- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 10-12-2012

The dollar weakened against most its major counterparts amid better-than-forecast factory data from China and bets the U.S. central bank will add to monetary stimulus.

The U.S. currency fell versus the euro and the yen before the Federal Reserve starts a policy meeting tomorrow amid forecasts it will expand bond-buying plans.

The U.S. Federal Open Market Committee meets for the last time this year on Dec. 11-12. It will consider whether to expand purchases of assets after its so-called Operation Twist program of swapping $45 billion a month in short-term Treasuries for long-term debt expires this month.

Japan’s currency touched the highest in almost two weeks versus the euro after Italy’s Prime Minister Mario Monti said he intends to resign. Mexico’s peso advanced after a report showed exports increased 13 percent from a year earlier.

Italy’s Monti will attempt to convince his coalition, which includes his predecessor Silvio Berlusconi’s People of Liberty Party, to vote to pass budget legislation before handing in his “irrevocable resignation,” national President Giorgio Napolitano’s office said Dec. 8.

Canada’s dollar strengthened after the government approved Cnooc Ltd.’s $15.1 billion purchase of energy company Nexen Inc. and signed off on Malaysian Petroliam Nasional Bhd.’s purchase of Progress Energy Resources Corp. on Dec. 7.

European stocks closed little changed at an 18-month high as China’s industrial output and retail sales exceeded forecasts, offsetting concern a leadership change in Italy will disrupt efforts to reduce debt.

In China, industrial output and retail sales exceeded forecasts last month in signs the economic recovery is accelerating. Factory production climbed 10.1 percent in November from a year earlier, the National Bureau of Statistics said yesterday, compared with the 9.8 percent median estimate of analysts. Retail sales growth accelerated to 14.9 percent.

National benchmark indexes gained in 10 of the 18 western European markets. Germany’s DAX and France’s CAC 40 added 0.2 percent, while the U.K.’s FTSE 100 rose 0.1 percent.

The FTSE MIB slid 2.2 percent as Monti said he will quit after losing support in Parliament. Silvio Berlusconi, his predecessor, announced a return to politics and criticized Monti for running a “German-centric” program. Monti will try to corral his coalition for a vote to pass the budget before handing in his resignation, President Giorgio Napolitano’s office said on Dec. 8.

UniCredit declined 5.2 percent to 3.46 euros, the biggest drop in four months, as a gauge of banks in the Stoxx 600 slid 0.9 percent.

Fiat SpA, Italy’s largest carmaker lost 3.5 percent to 3.49 euros, snapping four days of gains. Finmeccanica SpA, the Italian defense contractor, retreated 2.2 percent to 4 euros.

STMicroelectronics gained 4.2 percent to 5.21 euros in Milan. The European chipmaker struggling with weakening demand and competition from Asia will sell its stake in the ST-Ericsson joint venture by the third quarter of next year as part of a new strategy to make the company more profitable.

Oriflame Cosmetics SA, which sells beauty products through 3 million consultants worldwide, rose 4.2 percent to 196.50 kronor as Danske Bank A/S said it may report profit that will beat analyst estimates.

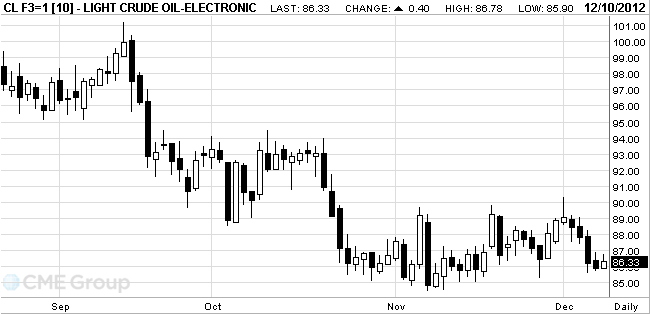

Oil rose for the first time in five days as China’s net crude imports climbed to a six-month high in November and German exports unexpectedly increased.

Prices advanced from a three-week low as China bought the equivalent of 5.68 million barrels a day more than it exported, the most since May. German exports gained in October on goods shipments to countries outside Europe. OPEC will probably leave its production quota unchanged when it meets Dec. 12.

China, the world’s second-largest oil consuming country after the U.S., bought 23.25 million metric tons of crude more than it exported last month, according to figures released on the website of the Beijing-based General Administration of Customs today. The equivalent of 5.68 million barrels a day, that’s up 3 percent from a year earlier, data show.

Exports from Germany, the biggest oil consumer in the European Union, increased 0.3 percent from September adjusted for work days and seasonal changes, the Federal Statistics Office in Wiesbaden said today. Economists forecast a 0.3 percent decline, according to the median estimates.

The Organization of Petroleum Exporting Countries will probably maintain its production quota at 30 million barrels a day of oil, according to analysts.

Crude for January delivery rose to $86.78 a barrel on the New York Mercantile Exchange.

Brent for January settlement climbed 96 cents, or 0.9 percent, to $107.98 a barrel on the London-based ICE Futures Europe exchange.

Gold is going up because the market expects to maintain soft policy of the Federal Reserve after the meeting this week.

From the beginning, gold prices rose by 9 percent, mainly due to the Fed's stimulus measures. Investors assume that at the meeting on Tuesday and Wednesday, the central bank will announce a new program to purchase government bonds to $ 45 billion per month in return completes the "Operation Twist".

Stocks of gold-ETFs on Friday rose to a record 76.129 million ounces despite the fact that gold prices have stopped growing in recent weeks.

China reported conflicting macroeconomic indicators: industrial production and retail sales rose in November, consumer price inflation has risen from a low of 33 months. However, the growth of Chinese exports in November was much weaker than expected, while imports remained unchanged as compared to last year.

February futures price of gold on COMEX today rose to 1718.80 dollars per ounce.

U.S. stock futures fluctuated on concern a leadership change in Italy will disrupt efforts to curb debt and amid American budget talks.

Global Stocks:

Nikkei 9,533.75 +6.36 +0.07%

Hang Seng 22,276.72 +85.55 +0.39%

Shanghai Composite 2,083.77 +21.98 +1.07%

FTSE 5,911.09 -3.31 -0.06%

CAC 3,602.93 -2.68 -0.07%

DAX 7,508.92 -8.88 -0.12%

Crude oil $86.54 +0.71%

Gold $1716.50 +0.64%

Apple’ target was lowered to $800 from $900 at Jefferies

EUR/USD $1.2800, $1.2885, $1.2900, $1.3000

USD/JPY Y82.20, Y82.70, Y83.00

EUR/JPY Y105.95, Y106.75, Y108.25

GBP/USD $1.6000

USD/SEK Sek6.6260

AUD/USD $1.0435, $1.0450, $1.0465, $1.0525

USD/CAD C$0.9920Data

00:30 Australia Home Loans October 1.1% +3.1% +0.1%

02:00 China Trade Balance, bln November 32.0 26.7 19.6

05:00 Japan Consumer Confidence November 39.7 40.3 39.4

06:00 Japan Eco Watchers Survey: Current November 39.0 39.7 40.0

06:00 Japan Eco Watchers Survey: Outlook November 41.7 41.9

07:00 Germany Trade Balance October 16.9 15.9 15.2

07:45 France Industrial Production, m/m October -2.7% +0.4% -0.7%

07:45 France Industrial Production, y/y October -2.5% -2.3% -2.4%

09:30 Eurozone Sentix Investor Confidence December -18.8 -16.2 -16.8

The euro fell back to two-week low against the dollar, as the Italian prime minister, said he intends to retire, which struck the same renewed speculation that a change in government can destroy all the efforts to resolve the debt crisis. Italian Prime Minister Mario Monti will try to convince his coalition, which includes people of his predecessor, Silvio Berlusconi, to vote for the adoption of the budget law, before he retires.

Note that the popularity of Monty has been undermined after his tax increases to push Italy into an even greater recession. We also recall that on December 8 Berlusconi announced that he would participate in the election of the Prime Minister in the next year. At the same time, he expressed his dissatisfaction with the launch of the German-based program that promotes Monti.

The single currency shows a three-day decline against the yen ahead of the meeting of leaders of the European Union, to be held this week, and the purpose of which is to discuss measures to end the crisis, including increased powers to intervene in the national budgets and creating a single supervisor.

The yen strengthened against all 16 major currencies as investors sought safer assets.

The Australian dollar weakened against the yen after China reported a lower-than-expected trade surplus.

EUR / USD: during the European session, the pair fell to a new low of $ 1.2885, but then recovered and is now trading at $ 1.2917

GBP / USD: during the European session the pair fell to the low of $ 1.6013, and then rose to $ 1.6061

USD / JPY: during the European session the pair fell to Y82.10, but then rose to Y82.29

At 13:15 GMT, Canada will present a report on the number of new foundations of bookmarks for November. At 17:15 GMT BOE King make a speech. At 19:30 GMT New Zealand publish house price index from REINZ for November. At 19:30 GMT New Zealand said the change of volume of home sales from REINZ for November.

EUR/USD

Offers $1.2990/95, $1.2970/80, $1.2950/55, $1.2920

Bids $1.2865, $1.2850, $1.2835/25, $1.2810/00

GBP/USD

Offers $1.6120, $1.6100, $1.6075/85, $1.6060/65, $1.6050

Bids $1.6000, $1.5980, $1.5965/55, $1.5940-20

AUD/USD

Offers $1.0550, $1.0525, $1.0520, $1.0500

Bids $1.0465/60, $1.0450, $1.0440, $1.0425/20, $1.0410/00

EUR/JPY

Offers Y107.20, Y106.95/00, Y106.40/45

Bids Y105.80, Y105.50, Y105.00

USD/JPY

Offers Y83.30, Y83.00, Y82.40/50

Ордера на покупку Y82.00, Y81.80, Y81.60

EUR/GBP

Offers stg0.8120/25, stg0.8100, stg0.8070/75

Bids stg0.8030, stg0.8020, stg0.8005/00, stg0.7970/60

Decline began trading the major European stock indexes. The reason - the instability in the Eurozone. As might have been expected - investors reacted negatively to the statement, the Prime Minister of Italy, Mario Monti's intention to resign after parliamentary approval of the budget of the country in 2013.

In turn, the ex-Prime Minister Silvio Berlusconi has declared his intention to continue his political career.

The data for the indicator of investor confidence in France from Sentix for December came slightly below analysts' forecasts, the figure was -16.8 -16.2 at the forecast. Also recorded decline in industrial production y / y in October to -2.4%, forecast -2.3%, and m / m -0.7% vs. +0.4%.

FTSE 100 5,894.01 -20.39 -0.34%

CAC 40 3,577.59 -28.02 -0.78%

DAX 7,465.49 -52.31 -0.70%

STMicroelectronics stock prices have risen by 7.3%. Europe's largest manufacturer of electronic components announced plans for the third quarter of 2013 to sell its stake in the joint venture with the Swedish Ericsson - ST-Ericsson.

EUR/USD $1.2800, $1.2885, $1.2900, $1.3000

USD/JPY Y82.20, Y82.70, Y83.00

EUR/JPY Y105.95, Y106.75, Y108.25

GBP/USD $1.6000

USD/SEK Sek6.6260

AUD/USD $1.0435, $1.0450, $1.0465, $1.0525

USD/CAD C$0.9920

Asian stocks gained, with a regional gauge excluding Japan heading for its highest close in more than a year after U.S. jobs data topped estimates and China’s factory output and retail sales signaled a quickening economic recovery.

Nikkei 225 9,533.75 +6.36 +0.07%

S&P/ASX 200 4,557.95 +6.19 +0.14%

Shanghai Composite 2,083.77 +21.98 +1.07%

Yue Yuen Industrial Holdings Ltd., a maker of shoes for Nike Inc., gained 1.9 percent in Hong Kong.

Rio Tinto Group, the world’s second-largest mining company, rose 1.9 percent in Sydney after Chinese industrial production beat estimates.

Advantest Corp., the largest producer of semiconductor-testing devices, jumped 5.1 percent in Tokyo after saying orders will rise.

Hino Motors Ltd. slid 1.3 percent after recalling trucks in the U.S. due to a battery flaw.

On Friday the single currency fell against most major currencies after it was reported that most members of the European Central Bank showed support for the decision to reduce rates if the economy will not show signs of recovery. Well as the pressure on the exchange rate had a message about lowering the economic outlook in Germany. A little later, the euro continued to fall, as a report showed that U.S. employers added more jobs than expected last month. Additionally pleasant surprise was that the U.S. unemployment rate has decreased to almost four-year low. But, despite all these positive data for the dollar, the currency could not hold its positions, and began a sharp decline. Note that this situation was caused by the fact that as the index of consumer sentiment registered a sharp decline, reaching a minimum value at the same time in a year. Analysts say that this was a result of the concern among Americans about "fiscal cliff" has increased markedly.

The Canadian dollar rose while still achieving the highest value for the month, as Statistics Canada reported a significant increase in the number of jobs with the fall in unemployment.

Asian stocks climbed, with the regional benchmark index heading for its longest streak of weekly gains in three months, as fewer Americans filed for unemployment benefits and Australia’s building industry shrank at a slower pace.

Nikkei 225 9,527.39 -17.77 -0.19%

S&P/ASX 200 4,551.76 +42.41 +0.94%

Shanghai Composite 2,061.79 +32.55 +1.60%

James Hardie Industries SE, a building materials supplier that gets about 67 percent of sales from the U.S., climbed 2.8 percent in Sydney.

People’s Insurance Company of China Ltd., Hong Kong’s biggest initial public offering in two years, jumped 7.5 percent in its trading debut.

Tokyo Electric Power Co., the owner of the power plant at the heart of Japan’s nuclear disaster last year, surged 13 percent on a report reactors may restart next summer.

Most European stocks advanced, with the Stoxx Europe 600 Index extending an 18-month high, as a better-than-expected jobs report from the U.S. offset a cut in economic growth forecasts for Europe’s largest economy.

Berkeley Group Holdings Plc (BKG) climbed to its highest in more than five years after the homebuilder said first-half profit rose 45 percent. William Demant (WDH) Holding A/S added 2.8 percent after UBS AG said the maker of hearing aids will benefit from a market recovery next year. Alcatel-Lucent (ALU) SA fell 2.9 percent after it was removed from France’s benchmark equity index.

The Stoxx 600 rose 0.1 percent to 279.17 at the close of trading, its highest level since May 31, 2011.

U.S. payrolls rose more than anticipated in November and the jobless rate fell to an almost four-year low, indicating superstorm Sandy had little effect on the labor market.

Employment climbed by 146,000 following a revised 138,000 gain in October that was less than initially estimated, Labor Department figures showed today in Washington. The median estimate of economists called for a gain of 85,000. The unemployment rate fell to 7.7 percent.

The Frankfurt-based Bundesbank reduced its 2013 projection for German economic growth to 0.4 percent from the 1.6 percent predicted in June and said the economy will grow 0.7 percent this year, down from its previous forecast of 1 percent.

National benchmark indexes rose in 12 of the 18 western European (SXXP) markets.

FTSE 100 5,914.4 +12.98 +0.22% CAC 40 3,605.61 +3.96 +0.11% DAX 7,517.8 -16.74 -0.22%

Berkeley Group advanced 4.7 percent to 1,728 pence, its highest price since July 2007, after it said first-half profit rose to 107.5 million pounds ($173 million) from 74 million pounds a year earlier, as it sold more homes at wider margins.

William Demant gained 2.8 percent to 495.10 kroner. UBS said the Nordic region’s largest maker of hearing aids will benefit from a market recovery next year, as it raised the stock to buy from neutral.

Wincor Nixdorf AG (WIN), Europe’s biggest maker of automated teller machines, added 3.6 percent to 34.60 euros. The company expects earnings before interest, taxes and amortization in 2014 to be higher than 2013.

Alcatel-Lucent fell 2.9 percent to 85.8 euro cents. The former industrial giant whose operations once ranged from spaceflight to cutting-edge theoretical physics will be removed from the CAC 40 effective Dec. 24.

Deutsche Telekom AG (DTE) fell 1.9 percent to 8.42 euros. Germany’s biggest phone company said it will pay a dividend of 50 euro cents per share in 2013 and 2014, down from the 70 cents pledged this year.

Norsk Hydro ASA, (NHY) Europe’s third-largest aluminum maker, fell 2.4 percent to 27.04 kroner. Nomura Holdings Inc. downgraded its recommendation on the shares to reduce, the equivalent of sell, from neutral, citing aluminum price uncertainty.

Major U.S. stock indexes fell after the publication of the data, but then recovered. For the week DOW index rose 0,99%, Nasdaq fell by 1,07%, S & P500 gained 0.13%

After a strong start of trading today, helped by data exceeded expectations for the U.S. labor market, the major stock indexes retreated from session highs, with the Nasdaq index fell below zero.

Cause a fundamental change in the situation were data on the index of consumer sentiment from the Reuters / Michigan, which is a preliminary value for December was much lower than forecast, the envisioned decline to the level of 82.1 points against the values from 82.7 points in November. The actual value of the index has reached a level of 74.5 points.

Later added negative comments Speaker U.S. House of Representatives, John Boehner, who said that progress on the issue of "fiscal cliff" no.

Most of the components of the index DOW rising in price (25 of 30). Lead in the current promotions JPMorgan (JPM, +2.51%). Maximum loss show stock Microsoft (MSFT, -1.08%).

All sectors of the index S & P, but one of the show sector. Leading conglomerates sector (+0.6%). Dropped only technology sector (-0.3%).

To date:

Dow +81.09 13,155.13 +0.62%

Nasdaq -11.23 2,978.04 -0.38%

S & P +4.14 1,418.08 +0.29%

00:30 Australia Home Loans October 1.1% +3.1% +0.1%

02:00 China Trade Balance, bln November 32.0 26.7 19.6

05:00 Japan Consumer Confidence November 39.7 40.3 39.4

06:00 Japan Eco Watchers Survey: Current November 39.0 39.7 40.0

06:00 Japan Eco Watchers Survey: Outlook November 41.7 41.9

The euro traded 0.2 percent from its lowest level in two weeks after Italy’s prime minister said he intends to resign, rekindling concern that a change in government will upend efforts to rein in debt. Italy’s Mario Monti will try to corral his coalition, which includes his predecessor Silvio Berlusconi’s People of Liberty Party, for a vote to pass budget legislation before handing in his “irrevocable resignation,” national President Giorgio Napolitano’s office said in an e-mailed statement on Dec. 8. Monti, 69, will quit immediately if his allies won’t comply, the premier’s spokeswoman, Elisabetta Olivi, said in a telephone interview.

The euro slid versus most of its 16 major counterparts ahead of a Dec. 13-14 summit of European Union leaders to debate a road map to overhaul the currency bloc.

Demand for the dollar was limited amid speculation the Federal Reserve may announce this week additional bond purchases. In the U.S., the Federal Open Market Committee meets for the final time this year on Dec. 11-12. It will consider whether to expand purchases of assets after its Operation Twist program of swapping $45 billion a month in short-term Treasuries for long-term debt expires this month. Expectations for more central bank stimulus come as data released Dec. 7 by the Labor Department showed the unemployment rate in the world’s biggest economy dropped to 7.7 percent, the lowest level since December 2008.

Australia’s currency slid after data from China’s customs administration showed that exports rose 2.9 percent in November from a year earlier while imports were unchanged. Both trailed the median analyst estimates in a Bloomberg News survey.

EUR/USD: during the Asian session, the pair traded in the range of $1.2885-15.

GBP/USD: during the Asian session the pair fell to $1.6015.

USD/JPY: during the Asian session the pair was trading around the level of Y82.50.

Wednesday's European calendar gets underway at 0800GMT, with the release of Spanish October industrial output data offering a further look at the depth of the recession in Spain. However, the main releases start from 0813GMT, as eurozone service sector final November PMI numbers cross the screens. Spanish data is at 0813GMT, Italy at 0843GMT, France at 0848GMT, Germany at 0853GMT and the aggregate eurozone PMI is due at 0858GMT. The UK also sees the release of service sector PMI data, with the November Markit/CIPS Services release due at 0930GMT. More EMU data is expected at 1000GMT, with the release of the October retail trade numbers.

00:30 Australia Home Loans October 1.1% +3.1% +0.1%

02:00 China Trade Balance, bln November 32.0 26.7 19.6

05:00 Japan Consumer Confidence November 39.7 40.3 39.4

06:00 Japan Eco Watchers Survey: Current November 39.0 39.7

06:00 Japan Eco Watchers Survey: Outlook November 41.7

07:00 Germany Trade Balance October 17.0 15.9

07:45 France Industrial Production, m/m October -2.7% +0.4%

07:45 France Industrial Production, y/y October -2.5% -2.3%

08:00 China New Loans November 505 550

09:30 Eurozone Sentix Investor Confidence December -18.8 -16.2

13:15 Canada Housing Starts November 204 202

17:15 United Kingdom BOE Gov King Speaks -

19:30 New Zealand REINZ Housing Price Index, m/m November +1.5%© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.