutively.

- A lower Australian Consumer Inflation Expectations print has failed to support aussie bulls.

The AUD/NZD pair has turned sideways at around 1.0400 after a downside move from 1.0500. The asset is on the verge of printing a fresh weekly low if the kiwi bulls manage to drag the cross below the immediate support of 1.0300. A release of an upbeat Business NZ PMI has strengthened the kiwi bulls.

The Business NZ PMI data has landed at 52.7, higher than the expectations of 52.5 and the prior release of 50. This is going to delight the Reserve Bank of New Zealand (RBNZ) in its fight against inflation. Next week, the RBNZ will announce an interest rate decision in its monetary policy meeting. RBNZ Governor Adrian Orr is expected to step up its Official Cash Rate (OCR) by 50 basis points (bps) consecutively for the fourth time. An announcement of the same will elevate the OCR to 3%.

As per the Reuters survey, the RBNZ will elevate its OCR to 4.00% by mid-2023. And, the Inflation is expected to fall within the target range of 2-3% in the H1CY2023. It seems like the RBNZ’s goal of bringing price stability is visible now.

On the Aussie front, lower Consumer Inflation Expectations data has failed to support the aussie bulls. A slippage in aussie Consumer Inflation Expectations, which presents the consumer expectations of future inflation during the next 12 months will force a decline in the hawkish guidance by the Reserve Bank of Australia (RBA).

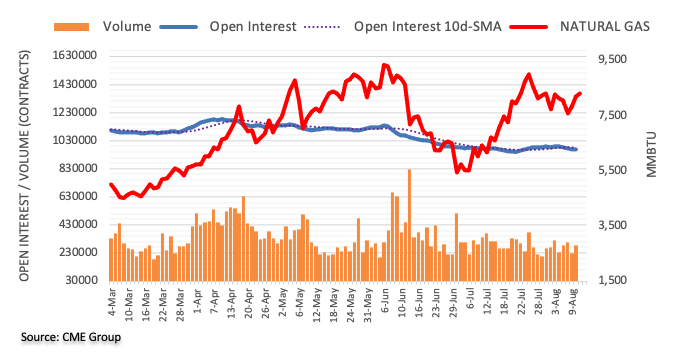

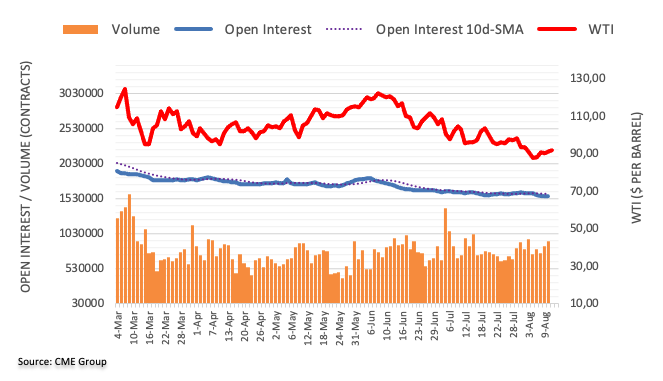

- WTI retreats from one-week high, probes two-day uptrend.

- OPEC, EIA anticipate world energy demand to ease in 2022, and increase next year.

- Mixed sentiment, light calendar could restrict short-term moves.

- US Michigan Consumer Sentiment Index eyed for clear directions.

WTI crude oil prices remain sidelined at around $93.30-35 during Friday’s Asian session, pausing a two-day recovery around the weekly top. The black gold’s latest inaction could be linked to the light calendar and mixed catalysts. However, downbeat demand forecasts for 2022 by the Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA), published on Thursday, appear to weigh on the quote.

That said, OPEC said that it lowered the 2022 full-year demand growth forecast to 3.1 million barrels per day (bpd) from 3.36 million bpd reported previously, per Reuters. "2023 world oil demand to rise by 2.7 million bpd, unchanged from the previous forecast," the forecasts add. The OPEC update also mentioned that the 2022 global economic growth forecast was lowered to 3.1% (prev. 3.5%), 2023 view was trimmed to 3.1% with significant downside risks prevailing.

On the other hand, the EIA said that it expects the global oil demand to rise by 2.1 million barrels per day in 2023 to surpass the pre-Covid levels at 101.8 million bps. “Demand growth is expected to slow from 5.1 mln bpd in 1Q22 to just 40,000 bpd by 4Q22,” adds EIA. The report also mentioned that the world oil supply hit a post-pandemic high of 100.5 million bpd in July.

Elsewhere, market sentiment remains mixed and joins the recent rebound in the oil prices to weigh on the black gold. While portraying the mood, Wall Street began the day on a positive side before closing mixed while the US 10-year Treasury yields rallied 10 basis points (bps) to 2.88% at the latest.

Behind the moves could be the comments from Minneapolis Fed President Neel Kashkari and Chicago Fed President Charles Evans challenged the market optimism earlier on Thursday. That said, Fed’s Kashkari mentioned that he hasn't "seen anything that changes" the need to raise the Fed's policy rate to 3.9% by year-end and 4.4% by the end of 2023. Further, Fed policymaker Evens stated, “The economy is almost surely a little more fragile, but would take something adverse to trigger a recession.” Fed’s Evans also called inflation "unacceptably" high.

On the same line were the headlines surrounding China. Reuters relied on sources to mention that the saying US President Biden rethinks steps on China tariffs in wake of Taiwan response. Additionally, a jump in the coronavirus cases from China, to 700 new confirmed cases in the mainland on August 10 versus 444 a day earlier, also weighs on the pair. Furthermore, Taiwan’s criticism of the “One China” policy and US House Speaker Nancy Pelosi’s support for Taipei also challenged the market optimism.

It’s worth noting that the softer prints of the US Jobless Claims and Producer Price Index (PPI) for July underpinned the risk-on mood and restricted the black gold’s downside.

Moving on, a light calendar at home requires the WTI crude oil traders to keep their eyes on the qualitative catalysts for fresh directions ahead of the US Michigan Consumer Sentiment Index (CSI) for August, expected at 52.5 versus 51.5 prior.

Also read: Michigan Consumer Sentiment Index Preview: Good news for the dollar but not for households

Technical analysis

A two-month-old descending resistance line precedes the 21-DMA to restrict immediate WTI rebound near $93.40 and $94.15 levels in that order. Given the recently firmer MACD, coupled with the gradual rebound from the yearly low, the commodity buyers are likely to keep reins.

- Silver price holds lower ground near the short-term key support comprising 50-day EMA, three-week-old ascending support line.

- Receding bullish MACD signals, sustained pullback from 61.8% Fibonacci retracement tease sellers.

- Bulls need validation from $21.00 to retake control.

Silver price (XAG/USD) remains pressured at around $20.30, keeping the previous day’s bearish bias during Friday’s Asian session. In doing so, the bright metal holds on to the latest downside break of the 50% Fibonacci retracement level of the June-July fall amid recently easing bullish signals of the MACD.

That said, the quote’s U-turn from the 61.8% Fibonacci retracement level earlier in the week also keeps XAG/USD sellers hopeful to conquer the $20.20 support confluence including the 50-DMA and an upward sloping trend line from July 25.

It’s worth noting that the silver sellers might search for the daily closing below the $20.00 threshold to validate the weakness past $20.20.

Following that, a south-run towards the five-week-long horizontal area near $19.55-45 can’t be ruled out.

Meanwhile, the 50% and the 61.8% Fibonacci retracement levels, respectively near $20.35 and $20.85 could restrict short-term upside moves of the silver price.

Should the quote manage to cross the $20.85 hurdle, the mid-June swing low near $21.00 will act as an extra filter to the north before directing the XAG/USD buyers towards the June 27 peak of $21.53.

Silver: Daily chart

Trend: Further weakness expected

- NZD/USD is advancing towards its two-month high at 0.6260 as Business NZ PMI lands higher at 52.7.

- A fourth consecutive 50 bps rate hike is expected by the RBNZ.

- The impact of the lower US CPI print is fading away and investors are focusing on Fed’s next meeting.

The NZD/USD pair has continued its four-day winning streak and is likely to recapture its two-month high at 0.6260 as Business NZ has reported upbeat PMI data. The economic data has landed at 52.7, higher than the expectations of 52.5 and the prior release of 50.

An upbeat PMI data has strengthened the kiwi bulls against the greenback. Also, it may back the former to print a fresh two-month high.

Going forward, the kiwi bulls are likely to dance to the tunes of the Reserve Bank of New Zealand (RBNZ) as the central bank will announce an interest rate decision on Wednesday.

As per the Reuters poll, the RBNZ will elevate its Official Cash Rate (OCR) by 50 basis points (bps) consecutively for the fourth time, taking the interest rates to 3%. Also, the insights from Reuters’ survey indicate that the RBNZ will elevate its OCR to 4.00% by mid-2023. And, the Inflation is expected to fall within the target range of 2-3% in the H1CY2023.

Meanwhile, the US dollar index (DXY) is likely to display a minor correction after facing hurdles around 105.20. The upside seems intact as investors have ignored the evidence of exhausting inflation and are now focusing on the extent of the rate hike that the Federal Reserve (Fed) will feature in its monetary policy meeting in September.

There is no denying the fact that inflation exhaustion signals cheered the market participants. However, price pressures are still on the rooftop and highly deviated from the desired levels. So Fed’s rate announcement will continue further.

- USD/CHF broke below the 200-DMA, ending the major’s upward bias.

- In the near term, the USD/CHF is neutral to downwards, but buyers reclaiming 0.9450 exerts upward pressure on the major.

The USD/CHF stumbles for the sixth consecutive day and breaks support provided by the 200-DMA at 0.9427, shifting the major’s bias downwards, with sellers reclaiming the latter, extending the USD/CHF losses in the week to 2.17%. At the time of writing, the USD/CHF is trading at 0.9408.

USD/CHF Price Analysis: Technical outlook

From a daily chart perspective, although breaking below the 200-day EMA, the USD/CHF risks are skewed to the upside. Thursday’s price action formed a hammer, preceded by a downtrend. That said, the major might re-test the 200-day EMA as a resistance level. If the latter holds, that could pave the way towards the March 31 low at 0.9194.

USD/CHF Daily chart

USD/CHF Daily chart

Zooming into the one-hour scale, the USD//CHF chart portrays the pair as neutral-to-downwards, but a positive divergence between the RSI and price action suggests an upward correction is on the cards. If that scenario plays out, the USD/CHF first resistance would be the confluence of the 50-hour EMA and the R1 pivot at 0.9447. Break above will expose the R2 daily pivot at 0.9484, followed by 0.9500.

USD/CHF 1-hour chart

USD/CHF 1-hour chart

USD/CHF Key Technical Levels

Analysts at the investment bank Morgan Stanley (MS) think that the British Pound (GBP) has a limited scope of portraying a heavy downside.

"We turn bearish skew for GBP but see another sharp leg lower in GBP as unlikely. The BoE delivered a 50bp hike, in line with market expectations, but this decision was accompanied by a very bleak set of forecasts and an explicit warning of a protracted UK recession starting from 4Q22," mentioned MS ahead of the preliminary readings of the UK’s second quarter (Q2) Gross Domestic Product (GDP).

The US bank also adds, "It is these weak growth expectations which we think will continue to keep GBP on the back foot against its G10 peers. However, given how low growth expectations already are and how bearish sentiment is on GBP, we think the risk of a further sharp leg lower in GBP has decreased.”

Also read: UK GDP Preview: Early confirmation of BOE’s recession forecast

- GBP/JPY fades bounce off weekly low ahead of the preliminary UK Q2 GDP.

- Multiple failures to cross 50-day EMA, previous support line from March favor sellers amid steady RSI, bearish MACD signals.

- 200-day EMA offers strong support, six-week-old horizontal line adds to upside filters.

GBP/JPY holds lower grounds inside an immediate 30-pip trading range above 162.10 during Friday’s initial Asian session. In doing so, the cross-currency pair fails to extend the late Thursday’s rebound from the weekly bottom ahead of the preliminary readings of the UK’s second quarter (Q2) Gross Domestic Product (GDP).

Also read: UK GDP Preview: Early confirmation of BOE’s recession forecast

Technically, the pair has been on the bear’s radar for the last two weeks after it dropped below an upward sloping trend line from March to late July. Also keeping the sellers hopeful is the quote’s multiple failures to cross the 50-day EMA resistance, as well as bearish MACD signals and the steady RSI.

That said, GBP/JPY sellers currently aim for the 38.2% Fibonacci retracement level of March-June upside, near 161.95 ahead of challenging multiple supports around 161.15-10.

It should be noted, however, that the quote’s weakness past 161.10 appears difficult as the 160.00 psychological magnet will precede the 200-day EMA level surrounding 159.50 to challenge the bears.

Alternatively, the 50-day EMA level near 163.30 guards the GBP/JPY pair’s immediate recovery ahead of the support-turned-resistance line around 164.10.

Following that, a daily closing beyond the 23.6% Fibonacci retracement level of 164.55 becomes necessary for the GBP/JPY bulls to mark another attempt in crossing the 1.5-month-long horizontal hurdle close to 166.25-35.

GBP/JPY: Daily chart

Trend: Further upside expected

“The Reserve Bank of New Zealand (RBNZ) will stick to its hawkish stance and deliver a fourth straight half-point rate hike on Wednesday in its most aggressive tightening in over two decades to try to rein in stubbornly-high inflation,” as per the latest Reuters poll published early Friday morning in Asia.

Key findings

All 23 economists in the Aug. 8-11 Reuters poll forecast rate setters at the RBNZ would hike its official cash rate by another 50 basis points at its Aug. 17 meeting, taking it to 3.00%. It was 1.00% before the COVID-19 pandemic.

All but one of the 23 economists polled also forecast rates to reach 3.50% or higher by the end of 2022 in what would be the most aggressive policy tightening since the official cash rate was introduced in 1999.

While the RBNZ has signaled plans to increase the rate to 4.00% by mid-2023, almost matching the U.S. Federal Reserve, few economists in the poll said it would go that far.

Only five of 23 economists predicted rates would reach 4.00% by end-2022, up from one in the previous poll.

Twelve of 19 respondents forecast the cash rate to either stay steady at 3.50% or be lower by end-2023. The remaining seven predicted it would climb to 3.75% or higher by then.

Inflation was expected to fall within the target range of 2%-3% in the second half of next year, a separate Reuters poll showed.

Also read: NZD/USD: RBNZ’s tone should underpin the kiwi – ANZ

- GBP/USD is facing barricades around 1.2200 as investors await UK GDP data.

- A vulnerable UK GDP will accelerate troubles for the BOE.

- Higher Initial Jobless Claims have supported the DXY at lower levels.

The GBP/USD pair is hovering around the immediate hurdle of 1.2200 after a modest rebound from 1.2185. The asset defended Wednesday’s low at around 1.2180 but is now displaying a torpid rebound, which could be fragilized effortlessly by the market participants. The cable is expected to remain subdued as investors are awaiting the release of the Gross Domestic Product (GDP) data. Apart from that, the release of the Industrial Production and Manufacturing Production data holds utmost importance.

As per the market consensus, the UK economy has shrunk by 0.2% in the second quarter of CY2022 vs. the expansion of 0.8% recorded in Q1CY22. Also, the annual data is expected to shift lower to 2.8% from the prior release of 8.7%. An occurrence of the same is likely to create more troubles for the Bank of England (BOE). The central bank is already stuck in the laborious job of dealing with ramping up inflation and over that, a slump in growth rates will restrict the BOE to combat price pressures with full power.

Adding to that, the Manufacturing Production data is also expected to display a vulnerable performance. The economic data is expected to slip lower to 0.9% against the former release of 2.3% on an annual basis. Adding to that, the monthly data is expected to display a de-growth of 1.8% against the previous print of 1.4%.

Whereas the Industrial Production data is seen higher by 20 basis points on yearly basis but the monthly culture is likely to land in negative territory.

On the dollar front, the US dollar index (DXY) defended the downside bias confidently and now, has advanced to near 105.20. Printing of higher jobless claims by the first-timers supported the DXY from refreshing its monthly lows. The economic data landed at 262k, mostly in line with the expectations but lower than the prior release of 248k.

- AUD/USD bulls take a breather around 11-week top amid cautious optimism.

- Softer US PPI, Aussie CPI joined firmer equities to favor the pair buyers.

- Strong yields, fears of US-China tussles and the Fedspeak tested the upside momentum.

- Risk catalysts eyed for immediate directions amid a light calendar in Asia, US Michigan Consumer Sentiment Index is the key.

AUD/USD steps back from a two-month high, recently sidelined, as bulls seek fresh clues to extend the latest uptrend amid a light calendar and recently mixed mood during Friday’s Asian session. That said, the Aussie pair seesaws around 0.7100, after refreshing the multi-day high with 0.7137, during Friday’s initial Asian session.

US Producer Price Index (PPI) for July tracked the headline Consumer Price Index (CPI) while easing to 9.8% YoY versus 11.3% prior and 10.4% market forecasts, the data published by the US Bureau of Labor Statistics revealed on Thursday. That said, the monthly PPI dropped to the lowest levels since May 2020, to -0.5% compared to 1.0% expected and 0.2% prior, which in turn signaled more easing of inflation fears.

At home, Australia’s downbeat prints of Consumer Inflation Expectations for August, to 5.9% from 6.3%, offered additional relief to the Reserve Bank of Australia (RBA) that raised concerns over a surge in the prices of late.

In addition to the receding inflation woes, the softer prices of the US Weekly Jobless Claims also portrayed improvement in the employment scenario, tracking the recent job numbers from the world’s largest economy, which in turn helped to build the risk-on mood. That said, US Initial Jobless Claims eased to 262K for the week ending August 6 versus 263K expected and downwardly revised 248K prior.

Alternatively, comments from Minneapolis Fed President Neel Kashkari and Chicago Fed President Charles Evans challenged the market optimism earlier on Thursday. That said, Fed’s Kashkari mentioned that he hasn't "seen anything that changes" the need to raise the Fed's policy rate to 3.9% by year-end and to 4.4% by the end of 2023. Further, Fed policymaker Evens stated, “The economy is almost surely a little more fragile, but would take something adverse to trigger a recession.” Fed’s Evans also called inflation "unacceptably" high.

On the same line were the headlines surrounding China. Reuters relied on sources to mention that the saying US President Biden rethinks steps on China tariffs in wake of Taiwan response. Additionally, a jump in the coronavirus cases from China, to 700 new confirmed cases in the mainland on August 10 versus 444 a day earlier, also weighs on the pair. Furthermore, Taiwan’s criticism of the “One China” policy and US House Speaker Nancy Pelosi’s support for Taipei also challenged the market optimism.

Amid these plays, Wall Street began the day on a positive side before closing mixed while the US 10-year Treasury yields rallied 10 basis points (bps) to 2.88% at the latest.

Looking forward, a light calendar at home requires the AUD/USD traders to keep their eyes on the qualitative catalysts for fresh directions ahead of the US Michigan Consumer Sentiment Index (CSI) for August, expected at 52.5 versus 51.5 prior.

Technical analysis

An upwards loping support line from early July, around 0.7090, restricts the immediate downside of the AUD/USD pair. The fresh upside momentum, however, needs validation from 0.7140.

- The EUR/JPY rebounded from 136.29 weekly lows and reclaimed the 137.00 area towards Thursday’s close.

- The cross-currency pair is neutral-to-downward biased, and a break below 136.31 will send the pair sliding towards 135.80.

The EUR/JPY jumps off weekly lows and trims some of Wednesday’s losses amidst a mixed market mood as reflected by the US equities split between gainers/losers towards the end of the session.

Earlier risk appetite improved due to US PPI data, which showed that inflation on the producer’s side is also cooling. So traders asses that the previously-mentioned data, alongside Wednesday’s US CPI, might ease Fed pressures to tackle inflation, meaning a less aggressive tightening

EUR/JPY Price Analysis: Technical outlook

Reviewing Wednesday’s notes, I wrote that a bearish-engulfing candle pattern emerged on the daily chart, which has bearish implications. So Thursday’s price action followed suit and reached a weekly low at 136.29. Nevertheless, as the yen weakened, the EUR/JPY aimed higher, though recorded its daily close below the August 8 daily low at 137,26. Still, the Relative Strength Index (RSI) is in bearish territory, so sellers are in charge, so any rallies could be better entry prices for shorts.

Therefore, the EUR/JPY’s first support would be the August 10 daily low at 136.61. Break below will expose the August 11 pivot low at 136.30, followed by the August 5 daily low at 135.80. On the other hand, If the EUR/JPY clears the 100-day EMA, then a test towards the 138.35 weekly highs is on the cards.

EUR/JPY Daily chart

EUR/JPY Daily chart

EUR/JPY Key Technical Levels

- EUR/USD has turned sideways around 1.0320 as DXY rebounds sharply.

- Fresh evidence of exhaustion in the US CPI is meaningful but short-lived if not find follow-ups.

- A vulnerable performance is expected from Eurozone Industrial Production data.

The EUR/USD pair is auctioning in an inventory distribution phase after a sheer downside move. The asset declined sharply after testing the monthly high of 1.0370. Failing to print a fresh monthly high due to a less-confident upside rally delighted the market participants to deploy significant offers at elevated levels. Usually, an inventory distribution phase after a vertical fall results in a continuation of downside momentum as investors bet on breaking the consolidation.

The US dollar index (DXY) displayed a confident rebound after sensing an intense buying interest while revisiting the six-week low at 104.64. The DXY has extended its gains to near 105.20 after a firmer rebound and is likely to advance further as investors are shrugging off a one-time softer US inflation show.

No doubt, the fresh evidence of exhaustion in the US Consumer Price Index (CPI) is indicating that good days are ahead and the Federal Reserve (Fed)’s journey towards achieving price stability is visible now despite being blurred. However, an annual US CPI figure of 8.5% is not the right time to enjoy a ball as the Fed will continue on its path of accelerating interest rates. For the record, the extent of hawkish guidance will trim abruptly.

Going forward, investors will keep an eye on the US Michigan Consumer Sentiment Index (CSI) data. The sentiment data is expected to improve to 52.2 from the prior release of 51.5. A consecutive improvement is expected in the confidence of consumers after the data slipped to 50 for the first time in the past 20 years.

Also, the Eurozone will report the Industrial production data, which are seen lower at 0.2% and 0.8% from their prior releases on a monthly and an annual basis respectively.

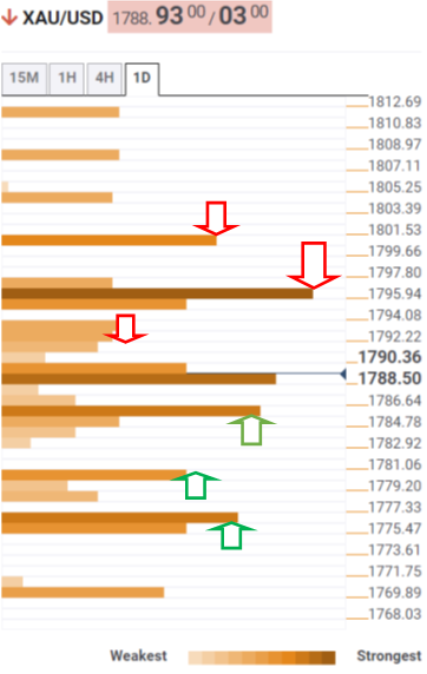

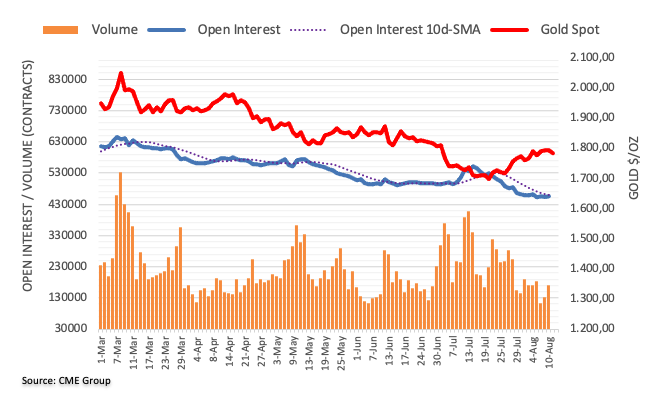

- Gold could be on the verge of a significant downside correction.

- The US dollar bulls are emerging as markets digest Fed speak and inflation data.

The gold price is back to flat in the close on Wall Street following a move in the US dollar and yields that have shaken out some weak hands that have been positioned short in the greenback. The market backdrop has turned increasingly risk-friendly over the past two days which has supported the yellow metal with sentiment reflecting some upside in growth indicators and the downside of inflation pressures.

However, at the time of writing, the greenback is moving higher on the 4-hour charts in a solid correction of the inflation blowout as markets take some time out to look ahead. Thursday's Producer Price Index sent similar signals to that of Wednesday's CPI and embedded the hope that the Federal Reserve will be able to cool down price growth without shoving the economy into the deep freeze of recession.

July PPI month-over-month and year-over-year came in below expectations. In fact, the month-over-month reading was actually negative. Core readings were below the Reuters poll on a month-over-month basis and in-line on a year-over-year basis. The report lessened the prospects of the Fed up interest rates by 75 basis points for the third time in a row at the conclusion of its September policy meeting. Instead, CME Fed funds futures now predict a smaller 50 bp rate hike by nearly two to one.

The markets were digesting the recent Consumer Price Index and PPI outcomes that came in below expectations, taking on board subsequent comments made by Federal Reserve officials also.

Fed officials are hawkish

Fed officials spoke after the inflation data this week. For instance, following yesterday's CPI, Neel Kashkari unleashed his inner hawk and said the July CPI data did not change his expected rate path, though he was happy to see inflation surprise to the downside. Kashkari stressed that the Fed is far from declaring victory over inflation and stressed that recession “will not deter me” from getting to the 2% target.

Today, Mary Daly, President of the San Francisco Fed did not rule out a third consecutive 0.75 percentage point rate rise at the central bank’s next policy meeting in September, although she signalled her initial support for the Fed to slow the pace of its interest rate increases, the Financial Times reported. "We have a lot of work to do. I just don’t want to do it so reactively that we find ourselves spoiling the labour market," the central banker said while also indicating that she would be watching the next consumer price and non-farm payroll reports to better calibrate her decision.

US stocks faded

On Wall Street, heading towards the final hour of trade, stocks had turned over easing earlier gains as investors figure that the one-month data is not enough to start calling peak inflation. As a consequence, after adding more than 2% on Wednesday and rising more than 1% to a 3-month high earlier on Thursday, the S&P 500 edged 0.1% lower to 4,207.32 and the Nasdaq Composite was 0.6% lower at 12,779.91. The Dow Jones Industrial Average rose 0.1% to 33,336.67.

The 10-year yield was 3.41% higher on the day and has made a fresh high for the day of 2.902%. The move coincided with the 30-year bond auction. Meanwhile, the DXY, an index that measures the greenback vs. a basket of currencies was back to near flat for the day at 105.14. The index has recovered from a low of 104.646.

Commenting on the US dollar and in light of yesterday's CPI data, analysts at Brown Brothers Harriman said, ''we stress that there is a lot of noise right now even as markets remain thin during the summer months.''

''We are likely to continue seeing violent moves in the markets in the coming weeks as markets continue to struggle to find a stable and sustainable macro outlook to trade on.

Analysts at TD Securities argued that the recent downside miss of US core inflation underscores that we have likely seen the peak of inflation and perhaps the stagflation concerns. Even so, however, they ''don't think that risk assets are out of the woods yet, suggesting it could a bit more time to expect a persistent, positive boost in growth expectations and financial conditions.''

''A potential inflation peak (and associated end to Fed terminal rate price discovery) is an important ingredient to call the top in the USD. The other key (and arguably) more important ingredient is the outlook for global growth. On that factor, we don't think it is time to completely fade the USD, though the recent backdrop reductions convictions on USD long exposure,'' the analysts explained.

Meanwhile, the analysts at TD Securities said that the gold sellers are lurking.

''Gold's failure to break north of a key threshold for substantial short covering from CTA trend followers amid a miss in the highly anticipated US inflation data may be pointing to significant selling interest. After all, strong physical demand may have exacerbated the short covering rally sparked by Chair Powell's FOMC speech, but we see evidence that the Chinese bid in gold continues to unwind.''

''Prices now need to break north of $1830/oz to catalyze a buying program from trend followers. Ultimately, prop traders are still holding a massive amount of complacent length, suggesting we have yet to see capitulation in gold, which argues that the pain trade remains to the downside.''

Gold technical analysis

As illustrated, the price has run up to the 61.8% golden ratio where some profit taking would be expected to occur. A build-up of supply could pick up over the course of the coming days and weeks ahead resulting in a topping of this correction of the M-formation's bearish leg.

- The AUD/JPY is trading near two-week highs around 94.66.

- Risk appetite is mixed, as shown by Wall Street, finishing mixed.

- In the short-term, the AUD/JPY could test 95.00; otherwise, a fall towards the 100-EMA is on the cards.

The AUD/JPY snaps two days of losses and advances after Wall Street closed mixed as investors’ upbeat sentiment pauses. Earlier risk appetite improved due to US PPI data, which showed that inflation on the producer’s side is also cooling. So traders asses that the previously-mentioned data, alongside Wednesday’s US CPI, might ease Fed pressures to tackle inflation, meaning a less aggressive tightening. At the time of writing, the AUD/JPY is trading at 94.53, up 0.47%.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY daily chart illustrates buyers reclaiming control. On Thursday, the AUD/JPY hit a two-week high at 94.60, followed by a retracement due to a three-month-old upslope trendline-turned-resistance, which was challenging to overcome. Nevertheless, the Relative Strength Index (RSI) is still aiming upwards, meaning buyers are gathering momentum.

Zooming into the 4-hour scale, the AUD/JPY is neutral-to-upward biased, but the uptrend appears to be losing steam. The intersection of the R2 daily pivot with the previously mentioned three-month-old upslope trendline is solid resistance around the 94.50-80 area. A breach of the latter will expose the figure at 95.00, followed by the July 27 daily high at 95.70.

On the flip side, if the AUD/JPY breaks below the 94.00 mark, the first support would be the 200-EMA at 93.60, previous to testing the August 10 pivot low at 93.48-

AUD/JPY 4-hour chart

AUD/JPY 4-hour chart

AUD/JPY Key Technical Levels

What you need to take care of on Friday, August 12:

The greenback seesawed between gains and losses, ending the day lower against most major rivals. Wall Street opened the day firmly higher amid more signals of receding US inflationary pressures, as the July Producer Price Index advanced by 9.8%, below expected.

Nevertheless and as US government bond yields advanced, equities lost steam, helping the dollar to recover some ground ahead of the daily close. At the time being, US indexes trade mixed around their opening levels, while the yield on the 10-year Treasury note stands at 2.88%.

The EUR/USD pair peaked at around 1.0360 for a second consecutive day, settling at around 1.0320. The GBP/USD pair trades just below 1.2200 ahead of the release of first-tier UK data. The country will publish the preliminary Q2 Gross Domestic Product estimate and June Industrial and Manufacturing Production.

The AUD/USD pair hovers around 0.7100, while USD/CAD trades at around 1.2770. Finally, safe-haven currencies eased at the end of the day, finishing it pretty much unchanged. USD/CHF hovers around 0.9420 while USD/JPY stands at 133.10.

Gold eased and is now trading at $1,785 a troy ounce. Crude oil prices increased, with WTI ending at $94.00 a barrel.

Will the Ethereum price finally flip Bitcoin?

Like this article? Help us with some feedback by answering this survey:

- USD/JPY bulls moving in as US yields bounce back.

- The US dollar is finding buyers in a short squeeze and US stocks flip over.

The market backdrop has turned increasingly risk-friendly over the past two days. The mood is reflecting some upside in growth indicators and the downside of inflation pressures. However, USD/JPY is back to being flat on the day following a move in the US dollar and yields that have shaken out some weak hands that have been positioned short in the greenback.

At the time of writing, USD/JPY is trading at 105.13 within the 104.646/105.461 day range. The markets are digesting the recent inflation data that has been released over two days, including Thursday's Producer Price Index.

The PPI echoed that of Wednesday's and embedded the hope that the Federal Reserve will be able to cool down price growth without shoving the economy into the deep freeze of recession. US stocks were higher in early trade on the fresh evidence of calming inflation but they have started to ease in midday trade as investors take profits and in the wake of a sell-off across the US dollar forex pairs with the 10-year yield rallying.

US stocks faded

On Wall Street, heading towards the final hour of trade, stocks have flipped over into negative territories as investors figure that the one-month data is not enough to start calling peak inflation. As a consequence, after adding more than 2% on Wednesday and rising more than 1% to a 3-month high earlier on Thursday, both the S&P and Nasdaq turned negative.

At the time of writing, the 10-year yield is 3.41% higher on the day and has made a fresh high for the day of 2.902%. The move coincides with the 30-year bond auction. Meanwhile, the DXY, an index that measures the greenback vs. a basket of currencies is now back to near flat for the day at 105.14. The index has recovered from a low of 104.646.

July PPI month-over-month and year-over-year came in below expectations. In fact, the month-over-month reading was actually negative. Core readings were below the Reuters poll on a month-over-month basis and in-line on a year-over-year basis. The report lessened the prospects of the Fed up interest rates by 75 basis points for the third time in a row at the conclusion of its September policy meeting. Instead, CME Fed funds futures now predict a smaller 50 bp rate hike by nearly two to one.

Fed officials remain hawkish

Meanwhile, Fed officials spoke after the inflation data this week. For instance, following yesterday's CPI, Neel Kashkari unleashed his inner hawk and said the July CPI data did not change his expected rate path, though he was happy to see inflation surprise to the downside. Kashkari stressed that the Fed is far from declaring victory over inflation and stressed that recession “will not deter me” from getting to the 2% target.

Today, Mary Daly, President of the San Francisco Fed did not rule out a third consecutive 0.75 percentage point rate rise at the central bank’s next policy meeting in September, although she signalled her initial support for the Fed to slow the pace of its interest rate increases, the Financial Times reported. "We have a lot of work to do. I just don’t want to do it so reactively that we find ourselves spoiling the labour market," the central banker said while also indicating that she would be watching the next consumer price and non-farm payroll reports to better calibrate her decision.

Commenting on the US dollar and in light of yesterday's CPI data, analysts at Brown Brothers Harriman said, ''we stress that there is a lot of noise right now even as markets remain thin during the summer months.''

''We are likely to continue seeing violent moves in the markets in the coming weeks as markets continue to struggle to find a stable and sustainable macro outlook to trade on.

Recession? Soft landing? Tightening? Easing? All of these questions remain unanswered right now and we will not know the truth for months, if not quarters.''

Analysts at TD Securities argued that the recent downside miss of US core inflation underscores that we have likely seen the peak of inflation and perhaps the stagflation concerns. Even so, however, they ''don't think that risk assets are out of the woods yet, suggesting it could a bit more time to expect a persistent, positive boost in growth expectations and financial conditions.''

''A potential inflation peak (and associated end to Fed terminal rate price discovery) is an important ingredient to call the top in the USD. The other key (and arguably) more important ingredient is the outlook for global growth. On that factor, we don't think it is time to completely fade the USD, though the recent backdrop reductions convictions on USD long exposure,'' the analysts explained.

- Silver price is dropping close to 1.50% on Thursday.

- July’s US CPI and PPI inflation reports show signs of topping; however, Fed officials remained hawkish.

- Traders’ focus shifts toward the University of Michigan Consumer Sentiment and Inflation Expectations.

Silver price drops moderately as market sentiment remains upbeat following the release of the US inflation data on Wednesday, followed by Thursday’s PPI report, which showed prices are slowing down, painting a positive picture for the US Federal Reserve. Given the previously mentioned, traders reduced their exposure to safe-haven assets to the detriment of the white metal. At the time of writing, XAGUUSD is trading at $20.28, near the daily lows.

The Department of Labor revealed that prices paid by producers, also known as PPI, rose slower than estimated. The PPI for July jumped by 9.8%YoY, higher than the 10.4% estimates, while the so-called core CPI, which strips volatile items, increased 7.6% YoY, aligned with expectations. Adding the previously mentioned pieces of data to Wednesday’s release of US CPI, which is around 8.5%, still paints a picture of hot US inflation. Even though Fed policymakers welcomed the reports, they reiterated the Fed’s commitment to bringing inflation towards their 2% target.

On Wednesday, Minnesota Fed’s Kashkari said that although the CPI news was good, he said that the Fed is “far, far away from declaring victory.” He added that he hadn’t seen anything that changes the Fed’s path to 3.9% by year-end and the 4.4% by 2023. Kashkari also pushed back against the market’s rate cuts expectations early in the next year and said they are “not realistic.”

In the meantime, the US Dollar Index, a gauge of the greenback’s value, drops 0.10%, at 105.100, while the US 10-year bond yield rallies nine bps, up at 2.88%, weighing on the white metal prices.

What to watch

By Friday, the US economic calendar will feature the University of Michigan Consumer Sentiment alongside inflation expectations.

Silver (XAGUSD) Key Technical Levels

Reuters reported that the Bank of Mexico hiked its benchmark interest rate by three-quarters of a percentage point to a record rate of 8.5% on Thursday, mirroring the US Federal Reserve's most recent policy decision as inflation surged to an over two-decade high.

The five board members of Banxico, as the central bank is known, voted unanimously for the second 75 basis points rate hike in a row, saying they would "assess the magnitude of the upward adjustments in the reference rate for its next policy decisions based on the prevailing conditions."

- Mexico central bank sets benchmark interest rate at 8.5%.

- Mexico central bank say board was unanimous on rate decision.

- Mexican central bank says the board will assess the magnitude of the upward adjustments in the reference rate for its next policy decisions based on the prevailing conditions.

- Mexico central bank says the balance of risks for the trajectory of inflation within the forecast horizon remains biased significantly to the upside.

- Mexico central bank says the board will thoroughly monitor inflationary pressures as well as all factors that have an incidence on the foreseen path for inflation and its expectations.

- Mexico's central bank says in view of greater-than-anticipated inflationary pressures, forecasts for headline and core inflation were revised upwards up to the third quarter of 2023.

- Mexico's central bank says among key global risks are those associated with the pandemic, the persistence of inflationary pressures, the intensification of geopolitical turmoil, and greater adjustments in economic, monetary and financial conditions.

- Mexico central bank says recent information indicates that during the second quarter of 2022, economic activity grew at a similar rate to that observed during the first quarter, thus continuing its gradual recovery, while slack conditions decreased.

- Mexico central bank says an environment of uncertainty prevails, while the balance of risks remains biased to the downside.

- Mexico central bank sees average annual headline inflation of 8.1% for the fourth quarter 2022.

USD/MXN trimmed the losses of the day and is now printing at 19.9611.

- AUD/USD is being pressured as the US dollar recovers in midday New York trade.

- The bears are moving in with US yields also rallying and as US stocks tail-off.

The US dollar DXY, and the US 10-Year Treasury yields were lower which had been giving US stocks and higher beta currencies such as the Aussie a lift at the start of the New York day, extending the overnight gains. AUD/USD rallied from a low of 0.7062 to a high of 0.7136 on Thursday, extending the prior day's range of between 0.6946-0.7109.

More inflation data released on Thursday rhymed with that of Wednesday's and embedded the hope that the Federal Reserve will be able to cool down price growth without shoving the economy into the deep freeze of recession. US stocks were higher in early trade on the fresh evidence of calming inflation but they have started to ease in midday trade as investors take profits and in the wake of a sell-off across the US dollar forex pairs with the 10-year yield rallying. At the time of writing, the 10-year yield is 3.41% higher on the day and has made a fresh high for the day of 2.880%. The move coincides with the 30-year bond auction. Meanwhile, the DXY, an index that measures the greenback vs. a basket of currencies is now back to near flat for the day at 105.14. The index has recovered from a low of 104.646.

July PPI month-over-month and year-over-year came in below expectations. In fact, the month-over-month reading was actually negative. Core readings were below the Reuters poll on a month-over-month basis and in-line on a year-over-year basis. The report lessened the prospects of the Fed up interest rates by 75 basis point for the third time in a row at the conclusion of its September policy meeting. Instead, CME Fed funds futures now predict a smaller 50 bp rate hike by nearly two to one.

Meanwhile, commenting on the US dollar and in light of yesterday's CPI data, analysts at Brown Brothers Harriman said, ''we stress that there is a lot of noise right now even as markets remain thin during the summer months.''

''We are likely to continue seeing violent moves in the markets in the coming weeks as markets continue to struggle to find a stable and sustainable macro outlook to trade on. Recession? Soft landing? Tightening? Easing? All of these questions remain unanswered right now and we will not know the truth for months, if not quarters.''

While the CPI data came in softer than expected, it has not changed the expected rate path of some Fed officials that spoke after the event. For instance, Neel Kashkari unleashed his inner hawk and said the July CPI data did not change his expected rate path, though he was happy to see inflation surprise to the downside. Kashkari stressed that the Fed is far from declaring victory over inflation and stressed that recession “will not deter me” from getting to the 2% target.

Meanwhile, Mary Daly, President of the San Francisco Fed did not rule out a third consecutive 0.75 percentage point rate rise at the central bank’s next policy meeting in September, although she signalled her initial support for the Fed to slow the pace of its interest rate increases, the Financial Times reported. "We have a lot of work to do. I just don’t want to do it so reactively that we find ourselves spoiling the labour market," the central banker said while also indicating that she would be watching the next consumer price and non-farm payroll reports to better calibrate her decision.

RBA in focus

As for the Aussie dollar, Net AUD short positions increased for a third straight week reflecting the recent weakness in commodity prices. Markets are anticipation that the Reserve Bank of Australia will hike another 50 bps RBA rate hike this month. The central bank recently stated that the domestic economy has been resilient, forecasting the unemployment rate to drop to 3.25% over the coming months. Headline and underlying inflation are expected to peak around the end of this year and the Bank's cash rate assumption is for a year-end 2022 target rate of 3%. With the target cash rate currently at 1.85%, the RBA assumes another 115bps of hikes over the next 4 meetings. In other words, the RBA is placing some chance of delivering a 50bps hike and 3x25bps hikes for a total of 125bps in hikes by year-end. This would take the year-end 2022 cash rate to 3.10%.

- The NZD/USD advances for the second straight day, up in the week by 3.03%.

- The US PPI for July rose by 9.8% YoY, less than estimates and last month’s reading.

- US Initial Jobless Claims jumped for two consecutive weeks, hinting the labor market is moderating.

The NZD/USD climbs above the 100-day EMA around 0.6439, courtesy of investors’ positive sentiment, as reports emerging from the US showed that prices might be peaking. Still, even though Fed speakers cheered and welcomed the information, they held to their hawkish stance. Given the abovementioned scenario, the greenback remains soft during the day.

At the time of writing, the NZD/USD is trading at 0.6444, after hitting a daily low below the 0.6400 figure, gaining 0.68%.

Sentiment remains positive, with US equities registering gains between 0.14% and almost 1%. The US Producer Price Index for July slowed its pace to 9.8% YoY, vs. estimations of 10.4%. Additionally, the so-called core PPI, which strips food and energy, rose by 7.6% YoY, in line with measures.

Meanwhile, US Initial Jobless Claims for the last week, which ended on August 6, increased by 262K, less than estimations, but began to show signs of moderation. Worth noticing that claims jumped for the second consecutive week, further confirming the latter.

The US Dollar Index, a gauge of the buck’s value against a basket of six rivals, edges down 0.12% at 105.055, a tailwind for the NZD/USD.

Data-wise, the New Zealand calendar reported that Visitor Arrivals rose by 83.5%, crushing expectations of 15%.

What to watch

The New Zealand economic docket will feature Business PMI for July, estimated at 49.2, alongside Food Inflation, estimated at 6.5%. On the US front, the US calendar will reveal the University of Michigan Consumer Sentiment, estimated at 52.5, and Consumer Inflation expectations for a 5-year horizon, forecasted at 2.8%.

NZD/USD Key Technical Levels

- Treasury bonds decline even after another reading below expectations of US inflation.

- Gold fails to rise above $1800 and correct lower.

- Immediate support is seen at $1785, followed by $1774.

Gold turned negative for the day after a reversal from near $1800. XAUUSD peaked at $1799 during the American session and then turned to the downside falling toward $1785.

Gold not shining

Data released on Thursday showed the Producer Price Index in the US dropped by 0.5% in July, and the annual rate fell to 9.8%, against expectations of a 0.2% monthly advance. On Wednesday, it was reported the Consumer Price Index was unchanged in July against expectations of a 0.2% gain. The decline in inflation weighed on the US dollar.

Market participants still expect the Federal Reserve to hike by at least 50 basis points at the September meeting. However, US yields are up even amid the probability of an inflation peak in the US. The US 10-year yield is up 1.90% at 2.83%, while the 2-year is at 3.20%, both at the highest level in almost a week.

The increase in US yields limited the upside in gold. XAU/USD’s inability of holding above 1800$, even after the recent US data, rises doubts about the rally. The immediate support is seen at $1785 followed by the weekly opening at $1774. If the yellow metal consolidates above $1800 more gains seem likely.

Technical levels

- USD/CAD extended its losses for the second straight day as sellers eye a break of the 200-DMA.

- July’s US inflation reports show signs of peaking, with CPI at 9% YoY and PPI at 10% YoY, below their previous month’s readings.

- Traders’ focus shifts toward the University of Michigan Consumer Sentiment and Inflation Expectations.

The USD/CAD slides towards the 200-day EMA on Thursday due to a risk-on impulse propelled by additional US inflation data, which completes the puzzle alongside consumer inflation, leaving to the Fed, the decision if US inflation has already peaked or not. Also, the labor market began to show signs of moderation. All those factors weighed on the greenback, which, as portrayed by the US Dollar Index, is down 0.24% at 104.960.

The USD/CAD is trading at 1.2738 under its opening price after hitting a daily high at 1.2792, but as North American traders got to their desks, tumbled the major to its daily low at 1.2727, 13 pips below the 200-day EMA.

USD/CAD falls on US inflation slows, easing Fed's pressure

Investors’ mood is positive, as reflected by EU and US equities trading in the green. A report from the US Labor Department showed that wholesale prices cooled down, with the PPI increasing by 9.8% YoY, lower than foreseen. Moreover, the core PPI, which excluded volatile items, came aligned to estimations of 7.6% YoY, less than June’s 7.9%.

Regarding the labor market, US Initial Jobless Claims for the week ending on August 6 rose 262K, less than 263K expected but jumped for the second-consecutive week.

Given the abovementioned, the USD/CAD dropped as US inflation on both sides of the spectrum slid. Therefore, traders moved towards riskier assets in the FX space, namely the antipodeans and commodity-linked currencies, like the Loonie.

That said, crude oil prices rose for the second consecutive day, underpinning the CAD after hitting a weekly low of $87.25 PB. At the time of writing, Western Texas Intermediate (WTI), the US crude oil benchmark, exchanges hands at $94.48 PB.

Hence, USD/CAD traders should also be aware of a possible break of the 200-DMA, which, once decisively broken, exposes the 1.2700 mark as sellers’ next challenge.

What to watch

On Friday, the US economic calendar will feature the University of Michigan Consumer Sentiment, alongside inflation expectations.

USD/CAD Key Technical Levels

- Fresh US data shows a slowdown in inflation.

- Banxico is expected to hike rates by 75 basis points on Thursday.

- USD/MXN falls for the fourth consecutive day.

The USD/MXN printed a fresh monthly low on Thursday at 19.90. It remains near the bottom, under pressure ahead of Banxico’s decision and amid a weaker US dollar.

Economic data in the US shows inflation slowed down in July. The Consumer Price Index remained unchanged while the Produce Price Index dropped by 0.5% according to data released on Thursday.

The decline in inflation eased expectations about further aggressive tightening from the Federal Reserve. Still, market participants see a 50 basis points rate hike at the next meeting in September.

The US dollar remains under pressure. The greenback tumbled on Wednesday and so far on Thursday is holding onto those losses, unable to recover ground on a sustained basis, even as US yields soar. The US 10-year climbed from 2.75% to 2.84%, the 2-year rose to 3.20% and the 30-year to 3.11%.

Emerging market currencies in general are rising against the US dollar supported also by the improvement in risk sentiment. The Dow Jones is up by 0.47% and the S&P by 0.37%, adding to Wednesday’s strong gains.

The Bank of Mexico will announce its decision in a few hours. The central bank is expected to raise the key rate from 7.75% to 8.50% as inflation shows no signs of a slowdown. The CPI rose in July to 8.15%, the highest annual rate since December 2002, well above Banxico’s 2-4% target. “The swaps market is pricing in 175 bp of further tightening over the next 6 months that would see the policy rate peak near 9.50% but we see some upside risks”, said analysts at Brown Brothers Harriman.

Technical levels

- US July PPI drops unexpectedly in July while jobless claims hit monthly highs.

- The dollar remains in negative territory, even as US yields rise.

- EUR/USD up for the fifth consecutive day, holds under Wednesday’s top.

The EUR/USD failed to break Wednesday’s highs around 1.0355 and pulled back. It is hovering around 1.0325 as the US dollar attempts to recover during the American session as US yield surge.

Other indicator shows a slowdown in US inflation

Data released on Thursday showed the Producer Price Index in the US dropped by 0.5% in July, and the annual rate slid to 9.8%, against expectations of a 0.2% advance. On Wednesday, it was reported the Consumer Price Index was unchanged in July against expectations of a 0.2% gain. On Thursday, a report from US Labor Department informed Initial Jobless Claims rose to 262K in the week ended August 6, the highest level since November. Continuing Claims hit monthly highs.

US yields are rising sharply despite the signs of a slowdown in inflation. Market participants continue to see an increase in the Fed Fund rate at the next meeting by at least 50 basis points. The US 10-year yield stands at 2.84%, the highest in almost a week, while the 30-yield is at the highest level since July 21 at 3.10%. The US Dollar Index is falling for the fourth consecutive day trading around 105.00, after finding support again above 104.60.

The EUR/USD peaked at 1.0363 after the beginning of the American session, slightly below yesterday’s high. It failed to break and retreat. So far it found support at 1.0320. A break lower would expose the next support at 1.0305, followed by the daily low at 1.0274. The technical outlook looks bullish as long as EUR/USD holds above 1.2060/80.

Technical levels

- The GBP/USD drops almost 0.05% amidst a risk-off impulse while the US dollar weakens.

- US prices paid by producers easied, while unemployment claims jumped for the second consecutive week.

- GBP/USD Price Analysis: Retreated from a descending-channel trendline, eyes a break below 1.2200.

GBP/USD edges lower off the weekly highs around 1.2276 near a top-trendline of a descending channel, amidst an upbeat sentiment spurred by a cooler-than-expected US inflation report, now on the side of producers. Further, the US labor market shows signs of ease, weighing on the greenback, underpinned by a hawkish Fed from YTD.

That said, the GBP/USD is trading at 1.2204, down almost 0.05%. Earlier in the day, the pound retraced some of Wednesday’s gains, reaching a daily low at 1.2182, before hitting a daily high at 1.2249. Nevertheless, once the dust settled, cable meanders around current price levels.

The US Department of Labor released another piece of the puzzle regarding inflation. The Producer Price Index (PPI), also known as prices paid by producers, rose by 9.8% YoY, less than the 10.4% estimates and less than June’s reading. In the meantime, the so-called core PPI, which excludes volatile items, followed suit, increasing by 7.6%, unchanged compared to forecasts, but 0.3% less than the previous month.

The data suggests that inflationary pressures on the wholesale side have begun to ease. That would temper the pace of prices paid by consumers in upcoming months. Additionally, the survey added that there are indications that supply-chain conditions are improving.

At the same time, the US Initial Jobless Claims for the week ending on August 6 jumped by 262K less than forecast but rose for the second-consecutive week.

On the UK’s side, the Bank of England (BoE) Chief Economist Huw Pill said that the bank would need to double down on the 2% inflation target on Wednesday. He added that “higher rates in the short term” could also mean some “slowing in the economy.”

Given that the Bank of England has hiked six times since December 2021, Pill added that the effects of measures taken would be felt at the end of 2023.

Earlier in the week, BoE’s Deputy Governor Dave Ramsden backed the BoE’s plan to sell its stock of Gilts, even if an economic slowdown “forces” the bank to cut rates.

Dave Ramsden said that he backs up the need to raise rates further while adding that due to the “extraordinary period where a lot is changing,” he won’t make predictions of where the Bank Rate will end.

What to watch

Friday’s UK calendar is packed, reporting GDP, Industrial Production, and the Balance of Trade. On the US front, the University of Michigan Consumer Sentiment, alongside inflation expectations.

GBP/USD Price Analysis: Technical outlook

The GBP/USD exchange rate is located near a two-month-old top-trendline of a descending channel, briefly broken yesterday. However, the false breakout is a sign of buyers’ weakness, with the spot price tumbling within the boundaries of the previously mentioned channel, opening the door for selling pressure.

To the upside, the GBP/USD crucial ceiling level to break would be 1.2300. Once cleared, it could send the pair towards the 100-day EMA at 1.2432. On the flip side, a breach of 1.2200 would pave the way toward the 20-day EMA at 1.2085.

GBP/USD is capped at key 1.2270 resistance. A break above here could clear the path for substantial gains, economists at Scotiabank report.

GBP/USD on the cusp of a potentially bullish technical break out

“Key resistance at 1.2270 stands in the way of the GBP and a possibly sharp (+4%) squeeze higher, as improbable as this might sound.”

“Cable has developed an inverse head and shoulders reversal through Jun/Jul but the neckline trigger at 70 held yesterday’s test. Progress here is, however, time sensitive and a break higher should happen sooner, rather than later, if it is to happen at all – otherwise 1.2270 becomes a wall, rather than a springboard.”

Economists at Scotiabank do note that technical signals hint at a potentially positive outlook for the EUR/USD. The pair could surge towards 1.05/06 on a break past 1.0380/85.

Techs lean bullish

“EUR/USD renewed buying pressure through early European trade has built a solid, short-term base around 1.0275 (40-day MA and former resistance, now support) for a renewed attack on yesterday’s high just under 1.0370 (May and June lows at 1.0360, therefore resistance).”

“Spot is nearing the top of the bear channel in place since Feb (1.0380/85); a breakout should confer more strength on the EUR and prompt a rise to 1.05/1.06.”

- USD/TRY keeps the side-lined trading below 18.00.

- Türkiye Current Account deficit came at $3.46B in June.

- US Producer Prices contracted 0.5% MoM in July.

USD/TRY reverses two consecutive daily pullbacks and resumes the upside near 17.96 on Thursday.

USD/TRY holds on just below 18.00

Bulls keep pushing harder but there seems to be a huge resistance in the 18.00 neighbourhood so far.

Indeed, while the selling bias around the Turkish lira remained well in place in the past couple of weeks, the contention area around the 18.00 mark has so far held on pretty well.

In the domestic calendar, the Current Account deficit shrank to $3.46B in June (from $6.47B).

In the meantime, investors have started to shift their focus to the upcoming monetary policy meeting by the Turkish central bank (CBRT) on August 18, where consensus remains so far biased towards another “on hold” stance despite inflation ran at the fastest pace since 1998 at nearly 80% YoY in July.

What to look for around TRY

The upside bias in USD/TRY remains unchanged and stays on course to revisit the key 18.00 zone.

In the meantime, the lira’s price action is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent. In addition, there seems to be no Plan B to attract foreign currency in a context where the country’s FX reserves dwindle by the day.

Key events in Türkiye this week: End year CPI Forecast, Industrial Production, Retail Sales (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.92% at 17.9524 and faces the immediate target at 17.9874 (2022 high August 3) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.1903 (weekly low July 15) would pave the way for 16.2471 (100-day SMA) and finally 16.0365 (monthly low June 27).

- USD/JPY turns lower for the second straight day and drops to over a one-week low on Thursday.

- The post-US CPI USD selling bias, sliding US bond yields continue to exert pressure on the pair.

- The risk-on impulse could undermine the safe-haven JPY and help limit the fall, for the time being.

The USD/JPY pair attracts fresh selling near the 133.30 region on Thursday and prolongs the previous day's rejection slide from the 50-day SMA. The intraday descent extends through the early North American session and drags spot prices to a one-week low, around the 131.75-131.70 area in the last hour.

The US dollar remains depressed near its lowest level since late June amid diminishing odds for a more aggressive rate hike by the Fed. Apart from this, a fresh leg down in the US Treasury bond yields narrows the US-Japan rate differential and benefits the Japanese yen, which, in turn, exerts downward pressure on the USD/JPY pair.

That said, the risk-on rally - as depicted by a strong performance across the equity markets - could keep a lid on any further gains for the safe-haven JPY. This, the divergent monetary policy stance adopted by the Fed and the Bank of Japan, should lend some support to the USD/JPY pair and limit the fall, at least for the time being.

From a technical perspective, bulls now look to the 131.50-40 strong horizontal resistance breakpoint to offer some support. This is closely followed by the 100-day SMA, around the 131.20 region, which if broken decisively would be seen as a fresh trigger for bearish traders and prompt aggressive technical selling around the USD/JPY pair.

The downward trajectory could then accelerate towards challenging the monthly swing low, around the 130.40-130.35 region touched on August 2. The next relevant support is pegged near the key 130.00 psychological mark, which should act as a pivotal point for traders and help determine the next leg of a directional move for the USD/JPY pair.

On the flip side, the 132.50-132.55 region now seems to cap any recovery move. Sustained strength beyond might trigger some short-covering and allow the USD/JPY pair to reclaim the 133.00 round-figure mark. Some follow-through buying, leading to a subsequent move above the daily high, around the 133.30 region, would negate the negative bias.

The USD/JPY pair might then climb to the 133.80-133.85 intermediate hurdle en route to the 134.00 mark and the 134.30 resistance zone. The upward trajectory could get extended toward the 135.00 psychological mark, above which bulls could aim to conquer the 50-day SMA strong barrier, currently around the 135.20-135.25 region.

USD/JPY daily chart

-637958224787537095.png)

Key levels to watch

- Gold attracts some dip-buying and climbs to $1,800 neighbourhood amid sustained USD selling.

- Diminishing odds for a larger Fed rate hike, sliding US bond yields continue to weigh on the USD.

- The risk-on impulse seems to be the only factor capping the upside for the safe-haven commodity.

Gold reverses an intraday dip to the $1,784-$1,783 region and climbs to a fresh daily high during the early North American session. Bulls, however, seem struggling to capitalize on the move and push the XAU/USD back above the $1,800 round-figure mark.

The US dollar struggles to attract any buyers and remains well within the striking distance of its lowest level since late June, which, in turn, offers some support to the dollar-denominated gold. The softer-than-expected US consumer inflation figures released on Wednesday forced investors to pare bets for a 75 bps Fed rate hike move at the September policy meeting. This, along with a fresh leg down in the US Treasury bond yields, further undermines the greenback and benefits the non-yielding yellow metal.

That said, the risk-on mood keeps a lid on any further gains for the safe-haven gold, at least for the time being. Signs that inflation might have peaked already continue to fuel speculations for a less aggressive policy tightening by the US central bank. The US Producer Price Index (PPI) released this Thursday reinforces market expectations and further boosts investors' confidence. This is evident from a strong performance around the equity markets, which seems to act as a headwind for the commodity.

Furthermore, the Fed is still expected to hike interest rates by at least 50 bps in September and might further contribute to capping the upside for gold. Hence, it would be prudent to wait for some follow-through buying beyond the $1,808 area - a five-week high touched on Wednesday - before positioning for any further appreciating move. Nevertheless, the intraday bounce favours bullish traders and suggests that any meaningful pullback could still be seen as a buying opportunity.

Technical levels to watch

XAU/USD is keeping the corrective momentum intact, as it remains below the $1,800 mark. In the view of strategists at TD Securities, gold’s price action may be revealing substantial selling interest.

Chinese bid in gold is reversing at a fast clip

“Gold's failure to break north of a key threshold for substantial short covering from CTA trend followers amid a miss in the highly anticipated US inflation data may be pointing to significant selling interest.”

“Strong physical demand may have exacerbated the short covering rally sparked by Chair Powell's FOMC speech, but we see evidence that the Chinese bid in gold continues to unwind.”

“The bar for additional CTA purchases continues to rise – prices now need to break north of $1,830 to catalyze a buying program from trend followers.”

- EUR/USD extends the upside momentum and retests 1.0350.

- Extra gains await on a break above 1.0390.

EUR/USD adds to the weekly rebound and revisits the 1.0350 region on Thursday.

The continuation of the ongoing upside looks favoured in the short term. Immediately to the upside emerges the August high at 1.0368 (August 10), an area coincident with the 55-day SMA.

The breakout of the latter should pave the way for a challenge of the 6-month resistance line around 1.0390. If the pair clears the latter, it could then accelerate the upside to, initially, the 100-day SMA at 1.0530.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0901.

EUR/USD daily chart

- Initial Jobless Claims rose by 14,000 in the week ending August 6.

- US Dollar Index continues to push lower, trades below 105.00.

There were 262,000 initial jobless claims in the week ending August 6, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 248,000 (revised from 260,000) and came in slightly lower than the market expectation of 263,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 252,000, an increase of 4,500 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending July 30 was 1,428,000, an increase of 8,000 from the previous week's revised level," the DOL said.

Market reaction

The dollar stays under constant selling pressure on Thursday and the US Dollar Index was last seen losing 0.26% on the day at 104.92.

- Annual PPI in US fell at a stronger pace than expected in July.

- The dollar stays under bearish pressure with the DXY dropping below 105.00.

The Producer Price Index (PPI) for final demand in the US declined to 9.8% on a yearly basis in July from 11.3% in June, the data published by the US Bureau of Labor Statistics revealed on Thursday. This print came in lower than the market expectation of 10.4%.

The annual Core PPI fell to 7.6% from 8.2%, matching the market expectation. On a monthly basis, the Core PPI fell by 0.5% following June's 1% increase.

Market reaction

The dollar came under renewed selling pressure with the initial reaction and the US Dollar Index was last seen losing 0.4% on the day at 104.82.

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comment on the publication of the Malaysian jobs report.

Key Takeaways

“Malaysia’s labour market continues its steady march towards full recovery with the number of employed persons and unemployment rate improving further. Total number of employed persons rose for the 11th month by 36.3k to 15.94mn in Jun. The non-seasonally adjusted unemployment rate edged lower to 3.8% while the seasonally adjusted rate fell to 3.6%, a shade above the prepandemic unemployment rate of 3.3%.”

“Employment gains recorded in the services sector particularly in food & beverages, wholesale & retail trade, and administrative & support services activities. Agriculture, manufacturing and construction sectors also saw job gains while the mining & quarrying sector recorded further declines in employment. The worker segment that is temporarily not working but had jobs to return to declined further to 87.8k (vs 801.1k in Jun 2021). Workers who are unemployed for more than 12 months also eased to 35.0k or 6.6% of total actively unemployed (vs 62.9k or 9.8% in Jun 2021).”

“According to the Monster Employment Index (MEI), Malaysia’s job market recorded 31% growth in job demand with 5% increase in hiring activities in Jun. Several key industries continue to face labour shortages as reopening activities spur demand. Despite the improvement, the employment outlook waned in 2Q22 amid more cautious consumer and business sentiment. Elevated costs, supply chain disruptions, and rising recession risks could moderate the recruitment drive. We maintain our yearend unemployment rate target of 3.6% (BNM est: average ~4.0%).”

In its monthly report published on Thursday, the Organization of the Petroleum Exporting Countries (OPEC) said that it lowered the 2022 full-year demand growth forecast to 3.1 million barrels per day (bpd) from 3.36 million bpd, as reported by Reuters.

Additional takeaways

"2023 world oil demand to rise by 2.7 million bpd, unchanged from previous forecast."

"2022 global economic growth forecast lowered to 3.1% (prev. 3.5%), 2023 view trimmed to 3.1% with significant downside risks prevailing."

"Refined product markets in the second half of the year is likely to see seasonal support from transport fuels, fuel sales could benefit from moderating product prices."

"OPEC's oil output rose by 162,000 bpd in July to 28.84 million bpd."

Market reaction

Crude oil prices showed no immediate reaction to this publication and the barrel of West Texas Intermediate was last seen rising 1.5% on a daily basis at $92.90.

- DXY revisits the sub-105.00 region once again on Thursday.

- A drop below 104.60 opens the door to extra losses.

DXY remains well on the defensive and puts the 105.00 support under further pressure on Thursday.

If the selling bias picks up extra pace, the dollar risks a deeper pullback to, initially, the August low at 104.63 (August 10), just ahead of the 6-month support line, today near 104.50.

Looking at the broader scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 99.98.

DXY daily chart

- AUD/USD catches fresh bids on Thursday and climbs to a two-month high amid weaker USD.

- Diminishing odds for a larger Fed rate hike in September, the risk-on mood weighs on the USD.

- The technical set-up favours bullish traders and supports prospects for further near-term gains.

The AUD/USD pair attracts some dip-buying on Thursday and steadily climbs to a fresh two-month high during the mid-European session. The pair is currently trading around the 0.7110-0.7115 region, with bulls looking to build on the overnight move beyond the previous monthly high.

The US dollar languishes near its lowest level since late June and offers some support to the AUD/USD pair. Softer US CPI report forced investors to trim their bets for a more aggressive Fed rate hike in September. This, along with a generally positive tone around the equity markets, further undermines the safe-haven buck and benefits the risk-sensitive aussie.

From a technical perspective, spot prices now seem to have found acceptance above the 38.2% Fibonacci retracement level of the April-July downfall. Furthermore, the recent goodish bounce from over a two-year low has been along an ascending channel, which points to a short-term bullish trend and supports prospects for further gains.

The constructive setup is reinforced by the fact that oscillators on the daily chart have been gaining positive traction and are still far from being in the overbought territory. The top boundary of the aforementioned channel, meanwhile, coincides with the very important 200-day SMA and should now act as a key pivotal point.