- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 09-11-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | National Australia Bank's Business Confidence | October | -4 | |

| 01:30 (GMT) | China | PPI y/y | October | -2.1% | -2% |

| 01:30 (GMT) | China | CPI y/y | October | 1.7% | 0.8% |

| 05:00 (GMT) | Japan | Eco Watchers Survey: Current | October | 49.3 | 57.6 |

| 05:00 (GMT) | Japan | Eco Watchers Survey: Outlook | October | 48.3 | 59.2 |

| 07:00 (GMT) | United Kingdom | Average earnings ex bonuses, 3 m/y | September | 0.8% | 1.5% |

| 07:00 (GMT) | United Kingdom | Average Earnings, 3m/y | September | 0% | 1% |

| 07:00 (GMT) | United Kingdom | ILO Unemployment Rate | September | 4.5% | 4.8% |

| 07:00 (GMT) | United Kingdom | Claimant count | October | 28 | |

| 07:45 (GMT) | France | Industrial Production, m/m | September | 1.3% | 0.7% |

| 10:00 (GMT) | Eurozone | ZEW Economic Sentiment | November | 52.3 | |

| 10:00 (GMT) | Germany | ZEW Survey - Economic Sentiment | November | 56.1 | 40 |

| 15:00 (GMT) | U.S. | JOLTs Job Openings | September | 6.493 | 5.59 |

| 19:00 (GMT) | U.S. | FOMC Member Quarles Speaks | |||

| 22:00 (GMT) | U.S. | FOMC Member Brainard Speaks | |||

| 23:30 (GMT) | Australia | Westpac Consumer Confidence | November | 105 |

FXStreet notes that although President Trump is contesting the outcome, Biden is likely to be sworn in as the next President of the United States on January 20. However, we may have to wait until January 5 to know whether he will be supported by a majority in the Senate. If not, his ability to govern will be severely restricted by a Republican Senate, especially when it comes to domestic policy, per Rabobank.

“Biden has been declared the winner of the presidential election. While it remains uncertain until January 5 which party gets control of the Senate, the most likely outcome is that the Republicans hold on to a majority. The Democrats will keep a majority in the House of Representatives, albeit smaller.”

“Under a Biden administration, foreign and trade policy will remain focused on meeting the challenge of China as the main rival of the US. However, Biden is likely to return to a multilateral approach.”

“The fiscal policy plans of the Democrats are likely to be stopped by the Republicans in the Senate. We are looking at two years of gridlock on domestic policy, until the midterm elections of 2022.”

“With limited support from fiscal policy, it is up to monetary policy to prop up the economy. However, this comes at a time when the Fed’s ammunition is almost depleted and fiscal policy would be more effective. The combination of limited fiscal policy and continued need for monetary stimulus is likely to remain a drag on longer-term interest rates.”

- Germany will try to get new start to trade policy with U.S. after Biden's victory

- We are trying to de-escalate existing conflicts with old U.S. administration and will focus on future policy with new administration

- BoE aims to keep borrowing costs at rock-bottom levels for as long as necessary to get economy moving

- Financial markets point to a lengthy period of very low interest rates but things can change

- A credible vaccine announcement would significantly boost public and business confidence

- It is not very unusual for UK debt to be over 100% of GDP in the 19th and the 20th century, servicing costs are now much lower

- Growth, rather than paying down debt has been the most successful way of reducing UK debt-to-GDP ratio

- If tax rises are needed, pollution taxes should be considered

- Says Pfizer vaccine results are extraordinary

“We have made clear at every stage that we want to settle this long-running issue. Regrettably, in spite of our best efforts, due to the lack of progress from the U.S. side, we can confirm that the European Union will later today exercise our rights and impose the countermeasures awarded to us by the WTO in respect of Boeing,” Europe’s trade chief, Valdis Dombrovskis, said on Monday.

The new tariffs will be published Monday afternoon and will come into effect on Tuesday.

Dombrovskis also said the EU will remove the duties if the United States does the same. “We are not escalating anything, we are exercising our rights,” he added.

U.S. stock-index futures climbed on Monday, as investors reacted positively to news that Democrat Joe Biden was informally declared the winner of the U.S. presidential race and the report from Pfizer (PFE) and BioNTech (BNTX) that their COVID-19 vaccine candidate was more than 90% effective for people without evidence of prior infection.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 24,839.84 | +514.61 | +2.12% |

Hang Seng | 26,016.17 | +303.20 | +1.18% |

Shanghai | 3,373.73 | +61.57 | +1.86% |

S&P/ASX | 6,298.80 | +108.60 | +1.75% |

FTSE | 6,239.30 | +329.28 | +5.57% |

CAC | 5,321.95 | +361.07 | +7.28% |

DAX | 13,175.49 | +695.47 | +5.57% |

Crude oil | $40.95 | +10.26% | |

Gold | $1,879.80 | -3.68% |

FXStreet reports that according to economists at Credit Suisse, the S&P 500 Index needs to close above 3550 to see its bullish “triangle” continuation pattern earlier than expected, clearing the way for a move back to the 3588 record high and new highs in due course.

“S&P 500 strength has stalled as expected at the top of its ‘triangle’ range, seen starting at 3523 and stretching up to the 3550 October high, but whilst our bias has been for a fresh swing lower in the range before the bullish ‘triangle’ is established, there is a clear and growing risk we may see an upward resolution sooner than expected, especially with the rising 13 and 63-day moving averages now completing a bullish ‘golden cross’.”

“A close above 3550 remains needed to see the bull ‘triangle’ confirmed for a move back to the 3588 record high, with scope for an overshoot to its ‘typical’ extreme at 3600/02 (15% above the 200-day average), which we would look to cap at first. If the ‘triangle’ story is correct though we would see scope for new record highs in due course and a move towards 3655/57 next and eventually we think 3900.”

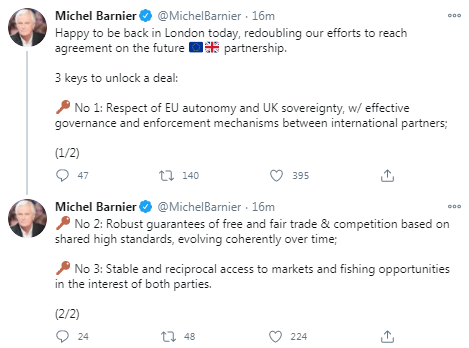

FXStreet notes that the pound has been one of the worst-performing G10 currencies over the past week although it has still advanced by around 1.4% against the US dollar. Broad-based USD weakness has helped to lift cable back above the 1.3000-level but it remains some distance below the high from the start of September at just below 1.3500. The prospect of a trade deal remains a positive potential catalyst for the GBP but doubts remain over the sustainability of any gains given weak UK fundamentals, per MUFG Bank.

“There is still a lack of progress in Brexit trade talks. EU Chief Brexit negotiator Michel Barnier has warned that ‘serious divergences’ remain over fishing and competition rules. It has dampened expectations for a trade agreement early this month... If Joe Biden is confirmed as the new President, it could increase pressure on the UK to finalise a trade with the EU. That prospect is likely helping to dampen downside risks for the GBP.”

“The government has placed England back into a national lockdown until at least the 2nd December although it could be extended beyond. It has already prompted the BoE to forecast a renewed GDP contraction of 2% in Q4 and deeper contraction of -11% for 2020 as a whole. In response, the BoE and government have implemented further ‘co-ordinated’ stimulus. The BoE has significantly expanded QE by GBP150 B and the government has extended the jobs furlough scheme until the end of March. At the current juncture, market participants don’t appear overly concerned by downside risks from monetary financing fears judging by the relative stability of the GBP. The BoE is helping the government to borrow at record low yields.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 09:25 | Eurozone | ECB President Lagarde Speaks | ||||

| 09:30 | Eurozone | Sentix Investor Confidence | November | -8.3 | -10.0 | |

| 10:35 | United Kingdom | BOE Gov Bailey Speaks | ||||

| 12:00 | Eurozone | ECB's Yves Mersch Speaks |

Safe-haven currencies - USD, JPY and CHF - depreciated in the European session on Monday as investors’ risk appetite improved after Democrat Joe Biden was informally declared the winner of the U.S. presidential race. Incumbent U.S. President Donald Trump, however, threatened to challenge the results.

Markets hope that the U.S. trade policy, under a Biden administration, will be less protectionist, boosting global commerce and that the U.S. Federal Reserve's monetary policy will remain easy.

Investor sentiment was also supported by the report from Pfizer (PFE) and BioNTech (BNTX) that their COVID-19 vaccine candidate was more than 90% effective for people without prior evidence of infection.

FXStreet reports that Joe Biden has been declared president-elect after securing crucial swing states in the Midwest. With Biden at the helm, a split Congress scenario constrains fiscal stimulus but also implies a less burdensome regulatory environment. President Biden combined with a gridlocked Congress can provide a constructive backdrop for US risk assets. Overall, economists at HSBC remain overweight global and US equities amid highly supportive global monetary policy, ongoing fiscal measures and favourable prospects for global growth in 2021.

“Joe Biden has been declared president-elect after securing crucial swing states in the Midwest, including Pennsylvania. Meanwhile, the race for the Senate remains uncertain. The Democrats’ failure to win Maine makes it more difficult for the party to wrestle control of the chamber from the Republicans. The final outcome hinges on two run-off votes in Georgia on 5 January.”

“With Biden in the White House, a Democratic-led administration is expected to pursue a new round of fiscal stimulus to support the US economy. The magnitude of such stimulus will depend on the final configuration of Congress. In a scenario of a Republican-controlled Senate, the package is likely to be a significantly watered-down version of the Democrats’ $2.2 trillion proposal that came in late September.”

“A President Biden combined with a ‘gridlocked’ Congress can provide a constructive backdrop for US risk assets. Fiscal stimulus is still likely in 2021 as the US economy continues its recovery. There is diminished risk of the Democrats implementing some of the more business unfriendly aspects of their policy agenda, including a hike in corporation tax and tougher regulations.”

FXStreet notes that the confirmation of victory for Joe Biden in Pennsylvania on Saturday brought his electoral college vote total past the magic 270 level which prompted all the major media outlets in the US to confirm the election process over – and Joe Biden became President-elect. Economists at MUFG Bank look at the three-month S&P 500 performances around election days and highlight the index rose in eight out of the last ten presidential elections.

“Biden is expected to announce his transition’s COVID-19 task force, consistent with his election promise to focus first on tackling the escalating pandemic. Record infection rates are being recorded in the US, with daily levels surpassing 100K for the fourth consecutive day.”

“We expect Joe Biden to focus on a fiscal support package focused on COVID-19 which is likely to prove successful even without a ‘blue-wave’ victory. We also expect the Fed to reinforce its loose monetary stance and there is now a real prospect of the pace of QE being increased. These actions will help keep the US dollar under downward pressure. General risk appetite will reinforce that scenario.”

“The US equity markets tend to perform well in the three-month period following an election, no matter who wins. In 8 out of the last 10 presidential elections, the S&P 500 has advanced in the three-month period following election day. 2000 and 2008 were the only two down years. While 2000 was the election in which the result dragged on it was also the period into the 2001 recession while in 2008 it was during the worst period of the Global Financial Crisis. So the omens for risk are very good which means the prospects for the dollar are not great.”

McDonald's (MCD) reported Q3 FY 2020 earnings of $2.20 per share (versus $2.11 per share in Q3 FY 2019), beating analysts’ consensus estimate of $1.90 per share.

The company’s quarterly revenues amounted to $5.418 bln (-1.5% y/y), roughly in line with analysts’ consensus estimate of $5.365 bln.

The company also declared a 3% increase in its quarterly cash dividend to $1.29 per share.

MCD rose to $229.94 (+6.18%) in pre-market trading.

November 9

Before the Open:

McDonald's (MCD). Consensus EPS $1.90, Consensus Revenues $5365.44 mln

After the Close:

Beyond Meat (BYND). Consensus EPS $0.05, Consensus Revenues $132.24 mln

November 10

After the Close:

Lyft (LYFT). Consensus EPS -$0.90, Consensus Revenues $487.22 mln

November 12

After the Close:

Applied Materials (AMAT). Consensus EPS $1.17, Consensus Revenues $4603.30 mln

Cisco (CSCO). Consensus EPS $0.70, Consensus Revenues $11854.84 mln

Walt Disney (DIS). Consensus EPS -$0.65, Consensus Revenues $14139.91 mln

FXStreet reports that EUR/USD has not only completed a base above 1.1881 but also a large bullish “outside week” and economists at Credit Suisse look for this to act as the catalyst for a resumption of the core bull trend for a move back to the 1.2011 high.

“A strong week for EUR/USD has not only seen bullish ‘reversal day’ established but also a bullish ‘outside week’ and a base above the October high at 1.1881 and with the 13 and 55-day moving averages looking close to also completing a bullish cross, we look for this to mark an end to the consolidation phase from September for a resumption of its core bull trend.”

“We see resistance at 1.1918 initially ahead of 1.1962/66 and then the 1.2011 September high. Whilst this should again be respected, we look for a break in due course for our 1.2145/55 first core upside objective – the ‘neckline’ to the early 2018 top and 78.6% retracement of the 2018/2020 bear trend. Whilst we would expect a fresh phase of consolidation to emerge here, big picture, we continue to look for strength to extend above 1.2500.”

FXStreet notes that the Bank of England (BoE) exceeded expectations by announcing GBP150 B of additional quantitative easing (QE) in November. For now, the GBP remains content with the BoE policy and hopes for the best from Brexit talks, taking its cue from global risk appetite. Looking into next year, the challenges that the UK economy faces should see downside risks for the GBP, economists at HSBC apprise.

“On 5 November, the BoE announced that it had increased its QE purchase programme by GBP150 B. Meanwhile, the central bank kept its benchmark interest rate unchanged at 0.1%. Unsurprisingly, the additional easing reflected the weaker near-term economic outlook as a result of rising COVID-19 infections. The GBP weakened initially, but that did not last long.”

“Looking into 2021, we believe the outlook for economic growth is likely to become a chief differentiator for FX. For the GBP, even if a Brexit trade deal is secured (which is also our central scenario), the UK economy still faces the additional headwind from moving to a new trade regime alongside the challenges of COVID-19 and a faltering cyclical recovery. The UK government’s fiscal firepower to respond also faces the constraint of a high and rising debt level. All this suggests that the outlook for the GBP remains thorny.”

- Oil market still stable despite Libya return, new lockdowns

- New lockdowns won't impact demand to same extent as in April

- We have choices, keeping flexibility

- OPEC+ output deal could be extended if needed to be

FXStreet reports that According to the economists at Credit Suisse, EUR/USD has not only completed a base above 1.1881 but also a large bullish “outside week”.

“A strong week for EUR/USD has not only seen bullish ‘reversal day’ established but also a bullish ‘outside week’ and a base above the October high at 1.1881 and with the 13 and 55-day moving averages looking close to also completing a bullish cross, we look for this to mark an end to the consolidation phase from September for a resumption of its core bull trend.”

“We see resistance at 1.1918 initially ahead of 1.1962/66 and then the 1.2011 September high. Whilst this should again be respected, we look for a break in due course for our 1.2145/55 first core upside objective – the ‘neckline’ to the early 2018 top and 78.6% retracement of the 2018/2020 bear trend. Whilst we would expect a fresh phase of consolidation to emerge here, big picture, we continue to look for strength to extend above 1.2500.”

eFXdata reports that Credit Suisse maintains a long-term bullish bias on Gold.

"Gold extends its consolidation from our $2075 target hit in August and we maintain our core view this is a temporary and corrective pause in the broader uptrend," CS notes.

"Indeed, price action is beginning to increasingly look like a bullish “wedge” continuation pattern, adding weight to our view. Key support stays seen intact at $1837 – the 38.2% retracement of the 2020 rally – and our bias remains for this to continue to hold. Above $1933 would now suggest the “wedge” has been completed for strength back to $2016, then the $2075 high. Big picture, we continue to look for $2300," CS adds.

Reuters reports that Britain said on Monday it was open to a "sensible" compromise on fishing and that there was goodwill on both sides to progress towards a Brexit trade deal as a new round of talks began in London.

"There are still differences, there are still some obstacles to overcome," British Environment Secretary George Eustice told Sky. "But I think there is now some goodwill on both sides to progress things."

After congratulating Joe Biden on his U.S. presidential election win, Prime Minister Boris Johnson said on Sunday an EU trade deal was "there to be done" and that the broad outlines were clear.

EU chief Brexit negotiator Michel Barnier told Reuters he was "very happy to be back in London (for talks) and work continues."

FXStreet reports that according to the Credit Suisse analyst team, GBP/USD is expected to see a clear break above 1.3174/84 for strength back to the “neckline” to the August top at 1.3247 and eventually long-term resistance at 1.3482/1.3514.

“GBP/USD has extended its defence of key price support at 1.2863/46 for the completion of a bullish ‘outside week’ and with the market back above its 13 and 55-day averages we look for a clear break above resistance at 1.3174/84 – the October high and 61.8% retracement of the September/October fall - for a challenge on the ‘neckline’ to the August top, currently at 1.3247.

“Whilst the August top at 1.3247 should again be respected, we remain of the view price action over the past two months stays seen as the potential ‘right-hand shoulder’ to a major basing process and look for a sustained break in due course with resistance seen at 1.3310/19 next, ahead of 1.3403/09 and eventually back at long -term price and ‘neckline’ resistance at 1.3482/1.3514, above which is needed to see a major base secured.”

According to the report from Sentix, the rising number of positive PCR test results is causing politicians to fear an uncontrolled spread of the corona virus. Although the serious consequences of a lockdown on economic development were experienced in March, most governments in Europe are going down the path of renewed contact restrictions. Although these do not have the same negative effect as in March, they do dampen the economic recovery process. Surprisingly, however, the effect on the sentix business cycle index is surprisingly limited at -1.7 points. The reason for this "mild lockdown" is probably the positive dynamics in Asia and the USA.

The corona containment measures taken by governments in Europe are not only a human burden for citizens, but also have a negative impact on the economic recovery process in the euro area. The sentix overall economic index falls by 1.7 points to -10 points in November. The so-called "lockdown light" has so far had little effect on investors' assessment of the situation. The situation index falls only marginally to -32.3 points. Nevertheless, this negative value still means an economy in contraction mode. In our opinion, however, the expectation values are more important. Here we measure a somewhat sharper decline to 15.3 points, the lowest value since May 2020. The fact that the setback was not more severe is probably related to the international situation.

FXStreet reports that Thomas Harr, Ph.D., Global Head of FI&C Research at Danske Bank discusses some of the political and economic consequences of the US election.

“Biden’s win improves the prospects of transatlantic cooperation and re-engagement with multilateral agreements and institutions such as the Paris Agreement, WTO and NATO. However, it is his approach to China which will have the most far-reaching geopolitical and economic consequences. The US and China need a mechanism for dialogue but the US has changed, as well as China under Xi Jinping’s leadership, and I don’t believe the relationship will improve under Biden.”

“A possible prolonged period where Trump refuses to concede defeat would not have much impact on markets, which will refocus on the virus, the prospects of vaccines and the economy. However, Georgia run-offs are crucial for markets.”

“The USD initially strengthened on election uncertainty and a divided government but weakened as Biden emerged as the likely winner with a chance of Senate control. I expect more USD weakness against CNY/CNH as the risk of trade wars has diminished, whereas I believe that EUR/USD will peak below 1.20 and range-trade due to the very weak macro backdrop in the eurozone.”

CNBC reports that Standard Chartered Bank’s Eric Robertsen predicted that Emerging markets could benefit from a political environment that looks set to become “more benign” following the victory of Democratic candidate Joe Biden in the U.S. presidential election.

“There’s quite a bit of cash sitting on the sidelines and that has been hiding in U.S. assets for a few years,” Robertsen, global head of research at Standard Chartered, told.

He explained that over the last 10 years, the S&P 500 stateside has “outperformed emerging market equities by 100%.”

That money could “potentially be deployed” into foreign and emerging markets, representing one of the “key potential pivots” following Biden’s election win over incumbent President Donald Trump, he said.

Asia is set to be the first region to benefit from this shift for two reasons, Robertsen suggested.

Firstly, he said: “Asia’s markets tend to be a little bit lower beta. In other words, a little bit lower volatility than some of (their) peers ... and cousins across other emerging markets.”

Robertsen said the other “incredibly powerful” factor is China, which has been a “strong recovery force” both economically and in terms of financial assets.

Reuters reports that Bank of France said that France's economic activity is 12% lower than normal this month after the country entered a coronavirus lockdown for the second time this year.

The government imposed the new lockdown on Oct. 30 to rein in a surge in new cases although the restrictions were softer than the first time to limit the impact to the euro zone's second-biggest economy.

The Bank of France said economic activity was expected to be reduced by 12% of normal levels as a result, worse than the 4% drop in October but far better than the 31% loss seen in April during one of the strictest lockdowns in Europe.

To make its estimates, the central bank drew on its monthly survey of 8,500 business leaders, which was conducted this time on Oct. 28-Nov.4 with 90% of responses coming after the lockdown started.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 05:00 | Japan | Leading Economic Index | September | 88.5 | 88.6 | 92.9 |

| 05:00 | Japan | Coincident Index | September | 79.4 | 79 | 80.8 |

| 06:45 | Switzerland | Unemployment Rate (non s.a.) | October | 3.2% | 3.3% | 3.2% |

| 07:00 | Germany | Current Account | September | 16.5 | 26.3 | |

| 07:00 | Germany | Trade Balance (non s.a.), bln | September | 11.9 | 20.8 |

During today's Asian trading, the US dollar fell against the euro, but rose against the yen.

Voting in the US presidential election took place on November 3. Most votes have already been counted, but official results will be announced later in November. Based on the available data, the leading American media predicted the victory of the candidate from the Democratic pariah Joe Biden. Biden also considers himself elected President of the United States, and many world leaders congratulated him on his success in the election.

Incumbent President Donald Trump, who tried to be re-elected for a second presidential term, did not recognize Biden's victory and intends to challenge the results of voting in several states in court.

Meanwhile, Chinese exports rose for the fifth consecutive month in October as global demand recovered from the crisis caused by the coronavirus pandemic and quarantine measures. Exports in dollar terms jumped by 11.4% relative to the same month last year to $237.18 billion, according to data from the Customs administration of China. Experts expected an increase of 9.3%.

The ICE index, which tracks the dynamics of the US dollar against six currencies (Euro, Swiss franc, yen, canadian dollar, pound sterling and Swedish Krona), fell by 0.06%.

FXStreet reports that the Goldman Sachs analysts provide probable scenarios on a post-US election fiscal stimulus.

“Neither party has as much to gain from postponing passage since Senate control looks less likely to change than it seemed prior to the election.”

“The upcoming runoff elections in Georgia might make Senate Republicans more eager to reach a deal, as they will want to avoid any perception the Republican majority is an obstacle to fiscal relief.”

“Some fiscal measures are likely to pass in December along with the spending bill, and political trade-offs might make it easiest to just pass the broader bill at that point.”

Reuters reports that an official with the International Energy Agency (IEA) said that renewed lockdown measures in Europe aimed at containing a rise in COVID-19 cases appear set to push the outlook for global oil demand toward the downside.

Keisuke Sadamori, IEA director for energy markets and security, told the impact would, however, likely be less severe than under lockdowns earlier in the year.

"Major parts of the European continent are in lockdown. This would surely work toward the negative side," he said in an interview, but stopped short of saying the group would formally lower its forecast.

"We certainly expect this time for there to be a lower impact than the last lockdown ... This time schools are kept open and some of the stores are still open."

The IEA kept its 2020 and 2021 oil demand forecast steady in its monthly report on Oct. 14, before major European countries including Germany, France and the United Kingdom imposed strict new curbs on movement to check the spread of the virus. The IEA is set to publish its next analysis of the oil market on Thursday.

CNBC reports that Eswar Prasad, a former head of the International Monetary Fund’s China division, said that the U.S. under a Biden administration could cooperate with China on health care and climate change.

President-elect Joe Biden has made the coronavirus outbreak one of his priorities. Biden also called climate change the “number one issue facing humanity” during the campaign.

“Both of these are issues that are very important to the incoming administration and certainly, on these issues at least China has to be seen as something of a partner even if not a close ally,” Prasad told.

He pointed out in the area of health care, China — where Covid-19 was first detected — appears to have done a “reasonably good job” in handling the pandemic and its fallout. In terms of climate change, the U.S. may not be able to achieve much globally without China’s cooperation, he added.

“So these are areas where I think the two countries might see eye-to-eye, which I hope would provide a better basis for negotiation on much more difficult areas, especially economic and trade policies where there are contentious issues almost built in,” said Prasad.

According to the report from the Federal Statistical Office (Destatis), German exports in September 2020 were up 2.3% and imports were down 0.1% on August 2020, adjusted for calendar and seasonal variations. Destatis also reports that, compared with February 2020, the month before restrictions were imposed due to the coronavirus pandemic, exports were down 7.7%, and imports 5.7%, adjusted for calendar and seasonal effects.

Germany exported goods to the value of 109.8 billion euros and imported goods to the value of 89.0 billion euros in September 2020. Compared with September 2019, exports decreased by 3.8%, and imports by 4.3% in September 2020.

The foreign trade balance showed a surplus of 20.8 billion euros in September 2020. In September 2019, the surplus amounted to 21.2 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 17.8 billion euros in September 2020.

The German current account of the balance of payments showed a surplus of 26.3 billion euros in September 2020, which takes into account the balances of trade in goods (+23.2 billion euros), services (-0.8 billion euros), primary income (+7.4 billion euros) and secondary income (-3.4 billion euros). In September 2019, the German current account showed a surplus of 23.5 billion euros.

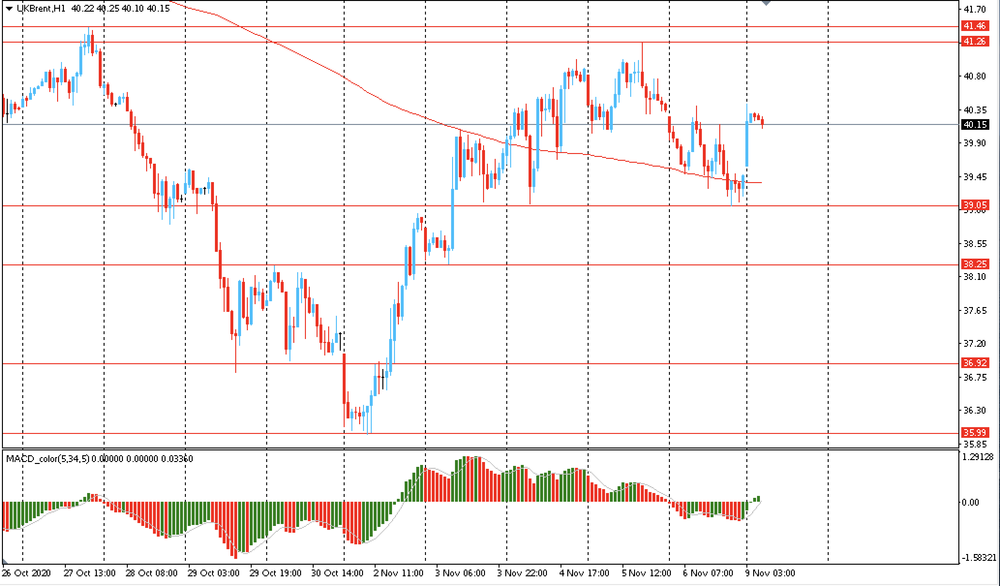

Brent crude traded lower on Friday and closed the day in the red around $39.45. Today oil is slightly higher, rising to $40.40. On the hourly chart, Brent continues to test the strength of the resistance - the moving average line MA (200) H1 ($39.35). On the four-hour chart, oil remains below the MA 200 H4 line. Based on the foregoing, it is probably worth sticking to the south direction in trading and while Brent remains below MA 200 H1, it may be necessary to look for a sell entry point at the end of the correction.

Resistances levels are at: $41.25-45, $42.70, $43.20

Support levels are at: $39.05, $38.25, $36.95

Probably, the main scenario - is a subsequent decline to $39.05 (Nov 6 low). An alternative scenario - may be final consolidation above the MA 200 H1 with a subsequent rise to $42.70 (Oct 23 high).

EUR/USD

Resistance levels (open interest**, contracts)

$1.2016 (1040)

$1.1987 (3128)

$1.1921 (637)

Price at time of writing this review: $1.1888

Support levels (open interest**, contracts):

$1.1749 (1588)

$1.1715 (2606)

$1.1676 (1897)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 4 is 98317 contracts (according to data from November, 6) with the maximum number of contracts with strike price $1,1200 (6241);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3281 (649)

$1.3245 (1295)

$1.3219 (1613)

Price at time of writing this review: $1.3181

Support levels (open interest**, contracts):

$1.3093 (1120)

$1.2982 (566)

$1.2918 (1023)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 22520 contracts, with the maximum number of contracts with strike price $1,3500 (2654);

- Overall open interest on the PUT options with the expiration date December, 4 is 23241 contracts, with the maximum number of contracts with strike price $1,2500 (2604);

- The ratio of PUT/CALL was 1.03 versus 0.82 from the previous trading day according to data from November, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 39.46 | -1.99 |

| Silver | 25.55 | 0.99 |

| Gold | 1951.674 | 0.17 |

| Palladium | 2488.82 | 4.73 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 219.95 | 24325.23 | 0.91 |

| Hang Seng | 17.05 | 25712.97 | 0.07 |

| KOSPI | 2.71 | 2416.5 | 0.11 |

| ASX 200 | 50.6 | 6190.2 | 0.82 |

| FTSE 100 | 3.84 | 5910.02 | 0.07 |

| DAX | -88.07 | 12480.02 | -0.7 |

| CAC 40 | -23.11 | 4960.88 | -0.46 |

| Dow Jones | -66.78 | 28323.4 | -0.24 |

| S&P 500 | -1.01 | 3509.44 | -0.03 |

| NASDAQ Composite | 4.3 | 11895.23 | 0.04 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 (GMT) | Japan | Leading Economic Index | September | 88.4 | 88.6 |

| 05:00 (GMT) | Japan | Coincident Index | September | 79.4 | 79 |

| 06:45 (GMT) | Switzerland | Unemployment Rate (non s.a.) | October | 3.2% | 3.3% |

| 07:00 (GMT) | Germany | Current Account | September | 16.5 | |

| 07:00 (GMT) | Germany | Trade Balance (non s.a.), bln | September | 12.8 | |

| 09:25 (GMT) | Eurozone | ECB President Lagarde Speaks | |||

| 09:30 (GMT) | Eurozone | Sentix Investor Confidence | November | -8.3 | |

| 10:35 (GMT) | United Kingdom | BOE Gov Bailey Speaks | |||

| 12:00 (GMT) | Eurozone | ECB's Yves Mersch Speaks | |||

| 14:00 (GMT) | United Kingdom | MPC Member Andy Haldane Speaks | |||

| 18:30 (GMT) | U.S. | FOMC Member Mester Speaks | |||

| 19:20 (GMT) | U.S. | FOMC Member Harker Speaks | |||

| 23:50 (GMT) | Japan | Current Account, bln | September | 2102.8 | 1994.9 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.72629 | -0.3 |

| EURJPY | 122.734 | 0.26 |

| EURUSD | 1.18791 | 0.43 |

| GBPJPY | 135.96 | -0.1 |

| GBPUSD | 1.31598 | 0.09 |

| NZDUSD | 0.67705 | 0.01 |

| USDCAD | 1.30361 | -0.09 |

| USDCHF | 0.8998 | -0.46 |

| USDJPY | 103.314 | -0.17 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.