- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-11-2020

On Monday, at 03:00 GMT, China will announce a change in the foreign trade balance for October. At 05:00 GMT, Japan will present an index of leading economic indicators for September. At 06:45 GMT, Switzerland will report a change in the unemployment rate for October. At 07:00 GMT, Germany will announce a change in the foreign trade balance for September. At 09: 25 GMT ECB chief Lagarde will deliver a speech. At 09:30 GMT, the eurozone will release the Sentix investor confidence indicator for November. At 10: 35 GMT Bank of England Governor Bailey will speak. At 23:50 GMT, Japan will announce a change in the current account balance for September.

On Tuesday, at 00:30 GMT, Australia will publish the NAB business confidence index for October. At 01:30 GMT, China will present the consumer price index and the producer price index for October. At 05:00 GMT, in Japan, Eco Watchers Survey for October will be released. At 07:00 GMT, Britain will report changes in the number of applications for unemployment benefits for October, as well as the unemployment rate and average earnings for September. At 07:45 GMT France will announce the change of volume of industrial production for September. At 10:00 GMT, Germany and the Euro zone will present the ZEW Economic Sentiment index for November. At 15:00 GMT, the US will announce changes in the level of vacancies and labor turnover for September. At 23:30 GMT, Australia will release the Westpac consumer confidence index for November.

On Wednesday, at 01:00 GMT in New Zealand, the RBNZ's interest rate decision will be announced, as well as the RBNZ statement and the RBNZ monetary policy report. At 02: 00 GMT, RBNZ will hold a press conference. At 06:00 GMT, Japan will announce a change in the volume of orders for equipment for October, and at 23:50 GMT - a change in the volume of orders for machinery for September.

On Thursday, at 00:00 GMT, Australia will report a change in consumer price inflation expectations for November. At 04:30 GMT, Japan will release the service sector activity index for September. At 07:00 GMT, Britain will report changes in GDP for the 3rd quarter and September, as well as industrial production, manufacturing production, the balance of visible trade for September and total investment for the 3rd quarter. Also at 07:00 GMT, Germany will release the consumer price index for October. At 08: 00 GMT Bank of England Governor Bailey will speak. At 10:00 GMT, the Euro zone will announce changes in industrial production for September. At 13:30 GMT, Canada will present the primary housing price index for October. Also at 13:30 GMT, the US will publish the consumer price index for October and announce a change in the number of initial applications for unemployment benefits for October. At 16:00 GMT in the US, the report of the Ministry of energy on changes in oil reserves will be released. At 16:45 GMT, ECB chief Lagarde, Bank of England Governor Bailey and Fed chief Powell will deliver speeches. At 19:00 GMT, the US will present its monthly budget report for October. At 21:30 GMT New Zealand will release the index of business activity in the manufacturing sector from Business NZ for October.

On Friday, at 07:30 GMT, Switzerland will publish the producer and import price index for October. At 07:45 GMT, France will release the consumer price index for October. At 10:00 GMT, the Euro zone will announce changes in GDP and employment for the 3rd quarter, as well as the foreign trade balance for September. At 15:00 GMT, the US will present the University of Michigan consumer sentiment index for November. At 16: 00 GMT Bank of England Governor Bailey will speak. At 18:00 GMT, in the US, the Baker Hughes report on the number of active oil drilling rigs will be released.

On Sunday, at 23:50 GMT, Japan will announce changes in GDP for the 3rd quarter.

According to ActionForex, analysts at RBC Financial Group note that employment in Canada rose 84k in October, despite a drag from virus containment measures in some industries.

"Employment was still running over 600k below pre-shock February levels in October, and the pace of employment growth is clearly slowing. The 84k increase in employment in October was about a quarter of the average over the prior three months. The re-imposition of Covid-19 containment measures – targeting largely indoor restaurants, bars, and recreational facilities – pushed employment in accommodation & food services down sharply again (-48k)."

"Labour markets are still exceptionally weak. The unemployment rate ticked down to 8.9% in October, but that is still above the peak rate in the 2008/09 recession. Labour force participation has rebounded relatively quickly. The participation rate for 25-54 year-olds actually hit a new record high in October, well-above pre-shock levels. But there were still more than 400k people working less than half their usual hours in October."

"The big question remains how much of the already slowing pace of job growth can be sustained given the resurgence in virus cases. Hours worked also rose 0.8% in October, suggesting that the GDP may have continued to increase in the month, but the risk of more stringent containment measures will remain as long as does the virus risk."

FXStreet notes that Nonfarm Payrolls (NFP) in the US rose by 638,000 in October beating market expectations. The solid report has not really resonated with FX markets much. The exception is USD/JPY as it is the only pair in the G10 that has broken through a key threshold of 104 (which others have respected their range extremes thus far), economists at TD Securities report.

“Payrolls were +638K in October, above the +580K consensus; we had forecast +300K.”

“Much of the strength in recent months has likely been due to CARES Act spending, which is now fading. The ongoing surge in COVID cases also cautions against extrapolating from the strength in today's data.”

“USD/JPY could be a bit more sensitive and potentially, a leader in USD direction. Though we like this pair lower over the medium-term, we think it may have stretched tactically too far. 103.00/20 is a pivot we are watching for key support. 103.80/00 should be key resistance.”

“We are also mindful of USD/CAD which has budged little despite its own jobs beat. We think a lot of good news is in the price and view 1.30 as a key line in the sand.”

“More broadly, as election uncertainty dissipates, we think more focus will be given to rising COVID-19 infections, slowing mobility data and economic growth. With the prospect for large-scale fiscal stimulus unlikely and anytime soon, that could sour risk sentiment and some of the risk-sensitive currencies like CAD.”

- Thinks there will be a peaceful transfer of power

- We abide by the rule of law and so will this President

The Commerce Department announced on Friday the U.S. wholesale inventories rose 0.4 percent m-o-m in September, better than the preliminary estimate of a 0.1 percent m-o-m drop.

Economists had forecast the reading to stay unrevised at -0.1 percent m-o-m.

In August,

wholesale inventories increased 0.5 percent m-o-m.

According to

the report, durable goods inventories edged up 0.1 percent m-o-m in September,

while stocks of nondurable goods climbed 0.7 percent m-o-m.

The Ivey

Business School Purchasing Managers Index (PMI), measuring Canada’s economic

activity, increased to 54.5 in October from 54.3 in September.

Economist had

forecast the indicator to drop to 51.5 in October.

A reading above

50 signals expansion, while a reading below 50 indicates contraction.

Within

sub-indexes, the employment measure rose to 56.1 in October from 53.8 in the

previous month, while the prices index climbed to 63.0 from 60.3, the

inventories indicator increased to 45.5 from 44.1 and the supplier deliveries

gauge jumped to 44.8 from 40.7.

- Unemployment rate in UK is already quite a bit higher than official measure

- Furlough scheme is not stopping adjustment in labour market

- I don't think we will have sudden rush of job losses when furlough scheme ends

- I do worry that COVID will be negative for certain aspects of real estate, challenging to re-purpose

- We are keeping UK bank exposure to commercial real estate sector under close review

U.S. stock-index futures fell on Friday, as investors digested U.S. October jobs data, while looking for clarity around the presidential and congressional election results.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 24,325.23 | +219.95 | +0.91% |

Hang Seng | 25,712.97 | +17.05 | +0.07% |

Shanghai | 3,312.16 | -7.97 | -0.24% |

S&P/ASX | 6,190.20 | +50.60 | +0.82% |

FTSE | 5,921.99 | +15.81 | +0.27% |

CAC | 4,963.81 | -20.18 | -0.40% |

DAX | 12,495.84 | -72.25 | -0.57% |

Crude oil | $38.03 | -1.96% | |

Gold | $1,960.70 | +0.71% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 162.5 | -0.70(-0.43%) | 1880 |

ALCOA INC. | AA | 14.1 | 0.05(0.36%) | 9114 |

ALTRIA GROUP INC. | MO | 37.4 | 0.09(0.24%) | 10165 |

Amazon.com Inc., NASDAQ | AMZN | 3,307.00 | -15.00(-0.45%) | 80096 |

American Express Co | AXP | 98.35 | 0.24(0.24%) | 7699 |

AMERICAN INTERNATIONAL GROUP | AIG | 33.5 | 0.07(0.21%) | 7323 |

Apple Inc. | AAPL | 118 | -0.83(-0.69%) | 2538975 |

AT&T Inc | T | 27.46 | -0.05(-0.18%) | 74200 |

Boeing Co | BA | 157.04 | -0.05(-0.03%) | 149615 |

Caterpillar Inc | CAT | 163.3 | 0.21(0.13%) | 11582 |

Chevron Corp | CVX | 72.27 | 0.13(0.18%) | 11335 |

Cisco Systems Inc | CSCO | 37.1 | -0.13(-0.35%) | 33003 |

Citigroup Inc., NYSE | C | 43.44 | 0.37(0.86%) | 59075 |

Exxon Mobil Corp | XOM | 33.32 | 0.15(0.45%) | 224330 |

Facebook, Inc. | FB | 293.49 | -1.19(-0.40%) | 145318 |

FedEx Corporation, NYSE | FDX | 279 | -0.07(-0.03%) | 6672 |

Ford Motor Co. | F | 8 | 0.01(0.13%) | 409009 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.22 | 0.40(2.13%) | 158320 |

General Motors Company, NYSE | GM | 37.6 | 0.46(1.24%) | 442122 |

Goldman Sachs | GS | 203.65 | 0.69(0.34%) | 6391 |

Google Inc. | GOOG | 1,743.99 | -19.38(-1.10%) | 7962 |

Hewlett-Packard Co. | HPQ | 18.91 | -0.22(-1.15%) | 1298 |

Home Depot Inc | HD | 286.49 | 0.64(0.22%) | 5474 |

HONEYWELL INTERNATIONAL INC. | HON | 183.94 | 0.66(0.36%) | 2233 |

Intel Corp | INTC | 45.5 | -0.18(-0.39%) | 103080 |

International Business Machines Co... | IBM | 114.85 | 0.08(0.07%) | 16829 |

Johnson & Johnson | JNJ | 140.65 | 0.89(0.64%) | 43190 |

JPMorgan Chase and Co | JPM | 105.02 | 0.67(0.64%) | 63613 |

McDonald's Corp | MCD | 216.6 | 0.29(0.13%) | 4338 |

Merck & Co Inc | MRK | 79.87 | -0.59(-0.73%) | 2060 |

Microsoft Corp | MSFT | 221.89 | -1.40(-0.63%) | 220797 |

Nike | NKE | 129.19 | -0.51(-0.39%) | 11174 |

Pfizer Inc | PFE | 36.5 | 0.11(0.30%) | 81599 |

Starbucks Corporation, NASDAQ | SBUX | 90.1 | -0.52(-0.57%) | 8260 |

Tesla Motors, Inc., NASDAQ | TSLA | 434.6 | -3.49(-0.80%) | 459544 |

The Coca-Cola Co | KO | 49.65 | 0.21(0.42%) | 18415 |

Travelers Companies Inc | TRV | 126.5 | -1.01(-0.79%) | 4546 |

Twitter, Inc., NYSE | TWTR | 43.38 | -0.33(-0.76%) | 131087 |

UnitedHealth Group Inc | UNH | 354.88 | 0.48(0.14%) | 2605 |

Verizon Communications Inc | VZ | 58.4 | 0.25(0.43%) | 11365 |

Visa | V | 197.5 | -0.14(-0.07%) | 14402 |

Wal-Mart Stores Inc | WMT | 143.41 | -0.06(-0.04%) | 25073 |

Walt Disney Co | DIS | 126.88 | -0.08(-0.06%) | 21791 |

Yandex N.V., NASDAQ | YNDX | 62.48 | -0.63(-1.00%) | 7750 |

Statistics

Canada reported on Friday that the number of employed people increased by 83,600

m-o-m in October (or +0.5 percent m-o-m) after an unrevised increase of 378,200

m-o-m in the previous month. This was the smallest employment gain since the Canadian

labour market started its recovery in May.

Economists had

forecast an advance of 100,000 m-o-m.

Meanwhile,

Canada's unemployment rate edged down to 8.9 percent in October from 9.0

percent in September, exceeding economists’ forecast for 8.8 percent. That was

the lowest rate since March.

According to

the report, full-time employment rose by 69,100 (or +0.5 percent m-o-m) in October,

while part-time jobs increased by 14,500 (or +0.4 percent m-o-m).

In September,

the number of public sector employees fell by 25,600 (or -0.6 percent m-o-m),

while the number of private sector employees jumped by 76,300 (or +0.6 percent

m-o-m) and the number of self-employed grew by 32,800 (or +1.2 percent m-o-m)

last month.

Sector-wise,

employment increased both in goods-producing (+0.5 percent m-o-m) and

service-producing (+0.5 percent m-o-m) businesses.

The U.S. Labor

Department announced on Friday that nonfarm payrolls rose by 638,000 in October

after an upwardly revised 672,000 advance in the prior month (originally a gain

of 661,000), reflecting he continued resumption of economic activity that had

been curtailed due to the coronavirus pandemic and efforts to contain it. This,

however, was the smallest employment gain since the U.S. job market started to

recover in May.

According to

the report, employment rose notably in leisure and hospitality (+271,000 jobs),

professional and business services (+208,000), retail trade (+104,000), and

construction (+84,000). Meanwhile, employment in government (-268,000) dropped.

The

unemployment rate fell to 6.9 percent in October from 7.9 percent in September.

Economists had

forecast the nonfarm payrolls to increase by 600,000 and the jobless rate to

drop to 7.7 percent.

The labor force

participation rate increased by 0.3 percentage point to 61.7 percent, while

hourly earnings for private-sector workers edged up 0.1 percent m-o-m (or $0.04)

to $29.50, following an unrevised 0.1 percent m-o-m advance in September. Economists

had forecast the average hourly earnings to increase 0.2 percent m-o-m in October.

Over the year, average hourly earnings increased by 4.5 percent in October,

following a revised 4.6 percent rise in September (originally an increase of

4.7 percent).

The average

workweek was unchanged at 34.8 hours in October, exceeding economists' forecast

for 34.7 hours.

- Question on negative rates is whether or not they would be effective

- It's probable that mitigating efforts could be stronger when bank balance sheets are under pressure

- We will be getting answers back from banks on negative rates soon

- There are complex issues involved in negative rates

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:00 | Germany | Industrial Production s.a. (MoM) | September | 0.5% | 2.7% | 1.6% |

| 07:45 | France | Non-Farm Payrolls | Quarter III | -0.8% | 1.8% | |

| 07:45 | France | Trade Balance, bln | September | -7.7 | -6.32 | -5.8 |

| 08:00 | Switzerland | Foreign Currency Reserves | October | 873.531 | 871.486 | |

| 08:30 | United Kingdom | Halifax house price index | October | 1.5% | 0.5% | 0.3% |

| 08:30 | United Kingdom | Halifax house price index 3m Y/Y | October | 7.3% | 8.2% | 7.5% |

EUR rose against its major rivals in the European session on Friday, as the reports about the progress on legislation necessary to roll out the EU rescue package continued to support the single currency.

On Thursday, the European Parliament and the European Commission (EC) reached an agreement on a mechanism that enables the EU to suspend/cut EU funds if a member state breaches the rule of law. This is an important step on the road to releasing a EUR1.8 trillion coronavirus recovery package. Under the new proposal, the EC will get powers to identify breaches of the EU rules and values and to propose a suspension or reduction of budget handouts. The decision on sanctions would require the approval of a qualified majority of EU member states. The new agreement still needs to be approved by a majority of the EU governments before it can be implemented into the bloc’s rules.

However, the further growth of the euro is restricted by growing coronavirus infections in Europe and worries about the economic impact of re-imposed lockdown measures.

Investors digested disappointing data out of Germany, which showed that the country’s industrial output rose by less than forecast in September as a resurgence of the coronavirus began to weigh on a recovery in business activity. According to Destatis, Germany's industrial output grew by 1.6 percent m-o-m in September following a revised 0.5 percent m-o-m rise in August. but slower than economists' forecast of 2.7 percent.

FXStreet reports that strategists at Capital Economics think that energy commodities will claw back a bit of the ground that they have lost relative to industrial metals over the next two years or so, as some cyclical factors linked to COVID-19 which have weighed more heavily on the former unwind. However, certain structural headwinds mean that energy commodities should underperform considerably in the longer-term.

“Notwithstanding the dip in oil prices in recent weeks due to the resurgence of coronavirus in advanced economies, our forecasts assume the virus is eventually brought under control globally. Accordingly, we project that the price of Brent crude will gradually recover from ~$40 per barrel at present to $60 by end-2022."

"We think that the boost to metals prices from China’s strong economic recovery has now mostly run its course, and expect prices to fall back a bit by 2022, as the boost from earlier stimulus fades.”

“Beyond the next two years or so, we expect structural factors to mean that energy commodities resume their underperformance relative to industrial metals. The structural slowdown in oil demand, which is already underway due to the ongoing transition towards green energy, could deepen if greater working from home and less international travel for business purposes become permanent legacies of COVID-19.”

“We do not expect a stellar performance from industrial metals over the next decade or so, and suspect that the returns from them will fall short of those from equities, given the structural slowdown we anticipate in China. But unlike energy commodities, metals such as copper and aluminium stand to benefit from efforts to combat climate change due to their extensive use in green technologies.”

FXStreet notes that USD/JPY has seen a further sharp collapse for a conclusive break of key price support at 104.02/00 and a weekly close below here should reinforce the view that the pair has seen a significant regime shift, exposing support at 101.57/18 – the March spike low and potential trend support, per Credit Suisse.

“USD/JPY has seen a further sharp collapse following its bearish ‘outside day’ for a conclusive break of key price support at 104.02/00. Whilst we would like to see a weekly close below here to confirm, we think this is highly likely to be seen to reinforce the view we have seen a significant break to the downside and regime shift.”

“Weakness has already extended to test 103.43 – the 78.6% retracement of the rally from March – but whilst a rebound from here should still be allowed for our broader outlook remains for a clear break for a test of what we see as more important support at 101.57/18 – the March spike low and potential trend support.”

FXStreet reports that FX Strategists at UOB Group note that USD/JPY remains bearish but a move to 103.00 looks unlikely in the next weeks.

24-hour view: “Yesterday, we highlighted that there is chance for USD to ‘test the solid support at 104.00’. We added, ‘a sustained decline below this level is unlikely’. While we got the direction of the price action right, we did not quite anticipate the reaction upon the break of 104.00 as USD plunged to a low of 103.43 before closing 103.47, its lowest daily closing since March. The sharp and rapid decline appears to be overdone and further sustained weakness appears unlikely.”

Next 1-3 weeks: “We highlighted yesterday (05 Nov, spot at 104.40) that ‘while the volatile price actions have clouded the outlook, shorter-term downward momentum still suggests that 104.00 is at risk’ and we expected ‘any weakness to be part of a lower trading range of 103.70/105.00’. USD subsequently cracked both 104.00 and 103.70 and plunged to a low of 103.47. The surge in downward momentum suggests USD is likely to weaken further even though the next major support at 103.00 may not come into the picture so soon. On the upside, a break of 104.60 would indicate that USD is not ready for 103.00. On a shorter-term note, 104.30 is already a strong level.”

Uber (UBER) reported Q3 FY 2020 loss of $0.68 per share (versus -$0.68 per share in Q3 FY 2019), worse than analysts’ consensus estimate of -$0.60 per share.

The company’s quarterly revenues amounted to $3.129 bln (-20.0% y/y), missing analysts’ consensus estimate of $3.194 bln.

UBER fell to $40.54 (-3.38%) in pre-market trading.

FXStreet notes that gold looks to be completing a bullish “wedge” continuation pattern for the expected resumption of its core bull trend and strategists at Credit Suisse continue to look for new highs in due course and a move to $2300.

“...the break above $1993 suggests we are seeing the completion of a bullish ‘wedge’ continuation pattern for a resumption of the core bull trend, earlier than we were expecting.”

“We thus reiterate our core bullish view and look for a move to $2016 initially, then a retest of the $2075 August high. An eventual move above here stays looked for with resistance seen next at $2175, then $2300.”

FXStreet reports that in opinion of FX Strategists at UOB Group, USD/CNH risks a deeper pullback in the next weeks.

Next 1-3 weeks: “We highlighted yesterday that ‘further USD weakness is likely even though the major support at 6.6030 may not be easy to crack’. However, USD managed to breach 6.6030, albeit not by much (low of 6.6020). While USD is still on the defensive, the weakness appears to be running ahead of itself and the next support at 6.5800 may not come into the picture so soon. On the upside, a break of 6.6900 would indicate that the current downward pressure has eased.”

Bloomberg reports that according to the U.K.’s public spending watchdog, companies face major upheaval at the end of the year due to Brexit even if Britain and the EU sign a free-trade agreement.

“There is likely to be significant disruption at the border,” the National Audit Office said in a report on Britain’s Brexit readiness published Friday. “Many traders and third parties will not be ready for new EU controls.”

The NAO report, which lists multiple areas of risk in the government’s Brexit planning, highlights the looming dangers for commerce between the U.K. and its largest trading partner. From Jan 1., even with a trade deal, businesses will need to file new customs paperwork and comply with new government IT systems to cross the border.

The problems highlighted by the NAO include a failure to expand the number of customs intermediaries to handle post-Brexit paperwork, meaning some companies will have to stop trading with the EU. Household names including Tesla Inc. and Kraft Heinz Co. have been among those that have struggled to source the necessary manpower.

FXStreet reports that Lee Hardman, Currency Analyst at MUFG Bank, notes that Democrat candidate Biden is still on course to become President and that is weighing on the US dollar.

“The final results of the US election have still not been called but market participants are increasingly confident that Joe Biden will become the next President. According to the latest Bloomberg report, he has strengthened his hold on the race. A win for Joe Biden in Pennsylvania which appears increasingly likely would be sufficient for him to become President.”

“In a sign of increasing desperation over the likely outcome of the election, President Trump’s team has been staging a legal fight with mixed results. The developments will heighten concerns as well that he will seek to undermine the incoming administration should he become a lame-duck president.”

Reuters reports that Bank of Japan board member Makoto Sakurai said that effective and quick policy coordination among major economies have helped keep currencies stable despite the shock caused by the coronavirus pandemic.

The yen spiked against the dollar during the global financial crisis in 2008 because the extent of monetary easing by the BOJ was much smaller than the quantitative easing policy deployed by the U.S. Federal Reserve, Sakurai said.

This year, major economies have implemented large-scale stimulus measures as the spread of COVID-19 has brought about a global depression, Sakurai said.

"What is noteworthy about the current response is that policy coordination between governments and central banks in major economies and close cooperation among major central banks ... have been established quickly and are functioning effectively," Sakurai said.

"As a result, despite some temporary swings, exchange rates between the major economies have remained stable," he added.

FXStreet reports that Mitul Kotecha, Senior Emerging Markets Strategist at TD Securities, said that trade-orientated FX such as CNY, KRW, SGD and TWD will likely be the main beneficiaries of Biden Presidency, but high yielders such as IDR also likely to strengthen.

“The prospects of a prolonged period of uncertainty surrounding the outcome of US elections would not usually bode well for EM assets but Asia is already proving highly resilient. It is increasingly looking likely that we see a Biden administration, with a split Congress but it is not a done deal, with litigation and recounts likely to prolong the outcome. Tariffs may not be utilized so bluntly by Biden. This would likely bode well for Asia, given the highly trade-dependent nature of most economies in the region and their close connection with China. Additionally, the US would likely play a bigger role in global trade bodies.”

“A weaker USD will help lift all boats, but we do expect CNH to continue to be one of the leaders. Similarly, trade-orientated FX such as KRW, SGD and to a lesser extent TWD will likely be key beneficiaries.”

Reuters reports that ECB Vice-President Luis de Guindos said that Eurozone growth will likely be negative in the fourth quarter, as countries have imposed new restrictions to the economic activity over the past weeks in a bid to slow the coronavirus contagion.

European Commission downgraded on Thursday its GDP forecast expectations for 2020 and 2021 because of the second wave of infections.

FXStreet reports that Fed meeting did little to impact FX markets, which are currently preoccupied with the US election, economists at TD Securities apprise.

“Fed officials did not announce any new policy action, and changes to the post-meeting statement were minimal, but the chairman once again struck a fairly dovish tone at the press conference.”

“Fed Chairman Powell communicated that officials ‘had a full discussion of the options around quantitative easing,’ adding, ‘we understand the ways in which we can adjust the parameters of it to deliver more accommodation if it turns out to be appropriate.’ We expect the case for more accommodation to build as employment growth, and the economy broadly slows in the months ahead.”

“Powell's focus on COVID-19 and more fiscal stimulus need highlight some of the tactical concern in chasing a weaker USD from current levels.”

According to the report from Halifax, on a monthly basis, house prices in October were 0.3% higher than in September. In the latest quarter (August to October) house prices were 4.0% higher than in the preceding three months (May to July)

House prices in October were 7.5% higher than in the same month a year earlier – the strongest growth since June 2016

Russell Galley, Managing Director, Halifax, said: “The average UK house price now tops a quarter of a million pounds (£250,547) for the first time in history, as annual house price inflation rose to 7.5% in October, its highest rate since mid-2016. Underlying the pace of recent price growth in the market is the 5.3% gain over the past four months, the strongest since 2006. However, month-on-month price growth slowed considerably, down to just 0.3% compared to 1.5% in September.

“Overall we saw a broad continuation of recent trends with the market still predominantly being driven by home-mover demand for larger houses. Since March flat prices are up by 2.0% compared to a 6.0% increase for a typical detached property. In cash terms that equates to a £2,883 increase for flats compared to a £27,371 rise for detached houses. This level of price inflation is underpinned by unusually high levels of demand, with latest industry figures showing home-buyer mortgage approvals at their highest level since 2007“.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | RBA Monetary Policy Statement | ||||

| 07:00 | Germany | Industrial Production s.a. (MoM) | September | 0.5% | 2.7% | 1.6% |

| 07:45 | France | Non-Farm Payrolls | Quarter III | -0.8% | 1.8% | |

| 07:45 | France | Trade Balance, bln | September | -7.7 | -6.32 | -5.8 |

| 08:00 | Switzerland | Foreign Currency Reserves | October | 873.531 | 871.486 |

During today's Asian trading, the US dollar rose against most of the world's major currencies.

Traders are assessing the results of the Fed meeting and waiting for the final results of the us presidential election. According to the latest data, democratic candidate Joe Biden is ahead of Trump, gaining 264 electoral College votes out of the necessary 270 with 214 votes for Trump.

The ICE index, which tracks the dynamics of the US dollar against six currencies (Euro, Swiss franc, yen, canadian dollar, pound sterling and Swedish Krona), rose by 0.05%.

Recall that the Fed kept the interest rate in the range from 0% to 0.25% per annum at the end of the meeting on November 4-5, as expected. The US Central Bank confirmed that it is ready to use all the tools at its disposal to support the US economy.

Federal reserve chief Jerome Powell said the outlook for the US economy remains "extremely uncertain" in the face of the coronavirus pandemic, and noted a slight slowdown in the pace of economic recovery in recent months. Several times during the speech, Powell called on Congress to pass a new stimulus package.

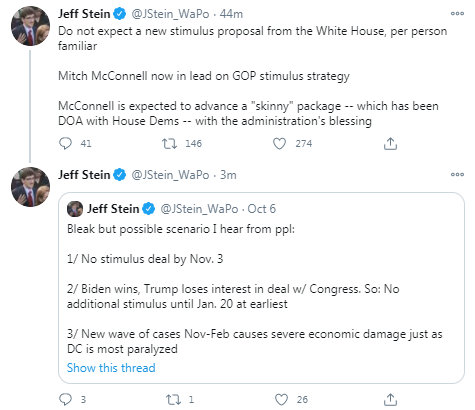

Meanwhile, the likelihood of a major stimulus package in the United States is fading, as hopes that Democrats will gain control of both houses of Congress do not materialize. Republicans are likely to retain control of the Senate, while Democrats will retain control of the House of representatives. Thus, regardless of who becomes President, it will be difficult for him to adopt a new package of incentive measures.

According to the report from the INSEE, between the end of June and the end of September 2020, private payroll employment increased by 1.8%, or 344,400 net job creations; it rebounded after 491,600 net job losses in the first quarter and 158,400 net job losses in the second quarter. Private payroll employment remains below the level it reached a year ago, by 1.1%, or -214,000 jobs. It returns to a level comparable to that at the end of September 2018.

In the so-called "non-agricultural market" field (industry, construction and market services), payroll employment has been measured in quarterly time series since the end of 1970. In the third quarter of 2020, it increased by 1.9% in this field. This is the strongest quarterly increase since the series began, after the successive decreases of the first quarter (-2.8%) and the second quarter (-0.8%), whose accumulation was also unprecedented.

Temporary employment continues to recover strongly in the third quarter of 2020: +23.5% (+135,900 jobs) after +22.9% (+107,800 jobs) in the previous quarter. It fall to an historic low in the first quarter (-40.4%, or -318,100 jobs) and remains below the level it reached a year ago (-9.7%, that is -76,900 jobs) close to its level at the beginning of 2017.

Excluding temporary work, private payroll employment increased by 1.1% (+208,500 jobs).

CNBC reports that Mark Zandi, chief economist of Moody’s Analytics, said that the U.S. economy, which has shown signs of recovering, could see its prospects turn given the intensifying spread of Covid-19 in the country and a lack of additional support measures.

“I think the risks are pretty high here that the economy backtracks,” he told CNBC.

“We are suffering a very significant reintensification of the virus. I mean 40,000 daily confirmed infections four, six, eight weeks ago and we’re now close to 100,000 — that’s going to start doing some damage,” he said.

The surge in cases could see the U.S. follow in the footsteps of Europe, where the outbreak trajectory is about four to six weeks ahead of the U.S., Zandi suggested. He pointed out that Europe has had to reimpose social-distancing measures to contain a resurgence in the coronavirus, which would cause economic damage.

The lack of economic support from the U.S. government is worsening the outlook, the economist said.

According to the report from the Federal Statistical Office (Destatis), in September 2020, production in industry was up by 1.6% on the previous month on a price, seasonally and calendar adjusted basis. Economists had expected a 2.7% increase.

Compared with September 2019, the decrease in calendar adjusted production in industry amounted to 7.3%.

The corona crisis has affected the development in manufacturing for several months now. Compared with February 2020, the month before restrictions were imposed due to the corona pandemic in Germany, production in September 2020 were 8.4 % lower in seasonally and calendar adjusted terms.

In September 2020, production in industry excluding energy and construction was up by 2.0%. Within industry, the production of intermediate goods showed an increase by 1.4%. The production of consumer goods increased by 3.0% and the production of capital goods by 2.2%. Outside industry, energy production was down by 2.5% in September 2020 and the production in construction increased by 1.5%.

Production in the automotive industry - the largest branch of manufacturing - rise by 10.0% on the previous month in September, following a decrease of 10.3% in August. This means that it was by just under 15% below the level of February 2020.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1906 (1239)

$1.1871 (3623)

$1.1854 (4299)

Price at time of writing this review: $1.1828

Support levels (open interest**, contracts):

$1.1794 (1035)

$1.1748 (1689)

$1.1699 (1945)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 6 is 60933 contracts (according to data from November, 5) with the maximum number of contracts with strike price $1,1800 (4299);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3213 (1968)

$1.3181 (1623)

$1.3148 (2459)

Price at time of writing this review: $1.3120

Support levels (open interest**, contracts):

$1.3085 (276)

$1.3045 (259)

$1.2999 (945)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 32603 contracts, with the maximum number of contracts with strike price $1,3950 (3784);

- Overall open interest on the PUT options with the expiration date November, 6 is 26795 contracts, with the maximum number of contracts with strike price $1,2050 (2391);

- The ratio of PUT/CALL was 0.82 versus 0.81 from the previous trading day according to data from November, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 40.34 | -1.18 |

| Silver | 25.33 | 6.12 |

| Gold | 1948.932 | 2.4 |

| Palladium | 2378.89 | 3.99 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 410.05 | 24105.28 | 1.73 |

| Hang Seng | 809.78 | 25695.92 | 3.25 |

| KOSPI | 56.47 | 2413.79 | 2.4 |

| ASX 200 | 77.5 | 6139.6 | 1.28 |

| FTSE 100 | 22.92 | 5906.18 | 0.39 |

| CAC 40 | 61.14 | 4983.99 | 1.24 |

| Dow Jones | 542.52 | 28390.18 | 1.95 |

| S&P 500 | 67.01 | 3510.45 | 1.95 |

| NASDAQ Composite | 300.15 | 11890.93 | 2.59 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | RBA Monetary Policy Statement | |||

| 07:00 (GMT) | Germany | Industrial Production s.a. (MoM) | September | -0.2% | 2.7% |

| 07:45 (GMT) | France | Non-Farm Payrolls | Quarter III | -0.8% | |

| 07:45 (GMT) | France | Trade Balance, bln | September | -7.7 | -6.32 |

| 08:00 (GMT) | Switzerland | Foreign Currency Reserves | October | 873.5 | |

| 08:30 (GMT) | United Kingdom | Halifax house price index | October | 1.6% | 0.5% |

| 08:30 (GMT) | United Kingdom | Halifax house price index 3m Y/Y | October | 7.3% | 8.2% |

| 13:30 (GMT) | U.S. | Average workweek | October | 34.7 | 34.7 |

| 13:30 (GMT) | U.S. | Government Payrolls | October | -216 | |

| 13:30 (GMT) | U.S. | Manufacturing Payrolls | October | 66 | 50 |

| 13:30 (GMT) | U.S. | Average hourly earnings | October | 0.1% | 0.2% |

| 13:30 (GMT) | U.S. | Private Nonfarm Payrolls | October | 877 | 700 |

| 13:30 (GMT) | U.S. | Labor Force Participation Rate | October | 61.4% | |

| 13:30 (GMT) | Canada | Employment | October | 378.2 | 100 |

| 13:30 (GMT) | Canada | Unemployment rate | October | 9% | 8.8% |

| 13:30 (GMT) | U.S. | Nonfarm Payrolls | October | 661 | 600 |

| 13:30 (GMT) | U.S. | Unemployment Rate | October | 7.9% | 7.7% |

| 14:00 (GMT) | Canada | BOC Deputy Governor Lawrence Schembri Speaks | |||

| 14:00 (GMT) | Canada | BOC Gov Tiff Macklem Speaks | |||

| 15:00 (GMT) | U.S. | Wholesale Inventories | September | 0.3% | -0.1% |

| 15:00 (GMT) | Canada | Ivey Purchasing Managers Index | October | 54.3 | 51.5 |

| 18:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | November | 221 | |

| 20:00 (GMT) | U.S. | Consumer Credit | September | -7.22 | 9 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.72851 | 1.46 |

| EURJPY | 122.454 | -0.04 |

| EURUSD | 1.18291 | 0.9 |

| GBPJPY | 136.126 | 0.28 |

| GBPUSD | 1.31496 | 1.23 |

| NZDUSD | 0.67708 | 1.1 |

| USDCAD | 1.30507 | -0.61 |

| USDCHF | 0.90393 | -0.83 |

| USDJPY | 103.512 | -0.94 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.