- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-11-2022

- Gold closed lower on Friday as the dollar and bond yields rose with FOMC minutes eyed.

- A deeper correction could be in order for the open this week with $1,750 eyed as per the confluence of the 38.2% Fibonacci.

Gold is flat in the open and straddles the $1,751 level, recently pressured by the US Dollar that made its biggest weekly gain in over a month as investors eyed rising bond yields and continued to make bets on the US Federal Reserve's interest rate hiking path.

The US Dollar index DXY, which measures the greenback against a basket of major currencies, was up 0.0.3% at 106.93 and has recovered the losses from when US inflation data triggered the index's sharpest weekly drop since March 2020. Treasury yields were up for the second day in a row on Friday with the 10-year yield yields last at 3.821%.

Earlier last week, stronger-than-expected US Retail Sales data poured cold water over speculation about easing interest rate hikes. Also, hawkish remarks from Fed officials such as James Bullard helped to thwart speculation that the Fed was nearing a pause helping to lift the US Dollar and yields. Meanwhile, Societe Generale's economist Kit Juckes wrote that "it may well be that the process of reducing positions ahead of year-end has started in earnest." He added that "2022 was a near perfect storm favoring the US Dollar, which rose on stronger growth, higher rates, terms of trade and geopolitical concerns. Liquidity conditions are deteriorating, and positions being cut back.''

For the week ahead, the Fed minutes will shed light on the FOMC's deliberations regarding the expected downshift in the pace of rate increases. ''With that said, policymakers will also emphasize that the terminal rate is likely edging higher vs prior expectations as the labor market remains overly tight. In terms of the data, we look for the mfg PMI to recede modestly, staying above the 50 level in November,'' analysts at TD Securities said.

With respect to gold, the analysts explained ''money managers continued to aggressively increase their net length in gold markets. Considering trend following remains the dominant return engine among money managers trading in the yellow metal, as highlighted by the strong correlation between CFTC money manager positioning and our independent estimates of CTA positioning, the aggressive rise in net length is more likely attributable to weakening downside momentum signals as opposed to growing belief in the Fed pivot narrative.''

''Indeed, money managers significantly covered shorts but only modestly added to their longs. Given we have found that non-CTA money managers were also likely net short, this recently popular narrative may have also played a role in explaining the scale of short covering in this week's data,' the analysts added.'

Gold technical analysis

Support is holding in the open but remains pressured below the prior structure and on the backside of the hourly trendline that had been broken mid-week. Nevertheless, a deeper correction could be in order for the open this week with $1,750 eyed as per the confluence of the 38.2% Fibonacci.

- AUDUSD has picked bids near 0.6660 as investors await PBOC’s interest rate policy.

- Rising Covid-19 cases and vulnerable real estate demand could compel the PBOC to an expansionary policy.

- Fed Bostic sees termination of the 75 bps rate hike regime and space for a mere 100 bps escalation ahead.

The AUDUSD pair has advanced after sensing support of around 0.6660 in the early Asian session. Earlier, the asset struggled as investors were having anxiety ahead of the interest rate decision by the People’s Bank of China (PBOC).

The risk impulse is quiet as potential triggers for a decisive action are absent from the market. Meanwhile, the US dollar index (DXY) is facing temporary barricades around 107.00 as investors have shifted their focus toward the release of the US Durable Goods Orders data.

Meanwhile, the returns on US government bonds could face some struggle after a rebound as Atlanta Federal Reserve (Fed) President Raphael Bostic see the termination of the 75 basis points (bps) rate hike regime from now.

Fed policymaker on Saturday cited that he is ready to "move away" from three-quarter-point rate hikes at the Fed's December meeting, reported Reuters. He further added that Fed's target policy rate will add no more than another percentage point to tackle inflation. After that, the Fed would need to pause and "let the economic dynamics play out," given that it may take what he estimates as anywhere from 12 to 24 months for the impact of Fed rate increases to be "fully realized."

On Monday, the monetary policy decision by the PBOC will be keenly watched. China’s central bank could move for an expansionary stance as economic projections have been tumbled led by rising Covid-19 cases. Also, vulnerable real estate demand would force injecting more funds into the economy. It is worth noting that Australia is a leading trading partner of China and a rate cut decision by the PBOC would support the Aussie bulls.

Reuters reports that the Atlanta Federal Reserve President Raphael Bostic said on Saturday he is ready to "move away" from three-quarter-point rate hikes at the Fed's December meeting. He feels the Fed's target policy rate need rise no more than another percentage point to tackle inflation.

"If the economy proceeds as I expect, I believe that 75 to 100 basis points of additional tightening will be warranted," Bostic said in remarks prepared for delivery at the Southern Economic Association.

"I believe this level of the policy rate will be sufficient to rein in inflation over a reasonable time horizon."

Bostic also 22222222said that given the inflation surprises of the past year, it is possible the "landing rate" might be higher than he currently anticipates, and that he was going to be "flexible in my thinking about both the appropriate policy stance and the pacing."

But at some point, he said, the Fed would need to pause and "let the economic dynamics play out," given that it may take what he estimate as anywhere from 12 to 24 months for the impact of Fed rate increases to be "fully realized."

US Dollar update

Meanwhile, the US Dollar gained slightly on Friday and made its largest weekly gain in over a month. Investors eyed rising bond yields and continued to make bets on the US Federal Reserve's interest rate hiking path.

The greenback could be driven by the FOMC minutes this week which will shed light on the FOMC's deliberations regarding the expected downshift in the pace of rate increases.

- GBPUSD is cementing a cushion below 1.1900 ahead of US Durable Goods data.

- An improvement in US Durable Goods Orders could create more troubles for the Fed ahead.

- UK Hunt is looking for more ways to strengthen its trade relations with the EU.

The GBPUSD pair is building a base marginally below the round-level resistance of 1.1900 in the early Asian session. The Cable is continuously getting cushion around 1.1880 as overall optimism in the market is support bulls while the upside is capped amid uncertainty over the release of the US Durable Goods Orders data.

The market sentiment remained upbeat on Monday despite tensions between North Korea and the US. Going forward, the risk profile is expected to remain solid amid an absence of critical triggers for decisive action. The US dollar index (DXY) is facing pressure around 107.00 after a sheer rebound on Friday from 106.40. Meanwhile, the 10-year US Treasury yields have rebounded to nearly 3.83% after Federal Reserve (Fed) hiked the target for neutral rates.

Fed policymaker has considered a range of 4.75% - 5.25% as reasonable for the policy rate end-point. She further added that the central bank wants to see a slowdown in the economy to cool down the red-hot inflation.

This week, major action will come after the release of the US Durable Goods Orders data, which will release on Wednesday. As per the estimates, the economic catalyst will remain steady at 0.4% Consistency in demand for durable goods in times when the Fed is struggling to drag the core Consumer Price Index (CPI) could create more vulnerability.

Fed chair Jerome Powell is focusing to cool down red-hot inflation by downsizing overall demand for households as it won’t leave any hope for manufacturers to keep prices stable or higher. Also, sustainability in demand for durable goods indicates that households are banking more on higher interest rate obligations to fulfill the demand of their durable goods.

On the UK front, UK Finance Minister Jeremy Hunt said on Friday, “I am confident we will be able to remove the vast majority of trade barriers with the European Union (EU) outside the single market.” He further added that “We can find other ways to more than compensate for the advantages of being in the single market,”

Last week, a rebound in monthly UK Retail Sales data failed to pour significant enthusiasm in the Pound Sterling. The monthly Retail Sales landed at 0.6%, against expectations of a flat performance. While the annual data improved to -6.1%.

- EURUSD has rebounded from 1.0310 as ECB Lagarde promised to bring down inflation to 2%.

- Fed Collins supported that more rate hikes are required followed by holding of restrictive monetary policy.

- ECB Lagarde cited that recession is unlikely to bring down inflation significantly.

The EURUSD pair has picked some bids after dropping to near the critical support of 1.0310 in the early Asian session. The asset has sensed buying interest after testing Friday’s low and may focus on risk sentiment for further guidance. The risk profile doesn’t see any pressure for now and is likely to support risk-perceived currencies ahead.

On Friday, S&P500 posted decent gains as chances are not sufficient for a consecutive 75 basis point (bps) rate hike by the Federal Reserve (Fed). While headline inflation rate at 7.7% is still a major concern for the market participants. Fed Bank of Boston President Susan Collins cited last week that the US central bank has more work to do to bring inflation down, as reported by Reuters. He further added that additional increases in the federal funds rate will be required, followed by a period of holding rates at a sufficiently restrictive level for some time."

Meanwhile, the US dollar index (DXY) has sensed barricades near the round-level resistance of 107.00 and is expected to remain on tenterhooks ahead of US Durable Goods Orders data. As per the projections, the economic data is seen stable at 0.4%.

Sustainability in the Durable Goods Orders data in times when interest rates are accelerating could create more troubles for Fed chair Jerome Powell. The Fed has been working on keeping the overall demand on a low profile to cool down inflation. This also indicates that households are resorting to higher interest obligations to address their need for durable goods.

On the Eurozone front, European Central Bank (ECB) President Christine Lagarde cleared in the European Banking Congress that the central bank is committed to bringing down medium-term inflation to 2% in a timely manner by escalating interest rates. She further added that a recession is unlikely to bring down inflation significantly.

Reserve Bank of New Zealand Shadow Board members recommend another hike in the Official Cash Rate (OCR) in the Reserve Bank’s upcoming November meeting. However, there was a range of views on the size of the increase.

''The majority view was that the OCR should increase by 75 basis points to 4.25 percent, given that strong action is required to bring down domestic inflation pressures.

One member also considered that, given the rapid increase in the US Fed rate in recent months, any increases smaller than 75 basis points would weigh on the New Zealand currency and add to inflation pressures as prices of imported goods increase. Three members preferred a smaller OCR increase. Two of them highlighted the increased risk of entering another recession if the RBNZ increases the OCR by more than 50 basis points, and the other member was concerned about the increased costs for owners of SMEs.

Regarding where the OCR should be in a year, the Shadow Board’s core views ranged from 3.50 percent to 5.25 percent. One member noted that more central banks are increasing their interest rates at a less rapid pace now, and the Reserve Bank should take similar actions in the coming year. Some members pointed out that the Reserve Bank should consider the cumulative effect of interest rate increases on the New Zealand economy more carefully when determining the degree of tightening next year.''

NZDUSD update

From a bullish perspective, the price is on the backside of the micro trend, and given the recent recovery 0.6060 structure, a bullish bias could be argued. In the other hand, if bulls fail to hold on to the 0.6100 area, a bearish case could be made:

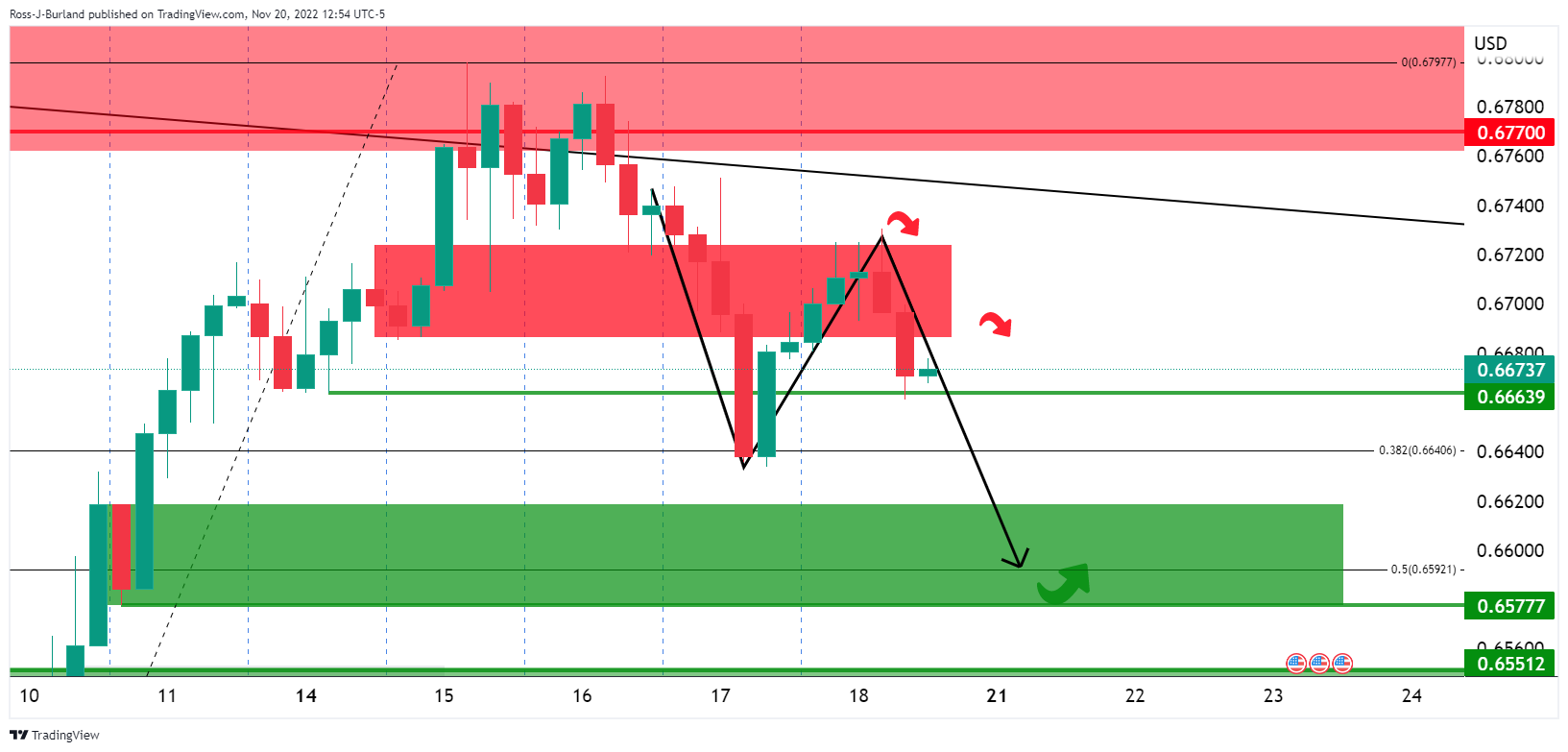

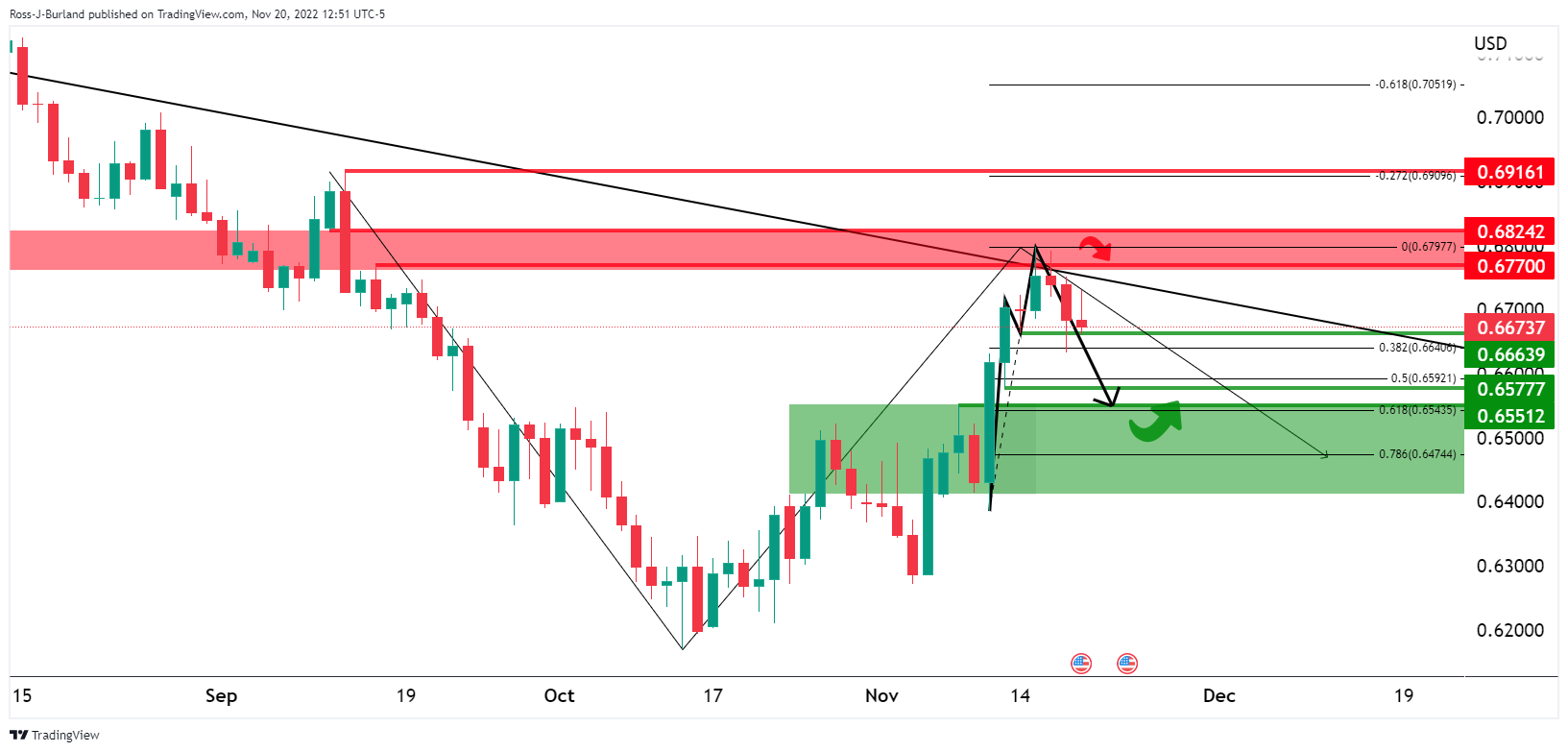

- AUDUSD's weekly rejection has been in play with 0.6500 eyed.

- Bears seek a break below 0.6670 and 0.6650 for the opening sessions.

AUDUSD was pressured at the end of last week with the US Dollar gaining slightly making its largest weekly gain in over a month as investors eye rising bond yields as they continued to make bets on the US Federal Reserve's interest rate hiking path. This puts the downside in focus on the charts as follows:

AUDUSD H1 chart

The hourly M-formation is compelling and argues for a downside continuation having already corrected into the bearish impulse and resistance.

AUDUSD H4 chart

The same can be said for the 4-hour chart with the price being rejected from resistance.

AUDUSD daily chart

The daily chart's support area beckons while the price is on the front side of the downside trend.

AUDUSD weekly chart

The weekly rejection has also been in play with 0.6500 eyed.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.