- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-11-2022

Polish President Duda said that what happened was a one-off incident, adding that there were no indications that there will be a repeat of today's incident.

More to come...

- GBPJPY remains pressured near a short-term key support line.

- Convergence of 50-SMA, two-week-old descending trend line restricts immediate upside.

- Six-week-old horizontal support lures bears, 100-SMA acts as extra filters to the north.

- RSI, MACD favor sellers as the pair fades the bounce off the monthly low.

GBPJPY remains pressured around 164.80 as sellers poke a one-week-old ascending support line during Wednesday’s Asian session. In doing so, the cross-currency pair fades the recovery moves from a two-week low while portraying a downtrend since October 31.

That said, the quote’s failure to cross the convergence of a 50-SMA and a fortnight-long descending resistance line, around 166.00-20, joins the retreat of the Relative Strength Index (RSI) placed at 14 to tease the sellers. On the same line could be the receding bullish bias of the Moving Average Convergence and Divergence (MACD) indicator.

With this, the GBPJPY bears are likely to conquer the immediate support line around 164.80, which in turn could drag the quote towards a 1.5-month-old broad support area between 162.60 and 163.00.

Although the quote is more likely to rebound from the aforementioned key support zone, a downside break of 162.60 won’t hesitate to challenge the previous monthly low near 159.70.

Alternatively, a daily closing beyond 166.20 could quickly propel GBPJPY toward the 100-SMA hurdle of 167.85.

Following that, the previous week’s top and the October 31 peak, respectively near 169.10 and 172.10, could challenge the pair buyers.

GBPJPY: Four-hour chart

Trend: Further downside expected

- AUDJPY is sensing initial selling action as sentiment has turned sour amid Russia-Poland tensions.

- The Japanese yen has still to show the impact of a contraction in growth rates.

- This week, the Australian payroll data will be of utmost importance.

The AUDJPY pair is facing headwinds in sustaining above the crucial support of 94.00 in the early Tokyo session. The asset is declining after facing barricades around 94.50 and is expected to remain on the tenterhooks ahead of the Australian employment data, which will release on Thursday.

The cross is been declining on escalating geopolitical tensions. The risk profile has soured after Russian rebels expanded their military activities to NATO-member Poland. In response to that, Russian Federation has denied any attack from their side, however, Poland has called for a meeting with NATO members.

On Tuesday, the risk barometer remained majorly in the bounded territory despite the release of the Reserve Bank of Australia (RBA) minutes. As per the RBA minutes, the chances for a 25 bps rate hike stood at 75% despite a historic surge in the inflation rate to 7.3%.

The board agreed that acting consistently on policy rates would support confidence in the monetary policy framework among financial market participants and the community more broadly. Also, RBA policymakers believed that the Official Cash Rate (OCR) has been elevated materially in a short span of time. Apart from that, interest rate guidance has been escalated to 8%.

Meanwhile, Japanese investors reacted less to the negative Gross Domestic Product (GDP) data released on Tuesday. The Japanese economy has displayed a contraction of 0.3% in the third quarter against expectations of a growth rate of 0.3% and the prior release of 0.9%. On an annualized basis, the economic catalyst has displayed a negative growth rate at 1.2% against an expansion of 1.1% as expected and the prior release of 3.5%.

This week, the critical trigger for the asset will be the Australian payroll data. As per the consensus, the economy has added 15k in October vs. a marginal increment of 0.9k earlier. While the Unemployment Rate is seen higher at 3.6% against the prior release of 3.5%.

- A Russian missile fired as part of an attack on Ukraine's energy systems landed in NATO member Poland.

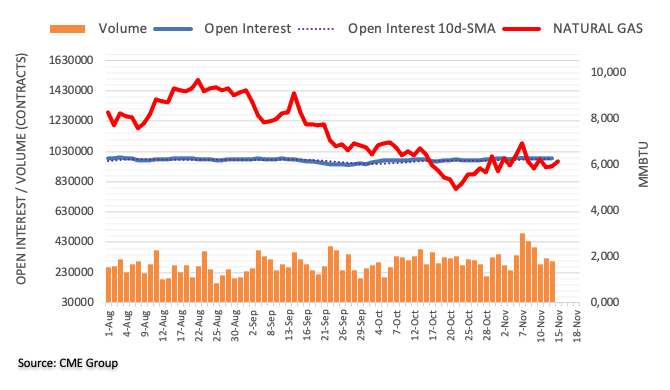

- WTI spikes after a key pipeline bringing Russian oil to Eastern Europe was halted.

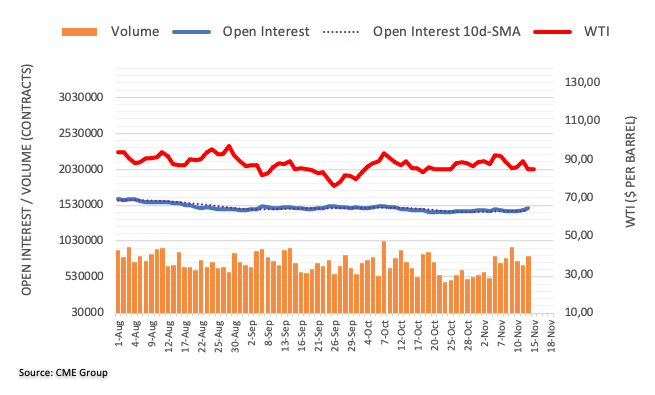

West Texas Intermediate, (WTI) put in a short squeeze in the final part of the Wall Street session on Tuesday, moving into in-the-money shorts from the start of the week's trading. At the time of writing, the black gold is trading at $87.47 and is higher by some 0.7% on the day so far.

The main news of the day comes with reports of a Russian missile fired as part of an attack on Ukraine's energy systems landed in NATO member Poland, killing two. Poland's leaders are in an emergency meeting referred to as a "crisis situation". Polish media reported two died in the attack near the village of Przewodow, close to the country's border with Ukraine. Polish foreign ministry has since confirmed that a Russian-produced rocket fell on the Polish village Przewodów. In response, NATO Security General Stoltenberg will chair an emergency meeting of NATO Wednesday morning.

Prices spiked late in the session after a key pipeline bringing Russian oil to Eastern Europe was halted after power was cut, analysts at ANZ Bank reported. ''The Ukrainian pipeline manager said Russian artillery was the cause. The halt affects flows to Hungary, Czech Republic and Slovakia. The length of the pipeline outage is still unknown. This comes ahead of European sanctions on Russian crude oil imports on 5 December. Crude oil prices had been under pressure earlier in the session amid concerns over demand.''

The report offset the bearish IEA news that said the agency has cut its forecast for 2023 demand growth to 1.6-million barrels per day from 2.1-million bpd this year, while expecting demand in the final quarter of this year to contract by 240,000 bpd. "The GDP outlook has worsened and 4Q22 global oil use will contract (-240 kb/d) compared with last year. China's persistently weak economy, Europe's energy crisis, burgeoning product cracks and the strong US dollar are all weighing heavily on consumption," the agency said in its report.

''Earlier this week, OPEC also voiced its concern about demand and subsequently cut its fourth quarter demand forecast. Rising COVID-19 cases in China also weighed on sentiment, despite hopes of easing virus restrictions earlier in the week,'' analysts at ANZ Bank explained. ''Several major cities continue to record high levels of cases. Travel also remains subdued across the country as the public remains concerned it will be caught up in quarantine.''

In separate news, China has reported a surge in Covid infections and many people under lockdown in the manufacturing hub of Guangzhou took to the streets to protest by breaking the confinement barriers. Weak demand from China has been weighing on oil prices. Reuters reported ''new cases in Guangzhou rose above 5,000 for the first time, raising concerns the city of more than 15 million could face wider lockdowns, with the country on Monday reporting a total 17,772 new cases of the coronavirus, up from 16,072 a day earlier.''

- AUDUSD prints mild losses at the highest levels in two months.

- NATO Ambassadors to hold emergency meeting as Russian missile struck Poland.

- Upbeat sentiment favored AUDUSD buyers despite softer data from US, China and Australia.

- Firmer Aussie wage numbers can renew buying but risk-aversion, US data are more important to watch for clear directions.

AUDUSD grinds lower around 0.6750, after refreshing a two-month high, as risk-off mood joins pre-data anxiety to challenge buyers during early Wednesday in Asia.

The Aussie pair’s latest weakness could be linked to the headlines surrounding Russia’s missiles that struck Poland, a North Atlantic Treaty Organization (NATO) nation. Following that hit, the global leaders criticized Moscow’s attempt whole the NATO ambassadors called for an emergency meeting even if Russia's defense ministry denied claims of Moscow’s strike on Poland.

Just after the news broke Wall Street pared initial gains and the US Treasury yields rebounded from the intraday low. That said, the S&P 500 Futures print mild losses by the press time.

The risk-off mood underpins the US Dollar’s safe-haven demand and weighs on the AUDUSD prices, mainly due to the pair’s risk barometer status.

On Tuesday, the Reserve Bank of Australia’s (RBA) openness for all moves joined the absence of major negatives from the Group of 20 Nations (G20) meeting in Indonesia to favor the AUDUSD prices initially. On the same line was China’s readiness for more stimulus and the softer US Producer Price Index (PPI) for October and the Federal Reserve Bank of New York's Empire State Manufacturing Index for the said month.

Given the latest risk aversion, as well as the pre-data caution, the AUDUSD pair is likely to remain pressured ahead of Australia’s Wage Price Index for the third quarter (Q3), expected 0.9% QoQ versus 0.7% prior. That said, an improvement in the wages could help the RBA to turn down the dovish expectations, which in turn may help the Aussie pair to consolidate the latest losses. However, US Retail Sales for October, expected 1.0% versus 0.0% prior, will be more important considering the growing chatters of the Federal Reserve’s (Fed) pivot.

It should be noted that the latest statements from the International Monetary Fund (IMF) challenges the AUDUSD bears and keeps buyers hopeful ahead of the key Aussie data. “Australia should keep tightening monetary and fiscal policy to help cool domestic demand and keep inflation expectations in check, the IMF said,” reported Bloomberg.

Technical analysis

Despite the latest pullback, the AUDUSD pair defends the previous day’s upside break of the 100-DMA, around 0.6700 by the press time, which in turn keeps the buyers hopeful of visiting September’s high near 0.6920.

- Producer Price Index in the United States drops, supporting Federal Reserve’s case for diminishing interest-rate size increases.

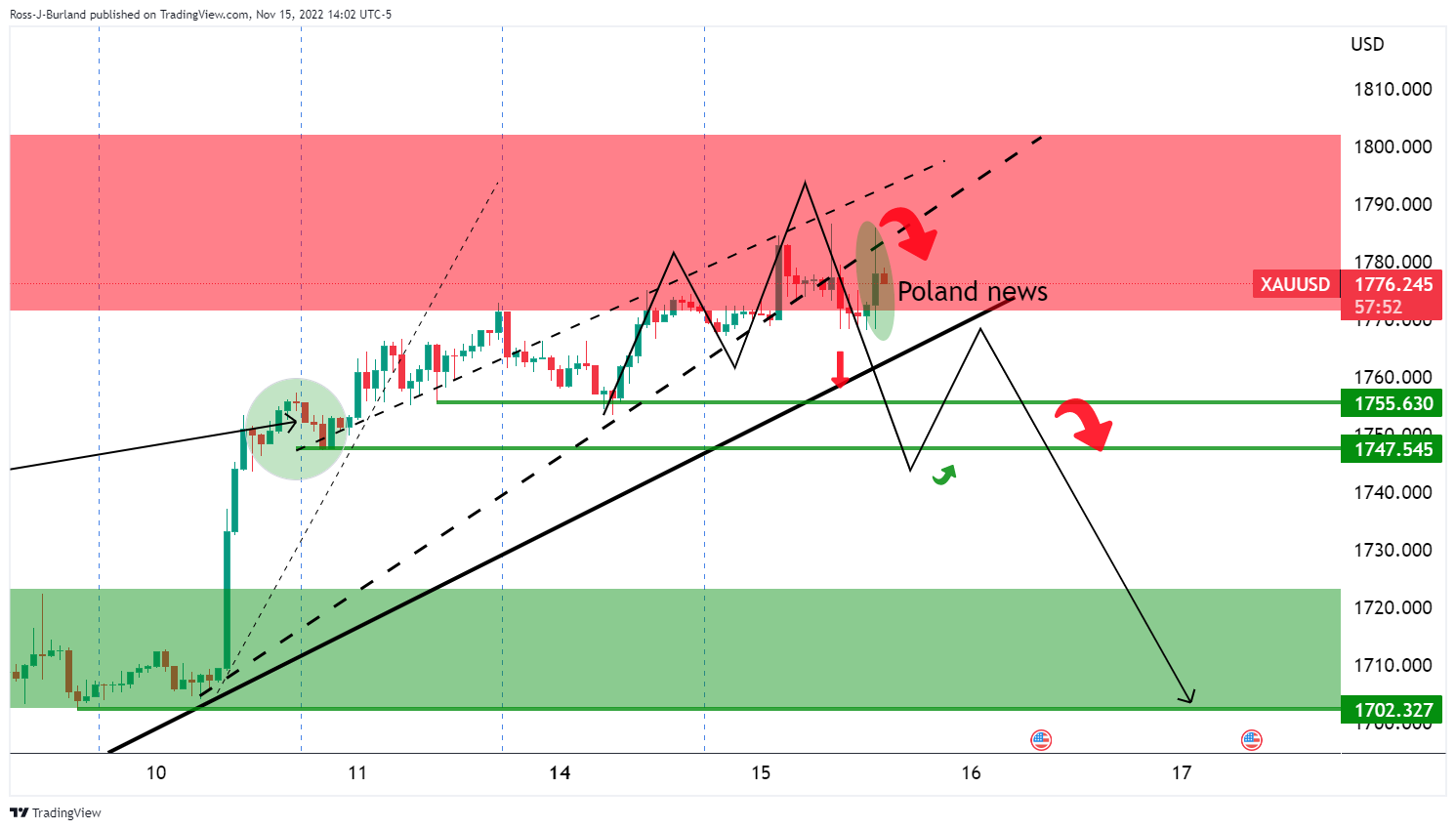

- Russia’s – Ukraine conflict extends to Poland, spurring safe-haven flows toward Gold.

- US Treasury bond yields plunged on Fed policymakers, paving the path for slower rate hikes.

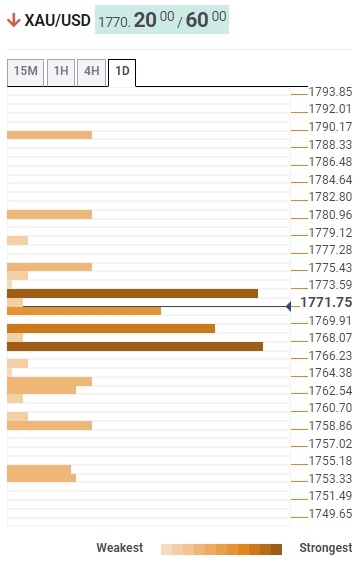

- XAUUSD prepares to assault the $1800 figure ahead of the 200-day EMA.

Gold Price is trading with solid gains on Tuesday after the release of a soft Producer Price Index(PPI) report in the United States, strengthening the Federal Reserve (Fed) case for tempering the pace of interest-rate increases. Another factor that propelled Gold Prices was geopolitical jitters linked to Russia’s invasion of Ukraine, which involved Poland and NATO. Therefore, the XAUUSD is trading at $1779 a troy ounce.

US Producer Price Index ratchet down, debilitate the US Dollar

The US Department of Labor (DoL) reported the US PPI for October decelerated compared to last month’s 8.2% and rose by 8% YoY, less than estimates of 8.3%. Excluding volatile items, the so-called core PPI advanced by 6.7% YoY, below the September 7.1%, and lower than the 7.2% uptick expected.

Given that Federal Reserve policymakers laid the ground to temper the tightening cycle after a positive Consumer Price Index (CPI) for October, Gold Prices are expected to rally. Traders should be aware that following the CPI release on Thursday, US Treasury bond yields plunged, with the 10-year benchmark note sliding 27 bps from 4.117% to 3.818%, a headwind for the US Dollar, which bolstered XAU.

Geopolitical tensions arose as Russia’s missiles landed in Poland

In the meantime, the Gold Price spiked late in the North American session on headlines: “Two Russian missiles landed on Poland, killing two Polish.” Even though there has not been a confirmation by Poland’s sources, the headline bolstered XAUUSD’s price from around $1767 to $1785, a troy ounce.

Delving into the latest newswires, a senior US intelligence official said that Russian missiles crossed into NATO member Poland, killing two people. After the incident, Polish Prime Minister Mateusz Morawiecki called an urgent meeting of a government committee for national security and defense affairs, according to a government spokesman, as reported by Reuters.

Federal Reserve policymakers committed to driving inflation down

Elsewhere, a slew of Federal Reserve officials continued to express the need to keep raising rates, though welcoming October’s CPI and PPI reports, as Atlanta’s Fed President Raphael Bostic noted, “There are glimmers of hope,” in an essay posted in the Atlanta Fed Website. Bostic was echoing comments from the Fed Vice-Chair Lael Brainard, who said the central bank could slow the pace of rate hikes but emphasized the work is not done. In the same tone, Fed Governor Christopher Waller commented there’s a “ways to go” before interest-rate hikes are done.

That said, XAUUSD is set to extend its gains but faces solid resistance around January 28 daily-low-turned-resistance at $1780. Nevertheless, once cleared, the Gold Price would resume its uptrend toward the 200-day Exponential Moving Average (EMA) at $1803.

Gold Price Analysis: Technical outlook

Gold Price remains neutral-to-upward biased, set to test the psychological $1800 figure, immediately followed by the 200-day Exponential Moving Average (EMA). Nevertheless, XAUUSD needs to clear November’s 15 daily high at $1786 before reaching the $1800 mark. Once cleared, the 200-day EMA at $1803 is up for grabs. Of note, if Gold achieves a daily close above the latter, a June 23 high test at $1857 is on the cards.

- USDCHF oscillates above 0.9400 as investors look for developments on Russia-Poland tensions.

- Hawkish commentaries from Fed policymakers have failed in supporting US Treasury yields.

- SNB Jordan sees more expansion in interest rates to keep inflation in a 0-2% range.

The USDCHF pair is witnessing rangebound moves above the immediate support of 0.9400 in early Asia. The asset has been trading in a tight range as a rebound in negative market sentiment after geopolitical tensions between Russia and Poland is supporting from the floor while hawkish guidance from Swiss National Bank (SNB) Chairman Thomas J. Jordan is capping the upside.

Escalating geopolitical tensions after Russia strike two stray missiles in the region of NATO-member Poland shifted traction in favor of safe-haven assets. The US dollar index (DXY) witnessed a sheer rebound after registering a fresh three-month low at 105.34. Gains in the DXY were trimmed quickly but still have left steam for an upside.

Meanwhile, the alpha generated by the US government bonds is not reflecting any positive reaction to hawkish commentaries from Federal Reserve (Fed) policymakers. Atlanta Fed President Raphael Bostic said on Tuesday that he wasn't expecting to see the full impact of monetary policy on inflation for months, as reported by Reuters.

He further added that indicators showing ease in inflationary pressures have not been witnessed yet so anticipating more rate hikes ahead. Also, Fed Governor Lisa Cook reiterated on Tuesday that inflation in the United States is still "much too high" and added that the focus for the Fed is on addressing inflation.

On the Swiss franc front, SNB Chairman cleared that monetary policy is still expansionary and ''we have most likely to adjust monetary policy again.'' The Swiss central bank is entitled to bring the inflation rate in the 0-2% range and in response to that current monetary policy is not restrictive enough to perform the job.

Going forward, investors will keep an eye on the outcome of NATO talks over Russia-Poland tensions. Poland's government has called for a meeting with NATO ambassadors after exercising Alliance’s Article 4. The outcome of the meeting will provide a fresh impetus for further action.

US inflation expectations, per the breakeven inflation rates per the St. Louis Federal Reserve (FRED) data, dropped during the five consecutive days in the last.

That said, the US Inflation expectations on the 10-year and 5-year horizons print 2.35% and 2.40% at the latest, matching the lowest levels since early October during the five-day downtrend.

The recent easing in the US inflation precursor adds strength to the talks surrounding the US Federal Reserve’s (Fed) monetary policy pivot and tried to pressure the US Dollar (USD) towards the south. However, the risk-off mood appeared to have challenged the USD bears of late.

It’s worth noting that the latest easing in the US Producer Price Index (PPI) for October and improvement in the Federal Reserve Bank of New York's Empire State Manufacturing Index for November also seemed to have favored the risk-on mood previously.

Moving on, the US Retail Sales for October, expected at 1.0% versus 0.0% prior, will be crucial for the market players to watch as the recent US numbers have been positive for the market’s risk profile, by pushing back the need for aggressive rate hikes.

- USDCAD licks its wounds at the lowest levels in two months, pressured near multi-day low of late.

- Convergence of 100-DMA, four-month-old horizontal support challenge bears.

- A two-week-long descending trend line restricts recovery moves.

- Bearish MACD signals, failure to rebound from the key support area keep bears hopeful.

USDCAD holds lower grounds around 1.3280, fading the bounce off a two-month low amid Wednesday’s initial Asian session.

Not only the USDCAD pair’s failure to defend the recovery from the 1.3220-30 support zone but bearish MACD signals and a two-week-old descending trend line also favor the Loonie pair sellers.

That said, a clear downside break of the 1.3220 mark could quickly direct USDCAD towards an upward-sloping trend line from early June, around 1.3050 by the press time.

It’s worth noting that the USDCAD weakness past 1.3050 will be restricted by the 1.3000 psychological magnet and 200-DMA support level near 1.2990.

Alternatively, an upside clearance of the aforementioned short-term resistance line, around 1.3380 by the press time, could renew the USDCAD buying.

Even so, lows marked during October, around 1.3495-3505, appear tough nut to crack for the USDCAD bulls before approaching the yearly high surrounding 1.3980.

Overall, USDCAD remains on the bear’s radar but the downside room appears limited.

USDCAD: Daily chart

Trend: Further weakness expected

- NZDUSD turns sideways as investors await more development on Russia-Poland tensions.

- NATO Ambassadors to meet on Wednesday as Poland exercises Alliance’s Article 4.

- An improvement in US Retail Sales despite a decline in inflation indicates robust retail demand.

The NZDUSD pair is witnessing a volatility contraction around the crucial hurdle of 0.6150 in the early Asian session. The asset witnessed an escalation in standard deviation on Tuesday after Poland's economy reported an attack by Russian rebels through two stray missiles. This led to a resurgence in the risk-off mood, however, the overall optimism regained glory.

The asset sensed selling pressure from the round-level resistance of 0.6200 and eased the majority of gains recorded on early Tuesday. Later, it turned sideways as expansion in volatility can be tamed by a period of contraction in the same.

Meanwhile, the US dollar index (DXY) has eased after a vertical movement to near 107.00 from a fresh three-month low of 105.34. Uncertainty amidst the Russian attack on NATO-member Poland is expected to remain for a while. In response to Russian military activity, Poland's administration has requested NATO Ambassadors to meet on Wednesday by enforcing Alliance’s Article 4, reported Reuters.

The returns on US government bonds are continuously losing their all support areas as the market participants don’t see the continuation of the 75 basis points (bps) rate hike structure by the Federal Reserve (Fed). The 10-year US Treasury yields have dropped to 3.77% and are expected to remain on tenterhooks ahead.

On Wednesday, the US Retail Sales data will remain in the spotlight. The economic data is seen higher at 0.9%vs. the prior release of 0%. An increment in Retail Sales data despite a decline in headline CPI figures in October indicates a robust demand by the households.

Meanwhile, Kiwi bulls are still solid on optimism fueled by upbeat Business NZ PSI data. The economic catalyst landed higher at 57.4 vs. the prior release of 55.9%. This week, the NZ economic calendar has nothing important to offer, therefore, the entire focus of investors will remain on geopolitical events for further guidance.

“The ambassadors to the North Atlantic Treaty Organization (NATO) will meet on Wednesday at the request of Poland on basis of the alliance's Article 4,” reported Reuters while quoting two European diplomats after an explosion in Poland close to the Ukrainian border reportedly caused by a stray Russian missile.

The news also defines Article 4 as it said, “According to article 4 of the alliance's founding treaty, members can raise any issue of concern, especially related to the security of a member country.”

Reuters also quotes one of the European diplomats as saying, “The alliance would act cautiously and needed time to verify how exactly the incident happened.”

Elsewhere, the United States and Western allies said they were investigating but could not confirm a report on Tuesday that a blast in NATO member Poland resulted from stray Russian missiles, while Russia's defense ministry denied it.

Also read: Ukrainian Pres': Russian missile strikes on NATO territory are ‘a significant escalation, action is needed’

Market implications

The news quickly reversed the market’s previous risk-on mood and helped the US Dollar to recover, which in turn exerts downside pressure on the EURUSD price. That said, the major currency pair stays pressured around 1.0350 at the latest.

Also read: EURUSD stays defensive near 1.0350 amid shift in sentiment, US Retail Sales, ECB’s Lagarde eyed

- EURUSD remains depressed after reversing from 4.5-month high.

- US Dollar bounces off three-month low as Russian missiles killed two in Poland.

- US/EU data, G20 updates enabled the previous run-up ahead of the key updates.

- Risk catalysts may entertain traders, mostly the bears, ahead of the US Retail Sales, speech from ECB’s Lagarde.

EURUSD teases the bear’s return by holding lower ground near the mid-1.0300s after rising to the highest levels since early July. The major currency pair cheered the market’s risk-on mood and upbeat data from home to refresh the multi-day high before the fresh geopolitical fears dragged prices ahead of important data/events.

News that Russian missiles struck in Polish border with Ukraine and killed two triggered the latest risk aversion as Poland is a North Atlantic Treaty Organization (NATO) nation. Ukrainian President Volodymyr Zelenskyy harshly criticized Russian missile strikes while NATO Ambassadors are up for a meeting early Wednesday to discuss the issue. Meanwhile, a Polish reporter was quoted on the blasts tonight while saying, ''My sources in the services say that what hit Przewowo is most likely the remains of a (Russian) rocket shot down by the Armed Forces of Ukraine.''

Talking about data, Germany’s ZEW Economic Sentiment Index improved to -36.7 in November versus -59.2 prior and the market expectation of -50. Further, the nation’s ZEW Current Situation Index also rose to -64.5 from -72.2 previous readings and the analysts' estimate of -68.4. Additionally, the second estimate of the Euro Area Gross Domestic Product (GDP) for the third quarter (Q3) matched the initial forecasts of 2.1% YoY and 0.2% QoQ.

On the other hand, US Producer Price Index (PPI) for October eased to 8.0% YoY versus market forecasts of 8.3% and the downwardly revised prior of 8.4%. It’s worth noting that the monthly figure reprinted the 0.2% prior (revised from 0.4%) while easing below 0.5% expectations. Moreover, the Federal Reserve Bank of New York's Empire State Manufacturing Index jumped to 4.5 in November from -9.1 in October and the market expectation of -5.

The recently softer data from the US and Eurozone renewed concerns about the Fed’s pivot and favored the market optimists previously. On the same line was an absence of major negatives from the Group of 20 Nations (G20) meeting in Indonesia. Further, China’s readiness for more stimulus, especially after witnessing downbeat data, also favored the risk-on mood and the EURUSD buyers previously.

Amid these plays, Wall Street closed with smaller gains than the early-day moves while the US 10-year Treasury yields struggle at six-week low.

Moving on, EURUSD is likely to remain pressured ahead of the US Retail Sales for October, expected 1.0% versus 0.0% prior, amid sour sentiment. Should the actual outcome of the data appear softer the pair may rebound. However, the recovery also depends upon the speech from European Central Bank (ECB) President Christine Lagarde amid looming fears of recession and recently mixed comments from the policymakers over the next hawkish step.

Technical analysis

A failure to provide a daily closing beyond the 200-DMA hurdle, around 1.0425 by the press time, joins overbought RSI conditions to challenge the bulls.

- GBPUSD is looking to recapture 1.2000 as risk-on regains traction post-Poland noise.

- Declining odds for a 75 bps rate hike by the Fed have weighed heaving on US Treasury yields.

- A significant rise in oil and food prices is expected to accelerate UK headline CPI to 10.7%.

The GBPUSD pair has turned sideways after resurfacing from the critical support of 1.1800 in the late New York session. The Cable bulls are expected to recapture the psychological resistance of 1.2000 as the risk-on impulse has regained traction.

A significant responsive buying move in the US dollar index (DXY) after registering a fresh three-month low of 105.34 has concluded around 107.00 as initiative sellers have stepped in. The S&P500 futures recovered sharply after a vertical decline as escalated geopolitical tensions mounted volatility in the global markets.

The cross of two stray Russian rockets into the territory of NATO-member Poland led to a resurgence of geopolitical tensions as the market participants considered that Russia is expanding its invasion plans to other NATO members. However, Russian defenses have denied the same.

Meanwhile, the 10-year US Treasury yields dropped further to 3.77% as the Federal Reserve (Fed) is highly expected to drop the continuation of the 75 basis points (bps) rate hike regime in its December monetary policy meeting. As per the CME FedWatch tool, chances for a 75 bps rate hike have tumbled below 15%.

On the UK front, Pound bulls capitalized on improvement in labor cost data but Poland's noise dented market sentiment. The Average Earnings landed higher at 5.7% than the consensus of 5.6%. Households in the UK region are already facing turbulence of decline in real income due to escalating inflationary pressures. An improvement in earnings data may support them to offset inflation-adjusted payouts.

Going forward, investors will keep an eye on the inflation data. The headline Consumer Price Index (CPI) is seen extremely higher at 10.7% vs. the prior release of 10.1%. While the core CPI that excludes oil and food prices may decline marginally to 6.4% against the former release of 6.5%.

- AUDUSD bulls stick to the course but meet key resistance.

- Geopolitical risks have raised their ugly head surrounding Poland, Russia noise.

AUDUSD is higher by some 1% and has rallied from a low of 0.6685 to test a key daily resistance line near 0.6800. However, there has been a glitch that is due to lending support to the risk-off complex, namely the US Dollar, in today's escalation of geopolitical tensions in the Russian / Ukraine conflict.

In midday trade on Wall Street, news that at least two are dead after Russian missiles landed in NATO state Poland on the Ukraine border, according to the Express. Poland and Hungary have convened national security committee meetings and the US Pentagon is seeking to collaborate on the news. A NATO official said ''we are looking into these reports linked to blast in Poland and closely coordinating with our ally Poland.'' Volodymyr Zelenskyy, the Ukrainian president, said the Russian missile strikes on NATO territory are a significant escalation, and action is needed. The Latvian defense minister said NATO ''could provide air defenses to Poland and part of the territory of Ukraine.''

RBA vs. geopolitical risks

The implications of this are highly bearish for financial markets and the high beta currencies such as the Aussie. Given that AUD is now meeting a daily trendline, see below, the path of least resistance is to the downside. For now, however, it is hovering near its strongest levels in nearly two months as traders digested the latest central bank policy meeting minutes, which showed that policymakers are open to either pausing the tightening cycle or returning to larger interest rate hikes depending on incoming data.

Reserve Bank of Australia Deputy Governor Michelle Bullock also recently stated that the cash rate would likely rise further. However, he added that an eventual pause in rate hikes is getting nearer. Earlier this month, the RBA delivered a smaller-than-expected 25 basis point rate increase and has now lifted the cash rate by a total of 275 basis points since May.

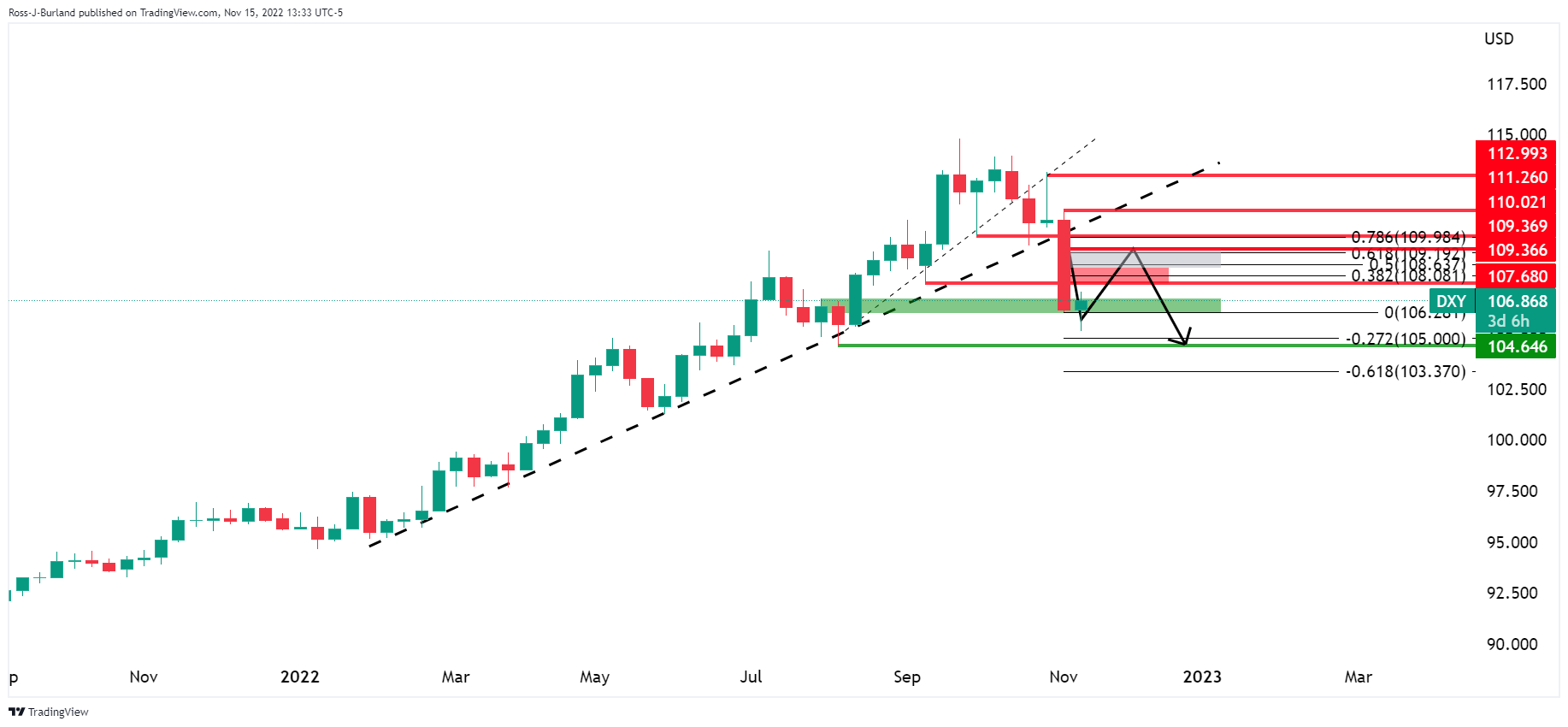

Meanwhile, investors remained cautious as Federal Reserve officials signaled that US rates could end higher than previously anticipated. Hawkish Fed speakers are lending support to the greenback which is now fuelled by geopolitical risks also. Nevertheless, Tuesday's Producer Price Index mirrored that of last week's Consumer Price Index. The DXY fell to its lowest since mid-August around 105.35 and was on track to test the August 10 low near 104.636. However, the bulls have moved in and are treading water again:

US yields reacted accordingly to the PPI whereby the headline came in at 8.0% vs. 8.3% expected and a revised 8.4% (was 8.5%) in September. The core came in at 6.7% YoY vs. 7.2% expected and actual in September. ''The PPI data will do nothing to dispel the notion that the Fed is moving closer to a pivot,'' analysts at Brown Brothers Harriman argued.

Aussie jobs eyed

Looking ahead on the domestic front, Aussie employment data will be in focus. ''Wages growth is likely to pick up again, boosted by the adjustment from the Fair Work Commission decision while private sector wage adjustment usually occurs in the third quarter,'' analysts at TD Securities said. ''On the other hand, we expect employment losses in October, contrary to expectations. A weak jobs number may drive expectations that the RBA is coming closer to a pause though we think it is still premature.''

AUDUSD technical analysis

The daily and weekly charts are offering a bearish outlook while the price remains on the front side of the bearish trendlines and below the weekly horizontal structure.

- The producer Price Index in the United States decelerates, flashing the impact of the Federal Reserve’s policy.

- After two US inflation reports, the US Dollar weakened on hopes that the Fed will pause rate hikes.

- Japan’s GDP contracted, justifying the Bank of Japan’s loose policy.

- Russian missiles hit Poland, though pending confirmation remained.

The USDJPY struggles to gain traction above the 100-day Exponential Moving Average (EMA) at 140.82 and drops following the release of a soft US inflation report, strengthening the case for the Federal Reserve and moderating the pace of rate hikes. Also, geopolitical tensions arose as reports emerged that two Russian missiles hit Poland. The USDJPY is trading at 139.05, below its opening price by 0.58%.

Sentiment remains fragile following the Poland events. Reports emerged that Ukrainian forces intercepted a Russian rocket, which dived into Poland, causing the tragedy. Of note, Polish authorities have not expressed an official version of what happened. At the time of typing, the White House said it couldn’t confirm the reports coming out from Poland.

Aside from this, US equities have recovered some ground after the Poland headlines. The US Department of Labor (DoL) revealed that the Producer Price Index (PPI) for October expanded 8% YoY, beneath 8.3% estimates, while excluding volatile items, the so-called core PPI jumped by 6.7% YoY, less than 7.1% foreseen. Now that CPI and the PPI reports are in the rearview mirror, suggesting that US inflation is cooling,

Elsewhere, Federal Reserve officials commented that a deceleration of tightening monetary conditions would be appropriate, but at the same time, emphasized that the work is not done. On Tuesday, Atlanta’s Fed President Raphael Bostic said that the Fed needs to be persistent. Meanwhile, the Fed Vice-Chair for Supervision, Michael Barr, cautioned that the economy could see “significant softening” following the Fed’s actions.

On the Japanese front, data revealed that Gross Domestic Product (GDP)for Q3 shrank by 1.2% against a 1.1% growth estimated by analysts, justifying the Bank of Japan’s (BoJ) monetary policy. The BoJ Governor Haruhiki Kuroda continually expressed that the central bank would keep monetary policy conditions loose to stimulate the Japanese economy.

What to watch

Ahead in the calendar, the Japanese economic calendar will feature Machinery Orders and Tertiary Industry Index for September. In the US, the docket will feature the MBA 30-year Mortgage Rate alongside Import and Export Prices, Retail Sales, and Industrial Production. Also, Fed speakers like the New York Fed President John Williams will cross newswires.

USDJPY Key Technical Levels

Ukrainian President Volodymyr Zelenskyy said the Russian missile strikes on NATO territory are ‘a significant escalation, action is needed’.

More to come

What you need to take care of on Wednesday, November 16:

It was another volatile day in the FX sphere, with optimism and fears mixing throughout the day. The American Dollar plummeted to fresh monthly lows against most major rivals ahead of Wall Street’s opening but posted a nice comeback ahead of the close.

Modest concerns surged at the beginning of the day following tepid Chinese data. According to official sources, Industrial Production grew by 5% YoY in October, missing the market expectation for an expansion of 5.2%. Also, Retail Sales contracted by 0.5% in the same period, worse than the 1% advance anticipated.

The market sentiment improved following the release of the US Producer Price Index as it rose by 8% YoY, improving from the previous 8.4%.

The mood changed following news that Russian missiles hit Poland, killing at least two people. Missiles landed in the Polish village of Przewodów, near the border with Ukraine, and the government called an emergency meeting. Worth remembering Poland is a NATO member, and things could escalate fast. Some Poland sources suggest it is most likely the remains of a Russian rocket shot down by the Armed Forces of Ukraine.

The EURUSD peaked at 1.0480, then fell to 1.0292. It currently trades at around 1.0320. GBPUSD hovers around 1.1830 after surging to 1.2028. UK-employment-related data was generally disappointing. The ILO Unemployment Rate rose to 3.6% in September, while wage inflation rose in October. The country will publish the October Consumer Price Index on Wednesday.

Commodity-linked currencies ended the day with modest gains vs their American rival, with AUDUSD trading at around 0.6750 and USDCAD surrounding 1.3300. Save-have currencies remained under pressure, with USDCHF now trading at 0.9450 and USDJPY at 139.40.

Gold extended its monthly rally but ended Tuesday with modest gains at around $1,776 a troy ounce. Crude oil prices rallied with Russian-Ukraine news, and WTI settled at around $86.80 a barrel.

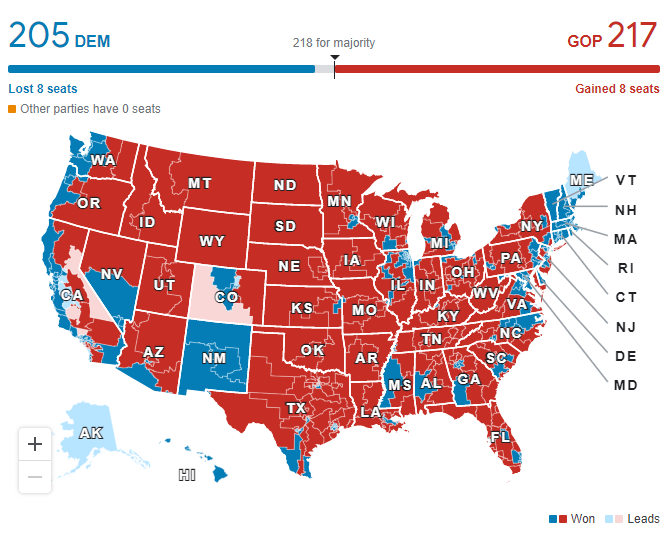

Former US President Donald Trump said he would do an announcement at his house at Mar-a-Lago tonight. Market players anticipate he will announce he will run for President again in 2024.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto Season faces resistance

Like this article? Help us with some feedback by answering this survey:

A Polish reporter was quoted on the blasts tonight:

''My sources in the services say that what hit Przewowo is most likely the remains of a [Russian] rocket shot down by the Armed Forces of Ukraine.''

S&P 500 M15 chart

The stocks are rallying on the relief of the prospects that this is a false alarm. Nevertheless, markets will be on the lookout for the outcome of official confirmation from the Pentagon, Polish, and Hungarian defense committees. The S&P 500 is technically in the bearish territory while on the back side of the broken trendline and while below the resistance as per the drawings above. A close below 3,955 will be significantly bearish.

- Two Russian missiles hit the city of Przewodow, killing two Polish.

- The Polish Prime Minister called an urgent meeting, according to Reuters.

- EURUSD plunged after hitting a daily high at 1.0481, approaching 1.0270s.

The EURUSD is plunging in the North American session on confirmation that two Russian missiles landed on Poland, killing two poles, near the Polish city of Hrubieszow on the border with Ukraine. Therefore, the EURUSD is plummeting from around 1.0388 to 1.0303 at the time of writing.

Reports confirmed by the AP said that a senior US intelligence official said Russian missiles crossed into NATO member Poland, killing two people.

In the meantime, Polish Prime Minister Mateusz Morawiecki called an urgent meeting of a government committee for national security and defense affairs, according to a government spokesman, as reported by Reuters.

Market’s Reaction

The EURUSD dived from around 1.0380s, extended its losses beneath the daily pivot point, and edged towards the S1 pivot level at around 1.0280. Meanwhile, US equities are pairing earlier gains, while the US Dollar Index is rising more than 0.19% at around 107.080 after hitting a daily low at 105.340.

EURUSD Price Analysis: Technical outlook

Therefore, the EURUSD is neutral-to-upward biased and briefly pierced the 200-day EMA at 1.0427 but retreated at around the London Fix, diving below 1.0360. if the EURUSD does not achieve a daily close above the November 11 high of 1.0364, it will exacerbate a fall beneath the 1.0300 figure. The EURUSD’s next support would be the 1.0200 figure, followed by the 100-day EMA at 1.0026.

- Gold perks up on risk-off turn in markets on Poland news.

- US Dollar could be on the verge of a significant correction, a weight on Gold.

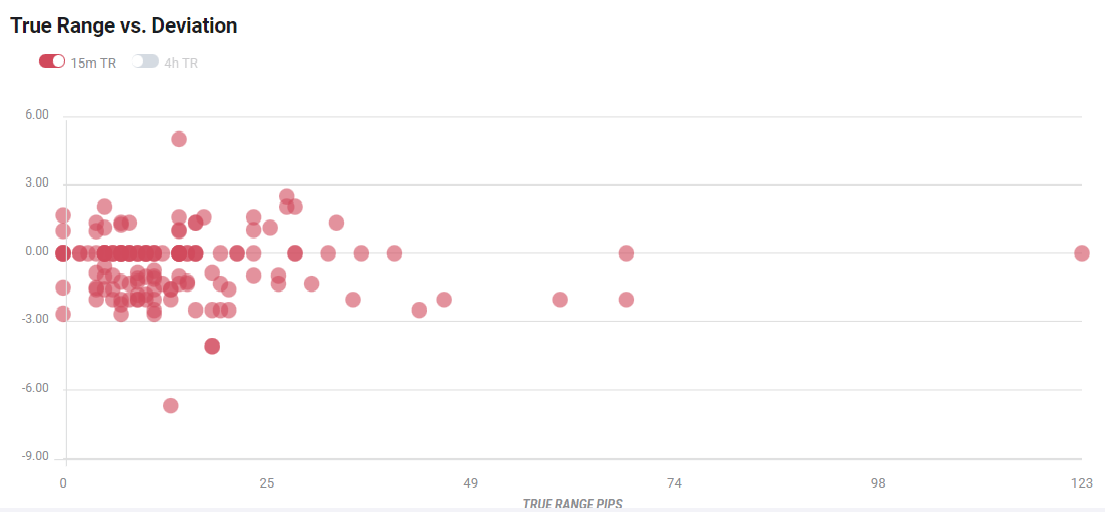

The Gold price is headed higher on the day, now trading at $1,778, up 0.4% on news that at least two are dead after Russian missiles landed in NATO state Poland on the Ukraine border, according to the Express. Poland has convened a national security committee meeting according to a spokesman. Before the news, the yellow metal was sliding.

The US Dollar had been pressured on Monday following Producer Price Index data that mirrored last week's Consumer Price Index. The DXY fell to its lowest since mid-August around 105.35 and was on track to test the August 10 low near 104.636. However, the bulls have moved in and are treading water again. US yields reacted accordingly to the PPI whereby the headline came in at 8.0% vs. 8.3% expected and a revised 8.4% (was 8.5%) in September. The core came in at 6.7% YoY vs. 7.2% expected and actual in September. ''The PPI data will do nothing to dispel the notion that the Fed is moving closer to a pivot,'' analysts at Brown Brothers Harriman argued.

Meanwhile, the US 2-year yield is trading near 4.37%, just above the recent low near 4.29% last Thursday. The 10-year yield is trading near 3.80%, below the recent low near 3.81% last Thursday. ''Yields are likely to continue probing the downside this week until the data say otherwise,'' analysts at BBH argued.

Equity markets had latched onto the PPI data as confirmation of the CPI data but flaked out on the day and started to melt towards the lows of the day, suddenly propelled lower on the geopolitical disruption:

The above is the 15-minute knee-jerk reaction in the SP 500 to the news. When coupled with the China COVID risks and an inverted US yield curve, that indicate that the US economy is likely to go into recession over the next 12 months or so, stocks could continue to feel the pressure. Such a scenario could play back into the hands of the US Dollar bulls and remain a weight on Gold prices in the face of hawkish Fed speakers.

Gold technical analysis

Prior to the news, there were prospects of a downside extension on the 4-hour chart. However, the news has put a bid into the yellow metal as per the following 15 minute chart:

Nevertheless, the state of play is bullish for a correcting US Dollar as seen in the following DXY chart:

This could be the makings of a significant correction as per the daily chart, capping Gold's advances:

- The United States Producer Price Index for October was softer-than-expected, justifying Fed officials’ case of moderating rate hikes.

- US economic data overshadowed Canadian economic data.

- USDCAD Price Analysis: Struggles at the 100-day EMA, reclaims 1.3300 on geopolitical woes.

The USDCAD climbed toward 1.3335 during the North American session after dropping beneath the 1.3300 figure following the release of a soft inflation report in the United States. A weaker-than-expected October Producer Price Index (PPI) report strengthened the case for the Federal Reserve to moderate increases. Nevertheless, geopolitical jitters caused a risk-off impulse at the time of typing, so the USDCAD is trading at 1.3322, above its opening price.

The US Department of Labor (DoL) revealed that the Producer Price Index (PPI) for October jumped by 8% YoY, below 8.3% expected, while the so-called core PPI increased by 6.7% YoY, less than 7.1% foreseen. Of late, the New York Empire State Manufacturing Index showed conditions improved in the New York Fed area, rose 4.5, vs. estimates for a -6 contraction.

Given that October’s inflation data in the United States is in the rearview mirror, it justifies the deceleration of interest-rate increases to the Federal Funds rate (FFR), as said by Federal Reserve (Fed) officials. On Monday, the Federal Reserve board members Christopher Waller and Vice-Chair Lael Brainard expressed that need, though Brainard emphasized that the Fed has “additional work” to tame inflation.

Traders should be aware that even though Fed policymakers support less aggressive monetary policy, they are still in a hiking cycle, so there’s no Federal Reserve pivot yet. Unless they lay the path of where they expect the FFR to peak and inflation continues its downtrend, further US Dollar (USD) strength is expected.

On the Canadian side, September’s Wholesales jumped 0.1%, exceeding a contraction of 0.2% estimates by economists, as reported by Statistics Canada. At the same time, Manufacturing Sales were unchanged in September after four straight months of declines.

USDCAD Price Analysis: Technical outlook

That said, the USDCAD edged lower as it continued towards achieving the head-and-shoulders chart pattern target at around 1.3030. However, buyers are stepping at around the 100-day Exponential Moving Average (EMA) at 1,3234, which probed to be a tough nut to crack. Key resistance levels lie at 1.3400, followed by the psychological 1.3500, ahead of the 50-day EMA at 1.3525.

Wall Street is printing in the red with benchmarks at the lows of the day following news that at least two are dead after Russian missiles landed in NATO state Poland on the Ukraine border, according to the Express.

Poland has convened a national security committee meeting according to a spokesman.

More to come...

Market reaction

US stocks are turning into a sea of red with the benchmarks heading south as per the SP 500 index:

The US Dollar can find support on the news also, potentially leading to a significant correction for the days ahead as geopolitics come to the fore:

The European Central Bank's Robert Holzmann has crossed the wires saying interest rates will be increased further.

More to come...

Swiss National Bank Chairman Thomas Jordan says monetary policy is still expansionary and ''we have most likely to adjust monetary policy again.''

This is a rehash of prior commentary where he has been continuously hinting that further interest rate hikes were on the way from the central bank.

In prior remarks recently made, he was saying "determined action" is required to check rising prices has said in trade today there is a "great probability" that the SNB will need to tighten monetary policy further as inflation is likely to remain elevated for a while.

He also said the nominal appreciation of the Swiss franc is helping guard against inflationary pressure. Jordan had said last week that the SNB was prepared to take "all measures necessary" to bring inflation back down to its 0-2% target range and that current monetary policy was not restrictive enough to do the job.

Key comments

Monetary policy is still expansionary and we have most likely to adjust monetary policy again.

Inflation is very high and there is still a risk that inflation will rise further.

We have an inflation rate in switzerland that is above our target, and expect it to be above our target if we don't take that into account.

Central banks around the world are now in a tightening cycle.

More to come ...

- A soft US Producer Price Index further cements Federal Reserve officials’ case for slowing the pace of tightening.

- Eurozone’s GDP beat estimates, though it continues to decrease as an upcoming recession looms.

- EURUSD will extend its losses if it dives below 1.0360 after struggling at the 200-DMA.

The EURUSD is climbing in the North American session, though it remains beneath the highs of the day at 1.0481, reached on the release of a softer-than-expected Producer Price Index (PPI) for the United States. That said, PPI and CPI report in the US, flashing signs that inflation is cooling down, added to Federal Reserve’s policymakers laying the ground for a slower pace of rate hikes, spurred a risk-on impulse. At the time of writing, the EURUSD is trading at 1.0364.

Inflation in the US is cooling as CPI and PPI ease in October

Global equities continue to rally, between 0.70% and 2.10%. The US Department of Labor (DoL) reported that PPI for October rose by 8% YoY, below 8.3%, while excluding volatile items, the so-called core PPI jumped by 6.7% YoY, less than 7.1% foreseen. Now that CPI and the PPI reports are in the rearview mirror, suggesting that US inflation is cooling, Federal Reserve (Fed) policymakers are lying the ground to decrease the size of rate hikes from 75 bps to 50. Therefore, US Dollar (USD) weakened on the release, as shown by the EURUSD spiking towards a new 5-month high at 1.0481, piercing on its way north of the 200-day Exponential Moving Average (EMA) at 1.0427, before retreating to the current exchange rates.

Meanwhile, a slew of Fed members crossed newswires led by Lisa Cook, which said that inflation remains too high and that the central bank’s focus will be addressing inflation. The Philadelphia Fed President Patrick Harker said that he’s not “overly worried” about inflation expectations and suggested that the Fed could pause as long as the US central bank stays committed to tame inflation.

Aside from this, the New York Fed Empire State Manufacturing Index rose by 4.5, smashing expectations for a contraction of 6, though the PPI report overshadowed it.

On the Eurozone front, European Central Bank (ECB) member Francois Villeroy said that the ECB would probably keep raising rates beyond the 2% level. He added that monetary policy divergence around the globe exerts downward pressures on the Euro and more on the Japanese Yen (JPY).

Data-wise, the Eurozone economic calendar featured the Eurozone’s GDP for Q3, with data showing that the block grew at 2.1% YoY, aligned with estimates but below Q2’s number. At the same time, the ZEW Economic Sentiment Index for the Euro area and Germany improved, though it remained negative, with both figures reaching -36.7 from -59.7 and -59.2, respectively.

EURUSD Price Analysis: Technical outlook

Therefore, the EURUSD is neutral-to-upward biased and briefly pierced the 200-day EMA at 1.0427 but retreated at around the London Fix, diving below 1.0360. if the EURUSD does not achieve a daily close above the November 11 high of 1.0364, it will exacerbate a fall beneath the 1.0300 figure. That said, the EURUSD’s next support would be the 1.0200 figure, followed by the 100-day EMA at 1.0026.

Atlanta Federal Reserve President Raphael Bostic said on Tuesday that he wasn't expecting to see the full impact of monetary policy on inflation for months, as reported by Reuters.

Additional takeaways

"Fed must look to economic signals other than inflation as policy guideposts."

"Seen clues that tighter financial conditions may be pinching commercial real estate, banking."

"Tighter financial conditions have not yet constrained business activity enough to seriously dent inflation."

"Anticipating that more interest rate hikes will be needed."

"Indicators of broad-based easing of inflation need to be seen."

"There are glimmers of hope in goods inflation, need to see services inflation slow as well."

"Labor market remains tight, seeing upward pressure on wages."

"Fed's number one job is to tame unacceptably high inflation."

"Fed's policy actions risk inducing a recession but that is preferable to high inflation getting entrenched."

"Recession is not a foregone conclusion, Fed will try to avoid one if possible."

"There are many scenarios in which a recession could turn out to be mild."

"Once Fed reaches appropriately restrictive policy, it needs to stay there until there is convincing evidence inflation is firmly on track to 2% target."

Market reaction

US Dollar Index showed no immediate reaction to these comments and was last seen losing 0.6% on the day at 106.30.

Gold has plunged from $2,050 in March to as low as $1,617 in early-November. Strategists at TD Securities expect XAUUSD to trade lower on further real rate increases before rallying later in 2023.

XAUUSD set to go into $1,575 territory over the next several months

“A continued sharp increase in US real and nominal rates along the short end of the curve is projected to drive Gold toward $1,575 in early 2023.”

“The yellow metal may well start to trend up toward $1,800 after Q1, as it becomes clear that the Fed is approaching the end of its tightening cycle and the market starts to look toward cuts on the horizon.”

Analysts at MUFG Bank have now a bullish bias for the EURUSD pair. They see it trading in the range 0.9800-1.0800 over the next weeks. They point out that a consolidation above the 200-day SMA at 1.0435 would increase the risks of a rally toward 1.0800.

Key Quotes:

The EUR has staged a strong rebound against the USD in recent weeks resulting in EUR/USD moving further above the low from the end of September at 0.9536. The down trend that had been in place since the start of the Ukraine conflict from late February has just been broken providing a strong technical signal that the balance of risks has become less favourable for the USD in the near-term. The best-case scenario for the USD in the month ahead is that it begins to consolidate at lower levels against the EUR between 1.0000 and 1.0500.”

“There is a heightened risk that the USD sell-off could extend further if EURUSD breaks above resistance provided by the 200-dma at around 1.0435 that would open the door to a further leg higher towards the next resistance area between 1.0800-1.1100. The pair has not closed above the 200-dma since June 2021.”

“The main downside risk to our bullish EURUSD bias in the month ahead would be a sharper sell-off for risk assets triggered by intensified fears over a hard landing for the global economy. It would trigger a renewed safe haven bid into the USD pulling EURUSD back below parity and towards year to date lows. The most likely triggers would be a stronger US CPI report for November followed by a hawkish Fed policy update next month.”

- Mexican peso loses momentum across the board on Tuesday.

- USDMXN holds bearish bias, but strong support at 19.30 prevails.

- US Dollar faces resistance at the 19.60 zone.

The USDMXN is trading flat on Tuesday, after hitting the lowest intraday level since March 2020 at 19.24, following the release of the October US Producer Price Index. The greenback reversed sharply after a few minutes and gained momentum across the board. The pair rose back above 19.30.

The area around 19.30 is the critical support in the short-term. A daily close below keep the doors open to more losses with the next key area at 19.00/05 (intermediate support at 19.15). The RSI is moving away from oversold readings but not showing yet an upside slope. Momentum remains flat.

While above 19.30, losses seem limited for USDMXN. Still the outlook is constructive for the Mexican peso. Only a recovery above 19.60 would alleviate the bearish tone for the greenback. Before that area, there is a resistance at 19.45.

USDMXN daily chart

-638041242155299324.png)

Economists at TD Securities forecast the Lira to depreciate substantially over the course of the last quarter of the year and the start of 2023.

There could be scope for a TRY rally in H2 2023

“TRY will not find support in CBRT's expansive policy (and deeply negative real rates) and the sharply deteriorating current account deficit.”

“The macro trends, global risks and policy missteps are likely to trigger a currency crisis in 22Q4 or 23Q1.”

“We expect USDTRY to leapfrog to 27 or higher before emergency hikes stabilize the lira.”

“With a crucial election by June 2023 and the possible ousting of Erdogan, there could be scope for a TRY rally in H2 2023. This is entirely predicated on Erdogan and the AKP losing the vote and conceding to the opposition.”

The United Kingdom will release the Consumer Price Index (CPI) data on Wednesday, November 16 at 07:00 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of four major banks regarding the upcoming UK inflation print.

Headline is expected at 10.7% vs. 10.1% in September while Core, which excludes volatile food and energy prices, is expected at 6.4% year-on-year vs. 6.5% in September.

Wells Fargo

“We look for another jump in electricity and gas prices, and see the October CPI rising 1.8% MoM and rising to 10.9% YoY. The latter would represent the fastest pace of CPI inflation for multiple decades. Broader price pressures will likely remain steady, however, and we anticipate the increase in the October core CPI will be similar to the 6.5% YoY gain seen in September. As the energy price cap becomes more binding, the BoE expects CPI inflation to remain through the rest of Q4, before easing from early 2023. The elevated rates of inflation will probably see the BoE raise its policy rate further at upcoming meetings. However, with the UK likely already in sharp recession, easing of inflation could be enough to curtail central bank rate hikes, and we see a peak in the UK policy rate of 3.75% by early 2023.”

TDS

“UK inflation likely rose significantly in Oct (11% YoY) due to a sharp increase in energy prices. While the ex-PM's £2500 energy price cap protected households from an 80% increase, household energy bills still rose by about 25% in Oct. Core inflation will be weighed down by base effects from last October's VAT hike, but we think firm services inflation will keep the YoY rate at 6.5%.”

SocGen

“Despite the Energy Price Guarantee (EPG) coming into effect in October, helping limit a potentially eye-watering 80% increase in utility prices, rising utility prices will almost certainly be the largest contributor to CPI inflation rising from 10.1% to 10.5% in October. Consequently, according to the CPI index, utility prices will increase by 27% and add around 0.7pp to CPI on a YoY rate. Outside of utility prices, a fall in fuel prices should shave 0.2pp off headline inflation, but this will be partially offset by an acceleration in food prices from 14.5% to 15.5%. However, there is always the risk that these volatile components surprise to the upside, as they have for the past few months. For core, we see price growth decelerating from 6.5% to 6.4%, driven by a marginally lower services inflation to 2.6% while goods inflation may remain stable at 2.3%.”

Citibank

“Inflation in the UK is also likely to increase with headline CPI jumping to 10.8% YoY. The Bank expects 10.9%. The main driver here is the move to a new Ofgem price cap, which alone is likely to add 60 bps to headline inflation. We believe RPI will print at 14.1% YoY. The marginal downside surprise versus the Bank’s forecast primarily reflects the impact of the tuition fee freeze in place over the coming years. Otherwise, we think underlying momentum remains robust. This will likely keep rates elevated through Q4, although Citi Research expect inflation to begin to fall back through 2023.”

- US data: PPI below market consensus while Empire Index soars.

- US Dollar tumbles after economic reports and then reverses.

- USDJPY recovers all PPI losses, after a bounce of more than 150 pips.

The USDJPY pair recovered more than 150 pips during the last hours, rising back to the 139.50 area. Previously the pair reached fresh two-month lows at 137.62, following the US PPI report.

Inflation down, activity up

The Producer Price Index (PPI) rose 8% from a year earlier in October, below the 8.3% of market consensus and down from the 8.4% of September. It was the lowest reading since mid-2021. The numbers contribute to increasing expectations that the Federal Reserve might slow down its rate hikes. The Empire Manufacturing Index soared in November from -9.1 to 4.5 surpassing expectations.

Federal Reserve Bank of Philadelphia President Patrick Harker said on Tuesday that he is not overly worried about inflation expectations. "As long as we're moving consistently to collapse inflation down, we can pause."

On Asian hours, Japan reported that GDP contracted unexpectedly by 0.3% during the third quarter. It was the first negative reading since the third quarter of 2021. “Weakness in inventories and net exports were the main drivers. In a nutshell, this is why policymakers are worried about removing stimulus too soon. To us, this is a green light to buy USD/JPY. Next BOJ meeting is December 19-20 and another dovish hold is expected”, said analysts at Brown Brothers Harriman.

Dollar down then up

The US Dollar reacted as expected initially after the PPI with a sharp decline to fresh lows across the board. But it then reversed sharply, rising above the level it had before the PPI, even as US yields remain down for the day and amid higher equity prices.

The USDJPY is hovering above 139.00, still with a negative bias in the short-term but far from the lows. A slide below 138.50 would increase the bearish pressure, while above 139.60, the US Dollar could gain strength for a test of the daily high at 140.60.

Technical levels

Economists at TD Securities maintain a bearish view on the Pound and expect the British currency to struggle at the start of 2023.

Further terminal rate divergence between the Fed/BoE

“GBP should have a tough start of the year, reflecting a mix of external and local factors.”

“On the global side, the USD outlook will feature prominently in the gyrations of GBP. We anticipate further terminal rate divergence between the Fed/BoE, especially as UK growth looks vulnerable to housing risks.”

“Fiscal prudence comes at a cost, likely undermining UK growth relative to the rest of the G10. In turn, low real rates and weak growth won't capture the capital flows needed to plug the current account balance. GBP remains the shock absorber.”

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comment on the release of GDP figures in Malaysia.

Key Takeaways

“Malaysia’s economy surprised on the upside in 3Q22 with real GDP growth accelerating further to 14.2% y/y last quarter (from +8.9% in 2Q22). It was the strongest gain since 2Q21, beating our estimate (+13.6%) and Bloomberg consensus (+12.5%). On a seasonally adjusted basis, real GDP grew by 1.9% q/q (2Q22: +3.5% y/y).”

“The outperformance of 3Q22 GDP was credited to favourable base effects, the ongoing transition to endemicity since Apr this year, continued government subsidies, higher national monthly minimum wages and strong global demand for Malaysia’s electrical & electronics (E&E) products. This led to a robust improvement in both domestic and external demand amid modest stock replenishment activities last quarter. All economic sectors also logged respectable growth, led by services, manufacturing and construction sectors.”

“We revise our 2022 full-year real GDP growth estimate up to 8.3% (from 6.5% previously) after taking into account a much stronger-than-initially-expected economic expansion of 9.3% in the first nine months of 2022 and a projected normalization to 5.5% growth in 4Q22. For 2023, we maintain a moderate real GDP growth projection at 4.0% (official est: 4.0%-5.0%) given a confluence of more challenging external factors.”

Economists at TD Securities think the outlook for the Canadian Dollar remains troubled and expect the Loonie to underperformance early next year.

Fundamental concerns about the CAD overall

“We have been bearish CAD since mid-2022 on the basis that the higher rates go to fight inflation, the greater the downside macro shock associated with household debt servicing and hence the more the CAD will need to reflect it. That should intensify in the months ahead.”

“Moreover, slowing global growth is likely to put a spotlight on Canada's energy trade balance, which has masked historical weakness in the non-energy trade balance.”

“After a resilient 2022, we see scope for broad CAD underperformance early next year.”

- Prices paid by producers in the United States ticked lower, a welcomed sign by investors seeking risk, and the US Dollar weakened.

- Employment data in the UK was mixed, though the GBP is supported by overall US Dollar weakness.

- Federal Reserve officials committed to tackling inflation, albeit slowing the pace of interest-rate increases.

The Pound Sterling soars sharply against the US Dollar (USD) following the release of prices paid by producers in the United States, showing that inflation is easing. Also, an upbeat UK employment data report underpinned the Cable, as shown by the GBPUSD gaining more than 1.50%. At the time of writing, the GBPUSD is trading at 1.1915.

Inflation in the US is cooling as CPI and PPI ease in October

The sentiment is upbeat, triggered by two Federal Reserve (Fed) officials saying it would be appropriate to slow the pace of rate hikes following the release of a soft October US Consumer Price Index report. Also, the Producer Price Index (PPI) for the same period expanded by 8% on an annual pace, below the 8.3% estimated, as shown by a US Department of Labor (DoL) survey. The core PPI, which excludes volatile items, rose 6.7% YoY, below the expected 7.1%. Given that US CPI and PPI readings are beginning to flash signs that inflation in the United States is starting to cool down, the Federal Reserve has some reasons to slow down the pace of tightening. Therefore, further US Dollar weakness is expected.

On the US PPI release, the GBPUSD edged towards its daily high at 1.2028, registering a three-month fresh high, but retreated some of its gains, as the GBPUSD sits below the 1.2000 figure.

Of late, several Federal Reserve policymakers crossed newswires. Lisa Cook, one of the newest Fed Governors, said that inflation is much too high and the central bank’s focus is on addressing inflation. At the same time, Philadelphia’s Fed President Patrick Harker expressed that removing $2.5 trillion from the Fed’s Balance Sheet is a “best guess.”Harker added that he is not “overly worried” about inflation expectations and that the Fed can pause as long as the central bank continues to fight inflation.

Meanwhile, the NY Fed Empire Manufacturing rose by 4.5, smashing expectations for a contraction of 6.

On the UK side, the UK’s Chancellor of the Exchequer, Jeremy Hunt, gave some clues regarding the Autumn Budget, to be released on Thursday. He said that those who have more will be asked to provide more and that “inflation-busting pay awards would just fuel inflation,” suggesting that the new Tory government would be fiscally responsible.

Data wise, employment data in the UK showed that the number of people in work in the UK dropped 52K, more than the 25K falls estimated by street economists. At the same time, the Unemployment Rate rose by 3.6%, exceeding the 3.5% expected.

That said, the UK economic docket will feature the Consumer Price Index (CPI), the Producer Price Index (PPI), and Retail Sales for October. On the US front, the calendar will reveal Retail Sales, Industrial Production, Capacity Utilization, and Fed speak.

GBPUSD Key Technical Levels

- The index seems to have met some initial contention near 105.30.

- US yields keep navigating in the negative territory on Tuesday.

- US Producer Prices rose less than expected in October.

The USD Index (DXY), which tracks the greenback vs. a basket of its main rivals, resumes the intense leg lower and retests the 105.30 region on Tuesday.

USD Index rebounds from 3-month lows

The index rapidly sets aside Monday’s bullish attempt and resumes the downtrend on turnaround Tuesday, briefly revisiting the 105.30 region for the first time since mid-August just to pick up some pace afterwards.

Also collaborating with the decline in the dollar comes another negative session in US yields across the curve, amidst unabated repricing of a Fed’s pivot in its policy.

Extra pessimism in the dollar came after US Producer Prices rose less than expected 0.2% MoM in October and 8% over the last twelve months, supporting the view that inflation has lost some traction as of late.

Additional results saw the NY Empire State Manufacturing Index improve to 4.5 in November (from -9.1).

What to look for around USD

The index remains under heavy pressure, always stemming from the probability of a slower rate path in the next months by the Fed and its positive impact on the risk-associated universe.

In the meantime, investors’ repricing of a probable pivot in the Fed’s policy now emerges as a fresh and quite reliable source of weakness for the dollar, in line with a corrective decline in US yields across the curve.

Key events in the US this week: Producer Prices (Tuesday) - MBA Mortgage Applications, Retail Sales, Industrial Production, Business Inventories, NAHB Index, TIC Flows (Wednesday) - Building Permits, Initial Jobless Claims, Housing Starts, Philly Fed Index (Thursday) - CB Leading Index, Existing Home Sales (Friday).

Eminent issues on the back boiler: US midterm elections. Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 0.82% at 106.06 and the breakdown of 105.34 (monthly low November 15) would open the door to 104.89 (200-day SMA) and finally 104.63 (monthly low August 10). On the other hand, the next up barrier aligns at 109.10 (100-day SMA) seconded by 110.91 (55-day SMA) and then 113.14 (monthly high November 3).

"My best guess is we will remove about $2.5 trillion from the balance sheet overall but data will guide us," Federal Reserve Bank of Philadelphia President Patrick Harker said on Tuesday, as reported by Reuters.

"We want to reduce the balance sheet methodically until we start to see where we need to stop," Parker added and noted he is not overly worried about inflation expectations while adding that they are moving in the right direction.

Market reaction

The US Dollar (USD) stays on the back foot following these comments and the US Dollar ındex was last seen losing 0.85% on the day at 106.05.

Additional takeaways

"I don't like to base policy on a couple of headline numbers."

"As long as we're moving consistently to collapse inflation down, we can pause."

"I don't want to move interest rates way up and then way down."

"We need to balance minimizing job losses while getting inflation under control."

"I think that outcome is still possible."

EUR is powering ahead, reaching its highest level against the USD since July. Economists at Scotiabank expect the EURUSD pair extend its race higher to the 1.05/1.07 range

Technical momentum drives gains

“While it is a little difficult to pin down a precise reason for the EUR’s pop higher, the technical logic is clear; EUR gains picked up strong momentum after trading through technical resistance at 1.0350 that had capped spot gains three times over the past 24 hours or so.”

“The EUR is now trading well through the high 1.02s (38.2% Fib retracement of the 2022 decline at 1.0286) which puts additional strength to the 1.05/1.07 range (50% retracement at 1.0517) on the cards.”

“Key support is 1.0340/50 intraday.”

Federal Reserve Governor Lisa Cook reiterated on Tuesday that inflation in the United States is still "much too high" and added that the focus for the Fed is on addressing inflation, as reported by Reuters.

Market reaction

These comments don't seem to be helping the US Dollar (USD) find demand. Following the softer-than-expected October Producer Price Index (PPI), the US Dollar Index turned south and touched its lowest level in three months below 105.50 before staging a rebound. As of writing, the index was down 0.9% on the day at 105.95.

Economists at Riksbank expect EURSEK to move higher over the coming months to 11.20. On a six to 12-month horizon, they see a recovery and sustainable support to risk assets and the Krona.

SEK weakness to return

“We stick to our non-consensus view on a weaker SEK amid weak growth dynamics, especially for Europe, scope for another downturn in global equities and relative monetary policy. We therefore forecast EURSEK at 11.20 in 6M.”

“Further out, we expect recovery and sustainable support to risk assets and the SEK and forecast EURSEK at 11.00 in 12M.”

“The key downside risks to our forecasts are a dovish Fed pivot, sustained equities rebound, brighter growth outlook not least for Europe or a shift in Riksbank monetary policy stance including a shift in FX policies.”

- EURUSD quickly sets aside Monday’s drop and surpasses 1.0400.

- The continuation of the uptrend could now look at 1.0600 and above.

EURUSD resumes the upside and clinches new multi-month peaks north of the 1.0400 hurdle on turnaround Tuesday .

The continuation of the recovery looks the most likely scenario in the very near term. Against that, a close above the always relevant 200-day SMA, today at 1.0427, should spark further gains in the short-term horizon.

In such a scenario, there are no up barriers of note until the weekly top at 1.0614 (June 27).

EURUSD daily chart

Sterling is one of the better performers today. Economists at Scotiabank note that the GBPUSD pair could climb as high as 1.20/21.

Technical tone is very constructive

“Sterling’s extension to new cycle highs keeps the technical tone here very constructive as well.”

“Now, gains through key technical resistance in the upper 1.17 zone mean there is little – technically, at least – in the way of a further rise to the 1.20/1.21 range in the near term.”

“Key support now is seen at 1.1765/75.”

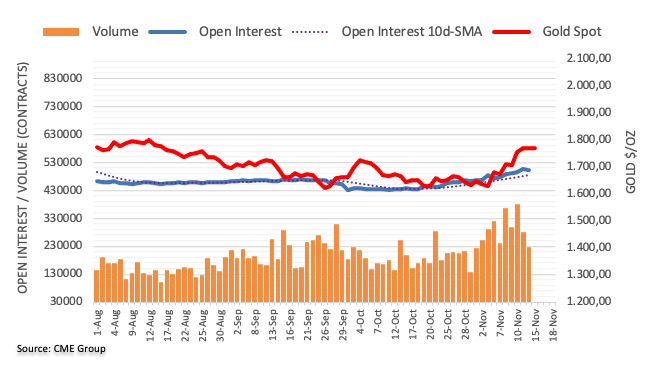

- Gold rallies to its highest level since mid-August amid the prevalent USD selling bias.

- Bets for less aggressive Fed rate hikes, sliding US bond yields weigh on the greenback.

- The softer-than-expected US PPI adds to the heavily offered tone surrounding the buck.

- A positive risk tone caps the XAUUSD amid a slightly overbought RSI on the daily chart.

Gold prolongs its recent upward trajectory and touches its highest level since mid-August, around the $1,784-$1,785 region on Tuesday. The XAUUSD maintains its bid tone through the early North American session, with bulls now eyeing a move towards reclaiming the $1,800 psychological mark.

Following the previous day's modest bounce, the US Dollar comes under some renewed selling pressure and extends the softer US consumer inflation-inspired downfall. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, drops to a fresh three-month low and acts as a tailwind for the dollar-denominated gold.

The US CPI report released last week indicated that the worst of the post-pandemic price spike is over and fueled speculations for a less aggressive policy tightening by the Federal Reserve. This is evident from the ongoing decline in the US Treasury bond yields, which continues to weigh on the greenback and offers additional support to the non-yielding gold.

The intraday USD selling picks up pace following the release of the softer-than-expected US Producer Price Index (PPI). The US Bureau of Labor Statistics reported that PPI declined to 8% YoY in October from 8.4% in September, missing expectations for a reading of 8.3%. The Core PPI also missed estimates and decelerated to 6.7% during the reported month from 7.2% in September.

That said, a positive risk tone and indications of a strong opening in the US equity markets keep a lid on any further gains for the safe-haven precious metal. Apart from this, a slightly overbought RSI (14) on the daily chart holds back bulls from placing fresh bets around gold. The fundamental backdrop, however, supports prospects for additional near-term gains.

Hence, any meaningful corrective pullback might still be seen as a buying opportunity and is more likely to remain limited, at least for the time being. Gold seems poised to reclaim the $1,800 mark, which coincides with a technically significant 200-day SMA. This, in turn, should act as a pivotal point for the next leg of a directional move for spot prices.

Technical levels to watch

- NY Fed Empire State Manufacturing Index rose sharply in November.

- US Dollar (USD) stays under stroıng selling pressure on Tuesday.

The headline General Business Conditions Index of the Federal Reserve Bank of New York's Empire State Manufacturing survey improved sharply to 4.5 in November from -9.1 in October. This reading came in much better than the market expectation of -5.

"New orders decreased slightly, while shipments expanded modestly," NY Fed noted in its publication.

"Labor market indicators pointed to a solid increase in employment and a longer average workweek. Input prices increased at about the same pace as last month, while selling price increases picked up. Looking ahead, firms expect business conditions to worsen over the next six months."

Market reaction

The relentless US Dollar (USD) selloff continues in the early American session and the US Dollar Index was last seen losing 1.4% on the day at 105.45.

- Producer inflation in the US rose at a softer pace than expected in October.

- US Dollar Index stays deep in negative territory below 106.00.

The Producer Price Index (PPI) for final demand in the US declined to 8% on a yearly basis in October from 8.4% in September, the data published by the US Bureau of Labor Statistics revealed on Tuesday. This print came in lower than the market expectation of 8.3%.

The annual Core PPI edged lower to 6.7% from 7.2% in the same period, compared to analysts' estimate of 7.2%. On a monthly basis, the Core PPI was unchanged.

Market reaction

The US Dollar remains under heavy selling pressure after the PPI data and it was last seen losing 1% on the day at 105.85.

Economists at TD Securities think EURUSD will decline back below parity despite the most recent uptick.

EURUSD likely to bottom out around 0.96

“The EUR is not out of the wood yet, leaving us to expect another trip below parity to start 2023.”

“The macro outlook provides a weak handoff to the EUR to start a new year. EUR is closely linked with European and global growth expectations. We don't expect the global outlook to bottom until Q2.”

“EUR is also exposed to a winter terms of trade shock, especially if the weather runs cooler than expected.”

“EURUSD likely to bottom out around 0.96, paving the way for a sharp rally in H2.”

- NZDUSD gains strong positive traction on Tuesday and rallies to its highest level since August.

- Bets for less aggressive Fed rate hikes, sliding US bond yields continue to weigh on the USD.

- The risk-on impulse also undermines the safe-haven buck and benefits the risk-sensitive Kiwi.

The NZDUSD pair catches aggressive bids on Tuesday and sticks to its strong gains above mid-0.6100s, or its highest level since late August heading into the North American session.

The positive momentum is sponsored by the emergence of fresh selling around the US Dollar, which hits a three-month low amid expectations for a less aggressive policy tightening by the Federal Reserve. Last week's softer US consumer inflation figures fueled speculations that the US central bank will slow the pace of its rate-hiking cycle. In fact, the markets are now pricing in over a 90% chance of a 50 bps rate hike at the next FOMC policy meeting in December.