- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 17-11-2022

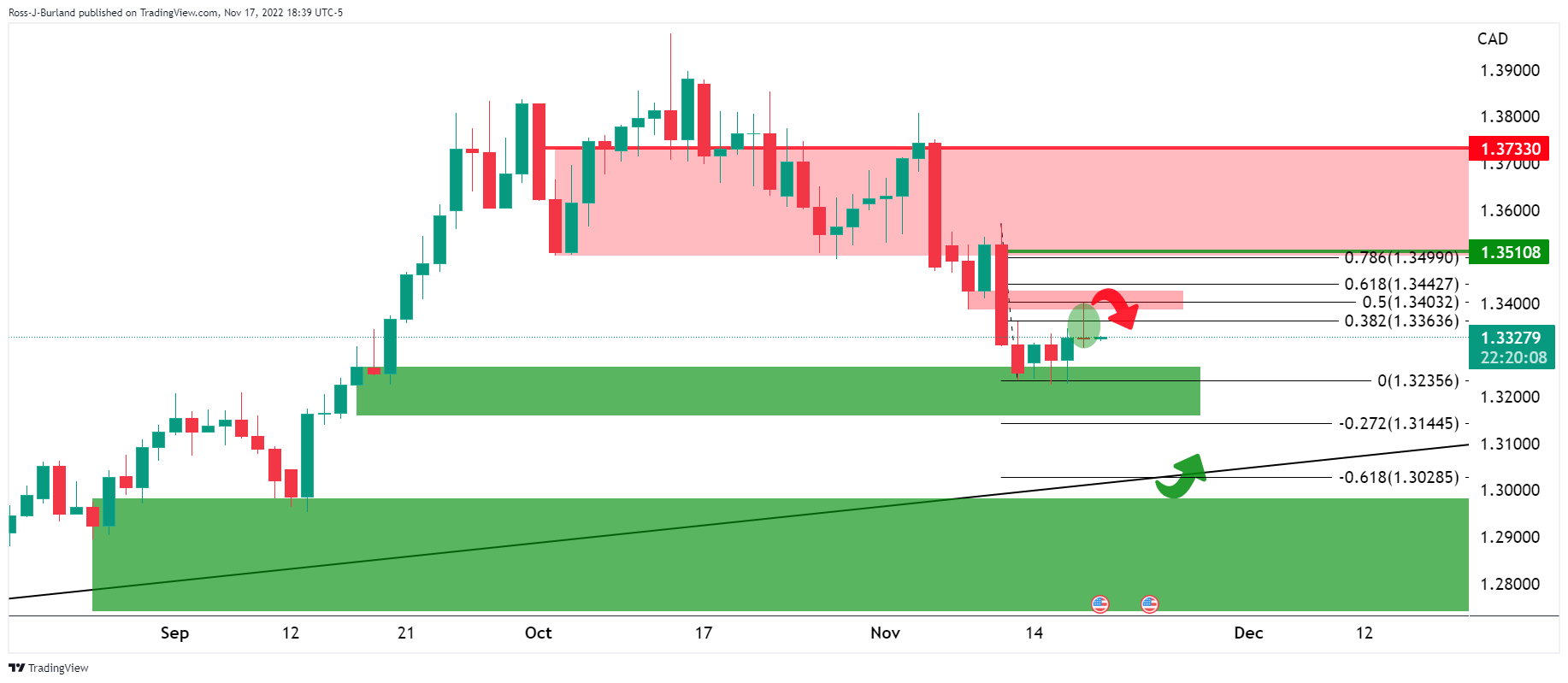

- USDCAD bulls remain in play but there are risks of a break below 1.3300.

- Bulls need to clear 1.3380 for the prospects fo a firmer run to 1.3550.

As per the prior day's bullish thesis, USDCAD Price Analysis: Bulls moving in and eye a 38.2% Fibo, the price indeed moved in on the targetted area. However, the bears were quick to pounce on the rally and we are back to square one as the following illustrates:

it was explained that the Bank of Canada next meets on December 7 and a 25 bp hike to 4.0% is expected and that there is a long time between now and then that gave rise to prospects of a meanwhile correction as follows:

USDCAD weekly chart

The M-Formation was a compelling bullish feature, but it was also explained that there could still be some downside to come:

A break of the support was eyed as a catalyst that would open up the way to dynamic trendline support.

However, the bulls were firming and the 38.2% Fibonacci was eyed for the remainder of the week:

USDCAD update

We have seen that move already. Until a break of 1.33 the figure, the emphasis remains on the upside as per the hourly chart:

The M-formation is a reversion pattern and so long as the bulls can get above 1.3380 and then 1.3420, there will be prospects of a move into the price imbalance and 1.3550 will be vulnerable.

- NZDUSD remains sidelined after bouncing off a one-week-old horizontal support.

- Sluggish oscillators, bullish chart pattern keeps buyers hopeful but 0.6160 holds the key for the bull’s conviction.

- 200-HMA, fortnight-old ascending trend line restricts immediate downside.

NZDUSD seesaws around 0.6130, challenging a two-day downtrend, as traders struggle for fresh clues inside a one-week-old descending triangle bullish formation during early Friday.

In doing so, the Kiwi pair makes rounds to the 50-HMA amid the inactive performance of the Relative Strength Index (RSI) placed at 14, as well as the Moving Average Convergence and Divergence (MACD).

With this, the Kiwi pair is likely to remain sidelined during the five-week uptrend, despite the latest pullback.

However, a downside break of the stated triangle’s support area, near 0.6060, won’t hesitate to recall the NZDUSD bears.

Following that, the 200-HMA and a two-week-long ascending support line, respectively around 0.6040 and 0.5955, could challenge the quote’s further downside.

Meanwhile, the 50-HMA level surrounding 0.6140 restricts the immediate upside of the NZDUSD pair.

Even so, the stated triangle’s top line near 0.6160 appears crucial to convince the pair buyers in retaking control. Also acting as an upside filter is the monthly high near 0.6205.

Overall, NZDUSD buyers are likely to keep the reins despite the latest pullback in prices.

NZDUSD: Hourly chart

Trend: Limited recovery expected

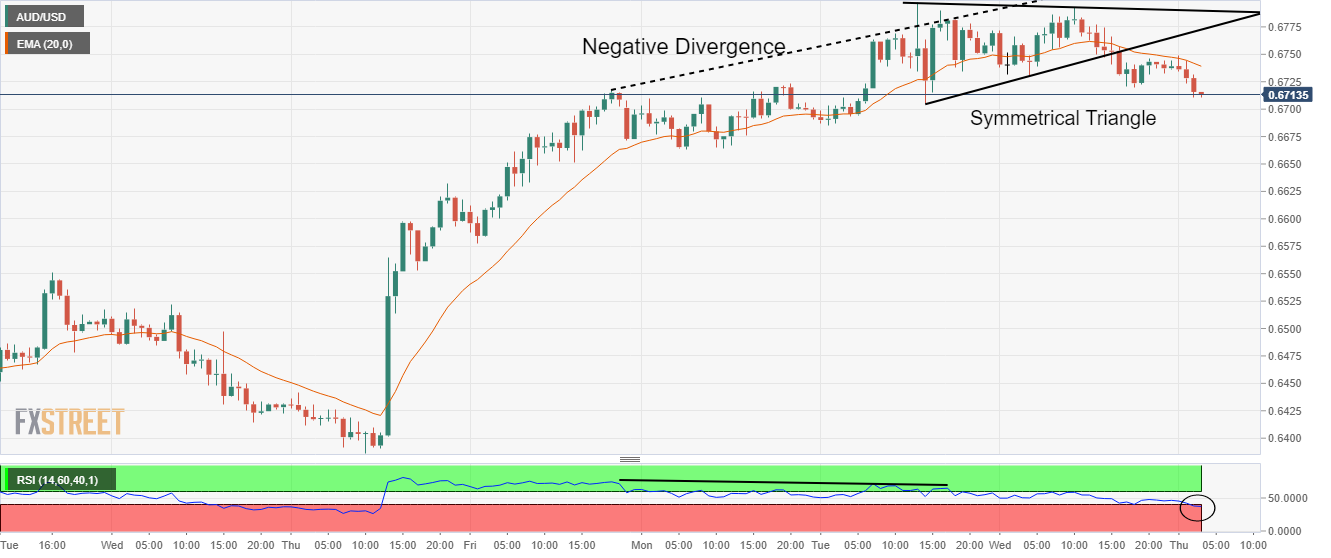

- AUDUSD braces for the first weekly loss in five, remains sidelined of late.

- Hawkish Fedspeak, risk aversion propelled US Treasury yields and US Dollar.

- Headlines surrounding China, Russia exert additional downside pressure on the Aussie pair.

- Mixed US data, firmer Australia jobs report failed to impress buyers.

AUDUSD treads water around 0.6690 after a two-day downtrend as bears seek more clues to snap a four-week uptrend. That said, a light calendar on Friday also challenges the Aussie pair sellers during the Asian session. Even so, the US Dollar’s rebound, backed by the firmer Treasury yields, joins the market’s sour sentiment to keep the pair sellers hopeful.

US Dollar Index (DXY) eyes a recovery from the three-month low marked earlier in the week on recently hawkish comments from the US Federal Reserve (Fed) officials, as well as firmer top-tier data from the United States. In doing so, the greenback ignores Thursday’s mixed figures of the second-tier statistics.

Strong prints of the US Retail Sales and Producer Price Index (PPI) for October seemed to favor the Fed hawks. That said, St. Louis Federal Reserve President James Bullard said on Thursday that the US Federal Reserve's (Fed) monetary policy is not yet in a range estimated to be sufficiently restrictive to reduce inflation. On the same line were the latest comments from Minneapolis Federal Reserve Bank President Neel Kashkari. “With inflation still high but a lot of monetary policy tightening already in the pipeline, it's unclear how high the US central bank will need to raise its policy rate,” said Fed’s Kashkari.

Talking about the data, US Philadelphia Fed Manufacturing Index fell to -19.4 versus -6.2 market forecasts and -8.7 prior. Further, Housing Starts declined by 4.2% MoM in October following September's 1.3% contraction whereas Building Permits fell by 2.4%, compared to a 1.4% increase recorded in the previous month. Additionally, the Jobless Claims eased to 222K for the week ended on November 11 versus 225K expected and upwardly revised 226K prior.

At home, Australia’s Employment Change jumped by 32.2K versus 15K market forecasts and 0.9K prior whereas the Unemployment Rate dropped to 3.4% from 3.5% previous readings and 3.6% expected. The employment statistics gained an additional edge to lure buyers, especially after the strong Wage Price Index was published. However, the previously dovish statements from the Reserve Bank of Australia (RBA) officials seemed to have kept the AUDUSD buyers on the board.

Elsewhere, fresh tension between Russia and Ukraine due to missile strikes on Poland, as well as the increasing Covid counts in China also weighed on the market’s sentiment and the risk-barometer pair.

While portraying the mood, Wall Street closed in the red while the US 10-year Treasury yields bounced off a six-week low.

Moving on, a lack of major data/events could allow bears to take a breather but the risk-off mood and hawkish Fed concerns may push the AUDUSD price toward the weekly loss.

Technical analysis

As the retreat in the RSI (14) backing the Aussie pair’s U-turn from the 61.8% Fibonacci retracement level of the August-October downside, around 0.6770, the odds of the quote’s downside break of the 100-day EMA support, near 0.6670 at the latest, are too high.

- The GBPJPY extended its gains and reached a fresh weekly high of around 166.45.

- For the GBPJPY buyers to invalidate the head-and-shoulders pattern, they must reclaim 169.00.

- GBPJPY's fall below 165.30 would keep the head-and-shoulders pattern in play.

The GBPJPY rises for the fourth consecutive day, threatening to invalidate a head-and-shoulders chart pattern formed in the daily chart, as the exchange rate surpasses the neckline as the cross pushes above the 165.00 mark. At the time of writing, the GBPJPY is trading at 166.37, above its opening price by 0.10%, after hitting a daily low of 165.17.

GBPJPY Price Analysis: Technical outlook

The GBPJPY shifted from neutral-to-downward to upward-biased once the cross-currency pair achieved two conditions: reclaimed the 50-day Exponential Moving Average (EMA) and broke above the head-and-shoulder pattern neckline, which is still in play. That said, the GBPJPY consolidates on top of the neckline but remains unable to crack the weekly high of 166.40. The Relative Strength Index (RSI) is almost flat ath the 50-midline, suggesting the pair would remain sideways.

Therefore, the GBPJPY's first resistance area would be the 166.45 area. Once cleared, the next supply zone would be the 167.00 psychological level, followed by the November 8 swing high at 169.08, invalidating the head-and-shoulders chart pattern.

On the flip side, if GBPJPY sellers want to reclaim the head-and-shoulders neckline, they need to break below 165.30. A breach of the latter would send the pair diving to the 165.00 figure, followed by key support levels, like the 50-day EMA at 164.88 and the 100-day EMA at 163.94.

GBPJPY Key Technical Level

- GBPUSD made a break below the structure and the W-formation is a reversion pattern.

- Bears are coming back in at the counter-trendline resistance and eye a target of 1.1700 with 1.1650 below there.

GBPUSD was pressured on Wednesday as US Treasury yields moved higher and investors eyed hawkish comments from Federal Reserve officials. Meanwhile, the Pound came under pressure due to the UK government's latest budget. When marrying the technicals, there is a bearish outlook for Cable as the following illustrates:

GBPUSD daily chart

Wednesday was a red day, leaving a bearish wick on the charts which is essentially a lower time frame business that is vulnerable to a correction, as per the following 15-min chart:

GBPUSD H1 charts

GBPUSD H1 zoomed in:

The trapped volume up top needs the price to continue higher, but those longs could be out of luck as the retest of the counter-trendline could prove to be a failed effort if the bears commit over the course of the next day and final sessions of the week. We have seen a break of structure already and the W-formation is a reversion pattern that would be expected to hamstring the price to the downside for a target of 1.1700 and 1.1650 below there.

- EURUSD seesaws around a two-week-old ascending support line.

- Repeated failures to cross 200-DMA, overbought RSI conditions favor sellers.

- Bulls need validation from the monthly top to retake control.

EURUSD flirts with a fortnight-old support line as pares the fifth consecutive weekly gain around 1.0360 during Friday’s Asian session. In doing so, the major currency pair portrays an inability to cross the 200-DMA despite multiple attempts during the week.

Not only the failure to cross the key Daily Moving Average (DMA) but the overbought RSI conditions and receding bullish bias of the MACD also keep EURUSD bears hopeful.

It’s worth noting that a clear break of the immediate support line, near 1.0350 by the press time, needs to crack the 61.8% Fibonacci retracement level of May-September downside, around 1.0300, to convince EURUSD bears.

Following that, a slump toward September’s high of 1.0198 appears imminent. However, multiple levels around 1.0100 could challenge the pair sellers afterward.

If at all the EURUSD drops below 1.0100 support, a convergence of the 100-DMA and 38.2% Fibonacci retracement level, near 1.0020, will be the last defense of the buyers.

Alternatively, recovery moves not only need to cross the 200-DMA resistance surrounding 1.0415 but should also refresh the monthly high, currently around 1.0480, to convince EURUSD bulls.

In that case, a run-up towards the late June swing high around 1.0615 can’t be ruled out.

EURUSD: Daily chart

Trend: Further weakness expected

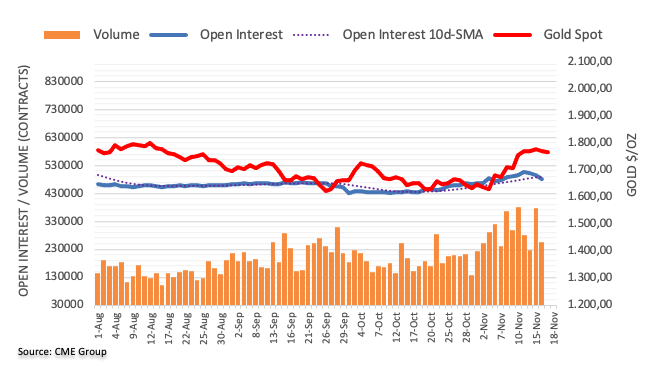

- Gold price remains set to snap two-week uptrend, pressured of late.

- Federal Reserve talks, Russia-Ukraine tussles and Covid woes underpin US Dollar demand.

- Data from United States came in softer but failed to weigh on the greenback.

- Light calendar needs XAUUSD traders to rely on risk catalysts for fresh impulse.

Gold price (XAUUSD) stays bearish around $1,760, after a two-day downtrend, as sellers cheer the US Dollar’s rebound despite softer economics from the United States. In doing so, the precious metal bears observe the recently hawkish comments from the US Federal Reserve (Fed) officials, as well as the risk-negative catalysts, while bracing for the first weekly loss in three.

Federal Reserve officials recall Gold price sellers

Although the latest second-tier data from the United States came in mixed, mostly softer, the Federal Reserve policymakers’ resistance to reiterate the statements favoring the 50 bps rate hike in December favored the US Dollar and triggered the recent sell-off in the Gold price.

“US Federal Reserve's (Fed) monetary policy is not yet in a range estimated to be sufficiently restrictive to reduce inflation,” St. Louis Federal Reserve President James Bullard said on Thursday.

On the same line were the latest comments from Minneapolis Federal Reserve Bank President Neel Kashkari. “with inflation still high but a lot of monetary policy tightening already in the pipeline, it's unclear how high the US central bank will need to raise its policy rate,” said Fed’s Kashkari.

Talking about Thursday’s data from the United States, Philadelphia Fed Manufacturing Index fell to -19.4 versus -6.2 market forecasts and -8.7 prior. Further, Housing Starts declined by 4.2% MoM in October following September's 1.3% contraction whereas Building Permits fell by 2.4%, compared to a 1.4% increase recorded in the previous month. Additionally, the Jobless Claims eased to 222K for the week ended on November 11 versus 225K expected and upwardly revised 226K prior.

It’s worth noting that the previously released United States Retail Sales and Producer Price Index (PPI) for October could be linked to the Fed officials’ hawkish comments as both of them offered a positive surprise.

Risk catalysts also underpinned US Dollar demand and lured XAUUSD bears

Market’s fears also highlighted the US Dollar’s safe-haven demand and weighed on the Gold price. Among the major ones was the fresh tension between Russia and Ukraine due to missile strikes on Poland, as well as the increasing Covid counts in China.

Recently, Ukrainian President, Volodymyr Zelenskyy rejected the blames for the missile strike that hit a Polish city and killed two people. The North Atlantic Treaty Organization (NATO) believes Russia was responsible even if the initial findings suggested that the missile likely coming from Ukraine’s defense.

On the other hand, China’s Coronavirus numbers reach more than a year’s high but the Dragon Nation eased a few of the virus-led activity controls. As a result, markets are worried about a fresh, as well as fierce, wave of the disease that drowned the global economy in the last two years. It’s worth noting that China is among the world’s top Gold consumers and hence and negatives from it should weigh on the XAUUSD prices.

Nothing major to challenge Gold price downside

Given the lack of major data/events, the Gold price could extend the latest weakness unless risk appetite improves notably, which is less likely. That said, the market’s recent risk-aversion could be witnessed via downbeat prints of Wall Street, despite the late rebound, as well as a recovery in the US Treasury yields.

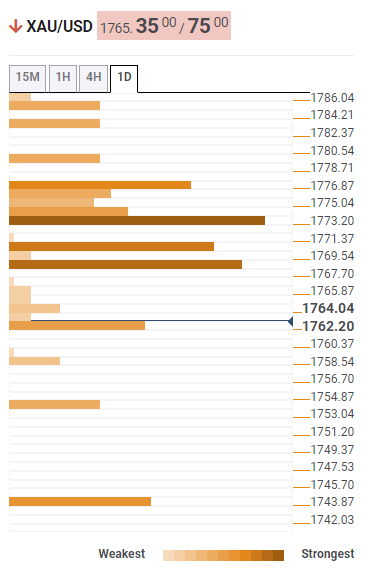

Gold price technical analysis

A clear downside break of a two-week-old ascending trend line joins the RSI retreat from the overbought territory to keep Gold sellers hopeful of the precious metal’s further decline. Adding strength to the bearish bias could be the quote’s U-turn from the 61.8% Fibonacci retracement level of the June-September downturn.

That said, a 50% Fibonacci retracement level surrounding $1,746 and tops marked during September and October around $1,730 could restrict immediate downside.

However, a convergence of the 100-DMA and 38.2% Fibonacci retracement, around $1,715-13, could restrict the Gold price downside afterward.

Meanwhile, the 61.8% Fibonacci retracement and the aforementioned support line, now resistance, could restrict short-term recovery of the yellow metal around $1,779 and $1,786 in that order.

Above all, a horizontal area comprising the 200-DMA and multiple levels marked since May, near $1,805-08, appears a tough nut to crack for the Gold bulls.

Overall, the Gold price returns to the bear’s table after a fortnight holiday.

Gold price: Daily chart

Trend: Further weakness expected

- The USDJPY tumbled below the 100-day EMA and recorded a three-month-low of around 137.65.

- The USDJPY has been building a bottom around eh 137.60-140.80 area for the last five consecutive days.

- The Relative Strength Index exiting from oversold conditions suggests an upward correction likely.

The USDJPY consolidated below the 100-day Exponential Moving Average (EMA), after dropping from YTD highs reached in October at 151.94. Still, since then, the US Dollar (USD) depreciated almost 8% against the Japanese Yen (JPY) in nearly a month. At the time of writing, the USDJPY is trading at 140.15, above its opening price by 0.49%, after hitting a daily low of 138.87.

USDJPY Price Analysis: Technical outlook

During the week, the USDJPY remains trapped in a narrow 137.50-140.80 range so far, after diving towards a fresh three-month low at around 137.65, reached on November 15, it formed a hammer. Since then, the USDJPY recorded two successful days without reaching lower lows below 138.70 and climbed towards the 100-day Exponential Moving Average (EMA) at 140.89. However, unless USD buyers reclaim the latter, the major bias would remain neutral to downwards.

That said, the USDJPY's first support would be the November 16 daily low at 138.72. A breach of the latter will expose key support levels like the weekly low at 137.65. Once cleared, the next support would be a three-month-old upslope support trendline that passes around 137.48, immediately followed by the 200-day Exponential Moving Average (EMA).

On the other hand, the USDJPY's first resistance would be the 100-day EMA at 140.89. A break above will expose the November 11 daily high at 142.48, followed by the 50-day EMA at 145.13.

USDJPY Key Technical Levels

A Reuters poll sees the Reserve Bank of New Zealand hiking by 75Bps next week.

Stubbornly high inflation expectations reinforced the case for more aggressive rate hikes from the Reserve Bank of New Zealand.

The latest central bank survey showed that inflation expectations moved higher across the curve and the market is pricing higher rates, expecting a larger increment of 75 basis points next week after delivering a half-percentage point increase in October.

Meanwhile, RBNZ officials have been outspoken of late, explaining that high inflation and a tight labor market in the country call for demand to be cooled, though they flagged downside risks to the global economy.

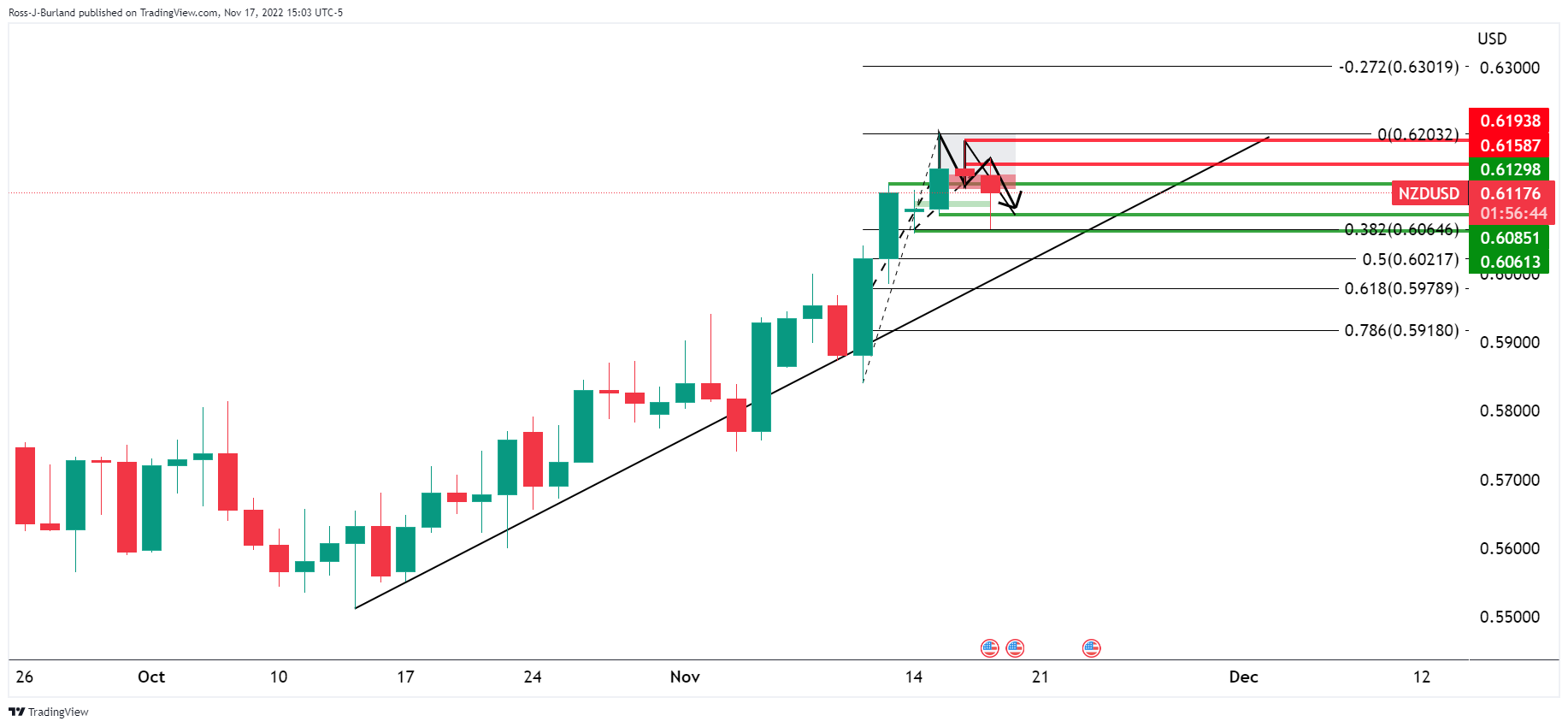

NZDUSD update

- With the price on the front side of the bearish trendline.

- W-formation is a reversion pattern that would be expected to be a drag on the recent rally.

- A retest of the lows could see a push below and on to the 61.8% golden ratio that aligns with prior support in a 200% measured expansion of the trapped volume up top.

- NZDUSD bears could be about to sink in their teeth again.

- Central bank sentiment is the key driving force as the US Dollar attempts to correct.

NZDUSD has corrected the session's sell-off. The bird rallied from a low of 0.6064 and is testing 0.6120 towards the close on Wall Street. However, longs are still trapped up high near the pair's strongest levels in nearly three months.

The day was mixed on Thursday and two-way business made for a range of between 0.6064 and 0.6167. The US Dollar was supported by stronger-than-expected US Retail Sales data on Wednesday and hawkish remarks from Federal Reserve speakers. However, sentiment and Fed rhetoric have been mixed as data continues to conflict from one day to the next, clouding the path for interest rates.

Tuesday's producer price inflation data was below expectations and this mirrored last week's cooler-than-expected consumer price inflation, signaling that it was not a one-off. This in turn has been fueling hopes that the US Federal Reserve can slow aggressive rate hikes that had sent the US Dollar higher. However, Fed Governor Christopher Waller came to the bull's rescue again when he said the Fed will still need increases into next year although. St Louis Fed President James Bullard spoke at the start of the New York day and said rates should lift to at least 5%-5.25% which is 25bp higher than he previously stated. He also indicated that rates will need to be between 5 to 7% to be sufficiently restrictive to curb inflation.

The US dollar index, DXY, and US yields were firmer on the hawkish sentiment. DXY was recently up 0.4% sitting at 106.70 and between the day's range of 106.1 and 107.24. The 2-year yield sat comfortably around 4.45% and 2% higher on the day. Nev3ertheless, there was a late session dip in both US yields and the greenback which made way for a recovery in the Kiwi.

RBNZ to hike 75bps

Domestically, stubbornly high inflation expectations reinforced the case for more aggressive rate hikes from the Reserve Bank of New Zealand. The latest central bank survey showed that inflation expectations moved higher across the curve and the market is pricing higher rates, expecting a larger increment of 75 basis points next week after delivering a half-percentage point increase in October. RBNZ officials have been outspoken of late, explaining that high inflation and a tight labor market in the country call for demand to be cooled, though they flagged downside risks to the global economy.

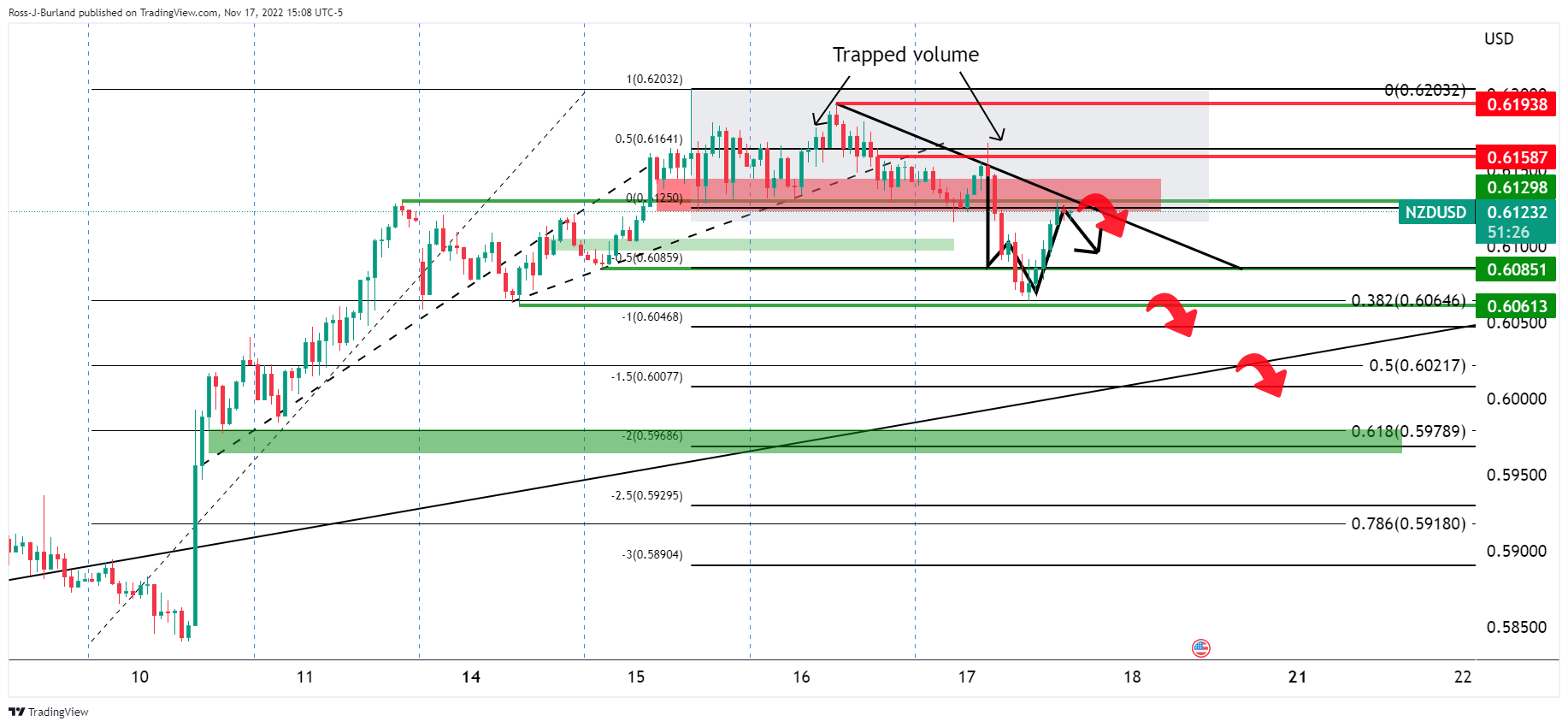

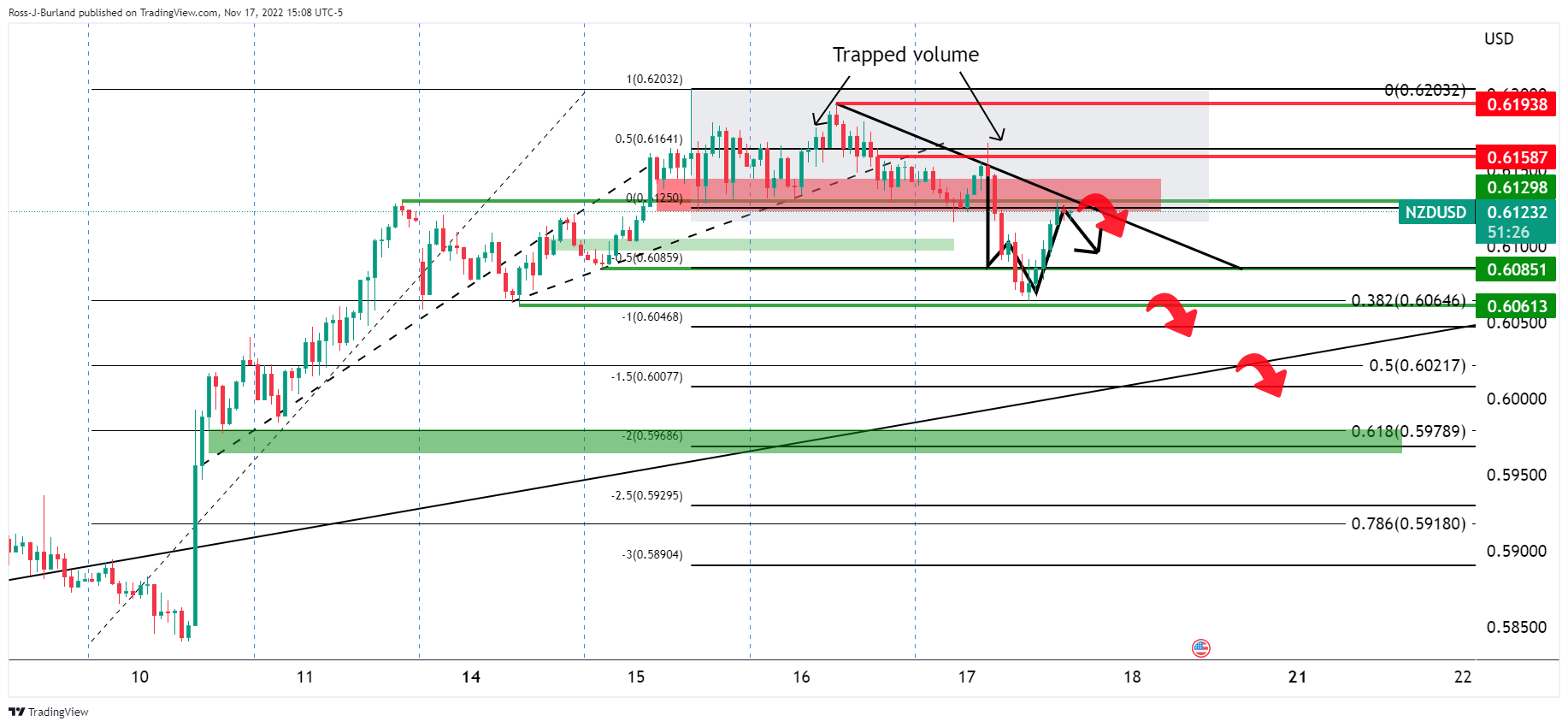

NZDUSD technical analysis

As per the prior sessions' bearish thesis, NZDUSD bears eye a break below 0.6130, the pair dropped to target:

Prior analysis:

The price was topping out on the time frames as per the hourly chart above and the 4-hour chart below:

On the 4-hour chart, however, there were prospects of a triple-top scenario as illustrated above.

NZDUSD update

H4 H&S played out.

As illustrated, the H&S played out but the daily 38.2% Fibonacci has supported a bounce back into the breakout territory. However, this might just give the trapped longs up top a lifeline and their subsequent breakeven stop losses could eventuate a move to the downside again when coupled with fresh sellers taking advantage of the discount:

With the price on the front side of the bearish trendline, the W-formation is a reversion pattern that would be expected to be a drag on the recent rally. A retest of the lows could see a push below and on to the 61.8% golden ratio that aligns with prior support in a 200% measured expansion of the trapped volume up top.

What you need to take care of on Friday, November 18:

The market mood remained sour, which help the US Dollar to recover some of the ground lost earlier in the week. Nevertheless, the greenback posted uneven and modest advances across the FX board, as speculation the US Federal Reserve will soon pivot weighed more.

Generally speaking, the dismal sentiment could be attributed to renewed concerns related to the Ukraine-Russia war and tensions with Western nations following the latest developments in Polonia. Ukrainian President, Volodymyr Zelenskyy, said that Ukraine was not to blame for the missile strike that hit a Polish city, killing two people. NATO believes Russia was responsible, despite the missile likely coming from Ukraine’s defence.

Meanwhile, in China, the coronavirus outbreak worsens. The country reports increased cases on a daily basis, although at the same time, the government eased some restrictions for close contacts and travellers. Nevertheless, potential supply-chain issues are back on the table, with all that that means for the global economy.

Stocks in Asia and Europe closed in the red, triggering substantial losses on Wall Street. However, US indexes bounced back ahead of the close and finished the day little changed.

Further support for the greenback came from government bond yields. At the end of the day, the 10-year Treasury note offers 3.76%, while the 2-year one pays 4.46%. The advance is more notorious at the shorter end of the curve, a warning for those betting against the American currency.

US House Speaker Nancy Pelosi announced Thursday she would not seek reelection to her congressional leadership role as the top House Democrat after midterm elections showed Republicans seized control of the House.

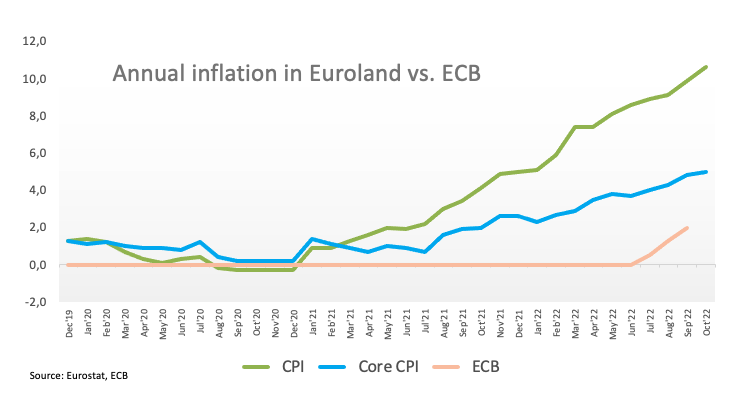

EURUSD finished the day in the 1.0360 price zone, recovering again from near the 1.0300 threshold, a sign that bulls are not giving up. EU inflation was downwardly revised from 10.7% to 10.6% in October, still at record highs.

The UK government presented a fiscal plan after the obstreperous failure of former Prime Minister Liz Truss’s mini-budget. Finance Minister Jeremy Hunt outlined spending cuts and tax hikes worth £55 billion. “We need fiscal and monetary policy to work together,” he said. “That means the government and the Bank working in lockstep. It means, in particular, giving the world confidence in our ability to pay our debts.” GBPUSD sunk to 1.1762 but recovered roughly 100 pips ahead of the close.

The AUDUSD pair trades around 0.6690, down for the day, while USDCAD hovers around 1.3300. A steep decline in crude oil prices partially weighed on the Loonie, as WTI trades at $82.20 a barrel.

Gold extended its weekly decline and settled at $1,760 a troy ounce.

The crypto scandal related to the FTX collapse keeps spreading like wildfire among exchanges. The market has just seen the tip of the iceberg, although the market remains pretty stable after the initial impact.

Like this article? Help us with some feedback by answering this survey:

Reuters reported that ''Minneapolis Federal Reserve Bank President Neel Kashkari on Thursday said that with inflation still high but a lot of monetary policy tightening already in the pipeline, it's unclear how high the US central bank will need to raise its policy rate.''

''It is the Fed's job to bring inflation down by restraining demand through higher borrowing costs, he told the Minnesota Chamber of Commerce in an event webcast by the regional Fed bank.''

"It's an open question of how far we are going to have to go with interest rates to bring that demand down in the balance," he said.

US Dollar update

The bulls are moving in on the back side of the trend, but they need to get above 107.00 to target the 109.00s or face prospects of further supply and a breakout below 105.90 that will look to test the 104.64 August lows.

- US Dollar got underpinned by Federal Reserve policymakers, hawkish speaking.

- US economic data was mixed as the housing market plunged while unemployment claims decelerated.

- Swiss National Bank Maechler: “To continue rate hikes if inflation projections remain above target.”

- USDCHF remains bearish-biased, though a break of 0.9600 would exacerbate a rally to the 200-DMA.

The USDCHF extended its weekly rally, to four consecutive days, after registering a new seven-month-old low around 0.9356 on Monday. However, hawkish commentary by US Federal Reserve (Fed) speakers shifted sentiment sour for the benefit of the US Dollar (USD). Hence, the USDCHF is trading at 0.9518, above its opening price by 0.86%.

Fundamentally speaking, nothing has changed. The Federal Reserve would continue on its upward trajectory, hiking rates, after the St. Louis Fed President James Bullard said that rates are not “sufficiently restrictive,” as he foresees the Federal Funds rate (FFR) to peak at around the 5% to 7% range. On Wednesday, the San Francisco Fed President Mary Daly said that pausing hikes “was off the table.”

Data-wise, the housing market continued to weaken, even though speculations that a Fed pause might occur increased due to US equities pairing some of its year losses. Housing Starts plunged 4.2% in October, on a monthly pace, below September’s 1.3% contraction. Building Permits followed suit, dropping 2.4%, below 1.4$ September’s increase.

Of late, US Initial Jobless Claims for the last week decelerated to 222K, beneath estimates of 225K. At the same time, Continuing claims advanced 13K to 1.51 million, flashing signs that the labor market is easing.

Aside from this, the Switzerland National Bank (SNB) Governor, Andrea Maechler, is crossing newswires. She said that inflation in Switzerland is no longer “shock driven” and added that the SNB would continue to lift rates if inflation projections remained above the central bank’s target.

USDCHF Price Analysis: Technical outlook

All that said, the USDCHF recovered from last week’s losses and is up in the week 1.13%. Nevertheless, the USDCHF is bearish-biased once it cleared the 200-day Exponential Moving Average (EMA) at 0.9623. Still, it could be subject to a correction, as the Relative Strength Index (RSI) pulled out from oversold conditions, exacerbating a rally above 0.9500.

That said, the USDCHF’s first resistance would be 0.9600, ahead of the 200-day EMA at 0.9623. On the flip side, USDCHF key supports are the 0.9500 psychological figure, followed by the September 13 daily low at 0.9479, ahead of the August 11 swing low at 0.9370.

The Swiss National Bank will continue to raise rates if see inflation projections above target, SNB governing board member Andrea Maechler said on Thursday.

The battle against inflation has not been won despite a dip in Swiss inflation to 3.0% in October from 3.3% in September, Maechler told Swiss business newspaper L'Agefi said last week.

In its latest inflation forecast, the SNB expects inflation to decline to 2% by the third quarter of 2023, the top end of its price stability goal which it defines as inflation of 0-2%.

Key notes

- Inflation started with shocks but it's no longer shock-driven and has the risk of being more persistent.

- Will continue to raise rates if see inflation projections above target.

- Important we maintain our focus on achieving price stability.

- We are willing to intervene in the FX market by buying or selling as necessary, but not yet ready to reduce our balance sheet.

USDCHF update

The price is correcting the prior bearish impulse after a 150% expansion of the prior consolidative tops from the harmonic patterns neckline support area on the weekly chart.

On the hourly chart, the bulls have broken structure and eye a correction to test the trendline resistance with eyes on 0.9580, 0.9650 / 0.9700.

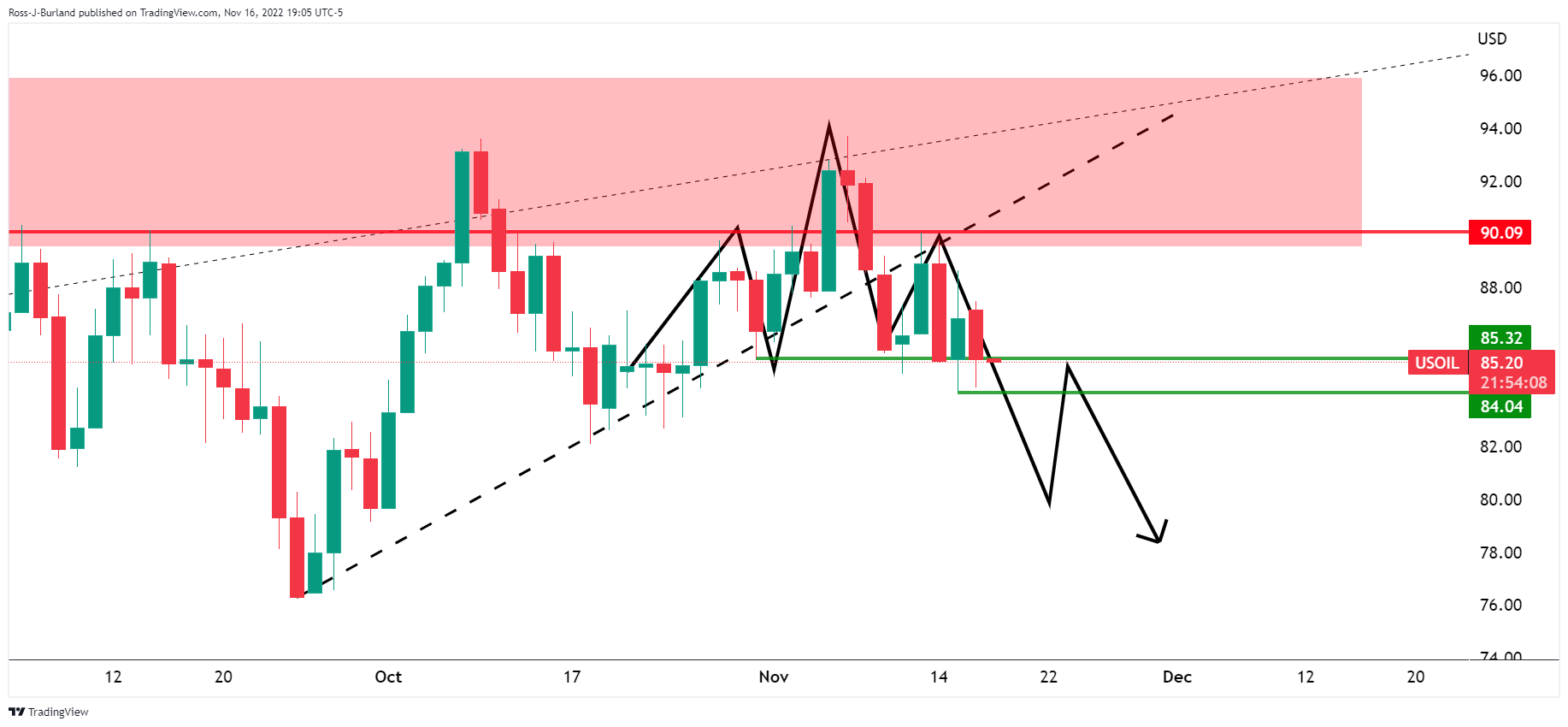

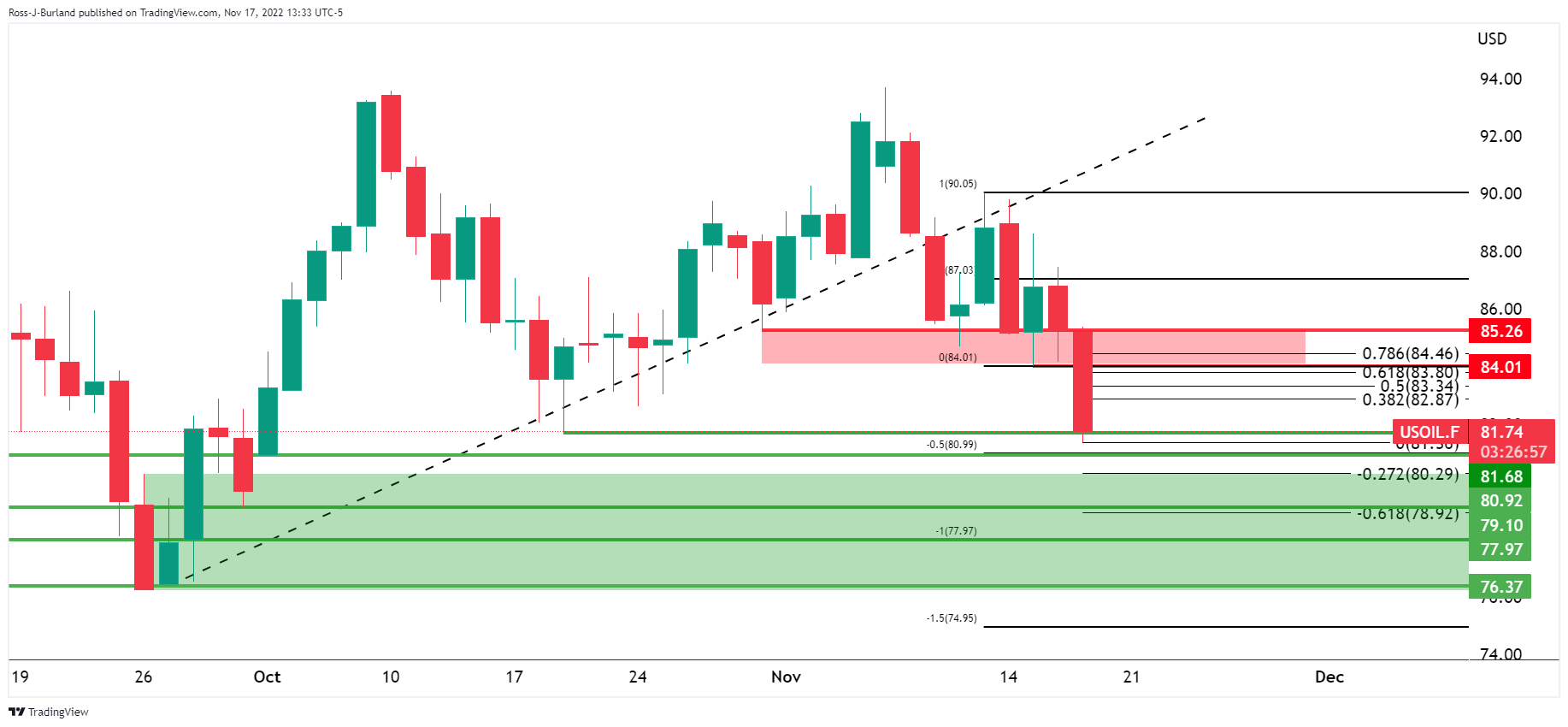

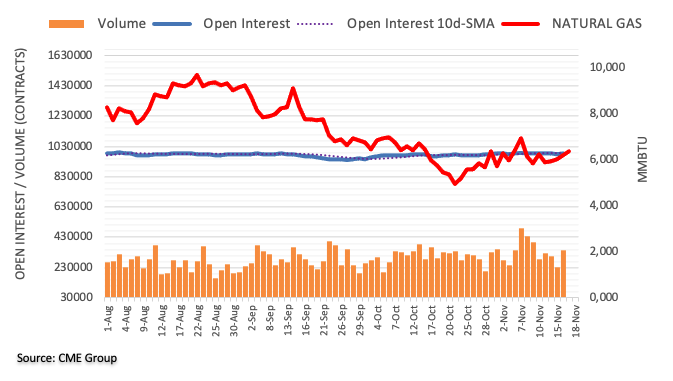

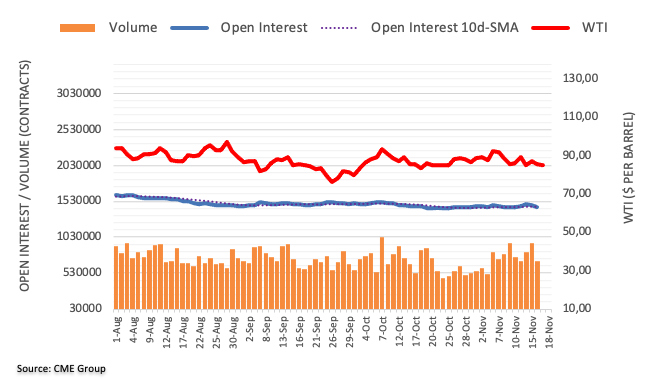

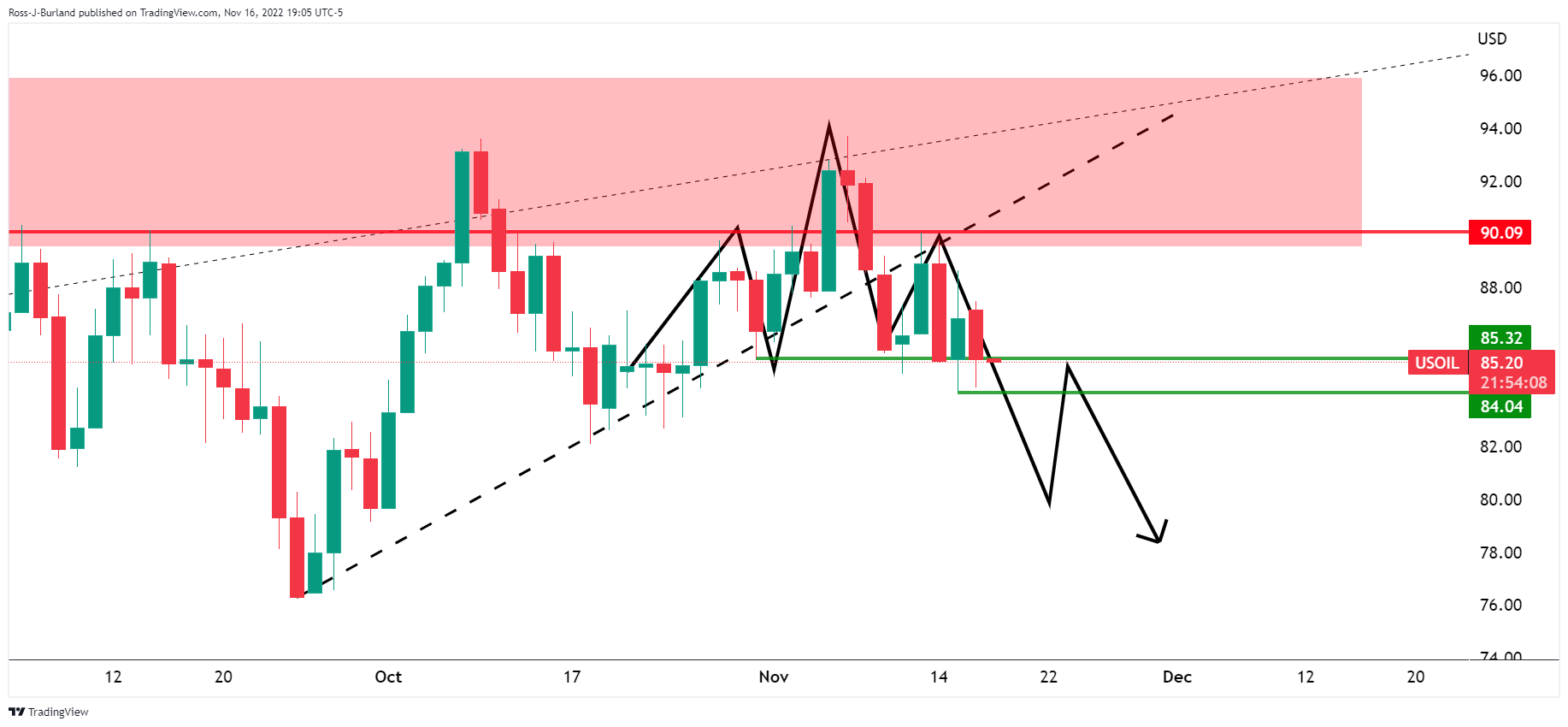

- WTI bulls are moving in from the lows and eye the 38.2% ratio.

- Bears look for a discount to run deeper towards $78.00.

As per the prior analysis, WTI bears are pressuring the bulls below critical resistance, break of $84.00 on the cards, and the price of oil dropped on Thursday into low-hanging fruit below 84.00 following a build-up of longs.

WTI prior analysis

The price was shown to be on the back side of the monthly trendline and was being rejected on a restest:

The price was looking to be on the verge of completing an M-formation below the locked-in highs below horizontal resistance:

A bearish H&S pattern had emerged on the daily chart with the right-hand shoulder on the backside of the micro trendline:

Zoomed in:

A move below $84 the figure was required to shift the bias fully:

WTI update

As illustrated, the price has indeed followed the projected trajectory on Thursday. Bears can now target lower into the origin of the prior bullish trend:

WTI H1 chart

From an hourly perspective, drawing the expansion of the prior consolidative range, a full 100% measured move aims for a test of $78.00. However, a correction could be in order given the Grab harmonic pattern. A 38.2% Fibonacci retracement of the bearish impulse comes in near $82.90.

- Fed speakers hawkish commentary shifted sentiment sour and bolstered the US Dollar.

- Risk aversion weighed on risk-perceived currencies in the FX space, like the Australian Dollar.

- US housing data disappoints, contrary to unemployment claims, which dropped below estimates, suggesting the tight labor market.

- AUDUSD Price Analysis: Remains neutral-to-upward biased, but the pullback could extend towards 0.6500 before resuming the uptrend.

The Australian Dollar (AUD) plunged against the US Dollar (USD), blamed on Federal Reserve (Fed) policymakers’ hawkish commentary, which turned traders’ sentiment sour, as shown by US equities falling. The AUDUSD is trading at 0.6688, below its opening price by almost 1%, after hitting a daily high of 0.6751.

Federal Reserve’s hawkish commentary boosted the US Dollar

On Thursday, the St. Louis Fed President James Bullard commented that monetary policy is not “sufficiently restrictive,” adding that rates need to rise higher, within the 5% to 7% area, which spooked investors. Of late, the Cleveland Fed President Loretta Mester echoed his comments, saying that inflation is too high.

Meanwhile, a tranche of mixed economic data from the United States (US) was revealed on Thursday. Housing Starts for October shrank more than September’s 1.3% contraction, and Building Permits plummeted 2.4% MoM in October, against a 1.4% expansion in September

Regarding the labor market, US Initial Jobless Claims for the week ended on November 12 fell by 222K, below the 225K expected and lower than the previous week’s 226K. Contrarily Continuing Claims rose 13K, to 1.51 million, in the week ended on November 5, increasing for the fifth straight week, an uptrend signing that Americans are out of work for longer.

Elsewhere, the US Dollar Index, a gauge of the buck’s value against a basket of six currencies, remains above its opening price by 0.58%, at 106.902 underpinned by high US Treasury yields, with the US 10-year note rate raising nine bps, at 3.781%, after hitting a weekly low of 3.671%.

Australia’s employment data warrants further RBA action

Earlier in the Asian session, Australia’s employment figures beat estimations. The Employment Change indicator rose by 32.2K, above estimates of 15K, while the unemployment rate fell to 3.4%, below forecasts of 3.5%. According to TD Securities analysts: “The stronger-than-expected jobs report should also dampen hopes for any imminent pause from the Reserve Bank of Australia (RBA) after RBA Deputy Governor’s Bullock commented that the peak of the inflation cycle is near. As such, we continue to look for the Bank to proceed with 25bps hikes till Q1 next year.”

AUDUSD Price Analysis: Technical outlook

Given the backdrop, the AUDUSD plunged below 0.6700, extending its losses beyond the 100-day Exponential Moving Average (EMA) at 0.6694. although the inverted head-and-shoulders pattern is intact, the Relative Strength Index (RSI) peaking around 66, and with its slope aiming lower, suggests buying pressure is fading. If sellers clear the neckline at around the confluence of the 50-day EMA at 0.6495, it would invalidate the pattern; otherwise, the chart pattern remains in play.

AUDUSD key support levels lie at the weekly low at 0.6633, followed by the 0.6600 psychological figure, ahead of the 0.6500 mark. On the flip side, the AUDUSD’s first resistance would be the 100-day EMA at 0.6694, followed by the weekly high at 0.6797, ahead of the 0.6800 figure.

- EURUSD bears are eyeing a break of key daily trendline support from the critical resistance area.

- US Dollar bulls are moving in on hawkish Fed prospects.

EURUSD is battling back, down some 0.5% still, however, having fallen from a high of 1.0406 to a low of 1.0305. US Treasury yields increased on Thursday as investors bet on a relatively hawkish Federal Reserve.

The greenback was pressured in recent days due to last week's and this week's inflation data missing the mark vs. expectations. This had fanned the flames of the expectations of a Fed pivot while some of the Federal Reserve commentaries that accompanied the data implied that it could soon slow the pace of its interest rate hikes. However, a switch in sentiment on Thursday gave rise to a bid in the greenback once again.

A number of other Fed officials, including Raphael Bostic, Michelle Bowman, James Bullard, Philip Jefferson, Loretta Mester, and Neel Kashkari, were all lining up to speak toward the end of the week. To start the day, Fed's Bullard said that policy is not getting in a range to be sufficiently restrictive and that hikes to date had only made a limited effect on observed inflation. He also said that signs of disinflation are tentative at best, but he is hopeful for 2023. He sees a minimum level for restrictive policy between 5% – 5.25%.

US Dollar bulls move in

Consequently, it was a bearish start to the day with US benchmarks in the red, US yields higher along with a firmer US Dollar. The dollar index

DXY, which measures the currency against six major peers, was recently up 0.50% at 106.81 in midday trade. The index has traveled between a range of 106.098 and 107.240 on the day. However, the index remains in bearish territories while below 107.00. After hitting a 20-year high in late September the index had lost more than 8% when it touched its most recent intraday low on Tuesday.

EURUSD & DXY technical analysis

The daily chart shows the price below a key trendline and within an M-formation. The correction is underway, however. While below 107.00, the outlook remains bearish but a break of there opens the risk of a deeper bullish correction towards 108.80.

This leaves the outlook for EURUSD correctively bearish below 1.0270:

It has been reported that House Speaker Nancy Pelosi, who became Speaker of the House in 2007, announced that she will step down from her congressional leadership role, ending a two-decade streak as the top House Democrat. This follows signs that the Democrats will narrowly lose their House majority to Republicans following the midterm elections. She will remain a Congress member where she has been since 1987.

CNBC reported that ''current House Minority Leader Kevin McCarthy, R-Calif., is considered the top candidate to become speaker in the next Congress. On Tuesday, McCarthy won a party vote to become the GOP nominee for speaker, though he secured fewer votes than the 218 he will need when the full House casts its leadership votes in early January.''

- Hawkish commentary by Federal Reserve officials underpinned the US Dollar.

- US economic data was mixed as unemployment claims dropped, while housing data paints a gloomy scenario.

- Wednesday’s Canadian Consumer Price Index failed to underpin the Loonie.

- USDCAD Price Analysis: The head-and-shoulders pattern is intact unless exchange rates clear 1.3500.

The Loonie (CAD) weakened against the US Dollar (USD) after Federal Reserve policymakers expressed that inflation remains too high and rates need to be above the 5% threshold, undermining investors’ sentiment. Factors like Wednesday’s solid Retail Sales report in the United States (US) and Thursday’s claims for unemployment dropping below estimates justify further Fed tightening. At the time of writing, the USDCAD is trading at 1.3355.

Federal Reserve’s hawkish commentary undermined XAUUSD

US equities were rattled by Fed officials reiterating the need to tackle inflation, led by the St. Louis Fed President James Bullard. Bullard commented that the policy rate is not “sufficiently restrictive” and said that the Federal Funds rate (FFR) would be in the area between 5% to 7%, which spooked investors once the headline crossed wires. Cleveland’s Fed President Loretta Mester echoed his comments, saying that inflation is too high.

US housing market deteriorated further, while Initial Jobless Claims dropped

The US economic calendar was busy, with Housing Starts for October contracting 4.2% MoM beneath the last month’s 1.3% contraction, blamed on the Federal Reserve tightening monetary conditions. Building Permits for the same period shrank 2.4% MoM vs. September’s 1.4% increase.

Later, US Initial Jobless Claims for the week ended on November 12 dropped 222K, below estimates of 225K and the previous week’s 226K. Contrarily Continuing Claims rose 13K, to 1.51 million, in the week ended on November 5, increasing for the fifth straight week, an uptrend signing that Americans are out of work for longer.

Aside from this, the US Dollar Index, a gauge of the buck’s value against a basket of six currencies, remains above its opening price by 0.78%, at 107.109, underpinned by high US Treasury yields, with the US 10-year note rate raising nine bps, at 3.771%, after hitting a weekly low of 3.671%.

Canada’s CPI failed to underpin the Loonie

An absent Canadian economic docket left the Loonie adrift to the dynamics of the US Dollar and Wednesday’s Consumer Price Index (CPI) report. Canada’s CPI was unchanged at 6.9% YoY in October, blamed on higher energy and food prices. Core inflation edged up, suggesting that the Bank of Canada (BoC) would not decelerate its tightening pace. According to TD Securities analysts, “We don’t think this report is enough to single-handedly tip the scales towards a 50bp hike in December and continue to look for a 25bps at the upcoming meeting.

USDCAD Price Analysis: Technical outlook

The USDCAD daily chart portrays the major as neutral biased. Traders should be aware the head-and-shoulders chart pattern is intact unless the USDCAD clears the 1.3500 mark. However, if USD buyers breach the psychological 1.3400 figure, a re-test of the neckline around 1.3500 is likely. Nevertheless, at the time of typing, the USDCAD retraced after testing the 1.3400 mark. USDCAD key resistance lies at 1.3400, followed by the neckline at 1.3500. On the flip side, USDCAD’s first support would be 1.3300, followed by the solid demand zone at the 100-day Exponential Moving Average (EMA) at 1.3243, followed by the 1.3200 mark.

In 2023, the Canadian Dollar may emerge as a more attractive pro-cyclical bet. Economists at ING believe that the USDCAD pair could plunge to the 1.25 level.

Overall commodity picture should prove rather supportive for the CAD in 2023

“We expect Brent to average slightly above $100/bbl next year, and Western Canadian Select around $85/bbl. Along with our expectations for higher gas prices, the overall commodity picture should prove rather supportive for the CAD in 2023.”

“In our base-case scenario, where global risk sentiment gradually recovers but two major risk-off forces – Ukraine/Europe and China – remain, CAD would be in an advantageous position, since Canada has much more limited direct exposure to China and Europe compared to other commodity exporting economies.”

“Accepting the downside risks stemming from the housing market and/or a further deterioration in risk sentiment, we see room for a descent in USDCAD to the 1.25 level towards the end of 2023.”

Brasilian President-elect Lula is likely to be less orthodox than what Lula was during his two-term presidency between 2003 and 2011, according to analysts from Brown Brother Harriman. They point out USDBRL coudl rise to 5.7240, it if breaks above 5.52.

Key Quotes:

“Reports suggest he favors leftist Fernando Haddad for Finance Minister. While no final decision has been made, unnamed sources say the former mayor of Sao Paulo is the front-runner. If so, it would be a bad signal as markets were hoping for a more orthodox choice with market experience and credibility. To make matters worse, Lula said the government needs to start talking about “social responsibility rather than fiscal responsibility.” Reports suggest Lula is unlikely to announce any members of his cabinet until early December, after he returns from planned trips to Egypt and Portugal.”

“Lula 2.0 is likely to be less orthodox than Lula 1.0.”

“USD/BRL tested the July high near 5.5140 and a break above would target the January high near 5.7240.”

- Mexican Peso erases weekly gains versus US Dollar.

- A decline in equity markets weighs on emerging market currencies.

- Slides in USDMXN seem limited while above 19.30.

The USDMXN rose from 19. 30 and peaked at 19.47, the highest level in three days during Thursday’s American session, boosted by a stronger US Dollar and a deterioration in risk sentiment.

US Dollar up across the board

Economic data from the US released on Thursday showed an unexpected decline in the Philly Fed to -19.4 in November from -8.7. In a different report, Continuing Jobless Claims rose to the highest level since April. Housing Starts and Building Permits dropped in October, although numbers came in above expectations.

The Dollar Initially it dropped but then recovered strength boosted by higher US yields and also risk aversion. In Wall Street, the Dow Jones is falling by 0.60%, the Nasdaq drops by 0.80% and the S&P 500 by 0.98%. The deterioration in risk sentiment weighs on emerging market currencies with the Mexican Peso no among the worst performers.

Trend still favors the MXN

Despite rising on Thursday, USDMXN remains with a bearish bias. In the short-term it continues to consolidate after finding support above 19.30. A firm break lower would open the doors to further losses targeting 19.15 initially and then 19.00/05.

On the upside, initial resistance emerges at 19.50 and then a stronger area at 19.60. A daily close above would alleviate the bearish bias, suggesting a test of 19.80.

Technical levels

- Hawkish commentary by Federal Reserve officials undermines Gold Prices.

- Unemployment claims in the United States diminished compared to last week’s data.

- The US housing market continues to deteriorate as the Federal Reserve aggressively tightens.

- Gold sliding below $1753 would pave the way toward the 100-DMA.

Gold Price drops, eyeing a test of the weekly lows around $1753, following hawkish Federal Reserve (Fed) commentary, amidst a tranche of United States (US) economic data released that underpinned the US Dollar (USD). Also, a jump in US Treasury bond yields weighed on the yellow metal. At the time of writing, XAUUSD is trading at $1759.40, below its opening price by 0.80%, after hitting a daily high of $1774.81.

Federal Reserve’s hawkish commentary undermined XAUUSD

Sentiment shifted sour as Fed policymakers emphasized the need to tackle inflation, led by the St. Louis Fed President James Bullard. Bullard said, “Even under these generous assumptions, the policy rate is not yet in a zone that may be considered sufficiently restrictive.” In his presentation, he showed charts that showed rates might be “sufficiently restrictive” at around 5% to 7% and called his colleagues to raise rates further if they’re to achieve the Fed’s 2% goal.

US Initial Jobless Claims retraced

Data-wise, a busy economic calendar in the United States would entertain Gold traders, led by unemployment claims and housing data. Initial Jobless Claims for the week ended on November 12 dropped 222K, below estimates of 225K and the previous week’s 226K. Contrarily Continuing Claims rose 13K, to 1.51 million, in the week ended on November 5, increasing for the fifth straight week, an uptrend signing that Americans are out of work for longer.

The US housing market continues to cool down

In the housing market segment, Housing Starts for October tumbled, shrinking 4.2% below September’s 1.3% contraction, as further interest-rate hikes by the Fed keep pouring cold water into an already battered housing market. Building Permits decreased by 2.4%, while the previous month’s data was upward reviewed to a 1.4% increase.

The US Dollar Index, a gauge of the buck’s value against a basket of peers, remains above its opening price by 0.62%, at 106.948, snapping two days of consecutive losses. The US 10-year Treasury bond yield, a headwind for the non-yielding metal, jumps nine bps, at 3.781%, after hitting a weekly low of 3.671%.

Gold Price Analysis: Technical outlook

From a technical perspective, the XAUUSD remains neutral-to-upward biased, struggling to crack the $1787 barrier. The XAUUSD drop toward the weekly low at $1753, exposing the yellow metal to selling pressure. The Relative Strength Index (RSI), exiting from oversold conditions, cements the sellers’ case to push prices lower. Therefore, the XAUUSD’s first support would be the weekly low at $1753, followed by the September 12 swing high at $1735.10, and immediately followed by the 100-day Exponential Moving Average (EMA).

Sterling has stabilised as the newly appointed government is working to restore fiscal credibility. However, the growth backdrop provides little incentive to buy sterling which may underperform on the crosses, economists at ANZ Bank report.

Policy settings are not going to be growth positive in the short term

“Policy settings are not going to be growth positive in the short term, even if many of the planned spending cuts may be pushed back until after the next election, which must be held no later than January 2025.”

“From a growth perspective it is difficult to get excited about Sterling’s prospects. We think this is particularly the case on the crosses as we expect the Pound’s fortunes against the USD will be determined more by the direction of the USD than GBP.”

“We think selling rallies in GBP versus EUR and AUD as UK growth suffers and politicians grapple to find a coherent vision of the UK’s economic future could prove rewarding in coming months.”

In the view of economists at ING, the Swedish Krona may struggle to enter a sustained uptrend next year given its elevated exposure to the eurozone’s growth story.

Eurozone exposure a drag on SEK

“We see some room for EURSEK to move lower throughout the year – also considering that we estimate the pair to be around 9.0% overvalued. However, the high risk of a prolonged energy crisis in the eurozone means that SEK is significantly less attractive than other pro-cyclical currencies next year.”

“Incidentally, SEK is highly correlated to the US tech stock market, which looks particularly vulnerable at the moment.”

“A return to 10.00 or below would likely require a significant improvement in European sentiment.”

- The index extends the rebound past the 107.00 barrier.

- Higher US yields also prop up the uptick in the dollar.

- The Philly Fed index worsened to -19.4 for the current month.

The greenback regains poise and advances to the area above the 107.00 barrier, near weekly tops, when measured by the USD Index (DXY) on Thursday.

USD Index: Upside bolstered by higher yields

The index attracts renewed buying interest and advances to multi-day peaks north of the 107.00 hurdle following a soft tone in the risk-linked galaxy, while extra help also comes from the US debt market.

On the latter, yields across the curve seem to have woken up and manage to leave behind several sessions in the red – especially in the belly and the long end of the curve, all against the backdrop of somewhat consolidated speculation of a Fed’s pivot in its monetary policy.

In the US docket, Initial Jobless Claims rose by 222K in the week to November 12, Housing Starts contracted 4.2% MoM in October, or 1.425M units, and flash Building Permits contracted 2.4% from a month earlier, or 1.526M units.

Additionally, the always relevant Philly Fed Manufacturing Index deteriorated to -19.4 for the current month.

What to look for around USD

The index regained upside momentum and trespasses the key 107.00 barrier on Thursday.

In the meantime, the greenback is expected to remain under the microscope amidst persistent investors’ repricing of a probable slower pace of the Fed’s rate path in the upcoming months.

Key events in the US this week: Building Permits, Initial Jobless Claims, Housing Starts, Philly Fed Index (Thursday) - CB Leading Index, Existing Home Sales (Friday).

Eminent issues on the back boiler: US midterm elections. Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.63% at 106.95 and faces the next resistance at 109.13 (100-day SMA) seconded by 110.81 (55-day SMA) and then 113.14 (monthly high November 3). On the other hand, the breakdown of 105.34 (monthly low November 15) would open the door to 105.00 (200-day SMA) and finally 104.63 (monthly low August 10).

- Pound among worst performers in G10 space after Autumn budget.

- US Dollar remains strong despite mixed US economic data.

- GBPUSD trims weekly gains on Thursday, and backs away from three-month highs.

The GBPUSD pair dropped further during the American session and bottomed at 1.1760. It then trimmed losses rising back toward 1.1800. It is losing more than a hundred pips on Thursdays, after US data and UK’s budget presentation.

Pound falls after Autumn Budget

On Thursday in the United Kingdom, Chancellor of the Exchequer, Jeremy Hunt presented the Autumn Statement, the budget of the Primer Minister Rishi Sunak. The budget was largely as expected by analysts. Hunt presented an increase in taxes of £55 billion and spending cuts in order to restore the UK’s fiscal reputation after a chaotic September and October.

“The UK government announced the largest tax increases and spending cuts in a decade, becoming the first major Western economy to start sharply limiting its spending growth after years of ramped-up fiscal stimulus during the pandemic and recent energy subsidies,” reported the WSJ. The pound hit fresh daily lows across the board during the presentation but falling at a moderate pace.

Dollar holds its strength after US data

Economic data from the US showed an unexpected decline in the Philly Fed to -19.4 in November from -8.7. Continuing Jobless Claims rose to the highest level since April. Housing Starts and Building Permits dropped less than expected. The US Dollar initially doped after the reports, trimming gains but after a few minutes it resumed the upside, hitting fresh daily highs.

The DXY is hovering around 107.00, up 0.69% for the day. US yields are higher with the US 10-year bond yield at 3.79% and the 2-year note at 4.44%.

GBPUSD upside limited while under 1.1950

For the third consecutive day, GBPUSD failed to hold above 1.1950 and pulled back. The pound needs to post a daily close above that could open the doors for a recovery of 1.20 and more. The next critical target is the 200-day Simple Moving Average at 1.2240.

If the ongoing correction extends, the area around 1.1740 emerges as a strong support that should favor a rebound. The following support is seen at 1.1640. A slide below would target the 20-day SMA at 1.1560.

Technical levels

St. Louis Federal Reserve President James Bullard said on Thursday that a minimum level for a restrictive Federal Reserve (Fed) policy rate would be 5% to 5.25%, as reported by Reuters.

Additional takeaways

"Once disinflationary process begins it could proceed rapidly as businesses compete to keep market share."

"Recent Retail Sales suggests household spending cushion remains, a slowdown for the coming Christmas shopping season would be fine."

"October inflation data was encouraging but could easily go the other way next time, inflation is still bad."

"Any signs of disinflation so far are tentative at best but hope 2023 will be the year when it happens."

"Not seeing much cooling in the labor market."

"Fed will want to err on the side of keeping rates higher for longer to avoid mistakes of the 1970s."

"Housing is showing impact of monetary policy, but also boomed unexpectedly during the pandemic."

Market reaction

The US Dollar Index edged slightly lower in the last hour but it was still up 0.6% at 106.90 at the time of press.

What is the outlook for long-term returns? In the view of David M. Lebovitz, Global Market Strategist at JP Morgan, markets offer the best potential long-term returns in more than a decade.

Expectations for asset returns have markedly improved

“The combination of higher yields and lower valuations – both of which have materialized in the wake of extreme shifts in the macro landscape this year – now suggest that markets offer the best potential long-term returns in more than a decade.”

“The swift normalization of interest rates this year left bonds once again as a plausible source of income and diversification. Higher risk-free rates have also translated to improved credit return forecasts, with spread assumptions remaining relatively stable.”

“On the equity side, current valuations present an attractive entry point, with public equity returns notably higher across the board. Meanwhile, alternatives still offer alpha, inflation protection, and diversification benefits, but manager selection will be key.”

“With the US Dollar more overvalued than at any time since the 1980s, FX translation will be a significant component of forecast returns.”

- EURUSD corrects moderately lower following recent strength.

- The next support comes at the 100-day SMA near 1.0020.

EURUSD comes under pressure after two daily gains in a row and retreats to the low-1.0300s on Thursday.

The inability of the pair to close above the 1.0400 level coupled with the proximity of the overbought territory seems to have sparked some correction in the pair. Against that, extra losses carry the potential to drag spot to as low as the 100-day SMA, today at 1.0024. The loss of this region could put a test of the parity zone back on the radar.

So far, while below the 200-day SMA, the outlook for the pair remains bearish.

EURUSD daily chart

- Philadelphia Fed Manufacturing Index fell sharply in November.

- US Dollar Index clings to strong daily gains slightly above 107.00.

The Federal Reserve Bank of Philadelphia's Manufacturing Business Outlook Survey's diffusion index for current general activity dropped to -19.4 in November from -8.7 in October. This print came in worse than the market expectation of -6.2.

"The employment index declined but continued to suggest overall hiring, and the price indexes continued to suggest overall increases," the publication further read. "Although the survey’s future indexes rose slightly, they continued to suggest that the firms expect overall declines in activity and new orders six months from now."

Market reaction

The US Dollar (USD) preserves its strength despite the disappointing data and the US Dollar Index was last seen rising 0.75% on the day at 107.08.

- AUDUSD attracts fresh sellers on Thursday amid a strong pickup in the US Dollar demand.

- Rebounding US Treasury bond yields, the risk-off impulse boosts the safe-haven Greenback.

- The fundamental backdrop supports prospects for a further depreciating move for AUDUSD.

The AUDUSD pair comes under heavy selling pressure on Thursday and extends the overnight retracement slide from the vicinity of the 0.6800 mark, or over a two-month high. The intraday downfall remains uninterrupted through the early North American session and drags spot prices to a fresh weekly low, around the 0.6635 region in the last hour.

Resurgent US Dollar demand prompts aggressive selling around AUDUSD

The US Dollar makes a solid comeback on Thursday and moves away from its lowest level since August 12 touched earlier this week, which, in turn, is seen exerting downward pressure on the AUDUSD pair. The upbeat release of Retail Sales figures from the United States on Wednesday cast doubts on the peak inflation narrative. The positive consumption data forces market participants to scale back their bets for a less aggressive policy tightening by the Federal Reserve (Fed). This is evident from a goodish pickup in the US Treasury bond yields and helps revive the USD demand.

The USD bulls further took cues from St. Louis Fed President James Bullard's hawkish remarks, saying that the policy is not yet in a range estimated to be sufficiently restrictive to reduce inflation. The USD maintains its bid tone following the release of better-than-expected housing market data and Initial Jobless Claims, which offset the Philly Fed Manufacturing Index. Traders now look forward to speechs by other regional Fed Presidents - Raphael Bostic, Loretta Mester and Neel Kashkari - for a fresh impetus.

Risk-off impulse contributes to the sharp intraday downfall

Apart from this, a fresh wave of the global risk-aversion trade - as depicted by a steep intraday fall in the equity markets - provides an additional boost to the safe-haven Greenback. The market sentiment remains fragile amid concerns over economic headwinds stemming from a new COVID-19 outbreak in China - the world's second-largest economy. Adding to this, the risk of a further escalation of geopolitical tensions - amid the protracted Russia-Ukraine war - temper investors' appetite for riskier assets and contributed to driving flows away from the risk-sensitive Australian Dollar.

AUDUSD seems vulnerable to extending the corrective decline

The resources-linked Aussie is further pressured by the ongoing slide in Copper prices, weighed down by growing worries about a deeper global economic downturn. The combination of the aforementioned factors overshadows mostly upbeat Australian employment details released earlier this Thursday. Market players seem convinced that the data was not strong enough for the Reserve Bank of Australia to shift from its dovish course. This, in turn, suggests that the path of least resistance for the AUDUSD pair is to the downside and any attempted recovery might still be seen as an opportunity for bearish traders.

AUDUSD technical outlook

From a technical perspective, repeated failures near the 0.6800 mark over the past two trading sessions seem to have prompted traders to unwind their bullish positions around the AUDUSD pair. A subsequent fall below the previous weekly low, around the 0.6665-0.6660 area, might have already set the stage for deeper losses. Hence, some follow-through weakness towards the 0.6600 mark, en route to the 0.6560-0.6550 strong horizontal resistance breakpoint, now looks like a distinct possibility.

On the flip side, any meaningful recovery attempted now seems to confront stiff resistance and runs the risk of fizzling out near the 0.6700 round figure. That said, a sustained strength beyond might trigger a short-covering rally and lift spot prices towards the 0.6735-0.6740 region. Bulls might then aim back towards conquering the 0.6800 mark, which should act as a pivotal point and help determine the next leg of a directional move for the AUDUSD pair.

AUDUSD key levels to watch

- Initial Jobless Claims in the US fell by 4,000 in the week ending November 12.

- US Dollar Index stays in positive territory near 107.00.

There were 222,000 initial jobless claims in the week ending November 12, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 226,000 and came in slightly better than the market expectation of 225,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 221,000, an increase of 2,000 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending November 5 was 1,507,000, an increase of 13,000 from the previous week's revised level," the DOL further noted in its publication.

Market reaction

The US Dollar Index clings to strong daily gains at around 107.00 after this data.

- DXY gives some signs of life and reclaims 107.00 and above.

- Immediately to the downside emerges the 200-day SMA at 105.00.

DXY reverses two daily drops in a row and manages to reclaim the area above the 107.00 mark on Thursday.

Despite the bounce, the index still remains under scrutiny. That said, a breach of the November low at 105.34 (November 15) should prompt DXY to extend losses to the critical 200-day SMA, today at 105.00. The loss of this important region could put a potential drop to the August low at 104.63 (August 10) back on the radar.

Below the 200-day SMA, the dollar’s outlook should shift to negative.

DXY daily chart

- Housing Starts and Building Permits in the US declined in October.

- US Dollar Index clings to strong daily gains slightly below 107.00.

The monthly data published by the US Census Bureau revealed on Tuesday that Housing Starts declined by 4.2% on a monthly basis in October following September's 1.3% contraction.

In the same period, Building Permits fell by 2.4%, compared to a 1.4% increase recorded in September.

Market reaction

With the initial reaction, the US Dollar Index, which tracks the US Dollar's (USD) performance against a basket of six major currencies, retreated from the daily high it set at 107.13. As of writing, the index was up 0.6% on the day at 106.90.

Gold remains under some selling pressure for the second successive day on Thursday. The pain trade could extend further, in the view of strategists at TD Securities.

Low bar for additional short covering

“We still see risks that the pain trade in precious metals could extend further, as positioning risks remain skewed to the upside in Gold.”

“A series of key trend reversal thresholds associated with substantial short covering flow remain just north of the $1,800 mark, which points to a low bar for additional short covering.”

“Return on patience is elevated for those looking to fade the recent rally.”

The Canadian Dollar weakens on soft risk appetite. However, the technical picture suggests risks for the USDCAD pair are tilted to the downside, economists at Scotiabank

Negative technical factors

“USDCAD sentiment remains heavily influenced by choppy risk sentiment but our fair value estimate for spot currently (1.3389) suggests that the market is about where it should be, all things (equities, volatility, spreads, commodities) considered.”

“USDCAD has effectively triggered a minor double bottom at 1.3230 on the move above 1.3330 which paves the way for a further squeeze up to the 1.3430 into the end of the week. Broader patterns remain negative for the USD (the daily Head and Shoulders formation remains in play), however, and we still favour looking to fade USD rallies.”

The US Federal Reserve's (Fed) monetary policy is not yet in a range estimated to be sufficiently restrictive to reduce inflation, St. Louis Federal Reserve President James Bullard said on Thursday, as reported by Reuters.

Additional takeaways

"Fed rate hikes to date have had only limited effect on observed inflation."

Even dovish assumptions about the state of monetary policy warrant further rate increases."

"Monetary rule would set lower bound on restrictive policy of around 5%, versus current Fed target rate range of 3.75% to 4%."

"Range of restrictive policy estimates could be lower if inflation falls, markets expect disinflation in 2023."

"Caution warranted given markets, Fed, have been expecting inflation to fall for more than a year."

Market reaction

The US Dollar Index continues to push higher heading into the American session and was last seen gaining 0.8% on the day at 107.12.

- GBPUSD comes under heavy selling pressure and is weighed down by a combination of factors.

- A goodish pickup in the US bond yields, the risk-off mood revive demand for the safe-haven USD.

- A gloomy outlook for the UK economy undermines the GBP and contributes to the intraday slide.

The GBPUSD pair meets with a fresh supply following an early uptick to the 1.1955-1.1960 region and the intraday selling picks up pace during the mid-European session. The pair is currently flirting with the daily low, with bears now awaiting a sustained break below the 1.1800 round figure mar.

The initial leg of the intraday downfall was sponsored by the emergence of some buying around the US Dollar, which is drawing some support from a goodish pickup in the US Treasury bond yields. The British Pound, on the other hand, weakens across the board after UK Finance Minister Jeremy Hunt presents the Autumn Budget to the Parliament. The combination of the aforementioned factors exerts downward pressure on the GBPUSD pair.

Wednesday's upbeat US Retail Sales data forces market participants to scale back their bets for a less aggressive policy tightening by the Federal Reserve. Moreover, the US central bank is expected to hike interest rates by a relatively smaller 50 bps at the next meeting in December. This, in turn, acts as a tailwind for the US bond yields, which, along with a generally weaker risk tone, offers some support to the safe-haven USD.

The GBP bulls, meanwhile, seem rather unimpressed by Chancellor Jeremy Hunt's £55 billion fiscal plan. Adding to this, the Office for Budget Responsibility (OBR) says that the economy is already in a recession. The OBR now expects the UK GDP to slump by 1.4% next year as compared to a projection for growth of 1.8% in the previous outlook published in March. This is seen as another factor weighing on the Sterling Pound.

With the latest leg down, spot prices have now retreated over 225 pips from a nearly two-month high touched earlier this week and seem vulnerable to depreciating further. Next on tap is the US economic docket, featuring the Philly Fed Manufacturing Index and Weekly Initial Jobless Claims. Apart from this, speeches by a slew of influential FOMC members, will influence the USD and provide some impetus to the GBPUSD pair.

Technical levels to watch

S&P 500’s strength has stalled at the 38.2% retracement of the 2022 fall at 3999. However, analysts at Credit Suisse still expect a break in due course and another short-term leg higher to test tough resistance at the 200-Day Moving Average, currently at 4073.

3860/46 to hold to maintain the potential for a test of the 200DMA

“Whilst further consolidation below 3999 should be allowed for, or even a 1-2 day deeper correction lower, our bias remains to look for a sustained move above here in due course for another short-term leg higher to test what we see as more significant resistance from the long-term 200DMA, currently seen at 4073, where we would then look for better sellers to show.”

“Support is seen at 3953/49 initially, below which would confirm a deeper 1-2 day setback to the 3912 recent high, potentially even the recent price gap and broken 63-day average at 3860/46. However, we look for this to hold to maintain the potential for a test of the 200DMA. Below though would be a strong signal that this bear market rally is over for a resumption of the broader downtrend.”

- EURJPY fades part of Wednesday’s uptick and drops from 145.00.

- The 3-month support line near 141.00 holds the downside.

EURJPY comes under pressure soon after surpassing the key 145.00 barrier on Thursday.

If the corrective bounce gathers extra steam, then the cross should face initial resistance at the so far November high at 147.11 (November 9). The surpass of this level could open the door to a more meaningful move to the 2022 peak at 148.40 (October 21).

In the meantime, further gains look in store in the near term as long as the cross navigates above the 3-month support line near 141.20. This area of contention is also propped up by the October lows in the 141.00 region.

In the longer run, while above the key 200-day SMA at 138.33, the constructive outlook is expected to remain unchanged.

EURJPY daily chart

EURUSD faltered around 1.0400 and is edging lower on Thursday. Still, economists at Scotiabank expect the pair to target the 1.05 mark.

Minor EUR dips remain a buy from a technical perspective

“EUR gains have stalled and there is scope for losses to extend modestly as spot consolidates the sharp advance seen over the past week.”

“Intraday support is 1.0295/00. Resistance is 1.04.”

“Broader trend signals remain EUR-bullish and we think that minor EUR dips remain a buy from a technical perspective.”

“We target a test of the low 1.05 zone (50% Fibonacci retracement of the 2022 decline).”

UK Finance Minister Jeremy Hunt is presenting the Autumn Budget to parliament.

Key takeaways

"Will cap increase in rents on public housing to maximum 7%."

"Will raise minimum wage by 9.7%."

"Hourly rate of minimum wage will rise to 10.42 sterling."

"Will raise working-age and disability benefits in line with inflation."

"Rise in benefits will cost 11 billion sterling."

"Will increase pension credit by 10.1%."

"Will increase state pension in line with triple lock."

Market reaction

GBPUSD stays under modest bearish pressure and was last seen trading at 1.1830, where it was down 0.65% on a daily basis.

- USDJPY gains some positive traction amid a modest USD uptick, though lacks follow-through.

- A goodish pickup in the US bond yields helps revive the USD demand and acts as a tailwind.

- The risk-off mood underpins the safe-haven JPY and caps any meaningful gains for the major.

The USDJPY pair continues to show resilience below the 139.00 round figure and regains some positive traction Thursday. The momentum lifts spot prices to a fresh daily top during the mid-European session, with bulls still awaiting a convincing breakout through the 140.00 psychological mark.

The intraday uptick is sponsored by the emergence of some buying around the US Dollar, bolstered by a goodish pickup in the US Treasury bond yields. Wednesday's upbeat US Retail Sales data forces market participants to scale back their bets for a less aggressive policy tightening by the Federal Reserve and acts as a tailwind for the US bond yields.

Moreover, the US central bank is expected to hike interest rates by a relatively smaller 50 bps at the next meeting in December. In contrast, the Bank of Japan remains committed to its ultra-loose monetary policy, marking a big divergence in comparison to a more hawkish Fed. This, in turn, weighs on the Japanese Yen and further offers support to the USDJPY pair.

That said, a bout of global risk-aversion trade - as depicted by a generally weaker tone around the equity markets - seems to underpin the safe-haven JPY. This is holding back traders from placing aggressive bullish bets around the USDJPY pair, making it prudent to wait for strong follow-through buying before confirming that spot prices have formed a bottom.

Even from a technical perspective, the USDJPY pair, so far, has struggled to move back above the 141.00 confluence support breakpoint. The said handle should now act as a pivotal point and help determine the near-term trajectory for the USDJPY pair. Traders now look to the US macro releases - the Philly Fed Manufacturing Index and the usual Weekly Initial Jobless Claims.

Apart from this, speeches by a slew of influential FOMC members, along with the US bond yields, will drive the USD demand. Furthermore, the broader market risk sentiment might also contribute to producing short-term trading opportunities around the USDJPY pair.

Technical levels to watch

GBPUSD has been recovering on the expectation of more credible UK fiscal plans and the softer Dollar. Nonetheless, economists at ING expect the pair to reverse back lower to the 1.10 zone.

UK economy to contract every quarter in 2023

“We doubt 2023 will prove the year of a benign Dollar decline. And the risk is that the Fed keeps rates at elevated levels for longer. Given Sterling’s large current account deficit and its transition to high beta on the external environment, we think it is too early to be expecting a sustained recovery here.”

“We favour a return to the 1.10 area into year-end as the government introduces Austerity 2.0 and the Bank of England cycle is repriced lower.”

“We look for the UK economy to contract every quarter in 2023 – making it a very difficult environment for Sterling.”

“GBPUSD realised volatility is now back to levels seen during Brexit and our market call for 2023 is that these types of levels will become more, not less, common.”

UK Finance Minister Jeremy Hunt is presenting the Autumn Budget to parliament.

Key takeaways

"Will continue to maintain defence spending at least 2% of GDP."

"Will raise schools budget with extra 2.3 billion sterling per year."

"Will delay implementation of social care reforms by 2 years."

"Will raise NHS budget by 3.3 billion sterling in each of next 2 years."

"Tax as a percentage of GDP will rise by just 1% over next 5 years."

"Maintaining tax thresholds for another 2 years."

"We will grow public spending by less than GDP."

"We will raise resource spending by 1% a year in real terms."

"Overall spending on public spending will rise in real terms over next 5 years."

Market reaction

GBPUSD has managed to rebound from the daily low it touched at 1.1800 and was last seen trading at 1.1865, where it was still down 0.35% on the day.

UK Finance Minister Jeremy Hunt is presenting the Autumn Budget to parliament.

Key takeaways

"Just under half of the £55 billion consolidation coming from tax, and just over half from spending."

"We have not raised headline rates of taxation."

"We will retain the employment allowance at its new, higher level of £5,000."

"Any windfall tax should be temporary and not deter investment."

"From January next year to March 2028, will increase a windfall tax on oil and gas firms to 35%, from 25%."

"Will extend windfall tax to electricity generation firms."

"Temporary levy on electricity generators will be 45%."

UK Finance Minister Jeremy Hunt is presenting the Autumn Budget to parliament.

Key takeaways

"OBR sees CPI of 9.1% in 2022 (March forecast 7.4%)."

"OBR sees CPI of 7.4% in 2023 (March forecast 4.0%)."

"OBR sees GDP growth of 4.2% in 2022, -1.4% in 2023, +1.3% in 2024, +2.6% in 2025 and +2.7% in 2026."

"Our priorities are stability, growth and public services."

"Our plan also leads to a shallower downturn, higher long-term growth."

"Inflation figures show we must continue relentless fight to bring it down, including important commitment to rebuild public finances."

"OBR expects rise in unemployment from 3.6% today to 4.9% in 2024 before falling to 4.1%."

"Two new fiscal rules: Underlying debt must fall as percentage of GDP by fifth year in rolling period. Second is public sector borrowing, over the same period, must be below 3% of GDP."

"Today’s statement delivers a consolidation of £55 billion and means inflation and interest rates end up significantly lower."

"In the short term, as growth slows and unemployment rises, we will use fiscal policy to support the economy."