- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-11-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | RBA Monetary Policy Statement | |||

| 07:00 (GMT) | Germany | Industrial Production s.a. (MoM) | September | -0.2% | 2.7% |

| 07:45 (GMT) | France | Non-Farm Payrolls | Quarter III | -0.8% | |

| 07:45 (GMT) | France | Trade Balance, bln | September | -7.7 | -6.32 |

| 08:00 (GMT) | Switzerland | Foreign Currency Reserves | October | 873.5 | |

| 08:30 (GMT) | United Kingdom | Halifax house price index | October | 1.6% | 0.5% |

| 08:30 (GMT) | United Kingdom | Halifax house price index 3m Y/Y | October | 7.3% | 8.2% |

| 13:30 (GMT) | U.S. | Average workweek | October | 34.7 | 34.7 |

| 13:30 (GMT) | U.S. | Government Payrolls | October | -216 | |

| 13:30 (GMT) | U.S. | Manufacturing Payrolls | October | 66 | 50 |

| 13:30 (GMT) | U.S. | Average hourly earnings | October | 0.1% | 0.2% |

| 13:30 (GMT) | U.S. | Private Nonfarm Payrolls | October | 877 | 700 |

| 13:30 (GMT) | U.S. | Labor Force Participation Rate | October | 61.4% | |

| 13:30 (GMT) | Canada | Employment | October | 378.2 | 100 |

| 13:30 (GMT) | Canada | Unemployment rate | October | 9% | 8.8% |

| 13:30 (GMT) | U.S. | Nonfarm Payrolls | October | 661 | 600 |

| 13:30 (GMT) | U.S. | Unemployment Rate | October | 7.9% | 7.7% |

| 14:00 (GMT) | Canada | BOC Deputy Governor Lawrence Schembri Speaks | |||

| 14:00 (GMT) | Canada | BOC Gov Tiff Macklem Speaks | |||

| 15:00 (GMT) | U.S. | Wholesale Inventories | September | 0.3% | -0.1% |

| 15:00 (GMT) | Canada | Ivey Purchasing Managers Index | October | 54.3 | 51.5 |

| 18:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | November | 221 | |

| 20:00 (GMT) | U.S. | Consumer Credit | September | -7.22 | 9 |

Bert Colijn, senior economist at ING, suggests that the September decline in Eurozone retail sales brings them back to the level seen before the pandemic, but things are likely to get much worse before they get better, as new lockdown measures will hit the retail sector heavily.

"The September decline in eurozone retail sales was to be expected."

"Retail sales is a volatile indicator and August numbers were inflated by a postponed sales period in several countries. This is confirmed by the country differences as declines in retail sales were the sharpest in France and Belgium -countries that postponed the sales period. The overall eurozone decline was very modest though and still leaves sales 1.1% higher than in February 2020 - the last month before the first wave lockdowns."

"From here on, retail sales are likely to dip further though."

"The new restrictive measures announced will impact retail stores and their sales significantly, especially in November. Countries like France, Ireland and Belgium have closed non-essential retail stores to limit the spread of the virus."

"The consumption outlook for the last quarter of the year has therefore turned negative again and so has the outlook for GDP in general."

FXStreet reports that according to economists at Natixis, it will be important to monitor in the United States the wage policy, with possible repercussions for inflation and interest rates, tax policy and competition policy, with possible repercussions for the attractiveness of US equities, and therefore for share prices and the dollar’s exchange rate, and the fiscal deficit, with the risk of the US’ savings shortfall becoming further entrenched at a time when European and emerging countries will retain their savings instead of lending them to the US. In contrast, it is not clear that one should expect to see major changes to US trade or energy policy.

“If the US moved to a wage policy that entailed the correction of the skewing of its income distribution and an actual increase in low wages, then there would be a return to quite high inflation in the United States, forcing the Federal Reserve to raise its interest rates and driving up expected inflation and long-term interest rates. Even if the Federal Reserve has switched to average inflation targeting, it may accept inflation that is slightly higher than 2% (2.5% or 2.75%) but not much higher than its average inflation target.”

“Large non-resident purchases of US equities are boosting the stock market, especially technology stocks, and helping finance the US external deficit. They are therefore propping up the dollar. A tax reform that sharply hiked taxes on capital in the US and a competition policy that broke up monopoly rents (those enjoyed by the GAFAM tech giants in particular) would deter purchases of US equities and result in a negative effect on stock market indices and the dollar.”

“An increase in the US fiscal deficit would worsen the current account balance. This would create a financing problem for the US... A financing problem for the US would lead to a steepening of the yield curve and to a depreciation of the dollar.”

“In reality, there is no major difference between Republicans and Democrats in the US when it comes to trade policy as there is a consensus to try to rebalance US foreign trade with Europe and China and energy policy, with the determination not to weaken the oil and natural gas industry given its weight in the economy.”

- This time the economic fallout is likely to be less severe than in spring

- It's negligent to rule out inflationary forces in the future

- Explicitly symmetric inflation target would be clearer and easier to understand

- Existing medium-term orientation provides a high degree of flexibility

- Inflation should really include owner-occupied housing costs

- It is important that monitary policy remains expansionary

- Progress has been made on Brexit but divergences remain

U.S. stock-index futures surged on Thursday, as investors digested the 2020 U.S. election results, while awaiting the Fed's policy decision.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 24,105.28 | +410.05 | +1.73% |

Hang Seng | 25,695.92 | +809.78 | +3.25% |

Shanghai | 3,320.13 | +42.69 | +1.30% |

S&P/ASX | 6,139.60 | +77.50 | +1.28% |

FTSE | 5,919.33 | +36.07 | +0.61% |

CAC | 4,972.65 | +49.80 | +1.01% |

DAX | 12,515.32 | +191.10 | +1.55% |

Crude oil | $39.04 | -0.28% | |

Gold | $1,933.00 | +1.94% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 161.5 | 1.34(0.84%) | 3747 |

ALCOA INC. | AA | 13.34 | 0.15(1.14%) | 14453 |

ALTRIA GROUP INC. | MO | 38.53 | 0.45(1.18%) | 12794 |

Amazon.com Inc., NASDAQ | AMZN | 3,324.00 | 82.84(2.56%) | 105911 |

American Express Co | AXP | 97.12 | 0.72(0.75%) | 2250 |

AMERICAN INTERNATIONAL GROUP | AIG | 31.85 | 0.26(0.82%) | 2553 |

Apple Inc. | AAPL | 118.15 | 3.20(2.78%) | 1925177 |

AT&T Inc | T | 27.19 | 0.15(0.55%) | 145460 |

Boeing Co | BA | 153.1 | 1.47(0.97%) | 116950 |

Caterpillar Inc | CAT | 157.2 | 1.97(1.27%) | 40312 |

Chevron Corp | CVX | 72 | 0.23(0.32%) | 8576 |

Cisco Systems Inc | CSCO | 37.2 | 0.63(1.72%) | 117678 |

Citigroup Inc., NYSE | C | 42.3 | 0.22(0.52%) | 91118 |

Deere & Company, NYSE | DE | 234.5 | 1.20(0.51%) | 405 |

E. I. du Pont de Nemours and Co | DD | 58.89 | 0.73(1.26%) | 864 |

Exxon Mobil Corp | XOM | 33.37 | 0.14(0.42%) | 75509 |

Facebook, Inc. | FB | 294.09 | 6.71(2.33%) | 219760 |

FedEx Corporation, NYSE | FDX | 272.5 | 3.40(1.26%) | 9382 |

Ford Motor Co. | F | 7.79 | 0.15(1.96%) | 1108875 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 18.3 | 0.30(1.67%) | 80797 |

General Electric Co | GE | 7.97 | 0.12(1.53%) | 650818 |

General Motors Company, NYSE | GM | 37.29 | 2.05(5.82%) | 1203749 |

Goldman Sachs | GS | 199.23 | 1.36(0.69%) | 6551 |

Google Inc. | GOOG | 1,795.00 | 45.87(2.62%) | 14601 |

Hewlett-Packard Co. | HPQ | 18.6 | 0.32(1.75%) | 2151 |

Home Depot Inc | HD | 286.74 | 4.02(1.42%) | 2909 |

HONEYWELL INTERNATIONAL INC. | HON | 181 | 2.09(1.17%) | 890 |

Intel Corp | INTC | 46.16 | 0.79(1.74%) | 176490 |

International Business Machines Co... | IBM | 113.68 | 1.78(1.59%) | 34390 |

Johnson & Johnson | JNJ | 140.51 | 1.11(0.80%) | 11202 |

JPMorgan Chase and Co | JPM | 100.7 | 0.45(0.45%) | 56285 |

McDonald's Corp | MCD | 217.4 | 2.53(1.18%) | 7208 |

Merck & Co Inc | MRK | 81.7 | 1.08(1.34%) | 4985 |

Microsoft Corp | MSFT | 222.25 | 5.86(2.71%) | 435909 |

Nike | NKE | 129.47 | 2.13(1.67%) | 5099 |

Pfizer Inc | PFE | 37.34 | 0.39(1.06%) | 105129 |

Procter & Gamble Co | PG | 141.9 | 1.26(0.90%) | 3463 |

Starbucks Corporation, NASDAQ | SBUX | 91.05 | 1.26(1.40%) | 8121 |

Tesla Motors, Inc., NASDAQ | TSLA | 429 | 8.02(1.91%) | 655769 |

The Coca-Cola Co | KO | 49.62 | 0.45(0.92%) | 50502 |

Twitter, Inc., NYSE | TWTR | 43.25 | 0.49(1.15%) | 151614 |

UnitedHealth Group Inc | UNH | 356 | 1.44(0.41%) | 3466 |

Verizon Communications Inc | VZ | 57.91 | 0.69(1.21%) | 42204 |

Visa | V | 197.8 | 3.83(1.97%) | 13686 |

Wal-Mart Stores Inc | WMT | 143.2 | 1.24(0.87%) | 20956 |

Walt Disney Co | DIS | 126.71 | 1.64(1.31%) | 13598 |

Yandex N.V., NASDAQ | YNDX | 61.67 | 0.43(0.70%) | 85186 |

The preliminary

data from the U.S. Labour Department showed on Thursday that nonfarm business

sector labor productivity in the United States rose 4.9 percent q-o-q in the third

quarter of 2020, as output surged 43.5 percent q-o-q and hours worked jumped

36.8 percent q-o-q (seasonally adjusted). This was below economists’ forecast

for a 5.6 percent q-o-q advance after a revised 10.6 percent q-o-q surge in the

second quarter (originally a 10.1 percent q-o-q climb).

Meanwhile, unit

labor costs in the nonfarm business sector in the third quarter fell 8.9

percent q-o-q compared to a revised 8.5 percent q-o-q jump in the prior quarter

(originally a 9.0 percent q-o-q gain). This was the biggest decrease in this

measure since the first quarter of 2009. Economists had forecast a 11.5 percent

tumble in third-quarter unit labor costs.

Unit labor

costs quarterly decline reflected a 4.4-percent q-o-q drop in hourly

compensation and a 4.9-percent advance in productivity.

Verizon (VZ) upgraded to Overweight from Neutral at JP Morgan; target raised to $65

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment unexpectedly fell less than expected last week, as the U.S. labor

market is struggling to recover from its biggest shock in history, caused by

the COVID-19 pandemic.

According to

the report, the initial claims for unemployment benefits totaled 751,000 for

the week ended October 31. This was the lowest level since the U.S. went into

coronavirus lockdown in mid-March, but well above pre-pandemic levels.

Economists had

expected 732,000 new claims last week.

Claims for the

prior week were revised upwardly to 758,000 from the initial estimate of 751,000.

Meanwhile, the

four-week moving average of claims dropped to 787,000 from an upwardly revised 791,000

in the previous week.

Continuing

claims declined to 7,823,000 million from an upwardly revised 7,823,000 in the

previous week.

General Motors (GM) reported Q3 FY 2020 earnings of $2.83 per share (versus $1.72 per share in Q3 FY 2019), beating analysts’ consensus estimate of $1.43 per share.

The company’s quarterly revenues amounted to $35.480 bln (0.0% y/y), roughly in line with analysts’ consensus estimate of $35.350 bln.

GM rose to $37.17 (+5.48%) in pre-market trading.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 09:30 | United Kingdom | PMI Construction | October | 56.8 | 55 | 53.1 |

| 10:00 | Eurozone | Retail Sales (YoY) | September | 4.4% | 2.8% | 2.2% |

| 10:00 | Eurozone | Retail Sales (MoM) | September | 4.2% | -1% | -2% |

| 12:30 | United Kingdom | BOE Gov Bailey Speaks |

USD weakened against its major rivals in the European session on Thursday, as investors digested the 2020 U.S. election results, while awaiting the Fed's policy decision.

The U.S. Dollar Index (DXY), measuring the U.S. currency's value relative to a basket of foreign currencies, dropped 0.95% to 92.52.

The results of the U.S. elections suggested that a “blue wave” would not materialize. Before the elections, Wall Street expected that Joe Biden would be a clear winner and the Democrats would turn over the Senate, while keeping control over the House, which would allow them full legislative control. However, the election results signal the prospect of a divided Congress, denting expectations of a massive stimulus bill. As a result, investors reappraised their outlook for the path of the economy and interest rates in the U.S. to reflect expectations of slower growth and more stimulus from the Fed.

Some investors believe that today's Fed policy statement might hint at more stimulus, though major policy changes are not expected.

FXStreet notes that the S&P 500 has gapped sharply higher above price/gap and moving average resistance at 3390/95 to add further weight to the view the index is seeing the construction of a large bull “triangle”, with key resistance seen at 3525/50, per Credit Suisse.

“The strong recovery in the S&P 500 continues with the market gapping higher to clear key flagged resistance test at 3390/95 - the 13 and 63-day averages and the top of the price gap from Wednesday last week – and this adds weight to our broader view we are seeing the formation of a large bullish ‘triangle’ continuation pattern.”

“We look for the strong tone to be maintained for now for a move to 3502 next, then the top of the ‘triangle’, seen starting at 3525 and stretching up to the 3550 October high. Our bias would be for this to then cap again for now for a fresh swing lower in the ‘triangle’. Above 3550 is needed to suggest the ‘triangle’ is already completed for a move back to the 3588 record high.”

FXStreet reports that Lee Sue Ann, economist at UOB Group, reviews the latest labour market data in New Zealand.

“New Zealand’s jobless rate rose to 5.3% in 3Q20 from 4.0% in 2Q20, in line with expectations. This is the highest since late 2016, and the biggest quarterly increase on record. This was in part due to the higher participation rate, which increased to 70.1%, after slumping to a four-year-low of 69.9% in the second quarter, when the lockdown meant people opted against looking for work... Compared to the same period a year ago, employment rose 0.2% y/y, much lower from the revised 1.5% y/y pace in the second quarter, and the weakest growth since mid2013. Meanwhile, private sector wages grew 0.4% q/q in 3Q20, up from 0.2% q/q in 2Q20, as occupations that faced voluntary pay decreases recovered to pre-COVID-19 levels.”

Alibaba (BABA) reported Q2 FY 2021 earnings of RMB17.97 per share (versus RMB13.10 per share in Q2 FY 2020), beating analysts’ consensus estimate of RMB13.75 per share.

The company’s quarterly revenues amounted to RMB155.059 bln (+30.3% y/y), roughly in line with analysts’ consensus estimate of RMB155.001 bln.

BABA fell to $291.59 (-1.39%) in pre-market trading.

FXStreet notes that after a spectacular run since March, the S&P 500 index’s rally has stalled in the last two months ahead of the US presidential election. However, if history is any guide, the index could resume its uptrend once the event risk has passed, according to Standard Chartered.

“Historically, on average, Q4 tends to be positive, and a US election year is no exception.”

“...since 1970, the S&P 500 index has shown a tendency to post positive returns in November-December (median return of 2.8%). This trend is also maintained in a US election year, with a median return of 4.1%.”

“The range since the start of the current quarter is in line with the historical norm in an election year and that the momentum tends to pick up once the election is over.”

Barrick (GOLD) reported Q3 FY 2020 earnings of $0.41 per share (versus $0.15 per share in Q3 FY 2019), beating analysts’ consensus estimate of $0.32 per share.

The company’s quarterly revenues amounted to $3.540 bln (+32.2% y/y), beating analysts’ consensus estimate of $3.443 bln.

The company also declared a dividend for Q3 FY 2020 of $0.09 per share, a 12.5% increase on the previous quarter's dividend.

GOLD rose to $28.10 (+2.48%) in pre-market trading.

FXStreet reports that economist at UOB Group Lee Sue Ann expects the Fed to leave the FFRT unchanged at its meeting later on Thursday.

“In line with the Fed’s adopting of the new strategy of Average Inflation Targeting (AIT) and putting emphasis on “broad and inclusive” employment, the September FOMC has effectively confirmed a shift to a prolonged low rates era.”

“We expect the Fed to keep its near-zero percent policy rate until at least 2023.”

Qualcomm (QCOM) reported Q4 FY 2020 earnings of $1.45 per share (versus $0.78 per share in Q4 FY 2019), beating analysts’ consensus estimate of $1.18 per share.

The company’s quarterly revenues amounted to $6.502 bln (+35.3% y/y), beating analysts’ consensus estimate of $5.936 bln.

The company also issued upside guidance for Q1 FY 2021, projecting EPS of $1.95-2.15 versus analysts’ consensus estimate of $1.68 and revenues of $7.8-8.6 bln versus analysts’ consensus estimate of $7.16 bln.

QCOM rose to $148.00 (+14.76%) in pre-market trading.

FXStreet notes that USD/CNY has fallen to fresh lows around 6.62 after briefly hitting an intraday high on Wednesday of almost 6.7500 when it looked more likely that Donald Trump would deliver another surprise victory and remain President. As Democratic candidate Joe Biden is on the verge of victory, the Chinese yuan should see more gains against the US dollar, per MUFG Bank.

“After winning the key swing states of Michigan and Wisconsin, Joe Biden is now on the brink of victory. He has won 264 Electoral College votes out of the 270 needed to win the presidency, and now only needs to win one additional state. He is currently leading in Nevada and still has a fighting chance of winning in Georgia, North Carolina and Pennsylvania where he is currently behind. In contrast, Donald Trump must win all remaining states to remain president which is an uphill task but not impossible at this stage.”

“The upshot is that Congress is set to remain divided following the election. Hopes for a Blue Wave did not materialize and this has resulted in one of the clearest financial market outcomes as long-term US yields have fallen sharply in response to the paring back of fiscal stimulus expectations. It will now be much harder to push through significant stimulus under a divided Congress although not impossible as we have seen following the covid shock.”

“The prospect of less fiscal support will increase pressure on the Fed to deliver more fiscal stimulus to support the economy... It should help to keep the US dollar under downward pressure in the year ahead although downside risks have eased in comparison to if there had been a Blue Wave which would have helped push down real yields more in the US. We do not expect the Fed to take any immediate policy action tonight given its close proximity to the election, but remain hopeful that more stimulus will be delivered in December.”

“The renminbi and other Asian currencies should also continue to benefit against the US dollar on the back of expectations that US trade policy is likely to become less confrontational under a Biden presidency. It will keep alive hopes that Trump’s tariffs could be reversed in the coming years. A development that should be supportive for emerging market and commodity-related currencies more broadly, but it is partially offset by the reduced likelihood of bigger fiscal stimulus.”

CNBC reports that China’s Vice Foreign Minister Le Yucheng said he hopes the next U.S. administration will take steps to work with the Asian country.

Le said he hoped the election would proceed stably and smoothly.

“The Chinese attitude on China-U.S. relations is clear and consistent,” the report said, citing Le. “Although there are disagreements between China and the U.S., there is vast room for mutual benefit and cooperation. (I) hope the new U.S. administration will meet China halfway.”

That approach would include “upholding a principle of no conflict, no confrontation, mutual respect and win-win cooperation,” Le said, according to the report.

Analysts expect U.S. policy on China will stick to a more stringent tone, regardless of which candidate wins.

FXStreet reports that analysts at UBS continue to expect the AUD/USD pair to trade around 0.71 into the year-end.

“Lower for longer rates among major central banks pose a significant challenge in the global hunt for yield, but we still see a number of opportunities globally in the credit space to generate income.”

“A deterioration in the current account is likely to pose a further challenge, especially following the latest reports that China will ban imports on seven types of Australian commodities due to worsening bilateral relations.”

“Price-supportive fundamentals for iron ore and improving risk sentiment as the global economy recovers, will be positive for the pair going into 2021. We expect the AUD/USD pair to recover to 0.74 by the end of September next year amid broad-based USD weakness.”

Reuters reports that according to the European Commission forecast, the euro zone will rebound in 2021 from its unprecedented coronavirus recession this year, but the recovery will be smaller than previously expected because of the second wave of infections.

European Commission cut the euro zone growth forecast for next year to 4.2% from 6.1% predicted in July and saw 3.0% growth in 2022 after an unprecedented 7.8% recession this year.

The Commission said its forecast assumed COVID-related restrictions would remain, to some degree, until 2022, but that they would be gradually ease next year and that their economic impact would diminish over time.

The Commission expects the euro zone economy will contract 0.1% in the last quarter against the previous three months due to new restrictions to stem the second wave of the pandemic.

Euro zone inflation, which the European Central Bank wants to keep below, but close to 2% over the medium term, is to stay at 0.3% this year, and rise to 1.1% in 2021 and 1.3% in 2022.

Thanks to government short-time work schemes introduced at the start of the pandemic, unemployment in the euro zone is to rise to only 8.3% this year despite the deep recession, from 7.5% in 2019. It is to increase to 9.3% in 2021 and then fall again to 8.9% of the workforce in 2022.

According to the report from Eurostat, in September 2020, the seasonally adjusted volume of retail trade fell by 2.0% in the euro area and by 1.7% in the EU, compared with August 2020. Economists had expected a 1.0% decrease in the euro area. In August 2020, the retail trade volume rose by 4.2% in the euro area and by 3.6% in the EU.

In September 2020 compared with September 2019, the calendar adjusted retail sales index increased by 2.2% in the euro area and by 2.1% in the EU. Economists had expected a 2.8% increase in the euro area.

In the euro area in September 2020, compared with August 2020, the volume of retail trade decreased by 2.6% for non-food products, by 1.4% for food, drinks and tobacco and by 0.2% for automotive fuels. In the EU, the volume of retail trade decreased by 2.1% for non-food products, by 1.1% for food, drinks and tobacco and by 0.5% for automotive fuels.

In the euro area in September 2020, compared with September 2019, the volume of retail trade increased by 2.9% for food, drinks and tobacco and by 2.6% for non-food products, while automotive fuel decreased by 3.8%. In the EU, the retail trade volume increased by 2.9% for non-food products and by 2.4% for food, drinks and tobacco, while automotive fuel decreased by 4.6%.

According to the report from IHS Markit/CIPS, UK construction companies reported a sustained recovery in output volumes during October, but the rate of expansion was the slowest for five months. This was signalled by a fall in the headline seasonally adjusted UK Construction Total Activity Index to 53.1, from 56.8 in September. The index has registered above the 50.0 no-change mark in each month since June.

House building was by far the best-performing area of construction activity in October (index at 62.4) and the speed of recovery eased only slightly since September. Survey respondents often commented on pent up demand and a boost from improving housing market conditions in recent months.

Higher levels of overall construction work also reflected another rise in commercial activity (index at 52.1), although the latest expansion was the weakest for five months. Meanwhile, civil engineering activity (index at 36.4) dropped for the third month running and the rate of decline accelerated to its fastest since May.

October data indicated a robust increase in new work received by construction companies. The latest improvement in new order books was the strongest since December 2015.

Looking ahead, construction companies reported optimism towards their prospects for the next 12 months, despite concerns about the wider economic outlook. Around 45% of the survey panel anticipate a rise in output during the year ahead, while only 14% forecast a reduction.

According to the report from the Society of Motor Manufacturers and Traders (SMMT), the UK new car market declined again in October, with registrations falling by -1.6% year on year. The industry recorded 140,945 new registrations last month, making it the weakest October since 2011 and -10.1% lower than the average recorded over the last decade.

The arrival of new models and ongoing financial incentives helped initially to sustain UK demand in the month, but the introduction of a ‘firebreak’ lockdown in Wales on 23 October contributed to the nation recording -25.5% fewer registrations by the end of the month, which accounted for more than half of the overall UK decline

Subdued activity from businesses drove much of the month’s drop, with around 2,500 fewer vehicles joining larger fleets than in October last year, while private registrations saw a modest increase of 0.4%. However, this performance was flattered by a weak October 2019, when ongoing supply issues arising from regulatory challenges, as well as political and economic uncertainty ahead of the anticipated Halloween Brexit withdrawal date, saw overall registrations by private buyers recede by -13.1% in the month.

As of mid-October, the industry had been expecting to register about 1.66 million new cars in 2020. However, with the announcement of a second lockdown for England, which will include the closure of vehicle showrooms, the market forecast has been downgraded by a further 100,000 units to 1.56 million. This equates to a total year-on-year decline of around 750,000 registrations and a £22.5 billion loss in turnover, with 2020 now likely to be the weakest year since 1982.

According to the report from IHS Markit, at 44.9 in October, the Eurozone Construction Total Activity Index, down from 47.5 in September, signalled an eighth consecutive monthly decline in output. Moreover, the rate of reduction was the quickest since May. The latest survey data indicated that activity declined across all three monitored construction sectors, with the sharpest fall seen in civil engineering, followed by the commercial sector. Furthermore, contractions were seen across the three largest eurozone economies, with France registering the most severe downturn.

Home building among eurozone construction firms was reduced at a quicker pace in October. The sharper decline brought to an end a three-month sequence of broadly similar, marginal contractions, and signalled renewed downward momentum in housing activity. The slight rise in residential construction in Germany, was offset by a marked decline in France and a renewed fall in Italy.

Work undertaken on commercial construction projects continued to contract during the latest survey period. The pace of decline quickened and was the fastest since May.

Meanwhile, civil engineering was the worst performing of the monitored sub-sectors in October, as infrastructure activity continued to decline sharply. The latest data signalled a further extension to the current sequence of contraction, with output falling for 15 successive months.

Employment levels in the eurozone construction sector continued to shrink in the latest survey period. The rate of reduction was the sharpest for five months amid reduced output requirements.

Eurozone construction companies were increasingly pessimistic regarding the year-ahead outlook for activity, as signalled by the Future Activity Index remaining below the neutral 50.0 threshold for the third month running.

FXStreet reports that economists at HSBC remain constructive on the US economic outlook, on further fiscal support and loose monetary conditions but electoral uncertainty may cause some near-term market volatility.

“In most scenarios, further pandemic-related fiscal support remains likely. This provides a constructive backdrop for US risk assets amid the ongoing economic recovery and loose financial conditions, supported by the Fed’s ‘lower-for-even-longer’ monetary policy.”

“We believe fresh government stimulus measures could benefit cyclical parts of the market which have lagged in their performance this year and look relatively attractively valued. Strong US consumer demand may also support other global equity markets, particularly those geared to exports.”

“In the event of a delayed or contested election outcome, risks assets could experience some volatility in the near term. Other key near-term risks to the economic and market outlook also require monitoring, particularly virus-related developments.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | Trade Balance | September | 2.618 | 5.630 | |

| 07:00 | Germany | Factory Orders s.a. (MoM) | September | 4.9% | 2% | 0.5% |

| 07:00 | United Kingdom | BOE Inflation Letter | ||||

| 07:00 | United Kingdom | BoE Interest Rate Decision | 0.1% | 0.1% | 0.1% | |

| 07:00 | United Kingdom | Asset Purchase Facility | 745 | 825 | 875 | |

| 07:00 | United Kingdom | Bank of England Minutes |

During today's Asian trading, the dollar fell against the euro and the yen, while traders continue to monitor the counting of votes in the US presidential election and wait for the results of the meetings of the Federal reserve system.

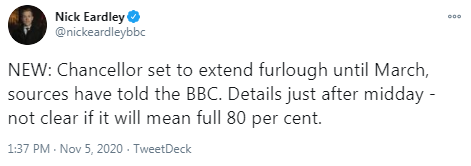

The pound rose on the back of the results of the Bank of England meeting. As expected, the Bank of England kept its benchmark interest rate unchanged at 0.1%. At the same time, the Central Bank increased the volume of the asset repurchase program by 150 billion pounds, to 895 billion pounds. It was expected to increase to 845 billion pounds.

Experts do not expect the Fed to change monetary policy at the end of the two-day meeting ending on Thursday. However, in their opinion, the Fed can take some measures in case of destabilization of financial markets after the US presidential election.

Despite the fact that the Fed usually does not comment on political events, it can decide to support financial markets if the election result is controversial and provokes sharp market fluctuations.

Counting of votes after the presidential election held in the United States on November 3, continues, and according to the latest data, the democratic candidate Joe Biden is ahead of the incumbent President Donald Trump.

The ICE index, which tracks the dynamics of the US dollar against six currencies (Euro, Swiss franc, yen, canadian dollar, pound sterling and Swedish Krona), fell 0.1%

According to the report from SECO, consumer sentiment in Switzerland has largely been stagnating since the summer. All sub-indices used for the calculation are still below their long-term average and none have improved significantly compared to this summer’s survey. Economic development and the situation on the labour market are seen as unfavourable.

As of October, the consumer sentiment index stands at –13 points, almost at the same level as in July (–12 points). The sentiment remains gloomy, coming in well below the long-term average of –5 points.

Expectations regarding general economic development have made little improvement compared to July, with the relevant sub-index standing at –14 points, indicating below-average momentum in the economy. Consumers were noticeably more negative in their rating of economic development in the last twelve months (–94 points) than in the previous survey.

The situation on the labour market is assessed as very unfavourable. The index on expected unemployment (112 points) remains close to the historic level reached during the financial and economic crisis. Job security (–122 points) has also received a worse assessment than in the previous survey for the third time in a row.

CNBC reports that Nobel prize-winning economist Paul Krugman said that the U.S. may need several hundred billion dollars a month in “disaster relief” to keep the economy afloat as a raging coronavirus outbreak continues to suppress prospects for workers and businesses.

“We really are still very much in the disaster relief stage,” he told CNBC.

“A lot of people are going to be out of work, a lot of businesses are going to be stressed. We need to just make life tolerable for them,” he added.

Krugman said it’s difficult to put a total price tag on an ideal relief package for the U.S. But he stressed that a “really, really big” one is needed given that the U.S. hasn’t managed to contain the virus.

“We’re still 11 million jobs down from where we were before this thing hit and all of those people are without wages, state local governments are in extreme financial distress, thousands of businesses — maybe hundreds of thousands — are on the verge of collapse,” he said.

“So we need a lot to keep this thing afloat.”

Senate Majority Leader Mitch McConnell (R-Ky.), who has won his reelection bid for a seventh term, said on Wednesday that the additional relief package will be his priority when the chamber reconvenes next week.

Still, Krugman said there’s no indication that McConnell would agree to a large relief bill or extend enhanced unemployment benefits which have been the “most important policy” to cushion the pandemic’s economic impact.

According to provisional results of the Federal Statistical Office (Destatis), real (price adjusted) new orders increased by a seasonally and calendar adjusted 0.5% in September 2020 compared with August 2020. Economists had expected a 2.0% increase.

Compared with September 2019, the decrease in calendar adjusted new orders amounted to -1.9%. Excluding major orders, real new orders in manufacturing (seasonally and calendar adjusted) were also 4.5% higher than in the previous month.

The corona crisis has affected the development in manufacturing for several months now. Compared with February 2020, the month before restrictions were imposed due to the corona pandemic in Germany, new orders in September 2020 were 2.6% lower in seasonally and calendar adjusted terms.

Domestic orders increased by 2.3% and foreign orders decreased by 0.8% in September 2020 on the previous month. New orders from the euro area went down 6.0%, and new orders from other countries increased by 2.7% compared with August 2020.

In September 2020, the manufacturers of intermediate goods saw new orders increase by 4.0% compared with August 2020. The manufacturers of capital goods saw a decrease of 2.0% on the previous month. Regarding consumer goods, new orders rose 2.6%.

At its meeting ending on 4 November 2020, the Bank of England’s Monetary Policy Committee (MPC) voted unanimously to maintain Bank Rate at 0.1%.

The Committee voted unanimously for the Bank of England to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £20 billion.

The Committee voted unanimously for the Bank of England to continue with the existing programme of £100 billion of UK government bond purchases, financed by the issuance of central bank reserves, and also for the Bank of England to increase the target stock of purchased UK government bonds by an additional £150 billion, financed by the issuance of central bank reserves, to take the total stock of government bond purchases to £875 billion.

There are signs that consumer spending has softened across a range of high-frequency indicators, while investment intentions have remained weak.

The Committee’s latest projections for activity and inflation assume that developments related to Covid will weigh on near-term spending to a greater extent than projected in the August Report, leading to a decline in GDP in 2020 Q4.

Household spending and GDP are expected to pick up in 2021 Q1, as restrictions loosen.

The level of activity in the first quarter is expected to remain materially lower than in 2019 Q4.

UK trade and GDP are also likely to be affected during an initial period of adjustment, over the first half of next year.

Over the remainder of the forecast period, GDP is projected to recover further as the direct impact of Covid on the economy is assumed to wane.

Activity is also supported by the substantial fiscal policies already announced and accommodative monetary policy.

The recovery takes time, however, and the risks around the GDP projection are judged to be skewed to the downside.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1856 (3608)

$1.1813 (4579)

$1.1779 (722)

Price at time of writing this review: $1.1738

Support levels (open interest**, contracts):

$1.1706 (1643)

$1.1679 (1785)

$1.1641 (1184)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 6 is 61287 contracts (according to data from November, 4) with the maximum number of contracts with strike price $1,1800 (4579);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3114 (1975)

$1.3046 (2460)

$1.3002 (809)

Price at time of writing this review: $1.2944

Support levels (open interest**, contracts):

$1.2886 (548)

$1.2843 (1881)

$1.2796 (923)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 32789 contracts, with the maximum number of contracts with strike price $1,3950 (3784);

- Overall open interest on the PUT options with the expiration date November, 6 is 26689 contracts, with the maximum number of contracts with strike price $1,2050 (2391);

- The ratio of PUT/CALL was 0.81 versus 0.81 from the previous trading day according to data from November, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 40.9 | 2.94 |

| Silver | 23.87 | -1.32 |

| Gold | 1903.209 | -0.29 |

| Palladium | 2287.98 | 0.09 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 399.75 | 23695.23 | 1.72 |

| Hang Seng | -53.59 | 24886.14 | -0.21 |

| KOSPI | 14.01 | 2357.32 | 0.6 |

| ASX 200 | -4.3 | 6062.1 | -0.07 |

| FTSE 100 | 96.49 | 5883.26 | 1.67 |

| CAC 40 | 117.24 | 4922.85 | 2.44 |

| Dow Jones | 367.63 | 27847.66 | 1.34 |

| S&P 500 | 74.28 | 3443.44 | 2.2 |

| NASDAQ Composite | 430.21 | 11590.78 | 3.85 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Trade Balance | September | 2.643 | |

| 07:00 (GMT) | Germany | Factory Orders s.a. (MoM) | September | 4.5% | 2% |

| 07:00 (GMT) | United Kingdom | BOE Inflation Letter | |||

| 07:00 (GMT) | United Kingdom | BoE Interest Rate Decision | 0.1% | 0.1% | |

| 07:00 (GMT) | United Kingdom | Asset Purchase Facility | 745 | 825 | |

| 07:00 (GMT) | United Kingdom | Bank of England Minutes | |||

| 09:30 (GMT) | United Kingdom | PMI Construction | October | 56.8 | 55 |

| 10:00 (GMT) | Eurozone | Retail Sales (YoY) | September | 3.7% | 2.8% |

| 10:00 (GMT) | Eurozone | Retail Sales (MoM) | September | 4.4% | -1% |

| 12:30 (GMT) | United Kingdom | BOE Gov Bailey Speaks | |||

| 13:30 (GMT) | U.S. | Continuing Jobless Claims | October | 7756 | 7200 |

| 13:30 (GMT) | U.S. | Unit Labor Costs, q/q | Quarter III | 9% | -11.5% |

| 13:30 (GMT) | U.S. | Nonfarm Productivity, q/q | Quarter III | 10.1% | 5.6% |

| 13:30 (GMT) | U.S. | Initial Jobless Claims | October | 751 | 732 |

| 15:00 (GMT) | Germany | German Buba President Weidmann Speaks | |||

| 15:00 (GMT) | Switzerland | Gov Board Member Maechler Speaks | |||

| 19:00 (GMT) | U.S. | Fed Interest Rate Decision | 0.25% | 0.25% | |

| 19:30 (GMT) | U.S. | Federal Reserve Press Conference | |||

| 21:30 (GMT) | Australia | AIG Services Index | October | 36.2 | |

| 23:30 (GMT) | Japan | Labor Cash Earnings, YoY | September | -1.3% | |

| 23:30 (GMT) | Japan | Household spending Y/Y | September | -6.9% | -10.7% |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71812 | 0.25 |

| EURJPY | 122.518 | 0.04 |

| EURUSD | 1.17243 | 0.05 |

| GBPJPY | 135.761 | -0.55 |

| GBPUSD | 1.29917 | -0.55 |

| NZDUSD | 0.66984 | 0.03 |

| USDCAD | 1.31332 | -0.02 |

| USDCHF | 0.91187 | 0 |

| USDJPY | 104.494 | -0.01 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.