- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-11-2022

October month employment statistics from the Australian Bureau of Statistics, up for publishing at 00:30 GMT on Thursday, will be the immediate catalyst for the AUDUSD pair traders.

Market consensus suggests that the headline Unemployment Rate may increase to 3.6% versus 3.5% previous rise on a seasonally adjusted basis whereas Employment Change rise by 15K versus the previous addition of 0.9K. Further, the Participation Rate is expected to remain unchanged at 66.6%.

Considering the Reserve Bank of Australia (RBA) policymakers’ recently cautious comments, coupled with the Covid trouble in China, today’s Aussie jobs report become crucial for the AUDUSD pair traders. Also increasing the importance of today’s data is the strong Wage Price Index for the third quarter (Q3), to 3.1% YoY versus 3.0% expected and 2.6% prior.

Ahead of the event, analysts at Westpac said,

A small improvement in employment growth is anticipated in October, coming off a very weak base over the last few months (Westpac f/c: 15k, in line with consensus). With participation set to hold flat, Westpac expects the unemployment rate to round up from 3.5% to 3.6% (consensus 3.5%), though risks are to the downside for employment, and hence to the upside for unemployment.

How could the data affect AUDUSD?

AUDUSD struggles for clear directions after reversing from a two-month high the previous day. The Aussie pair’s latest inaction could be linked to the pre-data anxiety, as well as mixed sentiment in the market.

That said, Wednesday’s strong prints of Australia’s Q3 Wage Price Index (WPI) raised doubts about the RBA policymakers’ ability to push back the hawkish bias. However, the latest Minutes and the comments from the Monetary Policy Committee (MPC) members have been backing the latest softer rate hike and keep the AUDUSD bears hopeful.

Should the actual data arrive stronger, the Aussie pair may witness intermediate recovery moves towards refreshing the monthly top, currently around 0.6800. The pullback moves, however, need validation from the resistance-turned-support line from April, around 0.6730 by the press time. Hence, the odds favoring a short-term advance by the AUDUSD are higher even if the bearish bias for the RBA is likely to challenge the bulls.

Technically, the AUDUSD pair’s ability to stay beyond a seven-month-old descending trend line surrounding 0.6730 teases the buyers to aim for the 200-DMA level, near 0.6950 by the press time.

Key Notes

AUDUSD dribbles around mid-0.6700s ahead of Australia employment data

AUDUSD Forecast: Aussie poised to decline, but employment data in the way

About the Employment Change

The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

About the Unemployment Rate

The Unemployment Rate released by the Australian Bureau of Statistics is the number of unemployed workers divided by the total civilian labor force. If the rate hikes, indicates a lack of expansion within the Australian labor market. As a result, a rise leads to weaken the Australian economy. A decrease of the figure is seen as positive (or bullish) for the AUD, while an increase is seen as negative (or bearish).

- GBPJPY remains sidelined around weekly top, struggles to justify monthly resistance break.

- Bearish MACD signals challenge buyers amid sluggish session.

- Resistance-turned-support, key DMAs restrict immediate downside.

GBPJPY treads water around 166.00 as traders await the UK’s Autumn Statement during early Thursday. In doing so, the cross-currency pair failed to justify the previous day’s upside break of a two-week-old descending trend line.

The quote’s failure to cheer the previous key resistance could be linked to the bearish MACD signals, as well as the cautious mood ahead of the key UK event.

Also read:

That said, the GBPJPY buyers could witness a bumpy road during the further upside as the previous weekly top near 169.10 precedes the 170.00 psychological magnet and October 2022 high near 172.15 to challenge the pair’s further advances.

Meanwhile, pullback moves will initially have to remain below the previous resistance line stretched from October 31, around 165.70 by the press time.

Following that, the 100-DMA and the 200-DMA, respectively near 164.00 and 162.30, should challenge the GBPJPY buyers.

In a case where the pair remains bearish past 162.30, the October 11-12 swing low near 159.70 will be a tough nut to crack for the GBPJPY bears.

Overall, GBPJPY remains bullish even if the road to the north is bumpy and long.

GBPJPY: Daily chart

Trend: Further upside expected

- GBPUSD is advancing to recapture the psychological resistance of 1.2000 as UK inflation surges.

- A sharp recovery in the United States Retail Sales has escalated troubles for the Federal Reserve policymakers.

- The collaboration of fiscal policy measures and the continuation of policy tightening by the Bank of England could trim roaring inflation.

- GBPUSD is expected to remain on the sidelines till the announcement of the United Kingdom Autumn Budget.

GBPUSD has resurfaced firmly after dropping to near the critical support of 1.1850 in the late New York session. The Cable has extended its recovery after overstepping the round-level resistance of 1.1900 and is gathering momentum to recapture the psychological hurdle of 1.2000 ahead. A significant jump in the United Kingdom inflation rate has triggered chances of further policy tightening by the Bank of England (BOE) in the upcoming monetary policy announcements. The headline Consumer Price Index (CPI) has pushed to 11.1%, a historic surge led by the tight energy market. While the core CPI has remained flat at 6.5% but higher than projections of 6.4%. One thing is for sure, that price growth in the United Kingdom has not displayed signs of exhaustion yet not they have reached their ultimate peaks, which will keep the job of the Bank of England policymakers filled with troubles. The US Dollar Index (DXY) is displaying signs of volatility contraction despite a surge in United States Retail Sales data. Also, clarification over the Russia-Poland noise has turned the market mood quite after a heated one. Meanwhile, the 10-year US Treasury yields have tumbled further below 3.7% as chances of a slowdown in interest rate hike pace by the Federal Reserve (Fed) have soared.

Higher US Retail Sales shift pressure on Federal Reserve policymakers

Better-than-projected recovery in the United States Retail Sales data is expected to force the Federal Reserve policymakers to put in blood and sweat to avoid further inflation shocks. While Fed chair Jerome Powell is going through sleepless nights to slow down inflationary pressures by continuously hiking interest rates and impacting employment levels, a sharp recovery in consumer spending has spoiled the effort. The economic data rose by 1.3% in October against the projections of 0.9% and flat performance in September. Despite higher payouts after adjusting for inflation impact, consumer demand has been ‘resilience’ due to higher dependency on credit card borrowing.

Analysts at Wells Fargo are of the view that robust consumer demand gives businesses no incentive to forgo price increases, thereby making the task of getting inflation in check more difficult for Federal Reserve policymakers.” Households have increasingly relied on credit to spend which has resulted in a jump in the overall debt by $351 billion in the third quarter, according to data released yesterday by the NY Federal Reserve. They further added that a drawdown in households’ savings and reliance on debt to address spending may eventually spell economic trouble. Higher reliance on borrowings to cater to spending needs kept the US Dollar displaying strength.

Absence of an ultimate peak in UK Inflation raises hopes of more interest rate hikes

Inflationary pressures in the United Kingdom have jumped above the critical figure of 11% in October. Thanks to the tight energy market and labor force, which have kept reins in the overall demand. Also, an unexpected bond-buying program by the Bank of England is highly responsible for sky-rocketing inflation. While testifying before the UK Treasury Select Committee on Wednesday, BOE Governor Andrew Bailey cleared that “Still likely we will increase interest rates further” as the labor market is extremely tight according to the latest data. He further added that supply chain shocks are fading now.

As the Federal Reserve is looking to adopt a less-aggressive approach toward the interest rates and the Bank of England is bound to keep policy tightening intact. This may lead to a decline in the Fed-BOE policy divergence, which could further support the Pound.

UK Autumn Budget- a key trigger for Cable

The First Autumn budget under the leadership of UK Prime Minister Rishi Sunak and Chancellor Jeremy Hunt will dismantle Liz Truss’s mini-budget and put forward a strategic plan to wipe out the fiscal hole. For Autumn Budget, investors will focus on the bifurcation of tax hikes and spending cuts to meet the GBP 60bln fiscal hole. Treasury sources told Sky News the financial "black hole" could be as large as £60bn - which may require up to £35bn of spending cuts and an extra £25bn raised through taxation.

The effort for curtailing the pile-up of debt through fiscal measures will also be supportive to cool down the heated inflation as it will lead to a significant decline in consumer spending. A significant hike in tax collections by the government may leave a small purse in the hands of households to augment their entire expenditure. This may support Sterling ahead.

GBPUSD technical outlook

GBPUSD has retreated smartly after testing the breakout of the Rising Channel chart pattern on a four-hour scale. The upper portion of the chart pattern is placed from October 5 high at 1.1496 while the lower portion is plotted from September 26 low at 1.0339.

Advancing 20-and 50-period Exponential Moving Averages (EMAs) at 1.1833 and 1.1700, indicate more upside ahead.

Also, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which signals that the bullish momentum is active.

JP Morgan analysts hold onto their medium-term bullish bias for the US Dollar in the latest report.

Key quotes

The durability of a broad USD sell-off is fragile with macro uncertainty near 5-decade highs and the dollar yielding more than half of global FX.

Growth momentum outside the US has admittedly neutralized, but not out of the woods yet.

USD performance around the last four Fed pauses was not consistent and growth-dependent; more consistent was the decline in US rates regardless of the growth outcome.

USD valuations are rich but odds of a US recession have not been so high before the Fed is done hiking since the 1970s," JPM notes.

The mix of growth/ inflation surprises matters for composition of USD moves. Such high odds of a US recession keeps us more cautious on high beta FX but USD/JPY is likely most affected if US rates have indeed peaked.

Also read: USDJPY Price Analysis: Bulls tread with caution as bearish coil dominates

- EURJPY reclaims the 145.00 figure on risk aversion.

- If the EURJPY tumbles below the 100-day EMA, a fall toward 142.50s is on the cards.

The EURJPY erased last Tuesday’s losses on Wednesday and rose more than 0.60% amidst a risk-off impulse spurred by a positive Retail Sales report in the United States. Given the jump in sales in the report, speculations that the Federal Reserve (Fed) would continue aggressively tightening augmented, though Fed officials’ commentary, calmed traders. At the time of writing, the EURJPY is trading at 145.01, above its opening price by 0.02%, as the Asian session begins.

EURJPY Price Analysis: Technical outlook

The EURJPY trades shy of the weekly highs reached on Wednesday, around 145.49. Earlier, the EURJPY hit a daily low at 143.56, below the 50-day Exponential Moving Average (EMA) at 143.98, but Euro (EUR) buyers lifted the cross-currency pair, reclaiming the 144.00 and 145.00 psychological price levels. Of note, the Relative Strength Index (RSI) climbed above its 50-midline, showing buyers gathered momentum. However, late in the New York session, RSI’s slope aimed downward, a signal that buying pressure was fading.

Therefore, the EURJPY’s first resistance would be the weekly high at 145.49. Break above will expose the 146.00 psychological level, followed by the 147.00 mark.

On the other hand, the EURJPY’s first support would be the 145.00 mark. Once cleared, the next demand area would be the 50-day EMA at 143.98, followed by the last week’s low at 142.54.

EURJPY Key Technical Levels

- USDCHF licks its wounds after falling the most since January 2015 the last week.

- US Dollar’s failure to cheer risk-aversion, strong Retail Sales data challenge buyers.

- Hawkish comments from SNB’s Jordan contrast with downbeat Fedspeak to keep sellers hopeful ahead of the key data/events.

USDCHF repeats its sluggish momentum around 0.9450 as it consolidates the biggest weekly loss in seven years during early Thursday. In addition to the balancing of losses, mixed catalysts and cautious mood ahead of Swiss trade numbers for October, as well as a speech from Swiss National Bank (SNB) Governing Board Member Andréa M. Maechler, also restrict immediate moves of the Swiss Franc (CHF) pair.

In doing so, the quote failed to portray the market’s risk-off mood as the US dollar remains depressed despite the latest rebound. That said, the US Dollar Index (DXY) treads water around 106.30 after declining in the last two days.

It should be noted that the greenback’s latest inaction could be linked to the US Federal Reserve (Fed) officials’ sustained support for an easy rate hike in December. With this, the Fed policymakers resist praising the three-year high US Retail Sales, which rose 1.3% MoM in October versus 1.0% expected and 0.0% prior.

Elsewhere, market sentiment remains sour amid mixed concerns over the rocket fires in Poland and China’s coronavirus woes.

The news that Russian-made rockets were fired at Poland and killed two people triggered emergency meetings of the North Atlantic Treaty Organization (NATO) and the Group of Seven (G7. However, the updates shared by the Associated Press (AP) quoted an anonymous US official’s findings while mentioning that the missile may have been fired by Ukraine, which in turn allowed Moscow the criticize Kyiv for the same and worsen the mood.

On the other hand, China’s Coronavirus numbers reached the highest levels since April 2021 and raised fears of more lockdowns in the world’s largest industrial player, as well as Australia’s key customer.

Amid these plays, Wall Street closed in the red but the US Treasury yields struggle to stage recovery. That said, the S&P 500 Futures print mild losses by the press time, after reversing from the monthly high the previous day.

Moving on, the Swiss Trade Balance for October, expected 3,698M versus 4,003M prior, could initially entertain USDCHF traders ahead of a speech from SNB’s Maechler. Given the recently hawkish comments from SNB Chairman Thomas Jordan, upbeat statements from Maechler could recall the sellers.

Technical analysis

Although multiple supports around 0.9355-70 challenge USDCHF bears, a clear downside break of the 10-month-old ascending trend line, near 0.9500 by the press time, keeps buyers away.

- USDCAD is moving to the upside in a correction of the recent bear trend.

- The bears eye the bullish trendline for the weeks ahead.

USDCAD staged a correction in the middle of the week as the following charts illustrate. The greenback is under pressure still and the data on the domestic chart remained steady as expected at 6.9%, but core common came in at 6.2% YoY vs. 5.9% expected and a revised 6.2% (was 6.0%) in September. This initially supported the CAD but overall price pressures appeared to have peaked. The Bank of Canada next meets on December 7 and a 25 bp hike to 4.0% is expected. There is a long time between now and then and this gives rise to prospects of a meanwhile correction as follows:

USDCAD weekly chart

The M-Formation is a compelling bullish feature, but there could still be some downside to come.

A break of the support opens up the way to dynamic trendline support, although the bulls are firming and the 38.2% Fibonacci is eyed for the days ahead.

- US Retails Sales smashed forecasts, flashing consumers’ resilience and pressuring the Federal Reserve.

- Industrial Production in the United States showed signs of weakness, justifying 50 bps hikes by the Federal Reserve.

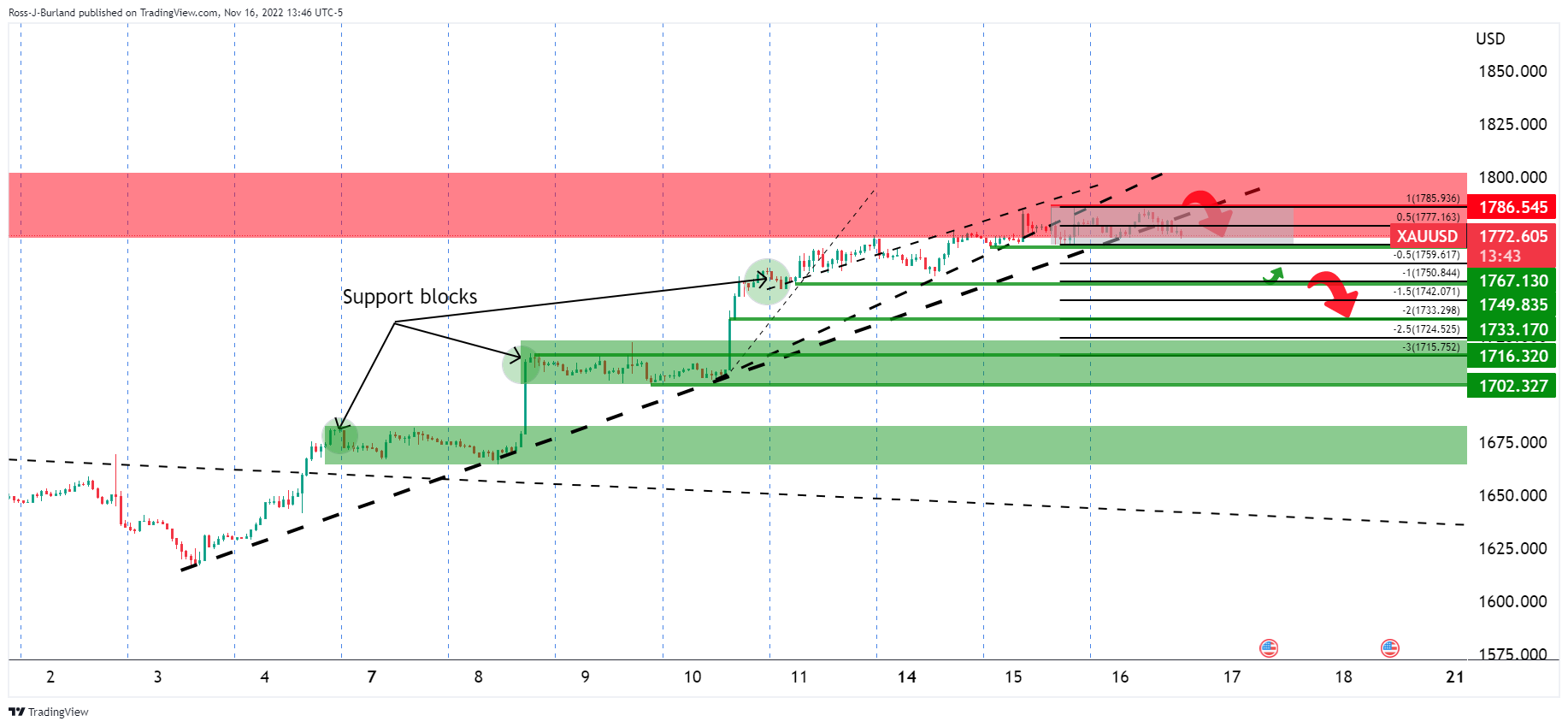

- XAUUSD is neutral-upward biased and can claim $1800 once it regains $1786.

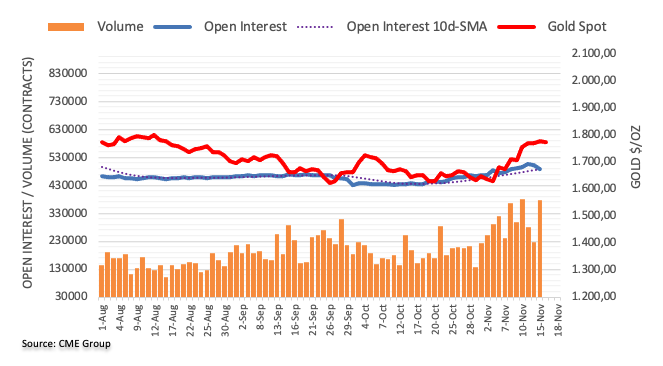

Gold Price creeps lower after testing the weekly high around $1786 on Wednesday following the release of mixed data from the United States, which spurred a risk-off impulse, bolstering the US Dollar (USD). However, XAU failed to capitalize on falling US Treasury bond yields and on Federal Reserve (Fed) speakers expressing that they would slow the pace of tightening, which sent US bond yields plummeting. Hence, XAUUSD is trading at $1772.20, below its opening price.

US Dollar bolstered by an upbeat US Retail Sales report

US equities declined following the release of upbeat economic data for the United States (US). Retail Sales for October grew by 1.3% on a monthly pace, above estimations of 1%, showing consumers resilience amidst a 4-decade inflation period. Delving into the report, Retail Sales for the control group, used on Gross Domestic Product (GDP) calculation, rose by 0.7% MoM against forecasts of 0.3%. Further data from the Federal Reserve (Fed) revealed that Industrial Production (IP) for October in the United States shrank by 0.1% MoM in October, beneath estimates of a 0.2% expansion, the second decline in three months.

Given that Federal Reserve policymakers expressed that interest-rates hikes moderation is appropriate, today’s reports gave mixed signals to the central bank. On one side, further tightening is needed, as growing demand will keep prices elevated, but weakening industrial activity would need support. That said, a slew of Federal Reserve policymakers crossed newswires.

Federal Reserve officials lay the ground for 50 bps hikes

Federal Reserve officials said inflation is too high and higher rates are needed. They added that interest-rate increases could slow down soon, though they emphasized that they need work to do, and “pausing” is not an option. It should be noted that Kansas City Fed President Esther George said it would be hard to lower inflation without triggering a recession, whilst Governor Christopher Waller stated that the higher the policy rate, the stronger the case for slowing to 50 bps hikes.

Gold Price falls albeit a soft US Dollar

Once data was revealed, XAUUSD edged toward the low $1770s, beneath Wednesday’s opening price, while the US Dollar (USD) continued its downtrend. The US Dollar Index (DXY), a gauge of the greenback’s value against a basket of six peers, dives 0.25%, down at 106.306, losing 8.40%, from its recent fall from YTD highs.

Meanwhile, US Treasury bond yields edge lower, a headwind for the USD and a tailwind for XAU. The US 10-year bond yield fell eight bps at 3.690%. Although US nominal bond yields dropped, the US 10-year Treasury Real Yields remained around 1.53%, capping XAUUSD’s rally.

Gold Price Forecast: Technical outlook

The XAUUSD daily chart portrays Gold as neutral-to-upward biased. After retracing from weekly highs around $1786, forming a bearish-harami candle pattern, it could exacerbate a fall below $1767, which, once cleared, could open the door toward $1750, ahead of the 100-day Exponential Moving Average (EMA) at $1712.89. On the other hand, if XAUUSD breaks to new weekly highs above $1786, it could challenge the $1800 figure, immediately followed by the 200-day EMA at $1802.85. A daily close above the latter could send Gold rallying towards June 17 highs around $1857.20.

- AUDJPY remains sidelined after reversing from one-week high.

- 21, 50 and 100 DMAs constitute the 94.30 key hurdle ahead of the two-month-old resistance line.

- Bearish MACD signals, pullback from important resistance levels keep sellers hopeful of retesting monthly horizontal support area.

AUDJPY treads water around the 94.00 threshold, after reversing from crucial resistances the previous day, as traders await Australia’s monthly employment data on Thursday.

That said, the cross-currency pair reversed from the two-month-old resistance line, as well as a convergence of the 21, 50 and 100 DMAs, on Wednesday.

Given the bearish MACD signals, the quote is likely to stay on the seller's radar should the Aussie job numbers disappoint. Even if the scheduled employment numbers arrive stronger, there prevails a bumpy road to the north that makes AUDJPY buyers less interested.

With this, the bears could again aim for the one-month-old horizontal support area between 93.00 and 92.90. However, the 200-DMA support of 92.30 could challenge the pair’s further downside.

On the flip side, the aforementioned DMA confluence near 94.30 is a tough nut to crack for the AUDJPY bulls ahead of the downward-sloping resistance line from September, near 94.60.

In a case where the quote rises past 94.60, the monthly high near 95.55 and the previous month’s peak surrounding 95.75 could challenge the pair’s further upside.

AUDJPY: Daily chart

Trend: Further weakness expected

- AUDUSD remains pressured after reversing from a two-month high.

- Downbeat sentiment, fears emanating from China keep sellers hopeful.

- Jobs report will be the key as upbeat Aussie Wage Price Index challenged RBA doves.

AUDUSD holds onto the previous day’s pullback from the highest levels in three months as traders await Australia’s monthly employment data on early Thursday in Asia. That said, the Aussie pair remains pressured around 0.6730 by the press time.

The market’s risk-off mood triggered the AUDUSD pair’s U-turn from the multi-day high on Wednesday. In doing so, the Aussie pair failed to cheer a three-year high print of Australia’s Wage Price Index for the third quarter (Q3), to 3.1% YoY versus 3.0% expected and 2.6% prior.

The chatters surrounding rocket fires in Poland and China Covid woes joined upbeat US Retail Sales data to weigh on the sentiment.

The news that Russian-made rockets were fired at Poland and killed two people initially soured sentiment. The same triggered emergency meetings of the North Atlantic Treaty Organization (NATO) and the Group of Seven (G7), which in turn favored the US Dollar (USD) due to its safe-haven appeal. However, the updates shared by the Associated Press (AP) quoted an anonymous US official’s findings while mentioning that the missile may have been fired by Ukraine, which in turn allowed Moscow the criticize Kyiv for the same and worsen the mood.

Elsewhere, China’s Coronavirus numbers reached the highest levels since April 2021 and raised fears of more lockdowns in the world’s largest industrial player, as well as Australia’s key customer.

Moving on, US Retail Sales growth rose by 1.3% MoM in October versus 1.0% expected and 0.0% prior. The details suggest that the Retail Sales ex Autos also grew 1.3% MoM compared to 0.4% market consensus and 0.1% previous readings. Further, US Industrial Production contracted by 0.1% in October versus 0.2% forecast and 0.1% prior (revised from 0.4%).

It’s worth noting that the US Federal Reserve (Fed) officials didn’t praise the strong Retail Sales data and kept suggesting a softer rate hike in their latest public speeches, which in turn kept Wall Street in the red but weighed on the US 10-year Treasury yields.

Alternatively, strong numbers of Australia’s Q3 Wage Price Index challenged the bearish bias surrounding the Reserve Bank of Australia (RBA). However, it all depends upon today’s Employment Change, expected 15K versus 0.9K prior, as well as the Unemployment Rate that is likely to increase to 3.6% versus 3.5% previous readings. Should the jobs report fail to shake the current market view of easy rate hikes from the RBA, the AUDUSD may witness further downside amid grim sentiment.

Technical analysis

AUDUSD needs to stay beyond a seven-month-old descending trend line, previous resistance around 0.6730, to keep buyers directed towards the 200-DMA hurdle surrounding 0.6950.

- EURUSD is expected to witness more gains after an establishment above the immediate hurdle of 1.0400.

- Market impulse has cooled down as the Russia-Polish noise has calmed.

- Fed’s Daly has considered a range of 4.75% - 5.25% as reasonable for policy rate end-point

The EURUSD pair has rebounded after retracing to near 1.0355 in the early Asian session. The asset is majorly sideways but is expected to pick up momentum after crossing the immediate of 1.0400 decisively. The major is re-gaining strength as the risk profile is turning positive led by vanishing fears of geopolitical tensions between Russia and Poland.

The market impulse was heated after the Polish government blamed Russia for striking two stray missiles in their region. While things turned next to normal when NATO ambassadors cited that missiles belonged to Ukraine. This has led to a volatility contraction in the US dollar index (DXY) and a power-pack action is expected for the overall market ahead.

S&P500 faced volatility on Wednesday as general merchandise retailer Target Corp (TGT) trimmed its sales forecast, which indicates that consumer spending will trim further. Earlier Federal Reserve (Fed) Beige Book also cleared that consumer spending has been scaled down to 1.4% in the third quarter from the prior release of 2.0%.

Meanwhile, the returns on the US government bonds are losing their traction as investors see an adaptation of a less-aggressive approach by the Fed in its December monetary policy meeting. The 10-year US Treasury yields are on a losing spree and have dropped below the crucial support of 3.70%. The yields have plummeted further despite San Francisco Fed President Mary Daly hiking its interest rate guidance.

Fed policymaker has considered a range of 4.75% - 5.25% as reasonable for the policy rate end-point. She further added that the central bank wants to see a slowdown in the economy to cool down the red-hot inflation.

On the Eurozone front, clarity over the Russia-Poland noise has vanished fears of further supply chain disruptions. Meanwhile, European Central Bank (ECB) Governing Council member Ignazio Visco said on Wednesday that the need for continued tightening is evident but noted that the case for implementing a less aggressive approach was "gaining ground," as reported by Reuters.

- NZDUSD bulls eye further weakness in the US Dollar.

- Technicals point to the downside on a break below 0.6130.

NZDUSD is potentially topping as per the charts below, but it was a quiet day mid-week in financial markets. The price is hovering around 0.6150, between the overnight high of 0.6193 and 0.6128.

Stellar US Retail Sales did little to help the beaten-down US Dollar. In the US, October sales climbed 1.3% MoM beating, expectations of a 1.0% rise and strongly up vs the 0.0% print in September. ''The data point to still strong consumer demand which is something that the Fed is trying to reduce via its rapid monetary tightening. The data justify a 50bp rate increase from the Fed in December,'' analysts at ANZ Bank explained.

There is growing confidence that the US Dollar cycle has peaked, and the analysts at ANZ Bank said their focus is on the NZD’s gap to fair value (which they see at ~0.65), on the RBNZ. The analysts said the central bank is ''well placed to close the gap on US interest rates, and on China’s re-opening, which ought to be good for commodities. But it’s complex given late-cycle fears of the Fed’s still fairly resolute tone. Technicals still look reasonably bullish, in our view.''

NZDUSD technical analysis

The price is topping out on the time frames as per the hourly chart above and the 4-hour chart below:

On the 4-hour chart, however, there are prospects of a triple-top scenario as illustrated above.

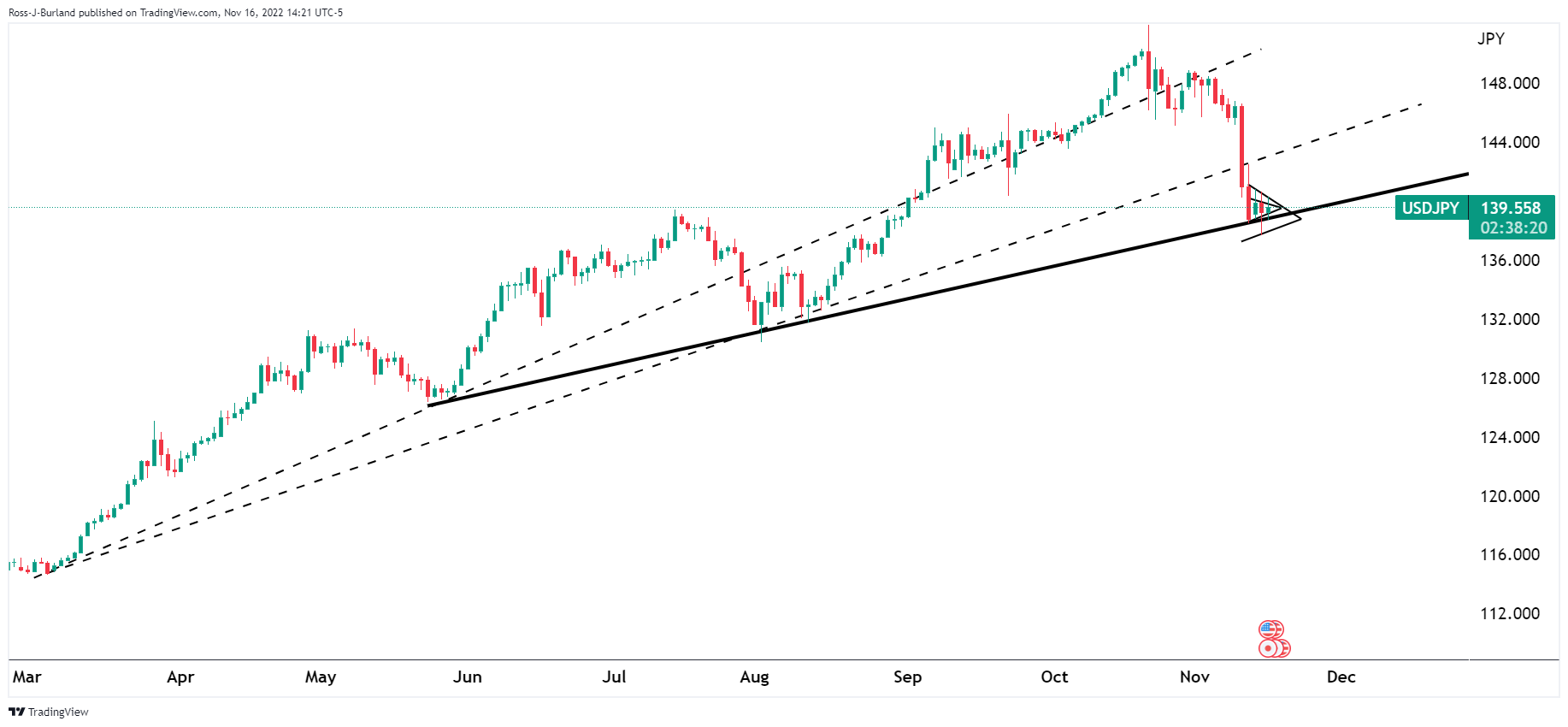

- USDJPY is coiled and could be about to continue to the downside.

- US Dollar bulls eye a correction into the 108.00s, DXY.

USDJPY is relatively flat in the session after falling from a high of 140.29 to a low of 138.72, now trading back at 139.30. The greenback has been under pressure, sliding from currently elevated levels on the sentiment that the Federal Reserve will be forced to pause its rate hikes. As interest rate differentials with other countries narrow, the greenback would be expected to continue to slide. The sentiment is fueling a bid in the Yen as the following technical analysis will illustrate:

USDJPY daily chart

The price has broken prior supporting trendlines and is now meeting fresh dynamic support and is coiling into a bearish continuation triangle.

USDJPY H4 charts

On the 4-hour chart we can see the important levels and price imbalances should there be a break to the upside.

Zoomed in, we can see this more clearly.

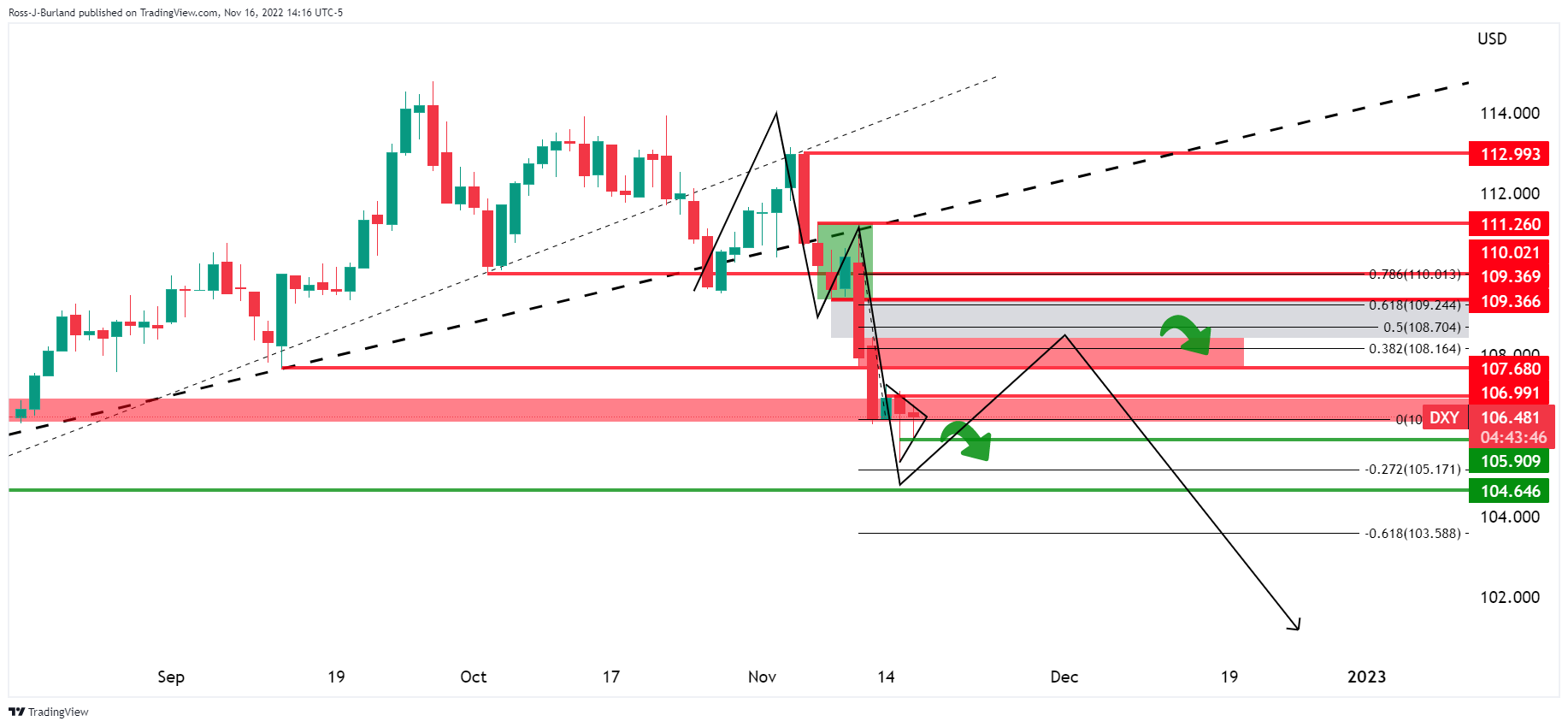

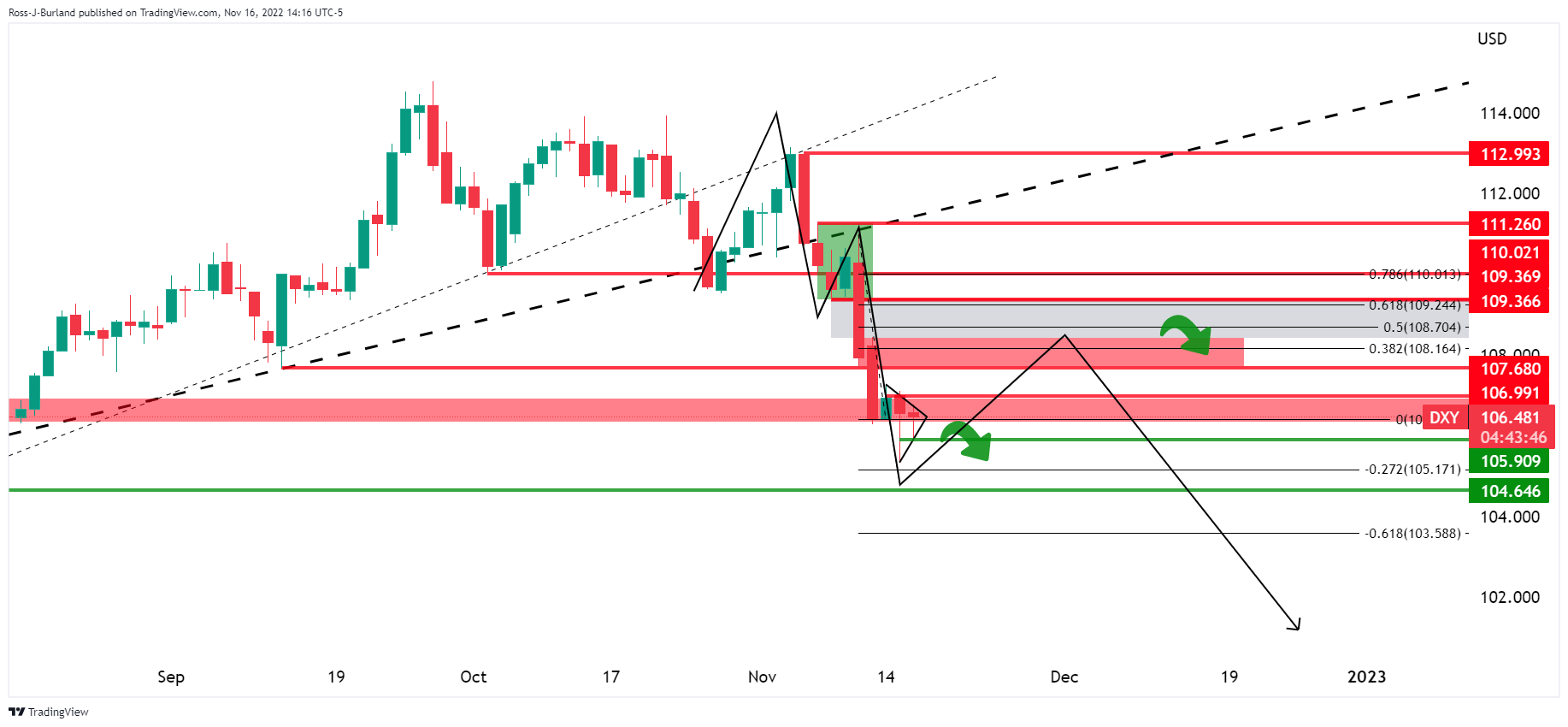

DXY daily charts

The US Dollar is also coiled and bearish while below the resistance. The M-formation, on the other hand, is a bullish feature whereby the price would be expected to revert towards the neckline, at least to test the 38.2% Fibonacci.

Federal Reserve Governor Christopher Waller who last week said “we’ve still got a ways to go” before the US central bank stops raising interest rates, despite good news last week on consumer prices, jolting risk appetite, repeats the same hawkish rhetoric on Wednesday.

Waller continues to caution that officials were not close to a pause. He said today that there is still a ways to go on rates and but he is now "more comfortable" with smaller rate increases going forward after recent data showed the pace of price increases slowing.

In remarks prepared for delivery at an Arizona economic conference, Waller said it remains unclear how high the Fed will need to raise interest rates, and that he will not make a final decision about what to do at the Fed's Dec. 13-14 policy meeting until reviewing the rest of the data between now and then.

"I will not be head-faked by one report," Waller said of consumer price data released last week that saw larger-than-expected declines in both headline inflation and a narrower but more closely watched index of "core" prices. "We've seen this movie before."

Reuters reported that he also said the most recent reports were a "positive development" that he hoped would be "the beginning of a meaningful and persistent decline in inflation" back to the Fed's 2% target.

Key notes

After raising rates in atypically large three-quarter point increments at its last four meetings, Waller said that as it stands "the data of the past few weeks have made me more comfortable considering stepping down to a 50-basis-point hike," in December and possibly to smaller quarter-point increases after that.

Waller said signs the economy and wage growth are slowing have added to his sense that Fed policy is beginning to do its job.

He cautioned it was too early to pin down just how high rates may need to go.

"One report does not make a trend. It is way too early to conclude that inflation is headed sustainably down," he said. "Getting inflation to fall meaningfully and persistently toward our 2% target will require increases in the federal funds rate into next year. We still have a ways to go."

US Dollar update

The US dollar index is coiled and could be subject to a breakout to the downside immanently. However, the M-formation is a reversion pattern that brings the risks of a move through current resistance into the Fibonacci scales with the 38.2% ratio as the first target around 108.00.

What you need to take care of on Thursday, November 17:

The American Dollar gathered some strength in the last trading session of the day, ending the day mixed across the FX board. The greenback benefited from a worsening sentiment following Tuesday’s developments in the Ukraine-Russia war, but also from some fresh macroeconomic news.

Former President Donald Trump announced he will seek another term in the office, launching his Presidential run for 2024. The news came as no surprise, but still lifted concerns amid his views on the US relationship with China and other polemic issues.

Donald Trump is seeking another term in office, hoping to become the first US president in 130 years to stage a comeback after being rejected by voters. Also, Republicans are close to winning control of the House of Representatives, adding 8 seats to a total of 217, just one short of the total needed to create a majority.

The United Kingdom published the annualized Consumer Prices Index, which came in at 11.1% in October when compared to 10.1% in the previous month, the highest reading in over four decades.

US Treasury yields reflect renewed growth-related concerns. The yield on the 2-year note is marginally higher, at 4.37%, while the 10-year note pays 3.70%, down roughly 9 bps on the day. The US published an upbeat Retail Sales report, which rose by 1.3% MoM in October, better than anticipated. The figure sent stocks down amid speculation inflation may resume its advance, forcing the US Federal Reserve to maintain the aggressive tightening path. The same reason backed yields gain at the shorter end of the curve.

Additionally, central banks’ officials are back on the wires. European Central Bank (ECB) Vice President Luis de Guindos said that the ECB would continue with policy normalisation and continue with the restrictive monetary policy, although Governing Council member Ignazio Visco added that reasons for a less aggressive ECB approach is gaining ground.

Across the pond, US Federal Reserve (Fed) Kansas President Esther George said the Fed should slow the pace of rate increases, noting that an economic contraction may be necessary to bring the services sector inflation down.

Finally, tensions arose in China as the country keeps reporting increased coronavirus contagions. Regional lockdowns spread across the country and even triggered protests in the streets, likely worsening the situation.

Wall Street spent the day in the red, following the lead of its overseas counterparts. Losses, however, have been limited.

Australia will publish October employment figures on Thursday. The country is expected to have added 15,000 new job positions in the month, while the unemployment rate is foreseen to tick higher, to 3.6% from the current 3.5%.

The EURUSD pair trades at around 1.0370, while GBPUSD is stable around 1.1890. Commodity-linked currencies suffered the most, with AUDUSD down to the 0.6720 region and USDCAD trading at 1.3230. There was little action around safe-haven currencies, with USDCHF and USDJPY confined to tight intraday ranges and settling at 0.9440 and 139.60, respectively.

Gold consolidated gains and held within familiar levels, now trading at around $1,773 a troy ounce, while crude oil prices edged lower, with the barrel of WTI changing hands at $85.50.

Like this article? Help us with some feedback by answering this survey:

- Mixed US economic data kept the EURUSD from staying above 1.0400.

- US Retail Sales report crushing expectations requires further rate hikes by the Federal Reserve.

- According to Reuters, European Central Bank policymakers to lift rates by 50 bps at December’s meeting.

- EURUSD failure to register a daily close above 1.0400 would exacerbate a fall toward 1.0200.

The EURUSD extends its gains for the second consecutive day but struggles to hurdle the 200-day Exponential Moving Average (EMA) and retraces. The release of an upbeat Retail Sales report for the United States capped the Euro (EUR) gains, as the major slid below 1.0400. At the time of writing, the EURUSD is trading at 1.0371, above its opening price by 0.22%.

US Dollar bolstered by an upbeat US Retail Sales report

Sentiment remains negative, as shown by US equities trading with losses. A report from the US Department of Commerce (DoC) showed consumers’ resilience amidst one of the most aggressive tightening cycles by the Federal Reserve (Fed). October’s Retail Sales jumped by 1.3% MoM, vs. 1% estimations, the largest increase in eight months. Regarding the control group used for Gross Domestic Product (GDP) calculations, sales grew by 0.7% MoM against a 0.3% forecast.

Later, US Industrial Production plunged from September’s 0.1% to -0.1% MoM, missing estimates of a 0.2% increase.

After the reports, Federal Reserve officials expressed that inflation and higher rates are needed. They added that moderation to interest-rate increases could happen soon, though they emphasized that they need work to do. It should be noted that Kansas City Fed President Esther George said in an interview with the Wall Street Journal (WSJ) said it would be hard to lower inflation without triggering a recession.

In the meantime, Atlanta’s Fed GDPNow projection for Q4 is at 4.38%, above its previous reading of 4%, an optimistic forecast for the US economy,

European Central Bank members committed to taming inflation

Across the pond, European Central Bank (ECB) policymakers are crossing news wires, led by Vice-President Luis de Guindos saying that inflation is their top priority, while Ignacio Vizco added that the case for less aggressive rate hikes is growing. Meanwhile, the Eurozone Financial Stability Report published by the ECB said risks for financial stability grew sparked by worsening economic and financial conditions, blamed on the energy crisis and Russia’s invasion of Ukraine.

Elsewhere reports that ECB officials are favoring a 50 bps rate hike in December, contrarily to 75 bps, emerged, according to Reuters.

EURUSD Price Analysis: Technical outlook

The EURUSD sits comfortably above the November 14 daily high of 1.0358 after probing the 1.0400 figure. Of note, the Euro rallied toward the 200-day Exponential Moving Average (EMA) for the second time, but sellers outweighed buyers, sending the pair below the 1.0400 mark. So EURUSD traders should be aware that EURUSD’s failure to print a daily close above 1.0400 would exacerbate a fall towards the September 12 high at 1.0197, followed by the October 26 swing high-turned-support at 1.0088.

- The Gold price has glided out of the trendline supports and hovers over Tuesday's lows.

- A 100% expansion of the current consolidative range is located at the $1,750 mark for an initial target.

At $1,774.20 currently, 09.23%. the Gold price stalled on Wednesday, gliding across a bearish structure as yesterday's lows of $1,767.13. The yellow metal has traveled between a tight consolidative range of $1,773.99 and $1,785.09 so far on the day. The precious metal sits near a three-month peak and remains buoyed by a softer dollar as investors expect that the Federal Reserve can ease its aggressive interest rate hikes following a round of data that points to slowing inflation.

The safe-haven dollar weakened further on Wednesday despite stronger-than-expected US Retail Sales that have clouded the inflation outlook. Last week, the US Consumer Price Index missed expectations as did the Producer Price Index which both have weighed on the greenback. DXY, an index that measures the US Dollar vs. a basket of major currencies has fallen around 7% in November suffering the bulk of the drop last Friday on the back of the inflation data. Gold has benefitted in a softer US yield environment as a consequence as benchmark 10-year yields were near their lowest since Oct. 5. Rising rates reduce the appeal of non-yielding bullion.

Poland tensions have cooled

Besides the Fed, geopolitics is coming to the fore once again and moving the needle in financial markets having been on the back burner for some time. Bullion moved to the highest since August 15 following reports of a missile killing two people in Poland near the border with Ukraine. An investigation is underway but tensions were high. Nevertheless, so far, the United States has not seen anything that contradicts Poland's preliminary assessment that a missile that landed within its borders on Tuesday was most likely the result of a Ukrainian air defense missile. This comes from US National Security Council spokesperson Adrienne Watson who commented on the situation on Wednesday.

"Whatever the final conclusions may be, it is clear that the party ultimately responsible for this tragic incident is Russia, which launched a barrage of missiles on Ukraine specifically intended to target civilian infrastructure," he said. The cooling tensions have curbed the appetite for both gold and the US Dollar.

''Positioning risks are still skewed to the upside in gold, the analysts at TD Securities said. ''A series of key trend reversal thresholds associated with substantial short covering flow lies just north of the $1800/oz mark. In turn, the pain trade in the yellow metal has room to extend further, which suggests that the return on patience is elevated for those looking to fade the recent rally.''

Gold technical analysis

If Gold does not move higher from here, imminently, then the pressures will leave the 38.2% Fibonacci and the 50% mean reversion levels vulnerable around $1,750. However, while on the back side of the broken trendlines, the bias is weighted to the upside with the $1,800's eyed.

If there is to be a meanwhile correction, it could play out as follows on the hourly chart:

The price has glided out of the trendline supports and hovers over Tuesday's lows as the structure that the bears need to break. A 100% expansion of the current consolidative range is located at the $1,750 mark for an initial target.

- Economic data from the United States was mixed and bolstered the US Dollar.

- US Retail Sales grew the most in eight months, while Industrial Production disappointed.

- Albeit Australia’s WPI jumped, it won’t deter the Reserve Bank of Australia from 25 bps hikes.

The AUDUSD retreats from weekly highs around 0.6800 after a sales report in the United States, showing consumers resilience despite higher interest rates. Also, a risk-off impulse spurred by geopolitical jitters capped the Australian Dollar (AUD) gains. At the time of writing, the AUDUSD is trading at 0.6741, beneath its opening price, after hitting a daily high of 0.6792.

US Retail Sales jumped, spurring a risk-off impulse

US equities remain negative, following the US Retail Sales report. The US Department of Commerce (DoC) informed that October’s Retail Sales grew by 1.3% MoM against 1% expectations by analysts. In the same report, the control group sales used to calculate the Gross Domestic Product (GDP) rose 0.7% MoM against a 0.3% increase.

Given that the last two inflation reports in the United States, the Consumer Price Index (CPI) and the Producer Price Index (PPI), were softer, consumers exerted additional pressure on the Federal Reserve (Fed). However, a slew of Federal Reserve officials crossing newswires commented that the central bank is resolute in tackling inflation but with gradual interest-rate increases.

Later, two Fed officials crossed wires. New York Fed President John Williams said that price stability is essential for the US economy to function well. Later, the San Francisco Fed President Mary Daly said the central bank wants to see the economy slow, so they can get inflation down. She added that “Pausing is not part of the discussion” and foresees the Federal Funds rate (FFR) to peak at around 4.75% - 5.25%.

Further US data revealed during the day saw Industrial Production (IP) plunging from September’s 0.1% to -0.1% MoM, below estimates of a 0.2% increase.

Australia’s WPI jumped thought won’t deter RBA’s from gradual hikes

Elsewhere, the Australian Wage Price Index (WPI) rose by 3.1% in the Q3, higher than expected but consistent with what the Reserve Bank of Australia (RBA) thought was a necessary condition for achieving their 2-3% CPI inflation target, according to ING analysts.

Analysts at ING said: “Consequently, even with the last inflation and now wages data surprising on the upside, we don’t believe they will shift back to their previous 50bp pace of tightening and will continue at a 25bp pace at coming meetings, with the peak for cash rates likely to come in 1Q23 as the cash rate hits 3.6%.”

The AUDUSD retreated from weekly highs and trimmed its earlier gains, even though the inverted head-and-shoulders pattern remained in play. As long as the AUDUSD remains above the 0.6700 figure, a move to the inverted head-and-shoulders pattern target at 0.6870 is on the cards.

AUDUSD Price Analysis: Technical outlook

From a daily chart perspective, the AUDUSD remains neutral-to-upward biased. The inverted head-and-shoulders are still intact unless the major plunges below 0.6400. OF note, the 100-day Exponential Moving average (EMA) at around 0.6696 acted as support twice, meaning buyers stepped in at that level. The Relative Strength Index (RSI) in bullish territory reaffirms buyers are in charge, though its downward slope suggests the AUDUSD might consolidate in the 0.6700/0.6800 area.

The United States has not seen anything that contradicts Poland's preliminary assessment that a missile that landed within its borders on Tuesday was most likely the result of a Ukrainian air defense missile, US National Security Council spokesperson Adrienne Watson said on Wednesday.

"Whatever the final conclusions may be, it is clear that the party ultimately responsible for this tragic incident is Russia, which launched a barrage of missiles on Ukraine specifically intended to target civilian infrastructure."

Key quotes

- US sees nothing that contradicts Polish president's preliminary assessment explosion was most likely the result of a Ukrainian air defense missile.

- US spokesperson says whatever final conclusions may be, it is clear Russia is ultimately responsible

- Ukraine has every right to defend itself.

The comments follow Poland's investigation into Tuesday's news that at least two people died after Russian missiles landed in NATO state Poland on the Ukraine border. The event weighed on risk appetite on Wall Street and at the start of the day in Asia on Wednesday.

Retail Sales rose in October by 1.3% above the 1% of market consensus. Analysts at Wells Fargo point out that despite the apparent endurance, consumers are struggling to keep up the pace. They warn that the last time credit card borrowing was growing like it is now, the US was heading into the 2008-2009 recession.

Key Quotes:

“The fundamentals are not supportive for consumer spending, yet retail sales continues to forge ahead. While it is certainly true that this is a nominal measure, even after adjusting for inflation, consumers are spending more. It is tempting to cheer on the "resilience" of the consumer, but the staying power of spending gives businesses no incentive to forgo price increases, thereby making the task of getting inflation in check more difficult for policymakers.”

“Even with continued consumer resilience, some cracks are slowing forming in the foundation. Households have increasingly relied on credit to spend and increased overall debt $351 billion in the third quarter, putting the total debt burden for households at $16.5 trillion, according to data released yesterday by the NY Federal Reserve. That’s an increase of 8.3% from a year earlier, the biggest annual increase since a 9.1% jump in Q1-2008 at the start of the 2008-2009 recession.”

“Near-term consumer resilience will come at a further deterioration in household finances as households draw down savings and accumulate debt to spend. That may eventually spell economic trouble.”

Data released on Wednesday showed the Consumer Prince Index (CPI) in Canada rose 0.7% in October, in line with expectations while the Core rate increased by 0.4% below the 0.7% of market consensus. Analysts at CIBC expected inflation to continue moving lower. They look for the Bank of Canada to raise rates by 50 basis points at the next meeting.

Key Quotes:

“Inflation remains very heated, with the CPI holding to a 6.9% 12-month pace, and prices up another 0.7% in October (or 0.6% seasonally adjusted).”

“Today's data were in line with consensus, and although the headline CPI was a few ticks lower than we expected, prices excluding food/energy were only one tick softer than we had built into our projection. We still expect much lower inflation by the latter half of 2023, but today's data were generally a reminder that we need to first see downward pressure from on demand from softer job and income gains to make that happen.”

“We look for the Bank of Canada to add another half point to overnight rates in December, and they will have to rely on indicators of slowing growth, rather than immediate progress on inflation, to justify a pause in Q1.”

- Retail Sales in the United States registered their largest gains in eight months, bolstering the US Dollar.

- UK’s inflation data and Bank of England speakers kept the GBP from falling.

- GBPUSD Price Analysis: Once it breaks 1.2029, it could test the 200-DMA; otherwise, it could drop to 1.1647.

The GBPUSD climbed following the release of mixed US economic data from the United States, while also a slew of Bank of England (BoE) Governors crossed newswires after a red-hot UK CPI report. At the time of writing, the GBPUSD is trading at 1.1888, registering gains of 0.16% after hitting a daily high of 1.1941.

US Retail Sales showed consumer spending increased

US stocks are trading in the red after a solid US Retail Sales report. The US Department of Commerce (DoC) reported that sales grew the most in eight months, with readings hitting 1.3% MoM vs. 1% estimated by analysts. Digging deep into the report, Retail Sales in the control group, used to calculate Gross Domestic Product (GDP), expanded by 0.7% MoM vs. 0.3% foreseen.

Even though inflation data in the United States showed signs that an era of elevated prices could end, consumer resilience proves otherwise. Instead, Federal Reserve officials could be forced to continue its aggressive tightening, although they expressed a desire to slow the pace of tightening conditions,

Further US data revealed during the day saw Industrial Production (IP) plunging from September’s 0.1% to -0.1% MoM, below estimates of a 0.2% increase.

Of late, two Federal Reserve (Fed) policymakers crossed wires. New York Fed President John Williams said that price stability is essential for the US economy to function well. Later, the San Francisco Fed President Mary Daly said the central bank wants to see the economy slow, so they can get inflation down. She added that “Pausing is not part of the discussion” and foresees the Federal Funds rate (FFR) to peak at around 4.75% - 5.25%.

UK inflation breaks above 11%, pressuring the BoE

On the UK front, the Consumer Price Index for October jumped 11.1% YoY, smashing estimates of 10.7%, reported the Office for National Statistics (ONS). Notably, the inflation report comes one day before Chancellor Jeremy Hunt unveils the Autumn Budget, which is expected to show a “fiscally responsible” government under the new Prime Minister (PM) Rishi Sunak.

Following the release of the UK inflation report, the Bank of England Governor Andrew Baily said that inflation is reflecting a series of supply shocks. However, he added that those shocks are beginning to fade and noted that the central bank would raise rates further. In the meantime, the BoE’s newest member Swati Dhingra said the UK could get into a much deeper recession if rates continue to rise.

After a busy economic docket, the GBPUSD continued its uptrend, though stalled at around 1.1900. the major bias is neutral-to-upwards, though if it reclaims the 200-day Exponential Moving Average (EMA) at 1.2237, that could pave the way for further gains.

GBPUSD Price Analysis: Technical outlook

From a technical perspective, the GBPUSD’s unable to recapture 1.2000 exposes the pair to selling pressure. Although the Relative Strength Index (RSI) shows buyers’ momentum stills, November’s 15 inverted hammer candlestick with a long upper shadow showed signs of some liquidations. However, a renewed push above the weekly high at 1.2029 could motivate buyers to engage on the GBPUSD’s way toward the 200-day EMA. On the flip side, GBPUSD key support levels are 1.1800, followed by the 100-day EMA at 1.1647.

- Mexican peso firm again versus US Dollar.

- USDMXN holds bearish bias, unable to recover 19.50.

- Strong support at 19.30 prevails, for now.

The USDMXN is falling modestly on Wednesday as the US Dollar remains weak across the board amid expectations of a less aggressive Federal Reserve. The pair remains near the lowest levels since March 2020. It bottomed at 19.28, and it is hovering around 19.30.

On Tuesday, the USDMXN peaked at 19.47 and then pulled back. The rebounds of the US Dollar continue to be limited, unable to reclaim the 19.50 zone. A daily close above 19.60 would alleviate the bearish pressure.

The Mexican peso is testing the 19.25/30 critical support in the short-term. A daily close below would open the doors to more losses with an in initial target at 19.15 and the next key support at 19.00/05. The RSI remains slightly above the 30, while Momentum is turning south again.

USDMXN daily chart

-638042126135891479.png)

Gold has rebounded further but still remains below the 200-Day Moving Average at $1,803. Therefore, strategists at Credit Suisse stick to their bearish bias.

200-DMA at $1,803 to cap further upside for now

“Gold has rebounded further and is now hovering solidly above the 55DMA at $1,680, hence questioning the validity of the large ‘double top’.”

“A break back below the 55DMA is needed to inject fresh downside momentum into the market again, with next supports seen at the recent YTD low at $1,614, before the 50% retracement of the whole 2015/2020 upmove seen at $1,560.”

“The 200DMA, currently seen at $1,803, is expected to cap further upside for now. However, above would open the door for a potential rise toward the $1,877 June high next.”

EURUSD is expected to hold its 200-Day Moving Average at 1.0430 on a closing basis for now. However, economists at Credit Suisse expect to see an eventual break for a move to the 38.2% retracement of the 2021-2022 downtrend at 1.0612/15.

Support for a pullback is seen at 1.0271

“EURUSD is currently testing the falling 200DMA, currently at 1.0430. Whilst this may cap at first on a closing basis for a pullback, our bias is for a closing break in due course and for further strength to the 38.2% retracement of the entire 2021-2022 downtrend and late June high at 1.0612/15, which we then look to prove tougher resistance.”

“Support for a pullback is seen at 1.0271 initially, with 1.0097/95 now ideally holding further weakness.”

The US Dollar has fallen since last week’s milder-than-expected inflation data. Nonetheless, economists at UBS expect the greenback to stay on a solid foot for the time being, dragging EURUSD and GBPUSD down to 1.00 and 1.10, respectively.

Near-term risks remain tilted toward a stronger US Dollar

“We think the near-term risks remain tilted toward a stronger US Dollar. We continue to rate the greenback as most preferred in our foreign exchange strategy, alongside the Swiss Franc, another safe-haven currency.”

“We think there is a high chance that risk aversion will return and recommend investors prepare for another drop below parity for the Euro and Cable to fall toward 1.10.”

“We also recommend selling upside risk in EURUSD and the downside risk in the US Dollar versus the Yen as a short-term yield-enhancement strategy, given the pick-up in foreign exchange volatility.”

In an interview with CNBC on Wednesday, San Francisco Fed President Mary Daly said the latest Consumer Price Index and Producer Price Index data were positive news, as reported by Reuters.

Additional takeaways

"Consumers are preparing for slower economy, that's a good start."

"We want to see economy slow."

"We want to get inflation down"

"Slower inflation, labor market are encouraging; need more of that."

"Pausing is not part of the discussion, now the focus is on level of rates."

"IN September, I wrote down 5% as an ending place for rates."

"I still think 5% is reasonable."

"When we hold rates, monetary policy becomes tighter as inflation comes down."

"Discussion now is how high we have to go, then will be, how long do we need to hold it."

"Global conditions are a headwind on US growth."

"A range of 4.75% - 5.25% is reasonable for policy rate end-point."

"Unemployment rate at 4.5%-5% would be reasonable."

"I'm 100% determined to slow the economy effectively, gently."

Market reaction

The US Dollar Index extends its daily recovery after these comments and was last seen losing 0.15% on the day at 106.41.

Bank Indonesia (BI) will hold its monthly governor board meeting on Thursday, November 17. Here you can find the expectations as forecast by the economists and researchers of six major banks regarding the upcoming central bank's rate decision.

Bank Indonesia is expected to hike rates by 50 basis points to 5.25%. At the last policy meeting on October 20, the bank hiked rates 50 bps to 4.75%

Standard Chartered

“We expect BI to hike the 7-day reverse repo rate by 25 bps to 5.0% to maintain IDR stability and contain imported inflation. With the inflation impact of the subsidised fuel price adjustment appearing softer than expected and economic growth momentum staying upbeat in Q3, BI will likely focus on maintaining IDR stability. We think BI will need to continue hiking the policy rate to calibrate IDR pricing with Fed hikes, while at the same time reducing excess liquidity to accelerate monetary policy transmission. Accelerated government spending towards year-end and the burden-sharing programme should boost liquidity, dampening the effectiveness of a higher policy rate on IDR pricing, as reflected in sticky low IDR deposit rates.”

ING

“BI will likely hike rates by 50 bps to help steady the Indonesian rupiah, which has been under some pressure of late. The third-quarter GDP growth report was better than expected, giving the central bank some room to be aggressive with its tightening now that core inflation is moving higher.”

ANZ

“We have pencilled in a 50 bps rate hike at BI’s upcoming meeting. Admittedly, recent inflation data per se does not call for aggressive rate hikes. The headline number eased, and while core inflation continued to rise, the pass-through from earlier fuel price adjustments has been weaker than previously anticipated. That said, stabilising the IDR has become an increasingly important consideration; a hawkish US Fed gives BI impetus to maintain an assertive response to cap downward pressure on the currency, which has underperformed regional peers over the past month. Recent Q3 GDP data which showed robust economic activity and October’s consumer survey that pointed to robust sentiment could give BI confidence to deliver another outsized hike.”

TDS

“BI is likely to step down to 25 bps hiking steps given the downside surprise in headline inflation. The rebound in IDR strength also lessens the need for BI to continue with outsized hikes to support IDR.”

SocGen

“We see a possibility of BI extending the debt monetisation scheme to 2023. Also, in an effort to improve the relative attractiveness of real yields, BI has brought forward its target of bringing core inflation back to the 3.0% level from 3Q23 to 1Q23. This will require it to continue to be aggressive on rate hikes (given the assumed lag in the effect of monetary policy actions on the real economy) and hence we expect it to announce another 50 bps rate hike, taking the policy rate to 5.25%. The near-term risks remain skewed to the upside in USDIDR as the focus remains on inflation and a tighter Fed policy for longer.”

MUFG

“We forecast a 25 bps to bring the 7-day reverse repo rate to 5.00%. This comes amid easing but still elevated price pressures. Inflation eased to 5.71% YoY in October from 5.95% a month ago. This showed easing food price pressures. Still, core inflation rose to 3.31%YoY in October compared to 3.21% prior.”

- US Retail Sales rise more than expected in October.

- Quiet session across financial markets on Wednesday.

- USDJPY is marginally higher, moving between 139.00 and 140.00.

The USJPY is hovering around 139.40, marginally higher for the day, following the release of US economic data, on a relatively quiet session. The pair continues to stabilize after sharply moves last week.

Dollar mixed after data

US data come in mixed to positive. Retail Sales in October rose 1.3%, the best reading in eight months. Industrial production dropped 0.1%, against expectations of an increase of 0.2; September numbers were revised lower from 0.4% to 0.1%.

The numbers boosted the US Dollar but only modestly. The DXY remains in negative territory but above 106.00. While the US 2-year bond yield remains steady at 4.36%, the 10-year is at 3.73%, the lowest since October 22. The USDJPY spiked to 140.00 after retail sales but then dropped to as low as 139.03.

In Japan, Machinery Orders tumbled in September unexpectedly 4.6%. “This comes after weaker-than-expected Q3 GDP readings and of course bodes ill for growth going forward. As such, it’s no surprise that Japan policymakers remain cautious about removing stimulus too soon”, said analysts at Brown Brother Harriman.

Bearish but consolidating

The USDJPY is moving sideways after being able to recover the 138.50 zone. A consolidation below would increase the bearish pressure. On the upside the immediate resistance is seen around 140.00 and then the 140.60 zone. A consolidation above would open the doors for a test of 141.00 and probably more gain.

The ongoing consolidation follows a sharp decline last week that changed the short-term bias from bullish to bearish.

Technical levels

Australia is set to report its October employment figures on Thursday, November 17 at 00:30 GMT and as we get closer to the release time, here are forecasts from economists and researchers at five major banks regarding the upcoming employment data.

Australia is expected to have added 15K positions in the month vs. 0.9K in September, with the unemployment rate seen rising a tick to 3.6%.

ANZ

“A weak report expected, with employment to fall 20K and unemployment to edge up to 3.6%.”

Westpac

“The 900 in employment in September was an increase of just 0.01%. Contrast that with a gain in the working age population of 0.08% and a 9.8K, or 0.07%, lift in the labour force. This left the participation rate flat at 66.6% and the unemployment rate flat at 3.5%. However, at two decimal points, it lifted from 3.48% to 3.54% so very close to rounding up to 3.6% while the employment-to-population ratio eased back to 64.22% from 64.27%. Given the rounding only just kept the unemployment rate at 3.5%, we would argue that September was a softer-than-expected update on the labour market. Holding participation flat in October, our forecast 15K gain in employment is not enough to prevent the unemployment rate from rounding up to 3.6%. We see there is a risk of a softer gain in employment in October while participation can remain robust, hence we see upside risk to our unemployment rate.”

TDS

“We expect employment to fall by 10K. We expect the participation rate stayed elevated at 66.6% and for the unemployment rate to rise to 3.7% from 3.5% previously. Thus, the RBA Q4 forecast for unemployment at 3.4% looks increasingly unlikely to be realised as the job market softens towards year-end. We still look for the Board to continue with 25 bps hikes though the Bank is sounding more dovish, with Deputy Governor Bullock hinting that the Bank is getting closer to a pause in this hiking cycle.”

SocGen

“We expect that MoM changes in employment will return to a sizeable gain in October (30K). It is true that the slowdown in consumption that was already confirmed by the sluggish real retail sales in Q3 also weighs on employment growth. However, it is natural to expect a gain in employment after a pause between June and September (a dip in July, a rebound in August and zero growth in September). The unemployment rate is likely to fall again to a historically low level of 3.4%, and the participation rate is expected to stay at a historically high level of 66.6%. Weekly hours worked should also return to healthy growth after the weakness in the previous months. The unemployment rate is likely to stay around the current level for a considerable period, as we expect only a relatively mild slowdown of economic activity.”

Citibank

“Australia October Labour Force Survey Citi employment forecast; 10K, Previous, 0.9k; Citi unemployment rate forecast; 3.5%, Previous; 3.5%; Citi participation rate forecast; 66.6%, Previous; 66.6% The labour market remains tight, however, there are early signs that it has started to loosen from its extremely tight levels earlier in the year. Sentiment indicators from businesses suggest labour hiring will continue over the coming months, but at a slower pace than what businesses had previously expected. Indeed, Citi Research’s view is that the unemployment rate will likely start rising in 20 23, up from 3.5% to 4.3%. However, there are risks that it could begin to do so little earlier.”

- A tranche of economic data from the United States bolstered the US Dollar and capped the USDCAD fall.

- Canada’s Consumer Price Index for October was unchanged, undermining the Loonie.

- USDCAD Price Analysis: The head-and-shoulders remain in place, but sellers need to crack the 100-day EMA.

The USDCAD is still subdued after United States economic data showed consumers resilience, while Canada’s inflation appeared to pause following a report. Also, a risk-off impulse, spurred by an upbeat US sales report, capped the USDCAD fall. At the time of writing, the USDCAD is trading at 1.3304, above its opening price by 0.21%.

US Retail Sales showed consumer spending increased

US equity futures point to a lower open. The US Department of Commerce (DoC) reported that October Retail Sales in the US rose the most in eight months, with readings hitting 1.3% MoM vs. 1% expected by analysts. Delving into the report, Retail Sales in the control group, used to calculate Gross Domestic Product (GDP), expanded by 0.7% MoM vs. 0.3% consensus.

Even though Federal Reserve officials have expressed their desire to moderate interest rate hikes, US consumers resilience, would complicate their work. Nevertheless it should be remembered the Fed’s latest monetary policy statement where they said that “the Committee will take into account the cumulative tightening of monetary policy.” So traders better be aware of Fed policymakers reaction to the Retail Sales report.

Further US data revealed during the day saw Industrial Production (IP) plunging from September’s 0.1% to -0.1% MoM, below estimates of a 0.2% increase. According to the report, “Capacity utilization decreased 0.2 percentage points in October to 79.9%, a rate that is 0.3 percentage points above its long-run (1972–2021) average.”

Canada’s Consumer Price Index was unchanged, weighing on the Loonie

On the Canadian side, the Canadian Consumer Price Index (CPI) held at 6.9% YoY in October, blamed mainly on high gasoline prices and the Bank of Canada (BoC) interest rate hikes. In the same report, the core CPI number, which excludes volatile items like food and energy, rose by 5.3% YoY. Analyst at CIBC commented that Canada’s inflation rate got fueled up in October, but there was just a hint of better news in the underlying detail, as prices outside food and energy saw a tamer seasonally adjusted gain.

Given the amount of data revealed, the USDCAD remained almost unchanged, at around its opening price. However, it should be noted that the USDCAD bias is neutral-to-downwards but faces solid support at the 100-day Exponential Moving Average (EMA) at 1.3238.

USDCAD Price Analysis: Technical outlook

The head-and-shoulders chart pattern remains in place as long as the USDCAD exchange rates continue to trade below the neckline, which is around 1.3500. The Relative Strength Index (RSI) shows that buyers are beginning to gather momentum as it stalled its fall and its slope turned upwards. Nevertheless, until it crosses the 50-midline, sellers remain in charge. USDCAD key support levels lie a the 100-day EMA, followed by the 1.3200 psychological level. Once cleared, it would exacerbate a fall toward the head-and-shoulders target at around 1.3030. Otherwise, if USDCAD buyers regain control, a re-teste of 1.3400 is on the cards.

New York Federal Reserve President John Williams said on Wednesday that the monetary policy is not the best tool to address financial stability risks, as reported by Reuters.

Key takeaways

"Price stability is essential for the US economy to function well."

"Central banks around the world taking strong action to restore price stability."

"It is important to bolster the resilience of the treasury market."

Market reaction

US Dollar Index continues to erase its daily losses following these comments and was last seen losing 0.17% on the day at 106.38.

Bank of England Governor Andrew Bailey comments on the monetary policy as he testifies before the UK Treasury Select Committee on Wednesday.

Key takeaways

"UK labour market remains very tight as the latest data show."

"Still likely we will increase interest rates further."

"Most of the UK-specific risk premium in markets has gone, but not zero."

Market reaction

The Pound Sterling is losing some interest following these comments. As of writing, the GBPUSD pair was trading at 1.1865, where it was up only 0.05% on a daily basis.

The economic data releases from the UK this week have provided further evidence that the BoE continues to face an uncomfortable mix of elevated inflation and weak growth. Therefore, economists at MUFG Bank expect the British Pound to remain under pressure.

BoE will disappoint rate hike expectations

“The release of the latest UK labour market report revealed that wage growth remains uncomfortably strong amidst tight labour market conditions.”

“The release of the latest UK CPI report for October revealed that inflation surprised to the upside again reaching a new cycle high of 11.1%.”

“Overall, the latest data releases keep pressure on the BoE to keep tightening policy although we still believe that the amount of rate hikes will fall short of what is priced by market participants. The UK rate market is currently pricing in a terminal rate of just over 4.50% for next year.”

“The unfavourable combination of elevated inflation and recession risk in the UK, and likelihood the BoE will disappoint rate hike expectations supports our view that the pound will continue to underperform more broadly.”

Bank of England Governor Andrew Bailey comments on the monetary policy as he testifies before the UK Treasury Select Committee on Wednesday.

Key takeaways

"UK inflation reflects series of supply shocks."

"We are now seeing signs that supply chain shock is starting to fade."

"Central banks worldwide have faced a sequence of supply shocks that couldn't have been predicted."

"Quantitative easing has not made a very big contribution to the UK inflation overshoot."

Market reaction

GBPUSD showed no immediate reaction to these comments and it was last seen trading modestly higher on the day at 1.1885.

USDIDR has experienced a steady uptrend. The pair could reach 16,300 on a break past the 15,810/15,880 resistance zone, economists at Société Générale report.

Important support aligns at 15,070

“USDIDR is inching towards the objective of 15,810/15,880 representing a bearish gap formed in 2020. Achievement of this hurdle is likely to result in a pause, however, signals of a deeper downtrend are not yet visible.”

“July high of 15,070 is expected to be an important support.”

“If the pair establishes itself beyond 15,810/15,880, the up move could extend towards projections of 16,000 and 16,300.”

- The index manages to bounce off lows near 105.80.

- Retail Sales expanded more than expected in October.

- Industrial Production disappointed consensus last month.

Following an earlier drop to the 105.80 region, the USD Index (DXY) picked up some traction and is back above the 106.00 mark on Wednesday.

USD Index rebounds on positive data

Despite the bounce off lows, the index remains entrenched in the negative territory amidst persistent investors’ repricing of the next steps of the Federal Reserve when it comes to future interest rate hikes.

So far, market participants keep leaning towards a 50 bps rate raise at the December 14 event, according to the FedWatch Tool gauged by CME Group.

In the US data space, MBA Mortgage Applications increased 2.7% in the week to November 11, while Retail Sales expanded 1.3% in October vs. the previous month and Industrial Production unexpectedly contracted 0.1% MoM also in October.

Later in the session, the NAHB Index, Business Inventories and TIC Flows will all close the daily calendar.

In addition, NY Fed J.Williams (permanent voter, centrist) and FOMC’s C.Waller (permanent voter, dove) are also due to speak along with another testimony by FOMC’s S.Barr.

What to look for around USD

Price action around the dollar remains depressed and relegates the index to navigate in the area of multi-month lows around the 106.00 zone.

In the meantime, the greenback is expected to remain under the microscope amidst persistent investors’ repricing of a probable slower pace of the Fed’s rate path in the upcoming months.

Key events in the US this week: MBA Mortgage Applications, Retail Sales, Industrial Production, Business Inventories, NAHB Index, TIC Flows (Wednesday) - Building Permits, Initial Jobless Claims, Housing Starts, Philly Fed Index (Thursday) - CB Leading Index, Existing Home Sales (Friday).

Eminent issues on the back boiler: US midterm elections. Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 0.41% at 106.13 and the breakdown of 105.34 (monthly low November 15) would open the door to 104.94 (200-day SMA) and finally 104.63 (monthly low August 10). On the other hand, the next up barrier aligns at 109.11 (100-day SMA) seconded by 110.87 (55-day SMA) and then 113.14 (monthly high November 3).

- Industrial Production in the US contracted modestly in October.

- US Dollar Index stays in negative territory above 106.00.

Industrial Production in the United States (US) contracted by 0.1% on a monthly basis in October, the US Federal Reserve announced on Wednesday. This reading followed September's increase of 0.1% and came in worse than the market expectation for an expansion of 0.2%.

"Capacity utilization decreased 0.2 percentage point in October to 79.9%, a rate that is 0.3 percentage point above its long-run (1972–2021) average," the publication further read.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen losing 0.32% on the day at 106.23.

- Gold holds steady near its highest level since mid-August amid a softer US Dollar.

- Bets for less aggressive rate hikes by the Federal Reserve weigh on the greenback.

- Sliding US bond yields further undermines the USD and benefits the commodity.

- A recovery in the risk sentiment seems to cap any further gains for the XAUSD.

Gold attracts some dip-buying near the $1,770 area on Wednesday and steadily climbs back closer to its highest level since mid-August touched the previous day. The XAUUSD holds steady above the $1,780 level through the early North American session, though a slight recovery in the risk sentiment keeps a lid on any further gains.

Fresh US Dollar selling offers support to gold

The US Dollar (USD) fails to capitalize on the overnight bounce from a three-month low and meets with a fresh supply, which, in turn, offers some support to the dollar-denominated gold. The markets now seem convinced that the Federal Reserve (Fed) will hike interest rates at a slower pace in the coming months amid signs of easing inflationary pressures. The speculations were fueled by a surprise drop in US consumer inflation during October. Furthermore, Tuesday's softer Producer Price Index (PPI) reinforces the peak inflation narrative and continues to weigh on the buck.

Softer US bond yields further benefit the XAUUSD

The repricing of the pace of the Fed's rate-hiking cycle, meanwhile, keeps the US Treasury bond yields depressed. In fact, the yield on the benchmark 10-year US government bond languishes near its lowest level for the yield since October 5. This is seen as another factor undermining the USD and leading additional support to the non-yielding yellow metal. The intraday uptick, however, lacks bullish conviction. This, in turn, makes it prudent to wait for some follow-through buying before traders start positioning for any extension of a two-week-old strong uptrend.

A positive risk tone, and upbeat US Retail Sales cap gains for the metal