- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 11-11-2022

- EURUSD finished up in the week close to 4%, spurred by a weak US Dollar.

- Softer-than-expected US CPI report and consumer inflation expectations rising tumbled the US Dollar.

- The double-digit inflation level in Germany underpinned the Euro.

- EURUSD Price Analysis: Upward biased, might test the 200-DMA in the short term.

The Euro (EUR) finished the week on a higher note, following the release of a soft inflation report in the United States, as informed by the Department of Labor (DoL) October’s Consumer Price Index (CPI) report. Consequently, the US Dollar (USD) extended its losses to four consecutive weeks as hopes for a slowdown in the Federal Reserve (Fed) tightening cycle following the CPI release remained high. Therefore, the Euro continued its advance, as the EURUSD gained 1.42%, exchanging hands at 1.0352.

US Consumer Price Index weighs on the US Dollar

Wall Street finished the week with solid gains. The US inflation report on Thursday showed that core CPI, closely followed by the Federal Reserve, eased from 6.6% YoY in September to 6.3%, well below estimates. Meanwhile, the University of Michigan (UoM) Consumer Sentiment for November tumbled to a four-month low from 59.5 to 54.7, as reported on Friday. Delving the UoM poll, inflation expectations for the one-year horizon increased to 5.1%, while the five to 10-year horizon jumped from 2.9% to 3%. Joanne Hsu, director of the survey, said, “Continued uncertainty over inflation expectations suggests that such entrenchment in the future is still possible.”

Last Thursday’s CPI report overshadowed traders’ reaction to the UoM poll. The EURUSD extended its rally on Friday after dipping to its daily low of 1.0163 and soaring sharply toward its daily high at 1.0364.

Traders expect the Fed to hike 50 bps in December

Investors are beginning to price in a less “hawkish” Fed. As shown by the CME FedWatch Tool, money market futures are pricing in a 50 bps rate hike, with odds at around 85.6%, unchanged after the release of US inflation data.

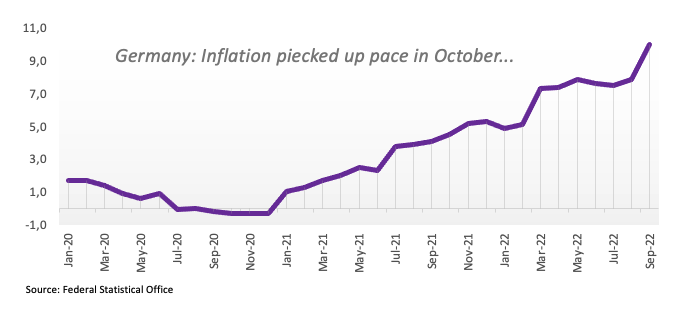

German Harmonised Index of Consumer Prices above 11%

On the Eurozone (EU) side, CPI in Germany increased by 10.4%, at a yearly pace, aligned with the estimate. Meanwhile, as expected, the German Harmonised Index of Consumer Prices (HICP) for October jumped by 11.6% YoY, but 0.7% higher than September’s figures.

Aside from this, a tranche of European Central Bank (ECB) policymakers crossed newswires and kept its hawkish stance, bolstering the Euro. ECB member Robert Holtzman said he would vote for a 50 or 75 bps hike at the December meeting, while the ECB Vice-President Luis De Guindos said that a technical recession in the Eurozone is likely, and added that markets overreacted to US CPI.

Furthermore, ECB Pablo Hernandez de Cos added that the Quantitative Tightening (QT) could be announced in December and that recession probability had increased. In the meantime, ECB member Mario Centeno said that the Euro is not going through an “existential crisis.”

EURUSD Price Forecast: Technical outlook

Given the fundamental backdrop, the EURUSD climbed toward the August 10 swing high at 1.0364. Nevertheless, it failed short of achieving a daily close above it, which could have exacerbated a rally to the 200-day Exponential Moving Average (EMA) at 1.0438. OF note, the Relative Strength Index (RSI), at bullish territory, is almost overbought, but given that the uptrend is strong, technicians consider RSI’s 80 levels as the most extreme. That said, the path of least resistance is upwards.

Therefore, the EURUSD’s first resistance would be the August 10 daily high at 1.0364, followed by the psychological 1.0400 figure. The break above will expose the 200-day EMA. On the other hand, the EURUSD’s first support would be the 1.0300 mark, followed by the 1.0250 and the November 11 low at 1.0163.

- The Euro finds sellers at 0.8775 and remains moving sideways.

- UK economy contracts less than expected in Q3.

- EURGBP: Still keeping the three-month forecast at 0.89 – Rabobank.

The Euro recovery attempt from Thursday’s lows at 0.8695 has been capped at 0.8775 in Friday’s early US session before retreating to 0.8740. From a wider perspective, the pair remains wavering. Between 0.8687, practically unchanged in the weekly chart

UK GDP data shows a softer-than-expected contraction in Q3

According to preliminary estimations, UK Gross Domestic Product contracted by 0.2% in the third quarter, well above the -0.5% market consensus after having grown 0.2% in the previous quarter. Year on year, the UK economy slowed down to 2.4% from 4.4%, also improving expectations of a 2.1% reading.

These figures confirm the forecasts of the Bank of England anticipating a is entering a lengthy recession ahead. The market, however, has shown a certain relief which has reflected in a moderate appreciation of the British Pound.

EURGBP: Still keeping the three-month forecast at 0.89 – Rabobank

Looking forward, analysts at Rabobank maintain a positive outlook on the pair: Over the coming weeks, we would expect GBP investors to be focused on the impact of the November 17 Autumn Statement, the ability of PM Sunak to hold the Tory party together, the outlook for UK growth/recession and BoE interest rates (…) We would expect issues surrounding the protocol only to have a clear impact on GBP as any related deadlines approach. We are yet to be persuaded to alter our bearish view on the pound and maintain a 3-month forecast of EUR/GBP 0.89.”

Technical levels to watch

- The USDJPY is set to finish the week with losses of more than 5%.

- From a daily chart perspective, the USDJPY is neutral-to-downward biased if the major stays below the 100-day EMA.

The USDJPY extended its free fall and plummeted another 200 plus pips on Friday, below the 100-day Exponential Moving Average (EMA) at 140.76. Speculations that the Federal Reserve might slow the pace of rate hikes and US Treasury yields falling are the two main factors weighing on the US Dollar (USD). Therefore, the USDJPY is trading at 138.54, below its opening price by 1.73%.

USDJPY Price Analysis: Technical outlook

The USDJPY portrays that Thursday’s price action broke a one-month-old upslope support trendline, exacerbating a fall toward the 100-day EMA at 140.74. On Friday, the USDJPY hit a daily high at around 142.50 before diving sharply, as buyers failed to clear the September 22 swing low at 140.34, which shifted the pair’s bias from neutral to neutral downwards. The Relative Strength Index (RSI) tumbled toward the bearish territory, entering oversold conditions.

Even though the USDJPY cleared key support levels, a break of the 200-day EMA is needed so that Japanese Yen (JPY) buyers could be in charge. Otherwise, the USDJPY might be subject to buying pressure.

Therefore, the USDJPY first support would be the 138.00 figure. Break below will expose the 137.50 psychological level, followed buy a six-month-old upslope trendline that passes around 136.50, ahead of the 136.00 mark.

On the flip side, the USDJPY's first resistance would be the July 14 daily high at 139.38, followed by the psychological 140.00, ahead of the 100-day EMA.

USDJPY Key Technical Levels

- The Pound continues appreciating and reaches a 2, 1/2-month high at 1.1840.

- UK GDP contracted less than expected in Q3.

- The US Dollar remains under pressure on Fed easing hopes.

The pound has rallied for the second consecutive day against a battered US Dollar, to hit fresh two-week highs at 1.1840 so far. On the weekly chart, the pair is on track to a 4.8% rally in its best weekly performance in more than two years.

UK GDP contracts less than expected in Q3

Preliminary UK Gross Domestic Product has shown a 0.2% contraction in the third quarter, significantly above the -0.5% market consensus following a 0.2% advance in the previous quarter. Year on year, the UK economy slowed down to 2.4% from 4.4%, still better than the 2.1% reading anticipated by market analysts.

Although these figures confirm the Bank of England’s forecasts that the country is entering a lengthy recession, the market seems to have welcomed the data, which has allowed the pair to extend its sharp two-day rally.

On the other end, the US Dollar has extended its sell-off, triggered by the softer US inflation figures seen on Thursday, which has acted as a tailwind for the pair. US CPI slowed down to a 7.7% yearly rate in October, according to data from the US Bureau for Labor Statistics, well below market expectations of 8% and down from the 8.2% reading seen in September.

These data suggest that inflationary pressures may be easing, which has boosted expectations of a dovish shift by the US Federal Reserve over the coming months. This has crushed demand for the US and boosted world equity markets.

In a very thin US calendar, the Preliminary Michigan Consumer Sentiment Index anticipated a sharper-than-expected deterioration in November. Higher prices and concerns about the increasing interest rates are weighing on consumers’ confidence.

Technical levels to watch

- Silver's rally fails at $22.05 and retreats to $21,50.

- The precious metal has reached an important resistance near $22.00.

- With RSI at overbought levels, some consolidation is likely.

Silver prices’ uptrend from early November lows in the area of $19.00 have been halted on Friday at five-month highs of $22.05, before pulling back to the mid-range of $21.00. On the weekly chart, however, the pair is on track to post a nearly 5% rally.

The precious metal has reached an important resistance hurdle in the vicinity of $22.00, where the 50% Fibonacci retracement level of the April - September downtrend and the June 16, 17, and 21 highs are holding back the bulls.

Beyond that, the pair has reached overbought levels on hourly and daily charts, which suggest that some consolidation or even a moderate pullback is still consistent with the possibility of further appreciation.

On the upside, above the mentioned $22.00, the pair might target June 3 and 6 highs at $22.50 before aiming for the 61.8% retracement of the mentioned downtrend, at $23.00.

Bearish attempts are so far held above the 200-day MA, now at $21.45, with the next potential support levels at $20.95 (October 10 low) and $20.35 (November 7 low).

XAGUSD daily chart

Technical levels to watch

- The AUDUSD tests the 100-day EMA, propelled by an inverted head-and-shoulders chart pattern.

- Once the head-and-shoulders pattern is achieved, the AUUSD could extend its gains toward the 200-day EMA.

The AUDUSD is rallying sharply in the North American session and challenges the 100-day Exponential Moving Average (EMA) at 0.6701. Fundamental factors, but also an inverted head-and-shoulders chart pattern in the AUDUSD daily chart, underpinned the Australian Dollar (AUD), which is gaining 1.24%. At the time of writing, the AUDUSD is trading at 0.6701 after hitting a daily low of 0.6577.

AUDUSD Price Analysis: Technical outlook

The AUDUSD daily chart depicts the AUD clearing the inverted head-and-shoulders neckline on Thursday, November 11. It should be noted that during that day, the AUDUSD registered a daily low of 0.6412. But a softer US Consumer Price Index (CPI) report lifted the AUDUSD, which rallied almost 190 pips.

At the time of typing, the AUDUSD probes the 100-day EMA, which, once cleared, could pave the way for further gains. Traders should be aware that the Relative Strength Index (RSI) is at bullish territory. So the path of least resistance in the AUDUSD is upward biased.

The AUDUSD's first resistance would be the 100-day EMA at 0.6701. The break above will expose the 0.6800 psychological mark, followed by the inverted head-and-shoulders target at 0.6870. However, a breach of the latter will pave the way toward key resistance areas like the September 13 swing high at 0.6916 and the 200-day EMA at 0.6956.

AUDUSD Key Technical Levels

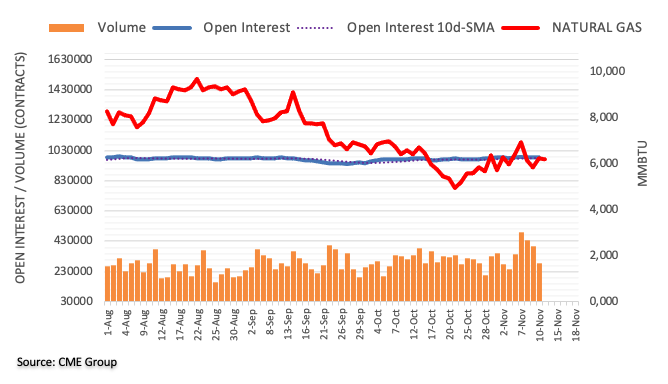

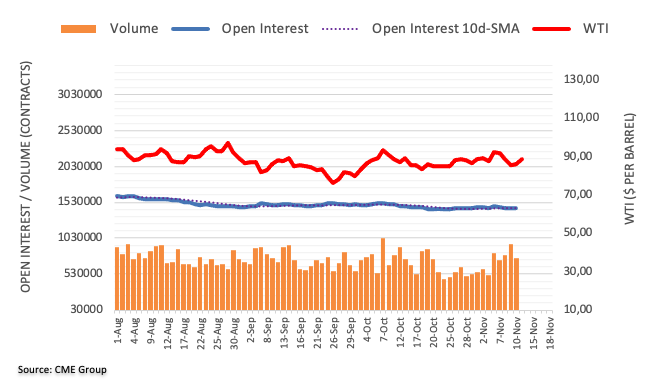

- WTI’s trim some of their weekly losses, bolstered by a weak US Dollar.

- Easing inflation in the United States undermined the US Dollar as traders brace for a less aggressive Fed.

- China’s refineries asked Saidu Aramco to reduce December’s crude-oil volumes, capping WTI’s recovery.

Western Texas Intermediate (WTI), the US crude oil benchmark, is recovering some ground during the North American session following the United States (US) inflation report that informed prices are easing. Another factor that boosted the appetite for Oil is China’s easing Covid-19 restrictions, underpinned oil prices. At the time of writing, WTI is trading at $88.29 per barrel, gaining 2.37%.

Sentiment remains positive as a cooler-than-expected US Consumer Price Index (CPI) information showed that the US economy is feeling the impact of the Federal Reserve (Fed) monetary policy. The headline inflation came at 7.7% YoY, and the core CPI fell to 6.3% YoY, both below expectations. Following the release, speculations piled up that the Fed might gradually increase the Federal Funds rate (FFR) instead of raising rates on 75 bps ones. The reflection is that odds for a Fed 50 bps rate hike in December jumped from 50% to 85%.

Therefore, the US Dollar (USD) weakened across the board, as the US Dollar Index plunged 3.76% in the week, undermined by US Treasury yields, plummeting almost 30 bps.

Aside from this, Chinese officials announced that quarantines for inbound travelers would be cut by two days to five, a sign cheered by investors.

According to Reuters, several Chinese refiners asked Saudi Aramco to reduce December-loading crude oil volumes, meaning that China’s economy is accounting for a deceleration as it’s struggling to avoid a recession.

WTI Price Analysis: Technical outlook

WTI is neutral-biased, as shown by the daily chart. It should be noted that Friday’s daily high at $90.08 tested a one-month-old downslope trendline drawn from September highs. However, WTI was quickly rejected and retreated above November’s 10 daily high at $87.31. The Relative Strength Index (RSI) in bullish territory suggests Oil prices could increase. However, WTI needs to clear the $90.00 mark, alongside the 100-day Exponential Moving Average (EMA) at $91.07, to turn the bias neutral to upwards.

- The Kiwi rallies to fresh two-month highs past 0.6100.

- Hopes of a softer Fed tightening pace are crushing US Dollar demand.

- NZDUSD to consolidate over the next days/weeks – ANZ.

The New Zealand Dollar is going through a sharp two-day rally, boosted by a positive market sentiment on Friday. The pair has surged about 3.8% in the last two days to reach prices right above 0.6100 at the moment of writing.

Broad-based Dollar weakness has sent the NZD surging

The positive market sentiment following the release of US inflation data on Thursday has hammered the US dollar, boosting demand for the sentiment-linked Kiwi.

US Consumer inflation eased beyond expectations in October, with yearly inflation down to 7.7% from 8.2% in September. These data suggest that price pressures may have started to ebb which has spurred expectations of a ‘dovish pivot’ by the Federal Reserve.

Furthermore, news that Chinese authorities have decided to ease COVID-19 restrictions has buoyed market sentiment further, acting as a tailwind for the NZD, as New Zealand is one of China’s main trade partners.

In the economic calendar, the US Preliminary Michigan Consumer Sentiment Index anticipated a sharper-than-expected deterioration in November. Higher prices and concerns about the increasing interest rates are weighing on consumers’ confidence.

NZDUSD: Consolidation for the next days/weeks – ANZ

Looking forward, analysts at ANZ expect the pair to consolidate gains over the next days or weeks: “The US Dollar slumped sharply lower after the release of much softer than expected US CPI data (…) However, we’re not out of the woods yet, and US markets are still pricing in cuts from June, and if these get priced out, that could slow the USD’s adjustment (…) Local interest rates will also fall today, and that might slow further NZD progress a touch, and leave markets in more of a consolidatory mood for the next few days/weeks.”

Technical levels to watch

- The dollar dives to fresh six-week lows at 1.3255.

- The CAD extends gains on higher oil prices and risk appetite.

- US consumer sentiment deteriorated beyond expectations in November.

The US Dollar has extended losses against its Canadian counterpart on Friday, reaching a fresh six-week low at 1.3255. The pair remains on the defensive after having depreciated nearly 2% over the last two days with upside attempts capped below 1.3300 so far.

The Canadian Dollar rises on risk appetite and higher oil prices

Oil prices appreciated nearly 3% on Friday, with the US benchmark WTI oil struggling to return above the $88.00 mark after bouncing off at $84.00 on Thursday. This has underpinned the Loonie's advance, as Canada is one of the world’s major crude producers.

On Thursday, the softer-than-expected US inflation data, with the yearly CPI easing to 7.7% in October from 8.2% in September, hammered the Greenback across the board. These figures have added to evidence that price pressures are starting to ease, which has prompted investors to anticipate a Federal Reserve shift towards slower rate hikes.

US Inflation data has boosted appetite for risk, sending US Treasury bonds and the greenback. The USD Index, which measures the value of the Dollar against a basket of currencies has plummeted 3.3% over the last two days to hit levels sub-107.00 for the first time since mid-August.

In a very thin macroeconomic calendar, with the US celebrating Veteran’s Day, the Preliminary Michigan Consumer Sentiment index has deteriorated beyond expectations, weighed by concerns about inflation and higher interest rates.

Technical levels to watch

- The GBP extended its gains towards 1.1790s after a soft US inflation report.

- The US Dollar plunges sharply, as shown by the US Dollar Index, down 1.20%, below the 107.000 mark.

- Consumer sentiment in the United States worsened as inflation expectations rose.

The Pound Sterling rises in the North American session, following a softer inflation report in the United States, which augmented speculations that the Federal Reserve might lift rates at a slower pace. Also, China’s Covid-19 restrictions were relaxed, a sign that could bolster the world’s second-largest economy. At the time of writing, the GBPUSD is trading at 1.1795., above its opening price by 0.65%.

Wall Street’s cling to Thursday gains, a reflection of an upbeat sentiment. The University of Michigan’s (UoM) Consumer Sentiment for November fell to a four-month low, from 59.5 to 54.7, while inflation expectations rose. Americans expected inflation in one-year would rise to 5.1%, and for five to 10 years, consumers foresee inflation peaking at 3%. Joanne Hsu, director of the survey, said, “Continued uncertainty over inflation expectations suggests that such entrenchment in the future is still possible.”

Aside from this, the latest US Consumer Price Index (CPI) report is still weighing on the US Dollar (USD), as headline CPI and core CPI for October fell below expectations. Therefore, speculations that the Federal Reserve would lift rates in smaller sizes increased. Reflection of that is the Fed CMEWatchTool showing traders expecting the Fed to hike rates by 50 bps in its December meeting, as chances lie at 85.4%, unchanged from Thursday.

Elsewhere, a slew of Federal Reserve officials commented that it was “appropriate” to slow the pace of interest-rate hikes. Nevertheless, most of them commented that the Fed is still tightening monetary policy, as the Dallas Fed President Lorie Logan said that “a slower pace should not be taken to represent easier policy.”

In the meantime, the US Dollar Index, a gauge of the buck’s value against a basket of peers, plunges more than 1%, below the 107.000 mark, for the first time since August 18, a tailwind for the GBPUSD.

Aside from this, on the UK front, the Gross Domestic Product (GDP) for Q3 shrank more than foreseen in September, indicating the beginning of a prolonged projected recession by the Bank of England (BoE). UK GDP fell 0.6% between August and September, more than the 0.4% contraction estimates by analysts.

The latest data would provide a rugged backdrop to the newest Chancellor, Jeremy Hunt, who is expected to tighten fiscal policy as the UK battles 40-year high inflationary pressures. Rishi Sunak’s budget is considering tax rises and cutting public spending up to GBP 55 Billion a year.

Of late, crossing newswires, the US Treasury Secretary and former Federal Reserve Chair Janet Yellen said October’s inflation reading was positive. Still, she cautioned that core CPI was lower, but shelter prices remain high.

GBPUSD Key Technical Levels

Analysts at the Research Department at BBVA explained that Industrial Production in Türkiye grew by just 0.4% in September below the 3% expected. They forecast a GDP growth rate at near 5.5% during 2022.

Key Quotes:

“In seasonal and calendar adjusted series, IP declined in September (-1.6% m/m) on the back of a broad-based deterioration in subcomponents. The slowdown in industrial activity was more pronounced in quarterly terms with IP contracting by 4.1% in 3Q (vs. 0.8% in 2Q), led by the intermediate goods production contributing 2.2pp to the decline. This was followed by consumer goods (mainly non-durables), capital and energy goods, respectively.”

“According to our nowcasts, GDP growth has started to decelerate more clearly as of 3Q and the slow-down has started to become much faster than expected with 4Q early indicators. The political priority to maintain pro-growth policies at all costs leads us to expect more countercyclical fiscal measures ahead of the elections in addition to the continuation of ultra-loose monetary policy. Therefore, we expect 2022 GDP growth to reach near 5.5%, which would be followed by a strong pace in the first half of the year with around 5%.”

- US dollar extends losses on Friday, even as stocks decline.

- Japanese yen is among the best performers of the day and the week.

- USDJPY heads for a weekly loss of near 900 pips.

The USDJPY is testing levels under 139.00 during Friday’s American session, holding onto significant weekly losses. During the last two days, the pair dropped more than 700 pips.

The October US CPI triggered sharp market moves that favored the yen. On Friday, the USDJPY rose to 142.40/50 only to turn to the downside again breaking under 140.00.

Terrible week for USD, outlook still negative

The collapse of the Dollar and lower US yields sent the USDJPY down during the week from 147.15 to levels under 139.00, falling almost 6% on the worst week in years. The pair is back at August levels and clearly below the 20-week Simple Moving Average for the first time since January 2021.

The DXY is extending weekly losses late on Friday as it drops 1.12%, to 106.70, the lowest since mid-August. Not even a decline in equity prices, nor a bad reading in US Consumer Sentiment is helping the Dollar.

Next week, attention will continue to be on the USD’s trend. Economic data in the US includes the Producer Price Index on Tuesday and Retail Sales on Wednesday. In Japan, the National CPI will be released Friday with an increase expected from 3.0% to 3.7%. “In a sign that inflation is becoming more broad-based, core ex-energy is expected at 2.4% y/y vs. 1.8% in September. Yet the BOJ shows no signs of pivoting under Governor Kuroda. The next policy meeting is December 19-20 and no change is expected then”, said analysts at Brown Brothers Harriman.

Technical levels

- The Euro rallies further and hits fresh three-month highs above 1.0300.

- Hopes of softer Fed rate hikes have hammered the Dollar.

- EUR/USD might reach 1.05 but it is seen at 0.97 in three months – Nordea.

The Euro remains strongly bid for the second consecutive day against a weak US dollar. The pair has breached the 1.0300 level to reach fresh three-month highs and approach August’s peak at 1.0365.

Soft US inflation figures have sent the Dollar plunging

The common currency has rallied beyond 3% over the last two days, with the US dollar hammered by a softer-than-expected US inflation report released on Thursday, and is on track to close its best weekly performance in more than two years.

Consumer prices accelerated at a 7.7% yearly pace in October, down from the 8.2% increase posted in September and well below the 8% reading forecasted by the market. These figures suggest that inflationary pressures are starting to ease, which clears the way for the US Federal Reserve to lift its feet off the rate hike accelerator over the next month.

Hopes of some Fed easing have boosted risk appetite, which has favored equity markets, triggering sharp declines in the US Dollar and US Treasury bonds.

Beyond that, news reporting that the Chinese authorities have decided to relax their strict COVID-19 restrictions and shorten quarantine periods have eased fears about a new set of lockdowns next winter and boosted market sentiment further.

EURUSD might reach 1.05 but it is seen at 0.97 in three months – Nordea

Analysts at Nordea Bank, however, are skeptical about the sustainability of the current Euro uptrend: While EURUSD could rise until the start of December, we still see a lower EURUSD at 0.97 in three months (…) The Fed's fight against inflation is still not yet over given the high wage growth and tightness in the labor market (…) The interest differentials between EUR and USD are likely to move in favor of a lower EURUSD.

Technical levels to watch

On Thursday, the Bank of Mexico rose the key interest rate by 75 basis points as expected to 10%. According to the Research Department at BBVA, Banxico will likely still match December’s Federal Reserve interest rate hike but they point out that a decouple in February seems now possible.

Key Quotes:

“Banxico acknowledged for the first time, when explaining what it took into account for today’s decision, the “policy stance that has already been reached in this hiking cycle. Also hinting at a near end of the tightening cycle, Mr Gerardo Esquivel

voted for a smaller 50bp rate hike.”

“We continue to think that Banxico will still stick to its strategy of matching December’s Fed most likely hike of 50bp. Yet, we now think that today’s acknowledgement of “the policy stance that has already been reached” with inflation set to soften ahead and the monetary stance becoming more restrictive by the first meeting of next year (in Feb) opens the door for a decoupling for the Fed as soon as in Feb.”

Bank of England (BOE) policymaker Jonathan Haskel said on Friday that it's important for the monetary policy to stand firm against the risk of persistent inflationary pressure, as reported by Reuters.

Additional takeaways

"Concern for me is the risk that if price rises become embedded, monetary policy would have to be tighter for longer."

"Latest signs of activity suggest the UK is already slowing down."

"Signs of slowdown do not imply less tightening given strength of labour market, rise in inactivity."

"Supply-side stresses risk persistent inflationary pressure."

Market reaction

GBPUSD showed no immediate reaction to these comments and was last seen rising 0.6% on the day at 1.1780.

The stars do seem to be aligning for a more sustained rebound in the oversold EUR in the next few weeks at least. Economists at Scotiabank list five factors that are set to underpin the shared currency.

Euro helped by unhedged equity inflow

“Purchases of FX unhedged European equity ETFs are outpacing hedged ETFs which may help underpin EUR gains in the near-term.”

“Nominal and real yield spreads have narrowed in the past few weeks – whilst admittedly remaining very negative for the EUR.”

“Positioning and sentiment data have turned more supportive of the EUR; the latest CFTC data showed speculative accounts holding a net long of some 106k contracts, the biggest bullish bet on the EUR since mid-2021.”

“Technical factors suggest that – finally – the EUR is showing some significant, positive traction on the charts; major bear trend resistance off the early 2022 high has been clearly broken and EURUSD is within fractions of breaking the pattern of successively lower lows and lower highs that has persisted since February. Longer-term charts also indicate that the EUR slide has stalled (at least) while a high close on the month (Nov) will form the third leg of a bullish ‘morning star’ monthly reversal.”

“Dec is historically the strongest month of the year for the EUR (average return of +1.29% over the past 25 years, 1.25% over 20 years, 0.48% over the past 10 years and 1.14% over the past 5 years).”

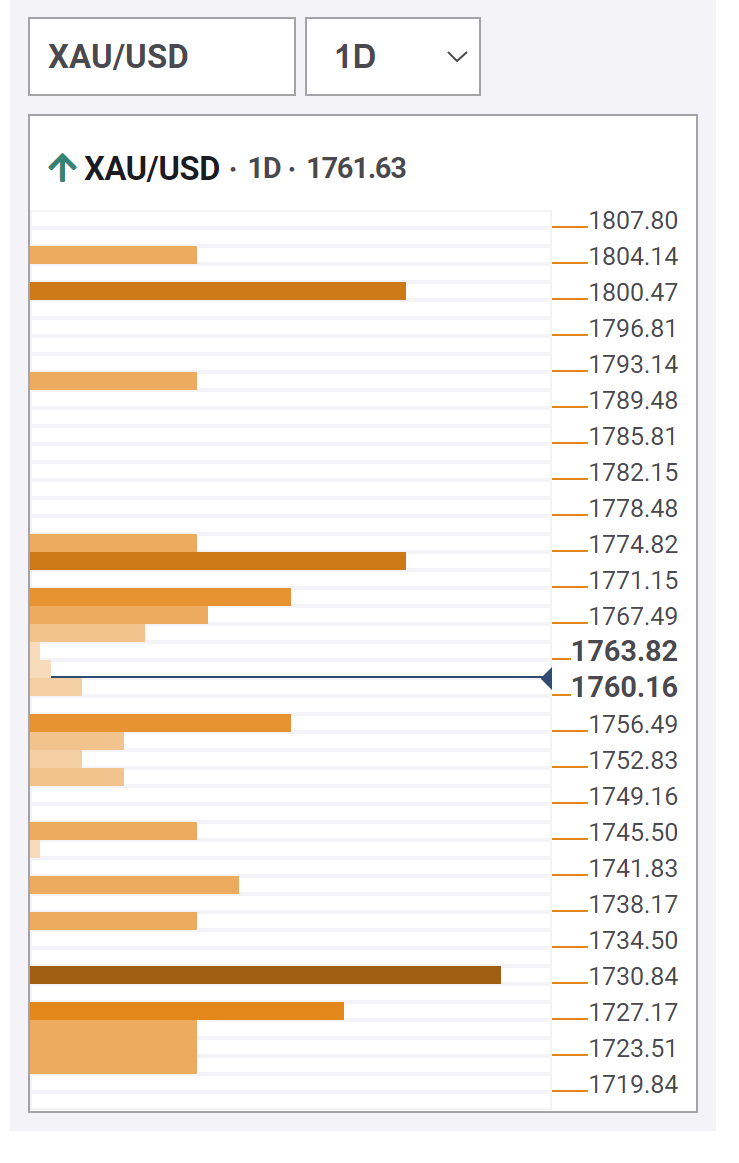

Gold has reached its highest level since August above $1,760. Next resistance is seen at $1,780, then the $1,800 figure, FXStreet’s Eren Sengezer reports.

$1,720 aligns as significant support

“$1,760 aligns as interim resistance and in case this level is confirmed as support, XAUUSD could target $1,780 (Fibonacci 38.2% retracement) and $1,800 (200-day SMA, psychological level).”

“On the downside, $1,720 (100-day SMA, Fibonacci 23.6% retracement) aligns as significant support. Only a daily close below that level could be seen as a significant bearish development and open the door for further losses toward $1,700 (psychological level) and $1,675 (50-day SMA).”

- The Aussie consolidates at six-week highs near 0.6700.

- Investors are pricing in a softer Fed monetary tightening ahead.

- China's decision to ease COVID-19 restrictions has contributed to improving sentiment.

The Australian Dollar keeps rallying for the second consecutive day, buoyed by a weak US dollar on the back of increasing hopes that the US Federal Reserve will start to relax its monetary tightening path over the coming months as well as easing COVID-19 restirctions in key trading neighbour China.

On Friday, the pair appreciates about 0.8%, and is nearly 4% higher over the last two days, after having hit a fresh six-week high at 0.6690, with bearish attempts capped above 0.6650 so far.

Hopes of Fed easing have boosted market sentiment

Investors’ appetite for risk surged on Thursday following the release of cooler-than-expected US Consumer Prices Index data. Yearly inflation slowed down to 7.7% in October from 8.2% in the previous month, beating expectations of an 8% reading.

These figures suggest that inflationary pressures might have peaked and provided some leeway to the US central bank to ease its monetary tightening cycle over the next months.

The US Dollar and Treasury yields tanked in the data, sending equities and risk-sensitive currencies like the AUD skyrocketing over the last sessions.

Beyond that, news that China is relaxing some of its strict COVID-19 restrictions and cutting quarantine periods has eased concerns about the potential impact on the global economy of a new set of lockdowns which has boosted investor sentiment further. As a result of the news the price of Iron Ore, a key export of Australia to China has rallied substantially overnight and its correlation to AUD will help boost the currency.

The economic calendar is rather thin today with the US celebrating Veterans Day. The only relevant indicator is the Preliminary Michigan Sentiment Index, which has eased beyond expectations, to 54.7 from 59.9 in October while the consensus anticipated a softer decline to 59.5.

Technical levels to watch

It is nearly two full days after the mid-term elections in the US and while we still do not know the outcome, markets may know enough to forecast its impact, strategists at Morgan Stanley report.

Republicans controlling at least one chamber of Congress is enough to yield a divided government

“It may take several days, maybe weeks to determine which party will control the Senate. But knowing which party controls the Senate won't matter much if Republicans gain a majority in the House of Representatives, as they appear likely to do as of this recording. That's because Republicans controlling at least one chamber of Congress is enough to yield a divided government, meaning that the party in control of the White House is not also in control of Congress and so can't unilaterally choose its legislative path.”

“For bond markets, this is a mostly friendly outcome. It takes off the table the scenario that could have led to fiscal policy from Congress that would cut against the Fed's inflation goals. That outcome might have suggested inflation was less a political and electoral concern than previously thought, and through a broader Senate majority, given Democrats more room to legislate.”

- Consumer confidence in the US deteriorated in early November.

- US Dollar Index stays deep in negative territory below 107.00.

Consumer sentiment in the US weakened in early November with the University of Michigan's (UoM) Consumer Confidence Index falling to 54.7 (flash) from 59.9 in October. This reading came in below the market expectation of 59.5.

"Inflation expectations are little changed. The median expected year-ahead inflation rate was 5.1%, up from 5.0% last month," the publication further read. "Long run inflation expectations, currently at 3.0%, have remained in the narrow (albeit elevated) 2.9-3.1% range for 15 of the last 16 months."

Market reaction

This report failed to trigger a significant market reaction and the US Dollar Index was last seen losing 1% on the day at 106.88.

Dollar bulls have been shaken. However, Kit Juckes, Chief Global FX Strategist at Société Générale, warrants caution before confirming the turn of the Dollar.

More twists and turns before Euro’s clear uptrend towards 1.12 emerges

“We are confident that the Dollar will be significantly weaker in six months’ time, but we remain wary in the coming weeks. There are still traps for over-enthusiastic bears.”

“In Europe, we’re confident that we have seen the low in GBPUSD, but not 100% sure we’ve seen the low in EURUSD. After all, the Russian elephant is still loitering in the corner of the room. EURUSD has broken out of its downtrend, but there will be a few more twists and turns before a clear uptrend towards 1.12 emerges.”

“Where we are more confident is in Asia/Pacific; the yen has continued to track 10-year Treasury yields and if they have peaked, so has USDJPY.”

- SNB Chairman says monetary policy not sufficiently restrictive enough.

- The Swiss Franc soars across the board, EURCHF falls hundred pips in minutes.

- USDCHF drops to its lowest in three months under 0.9500.

The USDCHF fell sharply to 0.9450, reaching the lowest level since mid-August following comments from the chair of the SNB Thomas Jordan. The Swiss Franc became the top performer of the American session with the EURCHF falling a hundred pips to 0.9743, the lowest in a month.

Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank, said on Friday the central bank is reading to take all necessary measures to bring inflation back into the range of price stability. He mentioned they have to take action and mentioned monetary policy is not sufficiently restrictive enough.

Jordan’s comments boosted the Swiss Franc. The USDCHF was already lower on the back of the broad-based slide of the US Dollar and tumbled to 0.9450 on his comments. It then rebounded back toward 0.9500.

The pair is about to post a weekly loss of more than 450 pips, extending the reversal after making a double top at 1.0150. The Dollar is suffering the worst weekly performance in months amid expectations of a less aggressive Federal Reserve ahead.

Data release on Thursday showed inflation cooled in the US in October. On Friday, the University of Michigan presented the November Consumer Sentiment report: the Sentiment Index declined from 59.9 to 54.7 while 5-year Inflation expectations rose from 2.9% to 3%.

Technical levels

The US October inflation figures came out below expectations. Nonetheless, economists at Danske Bank believe that price pressures are still set to persist.

Inflation risks are not over yet

“While markets have reacted very positively to the October CPI print, we continue to see further risks of more persistent inflation and think it is too early to trade a clear Fed pivot.”

“Still elevated underlying price growth, tight labour markets, inflationary market reaction and China reopening risks all favour remaining cautious on inflation.”

“The figures challenge our hawkish call for a 75 bps hike in December, but Fed’s focus remains on terminal rate level and maintaining financial conditions restrictive. Slower hiking pace could extend the cycle further into 2023.”

- Gold prices marched firmly following the release of a soft United States Consumer Price Index in October.

- The US Dollar extends its weekly losses, down 3.31%.

- Federal Reserve policymakers agreed to slow down the pace of rate hikes and clarified they’re not easing policy.

Gold price advances steadily in the North American session, clinging to its Thursday gains. Factors like a softer US Consumer Price Index (CPI) report, and China’s relaxing some Covid-19 restrictions, were cheered by investors, as shown by US equity futures trading in the green. At the time of writing, the XAUUSD is trading at $1761, above its opening price, after hitting a daily low of $1747.

Gold gains as speculations for a less aggressive Fed, augmented

US equities are set for a higher open, as shown by the futures market. The crypto turmoil keeps the Nasdaq pressured, as FTX began the chapter 11 process, but an optimistic US inflation report augmented speculations for a less aggressive Federal Reserve (Fed). The October US inflation report showed that headline and core CPI’s, albeit above the Fed’s target, eased compared with the last month’s figures. US CPI rose by 7.7% YoY, below estimates of 7.9% and core CPI, which excludes volatile items and was bucking the CPI downtrend, fell to 6.3% YoY, below the 6.5% expected.

Gold’s reacted positively to the report and finished Thursday’s session at $1757, for a 2.86% gain. Contrarily, US Treasury bond yields plunged, with the US 10-year Treasury yield dropping 28 bps, closing at 3.829%. Of note, the US bond market will be closed on Friday in observance of the Veteran’s Day Holiday.

Following the data release, a slew of Federal Reserve officials commented that it was “appropriate” to slow the pace of interest-rate hikes. Nevertheless, most of them commented that the Fed is still tightening monetary policy, as the Dallas Fed President Lorie Logan said that “a slower pace should not be taken to represent easier policy.”

Meanwhile, the CME FedWatch Tool shows investors expect the Fed to lift rates by 50 bps in its December meeting, as chances lie at 85.4%, unchanged from Thursday.

Of late, crossing newswires, the US Treasury Secretary and former Federal Reserve Chair Janet Yellen said October’s inflation reading was positive. Still, she cautioned that core CPI was lower, but shelter prices remain high.

Ahead in the US calendar, the University of Michigan (UoM) Consumer Sentiment will be informed at 15:00 GMT, with expectations lying at 59.5, and inflation expectations will be updated.

Gold Price Analysis: Technical outlook

The XAUUSD is testing the August 25 daily high at $1765.48. After hitting a daily high of $1766.62, the yellow metal slid below the latter, and Gold remains above Thursday’s $1757.26 high. Of note, the Relative Strength Index (RSI), at bullish territory, suggests further upside ahead. However, as traders are bracing for the weekend, XAUUSD might consolidate in the $1757-$1766 range.

XAUUSD’s first resistance level would be $1765.48. Break above will expose the $1800 figure, followed by the 200-day Exponential Moving Average (EMA). On the downside, the XAUUSD’s first support would be Thursday’s high at $1757.26, followed by the $1750 psychological level and the August 22 swing low at $1727.80.

EURUSD has risen sharply. The pair could rise even more until the beginning of December, however, economists at Nordea expect EURUSD to fall to 0.97 in three months.

The Fed will keep rates higher for longer than what markets expect

“In the very short-term, until the start of December, the USD could weaken more with EURUSD rising to 1.05. The USD does usually weaken during times of risk-on as we could see in the weeks to come.”

“While EURUSD could rise until the start of December, we still see a lower EURUSD at 0.97 in three months.”

“The Fed's fight against inflation is still not yet over given the high wage growth and tightness in the labour market. The Fed could need to hike rates more next year than we and markets currently expect. The interest differentials between EUR and USD are likely to move in favour of a lower EURUSD. Moreover, higher rates also imply that risk-off could re-enter the arena in the next three months, leading to a lower EURUSD.”

In the short-term, economists at Wells Fargo expect a range bound Mexican Peso, while MXN can gradually strengthen over the second half of 2023 into early 2024.

USDMXN to hover between the 19.50-19.75 range into mid-2023

“Going forward, we expect the dynamic of attractive carry and stable local politics to continue, and for the Peso's recent stability to persist for the time being.”

“Through the end of this year and into mid-2023, we believe the USDMXN exchange rate can hover between the 19.50-19.75 range.”

“Over the second half of 2023 and into early 2024, we believe the USDMXN exchange rate can gradually move toward 19.00.”

EURUSD has surged higher. Economists at Credit Suisse look for further strength to resistance at 1.0350/90, which is set to cap at first, albeit with next resistance at 1.0440.

1.0097/95 support to keep the immediate risk higher

“With weekly MACD momentum having already crossed higher a while ago we stay bullish for a test of the key price pivot from May/August and trend resistance at 1.0350/95. With the 200-day not far above at 1.0440, we would look for a major barrier here. Should strength directly extend though we believe this would clear the way for a test of resistance at the 38.2% retracement of the entire 2021 -2022 fall at 1.0612/15.

“Support is seen at 1.0197 initially, then 1.0034 with 1.0097/95 now ideally holding to keep the immediate risk higher. Below can see a setback to the 13-day exponential average, now at 1.0014, with fresh buyers expected here.”

- The index melts below the 107.00 barrier, fresh 3-month lows.

- The appetite for the riskier assets remains on the rise on Friday.

- US Flash Michigan Consumer Sentiment comes next in the docket.

The selling pressure gathers further steam and drags the dollar to new 3-month lows in the 106.70 region when gauged by the USD Index (DXY) at the end of the week.

USD Index melts, as risk-on trade surges

The sentiment around the dollar continues to deteriorate on Friday, forcing the index to slip back to levels last traded in mid-August near 106.70. The DXY has already lost nearly 4% since Thursday’s tops near the 111.00 neighbourhood to the current area of multi-week lows.

The increasing appetite for the risk complex keeps propping up the intense selling bias in the dollar in line with rising speculation that the Federal Reserve could slow the pace of its future interest rate hikes. A decision on the latter could very well be on the table at the FOMC’s event in December.

In the data space, the only release of note will be the preliminary Michigan Consumer Sentiment for the month of November.

What to look for around USD

The index extends the sharp decline in the aftermath of US inflation figures and against the backdrop of a firmer sentiment in the risk-linked galaxy.

In the meantime, investors’ repricing of a probable pivot in the Fed’s policy now emerges as a fresh and quite reliable source of weakness for the dollar, in line with a corrective decline in US yields across the curve.

Key events in the US this week: Preliminary Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: US midterm elections. Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 1.06% at 106.78 and the breakdown of 104.78 (200-day SMA) would open the door to 104.63 (monthly low August 10) and finally 103.67 (weekly low June 27). On the other hand, the next up barrier aligns at 109.06 (100-day SMA) seconded by 110.99 (55-day SMA) and then 113.14 (monthly high November 3).

Softer US inflation offered markets some long-awaited relief, sending the Norwegian krone and the Swish krona up. Economists at Nordea believe that the Scandinavian currencies could remain resilient until December.

EURNOK and EURSEK will likely rise in the next 3M, to 10.60 and 10.90 respectively

“If our expectation for a continuation of risk-on until December materialises, that would be good news for the NOK and SEK, which are both extremely sensitive to sentiment.”

“EURNOK could come around 10.00 and we could see USDNOK around 0.95 in the next few weeks. However, we don’t expect this situation to last for a long time.”

“The Fed could stop the rally with a hawkish message in December as good market developments are not in favour of reducing inflationary pressures, the Fed wants tighter financial conditions (stocks down; credit spreads, rates and USD up). This is why we see EURNOK at 10.60 (USDNOK around 10.90) and EURSEK at 10.90 (USDSEK around 11.25) in three months’ time.”

USDJPY plunges lower and is now trading below 140.00. Economists at BBH expect the pair to test the August 23 low near 135.80.

Japan reported October PPI

“USDJPY broke below its September 22 low near 140.35 and sets up a test of the August 23 low near 135.80.”

“October PP came in at 9.1% YoY vs. 8.8% expected and a revised 10.2% (was 9.7%) in September. That revised September reading was the highest in 42 years. It’s tempting to say PPI has peaked but if the drop is sustained, that bodes well for CPI in the coming months.”

- AUDUSD builds on the post-US CPI rally and climbs to its highest level since September 21.

- A slightly overbought RSI on hourly charts could hold back bulls from placing aggressive bets.

- A sustained break below the mid-0.6500s horizontal support will negate the positive outlook.

The AUDUSD pair builds on the overnight softer US CPI-inspired blowout rally and gains traction for the second successive day on Friday. The pair sticks to its intraday gains through the early North American session and is currently placed near the 0.6670-0.6680 region, or the highest level since September 21.

Firming expectations that the Federal Reserve will slow the pace of its policy tightening amid signs of easing inflationary pressures drags the US Dollar to a two-and-half-month low. Adding to this, the risk-on mood is seen as another factor undermining the safe-haven buck and further benefiting the risk-sensitive Aussie. This, in turn, acts as a tailwind for the AUDUSD pair and remains supportive of the intraday positive move.

From a technical perspective, a slightly overbought RSI (14) on hourly charts suggests that any further gains are likely to remain capped near the 100-day SMA, currently around the 0.6700 round figure. This is followed by the 0.6740 barrier, representing the top end of a descending channel extending from May 2022, which should act as a pivotal point for the AUDUSD pair. A convincing breakthrough will be seen as a fresh trigger for bulls.

Spot prices might then accelerate the momentum towards reclaiming the 0.6800 round-figure mark, above which the AUDUSD pair could test the next relevant hurdle near the 0.6850-0.6855 supply zone.

On the flip side, the 0.6640-0.6635 region now seems to protect the immediate downside ahead of the 0.6600 round figure and the daily low, around the 0.6580-0.6575 area. Any further pullback is likely to attract fresh buying and remain limited near the 0.6545-0.6540 horizontal resistance breakpoint. That said, some follow-through selling will negate the near-term positive outlook and prompt some technical selling around the AUDUSD pair.

The next relevant support to the downside is pegged near the 0.6500 psychological mark, below which spot prices would turn vulnerable to test the 0.6440 support zone. The AUDUSD pair could eventually slide back to the 0.6400 mark. Some follow-through selling below the weekly low, around the 0.6385 region, will shift bias in favour of bearish traders.

AUDUSD daily chart

Key levels to watch

Bank of England (BOE) policymaker Silvana Tenreyro explained on Friday that her main rationale for a further tightening of the monetary policy last week was risk management, as reported by Reuters.

Key takeaways

"Too early to judge whether the labour market will loosen as forecast by the BOE."

"I expect this risk management rationale to be weaker in future months."

"I would expect that bank rate held at 3% over 2023 would reduce output further below potential."

"Policy would have to loosen, perhaps in 2024, to try to prevent inflation falling below target."

Market reaction

GBPUSD preserves its bullish momentum following these comments and was last seen rising 0.55% on the day at 1.1780.

Gold price climbed to $1,760 after the US inflation data sparked another surge in precious metals prices. Today’s Commodity Futures Trading Commission (CFTC) data could curb the rally if short positions were reduced, economists at Commerzbank report.

XAUUSD has considerable upside potential once the Fed rate hikes come to an end

“US consumer prices rose much less sharply than expected in October, thereby dampening Fed rate hike expectations, putting pressure on the US Dollar and causing US bond yields to fall noticeably.”

“Yesterday’s price response shows once again that the gold price has considerable upside potential once the Fed rate hikes come to an end.”

“Today’s CFTC data are likely to reveal whether the surge in the gold price was attributable to speculative short covering. If short positions were indeed reduced substantially in the last reporting week, one key price-driving factor would fall away in future. If so, the upswing could run out of steam.”

GBPUSD edges higher and is currently trading around the mid-1.1700s. Economists at BBH expect Cable to test the August 26 high near 1.19.

Monthly UK data dump began

“Cable broke above its September 13 high near 1.1740 and sets up a test of the August 26 high near 1.19.”

“Q3 growth came in at -0.2% QoQ vs. -0.5% expected and 0.2% in Q2, which translated into a YoY rate of 2.4% vs. 2.1% expected and 4.4% in Q2. This is just the beginning, as the BoE has warned that the recession had already started and would likely last two years. Of note, strong government spending, GFCF, and net exports all boosted the overall number and those components are likely to be large drags in Q4 and beyond.”

- USDJPY dives to its lowest level since late August amid sustained USD selling bias.

- Oversold conditions help bulls to defend the 61.8% Fibo. level support amid risk-on.

- The technical setup supports prospects for an extension of the recent sharp downfall.

The USDJPY pair attracts fresh selling following an intraday uptick to the 146.50 area and dives to its lowest level since late August during the mid-European session. The pair, however, recovers a few pips from the daily low and is currently placed just below mid-139.00s.

The post-US CPI US Dollar (USD) selling pressure remains unabated on the last day of the week amid bets for smaller rate hikes by the Federal Reserve. Furthermore, the narrowing US-Japan rate differential boosts the Japanese Yen and exerts additional downward pressure on the USDJPY pair. That said, the risk-on mood undermines the safe-haven JPY and offers some support to the major.

From a technical perspective, a sustained break below the 140.75 confluence support is seen as a fresh trigger for bearish traders. The said area breakpoint comprises the 100-day SMA and the 50% Fibonacci retracement level of the strong rally from the August monthly low to a 32-year high touched in October. This, in turn, should now act as a pivotal point for the USDJPY pair.

The sharp intraday downfall, meanwhile, stalls near 61.8% Fibo. level amid extremely oversold conditions on intraday charts. Furthermore, the RSI (14) on the daily chart has moved on the verge of breaking below the 30 mark. This is holding back bearish traders from placing fresh bets around the USDJPY pair. Nevertheless, the setup still supports prospects for additional losses.

Hence, any recovery back above the 140.00 psychological mark could be seen as a selling opportunity and runs the risk of fizzling out rather quickly near the 140.75 confluence support breakpoint. That said, some follow-through buying beyond the 141.00 round figure could trigger a short-covering rally towards the 142.00 mark en route to the daily peak, around mid-142.00s.

On the flip side, the 138.75 region, or 61.8% Fibo. level might continue to protect the immediate downside. A convincing breakthrough will set the stage for an extension of the recent sharp pullback from the vicinity of the 152.00 mark. The USDJPY pair might then accelerate the fall towards the 138.00 mark and eventually drop to the 137.50 horizontal support.

USDJPY daily chart

-638037674271039272.png)

Key levels to watch

EURUSD accelerates the upside to the boundaries of 1.0300. Economists at BBH expect the pair to test the August 10 high near 1.0370.

European Union updated its macro forecasts

“EURUSD broke above its September 12 high near 1.02 and sets up a test of the August 10 high near 1.0370.”

“Eurozone growth is seen at 3.2% this year but slowing sharply to 0.3% next year vs. 1.4% previously. Growth is expected to recover to 1.5% in 2024. Inflation is seen at 8.5% this year, up nearly a percentage point from the previous forecast. Inflation is expected to slow to 6.1% next year vs. 4.0% previously, and then to 2.6% in 2024.”

- EURUSD accelerates the upside to the boundaries of 1.0300.

- The August top at 1.0368 emerges as the next target.

EURUSD adds to Thursday’s strong advance and flirts with the key barrier at the 1.0300 neighbourhood at the end of the week.

The continuation of the recovery looks the most likely scenario in the very near term. Against that, further upside could motivate the pair to challenge the August high at 1.0368 (August 10) ahead of the always relevant 200-day SMA, today at 1.0437.

In the longer run, the pair’s bearish view should remain unaltered while below the latter.

EURUSD daily chart

- DXY’s decline gathers extra pace and tests 3-month lows.

- Next support of note now emerges at the key 200-day SMA.

DXY extends the post-CPI sell-off to the vicinity of the 107.00 region, or fresh multi-week lows.

Considering the recent price action, the dollar looks poised to extend the current bearish tone in the short-term horizon. That said, the next target of relevance is now seen at the critical 200-day SMA, today at 104.78.

While above the latter, the index is expected to maintain its constructive stance.

DXY daily chart

Economists at the Bank of America Global Research analyze how the balance of payments dynamics will impact a basket of currencies next year. In their view, the likes of the Euro, the British Pound and the New Zealand Dollar are the most vulnerable to these dynamics.

Balance of payments dynamics will be supportive for AUD and NOK

“In recent reports, we have discussed the potential areas of concern, which we think will be an important theme for FX. One key area, which we will be focusing on is the balance of payments dynamics.”

“The impact of rising energy costs and the relative speed of central bank policy normalization has affected both sides of the balance of payments ledger. We looked at how this may impact the G10 FX landscape over the coming year and conclude that balance of payments dynamics will be a headwind for the likes of EUR, NZD and GBP, whilst supportive for AUD and NOK.”

- EURJPY adds to the weekly leg lower and breaks below 143.00.

- Next on the downside now comes the October lows near 140.90.

EURJPY accelerates its decline and breaches the key support at 143.00 the figure so far on Friday.

The cross seems to have embarked on a corrective phase and the continuation of this stance could now extend to the October low near 140.90, an area coincident with the 3-month support line (off the August low).

In the longer run, while above the key 200-day SMA at 138.08, the constructive outlook is expected to remain unchanged.

EURJPY daily chart

Precious metals prices have recovered of late. But Silver could suffer a setback if the Silver Institute factors the high ETF outflows into its forecasts, strategists at Commerzbank report.

Risk of setback on Silver market

“Next week could see the Silver Institute spark gloomier sentiment again. For one thing, it will probably not be quite as optimistic about global physical Silver demand as it was back in the spring. Accordingly, the supply gap will presumably no longer be quite as high. And for another thing, Silver ETFs have been registering sizeable outflows since the early summer, which could even over-compensate for the deficit.”

“Silver is likely to drop back again somewhat against this backdrop.”

GBPUSD swings above the 1.17 level. The pair could extend its race higher on a break past the 1.1760/1.1840 area, economists at Société Général report.

Near-term support aligns at 1.1330

“GBPUSD has crossed above the trend line since February denoting short-term upside.”

“The pair could revisit July and 2016 low of 1.1760/1.1840 and projections of 1.2070.”

“The 50-Day Moving Average near 1.1330 is near-term support.”

See – GBPUSD: At risk of rather fast corrections as domestic picture for Sterling remains uncertain at best – ING

- GBPUSD edges higher to its highest level since late August, albeit lacks follow-through.

- The heavily offered tone surrounding the USD is seen as a key factor offering support.

- A bleak outlook for the UK economy is holding back bulls from placing aggressive bets.

The GBPUSD pair attracts some buying near the 1.1650-1.1645 region on Friday and climbs to its highest level since late August during the first half of the European session. The pair is currently trading around the mid-1.1700s and is looking to build on the previous day's post-US CPI strong bullish momentum beyond the 100-day SMA.

The US Dollar (USD) selling remains unabated amid firming expectations that the Fed will slow the pace of its policy tightening. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, drops to a two-and-half-month low and turns out to be a key factor acting as a tailwind for the GBPUSD pair.

The British Pound, on the other hand, draws some support from mostly upbeat UK economic data released earlier this Friday. The UK Office for National Statistics reported this Friday that the domestic economy contracted by 0.6% in September against -0.4% expected and the previous month's upwardly revised reading of -0.1%.

Furthermore, the quarterly GDP print, the yearly growth rate, along with the Manufacturing and Industrial production, came in better than market expectations and offers additional support to the GBPUSD pair. Spot prices, however, lack follow-through buying amid a gloomy outlook for the UK economy, which is holding back bulls from placing fresh bets.

It is worth recalling that the Bank of England (BoE) warned last week that a recession in the UK could last for all of 2023 and the first half of 2024. This, in turn, warrants caution before positioning for any further near-term appreciating move. Traders now look to the Preliminary Michigan US Consumer Sentiment Index for a fresh impetus.

Technical levels to watch

USDJPY thunders lower by 3.5% in two days. The pair could extend its decline towards 137.80 and even 132.50 on failure to hold 140.30/139.40, economists at Société Générale report.

Failure to cross 145.00 could mean continuation in downside

“USDJPY has dipped towards the lower limit of the channel drawn since March at 140.30/139.40 which is also the peak of July. This is first layer of support.”

“Failure to cross 145.00 could mean continuation in downside.”

“In case the pair struggles to defend 140.30/139.40, the down move could extend towards 137.80 and 132.50, the 38.2% retracement from 2020.”

- USDCAD drops to its lowest level since September 20 and is pressured by a combination of factors.

- Rallying crude oil prices underpins the Loonie and drags the pair lower amid sustained USD selling.

- Bets for less aggressive Fed rate hikes, sliding US bond yields, the risk-on mood weigh on the buck.

The USDCAD pair struggles to capitalize on its modest intraday uptick to levels just above the 1.3600 mark and attracts fresh selling on the last day of the week. The pair drops to its lowest level since September 20, around the 1.3284 region during the first half of the European session and is pressured by a combination of factors.

Crude oil prices rally over 3% on Friday in reaction to the news that China, the world's top oil importer, eased some of the strict COVID restrictions. This, in turn, underpins the commodity-linked Loonie and drags the USDCAD pair lower for the second successive day, also marking the fifth day of a negative move in the previous six. Apart from this, the prevalent selling bias surrounding the US Dollar (USD) is seen as another factor exerting downward pressure on the major.

In fact, the USD Index, which measures the greenback's performance against a basket of currencies, hits a two-and-half-month low amid expectations for a less aggressive policy tightening by the Fed. The softer US consumer inflation figures released on Thursday indicated that the worst of the post-pandemic price spike is over. The data reaffirms bets for smaller Fed rate hikes in coming months, which leads to a further decline in the US bond yields and weighs on the greenback.

Furthermore, the risk-on mood - as depicted by a strong rally in the equity markets - takes its toll on the safe-haven buck. That said, slightly oversold conditions on intraday charts offer some support to the USDCAD pair and help limit the downside, at least for the time being. Traders now look forward to the US economic docket, featuring the release of the Preliminary Michigan US Consumer Sentiment Index for some short-term opportunities later during the early North American session.

Technical levels to watch

Yesterday’s US Consumer Price Index (CPI) read dealt a big blow to the Dollar. Nonetheless, economists at ING think it is premature for a sustained Dollar downtrend.

Too early for a broad Dollar downtrend

“It simply appears too early to call victory in the inflation battle, and more evidence will need to come from the jobs markets – which has remained exceptionally tight. There may not be much interest from the Fed to switch to a more dovish stance without having gathered all possible data before the December meeting.”

“There is still a lack of alternatives to the Dollar at the moment. European currencies are benefitting from lower gas prices, but that has been due to mild weather, and concerns about the energy crisis for this and next winter are unlikely to abate over the next few months. In China, markets are welcoming looser covid rules, but infection numbers are elevated and vaccination rates are low, which means that the path to complete removal of restrictions still looks long. A heavy return to other EMFX currencies also appears premature given the worsening financial conditions and slowing global demand.”

“Risk assets are facing downside risks that go beyond the Fed story: from likely contracting corporate profits to housing market woes and, recently, the turmoil in the crypto market.”

“The Dollar peak might be past us, but a Dollar downtrend may not be there yet. We remain moderately bullish on the Dollar into year-end.”

In its quarterly publication released on Friday, the European Commission projects Eurozone Gross Domestic Product (GDP) to grow 3.2% in 2022, slow down to 0.3% growth in 2023 and accelerate to 1.5% in 2024.

Key takeaways

Forecasts Eurozone unemployment at 6.8% of the workforce in 2022, rising to 7.2% in 2023 and falling again to 7.0% in 2024.

Forecasts Eurozone inflation at 8.5% in 2022, slowing to 6.1% in 2023 and to 2.6% in 2024.

Forecasts Eurozone aggregated budget deficit to fall to 3.5% of GDP in 2022, inch up to 3.7% in 2023 and fall again to 3.3% in 2024.

Forecasts Eurozone aggregated public debt to fall to 93.6% of GDP in 2022, 92.3% in 2023 and 91.4% in 2024.

Forecasts Eurozone quarterly GDP to contract in Q4 2022 and Q1 2023, return to growth in Q2 2023.

European Economic Commissioner Paolo Gentiloni said, "We are approaching the end of a year in which Russia has cast the dark shadow of war across our continent once again.”

"The EU economy has shown great resilience to the shockwaves this has caused. Yet soaring energy prices and rampant inflation are now taking their toll and we face a very challenging period both socially and economically," he said.

Market reaction

The quarterly forecasts failed to move the need around the Euro, as EUR/USD continues to hover near 1.0260, up 0.50% on a daily basis.

Bank of England (BoE) Governor Andrew Bailey said on Friday, “more increases to interest rates likely in the coming months.”

Additional quotes

“Efforts to bring inflation under control are likely to take between 18 months and two years.”

“Sensible for firms to direct pay rises towards the lower paid.”

Market reaction

GBPUSD is keeping its range at around 1.1730 despite Bailey's hawkish remarks, adding 0.15% on the day.

- Gold climbs to its highest level since August 18 amid sustained USD selling bias.

- Bets for less aggressive Fed rate hikes, sliding US bond yields weigh on the buck.

- The risk-on mood might turn out to be the only factor capping gains for the metal.

- Some follow-through buying will set the stage for gains towards the $1,800 mark.

Gold builds on the previous day's post-US CPI breakout momentum beyond the 100-day SMA and gains some follow-through traction on Friday. The upward trajectory lifts the XAUUSD to its highest level since August 18, around the $1,766 region during the first half of the European session.

The softer US consumer inflation figures released on Thursday reaffirm bets for smaller rate hikes by the Federal Reserve. This, in turn, drags the US Dollar to a two-and-half-month low and acts as a tailwind for the dollar-denominated gold. Moreover, expectations for peak US interest rates dropped below 5%, which leads to a further decline in the US Treasury bond yields and offers additional support to the non-yielding yellow metal. That said, the prevalent risk-on mood might hold back bulls from placing aggressive bets and keep a lid on any further gains for the safe-haven XAUUSD.

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the next relevant hurdle for gold is pegged near the $1,770 area - Pivot Point 1-Week R3. This is closely followed by $1,773-$1,775 region - Pivot Point 1-Month R2 and Pivot Point 1-Day R1. Some follow-through buying will be seen as a fresh trigger for bullish traders and set the stage for a move towards the $1,790 level - Pivot Point 1-Day R2 - en route to the $1,800 psychological mark – Fibonacci 161.8% 1-Month.

On the flip side, the $1,757-$1,756 area - Previous High 1-Day - now seems to protect the immediate downside ahead of the $1,745 level - Fibonacci 23.6% 1-Day. A convincing break below might prompt some technical selling and accelerate the corrective slide, dragging gold to the $1,730 region - Previous Month High. The latter should act as a strong base for the XAUUSD, which if broken decisively could probably negate prospects for any further appreciating move.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

EURUSD is above 1.02 after the loosening of covid quarantine rules in China. Economists at Société Générale expect the pair to extend its advance toward the 1.0360/1.0450 region.

The low for EURUSD is probably behind us

“The loosening of covid quarantine rules in China helps to lift the global economic gloom and will speed the normalisation of supply chains. From a macro perspective for Europe, the prospective re-opening of the Chinese economy is a second necessary condition after the Fed that justifies a more upbeat outlook for foreign trade and the currency.”

“Notwithstanding the energy crisis and pessimism over the conflict in Ukraine, inflation and growth, the low for EURUSD is probably behind us and medium-targets can be raided.”

“The pair is expected to inch higher towards projections of 1.0285 and August high of 1.0360/1.0450 which is also the 200-DMA. This could be a potential resistance zone.”

“Defending 1.0000/0.9930 is crucial for persistence in up move.”

- EURUSD adds to Thursday’s gains well north of 1.0200.

- The dollar remains well on the defensive following US CPI.

- Germany final Inflation Rate came at 10.4% YoY in October.

The buying pressure keeps growing around the European currency and the rest of the risk complex and lifts EURUSD to new multi-week highs around 1.0270 on Friday.

EURUSD boosted by dollar weakness

EURUSD advances for the second session in a row and flirts with the 1.0270 region, an area last traded back in mid-August, at the end of the week.

The pair saw its upside abruptly reinvigorated after lower-than-estimated US CPI results in October lend support to the idea that inflation pressures could be cooling down and that the Fed could slow the pace of its current hiking cycle.

The daily uptick in the pair so far comes in tandem with a modest upside in German 10-year bund yields, which manage to set aside three consecutive daily pullbacks.

In the domestic calendar, final inflation figures in Germany showed the CPI rise 10.4% YoY and 0.9% vs. the previous month.

Across the Atlantic, the only release will be the preliminary Michigan Consumer Sentiment for the month of November.

What to look for around EUR

EURUSD’s post-US CPI rally remains unabated and trades closer the 1.0300 area at the end of the week.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The recent decision by the Fed to hike rates and the likelihood of a tighter-for-longer stance now emerges as the main headwind for a sustainable recovery in the pair.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the fragile sentiment around the euro in the longer run.

Key events in the euro area this week: Germany Final Inflation Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EURUSD levels to watch

So far, the pair is gaining 0.39% at 1.0247 and faces the next up barrier at 1.0273 (monthly high November 11) seconded by 1.0368 (monthly high August 12) and finally 1.0437 (200-day SMA). On the other hand, a breach of 1.0029 (100-day SMA) would target 0.9898 (55-day SMA) en route to 0.9730 (monthly low November 3).

GBPUSD catches a fresh bid above 1.1700 on upbeat UK Gross Domestic Product (GDP) data. However, economists at ING still believe that the domestic background remains challenging for Sterling.

Economic slump not as bad as feared, for now

“Second-quarter GDP numbers showed a smaller-than-expected contraction (-0.2% quarter-on-quarter), although that was mainly due to the upward revision in August’s figures. Incidentally, September figures have been heavily affected by the Queen’s funeral bank holiday.Still, our UK economist expects a contraction in every quarter until 2Q23, and a lot of focus will obviously be on the measures announced next week by the Treasury.

“The domestic picture for Sterling remains uncertain at best, and we think this puts GBPUSD at risk of rather fast corrections should the support of a weaker USD evaporate.”

- USDJPY struggles to preserve its intraday recovery gains amid sustained USD selling.

- Bets for less aggressive Fed rate hikes and sliding US bond yields weigh on the buck.

- The risk-on impulse could undermine the safe-haven JPY and lend support to the pair.

- A more dovish BoJ might also hold back bears from placing fresh bets around USDJPY.

The USDJPY gains some positive traction on Friday and recovers a part of the previous day's softer US CPI-inspired slump to the 140.20 area, or a two-month low. The intraday uptick, however, falters in the vicinity of the mid-142.00s. The pair surrenders a major part of its intraday gains and slides back below the 141.00 mark during the first half of the European session.

The US Dollar (USD) drops to its lowest level since August 18 during the first half of the European session and turns out to be a key factor acting as a headwind for the USDJPY pair. The latest US consumer inflation figures released on Thursday indicated that the worst of the post-pandemic price spike is over. This, in turn, reaffirms expectations that the Federal Reserve will slow the pace of its policy tightening in the coming months, which, in turn, continues to weigh on the greenback.

In fact, the current market pricing points to over an 80% chance of a 50 bps Fed rate hike in December as compared to the probability of 56.8% before the US CPI report. Moreover, expectations for peak US interest rates also dropped below 5%, which is evident from a further decline in the US Treasury bond yields. The resultant narrowing of the US-Japan rate differential offers some support to the Japanese Yen and further contributes to the USDJPY pair's intraday pullback of over 170 pips.

That said, the prevalent risk-on mood, as depicted by a strong rally in the equity markets - might hold back traders from placing aggressive bullish bets around the safe-haven JPY. Apart from this, a more dovish stance adopted by the Bank of Japan could help ease the bearish pressure surrounding the USDJPY pair. Nevertheless, spot prices remain on track to register losses for the fourth successive week. Traders now look to the Preliminary Michigan US Consumer Sentiment Index for some impetus.

Technical levels to watch

- The index remains well on the defensive near 107.40.

- The persistent risk-on trade keeps hurting the dollar.

- Flash Michigan Consumer Sentiment next of note in the docket.

The dollar keeps losing ground and navigates an area last seen back in mid-August in the mid-107.00s when tracked by the USD Index (DXY) on Friday.

USD Index weaker post-CPI, risk-on mood

The index adds to Thursday’s post-CPI acute sell-off and flirts with the 107.50 region at the end of the week on the back of the robust performance of the risk complex and the loss of momentum in US yields across the curve.

The index drops to multi-week lows pari passu with markets repricing the Fed’s normalization process in the next months, where the central bank is expected to slow the pace of the upcoming interest rate hikes and turn to a more dovish stance.

In the US data space, the sole release will be the advanced print of the Michigan Consumer Sentiment for the month of November.

What to look for around USD

The index extends the sharp decline in the aftermath of US inflation figures and against the backdrop of a firmer sentiment in the risk-linked galaxy.

In the meantime, investors’ repricing of a probable pivot in the Fed’s policy now emerges as a fresh and quite reliable source of weakness for the dollar, in line with a corrective decline in US yields across the curve.

Key events in the US this week: Preliminary Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: US midterm elections. Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 0.49% at 107.38 and the breakdown of 104.87 (200-day SMA) would open the door to 104.63 (monthly low August 10) and finally 103.67 (weekly low June 27). On the other hand, the next up barrier aligns at 109.06 (100-day SMA) seconded by 111.00 (55-day SMA) and then 113.14 (monthly high November 3).